UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS II

Three Canal Plaza, Suite 600

Portland, Maine 04101

Zachary Tackett, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end June 30

Date of reporting period: July 1, 2024– December 31, 2024

ITEM 1. REPORT TO SHAREHOLDERS.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended (“Act”), is attached hereto.

Semi-Annual Shareholder Report - December 31, 2024

This semi-annual shareholder report contains important information about the Acuitas US Microcap Fund for the period of July 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://acuitasfunds.com/invest-with-us/. You can also request this information by contacting us at (844) 805-5628.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $79 | 1.50% |

|---|

How did the Fund perform in the last six months?

The Fund returned +9.61% over the last six months, underperforming the Russell Microcap Index’s return of +14.67% by 506 basis points. Generally speaking, it was a difficult market environment for active managers, with a few notable outlier companies within technology that were a meaningful drag on the Fund’s excess returns. These stocks were boosted by the AI and quantum computing frenzy within U.S. equity markets.

We are excited about the addition of a new subadviser to the Fund during this time period. While it has only been a few months, the manager got off to a solid performance start by outperforming our benchmark.

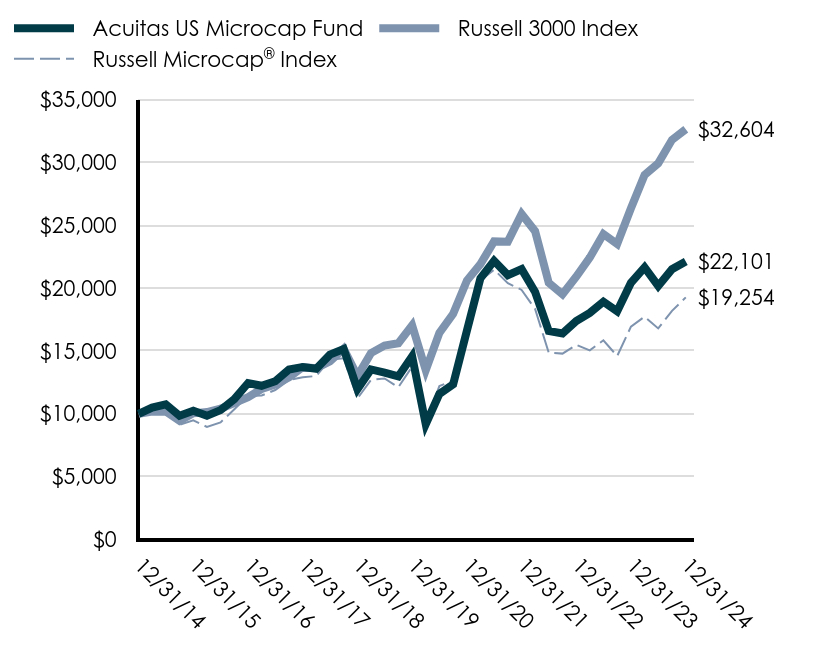

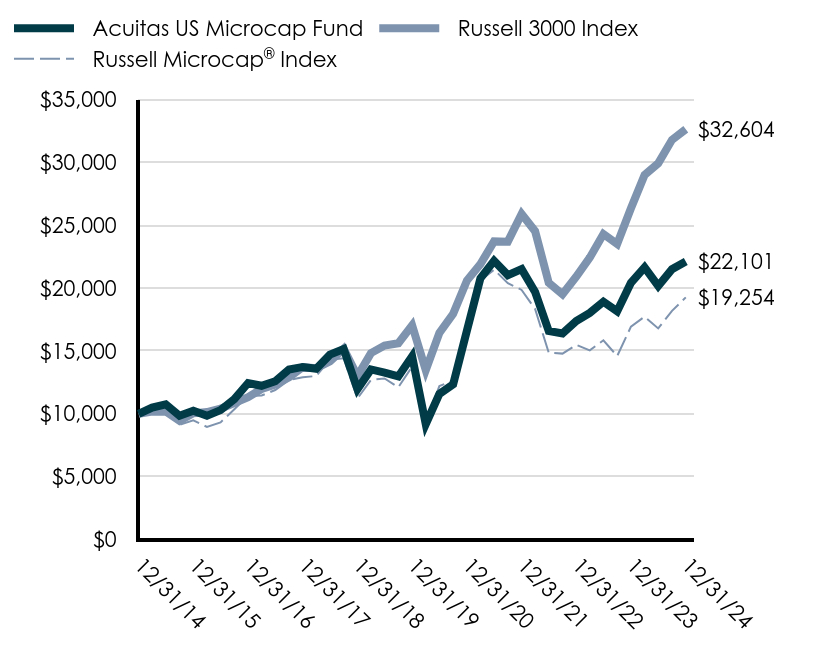

Total Return Based on a $10,000 Investment

| Date | Acuitas US Microcap Fund | Russell 3000 Index | Russell Microcap® Index |

|---|

| 12/31/14 | $10,000 | $10,000 | $10,000 |

|---|

| 03/31/15 | $10,506 | $10,180 | $10,314 |

|---|

| 06/30/15 | $10,764 | $10,194 | $10,603 |

|---|

| 09/30/15 | $9,857 | $9,455 | $9,142 |

|---|

| 12/31/15 | $10,245 | $10,048 | $9,484 |

|---|

| 03/31/16 | $9,848 | $10,145 | $8,969 |

|---|

| 06/30/16 | $10,305 | $10,412 | $9,325 |

|---|

| 09/30/16 | $11,168 | $10,870 | $10,373 |

|---|

| 12/31/16 | $12,453 | $11,327 | $11,416 |

|---|

| 03/31/17 | $12,233 | $11,978 | $11,459 |

|---|

| 06/30/17 | $12,594 | $12,339 | $11,899 |

|---|

| 09/30/17 | $13,525 | $12,903 | $12,690 |

|---|

| 12/31/17 | $13,730 | $13,721 | $12,919 |

|---|

| 03/31/18 | $13,585 | $13,633 | $13,006 |

|---|

| 06/30/18 | $14,706 | $14,163 | $14,303 |

|---|

| 09/30/18 | $15,152 | $15,172 | $14,422 |

|---|

| 12/31/18 | $11,961 | $13,002 | $11,229 |

|---|

| 03/31/19 | $13,534 | $14,828 | $12,700 |

|---|

| 06/30/19 | $13,283 | $15,435 | $12,817 |

|---|

| 09/30/19 | $12,979 | $15,614 | $12,118 |

|---|

| 12/31/19 | $14,579 | $17,035 | $13,748 |

|---|

| 03/31/20 | $9,181 | $13,475 | $9,350 |

|---|

| 06/30/20 | $11,589 | $16,443 | $12,206 |

|---|

| 09/30/20 | $12,356 | $17,957 | $12,657 |

|---|

| 12/31/20 | $16,629 | $20,593 | $16,629 |

|---|

| 03/31/21 | $20,770 | $21,900 | $20,602 |

|---|

| 06/30/21 | $22,159 | $23,705 | $21,455 |

|---|

| 09/30/21 | $21,021 | $23,681 | $20,386 |

|---|

| 12/31/21 | $21,501 | $25,877 | $19,845 |

|---|

| 03/31/22 | $19,689 | $24,512 | $18,337 |

|---|

| 06/30/22 | $16,582 | $20,418 | $14,861 |

|---|

| 09/30/22 | $16,395 | $19,506 | $14,789 |

|---|

| 12/31/22 | $17,382 | $20,907 | $15,488 |

|---|

| 03/31/23 | $18,024 | $22,408 | $15,050 |

|---|

| 06/30/23 | $18,911 | $24,288 | $15,847 |

|---|

| 09/30/23 | $18,146 | $23,497 | $14,590 |

|---|

| 12/31/23 | $20,409 | $26,334 | $16,933 |

|---|

| 03/31/24 | $21,632 | $28,973 | $17,726 |

|---|

| 06/30/24 | $20,164 | $29,904 | $16,791 |

|---|

| 09/30/24 | $21,494 | $31,767 | $18,183 |

|---|

| 12/31/24 | $22,101 | $32,604 | $19,254 |

|---|

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years. Effective June 12, 2024, the Fund changed its primary benchmark index from the Russell Microcap® Index to the Russell 3000® Index due to regulatory requirements. The Fund retained the Russell Microcap® Index as a secondary benchmark because the Russell Microcap® Index more closely aligns with the Fund’s investment strategies and investment restrictions.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Acuitas US Microcap Fund | 8.29% | 8.68% | 8.25% |

|---|

| Russell 3000 Index | 23.81% | 13.86% | 12.55% |

|---|

Russell Microcap® Index | 13.70% | 6.97% | 6.77% |

|---|

| Total Net Assets | $93,258,170 |

|---|

| # of Portfolio Holdings | 253 |

|---|

| Portfolio Turnover Rate | 30% |

|---|

| Investment Advisory Fees (Net of fees waived) | $432,726 |

|---|

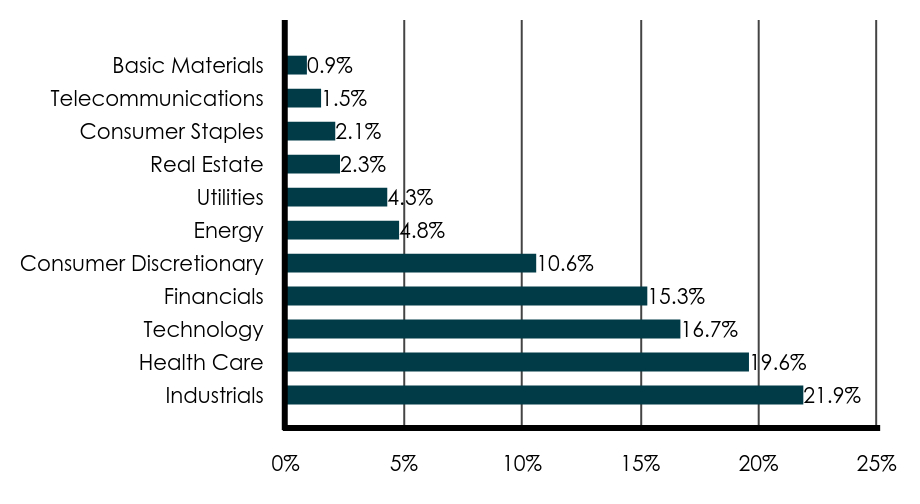

Sector Weightings

(% total investments)*

| Value | Value |

|---|

| Industrials | 21.9% |

| Health Care | 19.6% |

| Technology | 16.7% |

| Financials | 15.3% |

| Consumer Discretionary | 10.6% |

| Energy | 4.8% |

| Utilities | 4.3% |

| Real Estate | 2.3% |

| Consumer Staples | 2.1% |

| Telecommunications | 1.5% |

| Basic Materials | 0.9% |

* excluding cash equivalents

Top Ten Holdings

(% of total investments)*

| Ducommun, Inc. | 1.89% |

| Columbus McKinnon Corp. | 1.87% |

| Select Water Solutions, Inc., Class A | 1.64% |

| Interface, Inc. | 1.46% |

| Magnite, Inc. | 1.39% |

| Photronics, Inc. | 1.32% |

| Barrett Business Services, Inc. | 1.30% |

| American Coastal Insurance Corp. | 1.25% |

| iRadimed Corp. | 1.20% |

| ChromaDex Corp. | 1.17% |

* excluding cash equivalents

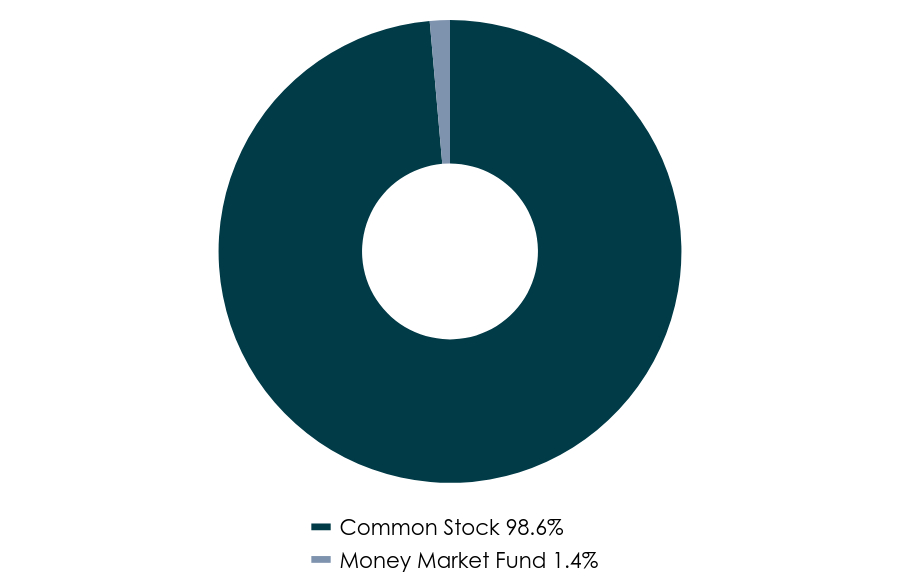

Asset Class Weightings

(% total investments)

| Value | Value |

|---|

| Common Stock | 98.6% |

| Money Market Fund | 1.4% |

Where can I find additional information about the fund?

If you wish to view additional information about the Fund; including but not limited to its prospectus, holdings, financial information, and proxy information, please visit https://acuitasfunds.com/invest-with-us/ .

Semi-Annual Shareholder Report - December 31, 2024

(b) Not applicable.

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

(a) Included as part of financial statements filed under Item 7(a).

(b) Not applicable.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

(a)

SEMI-ANNUAL

FINANCIALS

AND

OTHER

INFORMATION

December

31,

2024

(Unaudited)

Schedule

of

Investments

1

Statement

of

Assets

and

Liabilities

4

Statement

of

Operations

5

Statements

of

Changes

in

Net

Assets

6

Financial

Highlights

7

Notes

to

Financial

Statements

8

Other

Information

13

ACUITAS

US

MICROCAP

FUND

SCHEDULE

OF

INVESTMENTS

December

31,

2024

See

Notes

to

Financial

Statements.

Shares

Security

Description

Value

Common

Stock

-

98.3%

Basic

Materials

-

0.9%

17,111

LifeMD,

Inc.

(a)

$

84,699

35,432

Northern

Technologies

International

Corp.

477,978

136,189

Taseko

Mines,

Ltd.

(a)

264,207

826,884

Consumer

Discretionary

-

10.4%

2,606

Acme

United

Corp.

97,282

2,743

Allegiant

Travel

Co.

258,171

50,366

Arhaus,

Inc.

(a)

473,440

6,366

Beazer

Homes

USA,

Inc.

(a)

174,810

6,528

Blue

Bird

Corp.

(a)

252,177

9,490

Civeo

Corp.

215,613

6,100

Climb

Global

Solutions,

Inc.

773,175

19,887

Crown

Crafts,

Inc.

89,094

52,705

Duluth

Holdings,

Inc.,

Class B

(a)

162,858

13,872

First

Watch

Restaurant

Group,

Inc.

(a)

258,158

74,910

Fluent,

Inc.

(a)

188,773

7,969

Fox

Factory

Holding

Corp.

(a)

241,222

39,366

FTAI

Infrastructure,

Inc.

285,797

33,050

Guess?,

Inc.

464,683

39,939

Holley,

Inc.

(a)

120,616

55,120

Interface,

Inc.

1,342,172

5,956

Jack

in

the

Box,

Inc.

248,008

2,963

Kura

Sushi

USA,

Inc.,

Class A

(a)

268,388

19,491

Lands'

End,

Inc.

(a)

256,112

9,157

Malibu

Boats,

Inc.,

Class A

(a)

344,212

1,783

Miller

Industries,

Inc./TN

116,537

83,055

Motorcar

Parts

of

America,

Inc.

(a)

631,218

6,762

Rocky

Brands,

Inc.

154,174

6,033

Shoe

Carnival,

Inc.

199,572

57,030

Sportsman's

Warehouse

Holdings,

Inc.

(a)

152,270

13,074

The

Lovesac

Co.

(a)

309,331

18,682

The

RealReal,

Inc.

(a)

204,194

12,494

Travelzoo

(a)

249,255

16,345

Universal

Technical

Institute,

Inc.

(a)

420,230

9,609

Viad

Corp.

(a)

408,478

666

Victoria's

Secret

&

Co.

(a)

27,586

18,005

Zumiez,

Inc.

(a)

345,156

9,732,762

Consumer

Staples

-

2.1%

23,132

B&G

Foods,

Inc.

159,379

50,798

Cronos

Group,

Inc.

(a)

102,612

22,969

Mama's

Creations,

Inc.

(a)

182,833

3,353

Oil-Dri

Corp.

of

America

293,857

78,003

SunOpta,

Inc.

(a)

600,623

7,637

The

Chefs'

Warehouse,

Inc.

(a)

376,657

3,616

The

Vita

Coco

Co.,

Inc.

(a)

133,467

2,853

Vital

Farms,

Inc.

(a)

107,530

1,956,958

Energy

-

4.7%

12,369

American

Superconductor

Corp.

(a)

304,648

108,854

Berry

Corp.

449,567

4,905

Centrus

Energy

Corp.

(a)

326,722

13,600

Civitas

Resources,

Inc.

623,832

62,110

Geospace

Technologies

Corp.

(a)

622,342

14,176

Hallador

Energy

Co.

(a)

162,315

23,212

Innovex

International,

Inc.

(a)

324,272

101,221

NPK

International,

Inc.

(a)

776,365

31,135

Oil

States

International,

Inc.

(a)

157,543

15,500

Stabilis

Solutions,

Inc.

(a)

82,925

124,815

VAALCO

Energy,

Inc.

545,442

4,375,973

Shares

Security

Description

Value

Financials

-

15.1%

3,749

Alpine

Banks

of

Colorado

$

128,291

12,635

Amalgamated

Financial

Corp.

422,893

85,100

American

Coastal

Insurance

Corp.

(a)

1,145,446

6,924

Arrow

Financial

Corp.

198,788

7,228

Banco

Latinoamericano

de

Comercio

Exterior

SA,

Class E

257,100

12,469

Bank

of

Marin

Bancorp

296,388

12,714

Bankwell

Financial

Group,

Inc.

396,041

7,787

Business

First

Bancshares,

Inc.

200,126

8,791

Central

Pacific

Financial

Corp.

255,379

5,973

Community

Trust

Bancorp,

Inc.

316,748

10,344

ConnectOne

Bancorp,

Inc.

236,981

20,255

Customers

Bancorp,

Inc.

(a)

986,013

2,899

Dave,

Inc.

(a)

251,981

9,105

Dime

Community

Bancshares,

Inc.

279,842

23,825

eHealth,

Inc.

(a)

223,955

9,000

Enova

International,

Inc.

(a)

862,920

19,140

EZCORP,

Inc.,

Class A

(a)

233,891

9,348

First

Internet

Bancorp

336,435

26,573

First

Western

Financial,

Inc.

(a)

519,502

30,702

Heritage

Commerce

Corp.

287,985

16,458

Heritage

Insurance

Holdings,

Inc.

(a)

199,142

11,886

International

General

Insurance

Holdings,

Ltd.

282,411

2,037

Investors

Title

Co.

482,280

20,361

KKR

Real

Estate

Finance

Trust,

Inc.

REIT

205,646

6,083

LendingTree,

Inc.

(a)

235,716

68,325

Medallion

Financial

Corp.

641,572

4,453

Mercantile

Bank

Corp.

198,114

7,134

Mid

Penn

Bancorp,

Inc.

205,745

5,553

MidWestOne

Financial

Group,

Inc.

161,703

3,687

Northrim

BanCorp,

Inc.

287,365

16,830

OP

Bancorp

266,082

13,712

PRA

Group,

Inc.

(a)

286,444

2,802

QCR

Holdings,

Inc.

225,953

18,000

Regional

Management

Corp.

611,640

5,486

Silvercrest

Asset

Management

Group,

Inc.

100,888

7,960

Texas

Capital

Bancshares,

Inc.

(a)

622,472

4,436

Third

Coast

Bancshares,

Inc.

(a)

150,602

4,949

Unity

Bancorp,

Inc.

215,826

6,416

Univest

Financial

Corp.

189,336

22,975

Veritex

Holdings,

Inc.

624,001

14,029,643

Health

Care

-

19.3%

105,776

908

Devices,

Inc.

(a)

232,707

132,026

Accuray,

Inc.

(a)

261,411

27,203

Aclaris

Therapeutics,

Inc.

(a)

67,463

2,962

Addus

HomeCare

Corp.

(a)

371,287

22,169

ADMA

Biologics,

Inc.

(a)

380,198

7,221

AnaptysBio,

Inc.

(a)

95,606

2,774

ANI

Pharmaceuticals,

Inc.

(a)

153,347

15,382

Anika

Therapeutics,

Inc.

(a)

253,188

17,994

ARS

Pharmaceuticals,

Inc.

(a)

189,837

14,944

Astria

Therapeutics,

Inc.

(a)

133,599

12,349

Axogen,

Inc.

(a)

203,512

29,830

BioLife

Solutions,

Inc.

(a)

774,387

43,596

Butterfly

Network,

Inc.

(a)

136,020

17,317

Cantaloupe,

Inc.

(a)

164,685

11,914

CareDx,

Inc.

(a)

255,079

202,065

ChromaDex

Corp.

(a)

1,071,955

20,514

Corvus

Pharmaceuticals,

Inc.

(a)

109,750

22,263

Cytek

Biosciences,

Inc.

(a)

144,487

11,494

Edgewise

Therapeutics,

Inc.

(a)

306,890

ACUITAS

US

MICROCAP

FUND

SCHEDULE

OF

INVESTMENTS

December

31,

2024

See

Notes

to

Financial

Statements.

Shares

Security

Description

Value

Health

Care

-

19.3%

(continued)

10,758

Electromed,

Inc.

(a)

$

317,899

21,430

Embecta

Corp.

442,529

185,331

Harvard

Bioscience,

Inc.

(a)

391,048

52,321

Health

Catalyst,

Inc.

(a)

369,909

13,080

Healthcare

Services

Group,

Inc.

(a)

151,924

5,161

HealthStream,

Inc.

164,120

15,913

Immunome,

Inc.

(a)

168,996

54,688

InfuSystem

Holdings,

Inc.

(a)

462,114

15,278

Intellia

Therapeutics,

Inc.

(a)

178,141

20,047

iRadimed

Corp.

1,102,585

17,444

Kiniksa

Pharmaceuticals

International

PLC

(a)

345,042

67,273

KORU

Medical

Systems,

Inc.

(a)

259,001

8,666

LeMaitre

Vascular,

Inc.

798,485

30,577

MannKind

Corp.

(a)

196,610

34,311

MiMedx

Group,

Inc.

(a)

330,072

3,120

Nature's

Sunshine

Products,

Inc.

(a)

45,739

9,063

Nurix

Therapeutics,

Inc.

(a)

170,747

10,846

Orthofix

Medical,

Inc.

(a)

189,371

18,222

OrthoPediatrics

Corp.

(a)

422,386

18,247

Pacira

BioSciences,

Inc.

(a)

343,773

25,989

Pediatrix

Medical

Group,

Inc.

(a)

340,976

8,147

Phibro

Animal

Health

Corp.,

Class A

171,087

22,048

Pliant

Therapeutics,

Inc.

(a)

290,372

25,160

Quanterix

Corp.

(a)

267,451

51,755

Quipt

Home

Medical

Corp.

(a)

157,853

47,719

Savara,

Inc.

(a)

146,497

6,675

Scholar

Rock

Holding

Corp.

(a)

288,494

34,043

SI-BONE,

Inc.

(a)

477,283

25,347

Stoke

Therapeutics,

Inc.

(a)

279,577

10,308

Supernus

Pharmaceuticals,

Inc.

(a)

372,737

22,075

Syndax

Pharmaceuticals,

Inc.

(a)

291,832

114,196

Taysha

Gene

Therapies,

Inc.

(a)

197,559

25,771

The

Joint

Corp.

(a)

273,946

16,992

The

Pennant

Group,

Inc.

(a)

450,628

10,347

Tyra

Biosciences,

Inc.

(a)

143,823

4,457

US

Physical

Therapy,

Inc.

395,380

4,938

Utah

Medical

Products,

Inc.

303,539

19,116

Voyager

Therapeutics,

Inc.

(a)

108,388

6,893

Xenon

Pharmaceuticals,

Inc.

(a)

270,206

15,651

Zymeworks,

Inc.

(a)

229,131

44,101

Zynex,

Inc.

(a)

353,249

17,965,907

Industrials

-

21.5%

11,295

ACM

Research,

Inc.,

Class A

(a)

170,554

36,981

AerSale

Corp.

(a)

232,980

12,801

Allient,

Inc.

310,808

23,504

Archer

Aviation,

Inc.

(a)

229,164

27,536

Barrett

Business

Services,

Inc.

1,196,164

5,062

Bel

Fuse,

Inc.,

Class B

417,463

87,833

BGSF,

Inc.

460,245

7,435

BlueLinx

Holdings,

Inc.

(a)

759,560

46,155

Columbus

McKinnon

Corp.

1,718,812

32,781

Commercial

Vehicle

Group,

Inc.

(a)

81,297

33,556

Concrete

Pumping

Holdings,

Inc.

(a)

223,483

36,367

Conduent,

Inc.

(a)

146,923

37,024

Core

Molding

Technologies,

Inc.

(a)

612,377

4,064

CRA

International,

Inc.

760,781

212,800

DHI

Group,

Inc.

(a)

376,656

4,572

Douglas

Dynamics,

Inc.

108,036

27,264

Ducommun,

Inc.

(a)

1,735,626

7,315

Energy

Recovery,

Inc.

(a)

107,531

6,774

Franklin

Covey

Co.

(a)

254,567

Shares

Security

Description

Value

Industrials

-

21.5%

(continued)

14,373

Graham

Corp.

(a)

$

639,167

30,863

Great

Lakes

Dredge

&

Dock

Corp.

(a)

348,443

39,456

Information

Services

Group,

Inc.

131,783

13,178

Insteel

Industries,

Inc.

355,938

22,688

Kornit

Digital,

Ltd.

(a)

702,194

27,755

Mayville

Engineering

Co.,

Inc.

(a)

436,309

3,531

Mesa

Laboratories,

Inc.

465,633

21,725

Myers

Industries,

Inc.

239,844

4,661

MYR

Group,

Inc.

(a)

693,417

6,411

Natural

Gas

Services

Group,

Inc.

(a)

171,815

176,084

Orion

Energy

Systems,

Inc.

(a)

140,885

33,435

Park

Aerospace

Corp.

489,823

104,372

Paysign,

Inc.

(a)

315,203

4,845

Primoris

Services

Corp.

370,158

12,252

Proficient

Auto

Logistics,

Inc.

(a)

98,874

58,351

Radiant

Logistics,

Inc.

(a)

390,952

82,439

Ranpak

Holdings

Corp.

(a)

567,180

51,085

Resources

Connection,

Inc.

435,755

3,521

The

Gorman-Rupp

Co.

133,516

1,692

The

Monarch

Cement

Co.

369,430

12,863

The

Real

Brokerage,

Inc.

(a)

59,170

19,338

Thermon

Group

Holdings,

Inc.

(a)

556,354

4,666

Transcat,

Inc.

(a)

493,383

12,402

Ultralife

Corp.

(a)

92,395

34,052

Vishay

Precision

Group,

Inc.

(a)

799,200

39,786

Wabash

National

Corp.

681,534

20,081,382

Real

Estate

-

2.2%

14,867

Alpine

Income

Property

Trust,

Inc.

REIT

249,617

30,096

Anywhere

Real

Estate,

Inc.

(a)

99,317

56,633

Apartment

Investment

and

Management

Co.

REIT

(a)

514,794

18,345

Armada

Hoffler

Properties,

Inc.

REIT

187,669

8,323

BRT

Apartments

Corp.

REIT

150,063

33,536

Plymouth

Industrial

REIT,

Inc.

596,941

19,376

Whitestone

REIT

274,558

2,072,959

Technology

-

16.4%

38,917

A10

Networks,

Inc.

716,073

122,386

ADTRAN

Holdings,

Inc.

(a)

1,019,475

832

Amplitude,

Inc.

(a)

8,778

41,946

Arteris,

Inc.

(a)

427,430

15,544

AstroNova,

Inc.

(a)

186,683

7,272

AudioEye,

Inc.

(a)

110,607

18,070

Backblaze,

Inc.,

Class A

(a)

108,781

7,110

Benchmark

Electronics,

Inc.

322,794

54,830

Blend

Labs,

Inc.,

Class A

(a)

230,834

12,896

CEVA,

Inc.

(a)

406,869

15,629

Cohu,

Inc.

(a)

417,294

16,894

Consensus

Cloud

Solutions,

Inc.

(a)

403,091

3,887

Digimarc

Corp.

(a)

145,568

7,292

Donnelley

Financial

Solutions,

Inc.

(a)

457,427

21,902

Hurco

Cos.,

Inc.

422,490

16,777

Ichor

Holdings,

Ltd.

(a)

540,555

31,058

Immersion

Corp.

271,136

145,754

indie

Semiconductor,

Inc.,

Class A

(a)

590,304

42,691

inTEST

Corp.

(a)

366,716

52,100

Key

Tronic

Corp.

(a)

217,257

80,220

Magnite,

Inc.

(a)

1,277,102

6,852

NVE

Corp.

557,958

26,222

OneSpan,

Inc.

(a)

486,156

12,470

Ouster,

Inc.

(a)

152,383

75,200

Outbrain,

Inc.

(a)

539,936

ACUITAS

US

MICROCAP

FUND

SCHEDULE

OF

INVESTMENTS

December

31,

2024

See

Notes

to

Financial

Statements.

At

December

31,

2024,

The

Fund

held

the

following

exchange

traded

futures

contracts:

The

following

is

a

summary

of

the

inputs

used

to

value

the

Fund's investments

as

of

December

31,

2024.

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risks

associated

with

investing

in

those

securities.

For

more

information

on

valuation

inputs,

and

their

aggregation

into

the

levels

used

in

the

table

below,

please

refer

to

the

Security

Valuation

section

in

Note

2

of

the

accompanying

Notes

to

Financial

Statements.

The

Level

1

value

displayed

in

this

table

consists

of

common

stock

and

a

Money

Market

Fund.

Refer

to

this

Schedule

of

Investments

for

a

further

breakout

of

each

security

by

industry.

* Other

Financial

Instruments

are

derivatives

not

reflected

in

the

Schedule

of

Investments,

such

as

futures which

are

valued

at

unrealized

appreciation

(depreciation)

at

period

end.

Shares

Security

Description

Value

Technology

-

16.4%

(continued)

12,127

PDF

Solutions,

Inc.

(a)

$

328,399

51,510

Photronics,

Inc.

(a)

1,213,576

16,369

PROS

Holdings,

Inc.

(a)

359,463

70,614

Rackspace

Technology,

Inc.

(a)

156,057

4,942

Rigetti

Computing,

Inc.

(a)

75,415

20,360

Shutterstock,

Inc.

617,926

31,184

Solaris

Energy

Infrastructure,

Inc.,

Class A

897,476

9,698

SoundHound

AI,

Inc.

(a)

192,408

4,332

Spire

Global,

Inc.

(a)

60,951

47,161

TrueCar,

Inc.

(a)

175,911

12,036

Veeco

Instruments,

Inc.

(a)

322,565

16,109

Viant

Technology,

Inc.,

Class A

(a)

305,910

15,293

Weave

Communications,

Inc.

(a)

243,465

15,333,219

Telecommunications

-

1.5%

47,220

Aviat

Networks,

Inc.

(a)

855,154

114,291

Ondas

Holdings,

Inc.

(a)

292,585

39,255

Powerfleet,

Inc.

NJ

(a)

261,438

1,409,177

Utilities

-

4.2%

44,466

Aris

Water

Solutions,

Inc.,

Class A

1,064,961

95,188

Enviri

Corp.

(a)

732,948

42,234

Perma-Fix

Environmental

Services,

Inc.

(a)

467,530

11,886

Pure

Cycle

Corp.

(a)

150,714

113,480

Select

Water

Solutions,

Inc.,

Class A

1,502,475

3,918,628

Total

Common

Stock

(Cost

$78,930,106)

91,703,492

Shares

Security

Description

Value

Money

Market

Fund

-

1.4%

1,314,948

First

American

Government

Obligations

Fund,

Class X,

4.39%

(b)

(Cost

$1,314,948)

1,314,948

Investments,

at

value

-

99.7%

(Cost

$80,245,054)

$

93,018,440

Other

Assets

&

Liabilities,

Net

-

0.3%

239,730

Net

Assets

-

100.0%

$

93,258,170

PLC

Public

Limited

Company

REIT

Real

Estate

Investment

Trust

(a)

Non-income

producing

security.

(b)

Dividend

yield

changes

daily

to

reflect

current

market

conditions.

Rate

was

the

quoted

yield

as

of

December

31,

2024.

Contracts

Description

Expiration

Date

Notional

Contract

Value

Value

Net

Unrealized

Depreciation

5

CME

E-Mini

Russell

2000

Index

Future

03/25/25

$593,216

$562,450

$(30,766)

Valuation

Inputs

Investments

in

Securities

Other

Financial

Instruments*

Level

1

-

Quoted

Prices

$

93,018,440

$

(30,766)

Level

2

-

Other

Significant

Observable

Inputs

–

–

Level

3

-

Significant

Unobservable

Inputs

–

–

Total

$

93,018,440

$

(30,766)

ACUITAS

US

MICROCAP

FUND

STATEMENT

OF

ASSETS

AND

LIABILITIES

December

31,

2024

See

Notes

to

Financial

Statements.

*

Shares

redeemed

or

exchanged

within

60

days

of

purchase

are

charged

a

1.00%

redemption

fee.

ASSETS

Investments,

at

value

(Cost

$80,245,054)

$

93,018,440

Deposits

with

broker

207,339

Receivables:

Fund

shares

sold

161,286

Investment

securities

sold

67,865

Dividends

42,020

Variation

margin

525

Prepaid

expenses

12,405

Total

Assets

93,509,880

LIABILITIES

Payables:

Investment

securities

purchased

61,947

Fund

shares

redeemed

50,949

Accrued

Liabilities:

Investment

adviser

fees

78,513

Trustees’

fees

and

expenses

744

Fund

services

fees

27,599

Other

expenses

31,958

Total

Liabilities

251,710

NET

ASSETS

$

93,258,170

COMPONENTS

OF

NET

ASSETS

Paid-in

capital

$

82,259,553

Distributable

Earnings

10,998,617

NET

ASSETS

$

93,258,170

SHARES

OF

BENEFICIAL

INTEREST

AT

NO

PAR

VALUE

(UNLIMITED

SHARES

AUTHORIZED)

Institutional

Shares

6,640,280

NET

ASSET

VALUE,

OFFERING

AND

REDEMPTION

PRICE

PER

SHARE*

Institutional

Shares

(based

on

net

assets

of

$93,258,170)

$

14.04

ACUITAS

US

MICROCAP

FUND

STATEMENT

OF

OPERATIONS

FOR

THE

SIX

MONTHS

ENDED

DECEMBER

31,

2024

See

Notes

to

Financial

Statements.

INVESTMENT

INCOME

Dividend

income

(Net

of

foreign

withholding

taxes

of

$611)

$

565,229

Total

Investment

Income

565,229

EXPENSES

Investment

adviser

fees

574,928

Fund

services

fees

121,113

Custodian

fees

15,900

Registration

fees

11,892

Professional

fees

24,332

Trustees'

fees

and

expenses

7,822

Interest

expense

1,427

Other

expenses

91,254

Total

Expenses

848,668

Fees

waived

(157,328)

Net

Expenses

691,340

NET

INVESTMENT

LOSS

(126,111)

NET

REALIZED

AND

UNREALIZED

GAIN

(LOSS)

Net

realized

gain

(loss)

on:

Investments

782,512

Futures

(12,544)

Net

realized

gain

769,968

Net

change

in

unrealized

appreciation

(depreciation)

on:

Investments

7,593,708

Futures

(34,146)

Net

change

in

unrealized

appreciation

(depreciation)

7,559,562

NET

REALIZED

AND

UNREALIZED

GAIN

8,329,530

INCREASE

IN

NET

ASSETS

RESULTING

FROM

OPERATIONS

$

8,203,419

ACUITAS

US

MICROCAP

FUND

STATEMENTS

OF

CHANGES

IN

NET

ASSETS

See

Notes

to

Financial

Statements.

For

the

Six

Months

Ended

December

31,

2024

For

the

Year

Ended

June

30,

2024

OPERATIONS

Net

investment

loss

$

(126,111)

$

(92,219)

Net

realized

gain

769,968

3,832,122

Net

change

in

unrealized

appreciation

(depreciation)

7,559,562

28,187

Increase

in

Net

Assets

Resulting

from

Operations

8,203,419

3,768,090

DISTRIBUTIONS

TO

SHAREHOLDERS

Institutional

Shares

(2,943,933)

–

Total

Distributions

Paid

(2,943,933)

–

CAPITAL

SHARE

TRANSACTIONS

Sale

of

shares:

Institutional

Shares

10,150,548

22,076,434

Reinvestment

of

distributions:

Institutional

Shares

2,943,383

–

Redemption

of

shares:

Institutional

Shares

(7,664,178)

(6,160,312)

Redemption

fees:

Institutional

Shares

1,399

584

Increase

in

Net

Assets

from

Capital

Share

Transactions

5,431,152

15,916,706

Increase

in

Net

Assets

10,690,638

19,684,796

NET

ASSETS

Beginning

of

Period

82,567,532

62,882,736

End

of

Period

$

93,258,170

$

82,567,532

SHARE

TRANSACTIONS

Sale

of

shares:

Institutional

Shares

724,418

1,680,424

Reinvestment

of

distributions:

Institutional

Shares

195,924

–

Redemption

of

shares:

Institutional

Shares

(539,357)

(502,665)

Increase

in

Shares

380,985

1,177,759

ACUITAS

US

MICROCAP

FUND

FINANCIAL

HIGHLIGHTS

See

Notes

to

Financial

Statements.

These

financial

highlights

reflect

selected

data

for

a

share

outstanding

throughout

each

period.

For

the

Six

Months

Ended

December

31,

2024

For

the

Years

Ended

June

30,

2024

2023

2022

2021

2020

INSTITUTIONAL

SHARES

NET

ASSET

VALUE,

Beginning

of

Period

$

13.19

$

12.37

$

11.53

$

16.75

$

8.76

$

10.05

INVESTMENT

OPERATIONS

Net

investment

loss

(a)

(0.02)

(0.02)

(0.03)

(0.06)

(0.05)

(0.05)

Net

realized

and

unrealized

gain

(loss)

1.31

0.84

1.60

(3.91)

8.04

(1.23)

Total

from

Investment

Operations

1.29

0.82

1.57

(3.97)

7.99

(1.28)

DISTRIBUTIONS

TO

SHAREHOLDERS

FROM

Net

investment

income

(0.00)(b)

–

–

–

–

–

Net

realized

gain

(0.44)

–

(0.73)

(1.25)

–

(0.01)

Total

Distributions

to

Shareholders

(0.44)

–

(0.73)

(1.25)

–

(0.01)

REDEMPTION

FEES(a)

0.00(b)

0.00(b)

0.00(b)

0.00(b)

0.00(b)

0.00(b)

NET

ASSET

VALUE,

End

of

Period

$

14.04

$

13.19

$

12.37

$

11.53

$

16.75

$

8.76

TOTAL

RETURN

9.61%(c)

6.63%

14.04%

(25.17)%

91.21%

(12.75)%

RATIOS/SUPPLEMENTARY

DATA

Net

Assets

at

End

of

Period

(000s

omitted)

$

93,258

$

82,568

$

62,883

$

47,078

$

66,416

$

40,483

Ratios

to

Average

Net

Assets:

Net

investment

loss

(0.27)%(d)

(0.14)%

(0.23)%

(0.41)%

(0.36)%

(0.47)%

Net

expenses

1.50%(d)

1.50%

1.50%

1.50%

1.50%

1.70%

Gross

expenses

(e)

1.84%(d)

1.96%

2.05%

2.00%

2.08%

2.03%

PORTFOLIO

TURNOVER

RATE

30%(c)

64%

56%

61%

78%

74%

(a)

Calculated

based

on

average

shares

outstanding

during

each

period.

(b)

Less

than

$0.01

per

share.

(c)

Not

annualized.

(d)

Annualized.

(e)

Reflects

the

expense

ratio

excluding

any

waivers

and/or

reimbursements.

Expense

waivers

and/or

reimbursements

would

decrease

the

total

return

had

such

reductions

not

occurred.

ACUITAS

US

MICROCAP

FUND

NOTES

TO

FINANCIAL

STATEMENTS

December

31,

2024

Note

1.

Organization

The

Acuitas

US

Microcap

Fund

(the

“Fund”)

is

a

diversified

portfolio

of

Forum

Funds

II

(the

“Trust”).

The

Trust

is

a

Delaware

statutory

trust

that

is

registered

as

an

open-end,

management

investment

company

under

the

Investment

Company

Act

of

1940,

as

amended

(the

“Act”).

Under

its

Trust

Instrument,

the

Trust

is

authorized

to

issue

an

unlimited

number

of

the

Fund’s

shares

of

beneficial

interest

without

par

value.

The

Fund

currently

offers

two

classes

of

shares:

Institutional

Shares

and

Investor

Shares.

As

of

December

31,

2024,

Investor

Shares

had

not

commenced

operations.

The

Fund

seeks

capital

appreciation.

The

Fund

commenced

operations

on

July

18,

2014.

The

Fund

included

herein

is

deemed

to

be

an

individual

reporting

segment

and

is

not

part

of

a

consolidated

reporting

entity.

The

objective

and

strategy

of

the

Fund

is

used

by

the

Adviser,

as

defined

in

Note

3,

to

make

investment

decisions,

and

the

results

of

the

operations,

as

shown

on

the

Statement

of

Operations

and

the

financial

highlights

for

the

Fund

is

the

information

utilized

for

the

day-

to-day

management

of

the

Fund.

The

Fund

is

party

to

the

expense

agreements

as

disclosed

in

the

Notes

to

the

Financial

Statements

and

there

are

no

resources

allocated

to

the

Fund

based

on

performance

measurements.

Due

to

the

significance

of

oversight

and

their

role,

the

Adviser

is

deemed

to

be

the

Chief

Operating

Decision

Maker.

Note

2.

Summary

of

Significant

Accounting

Policies

The

Fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

under

Financial

Accounting

Standards

Board

Accounting

Standards

Codification

Topic

946,

“Financial

Services

–

Investment

Companies.”

These

financial

statements

are

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(“GAAP”),

which

require

management

to

make

estimates

and

assumptions

that

affect

the

reported

amounts

of

assets

and

liabilities,

the

disclosure

of

contingent

liabilities

at

the

date

of

the

financial

statements,

and

the

reported

amounts

of

increases

and

decreases

in

net

assets

from

operations

during

the

fiscal

period.

Actual

amounts

could

differ

from

those

estimates.

The

following

summarizes

the

significant

accounting

policies

of

the

Fund:

Security

Valuation

–

Securities

are

recorded

at

fair

value

using

last

quoted

trade

or

official

closing

price

from

the

principal

exchange

where

the

security

is

traded,

as

provided

by

independent

pricing

services

on

each

Fund

business

day.

In

the

absence

of

a

last

trade,

securities

are

valued

at

the

mean

of

the

last

bid

and

ask

price

provided

by

the

pricing

service.

Futures

contracts

are

valued

at

the

day’s

settlement

price

on

the

exchange

where

the

contract

is

traded.

Forward

currency

contracts

are

generally

valued

based

on

interpolation

of

forward

curve

data

points

obtained

from

major

banking

institutions

that

deal

in

foreign

currencies

and

currency

dealers.

Exchange-traded

options

for

which

the

last

quoted

sale

price

is

outside

the

closing

bid

and

ask

price

will

be

valued

at

the

mean

of

the

closing

bid

and

ask

price.

Shares

of

non-exchange

traded

open-end

mutual

funds

are

valued

at

net

asset

value

per

share

(“NAV”).

Short-term

investments

that

mature

in

sixty

days

or

less

may

be

recorded

at

amortized

cost,

which

approximates

fair

value.

Pursuant

to

Rule

2a-5

under

the

Investment

Company

Act,

the

Trust’s

Board

of

Trustees

(the

“Board”)

has

designated

the

Adviser

as

the

Fund’s

valuation

designee

to

perform

any

fair

value

determinations

for

securities

and

other

assets

held

by

the

Fund.

The

Adviser

is

subject

to

the

oversight

of

the

Board

and

certain

reporting

and

other

requirements

intended

to

provide

the

Board

the

information

needed

to

oversee

the

Adviser’s

fair

value

determinations.

The

Adviser

is

responsible

for

determining

the

fair

value

of

investments

for

which

market

quotations

are

not

readily

available

in

accordance

with

policies

and

procedures

that

have

been

approved

by

the

Board.

Under

these

procedures,

the

Adviser

convenes

on

a

regular

and

ad

hoc

basis

to

review

such

investments

and

considers

a

number

of

factors,

including

valuation

methodologies

and

significant

unobservable

inputs,

when

arriving

at

fair

value.

The

Board

has

approved

the

Adviser’s

fair

valuation

procedures

as

a

part

of

the

Fund’s

compliance

program

and

will

review

any

changes

made

to

the

procedures.

The

Adviser

provides

fair

valuation

inputs.

In

determining

fair

valuations,

inputs

may

include

market-based

analytics

that

may

consider

related

or

comparable

assets

or

liabilities,

recent

transactions,

market

multiples,

book

values

and

other

relevant

investment

information.

Adviser

inputs

may

include

an

income-based

approach

in

which

the

anticipated

future

cash

flows

of

the

investment

are

discounted

in

determining

fair

value.

Discounts

may

also

be

applied

based

on

the

nature

or

duration

of

any

restrictions

on

the

disposition

of

the

investments.

The

Adviser

performs

regular

reviews

of

valuation

methodologies,

key

inputs

and

assumptions,

disposition

analysis

and

market

activity.

ACUITAS

US

MICROCAP

FUND

NOTES

TO

FINANCIAL

STATEMENTS

December

31,

2024

Fair

valuation

is

based

on

subjective

factors

and,

as

a

result,

the

fair

value

of

an

investment

may

differ

from

the

security’s

market

price

and

may

not

be

the

price

at

which

the

asset

may

be

sold.

Fair

valuation

could

result

in

a

different

NAV

than

a

NAV

determined

by

using

market

quotes.

GAAP

has

a

three-tier

fair

value

hierarchy.

The

basis

of

the

tiers

is

dependent

upon

the

level

of

various

“inputs”

used

to

determine

the

value

of

the

Fund’s

investments.

These

inputs

are

summarized

in

the

three

broad

levels

listed

below:

Level

1

-

Quoted

prices

in

active

markets

for

identical

assets

and

liabilities.

Level

2

-

Prices

determined

using

significant

other

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

prepayment

speeds,

credit

risk,

etc.).

Short-term

securities

are

valued

at

amortized

cost,

which

approximates

market

value,

are

categorized

as

Level

2

in

the

hierarchy.

Municipal

securities,

long-term

U.S.

government

obligations

and

corporate

debt

securities

are

valued

in

accordance

with

the

evaluated

price

supplied

by

a

pricing

service

and

generally

categorized

as

Level

2

in

the

hierarchy.

Other

securities

that

are

categorized

as

Level

2

in

the

hierarchy

include,

but

are

not

limited

to,

warrants

that

do

not

trade

on

an

exchange,

securities

valued

at

the

mean

between

the

last

reported

bid

and

ask

quotation

and

international

equity

securities

valued

by

an

independent

third

party

with

adjustments

for

changes

in

value

between

the

time

of

the

securities’

respective

local

market

closes

and

the

close

of

the

U.S.

market.

Level

3

-

Significant

unobservable

inputs

(including

the

Fund’s

own

assumptions

in

determining

the

fair

value

of

investments).

The

aggregate

value

by

input

level,

as

of

December

31,

2024,

for

the

Fund’s

investments

is

included

at

the

end

of

the

Fund’s

Schedule

of

Investments.

Security

Transactions,

Investment

Income

and

Realized

Gain

and

Loss

–

Investment

transactions

are

accounted

for

on

the

trade

date.

Dividend

income

is

recorded

on

the

ex-dividend

date.

Interest

income

is

recorded

on

an

accrual

basis.

Premium

is

amortized

to

the

next

call

date

above

par,

and

discount

is

accreted

to

maturity

using

the

effective

interest

method

and

included

in

interest

income.

Identified

cost

of

investments

sold

is

used

to

determine

the

gain

and

loss

for

both

financial

statement

and

federal

income

tax

purposes.

Futures

Contracts

–

A

futures

contract

is

an

agreement

between

parties

to

buy

or

sell

a

security

at

a

set

price

on

a

future

date.

Upon

entering

into

such

a

contract,

a

fund

is

required

to

pledge

to

the

broker

an

amount

of

cash,

U.S.

Government

obligations

or

other

high-quality

debt

securities

equal

to

the

minimum

“initial

margin”

requirements

of

the

exchange

on

which

the

futures

contract

is

traded.

Pursuant

to

the

contract,

the

Fund

agrees

to

receive

from

or

pay

to

the

broker

an

amount

of

cash

equal

to

the

daily

fluctuation

in

the

value

of

the

contract.

When

the

contract

is

closed,

the

Fund

records

a

realized

gain

or

loss

equal

to

the

difference

between

the

value

of

the

contract

at

the

time

it

was

opened

and

value

at

the

time

it

was

closed.

Risks

of

entering

into

futures

contracts

include

the

possibility

that

there

may

be

an

illiquid

market

and

that

a

change

in

the

value

of

the

contract

may

not

correlate

with

changes

in

the

value

of

the

underlying

securities.

Notional

amounts

of

each

individual

futures

contract

outstanding

as

of

December

31,

2024,

for

the

Fund,

are

disclosed

in

the

Schedule

of

Investments.

Distributions

to

Shareholders

–

The

Fund

declares

any

dividends

from

net

investment

income

and

pays

them

annually.

Any

net

capital

gains

realized

by

the

Fund

are

distributed

at

least

annually.

Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date.

Distributions

are

based

on

amounts

calculated

in

accordance

with

applicable

federal

income

tax

regulations,

which

may

differ

from

GAAP.

These

differences

are

due

primarily

to

differing

treatments

of

income

and

gain

on

various

investment

securities

held

by

the

Fund,

timing

differences

and

differing

characterizations

of

distributions

made

by

the

Fund.

Federal

Taxes

–

The

Fund

intends

to

continue

to

qualify

each

year

as

a

regulated

investment

company

under

Subchapter

M

of

Chapter

1,

Subtitle

A,

of

the

Internal

Revenue

Code

of

1986,

as

amended

(“Code”),

and

to

distribute

all

of

its

taxable

income

to

shareholders.

In

addition,

by

distributing

in

each

calendar

year

substantially

all

of

its

net

investment

income

and

capital

gains,

if

any,

the

Fund

will

not

be

subject

to

a

federal

excise

tax.

Therefore,

no

federal

income

or

excise

tax

provision

is

required.

The

Fund

recognizes

interest

and

penalties,

if

any,

related

to

unrecognized

tax

benefits

as

income

tax

expense

in

the

Statement

of

Operations.

During

the

period,

the

Fund

did

not

incur

any

interest

or

penalties.

The

Fund

files

a

U.S.

federal

income

and

excise

tax

return

as

required.

The

Fund’s

federal

income

tax

returns

are

subject

to

examination

by

the

Internal

Revenue

Service

for

a

period

of

three

ACUITAS

US

MICROCAP

FUND

NOTES

TO

FINANCIAL

STATEMENTS

December

31,

2024

fiscal

years

after

they

are

filed.

As

of

December

31,

2024,

there

are

no

uncertain

tax

positions

that

would

require

financial

statement

recognition,

de-recognition

or

disclosure.

Income

and

Expense

Allocation

–

The

Trust

accounts

separately

for

the

assets,

liabilities

and

operations

of

each

of

its

investment

portfolios.

Expenses

that

are

directly

attributable

to

more

than

one

investment

portfolio

are

allocated

among

the

respective

investment

portfolios

in

an

equitable

manner.

Redemption

Fees

–

A

shareholder

who

redeems

or

exchanges

shares

within

60

days

of

purchase

will

incur

a

redemption

fee

of

1.00%

of

the

current

NAV

of

shares

redeemed

or

exchanged,

subject

to

certain

limitations.

The

fee

is

charged

for

the

benefit

of

the

remaining

shareholders

and

will

be

paid

to

the

Fund

to

help

offset

transaction

costs.

The

fee

is

accounted

for

as

an

addition

to

paid-in

capital.

The

Fund

reserves

the

right

to

modify

the

terms

of

or

terminate

the

fee

at

any

time.

There

are

limited

exceptions

to

the

imposition

of

the

redemption

fee.

Redemption

fees

incurred

for

the

Fund,

if

any,

are

reflected

on

the

Statements

of

Changes

in

Net

Assets.

Commitments

and

Contingencies

–

In

the

normal

course

of

business,

the

Fund

enters

into

contracts

that

provide

general

indemnifications

by

the

Fund

to

the

counterparty

to

the

contract.

The

Fund’s

maximum

exposure

under

these

arrangements

is

dependent

on

future

claims

that

may

be

made

against

the

Fund

and,

therefore,

cannot

be

estimated;

however,

based

on

experience,

the

risk

of

loss

from

such

claims

is

considered

remote.

The

Fund

has

determined

that

none

of

these

arrangements

requires

disclosure

on

the

Fund’s

Statement

of

Assets

and

Liabilities.

Note

3.

Fees

and

Expenses

Investment

Adviser

–

Acuitas

Investments,

LLC

(the

“Adviser”)

is

the

investment

Adviser

to

the

Fund.

Pursuant

to

an

investment

advisory

agreement,

the

Adviser

receives

an

advisory

fee,

payable

monthly,

from

the

Fund

at

an

annual

rate

of

1.25%

of

the

Fund’s

average

daily

net

assets.

The

sub-advisory

fees,

calculated

as

a

percentage

of

the

Fund’s

average

daily

net

assets

managed

by

the

subadvisers,

are

paid

by

the

Adviser.

Distribution

–

Foreside

Fund

Services,

LLC,

a

wholly

owned

subsidiary

of

Foreside

Financial

Group,

LLC

(d/b/a

ACA

Group)

(the

“Distributor”),

acts

as

the

agent

of

the

Trust

in

connection

with

the

continuous

offering

of

shares

of

the

Fund.

The

Fund

has

adopted

a

Distribution

Plan

(the

“Plan”)

for

Investor

Shares

in

accordance

with

Rule

12b-1

of

the

Act.

Under

the

Plan,

the

Fund

pays

the

Distributor

and/or

any

other

entity

as

authorized

by

the

Board

a

fee

of

up

to

0.25%

of

the

average

daily

net

assets

of

Investor

Shares.

The

Distributor

is

not

affiliated

with

the

Adviser

or

Atlantic

Fund

Administration,

LLC,

a

wholly

owned

subsidiary

of

Apex

US

Holdings

LLC

(d/b/a

Apex

Fund

Services)

(“Apex”)

or

their

affiliates.

Currently,

Investor

Shares

are

not

offered

for

sale,

therefore

the

Fund

is

not

currently

paying

12b-1

fees.

Other

Service

Providers

–

Apex

provides

fund

accounting,

fund

administration,

compliance

and

transfer

agency

services

to

the

Fund.

The

fees

related

to

these

services

are

included

in

Fund

services

fees

within

the

Statement

of

Operations.

Apex

also

provides

certain

shareholder

report

production

and

EDGAR

conversion

and

filing

services.

Pursuant

to

an

Apex

Services

Agreement,

the

Fund

pays

Apex

customary

fees

for

its

services.

Apex

provides

a

Principal

Executive

Officer,

a

Principal

Financial

Officer,

a

Chief

Compliance

Officer

and

an

Anti-Money

Laundering

Officer

to

the

Fund,

as

well

as

certain

additional

compliance

support

functions.

Trustees

and

Officers

–

Each

Independent

Trustee

receives

an

annual

fee

of

$25,000

($32,500

for

the

Chairman)

for

service

to

the

Trust.

Effective

January

1,

2025,

the

Audit

Committee

Chairman

receives

an

additional

$2,000

annually.

The

Independent

Trustees

and

Chairman

may

receive

additional

fees

for

special

Board

meetings.

The

Independent

Trustees

are

also

reimbursed

for

all

reasonable

out-of-pocket

expenses

incurred

in

connection

with

their

duties

as

Trustees,

including

travel

and

related

expenses

incurred

in

attending

Board

meetings.

The

amount

of

Independent

Trustees’

fees

attributable

to

the

Fund

is

disclosed

in

the

Statement

of

Operations.

Certain

officers

of

the

Trust

are

also

officers

or

employees

of

the

above

named

service

providers,

and

during

their

terms

of

office

received

no

compensation

from

the

Fund.

ACUITAS

US

MICROCAP

FUND

NOTES

TO

FINANCIAL

STATEMENTS

December

31,

2024

Note

4.

Expense

Reimbursement

and

Fees

Waived

The

Adviser

has

contractually

agreed

to

waive

its

fees

and/or

reimburse

expenses

to

limit

total

annual

operating

expenses

(excluding

all

taxes,

interest,

portfolio

transaction

expenses,

acquired

fund

fees

and

expenses,

proxy

expenses

and

extraordinary

expenses)

of

Institutional

Shares

to

1.50%

and

Investor

Shares

to

1.75%

through

November

1,

2025.

Other

fund

service

providers

have

agreed

to

waive

a

portion

of

their

fees

and

such

waivers

may

be

changed

or

eliminated

with

the

approval

of

the

Board

of

Trustees

of

the

Trust.

For

the

period

ended

December

31,

2024,

the

fees

waived

and/or

reimbursed

expenses

were

as

follows:

The

Adviser

may

be

reimbursed

by

the

Fund

for

fees

waived

and

expenses

reimbursed

by

the

Adviser

pursuant

to

the

Expense

Cap

if

such

payment

is

approved

by

the

Board,

made

within

three

years

of

the

fee

waiver

or

expense

reimbursement,

and

does

not

cause

the

Total

Annual

Fund

Operating

Expenses

After

Fee

Waiver

and/or

Expense

Reimbursement

to

exceed

the

lesser

of

(i)

the

then-

current

expense

cap

and

(ii)

the

expense

cap

in

place

at

the

time

the

fees/expenses

were

waived/reimbursed.

As

of

December

31,

2024,

$820,740

is

subject

to

recapture

by

the

Adviser.

Other

waivers

are

not

eligible

for

recoupment.

Note

5.

Security

Transactions

The

cost

of

purchases

and

proceeds

from

sales

of

investment

securities

(including

maturities),

other

than

short-term

investments

during

the

period

ended

December

31,

2024,

totaled

$

29,379,991

and

$

26,080,904

,

respectively.

Note

6.

Summary

of

Derivative

Activity

The

volume

of

open

derivative

positions

may

vary

on

a

daily

basis

as

the

Fund

transacts

derivative

contracts

in

order

to

achieve

the

exposure

desired

by

the

Adviser.

The

notional

value

of

activity

for

the

period

ended

December

31,

2024

,

for

futures

contracts

was

$

10,852,422

.

The

Fund’s

use

of

derivatives

for

the

period

ended

December

31,

2024,

was

limited

to

futures

contracts.

Following

is

a

summary

of

the

effect

of

derivatives

on

the

Statement

of

Assets

and

Liabilities

as

of

December

31,

2024.

Realized

and

unrealized

gains

and

losses

on

derivatives

contracts

for

the

period

ended

December

31,

2024,

are

recorded

by

the

Fund

in

the

following

locations

on

the

Statement

of

Operations:

Asset

(Liability)

amounts

shown

in

the

table

below