As filed with the Securities and Exchange Commission on May 31, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22842

FORUM FUNDS II

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2018 – March 31, 2019

ITEM 1. REPORT TO STOCKHOLDERS.

| | Semi-Annual Report March 31, 2019 (Unaudited) Advised by: SKBA Capital Management, LLC www.baywoodfunds.com |

Beginning in January 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds or your financial intermediary electronically by contacting the Fund at (855) 409-2297 or baywoodfunds.ta@atlanticfundservices.com or by contacting your financial intermediary directly.

You may elect to receive all future reports in paper free of charge. You can inform the Funds or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at (855) 409-2297 or baywoodfunds.ta@ atlanticfundservices.com or by contacting your financial intermediary directly. Your election to receive reports in paper will apply to the Baywood ValuePlus Fund or the Baywood SociallyResponsible Fund.

BAYWOOD VALUEPLUS FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2019

Dear Shareholders,

We are pleased to report our economic and financial market perspectives and the investment activities for the Baywood ValuePlus Fund (the “Fund”) for the six months ended March 31, 2019. The Fund is a large capitalization value-oriented portfolio of stock holdings selected from a universe of dividend-paying companies traded on U.S. exchanges. SKBA attempts to identify candidates for purchase that appear to have low expectations and pessimism already reflected in their current valuations by using its Relative Dividend Yield (RDY) discipline, which compares each stock’s yield history to SKBA’s own yield index of 500 large dividend-paying companies. A high RDY compared to a stock’s own history that captures such pessimism provides a useful starting point for research into each stock’s underlying fundamentals.

The longest streak of consecutive years of positive returns in the stock market was broken with the stock market’s plunge in the fourth quarter of 2018. With the market’s trough on Christmas Eve, producing the single worst decline on this day since the Great Depression, many investors concluded that stocks had finally entered a new bear market. Amidst these fears, we did not share the consensus in the market that the U.S. was headed for recession. And indeed, the stock market shifted from “famine” back to “feast” with the sharp advance in the first quarter of 2019. The market’s overall action took the shape of a “V” over the two quarters.

After a string of years outperforming our value benchmarks and after also outperforming them in the first nine months of 2018, the sharp decline in the fall caused ValuePlus to lag the benchmark beginning this new fiscal year. We had not in some time underperformed in a down period yet it has often been the case that in the initial phases of a market decline, stock prices fall indiscriminate of changes in their underlying fundamentals. Yet usually in short order, ValuePlus stocks typically begin holding up better than the overall market. In October, the widespread decline in the average stock continued throughout the month. After the bounce in November, SKBA’s stocks began to demonstrate downside protection during the market’s plunge in December; not enough, however, to overcome the indiscriminate selling witnessed in October.

The rebound so far in 2019 followed a more typical pattern of recovery. SKBA maintained our belief in the likelihood of a market recovery. The team continued owning and adding to out-of-favor stocks with pro-cyclical exposure to the economy. Indeed, the fourth quarter decline provided the opportunity to “high grade” positions (selling a slightly lower quality company in favor of a newly cheap higher quality company) or to take advantage of newly depressed valuations. Yet such out-of-favor stocks often are not the “hot dots” that drive the market higher in a robust advance. Such was the case between January and March. New positions were established during the six months in companies such as Brookfield Properties, Citigroup, Comcast, Dominion Energy, Lear, Packaging Corp, Phillips 66, and TE Connectivity. Cummins has already become one of the top holdings in this strategy. It is a high quality company, with superior returns on capital, that has seen unusually large declines in its price despite a leading global market position in engines. The declines began earlier in the year when it reported larger than usual warranty expenses that should prove to be one-time in nature. The near indiscriminate market sell-off during the fourth quarter further pushed the stock into our welcoming hands. It is rare we get to purchase great companies at such distressed prices outside the depths of a recession. Furthermore, Cummins is one of the only truck engine manufacturers whose engines are in compliance with new regulations being enacted around the world which helps cement its position as a leading engine manufacturer. These new positions were established in place of prior holdings that include a combination of past winners and losers such as Exelon, L Brands, Microsoft, Novo Nordisk, Valero Energy, and WestRock. We believe the recent high-grading, based on our continued focus on our underlying valuation disciplines and fundamental research, will position the Fund well for the future.

For the six-month period as a whole, part of the total underperformance was created by the Fund’s overweight in energy, the single worst performing sector over the period with a greater than 10% decline, and the underweight in utilities, the single best performing sector with a greater than 13% gain using the S&P 500 Value benchmark results. SKBA has underweighted electric utilities for some time due to both valuation and fundamental concerns, but the sector responded positively in the fashion of a bond substitute with the decline in Treasury bond yields in the fourth quarter and the continued decline in the first quarter. We believe it is unlikely that the recent selective flight to safety will continue. In contrast, we believe energy stocks will benefit from the recovery of WTI prices (using West Texas Intermediate oil) back into the $60 plus range and see no reason to reverse course with our underweight of utilities. While Chevron (up 3%) fully recovered its fourth quarter losses in the first quarter, even the large quarterly gains in the first quarter did not offset the fourth quarter declines for Occidental Petroleum (with -18% for the six months) and Schlumberger (-27%). We believe the lag will prove to be temporary as the rise in oil prices should produce positive earnings surprises as the year progresses.

Whereas energy stands out as the worst performing sector in the Fund in both an absolute and relative sense, consumer staples produced the best absolute and relative returns of any sector for ValuePlus. Having been underweight staples for a few years, price declines provided the opportunity to raise weights in the group during the spring and summer of 2018. Kimberly Clark, Mondelez, PepsiCo,

BAYWOOD VALUEPLUS FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2019

and Walmart all held up well in the downturn and continued to see gains in the recovery. Each produced gains in the teens except for Walmart with its 5% advance.

In addition to consumer staples, holdings in the industrials sector, Cummins (up 9%), Johnson Controls (up 7%), and Union Pacific (up %) all produced net positive returns for the entire period, compared to the benchmark’s 2% decline. Overall, we have maintained our weights in staples and increased those in industrials as an attractive balance of defensive and offensive sector characteristics.

While healthcare is traditionally a defensive sector, pharmaceuticals have generally lagged due to concern over pricing power and possible price controls. Among our holdings, AbbVie, Amgen, and Gilead Sciences fell victim to this investor aversion. We can attempt to find issues with each of these companies yet lackluster performance is better explained by looking at the overall sector. There have been very few “winners” recently due to bipartisan political desire to control spiraling healthcare costs. We are coming up on an election in 2020, after all, and officials and candidates are vying for as many votes as possible. While controlling costs is a noble objective, consensus, let alone implementation, will take time. Stock prices rarely wait for final outcomes, however. We believe this to be the prevailing reason for weakness across the industry and we remain underweight the sector.

As we look towards the second half of the year, we’re inclined to suggest that the recent bout of volatility will moderate. We would not, however, suggest that calm will remain for very long. With trade tensions, aging economic expansions and contentious elections on the not-too-distant horizon, there are plenty of reasons for “vol” to rear its ugly head once again. Yet these are the environments we seek in order to capture mis-pricings. Those mis-pricings are what improve prospective total returns with lower risk levels; the combination of locking in attractive dividend yields as stock prices have declined for temporary reasons. We look forward to this being the case over the next six months. This generally simple yet difficult to adhere to strategy has served us and Fund shareholders well in the past and should continue to in the future.

Current and future portfolio holdings are subject to change and risk.

The Morningstar category is used to compare fund performance to its peers. It is not possible to invest directly into an index or category. Past performance is no guarantee of future results.

Risk Considerations: Mutual fund investing involves risk, including the possible loss of principal. The Fund primarily invests in undervalued securities, which may not appreciate in value as anticipated by the Advisor or remain undervalued for longer than anticipated. The Fund may invest in American Depositary Receipts (ADRs), which involves risks relating to political, economic or regulatory conditions in foreign countries and may cause greater volatility and less liquidity. The Fund may also invest in convertible securities and preferred stock, which may be adversely affected as interest rates rise.

BAYWOOD VALUEPLUS FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2019

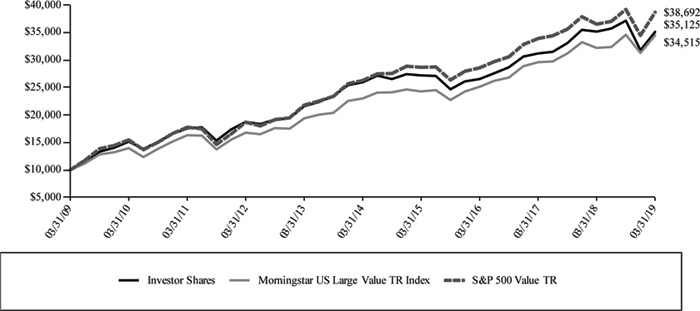

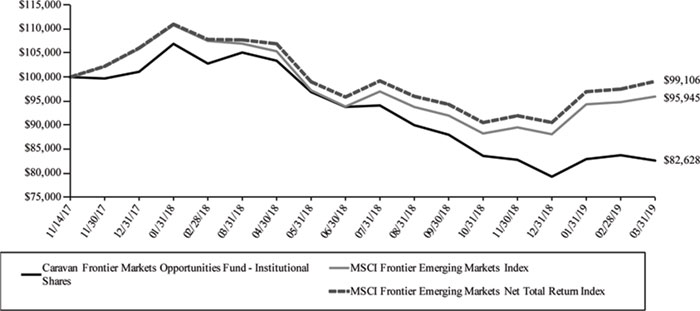

The following charts reflect the change in the value of a hypothetical $10,000 investment in Investor Shares and a hypothetical $10,000 investment in Institutional Shares, including reinvested dividends and distributions, in the Baywood ValuePlus Fund (the “Fund”) compared with the performance of the benchmarks, Morningstar Large Value Index, and the secondary benchmark, S&P 500 Value TR Index (the “indices”), since inception. The Morningstar US Large Value TR Index measures the performance of large-cap stocks with relatively low prices given anticipated per share earnings, book value, cash flow, sales and dividends. The S&P 500 Value TR Index is a market capitalization weighted index. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $10,000 Investment

Investor Shares vs. Morningstar US Large Value TR Index and S&P 500 Value TR Index

Average Annual Total Returns

Periods Ended March 31, 2019 | One Year | Five Year | Ten Year |

| Baywood ValuePlus Fund Investor Shares* | -0.15% | 6.24% | 13.39% |

| Morningstar US Large Value TR Index | 7.17% | 8.45% | 13.19% |

| S&P 500 Value TR | 5.93% | 8.05% | 14.49% |

| * | The Fund’s Investor Shares performance for periods prior to the commencement of operations (12/2/13) is that of a collective investment trust managed by the Fund’s Advisor and portfolio management team. The Investor Shares of the collective investment trust commenced operations on June 27, 2008. |

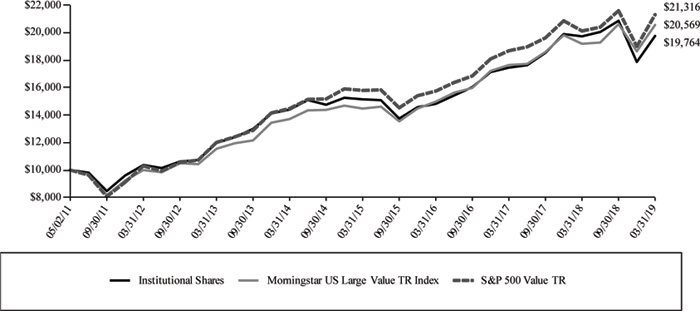

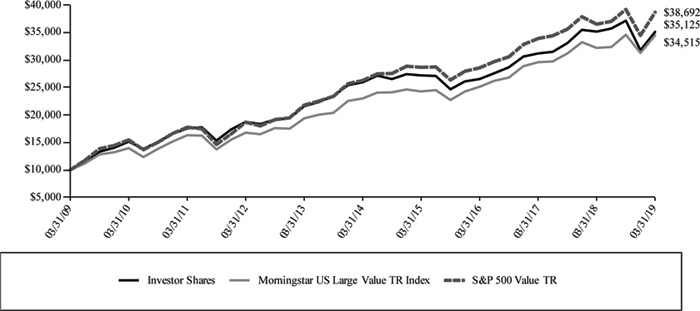

BAYWOOD VALUEPLUS FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2019

Comparison of Change in Value of a $10,000 Investment

Institutional Shares vs. Morningstar US Large Value TR Index and S&P 500 Value TR Index

Average Annual Total Returns

Periods Ended March 31, 2019 | One Year | Five Year | Since Inception (05/02/11) |

| Baywood ValuePlus Fund Institutional Shares* | 0.15% | 6.53% | 13.61% |

| Morningstar US Large Value TR Index | 7.17% | 8.45% | 13.19% |

| S&P 500 Value TR | 5.93% | 8.05% | 14.49% |

| * | The Fund’s Institutional Shares performance for periods prior to the commencement of operations (12/2/13) is that of a collective investment trust managed by the Fund’s Advisor and portfolio management team. The Institutional Shares of the collective investment trust commenced operations on May 2, 2011. |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratios (gross) for Investor Shares and Institutional Shares are 6.79% and 8.83%, respectively. However, the Fund’s advisor has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 0.95% and 0.70% for Investor Shares and Institutional Shares, respectively, through January 31, 2020 (the “Expense Cap”). The Expense Cap may be raised or eliminated only with the consent of the Board of Trustees. The advisor may be reimbursed by each Fund for fees waived and expenses reimbursed by the advisor pursuant to the Expense Cap if such payment is approved by the Board, made within three years of the fee waiver or expense reimbursement and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap and (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement will increase if exclusions from the Expense Cap apply. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (855) 409-2297.

BAYWOOD VALUEPLUS FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2019

| Shares | | | Security Description | | Value | |

| Common Stock - 94.8% | |

| Basic Materials - 4.9% |

| | 400 | | | DowDuPont, Inc. | | $ | 21,324 | |

| | 1,160 | | | Nutrien, Ltd. | | | 61,202 | |

| | 500 | | | Packaging Corp. of America | | | 49,690 | |

| | | | | | | | 132,216 | |

| Capital Goods / Industrials - 8.3% |

| | 600 | | | Cummins, Inc. | | | 94,722 | |

| | 500 | | | Eaton Corp. PLC | | | 40,280 | |

| | 1,300 | | | Johnson Controls International PLC | | | 48,022 | |

| | 500 | | | TE Connectivity, Ltd. | | | 40,375 | |

| | | | | | | | 223,399 | |

| Communication Services - 5.9% |

| | 3,200 | | | CenturyLink, Inc. | | | 38,368 | |

| | 1,400 | | | Comcast Corp., Class A | | | 55,972 | |

| | 1,100 | | | Verizon Communications, Inc. | | | 65,043 | |

| | | | | | | | 159,383 | |

| Consumer Discretionary - 6.1% |

| | 200 | | | Lear Corp. | | | 27,142 | |

| | 1,800 | | | Tapestry, Inc. | | | 58,482 | |

| | 1,000 | | | Target Corp. | | | 80,260 | |

| | | | | | | | 165,884 | |

| Consumer Staples - 8.7% |

| | 300 | | | Kimberly-Clark Corp. | | | 37,170 | |

| | 800 | | | Molson Coors Brewing Co., Class B | | | 47,720 | |

| | 900 | | | Mondelez International, Inc., Class A | | | 44,928 | |

| | 300 | | | PepsiCo., Inc. | | | 36,765 | |

| | 700 | | | Walmart, Inc. | | | 68,271 | |

| | | | | | | | 234,854 | |

| Energy - 12.1% |

| | 600 | | | BP PLC, ADR | | | 26,232 | |

| | 500 | | | Chevron Corp. | | | 61,590 | |

| | 400 | | | ConocoPhillips | | | 26,696 | |

| | 800 | | | Helmerich & Payne, Inc. | | | 44,448 | |

| | 1,100 | | | Occidental Petroleum Corp. | | | 72,820 | |

| | 400 | | | Phillips 66 | | | 38,068 | |

| | 1,300 | | | Schlumberger, Ltd. | | | 56,641 | |

| | | | | | | | 326,495 | |

| Financials - 19.2% |

| | 1,700 | | | American International Group, Inc. | | | 73,202 | |

| | 700 | | | BOK Financial Corp. | | | 57,085 | |

| | 140 | | | Chubb, Ltd. | | | 19,611 | |

| | 1,000 | | | Citigroup, Inc. | | | 62,220 | |

| | 700 | | | FNF Group | | | 25,585 | |

| | 400 | | | M&T Bank Corp. | | | 62,808 | |

| | 1,400 | | | MetLife, Inc. | | | 59,598 | |

| | 1,800 | | | Morgan Stanley | | | 75,960 | |

| | 700 | | | Prosperity Bancshares, Inc. | | | 48,342 | |

| | 700 | | | U.S. Bancorp | | | 33,733 | |

| | | | | | | | 518,144 | |

| Health Care - 11.8% |

| | 500 | | | AbbVie, Inc. | | | 40,295 | |

| | 300 | | | Amgen, Inc. | | | 56,994 | |

| | 1,000 | | | AstraZeneca PLC, ADR | | | 40,430 | |

| | 700 | | | Gilead Sciences, Inc. | | | 45,507 | |

| | 2,000 | | | Koninklijke Philips NV, ADR | | | 81,720 | |

| | 600 | | | Medtronic PLC | | | 54,648 | |

| | | | | | | | 319,594 | |

| Real Estate - 5.1% |

| | 1,900 | | | Brookfield Property REIT, Inc. | | | 38,931 | |

| | 1,100 | | | Taubman Centers, Inc. REIT | | | 58,168 | |

| | 1,500 | | | Weyerhaeuser Co. REIT | | | 39,510 | |

| | | | | | | | 136,609 | |

| Shares | | | Security Description | | Value | |

| Technology - 8.9% | |

| | 1,900 | | | Cisco Systems, Inc. | | $ | 102,581 | |

| | 2,100 | | | HP, Inc. | | | 40,803 | |

| | 1,300 | | | Intel Corp. | | | 69,810 | |

| | 200 | | | International Business Machines Corp. | | | 28,220 | |

| | | | | | | | 241,414 | |

| Transportation - 1.8% | | | | |

| | 300 | | | Union Pacific Corp. | | | 50,160 | |

| | Utilities - 2.0% | | | | | | | |

| | 700 | | | Dominion Energy, Inc. | | | 53,662 | |

| Total Common Stock (Cost $2,356,494) | | | 2,561,814 | |

| Shares | | | Security Description | | Value | |

| Money Market Fund - 4.2% | | |

| | 113,019 | | | Federated Government Obligations Fund, Institutional Class, 2.30% (a) | | | | |

| | | | | (Cost $113,019) | | | 113,019 | |

| Investments, at value - 99.0% (Cost $2,469,513) | | $ | 2,674,833 | |

| Other Assets & Liabilities, Net - 1.0% | | | 26,426 | |

| Net Assets - 100.0% | | $ | 2,701,259 | |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| (a) | Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of March 31, 2019. |

The following is a summary of the inputs used to value the Fund's instruments as of March 31, 2019.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| Valuation Inputs | | Investments in Securities | |

| Level 1 - Quoted Prices | | $ | 2,561,814 | |

| Level 2 - Other Significant Observable Inputs | | | 113,019 | |

| Level 3 - Significant Unobservable Inputs | | | – | |

| Total | | $ | 2,674,833 | |

The Level 1 value displayed in this table is Common Stock. The Level 2 value displayed in this table is a Money Market Fund. Refer to this Schedule of Investments for a further breakout of each security by industry.

| PORTFOLIO HOLDINGS |

| % of Total Investments |

| Basic Materials | 4.9% |

| Capital Goods / Industrials | 8.4% |

| Communication Services | 6.0% |

| Consumer Discretionary | 6.2% |

| Consumer Staples | 8.8% |

| Energy | 12.2% |

| Financials | 19.4% |

| Health Care | 11.9% |

| Real Estate | 5.1% |

| Technology | 9.0% |

| Transportation | 1.9% |

| Utilities | 2.0% |

| Money Market Fund | 4.2% |

| | 100.0% |

See Notes to Financial Statements.

BAYWOOD VALUEPLUS FUND

STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2019

| ASSETS |

| Investments, at value (Cost $2,469,513) | | $ | 2,674,833 | |

| Receivables: |

| Fund shares sold | | | 1,781 | |

| Investment securities sold | | | 9,132 | |

| Dividends | | | 5,896 | |

| From investment advisor | | | 13,029 | |

| Prepaid expenses | | | 20,545 | |

| Total Assets | | | 2,725,216 | |

| |

| LIABILITIES |

| Payables: |

| Investment securities purchased | | | 5,222 | |

| Accrued Liabilities: |

| Trustees’ fees and expenses | | | 22 | |

| Fund services fees | | | 5,208 | |

| Other expenses | | | 13,505 | |

| Total Liabilities | | | 23,957 | |

| NET ASSETS | | $ | 2,701,259 | |

| |

| COMPONENTS OF NET ASSETS |

| Paid-in capital | | $ | 2,385,462 | |

| Distributable earnings | | | 315,797 | |

| NET ASSETS | | $ | 2,701,259 | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) |

| Investor Shares | | | 111,497 | |

| Institutional Shares | | | 52,096 | |

| |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE |

| Investor Shares (based on net assets of $1,838,022) | | $ | 16.48 | |

| Institutional Shares (based on net assets of $863,237) | | $ | 16.57 | |

See Notes to Financial Statements.

BAYWOOD VALUEPLUS FUND

STATEMENTS OF OPERATIONS

SIX MONTHS ENDED MARCH 31, 2019

| INVESTMENT INCOME |

| Dividend income (Net of foreign withholding taxes of $163) | | $ | 42,944 | |

| Total Investment Income | | | 42,944 | |

| | | | | |

| EXPENSES |

| Investment advisor fees | | | 6,611 | |

| Fund services fees | | | 33,321 | |

| Transfer agent fees: |

| Investor Shares | | | 9,214 | |

| Institutional Shares | | | 9,313 | |

| Distribution fees: |

| Investor Shares | | | 2,230 | |

| Custodian fees | | | 2,543 | |

| Registration fees: |

| Investor Shares | | | 8,196 | |

| Institutional Shares | | | 8,269 | |

| Professional fees | | | 11,118 | |

| Trustees' fees and expenses | | | 981 | |

| Other expenses | | | 13,619 | |

| Total Expenses | | | 105,415 | |

| Fees waived and expenses reimbursed | | | (93,931 | ) |

| Net Expenses | | | 11,484 | |

| | | | | |

| NET INVESTMENT INCOME | | | 31,460 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) |

| Net realized gain on investments | | | 119,340 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (301,060 | ) |

| NET REALIZED AND UNREALIZED LOSS | | | (181,720 | ) |

| DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (150,260 | ) |

See Notes to Financial Statements.

BAYWOOD VALUEPLUS FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the Six Months Ended March 31, 2019 | | For the Year Ended September 30, 2018 | |

| OPERATIONS |

| Net investment income | | $ | 31,460 | | | $ | 52,117 | |

| Net realized gain | | | 119,340 | | | | 113,563 | |

| Net change in unrealized appreciation (depreciation) | | | (301,060 | ) | | | 143,093 | |

| Increase (Decrease) in Net Assets Resulting from Operations | | | (150,260 | ) | | | 308,773 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Investor Shares | | | (103,614 | ) | | | (82,827 | )* |

| Institutional Shares | | | (51,493 | ) | | | (39,334 | )** |

| Total Distributions Paid | | | (155,107 | ) | | | (122,161 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Sale of shares: | | | | | | | | |

| Investor Shares | | | 7,650 | | | | 12,064 | |

| Institutional Shares | | | 397,998 | | | | 137,213 | |

| Reinvestment of distributions: | | | | | | | | |

| Investor Shares | | | 103,297 | | | | 82,750 | |

| Institutional Shares | | | 51,493 | | | | 39,334 | |

| Redemption of shares: | | | | | | | | |

| Investor Shares | | | (3,664 | ) | | | (1,103 | ) |

| Institutional Shares | | | (426,319 | ) | | | (8,552 | ) |

| Increase in Net Assets from Capital Share Transactions | | | 130,455 | | | | 261,706 | |

| Increase (Decrease) in Net Assets | | | (174,912 | ) | | | 448,318 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Period | | | 2,876,171 | | | | 2,427,853 | |

| End of Period | | $ | 2,701,259 | | | $ | 2,876,171 | *** |

| | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | |

| Sale of shares: | | | | | | | | |

| Investor Shares | | | 471 | | | | 649 | |

| Institutional Shares | | | 26,006 | | | | 7,574 | |

| Reinvestment of distributions: | | | | | | | | |

| Investor Shares | | | 6,656 | | | | 4,630 | |

| Institutional Shares | | | 3,304 | | | | 2,189 | |

| Redemption of shares: | | | | | | | | |

| Investor Shares | | | (220 | ) | | | (62 | ) |

| Institutional Shares | | | (27,469 | ) | | | (474 | ) |

| Increase in Shares | | | 8,748 | | | | 14,506 | |

| * | Distribution was the result of net investment income and net realized gain of $31,550 and $51,277, respectively, at September 30, 2018. |

| ** | Distribution was the result of net investment income and net realized gain of $16,732 and $22,602, respectively, at September 30, 2018. |

| *** | Includes undistributed net investment income of $5,683 at September 30, 2018. The requirement to disclose the corresponding amount as of March 31, 2019 was eliminated. |

See Notes to Financial Statements.

BAYWOOD VALUEPLUS FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each period.

| | | For the Six Months Ended March 31, 2018 | | | For the Year Ended September 30, 2018 | | | For the Year Ended September 30, 2017 | | | For the Period Ended September 30, 2016 (a) | | | For the Year Ended November 30, 2015 | | | December 2, 2013 (b) Through November 30, 2014 | |

| INVESTOR SHARES | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Year | | $ | 18.55 | | | $ | 17.28 | | | $ | 15.52 | | | $ | 16.90 | | | $ | 19.28 | | | $ | 17.47 | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (c) | | | 0.19 | | | | 0.33 | | | | 0.33 | | | | 0.26 | | | | 0.34 | | | | 0.36 | |

| Net realized and unrealized gain (loss) | | | (1.27 | ) | | | 1.77 | | | | 2.02 | | | | 0.93 | | | | (1.06 | ) | | | 1.49 | |

| Total from Investment Operations | | | (1.08 | ) | | | 2.10 | | | | 2.35 | | | | 1.19 | | | | (0.72 | ) | | | 1.85 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.18 | ) | | | (0.31 | ) | | | (0.32 | ) | | | (2.20 | ) | | | (0.26 | ) | | | (0.04 | ) |

| Net realized gain | | | (0.81 | ) | | | (0.52 | ) | | | (0.27 | ) | | | (0.37 | ) | | | (1.40 | ) | | | – | |

| Total Distributions to Shareholders | | | (0.99 | ) | | | (0.83 | ) | | | (0.59 | ) | | | (2.57 | ) | | | (1.66 | ) | | | (0.04 | ) |

| NET ASSET VALUE, End of Year | | $ | 16.48 | | | $ | 18.55 | | | $ | 17.28 | | | $ | 15.52 | | | $ | 16.90 | | | $ | 19.28 | |

| TOTAL RETURN | | | (5.48 | )%(d) | | | 12.35 | % | | | 15.32 | % | | | 8.40 | %(d) | | | (3.86 | )% | | | 10.59 | %(d) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (000s omitted) | | $ | 1,838 | | | $ | 1,940 | | | $ | 1,717 | | | $ | 1,699 | | | $ | 1,362 | | | $ | 1,471 | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 2.31 | %(e) | | | 1.84 | % | | | 2.03 | % | | | 2.07 | %(e) | | | 1.97 | % | | | 1.98 | %(e) |

| Net expenses | | | 0.95 | %(e) | | | 0.95 | % | | | 0.95 | % | | | 0.95 | %(e) | | | 0.95 | % | | | 0.95 | %(e) |

| Gross expenses (f) | | | 7.28 | %(e) | | | 6.79 | % | | | 7.67 | % | | | 9.43 | %(e) | | | 5.80 | % | | | 4.54 | %(e) |

| PORTFOLIO TURNOVER RATE | | | 28 | %(d) | | | 34 | % | | | 48 | % | | | 22 | %(d) | | | 32 | % | | | 35 | %(d) |

| (a) | Effective March 24, 2016, the Fund changed its fiscal year end from November 30 to September 30. The information presented is for the period December 1, 2015 to March 31, 2016. |

| (b) | Commencement of operations. |

| (c) | Calculated based on average shares outstanding during each period. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements.

BAYWOOD VALUEPLUS FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each period.

| | | For the Six Months Ended March 31, 2018 | | | For the Year Ended September 30, 2018 | | | For the Year Ended September 30, 2017 | | | For the Period Ended September 30, 2016 (a) | | | For the Year Ended November 30, 2015 | | | December 2, 2013 (b) Through November 30, 2014 | |

| INSTITUTIONAL SHARES | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Period | | $ | 18.63 | | | $ | 17.36 | | | $ | 15.59 | | | $ | 17.00 | | | $ | 19.42 | | | $ | 17.56 | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (c) | | | 0.21 | | | | 0.38 | | | | 0.38 | | | | 0.29 | | | | 0.39 | | | | 0.41 | |

| Net realized and unrealized gain (loss) | | | (1.26 | ) | | | 1.76 | | | | 2.02 | | | | 0.94 | | | | (1.06 | ) | | | 1.50 | |

| Total from Investment Operations | | | (1.05 | ) | | | 2.14 | | | | 2.40 | | | | 1.23 | | | | (0.67 | ) | | | 1.91 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.20 | ) | | | (0.35 | ) | | | (0.36 | ) | | | (2.27 | ) | | | (0.35 | ) | | | (0.05 | ) |

| Net realized gain | | | (0.81 | ) | | | (0.52 | ) | | | (0.27 | ) | | | (0.37 | ) | | | (1.40 | ) | | | – | |

| Total Distributions to Shareholders | | | (1.01 | ) | | | (0.87 | ) | | | (0.63 | ) | | | (2.64 | ) | | | (1.75 | ) | | | (0.05 | ) |

| NET ASSET VALUE, End of Period | | $ | 16.57 | | | $ | 18.63 | | | $ | 17.36 | | | $ | 15.59 | | | $ | 17.00 | | | $ | 19.42 | |

| TOTAL RETURN | | | (5.28 | )%(d) | | | 12.57 | % | | | 15.60 | % | | | 8.65 | %(d) | | | (3.58 | )% | | | 10.87 | %(d) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Period (000s omitted) | | $ | 863 | | | $ | 936 | | | $ | 711 | | | $ | 536 | | | $ | 426 | | | $ | 11,067 | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 2.53 | %(e) | | | 2.10 | % | | | 2.28 | % | | | 2.30 | %(e) | | | 2.23 | % | | | 2.26 | %(e) |

| Net expenses | | | 0.70 | %(e) | | | 0.70 | % | | | 0.70 | % | | | 0.70 | %(e) | | | 0.70 | % | | | 0.70 | %(e) |

| Gross expenses (f) | | | 9.41 | %(e) | | | 8.83 | % | | | 11.16 | % | | | 14.43 | %(e) | | | 2.09 | % | | | 2.50 | %(e) |

| PORTFOLIO TURNOVER RATE | | | 28 | %(d) | | | 34 | % | | | 48 | % | | | 22 | %(d) | | | 32 | % | | | 35 | %(d) |

| (a) | Effective March 24, 2016, the Fund changed its fiscal year end from November 30 to September 30. The information presented is for the period December 1, 2015 to March 31, 2016. |

| (b) | Commencement of operations. |

| (c) | Calculated based on average shares outstanding during each period. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2019

Dear Shareholder,

We are pleased to report our economic and financial market perspectives and the investment activities for the Baywood SociallyResponsible Fund (the “Fund”) for the six months ended March 31, 2019. The Fund is a mid-to-large capitalization value-oriented portfolio of stock holdings selected from a universe of stocks created through the application of inclusionary and exclusionary social screens and assessments of the ESG profile of each company. Among these stocks, we further evaluate and assess each prospective holding’s valuation and fundamental business attraction to determine the current portfolio holdings. In selecting investments, we consider social criteria such as an issuer’s community relations, corporate governance, employee diversity, employee relations, environmental impact and sustainability, human rights record and product safety.

Just as we wrote in the previous semi-annual shareholder letter, the prior six months is better explained as a tale of two quarters. The fourth quarter witnessed one of the worst fourth quarter declines on record. Fears of a global economic slowdown, higher interest rates and a lingering trade war caused selling of a panic order. The sudden negative shift in investor sentiment during the fourth quarter resulted in a massive swing toward defensive sectors and industries, regardless of long-term fundamentals or valuation attraction. This was most dramatically seen in the swing in favor of utilities, few of which fit our ESG mandate for ownership, which was the only sector to record a positive return for the quarter. And as such, the Baywood SociallyResponsible fund underperformed in the fourth quarter.

For the fourth quarter of 2018, stock selection in healthcare, financial and energy sectors was responsible for much of the underperformance. The underweight position in energy added to returns, however the smaller, less carbon intensive companies that we have had exposure to in this strategy saw their prices decline much more than the large diversified energy companies. High yield dividend stocks in healthcare helped buoy the overall index’s returns as the sector returns were down half as much as the overall index. Not owning the largest and highest yielding stocks detracted from performance, however, and this “flight to safety” proved to be temporary. Many of these companies face pipeline drop-offs and their high dividend yields were indicative of an overall disbelief in their ability to grow earnings. Furthermore, some are also responsible for the significant price taking that has plagued the sector and, absent changes in industry practice, we will approach with caution. None of that mattered, however, when the panic set in and investors rushed into these and other “safety stocks” in the quarter.

“Safety stocks” in general were in-favor again after experiencing their long overdue declines in the first half of 2018 and this overall flight to safety was the single largest reason for the underperformance in the fourth quarter. Given performance differences in what are considered “safe” sectors and those that aren’t, we believe the opportunity set greatly increased in most sectors not considered defensive (industrials, autos, consumer discretionary) and also narrowed for those that are.

While we did not dismiss the factors weighing on the stock market nor the possibility of a continued economic slowdown, we believe the market had already discounted some of the worst-case scenarios. And so, we used the opportunity, as we have done many times over the years, to purchase companies, rather than sell. It has been our experience that when panicked investors sell, we stand to benefit as the willing purchaser of good companies at distressed prices. We added more new companies to the portfolio in the fourth quarter than we did in the rest of 2018.

The price declines in companies like Disney, CarMax, Aptiv and Cummins provided us the opportunity to continue to add to our portfolio of market-leading companies, with strong fundamental prospects at valuations not witnessed in a long time. Disney had long been out-of-reach in terms of its valuation. It’s not that we don’t like companies with dominant market share, high returns on capital and very large barriers to entry. It’s just that these companies tend to have the majority of their fundamental improvements already priced in. However, when major market dislocations such as these provide the opportunity, we tend to jump. Disney created a win-win situation by ceding certain assets from Sky to Comcast during the recent auction. Because it already holds a 39% position, Comcast’s bid only increased the value of its holdings and saved it the burden of the debt it would have needed to acquire the remaining position. Disney’s acquisition of Twenty-First Century Fox should provide it with the content that will continue to solidify its position as a premium content provider. As the company rebalances its sources of earnings away from sports, prepare yourselves to see an Avatar theme park ride and movie franchise in the not too distant future.

The entire auto vertical supply chain has seen price declines that can be compared to that of the financial crisis, which saw several automakers and parts suppliers file for bankruptcy. If one were to think those conditions were going to be repeated anytime soon, then valuations may begin to make sense, however, the conditions that were present in 2005-2008 that brought the industry to its knees are nowhere near close to being present today. The industry is much healthier due to renegotiated labor contracts, debt repayments/ renegotiations, reduced capacity and consolidation. Auto suppliers that were spun out of the OEMs have used the opportunity to increase investments in R&D, enabling meteoric technology advances in a once very staid and stagnant industry.

BAYWOOD SOCIALLYRESPONSIBLE FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2019

Aptiv is one such supplier, the largest of its kind, mostly focused on a new generation of evolving technology in autos. It is the premium supplier of connectors, sensors and software that will eventually enable autonomous driving on a large scale. It has been able to grow its revenues well above market rates by increasing the sales of its content per vehicle. It has very little debt and is well diversified across geographies. It is now one of the few suppliers focused on the emerging technology within autos and should continue to benefit from the increased penetration of electric vehicles and hybrids in the market as well as the penetration of active safety components in vehicles. Having declined nearly 40% from its peak it now trades at valuations suggestive of top-line declines over the next several years, we are delighted to add this top quality company to the portfolio at current prices. Additionally, we believe this company is a great fit in our SociallyResponsible Value strategy which aids in the reduction in traffic deaths, enables better fuel economy and can possibly help reduce the overall number of cars on the road.

Cummins is another high quality company, with superior returns on capital, that has seen unusually large declines in its price despite a leading global market position in engines. The declines began earlier in the year when it reported larger than usual warranty expenses that should prove to be one-time in nature. The near indiscriminate market sell-off during the fourth quarter further pushed the stock into our welcoming hands. It is rare we get to purchase great companies at such distressed prices outside the depths of a recession. Furthermore, Cummins is one of the only truck engine manufacturers whose engines are in compliance with new regulations being enacted around the world. Not only should the company benefit from this position, but it will aid in the reduction of emissions worldwide.

The second half of the period, the first quarter of 2019, somewhat vindicated our conviction to hold steady and stay the course. Volatility, broadly speaking, is not desirable when it comes with a reduction in the value of a portfolio. However, for us managers, it also brings about opportunity. When “disaster” struck in the fourth quarter of 2018 and the odds of an impending recession reached levels not witnessed in years, our opportunistic purchasing set the strategy up for the excess returns in the first quarter. This is a practice we have repeated over the years. After the ebullient markets of 2012 – 2014 in which the indices climbed seemingly without a stop, the volatility in the individual components that make up the market began to increase. In each case we were able to purchase good companies at large discounts to their underlying value. And while the strategy may underperform in the interim as the selling continues, the moves we made set the portfolio up for excess return potential over longer periods of time. The rebound in the first quarter typifies this pattern.

Additional factors that help explain returns in the first quarter can be reduced to a few explanatory notes. In this case, it was our affinity for managers who we consider somewhat like-minded. Brookfield Asset Management is a long-term holding in the strategy. It goes through periods in which its penchant for acquiring undervalued and selling over-valued assets mirrors SKBA’s buying of out-of-favor stocks and selling those in favor, respectively. Furthermore, we constantly survey the market for more opportunities like these, but often find that the value placed on them exceeds what we are willing to pay. Such has been the case for another like-minded manager who tends to be a lot more active during periods of heightened volatility, Oaktree Capital Group.

We initiated a position in the company during the first quarter after years of watching its stock price flail as the market had appropriately discounted that the type of environment that Oaktree excels in is not near. However, time has a way of resolving these things and with each passing day we get closer to the time that will bring about opportunities for Oaktree to purchase distressed assets. Without knowing exactly when this change will occur, but appropriately discounting it into the price of its stock, we finally came to the conclusion that we were being sufficiently rewarded by its high dividend yield and low relative price.

Brookfield may have been thinking something similar when it announced its intention to acquire Oaktree merely one month after we initiated a position in the company. We will often initiate a position in a company well before any fundamental improvements actually take place when we believe the conditions are being appropriately and often times excessively discounted. The acquisition will make Brookfield one of the largest money-managers and was well received by the market. The combination of these stocks is the largest source of outperformance in the first quarter of 2019.

Other top performing stocks for the first quarter were some of those that performed the worst in the fourth quarter, like Aptiv, Devon Energy and Radian. Nothing materially changed in our thesis to own these companies, only that the market’s knee-jerk reaction in one way is often followed by a reaction in the opposite direction.

Somewhat offsetting the strong performance in the stocks mentioned above were CenturyLink, which announced a long-awaited dividend cut in the first quarter, Centennial Resource Development and AbbVie. We initiated a position in CenturyLink aware of the high probability of a dividend cut. Even though dividend cuts are not generally well-received by the market in the short term, they can make a company more fundamentally sound if they strengthen a company’s balance sheet or in this case, free up capacity to pay down debt. The resulting relative dividend yield still remained high enough to reward us while we wait for the company to further strengthen

BAYWOOD SOCIALLYRESPONSIBLE FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2019

its balance sheet. We believe the track record its CEO, Jeff Storey, has created in turning around companies is worth paying more than the existing discount on the shares.

Within healthcare, pharmaceuticals have generally lagged due to concern over pricing power and future price controls. Among our holdings, AbbVie fell victim to this investor aversion. We can attempt to find issues with the individual company yet lackluster performance is better explained by looking at the overall sector. There have been very few “winners” recently due to bipartisan desire to control spiraling healthcare costs. While this is a noble objective, consensus, let alone implementation, will take time. Stock prices rarely wait for final outcomes, however. This is what we believe to be the prevailing reason for weakness across the industry.

Other additions include Weyerhaeuser, Packaging Corp, NXP Semiconductors, and Carmax. We eliminated Auto Nation, Encompass Health, Johnson Controls and International Business Machines in favor of those added.

As we look towards the second half of the fiscal year, we’re inclined to suggest that the recent bout of volatility will moderate. We would not, however, suggest that calm will remain for very long. With trade tensions, aging economic expansions and contentious elections on the not-too-distant horizon, reasons abound for volatility to rear its ugly head once again. Yet these are the environments we seek in order to capture mis-pricings. Those mis-pricings are what improve prospective total returns with lower risk levels. This generally simple yet difficult to adhere to strategy has served us, our clients and our shareholders well in the past and should continue to in the future.

Current and future portfolio holdings are subject to change and risk.

The MSCI KLD 400 Social Index and the Morningstar Category are used to compare fund performance to its peers. It is not possible to invest directly into an index or category. Past performance is no guarantee of future results.

Risk Considerations: Mutual fund investing involves risk, including the possible loss of principal. Socially responsible investment criteria may limit the number of investment opportunities available to the Fund or it may invest a larger portion of its assets in certain sectors which could be more sensitive to market conditions, economic, regulatory and environmental developments. These factors could negatively impact the Fund’s returns. The Fund primarily invests in undervalued securities, which may not appreciate in value as anticipated by the Advisor or remain undervalued for longer than anticipated. The Fund may invest in American Depositary Receipts (ADRs), which involves risks relating to political, economic or regulatory conditions in foreign countries and may cause greater volatility and less liquidity. The Fund may also invest in convertible securities and preferred stock, which may be adversely affected as interest rates rise.

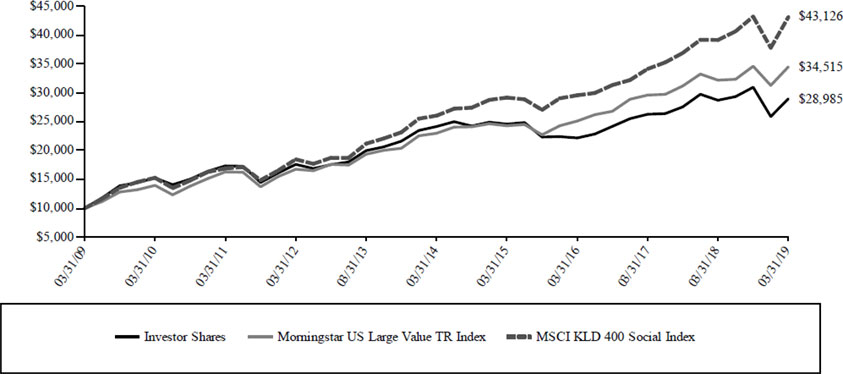

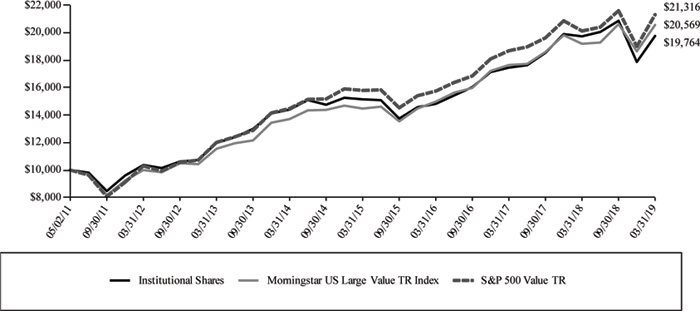

BAYWOOD SOCIALLYRESPONSIBLE FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2019

The following charts reflect the change in the value of a hypothetical $10,000 investment in Investor Shares and a hypothetical $10,000 investment in Institutional Shares, including reinvested dividends and distributions, in the Baywood SociallyResponsible Fund (the “Fund”) compared with the performance of the primary benchmark, Morningstar Large Value Index, and the secondary benchmark, MSCI KLD 400 Social Index (the “indices”), over the past ten fiscal years. The Morningstar US Large Value TR Index measures the performance of large-cap stocks with relatively low prices given anticipated per share earnings, book value, cash flow, sales and dividends. The MSCI KLD 400 Social Index is a capitalization weighted index of 400 US securities that provides exposure to companies with outstanding Environmental, Social and Governance ratings and excludes companies whose products have negative social or environmental impacts. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $10,000 Investment

Investor Shares vs. Morningstar US Large Value TR Index and MSCI KLD 400 Social Index

Average Annual Total Returns Periods Ended March 31, 2019 | One Year | Five Year | Ten Year |

| Baywood SociallyResponsible Fund Investor Shares* | 0.91% | 3.69% | 11.23% |

| Morningstar US Large Value TR Index | 7.17% | 8.45% | 13.19% |

| MSCI KLD 400 Social Index | 10.14% | 10.61% | 15.74% |

| * | Performance for Investor Shares for periods prior to January 8, 2016, reflects the performance and expenses of City National Rochdale Socially Responsible Equity Fund, a series of City National Rochdale Funds (the “Predecessor Fund”). |

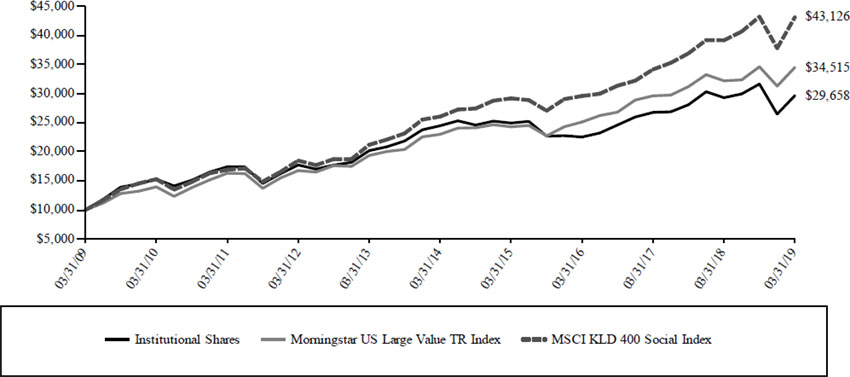

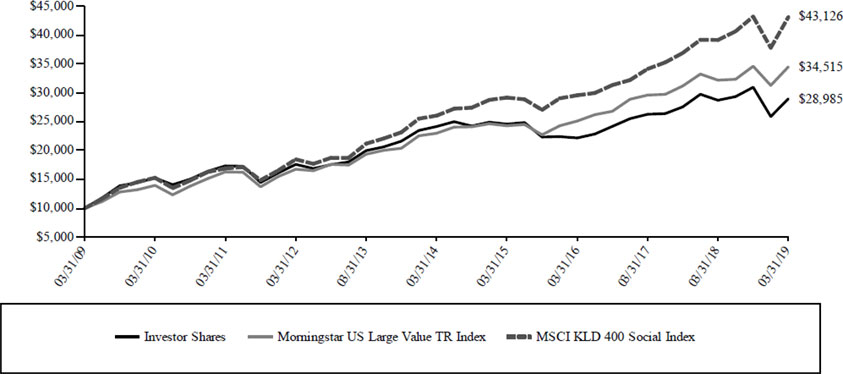

BAYWOOD SOCIALLYRESPONSIBLE FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2019

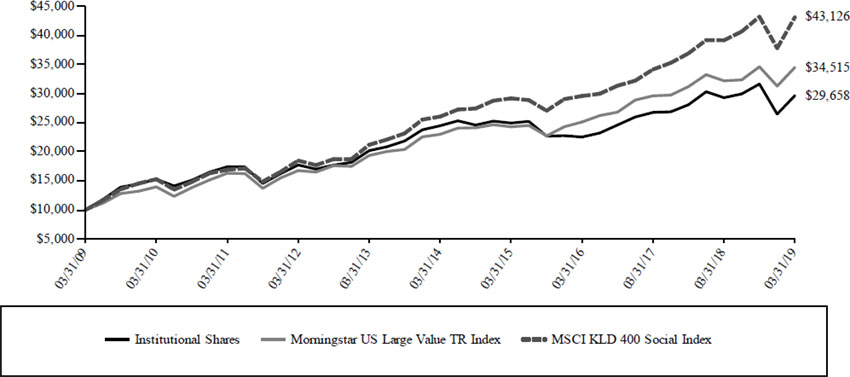

Comparison of Change in Value of a $10,000 Investment

Institutional Shares vs. Morningstar US Large Value TR Index and MSCI KLD 400 Social Index

Average Annual Total Returns Periods Ended March 31, 2019 | One Year | Five Year | Ten Year |

| Baywood SociallyResponsible Fund Institutional Shares* | 1.22% | 3.92% | 11.48% |

| Morningstar US Large Value TR Index | 7.17% | 8.45% | 13.19% |

| MSCI KLD 400 Social Index | 10.14% | 10.61% | 15.74% |

| * | Performance for Institutional Shares for periods prior to January 8, 2016, reflects the performance and expenses of City National Rochdale Socially Responsible Equity Fund, a series of City National Rochdale Funds (the “Predecessor Fund”). |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratios (gross) for Investor Shares and Institutional Shares are 3.98% and 3.03%, respectively. However, the Fund’s advisor has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 1.14% and 0.89% for Investor Shares and Institutional Shares, respectively, through January 31, 2020 (the “Expense Cap”) (the “Expense Cap”). The Expense Cap may be raised or eliminated only with the consent of the Board of Trustees. The advisor may be reimbursed by each Fund for fees waived and expenses reimbursed by the advisor pursuant to the Expense Cap if such payment is approved by the Board, made within three years of the fee waiver or expense reimbursement and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap and (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement will increase if exclusions from the Expense Cap apply. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (855) 409-2297.

BAYWOOD SOCIALLYRESPONSIBLE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2019

| Shares | | | Security Description | | Value | |

| Common Stock - 96.5% | |

| Basic Materials - 5.8% |

| | 1,800 | | | Nutrien, Ltd. | | $ | 94,968 | |

| | 700 | | | Packaging Corp. of America | | | 69,566 | |

| | 2,100 | | | The Mosaic Co. | | | 57,351 | |

| | | | | | | | 221,885 | |

| Capital Goods / Industrials - 4.9% |

| | 500 | | | Cummins, Inc. | | | 78,935 | |

| | 2,400 | | | Sensata Technologies Holding PLC (a) | | | 108,048 | |

| | | | | | | | 186,983 | |

| Communication Services - 7.7% |

| | 5,300 | | | CenturyLink, Inc. | | | 63,547 | |

| | 3,400 | | | Discovery Communications, Inc., Class C (a) | | | 86,428 | |

| | 700 | | | The Walt Disney Co. | | | 77,721 | |

| | 1,200 | | | Verizon Communications, Inc. | | | 70,956 | |

| | | | | | | | 298,652 | |

| Consumer Discretionary - 7.5% |

| | 800 | | | Aptiv PLC | | | 63,592 | |

| | 900 | | | CarMax, Inc. (a) | | | 62,820 | |

| | 1,600 | | | Tapestry, Inc. | | | 51,984 | |

| | 8,700 | | | TRI Pointe Group, Inc. (a) | | | 109,968 | |

| | | | | | | | 288,364 | |

| Consumer Staples - 4.9% |

| | 2,300 | | | Mondelez International, Inc., Class A | | | 114,816 | |

| | 600 | | | PepsiCo., Inc. | | | 73,530 | |

| | | | | | | | 188,346 | |

| Energy - 4.8% |

| | 3,600 | | | Centennial Resource Development, Inc., Class A (a) | | | 31,644 | |

| | 3,100 | | | Devon Energy Corp. | | | 97,836 | |

| | 1,300 | | | Schlumberger, Ltd. | | | 56,641 | |

| | | | | | | | 186,121 | |

| Financials - 25.0% |

| | 3,400 | | | Air Lease Corp. | | | 116,790 | |

| | 1,500 | | | American Express Co. | | | 163,950 | |

| | 2,100 | | | American International Group, Inc. | | | 90,426 | |

| | 3,800 | | | Bank of America Corp. | | | 104,842 | |

| | 1,600 | | | BOK Financial Corp. | | | 130,480 | |

| | 3,250 | | | Brookfield Asset Management, Inc., Class A | | | 151,613 | |

| | 600 | | | M&T Bank Corp. | | | 94,212 | |

| | 1,100 | | | Oaktree Capital Group, LLC | | | 54,615 | |

| | 2,800 | | | Radian Group, Inc. | | | 58,072 | |

| | | | | | | | 965,000 | |

| Health Care - 15.4% |

| | 700 | | | AbbVie, Inc. | | | 56,413 | |

| | 1,700 | | | AstraZeneca PLC, ADR | | | 68,731 | |

| | 500 | | | Becton Dickinson and Co. | | | 124,865 | |

| | 3,800 | | | Koninklijke Philips NV, ADR | | | 155,268 | |

| | 400 | | | Laboratory Corp. of America Holdings (a) | | | 61,192 | |

| | 1,400 | | | Medtronic PLC | | | 127,512 | |

| | | | | | | | 593,981 | |

| Real Estate - 3.7% |

| | 4,200 | | | Brookfield Property Partners LP | | | 86,394 | |

| | 2,100 | | | Weyerhaeuser Co. REIT | | | 55,314 | |

| | | | | | | | 141,708 | |

| Technology - 12.8% |

| | 2,800 | | | Cisco Systems, Inc. | | | 151,172 | |

| | 3,000 | | | Corning, Inc. | | | 99,300 | |

| | 3,400 | | | HP, Inc. | | | 66,062 | |

| | 1,800 | | | Intel Corp. | | | 96,660 | |

| | 900 | | | NXP Semiconductors NV | | | 79,551 | |

| | | | | | | | 492,745 | |

| Shares | | | Security Description | | Value | |

| Transportation - 4.0% | | | |

| | 8,800 | | | AP Moller - Maersk A/S, ADR | | $ | 55,484 | |

| | 600 | | | Union Pacific Corp. | | | 100,320 | |

| | | | | | | | 155,804 | |

| Total Common Stock (Cost $3,128,680) | | | 3,719,589 | |

| Shares | | | Security Description | | Value | |

| Money Market Fund - 2.9% | | | | |

| | 113,665 | | | Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class, 2.34% (b) | | | | |

| | | | | (Cost $113,665) | | | 113,665 | |

| Investments, at value - 99.4% (Cost $3,242,345) | | $ | 3,833,254 | |

| Other Assets & Liabilities, Net - 0.6% | | | 22,945 | |

| Net Assets - 100.0% | | $ | 3,856,199 | |

| ADR | American Depositary Receipt |

| LLC | Limited Liability Company |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of March 31, 2019. |

The following is a summary of the inputs used to value the Fund's instruments as of March 31, 2019.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| Valuation Inputs | | Investments in Securities | |

| Level 1 - Quoted Prices | | $ | 3,719,589 | |

| Level 2 - Other Significant Observable Inputs | | | 113,665 | |

| Level 3 - Significant Unobservable Inputs | | | – | |

| Total | | $ | 3,833,254 | |

The Level 1 value displayed in this table is Common Stock. The Level 2 value displayed in this table is a Money Market Fund. Refer to this Schedule of Investments for a further breakout of each security by industry.

PORTFOLIO HOLDINGS

| % of Total Investments |

| Basic Materials | | | 5.8% | |

| Capital Goods / Industrials | | | 4.9% | |

| Communication Services | | | 7.8% | |

| Consumer Discretionary | | | 7.5% | |

| Consumer Staples | | | 4.9% | |

| Energy | | | 4.8% | |

| Financials | | | 25.2% | |

| Health Care | | | 15.5% | |

| Real Estate | | | 3.7% | |

| Technology | | | 12.8% | |

| Transportation | | | 4.1% | |

| Money Market Fund | | | 3.0% | |

| | | | 100.0% | |

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2019

| ASSETS |

| Investments, at value (Cost $3,242,345) | | $ | 3,833,254 | |

| Cash | | | 625 | |

| Receivables: |

| Fund shares sold | | | 953 | |

| Investment securities sold | | | 8,949 | |

| Dividends | | | 7,954 | |

| From investment advisor | | | 10,820 | |

| Prepaid expenses | | | 20,866 | |

| Total Assets | | | 3,883,421 | |

| | | | | |

| LIABILITIES |

| Payables: |

| Investment securities purchased | | | 8,084 | |

| Fund shares redeemed | | | 860 | |

| Accrued Liabilities: |

| Trustees’ fees and expenses | | | 23 | |

| Fund services fees | | | 4,972 | |

| Other expenses | | | 13,283 | |

| Total Liabilities | | | 27,222 | |

| NET ASSETS | | $ | 3,856,199 | |

| | | | | |

| COMPONENTS OF NET ASSETS |

| Paid-in capital | | $ | 3,263,153 | |

| Distributable earnings | | | 593,046 | |

| NET ASSETS | | $ | 3,856,199 | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) |

| Investor Shares | | | 208,946 | |

| Institutional Shares | | | 148,789 | |

| | | | | |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE |

| Investor Shares (based on net assets of $2,254,297) | | $ | 10.79 | |

| Institutional Shares (based on net assets of $1,601,902) | | $ | 10.77 | |

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

STATEMENTS OF OPERATIONS

SIX MONTHS ENDED MARCH 31, 2019

| INVESTMENT INCOME |

| Dividend income (Net of foreign withholding taxes of $434) | | $ | 41,737 | |

| Total Investment Income | | | 41,737 | |

| | | | | |

| EXPENSES |

| Investment advisor fees | | | 13,555 | |

| Fund services fees | | | 34,558 | |

| Transfer agent fees: |

| Investor Shares | | | 8,942 | |

| Institutional Shares | | | 9,192 | |

| Distribution fees: |

| Investor Shares | | | 2,898 | |

| Custodian fees | | | 2,487 | |

| Registration fees: |

| Investor Shares | | | 7,336 | |

| Institutional Shares | | | 7,554 | |

| Professional fees | | | 10,779 | |

| Trustees' fees and expenses | | | 1,005 | |

| Other expenses | | | 14,621 | |

| Total Expenses | | | 112,927 | |

| Fees waived and expenses reimbursed | | | (92,795 | ) |

| Net Expenses | | | 20,132 | |

| | | | | |

| NET INVESTMENT INCOME | | | 21,605 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) |

| Net realized gain on investments | | | 119,453 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (432,524 | ) |

| NET REALIZED AND UNREALIZED LOSS | | | (313,071 | ) |

| DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (291,466 | ) |

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the Six Months Ended March 31, 2019 | | | For the Year Ended September 30, 2018 | |

| OPERATIONS |

| Net investment income | | $ | 21,605 | | | $ | 68,010 | |

| Net realized gain | | | 119,453 | | | | 890,310 | |

| Net change in unrealized appreciation (depreciation) | | | (432,524 | ) | | | (186,732 | ) |

| Increase (Decrease) in Net Assets Resulting from Operations | | | (291,466 | ) | | | 771,588 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS |

| Investor Shares | | | (196,957 | ) | | | (51,496 | )* |

| Institutional Shares | | | (132,573 | ) | | | (120,653 | )** |

| Total Distributions Paid | | | (329,530 | ) | | | (172,149 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS |

| Sale of shares: |

| Investor Shares | | | 84,428 | | | | 48,352 | |

| Institutional Shares | | | 60,612 | | | | 190,483 | |

| Reinvestment of distributions: |

| Investor Shares | | | 185,914 | | | | 48,772 | |

| Institutional Shares | | | 130,131 | | | | 120,102 | |

| Redemption of shares: |

| Investor Shares | | | (336,965 | ) | | | (542,020 | ) |

| Institutional Shares | | | (47,848 | ) | | | (4,342,445 | ) |

| Increase (Decrease) in Net Assets from Capital Share Transactions | | | 76,272 | | | | (4,476,756 | ) |

| Decrease in Net Assets | | | (544,724 | ) | | | (3,877,317 | ) |

| | | | | | | | | |

| NET ASSETS |

| Beginning of Period | | | 4,400,923 | | | | 8,278,240 | |

| End of Period | | $ | 3,856,199 | | | $ | 4,400,923 | *** |

| | | | | | | | | |

| SHARE TRANSACTIONS |

| Sale of shares: |

| Investor Shares | | | 7,432 | | | | 3,910 | |

| Institutional Shares | | | 5,610 | | | | 15,647 | |

| Reinvestment of distributions: |

| Investor Shares | | | 18,356 | | | | 4,058 | |

| Institutional Shares | | | 12,863 | | | | 10,021 | |

| Redemption of shares: |

| Investor Shares | | | (30,956 | ) | | | (44,965 | ) |

| Institutional Shares | | | (4,596 | ) | | | (363,462 | ) |

| Increase (Decrease) in Shares | | | 8,709 | | | | (374,791 | ) |

| * | Distribution was the result of net investment income and net realized gain of $14,499 and $36,997, respectively, at September 30, 2018. |

| ** | Distribution was the result of net investment income and net realized gain of $45,236 and $75,417, respectively, at September 30, 2018. |

| *** | Includes undistributed net investment income of $1,735 at September 30, 2018. The requirement to disclose the corresponding amount as of March 31, 2019 was eliminated. |

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each period.

| | | For the Six Months Ended March 31, 2019 | | | For the Years Ended September 30, | |

| | | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| INVESTOR SHARES |

| NET ASSET VALUE, Beginning of Year | | $ | 12.62 | | | $ | 11.45 | | | $ | 10.14 | | | $ | 10.16 | | | $ | 11.42 | | | $ | 12.26 | |

| INVESTMENT OPERATIONS |

| Net investment income (a) | | | 0.06 | | | | 0.09 | | | | 0.06 | | | | 0.08 | | | | 0.11 | | | | 0.18 | |

| Net realized and unrealized gain (loss) | | | (0.94 | ) | | | 1.30 | | | | 1.35 | | | | 0.71 | | | | (0.98 | ) | | | 1.15 | |

| Total from Investment Operations | | | (0.88 | ) | | | 1.39 | | | | 1.41 | | | | 0.79 | | | | (0.87 | ) | | | 1.33 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | |

| Net investment income | | | (0.07 | ) | | | (0.06 | ) | | | (0.10 | ) | | | (0.28 | ) | | | (0.10 | ) | | | (0.15 | ) |

| Net realized gain | | | (0.88 | ) | | | (0.16 | ) | | | – | | | | (0.53 | ) | | | (0.29 | ) | | | (2.02 | ) |

| Total Distributions to Shareholders | | | (0.95 | ) | | | (0.22 | ) | | | (0.10 | ) | | | (0.84 | ) | | | (0.39 | ) | | | (2.17 | ) |

| NET ASSET VALUE, End of Year | | $ | 10.79 | | | $ | 12.62 | | | $ | 11.45 | | | $ | 10.14 | | | $ | 10.16 | | | $ | 11.42 | |

| TOTAL RETURN | | | (6.41 | )%(b) | | | 12.29 | % | | | 13.98 | % | | | 8.28 | % | | | (7.86 | )% | | | 12.11 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTARY DATA | |

| Net Assets at End of Year (000s omitted) | | $ | 2,254 | | | $ | 2,701 | | | $ | 2,874 | | | $ | 9,890 | | | $ | 23,045 | | | $ | 26,763 | |

| Ratios to Average Net Assets: |

| Net investment income | | | 1.01 | %(c) | | | 0.76 | % | | | 0.60 | % | | | 0.77 | % | | | 0.99 | % | | | 1.55 | % |

| Net expenses | | | 1.14 | %(c) | | | 1.14 | % | | | 1.14 | % | | | 1.28 | % | | | 1.14 | % | | | 1.14 | % |

| Gross expenses(d) | | | 5.60 | %(c) | | | 3.98 | % | | | 2.64 | % | | | 1.84 | % | | | 1.37 | % | | | 1.46 | % |

| PORTFOLIO TURNOVER RATE | | | 19 | %(b) | | | 31 | % | | | 42 | % | | | 57 | % | | | 29 | % | | | 34 | % |

| (a) | Calculated based on average shares outstanding during each period. |

| (d) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each period.

| | | For the Six Months Ended March 31, 2019 | | | For the Years Ended September 30, | |

| | | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| INSTITUTIONAL SHARES |

| NET ASSET VALUE, Beginning of Year | | $ | 12.60 | | | $ | 11.43 | | | $ | 10.15 | | | $ | 10.18 | | | $ | 11.45 | | | $ | 12.28 | |

| INVESTMENT OPERATIONS |

| Net investment income (a) | | | 0.07 | | | | 0.12 | | | | 0.10 | | | | 0.14 | | | | 0.14 | | | | 0.19 | |

| Net realized and unrealized gain (loss) | | | (0.93 | ) | | | 1.31 | | | | 1.33 | | | | 0.66 | | | | (0.99 | ) | | | 1.18 | |

| Total from Investment Operations | | | (0.86 | ) | | | 1.43 | | | | 1.43 | | | | 0.80 | | | | (0.85 | ) | | | 1.37 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | |

| Net investment income | | | (0.09 | ) | | | (0.10 | ) | | | (0.15 | ) | | | (0.30 | ) | | | (0.13 | ) | | | (0.18 | ) |

| Net realized gain | | | (0.88 | ) | | | (0.16 | ) | | | – | | | | (0.53 | ) | | | (0.29 | ) | | | (2.02 | ) |

| Total Distributions to Shareholders | | | (0.97 | ) | | | (0.26 | ) | | | (0.15 | ) | | | (0.83 | ) | | | (0.42 | ) | | | (2.20 | ) |

| NET ASSET VALUE, End of Year | | $ | 10.77 | | | $ | 12.60 | | | $ | 11.43 | | | $ | 10.15 | | | $ | 10.18 | | | $ | 11.45 | |

| TOTAL RETURN | | | (6.28 | )%(b) | | | 12.66 | % | | | 14.18 | % | | | 8.40 | % | | | (7.70 | )% | | | 12.46 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTARY DATA |

| Net Assets at End of Year (000s omitted) | | $ | 1,602 | | | $ | 1,699 | | | $ | 5,404 | | | $ | 5,555 | | | $ | 238,379 | | | $ | 172,830 | |

| Ratios to Average Net Assets: |

| Net investment income | | | 1.27 | %(c) | | | 1.01 | % | | | 0.92 | % | | | 1.35 | % | | | 1.22 | % | | | 1.62 | % |

| Net expenses | | | 0.89 | %(c) | | | 0.89 | % | | | 0.89 | % | | | 0.89 | % | | | 0.89 | %(d) | | | 0.89 | % |

| Gross expenses(e) | | | 6.18 | %(c) | | | 3.03 | % | | | 2.64 | % | | | 1.00 | % | | | 0.87 | % | | | 0.96 | % |

| PORTFOLIO TURNOVER RATE | | | 19 | %(b) | | | 31 | % | | | 42 | % | | | 57 | % | | | 29 | % | | | 34 | % |

| (a) | Calculated based on average shares outstanding during each period. |

| (d) | Ratio includes waivers and previously waived investment advisory fees recovered. The impact of the recovered fees may cause a higher net expense ratio. |

| (e) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements.

BAYWOOD FUNDS

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2019

Note 1. Organization

Baywood ValuePlus Fund and Baywood SociallyResponsible Fund (individually, a “Fund” and collectively, the “Funds”) are diversified portfolios of Forum Funds II (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940, as amended (the “Act”). Under its Trust Instrument, the Trust is authorized to issue an unlimited number of each Fund’s shares of beneficial interest without par value. The Baywood ValuePlus Fund commenced operations on December 2, 2013, through a reorganization of a collective investment trust into the Baywood ValuePlus Fund. The collective investment trust was previously managed by the Baywood ValuePlus Fund’s Advisor and portfolio management team. This collective investment trust was organized and commenced operations on June 27, 2008. The Baywood ValuePlus Fund currently offers two classes of shares: Investor Shares and Institutional Shares. The Baywood ValuePlus Fund seeks to achieve long-term capital appreciation by investing in undervalued equity securities. The Baywood SociallyResponsible Fund commenced operations on January 3, 2005. The Baywood SociallyResponsible Fund currently offers two classes of shares: Investor Shares and Institutional Shares. The Baywood SociallyResponsible Fund seeks to provide long-term capital growth.

On December 7, 2015, at a special meeting of shareholders of Baywood SociallyResponsible Fund, formerly City National Rochdale Socially Responsible Equity Fund, a series of City National Rochdale Funds (the "Predecessor Fund"), the shareholders approved a proposal to reorganize the Predecessor Fund into the Baywood SociallyResponsible Fund, a newly created series of the Forum Funds II. The Predecessor Fund was sub-advised by the Fund's Advisor, SKBA Capital Management, LLC, with the same portfolio managers as the Baywood SociallyResponsible Fund. The Baywood SociallyResponsible Fund is managed in a manner that is in all material respects equivalent to the management of the Predecessor Fund, including the investment objective, strategies, guidelines and restrictions. The primary purpose of the reorganization was to move the Predecessor Fund to a newly created series of Forum Funds II. As a result of the reorganization, the Baywood SociallyResponsible Fund is now operating under the supervision of the Trust’s board of trustees. On January 8, 2016, the Baywood SociallyResponsible Fund acquired all of the assets, subject to liabilities, of the Predecessor Fund. The shares of the Predecessor Fund were, in effect, exchanged on a tax-free basis for Shares of the Baywood SociallyResponsible Fund with the same aggregate value. No commission or other transactional fees were imposed on shareholders in connection with the tax-free exchange of their shares.

Note 2. Summary of Significant Accounting Policies

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services - Investment Companies.” These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the fiscal period. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of each Fund:

Security Valuation – Securities are valued at market prices using the last quoted trade or official closing price from the principal exchange where the security is traded, as provided by independent pricing services on each Fund business day. In the absence of a last trade, securities are valued at the mean of the last bid and ask price provided by the pricing service. Shares of non-exchange traded open-end mutual funds are valued at net asset value (“NAV”). Short-term investments that mature in sixty days or less may be valued at amortized cost.

Each Fund values its investments at fair value pursuant to procedures adopted by the Trust’s Board of Trustees (the “Board”) if (1) market quotations are not readily available or (2) the Advisor, as defined in Note 3, believes that the values available are unreliable. The Trust’s Valuation Committee, as defined in each Fund’s registration statement, performs certain functions as they relate to the administration and oversight of each Fund’s valuation procedures. Under these procedures, the Valuation Committee convenes on a regular and ad hoc basis to review such investments and considers a number of factors, including valuation methodologies and significant unobservable inputs, when arriving at fair value.

The Valuation Committee may work with the Advisor to provide valuation inputs. In determining fair valuations, inputs may include market-based analytics that may consider related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant investment information. Advisor inputs may include an income-based approach in which the anticipated future cash flows of the investment are discounted in determining fair value. Discounts may also be applied based on the nature or duration of any

BAYWOOD FUNDS

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2019

restrictions on the disposition of the investments. The Valuation Committee performs regular reviews of valuation methodologies, key inputs and assumptions, disposition analysis and market activity.

Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotes.

GAAP has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 - Quoted prices in active markets for identical assets and liabilities.