As filed with the Securities and Exchange Commission on November 28, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22842

FORUM FUNDS II

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2015 – September 30, 2016

ITEM 1. REPORT TO STOCKHOLDERS.

BAYWOOD VALUEPLUS FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited) SEPTEMBER 30, 2016 |

Dear Shareholder,

We are pleased to report our economic and financial market perspectives and the investment activities for the Baywood ValuePlus Fund (the "Fund") for the ten months ended September, 2016. The Fund is a large-capitalization value fund that purchases primarily dividend-paying companies traded on U.S. exchanges and uses SKBA Capital Management's ("SKBA") Relative Dividend Yield (RDY) discipline as the initial valuation framework. We believe that RDY points out attractive investment opportunities, not simply among companies with above-average dividend yield, but just as importantly among stocks for which low expectations are already discounted into their valuations at the time of purchase. This provides the potential for attractive capital appreciation opportunities, while offering desirable downside protection.

The ten month period ending September 2016 marked a new regime in the market. The robust market advances of the prior years abated and we have begun a period marked with uncertainty which precipitates wild market swings at just the slightest hint of disappointment. This was twice on display in 2016. The first instance occurred in the first month and a half of the year when the broad market lost as much as 12%. What struck us, however, was the nature of the sell-off not just the sell-off itself. A number of high-flying stocks responsible for advancing the indexes over the last 5-7 years, companies like Facebook, Amazon, Netflix and Google (Alphabet) declined the most, as did other, less recognizable, highly valued companies. At the same time companies we tend to favor and own suddenly came into favor. These less exciting, stable, high cash flow yielding, yet out-of-favor companies declined much less than the recent high-flyers. During these early weeks of the year the Baywood ValuePlus fund outperformed its benchmarks meaningfully.

Not surprisingly, sectors commonly believed to be "defensive", many of which have high dividend yields like utilities and telecom also outperformed. We happen to be underweight telecom and utilities for the opposite reason so many others find them attractive. The historical tendency of these sectors to be defensive in periods of extreme volatility coupled with low worldwide investment yields has resulted in extraordinary demand for these expensive yet relatively high-yielding investments. Global bond substitution effects in the search for yield have resulted in valuations inconsistent with what we view as generally poor company fundamentals. As value investors having experienced many cycles, we can confidently state that market regimes change over time. Yesterday's low beta, low volatility, defensive, perceived to be safe investments are often tomorrow's blow-ups. Electric utilities, for example, are currently more highly valued than they arguably have ever been while their dividend yields are near record lows for the industry. Out-of-favor, they are not. But what about fundamentals? Are the high valuations associated with improving fundamentals? With valuations at record highs and dividend yields at record lows, what are investors paying for if not extraordinary fundamental improvement? Alas, this is where we take exception. The utility business model is under pressure from more efficient households and enterprises. Power demand as a function of GDP is at an all-time low, with conceivably more room to squeeze out efficiencies. Renewable resources put strain on the grid as well as lower the price of electricity without commensurate decreases in cost. Furthermore, with the recent strides in storage technology (batteries), prospective profitability looks to decrease, not increase.

This is where we differ from many of our contemporaries. As value investors we simply look for stocks that are out-of-favor, where the relative dividend yield is high due to a depressed stock price, not purely by dividend policy. Dividend policies in and of themselves can be highly misleading. For example, before the crash in oil prices, several exploration and production companies that have no business paying a dividend, let alone one high enough to be attractive, had high absolute dividend yields. This was not due to their stock prices being depressed or their cash flows being in excess of their capital needs, it was due to managements trying to appeal to a certain investor base looking for yield. When the price of the commodity dropped and no offsetting business like refining was able to mitigate losses tied to production; dividends had to be slashed and with it went the price of their shares.

Instead we look for sustainable businesses, often with market leading positions in their respective industries that have strong enough balance sheets to support a healthy dividend policy and have become temporarily out-of-favor. Companies like Packaging Corp, Albemarle, Baxter and Chubb all contributed meaningfully in recent months, yet would not otherwise be considered "defensive" under recently accepted definitions. These companies' historic betas may have been somewhat elevated at time of purchase, and would not have typically fit in a "low-vol" strategy, yet in fact proved to be much more defensive due to valuations low enough to provide downside protection and capture market upside during a recovery.

Market regimes change and what was true last year may no longer be this year. In the latter half of the fund's fiscal year, utility stocks began to fall out of favor. Bond substitution, the only leg upon which such securities were priced, vanished with the Fed signaling a change in policy. Technical factors driving up prices of traditionally high yielding sectors ceased, which helped contribute meaningfully to the fund's returns over the second half of the fiscal year. ValuePlus' absolute returns will not always keep up with very robust market advances as we experienced between 2012 and 2014. Under more normal environments and those with heightened volatility as we recently experienced, the increase in our investment opportunity set resulted in the fund performing

BAYWOOD VALUEPLUS FUNDA MESSAGE TO OUR SHAREHOLDERS (Unaudited) SEPTEMBER 30, 2016 |

very well in its Morningstar Large Cap Value category over this past year. Following an unprecedented period of consecutive yearly increases in the stock market, it is unlikely that returns in the future will be as strong as they have been. The market regime has shifted. To investors like ourselves, however, the uncertainty of myriad geo-political and economic events worldwide is likely to continue to offer an increased investment opportunity set. As such, we should continue to find attractive investment prospects in the foreseeable future.We look forward to reporting to you in our semi-annual shareholder letter in another few months.

For more detailed information on SKBA Capital Management, LLC and our investment process and perspectives, visit our website at www.SKBA.com.

Current and future portfolio holdings are subject to change and risk.

The Morningstar category is used to compare fund performance to its peers. It is not possible to invest directly into an index or category. Past performance is no guarantee of future results.

Risk Considerations: Mutual fund investing involves risk, including the possible loss of principal. The Fund primarily invests in undervalued securities, which may not appreciate in value as anticipated by the Advisor or remain undervalued for longer than anticipated. The Fund may invest in American Depositary Receipts (ADRs), which involves risks relating to political, economic or regulatory conditions in foreign countries and may cause greater volatility and less liquidity. The Fund may also invest in convertible securities and preferred stock, which may be adversely affected as interest rates rise.

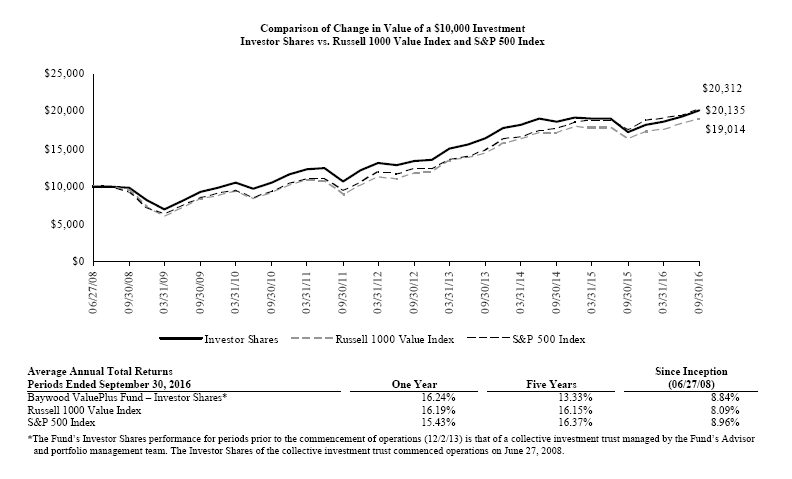

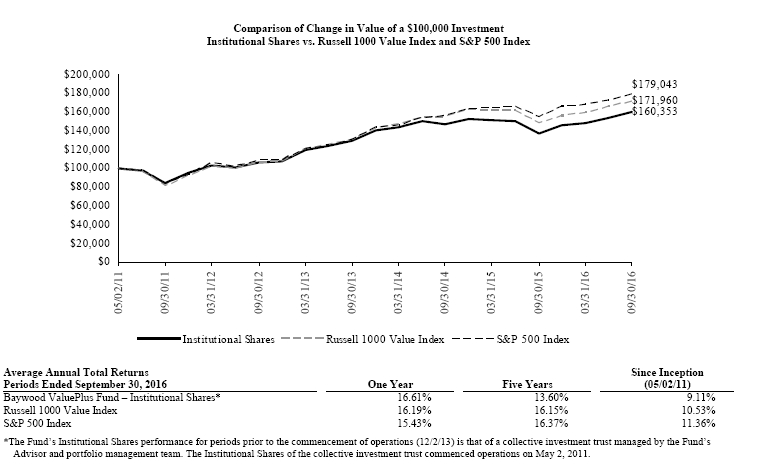

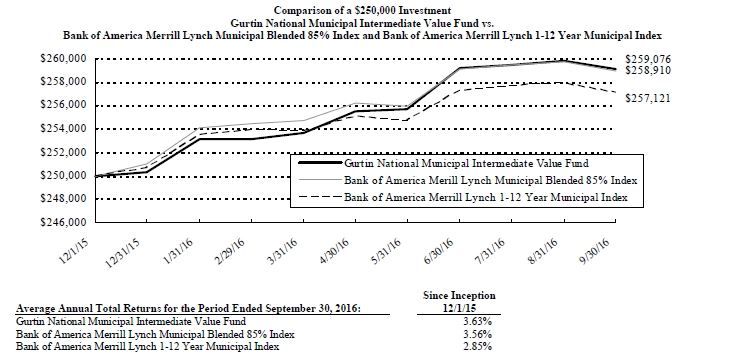

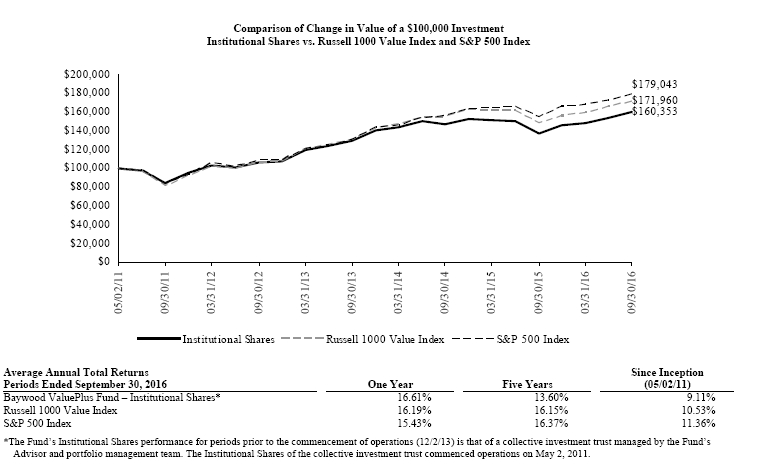

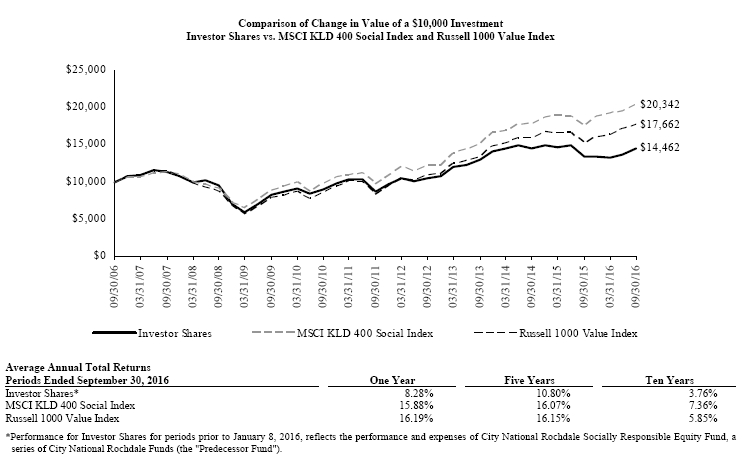

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (855) 409-2297. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Investor Shares and Institutional Shares are 5.80% and 2.09%, respectively. However, the Fund's advisor has agreed to contractually waive its fees and/or reimburse expenses such that total operating expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) do not exceed 0.95% and 0.70% for Investor Shares and Institutional Shares, respectively through March 31, 2017 (the "Expense Cap"). The Fund may repay the Advisor for fees waived and expenses reimbursed pursuant to the expense cap if such payment is made within three years of the fee waiver or expense reimbursement, is approved by the Fund's Board of Trustees, and the reimbursement does not cause the Fund's net annual operating expenses of that class to exceed the expense cap in place at the time the fees were waived. During the period, certain fees were waived and/or expenses reimbursed, otherwise returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

| | 275 | | Baxter International, Inc. | $ | 13,090 | |

| | 100 | | Becton Dickinson and Co. | | 17,973 | |

| | 800 | | Eli Lilly & Co. | | 64,208 | |

| | 1,000 | | HealthSouth Corp. | | 40,570 | |

| | 200 | | Johnson & Johnson | | 23,626 | |

| | 1,100 | | Koninklijke Philips NV, ADR | | 32,549 | |

| | | 242,472 | |

| Technology - 15.0% |

| | 2,100 | | Cisco Systems, Inc. | | 66,612 | |

| | 500 | | Harris Corp. | | 45,805 | |

| | 200 | | International Business Machines Corp. | | 31,770 | |

| | 1,200 | | Microsoft Corp. | | 69,120 | |

| | 800 | | QUALCOMM, Inc. | | 54,800 | |

| | 700 | | TE Connectivity, Ltd. | | 45,066 | |

| | 300 | | Texas Instruments, Inc. | | 21,054 | |

| | | 334,227 | |

| Telecommunications - 2.3% |

| | 1,000 | | Verizon Communications, Inc. | | 51,980 | |

| | | | |

| Transportation - 0.9% |

| | 300 | | CH Robinson Worldwide, Inc. | | 21,138 | |

| | | | |

| Utilities - 1.2% |

| | 800 | | Exelon Corp. | | 26,632 | |

| | | | |

Total Common Stock (Cost $1,966,412) | | 2,137,270 | |

| Money Market Fund - 5.0% |

| | 111,214 | | Federated Government Obligations Fund, 0.27% (a) (Cost $111,214) | | 111,214 | |

| | | | |

Total Investments - 100.6% (Cost $2,077,626)* | $ | 2,248,484 | |

| Other Assets & Liabilities, Net – (0.6)% | | (14,169 | ) |

| Net Assets – 100.0% | $ | 2,234,315 | |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| (a) | Variable rate security. Rate presented is as of September 30, 2016. |

* Cost for federal income tax purposes is $2,102,642 and net unrealized appreciation consists of:

| Gross Unrealized Appreciation | | $ | 206,343 | |

| Gross Unrealized Depreciation | | | (60,501 | ) |

| Net Unrealized Appreciation | | $ | 145,842 | |

The following is a summary of the inputs used to value the Fund's investments as of September 30, 2016.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| Valuation Inputs | | Investments in Securities |

| Level 1 - Quoted Prices | | $ | 2,137,270 | |

| Level 2 - Other Significant Observable Inputs | | | 111,214 | |

| Level 3 - Significant Unobservable Inputs | | | - | |

| Total | | $ | 2,248,484 | |

The Level 1 value displayed in this table is Common Stock. The Level 2 value displayed in this table is a Money Market Fund. Refer to this Schedule of Investments for a further breakout of each security by industry.

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the period ended September 30, 2016.

| PORTFOLIO HOLDINGS | | |

| % of Total Investments | | |

| Basic Materials | 8.1 | % |

| Capital Goods / Industrials | 10.4 | % |

| Consumer Cyclicals | 4.5 | % |

| Consumer Staples | 7.4 | % |

| Energy | 15.3 | % |

| Financials | 19.2 | % |

| Health Care | 10.8 | % |

| Technology | 14.9 | % |

| Telecommunications | 2.3 | % |

| Transportation | 0.9 | % |

| Utilities | 1.2 | % |

| Money Market Fund | 5.0 | % |

| | 100.0 | % |

| ASSETS | | | | |

| . | Total investments, at value (Cost $2,077,626) | | $ | 2,248,484 | |

| | Receivables: | | | | |

| | | Fund shares sold | | | 2,404 | |

| | | Investment securities sold | | | 3,074 | |

| | | Dividends | | | 2,666 | |

| | | From investment advisor | | | 8,044 | |

| | Prepaid expenses | | | 9,448 | |

| Total Assets | | | 2,274,120 | |

| | | | | | | |

| LIABILITIES | | | | |

| | Payables: | | | | |

| | | Investment securities purchased | | | 13,143 | |

| | Accrued Liabilities: | | | | |

| | | Fund services fees | | | 4,281 | |

| | | Other expenses | | | 22,381 | |

| Total Liabilities | | | 39,805 | |

| | | | | | | |

| NET ASSETS | | $ | 2,234,315 | |

| | | | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| | Paid-in capital | | $ | 2,048,032 | |

| | Undistributed net investment income | | | 4,234 | |

| | Accumulated net realized gain | | | 11,191 | |

| | Net unrealized appreciation | | | 170,858 | |

| NET ASSETS | | $ | 2,234,315 | |

| | | | | | | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | | |

| | Investor Shares | | | 109,420 | |

| | Institutional Shares | | | 34,363 | |

| | | | | | | |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | | | | |

| | Investor Shares (based on net assets of $1,698,610) | | $ | 15.52 | |

| | Institutional Shares (based on net assets of $535,705) | | $ | 15.59 | |

| See Notes to Financial Statements. | 7 | |

| | | | December 1, 2015 | | | For the Year |

| | | | Through | | | Ended |

| INVESTMENT INCOME | | | September 30, 2016* | | | November 30, 2015 |

| | Dividend income (Net of foreign withholding taxes of $125 and $469, respectively) | . | | $ | 47,743 | | | | $ | 287,641 | |

| Total Investment Income | | | | 47,743 | | | | | 287,641 | |

| | | | | | | | | | | |

| EXPENSES | | | | | | | | | | |

| | Investment advisor fees | | | 7,909 | | | | | 49,163 | |

| | Fund services fees | | | 51,532 | | | | | 80,000 | |

| | Transfer agent fees: | | | | | | | | | |

| | Investor Shares | | | 15,150 | | | | | 18,180 | |

| | Institutional Shares | | | 15,150 | | | | | 18,180 | |

| | Distribution fees: | | | | | | | | | |

| | Investor Shares | | | 2,967 | | | | | 3,514 | |

| | Custodian fees | | | 5,633 | | | | | 5,000 | |

| | Registration fees: | | | | | | | | | |

| | Investor Shares | | | 13,054 | | | | | 13,663 | |

| | Institutional Shares | | | 13,083 | | | | | 13,397 | |

| | Professional fees | | | 24,637 | | | | | 34,391 | |

| | Trustees' fees and expenses | | | 2,519 | | | | | 2,587 | |

| | Miscellaneous expenses | | | 17,219 | | | | | 19,822 | |

| Total Expenses | | | | 168,853 | | | | | 257,897 | |

| | Fees waived and expenses reimbursed | | | (154,812 | ) | | | | (185,556 | ) |

| Net Expenses | | | | 14,041 | | | | | 72,341 | |

| | | | | | | | | | | | |

| NET INVESTMENT INCOME | | | | 33,702 | | | | | | 215,300 | |

| | | | | | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | | | | | | | |

| | Net realized gain on investments | | | 54,453 | | | | | 1,216,102 | |

| | Net change in unrealized appreciation (depreciation) on investments | | | 75,799 | | | | | | (2,370,562 | ) |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | 130,252 | | | | | | | (1,154,460 | ) |

| INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | $ | 163,954 | | | | $ | (939,160 | ) |

| See Notes to Financial Statements. | 8 | |

BAYWOOD VALUEPLUS FUNDSTATEMENTS OF CHANGES IN NET ASSETS |

| | | | | December 1, 2015 Through September 30, 2016* | | | For the Year Ended November 30, 2015 | | December 2, 2013** Through November 30, 2014 | |

| OPERATIONS | | | | | | | | | | | | | | |

| | Net investment income | | $ | 33,702 | | | | $ | 215,300 | | | $ | 268,748 | | |

| | Net realized gain | | | 54,453 | | | | | 1,216,102 | | | | 900,291 | | |

| | Net change in unrealized appreciation (depreciation) | | | 75,799 | | | | | (2,370,562 | ) | | | 93,057 | | |

| Increase (Decrease) in Net Assets Resulting from Operations | | | 163,954 | | | | | (939,160 | ) | | | 1,262,096 | | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | |

| | Net investment income: | | | | | | | | | | | | | | |

| | | Investor Shares | | | (184,835 | ) | | | | (21,548 | ) | | | (4,507 | ) | |

| | | Institutional Shares | | | (59,920 | ) | | | | (215,813 | ) | | | (25,497 | ) | |

| | Net realized gain: | | | | | | | | | | | | | | |

| | | Investor Shares | | | (30,026 | ) | | | | (106,575 | ) | | | - | | |

| | | Institutional Shares | | | (9,339 | ) | | | | (795,111 | ) | | | - | | |

| Total Distributions to Shareholders | | | (284,120 | ) | | | | (1,139,047 | ) | | | (30,004 | ) | |

| | | | | | | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | | | | | | | |

| | Sale of shares: | | | | | | | | | | | | | | |

| | | Investor Shares | | | 222,661 | | | | | - | | | | 2,156,450 | | |

| | | Institutional Shares | | | 82,490 | | | | | 1,666,328 | | | | 12,143,951 | | |

| | Reinvestment of distributions: | | | | | | | | | | | | | | |

| | | Investor Shares | | | 214,861 | | | | | 128,123 | | | | 4,507 | | |

| | | Institutional Shares | | | 69,259 | | | | | 1,010,924 | | | | 25,497 | | |

| | Redemption of shares: | | | | | | | | | | | | | | |

| | | Investor Shares | | | (4,481 | ) | | | | (54,025 | ) | | | (841,210 | ) | |

| | | Institutional Shares | | | (17,824 | ) | | | | (11,423,874 | ) | | | (2,183,041 | ) | |

| Increase (Decrease) in Net Assets from Capital Share Transactions | | 566,966 | | | | | (8,672,524 | ) | | | 11,306,154 | | |

| Increase (Decrease) in Net Assets | | | 446,800 | | | | | (10,750,731 | ) | | | 12,538,246 | | |

| | | | | | | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | | | | | | |

| | Beginning of Period | | | 1,787,515 | | | | | 12,538,246 | | | | - | | |

| | End of Period (Including line (a)) | | $ | 2,234,315 | | | | $ | 1,787,515 | | | $ | 12,538,246 | | |

| | | | | | | | | | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | | | | | | | |

| | Sale of shares: | | | | | | | | | | | | | | |

| | | Investor Shares | | | 14,548 | | | | | - | | | | 123,329 | | |

| | | Institutional Shares | | | 5,823 | | | | | 95,363 | | | | 687,361 | | |

| | Reinvestment of distributions: | | | | | | | | | | | | | | |

| | | Investor Shares | | | 14,608 | | | | | 7,383 | | | | 254 | | |

| | | Institutional Shares | | | 4,691 | | | | | 57,782 | | | | 1,428 | | |

| | Redemption of shares: | | | | | | | | | | | | | | |

| | | Investor Shares | | | (299 | ) | | | | (3,097 | ) | | | (47,306 | ) | |

| | | Institutional Shares | | | (1,208 | ) | | | | (697,866 | ) | | | (119,011 | ) | |

| Increase (Decrease) in Shares | | | 38,163 | | | | | (540,435 | ) | | | 646,055 | | |

| | | | | | | | | | | | | | | | | |

| (a) | Undistributed net investment income | | $ | 4,234 | | | | $ | 210,999 | | | | $ | 237,355 | | |

* | Effective March 24, 2016, the Fund changed its fiscal year end from November 30 to September 30. |

| ** | Commencement of Operations. |

| See Notes to Financial Statements. | 9 | |

| These financial highlights reflect selected data for a share outstanding throughout each period. |

| | | For the Period Ended September 30, 2016(a) | | For the Year Ended November 30, 2015 | | December 2, 2013 (b) through November 30, 2014 | |

| INVESTOR SHARES | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Period | $ | 16.90 | | | $ | 19.28 | | | $ | 17.47 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | |

| Net investment income (c) | | 0.26 | | | | 0.34 | | | | 0.36 | | |

| Net realized and unrealized gain (loss) | | 0.93 | | | | (1.06 | ) | | | 1.49 | | |

| Total from Investment Operations | | 1.19 | | | | (0.72 | ) | | | 1.85 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | |

| Net investment income | | (2.20 | ) | | | (0.26 | ) | | | (0.04 | ) | |

| Net realized gain | | (0.37 | ) | | | (1.40 | ) | | | — | | |

| Total Distributions to Shareholders | | (2.57 | ) | | | (1.66 | ) | | | (0.04 | ) | |

| NET ASSET VALUE, End of Period | $ | 15.52 | | | $ | 16.90 | | | $ | 19.28 | | |

| TOTAL RETURN | | 8.40 | %(d) | (3.86 | )% | | 10.59 | %(d) |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | |

| Net Assets at End of Period (000's omitted) | $1,699 | | | $1,362 | | | $1,471 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | |

| Net investment income | | 2.07 | %(e) | 1.97 | % | | 1.98 | %(e) |

| Net expenses | | 0.95 | %(e) | 0.95 | % | | 0.95 | %(e) |

| Gross expenses (f) | | 9.43 | %(e) | 5.80 | % | | 4.54 | %(e) |

| PORTFOLIO TURNOVER RATE | | 22 | %(d) | 32 | % | | 35 | %(d) |

| | | | | | | | | | | | | | |

| | |

| (a) | Effective March 24, 2016, the Fund changed its fiscal year end from November 30 to September 30. The information presented is for the period December 1, 2015 through September 30, 2016. |

| (b) | Commencement of operations. |

| (c) | Calculated based on average shares outstanding during each period. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

| See Notes to Financial Statements. | 10 | |

| These financial highlights reflect selected data for a share outstanding throughout each period. |

| | | For the Period Ended September 30, 2016(a) | | For the Year Ended November 30, 2015 | | December 2, 2013 (b) Through November 30, 2014 | |

| INSTITUTIONAL SHARES | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Period | $ | 17.00 | | | $ | 19.42 | | | $ | 17.56 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | |

| Net investment income (c) | | 0.29 | | | | 0.39 | | | | 0.41 | | |

| Net realized and unrealized gain (loss) | | 0.94 | | | | (1.06 | ) | | | 1.50 | | |

| Total from Investment Operations | | 1.23 | | | | (0.67 | ) | | | 1.91 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | |

| Net investment income | | (2.27 | ) | | | (0.35 | ) | | | (0.05 | ) | |

| Net realized gain | | (0.37 | ) | | | (1.40 | ) | | | — | | |

| Total Distributions to Shareholders | | (2.64 | ) | | | (1.75 | ) | | | (0.05 | ) | |

| NET ASSET VALUE, End of Period | $ | 15.59 | | | $ | 17.00 | | | $ | 19.42 | | |

| TOTAL RETURN | | 8.65 | %(d) | (3.58 | )% | | 10.87 | %(d) |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | |

| Net Assets at End of Period (000's omitted) | $536 | | | $426 | | | $11,067 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | |

| Net investment income | | 2.30 | %(e) | 2.23 | % | | 2.26 | %(e) |

| Net expenses | | 0.70 | %(e) | 0.70 | % | | 0.70 | %(e) |

| Gross expenses (f) | | 14.43 | %(e) | 2.09 | % | | 2.50 | %(e) |

| PORTFOLIO TURNOVER RATE | | 22 | %(d) | 32 | % | | 35 | %(d) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| (a) | Effective March 24, 2016, the Fund changed its fiscal year end from November 30 to September 30. The information presented is for the period December 1, 2015 through September 30, 2016. |

| (b) | Commencement of operations. |

| (c) | Calculated based on average shares outstanding during each period. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

| See Notes to Financial Statements. | 11 | |

BAYWOOD SOCIALLYRESPONSIBLE FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) SEPTEMBER 30, 2016 |

Dear Shareholder,

This letter covering the twelve months ended September 30, 2016 is SKBA Capital Management's ("SKBA") first regarding the economic and financial market perspectives and the investment activities for the Baywood SociallyResponsible Fund (the "Fund"). This report also marks a new chapter in the organization of the Fund as SKBA was pleased to be elected, effective January 8, 2016, the Advisor to the renamed Baywood SociallyResponsible Fund.

We have long desired to become the Advisor to the Fund in order to align our goals with those of our clients and shareholders through every aspect of fund management. During the transition, however, large client flows caused a material negative impact on Fund performance from November of 2015 through February of 2016. Yet SKBA has remained steadfast in its application of our investment approach to meet the needs of shareholders who want environmental, social, and governance (ESG) criteria applied to the stock selection decisions in the Fund and we are very excited at the Fund's prospects going forward. The Fund is a mid-to-large capitalization value-oriented portfolio of stock holdings selected from a universe of stocks created through the application of social screens and assessments of the ESG profile of each company. Among these stocks, we further evaluate and assess each prospective holding's valuation and fundamental business attraction to determine the current portfolio holdings.

As the new Advisor to the Fund we will do everything within our control to ensure we are aware of client commitments and intentions. Having completed the transition, we are looking forward to a fresh start as Advisor and as shareholders as well together with outside shareholders in the Fund. Additionally, we believe the Fund's return characteristics are more represented by the eight full months since the completion of the conversion.

In the most recently ended quarter, the Fund's returns meaningfully surpassed all of our benchmarks; a reminder that our investment horizons don't often match up with the clearly defined quarterly reporting that is commonplace. We manage for the long-term yet are measured in quarters. As value investors, there are periods of strong market advances where the Fund may not keep up; there are also periods in which the value of the securities we purchase tend to be unrecognized. These tend to be followed by periods in which those securities purchased do become recognized. Quite often those take place in times of either normal or volatile returns. While volatility may be difficult to "stomach", we seek it in order to take advantage of mis-pricings. The last year or so has been such an environment and we expect it to continue to provide opportunities over a considerable period.

During the recently ended quarter, consumer staples, an underperforming sector in the Russell 1000 Value Index, was flat in the benchmark. Not an unsurprising result given the high valuations and poor fundamentals. Our underweight position in this expensive sector contributed to returns as did the individual holdings which returned more than 4%. In a quarter where the portfolio outperformed in numerous ways, this sector's performance is more indicative of our valuation discipline and philosophy than of anything else. Consumer Staples, in general, are priced for perfection. The global hunt for yield and stability has pushed valuations to near record highs, reducing yields to record lows. Further, growth in the sector is pressured as emerging economies, once drivers of growth, slow down and pressure revenues. These two conditions make the decision to underweight an easy one, yet the two staple stocks the strategy does own - Pepsi and Procter & Gamble - were some of the two best performing stocks in the sector.

Both Pepsi and Procter & Gamble have divergent sets of fundamentals from other stocks in the sector. Where, on one pass, one might look at reported earnings and conclude they are expensive; normalizing the earnings yields a much different perspective. Procter & Gamble is recovering from years of underperformance as smaller, more focused companies willing to sacrifice margins for market share have eaten away at its lead. Yet it is in the process of completing its biggest change in strategy since the Gillette acquisition by divesting of nearly 2/3's of its slower growing, lower margin brands. The resulting company will be much more focused and the simple stemming of market share losses should result in large fundamental improvements. Pepsi, on the other hand has been widely successful in maintaining its market share in a competitive environment where carbonated, sugary drinks have lagged consumer preferences. Additionally, we have always liked its strategy of diversification with its snack foods segment. Indra Nooyi, to the extent that she is able, is shifting the company's beverage mix away from carbonated soft drinks and shifting its snacks mix to incorporate more healthy alternatives. This is not only good for consumer health and diets in general; it is also proving to be good for the company's financials. While the majority of stocks in the staples category suffer from high valuations and deteriorating fundamentals, these two companies have reasonable valuations and are showing improving fundamentals, which speaks to our philosophy. We don't chase sectors because somehow 'Value' has become defined or bound by certain sectors or stocks. We purchase stocks that are out-of-favor in which fundamentals aren't likely to be as bad as the valuation would suggest. It's not always what you invest in that will determine how you perform; it's also what you avoid. In this case, it was both.

Stocks in the utilities sector suffer from the same general condition as consumer staples, albeit to a much higher degree. Here, fundamentals are unambiguously poor and relative valuations are near stratospheric, the combination of which are the reasons we

BAYWOOD SOCIALLYRESPONSIBLE FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) SEPTEMBER 30, 2016 |

have no sector representation in the portfolio. This decision alone accounted for a large portion of the outperformance in the third quarter. Conversely, the decision to hold an overweight position in the Information Technology sector helped returns in addition to stock selection, the majority of which was from Qualcomm. Qualcomm is a stock whose valuation suggested it would be in perpetual decline despite the fact it holds a monopoly on the patents for most of the world's smart phones, a growing market. During the most recently ended quarter its fundamentals were proven to be "not as bad as feared" and its price recovered meaningfully off of multi-year lows. We initiated a position in Qualcomm two years ago and continued to add to our position as it declined through the earlier part of the year. Our conviction enabled us to lower our average purchase price all the way down to where the tiniest bit of good news propelled returns significantly.

Throughout the year we lowered our positions in financials and are currently underweight compared to the Russell 1000 Value Index. Overall our allocation to the sector contributed to returns, while a few stocks partially offset it. Our decision to underweight the sector came somewhat naturally when two of our holdings were acquired last year and we did not re-deploy the proceeds back into the sector as rate volatility persisted. Instead we increased positions elsewhere and held steady to our holdings in financials. That decision proved to be correct and in the most recent quarter as the companies we held were some of the most out-of-favor and a bit of reversion to the mean for Bank of America, Metlife and Kennedy Wilson's valuations led the group to an overall sector outperformance.

For most of the year markets have been volatile to say the least, which has proven beneficial for us value investors. While the benchmark averages continue to climb we're seeing more divergent valuations across sectors and individual stocks. This has led to an increase in activity in the portfolio. During the third quarter alone we added several new companies: Royal Philips, Discovery Communications, Range Resources and Radian Group. Phillips is a European conglomerate in the process of de-conglomerating and has underperformed for years as profitable divisions subsidized its loss-making businesses. Changes in management and a focus on industries with oligopoly structures within healthcare should boost profits as it divests its less profitable lighting divisions. Further, it is now a healthcare equipment manufacturing company that participates in some of the faster growing segments in the industry where valuation multiples tend to be much higher. A reasonable valuation and improving fundamentals point to a successful investment without having to make heroic assumptions.

Discovery is a new investment that follows a familiar theme: media stocks are cheap! We purchased Starz! several years ago because its valuation was suggestive that severe pricing pressures would persist, despite the fact that its shows were rejuvenated and gaining in popularity, the result of hiring a former HBO director. It needed to grow in order to increase its leverage in pricing negotiations, but even if it didn't its valuation was still too low, in our opinion. We didn't need to make heroic assumptions about Starz!, a successful investment that has agreed to merge with LionsGate and we don't need to make heroic assumptions about Discovery as its valuation is as similarly depressed.

Radian, another new addition from the portfolio provides mortgage insurance to individuals and financial institutions. It is a part of the solution in terms of the housing recovery and helps enable those without the ability to make down payments of 20%, a rarity in these days of high home values, to own a home. One of the major reasons for the protracted housing recovery is from the lack of buyers with credit good enough to purchase a home. This means that over the last 5-7 years, those with the ability to purchase a home have been in the highest tier of credit, which also means very low future losses for Radian. Its valuation still remains low as there have been fears of price competition in the industry, but with recent consolidation, those fears will likely subside.

Range Resources was also added in the third quarter as we reduced our holdings in Devon Energy. Devon was the top contributor in the third quarter and, as the strategy's largest energy related company, we are reducing the position to maintain our targeted exposure. Instead we are turning to Range Resources, whose production is geared towards NGLs and natural gas, much cleaner sources of energy and whose valuation has lagged its peers in the recent rally. Our goal in the energy sector is to remain underweight the benchmark while responsibly striking the proper balance between lower carbon emitters and attractive valuations. In the past this strategy detracted from returns as the cleaner segment of the energy industry has not performed particularly well from an investment perspective, but was rewarded in the most recent quarter as it added most to returns despite the underweight position in an outperforming sector.

For the twelve month period ending September 30, 2016, the Fund underperformed its benchmark, which includes significant deleterious effects from outflows that occurred prior to and during the transition of SKBA becoming Advisor to the Fund. The absence of such uncontrollable factors, factors we hope to contain going forward, combined with a market environment conducive to value investing have resulted in the Fund's improved returns over a number of months. We remain steadfast in our resolve to manage our shareholders' assets prudently. We believe the current environment and the heightened volatility associated with it lends itself to our value discipline; something that has been absent in the recent high absolute return environment At the same time,

BAYWOOD SOCIALLYRESPONSIBLE FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) SEPTEMBER 30, 2016 |

after nearly eight consecutive years of increasing stock prices, markets will not be forgiving of highly valued companies that disappoint. We will attempt to steer clear of those and continue our relentless search for value as we always have with capital preservation foremost, responsibly.

For more detailed information on SKBA Capital Management, LLC and our investment process and perspectives, visit our website at www.SKBA.com.

Current and future portfolio holdings are subject to change and risk.

The Russell 1000 Value Index is used to compare fund performance to its peers. It is not possible to invest directly into an index or category. Past performance is no guarantee of future results.

Risk Considerations: Mutual fund investing involves risk, including the possible loss of principal. Socially responsible investment criteria may limit the number of investment opportunities available to the Fund or it may invest a larger portion of its assets in certain sectors which could be more sensitive to market conditions, economic, regulatory and environmental developments. These factors could negatively impact the Fund's returns. The Fund primarily invests in undervalued securities, which may not appreciate in value as anticipated by the Advisor or remain undervalued for longer than anticipated. The Fund may invest in American Depositary Receipts (ADRs), which involves risks relating to political, economic or regulatory conditions in foreign countries and may cause greater volatility and less liquidity. The Fund may also invest in convertible securities and preferred stock, which may be adversely affected as interest rates rise.

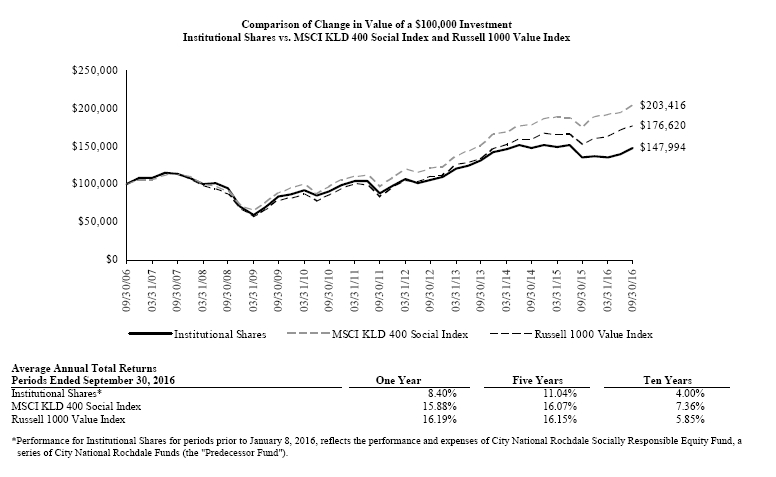

BAYWOOD SOCIALLYRESPONSIBLE FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) SEPTEMBER 30, 2016 |

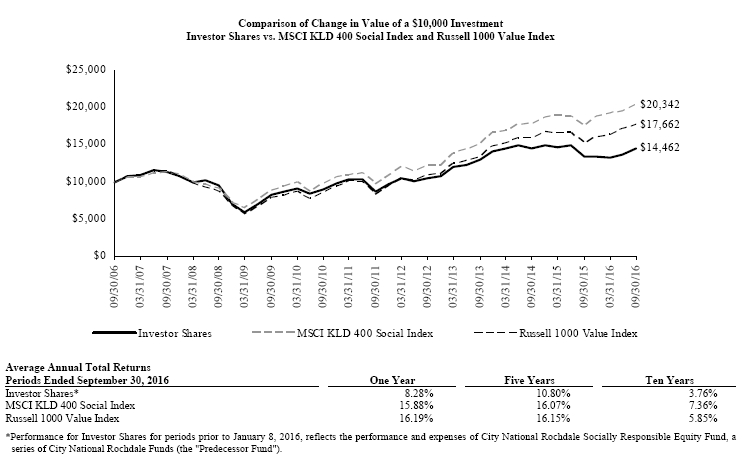

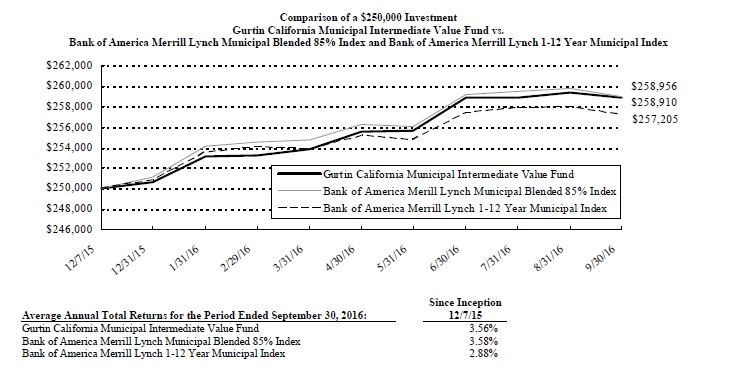

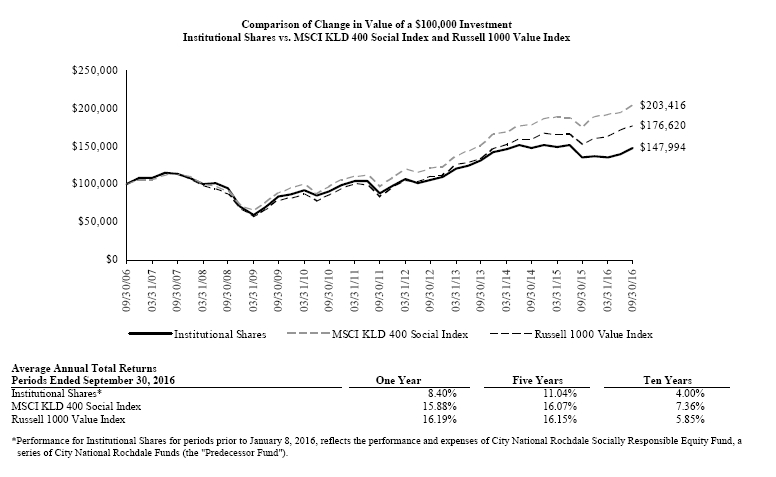

The following charts reflect the change in the value of a hypothetical $10,000 investment in Investor Shares and $100,000 investment in Institutional Shares, including reinvested dividends and distributions, in Baywood SociallyResponsible Fund (the "Fund") compared with the performance of the primary benchmark, MSCI KLD 400 Social Index and Russell 1000 Value Index, over the past ten fiscal years. The MSCI KLD 400 Social Index is a capitalization weighted index of 400 US securities that provides exposure to companies with outstanding Environmental, Social and Governance ratings and excludes companies whose products have negative social or environmental impacts. The Russell 1000 Value Index is an unmanaged index which measures the performance of the large-cap value segment of the Russell 1000 companies (that is, the 1,000 largest U.S. companies in terms of market capitalization) with lower price-to-book ratios and lower forecasted growth values. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The total return of both the MSCI KLD 400 Social Index and Russell 1000 Value Index include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the MSCI KLD 400 Social Index and Russell 1000 Value Index do not include expenses. The Fund is professionally managed, while the MSCI KLD 400 Social Index and Russell 1000 Value Index are unmanaged and are not available for investment.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (855) 409-2297. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Investor Shares and Institutional Shares are 1.22% and 0.85%, respectively. However, the Fund's advisor has agreed to contractually waive its fees and/or reimburse expenses such that total operating expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) do not exceed 1.14% and 0.89% for Investor Shares and Institutional Shares, respectively through December 31, 2017 (the "Expense Cap"). The Fund may repay the Advisor for fees waived and expenses reimbursed pursuant to the expense cap if such payment is made within three years of the fee waiver or expense reimbursement, is approved by the Fund's Board of Trustees, and the reimbursement does not cause the Fund's net annual operating expenses of that class to exceed the expense cap in place at the time the fees were waived. During the period, certain fees were waived and/or expenses reimbursed, otherwise returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

BAYWOOD SOCIALLYRESPONSIBLE FUND SCHEDULE OF INVESTMENTS SEPTEMBER 30, 2016 |

| Shares | | Security Description | | Value | |

| Common Stock - 93.4% |

| Basic Materials - 5.1% |

| | 1,300 | | Albemarle Corp. | $ | 111,137 | |

| | 5,300 | | Packaging Corp. of America | | 430,678 | |

| | 10,100 | | The Mosaic Co. | | 247,046 | |

| | | 788,861 | |

| Capital Goods / Industrials - 9.9% |

| | 8,338 | | Johnson Controls International PLC | | 387,967 | |

| | 8,200 | | Republic Services, Inc. | | 413,690 | |

| | 1,800 | | Stanley Black & Decker, Inc. | | 221,364 | |

| | 2,100 | | Union Pacific Corp. | | 204,813 | |

| | 11,600 | | USG Corp. (a) | | 299,860 | |

| | | 1,527,694 | |

| Consumer Discretionary - 10.9% |

| | 9,000 | | AutoNation, Inc. (a) | | 438,390 | |

| | 7,400 | | Discovery Communications, Inc., Class C (a) | | 194,694 | |

| | 21,900 | | Ford Motor Co. | | 264,333 | |

| | 16,800 | | Starz, Class A (a) | | 523,992 | |

| | 10,700 | | Twenty-First Century Fox, Inc., Class B | | 264,718 | |

| | | 1,686,127 | |

| Consumer Staples - 4.3% |

| | 3,400 | | PepsiCo, Inc. | | 369,818 | |

| | 3,300 | | The Procter & Gamble Co. | | 296,175 | |

| | | 665,993 | |

| Energy - 9.0% |

| | 14,100 | | Cabot Oil & Gas Corp. | | 363,780 | |

| | 2,600 | | ConocoPhillips | | 113,022 | |

| | 11,000 | | Devon Energy Corp. | | 485,210 | |

| | 8,600 | | National Oilwell Varco, Inc. | | 315,964 | |

| | 3,000 | | Range Resources Corp. | | 116,250 | |

| | | 1,394,226 | |

| Financials - 20.9% |

| | 13,100 | | Air Lease Corp. | | 374,398 | |

| | 6,400 | | American Express Co. | | 409,856 | |

| | 7,100 | | American International Group, Inc. | | 421,314 | |

| | 30,900 | | Bank of America Corp. | | 483,585 | |

| | 1,000 | | Berkshire Hathaway, Inc., Class B (a) | | 144,470 | |

| | 3,300 | | BOK Financial Corp. | | 227,601 | |

| | 9,150 | | Brookfield Asset Management, Inc., Class A | | 321,897 | |

| | 2,700 | | M&T Bank Corp. | | 313,470 | |

| | 6,500 | | MetLife, Inc. | | 288,795 | |

| | 17,700 | | Radian Group, Inc. | | 239,835 | |

| | | 3,225,221 | |

| Health Care - 16.4% |

| | 5,600 | | AbbVie, Inc. | | 353,192 | |

| | 6,185 | | Baxter International, Inc. | | 294,406 | |

| | 2,600 | | Becton Dickinson and Co. | | 467,298 | |

| Shares | | Security Description | | Value | |

| | 5,700 | | DaVita, Inc. (a) | $ | 376,599 | |

| | 1,900 | | Gilead Sciences, Inc. | | 150,328 | |

| | 11,200 | | HealthSouth Corp. | | 454,384 | |

| | 14,900 | | Koninklijke Philips NV, ADR | | 440,891 | |

| | | 2,537,098 | |

| Technology - 15.0% |

| | 12,900 | | Cisco Systems, Inc. | | 409,188 | |

| | 15,300 | | Corning, Inc. | | 361,845 | |

| | 1,200 | | International Business Machines Corp. | | 190,620 | |

| | 6,100 | | Microsoft Corp. | | 351,360 | |

| | 5,400 | | Oracle Corp. | | 212,112 | |

| | 7,300 | | QUALCOMM, Inc. | | 500,050 | |

| | 4,400 | | TE Connectivity, Ltd. | | 283,272 | |

| | | 2,308,447 | |

| Telecommunications - 1.9% |

| | 5,500 | | Verizon Communications, Inc. | | 285,890 | |

| | | | |

Total Common Stock (Cost $13,617,977) | | 14,419,557 | |

| Money Market Fund - 6.7% |

| | 1,033,572 | | Morgan Stanley Institutional Liquidity Fund, 0.31% (b) (Cost $1,033,572) | | 1,033,572 | |

| | | | |

Total Investments - 100.1% (Cost $14,651,549)* | $ | 15,453,129 | |

| Other Assets & Liabilities, Net – (0.1)% | | (7,871 | ) |

| Net Assets – 100.0% | $ | 15,445,258 | |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| (a) | Non-income producing security. |

| (b) | Variable rate security. Rate presented is as of September 30, 2016. |

* Cost for federal income tax purposes is $15,631,664 and net unrealized depreciation consists of:

| Gross Unrealized Appreciation | | $ | 506,512 | |

| Gross Unrealized Depreciation | | | (685,047 | ) |

| Net Unrealized Depreciation | | $ | (178,535 | ) |

The following is a summary of the inputs used to value the Fund's investments as of September 30, 2016.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| Valuation Inputs | | Investments in Securities |

| Level 1 - Quoted Prices | | $ | 14,419,557 | |

| Level 2 - Other Significant Observable Inputs | | | 1,033,572 | |

| Level 3 - Significant Unobservable Inputs | | | - | |

| Total | | $ | 15,453,129 | |

The Level 1 value displayed in this table is Common Stock. The Level 2 value displayed in this table is a Money Market Fund. Refer to this Schedule of Investments for a further breakout of

See Notes to Financial Statements. | 17 | |

BAYWOOD SOCIALLYRESPONSIBLE FUND SCHEDULE OF INVESTMENTS SEPTEMBER 30, 2016 |

each security by industry.

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level Level 1, Level 2 and Level 3 for the year ended September 30, 2016.

| PORTFOLIO HOLDINGS | | |

| % of Total Investments | | |

| Basic Materials | 5.1 | % |

| Capital Goods / Industrials | 9.9 | % |

| Consumer Discretionary | 10.9 | % |

| Consumer Staples | 4.3 | % |

| Energy | 9.0 | % |

| Financials | 20.9 | % |

| Health Care | 16.4 | % |

| Technology | 14.9 | % |

| Telecommunications | 1.9 | % |

| Money Market Fund | 6.7 | % |

| | 100.0 | % |

See Notes to Financial Statements. | 18 | |

BAYWOOD SOCIALLYRESPONSIBLE FUND STATEMENT OF ASSETS AND LIABILITIES SEPTEMBER 30, 2016 |

| ASSETS | | | | |

| . | Total investments, at value (Cost $14,651,549) | | $ | 15,453,129 | |

| | Cash | | | 893 | |

| | Receivables: | | | | |

| | | Fund shares sold | | | 2,487 | |

| | | Investment securities sold | | | 146,773 | |

| | | Dividends | | | 17,076 | |

| | Prepaid expenses | | | 3,193 | |

| Total Assets | | | 15,623,551 | |

| | | | | | | |

| LIABILITIES | | | | |

| | Payables: | | | | |

| | | Investment securities purchased | | | 145,565 | |

| | | Fund shares redeemed | | | 111 | |

| | Accrued Liabilities: | | | | |

| | | Investment advisor fees | | | 1,504 | |

| | | Trustees' fees and expenses | | | 40 | |

| | | Fund services fees | | | 5,530 | |

| | | Other expenses | | | 25,543 | |

| Total Liabilities | | | 178,293 | |

| | | | | | | |

| NET ASSETS | | $ | 15,445,258 | |

| | | | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| | Paid-in capital | | $ | 16,000,829 | |

| | Accumulated net realized loss | | | (1,357,151 | ) |

| | Net unrealized appreciation | | | 801,580 | |

| NET ASSETS | | $ | 15,445,258 | |

| | | | | | | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | | |

| | Investor Shares | | | 975,454 | |

| | Institutional Shares | | | 547,202 | |

| | | | | | | |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | | | | |

| | Investor Shares (based on net assets of $9,889,909) | | $ | 10.14 | |

| | Institutional Shares (based on net assets of $5,555,349) | | $ | 10.15 | |

See Notes to Financial Statements. | 19 | |

BAYWOOD SOCIALLYRESPONSIBLE FUND STATEMENT OF OPERATIONS YEAR ENDED SEPTEMBER 30, 2016 |

| INVESTMENT INCOME | | | | | | |

| | Dividend income (Net of foreign withholding taxes of $1,505) | . | | $ | 1,226,048 | | |

| Total Investment Income | | | | 1,226,048 | | |

| | | | | | | |

| EXPENSES | | | | | | |

| | Investment advisor fees | | | 419,145 | | |

| | Fund services fees | | | 101,552 | | |

| | Transfer agent fees: | | | | | |

| | Investor Shares | | | 13,515 | | |

| | Institutional Shares | | | 14,887 | | |

| | Distribution fees: | | | | | |

| | Investor Shares | | | 34,939 | | |

| | Custodian fees | | | 7,053 | | |

| | Registration fees: | | | | | |

| | Investor Shares | | | 7,769 | | |

| | Institutional Shares | | | 5,676 | | |

| | Professional fees | | | 23,734 | | |

| | Trustees' fees and expenses | | | 12,204 | | |

| | Miscellaneous expenses | | | 34,168 | | |

| Total Expenses | | | | 674,642 | | |

| | Fees waived and expenses reimbursed | | | (123,949 | ) | |

| Net Expenses | | | | 550,693 | | |

| | | | | | | | |

| NET INVESTMENT INCOME | | | | 675,355 | | |

| | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | | | |

| | Net realized loss on investments | | | (1,239,017 | ) | |

| | Net change in unrealized appreciation (depreciation) on investments | | | 15,453,930 | | |

| NET REALIZED AND UNREALIZED GAIN | | | | 14,214,913 | | |

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $ | 14,890,268 | | |

| | | | | | | | |

See Notes to Financial Statements. | 20 | |

BAYWOOD SOCIALLYRESPONSIBLE FUND STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | | | | | | | |

| | | | | For the Year Ended September 30, 2016 | | | For the Year Ended September 30, 2015 |

| OPERATIONS | | | | | | | | | |

| | Net investment income | | $ | 675,355 | | | | $ | 3,150,747 | |

| | Net realized gain (loss) | | | (1,239,017 | ) | | | | 2,738,120 | |

| | Net change in unrealized appreciation (depreciation) | | | 15,453,930 | | | | | (28,299,350 | ) |

| Increase (Decrease) in Net Assets Resulting from Operations | | | 14,890,268 | | | | | (22,410,483 | ) |

| | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | |

| | Net investment income: | | | | | | | | | |

| | | Investor Shares | | | (539,156 | ) | | | | (2,845,377 | ) |

| | | Institutional Shares | | | (213,418 | ) | | | | (240,990 | ) |

| | Net realized gain: | | | | | | | | | |

| | | Investor Shares | | | (1,155,096 | ) | | | | (5,652,223 | ) |

| | | Institutional Shares | | | (750,918 | ) | | | | (671,508 | ) |

| Total Distributions to Shareholders | | | (2,658,588 | ) | | | | (9,410,098 | ) |

| | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | | |

| | Sale of shares: | | | | | | | | | |

| | | Investor Shares | | | 1,397,425 | | | | | 4,091,605 | |

| | | Institutional Shares | | | 8,353,879 | | | | | 112,429,342 | |

| | Reinvestment of distributions: | | | | | | | | | |

| | | Investor Shares | | | 1,686,621 | | | | | 903,845 | |

| | | Institutional Shares | | | 944,207 | | | | | 8,463,173 | |

| | Redemption of shares: | | | | | | | | | |

| | | Investor Shares | | | (14,388,052 | ) | | | | (5,830,449 | ) |

| | | Institutional Shares | | | (256,204,428 | ) | | | | (26,406,009 | ) |

| Increase (Decrease) in Net Assets from Capital Share Transactions | | (258,210,348 | ) | | | | 93,651,507 | |

| Increase (Decrease) in Net Assets | | | (245,978,668 | ) | | | | 61,830,926 | |

| | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | |

| | Beginning of Year | | | 261,423,926 | | | | | 199,593,000 | |

| | End of Year (Including line (a)) | | $ | 15,445,258 | | | | $ | 261,423,926 | |

| | | | | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | | |

| | Sale of shares: | | | | | | | | | |

| | | Investor Shares | | | 152,505 | | | | | 363,291 | |

| | | Institutional Shares | | | 792,315 | | | | | 9,897,772 | |

| | Reinvestment of distributions: | | | | | | | | | |

| | | Investor Shares | | | 172,979 | | | | | 82,167 | |

| | | Institutional Shares | | | 96,286 | | | | | 767,411 | |

| | Redemption of shares: | | | | | | | | | |

| | | Investor Shares | | | (1,619,069 | ) | | | | (519,232 | ) |

| | | Institutional Shares | | | (23,760,340 | ) | | | | (2,343,458 | ) |

| Increase (Decrease) in Shares | | | (24,165,324 | ) | | | | 8,247,951 | |

| | | | | | | | | | | | |

| (a) | Undistributed net investment income | | $ | - | | | | $ | 76,785 | |

See Notes to Financial Statements. | 21 | |

BAYWOOD SOCIALLYRESPONSIBLE FUND |

| These financial highlights reflect selected data for a share outstanding throughout each year. | | | | | | |

| | | For the Years Ended September 30, | |

| | | 2016 | | | | 2015 | | | | 2014 | | | | 2013 | | | | 2012 | | |

| INVESTOR SHARES | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Year | $ | 10.16 | | | $ | 11.42 | | | $ | 12.26 | | | $ | 10.04 | | | $ | 8.37 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | 0.08 | | | | 0.11 | | | | 0.18 | | | | 0.09 | | | | 0.11 | | |

| Net realized and unrealized gain (loss) | | 0.71 | | | | (0.98 | ) | | | 1.15 | | | | 2.22 | | | | 1.67 | | |

| Total from Investment Operations | | 0.79 | | | | (0.87 | ) | | | 1.33 | | | | 2.31 | | | | 1.78 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.28 | ) | | | (0.10 | ) | | | (0.15 | ) | | | (0.09 | ) | | | (0.11 | ) | |

| Net realized gain | | (0.53 | ) | | | (0.29 | ) | | | (2.02 | ) | | | — | | | | — | | |

| Total Distributions to Shareholders | | (0.81 | ) | | | (0.39 | ) | | | (2.17 | ) | | | (0.09 | ) | | | (0.11 | ) | |

| NET ASSET VALUE, End of Year | $ | 10.14 | | | $ | 10.16 | | | $ | 11.42 | | | $ | 12.26 | | | $ | 10.04 | | |

| TOTAL RETURN | | 8.28 | % | | (7.86 | )% | | 12.11 | % | | 23.12 | % | | 21.28 | % |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (000's omitted) | $9,890 | | | $23,045 | | | $26,763 | | | $31,387 | | | $25,631 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | 0.77 | % | | 0.99 | % | | 1.55 | % | | 0.81 | % | | 1.13 | % |

| Net expenses | | 1.28 | % | | 1.14 | % | | 1.14 | % | | 1.13 | % | | 1.15 | % |

| Gross expenses (b) | | 1.84 | % | 1.37 | % | | 1.46 | % | | 1.38 | % | | 1.40 | % |

| PORTFOLIO TURNOVER RATE | | 57 | % | | 29 | % | | 34 | % | | 42 | % | | 38 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | Calculated based on average shares outstanding during each year. |

| (b) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements. | 22 | |

BAYWOOD SOCIALLYRESPONSIBLE FUND |

| These financial highlights reflect selected data for a share outstanding throughout each year. | | | | | | |

| | | For the Years Ended September 30, | |

| | | 2016 | | | | 2015 | | | | 2014 | | | | 2013 | | | | 2012 | | |

| INSTITUTIONAL SHARES | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Year | $ | 10.18 | | | $ | 11.45 | | | $ | 12.28 | | | $ | 10.06 | | | $ | 8.38 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | 0.14 | | | | 0.14 | | | | 0.19 | | | | 0.12 | | | | 0.13 | | |

| Net realized and unrealized gain (loss) | | 0.66 | | | | (0.99 | ) | | | 1.18 | | | | 2.22 | | | | 1.68 | | |

| Total from Investment Operations | | 0.80 | | | | (0.85 | ) | | | 1.37 | | | | 2.34 | | | | 1.81 | | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.30 | ) | | | (0.13 | ) | | | (0.18 | ) | | | (0.12 | ) | | | (0.13 | ) | |

| Net realized gain | | (0.53 | ) | | | (0.29 | ) | | | (2.02 | ) | | | — | | | | — | | |

| Total Distributions to Shareholders | | (0.83 | ) | | | (0.42 | ) | | | (2.20 | ) | | | (0.12 | ) | | | (0.13 | ) | |

| NET ASSET VALUE, End of Year | $ | 10.15 | | | $ | 10.18 | | | $ | 11.45 | | | $ | 12.28 | | | $ | 10.06 | | |

| TOTAL RETURN | | 8.40 | % | | (7.70 | )% | | 12.46 | % | | 23.38 | % | | 21.63 | % |

| RATIOS/SUPPLEMENTARY ATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (000's omitted) | $5,555 | | | $238,379 | | | $172,830 | | | $45,357 | | | $80,109 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | 1.35 | % | | 1.22 | % | | 1.62 | % | | 1.10 | % | | 1.37 | % |

| Net expenses | | 0.89 | % | | 0.89 | % | | 0.89 | % | | 0.87 | % | | 0.90 | % |

| Gross expenses (b) | | 1.00 | % | 0.87 | %(c) | 0.96 | % | | 0.87 | % | | 0.90 | % |

| PORTFOLIO TURNOVER RATE | | 57 | % | | 29 | % | | 34 | % | | 42 | % | | 38 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | Calculated based on average shares outstanding during each year. |

| (b) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

| (c) | Ratio includes waivers and previously waived investment advisory fees recovered. The impact of the recovered fees may cause a higher net expense ratio. |

See Notes to Financial Statements. | 23 | |

BAYWOOD FUNDS NOTES TO FINANCIAL STATEMENTS SEPTEMBER 30, 2016 |

Note 1. Organization

Baywood ValuePlus Fund and Baywood SociallyResponsible Fund (individually, a "Fund" and collectively, the "Funds") are diversified portfolios of Forum Funds II (the "Trust"). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940, as amended (the "Act"). Under its Trust Instrument, the Trust is authorized to issue an unlimited number of each Fund's shares of beneficial interest without par value. The Baywood ValuePlus Fund commenced operations on December 2, 2013. The Baywood ValuePlus Fund currently offers two classes of shares: Investor Shares and Institutional Shares. The Baywood ValuePlus Fund seeks to achieve long-term capital appreciation by investing in undervalued equity securities.

On December 2, 2013, the Baywood ValuePlus Fund commenced operations through a reorganization of a collective investment trust into the Baywood ValuePlus Fund. The collective investment trust was previously managed by the Baywood ValuePlus Fund's Advisor and portfolio management team. This collective investment trust was organized and commenced operations on June 27, 2008. The collective investment trust had an investment objective and strategies that were, in all material respects, identical to those of the Baywood ValuePlus Fund. The net assets and unrealized gain received by the Baywood ValuePlus Fund from this tax-free reorganization were as follows:

| Date of Contribution | | Net Assets Investor Shares | | Net Assets Institutional Shares | | Shares Issued Investor Shares | | Shares Issued Institutional Shares | | Cost of Investments | | Unrealized Gain on Investments |

| December 2, 2013 | | $2,099,735 | | $10,168,720 | | 120,217 | | 579,166 | | $9,396,973 | | $2,372,564 |

In addition to the securities transferred in, as noted above, $498,918 of cash and other receivables were also transferred in as part of the reorganization.

The Baywood SociallyResponsible Fund commenced operations on January 3, 2005. The Baywood SociallyResponsible Fund currently offers two classes of shares: Investor Shares and Institutional Shares. The Baywood SociallyResponsible Fund seeks to provide long-term capital growth.

On December 7, 2015, at a special meeting of Shareholders of Baywood SociallyResponsible Fund, formerly City National Rochdale Socially Responsible Equity Fund, a series of City National Rochdale Funds (the "Predecessor Fund"), the shareholders approved a proposal to reorganize the Predecessor Fund into the Baywood SociallyResponsible Fund, a newly created series of the Forum Funds II. The Predecessor Fund was sub-advised by the Fund's Advisor, SKBA Capital Management, LLC, with the same portfolio managers as Baywood SociallyResponsible Fund. The Baywood SociallyResponsible Fund is managed in a manner that is in all material respects equivalent to the management of the Predecessor Fund, including the investment objective, strategies, guidelines and restrictions. The primary purpose of the reorganization was to move the Predecessor Fund to a newly created series of Forum Funds II. As a result of the reorganization, the Baywood SociallyResponsible Fund is now operating under the supervision of a different board of trustees. On January 8, 2016, the Baywood SociallyResponsible Fund acquired all of the assets, subject to liabilities, of the Predecessor Fund. The shares of the Predecessor Fund were, in effect, exchanged on a tax-free basis for Shares of the Baywood SociallyResponsible Fund with the same aggregate value. No commission or other transactional fees were imposed on shareholders in connection with the tax-free exchange of their shares.

Note 2. Summary of Significant Accounting Policies

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 946, "Financial Services-Investment Companies". These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the fiscal period. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of each Fund:

Security Valuation – Exchange-traded securities and over-the-counter securities are valued using the last quoted trade or official closing price, provided by independent pricing services as of the close of trading on the market or exchange for which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and ask price provided by independent pricing services. Non-exchange-traded securities for which quotations are available are valued using

BAYWOOD FUNDS NOTES TO FINANCIAL STATEMENTS SEPTEMBER 30, 2016 |

the last quoted sales price, or in the absence of a sale, at the mean of the last bid and ask prices provided by independent pricing services. Shares of open-end mutual funds are valued at net asset value ("NAV"). Short-term investments that mature in 60 days or less may be valued at amortized cost.

Each Fund values its investments at fair value pursuant to procedures adopted by the Trust's Board of Trustees (the "Board") if (1) market quotations are insufficient or not readily available or (2) the Advisor, as defined in Note 3, believes that the values available are unreliable. The Trust's Valuation Committee, as defined in each Fund's registration statement, performs certain functions as they relate to the administration and oversight of each Fund's valuation procedures. Under these procedures, the Valuation Committee convenes on a regular and ad-hoc basis to review such investments and considers a number of factors, including valuation methodologies and significant unobservable inputs, when arriving at fair value.

The Valuation Committee may work with the Advisor to provide valuation inputs. In determining fair valuations, inputs may include market-based analytics which may consider related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant investment information. Advisor inputs may include an income-based approach in which the anticipated future cash flows of the investment are discounted in determining fair value. Discounts may also be applied based on the nature or duration of any restrictions on the disposition of the investments. The Valuation Committee performs regular reviews of valuation methodologies, key inputs and assumptions, disposition analysis and market activity.

Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security's market price and may not be the price at which the asset may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotes.

Each Fund has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various "inputs" used to determine the value of each Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets and liabilities

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including each Fund's own assumptions in determining the fair value of investments)

The aggregate value by input level, as of September 30, 2016, for each Fund's investments is included at the end of each Fund's Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after each Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium is amortized and discount is accreted using the effective interest method. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Distributions to Shareholders – Distributions to shareholders of net investment income, if any, are declared and paid at least annually. Distributions to shareholders of net capital gains, if any, are declared and paid at least annually. Distributions to shareholders are recorded on the ex-dividend date. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by each Fund, timing differences and differing characterizations of distributions made by each Fund.

Federal Taxes – Each Fund intends to continue to qualify each year as a regulated investment company under Subchapter M of Chapter 1, Subtitle A, of the Internal Revenue Code of 1986, as amended ("Code"), and to distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all of its net investment income and capital gains, if any, the Fund will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required. Each Fund files a U.S. federal income and excise tax return as required. Each Fund's federal income tax returns are subject to examination by the Internal Revenue Service for a period of three fiscal years after they are filed. As of September 30, 2016, there are no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment

BAYWOOD FUNDS NOTES TO FINANCIAL STATEMENTS SEPTEMBER 30, 2016 |

portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

The Fund's class-specific expenses are charged to the operations of that class of shares. Income and expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on the class' respective net assets to the total net assets of each Fund.

Commitments and Contingencies – In the normal course of business, each Fund enters into contracts that provide general indemnifications by each Fund to the counterparty to the contract. Each Fund's maximum exposure under these arrangements is dependent on future claims that may be made against each Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Note 3. Fees and Expenses

Investment Advisor – SKBA Capital Management, LLC (the "Advisor") is the investment advisor to the Funds. Pursuant to an Investment Advisory Agreement, the Advisor receives an advisory fee at an annual rate of 0.50% and 0.70% of the average daily net assets of Baywood ValuePlus Fund and Baywood SociallyResponsible Fund, respectively. Prior to January 8, 2016, for the Predecessor Fund to Baywood SociallyResponsible Fund, City National Rochdale received an advisory fee at an annual rate of 0.75% of the Fund's average daily assets. For the period October 1, 2015 through January 8, 2016, the advisory fee paid to City National Rochdale was $337,829 for the Baywood SociallyResponsible Fund.

Distribution – Foreside Fund Services, LLC serves as each Fund's distributor (the "Distributor"). The Funds have adopted a Distribution Plan (the "Plan") in accordance with Rule 12b-1 of the Act. Under the Plan, each Fund may pay the Distributor and/or any other entity as authorized by the Board a fee of up to 0.25% of each Fund's average daily net assets of Investor Shares for providing distribution and/or shareholder services to the Funds.

The Distributor is not affiliated with the Advisor or Atlantic Fund Administration, LLC (d/b/a Atlantic Fund Services) ("Atlantic") or their affiliates.

Other Service Providers – Atlantic provides fund accounting, fund administration, compliance and transfer agency services to each Fund. Atlantic also provides certain shareholder report production and EDGAR conversion and filing services. Pursuant to an Atlantic services agreement, each Fund pays Atlantic customary fees for its services. Prior to January 8, 2016, SEI Investments Global Funds Services served as the administrator to the Predecessor Fund to the Baywood SociallyResponsible Fund. For the period October 1, 2015 through January 8, 2016, the administration fee paid to SEI Investments Global Funds Services was $38,781 for the Baywood SociallyResponsible Fund.

Atlantic provides a Principal Executive Officer, a Principal Financial Officer, a Chief Compliance Officer and an Anti-Money Laundering Officer to each Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each Independent Trustee an annual fee of $16,000 ($21,000 for the Chairman). The Independent Trustees and Chairman may receive additional fees for special Board meetings. The Independent Trustees are also reimbursed for all reasonable out-of-pocket expenses incurred in connection with their duties as Trustees, including travel and related expenses incurred in attending Board meetings. The amount of Independent Trustees' fees attributable to each Fund is disclosed in the Statements of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from each Fund.

Note 4. Expenses Reimbursed and Fees Waived

The Advisor has contractually agreed to waive its fee and/or reimburse certain expenses to limit total operating expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) for Investor Shares to 0.95% and Institutional Shares to 0.70% through March 31, 2017 for Baywood ValuePlus Fund. Effective January 8, 2016, the Advisor also has contractually agreed to waive its fees and/or reimburse certain expenses to limit total operating expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) for Investor Shares to 1.14% and Institutional Shares to 0.89% through December 31, 2017 for Baywood SociallyResponsible Fund. Other Fund service providers have voluntarily agreed to waive and reimburse a portion of their fees. These voluntary fee waivers and reimbursements may be reduced or eliminated at any time. For the period ended September 30, 2016, fees waived and expenses reimbursed were as follows:

BAYWOOD FUNDS NOTES TO FINANCIAL STATEMENTS SEPTEMBER 30, 2016 |

| | Investment Advisor Fees Waived | | Investment Advisor Expenses Reimbursed | | Other Waivers | | Total Fees Waived and Expenses Reimbursed |

Baywood ValuePlus Fund | $ | 7,909 | | $ | 109,403 | | $ | 37,500 | | $ | 154,812 |

Baywood SociallyResponsible Fund | | 75,063 | | | 15,982 | | | 32,904 | | | 123,949 |

| | | | | | | | | | | | |

For the year ended November 30, 2015, fees waived and expenses reimbursed were as follows:

| | Investment Advisor Fees Waived | | Investment Advisor Expenses Reimbursed | | Other Waivers | | Total Fees Waived and Expenses Reimbursed |

Baywood ValuePlus Fund | $ | 49,163 | | $ | 91,393 | | $ | 45,000 | | $ | 185,556 |

The Funds may repay the Advisor for fees waived and expenses reimbursed pursuant to the expense cap if such payment is made within three years of the fee waiver or expense reimbursement, is approved by the Funds' Board of Trustees and the reimbursement does not cause the Funds' net annual operating expenses of that class to exceed the expense cap in place at the time the fees were waived. The amount of fees waived or expenses reimbursed eligible for recoupment are as follows:

Baywood ValuePlus Fund | | Amount of Fees Waived and/or Expenses Reimbursed | | Expiration Date to Recoup Fees Waived and/or Expenses Reimbursed | | Fees Recouped |

| November 30, 2014 | | $ | 201,724 | | November 30, 2017 | | $ | - |

| November 30, 2015 | | $ | 140,556 | | November 30, 2018 | | $ | - |

| September 30, 2016 | | $ | 117,312 | | September 30, 2019 | | $ | - |

| | | | | | | | | |

Baywood SociallyResponsible Fund | | Amount of Fees Waived and/or Expenses Reimbursed | | Expiration Date to Recoup Fees Waived and/or Expenses Reimbursed | | Fees Recouped |

| September 30, 2016 | | $ | 91,045 | | September 30, 2019 | | $ | - |

| | | | | | | | | |

Note 5. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments during the period ended September 30, 2016, were as follows:

| | | Purchases | | Sales |

Baywood ValuePlus Fund | | $ | 669,794 | | $ | 401,361 |