Use these links to rapidly review the document

TRADEMARKS

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(5)

Registration File No. 333-188695

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Maximum Aggregate Offering Price | Amount of Registration Fee Previously Paid(1)(2) | Amount of Registration Fee Paid Herewith(1)(3) | |||

|---|---|---|---|---|---|---|

4.625% Senior Notes due 2021 | $700,000,000 | $23,687 | $28,614 | |||

Guarantees of 4.625% Senior Notes due 2021 | N/A | N/A(4) | N/A(4) | |||

| ||||||

- (1)

- Calculated in accordance with Rule 457(r) under the Securities Act of 1933, as amended. This "Calculation of Registration Fee" table shall be deemed to update the "Calculation of Registration Fee" table in the registrants' Registration Statement on Form S-3 (File No. 333-188695) filed on May 20, 2013 (the "New Registration Statement"). Other than as set forth in the table above and in the footnotes below, in accordance with Rules 456(b) and 457(r), the registrants are continuing to defer payment of registration fees applicable to the New Registration Statement as provided in the "Calculation of Registration Fee" table included in the New Registration Statement.

- (2)

- A portion of the registration fee for the securities to which this prospectus supplement relates was previously paid in connection with the registrants' Registration Statement on Form S-3 (File No. 333-168846) filed with the Commission on August 13, 2010 (the "Prior Registration Statement"). An aggregate of $490,217,759 of unsold securities (the "Unsold Securities") that were originally registered by the registrants under the Prior Registration Statement were carried forward, pursuant to Rule 415(a)(6), to the New Registration Statement and are included in the securities to which this prospectus supplement relates. The registration fee of $23,687 previously paid with respect to the Unsold Securities (calculated at the rate in effect at the time the Prior Registration Statement was filed) continues to be applied to the Unsold Securities.

- (3)

- Relates to $209,782,241 of securities offered hereby that are not covered by filing fees carried forward from the Prior Registration Statement.

- (4)

- No additional consideration is being received for the guarantees and, therefore, no additional fee is required pursuant to Rule 457(n) of the Securities Act.

Prospectus Supplement

(To Prospectus Dated May 20, 2013)

$700,000,000

4.625% Senior Notes due 2021

We are offering $700,000,000 aggregate principal amount of 4.625% senior notes due 2021, or the notes. The notes will mature on June 1, 2021. Interest on the notes is payable on June 1 and December 1 of each year, and the first interest payment date will be December 1, 2013.

We may redeem some or all of the notes at any time on or after June 1, 2016 at the redemption prices set forth in this prospectus. We may redeem up to 35% of the aggregate principal amount of the notes prior to June 1, 2016 with the net proceeds from certain equity offerings. We may also redeem some or all of the notes at any time prior to June 1, 2016 at a redemption price equal to the "make whole" amount set forth in this prospectus supplement. In addition, if we sell certain of our assets or experience certain kinds of changes of control, we may be required to offer to repurchase the notes at the repurchase price set forth in this prospectus supplement. Redemption and repurchase prices are set forth under "Description of Notes—Optional Redemption" and "—Repurchase at the Option of Holders."

The notes will be our unsecured senior obligations and will be guaranteed on an unsecured senior basis by each of our existing and future domestic subsidiaries. The notes and the guarantees will rankpari passu in right of payment to all of our and the guarantors' existing and future unsecured senior debt (including any of our 7.625% senior notes due 2018 that remain outstanding following the completion of the tender and consent solicitation described below) and will rank senior in right of payment to our and such guarantors' other existing and future subordinated debt. The notes and the guarantees will be effectively subordinated to all of our and the guarantors' secured indebtedness (including all borrowings and other obligations under our credit agreement) to the extent of the value of the collateral securing such indebtedness and effectively junior in right of payment to all existing and future indebtedness and other liabilities of our subsidiaries that do not guarantee the notes.

We are offering to purchase for cash with net proceeds from this offering any and all of our outstanding 7.625% senior notes due 2018. We are also soliciting consents from the holders of the senior notes due 2018 to the adoption of certain proposed amendments to the indenture under which these notes were issued. See "Summary—Offer to Purchase and Consent Solicitation."

Investing in our notes involves risks. See "Risk Factors" beginning on page S-16 of this prospectus supplement. We urge you to carefully read the "Risk Factors" section before you make your investment decision.

| | Per Note | Total | |||||

|---|---|---|---|---|---|---|---|

| Initial public offering Price | 100.000 | % | $ | 700,000,000 | |||

| Underwriting discounts and commissions(1) | 1.500 | % | $ | 10,500,000 | |||

| Proceeds, before expenses, to B&G Foods, Inc. | 98.500 | % | $ | 689,500,000 | |||

- (1)

- See "Underwriting—Other Relationships."

Interest on the notes will accrue from June 4, 2013 to the date of delivery.

The underwriters expect that delivery of the notes and the guarantees will be made in book-entry form through The Depository Trust Company for the account of its participants on or about June 4, 2013, subject to conditions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the prospectus to which it relates is accurate or complete. Any representation to the contrary is a criminal offense.

| Joint Bookrunning Managers | ||||

Credit Suisse | Barclays | RBC Capital Markets | ||

| BofA Merrill Lynch | Deutsche Bank Securities |

Co-Manager

RBS

The date of this prospectus supplement is May 20, 2013.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

| | Page | |

|---|---|---|

SUMMARY | S-1 | |

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA | S-12 | |

RISK FACTORS | S-16 | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | S-22 | |

USE OF PROCEEDS | S-24 | |

CAPITALIZATION | S-25 | |

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA | S-26 | |

DESCRIPTION OF CERTAIN INDEBTEDNESS | S-28 | |

DESCRIPTION OF NOTES | S-31 | |

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS | S-80 | |

UNDERWRITING | S-85 | |

LEGAL MATTERS | S-88 | |

EXPERTS | S-88 | |

WHERE YOU CAN FIND MORE INFORMATION | S-89 | |

INCORPORATION BY REFERENCE | S-90 |

PROSPECTUS

| | Page | |

|---|---|---|

ABOUT THIS PROSPECTUS | i | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | ii | |

THE COMPANY | 1 | |

USE OF PROCEEDS | 1 | |

RISK FACTORS | 1 | |

GENERAL DESCRIPTION OF THE SECURITIES WE MAY OFFER | 2 | |

DESCRIPTION OF CAPITAL STOCK | 2 | |

DESCRIPTION OF DEBT SECURITIES | 8 | |

DESCRIPTION OF WARRANTS | 17 | |

DESCRIPTION OF UNITS | 20 | |

PLAN OF DISTRIBUTION | 20 | |

RATIO OF EARNINGS TO FIXED CHARGES | 23 | |

LEGAL MATTERS | 23 | |

EXPERTS | 23 | |

WHERE YOU CAN FIND MORE INFORMATION | 23 | |

INCORPORATION BY REFERENCE | 24 |

This document is in two parts. The first part is this prospectus supplement, which describes, adds to, updates and changes information contained in the accompanying prospectus and the documents incorporated by reference. The second part is the accompanying prospectus, which gives more general information. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or any document incorporated by reference, the information in this prospectus supplement controls.

We have not authorized anyone to provide information or to make any representations other than those contained in this prospectus supplement or the accompanying prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus supplement is not an offer to sell or solicitation of an offer to buy the notes in any circumstances under which the offer or sale is unlawful. You should not assume that the information we have included in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the date of this prospectus supplement or the accompanying prospectus or that any information we have incorporated by reference is accurate as of any date other than the date of the document incorporated by reference regardless of the time of delivery of this prospectus supplement or of our notes. Our financial condition, results of operations and business prospects may have changed since those dates.

S-i

The terms "B&G Foods," "our," "we" and "us," as used in this prospectus supplement, refer to B&G Foods, Inc. and its wholly owned subsidiaries, except where it is clear that the term refers only to the parent company.

Throughout this prospectus supplement, we refer to our fiscal years ended January 3, 2009, January 2, 2010, January 1, 2011, December 31, 2011, December 29, 2012 and December 28, 2013 as "fiscal 2008," "fiscal 2009," "fiscal 2010," "fiscal 2011," "fiscal 2012" and "fiscal 2013," respectively, and we refer to our thirteen week periods ended March 31, 2012 and March 30, 2013 as "first quarter of 2012" and "first quarter of 2013," respectively.

Ac'cent®,B&G®,B&M®,Bagel Crisps®,Baker's Joy®,Brer Rabbit®,Cream of Rice®,Cream of Wheat®,Don Pepino®,Grandma's®,Joan of Arc®,Kleen Guard®,Las Palmas®,Maple Grove Farms of Vermont®,Molly McButter®,Mrs. Dash®,New York Style®,Old London®,Ortega®,Panetini®,Polaner®,Polaner All Fruit®,Regina®,Sa-són Ac'cent®,Sclafani®,Static Guard®,Sugar Twin®,Trappey's®,TrueNorth®,Underwood®,Vermont Maid® andWright's® are registered trademarks of our company or one of our subsidiaries, andBloch & Guggenheimer™,Red Devil™ andSa-són™ are trademarks of our company or one of our subsidiaries.

Emeril's® is a registered trademark of MSLO Shared IP Sub LLC used under license by our company.

Cinnabon® is a registered trademark of Cinnabon, Inc. used under license by our company.

Crock-Pot® is a registered trademark of Sunbeam Products, Inc. used under license by our company.

All other trademarks used in this prospectus supplement are trademarks or registered trademarks of their respective owners.

S-ii

This summary highlights certain information appearing elsewhere in this prospectus supplement and should be read together with the more detailed information and financial data and statements contained elsewhere in or incorporated by reference into this prospectus supplement.

Overview

We manufacture, sell and distribute a diverse portfolio of high quality, shelf-stable foods across the United States, Canada and Puerto Rico. Many of our branded food products hold either the number one or number two market position in their relevant markets. Our business is characterized by a stable and growing revenue base from our existing product portfolio and is augmented by acquisitions of highly attractive, shelf-stable brands. On a consolidated basis, our operating income margin is among the highest in the packaged food industry. Additionally, we generate strong cash flows as a result of our attractive margins, efficient working capital management, modest capital expenditure requirements and tax efficiencies achieved through our acquisitions. We believe that these characteristics enable our company to be a leader in successfully achieving sales growth for shelf-stable branded products and executing an aggressive, disciplined acquisition strategy.

B&G Foods, including our subsidiaries and predecessors, has more than 120 years of experience in the marketplace. We have a well-established sales, marketing and distribution infrastructure that enables us to sell our products in all major U.S. food distribution channels. These channels include supermarkets, mass merchants, wholesalers, food service accounts, warehouse clubs, non-food outlets, such as drug store chains and dollar stores, specialty distributors and military commissaries. We have developed and leveraged this infrastructure through our acquisition of more than 25 high quality brands since 1996. Our history includes a number of acquisitions of non-core brands from large, global packaged food companies, such as theB&M,Underwood,Ac'cent,Joan of Arc,Sa-són Ac'cent andLas Palmas brands from Pillsbury in 1999, theOrtega brand from Nestlé in 2003, theGrandma's Molasses brand from Cadbury Schweppes in 2006, theCream of Wheat andCream of Rice brands from Kraft in 2007, the Culver Specialty Brands (Mrs. Dash,Sugar Twin,Baker's Joy,Molly McButter,Static Guard andKleen Guard brands) from Unilever in 2011 and theNew York Style,Old London,Devonsheer andJJ Flats brands from Chipita in 2012. Based on our demonstrated record of successful acquisitions, we believe that we are well-positioned as a strategic acquirer of non-core brands from large, global packaged food companies. We have also successfully acquired brands from smaller, private companies, including most recently theDon Pepino andSclafani brands from Violet Packing in 2010 and theTrueNorth brand from DeMet's Candy Company in May 2013.

For the twelve months ended March 30, 2013, our company generated $647.7 million of net sales, $62.1 million of net income, $170.9 million of EBITDA (which we define as earnings before net interest expense, income taxes, depreciation, amortization and loss on extinguishment of debt) and $102.7 million of net cash provided by operating activities. During the first quarter of 2013, as compared to the first quarter of 2012, net sales increased by 8.8%, net income increased by 17.0%, EBITDA increased by 7.2% and net cash provided by operating activities increased by 10.1%.

Our Competitive Strengths

We believe that our success in the packaged food industry and our financial results are due in large part to the following competitive strengths:

Portfolio of high-margin brands with leading market positions in key growth segments. We are focused on operating smaller, high-margin brands. We have assembled a diverse portfolio of brands consisting primarily of niche or specialty products with strong market positions and high operating

S-1

income margins. Several of our brands compete in high growth categories that benefit from positive consumer spending trends. For example, ourCream of Wheat andPolaner Sugar Free Preserves with Added Fiber products compete in the health and wellness market segment. OurOrtega,Las Palmas andSa-són Ac'cent brands compete in the U.S. Mexican and Hispanic market segment. Each of these categories has experienced among the highest growth in the packaged food industry. We believe that our diverse product portfolio provides a strong platform to capture growth in the packaged food industry and to generate strong profitability and significant cash flows while mitigating the financial impact of competitive pressure or commodity cost increases in any single brand or product.

Well-developed and proven acquisition platform. We believe that our focus on shelf-stable products, favorable relationships with retailers, operations and marketing expertise and leading acquisition integration capabilities allow us to be highly successful in growing our product and brand portfolio. We have acquired and successfully integrated over 25 brands since 1996. We seek to acquire shelf-stable brands with leading market positions, identifiable growth opportunities and high and sustainable margins that will add to our cash flows and return on capital. As a result, we seek to avoid brands in commodity driven categories. Our focus on shelf-stable branded products allows us to drive attractive profitability and gain efficiencies from our sales and distribution and general and administrative systems. We believe that our acquisition expertise and ability to integrate businesses quickly lead to successful expansion of acquired brands and the realization of significant cost synergies. As a result, we believe that we are an acquirer preferred by large, global packaged food companies for their non-core brands. We have successfully completed acquisitions from sellers such as Nabisco, Pillsbury, Nestlé, Cadbury Schweppes, Kraft, Unilever and Chipita. Our acquisitions of theOrtega,Cream of Wheat andMrs. Dash businesses are examples of our ability to acquire leading shelf-stable brands with high profitability from large packaged food companies. The Culver Specialty Brands acquisition included our first two household brands,Static Guard andKleen Guard, which opens up additional acquisition opportunities in the household category. With our recent acquisitions of theNew York Style,Old London andTrueNorth brands, we have entered into the snack category. We often integrate sales, marketing and distribution of acquired products and businesses within 30 days.

Track record of new product introductions. We have demonstrated the ability to develop new products and product extensions rapidly, and we have been able to deliver these new products to our customers quickly. We have generally been able to develop these products from concept to final product and deliver these products to our customers' shelves within six months of development. We work directly with certain of our customers to implement new product introduction in markets where we expect significant growth. For example, new products we have introduced in recent years include Cream of Wheat Cinnabon Instant Hot Cereal, Cream of Wheat Chocolate Flavor Instant Hot Cereal, Crock-Pot Seasoning Mixes, No Salt Added Joan of Arc Kidney Beans, Ortega Reduced Sodium Taco Seasoning, Ortega Whole Grain Corn Taco Shellsand Ortega Fiesta Flats.

Diversity of customers and distribution channels. We sell our products through all major U.S. food distribution channels, including supermarkets, mass merchants, warehouse clubs, wholesalers, food service accounts, specialty distributors, military commissaries and non-food outlets such as drug store chains and dollar stores. We have strong, long standing, national relationships with all our major customers. Our customers include Wal-Mart, Kroger, Sysco, C&S Wholesale Grocers, Cracker Barrel, Supervalu, Wakefern, Publix, Giant Supermarkets, Safeway, DOT Foods, Target and Costco. The breadth of our multiple-channel sales and distribution system allows us to capitalize on above-average growth trends within certain of these distribution channels and expand distribution of acquired brands. Our diverse distribution channels have also contributed to our ability to maintain a broad customer base, with sales to our ten largest customers accounting for 50.6% of our net sales for the first quarter of 2013.

S-2

Strong cash flow generation. We have generated significant cash flows from our operations. Beginning with fiscal 2008 through the first quarter of 2013, we have generated cumulative cash flows from operations of $397.9 million. Our strong financial performance is a result of our attractive operating income margins, efficient working capital management, modest capital expenditure requirements and tax efficiencies achieved through our acquisitions. Our business continues to be positioned to generate strong cash flows.

Experienced management team with proven track record. Our management team has extensive food industry experience and long standing experience managing our company in a highly competitive environment. Our chief executive officer and chief financial officer have been with us 24 and 30 years, respectively. Each of our other executive officers also has many years of experience with B&G Foods or otherwise within the industry. Our management team has acquired and integrated over 25 brands successfully since 1996 and has developed and implemented a business strategy which has enabled us to become a highly successful manufacturer and distributor of a diverse portfolio of shelf-stable branded products.

Growth Strategy

Our goal is to continue to increase sales, profitability and cash flows by enhancing our existing portfolio of shelf-stable branded products and by capitalizing on our competitive strengths. We intend to implement our growth strategy through the following initiatives:

Expand brand portfolio with acquisitions of complementary branded businesses. We intend to continue expanding our brand portfolio by acquiring shelf-stable brands with leading market positions, strong brand equity, distribution expansion opportunities and compelling cost efficiencies at attractive valuations. We believe we can continue our track record of building and improving acquired brands post-acquisition through increased management focus and integration into our well-established manufacturing, sales, distribution and administrative infrastructure. We believe we are well-positioned as a preferred acquirer to capitalize on the trend of large packaged food companies divesting smaller, non-core, yet profitable, brands to increase their focus on their large, global brands.

Continue to develop new products and deliver them to market quickly. We intend to continue to leverage our new product development capability and our sales and distribution breadth to introduce new products and product extensions. Our management has demonstrated the ability to launch new products quickly. Examples of the new products we have introduced in recent years are listed above under "Our Competitive Strengths—Track record of new product introductions."

Leverage our multiple-channel sales and distribution system. Our multiple-channel sales and distribution system allows us to capitalize on growth opportunities through the quick and efficient introduction of new and acquired products to our customers. We continue to strengthen our sales and distribution system in order to realize distribution economies of scale and provide an efficient, national platform for new products by expanding distribution channels, enlarging geographic reach, more effectively managing trade spending, improving packaging and introducing line extensions.

Continue to focus on higher growth distribution channels and customers. We sell our products through all major U.S. food distribution channels, including supermarkets, mass merchants, wholesalers, food service accounts, warehouse clubs, specialty distributors, military commissaries and non-food outlets such as drug store chains and dollar stores. Our distribution breadth allows us to benefit from high growth channels such as mass merchants, warehouse and club stores, specialty distributors, convenience stores, drug stores, vending machines and food services. We intend to continue to create products specific to our higher growth distribution channels and customers.

S-3

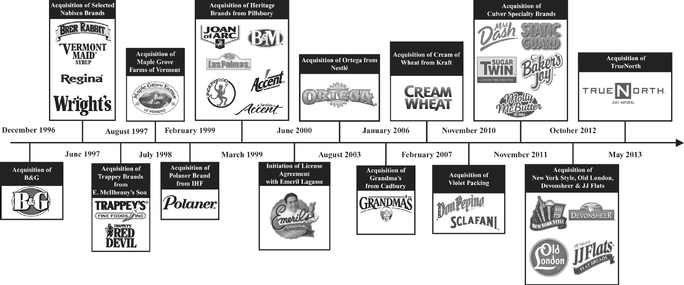

History

B&G Foods, including our subsidiaries and predecessors, has been in business for more than 120 years. Our company has been built upon a successful track record of both organic and acquisition-related growth. We have acquired more than 25 brands since 1996, demonstrating our ability to acquire, integrate and grow shelf-stable branded products.

The chart below includes some of the significant events in our recent history:

Products and Markets

The following is a brief description of our brands and product lines:

Brand | | Year Originated | Description | |||

|---|---|---|---|---|---|---|

Ortega | 1897 | • Taco shells, tortillas, seasonings, dinner kits, taco sauces, peppers, refried beans, salsas and related food products • Snack products such as Salsa Con Queso, Salsa Verde and Guacamole | ||||

| ||||||

Maple Grove Farms of |  | 1915 | • A leading brand of pure maple syrup sold in the United States • Also includes gourmet salad dressings, marinades, fruit syrups, confections, pancake mixes and organic products | |||

|

S-4

Brand | | Year Originated | Description | |||

|---|---|---|---|---|---|---|

Cream of Wheat | 1893 | • One of the most trusted and widely recognized brands of hot cereals sold in the United States • Cream of Wheat is available in original 10-minute, 21/2-minute and one-minute versions, and also in instant packets of original and other flavors • New product introductions over the past few years include:Cream of Wheat Healthy Grain,Cream of Wheat Cinnabon andCream of Wheat Chocolate • Cream of Rice is a rice-based hot cereal | ||||

| ||||||

Mrs. Dash |  | 1983 | • The original brand in salt-free seasonings; available in more than a dozen blends • In 2005, the leading brand in salt-free seasonings introduced six salt-free marinades • The brand essence ofMrs. Dash, "Salt-Free, Flavor-Full," resonates with consumers and underscores the brand's commitment to provide healthy products that fulfill consumers' expectations for taste | |||

| ||||||

Polaner | 1880 | • Fruit-based spreads as well as jarred wet spices such as chopped garlic and basil • Polaner All Fruit is a leading national brand of fruit-juice sweetened fruit spread • Polaner Sugar Free is the second leading national brand of sugar free preserves | ||||

| ||||||

Las Palmas | 1922 | • Authentic Mexican enchilada sauce, chili sauce and various pepper products | ||||

| ||||||

New York Style | 1985 | • Since 1985,New York Style has been making foods for snacking and entertaining, including OriginalBagel Crisps, MiniBagel Crisps, Pita Chips andPanetini Italian Toast | ||||

| ||||||

Bloch & Guggenheimer |  | 1889 | • Shelf-stable pickles, relishes, peppers, olives and other related specialty items | |||

|

S-5

Brand | | Year Originated | Description | |||

|---|---|---|---|---|---|---|

B&M | 1927 | • The original brand of brick-oven baked beans and remains one of the very few authentic baked beans • Includes a variety of baked beans and brown bread | ||||

| ||||||

TrueNorth | 2006 | • TrueNorth nut clusters combine freshly roasted nuts, a dash of sea salt and just a hint of natural sweetness. Their bite-sized shape makes them ideal for between meal snacking and on-the-go nourishment | ||||

| ||||||

Underwood |  | 1870 | • Underwood meat spreads include deviled ham, white-meat chicken, white-meat buffalo-style chicken, roast beef and liverwurst | |||

| ||||||

Ac'cent |  | 1947 | • An all-natural flavor enhancer for meat preparation and is generally used on beef, poultry, fish and vegetables | |||

| ||||||

Old London |  | 1932 | • Old London has a wide variety of flavors available in Melba Toasts, Melba Rounds and other snacks.Old London also markets specialty snacks under theDevonsheer andJJ Flats names | |||

| ||||||

Emeril's |  | 2000 | • Introduced under a licensing agreement with celebrity chef Emeril Lagasse • Pasta sauces, seasonings, cooking stocks, mustards, salsas, pepper sauces, dip mixes and cooking sprays | |||

| ||||||

Trappey's | 1898 | • High quality peppers and hot sauces, includingTrappey's Red Devil | ||||

| ||||||

Don Pepino and | 1955 and 1900 | • Primarily include pizza and spaghetti sauces, whole and crushed tomatoes and tomato puree | ||||

| ||||||

Static Guard |  | 1978 | • The number one brand name in static elimination sprays, created the anti-static spray category | |||

| ||||||

Joan of Arc | 1895 | • Canned beans including kidney, chili and other beans | ||||

|

S-6

Brand | | Year Originated | Description | |||

|---|---|---|---|---|---|---|

Regina | 1949 | • Vinegars and cooking wines • Products are most commonly used in the preparation of salad dressings as well as in a variety of recipe applications, including sauces, marinades and soups | ||||

| ||||||

Sugar Twin |  | 1968 | • A calorie-free sugar substitute • Mainly distributed in Canada | |||

| ||||||

Grandma's | 1890 | • Molasses offered in two distinct styles:Grandma's Original Molasses andGrandma's Robust Molasses | ||||

| ||||||

Baker's Joy |  | 1968 | • The original brand of no-stick baking spray with flour | |||

| ||||||

Wright's | 1895 | • An all-natural seasoning that reproduces the flavor and aroma of pit smoking in meats, chicken and fish; offered in three flavors: Hickory, Mesquite and Applewood | ||||

| ||||||

Sa-són Ac'cent | 1947 | • A flavor enhancer used primarily for Puerto Rican and Hispanic food preparation • Offered in four flavors: Original, Coriander and Achiote, Garlic and Onion, and Tomato | ||||

| ||||||

Crock-Pot Seasoning Mixes | 2012 | • With a delicious combination of savory spices and herbs,Crock-Pot Seasoning Mixes help consumers prepare and enjoy classic family dishes with ease.Crock-Pot Seasoning Mixes blend affordability, accessibility and convenience in one pot | ||||

| ||||||

Brer Rabbit | 1907 | • Mild and full-flavored molasses products and a blackstrap molasses product | ||||

| ||||||

Vermont Maid | 1919 | • Vermont Maid syrup is available in regular, sugar-free and sugar-free butter varieties • Mainly distributed in New England | ||||

| ||||||

Molly McButter | 1987 | • An all natural sprinkle, available in butter and cheese flavors |

S-7

Offer to Purchase and Consent Solicitation

On May 20, 2013, we commenced a tender offer to purchase for cash any and all of our outstanding 7.625% senior notes due 2018, which we refer to as our existing senior notes, and, in connection therewith, we are also soliciting consents to amend the indenture governing the existing senior notes to, among other things, eliminate substantially all of the restrictive covenants and eliminate or modify certain events of default.

We are a Delaware corporation. Our corporate headquarters are located at Four Gatehall Drive, Suite 110, Parsippany, New Jersey 07054, and our telephone number is (973) 401-6500. Our web site address iswww.bgfoods.com. The information contained on our web site is not part of this prospectus supplement and is not incorporated in this prospectus supplement by reference.

S-8

Issuer | B&G Foods, Inc. | |

Notes Offered | $700,000,000 in aggregate principal amount of 4.625% senior notes due 2021. | |

Maturity Date | June 1, 2021. | |

Interest Payment Dates | June 1 and December 1 of each year, commencing December 1, 2013. | |

Guarantees | Our obligations under the notes will be jointly and severally and fully and unconditionally guaranteed on a senior basis by all of our existing and future domestic subsidiaries. For a discussion of the risks relating to the guarantees, see "Risk Factors—Your right to receive payment on these notes is effectively subordinated to the rights of our existing and future secured creditors. Further, the guarantees of these notes are effectively subordinated to all the guarantors' existing and future secured indebtedness" and "—If the guarantees of the notes are held to be invalid or unenforceable or are limited in accordance with their terms, the notes would be structurally subordinated to the debt of our subsidiaries." | |

Ranking | The notes and the subsidiary guarantees will be our and the guarantors' general unsecured obligations and: | |

• will be effectively junior in right of payment to all of our and the guarantors' secured indebtedness; | ||

• will be effectively junior in right of payment to all existing and future indebtedness and other liabilities of our subsidiaries that do not guarantee the notes; | ||

• will bepari passu in right of payment to all of our and the guarantors' existing and future unsecured senior debt (including any remaining existing senior notes); and | ||

• will be senior in right of payment to all of our and the guarantors' future subordinated debt. | ||

As of March 30, 2013, after giving effect to the completion of this offering and the use of proceeds therefrom, we would have had $138.8 million principal amount of outstanding senior secured debt and $700.0 million principal amount of outstanding senior unsecured debt. In addition, as of March 30, 2013, after giving effect to the completion of this offering and the use of proceeds therefrom, we would have had the ability to borrow up to $199.5 million under our revolving credit facility (net of $0.5 million reserved for issued and outstanding letters of credit), which would be effectively senior in right of payment to the notes. |

S-9

As of March 30, 2013, after giving effect to the completion of this offering and the use of proceeds therefrom, our two foreign subsidiaries, B&G Foods Canada, ULC and Sirops Maple Grove Inc., that do not guarantee the notes would have no indebtedness outstanding other than intercompany indebtedness. | ||

Optional Redemption | On or after June 1, 2016, we may redeem some or all of the notes at the redemption prices set forth under "Description of Notes—Optional Redemption." | |

Prior to June 1, 2016, we may redeem up to 35% of the aggregate principal amount of the notes issued under the indenture from the proceeds of one or more equity offerings at the redemption prices set forth under "Description of Notes—Optional Redemption." | ||

At any time prior to June 1, 2016, we may on any one or more occasions redeem all or a part of the notes at a redemption price equal to 100% of the principal amount of the notes redeemed, plus a "make whole premium" as of, and accrued and unpaid interest, if any, to the date of redemption. See "Description of Notes—Optional Redemption." | ||

Sale of Assets; Change of Control | If we or any of the guarantors sell certain assets or experience specific kinds of changes in control, we must offer to purchase the notes at the prices set forth under "Description of Notes—Asset Sales" and "—Change of Control" plus accrued and unpaid interest, to the date of repurchase. | |

Covenants | We will issue the notes under an indenture among us, the guarantors and the trustee. The indenture (among other things) will limit our ability and the ability of the guarantors to: | |

• incur or guarantee additional indebtedness and issue preferred stock; | ||

• make restricted payments, including investments; | ||

• sell assets; | ||

• sell all or substantially all of our assets or consolidate or merge with or into other companies; | ||

• enter into certain transactions with affiliates; | ||

• create liens; | ||

• create unrestricted subsidiaries; and | ||

• enter into sale and leaseback transactions. | ||

Each of the covenants is subject to a number of important exceptions and qualifications. See "Description of Notes—Certain Covenants." |

S-10

Use of Proceeds | We intend to use a portion of the net proceeds from the offering to purchase in the tender offer commenced in connection with this offering or otherwise redeem all $248.5 million principal amount of our outstanding existing senior notes. We will also use a portion of the remaining net proceeds to repay tranche B term loans and revolving loans under our credit agreement. We will use any remaining net proceeds to pay fees and expenses related to the offering and the tender offer and consent solicitation, and for general corporate purposes, including the repayment of indebtedness and the acquisition of assets used or useful in, or the equity of an entity engaged in, our business or a related business. | |

Affiliates of certain of the underwriters serve as lenders under our credit agreement and will consequently receive a portion of the net proceeds of this offering. | ||

Tender Offer and Consent Solicitation | This offering will occur concurrently with the tender offer to purchase for cash any and all of our outstanding existing senior notes. In connection with the tender offer, we are also soliciting consents to amend certain provisions of the indenture governing those notes. See "—Offer to Purchase and Consent Solicitation." | |

Governing Law | The notes will be governed by the laws of the State of New York. |

You should carefully consider the information under the caption "Risk Factors" and all other information in this prospectus supplement before investing in our notes.

S-11

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following summary historical consolidated financial data should be read in conjunction with "Selected Historical Consolidated Financial Data" included elsewhere in this prospectus supplement and our audited and unaudited consolidated financial statements and notes to those statements incorporated by reference into this prospectus supplement. Our summary historical consolidated statement of operations data for fiscal years 2010, 2011 and 2012 have been derived from our audited consolidated financial statements incorporated by reference into this prospectus supplement. Our summary historical consolidated statements of operations data for the first quarter of fiscal 2012, the first quarter of fiscal 2013 and the twelve months ended March 30, 2013 have been derived from our unaudited consolidated financial statements incorporated by reference into this prospectus supplement. The following summary historical consolidated financial data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the year ended December 29, 2012 and our Quarterly Report on Form 10-Q for the quarter ended March 30, 2013, and our audited and unaudited consolidated financial statements and related notes to those statements incorporated by reference into this prospectus supplement and the accompanying prospectus.

| | | | | Thirteen Weeks Ended | Twelve Months Ended | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Fiscal 2010 | Fiscal 2011 | Fiscal 2012 | March 31, 2012 | March 30, 2013 | March 30, 2013 | |||||||||||||

| | | | | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| | (In thousands) | ||||||||||||||||||

Consolidated Statement of Operations Data(1): | |||||||||||||||||||

Net sales | $ | 513,337 | $ | 543,866 | $ | 633,812 | $ | 157,339 | $ | 171,194 | $ | 647,667 | |||||||

Cost of goods sold(2) | 345,668 | 366,090 | 410,469 | 100,514 | 112,382 | 422,337 | |||||||||||||

Gross profit | 167,669 | 177,776 | 223,343 | 56,825 | 58,812 | 225,330 | |||||||||||||

Selling, general and administrative expenses(3) | 56,495 | 57,618 | 66,212 | 16,640 | 16,508 | 66,080 | |||||||||||||

Amortization expense(4) | 6,457 | 6,679 | 8,126 | 2,022 | 2,067 | 8,171 | |||||||||||||

Operating income | 104,717 | 113,479 | 149,005 | 38,163 | 40,237 | 151,079 | |||||||||||||

Interest expense, net(5) | 40,342 | 36,675 | 47,660 | 11,989 | 9,773 | 45,444 | |||||||||||||

Loss on extinguishment of debt(6) | 15,224 | — | 10,431 | — | — | 10,431 | |||||||||||||

Income before income tax expense | 49,151 | 76,804 | 90,914 | 26,174 | 30,464 | 95,204 | |||||||||||||

Income tax expense | 16,772 | 26,561 | 31,654 | 9,396 | 10,830 | 33,088 | |||||||||||||

Net income | $ | 32,379 | $ | 50,243 | $ | 59,260 | $ | 16,778 | $ | 19,634 | $ | 62,116 | |||||||

S-12

| | | | | Thirteen Weeks Ended | Twelve Months Ended | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Fiscal 2010 | Fiscal 2011 | Fiscal 2012 | March 31, 2012 | March 30, 2013 | March 30, 2013 | |||||||||||||

| | | | | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| | (Dollars in thousands) | ||||||||||||||||||

Other Financial Data: | |||||||||||||||||||

EBITDA(7) | $ | 119,740 | $ | 129,708 | $ | 167,858 | $ | 42,604 | $ | 45,657 | $ | 170,911 | |||||||

Net cash provided by operating activities | 98,877 | 72,033 | 100,528 | 20,985 | 23,107 | 102,650 | |||||||||||||

Capital expenditures | (10,965 | ) | (10,556 | ) | (10,637 | ) | (1,770 | ) | (1,715 | ) | (10,582 | ) | |||||||

Payments for acquisition of businesses | (14,602 | ) | (326,000 | ) | (62,667 | ) | — | — | (62,667 | ) | |||||||||

Net cash provided by (used in) financing activities | (14,534 | ) | 182,575 | (24,744 | ) | (15,986 | ) | (24,456 | ) | (33,214 | ) | ||||||||

Ratio of earnings to fixed charges(8) | 2.2x | 3.0x | 2.8x | N/A | N/A | 1.7x | |||||||||||||

Total debt/EBITDA | 4.0x | 5.6x | 3.8x | N/A | N/A | 3.7x | |||||||||||||

EBITDA/cash interest expense(9) | 3.3x | 4.1x | 3.9x | N/A | N/A | 4.2x | |||||||||||||

| | | | | Thirteen Weeks Ended | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Fiscal 2010 | Fiscal 2011 | Fiscal 2012 | March 31, 2012 | March 30, 2013 | |||||||||||

| | | | | (Unaudited) | (Unaudited) | |||||||||||

| | (In thousands) | |||||||||||||||

Consolidated Balance Sheet Data (at end of period)(1): | ||||||||||||||||

Cash and cash equivalents | $ | 98,738 | $ | 16,738 | $ | 19,219 | $ | 19,964 | $ | 16,146 | ||||||

Total assets | 871,723 | 1,132,923 | 1,191,968 | 1,129,084 | 1,183,675 | |||||||||||

Long-term debt | 477,748 | 720,107 | 637,689 | 717,869 | 631,112 | |||||||||||

Total stockholders' equity | 230,585 | 235,547 | 361,175 | 237,582 | 363,820 | |||||||||||

- (1)

- We completed the acquisition of theDon Pepino andSclafani brands from Violet Packing LLC, which we refer to as theDon Pepino acquisition, on November 18, 2010. We completed the acquisition of theMrs. Dash, Baker's Joy, Sugar Twin, Static Guard, Molly McButter andKleen Guard brands from Conopco, Inc. dba Unilever United States, Inc., which we refer to as the Culver Specialty Brands acquisition, on November 30, 2011. We completed the acquisition ofNew York Style, Devonsheer, JJ Flats and Old London brands from Chipita America, Inc., which we refer to as theNew York Style andOld London acquisition, on October 31, 2012. Each of these acquisitions has been accounted for using the acquisition method of accounting and, accordingly, the assets acquired, liabilities assumed and results of operations of the acquired business is included in our consolidated financial statements from the date of acquisition.

- (2)

- Included in cost of goods sold for fiscal 2010 is a gain of $1.3 million relating to a legal settlement.

- (3)

- Selling, general and administrative expenses for fiscal 2011 include $1.4 million of transaction costs related to the Culver Specialty Brands acquisition. Selling, general and administrative expenses for fiscal 2012 include $1.2 million of transaction costs related to theNew York Style andOld London acquisition.

- (4)

- Amortization expense includes the amortization of customer relationship and other intangible assets acquired in theNew York Style andOld London acquisition, the Culver Specialty Brands acquisition, theDon Pepino acquisition and prior acquisitions.

- (5)

- Fiscal 2010 net interest expense includes a charge of $0.4 million relating to the unrealized loss on an interest rate swap, and a charge of $1.7 million for the reclassification of the amount recorded

S-13

in accumulated other comprehensive loss related to the swap. Fiscal 2011 net interest expense includes a benefit of $0.6 million related to the realized gain on an interest rate swap, a charge of $1.6 million for the reclassification of the amount recorded in accumulated other comprehensive loss related to an interest rate swap and a $2.1 million charge relating to the write-off of the remaining amount recorded in accumulated other comprehensive loss on the interest rate swap due to our early termination of $130.0 million in term loan borrowings.

- (6)

- Fiscal 2010 loss on extinguishment of debt includes costs relating to our repurchase of senior subordinated notes, including the repurchase premium of $10.7 million and the write-off of deferred financing costs of $4.5 million. Fiscal 2012 loss on extinguishment of debt includes costs relating to our partial redemption of $101.5 million aggregate principal amount of our 7.625% senior notes, including the repurchase premium and other expenses of $7.7 million, the write-off of deferred debt financing costs of $1.5 million and the write-off of unamortized discount of $0.5 million. Loss on extinguishment on debt during fiscal 2012 also includes costs related to the amendment and restatement of our credit agreement, including the write-off of deferred debt financing costs of $0.4 million, unamortized discount of $0.1 million and other expenses of $0.2 million.

- (7)

- EBITDA is a non-GAAP financial measure used by management to measure operating performance. A non-GAAP financial measure is defined as a numerical measure of our financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in our consolidated balance sheets and related consolidated statements of operations, comprehensive income, changes in stockholders' equity and cash flows. EBITDA is defined as net income before net interest expense, income taxes, depreciation and amortization and loss on extinguishment of debt (see (6) above). Management believes that it is useful to eliminate net interest expense, income taxes, depreciation and amortization and loss on extinguishment of debt because it allows management to focus on what it deems to be a more reliable indicator of ongoing operating performance and our ability to generate cash flow from operations. We use EBITDA in our business operations, among other things, to evaluate our operating performance, develop budgets and measure our performance against those budgets, determine employee bonuses and evaluate our cash flows in terms of cash needs. We also present EBITDA because we believe it is a useful indicator of our historical debt capacity and ability to service debt and because covenants in our credit agreement and the indenture governing our existing senior notes contain ratios based on this measure. As a result, internal management reports used during monthly operating reviews feature the EBITDA metric. However, management uses this metric in conjunction with traditional GAAP operating performance and liquidity measures as part of its overall assessment of company performance and liquidity and therefore does not place undue reliance on this measure as its only measure of operating performance and liquidity.

EBITDA is not a recognized term under GAAP and does not purport to be an alternative to operating income or net income as an indicator of operating performance or any other GAAP measure. EBITDA is not a complete net cash flow measure because EBITDA is a measure of liquidity that does not include reductions for cash payments for an entity's obligation to service its debt, fund its working capital, capital expenditures and acquisitions and pay its income taxes and dividends. Rather, EBITDA is one potential indicator of an entity's ability to fund these cash requirements. EBITDA also is not a complete measure of an entity's profitability because it does not include costs and expenses for depreciation and amortization, interest and related expenses, loss on extinguishment of debt and income taxes. Because not all companies use identical calculations, this presentation of EBITDA may not be comparable to other similarly-titled measures of other companies. However, EBITDA can still be useful in evaluating our performance against our peer companies because management believes this measure provides users with valuable insight into key components of GAAP amounts.

S-14

The following is a reconciliation of EBITDA to net income for the periods presented:

| | | | | Thirteen Weeks Ended | Twelve Months Ended | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Fiscal 2010 | Fiscal 2011 | Fiscal 2012 | March 31, 2012 | March 30, 2013 | March 30, 2013 | |||||||||||||

| | | | | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| | (In thousands) | ||||||||||||||||||

Net income | $ | 32,379 | $ | 50,243 | $ | 59,260 | $ | 16,778 | $ | 19,634 | $ | 62,116 | |||||||

Income tax expense | 16,772 | 26,561 | 31,654 | 9,396 | 10,830 | 33,088 | |||||||||||||

Interest expense, net(A) | 40,342 | 36,675 | 47,660 | 11,989 | 9,773 | 45,444 | |||||||||||||

Depreciation and amortization | 15,023 | 16,229 | 18,853 | 4,441 | 5,420 | 19,832 | |||||||||||||

Loss on extinguishment of debt(B) | 15,224 | — | 10,431 | — | — | 10,431 | |||||||||||||

EBITDA | $ | 119,740 | $ | 129,708 | $ | 167,858 | $ | 42,604 | $ | 45,657 | $ | 170,911 | |||||||

- (A)

- See note 5 in Summary Historical Consolidated Financial Data, above.

- (B)

- See note 6 in Summary Historical Consolidated Financial Data, above.

- (8)

- We have calculated the ratio of earnings to fixed charges by dividing earnings by fixed charges. For the purpose of this computation, earnings consist of income before income taxes plus fixed charges. Fixed charges consist of the sum of interest on indebtedness, amortized expenses related to indebtedness, reclassification to net interest expense of a portion of the amount recorded in accumulated other comprehensive loss related to an interest rate swap and an interest component of lease rental expense. Fixed charges exclude the unrealized loss (gain) on the interest rate swap.

- (9)

- Cash interest expense, calculated below, is equal to net interest expense less amortization of deferred financing and bond discount, unrealized loss on an interest rate swap, realized gain on an interest rate swap and reclassification to net interest expense of a portion of the amount recorded in accumulated other comprehensive loss related to an interest rate swap.

| | Fiscal 2010 | Fiscal 2011 | Fiscal 2012 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | (Dollars in thousands, except ratios) | |||||||||

Interest expense, net | $ | 40,342 | $ | 36,675 | $ | 47,660 | ||||

Amortization of deferred financing and bond discount | (2,016 | ) | (2,251 | ) | (5,028 | ) | ||||

Unrealized (loss) gain on interest rate swap | (436 | ) | — | — | ||||||

Realized gain on interest rate swap | — | 612 | — | |||||||

Reclassification to interest expense, net | (1,693 | ) | (3,669 | ) | — | |||||

Cash interest expense | 36,197 | 31,367 | 42,632 | |||||||

EBITDA | $ | 119,740 | $ | 129,708 | $ | 167,858 | ||||

EBITDA/Cash interest expense | 3.3x | 4.1x | 3.9x | |||||||

S-15

An investment in the notes involves a number of risks. Before deciding whether to purchase the notes, you should give careful consideration to the risks discussed below and elsewhere in this prospectus supplement, including those set forth under the heading "Special Note Regarding Forward-Looking Statements" on page S-23 of this prospectus supplement, and in our filings with the Securities and Exchange Commission (SEC) that we have incorporated by reference in this prospectus supplement and the accompanying prospectus. Additional risks and uncertainties not currently known to us or that we currently believe to be immaterial may also impair our business operations.

Any of the risks discussed below or elsewhere in this prospectus supplement or in our SEC filings incorporated by reference in this prospectus supplement and the accompanying prospectus, and other risks we have not anticipated or discussed, could have a material impact on our business, consolidated financial condition, results of operations or liquidity. In that case, you may lose all or part of your investment.

Risks Relating to this Offering

We have substantial indebtedness, which could restrict our ability to service the notes and impact our financing options and liquidity position.

We currently have and following this offering will continue to have a significant amount of indebtedness. At March 30, 2013, after giving effect to the completion of this offering and the use of proceeds therefrom, we would have had $138.8 million of senior secured indebtedness and $700.0 million of senior unsecured indebtedness.

The degree to which we are leveraged on a consolidated basis could have important consequences to the holders of the notes, including:

- •

- our ability in the future to obtain additional financing for working capital, capital expenditures or acquisitions may be limited;

- •

- we may not be able to refinance our indebtedness on terms acceptable to us or at all;

- •

- a significant portion of our cash flow is likely to be dedicated to the payment of interest on our indebtedness, thereby reducing funds available for future operations, capital expenditures and acquisitions; and

- •

- we may be more vulnerable to economic downturns and be limited in our ability to withstand competitive pressures.

Despite current indebtedness levels, we and our subsidiaries may still be able to incur substantially more debt. This could further exacerbate the risks associated with our substantial indebtedness.

Although our credit agreement contains total leverage and cash interest coverage maintenance covenants and the indenture governing the notes will contain covenants that will restrict our ability to incur debt as described under "Description of Notes" and "Description of Certain Indebtedness," as long as we meet these financial covenant tests we will be allowed to incur additional indebtedness. In addition, the indenture governing the notes will allow us to issue additional notes with terms identical (other than issuance date) to the notes we are currently offering under certain circumstances.

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control. We may not be able to repay or refinance the notes or our credit agreement upon terms acceptable to us or at all.

Our ability to make payments on and to refinance our indebtedness, including the notes and indebtedness under our credit agreement, and to fund planned capital expenditures and potential acquisitions will depend on our ability to generate cash flow from operations in the future. This ability, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

S-16

A significant portion of our cash flow from operations will be dedicated to servicing our debt requirements. In addition, we currently intend to continue distributing a significant portion of any remaining cash flow to our stockholders as dividends. Moreover, prior to the maturity of the notes, we will not be required to make any payments of principal on the notes.

Our ability to continue to expand our business will, to a certain extent, be dependent upon our ability to borrow funds under our revolving credit facility and to obtain other third-party financing, including through the sale of securities or the issuance of other indebtedness. Our credit agreement is subject to periodic renewal or must otherwise be refinanced. If we are unable to refinance our indebtedness, including our credit agreement or the notes, on commercially reasonable terms or at all, we would be forced to seek other alternatives, including:

- •

- sales of assets;

- •

- sales of equity; and

- •

- negotiations with our lenders or noteholders to restructure the applicable debt.

In addition, if we are unable to refinance our credit agreement, our failure to repay all amounts due on the maturity date would cause a default under the indenture governing the notes.

If we are forced to pursue any of the above options, our business or the value of your investment in the notes or both could be adversely affected.

We are a holding company and we rely on dividends, interest and other payments, advances and transfers of funds from our subsidiaries to meet our debt service and other obligations.

We are a holding company and all of our assets are held by our direct and indirect subsidiaries. We will rely on dividends and other payments or distributions from our subsidiaries to meet our debt service obligations and to enable us to pay dividends. The ability of our subsidiaries to pay dividends or make other payments or distributions to us will depend on their respective operating results and may be restricted by, among other things, the laws of their jurisdiction of organization (which may limit the amount of funds available for the payment of dividends), agreements of those subsidiaries, our credit agreement, the terms of the indenture governing the notes and the covenants of any future outstanding indebtedness we or our subsidiaries incur.

We will be subject to restrictive debt covenants and other requirements related to our debt that will limit our business flexibility by imposing operating and financial restrictions on our operations.

The agreements governing our indebtedness impose significant operating and financial restrictions on us. These restrictions prohibit or limit, among other things:

- •

- the incurrence of additional indebtedness and the issuance of certain preferred stock or redeemable capital stock;

- •

- a number of restricted payments, including investments;

- •

- specified sales of assets;

- •

- specified transactions with affiliates;

- •

- the creation of certain types of liens;

- •

- consolidations, mergers and transfers of all or substantially all of our assets; and

- •

- entry into sale and leaseback transactions.

Our credit agreement requires us to maintain specified financial ratios and satisfy financial condition tests, including, without limitation, the following: a maximum total leverage ratio and a minimum interest coverage ratio.

Our ability to comply with the ratios or tests may be affected by events beyond our control, including prevailing economic, financial and industry conditions. A breach of any of these covenants, or

S-17

failure to meet or maintain ratios or tests could result in a default under our credit agreement or the indenture governing the notes or both. In addition, upon the occurrence of an event of default under our credit agreement or the indenture governing the notes, the lenders could elect to declare all amounts outstanding under the credit agreement and the notes, together with accrued interest, to be immediately due and payable. If we were unable to repay those amounts, the credit agreement lenders could proceed against the security granted to them to secure that indebtedness. If the lenders accelerate the payment of the indebtedness, our assets may not be sufficient to repay in full this indebtedness and our other indebtedness, including the notes.

Our credit agreement permits us and the indenture governing the notes will permit us to pay a significant portion of our free cash flow to stockholders in the form of dividends. Any amounts paid by us in the form of dividends to our stockholders will not be available in the future to satisfy our obligations to the holders of the notes and our other indebtedness.

Although our credit agreement has and the indenture governing the notes will have some limitations on our payment of dividends, they permit us to pay a significant portion of our free cash flow to stockholders in the form of dividends. We intend to continue paying quarterly dividends on our common stock. Specifically, the indenture governing the notes will permit us to use up to 100% of our excess cash (which, as defined in the indenture, is consolidated cash flow, as defined in the indenture, minus the sum of cash income tax expense, cash interest expense, certain capital expenditures and certain repayments of indebtedness) for the period (taken as one accounting period) from and including the beginning of the fiscal quarter in which the indenture is executed to the end of our most recent fiscal quarter for which internal financial statements are available at the time of such payments, plus certain incremental funds described in the indenture for the payment of dividends, so long as the fixed charge coverage ratio for the four most recent fiscal quarters for which internal financial statements are available is not less than 1.6 to 1.0, subject to certain limitations, as more fully described in "Description of Notes—Certain Covenants—Restricted Payments." Our credit agreement (subject to certain financial ratio requirements) permits us to use up to 100% of our excess cash, as described in detail in "Description of Notes—Certain Covenants" and "Description of Certain Indebtedness—Senior Secured Credit Agreement" plus certain other amounts under certain limited circumstances to fund dividends on our shares of common stock. Any amounts paid by us in the form of dividends will not be available in the future to satisfy our obligations to the holders of our notes and our other indebtedness.

The realizable value of our assets upon liquidation may be insufficient to satisfy claims.

At March 30, 2013 our total assets included intangible assets in the amount of $903.1 million, representing approximately 76.3% of our total consolidated assets. The value of these intangible assets will continue to depend significantly upon the continued profitability of our brands. As a result, in the event of a default on the notes or any bankruptcy or dissolution of our company, the realizable value of these assets may be substantially lower and may be insufficient to satisfy the claims of our creditors.

We may not be able to repurchase the Notes upon a change of control, as required by the indenture.

Upon the occurrence of specific kinds of change of control events, we will be required to offer to repurchase all outstanding notes at 101% of their principal amount, plus accrued and unpaid interest. We may not be able to repurchase the notes upon a change of control because we may not have sufficient funds. Further, we may be contractually restricted under the terms of our credit agreement from repurchasing all of the notes tendered by holders upon a change of control. Accordingly, we may not be able to satisfy our obligations to purchase your notes unless we are able to refinance or obtain waivers under the credit agreement. Our failure to repurchase the notes upon a change of control would cause a default under the indenture and a cross default under the credit agreement. The credit agreement also provides that a change of control, as defined in such agreement, will be a default that permits lenders to accelerate the maturity of borrowings thereunder and, if such debt is not paid, to enforce security interests in the collateral securing such debt, thereby limiting our ability to raise cash

S-18

to purchase the notes, and reducing the practical benefit of the offer to purchase provisions to the holders of the notes. Any of our future debt agreements may contain similar provisions.

In addition, the change of control provisions in the indenture may not protect you from certain important corporate events, such as a leveraged recapitalization (which would increase the level of our indebtedness), reorganization, restructuring, merger or other similar transaction. Such a transaction may not involve a change in voting power or beneficial ownership or, even if it does, may not involve a change that constitutes a "Change of Control" as defined in the indenture that would trigger our obligation to repurchase the notes. If an event occurs that does not constitute a "Change of Control" as defined in the indenture, we will not be required to make an offer to repurchase the notes and you may be required to continue to hold your notes despite the event. See "Description of Other Indebtedness" and "Description of Notes—Repurchase at the Option of Holders—Change of Control."

You may not be able to determine when a change of control has occurred and may not be able to require us to purchase the notes as a result of a change in the composition of the directors on our board of directors.

Legal uncertainty regarding what constitutes a change of control and the provisions of the indenture may allow us to enter into transactions, such as acquisitions, refinancings or recapitalizations, that would not constitute a change of control but may increase our outstanding indebtedness or otherwise affect our ability to satisfy our obligations under the notes. The definition of change of control includes a phrase relating to the transfer of "all or substantially all" of the assets of us and our subsidiaries taken as a whole. Although there is a limited body of case law interpreting the phrase "substantially all," there is no precise established definition of the phrase under applicable law. Accordingly, your ability to require us to repurchase notes as a result of a transfer of less than all of our assets to another person may be uncertain.

In addition, in a 2009 decision, the Court of Chancery of the State of Delaware raised the possibility that a change of control put right occurring as a result of a failure to have "continuing directors" comprising a majority of a board of directors might be unenforceable on public policy grounds.

Although the notes are referred to as "senior" notes, your right to receive payments on these notes is effectively subordinated to the rights of our existing and future secured creditors. Further, the guarantees of these notes are effectively subordinated to all the guarantors' existing and future secured indebtedness.

Holders of our secured indebtedness and the secured indebtedness of the guarantors will have claims that are prior to your claims as holders of the notes to the extent of the value of the assets securing that other indebtedness. Notably, we and certain of our subsidiaries, including the guarantors, are parties to our credit agreement, which is secured by liens on substantially all of our and the guarantors' assets, other than our and the guarantors' real property. The notes will be effectively subordinated to all of that secured indebtedness. In the event of any distribution or payment of our assets in any foreclosure, dissolution, winding-up, liquidation, reorganization, or other bankruptcy proceeding, holders of secured indebtedness will have prior claim to those assets that constitute their collateral. Holders of the notes will participate ratably with all holders of our unsecured indebtedness that is deemed to be of the same class as the notes, and potentially with all of our other general creditors, based upon the respective amounts owed to each holder or creditor, in our remaining assets. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the notes. As a result, holders of the notes may receive less, ratably, than holders of secured indebtedness.

As of March 30, 2013, on an adjusted basis after giving effect to this offering and the use of proceeds therefrom, the aggregate amount of our secured indebtedness and the secured indebtedness of our subsidiaries would have been $138.8 million, and approximately $199.5 million would have been available for additional borrowing under the revolving credit facility under our credit agreement (net of $0.5 million reserved for issued and outstanding letters of credit). We will be permitted to borrow

S-19

substantial additional indebtedness, including additional secured debt, in the future under the terms of the indenture. See "Description of Certain Indebtedness—Senior Secured Credit Agreement."

The notes will be structurally subordinated to all indebtedness of our existing or future subsidiaries that are not guarantors of the notes.

You will not have any claim as a creditor against any of our existing or future subsidiaries that are not guarantors of the notes. Indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those subsidiaries will be effectively senior to your claims against those subsidiaries. Our two foreign subsidiaries, B&G Foods Canada, ULC and Sirops Maple Grove Inc., will not be guarantors of the notes, and any future foreign or partially-owned domestic subsidiaries will not be guarantors of the notes.

In addition, the indenture governing the notes will, subject to certain limitations, permit these subsidiaries to incur additional indebtedness and will not contain any limitation on the amount of other liabilities, such as trade payables, that may be incurred by these subsidiaries. Any such indebtedness will be effectively senior in right of payment to the notes.

Federal and state fraudulent transfer laws permit a court to void the notes and the guarantees, and, if that occurs, you may not receive any payments on the notes or the guarantees.

The issuance of the notes and the guarantees may be subject to review under federal and state fraudulent transfer and conveyance statutes. While the relevant laws may vary from state to state, under such laws the payment of consideration will generally be a fraudulent conveyance if (1) we paid the consideration with the intent of hindering, delaying or defrauding creditors or (2) we or any of our guarantors, as applicable, received less than reasonably equivalent value or fair consideration in return for issuing either the notes or a guarantee and, in the case of (2) only, one of the following is also true:

- •

- we or any of our guarantors were insolvent or rendered insolvent by reason of the incurrence of the indebtedness;

- •

- payment of the consideration left us or any of our guarantors with an unreasonably small amount of capital to carry on its business; or

- •

- we or any of our guarantors intended to, or believed that we or it would, incur debts beyond our or its ability to pay those debts as they mature.

We cannot be certain as to the standards a court would use to determine whether or not we or the guarantors were solvent at the relevant time. If a court were to find that the issuance of the notes or a guarantee was a fraudulent conveyance, the court could void the payment obligations under the notes or such guarantee or subordinate the notes or such guarantee to presently existing and future indebtedness of ours or such guarantor, or require the holders of the notes to repay any amounts received with respect to the notes or such guarantee. In the event of a finding that a fraudulent conveyance occurred, you may not receive any repayment on the notes. Further, the voidance of the notes could result in an event of default under our credit agreement that could result in acceleration of such indebtedness.

Generally, an entity would be considered insolvent if at the time it incurred indebtedness:

- •

- the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all its assets;

- •

- the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts and liabilities, including contingent liabilities, as they become absolute and mature; or

- •

- it could not pay its debts as they become due.

If the guarantees were legally challenged, any guarantee could also be subject to the claim that, since the guarantee was incurred for our benefit, and only indirectly for the benefit of the guarantor,

S-20

the obligations of the applicable guarantor were incurred for less than fair consideration. A court could thus void the obligations under the guarantees, subordinate them to the applicable guarantor's other debt or take other action detrimental to the holders of the notes.

Each guarantee will contain a provision intended to limit the guarantor's liability to the maximum amount that it could incur without causing the incurrence of obligations under its guarantee to be a fraudulent transfer. As was demonstrated in a bankruptcy case originating in the State of Florida which was affirmed by a recent decision by the Eleventh Circuit Court of Appeals on other grounds, this provision may not be effective to protect the subsidiary guarantees from being voided under fraudulent transfer laws.

You may find it difficult to sell your notes.

You may find it difficult to sell your notes because an active trading market for the notes may not develop. The notes are a new issue of securities for which there currently is no established trading market. We do not intend to apply for listing or quotation of the notes on any securities exchange. Therefore, we do not know the extent to which investor interest will lead to the development of a trading market or how liquid that market might be. Although the underwriters have advised us that they currently intend to make a market in the notes, they are not obligated to do so. Accordingly, any market-making activities with respect to the notes may be discontinued at any time without notice.

If a market for the notes does develop, it is possible that you will not be able to sell your notes at a particular time or that the prices that you receive when you sell will be unfavorable. It is also possible that any trading market that does develop for the notes will not be liquid. Future trading prices of the notes will depend on many factors, including:

- •

- our operating performance, financial condition and prospects, or the operating performance, financial condition and prospects of companies in our industry generally;

- •

- the interest of securities dealers in making a market for the notes;

- •

- prevailing interest rates; and

- •

- the market for similar securities.

The market price for the notes may be volatile.

Historically, the market for non-investment grade debt has been subject to disruptions that have caused volatility in prices. If a market for the notes develops, it is possible that the market for the notes will be subject to disruptions and price volatility. Any disruptions may adversely affect the value of your notes regardless of our operating performance, financial condition and prospects.

Variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Borrowings under our credit agreement are at variable rates of interest and expose us to interest rate risk. As such, our results of operations are sensitive to movements in interest rates. There are many economic factors outside our control that have in the past and may, in the future, impact rates of interest including publicly announced indices that underlie the interest obligations related to a certain portion of our debt. Factors that impact interest rates include governmental monetary policies, inflation, recession, changes in unemployment, the money supply, international disorder and instability in domestic and foreign financial markets. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our results of operations would be adversely impacted. Such increases in interest rates could have a material adverse effect on our financial conditions and results of operations.

S-21

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated or deemed to be incorporated herein or therein by reference contain forward-looking statements. The words "believes," "anticipates," "plans," "expects," "intends," "estimates," "projects" and similar expressions are intended to identify forward-looking statements. These forward looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance, or achievements expressed or implied by any forward-looking statements. We believe important factors that could cause actual results to differ materially from our expectations include the following:

- •

- our substantial leverage;

- •

- the effects of rising costs for our raw materials, packaging and ingredients;

- •

- crude oil prices and their impact on distribution, packaging and energy costs;

- •

- our ability to successfully implement sales price increases and cost saving measures to offset any cost increases;

- •

- intense competition, changes in consumer preferences, demand for our products and local economic and market conditions;

- •

- our continued ability to promote brand equity successfully, to anticipate and respond to new consumer trends, to develop new products and markets, to broaden brand portfolios in order to compete effectively with lower priced products and in markets that are consolidating at the retail and manufacturing levels and to improve productivity;

- •

- the risks associated with the expansion of our business;

- •

- our possible inability to integrate any businesses we acquire;

- •

- our ability to access the credit markets and our borrowing costs and credit ratings, which may be influenced by credit markets generally and the credit ratings of our competitors;

- •

- the effects of currency movements of the Canadian dollar as compared to the U.S. dollar;

- •

- other factors that affect the food industry generally, including:

- •

- recalls if products become adulterated or misbranded, liability if product consumption causes injury, ingredient disclosure and labeling laws and regulations and the possibility that consumers could lose confidence in the safety and quality of certain food products;

- •