UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

| | |

Filed by the Registrant ý |

| |

Filed by a Party other than the Registrant o |

| |

| Check the appropriate box: |

| | | |

| o | | Preliminary Proxy Statement |

| | | |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

| ý | | Definitive Proxy Statement |

| | | |

| o | | Definitive Additional Materials |

| | | |

| o | | Soliciting Material under §240.14a-12 |

Mirati Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

| |

| o | Fee paid previously with preliminary materials. |

| |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

MIRATI THERAPEUTICS, INC.

ANNUAL MEETING OF STOCKHOLDERS

May 12, 2020

NOTICE AND PROXY STATEMENT

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON May 12, 2020

To the Stockholders of Mirati Therapeutics, Inc.:

Notice is hereby given that the 2020 Annual Meeting of Stockholders (the "Annual Meeting") of Mirati Therapeutics, Inc., a Delaware corporation, will be held on Tuesday, May 12, 2020, beginning promptly at 9:00 a.m., Pacific Time. You are being asked to vote on the following matters:

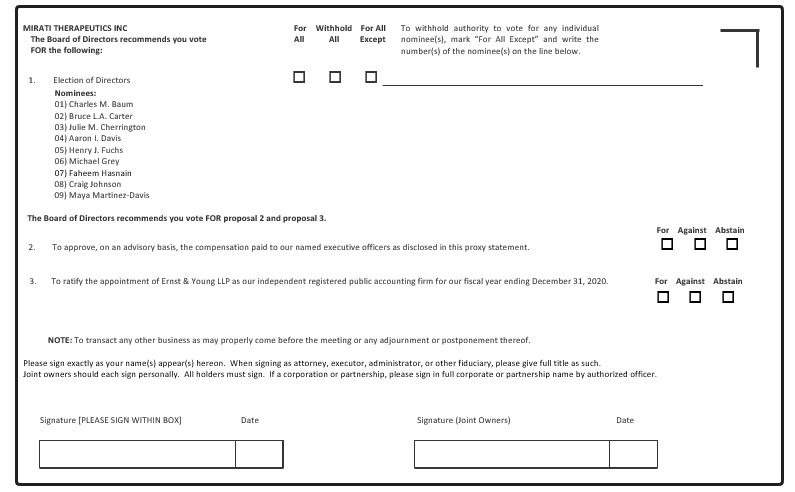

1.To elect the nine nominees for director named in the accompanying proxy statement to serve for the ensuing year and until their successors are elected.

2.To approve, on an advisory basis, compensation paid to our named executive officers as disclosed in this proxy statement.

3.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2020.

4.To conduct any other business properly brought before the meeting.

The accompanying proxy statement contains additional information and should be carefully reviewed by stockholders.

The Annual Meeting will be a completely virtual meeting of stockholders. To participate, vote or submit questions during the Annual Meeting via live webcast, please visit www.virtualshareholdermeeting.com/MRTX2020. You will not be able to attend the Annual Meeting in person.

Our Board of Directors has fixed the close of business on March 19, 2020, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof. We intend to mail these proxy materials on or about April 17, 2020 to all stockholders as of the record date.

Whether or not you expect to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy, or vote over the telephone or the Internet as instructed in these materials, as promptly as possible in order to ensure your vote is counted at the Annual Meeting. Even if you have voted by proxy, you may still vote if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

|

| | | | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on May 12, 2020 at 9:00 a.m. Pacific Time via live webcast at www.virtualshareholdermeeting.com/MRTX2020.

The proxy statement and annual report to stockholders are available at http://www.materials.proxyvote.com/60468T |

|

| |

| | By Order of the Board of Directors, |

| | |

| | Charles M. Baum, MD, PhD President and Chief Executive Officer |

San Diego, California

April 17, 2020

TABLE OF CONTENTS

2020 PROXY STATEMENT

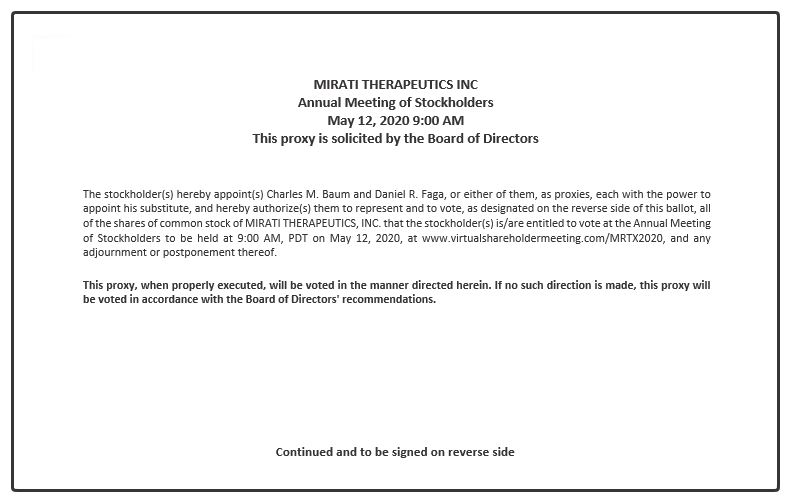

INTRODUCTION

The Board of Directors of Mirati Therapeutics, Inc., a Delaware corporation ("Mirati," the "Company," "we," "us" or "our"), has made these proxy materials available to you on the Internet and has delivered these proxy materials to you in connection with the solicitation of proxies for use at the 2020 Annual Meeting of Stockholders ("Annual Meeting"). The Annual Meeting will be a virtual meeting, conducted via live webcast on the Internet at www.virtualshareholdermeeting.com/MRTX2020 on Tuesday, May 12, 2020, at 9:00 a.m. (Pacific Time), or at any adjournment or postponement thereof, for the purposes stated herein.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Directors (sometimes referred to as the "Board") of Mirati is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

We intend to mail these proxy materials on or about April 17, 2020 to all stockholders of record.

What is the format of the Annual Meeting?

We will be hosting the Annual Meeting live via Internet webcast. You will not be able to attend the meeting in person. A summary of the information you need to attend the Annual Meeting online is provided below:

| |

| • | Any stockholder may listen to the Annual Meeting and participate live via webcast at www.virtualshareholdermeeting.com/MRTX2020. The webcast will begin at 9:00 a.m. Pacific Time on May 12, 2020. |

| |

| • | Stockholders may vote and submit questions during the Annual Meeting via live webcast. |

| |

| • | To enter the meeting, please have your 16-digit control number which is available on your proxy card. If you do not have your 16-digit control number, you will be able to listen to the meeting only and you will not be able to vote or submit questions during the meeting. |

| |

| • | Instructions on how to connect to and participate in the Annual Meeting via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/MRTX2020. |

How do you determine if a stockholder is eligible to vote?

Only stockholders of record as of the close of business on March 19, 2020, the record date, are entitled to notice of and to vote at the Annual Meeting. On the record date, 43,502,829 shares of our common stock were issued, outstanding and entitled to vote. Each share of our common stock that you own entitles you to one vote on all matters to be voted upon at the Annual Meeting. We will have a quorum to conduct the business of the Annual Meeting if the holders of at least 40% of the outstanding shares of our common stock entitled to vote are present themselves or by proxy. Abstentions and broker non-votes (i.e., shares of common stock held by a broker, bank or other nominee that are represented at the meeting, but that the broker, bank or other nominee is not empowered to vote on a particular proposal) will be counted in determining whether a quorum is present at the meeting.

Can I attend the Annual Meeting?

We will be hosting the Annual Meeting via live webcast on the Internet. You will not be able to attend the Annual Meeting in person. Any stockholder can listen to and participate in the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/MRTX2020. The webcast will start at 9:00 a.m., Pacific Time, on May 12, 2020. Stockholders may vote and submit questions while connected to the Annual Meeting on the Internet.

What do I need in order to be able to participate in the Annual Meeting online?

You will need the 16-digit control number included on your proxy card in order to be able to vote your shares or submit questions during the meeting. If you do not have your 16-digit control number, you will be able to listen to the meeting only—you will not be able to vote or submit questions during the meeting. Instructions on how to connect and participate in the Annual Meeting via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/MRTX2020.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 19, 2020, the record date, will be entitled to vote at the Annual Meeting. On the record date, there were 43,502,829 shares of our common stock outstanding and entitled to vote. A list of stockholders of record will be made available for inspection by stockholders for any legally valid purpose related to the Annual Meeting at www.virtualshareholdermeeting.com/MRTX2020.

Stockholder of Record: Shares Registered in Your Name

If on March 19, 2020, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 19, 2020, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in "street name" and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are three matters scheduled for a vote at the Annual Meeting:

| |

| • | Election of the nine nominees for director named in the proxy statement; |

| |

| • | To approve, on an advisory basis, the compensation of our named executive officers, as disclosed in this Proxy Statement; and |

| |

| • | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2020. |

How do I vote?

For the election of directors, you may either vote "For" all nominees or you may "Withhold" your vote for any nominee you specify. For any other matter to be voted on, you may vote "For" or "Against" or you may abstain from voting. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote at the Annual Meeting or vote by proxy using the enclosed proxy card. Alternatively, you may vote by proxy either by telephone or on the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote even if you have already voted by proxy.

| |

| • | To vote by telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control number from the enclosed proxy card. Your telephone vote must be received by 11:59 p.m. Eastern Time on May 11, 2020 to be counted. |

| |

| • | To vote on the Internet, go to www.proxyvote.com and follow the instructions to complete an electronic proxy card. You will be asked to provide the control number from the enclosed proxy card. Your Internet vote must be received by 11:59 p.m. Eastern Time on May 11, 2020 to be counted. |

| |

| • | To vote using the proxy card, simply complete, sign, date and return the enclosed proxy card as promptly as possible in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

| |

| • | To vote during the Annual Meeting, follow the instructions posted at www.virtualshareholdermeeting.com/MRTX2020. |

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a voting instruction form with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction form to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker, bank or other agent. To vote at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of March 19, 2020.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, "For" the election of all nominees for director as described in Proposal 1, "For" the approval of the stockholder advisory vote on the compensation of our named executive officers as described in Proposal 2, and "For" ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020 as described in Proposal 3.

If any other matter is properly presented at the meeting, your proxy holder (one of the individuals named on your proxy) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

The cost of soliciting proxies, including the preparation, assembly and mailing of the proxies and soliciting material, as well as the cost of forwarding such material to beneficial owners of our common stock, will be borne by us. Our directors, officers and regular employees may, without compensation other than their regular remuneration, solicit proxies personally or by telephone.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each proxy card in the proxy materials to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| |

| • | You may submit another properly completed proxy card with a later date. |

| |

| • | You may grant a subsequent proxy by telephone or through the Internet. |

| |

| • | You may send a timely written notice that you are revoking your proxy to our Investor Relations at 9393 Towne Centre Drive, Suite 200, San Diego, CA 92121. To be timely, a written notice revoking your proxy must be received by May 11, 2020. |

| |

| • | You may vote during the Annual Meeting which will be hosted via the Internet. |

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If your shares are held by your broker, bank or other agent as a nominee, you should follow the instructions provided by your broker, bank or other agent with respect to changing your vote.

When are stockholder proposals and director nominations due for the 2021 Annual Meeting of Stockholders?

To be considered for inclusion in next year's proxy materials, your proposal must be submitted in writing by December 18, 2020, to the attention of our Investor Relations at 9393 Towne Centre Drive, Suite 200, San Diego, California 92121. Nothing in this paragraph shall be deemed to require us to include in our proxy statement and proxy card for such meeting any stockholder proposal which does not meet the requirements of the SEC in effect at the time. Any such proposal will be subject to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). If you wish to submit a proposal (including a director nomination) at the 2021 Annual Meeting of Stockholders that is not to be included in next year's proxy materials, your written request must be received by our Investor Relations between January 12, 2021 and February 11, 2021. You are also advised to review our Bylaws, as amended, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count "For" and "Withhold" and, with respect to any proposals other than the election of directors, "Against" votes, abstentions and broker non-votes. Abstentions will be counted towards the vote total for proposals 2 and 3 and will have the same effect as "Against" votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

If your shares are held by your broker, bank or other agent as your nominee (that is, in "street name"), that nominee will provide you with a voting instruction form. Please follow the instructions included on that form regarding how to instruct your broker, bank or other agent to vote your shares. If you do not give instructions to your broker, bank or other agent, they can vote your shares with respect to "discretionary" items, but not with respect to "non-discretionary" items. Discretionary items are proposals considered routine under the rules and interpretations of the NASDAQ Stock Market Listing Rules on which your broker, bank or other agent may vote shares held in street name in the absence of your voting instructions and include the ratification of the selection of our independent registered public accounting firm. On non-discretionary items for which you do not give instructions to your broker, bank or other agent, which include the election of directors, and advisory approval of executive compensation, the shares will be treated as broker non-votes.

What are "broker non-votes"?

A "broker non-vote" occurs when a broker submits a proxy card with respect to shares held in street name on behalf of a beneficial owner but does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner, despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions. These un-voted shares are counted as broker non-votes.

How many votes are needed to approve each proposal?

| |

| • | For Proposal 1, regarding the election of directors, the nine nominees named in this proxy statement receiving the most "For" votes from the holders of shares present at the Annual Meeting or represented by proxy and entitled to vote on the election of directors will be elected. Only votes "For" or "Withheld" will affect the outcome. |

| |

| • | To be approved, Proposal 2, regarding the approval on an advisory basis of the compensation paid to our named executive officers, must receive "For" votes from the holders of shares of a majority of shares present at the Annual Meeting or represented by proxy and entitled to vote. If you "Abstain" from voting, it will have the same effect as an "Against" vote. |

| |

| • | To be approved, Proposal 3, the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2020 must receive "For" votes from the holders of a majority of shares present at the Annual Meeting or represented by proxy and entitled to vote. If you "Abstain" from voting, it will have the same effect as an "Against" vote. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least 40% of the outstanding shares entitled to vote are present at the Annual Meeting or represented by proxy. On the record date, there were 43,502,829 shares outstanding and entitled to vote. Thus, the holders of at least 17,401,132 shares must be present or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What proxy materials are available on the Internet?

The proxy statement and annual report to stockholders are available at http://www.materials.proxyvote.com/60468T.

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of nine members, all of whom have been nominated for re-election as a director this year: Charles M. Baum, M.D., Ph.D.; Bruce L.A. Carter, Ph.D.; Julie M. Cherrington, Ph.D.; Aaron I. Davis; Henry J. Fuchs, M.D.; Michael Grey; Faheem Hasnain; Craig Johnson; and Maya Martinez-Davis. Each nominee for director is to be elected at the Annual Meeting to serve until our 2021 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation or removal. Each of the nominees is currently a director of Mirati.

Directors are elected by a plurality of the votes of the holders of shares present at the Annual Meeting or represented by proxy and entitled to vote at the Annual Meeting. The nine nominees named in the proxy statement receiving the most "For" votes (among votes properly cast at the Annual Meeting or by proxy) will be elected. If no contrary indication is made, shares represented by executed or authenticated proxies will be voted "For" the election of the nine nominees named above or, if any nominee becomes unavailable for election as a result of an unexpected occurrence, "For" the election of a substitute nominee designated by our Board of Directors. Each nominee has agreed to serve as a director if elected and we have no reason to believe that any nominee will be unable to serve.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF

EACH NOMINEE NAMED ABOVE

|

| | | |

| Name | Age(1) | Position |

| Charles M. Baum, M.D., Ph.D. | 61 |

| President and Chief Executive Officer, Director |

Bruce L.A. Carter, Ph.D.(2)(3)(5) | 76 |

| Director |

Julie M. Cherrington, Ph.D.*(5) | 62 |

| Director |

| Aaron I. Davis | 41 |

| Director |

Henry J. Fuchs, M.D.(3)(4)(5) | 62 |

| Director |

Michael Grey(4)(5) | 67 |

| Director |

| Faheem Hasnain | 61 |

| Chairman of the Board |

Craig Johnson(2)(4) | 58 |

| Director |

Maya Martinez-Davis(2)(3) | 50 |

| Director |

| |

| * | Dr. Cherrington was appointed to the Company's Board of Directors on June 27, 2019. |

| |

| (1) | Respective ages are as of December 31, 2019. |

| |

| (2) | Member of the Audit Committee |

| |

| (3) | Member of the Compensation Committee |

| |

| (4) | Member of the Nominating and Corporate Governance Committee |

| |

| (5) | Member of the Research and Development Committee |

Charles M. Baum, M.D., Ph.D. has served as our President and Chief Executive Officer and member of our Board of Directors since November 2012. From June 2003 to September 2012, he was at Pfizer as Senior Vice President for Biotherapeutic Clinical Research within Pfizer's Worldwide Research & Development division and as Vice President and Head of Oncology Development and Chief Medical Officer for Pfizer's Biotherapeutics and Bioinnovation Center. From 2000 to 2003, he was responsible for the development of several oncology compounds at Schering-Plough Corporation (acquired by Merck). His career has included academic and hospital positions at Stanford University and Emory University, as well as positions of increasing responsibility within the pharmaceutical industry at SyStemix, Inc. (acquired by Novartis AG), G.D. Searle & Company (acquired by Pfizer), Schering-Plough Corporation (acquired by Merck) and Pfizer. Dr. Baum currently serves on the board of directors of Immunomedics, Inc. and was on the board of directors of Array BioPharma Inc. from 2014 until its acquisition by Pfizer in July 2019. Dr. Baum received his M.D. and Ph.D. (Immunology) degrees from Washington University School of Medicine in St. Louis, Missouri and completed his post-doctoral training at Stanford University.

Dr. Baum's experience in the pharmaceutical industry provides our Board of Directors with subject matter expertise. In addition, through his position as President and Chief Executive Officer of the Company and his past position as Chief Medical Officer for Pfizer's Biotherapeutics and Bioinnovation Center, Dr. Baum has acquired the operational expertise, which we believe qualifies him to serve on our Board of Directors.

Bruce L.A. Carter, Ph.D. has served as a member of our Board of Directors since September 2016. Dr. Carter currently serves as a director of Dr. Reddy’s Laboratories Limited and Enanta Pharmaceuticals, Inc. Dr. Carter is an affiliate Professor in the Department of Biotechnology at the University of Washington, Seattle Washington, a position he has held since 1986. Dr. Carter served on the Board of Xencor, Inc. from 2009 to 2017. Dr. Carter served on the board for QLT, Inc. from 2006 to 2012. Dr. Carter served as Executive Chairman of Immune Design Corp. a privately-held biotechnology company from 2009 to 2011, and he served as a director from 2009 to 2012. From 1998 to 2009, Dr. Carter served as President and Chief Executive Officer of ZymoGenetics, Inc., a publicly-held biotechnology company, and as its Chairman of the Board from 2005 until it was acquired by Bristol-Myers Squibb in October 2010. From 1994 to 1998 Dr. Carter was the Chief Scientific Officer of Novo Nordisk, a publicly-held pharmaceutical company. Previously, he held positions in research at Zymogenetics and G.D. Searle & Co. Ltd. Dr. Carter received a B.Sc. with Honors in Botany from the University of Nottingham, England, and a Ph.D. in Microbiology from Queen Elizabeth College, University of London.

We believe that Dr. Carter's experience as an executive and his breadth of knowledge and valuable understanding of the pharmaceutical industry qualify him to serve on our Board of Directors.

Julie M. Cherrington, PhD. has served as a member of our Board of Directors since June 2019. Dr. Cherrington is currently the President and Chief Executive Officer of Arch Oncology, Inc. a clinical-stage immuno-oncology company developing novel anti-CD47 mAbs, a position she has held since October 2017. Previously, she has served as President and Chief Executive Officer at several other oncology companies, including Revitope Oncology, Inc. from September 2015 to April 2017, Zenith Epigenetics from 2014 to 2015, and Pathway Therapeutics, a company advancing targeted kinase inhibitors for the treatment of cancer, from 2009 to 2013. In addition, she served as President and Executive Vice President, R&D at Phenomix Corporation. Earlier in her career, Dr. Cherrington was Vice President of Preclinical and Clinical Research at SUGEN, a Pharmacia/Pfizer company. Dr. Cherrington began her career at Gilead Sciences, where she held a range of positions of increasing responsibility. She is also currently on the board of directors of Que Oncology. Dr. Cherrington holds a B.S. in biology and an M.S. in microbiology from the University of California, Davis. She earned a Ph.D. in microbiology and immunology from the University of Minnesota and Stanford University. She completed a postdoctoral fellowship at the University of California, San Francisco.

We believe that Dr. Cherrington’s experience as an executive and her breadth of knowledge and valuable understanding of the pharmaceutical industry qualify her to serve on our Board of Directors.

Aaron I. Davis has served as a member of our Board of Directors since December 2018. Mr. Davis co-founded Boxer Capital, LLC (“Boxer Capital”), the healthcare arm of the Tavistock Group, where he has served as portfolio manager since 2005 and as Chief Executive Officer since 2012. At Boxer Capital, Mr. Davis is responsible for identifying, evaluating and structuring investment opportunities in private and public biotechnology companies. Since 2016, Mr. Davis has served as the Executive Chairman of CiVi Biopharma, Inc. and as a member of the Board of Directors of Odonate Therapeutics, Inc. (NASDAQ:ODT) and Sojournix, Inc. From 2006 to 2008, he served as a member of the Board of Directors of Kalypsys, Inc. Prior to joining the Tavistock Group, Mr. Davis worked in the Global Healthcare Investment Banking and Private Equity Groups at UBS Warburg, LLC. Mr. Davis received an M.A. degree in biotechnology from Columbia University and a B.B.A. degree in finance from Emory University.

We believe Mr. Davis' experience serving as a director of biotechnology companies and as a manager of funds specializing in the area of life sciences qualifies him to serve on our Board of Directors.

Henry J. Fuchs, M.D. has served as a member of our Board of Directors since February 2012. Dr. Fuchs served on the Board of Directors of Genomics Health, Inc. until its acquisition in 2019 by Exact Sciences and was on the Board of Directors of Ardea Biosciences, Inc. from 1996 until its acquisition by AstraZeneca PLC in 2012. Dr. Fuchs has served as the President of Worldwide Research & Development at BioMarin Pharmaceutical Inc. since September 2016 and as the Executive Vice President and Chief Medical Officer from March 2009 to August 2016. From September 2005 to December 2008, Dr. Fuchs was Executive Vice President and Chief Medical Officer of Onyx Pharmaceuticals, Inc. From 1996 to 2005, Dr. Fuchs served in multiple roles of increasing responsibility at Ardea Biosciences, Inc., first as Vice President, Clinical Affairs, then as President and Chief Operating Officer, and finally as Chief Executive Officer. From 1987 to 1996, Dr. Fuchs held various positions at Genentech Inc. Dr. Fuchs received a B.A. in Biochemical Sciences from Harvard University, and an M.D. from George Washington University.

We believe that Dr. Fuchs' experience as an executive and his breadth of knowledge and valuable understanding of the pharmaceutical industry qualify him to serve on our Board of Directors.

Michael Grey has served as a member of our Board of Directors since November 2014. Mr. Grey is currently a director of BioMarin Pharmaceutical, Inc. and Horizon Therapeutics, plc, public pharmaceutical companies. Mr. Grey currently serves as

Chairman of Mirum Pharmaceuticals, Inc. and Curzion Pharmaceuticals, Inc. and Executive Chairman of Amplyx Pharmaceuticals, Reneo Pharmaceuticals and Spruce Biosciences. He was previously President and Chief Executive Officer of Amplyx from October 2015 to December 2016, and Reneo from October 2014 to December 2017. He recently served as President and Chief Executive Officer of Lumena Pharmaceuticals, Inc., a privately-held biotechnology company before it was acquired by Shire. Mr. Grey also serves as a Venture Partner with Pappas Ventures, a life sciences venture capital firm, since January 2010. Between January and September 2009, he served as President and Chief Executive Officer of Auspex Pharmaceuticals, Inc., a private biotechnology company. From January 2005 until its acquisition in August 2008, Mr. Grey was President and Chief Executive Officer of SGX Pharmaceuticals, Inc., a public biotechnology company, where he previously served as President from June 2003 to January 2005 and as Chief Business Officer from April 2001 until June 2003. Prior to joining SGX Pharmaceuticals, Inc., Mr. Grey acted as President, Chief Executive Officer and Board member of Trega Biosciences, Inc., a biotechnology company. From November 1994 to August 1998, Mr. Grey was the President of BioChem Therapeutic, Inc., the pharmaceutical operating division of BioChem Pharma, Inc. During 1994, Mr. Grey served as President and Chief Operating Officer for Ansan, Inc., a pharmaceutical company. From 1974 to 1993, he served in various roles with Glaxo, Inc. and Glaxo Holdings, plc, culminating in the position of Vice President, Corporate Development. He received a B.Sc. in chemistry from the University of Nottingham, United Kingdom.

We believe that based on Mr. Grey's experience as an executive in the biopharmaceutical industry and his breadth of knowledge and valuable understanding of the pharmaceutical industry qualify him to serve on our Board of Directors.

Faheem Hasnain has served as a member of our Board of Directors and as Chairman of the Board since February 2019. Mr. Hasnain is the Co-Founder and served as Chairman and Chief Executive Officer of Gossamer Bio, Inc. from its inception through July 2018, at which time he became its Executive Chairman. Prior to that, Mr. Hasnain served as President, Chief Executive Officer and as a director of Receptos from November 2010 until the company’s acquisition by Celgene in August 2015. Prior to joining Receptos, Mr. Hasnain was the President and Chief Executive Officer and a director of Facet Biotech Corporation. He held that position from December 2008 until the company’s acquisition by Abbott Laboratories in April 2010. Previously, Mr. Hasnain was President, Chief Executive Officer and a director of PDL BioPharma, Inc. from October 2008 until Facet Biotech was spun off from PDL BioPharma in December 2008. From October 2004 to September 2008, Mr. Hasnain served at Biogen Inc., most recently as Executive Vice President in charge of the oncology/rheumatology strategic business unit. Prior to Biogen, Mr. Hasnain held roles with Bristol-Myers Squibb, where he was President of Oncology Therapeutics Network, and for 14 years at GlaxoSmithKline and its predecessor organizations. He serves as Chairman of the board of directors of SENTE, Inc., Tocagen, Inc. and Vital Therapies, Inc., and as a member of the board of directors of Kura Oncology, Inc. He previously served as Chairman of the board of directors of Ambit Biosciences Corporation and served as a member of the board of directors of Aragon Pharmaceuticals, Seragon Pharmaceuticals, Inc., Pernix Sleep, Inc., Somaxon Pharmaceuticals, Inc. and Tercica, Inc. Mr. Hasnain received a B.H.K. and B.Ed. from the University of Windsor Ontario in Canada.

We believe Mr. Hasnain's leadership and experience as an executive and his breadth of knowledge and valuable understanding of the pharmaceutical industry qualify him to serve on our Board of Directors.

Craig Johnson has served as a member of our Board of Directors since September 2013. He also serves as a director of Heron Therapeutics, Inc., a director of La Jolla Pharmaceutical Company and a director of Odonate Therapeutics, Inc. Mr. Johnson served as a director of GenomeDx Biosciences, Inc. from 2015 to 2018, a director of Adamis Pharmaceuticals Corporation from 2011 to 2014 and a director of Ardea Biosciences, Inc. from 2008 until its acquisition by AstraZeneca PLC in 2012. From 2004 through its acquisition by Raptor Pharmaceuticals Corp. in 2009, Mr. Johnson served as Vice President and Chief Financial Officer of TorreyPines Therapeutics, Inc. and, from 2009 to 2010, as Vice President of a wholly-owned subsidiary of Raptor Pharmaceuticals Corp. From 1994 to 2004, he held various positions at MitoKor, Inc., most recently serving as Chief Financial Officer and Senior Vice President of Operations. Mr. Johnson practiced as a Certified Public Accountant with Price Waterhouse, and he received a B.B.A. degree in accounting from the University of Michigan-Dearborn.

We believe Mr. Johnson's leadership and experience and skills in accounting and finance qualify him to serve on our Board of Directors.

Maya Martinez-Davis has served as a member of our Board of Directors since December 2018. Ms. Martinez-Davis currently serves as President, US Pharmaceuticals at GlaxoSmithKline plc., a position she has held since January 2020. Ms. Martinez-Davis was previously President of the Biopharma Latin America business for Merck KGaA, Darmstadt, Germany, and prior to that served as Senior Vice President and Head of Global Oncology for the biopharma business. Prior to joining Merck, Ms. Martinez-Davis worked at Pfizer, Inc. as a senior executive for over a decade, where she exercised her vast cross-border, regional and global leadership experience to boost sales growth and market penetration in the areas of oncology, vaccines and specialty portfolios. In her last role, Ms. Martinez-Davis was leading the Oncology US Business. Ms. Martinez-Davis holds an undergraduate degree from Saint Louis University and a Master’s in business leadership and marketing from the IE Business Institute in Madrid, Spain.

We believe Ms. Martinez-Davis' experience as an executive and her breadth of knowledge and valuable understanding of the pharmaceutical industry qualify her to serve on our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Board Composition and Independence

Our business and affairs are organized under the direction of our Board of Directors. The primary responsibilities of our Board of Directors are to provide oversight, strategic guidance, counseling and direction to our management. Our Board of Directors meets on a regular basis and additionally as required.

Our Board of Directors has determined that seven of our nine directors nominated for re-election, Bruce L.A. Carter, Ph.D., Julie M. Cherrington, Ph.D., Aaron I. Davis, Henry J. Fuchs, M.D., Michael Grey, Craig Johnson, and Maya Martinez-Davis, are independent directors, as defined by Rule 5605(a)(2) of the NASDAQ Listing Rules.

Each director serves until the next annual meeting of stockholders following such director's election to the Board of Directors and until his or her successor is duly elected and qualified. The authorized size of our Board of Directors is currently nine members. The authorized number of directors may be changed only by resolution of the Board of Directors. Our directors may be removed with or without cause by the affirmative vote of the holders of a majority of our voting stock.

Stockholder Communications with the Board of Directors

Our Board of Directors has adopted a formal process by which stockholders may communicate with the Board of Directors or any of its directors. Stockholders who wish to communicate with the Board of Directors may do so by sending written communications addressed to the Investor Relations of Mirati Therapeutics, Inc. at 9393 Towne Centre Drive, Suite 200, San Diego, CA 92121. Each communication must set forth: the name and address of our stockholder on whose behalf the communication is sent and the number of Company shares that are owned beneficially by such stockholder as of the date of the communication. Each communication will be reviewed by our Investor Relations to determine whether it is appropriate for presentation to the Board of Directors or such director. Communications determined by our Investor Relations to be appropriate for presentation to the Board of Directors or such director will be submitted to the Board of Directors or such director on a periodic basis.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all officers, directors and employees. The Code of Business Conduct and Ethics is available on our website at www.mirati.com. If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver from a provision of the Code of Business Conduct and Ethics to any executive officer or director, we will promptly disclose the amendment or waiver on our website. Note that the information on our website is not incorporated by reference in this Proxy Statement.

Board of Directors Leadership Structure

The Board of Directors has a Chairman of the Board, Mr. Hasnain, who has authority, among other things, to call and preside over Board of Directors meetings, to set meeting agendas, and to determine materials to be distributed to the Board of Directors. Accordingly, the Chairman has substantial ability to shape the work of the Board of Directors. In addition, we have a separate chair for each committee of the Board of Directors. The chairs of each committee are expected to report at least annually to the Board of Directors on the activities of their committee in fulfilling their responsibilities as detailed in their respective charters or specify any shortcomings should that be the case. We believe that separation of the positions of Chairman and Chief Executive Officer reinforces the independence of the Board of Directors in its oversight of our business and affairs. In addition, we believe that having a separate Chairman creates an environment that is more conducive to objective evaluation and oversight of management's performance, increasing management accountability and improving the ability of the Board of Directors to monitor whether management's actions are in our best interests and the best interests of our stockholders. As a result, we believe that having a separate Chairman can enhance the effectiveness of the Board of Directors as a whole.

Role of the Board of Directors in Risk Oversight

The Audit Committee of the Board of Directors is primarily responsible for overseeing our risk management processes on behalf of the Board of Directors. The Audit Committee receives reports from management at least annually regarding our assessment of risks. In addition, the Audit Committee reports regularly to the Board of Directors, which also considers our risk profile. The Audit Committee and the Board of Directors focus on the most significant risks we face and our general risk management strategies. While the Board of Directors oversees our risk management, management is responsible for day-to-day risk management processes. The Board of Directors expects management to consider risk and risk management in each business decision, to proactively develop

and monitor risk management strategies and processes for day-to-day activities and to effectively implement risk management strategies adopted by the Audit Committee and the Board of Directors. We believe this division of responsibilities is the most effective approach for addressing the risks we face and that the Board of Directors leadership structure, which also emphasizes the independence of the Board of Directors in its oversight of its business and affairs, supports this approach.

Meetings of the Board of Directors

The Board of Directors held 6 meetings during 2019. Each Board member attended 75% or more of the aggregate number of meetings of the Board of Directors and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member.

We encourage, but do not require, our Board of Directors to attend our annual meeting of stockholders. Dr. Baum and Mr. Hasnain attended our 2019 Annual Meeting of Stockholders.

Information Regarding Committees of the Board of Directors

The Board of Directors has four standing committees: an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee, and a Research and Development Committee.

The following table provides membership and meeting information for fiscal year 2019 for each of the committees of the Board of Directors as of December 31, 2019:

|

| | | | | | | |

| Name | | Audit | | Compensation | | Nominating

and Corporate

Governance | Research and Development |

| Bruce L.A. Carter, Ph.D. | | X | | X* | | | X |

Julie M. Cherrington, Ph.D.(1) | | | | | | | X* |

| Aaron I. Davis | | | | | | | |

| Henry J. Fuchs, M.D. | | | | X | | X* | X |

| Michael Grey | | | | | | X | X |

| Faheem Hasnain | | | | | | | |

Craig Johnson**(2)(3) | | X* | | | | X | |

Maya Martinez-Davis(2) | | X | | X | | | |

| Total meetings in 2019 | | 4 | | 6 | | 2 | 4 |

| |

| (1) | In June 2019, Dr. Cherrington was appointed as chair of the Research and Development Committee. |

| |

| (2) | In June 2019, Ms. Martinez-Davis was appointed to the Compensation Committee and Mr. Johnson was removed from the Compensation Committee. |

| |

| (3) | In June 2019, Mr. Johnson was appointed to the Nominating and Corporate Governance Committee. |

Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that each member of each committee meets the applicable NASDAQ rules and regulations regarding "independence" and that each member is free of any relationship that would impair his individual exercise of independent judgment with regard to us.

Below is a description of each committee of the Board of Directors.

Audit Committee

The Audit Committee of the Board of Directors was established by the Board in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), to oversee our corporate accounting and financial reporting processes and audits of its financial statements. For this purpose, the Audit Committee performs several functions. The principal duties of the Audit Committee of the Board of Directors include assisting the Board of Directors in its oversight of:

| |

| • | the quality and integrity of our financial statements and reports; |

| |

| • | our accounting and financial reporting process, system of internal controls over financial reporting and audit process; |

| |

| • | compliance with, and process for monitoring compliance with, legal and regulatory requirements; |

| |

| • | the independent auditors' qualifications, independence and performance; |

| |

| • | our legal, regulatory and ethical compliance programs as established by management and the Board of Directors; and |

| |

| • | pre-approval of all audit and non-audit services provided by the independent registered public accounting firm. |

The current members of the Audit Committee are Mr. Johnson (chair), Dr. Carter, and Ms. Martinez-Davis. The Audit Committee met four times during 2019. Our Board of Directors has determined that each member of the Audit Committee is an independent director under Rule 5605(c)(2)(A) of the NASDAQ listing standards and under Rule 10A-3 under the Exchange Act. Each member of our Audit Committee can read and understand fundamental financial statements in accordance with NASDAQ audit committee requirements.

Our Board of Directors has determined that Mr. Johnson qualifies as an audit committee financial expert within the meaning of SEC regulations and meets the financial sophistication requirements of the NASDAQ Listing Rules. In making this determination, our Board of Directors has considered formal education and the nature and scope of experience each has previously had with public companies. Both our independent registered public accounting firm and management periodically meet privately with our Audit Committee.

The Audit Committee charter can be found on our website at www.mirati.com in the Corporate Governance section.

Report of the Audit Committee of the Board of Directors

The material in this report is not "soliciting material," is not deemed "filed" with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

The Audit Committee has reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2019 with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed under the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and Securities and Exchange Commission. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants' communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

|

| |

| | Audit Committee |

| | Craig Johnson, Chair |

| | Bruce L.A. Carter, Ph.D. |

| | Maya Martinez-Davis |

Compensation Committee

The principal duties of the Compensation Committee of the Board of Directors include:

| |

| • | reviewing and approving our overall compensation strategy and policies; |

| |

| • | reviewing and approving corporate performance goals, compensation and other terms of employment of our executive officers; |

| |

| • | reviewing the compensation of our non-employee directors; |

| |

| • | administering our stock option and purchase plans; and |

| |

| • | reviewing, discussing with management and approving the annual report on executive compensation for purposes of disclosure to our stockholders. |

The Compensation Committee reviews and approves overall compensation strategies and policies. In exercising these duties, the Compensation Committee ensures that our compensation programs, particularly in connection with bonus targets, are aligned with the interests of our stockholders and other stakeholders.

The current members of the Compensation Committee are Dr. Carter (chair), Dr. Fuchs, and Ms. Martinez-Davis. Our Board of Directors has determined that all such members are independent under the NASDAQ Listing Rules, and "non-employee directors" as defined in Rule 16(b)-3 promulgated under the Exchange Act. The Compensation Committee met six times during 2019.

Typically, the Compensation Committee holds meetings quarterly or with greater frequency, as it deems necessary. The agenda for each meeting is usually developed by the Chair of the Compensation Committee, in consultation with the Chief Executive Officer. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisers or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all our books, records, facilities and personnel. In addition, under the charter, the Compensation Committee has the authority to obtain, at our expense, advice and assistance from internal and external legal, accounting or other advisers and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. The Compensation Committee has direct responsibility for the oversight of the work of any advisers engaged for the purpose of advising the Committee. In particular, the Compensation Committee has the sole authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant's reasonable fees and other retention terms. Under the charter, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other advisers to the compensation committee, only after taking into consideration six factors, prescribed by the SEC and NASDAQ, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

During the past fiscal year, after taking into consideration the six factors prescribed by the SEC and NASDAQ described above, the Compensation Committee engaged Radford as compensation consultants. Radford was selected based upon its reputation and experience as compensation consultants and in its work with companies similar to Mirati. The Compensation Committee requested that Radford conduct an evaluation of current market compensation practices to benchmark against our current compensation practices.

Under its charter, the Compensation Committee may form, and delegate authority to, subcommittees as appropriate. During 2014, the Compensation Committee formed a New Hire Non-Officer Stock Option Subcommittee, currently composed of the Chief Executive Officer and the Chief Accounting Officer, to which it delegated authority to grant, without any further action required by the Compensation Committee, equity awards to newly hired employees and newly promoted employees who are not our executive officers, within pre-established guidelines.

Historically, the Compensation Committee has made most of the significant adjustments to annual compensation, determined bonus and equity awards and established new performance objectives at one or more meetings held during the first quarter of the year. Generally, the Compensation Committee's process comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee, which determines any adjustments to his compensation as well as awards to be granted. For all executives as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information, company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels and recommendations of the Compensation Committee's compensation consultant, including analyses of executive compensation paid at other companies identified by the consultant.

The Compensation Committee charter can be found on our website at www.mirati.com in the Corporate Governance section.

Nominating and Corporate Governance Committee

The principal duties of the Nominating and Corporate Governance Committee of the Board of Directors are to develop and implement a set of corporate governance principles and policies, including a code of business conduct and ethics, assess the performance of the Board of Directors, its committees and the contributions of individual directors, and review and oversee management succession planning. As part of this process the Nominating and Corporate Governance Committee periodically reviews and assesses these policies and principles and their application and recommends to the Board of Directors any changes to such policies and principles. The principal duties of the Nominating and Corporate Governance Committee in connection with the nomination of directors are to evaluate the size of the Board of Directors; identify the skill sets currently available and skill sets that may be required; and recommend to the Board of Directors the director nominees to be put before the stockholders at our annual meeting.

The current members of the Nominating and Corporate Governance Committee are Dr. Fuchs (chair), Mr. Grey, and Mr. Johnson. Our Board of Directors has determined that all such members are independent under Rule 5605(a)(2) of the NASDAQ listing standards. The Nominating and Corporate Governance Committee met two times during 2019.

The Nominating and Corporate Governance Committee believes that candidates for director, both individually and collectively, can and do provide the integrity, experience, judgment, commitment (including having sufficient time to devote to us and level of participation), skills, diversity and expertise appropriate for us. In assessing the directors, both individually and collectively, the Nominating and Corporate Governance Committee may consider our current needs and the needs of the Board of Directors, to maintain a balance of knowledge, experience and capability in various areas. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are assessed in the context of the current composition of the Board of Directors, our operating requirements and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee typically considers diversity, age, skills and such other factors as it deems appropriate given our current needs and the needs of the Board of Directors, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors' overall service to us during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors' independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for NASDAQ purposes, which determination is based upon applicable NASDAQ listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board of Directors. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates' qualifications and then selects a nominee for recommendation to the Board of Directors by majority vote.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board of Directors may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: 9393 Towne Centre Drive, Suite 200, San Diego, CA 92121, Attn: Investor Relations, no later than the 90th day and no earlier than the 120th day prior to the one year anniversary of the preceding year's annual meeting. Submissions must include (1) the name and address of the stockholder on whose behalf the submission is made; (2) number of Company shares that are owned beneficially by such stockholder as of the date of the submission; (3) the full name of the proposed candidate; (4) description of the proposed candidate's business experience for at least the previous five years; (5) complete biographical information for the proposed candidate; (6) a description of the proposed candidate's qualifications as a director and (7) any other information required by our Bylaws. The Nominating and Corporate Governance Committee may require any proposed nominee to furnish such other information as it may reasonably require to determine the eligibility of such proposed nominee to serve as our independent director or that could be material to a reasonable stockholder's understanding of the independence, or lack thereof, of such proposed nominee.

The Nominating and Corporate Governance Committee charter can be found on our website at www.mirati.com in the Corporate Governance section.

Research and Development Committee

The purpose of the Research and Development Committee of the Board of Directors is to review and provide advice for the Company’s research and development programs on behalf of the Board, including (i) to assist the Board in its oversight of the Company’s strategic direction and investment in research and development, (ii) to identify and discuss significant emerging trends

and issues in science and technology and consider the impact of such on the Company’s research and development, and (iii) to provide advice to the Company’s management and to the Board in connection with the allocation, deployment, utilization of, and investment of resources in the Company’s research and development. The principal duties of the Research and Development Committee of the Board of Directors include:

| |

| • | reviewing research and development programs from a scientific perspective; |

| |

| • | reviewing and providing strategic recommendations to the Board regarding the Company’s research and development programs; |

| |

| • | providing strategic advice and counsel to, and providing oversight over, the Company’s research and development organizations and personnel; |

| |

| • | assisting Company’s management in identifying and recommending experts to provide strategic technical advice regarding the Company’s research and development programs and initiatives; and |

| |

| • | identifying and discussing new and emerging trends in health care, pharmaceutical science, and technology to assist Company’s management. |

The current members of the Research and Development Committee are Dr. Cherrington (chair), Dr. Fuchs, Dr. Carter and Mr. Grey. The Research and Development Committee met 4 times during 2019.

PROPOSAL 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") and Section 14A of the Exchange Act, the Company's stockholders are entitled to vote to approve, on an advisory basis, the compensation of the Company's named executive officers as disclosed in this proxy statement in accordance with SEC rules.

This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company's named executive officers and the philosophy, policies and practices described in this proxy statement. The compensation of the Company's named executive officers subject to the vote is disclosed in the Compensation Discussion and Analysis, the compensation tables, and the related narrative discussion contained in this proxy statement. As discussed in those disclosures, the Company believes that its compensation policies and decisions are focused on pay-for-performance principles and strongly aligned with our stockholders' interests.

Accordingly, the Board is asking the shareholders to indicate their support for the compensation of the Company's named executive officers as described in this proxy statement by casting a non-binding advisory vote "FOR" the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.”

Because the vote is advisory, it is not binding on the Board of Directors or the Company. Nevertheless, the views expressed by the stockholders, whether through this vote or otherwise, are important to management and the Board and, accordingly, the Board and the Compensation Committee intend to consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR PROPOSAL 2

PROPOSAL 3

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected the San Diego, California, United States office of Ernst & Young, LLP ("Ernst & Young") as our independent registered public accounting firm for the fiscal year ending December 31, 2020 and has further directed that management submit the selection of its independent registered public accounting firm for ratification by the stockholders at the Annual Meeting.

Representatives of Ernst & Young are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our Bylaws, as amended, nor other governing documents or law require stockholder ratification of the selection of Ernst & Young as our independent registered public accounting firm. However, the Audit Committee is submitting the selection of Ernst & Young to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in our best interests and the best interests of our stockholders.

The affirmative vote of the holders of a majority of the shares present at the Annual Meeting or represented by proxy and entitled to vote on the matter at the Annual Meeting will be required to ratify the selection of Ernst & Young.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF PROPOSAL 3

Principal Accountant Fees and Services

The following table represents aggregate fees billed to us for the fiscal years ended December 31, 2019 and 2018 by Ernst & Young, our principal accountant for those years. All fees described below were pre-approved by the Audit Committee.

|

| | | | | | | |

| | Fiscal Year

Ended December 31, |

| | 2019 | | 2018 |

Audit Fees(1) | $ | 703,732 |

| | $ | 622,368 |

|

| Audit-Related Fees | — |

| | — |

|

Tax Fees(2) | 134,424 |

| | 58,665 |

|

All Other Fees(3) | 1,940 |

| | 1,975 |

|

| Total Fees | $ | 840,096 |

| | $ | 683,008 |

|

| |

| (1) | 2019 and 2018 Audit Fees consist of fees billed for professional services by Ernst & Young for the annual audit of our financial statements and review of the interim condensed consolidated financial statements included in our quarterly reports on Form 10-Q. Audit Fees also include fees for services associated with accounting consultations, public offering filings, review of our Form 8-Ks, and related services that are normally provided in connection with statutory and regulatory filings or engagements. |

| |

| (2) | Tax Fees consist of services related to the preparation of our corporate tax returns in the U.S. and Canada and fees related to an IRS Code Section 382 analysis. |

| |

| (3) | All Other Fees for both 2019 and 2018 consist of license fees for a web-based accounting research tool. |

In connection with the audit of the 2019 financial statements, we entered into an engagement agreement with Ernst & Young which sets forth the terms under which Ernst & Young performed audit services for us. The agreement is subject to alternative dispute resolution procedures.

PRE-APPROVAL POLICIES AND PROCEDURES

The Audit Committee must pre-approve the audit and non-audit services rendered by the Company's independent registered public accounting firm. Effective March 2015, the Audit Committee delegated authority for pre-approval to its Chair.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following table sets forth information regarding our executive officers as of March 31, 2020:

|

| | | | | |

| Name | | Age | | Title |

| Charles M. Baum, M.D., Ph.D. | | 61 |

| | President and Chief Executive Officer, Director |

| Isan Chen, M.D. | | 57 |

| | Executive Vice President and Chief Medical and Development Officer |

| James Christensen, Ph.D. | | 51 |

| | Executive Vice President and Chief Scientific Officer |

| Daniel Faga | | 40 |

| | Executive Vice President and Chief Operating Officer |

| Benjamin Hickey | | 45 |

| | Executive Vice President and Chief Commercial Officer |

The following is biographical information for our executive officers other than Dr. Baum, whose biographical information is included under Proposal 1.

Isan Chen, M.D. has served as our Executive Vice President and Chief Medical and Development Officer since September 2013. Dr. Chen is board certified in Internal medicine, hematology and medical oncology with experience in oncology and clinical trials from first-in-humans through global registrational studies. He has experience in oncology clinical development and interactions with regulatory agencies in the United States and Europe. From 2010 to 2013, he served as the Chief Medical Officer of Aragon Pharmaceuticals, which was acquired by Johnson & Johnson in 2013. At Aragon Pharmaceuticals, Dr. Chen was responsible for the clinical development strategy of all the company's programs, including prostate and breast cancer. From 2004 to 2010, Dr. Chen was with Pfizer, most recently serving as Vice President of tumor strategy. While at Pfizer, he was also the clinical lead for Sutent, a multiple kinase inhibitor, for the treatment of renal cell carcinoma, an indication for which the drug secured FDA approval in 2006. He was also the clinical lead for the Phase 1 studies of crizotinib and CDK 4/6 inhibitor palbociclib. Dr. Chen completed his hematology/oncology fellowship at University of California, San Diego. Before joining Pfizer, Dr. Chen practiced medicine as a staff physician at City of Hope Medical Center and later as an assistant professor at the University of Texas, M.D. Anderson Cancer Center.

James Christensen, Ph.D. has served as our Executive Vice President since December 2018 and Chief Scientific Officer since January 2014, Senior Vice President from January 2014 through December 2018, and Vice President, Research from June 2013 through January 2014. Prior to joining us, he held various positions at Pfizer from 2003 to 2013, the most recent of which was Senior Director of Oncology Precision Medicine in the Oncology Research Unit. Dr. Christensen joined Pfizer in 2003 and his responsibilities there included leading nonclinical research efforts for oncology programs including sunitinib malate research activities and leading the nonclinical and translational biology efforts for other research and development programs, including crizotinib. Dr. Christensen participated as a member of the Cancer Research or Oncology Research Unit leadership team from 2005 to 2013. Prior to 2003, Dr. Christensen was a Group Leader on the Preclinical Research and Exploratory Development team at SUGEN, Inc., which was acquired by Pharmacia Corporation, now owned by Pfizer. Dr. Christensen began his career in 1998 at Warner Lambert, now owned by Pfizer, with research focus in RTK biology and RTK pathway biomarker development in the oncology therapeutic area. Dr. Christensen participates on the editorial boards for Cancer Research and Molecular Cancer Therapeutics. Dr. Christensen received a Ph.D. in molecular pharmacology from North Carolina State University with dissertation research directed toward characterization of mechanisms of apoptosis dysregulation during the process of carcinogenesis.

Daniel Faga has served as our Executive Vice President and Chief Operating Officer since January 2020. Mr. Faga served as the Chief Business Officer for Spark Therapeutics, Inc. from May 2016 through December 2019, where he was responsible for the Corporate Strategy & Public Affairs organization including leadership of corporate strategy, portfolio and new product planning, patient advocacy, business development, alliance management, asset & program management and corporate communications functions. From July 2009 until April 2016, Mr. Faga was a Managing Director at Centerview Partners, an investment banking and advisory firm, where he served as a founding member of Centerview's healthcare advisory practice. Prior to Centerview, Mr. Faga worked at Merrill Lynch in its healthcare investment banking group and as a management consultant in the Life Sciences Practice at PRTM. Mr. Faga earned a B.S. in Engineering from Cornell University and an M.B.A. in Health Care Management from The Wharton School at the University of Pennsylvania.

Benjamin Hickey has served as our Executive Vice President and Chief Commercial Officer since January 2020. Mr. Hickey served as Senior Vice President and Chief Commercial Officer of Halozyme Therapeutics, Inc. from September 2018 through November 2019, where he was responsible for the global commercial strategy for its oncology portfolio. Prior to Halozyme, Mr. Hickey served from August 2016 to September 2018 as the General Manager UK & Ireland at Bristol-Myers Squibb, a global biopharmaceutical company, overseeing an organization of more than 300 people across the virology, immuno-science, oncology

and cardiovascular disease businesses. From March 2014 to August 2016, he served as Vice President Commercial, Immuno-Oncology for Bristol-Myers where he led a commercial team focused on the commercialization of Yervoy® and the launch preparedness of Opdivo®. From 2001 to March 2014, Mr. Hickey held positions of increasing responsibility at Bristol-Myers including Vice President, Hematology, responsible for all commercial activity for Sprycel® and Erbitux®. Mr. Hickey received his B.S. in Management and M.B.A. degrees from St. John's University in Queens, New York.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of our common stock as of March 1, 2020 by: (i) each director and nominee for director; (ii) each of the named executive officers in the Summary Compensation Table; (iii) all our executive officers and directors as a group; and (iv) all those known by us to be beneficial owners of more than five percent of our common stock.