Filed pursuant to Rule 424(b)(2)

Registration Nos.: 333-181822 and 333-181822-03

This prospectus supplement and the prospectus are not complete and may be changed. This prospectus supplement and the prospectus are not an offer to sell these securities and we are not seeking an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 15, 2013

Prospectus Supplement to Prospectus dated September 28, 2012

US$750,000,000

SMART ABS Series 2013-2US Trust

Issuing Entity or Trust

Perpetual Trustee Company Limited

(ABN 42 000 001 007)

in its capacity as trustee of the Trust

Issuer Trustee

| | |

Macquarie Leasing Pty Limited (ABN 38 002 674 982) Depositor, Sponsor, Originator and Servicer | | Macquarie Securities Management Pty Limited (ABN 26 003 435 443) Manager |

Before you purchase any notes, be sure you understand the structure and the risks. You should review carefully the risk factors beginning on page S-30 of this prospectus supplement and on page 5 of the prospectus.

The notes will be obligations of the issuer trustee in its capacity as trustee of the trust and will not be obligations of the issuer trustee’s affiliates or obligations of or interests in Macquarie Leasing Pty Limited, Macquarie Securities Management Pty Limited or any of their affiliates.

This prospectus supplement may be used to offer and sell the US$ notes only if accompanied by the prospectus.

The issuer trustee, in its capacity as trustee of the SMART ABS Series 2013-2US Trust, will issue:

| | | | | | |

| | | Initial Principal Balance | | Interest Rate | | Maturity Date* |

Class A-1 Notes | | US$142,500,000 | | [ ]% | | Distribution Date in May 2014 |

Class A-2a Notes | | {US$187,500,000} | | [ ]% | | Distribution Date in September 2015 |

Class A-2b Notes | | | One-month LIBOR + [ ]% | |

Class A-3a Notes | | {US$217,500,000} | | [ ]% | | Distribution Date in January 2017 |

Class A-3b Notes | | | One-month LIBOR + [ ]% | |

Class A-4a Notes | | {US$202,500,000} | | [ ]% | | Distribution Date in February 2019 |

Class A-4b Notes | | | One-month LIBOR + [ ]% | |

| | | | | | |

Total | | US$750,000,000 | | | | |

| * | If not a business day, the next business day. |

| • | This prospectus supplement and the prospectus relate to “Class A notes” (also called the “US$ notes”). The issuer trustee will also issue five classes of Australian dollar denominated notes that are not offered under this prospectus supplement or the prospectus (the “A$ notes”, and together with the US$ notes, the “notes”) with an aggregate initial principal balance of A$89,132,000. The A$ notes will initially be retained by the sponsor or one or more of its affiliates. |

| • | The notes will be backed by a pool of lease contracts, hire purchase contracts and loan contracts in relation to motor vehicle assets (including cars, trucks, buses, trailers, forklifts and motorcycles) located in Australia. |

| • | The notes are not deposits and neither the notes nor the underlying receivables are insured or guaranteed by any company or governmental agency or instrumentality. |

| • | Interest and principal on the notes will be paid on the 14th day of each calendar month (or if not a business day, the next business day). The first distribution date will be June 14, 2013, or if not a business day, the next business day. Each class of US$ notes will be paid in full on its maturity date (or if not a business day, the next business day) if not paid in full prior to such date. |

| • | Credit enhancement for the US$ notes consists of subordination and excess spread. Liquidity enhancement for the US$ notes consists of a liquidity reserve account and the re-direction of principal. |

| • | Macquarie Bank Limited (ABN 46 008 583 542) is the fixed rate swap provider and Australia and New Zealand Banking Group Limited (ABN 11 005 357 522) is the currency swap provider. |

The pricing terms of the US$ notes are:

| | | | | | |

| | | Price to Public | | Underwriting Commissions

and Discounts | | Proceeds to Depositor |

Class A-1 Notes | | [ ]% | | [ ]% | | [ ]% |

Class A-2a Notes | | [ ]% | | [ ]% | | [ ]% |

Class A-2b Notes | | [ ]% | | [ ]% | | [ ]% |

Class A-3a Notes | | [ ]% | | [ ]% | | [ ]% |

Class A-3b Notes | | [ ]% | | [ ]% | | [ ]% |

Class A-4a Notes | | [ ]% | | [ ]% | | [ ]% |

Class A-4b Notes | | [ ]% | | [ ]% | | [ ]% |

| | | | | | |

Total | | US$[ ] | | US$[ ] | | US$[ ] |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these notes or determined if this prospectus supplement or the prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Joint Lead Managers and Bookrunners for the US$ notes

J.P. Morgan and RBS

Joint Lead Manager for the US$ notes

Macquarie

Co-Manager for the US$ notes

ANZ Securities

The date of this prospectus supplement is May [ ], 2013

TABLE OF CONTENTS

TABLE OF CONTENTS

ii

TABLE OF CONTENTS

iii

IMPORTANT NOTICE ABOUT INFORMATION PRESENTED IN THIS PROSPECTUS

SUPPLEMENT AND THE PROSPECTUS

This prospectus supplement and the prospectus provide information about the SMART ABS Series 2013-2US Trust and the terms of the US$ notes to be issued by the issuer trustee in its capacity as trustee of the SMART ABS Series 2013-2US Trust. The A$ notes are not being offered by this prospectus supplement or the prospectus.

We describe the US$ notes in two separate documents that progressively provide more detail: (1) the accompanying prospectus, which provides general information, some of which may not apply to the US$ notes and (2) this prospectus supplement, which describes the specific terms of the US$ notes.

Neither this prospectus supplement nor the prospectus contains all of the information included in the registration statement. The registration statement also includes copies of various contracts and documents referred to in this prospectus supplement and the prospectus. You may obtain copies of these documents for review. See “Where You Can Find More Information” in the prospectus. You should rely only on information provided or referenced in this prospectus supplement and the prospectus. We have not authorised anyone to provide you with other information.

This prospectus supplement begins with the following brief introductory sections:

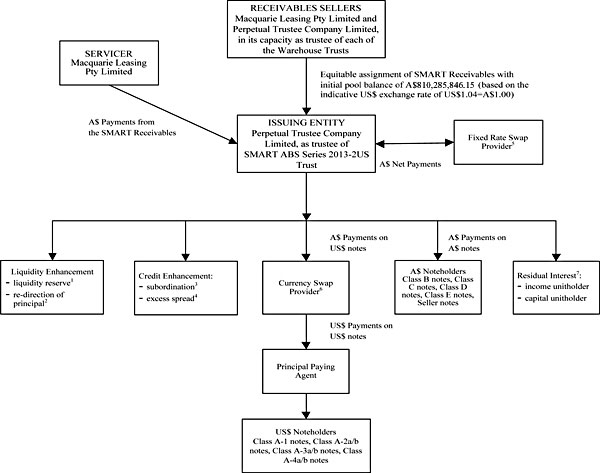

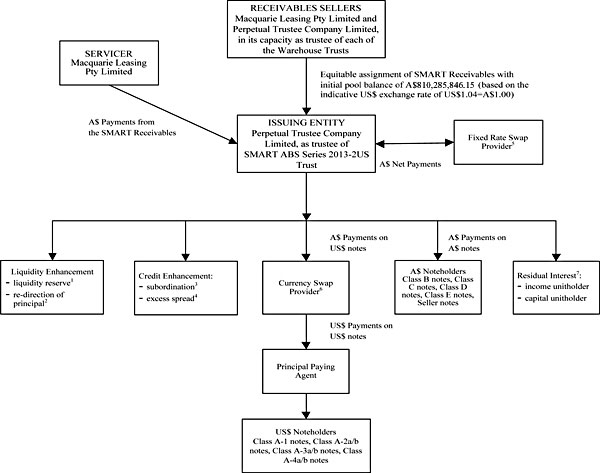

| | • | | Transaction Structure Diagram—illustrates the structure of this securitisation transaction, |

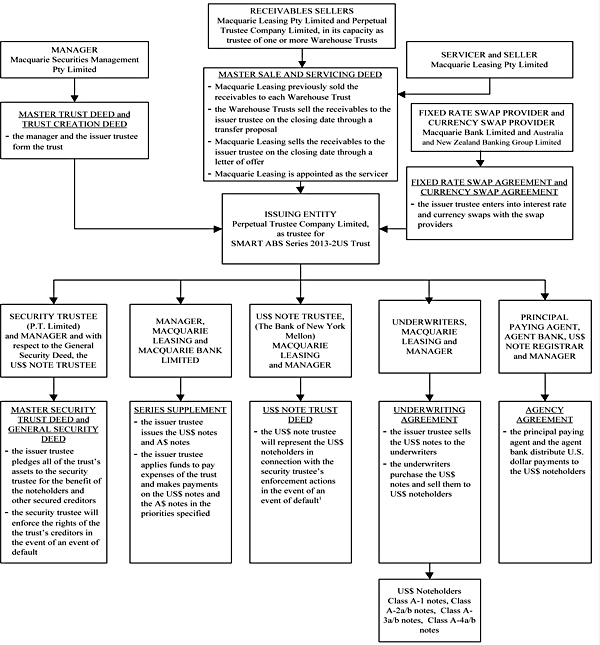

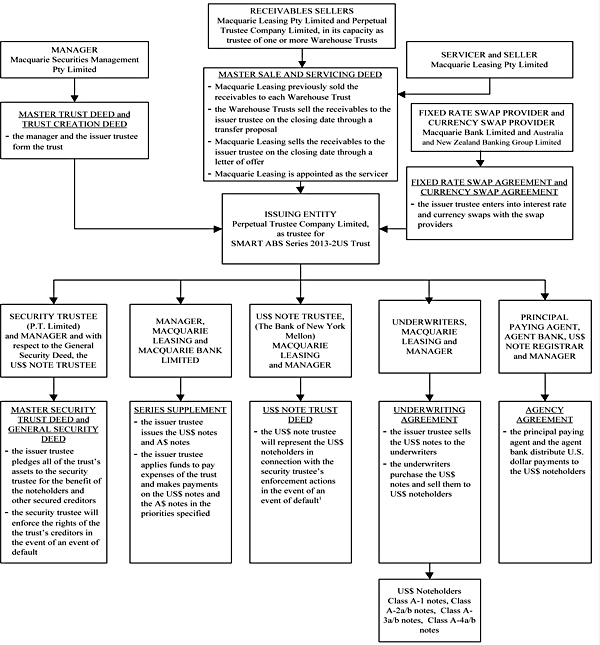

| | • | | Transaction Parties and Documents Diagram—illustrates the role that each transaction party and transaction document plays in this securitisation transaction, |

| | • | | Summary—describes the main terms of the notes, the cash flows in this securitisation transaction and the credit enhancement available to the notes, and |

| | • | | Risk Factors—describes some of the risks of investing in the US$ notes. |

The other sections of this prospectus supplement contain more detailed descriptions of the notes and the structure of the trust that will be formed in connection with the issuance of your notes. We include cross-references in this prospectus supplement and in the prospectus to captions in these materials where you can find further related discussions. The preceding Table of Contents and the Table of Contents included in the prospectus provide the pages on which these captions are located.

In this prospectus supplement, the terms“we”, “us” and“our” refer to Macquarie Leasing Pty Limited. In addition,“Macquarie Management” refers to Macquarie Securities Management Pty Limited,“Macquarie Leasing” refers to Macquarie Leasing Pty Limited and“Macquarie Bank” refers to Macquarie Bank Limited.

i

An index of defined terms with page numbers of definitions of all defined terms can be found in Appendix A of this prospectus supplement and in Appendix A of the prospectus, and a glossary of certain defined terms can be found in Appendix B of this prospectus supplement and in Appendix B of the prospectus.

ii

DISCLAIMERS

No Guarantee by Macquarie Entities

The notes do not represent deposits or other liabilities of Macquarie Bank or any member company of the Macquarie Group and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. None of Macquarie Bank, Macquarie Leasing, the manager or any other member company of the Macquarie Group guarantees any particular rate of return on, or the performance of, the notes nor do they guarantee the repayment of capital from the notes.

No Guarantee by Other Transaction Parties

The notes do not represent deposits of Perpetual Trustee Company Limited, in its personal capacity, as trustee of the SMART ABS Series 2013-2US Trust or as trustee of any other trust, or deposits or liabilities of P.T. Limited, in its personal capacity or as security trustee of the security trust or as security trustee of any other trust, The Bank of New York Mellon, in its personal capacity or as US$ note trustee, principal paying agent, US$ note registrar or agent bank, Australia and New Zealand Banking Group Limited (ABN 11 005 357 522), as currency swap provider, the underwriters or any of their respective associates.

Perpetual Trustee Company Limited’s liability as issuer trustee to make payments of interest and principal on the notes is limited to the extent of the assets of the trust available therefor. All claims against Perpetual Trustee Company Limited in relation to the notes may only be satisfied out of the assets of the trust and are limited in recourse to the assets of the trust.

None of Perpetual Trustee Company Limited, in its personal capacity, as trustee of the SMART ABS Series 2013-2US Trust or as trustee of any other trust, P.T. Limited, in its personal capacity or as security trustee of the security trust or as security trustee of any other trust, The Bank of New York Mellon, in its personal capacity or as US$ note trustee, principal paying agent, US$ note registrar or agent bank, Australia and New Zealand Banking Group Limited, as currency swap provider, the underwriters or any of their respective associates, guarantees the payment or repayment or the return of any principal invested in, or any particular rate of return on, the notes or the performance of the assets of the trust.

In addition, none of the obligations of Perpetual Trustee Company Limited, in its capacity as trustee of the SMART ABS Series 2013-2US Trust, or of the manager are guaranteed in any way by Perpetual Trustee Company Limited, in its personal capacity or as trustee of any other trust, P.T. Limited, in its personal capacity or as security trustee of the security trust or as security trustee of any other trust, The Bank of New York Mellon, in its personal capacity or as US$ note trustee, principal paying agent, US$ note registrar or agent bank, Australia and New Zealand Banking Group Limited, as currency swap provider, the underwriters or any of their respective associates.

iii

The Notes are Subject to Investment Risk

The holding of the notes is subject to investment risk, including possible delays in repayment and loss of income and principal invested.

For further details of the investment risk involved, see “Risk Factors” in the prospectus and in this prospectus supplement.

Additional Disclaimers

The notes will be the obligations solely of the issuer trustee in its capacity as trustee of the SMART ABS Series 2013-2US Trust.

The issuer trustee is not liable to satisfy any obligations or liabilities in relation to the notes or the trust from its personal assets except any obligations or liabilities arising from (and to the extent of) any reduction in its indemnity from the assets of the trust resulting from any fraud, negligence or wilful default (as defined in the transaction documents) on the part of the issuer trustee or any other person whose acts or omissions the issuer trustee is liable for under the transaction documents.

Save as summarised in the above paragraph, each noteholder is required to accept a final distribution of moneys under the master security trust deed and the general security deed in full and final satisfaction of all moneys owing to it, and any debt represented by any shortfall that exists after any such final distribution will be extinguished.

The US$ notes will be issued as book-entry notes. The A$ notes will be issued in the form of registered debt securities.

None of the underwriters or any of their respective affiliates has independently verified the information set forth herein, assumes any responsibility for such information’s accuracy or completeness, or makes any representations or warranties as to the accuracy or completeness of the information contained in this prospectus supplement and the prospectus, and nothing herein will be deemed to constitute such a representation or warranty by the underwriters or their respective affiliates, or a promise or representation as to the future performance of the SMART Receivables or the other related assets of the trust.

Neither Perpetual Trustee Company Limited (in its individual capacity or as trustee of the SMART ABS Series 2013-2US Trust) nor P.T. Limited (in its individual capacity or as security trustee) has had any involvement in the preparation of this prospectus supplement or the prospectus (other than (i) in respect of the sections of this prospectus supplement entitled “Transaction Parties—The Issuer Trustee”, “Transaction Parties—The Security Trustee” and, only to the extent that it relates to the trustee or the security trustee, “Legal Proceedings” and (ii) in respect of the sections of the prospectus entitled “The Issuer Trustee” and “The Security Trustee”), nor have they authorised or caused the issue of this prospectus supplement or the prospectus.

iv

The currency swap provider has not had any involvement in the preparation of this prospectus supplement or the prospectus (other than in respect of the first four paragraphs of the section of this prospectus supplement entitled “The Currency Swaps—The Currency Swap Provider”, and in respect of any documents incorporated by reference into this prospectus supplement referred to in that section), nor has it authorised or caused the issue of this prospectus supplement or the prospectus.

The fixed rate swap provider has not had any involvement in the preparation of this prospectus supplement or the prospectus (other than in respect of the section of this prospectus supplement entitled “The Fixed Rate Swap—The Fixed Rate Swap Provider”), nor has it authorised or caused the issue of this prospectus supplement or the prospectus.

All information contained in this prospectus supplement and the prospectus is given as of the date hereof. Neither the delivery of this prospectus supplement or the prospectus nor any sale made in connection with this prospectus supplement or the prospectus will, under any circumstances, create any implication that:

| | • | | there has been no change in the information contained in this prospectus supplement and the prospectus since the date hereof; |

| | • | | there has been no material change in the affairs of the trust or any party named in this prospectus supplement or the prospectus since the date of this prospectus supplement or the prospectus or the date upon which this prospectus supplement or the prospectus has been most recently amended or supplemented; or |

| | • | | any other information supplied in connection with the US$ notes is correct as of any time subsequent to the date on which it is supplied or, if different, the date indicated in the document containing the same. |

The contents of this prospectus supplement or the prospectus should not be construed as providing legal, business, accounting or tax advice. You should consult your own legal, business, accounting and tax advisers prior to making a decision to invest in the US$ notes.

Investor Representations and Restrictions on Resale

Each purchaser of US$ notes, by its acceptance thereof, will be deemed to have represented to, warranted and agreed with the issuer trustee, Macquarie Management, Macquarie Leasing, the US$ note trustee, the security trustee and the underwriters that (i) the purchaser is not a “retail client” within the meaning of section 761G of the AustralianCorporations Act 2001 (Cth) who received its offer in any state or territory of Australia, (ii) the purchaser is not an “associate” (as defined in Section 128F of the AustralianIncome Tax Assessment Act of 1936 (Cth)) of the issuer trustee, Macquarie Leasing or Macquarie Bank and (iii) either (a) the purchaser is not acquiring such US$ notes (or an interest therein) with the plan assets of (1) an “employee benefit plan” (as defined in Section 3(3) of the United States Employee Retirement Income Security Act of 1974, as amended (“ERISA”)), that is subject to Title I of ERISA, (2) a “plan” (as defined in Section 4975(e)(1) of the United States Internal Revenue Code of 1986, as amended (the “Code”), that is subject to Section 4975 of the Code, (3) an entity that is deemed to hold “plan assets” of the foregoing under 29 C.F.R.

v

§ 2510.3-101, as modified by Section 3(42) of ERISA (each such entity, and each plan described in (1) or (2), a “Benefit Plan Investor”); or (4) a non-U.S., governmental or church plan that is subject to any non-U.S. or U.S. federal, state or local law that is similar to Section 406 of ERISA or Section 4975 of the Code (“Similar Law”) or (b) the acquisition and holding of such US$ notes will not give rise to a non-exempt prohibited transaction under Section 406 of ERISA or Section 4975 of the Code (due to the applicability of a statutory or administrative exemption from the prohibited transaction rules) or a violation of any Similar Law; provided, further, that if, at the time of acquisition of the US$ notes, the ratings on the US$ notes are below investment grade or have been characterized as other than indebtedness for applicable local law purposes, the purchaser or transferee will be deemed to represent and warrant that it is not a Benefit Plan Investor. Each purchaser of US$ notes, by its acceptance thereof, will be deemed to have agreed that any transfer of the US$ notes in violation of the foregoing representations and warranties will be void. No purchaser may offer to resell or resell a US$ note unless the offer or sale (i) is made to a person who is not a “retail client” within the meaning of section 761G of the AustralianCorporations Act 2001 (Cth), receiving its offer in any state or territory of Australia and (ii) complies with any applicable laws in all jurisdictions in which the offer or sale is made.

European Union (“EU”) Article 122a

EU member states have been required to implement Article 122a of the Capital Requirements Directive 2006/48/EC (as amended by Directive 2009/111/EC) (“Article 122a”) that, among other things, places certain restrictions on the ability of an EU-regulated credit institution to invest in asset-backed securities. Article 122a requires such credit institutions to only invest in asset-backed securities where the sponsor or originator has disclosed to investors that it will retain a specified minimum net economic interest in the securitisation transaction. Additionally, the credit institution must be able to demonstrate that it has a comprehensive and thorough understanding of the securitisation transaction and its structural features by satisfying due diligence and monitoring requirements prior to investing in an asset-backed security.

None of the Sponsor, the Manager or the Underwriters nor any of their respective affiliates is obligated to retain a material net economic interest in the securitisation described in this prospectus supplement and the accompanying prospectus or to provide any additional information that may be required to enable a credit institution to satisfy the due diligence and monitoring requirements of Article 122a. Failure to comply with any of the requirements set forth in Article 122a may result in the imposition of a penalty regulatory capital charge on an EU regulated credit institution holding, or possibly holding exposure to, asset-backed securities such as the US$ notes. Purchasers of the US$ notes are responsible for analysing their own regulatory position and are advised to consult with their own advisors regarding the suitability of the US$ notes for investment and the requirements for compliance with Article 122a.

Notice to Residents of the United Kingdom

THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS MAY NOT BE COMMUNICATED IN THE UNITED KINGDOM OTHER THAN TO PERSONS AUTHORISED TO CARRY ON A REGULATED ACTIVITY UNDER THE FINANCIAL SERVICES AND MARKETS ACT 2000, AS AMENDED (THE “FSMA”) OR OTHERWISE HAVING PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS

vi

AND QUALIFYING AS INVESTMENT PROFESSIONALS UNDER ARTICLE 19(1), OR TO PERSONS QUALIFYING AS HIGH NET WORTH PERSONS UNDER ARTICLE 49(1) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, OR TO ANY OTHER PERSON TO WHICH IT IS OTHERWISE LAWFUL TO COMMUNICATE THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING PROSPECTUS. NEITHER THE US$ NOTES NOR THIS PROSPECTUS SUPPLEMENT NOR THE ACCOMPANYING PROSPECTUS ARE AVAILABLE TO OTHER CATEGORIES OF PERSONS IN THE UNITED KINGDOM AND NO ONE FALLING OUTSIDE SUCH CATEGORIES IS ENTITLED TO RELY ON, AND MUST NOT ACT ON, ANY INFORMATION IN THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING PROSPECTUS. THE TRANSMISSION OF THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING PROSPECTUS TO ANY PERSON IN THE UNITED KINGDOM OTHER THAN THE CATEGORIES STATED ABOVE, OR ANY PERSON TO WHOM IT IS OTHERWISE LAWFUL TO COMMUNICATE THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING PROSPECTUS, IS UNAUTHORISED AND MAY CONTRAVENE THE FINANCIAL SERVICES AND MARKETS ACT 2000, AS AMENDED.

vii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus supplement and the prospectus constitute forward-looking statements. Because forward-looking statements made in this prospectus supplement involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, those described herein under “Risk Factors”, the composition of the receivables, loss ratios, delinquency ratios, the actions of competitors, general economic conditions (especially in Australia), changes in interest rates, unemployment, the rate of inflation and consumer perceptions of the economy, compliance with U.S. and Australian federal and state laws, including consumer protection laws, tort laws and, in relation to the U.S., ERISA and changes in such laws, customer preferences and various other matters, many of which are beyond the control of the Sponsor, Macquarie Management and their respective affiliates.

viii

PRESENTATION OF CURRENCIES AND OTHER INFORMATION

In this prospectus supplement and the prospectus, references to“U.S. Dollars” and“US$” are references to U.S. currency and references to“Australian Dollars” and“A$” are references to Australian currency. Unless otherwise stated in this prospectus supplement or the prospectus, any translations of Australian Dollars into U.S. Dollars have been made at a rate of US$1.04* = A$1.00, or the“US$ Exchange Rate”. Use of such rate is not a representation that Australian Dollar amounts actually represent such U.S. Dollar amounts or could be converted into U.S. Dollars at that rate.

Prior to the enforcement of the Security under the Master Security Trust Deed and the General Security Deed, determinations and payments to US$ Noteholders in respect of principal and interest will be converted from Australian Dollars to U.S. Dollars at the US$ Exchange Rate described in “The Currency Swaps and the Fixed Rate Swap—The Currency Swaps—Payments under the Currency Swaps” in this prospectus supplement and paid in accordance with the provisions set forth in “Description of the Notes—Application of Available Income”, “—Available Income and Other Calculations” and “—Payments of Principal Prior to Enforcement of the Security” in this prospectus supplement. Following the enforcement of the Security under the Master Security Trust Deed and the General Security Deed, determinations and payments to US$ Noteholders in respect of principal and interest will be converted from Australian Dollars to U.S. Dollars and paid in accordance with the priorities set forth in “Description of the Notes—Post-Enforcement Priority of Payments” in this prospectus supplement.

References in this prospectus supplement and the prospectus to statutes followed by “(Cth)” are to legislation enacted by the federal parliament of the Commonwealth of Australia.

| * | Indicative US$ Exchange Rate, subject to revision and finalization. |

ix

SUMMARY

This summary highlights selected information from this prospectus supplement and the prospectus and does not contain all of the information that you need to consider in making your investment decision. This summary contains an overview of some of the concepts and other information to aid your understanding. All of the information contained in this summary is qualified by the more detailed explanations in other parts of this prospectus supplement and the prospectus.

Transaction Overview

Perpetual Trustee Company Limited, in its capacity as trustee of the SMART ABS Series 2013-2US Trust, will use the proceeds from the issuance and sale of the notes to purchase a pool of receivables from Perpetual Trustee Company Limited, in its capacity as trustee of each of the warehouse trusts established under the SMART securitisation programme, and from Macquarie Leasing. See “Description of the Assets of the Trust—Acquisition of the SMART Receivables on the Closing Date” in the prospectus.

The receivables consist of lease contracts, hire purchase contracts and loan contracts in relation to motor vehicle assets (including cars, trucks, buses, trailers, forklifts and motorcycles) that are located in Australia and are not subject to the Australian National Credit Code or the Australian Consumer Credit Code. Perpetual Trustee Company Limited, in its capacity as trustee of the SMART ABS Series 2013-2US Trust, will rely on collections (including proceeds of the SMART Receivables) to make payments on the notes and will be solely liable for the payment of the notes.

Transaction Parties

Issuing Entity | Perpetual Trustee Company Limited (ABN 42 000 001 007), in its capacity as trustee of the trust |

Trust | SMART ABS Series 2013-2US Trust |

Issuer Trustee | Perpetual Trustee Company Limited (ABN 42 000 001 007), in its capacity as trustee of the trust |

Depositor | Macquarie Leasing Pty Limited (ABN 38 002 674 982) |

Manager | Macquarie Securities Management Pty Limited (ABN 26 003 435 443) |

Sponsor | Macquarie Leasing Pty Limited (ABN 38 002 674 982) |

Originator | Macquarie Leasing Pty Limited (ABN 38 002 674 982) |

S-1

Receivables Sellers | Perpetual Trustee Company Limited, in its capacity as trustee of each of SMART RBS Warehouse Trust, SMART J Warehouse Trust and SMART ANZ Warehouse Trust (the“warehouse trusts”), and Macquarie Leasing. Macquarie Securities Management Pty Limited is the manager of each of the warehouse trusts. Macquarie Leasing Pty Limited is the beneficial owner of each of the warehouse trusts. |

Servicer | Macquarie Leasing Pty Limited (ABN 38 002 674 982) |

Security Trustee | P.T. Limited (ABN 67 004 454 666) |

US$ Note Trustee, Principal Paying Agent, Agent Bank and US$ Note Registrar | The Bank of New York Mellon |

Income Unitholder | Macquarie Leasing Pty Limited (ABN 38 002 674 982) |

Capital Unitholder | Macquarie Bank Limited (ABN 46 008 583 542) |

Underwriters for US$ Notes | J.P. Morgan Securities LLC |

RBS Securities Inc.

Macquarie Capital (USA) Inc.

ANZ Securities, Inc.

Fixed Rate Swap Provider | Macquarie Bank Limited (ABN 46 008 583 542) |

Currency Swap Provider | Australia and New Zealand Banking Group Limited (ABN 11 005 357 522) |

S-2

Transaction Structure Diagram

| 1. | On the closing date, Macquarie Bank will deposit A$8,102,858.46 (an amount representing approximately 1.00% of the aggregate of the initial pool balance on the closing date) in the liquidity reserve account maintained by the issuer trustee. |

| 2. | In the event that the issuer trustee has received insufficient income collections in any monthly period, after giving effect to a draw from the liquidity reserve, to meet payments of interest on the US$ notes and certain expenses, the issuer trustee will apply available principal collections in the amount of that deficit towards those required payments. Principal collections applied towards such required payments may be reimbursed by the application of excess income collections received by the issuer trustee in subsequent monthly periods, if any, or by drawing on the liquidity reserve to the extent the balance of the liquidity reserve exceeds the required reserve amount. |

| 3. | Interest payments on the A$ notes will always be subordinated to interest payments on the US$ notes. Principal payments on the A$ notes will be subordinated to principal payments on the US$ notes only if the pro rata paydown test is not satisfied. The priority of payments of interest and principal will change after the enforcement of the Security under the master security trust deed and the general security deed. The initial amount of subordination provided by the A$ notes for the US$ notes will be 11% of the initial aggregate outstanding principal balance of the SMART Receivables Pool, or A$89,132,000 (based on the indicative US$ exchange rate of US$1.04=A$1.00). |

| 4. | Excess spread in the form of excess interest collections is available, as a component of available income, for allocation towards total principal collections to satisfy any unreimbursed principal draws, defaulted amounts and prior unreimbursed charge-offs. |

| 5. | The issuer trustee will make fixed rate A$ payments to the fixed rate swap provider and the fixed rate swap provider will make floating rate A$ (based on the BBSW swap rate) payments to the issuer trustee. The payments will be netted against each other and one net payment will be made between the issuer trustee and the fixed rate swap provider. |

S-3

| 6. | The currency swap provider will receive A$ floating rate payments (based on the BBSW swap rate and the applicable spread) from the issuer trustee in respect of interest on the US$ notes and pay US$ fixed rate or floating rate (at LIBOR plus the applicable spread) amounts as interest on the US$ notes to the principal paying agent for distribution to US$ noteholders. The currency swap provider will receive A$ principal payments on the US$ notes from the issuer trustee and convert such A$ payments to US$ at the exchange rate specified in the currency swap agreement, which US$ amount will be paid as principal to the principal paying agent for distribution to US$ noteholders. |

| 7. | The residual interest in the trust will be held by Macquarie Leasing Pty Limited, the initial income unitholder, and Macquarie Bank Limited, the capital unitholder and an affiliate of the sponsor. On a current basis the income unitholder will receive excess interest collections not required to make prior ranking payments. |

S-4

Transaction Parties and Documents Diagram

| 1 | Generally, only the US$ note trustee may enforce, or direct the security trustee to enforce, the obligations of the issuer trustee or the manager to the US$ noteholders under the US$ notes and any other transaction document. No US$ noteholder is entitled to proceed directly against the issuer trustee, Macquarie Leasing or the manager in respect of the US$ notes or any other transaction document. The US$ note trustee will act at the direction of the US$ noteholders. See “Description of the Transaction Documents—The US$ Note Trust Deed—Duties of the US$ Note Trustee” in the prospectus. |

S-5

Summary of the Notes

The Class A-1 notes, the Class A-2a notes, the Class A-3a notes and the Class A-4a notes bear a fixed rate of interest (the“US$ fixed rate notes”). The Class A-2b notes, the Class A-3b notes and the Class A-4b notes bear a floating rate of interest (the“US$ floating rate notes”). In addition to the US$ notes, the issuer trustee will also issue the Class B notes, the Class C notes, the Class D notes, the Class E notes and the seller notes, which are denominated in A$ and are not being offered by this prospectus supplement or the prospectus. It is contemplated that the A$ notes will be sold in private transactions, initially to affiliates of Macquarie Bank. The A$ notes are transferable, subject to relevant restrictions on transfer, and there is no requirement that affiliates of Macquarie Bank retain any portion of the A$ notes. It is a condition to the issuance of the US$ notes that each class of the A$ notes be issued on the closing date.

The US$ notes and the A$ notes will be limited recourse obligations of the issuer trustee backed by the same pool of receivables. The initial principal balance for the US$ notes will be finalised once the exchange rate under the currency swaps has been determined.

The Class A-2a notes and the Class A-2b notes are collectively referred to as the “Class A-2 notes”. The Class A-3a notes and the Class A-3b notes are collectively referred to as the “Class A-3 notes”. The Class A-4a notes and the Class A-4b notes are collectively referred to as the “Class A-4 notes”. Each of the Class A-2a notes, the Class A-2b notes, the Class A-3a notes, the Class A-3b notes , and the Class A-4a notes and the Class A-4b notes is referred to as a “sub-class” of the Class A notes. The notes will be issued in nine classes: the Class A-1 notes, the Class A-2 notes, the Class A-3 notes, the Class A-4 notes, the Class B notes, the Class C notes, the Class D notes, the Class E notes and the seller notes, each referred to as a “class” of notes.

Money Market Notes

The Class A-1 notes will be structured to be “eligible securities” for purchase by money market funds under paragraph (a)(12) of Rule 2a-7 under the United States Investment Company Act of 1940, as amended. Rule 2a-7 includes additional criteria for investments by money market funds, including additional requirements relating to a portfolio of maturity, liquidity and risk diversification. If you are a money market fund contemplating a purchase of Class A-1 notes, you or your advisor should consider these requirements and consider whether an investment in the Class A-1 notes satisfies the fund’s investment objectives and policies before making a purchase.

Key Terms of the Notes

| | |

| Indicative Cut-Off Date | | The open of business on April 1, 2013 |

| |

| Cut-Off Date | | The open of business on May 1, 2013 |

S-6

| | |

| |

| Closing Date | | Subject to the satisfaction of certain conditions precedent, on or about May 22, 2013 |

| |

| Distribution Dates | | The 14th day of each calendar month (or if such day is not a business day, the next business day). The first distribution date is June 14, 2013. |

| |

| Business Day | | A day on which banks are open for business in Sydney, Melbourne, New York City and London |

S-7

US$ Notes

| | | | | | | | | | | | | | |

US$ Notes to be Issued at Closing | | Class A-1 notes | | Class A-2a

notes | | Class A-2b

notes | | Class A-3a

notes | | Class A-3b

notes | | Class A-4a

notes | | Class A-4b

notes |

| | | | |

Initial Invested Amount | | US$142,500,000 | | US$187,500,000 | | US$217,500,000 | | US$202,500,000 |

| | | | |

% of Total Initial Invested Amount of notes (based on A$ equivalents)* | | [16.91]% | | [22.25]% | | [25.81]% | | [24.03]% |

| | | | | | | |

Interest Rate | | [ ]% | | [ ]% | | One-month

LIBOR + [ ]% | | [ ]% | | One-month

LIBOR + [ ]% | | [ ]% | | One-month

LIBOR + [ ]% |

| | | | | | | |

Interest Accrual Method | | Actual/360 | | 30/360 | | Actual/360 | | 30/360 | | Actual/360 | | 30/360 | | Actual/360 |

| |

Clearance/ Settlement | | DTC/Euroclear/Clearstream, Luxembourg |

| | | | | | | |

CUSIP | | 78447U AA8 | | 78447U AB6 | | 78447U AC4 | | 78447U AD2 | | 78447U AE0 | | 78447U AF7 | | 78447U AG5 |

| | | | | | | |

ISIN | | US78447UAA88 | | US78447UAB61 | | US78447UAC45 | | US78447UAD28 | | US78447UAE01 | | US78447UAF75 | | US78447UAG58 |

| | | | | | | |

Maturity Date | | Distribution

Date in

May 2014 | | Distribution

Date in

September 2015 | | Distribution

Date in

September 2015 | | Distribution

Date in

January 2017 | | Distribution

Date in

January 2017 | | Distribution

Date in

February 2019 | | Distribution

Date in

February 2019 |

| | | | | | | | | | |

A$ Notes to be Issued at Closing | | Class B notes | | Class C notes | | Class D notes | | Class E notes | | Seller notes |

| | | | | |

Initial Invested Amount* | | A$8,913,000 | | A$29,576,000 | | A$20,257,000 | | A$18,231,000 | | A$12,155,000 |

| | | | | |

% of Total Initial Invested Amount of notes (based on A$ equivalents) * | | [1.10]% | | [3.65]% | | [2.50]% | | [2.25]% | | [1.50]% |

| | | | | |

Interest Rate | | One-month BBSW +

[ ]% | | One-month BBSW

+ [ ]% | | One-month BBSW

+ [ ]% | | One-month BBSW

+ [ ]% | | One-month BBSW

+ [ ]% |

| | | | | |

Interest Accrual Method | | Actual/365 | | Actual/365 | | Actual/365 | | Actual/365 | | Actual/365 |

| |

Clearance/Settlement | | Registered |

| |

Maturity Date | | The Distribution Date falling in May 2020. |

*Based on the indicative US$ exchange rate of US$1.04=A$1.00, subject to revision and finalization.

S-8

Establishment of the SMART ABS Series 2013-2US Trust

Macquarie Leasing and the manager established the SMART securitisation programme pursuant to a master trust deed dated March 11, 2002. The master trust deed provides the general terms and structure for securitisation under the SMART securitisation programme. The series supplement to be entered into by and among the manager, Macquarie Bank, Macquarie Leasing and the issuer trustee sets out the specific details of the trust including, among other things, the notes that will be issued in respect of the SMART ABS Series 2013-2US Trust by the issuer trustee and the distributions of interest and principal payments by the issuer trustee in respect of the trust. These details may vary from the terms set forth in the master trust deed.

Each securitisation under the SMART securitisation programme is a separate transaction with a separate trust. The assets of the SMART ABS Series 2013-2US Trust will not be available to pay the obligations of any other trust established under the SMART securitisation programme, and the assets of other trusts will not be available to pay the obligations of the SMART ABS Series 2013-2US Trust. See “The SMART Securitisation Programme” in the prospectus.

The beneficial interest in the trust is held by Macquarie Leasing Pty Limited as the initial income unitholder and Macquarie Bank Limited as the capital unitholder. The income unit may be transferred. The capital units are not transferable. The unitholders are only entitled to receive payments or distributions after payment of all prior ranking entitlements described under “Description of the Notes—Application of Available Income” and “—

Payments of Principal Prior to Enforcement of the Security” in this prospectus supplement.

As of the closing date and prior to the issuance of the notes, the issuer trustee has no indebtedness as trustee of the trust and the trust is capitalised to A$10 for the benefit of the income unitholder and the capital unitholder.

Following the issuance of the notes, assets of the trust will include:

| | • | | the SMART Receivables Pool, including all payments made on the SMART Receivables and proceeds received in relation to the underlying motor vehicles; |

| | • | | all retained title rights in relation to the SMART Receivables; |

| | • | | rights under the mortgages and any collateral securities securing the SMART Receivables and the insurance policies in relation to any mortgages or collateral securities relating to the SMART Receivables (see “Legal Aspects of the Receivables” in the prospectus for a description of the concept of a mortgage and its enforcement); |

| | • | | the other authorised short-term investments of the trust, including amounts on deposit in the bank accounts established in connection with the trust and any instruments in which these amounts or other assets of the trust are invested; and |

| | • | | the issuer trustee’s rights under the transaction documents. |

S-9

See “Description of the Assets of the Trust—Assets of the Trust” and “—Acquisition of the SMART Receivables on the Closing Date” in the prospectus.

The SMART Receivables Pool

The SMART Receivables Pool will consist of lease contracts, hire purchase contracts and loan contracts in relation to motor vehicle assets located in Australia. The finance leases and novated leases described below that constitute SMART Receivables both arise pursuant to lease contracts. The chattel mortgage contracts described below that constitute SMART Receivables arise under loan contracts.

A finance lease is an agreement where the lessor, as owner, rents a motor vehicle to the lessee. The lease agreement specifies the rental, term, payment timing, residual value and other general terms and conditions. The residual value is set in accordance with Australian tax guidelines. Upon the return of the motor vehicle to the lessor upon termination or expiration of the lease agreement, the lessee is required to pay the lessor the amount, if any, by which the residual value exceeds the sale proceeds of the motor vehicle. The lessee does not have a guaranteed option to purchase the motor vehicle at the end of the lease term but typically negotiates to do so.

A significant portion of the lease contracts included in the SMART Receivables are novated leases. A novated lease is an agreement where an employee, as lessee, leases a motor vehicle and then novates it to the employer who pays the lease rentals while the lessee remains its employee. The lessee remains fully liable to perform and observe all of the other obligations under the lease agreement not related to payment of the rentals, including obligations relating to the residual value.

A hire purchase contract is an agreement whereby the purchaser of a motor vehicle obtains possession of the motor vehicle before paying in full for it or obtaining legal title. Under a hire purchase contract, the purchaser pays prescribed instalments which together with an initial deposit (if any) and a final balloon payment (if any) enable Macquarie Leasing, as owner of the motor vehicle, to recoup its capital outlay and interest on that outlay. The purchaser has a guaranteed option to purchase the motor vehicle during the term of the hire purchase contract. Before the purchaser exercises its option to purchase and pays all amounts owed to Macquarie Leasing under the relevant hire purchase contract, Macquarie Leasing remains the legal owner of the motor vehicle, subject to the issuer trustee’s beneficial ownership of the motor vehicle being legally perfected following the occurrence of a perfection of title event. For a description of when a perfection of title event will be triggered, see “Description of the Transaction Documents—The Master Sale and Servicing Deed—Perfection of Title Event” in the prospectus.

A chattel mortgage contract is an alternative method of financing motor vehicles. Under a chattel mortgage contract, the purchaser of a motor vehicle executes a mortgage document over the motor vehicle against which Macquarie Leasing provides a loan financing the purchase on agreed terms. The purchaser remains the legal owner of the motor vehicle and Macquarie Leasing takes a mortgage over the motor vehicle. See “Origination of the SMART Receivables—Types of SMART Receivables—Chattel Mortgage Contracts” in the prospectus.

The manager expects the SMART Receivables Pool to be acquired on the closing date to have characteristics similar to

S-10

those in the following table, except that the number of contracts and the aggregate outstanding principal balance of the actual SMART Receivables Pool may be smaller:

Selected Data for the Indicative Receivables Pool as of the Indicative Cut-Off Date

| | | | |

Number of Receivables | | | 29,635 | |

Outstanding Principal Balance (A$) | | | 1,055,407,431.33 | |

Weighted Average Receivable Interest Rate (% p.a.) | | | 7.69 | |

Average Receivable Balance (A$) | | | 35,613.55 | |

Maximum Receivable Balance (A$) | | | 422,267.23 | |

Minimum Receivable Balance (A$) | | | 1,657.02 | |

Maximum Term Remaining (months) | | | 61.00 | |

Range of Original Term (months) | | | 6 to 61 | |

Range of Remaining Term (months) | | | 4 to 61 | |

Weighted Average Original Term (months) | | | 49.59 | |

Weighted Average Term Remaining (months) | | | 43.41 | |

Weighted Average Seasoning (months) | | | 6.18 | |

Weighted Average Balloon (A$) | | | 13,771.63 | |

Weighted Average Balloon by Original Balance (%) | | | 26.83 | % |

Weighted Average Balloon by Current Balance (%) | | | 29.36 | % |

Largest Customer Exposure (A$) | | | 425,512.66 | |

Largest Customer Exposure (%) | | | 0.04 | % |

New Vehicles by Current

Balance (%) | | | 64.67 | % |

Used Vehicles by Current

Balance (%) | | | 35.33 | % |

The information in the above table sets forth in summary format various details relating to the Indicative Receivables Pool. All percentages are by aggregate outstanding principal balance of the Receivables in the relevant category. All amounts have been rounded to the nearest Australian cent. The information is provided as of the indicative cut-off date. The Cut-Off Date for the actual SMART Receivables Pool to be acquired by the issuer trustee on behalf of the trust on the closing date will be the open of business on May 1, 2013.

The aggregate outstanding principal balance of the actual SMART Receivables Pool will be A$810,285,846.15 as of the Cut-Off Date based on the indicative US$ exchange rate of US$1.04=A$1.00 in order that the US$ notes constitute 89% of the initial pool balance and 89% of the total amount of US$ notes and

A$ notes issued. See “The SMART Receivables Pool and the Indicative Receivables Pool—Eligibility Criteria and Selection of the SMART Receivables” in this prospectus supplement.

The Receivables in the Indicative Receivables Pool were randomly selected by Macquarie Leasing for inclusion in the Indicative Receivables Pool from those motor vehicle receivables held by Perpetual Trustee Company Limited, in its capacity as trustee of each of the warehouse trusts established under the SMART securitisation programme, and by Macquarie Leasing, which comply with the eligibility criteria set out under “The SMART Receivables Pool and the Indicative Receivables Pool—Eligibility Criteria and Selection of the SMART Receivables” in this prospectus supplement as at the indicative cut-off date. The SMART Receivables will be randomly selected by Macquarie Leasing for inclusion in the SMART Receivables Pool from the Receivables in the Indicative Receivables Pool which comply with the eligibility criteria as at the Cut-Off Date. While the characteristics of the actual SMART Receivables Pool may vary somewhat from the characteristics of the Indicative Receivables Pool, Macquarie Leasing does not expect that variance to be material.

The manager may substitute Receivables proposed to be acquired by the issuer trustee on the closing date with other eligible Receivables, add additional eligible Receivables or remove eligible Receivables at any time up until the closing date.

Security for the Notes

The issuer trustee will pledge all of the assets of the trust to the security trustee in order to secure the issuer trustee’s payment obligations to the US$ noteholders, the A$ noteholders

S-11

and the other secured creditors. See “Description of the Transaction Documents—The Master Security Trust Deed and the General Security Deed—The Security” in the prospectus. The security trustee’s role in the transaction will be to maintain the Security over the assets of the trust and to take steps to liquidate the assets of the trust upon the occurrence of certain events of default. See “Description of the Transaction Documents—The Master Security Trust Deed and the General Security Deed—Events of Default” and “—Enforcement of the Security” in the prospectus.

Representations and Warranties of Macquarie Leasing and Certifications of the Manager

In connection with each transfer of Receivables by Macquarie Leasing to the warehouse trusts, Macquarie Leasing has previously provided certain representations and warranties as at the cut-off date relating to each such transfer of those Receivables from Macquarie Leasing to the relevant warehouse trust. Following the acquisition of the relevant SMART Receivables from each warehouse trust, the issuer trustee will hold the benefit of such representations and warranties previously given by Macquarie Leasing from the Cut-Off Date.

Although Macquarie Leasing will not repeat any of the representations and warranties previously given to the relevant warehouse trust, the manager will certify to the issuer trustee that to the best of its knowledge and belief all SMART Receivables purchased by the issuer trustee from a warehouse trust under a transfer proposal and included in the SMART Receivables Pool comply with the eligibility criteria described under” The SMART Receivables Pool and the Indicative Receivables Pool—Eligibility Criteria and Selection of the SMART Receivables” in this prospectus supplement at the Cut-Off Date.

However, the manager is not required to make any inquiry or investigation into whether any SMART Receivable complies with any of the specified eligibility criteria. The issuer trustee’s sole remedy for breach by the manager is to bring an action against the manager. There is no contractual indemnity or repurchase obligation by the manager.

In connection with the transfer of Receivables by Macquarie Leasing to the issuer trustee directly, Macquarie Leasing will provide certain representations and warranties, including as to compliance of such Receivables with the eligibility criteria described under “The SMART Receivables Pool and the Indicative Receivables Pool—Eligibility Criteria and Selection of the SMART Receivables” in this prospectus supplement, as at the Cut-Off Date. The issuer trustee will hold the benefit of such representations and warranties to be given by Macquarie Leasing from the Cut-Off Date. However, the manager will not make any certification to the issuer trustee with respect to the eligibility of the SMART Receivables purchased by the issuer trustee from Macquarie Leasing directly. See “Description of the Assets of the Trust—Macquarie Leasing’s Representations and Warranties in Relation to the SMART Receivables” in the prospectus.

If any representation and warranty provided by Macquarie Leasing in respect of a SMART Receivable was incorrect when given either at the time of transfer to the relevant warehouse trust (in the case of any SMART Receivable transferred by Macquarie Leasing to the relevant warehouse trust) or at the time of transfer to the issuer trustee (in the case of any SMART Receivable transferred by Macquarie Leasing to the issuer trustee directly), and such breach is not remedied to the satisfaction of the issuer trustee within 5 business days of Macquarie Leasing, the manager or the issuer trustee giving notice of the breach to the other

S-12

two parties, Macquarie Leasing is required to repurchase the relevant SMART Receivable. This repurchase remedy is available to the issuer trustee only if Macquarie Leasing gives or receives notice of the breach not later than 5 business days before the end of a 120-day prescribed period commencing on the date on which Macquarie Leasing sold the SMART Receivables to the relevant warehouse trust or to the issuer trustee, as applicable.

If the issuer trustee discovers the breach after the last day that the notice of breach described above can be given, the issuer trustee (as purchaser of the SMART Receivables sold from the warehouse trust and from Macquarie Leasing, as applicable) will have an indemnity claim against Macquarie Leasing for costs, damages or losses resulting from such representation and warranty being incorrect when given. The issuer trustee and Macquarie Leasing must agree on the amount of such costs, damages or losses; otherwise, Macquarie Leasing’s external auditors must make such determination. The amount of such costs, damages or losses will not exceed the principal amount outstanding, together with any accrued but unpaid interest and any outstanding fees, in respect of the SMART Receivable.

During the 120-day prescribed period, the issuer trustee’s sole remedy for any of the representations or warranties in respect of a SMART Receivable being incorrect when given is the right to require repurchase of such SMART Receivable as described above. Macquarie Leasing has no other liability for any loss or damage caused by any breach of any representations or warranties to the issuer trustee, any noteholder or any other person. After the 120-day prescribed period has ended, the issuer trustee’s sole remedy for a breach of a representation or warranty with respect to a SMART Receivable is the right to make an indemnity claim against Macquarie Leasing, and Macquarie Leasing will not be required to

repurchase any of the SMART Receivables with respect to which it has breached a representation or warranty. See “Description of the Assets of the Trust—Macquarie Leasing’s Representations and Warranties in Relation to the SMART Receivables—Consequences of a Breach of the Representations and Warranties” in the prospectus. With respect to a significant portion of the SMART Receivables to be acquired by the issuer trustee on the closing date from the warehouse trusts, the 120-day prescribed period has expired. With respect to the SMART Receivables to be acquired by the issuer trustee directly from Macquarie Leasing, the 120-day prescribed period will commence on the closing date.

Macquarie Leasing has not received any requests to repurchase or indemnity claims with respect to an underlying asset due to a breach of any representation or warranty in regard to any of its prior securitisation transactions.

Credit Enhancement

The following forms of credit enhancement will be available to support payments of interest and principal on the US$ notes:

Subordination

The A$ notes will always be subordinated to the US$ notes in their right to receive interest payments.

To the extent the Pro Rata Paydown Test is not satisfied with respect to the applicable distribution date prior to the enforcement of the Security under the master security trust deed and the general security deed, the issuer trustee will pay principal to each class of notes sequentially, beginning with the Class A-1 notes, and will not pay principal on any class of notes until the principal amount of all

S-13

more senior classes of notes is paid in full. The A$ notes will be subordinated to the US$ notes in their right to receive principal payments. Principal payments on each more junior class of the Class A notes will be subordinated to principal payments on the most senior class of the Class A notes, with each of (i) the Class A-2a notes and the Class A-2b notes, (ii) the Class A-3a notes and the Class A-3b notes and (iii) the Class A-4a notes and the Class A-4b notes constituting a single class.

To the extent the Pro Rata Paydown Test is satisfied with respect to the applicable distribution date prior to the enforcement of the Security under the master security trust deed and the general security deed, the issuer trustee will pay principal pari passu and on a pro rata basis towards each of the Class A notes, the Class B notes, the Class C notes, the Class D notes, the Class E notes and the seller notes. Among the Class A notes, all principal allocated to the Class A notes will be applied sequentially by class, with principal payments on each more junior class of the Class A notes subordinated to principal payments on the most senior class of Class A notes, with each of (i) the Class A-2a notes and the Class A-2b notes, (ii) the Class A-3a notes and the Class A-3b notes and (iii) the Class A-4a notes and the Class A-4b notes constituting a single class.

Following the enforcement of the Security under the master security trust deed and the general security deed, the security trustee or a receiver will pay principal sequentially towards repayment of the Class A notes, the Class B notes, the Class C notes, the Class D notes, the Class E notes and the seller notes. Among the Class A notes, principal payments will first be made to reduce the collateralised amount of the Class A-1 notes and will then be made pari passu and on a pro rata basis to reduce the collateralised amounts of the Class A-2 notes, the Class A-3 notes and the Class

A-4 notes, with each of (i) the Class A-2a notes and the Class A-2b notes, (ii) the Class A-3a notes and the Class A-3b notes and (iii) the Class A-4a notes and the Class A-4b notes constituting a single class. The A$ notes will be fully subordinated to the US$ notes in their right to receive principal payments following the enforcement of the Security under the master security trust deed and the general security deed.

The support provided to the US$ notes by the A$ notes is intended to enhance the likelihood that the US$ notes will receive expected payments of interest and principal. The initial amount of support provided by the A$ notes to the US$ notes as a percentage of the total initial invested amount of the notes is 11.00%.

Excess Interest Collections

On each distribution date, any available income (other than the liquidity reserve balance excess) remaining after payment of (i) interest on the notes (other than seller notes) and (ii) trust expenses will be allocated towards total principal collections to the extent needed to satisfy unreimbursed principal draws, defaulted amounts and unreimbursed charge-offs.

See “Description of the Notes—Application of Available Income”, “—Payments of Principal Prior to Enforcement of the Security” and “—Credit Enhancement” in this prospectus supplement and “Description of the Notes—Credit and Liquidity Enhancement” in the prospectus.

Liquidity Enhancement

The following forms of liquidity enhancement will be available to enhance the likelihood of timely payment of interest on the US$ notes:

S-14

Liquidity Reserve Balance

On the closing date, Macquarie Bank will deposit A$8,102,858.46 (an amount representing approximately 1.00% of the aggregate of the initial pool balance on the closing date) in the liquidity reserve account maintained by the issuer trustee to be applied as the liquidity reserve balance. In the event that the issuer trustee has received insufficient collections in any monthly period to meet payments of interest on the US$ notes and certain expenses, the issuer trustee may in certain circumstances apply the liquidity reserve balance to make those required payments.

Each liquidity reserve draw is repayable on the next distribution date to the extent that the issuer trustee has sufficient funds available to it for this purpose. See “Description of the Notes—Available Income and Other Calculations—The Liquidity Reserve Draw” in this prospectus supplement.

Re-Direction of Principal

In the event that the issuer trustee has received insufficient income collections in any monthly period, after giving effect to a draw from the liquidity reserve, to meet payments of interest on the US$ notes and certain expenses, the issuer trustee will apply available principal collections in the amount of that deficit towards those required payments. Principal collections applied towards such required payments may be reimbursed by the application of excess income collections received by the issuer trustee in subsequent monthly periods, if any, or by drawing on the liquidity reserve to the extent the balance of the liquidity reserve exceeds the required reserve amount. See “Description of the Notes—Available Income and Other Calculations—Principal Draws” in this prospectus supplement.

Charge-Offs

Any losses will be allocated to the notes in the following order: seller notes, Class E notes, Class D notes, Class C notes, Class B notes and Class A notes, in the manner described in “Description of the Notes—Charge-Offs” in this prospectus supplement.

Hedging Arrangements

To hedge its interest rate and currency exposures:

| | • | | the issuer trustee will enter into an interest rate swap to hedge the interest rate risk between the fixed interest rates on the receivables and the floating payment obligations of the issuer trustee, including the issuer trustee’s payment obligations under the currency swaps (see “The Currency Swaps and the Fixed Rate Swap—The Fixed Rate Swap” in this prospectus supplement); and |

| | • | | the issuer trustee will enter into seven currency swaps, one for each class or sub-class of US$ notes, to hedge the currency risk and the interest rate risk between the A$ floating rate payments received by the issuer trustee (under the fixed rate swap) and the US$ fixed rate payments and the US$ floating rate payments required to be made in respect of the US$ fixed rate notes and the US$ floating rate notes, respectively (see “The Currency Swaps and the Fixed Rate Swap—The Currency Swaps” in this prospectus supplement). |

Collections

Collections will include the following amounts:

S-15

| | • | | the sum of all amounts for which a credit entry is made to the accounts established in the servicer’s records for the SMART Receivables (but excluding any Adjustment Advances to be paid to each warehouse trust on the closing date)less (i) any credit entries made relating to SMART Receivables which have been written off as uncollectible andless (ii) any reversals made to such credit entries where the original credit entry (or part thereof) was made in error or was made but subsequently reversed due to funds not being cleared; |

| | • | | any amount received, which had previously been written off, by the servicer in relation to the SMART Receivablesless any reversals made in respect of any such amount received where the original credit entry (or part thereof) was made in error or subsequently reversed due to funds not being cleared; |

| | • | | any amounts received by the issuer trustee from Macquarie Leasing in respect of any SMART Receivables repurchased by Macquarie Leasing as a result of the discovery that any representation or warranty of Macquarie Leasing relating to the SMART Receivables was incorrect when given; |

| | • | | solely for the monthly period immediately preceding Macquarie Leasing’s exercise of the clean-up call, any amounts the manager reasonably expects the issuer trustee to receive upon Macquarie Leasing’s exercise of its right to acquire the assets of, and extinguish, the trust; |

| | • | | any damages received by the issuer trustee; |

| | • | | any amounts received by the issuer trustee as a result of the sale of the assets of the trust on or following the termination event date; |

| | • | | for the first monthly period only, any note proceeds received by the issuer trustee that are not used to acquire SMART Receivables; |

| | • | | any insurance proceeds received in relation to the SMART Receivables by the servicer or the issuer trustee; |

| | • | | any amounts received by the issuer trustee in respect of a sale of assets of the trust to another trust established under the master trust deed after the exercise of the clean-up call or the occurrence of a tax redemption event; and |

| | • | | any other amount received by the issuer trustee (excluding any amount drawn from the liquidity reserve balance, certain collateral or prepayment amounts provided under any support facility to the issuer trustee and the amount of any interest received in respect of a SMART Receivable which was already accrued at the time that the relevant SMART Receivable was acquired by the issuer trustee), |

lessany amount debited to the accounts established in the servicer’s records for the SMART Receivables representing fees or charges imposed by any governmental agency, bank accounts debits tax or similar taxes or duties imposed by any governmental agency, insurance premiums paid by the servicer or any amounts received by Macquarie Leasing or the servicer in respect of goods and services tax, hiring duty, rental business duty or credit business duty in relation to a SMART Receivable. See “Description of the Notes—Available Income and Other Calculations—The Income Collections” in this prospectus supplement.

S-16

Interest on the Notes

Prior to enforcement of the Security under the master security trust deed and the general security deed, interest on each of the US$ notes and the A$ notes is payable monthly in arrears on each distribution date.

The issuer trustee will apply available income pari passu and rateably towards payments to the currency swap provider of the A$ floating amounts in respect of each class or sub-class of US$ notes in exchange for the amount of interest (in US$) due and payable on each class or sub-class of the US$ notes for the interest period relating to that distribution date plus any interest amounts in respect of such US$ notes remaining unpaid from prior distribution dates and interest owing on any such unpaid amounts.

Interest on a US$ note is calculated for an interest period by dividing:

| | • | | the interest rate applicable to the relevant US$ note; |

| | • | | the outstanding invested amount of the relevant US$ note as at the beginning of that interest period; and |

| | • | | where the relevant US$ note is a: |

| | • | | Class A-2a note, Class A-3a note or Class A-4a note, 30 (or the number of days in that interest period assuming a 30/360 day count convention, in the |

| | | case of (i) the first interest period and (ii) the last interest period, if the last interest period does not end on a distribution date); or |

| | • | | Class A-1 note, Class A-2b note, Class A-3b note or Class A-4b note, the actual number of days in that interest period, |

Interest will accrue on the notes from and including the prior distribution date (or the closing date, in the case of the first distribution date) to but excluding the current distribution date.

Interest will be paid on the US$ notes on a distribution date only after the payments of certain fees, expenses and other obligations of the issuer trustee.

Interest will be paid on the A$ notes on a distribution date only after the payments of interest on the US$ notes and the payments of certain fees, expenses and other obligations of the issuer trustee are made.

See “Description of the Notes—Application of Available Income” in this prospectus supplement.

For a description of how the priority of payments of interest change after enforcement of the Security, see “— Events of Default, Acceleration of Notes and Changes to the Priority of Payments” below.

S-17

Application of Available Income on a Distribution Date

|

Prior to the enforcement of the Security, available income (other than any liquidity reserve balance excess) for the relevant

monthly period will be applied on the distribution date for the monthly period as follows: |

| i |

• First, up to A$1 to the income unitholder at the manager’s discretion. |

| i |

• Second, towards trust expenses in the order set out in “Description of the Notes—Application of Available Income—Trust Expenses” in this prospectus supplement. |

| i |

• Third, pari passu and rateably towards: • the net amount (if any) (including any termination payments payable to the fixed rate swap provider) payable by the issuer trustee to the fixed rate swap provider under the fixed rate swap for the relevant interest period (unless a fixed rate swap provider event of default is subsisting); and • the net amount (if any) (including any termination payments payable to the currency swap provider but excluding any amount which would otherwise be payable to the currency swap provider pursuant to the bullet point immediately below) payable by the issuer trustee under the currency swaps for the relevant interest period (unless a currency swap provider event of default is subsisting). |

| i |

• Fourth, pari passu and rateably to the currency swap provider of the A$ floating amounts due on that distribution date with respect to each class or sub-class of the US$ notes, together with any such amounts remaining unpaid from prior distribution dates and interest on any such unpaid amount, in exchange for the amount of interest (in US$) due and payable on each class or sub-class of the US$ notes. |

| i |

• Fifth, an amount equal to the aggregate of all liquidity reserve draws remaining unreimbursed from preceding distribution dates, to be allocated to the liquidity reserve balance. |

| i |

• Sixth, towards interest in respect of the Class B notes due on that distribution date plus any such interest remaining unpaid from prior distribution dates. |

| i |

• Seventh, towards interest in respect of the Class C notes due on that distribution date plus any such interest remaining unpaid from prior distribution dates. |

| i |

• Eighth, towards interest in respect of the Class D notes due on that distribution date plus any such interest remaining unpaid from prior distribution dates. |

S-18

|

| |

• Ninth, towards interest in respect of the Class E notes due on that distribution date plus any such interest remaining unpaid from prior distribution dates. |

| i |

• Tenth, an amount equal to any unreimbursed principal draws, to be allocated towards total principal collections. |

| i |

• Eleventh, an amount equal to the defaulted amount, to be allocated towards total principal collections. |

| i |

• Twelfth, an amount equal to any unreimbursed charge-offs applied against the notes, other than any charge-offs against the seller notes, remaining unreimbursed from prior distribution dates, to be allocated towards total principal collections. |

| i |

• Thirteenth, pari passu and rateably: • if a fixed rate swap provider event of default is subsisting, in payment towards any net amounts payable to the fixed rate swap provider under the fixed rate swap for the relevant interest period; and • if a currency swap provider event of default is subsisting, in payment towards any net amounts payable to the currency swap provider under the currency swap for the relevant interest period. |

| i |

• Fourteenth, to Macquarie Leasing towards any accrued interest adjustment owing, if any. |

| i |

• Fifteenth, to the holders of the seller notes in payment of any interest due on that distribution date plus any interest remaining unpaid from prior distribution dates. |

| i |

• Sixteenth, an amount equal to any unreimbursed charge-offs against the seller notes to be allocated towards total principal collections. |

| i |

• Seventeenth, an amount equal to any unreimbursed redirected liquidity reserve balance excess to Macquarie Bank. |

| i |

• Finally, the balance to the income unitholder (or in accordance with its directions). |

S-19

Principal on the Notes Prior to Enforcement of the Security

The issuer trustee will pay principal on the US$ notes and the A$ notes on each distribution date to the extent total principal collections are available. The priority in which such principal repayments are to be made depends upon (a) whether an event of default has occurred under the master security trust deed and the general security deed, (b) whether the Security imposed by the master security trust deed and the general security deed has been enforced, and (c) whether or not the Pro Rata Paydown Test is satisfied or will be satisfied immediately following a sequential paydown. For a description of the enforcement of the Security and the action required of the noteholders to enforce the Security (unless the security trustee elects in certain limited circumstances to act without noteholder direction), see “Description of the Transaction Documents—The Master Security Trust Deed and the General Security Deed—Enforcement of the Security” in the prospectus, and for a description of how the Pro Rata Paydown Test is determined, see “Description of the Notes—Payments of Principal Prior to Enforcement of the Security—Pro Rata Paydown Test” in this prospectus supplement.

Prior to the enforcement of the Security, the issuer trustee will apply total principal collections on each distribution date towards

the repayment of principal on the notes in the sequential order of priority set out in the table immediately below, until such time that the Subordination Percentage (after taking into account the repayment of any principal on the notes in accordance with this provision on that distribution date) equals 18.9%. Prior to the enforcement of the Security and as long as the Subordination Percentage is 18.9% or higher, the issuer trustee will apply total principal collections to the notes pro rata in the order of priority set out in the second table below.

In addition, once the total collateralised amount (using the A$ equivalent in the case of the US$ notes) of the notes expressed as a percentage of the aggregate initial invested amount (using the A$ equivalent in the case of the US$ notes) of the notes is less than or equal to 10%, the issuer trustee will apply total principal collections towards the repayment of the principal on the notes in the sequential order of priority set out in the table immediately below. See “Description of the Notes—Payments of Principal Prior to Enforcement of the Security” in this prospectus supplement.

For a description of how the priority of payments of principal changes after enforcement of the Security, see “Description of the Notes—Post-Enforcement Priority of Payments” in this prospectus supplement.

S-20

Sequential Payment of Total Principal Collections – Pro Rata Paydown Test Not Satisfied

|

Prior to the enforcement of the Security, to the extent that the Pro Rata Paydown Test is not satisfied, the issuer trustee will

apply total principal collections for the relevant monthly period on the distribution date for that monthly period as follows, until

the Pro Rata Paydown Test becomes satisfied immediately following such payments: |

| i |

• First, towards repayment of the Class A-1 notes until the adjusted invested amount of the Class A-1 notes is reduced to zero. |

| i |

• Second, pari passu and rateably towards: • repayment of the Class A-2a notes until the adjusted invested amount of the Class A-2a notes is reduced to zero; and • repayment of the Class A-2b notes until the adjusted invested amount of the Class A-2b notes is reduced to zero. |

| i |

• Third, pari passu and rateably towards: • repayment of the Class A-3a notes until the adjusted invested amount of the Class A-3a notes is reduced to zero; and • repayment of the Class A-3b notes until the adjusted invested amount of the Class A-3b notes is reduced to zero. |

| i |

• Fourth, pari passu and rateably towards: • repayment of the Class A-4a notes until the adjusted invested amount of the Class A-4a notes is reduced to zero; and • repayment of the Class A-4b notes until the adjusted invested amount of the Class A-4b notes is reduced to zero. |

| i |

• Fifth, towards repayment of the Class B notes until the invested amount of the Class B is reduced to zero. |

| i |

• Sixth, towards repayment of the Class C notes until the invested amount of the Class C notes is reduced to zero. |

| i |

• Seventh, towards repayment of the Class D notes until the invested amount of the Class D notes is reduced to zero. |

| i |

• Eighth, towards repayment of the Class E notes until the invested amount of the Class E notes is reduced to zero. |

| i |

• Ninth, towards repayment of the seller notes until the invested amount of the seller notes is reduced to zero. |

| i |

• Tenth, to the capital unitholder. |

S-21

Pro Rata Payment of Total Principal Collections – Pro Rata Paydown Test Satisfied

|

Prior to the enforcement of the Security, to the extent that the Pro Rata Paydown Test is, or immediately following the payments

or allocations made in accordance with the preceding table becomes, satisfied, the issuer trustee will apply the balance of total

principal collections for the relevant monthly period on the distribution date for that monthly period as follows: |

| i |