New Revenue Accounting Standard ASC 606 May 3, 2018 Exhibit 99.2

Safe Harbor This presentation may include forward-looking statements related to the future business and financial performance of Benefitfocus and future events or developments involving Benefitfocus, including our long-term financial model. These statements may be identified by words such as “expects,” “looks forward to,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “might,” “will,” “could,” “would,” “should,” “targets,” “projects”, “opportunity” or words of similar meaning. Forward-looking statements can involve a number of risks and uncertainties that could cause actual results to differ materially from those explicit or implicit in the forward-looking statements, including our continuing losses and need to achieve GAAP profitability; fluctuations in our financial results; risks related to changing healthcare and other applicable regulations; our ability to maintain our culture, recruit and retain qualified personnel and effectively expand our sales force; cyber-security risks; the immature and volatile market for our products and services; the need to innovate and provide useful products and services; our ability to compete effectively; privacy, security and other risks associated with our business; and the other risk factors set forth from time to time in our SEC filings, copies of which are available free of charge within the Investor Relations section of the Benefitfocus website at http://investor.benefitfocus.com/sec-filings or upon request from our Investor Relations Department. Benefitfocus assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

Overview of New Revenue Standard (ASC 606) Revenue is recognized when a customer obtains control of promised goods or services and is recognized in an amount that reflects the consideration that we expect to receive in exchange for those goods and services. Professional Services: Revenue will either be recognized over the contract term of the associated software services contract or over the period of delivery of the professional fees, both of which are typically shorter than the customer relationship period that was previously used under ASC 605. Brokerage Commissions: Commission revenue will be recognized when the orders for the underlying policies have been taken and transferred to the insurance carrier. As a result, revenue from these arrangements will be recognized as a lump sum and in earlier periods under the new standard in comparison to ASC 605 and the timing and amount of revenue recognized for annual and interim periods will change. Deferral & Amortization of Commission and Fullfillment Costs: Assets recognized for the costs to obtain a contract, primarily sales commissions, will be amortized in a consistent manner with the transfer of the services to which the asset relates. Assets recognized for the costs to fulfill a contract will be amortized in a manner consistent with the transfer of the services to which the asset relates.

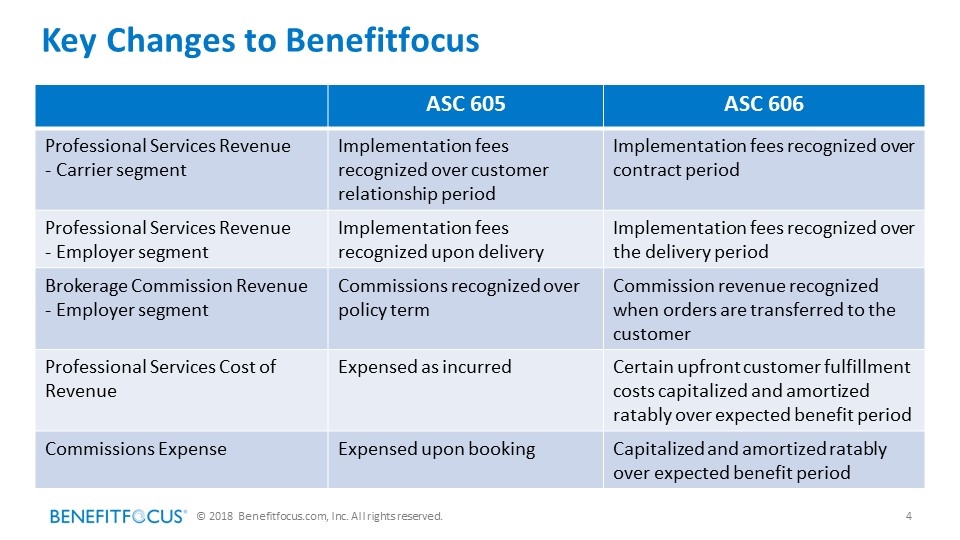

Key Changes to Benefitfocus ASC 605 ASC 606 Professional Services Revenue - Carrier segment Implementation fees recognized over customer relationship period Implementation fees recognized over contract period Professional Services Revenue - Employer segment Implementation fees recognized upon delivery Implementation fees recognized over the delivery period Brokerage Commission Revenue - Employer segment Commissions recognized over policy term Commission revenue recognized when orders are transferred to the customer Professional Services Cost of Revenue Expensed as incurred Certain upfront customer fulfillment costs capitalized and amortized ratably over expected benefit period Commissions Expense Expensed upon booking Capitalized and amortized ratably over expected benefit period

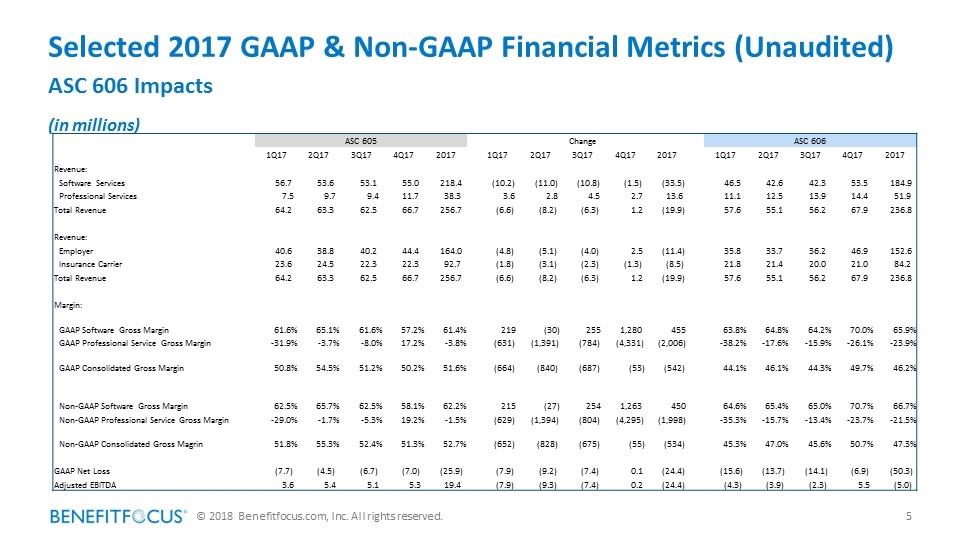

Selected 2017 GAAP & Non-GAAP Financial Metrics (Unaudited) ASC 606 Impacts (in millions) ASC 605 Change ASC 606 1Q17 2Q17 3Q17 4Q17 2017 1Q17 2Q17 3Q17 4Q17 2017 1Q17 2Q17 3Q17 4Q17 2017 Revenue: Software Services 56.7 53.6 53.1 55.0 218.4 (10.2) (11.0) (10.8) (1.5) (33.5) 46.5 42.6 42.3 53.5 184.9 Professional Services 7.5 9.7 9.4 11.7 38.3 3.6 2.8 4.5 2.7 13.6 11.1 12.5 13.9 14.4 51.9 Total Revenue 64.2 63.3 62.5 66.7 256.7 (6.6) (8.2) (6.3) 1.2 (19.9) 57.6 55.1 56.2 67.9 236.8 Revenue: Employer 40.6 38.8 40.2 44.4 164.0 (4.8) (5.1) (4.0) 2.5 (11.4) 35.8 33.7 36.2 46.9 152.6 Insurance Carrier 23.6 24.5 22.3 22.3 92.7 (1.8) (3.1) (2.3) (1.3) (8.5) 21.8 21.4 20.0 21.0 84.2 Total Revenue 64.2 63.3 62.5 66.7 256.7 (6.6) (8.2) (6.3) 1.2 (19.9) 57.6 55.1 56.2 67.9 236.8 Margin: GAAP Software Gross Margin 61.6% 65.1% 61.6% 57.2% 61.4% 219 (30) 255 1,280 455 63.8% 64.8% 64.2% 70.0% 65.9% GAAP Professional Service Gross Margin -31.9% -3.7% -8.0% 17.2% -3.8% (631) (1,391) (784) (4,331) (2,006) -38.2% -17.6% -15.9% -26.1% -23.9% GAAP Consolidated Gross Margin 50.8% 54.5% 51.2% 50.2% 51.6% (664) (840) (687) (53) (542) 44.1% 46.1% 44.3% 49.7% 46.2% Non-GAAP Software Gross Margin 62.5% 65.7% 62.5% 58.1% 62.2% 215 (27) 254 1,263 450 64.6% 65.4% 65.0% 70.7% 66.7% Non-GAAP Professional Service Gross Margin -29.0% -1.7% -5.3% 19.2% -1.5% (629) (1,394) (804) (4,295) (1,998) -35.3% -15.7% -13.4% -23.7% -21.5% Non-GAAP Consolidated Gross Magrin 51.8% 55.3% 52.4% 51.3% 52.7% (652) (828) (675) (55) (534) 45.3% 47.0% 45.6% 50.7% 47.3% GAAP Net Loss (7.7) (4.5) (6.7) (7.0) (25.9) (7.9) (9.2) (7.4) 0.1 (24.4) (15.6) (13.7) (14.1) (6.9) (50.3) Adjusted EBITDA 3.6 5.4 5.1 5.3 19.4 (7.9) (9.3) (7.4) 0.2 (24.4) (4.3) (3.9) (2.3) 5.5 (5.0)

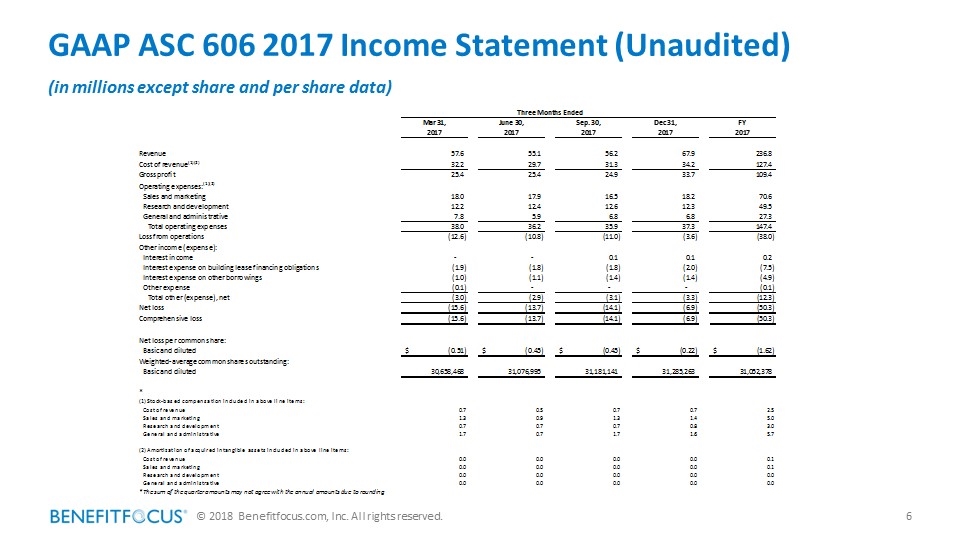

GAAP ASC 606 2017 Income Statement (Unaudited) (in millions except share and per share data)

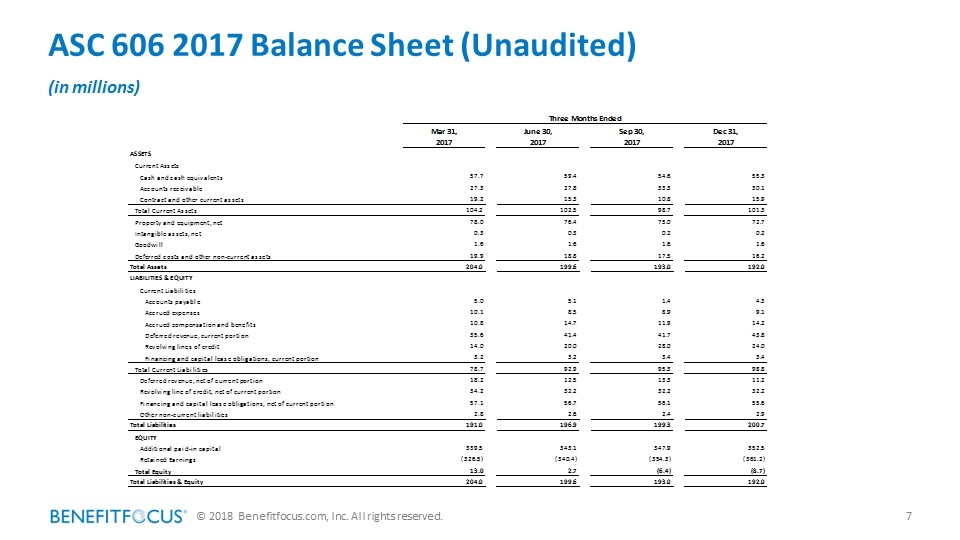

ASC 606 2017 Balance Sheet (Unaudited) (in millions)

ASC 606 2017 Reconciliation of GAAP and Non-GAAP Financial Measures