- GH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Guardant Health (GH) DEF 14ADefinitive proxy

Filed: 27 Apr 23, 4:17pm

| ☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only ( as permitted b y Rule14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11 |

3100 Hanover Street

Palo Alto, California, 94304

April 27, 2023

Dear Guardant Stockholder:

We are pleased to invite you to attend the Guardant Health, Inc. 2023 Annual Meeting of Stockholders to be held on Wednesday, June 14, 2023, at 9:30 a.m. Pacific Time, virtually at www.virtualshareholdermeeting.com/GH2023.

The last year was a breakthrough for us at Guardant Health in many ways. We continued to expand our core Guardant360® franchise with another year of record sales. We gained Medicare reimbursement for our Guardant Reveal™ test addressing both minimal residual disease (MRD) detection and recurrence monitoring in colorectal cancer (CRC), and also expanded its use to include early-stage breast and lung cancers. Towards the end of the year, we reached a historic milestone with positive results from ECLIPSE, an over 20,000 patient registrational study evaluating the performance of our blood test for detecting CRC in average-risk adults.

In our Oncology business, nearly nine years after we launched the first comprehensive liquid biopsy, Guardant360 continued to experience rapid growth in clinical volumes and revenues as we reinforced our market-leading position. On the regulatory front, we received approval for Guardant360® CDx in Japan for tumor mutation profiling and several companion diagnostic indications, and in the United States as a companion diagnostic for ENHERTU® in non-small cell lung cancer. Guardant Reveal volume grew by more than 250% as clinicians responded positively to the availability of the first tissue-free liquid biopsy for MRD testing. In addition, our Guardant360 TissueNext™ assay for comprehensive genomic profiling gained Medicare reimbursement and grew rapidly during the year, broadening our offering to clinical customers.

Our screening program achieved a significant development goal with the successful readout of our ECLIPSE trial in CRC screening. Our Shield™ test demonstrated 83% sensitivity for CRC detection at 90% specificity. This was the highest level of performance ever demonstrated by a blood-based cancer screening test in a large scale prospective clinical study. CRC screening continues to be one of the largest unmet medical needs in healthcare, with over 49 million eligible Americans remaining unscreened and at higher risk of CRC-related death. Lack of adherence to screening recommendations due to barriers associated with available test methods has been a major issue, but with our Shield LDT test, we have shown 90% test adherence, more than double the rate of fecal immunochemical testing (FIT), which is currently the most used colorectal cancer screening test in the United States. With the completion of our FDA submission in March 2023, we are well positioned to bring the first high-performance and high-adherence blood-based test to market for CRC screening. We continue to investigate multi-cancer screening to detect early-stage cancers where there is a clinical benefit from early detection and treatment. Specifically, in January 2022, we initiated the SHIELD LUNG study, a prospective, observational, multi-center basket study designed to enroll individuals undergoing cancer screening across multiple cancer types.

We also expanded our biopharma business, ending the year with over 150 partnerships to help bring the next generation of cancer therapeutics to patients sooner. In September 2022, we introduced GuardantINFINITY™, a “smart liquid biopsy” assay that provides researchers with novel genomic and epigenomic insights into the tumor microenvironment and patient immune responses from a simple blood draw. We also expanded our international presence further with the opening of our labs in Vall d’Hebron in Spain and The Royal Marsden in the United Kingdom.

These breakthrough technologies and advancements are enabling us to continue to fulfill our commitment to help patients at all stages of cancer live longer and healthier lives. We thank all of our stakeholders for their continued support and confidence in our efforts to transform cancer care.

We hope that you will join us at our 2023 Annual Meeting of Stockholders on June 14, 2023. Your continuing interest in Guardant Health is very much appreciated.

Sincerely,

Helmy Eltoukhy

Chairperson of the Board of Directors

and Co-Chief Executive Officer

AmirAli Talasaz

Co-Chief Executive Officer

3100 Hanover Street

Palo Alto, California, 94304

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 14, 2023

To the Stockholders of Guardant Health, Inc.:

NOTICE IS HEREBY GIVEN that the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Guardant Health, Inc., a Delaware corporation, will be held on Wednesday, June 14, 2023, at 9:30 a.m. Pacific Time, virtually at www.virtualshareholdermeeting.com/GH2023.

The Annual Meeting will be held for the following purposes:

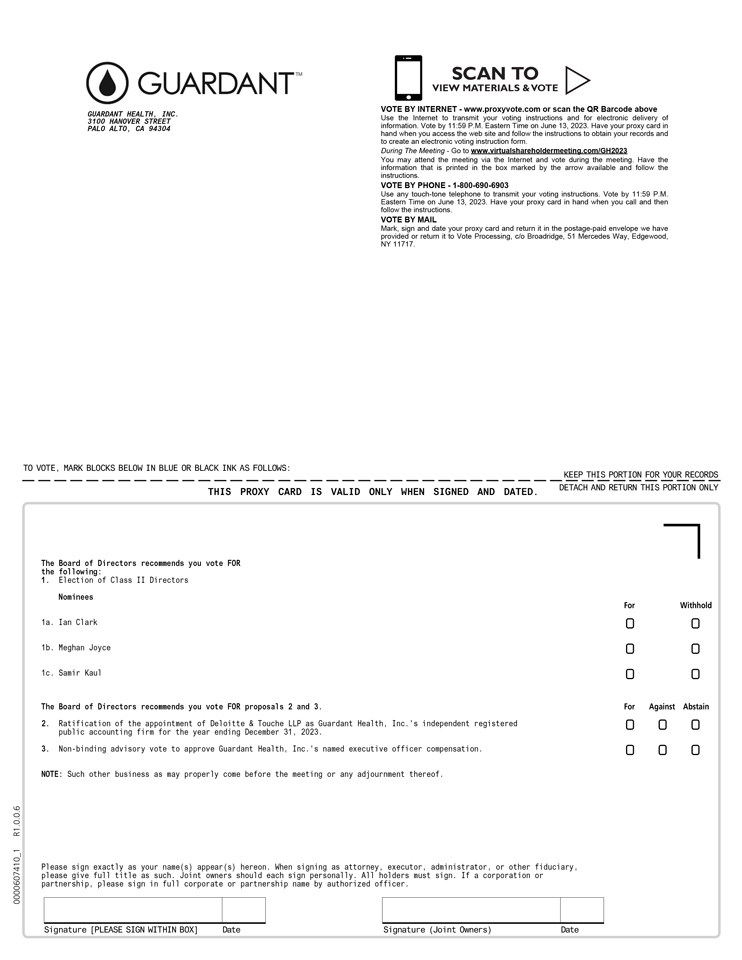

| 1. | To elect the three Class II director nominees to serve on the Board of Directors of Guardant Health, Inc. for a three-year term expiring at the 2026 annual meeting of stockholders or until their successors have been elected and qualified. The three nominees for election to the Board of Directors are Ian Clark, Meghan Joyce and Samir Kaul; |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2023; |

| 3. | To approve, on a non-binding advisory basis, the compensation of our named executive officers, as described in the “Compensation Discussion and Analysis,” executive compensation tables and accompanying narrative disclosures in our proxy materials; and |

| 4. | To consider and take action upon such other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

These matters are more fully described in our proxy materials accompanying this Notice.

We know of no other matters to come before the Annual Meeting. Only stockholders who owned shares of common stock of Guardant Health, Inc. at the close of business on April 17, 2023 are entitled to notice of and to vote on matters brought for vote at the Annual Meeting or at any postponements or adjournments thereof.

You are cordially invited to attend the meeting conducted via live webcast, by registering at www.virtualshareholdermeeting.com/GH2023. You will not be able to attend the Annual Meeting in person. Whether or not you expect to attend, the Board of Directors respectfully requests that you vote your shares of common stock in the manner described in this proxy statement. You may revoke your proxy in the manner described in this proxy statement at any time before it has been voted at the meeting. Regardless of the number of shares of common stock you own, as a stockholder your role is very important, and the Board of Directors strongly encourages you to exercise your right to vote.

By order of the Board of Directors of Guardant Health, Inc.,

John Saia

Chief Legal Officer and Corporate Secretary

Palo Alto, California

April 27, 2023

TABLE OF CONTENTS

| Item | Page | |

PROXY STATEMENT

INFORMATION CONCERNING VOTING AND SOLICITATION

General

Your proxy is solicited on behalf of the Board of Directors (the “Board”) of Guardant Health, Inc., a Delaware corporation (as used herein, “Guardant,” “Guardant Health,” “we,” “us” or “our”), for use at our 2023 annual meeting of stockholders (the “Annual Meeting”) to be held on Wednesday, June 14, 2023, at 9:30 a.m. Pacific Time, virtually at www.virtualshareholdermeeting.com/GH2023, or at any continuation, postponement or adjournment thereof, for the purposes discussed in this proxy statement and in the accompanying Notice of Annual Meeting and any other business properly brought before the Annual Meeting. Proxies are solicited to give all stockholders an opportunity to vote on matters properly presented at the Annual Meeting.

Virtual Annual Meeting. The Annual Meeting will be a virtual meeting of stockholders conducted via live audio webcast. You are invited to attend the Annual Meeting online. We believe that a virtual meeting provides expanded stockholder access and participation, as well as improved communications. You will be able to attend, vote and submit your questions online during the Annual Meeting. You will not be able to attend the Annual Meeting in person. Stockholders may attend the Annual Meeting online by logging onto www. virtualshareholdermeeting.com/GH2023 using the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, on your proxy card, or on the voting instruction form provided by your broker, bank or other nominee.

Notice and Access Proxy Delivery. We have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to most of our stockholders of record, and paper copies of the proxy materials to certain other stockholders of record. Brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar Notice to such beneficial owners. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. You can find instructions on how to request a printed copy by mail or electronically on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. On or about April 27, 2023, we intend to make this proxy statement available on the Internet and to commence mailing of the Notice to all stockholders entitled to vote at the Annual Meeting. We intend to mail this proxy statement, together with a proxy card, to those stockholders entitled to vote at the Annual Meeting who properly request paper copies of such materials, within three business days of such request.

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Stockholder Meeting to be Held on June 14, 2023

Our proxy statement and 2022 Annual Report are available at www.proxyvote.com. This website address contains: the Notice of Annual Meeting, the proxy statement and proxy card sample, and the 2022 Annual Report. You will need your 16-digit control number that is included on your Notice, on your proxy card, or on the voting instruction form provided by your

1

broker, bank or other nominee, to access these materials. You are encouraged to access and review all of the important information contained in the proxy materials before voting.

Who Can Vote, Outstanding Shares

Record holders of our common stock as of the close of business on April 17, 2023, the record date for the Annual Meeting (the “Record Date”), are entitled to notice of and to vote at the Annual Meeting on all matters to be voted upon. As of the Record Date, there were 102,764,757 shares of our common stock outstanding. On each matter presented to our stockholders for vote, the holders of common stock are entitled to one vote per share held as of the Record Date.

Voting of Shares

The method of voting by proxy differs (1) depending on whether you are viewing this proxy statement on the Internet or receiving a paper copy and (2) for shares held as a record holder and shares held in “street name.”

Record Holder. If you hold your shares of common stock as a record holder and you are viewing this proxy statement on the Internet, you may vote by submitting a proxy over the Internet by following the instructions on the website referred to in the Notice previously mailed to you. If you hold your shares of common stock as a record holder and you are reviewing a paper copy of this proxy statement, you may vote your shares by completing, dating and signing the proxy card that was included with the proxy statement and promptly returning it in the preaddressed, postage paid envelope provided to you, or by submitting a proxy over the Internet or by telephone by following the instructions on the proxy card.

Hold in Street Name. If you hold your shares of common stock in street name, which means your shares are held of record by a broker, bank or nominee, you will receive a Notice from your broker, bank or other nominee that includes instructions on how to vote your shares. Your broker, bank or nominee will allow you to deliver your voting instructions over the Internet and may also permit you to vote by telephone. In addition, you may request paper copies of the proxy statement and proxy card from your broker by following the instructions on the Notice provided by your broker.

General. The Internet and telephone voting facilities will close at 11:59 p.m. EDT on June 13, 2023. If you vote through the Internet, you should be aware that you may incur costs to access the Internet, such as usage charges from telephone companies or Internet service providers and that these costs must be borne by you. If you vote by Internet or telephone, then you need not return a written proxy card by mail.

Voting at the Virtual Annual Meeting. To attend and vote at the Annual Meeting you need to access the meeting via live audio webcast at www.virtualshareholdermeeting.com/GH2023 using the 16-digit control number included on your Notice, on your proxy card or on the voting instruction form. Attendance at the Annual Meeting will not, by itself, result in any vote or revocation of a prior vote. You must follow the instructions at www.virtualshareholdermeeting.com/GH2023 to vote your shares at the Annual Meeting.

2

YOUR VOTE IS VERY IMPORTANT. You should submit your proxy even if you plan to attend the Annual Meeting online. If you properly give your proxy and submit it to us in time to vote, one of the individuals named as your proxy will vote your shares as you have directed.

All shares entitled to vote and represented by properly submitted proxies (including those submitted electronically, telephonically and in writing) received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. If no direction is indicated on a proxy, your shares will be voted as follows:

| ✓ | FOR the election of each of the three Class II nominees for director named in our proxy materials; |

| ✓ | FOR the ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for our fiscal year ending December 31, 2023; and |

| ✓ | FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers, as described in the “Compensation Discussion and Analysis,” executive compensation tables and accompanying narrative disclosures in our proxy materials. |

The proxy gives each of Helmy Eltoukhy, AmirAli Talasaz and John Saia discretionary authority to vote your shares in accordance with their best judgment with respect to all additional matters that might come before the Annual Meeting.

If you receive more than one proxy card or Notice, it means you hold shares that are registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or, if you submit a proxy by telephone or the Internet, submit one proxy for each proxy card or Notice you receive.

Revocation of Proxy

If your shares are held of record, you may change or revoke your proxy at any time before your proxy is voted at the Annual Meeting by taking any of the following actions:

| • | timely delivering to our corporate secretary a signed written notice of revocation, bearing a date later than the date of the proxy, stating that the proxy is revoked; |

| • | signing and timely delivering a new paper proxy, relating to the same shares and bearing a later date than the original proxy; |

| • | submitting another proxy by telephone or over the Internet at or before 11:59 p.m. EDT on June 13, 2023 (your latest telephone or Internet voting instructions are followed); or |

| • | attending the Annual Meeting at www.virtualshareholdermeeting.com/GH2023 and timely voting your shares online, although attendance at the Annual Meeting will not, by itself, constitute a vote or revoke a proxy. |

3

Written notices of revocation and other communications with respect to the revocation of proxies by record holders should be addressed to:

Guardant Health, Inc.

3100 Hanover Street

Palo Alto, California 94304

Attention: Corporate Secretary

If your shares are held in the name of a broker, bank, or other nominee, you may change or revoke your voting instructions by following the instructions of your broker, bank, or other nominee contained on the Notice.

Broker Non-Votes

Brokers, banks or other nominees who hold shares of common stock in “street name” for a beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they have not received instructions on how to vote on such matter from the beneficial owners. However, brokers are not allowed to exercise their voting discretion with respect to the election of directors or for the approval of matters that are considered “non-routine” without specific voting instructions from the beneficial owner. If you hold your shares in street name and do not provide voting instructions to your broker on how to vote on the election of directors or other “non-routine” proposals, your broker cannot exercise discretion to vote you shares and your shares will be considered to be “broker non-votes” and will not be voted on such matters. Accordingly, if your broker holds your common stock in “street name,” your broker will vote your shares on the election of directors and other “non-routine” proposals only if you provide instructions to your broker on how to vote your shares by following the procedures outlined in the voting instruction form sent to you by your broker. Only Proposal No. 2 (ratifying the appointment of our independent registered public accounting firm) is considered a routine matter on which your broker may vote without instruction from you as the beneficial owner. Proposal No. 1 (election of directors) and Proposal No. 3 (advisory vote to approve named executive officer compensation) are considered non-routine matters, and without your instruction, your broker cannot vote your shares for either of Proposal No. 1 or Proposal No. 3.

Quorum and Votes Required

The inspector of elections appointed for the Annual Meeting will tabulate votes cast by proxy, telephone and via Internet at www.proxyvote.com as of 11:59 p.m. EDT on June 13, 2023. The inspector of elections will also tabulate votes cast at www.virtualshareholdermeeting.com/GH2023 during the Annual Meeting and will determine whether a quorum is present. In order to constitute a quorum for the conduct of business at the Annual Meeting, the holders of a majority of the shares of common stock issued and outstanding and entitled to vote at the Annual Meeting must be present or represented by proxy at the Annual Meeting. On the Record Date, there were 102,764,757 shares of common stock entitled to vote at the Annual Meeting. Shares that abstain from voting on any proposal, or that are represented by broker non-votes, will be treated as shares that are present and entitled to vote at the Annual Meeting for purposes of determining whether a quorum is present.

4

Proposal No. 1: Election of Directors. A plurality of the votes cast in the election of directors at the Annual Meeting is required for the election of directors. You may vote “FOR” or “WITHHOLD” your vote on any nominee. The three Class II director nominees receiving the highest number of “FOR” votes will be elected. Broker non-votes are considered votes not cast and thus will have no effect on the outcome of the election of directors.

Proposal No. 2: Ratification of Independent Registered Public Accounting Firm. The affirmative vote of the holders of a majority of the votes cast at the Annual Meeting is required for the ratification of the appointment of Deloitte as our independent registered public accounting firm. You may vote “FOR” or “AGAINST” or “ABSTAIN”. The number of votes “FOR” must exceed the number of votes “AGAINST” for the proposal to pass. Abstentions are considered to be votes not cast on this proposal and thus will have no effect. Brokers generally have discretionary authority to vote on the ratification of our independent registered public accounting firm, thus broker non-votes are not expected to result from the vote on Proposal No. 2. Any broker non-votes would be considered votes not cast and thus would have no effect.

Proposal No. 3: Advisory Vote to Approve Named Executive Officer Compensation. The affirmative vote of the holders of a majority of the votes cast at the Annual Meeting is required for determining approval on an advisory basis of the compensation of our named executive officers, as described in the “Compensation Discussion and Analysis,” executive compensation tables and accompanying narrative disclosures in our proxy materials. You may vote “FOR” or “AGAINST” or “ABSTAIN”. The number of votes “FOR” must exceed the number of votes “AGAINST” for the proposal to pass. Abstentions and broker non-votes are considered to be votes not cast on this proposal and thus will have no effect. This vote is advisory and not binding on us, our Board, or our Compensation Committee.

In their discretion, the proxy holders named in the proxy are authorized to vote on any other matters that may properly come before the Annual Meeting and at any continuation, postponement or adjournment thereof. The Board knows of no other items of business that will be presented for consideration at the Annual Meeting other than those described in this proxy statement. In addition, no stockholder proposal or nomination was received on a timely basis, so no such matters may be brought to a vote at the Annual Meeting.

Vote Recommendation

Our Board of Directors unanimously recommends that you vote:

| ✓ | FOR the election of each of the three Class II director nominees named in our proxy materials; |

| ✓ | FOR the ratification of the appointment of Deloitte as our independent registered public accounting firm for our fiscal year ending December 31, 2023; and |

| ✓ | FOR the approval, on a non-binding advisory basis, the compensation of our named executive officers, as described in the “Compensation Discussion and Analysis,” executive compensation tables and accompanying narrative disclosures in our proxy materials. |

5

Details Regarding the Virtual Annual Meeting

Similar to last year, the Annual Meeting will again be held virtually this year via live interactive audio webcast on the Internet. You will be able to attend, vote and submit your questions during the Annual Meeting by logging onto www.virtualshareholdermeeting.com/GH2023. You will not be able to attend the Annual Meeting in person.

Access to the Annual Meeting

The live audio webcast of the Annual Meeting will begin promptly at 9:30 a.m. Pacific Time. Online access to the audit webcast will open approximately 15 minutes prior to the start of the Annual Meeting to allow time for our stockholders to log in and test their devices’ audio system. We encourage our stockholders to access the meeting in advance of the designated start time.

Log-In Instructions

Instructions on how to connect to the Annual Meeting, participate and demonstrate proof of stock ownership are posted at www.virtualshareholdermeeting.com/GH2023. To participate in the Annual Meeting, you will need to log-in using the 16-digit control number on your Notice, proxy card or voting instruction form.

Technical Assistance

Beginning 15 minutes prior to the start of and during the Annual Meeting, we will have a support team ready to assist stockholders with any technical difficulties they may have accessing or hearing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page.

Submitting Questions at the Annual Meeting

Stockholders may submit questions and vote at www.virtualshareholdermeeting.com/GH2023 during the Annual Meeting. You will need to enter the 16-digit control number received with your Notice, proxy card or voting instruction form as proof of stock ownership in order to be able to submit questions and vote at our Annual Meeting. After the business portion of the Annual Meeting concludes and the meeting is adjourned, we will hold a Q&A session during which we intend to answer the questions submitted during the Annual Meeting that are pertinent to us and that are submitted in accordance with the Rules of Conduct for the Annual Meeting, as time permits. The Rules of Conduct will be posted on the virtual meeting web portal. Substantially similar questions will be answered only once. To promote fairness, efficient use our resources and to ensure all stockholder questions are able to be addressed, we will respond to no more than two questions from a single stockholder.

Solicitation of Proxies

Our Board is soliciting proxies for the Annual Meeting from our stockholders. We will bear the entire cost of soliciting proxies from our stockholders. In addition to the solicitation of proxies by delivery of the Notice or proxy statement by mail, we will request that brokers,

6

banks and other nominees that hold shares of our common stock, which are beneficially owned by our stockholders, send Notices, proxies and proxy materials to those beneficial owners and secure those beneficial owners’ voting instructions. We will reimburse those record holders for their reasonable expenses. We do not intend to hire a proxy solicitor to assist in the solicitation of proxies. We may use several of our regular employees, who will not be specially compensated, to solicit proxies from our stockholders, either personally or by telephone, Internet, facsimile or special delivery letter.

Stockholder List

A list of stockholders eligible to vote at the Annual Meeting will be available for inspection, for any purpose germane to the Annual Meeting, at our corporate headquarters for a period of no less than ten days ending on the day prior to the Annual Meeting date. Please contact our Corporate Secretary at CorpSecretary@guardanthealth.com if you are interested in viewing the list. The list of stockholders will also be made available during the Annual Meeting at www.virtualshareholdermeeting.com/GH2023.

7

CORPORATE GOVERNANCE

Corporate Governance Focus and Stockholder Outreach

Over the course of the last year, the Board has been actively engaged in a comprehensive review of its corporate governance practices and in taking steps to strengthen and enhance those practices in response to stockholder feedback. These steps have included increasing the size of the Board from seven to nine directors and increasing the gender diversity of the Board (which now includes three women directors). Most recently, the Board also made a number of meaningful enhancements to the Company’s corporate governance structure. In February 2022, our Board amended our Governance Committee Charter to enhance the Governance Committee’s oversight of corporate social responsibility, including ESG policies and practices and revised our Code of Conduct to increase the breadth and specificity of standards to be upheld by all directors, officers and employees of the Company, including adding and refining guidelines regarding conflicts of interest, business records, gifts and favors, antitrust practices, political contributions, environmental protection, and personal conduct and social media practices.

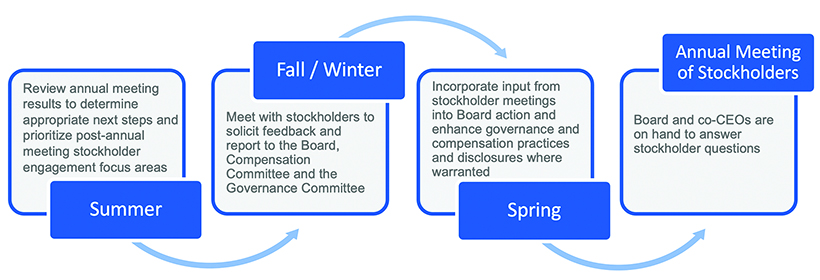

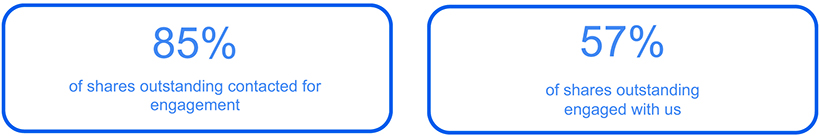

We recognize the value of a robust stockholder outreach program. We engage in regular, constructive dialogue with our stockholders on matters relevant to our business, including corporate governance, executive compensation, strategy, environmental, social and governance issues, and human capital management. During the third and fourth quarters of 2022 and the first quarter of 2023, we contacted our top 75 stockholders, representing more than 86% of the Company’s outstanding shares of common stock. We ultimately spoke with 21 stockholders representing approximately 57% of the Company’s outstanding shares of common stock. Please see “Compensation Discussion and Analysis – Stockholder Outreach” for more details regarding our outreach, stockholder feedback and responses by the Board and its committees.

Board Composition

The Board currently has nine members. Consistent with the Board’s commitment to Board refreshment, on June 30, 2022, Steve Krognes was appointed to the Board as a Class III director to serve for a term expiring at our 2024 annual meeting of stockholders. On February 21, 2023, Musa Tariq was appointed to the Board as a Class I director to serve for a term expiring at our 2025 annual meeting of stockholders.

8

The following provides summary information about each continuing director and director nominee and reflects their committee assignments as of April 27, 2023.

| Name | Position | Age | Director Since | AC | CC | N&CG | ||||||||||

Helmy Eltoukhy | Chairperson & Co-Chief Executive Officer (“Co-CEO”) | 44 | 2013 | |||||||||||||

AmirAli Talasaz | Director & Co-CEO | 43 | 2013 | |||||||||||||

Ian Clark | Lead Independent Director | 62 | 2017 |

| ||||||||||||

Vijaya Gadde | Director | 48 | 2020 |

| ||||||||||||

Meghan Joyce | Director | 39 | 2021 |

|

| |||||||||||

Samir Kaul | Director | 49 | 2014 |

| ||||||||||||

Steve Krognes | Director | 54 | 2022 |

|

| |||||||||||

Myrtle Potter | Director | 64 | 2021 |

|

| |||||||||||

Musa Tariq | Director | 40 | 2023 |

| ||||||||||||

Chair

Chair  Member

Member

AC Audit Committee CC Compensation Committee N&CG Nominating & Corporate Governance Committee

The Board is divided into three classes (Class I, Class II and Class III) with staggered terms of three years each and holding office until his or her successor is duly elected and qualified, or until his or her earlier resignation or removal. The term of one class expires at each annual meeting of stockholders.

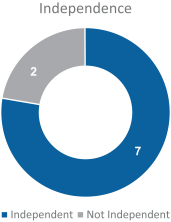

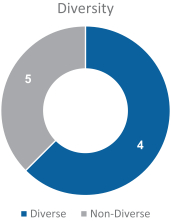

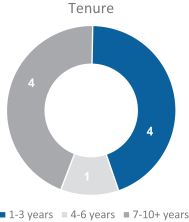

Statistics for Nine Continuing Directors and Director Nominees (As of Our Annual Meeting)

|  |  |

9

Independence |

Gender Diversity |

Racial / Ethnic Diversity |

Tenure | |||

78%

| 33%

| 44%

| 4.8 years

| |||

| 7 of 9 directors are independent | 3 of 9 directors are female | 4 of 9 directors are members of traditionally underrepresented racial/ethnic groups, as defined by current U.S. census racial/ethnic categories | Average tenure of directors | |||

In accordance with Nasdaq Stock Market (“Nasdaq”) rules, the following Board Diversity Matrix sets forth the required diversity statistics for our existing directors:

Nasdaq Board Diversity Matrix (As of April 27, 2023)

| ||||

Total Number of Directors: | 9 | |||

| Female | Male | |||

Part I: Gender Identity | ||||

Directors | 3 | 6 | ||

Part II: Demographic Background | ||||

African American or Black | 1 | — | ||

Asian | 1 | 2 | ||

White | 1 | 3 | ||

Did Not Disclose Demographic Background | — | 1 | ||

Diversity of Skills and Expertise for Directors as of Our Annual Meeting

The skills matrix below identifies our continuing directors’ prominent experiences and qualifications by name. Each director brings his or her own unique background and range of expertise, knowledge and experience which provides an appropriate and diverse mix of qualifications necessary for our Board to effectively fulfill its oversight responsibilities. By its nature, the information contained in this summary is not intended to be exhaustive but aims to convey the general breadth of experience and qualifications that our directors bring to their work on our Board to oversee strategy, performance, culture and risk at the Company.

10

Board Skills of Nine Continuing Directors

|  |  |  |  |  |  |  |  | ||||||||||||

| Senior Executive Leadership | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Other Public Company Board Experience | ● | ● | ● | ● | ● | ||||||||||||||

| Corporate Strategy / M&A | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||

| Financial / Accounting or Audit Experience | ● | ● | ● | ● | ● | ● | |||||||||||||

| Healthcare Industry Experience | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| Sales / Marketing Experience | ● | ● | ● | ● | ● | ● | |||||||||||||

| Risk Management and Compliance | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| Sustainability and ESG | ● | ● | ● | ● | ● | ||||||||||||||

| Cybersecurity / Technology | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| Global / International Experience | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

Our Nominating and Corporate Governance Committee (the “Governance Committee”) is responsible for determining Board membership qualifications and for selecting, evaluating and recommending to the Board nominees for annual election to the Board and to fill vacancies as they arise. When considering whether directors and nominees have the experience, qualifications, attributes or skills to enable the Board to satisfy its oversight responsibilities effectively in light of our business and structure, the Governance Committee and the Board evaluate each individual in the context of the Board as a whole, with the objective of assembling a team that can best perpetuate the success of the business and represent

11

stockholder interests through the exercise of sound judgment using its diversity of experience, thought, backgrounds and cultures. Directors and nominees should have a high level of personal and professional integrity, strong ethics and values and the ability to make mature business judgments. The Governance Committee maintains Director Qualification Standards for selecting nominees and for considering stockholder recommended nominees, which are included in this proxy statement as Appendix A. In determining whether to recommend a director for re-election, the Governance Committee also considers the director’s past attendance at meetings and participation in and contributions to the Board’s activities. Our directors possess a range of diverse skills, backgrounds, experience and viewpoints that we believe are integral to an effective board of directors. Detailed information about each individual’s qualifications, experience, skills and expertise along with select professional and community contributions can be found above and in the section entitled “Proposal 1: Election of Directors” in this proxy statement. We believe that our directors provide an appropriate mix of experience, diversity and skills relevant to the size and nature of our business.

The Governance Committee is mindful of the policies regarding board service of certain investors and proxy advisory firms, which policies were developed due to concerns that “overboarded” directors face excessive time commitments and challenges in fulfilling their duties. Mr. Clark may be deemed “overboarded” under certain policies. In 2022, Mr. Clark reduced the number of boards he serves on from six to five. The Governance Committee reviewed and considered the contributions of Mr. Clark to the Board and noted his strong attendance, preparedness and engagement at Board and committee meetings, as well as his leadership as our Lead Independent Director. The Governance Committee also noted Mr. Clark’s valuable and extensive public company director experience and expertise.

The Governance Committee will consider stockholder recommendations of candidates on the same basis as it considers all other candidates. Stockholders may propose director nominees by adhering to the advance notice procedures described in the section entitled “Other Matters: Stockholder Proposals and Nominations” in this proxy statement and must include all information as required under our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) and Amended and Restated Bylaws (the “Bylaws”), and any other information that would be required to solicit a proxy under federal securities laws. We may request from the recommending stockholder or recommending stockholder group such other information as may reasonably be required to determine whether each person recommended by a stockholder or stockholder group as a nominee meets the minimum director qualifications established by our Board and is independent based on applicable laws and regulations. The Governance Committee may also establish procedures, from time to time, regarding submission of candidates by stockholders and others.

Director Independence

Our Governance Committee and our Board have undertaken a review of the Board’s composition, the composition of Board committees and the independence of each director. Based upon information concerning each director’s background, employment and affiliations, including family relationships, the Board has affirmatively determined that each of Ian Clark, Vijaya Gadde, Meghan Joyce, Samir Kaul, Steve Krognes, Myrtle Potter and Musa Tariq is independent, as defined under the applicable listing requirements and rules of Nasdaq and

12

the Securities and Exchange Commission (the “SEC”), and that each of them and their respective family members have no material relationship with us, commercial or otherwise, that would interfere with the exercise of their independent judgment in carrying out the responsibilities of a director. Drs. Eltoukhy and Talasaz were determined to not be independent due to their service as our Co-CEOs. In making these determinations, the Board considered the current and prior relationships that each non-employee director has with us and all other facts and circumstances the Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Board Leadership Structure

Our Board has determined that at this time it is in the best interests of the Company and our stockholders to have Helmy Eltoukhy, our Co-CEO, serve as our Chairperson of the Board, coupled with a strong lead independent director, Ian Clark. Dr. Eltoukhy was appointed as Chairperson of the Board on August 5, 2021, succeeding AmirAli Talasaz in this role. We believe having one of our senior executives serve as Chairperson promotes responsibility and accountability, and that our Board benefits from having a Chairperson with his extensive understanding of our business and the unique challenges we face. The Board believes that this structure best facilitates consistent leadership direction and long-term strategic planning, while building a cohesive corporate culture that speaks with a single voice.

Our Board also recognizes the value and importance of a strong independent lead director with clearly delineated responsibilities. The independent directors have appointed Ian Clark to serve as our lead independent director. As set forth in our Corporate Governance Guidelines, Mr. Clark, as our independent lead director, has clearly delineated and comprehensive duties, including:

| • | presiding at all meetings of the Board at which the Chairperson is not present, including all executive sessions of the independent directors; |

| • | approving Board meeting schedules and agendas; |

| • | meeting in executive session without non-independent directors or management present on a regularly scheduled basis, but no less than twice per year; and |

| • | acting as the liaison between the independent directors and our Co-CEOs and Chairperson. |

Our Board will continue to evaluate its leadership structure in order to ensure it aligns with and supports the evolving needs and circumstances of Guardant and its stockholders.

Corporate Governance Guidelines

Our Board has adopted corporate governance guidelines covering, among other things, the duties and responsibilities of and independence standards applicable to our directors and Board committee structures and responsibilities. These guidelines are available on the “Corporate Governance” section of our website at https://investors.guardanthealth.com.

13

Attendance by Members of the Board at Meetings

Our Board held six meetings and acted by written consent three times during the year ended December 31, 2022. During 2022, all of our then incumbent directors attended at least 75% of the combined total of (i) all Board meetings and (ii) all meetings of committees of the Board of which the incumbent director was a member. The membership of each standing committee in 2022 and the number of meetings held during 2022 are identified in the table below.

Director

|

Audit

|

Compensation

|

Governance

| |||||||

Helmy Eltoukhy

| ||||||||||

AmirAli Talasaz

| ||||||||||

Ian Clark

|

Chair

| |||||||||

Vijaya Gadde

|

Chair

| |||||||||

Meghan Joyce

|

✓

| ✓

| ||||||||

Samir Kaul

|

✓ | |||||||||

Steve Krognes

|

Chair

|

✓

| ||||||||

Myrtle Potter

|

✓

| ✓

| ||||||||

Number of meetings held during FY 2022

|

4

|

6

|

4

|

* Does not include action by written consent

Currently, we do not maintain a formal policy regarding director attendance at the Annual Meeting; however, it is expected that, absent compelling circumstances, each of our directors will attend our Annual Meeting. Each of our then-seven incumbent directors attended our 2022 Annual Meeting of Stockholders (the “2022 Annual Meeting”).

Executive Sessions

Our non-management directors meet regularly in executive sessions without management, to consider such matters as they deem appropriate. Our lead independent director, Mr. Clark, presides over all executive sessions.

Board Committees

We currently have three standing committees: Audit Committee, Compensation Committee and Governance Committee. From time to time, the Board may form a new committee or disband a current committee, depending on the circumstances. The charters of all three of our standing Board committees are available on our website under the “Corporate Governance – Governance Documents” section at https://investors.guardanthealth.com.

Audit Committee

Our Audit Committee currently consists of Steve Krognes, Meghan Joyce and Myrtle Potter, with Mr. Krognes serving as chair. Mr. Krognes joined the Audit Committee as the

14

chair upon his appointment to the Board effective June 30, 2022. Mr. Kaul served as chair of the Audit Committee from the date of our 2022 Annual Meeting until June 30, 2022. Ian Clark served on the Audit Committee until our committee refreshment effective May 1, 2022. Our Board has determined that each of these directors is independent as defined by the applicable rules of the Nasdaq and the SEC, and that each member of the Audit Committee meets the financial literacy and experience requirements of the applicable SEC and Nasdaq rules. In addition, our Board has determined that each of Messrs. Krognes and Kaul, and Mss. Joyce and Potter is an “audit committee financial expert” as defined by the SEC. The Audit Committee met four times and did not act by written consent during the year ended December 31, 2022.

Our Audit Committee charter requires that the Audit Committee oversee our corporate accounting and financial reporting processes. The primary responsibilities and functions of our Audit Committee are, among other things, as follows:

| • | appointing, approving the compensation of, and assessing the independence of, our independent registered public accounting firm; |

| • | overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of reports from such firm; |

| • | reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| • | monitoring our internal control over financial reporting and disclosure controls and procedures; |

| • | discussing our risk management policies and oversight of enterprise risk management process, which includes a consideration of climate and other ESG-related risks; |

| • | reviewing and approving or ratifying any related person transactions; and |

| • | preparing the audit committee report required by SEC rules. |

Compensation Committee

Our Compensation Committee currently consists of Vijaya Gadde, Samir Kaul and Myrtle Potter, with Ms. Gadde serving as chair. Ian Clark served on the Compensation Committee until our committee refreshment effective May 1, 2022. Our Board has determined that each of these directors is independent under Nasdaq rules and that each qualifies as a “non-employee director” under Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Compensation Committee met six times and did not act by written consent during the year ended December 31, 2022.

15

The Compensation Committee’s responsibilities include, among other things:

| • | reviewing and approving, or recommending that our Board approve, the compensation of our Chief Executive Officer and our other executive officers; |

| • | reviewing and recommending to our Board the compensation of our directors; |

| • | selecting independent compensation consultants and advisers and assessing whether there are any conflicts of interest with any of the committees’ compensation advisers; and |

| • | reviewing and approving, or recommending that our Board approve, incentive compensation and equity plans. |

Since October 2019, the Compensation Committee has engaged Aon’s Human Capital Solutions Practice, a division of Aon plc (“Aon”), as independent compensation consultants to provide advice and guidance on the design of our executive compensation programs and practices. Aon attends Compensation Committee meetings when invited and meets with the Compensation Committee without management. Aon provides the Compensation Committee with third-party data and analysis as well as advice and expertise on competitive compensation practices and trends, executive compensation plans and program designs, and proposed executive and director compensation levels. Aon reports directly to the Compensation Committee and, as directed by the Compensation Committee, works with management and the chair of the Compensation Committee.

For 2022 compensation, Aon assisted the Compensation Committee with the following:

| • | updating the peer group of companies for our executive and director compensation analysis; |

| • | updating company-wide market-based compensation guidelines; |

| • | updating company-wide market-based equity compensation guidelines for new hires and annual grants; and |

| • | reviewing executive compensation market-based benchmarking data. |

Aon did not provide any additional services to the Company during 2022.

The Compensation Committee regularly reviews the services provided by its outside consultants, and it has assessed the independence of Aon consistent with SEC rules and Nasdaq listing standards. In doing so, the Compensation Committee considered each of the factors set forth by the SEC and Nasdaq with respect to a compensation consultant’s independence. The Compensation Committee also considered the nature and amount of work performed for the Compensation Committee and the fees paid for those services in relation to the firm’s total revenues. On the basis of its consideration of the foregoing and other relevant factors, the Compensation Committee has determined that Aon is independent, and that no conflicts of interest exist between the Company and Aon.

16

Nominating and Corporate Governance Committee

Our Governance Committee currently consists of Ian Clark, Meghan Joyce, and Steve Krognes, with Mr. Clark serving as chair. Samir Kaul served on the Governance Committee until our committee refreshment effective May 1, 2022. Our Board has determined that each of these directors is independent under Nasdaq rules. The Governance Committee met four times and acted by written consent once during the year ended December 31, 2022.

In response in part to stockholder feedback, in February 2022, the Board reviewed and enhanced the oversight responsibilities of the Governance Committee. The Governance Committee’s responsibilities include, among other things:

| • | identifying individuals qualified to become Board members; |

| • | recommending to our Board the persons to be nominated for election as directors and to each of the Board’s committees; |

| • | reviewing and making recommendations to the Board with respect to management succession planning; |

| • | reviewing and making recommendations to the Board with respect to corporate social responsibility, including climate and other ESG matters; |

| • | reviewing and discussing with management our information technology initiatives, particularly those that relate to healthcare regulatory compliance; |

| • | overseeing management’s efforts to monitor our internal control over our Code of Conduct; |

| • | developing and recommending to the Board corporate governance principles; and |

| • | overseeing a periodic evaluation of the Board and management. |

Risk Oversight

The Audit Committee of the Board is primarily responsible for overseeing our risk management processes on behalf of the Board. The Audit Committee receives reports from management on at least a quarterly basis regarding our assessment of risks. In addition, the Audit Committee reports regularly to the Board, which also considers our risk profile, about material issues affecting the quality or integrity of our financial statements, compliance with legal or regulatory requirements, the performance or independence of the independent auditor, the performance of the Company’s internal audit function, and other matters that the Audit Committee deems appropriate. The Audit Committee and the Board focus on the most significant risks we face and our general risk management strategies. While the Board oversees our risk management, management is responsible for day-to-day risk management processes. Our Board expects management to consider risk and risk management in each business decision, to proactively develop and monitor risk management strategies and processes for day-to-day activities and to effectively implement risk management strategies adopted by the Audit Committee and the Board. We believe this division of responsibilities is

17

the most effective approach for addressing the risks we face and that our Board’s leadership structure, which also emphasizes the independence of the Board in its oversight of its business and affairs, supports this approach. The standing committees of the Board retain primary responsibility for risk oversight in the following key areas:

Audit Committee |

Overseeing financial risk, capital risk, related party transactions, financial compliance risk and internal controls over financial reporting.

| |

Compensation Committee |

Overseeing our risks related to our compensation philosophy and practices and evaluating the balance between incentives and rewards.

| |

Governance Committee |

Evaluating director independence, the effectiveness of our Corporate Governance Guidelines and Code of Conduct, reviewing our ESG strategy and information technology initiatives, particularly those that relate to healthcare regulatory compliance, and overseeing management’s succession planning.

| |

Each of our committees periodically provide updates to the Board regarding risk management issues and management’s response.

Business Code of Conduct and Ethics

We have adopted a written Code of Conduct that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. In February 2022, our Board amended the Code of Conduct to increase the breadth and specificity of standards to be upheld by all directors, officers and employees of the Company, including adding and refining guidelines regarding conflicts of interest, business records, gifts and favors, antitrust practices, political contributions, environmental protection, and personal conduct and social media practices. We have posted a current copy of the code on our website, https://investors.guardanthealth.com. In addition, we intend to post on our website all disclosures that are required by law or the listing standards of Nasdaq concerning any amendments to, or waivers from, any provision of the code.

Environmental, Social and Governance

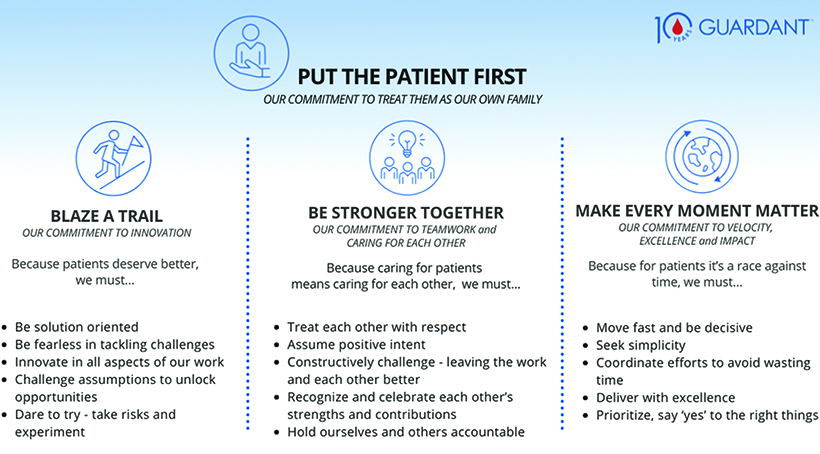

Guardant’s Values. Each day at Guardant starts and ends with putting the patient first. We are a team of diverse, passionate, and curious individuals, motivated to transform cancer care for patients at all stages of the disease. Guided by our core values, our commitment to advancing breakthrough science and giving patients the opportunity to live healthier lives are central to how we operate. Even as these values have evolved, we have never wavered from our commitment to putting the patient first.

18

Our Core Values

Environmental, Social and Governance (ESG) Commitment. Our vision is to transform cancer care by creating impactful diagnostic tools that will be affordable and accessible to far more patients around the world. We are driven by an intense passion to dramatically change the course of cancer patients’ journeys. Our frustration with the data-starved status quo and our strong desire to improve human health shapes our unique culture. Our mission — to conquer cancer — is at the heart of our ESG commitment and fully integrated into our business strategy.

Guided by our core values, our commitment to advancing breakthrough science and giving patients the opportunity to live healthier lives are central to how we operate and are foundational to our approach to corporate responsibility. We believe that to serve patients well, it is important to also act responsibly in our relationships with our employees, our communities and the environment. Therefore, we are committed to: (1) providing meaningful work and development opportunities to our employees; (2) striving to recruit, hire and retain a talented and diverse team of people who align with our values and fostering a diverse, inclusive, and equitable workplace; (3) conducting our business with the highest professional and ethical standards and operating with integrity and mutual respect; (4) maintaining a well-developed environmental, health and safety program, which is reinforced through rigorous policies, education and engagement of our employees and internal and external periodic audits; (5) making it easy and affordable to complete our tests; and (6) investing in environmental sustainability and responsible supply chain operations.

In an effort to capture and communicate on our goals and recent accomplishments, we will release our inaugural ESG annual report (“ESG Report”) in May 2023. We look forward to enchancing and expanding on our ESG Report in the years to come.

19

Grants and Giving. We sponsor and support numerous non-profits and patient advocacy groups and our employees donate their time. Our contributions help to support the work of non-profit organizations of all sizes, working in areas such as cancer research and patient support, community wellness and scientific education, and supporting the mission to accelerate access to innovation for cancer patients.

Safety and Wellness. We are committed to providing a safe and secure work environment and maintaining environmental, health and safety policies that seek to promote the health and safety of our employees and patients. We mandate continual training programs, and we have a robust employee wellness program that recognizes and supports the importance of personal health and work-life balance. We are committed to rewarding, supporting, and developing the employees who make it possible to deliver on our strategy. To that end, we offer a comprehensive total rewards package that includes market-competitive fixed and/or variable pay, broad-based equity grants and bonuses, access to medical, dental, vision and life insurance benefits, disability coverage, fertility subsidies, retirement savings plans, paid time off and family leave, caregiving support, fitness, cellphone and internet reimbursements, and mental health and other wellness benefits.

Governance. We evaluate input from our stockholders and consider their independent oversight of management and our long-term strategy. As part of our commitment to constructive engagement with investors, we evaluate and respond to the views voiced by our stockholders. Our dialogue has led to enhancements in our corporate governance, ESG, and executive compensation activities, which we believe are in the best interest of the Company and our stockholders. In February 2022, our Board amended our Governance Committee Charter to enhance the Governance Committee’s oversight of corporate social responsibility, including ESG policies and practices.

Communications with our Board

Any interested person, including any stockholder, may communicate with our Board by written mail addressed to Guardant Health, Inc. Board of Directors, c/o Corporate Secretary, 3100 Hanover Street, Palo Alto, California, 94304. We encourage stockholders to include proof of ownership of our stock in their communications. The corporate secretary will review the communications and forward them to the Board or the relevant committee of the Board, unless the communication is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate.

20

DIRECTOR COMPENSATION

Our Director Compensation Program is intended to fairly compensate our non-employee directors for the time and effort necessary to serve on our Board, in a manner that is competitive and serves the best interests of the Company and our stockholders.

Process for Determining Director Compensation. Decisions regarding the non-employee director compensation program are approved by our full Board based on recommendations by the Compensation Committee. The Compensation Committee reviews the total compensation of our non-employee directors and each element of our director compensation program each year, with this review usually scheduled before our annual stockholder meeting. The Compensation Committee consults with its independent compensation consultant periodically as to the competitive position of our director compensation program, both in terms of the compensation amount and with respect to the program’s design, against those of our peers (information about our peer group is on page 47).

The Board adopted its current equity-only compensation program, described below, effective as of June 12, 2020, the date of our 2020 annual stockholders’ meeting. The compensation for our Board members is aligned with long-term value creation because it consists solely of stock option and restricted stock unit awards that do not vest as to any of the underlying shares until one-year after the grant date. By using a program that is entirely based on stock awards, the Board has established that a compensation program that fully aligns their interests with those of our stockholders. Our directors do not receive cash compensation for their service as directors, but we pay their reasonable expenses incurred for attending meetings. The Compensation Committee did not recommend to the Board any adjustments to our director compensation program for 2022.

The following is a summary of our director compensation program that was adopted in June 2020 and remained in effect for 2022:

Initial Awards (each, an “Initial Award”)

| • | stock option award with an aggregate value of $362,500 (determined by dividing the value of the award by the per share Black-Scholes valuation as of the applicable grant date) and an exercise price equal to the fair market value of our common stock on the date of grant; and |

| • | restricted stock unit award with an aggregate value of $362,500 (determined by dividing the value by the fair market value of our common stock on the applicable grant date). |

Annual Awards (each, an “Annual Award”)

| • | stock option award with an aggregate value of $212,500 (determined by dividing the value of the award by the per share Black-Scholes valuation as of the applicable grant date) and an exercise price equal to the fair market value of our common stock on the date of grant; and |

21

| • | restricted stock unit award with an aggregate value of $212,500 (determined by dividing the value by the fair market value of our common stock on the applicable grant date). |

Annual Lead Independent Director Award (each, a “LID Award”)

| • | restricted stock unit award with an aggregate value of $45,000 (determined by dividing the value by the fair market value of our common stock on the applicable grant date). |

The Initial Award is granted to each non-employee director who is initially elected or appointed to serve on the Board and each Initial Award vests and becomes exercisable (as applicable) as to 25% of the shares subject to such award on the first anniversary of the director’s election to the Board, and as to the remaining 75% of the shares subject to the Initial Award in substantially equal installments on each monthly anniversary of the director’s election to the Board thereafter, subject to continued service through the applicable vesting date.

The Annual Award is granted on the date of each annual stockholders’ meeting to non-employee directors who have served on the Board for at least six months prior to the date of such annual stockholders’ meeting. Each Annual Award vests and become exercisable (as applicable) in full on the earlier to occur of (i) the one-year anniversary of the applicable grant date and (ii) the date of the next annual meeting of the Company’s stockholders following the grant date, subject to continued service through the applicable vesting date.

The LID Award is granted on the date of each annual stockholders’ meeting to the non-employee director who has served on the Board for at least six months as of the date of such annual stockholders’ meeting and who will also serve as Lead Independent Director of the Board immediately following such meeting. Each LID Award will vest in full on the earlier to occur of (i) the one-year anniversary of the applicable grant date and (ii) the date of the next annual meeting of the Company’s stockholders following the grant date, subject to continued service through the applicable vesting date. Our Board decided that the additional LID Award is appropriate given the significant role and scope of the responsibilities of the Board’s Lead Independent Director, such as responsibilities related to leading meetings of independent directors, providing input on meeting agendas, advising our co-CEOs as to quantity, quality and timeliness of information and materials, providing feedback to our co-CEOs on the co-CEOs’ evaluation, and leading the Board evaluation process.

In addition, each Initial Award, Annual Award and LID Award will vest in full immediately prior to the director’s death, disability, termination without cause, or a change in control (as defined in the 2018 Incentive Award Plan (the “2018 Plan”)).

Any compensation payable to a director will comply with the director annual compensation limit set forth in our 2018 Plan (currently, an annual limit of $750,000 per director).

Director Compensation Table. The following table contains information concerning the compensation received by our non-employee directors during the year ended December 31, 2022. Directors who are also employees do not receive compensation for service on our

22

Board (in addition to the compensation payable for their service as our employees). Drs. Eltoukhy and Talasaz are not included in the table below because they did not receive any additional compensation for their service on our Board. Drs. Eltoukhy’s and Talasaz’s 2022 compensation is presented in the Summary Compensation Table found on page 60.

On June 30, 2022, Steve Krognes was appointed to the Board as a Class III director to serve for a term expiring at our 2024 annual meeting of stockholders. Mr. Krognes received his Initial Award on August 9, 2022 in connection with his initial appointment to the Board.

2022 DIRECTOR COMPENSATION TABLE

Name

|

| Stock Awards (1)(3) ($)

|

|

| Option Awards (2)(3) ($)

|

|

| Total ($)

|

| |||

Ian Clark

|

| 257,529

|

|

| 212,643

|

|

| 470,172

|

| |||

Vijaya Gadde

|

| 212,501

|

|

| 212,643

|

|

| 425,144

|

| |||

Bahija Jallal(4)

| ||||||||||||

Meghan Joyce

|

| 212,501

|

|

| 212,643

|

|

| 425,144

|

| |||

Samir Kaul

|

| 212,501

|

|

| 212,643

|

|

| 425,144

|

| |||

Steven Krognes

|

| 362,549

|

|

| 362,597

|

|

| 725,146

|

| |||

Stanley Meresman(4)

| ||||||||||||

Myrtle Potter

|

| 212,501

|

|

| 212,643

|

|

| 425,144

|

|

| (1) | The amounts shown in the Stock Awards column reflects the aggregate grant date fair value of the restricted stock units (“RSUs”) awarded to our non-employee directors, computed in accordance with Topic 718, excluding the effect of estimated forfeitures. Amounts in this column reflect the market value of the RSUs using the closing price of a share of our common stock as reported on Nasdaq on the date of grant multiplied by the number of shares underlying each award, as follows: for Messrs. Clark, Gadde, and Kaul and Mses. Joyce and Potter using the closing price of $38.42 on June 15, 2022; for Mr. Krognes, using the closing price of $48.96 on August 9, 2022. |

| (2) | The amounts shown in the Option Awards column represent the aggregate grant date fair value of stock options computed in accordance with Topic 718. Valuations of options were determined using the Black-Scholes option pricing model. For information regarding assumptions, factors and methodologies used in our computations pursuant to Topic 718, see Note 12 to our consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2022. |

| (3) | The non-employee directors held the following outstanding RSUs and stock options as of December 31, 2022: |

Name

|

RSUs

|

Stock Options

| ||||||||

Ian Clark

|

| 6,703

|

|

| 15,571

|

| ||||

Vijaya Gadde

|

| 7,295

|

|

| 20,144

|

| ||||

Meghan Joyce

|

| 7,655

|

|

| 14,455

|

| ||||

Samir Kaul

|

| 5,531

|

|

| 19,335

|

| ||||

Steven Krognes

|

| 7,405

|

|

| 11,879

|

| ||||

Myrtle Potter

|

| 7,857

|

|

| 14,718

|

| ||||

| (4) | Ms. Jallal and Mr. Meresman did not receive any compensation in 2022 prior to departing from the Board and had no outstanding RSUs or stock options as of December 31, 2022. |

23

PROPOSAL 1:

ELECTION OF DIRECTORS

Board Nominees

Pursuant to our Certificate of Incorporation and our Bylaws, the total number of directors constituting the Board is fixed from time to time by the Board. There are currently nine authorized directors and nine persons serving as directors.

The Board is divided into three classes (Class I, Class II and Class III) with staggered terms of three years each and holding office until his or her successor is duly elected and qualified, or until his or her earlier resignation or removal. Each class contains as nearly as possible an equal number of directors. The term of one class expires at each annual meeting of stockholders; thus, directors typically stand for election after three years, unless they are filling an unexpired term. The current term of office of our Class II Directors expires at the Annual Meeting, while the term for our Class III Directors will expire at our 2024 annual meeting of stockholders and the term for our Class I Directors expires at our 2025 annual meeting of stockholders. On June 30, 2022, Steve Krognes was appointed to the Board as a Class III director to serve for a term expiring at our 2024 annual meeting of stockholders. On February 21, 2023, Musa Tariq was appointed to the Board as a Class I director, effective as of March 6, 2023, to serve for a term expiring at our 2025 annual meeting of stockholders.

Based upon the recommendation of our Governance Committee, the Board has nominated Ian Clark, Meghan Joyce and Samir Kaul, each a current Class II Director, for re-election at the Annual Meeting. Each director elected at the Annual Meeting will serve a three-year term expiring at the 2026 annual meeting of stockholders and until his or her successor is duly elected and qualified as a Class II Director, or until his or her earlier death, resignation or removal. At the Annual Meeting, proxies cannot be voted for a greater number of individuals than the three nominees named in this proxy statement.

The Board and the Governance Committee believe the skills, qualities, attributes and experience of our directors provide us with business acumen and a diverse range of perspectives to engage each other and management to effectively address our evolving needs and represent the best interests of our stockholders.

Vacancies on the Board, including any vacancy created by an increase in the size of the Board, may be filled only by a majority of the directors remaining in office, even though less than a quorum of the Board, or a sole remaining director. A director elected by the Board to fill a vacancy will serve until the next election of the class of directors for which such director was chosen and until such director’s successor is elected and qualified, or until such director’s earlier retirement, resignation, disqualification, removal or death.

If any nominee should become unavailable for election prior to the Annual Meeting, an event that currently is not anticipated by the Board, the proxies will be voted in favor of the election of a substitute nominee or nominees proposed by the Board or the number of directors may be reduced accordingly. Each nominee has agreed to serve if elected and the Board has no reason to believe that any nominee will be unable to serve.

24

Information about Class II Director Nominees

Set forth below is biographical information for each nominee and a summary of the specific qualifications, attributes, skills and experiences which led the Board to conclude that each nominee should serve on the Board at this time.

Class II Director with Term Expiring at the 2023 Annual Meeting

Ian Clark

Former Chief Executive Officer of Genentech Inc.

Current Committee Assignments:

• Nominating and Corporate Governance Committee (Chair) | Mr. Clark has served as a member of our Board since January 2017 and is our lead independent director. Mr. Clark currently serves on the Board of Directors of AVROBIO, Inc., Corvus Pharmaceuticals, Inc., Olema Oncology and Takeda Pharmaceutical Company Limited.

Previously, Mr. Clark served on the Board of Directors of Agios Pharmaceuticals, Inc. from January 2017 to June 2022, Forty Seven Inc. from May 2018 to April 2020, Kite Pharma, Inc. from January 2017 to October 2017, Shire Pharmaceuticals, Inc. from February 2017 to January 2019, and TerraVia Holdings, Inc. from May 2011 to January 2018.

Mr. Clark most recently served as an Operating Partner at Blackstone Life Sciences, formerly Clarus Ventures, LLC, a venture capital firm, from September 2017 to September 2020. Prior to that, he served as Chief Executive Officer of Genentech Inc., a biotechnology company, from January 2010 to December 2016. Prior to that, he was the Executive Vice President and Chief Marketing Officer of the Roche Group from April 2009 to December 2009. Prior to his time at the Roche Group, Mr. Clark held several senior management positions at Genentech Inc. from January 2003 to March 2009, including Head of Global Product Strategy, Chief Marketing Officer, Senior Vice President, General Manager of BioOncology and Executive Vice President, Commercial Operations. Before joining Genentech Inc., Mr. Clark spent 23 years in the biopharmaceutical industry in senior roles at Novartis International AG, Ivax Pharmaceuticals, Inc. and Sanofi S.A. in the United Kingdom, France and Eastern Europe. He started his career at G.D. Searle, LLC, a subsidiary of Monsanto Corporation, holding positions in sales and marketing. Mr. Clark received a B.S. degree in Biology from Southhampton University.

We believe that Mr. Clark is qualified to serve as a member of our Board due to his vast experience in the biopharmaceutical industry, combined with his experience serving on the boards of directors of successful, high-growth public and private companies. | |

25

Meghan Joyce

Independent Advisor

Current Committee Assignments:

• Audit Committee • Nominating and Corporate Governance Committee | Ms. Joyce has served as a member of our Board since August 2021. She currently serves as an independent advisor to select high growth organizations in the healthcare and consumer space, and co-founder and CEO or Duckbill Technnologies, Inc., a consumer tech startup, a role she has held since April 2022. Previously, from September 2019 to April 2022, Ms. Joyce served as Chief Operating Officer and Executive Vice President of Platform at Oscar Health, a high-growth health tech and health insurance company, where she led operations, technology, clinical, marketing, and new business lines.

Prior to joining Oscar Health, from 2013 to 2019, Ms. Joyce has held several leadership roles at Uber Technologies, most recently as Regional General Manager of the United States and Canada. Ms. Joyce has previously served as a Senior Policy Advisor at the United States Department of the Treasury, an investor at Bain Capital, and a consultant at Bain & Company.

Ms. Joyce currently serves as a member of the Board of Directors of The Boston Beer Company. She holds an M.B.A degree from Harvard Business School and an A.B. degree in History from Harvard College.

We believe that Ms. Joyce is qualified to serve as a member of our Board due to her extensive experience in business strategy, managing growth, financial modeling, implementation of new technologies, and management and retention of diverse employee groups. | |

Samir Kaul

General Partner at Khosla Ventures

Current Committee Assignments:

• Compensation Committee | Mr. Kaul has served as a member of our Board since April 2014. Mr. Kaul has been a General Partner at Khosla Ventures, a venture capital firm focusing on technology investing, since February 2006.

Mr. Kaul currently serves as a member of the Board of Directors of Khosla Ventures Acquisition Co., which is a special purpose acquisition company. Previously, Mr. Kaul served as a member of the Board of Directors of Vicarious Surgical Inc. from January 2018 to October 2022, Khosla Ventures Acquisition Co. II from March 2021 to November 2021 (merged with Nextdoor Holdings Inc.), Gevo, Inc. from March 2013 to May 2014 and Amyris, Inc. from May 2006 to May 2012. Prior to that, Mr. Kaul was a member of Flagship Pioneering Inc., a venture capital firm, from June 2002 to May 2006. Prior to that, Mr. Kaul worked at the Institute for Genomic Research. Mr. Kaul holds a B.S. degree in Biology from the University of Michigan, an M.S. degree in Biochemistry from the University of Maryland and an M.B.A. degree from Harvard Business School.

We believe that Mr. Kaul is qualified to serve as a member of our Board due to his wide-ranging experience in technology companies and insight in the management of startup companies and the building of companies from early stage to commercial scale. | |

26

Information about Other Directors Not Standing for Election at this Meeting

Directors who will continue to serve after the Annual Meeting are listed below.

Class III Director with Term Expiring at the 2024 Annual Meeting

Helmy Eltoukhy

Co-Chief Executive Officer at Guardant Health, Inc. | Dr. Eltoukhy is our co-founder and has served as our CEO and a member of our Board since January 2013. On August 5, 2021, Dr. Eltoukhy was appointed as Chairperson of our Board and Co-CEO.