- CCS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Century Communities (CCS) DEF 14ADefinitive proxy

Filed: 22 Mar 23, 7:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Century Communities, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

8390 East Crescent Parkway, Suite 650

Greenwood Village, Colorado 80111

(303) 770-8300

FROM OUR CHAIRMAN OF THE BOARD

Dear Fellow Stockholder:

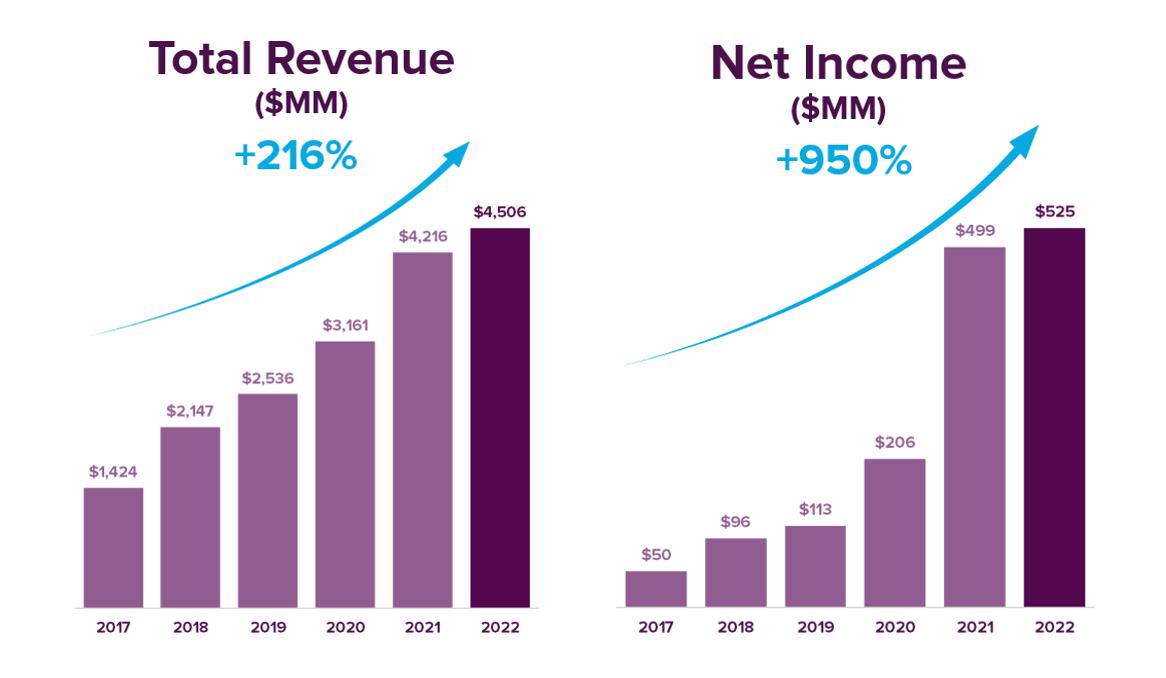

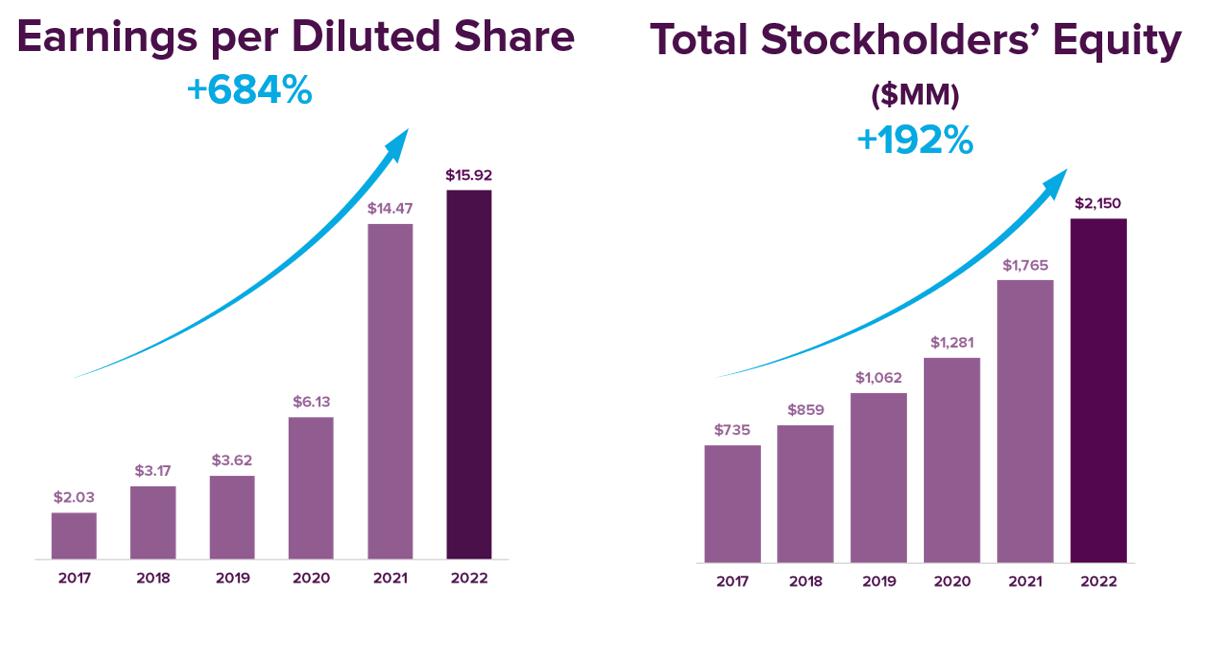

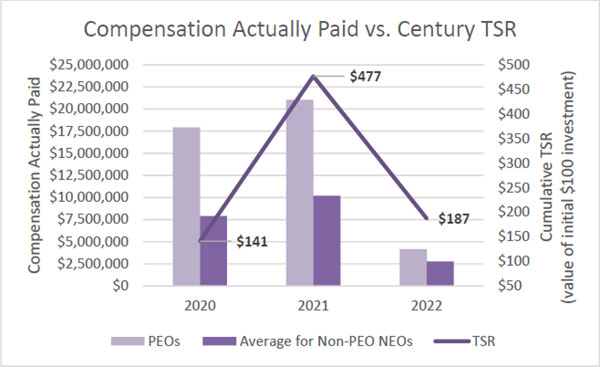

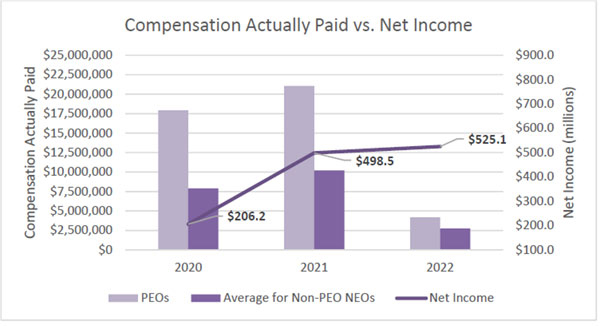

2022 was another strong year for our Company. We generated home sales revenues of $4.4 billion, a Company record, and delivered 10,594 homes, the second highest level in our history, resulting in record net income of $525 million. 2022 marked the 20th anniversary of the founding of Century Communities and was also our 20th year of consecutive profitability. The Company produced a return on equity of 27% and grew stockholders’ equity by 22% to a record $2.2 billion. Our book value per share increased to $67.67 per share, also a Company record, as of December 31, 2022.

During 2022, we continued to return cash to our shareholders while maintaining a strong balance sheet. Our quarterly dividend was increased to $0.20 per diluted share in the first quarter of 2022 and further increased to $0.23 per diluted share in the first quarter of 2023. For the full year, we invested $120.6 million in repurchasing approximately 2.3 million shares of common stock at an average price of $52.32 per share, a 23% discount to ending book value, reducing our share count by approximately 7%. We ended the year with a homebuilding debt to capital ratio of 32.0%, $1.2 billion of total liquidity, including $353 million of cash, and our first senior debt maturity not due until 2027.

Together with the Board of Directors and the management team at Century Communities, I am pleased to invite you to our 2023 Annual Meeting of Stockholders, which will be held at the Hyatt Regency Denver Tech Center located at 7800 East Tufts Avenue, Denver, Colorado 80237, at 1:00 p.m. local time, on Wednesday, May 3, 2023.

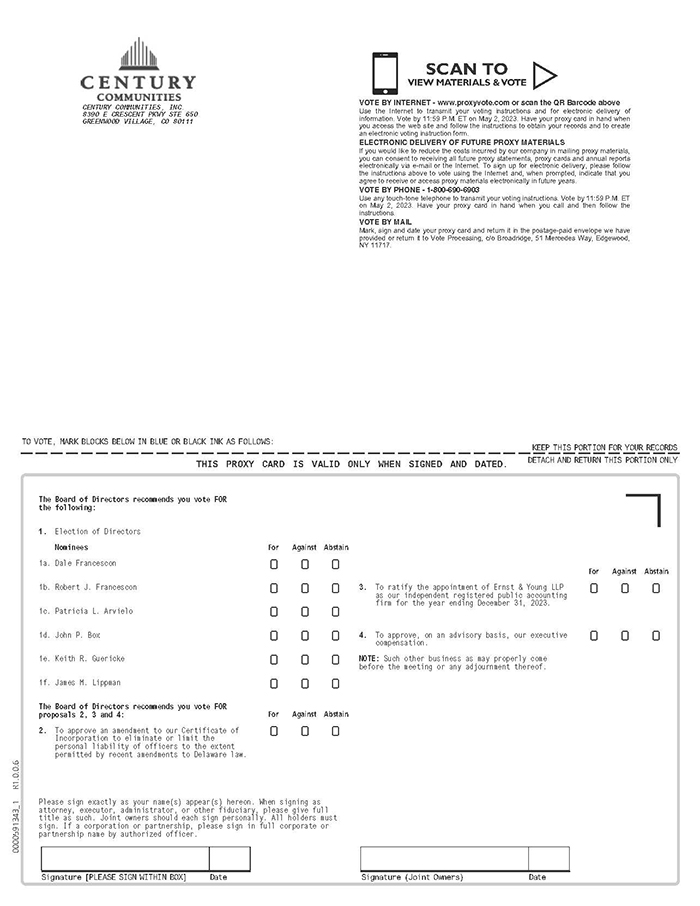

In connection with the Annual Meeting, stockholders will be asked to consider and vote upon the following proposals: (1) to elect six directors to serve for the ensuing year as members of the Board of Directors of Century; (2) to approve an amendment to our Certificate of Incorporation to eliminate or limit the personal liability of officers to the extent permitted by recent amendments to Delaware law; (3) to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; (4) to approve, on an advisory basis, our executive compensation; and (5) to transact such other business as may properly come before the Annual Meeting or at any continuation, postponement, or adjournment thereof. The accompanying Notice of 2023 Annual Meeting of Stockholders and proxy statement describe these matters in more detail. We urge you to read this information carefully.

The Board of Directors recommends a vote: FOR each of the six nominees for director named in the proxy statement and FOR the approval of the other proposals being submitted to a vote of stockholders.

Voting your shares of Century common stock is easily achieved without the need to attend the Annual Meeting in person. Regardless of the number of shares of Century common stock that you own, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to vote your shares of Century common stock via the Internet, by telephone, or by promptly marking, dating, signing, and returning the proxy card. Voting over the Internet, by telephone, or by written proxy will ensure that your shares are represented at the Annual Meeting.

On behalf of the Board of Directors, we thank you for your participation, investment and continued support.

| Sincerely, | |

Dale Francescon Chairman of the Board and Co-Chief Executive Officer

March 22, 2023 |

| You can help us make a difference by eliminating paper proxy materials. With your consent, we will provide all future proxy materials electronically. Instructions for consenting to electronic delivery can be found on your proxy card or at www.proxyvote.com. Your consent to receive stockholder materials electronically will remain in effect until canceled. |

| Century Communities, Inc. – 2023 Proxy Statement | 2 |

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

The 2023 Annual Meeting of Stockholders of Century Communities, Inc., a Delaware corporation, will be held on Wednesday, May 3, 2023, at 1:00 p.m. local time at the Hyatt Regency Denver Tech Center located at 7800 East Tufts Avenue, Denver, Colorado 80237, for the following purposes:

| 1. | To elect six directors to serve as members of the Board of Directors of Century until the next annual meeting of stockholders and until their successors are duly elected and qualified. The director nominees named in the proxy statement for election to the Board of Directors are: Dale Francescon, Robert J. Francescon, Patricia L. Arvielo, John P. Box, Keith R. Guericke, and James M. Lippman; |

| 2. | To approve an amendment to our Certificate of Incorporation to eliminate or limit the personal liability of officers to the extent permitted by recent amendments to Delaware law; |

| 3. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2023; |

| 4. | To approve, on an advisory basis, our executive compensation; and |

| 5. | To transact such other business as may properly come before the Annual Meeting or at any continuation, postponement, or adjournment thereof. |

The proxy statement accompanying this Notice describes each of these items of business in detail. Only holders of record of our common stock at the close of business on March 9, 2023 are entitled to notice of, to attend, and to vote at the Annual Meeting or any continuation, postponement, or adjournment thereof. A list of such stockholders will be available for inspection, for any purpose germane to the Annual Meeting, at our principal executive offices during regular business hours for a period of no less than 10 days prior to the Annual Meeting.

To ensure your representation at the Annual Meeting, you are urged to vote your shares of Century common stock via the Internet, by telephone, or by promptly marking, dating, signing, and returning the proxy card. If your shares of Century common stock are held by a bank, broker, or other agent, please follow the instructions from your bank, broker, or other agent to have your shares voted.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| |

David L. Messenger Chief Financial Officer and Secretary |

Greenwood Village, Colorado

March 22, 2023

| Century Communities, Inc. – 2023 Proxy Statement | 3 |

CONTENTS

References in this proxy statement to:

| · | “Century,” “we,” “us,” “our,” or the “Company” refer to Century Communities, Inc.; |

| · | “Board” refer to the Board of Directors of Century; |

| · | “Annual Meeting” refer to our 2023 Annual Meeting of Stockholders; and |

| · | “2022 Annual Report” or “2022 Annual Report to Stockholders” refer to our Annual Report to Stockholders for 2022, including our Annual Report on Form 10-K for the year ended December 31, 2022, being made available together with this proxy statement. |

| Century Communities, Inc. – 2023 Proxy Statement | 4 |

Information on our website and any other website referenced herein is not incorporated by reference into, and does not constitute a part of, this proxy statement.

™ and ® denote trademarks and registered trademarks of Century Communities, Inc. or our affiliates, registered as indicated in the United States. All other trademarks and trade names referred to in this proxy statement are the property of their respective owners.

We intend to make this proxy statement and our 2022 Annual Report available on the Internet and to commence mailing of the notice to all stockholders entitled to vote at the Annual Meeting beginning on or about March 22, 2023. We will mail paper copies of these materials, together with a proxy card, within three business days of a request properly made by a stockholder entitled to vote at the 2023 Annual Meeting of Stockholders.

| Century Communities, Inc. – 2023 Proxy Statement | 5 |

PROXY STATEMENT SUMMARY

| This executive summary provides an overview of the information included in this proxy statement. We recommend that you review the entire proxy statement and our 2022 Annual Report to Stockholders before voting. |

2023 ANNUAL MEETING OF STOCKHOLDERS

DATE AND TIME

Wednesday, May 3, 2023 1:00 p.m. (Mountain Time)

LOCATION

Hyatt Regency Denver Tech Center 7800 East Tufts Avenue Denver, CO 80237

RECORD DATE

Holders of record of our common stock at the close of business on March 9, 2023 are entitled to notice of, to attend, and to vote at the 2023 Annual Meeting of Stockholders or any continuation, postponement, or adjournment thereof. |

VOTING ITEMS

| Proposal | Board’s Vote Recommendation | |

Proposal No. 1: Election of directors | FOR | 33 |

Proposal No. 2: Approval of amendment to our Certificate of Incorporation to eliminate or limit the personal liability of officers | FOR | 38 |

Proposal No. 3: Ratification of appointment of independent registered public accounting firm | FOR | 41 |

Proposal No. 4: Advisory vote on executive compensation | FOR | 43 |

_____________________

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on Wednesday, May 3, 2023

This proxy statement and our 2022 Annual Report of Stockholders are available on the Internet, free of charge, at www.proxyvote.com. On this website, you will be able to access this proxy statement, our 2022 Annual Report, and any amendments or supplements to these materials that are required to be furnished to stockholders. We encourage you to access and review all of the important information contained in the proxy materials before voting. |

| Century Communities, Inc. – 2023 Proxy Statement | 6 |

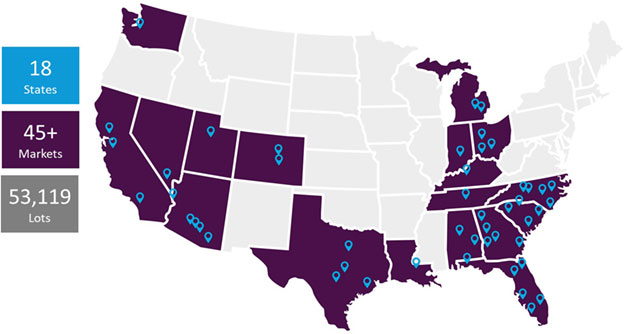

WHO WE ARE

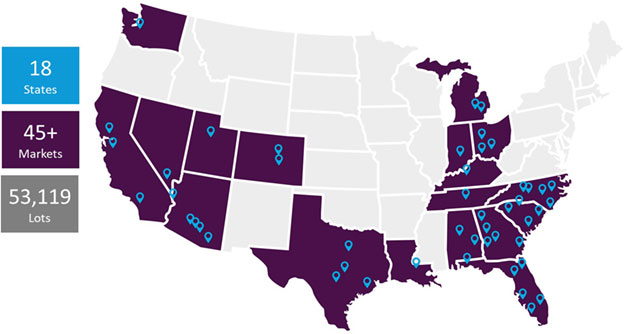

Century Communities, Inc. is a top 10 national U.S. homebuilder. We are engaged in the development, design, construction, marketing and sale of single-family attached and detached homes in 18 states across the United States. We market and sell homes under both the Century Communities and Century Complete brands. As of December 31, 2022, we operated in the 18 states and over 45 markets depicted below. We also offer title, insurance, and lending services in select markets.

Over the last six years, positive macro-economic conditions, along with our operating efficiencies, business strategy and geographic expansion through the acquisition of other homebuilders and organic entrances into new markets has resulted in significant increases in total revenue, net income, earnings per diluted share, and total stockholders’ equity.

|  |

| Century Communities, Inc. – 2023 Proxy Statement | 7 |

2022 BUSINESS HIGHLIGHTS

Highlights of our achievements for 2022, include:

FINANCIAL

| $4.5 billion | Total Revenues Achieved a record $4.5 billion in total revenues, a 7% |

| $525 million | Net Income Achieved a record net income of $525 million, a 5% |

$753 million

| Adjusted EBITDA* Achieved a record adjusted EBITDA of $753 million, a 3% |

| $0.20 share | Quarterly Cash Dividend Increased quarterly cash dividend to $0.20 per share in March 2022 from $0.15 per share, a 33% |

OPERATIONAL

| 208 | Selling Communities Year-end selling communities of 208 increased 3% year-over-year |

| 10,594 | Home Deliveries Achieved home deliveries of 10,594, the second highest in our history |

| 96% | Spec Builds 96% of total home deliveries were spec builds compared to 86% of total deliveries in 2021 |

| 77% | Entry-Level Homes Approximately 77% of our home deliveries qualified for Federal Housing Administration-insured (“FHA”) mortgages compared to approximately 75% in 2021 |

STRATEGIC

Properly Incentivized Homes with Near-Term Completions to Turn Inventories As the homebuilding industry started to slow in the latter half of 2022, we prioritized our sales efforts on properly incentivizing homes with near-term completions to turn inventories and generated $382 million of net operating cash flow in the fourth quarter | |

Reduced Controlled Lot Inventory and Land Spend Commitments Used low-risk, land-light business strategy to reduce our land pipeline by a total of 27,000 lots and acquisition commitments by over $650 million for a minimal cost of approximately $12 million | |

Continued Focus on Entry Level and Move-in-Ready/Spec Home Construction Our focus on spec homes allowed us to more easily monetize land, produce homes more efficiently and turn inventories more quickly, while allowing buyers to purchase quick-move-in homes and lock in mortgage rates |

| *See Annex I for a reconciliation of non-GAAP financial measures to most comparable measures under U.S. GAAP. |

| Century Communities, Inc. – 2023 Proxy Statement | 8 |

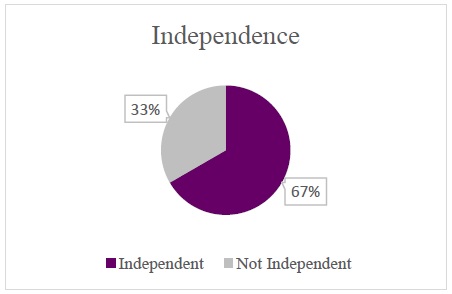

CORPORATE GOVERNANCE HIGHLIGHTS

| Two-thirds of directors are independent | Annual say-on-pay vote | ||

| Annual election of all directors | Officer and director stock ownership requirements | ||

| Majority vote standard for uncontested director elections, with a director resignation policy | Hedging, pledging, and stock option repricing prohibitions | ||

| Emphasis on gender and racial/ethnic diversity in Board refreshment efforts | Double trigger change in control arrangements | ||

| Independent presiding director | Robust clawback policy | ||

| Board oversight of ESG policies | No poison pill | ||

| Robust Board and committee evaluations | Single class of stock |

STOCKHOLDER ENGAGEMENT

We are committed to a robust and proactive stockholder engagement program. The Board of Directors values the perspectives of our stockholders, and feedback from stockholders on our business, corporate governance, executive compensation, and sustainability practices are important considerations for Board discussions throughout the year.

During 2022, our executives held approximately 175 meetings with stockholders, including all of our top 10 stockholders that are actively managed funds. Stockholder feedback is thoughtfully considered and has led to modifications in our executive compensation program, governance practices and disclosures. Some of the actions we have taken in response to feedback over the last several years are described below.

| What We Heard: | What We Did: |

| Increase stockholder influence over director elections. | We adopted a majority vote standard for uncontested director elections, with a director resignation policy, instead of a plurality vote standard. |

| Increase Board gender diversity. | We added Patricia L. Arvielo to the Board of Directors in the beginning of 2021 and have committed to including female candidates in our initial list of director candidates in future searches. |

| Increase Board racial/ethnic diversity. | We considered racial/ethnic diversity in our 2021 search for a new director and have committed to including racially/ethnically diverse candidates in our initial list of director candidates in future searches. Patricia L. Arvielo is a first-generation Latina. |

| Align the interest of directors and executive officers with those of stockholders. | We adopted stock ownership and retention guidelines applicable to our directors and executives to ensure that their interests would be closely aligned with those of our stockholders. All of our directors and executives are in compliance with our stock ownership guidelines. We also adopted an anti-hedging/pledging policy.

Dale Francescon and Robert J. Francescon beneficially own 6.0% and 5.0%, respectively, of our outstanding common stock, and together beneficially own 11.0% of our outstanding common stock.

|

| Century Communities, Inc. – 2023 Proxy Statement | 9 |

| What We Heard: | What We Did: |

| Emphasize long-term incentives. | Our long-term incentive (LTI) program provides for significant LTI opportunities for our executives, which for 2022 constituted 53% of our Co-Chief Executive Officer (Co-CEOs) target total direct compensation and 47% for our Chief Financial Officer (CFO), and comprised of 100% performance share unit (PSU) awards, which have a three-year performance period and then a one-year holding period on the shares issued in settlement thereof. |

| Emphasize performance-based compensation elements. | 89% of our Co-CEO target compensation and 85% of our CFO target compensation for 2022 is performance-based compensation. |

| Increase disclosure on corporate governance and executive compensation. | Each year, we have increased and improved our corporate governance and executive compensation disclosures, with an eye towards transparency and readability. |

| Ensure the recovery of incentive compensation based on incorrect calculations that resulted in a financial restatement. | We adopted a robust clawback policy covering cash and equity incentive compensation applicable to current and former executives. |

BOARD COMPOSITION AND KEY QUALIFICATIONS

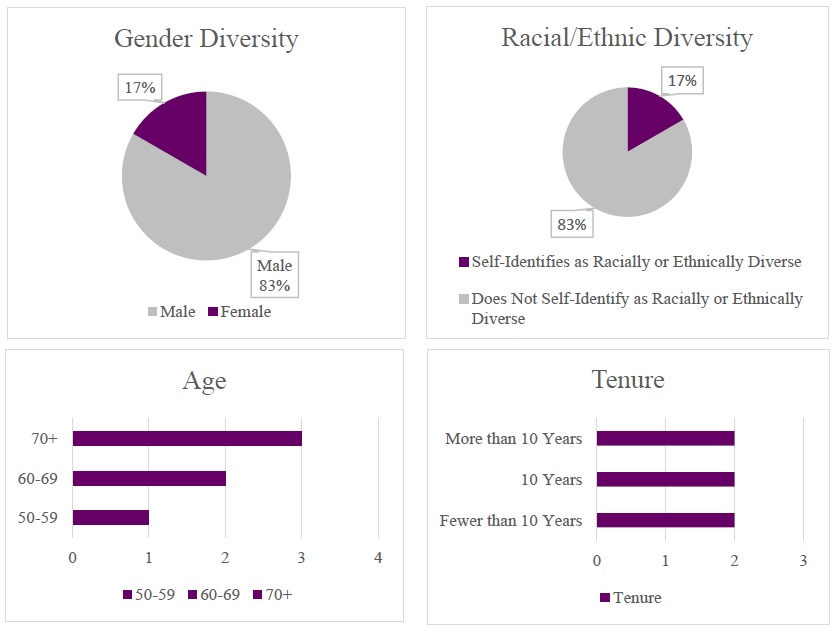

The following describes the current diversity, age and tenure of our Board of Directors:

| Century Communities, Inc. – 2023 Proxy Statement | 10 |

The following are some of the key qualifications, skills, and experiences of our Board of Directors:

Director | CEO/Senior Officer Experience | Financial/ Finance Experience | Industry Experience | Sales/ Marketing Experience | Corporate Governance | ESG Experience |

| Dale Francescon | ● | ● | ● | ● | ● | ● |

| Robert J. Francescon | ● | ● | ● | ● | ● | ● |

| Patricia L. Arvielo | ● | ● | ● | ● | ||

| John P. Box | ● | ● | ● | ● | ● | |

| Keith R. Guericke | ● | ● | ● | ● | ● | |

| James M. Lippman | ● | ● | ● | ● | ● |

The lack of a mark for a particular item does not mean that the director does not possess that qualification, characteristic, skill, or experience. We look to each director to be knowledgeable in these areas; however, the mark indicates that the item is a particularly prominent qualification, characteristic, skill, or experience that the director brings to the Board.

BOARD NOMINEES

Below are the directors nominated for election by stockholders at the Annual Meeting for a one-year term. The Board of Directors recommends a vote “FOR” each of these nominees.

| Director | Age | Serving Since | Independent | Committees | Other Public Boards |

| Dale Francescon(1) | 70 | 2013 | No(2) | N/A | 0 |

| Robert J. Francescon | 65 | 2013 | No(2) | N/A | 0 |

| Patricia L. Arvielo | 58 | 2021 | Yes | Audit, Compensation, Nominating and Corporate Governance | 1 |

| John P. Box | 76 | 2014 | Yes | Audit, Compensation, Nominating and Corporate Governance | 0 |

| Keith R. Guericke(1) | 74 | 2013 | Yes | Audit, Compensation, Nominating and Corporate Governance | 1 |

| James M. Lippman | 65 | 2013 | Yes | Audit, Compensation, Nominating and Corporate Governance | 0 |

| (1) | Dale Francescon serves as Chairman of the Board of Directors. Because the Board endorses the concept of an independent, non-employee director being in a position of leadership, Keith R. Guericke serves as the presiding independent director. |

| (2) | Dale Francescon and Robert J. Francescon are not independent because they also serve as Century’s Co-Chief Executive Officers. |

| Century Communities, Inc. – 2023 Proxy Statement | 11 |

EXECUTIVE COMPENSATION BEST PRACTICES

Our compensation practices include many best practices that support our executive compensation objectives and principles and benefit our stockholders.

| What We Do | What We Don’t Do | ||

| Structure our executive officer compensation so it is competitive and a significant portion of pay is at risk |  | No guaranteed salary increases |

| Emphasize long-term performance in our equity-based incentive awards |  | No guaranteed bonuses |

| Use a mix of performance measures and caps on payouts |  | No excessive perquisites |

| Require minimum vesting periods on equity awards |  | No current payment of dividends on unvested awards |

| Require a double-trigger for equity acceleration upon a change of control |  | No excise or other tax gross-ups |

| Have robust stock ownership guidelines and retention requirements for executive officers |  | No short sales or derivative transactions in Century stock, including hedges |

| Maintain a robust clawback policy |  | No pledging of Century securities |

| Hold an annual say-on-pay vote |  | No repricing of stock options |

2022 EXECUTIVE COMPENSATION ACTIONS

For 2022, our only named executive officers were our Co-Chief Executive Officers and Chief Financial Officer. 2022 compensation actions and incentive plan outcomes based on performance are summarized below:

| Pay Element | 2022 Actions |

| Base Salary | ● Our Co-CEOs received a base salary increase of 11.1% and our CFO received a base salary increase of 15.4%. |

| Short-Term Incentive | ● The threshold, target and maximum short-term incentive award opportunities for 2022 were 175%, 350% and 700% of base salary, respectively, for our Co-CEOs and 125%, 250% and 500% of base salary, respectively, for our CFO.

● Performance metrics were revenue (20%), EBITDA, as adjusted (60%), and closings (20%) for our Co-CEOs, and revenue (15%), EBITDA, as adjusted (45%), closings (15%), and individual goals (25%) for our CFO.

● Actual performance was between target and maximum for revenue, exceeded maximum for EBITDA, as adjusted, and was between threshold and target for closings.

|

| Long-Term Incentives | ● The target long-term incentive award opportunities for 2022 were 500% of base salary for our Co-CEOs and 313% of base salary for our CFO.

● Our 2022 long-term incentive program consisted of 100% performance share unit awards, which may vest and be paid out in shares of our common stock dependent upon the achievement of a cumulative adjusted pre-tax income goal for the years 2022-2024. All net shares issued in settlement of these PSU awards are subject to a one-year mandatory holding period. |

| Century Communities, Inc. – 2023 Proxy Statement | 12 |

| Pay Element | 2022 Actions |

● Our 2020 PSU awards were paid out at the maximum payout level, based on our 2020-2022 cumulative adjusted pre-tax income.

| |

| Other Compensation Related Actions | ● Approximately 98% of votes cast at our 2022 Annual Meeting of Stockholders were in favor of our annual say-on-pay vote. |

AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO ELIMINATE OR LIMIT THE PERSONAL LIABILITY OF OFFICERS

The State of Delaware, which is Century’s state of incorporation, recently amended Section 102(b)(7) of the Delaware General Corporation Law (“DGCL”) to permit a corporation to eliminate or limit the personal liability of certain officers to the corporation or its stockholders for breaches of the fiduciary duty of care as an officer in certain limited circumstances. We sometimes refer to this elimination or limitation of personal liability as “exculpation” in this proxy statement. Prior to amended DGCL Section 102(b)(7), Delaware law authorized such exculpation for directors but not for officers. As with directors, the exculpation protection does not apply to an officer’s breaches of the duty of loyalty, acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, or any transaction in which the officer derived an improper personal benefit. Unlike director exculpation, however, the protection for officers only permits officer exculpation for direct claims brought by stockholders for breach of an officer’s fiduciary duty of care, including class actions, but does not eliminate an officer’s monetary liability for breach of fiduciary duty claims brought by the corporation itself or for derivative claims brought by stockholders in the name of the corporation. To gain the added protection for officers, Century must amend its Certificate of Incorporation, as amended (“Certificate of Incorporation”), to add an officer exculpation provision.

The Board of Directors believes it is important to provide not only its directors but also its officers protection from certain liabilities and expenses that may discourage prospective or current officers from serving as officers of Century. Accordingly, on February 8, 2023, the Board of Directors, upon recommendation of the Nominating and Corporate Governance Committee, approved, subject to stockholder approval, a proposed amendment to our Certificate of Incorporation to eliminate or limit the personal liability of Century’s officers to the extent permitted by recent amendments to Delaware law.

The Board of Directors recommends a vote “FOR” the proposal to approve an amendment to our Certificate of Incorporation to eliminate or limit the personal liability of officers to the extent permitted by recent amendments to Delaware law.

2024 ANNUAL MEETING OF STOCKHOLDERS

We anticipate that our 2024 Annual Meeting of Stockholders will be held on Wednesday, May 8, 2024. The following are important dates in connection with our 2024 Annual Meeting of Stockholders.

| Stockholder Action | Submission Deadline |

| Proposal Pursuant to Rule 14a-8 of the Securities Exchange Act of 1934 | No later than November 23, 2023 |

| Nomination of a Candidate Pursuant to our Bylaws | Between January 4, 2024 and February 3, 2024 |

| Proposal of Other Business for Consideration Pursuant to our Bylaws | Between January 4, 2024 and February 3, 2024 |

| Century Communities, Inc. – 2023 Proxy Statement | 13 |

OUR COMMITMENT TO ENVIRONMENTAL, SOCIAL AND GOVERNANCE PRINCIPLES

ESG Approach AND MISSION

Century’s Board and management are committed to building environmental sustainability, social responsibility and effective corporate governance throughout our business. Our ESG reporting is centered on the industry-specific reporting standards as advised by the Sustainability Accounting Standards Board (SASB). These standards were launched in November 2018 and were created based on financially material ESG factors SASB has deemed most relevant to investors. SASB reporting is also aligned with the Task Force on Climate-related Financial Disclosures (TCFD) Recommendations.

Our mission is to create thriving, enduring neighborhoods by building new homes with lasting livability. We believe our commitment to pursuing environmental, social and governance initiatives can be achieved in parallel with and in furtherance of the interests of our homeowners as well as the long-term interests of our stockholders. The integration of sustainable business practices creates lasting results that benefit all our stakeholders, including our customers, employees, stockholders, investors, and the communities in which we live and operate.

esg INITIATIVES

As a leading, top-10 national home builder, we believe we can play an important role in building a sustainable future for our employees, our homeowners, our environment and the communities in which we live and build while we operate in an ethical, environmentally and socially responsible manner. Specific to our industry, we are focused on the following opportunities related to climate change, sustainability and social responsibility:

| Building sustainable homes that allow homeowners to reduce their carbon footprint by utilizing smart home technology to reduce energy consumption and conserve water; |

| Seeking to understand not only the carbon footprint of the homes that we build, but also their embodied carbon footprint – the climate impact associated with the materials that go into our homes; |

| Analyzing product-specific manufacturer embodied carbon data, developing a green building material procurement strategy, and exploring opportunities to pursue additional green building certifications; |

| Completing a GHG inventory to better contextualize the trend in our environmental impact over time and evaluate our efforts to date in incorporating efficient and waste reducing practices into our homebuilding operations; |

| Seeking opportunities to strengthen our rigorous environmental due diligence criteria through the development of a holistic biodiversity conservation and responsible land use policy; |

| Century Communities, Inc. – 2023 Proxy Statement | 14 |

| Offering sustainable, affordably priced homes to homebuyers; |

| Helping create happy, healthy communities in part by educating homebuyers, employees, business partners and other stakeholders on environmentally sustainable practices; |

| Giving back to the communities in which we operate; in 2021 the Company established the Century Communities Foundation to support our local teams at the corporate level with their initiatives and to make contributions at a more national level; |

| Complying with all relevant and applicable local, state and federal environmental laws, policies and regulations; |

| Maintaining work environments conducive to the health and safety of our employees, our trade partners, the public and our valued homeowners, especially in light of the COVID-19 pandemic; and |

| Creating a culture that fosters diversity, inclusivity, dignity and respect with equal employment opportunity hiring practices and policies with competitive compensation and benefit packages, which is reinforced by our employee trainings related to anti-harassment and anti-discrimination, annual training on the Century Code of Business Conduct and Ethics, and commitment to pay equity. |

Demonstrating our emphasis on environmental impact reduction, historically over 85% of the homes we built were certified for meeting or exceeding the enhanced standards established by the Federal government pursuant to the Energy Efficient Home Tax Credit.

Specific examples of environmentally sensitive products that we incorporate into many of our homes include:

| EnergyStar® appliances; |

| EnergyStar® Certified smart thermostats; |

| 100% low Volatile Organic Compound (VOC) paints; |

| Low-E windows that reduce the demand on HVAC systems as well as energy-efficient HVAC units with whole home air purification systems; |

| Efficient LED lighting; |

| Reduced water flow plumbing systems that do not compromise performance; and |

| Solar power, heat pumps and fully electric communities in select markets. |

esg COMMITMENTS

ENVIRONMENTAL COMMITMENTS: We are committed to operating in an environmentally responsible manner to reduce our impact on climate change, conserve natural resources and operate in compliance with environmental regulations.

SOCIAL COMMITMENTS: We are committed to being a socially responsible employer by fostering an environment of diversity and inclusion across our business, operating ethically and supporting our local communities.

GOVERNANCE COMMITMENTS: We are committed to building a culture dedicated to ethical business behavior and responsible corporate activity. This extends to our business partners’ vendor agreements which share our commitment to employee health & safety, human rights, and environmental stewardship. We believe strong corporate governance through Board and management teams that are engaged on ESG topics is the foundation to delivering on our commitments.

| Century Communities, Inc. – 2023 Proxy Statement | 15 |

esg DISCLOSURES

The Board of Directors believes environmental stewardship and social responsibility are important elements in driving long-term, organizational success. Century’s ESG initiatives and disclosures to the market include our inaugural ESG Sustainability Report and ESG & Sustainability Report Supplemental Data published in 2021, which we intend to update later this year, the ESG Policy Statement, the Human Rights Policy Statement, our Commitment to Training and Professional Development, the Labor Rights Policy, our Commitment to Diversity and Inclusion and our Vendor Code of Conduct, as well as the “Investors-ESG” section of our website located at www.centurycommunities.com. In our 2021 report, we published our first corporate greenhouse gas (GHG) emissions inventory for 2020 and, in our 2023 report, we will provide the results for both 2021 and 2019.

| Century Communities, Inc. – 2023 Proxy Statement | 16 |

CORPORATE GOVERNANCE

Governance best PRACTICES

We maintain several corporate governance best practices, which are designed to promote actions that benefit our stockholders and create a framework for our decision-making.

| Annual election of all directors | All directors are elected annually for a one-year term. |

| Majority vote standard for uncontested director elections, with a director resignation policy | We have a majority voting standard for uncontested director elections, and directors who do not receive more votes “for” than “against” their election must offer to resign from the Board. |

| Two-thirds of our directors are independent | Four of the six directors on our Board are independent. |

| Annual Board and committee evaluations | It is our policy to conduct annual Board and committees performance self-evaluations. |

| Overboarding policy | We limit the number of public company boards on which our directors may serve. |

| No poison pill | We believe that not having a poison pill benefits our stockholders by not discouraging takeover attempts that may increase value for our stockholders. |

| Board oversight of ESG initiatives | While the Nominating and Corporate Governance Committee has been delegated oversight authority of our ESG initiatives, the Audit Committee is responsible for climate-related and sustainability risks. |

| Emphasis on gender and racial/ethnic diversity in Board refreshment efforts | The Board added a female and Latina director to the Board in the beginning of 2021. |

| Robust stockholder outreach program | Each year, our executives hold numerous meetings to seek stockholder input and strive to take actions that reflect the input received. |

| Annual say-on-pay vote | Our Board recommended, and our stockholders voted in favor of, an annual advisory stockholder vote on executive compensation. |

| Officer and director stock ownership requirements | We have robust stock ownership guidelines for our directors and officers that require maintenance of a specified level of ownership based on compensation. |

| Hedging and pledging prohibitions | We prohibit certain employees, including our NEOs, from engaging in any hedging transactions, short sales, transactions in publicly traded options, such as puts, calls and other derivatives, or short-term trading. |

| Require a double trigger for cash severance and accelerated vesting of equity upon a change in control | The double trigger feature incentivizes executives to accept or continue employment with Century in the event of a change in control event. |

| Robust clawback policy | We maintain a robust clawback policy pursuant to which we may recover cash and equity incentive compensation from current or former officers in the event of a restatement. |

| Single class of stock | We have a single class of stock, so our stockholders all have equal voting rights. |

| Century Communities, Inc. – 2023 Proxy Statement | 17 |

CORPORATE GOVERNANCE GUIDELINES

The Board has adopted Corporate Governance Guidelines covering, among other things, the duties and responsibilities of, and independence standards applicable to, our directors and Board committee structures and responsibilities. Among the topics addressed in our Corporate Governance Guidelines are:

● Role of directors ● Selection of the Chairman of the Board ● Selection of new directors ● Director qualifications ● Care and avoidance of conflicts ● Confidentiality ● Limits on other directorships or “overboarding” ● Director independence ● Directors who change their present job responsibility ● Retirement and resignation policy ● Director tenure ● Board compensation ● Separate sessions of independent directors ● Board and Board committee self-evaluations ● Strategic direction of the Company ● Board access to management ● Director resignation policy | ● Board materials ● Board interaction with institutional investors, analysts, press, and customers ● Board orientation and continuing education ● Director attendance at annual meetings of stockholders ● Frequency of meetings ● Selection of agenda items for Board meetings ● Number and names of Board committees ● Independence of Board committees ● Assignment and rotation of committee members ● Evaluation of executive officers ● Succession planning ● Management development ● Risk management ● Prohibited loans ● Communications with directors |

From time to time, the Board, upon recommendation of the Nominating and Corporate Governance Committee, reviews and updates the Corporate Governance Guidelines as it deems necessary and appropriate. The Corporate Governance Guidelines are available in the “Discover Century—Investors—Corporate Governance—Governance Documents�� section of the Company’s website located at www.centurycommunities.com.

Director Independence

Under the listing standards and rules of the New York Stock Exchange (NYSE), independent directors must comprise a majority of a listed company’s board of directors. Under the NYSE rules, a director will only qualify as an “independent director” if the company’s board of directors affirmatively determines that the director has no material relationship with the company, either directly or indirectly, that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

NYSE rules also require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Audit committee members must also satisfy heightened independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934 (Exchange Act), and compensation committee members must satisfy heightened independence criteria set forth in the NYSE rules.

| Century Communities, Inc. – 2023 Proxy Statement | 18 |

The Board has undertaken a review of its composition, the composition of its Board committees, and the independence of each director. Based upon information requested from and provided by each of our directors concerning his or her background, employment, and affiliations, including family relationships with us, our senior management, and our independent registered public accounting firm, the Board has determined that all but two of our directors, Dale Francescon and Robert J. Francescon, are independent directors under the standards established by the Securities and Exchange Commission (SEC) and the NYSE. In making this determination, the Board considered the current and prior relationships that each non-employee director has with Century and all other facts and circumstances the Board deemed relevant in determining their independence.

Overboarding policy

Recognizing the substantial time commitments attendant to directorship, our Corporate Governance Guidelines provide for an overboarding policy which limits the number of public company boards on which our directors may serve. The overboarding limit depends upon whether a director is an executive officer of a public company. In addition, service on other boards and/or committees must be consistent with our conflict of interest policy.

| Type of Director | Overboarding Limit |

| Board Member who is an Executive Officer of a Public Company | 2 |

| Board Member who is not an Executive Officer of a Public Company | 4 |

Board Leadership Structure

Our Corporate Governance Guidelines provide that the Board does not require the separation of the offices of the Chairman of the Board and the Chief Executive Officers, and that the Board is free to choose its Chairman of the Board in any way that it deems best for the Company at any given point in time. Dale Francescon serves as Chairman of the Board and Co-Chief Executive Officer. However, the Board endorses the concept of an independent director being in a position of leadership and, thus, as mentioned above, Keith R. Guericke serves as our presiding independent director.

The Board has determined that this current leadership structure is appropriate and in the best interests of the Company and its stockholders at this time for several reasons, including: (i) Both Dale Francescon’s and Robert J. Francescon’s extensive knowledge of our Company, business, and industry, obtained through nearly 20 years of service to our Company and over 30 years of experience in the homebuilding industry, which benefit Board leadership and the Board’s decision-making process through their active roles as Co-Chief Executive Officers, and in the case of Dale Francescon, Chairman of the Board; (ii) unification of Board leadership and strategic direction as implemented by our management; and (iii) appropriate balance of risks relating to concentration of authority through the oversight of our independent and engaged presiding independent director and Board.

| Century Communities, Inc. – 2023 Proxy Statement | 19 |

Executive Sessions

Our non-management independent directors meet in executive sessions without management to consider such matters as they deem appropriate, such as reviewing the performance of management. Executive sessions of our independent directors are typically held in conjunction with regularly scheduled Board and committee meetings.

Our independent directors have appointed an independent director (referred to as the “presiding director”) to preside over the executive sessions of the independent directors. Keith R. Guericke serves as our presiding director. The main duties of the presiding director are to (i) preside at regularly scheduled executive sessions or other meetings of the independent directors; (ii) serve as liaison between the Chairman of the Board and the Co-Chief Executive Officers, on the one hand, and the independent directors, on the other hand, by means of consulting with the Chairman of the Board and the Co-Chief Executive Officers as to agenda items for Board and committee meetings and advising them of the outcome of such meetings, as necessary; and (iii) coordinate with Board committee chairs in the development and recommendations of Board and Board committee meeting agendas.

Committees of the Board of Directors

We currently have three standing committees of the Board: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The Board may establish other Board committees as it deems necessary or appropriate from time to time.

Each Board committee charter authorizes the committee to retain independent advisors as it deems necessary to carry out its responsibilities. Each Board committee reviews and evaluates, at least annually, the performance of the committee, including compliance with its charter.

Below are our directors and their current committee memberships.

| Director | Board | Audit | Compensation | Nominating and Corporate Governance |

| Dale Francescon | ● | |||

| Robert J. Francescon | ● | |||

| Patricia L. Arvielo | ● | ● | ● | ● |

| John P. Box | ● | ● | ● | Chair |

| Keith R. Guericke | ● | Chair | ● | ● |

| James M. Lippman | ● | ● | Chair | ● |

| Century Communities, Inc. – 2023 Proxy Statement | 20 |

Audit Committee

Key Responsibilities and Activities

● Oversees (i) our financial reporting, auditing, and internal control activities; (ii) the integrity and audits of our financial statements; (iii) our compliance with legal and regulatory requirements; (iv) the qualifications and independence of our independent auditors; (v) the performance of our internal audit function and independent auditors; and (vi) our overall risk exposure and management;

● Responsible for the appointment, retention, and termination of our independent auditors, and determines the compensation of our independent auditors;

● Reviews with the independent auditors the plans and results of the audit engagement;

● Evaluates the qualifications, performance, and independence of our independent auditors;

● Has sole authority to approve in advance all audit and non-audit services by our independent auditors, the scope and terms thereof, and the fees therefor;

● Reviews the adequacy of policies that govern risk exposure involving cybersecurity, data privacy, information technology, financial, legal, business continuity, regulatory, climate and sustainability risks;

● Reviews the adequacy of our internal accounting controls and oversees financial reporting activities;

● Reviews our cybersecurity efforts and cyber related risks; and

● Meets at least quarterly with our executive officers, internal audit staff, and our independent auditors in separate executive sessions.

| Chair Keith R. Guericke

Other Members Patricia L. Arvielo John P. Box James M. Lippman

2022 Meetings 6

Heightened Independence

The Board has determined that each Audit Committee member satisfies the heightened independence criteria for audit committee members under the NYSE rules.

Financial Literacy and Experts

The Board has determined that all Audit Committee members are financially literate and that each of Mr. Box, Mr. Guericke and Mr. Lippman meets the definition of “audit committee financial expert.” Other members of the Audit Committee also may be considered financial experts, but the Board has not so designated them. |

| Century Communities, Inc. – 2023 Proxy Statement | 21 |

Compensation Committee

Key Responsibilities and Activities

● Assists the Board in developing and evaluating potential candidates for executive officer positions and overseeing succession plans;

● Reviews, approves, and makes recommendations regarding compensation plans and administers all plans, including, the grant of equity-based awards to executive officers and employees;

● Reviews and approves corporate goals and objectives with respect to compensation for executive officers and, at least annually, evaluates each executive officer’s performance in light of such goals and objectives to set his or her annual compensation, including salary, bonus, and equity and non-equity incentive compensation;

● Reviews and approves executive employment, severance, change in control, retention, retirement, deferred compensation, perquisite, or similar compensatory agreements, plans, programs, or arrangements;

● Provides oversight of management’s decisions regarding the performance, evaluation, and compensation of other officers;

● Reviews incentive compensation arrangements to confirm that incentive pay does not encourage unnecessary risk-taking, and reviews and discusses, at least annually, the relationship between risk management policies and practices, business strategy, and our executive officers’ compensation;

● Oversees and reviews our culture and policies and strategies related to human capital management, including with respect to diversity and inclusion initiatives, pay equity, talent, recruitment and development, performance management and employee engagement; and

● Reviews and makes recommendations to the Board regarding all executive compensation related proposals and reviews the results of advisory stockholder votes on executive compensation and considers whether to recommend adjustments to our executive compensation policies and practices as a result of such votes and other stockholder input on executive compensation matters.

Compensation Consultant

The Compensation Committee has retained WealthPoint, LLC (WealthPoint) as its external compensation consultant. WealthPoint does not provide any services to the Company unrelated to executive or director compensation. | Chair James M. Lippman

Other Members Patricia L. Arvielo John P. Box Keith R. Guericke

2022 Meetings 5

Heightened Independence

The Board has determined that each Compensation Committee member satisfies the heightened independence criteria for compensation committee members under the NYSE rules. In addition, each Compensation Committee member is a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act.

|

| Century Communities, Inc. – 2023 Proxy Statement | 22 |

Nominating and Corporate Governance Committee

Key Responsibilities and Activities

● Identifies individuals qualified to become members of the Board and reviews with the Board on an annual basis the Board’s composition as a whole to ensure that it has the requisite and desired expertise, experience, qualifications, attributes and skills and that its membership consists of persons with sufficiently diverse and independent backgrounds, including female and racially/ethnically diverse candidates;

● Develops and recommends to the Board for its approval qualifications for director candidates and periodically reviews these qualifications with the Board;

● Makes recommendations to the Board regarding director diversity (which may include diversity of age, gender, race, ethnicity, education, skills, professional experience, knowledge, backgrounds and viewpoints), retirement age, tenure and refreshment policies;

● Reviews the committee structure of the Board and recommends directors to serve as members or chairs of each Board committee;

● Reviews and recommends Board committee slates annually and recommends committee members to fill vacancies;

● Develops and recommends to the Board a set of corporate governance guidelines and, at least annually, reviews such guidelines and recommends changes to the Board for approval as necessary;

● Considers and oversees corporate governance issues as they arise from time to time and develops appropriate recommendations for the Board;

● Reviews and monitors evolving corporate governance best practices and trends for consideration and incorporation into our governing documents, policies, and procedures;

● Reviews and recommends to the Board any responses to proposals submitted by stockholders;

● Reviews and approves our policies and practices pertaining to ESG issues and monitors our performance against relevant ESG indices; and

● Oversees the annual self-evaluations of the Board and each Board committee. | Chair John P. Box

Other Members Patricia L. Arvielo Keith R. Guericke James M. Lippman

2022 Meetings 4

|

| Century Communities, Inc. – 2023 Proxy Statement | 23 |

Board and Board Committee Meetings; Attendance

The Board held 6 meetings during 2022. All directors attended at least 75% of the combined total of (i) all Board meetings and (ii) all meetings of committees of the Board of which the director was a member during 2022. We expect all of our directors to attend our annual meeting of stockholders, and we customarily schedule a regular Board meeting on the same day as our annual meeting. All directors serving at the time of our 2022 Annual Meeting of Stockholders held on May 4, 2022 attended the meeting.

Director QUALIFICATIONS and Nominations Process

The Board seeks to ensure that the Board is composed of members whose particular expertise, experience, qualifications, attributes, and skills, when taken together, will allow the Board to satisfy its oversight responsibilities effectively. New directors are approved by the Board after recommendation by the Nominating and Corporate Governance Committee. In identifying candidates for director, the Nominating and Corporate Governance Committee and the Board take into account the following:

| ● | the comments and recommendations of Board members regarding the qualifications and effectiveness of the existing Board, or additional qualifications that may be required when selecting new Board members; |

| ● | the requisite expertise and sufficiently diverse backgrounds (which may include diversity of age, gender, race, ethnicity, education, skills, professional experience, knowledge, backgrounds and viewpoints) of the Board’s overall membership composition; |

| ● | the independence of outside directors and other possible conflicts of interest of existing and potential members of the Board; and |

| ● | any other factors they consider appropriate. |

As provided in its charter, the Nominating and Corporate Governance Committee is committed to including in its initial list of director candidates female and racially/ethnically diverse candidates and will require any third-party search consultants to include in their initial list of director candidates female and racially/ethnically diverse candidates. When considering whether directors and nominees have the expertise, experience, qualifications, attributes, and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Nominating and Corporate Governance Committee and the Board focuses primarily on the information discussed in each of the directors’ individual biographies.

The Nominating and Corporate Governance Committee will consider director candidates recommended to it by our stockholders. Those candidates must be qualified and exhibit the experience and expertise required of the Board’s own pool of candidates, as well as have an interest in our business, and demonstrate the ability to attend and prepare for Board, committee, and stockholder meetings. Any candidate must state in advance his or her willingness and interest in serving on the Board. Candidates should represent the interests of all stockholders and not those of a special interest group. The Nominating and Corporate Governance Committee will evaluate candidates recommended by stockholders using the same criteria it uses to evaluate candidates recommended by others as described above. A stockholder that desires to nominate a person for election to the Board at a meeting of stockholders must follow the specified advance notice requirements contained in, and provide the specific information required by, our Bylaws, as described under “Other Matters—Stockholder Proposals and Director Nominations for 2024 Annual Meeting of Stockholders” later in this proxy statement.

| Century Communities, Inc. – 2023 Proxy Statement | 24 |

BOARD REFRESHMENT AND BOARD DIVERSITY

The Board of Directors, including in particular the Nominating and Corporate Governance Committee, oversees board succession. To this end, at least once a year, in connection with the annual director nomination process, the Nominating and Corporate Governance Committee evaluates each director’s performance, relative strengths and weaknesses, and future plans, including any personal retirement objectives and the potential applicability of our director retirement policy. As part of that evaluation, the Nominating and Corporate Governance Committee also identifies areas of overall strength and weakness with respect to its composition and considers whether the Board of Directors as a whole possesses core competencies in the areas of accounting and finance, industry knowledge, management experience, sales and marketing, strategic vision, executive compensation, and corporate governance, among others.

The Board understands the importance of adding diverse, experienced talent to the Board in order to establish an array of experience and strategic views. In 2021, Board added a female first-generation Latina director when Patricia L. Arvielo was appointed. The Nominating and Corporate Governance Committee is committed to further diversifying the Board and as provided in its charter will include in its initial list of director candidates female and racially/ethnically diverse candidates and will require any third-party search consultants to include in their initial list of director candidates female and racially/ethnically diverse candidates. The Nominating and Corporate Governance Committee is committed to refreshment efforts to ensure that the composition of the Board and each of its committees encompasses a wide range of perspectives and knowledge in order to promote the success of our business and represent stockholder interests. In addition to gender, racial/ethnic and demographic diversity, we also recognize the value of other diverse attributes that directors may bring to our Board, including veterans of the U.S. military. Of our six current directors, two are military veterans.

| Century Communities, Inc. – 2023 Proxy Statement | 25 |

MANAGEMENT SUCCESSION PLAnning and development

The Board of Directors recognizes that one of its most important responsibilities is to ensure excellence and continuity in our senior leadership by overseeing the development of executive talent and planning for the effective succession of our Co-Chief Executive Officers and the other members of our management team. This responsibility is reflected in the Company’s Corporate Governance Guidelines, which provide for a review of CEO succession planning and management development, and the charter of the Compensation Committee, which requires the Compensation Committee to assist the Board in developing and evaluating potential candidates for executive officer positions and overseeing the development of executive succession plans, which includes transitional leadership in the event of an unplanned vacancy.

In furtherance of the foregoing, the Co-Chief Executive Officers provide an annual succession planning report to the Compensation Committee, which summarizes the overall composition of our senior leadership team, including their professional qualifications, tenure, and work experience. The report also identifies internal members of the management team who are viewed as potential successors to the Co-Chief Executive Officers. Succession planning is also regularly discussed in executive sessions of the Board of Directors. Our directors become familiar with internal potential successors for key leadership positions through various means, including the annual succession planning report and Board of Directors and committee meetings, and less formal interactions throughout the course of the year.

ANNUAL BOARD AND COMMITTEE SELF-EVALUATIONS

The Board recognizes that a thorough evaluation process is an important element of corporate governance and enhances the effectiveness of the full Board and each committee. Therefore, it is our policy to conduct annual Board and committee self-evaluations. Each year, the Nominating and Corporate Governance Committee oversees the evaluation process to ensure that the full Board and each committee conduct an assessment of their performance and solicit feedback for areas of improvement. Evaluations include a variety of survey questions to which directors assign a score. Additional feedback from directors is sought as well. The evaluation results are then aggregated and shared with and discussed by the full Board and each committee.

board Oversight OF BUSINESS STRATEGY

The Board of Directors oversees our strategic direction and business activities. Throughout the year, the Board and management discuss our short and long-term business strategy. As part of our long-term strategy, management typically formulates three-year financial targets against which performance is reviewed by the Board.

With respect to our short-term strategy, at the beginning of each year, our management presents to the Board a proposed annual business plan for the year and receives input from the Board and a final annual business plan is approved by the Board. At each subsequent regular board meeting, the Board reviews our operating and financial performance relative to the annual business plan.

| Century Communities, Inc. – 2023 Proxy Statement | 26 |

board role in Risk Oversight

Risk is inherent with every business. We face a number of risks, including financial (accounting, credit, interest rate, liquidity, and tax), operational, political, strategic, regulatory, compliance, legal, cybersecurity, competitive, and reputational risks.

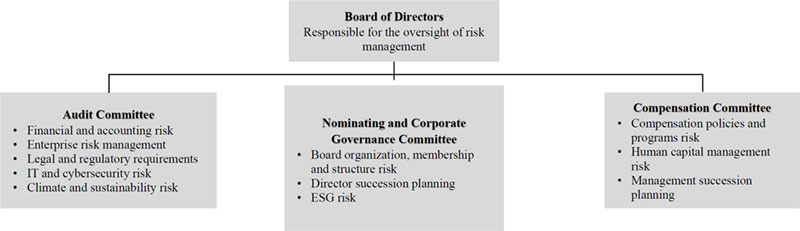

Our management is responsible for the day-to-day management of risks faced by us, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board ensures that the risk management processes designed and implemented by management are adequate and functioning as designed. The Board oversees risks through the establishment of policies and procedures that are designed to guide daily operations in a manner consistent with applicable laws, regulations, and risks acceptable to us. Our Co-Chief Executive Officers are members of the Board and regularly attend Board meetings and discuss with the Board the strategies and risks facing our Company.

One of the key functions of the Board is informed oversight of our risk management process. The Board administers this oversight function directly, with support from its three standing committees (the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee), each of which addresses risks specific to its respective areas of oversight. In addition, with respect to other risks that arise from time to time, the Board oversees those as well.

board role in cybersecurity risk Oversight

Information security is the responsibility of our Information Security team, overseen by our Chief Information Security Officer. We leverage the National Institute of Standards and Technology (NIST) Cybersecurity Framework to measure our security posture, deliver risk management and provide effective security controls.

Our information security practices include development, implementation, and improvement of policies and procedures to safeguard information and ensure availability of critical data and systems. Our Information Security team conducts annual information security awareness training for employees involved in our systems and processes that handle customer data and audits of our systems and enhanced training for specialized personnel. Our program further includes review and assessment by external, independent third-parties, who assess and report on our internal incident response preparedness and help identify areas for continued focus and improvement.

As set forth in its charter, our Audit Committee, comprised fully of independent directors, is responsible for oversight of risk, including cybersecurity and information security risk. At least semi-annually, the Audit Committee is responsible for reviewing and discussing with management our risk exposures related to our IT systems and data privacy. These management updates are designed to inform the Audit Committee of any potential risks related to our IT systems and data privacy, as well as any relevant mitigation or remediation tactics being implement. During 2022, the Audit Committee engaged a third party service provider to provide a seasoned CISO-level advisor to assist our technology teams and business leadership with strengthening our security systems and improve our cyber readiness, as well as on existing and emerging threat landscapes.

| Century Communities, Inc. – 2023 Proxy Statement | 27 |

In addition to managing our internal information security risk programs, we maintain cyber risk insurance as part of our risk mitigation efforts. Our insurance covers situations arising from, among other things, cyber related breaches and interruptions in the business continuity of our computing environment as well as certain coverage for under-insured third parties with whom we may be engaged. These policies are annually reviewed by industry underwriters at which time our security practices, programs, processes, and procedures are thoroughly disclosed, reviewed and evaluated for purposes of determining our insurability.

We have not experienced any computer data security breaches in the past three years as a result of a compromise of our information systems.

board role in ESG and Climate risk Oversight

The Board is ultimately responsible for oversight of our “ESG” initiatives. The Nominating and Corporate Governance Committee has been delegated responsibility for ESG oversight and approves our ESG related policy statements and our ESG report. We intend to publish an updated report later this year and to do so on an annual basis going forward. The Compensation Committee has oversight of human capital management as well as our diversity, equity and inclusion initiatives. The Audit Committee has oversight over general compliance with laws, applicable laws, including SEC and those affecting ESG issues, as well as risk management and climate-related and sustainability risks. In carrying out its responsibilities for ESG oversight, the Nominating and Corporate Governance Committee coordinates with the Compensation Committee and the Audit Committee on ESG-related subjects.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics that applies to our officers, directors, and employees. Among other matters, our Code of Business Conduct and Ethics is designed to deter wrongdoing and to promote the following:

| ● | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest; |

| ● | full, fair, accurate, timely, and understandable disclosure in our communications with and reports to our stockholders, including reports filed with the SEC, and other public communications; |

| ● | compliance with applicable governmental laws, rules, and regulations; |

| ● | prompt internal reporting of violations of the code to appropriate persons identified in the code; and |

| ● | accountability for adherence to our Code of Business Conduct and Ethics. |

Any waiver of our Code of Business Conduct and Ethics may be made only by the Nominating and Corporate Governance Committee and will be promptly disclosed as required by law and NYSE rules. We intend to satisfy the disclosure requirements of Item 5.05 of Form 8-K and applicable NYSE rules regarding amendments to or waivers from any provision of our Code of Business Conduct and Ethics by posting such information in the “Discover Century—Investors—Corporate Governance—Governance Documents” section of our website located at www.centurycommunities.com.

| Century Communities, Inc. – 2023 Proxy Statement | 28 |

Complaint Procedures

We maintain procedures to receive, retain, and treat complaints regarding accounting, internal accounting controls, or auditing matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. A 24-hour, toll-free, confidential ethics hotline and a confidential web-based reporting tool are available for the submission of concerns regarding these and other matters by any employee. Concerns and questions received through these methods relating to accounting, internal accounting controls, or auditing matters are promptly brought to the attention of the Chair of the Audit Committee and are handled in accordance with procedures established by the Audit Committee. Complete information regarding our complaint procedures is contained within our Code of Business Conduct and Ethics, which is described above and may be accessed on our website as noted above.

STOCKHOLDER ENGAGEMENT

We are committed to a robust and proactive stockholder engagement program. The Board values the perspectives of our stockholders, and feedback from stockholders on our business, corporate governance, executive compensation, and sustainability practices are important considerations for Board discussions throughout the year.

During 2022, our executives held approximately 175 meetings with stockholders, including all of our top 10 stockholders that are actively managed funds. Stockholder feedback is thoughtfully considered and has led to modifications in our executive compensation program, governance practices and disclosures.

Some of the actions we have taken in response to feedback over the last several years are described below.

| What We Heard | What We Did |

| Increase stockholder influence over director elections. | We adopted a majority vote standard for uncontested director elections, with a director resignation policy, instead of a plurality vote standard. |

| Increase Board gender diversity. | We added Patricia L. Arvielo to the Board of Directors in the beginning of 2021 and have committed to including female candidates in our initial list of director candidates in future searches. |

| Increase Board racial/ethnic diversity. | We considered racial/ethnic diversity in our 2021 search for a new director and have committed to including racially/ethnically diverse candidates in our initial list of director candidates in future searches. Patricia L. Arvielo is a first-generation Latina. |

| Align the interest of directors and executive officers with those of stockholders. | We adopted stock ownership and retention guidelines applicable to our directors and NEOs to ensure that their interests would be closely aligned with those of our stockholders. All of our directors and NEOs are in compliance with our stock ownership guidelines.

We also adopted an anti-hedging/pledging policy.

Dale Francescon and Robert J. Francescon beneficially own 6.0% and 5.0%, respectively, of our outstanding common stock, and together beneficially own 11.0% of our outstanding common stock.

|

| Century Communities, Inc. – 2023 Proxy Statement | 29 |

| What We Heard | What We Did |

| Emphasize long-term incentives. | Our long-term incentive program provides for significant LTI opportunities for our executives, which for 2022 constituted 53% of our Co-Chief Executive Officer target total direct compensation and 47% for our Chief Financial Officer, and comprised of 100% performance share unit awards, which have a three-year performance period and then a one-year holding period on the shares issued in settlement of the PSU awards. |

| Emphasize performance-based compensation elements. | 89% of our Co-CEO target compensation and 85% of our CFO target compensation for 2022 is performance-based compensation. |

| Increase disclosure on corporate governance and executive compensation. | Each year, we have increased and improved our corporate governance and executive compensation disclosure, with an eye towards transparency and readability. |

| Ensure the recovery of incentive compensation based on incorrect calculations that resulted in a financial restatement. | We adopted a robust clawback policy covering cash and equity incentive compensation applicable to current and former executives. |

Communications with the Board of Directors

The Board maintains a process for stockholders and interested parties to communicate with the Board. Stockholders and interested parties may contact our Board as provided below:

|  |  |  |

| WRITE | CALL | ATTEND | |

Corporate Secretary Century Communities, Inc. 8390 E. Crescent Pkwy. Suite 650 Greenwood Village, CO 80111 | Investor Relations 303-268-8398

| investorrelations@ centurycommunities.com

| Annual Meeting of Stockholders Wednesday, May 3, 2023 Hyatt Regency Denver Tech Center |

Management will initially receive and process communications before forwarding them to the addressee(s). We generally will not forward to the directors a communication that is primarily commercial in nature, relates to an improper or irrelevant topic, or requests general information about the Company.

CommITTEE CHARTERS AND OTHER INFORMATION

The charters of all three of our standing Board committees, Corporate Governance Guidelines and Code of Business Conduct and Ethics are available in the “Discover Century—Investors—Corporate Governance—Governance Documents” section of our website located at www.centurycommunities.com. The Board reviews each of these documents on an annual basis. Printed copies of any of these documents are available upon written request to Century Communities, Inc., 8390 East Crescent Parkway, Suite 650, Greenwood Village, Colorado 80111, Attention: Corporate Secretary.

| Century Communities, Inc. – 2023 Proxy Statement | 30 |

EXECUTIVE OFFICERS

We have three executive officers: Dale Francescon, Robert J. Francescon, and David L. Messenger. Below is information regarding our executive officers as of March 9, 2023. There are no family relationships among any of our executive officers or directors, except for Dale Francescon and Robert J. Francescon, who are brothers.

Century has been jointly led by our Co-Chief Executive Officers since our founding in 2002. The Board of Directors views this executive structure as optimal for our Company and not a temporary, transitional or duplicative arrangement. Our Co-Chief Executive Officers were the two founders of Century and share an aligned vision for the tone, direction and growth of the Company.

| Chairman of the Board and Co-Chief Executive Officer Dale Francescon has served as: ● Co-Chief Executive Officer since August 2002 and ● Chairman of the Board since April 2013.

Mr. Dale Francescon possesses a broad background in all facets of operating a real estate company and has had direct responsibility for the acquisition, financing, development, construction, sale, and management of various residential projects, including land development, single-family homes, townhomes, condominiums, and apartments. He has successfully managed the Company, through successive profitable years, in various economic cycles, from inception in August 2002 to the present.

Mr. Dale Francescon is licensed in the state of California as an attorney (inactive) and as a certified public accountant (inactive).

Mr. Dale Francescon received his B.S. in Business Administration from the University of Southern California and a J.D. from Loyola University School of Law. | |

| Dale | ||

| Francescon | ||

| Age 70 | ||

| Co-Chief Executive Officer and President Robert J. Francescon has served as: ● Co-Chief Executive Officer since August 2002 ● President since April 2013; and ● Board member since April 2013.

Mr. Robert Francescon possesses a broad background in all facets of operating a real estate company, and has had direct responsibility for the acquisition, financing, development, architecture, construction, sale and management of various residential projects including land development, single-family homes, townhomes, condominiums and apartments. He has successfully managed the Company, through successive profitable years, in various economic cycles, from inception in August 2002 to the present.

Mr. Robert Francescon also has management experience working in a variety of financial institutions, including thrifts and the Federal Home Loan Mortgage Corporation.

Mr. Robert Francescon received his B.S. in Business Administration from the University of Southern California. | |

| Robert J. | ||

| Francescon | ||

| Age 65 | ||

| Century Communities, Inc. – 2023 Proxy Statement | 31 |

| Chief Financial Officer David L. Messenger has served as our Chief Financial Officer since June 2013.

Mr. Messenger has extensive experience in finance and accounting for real estate companies. His direct responsibilities are overseeing all accounting, finance, capital markets, risk management, and financial planning and analysis.

Prior to Century, Mr. Messenger was at UDR, Inc. (a publicly traded multifamily real estate investment trust) and held the following positions: ● Independent Consultant from June 2012 to February 2013; and ● Chief Financial Officer from August 2002 to May 2012.

Mr. Messenger is licensed in the State of Virginia as a certified public accountant (inactive) and is a member of the American Institute of Certified Public Accountants and the Virginia Society of Certified Public Accountants.

Mr. Messenger received a B.B.A. and M.A. in Accounting from the University of Iowa. | |

| David L. | ||

| Messenger | ||

| Age 52 | ||

| Century Communities, Inc. – 2023 Proxy Statement | 32 |

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

Board Size and Structure

Our Bylaws provide that the Board of Directors shall consist of one or more members, with the number to be determined from time to time by the Board. The Board has fixed the number of directors at six, and we currently have six directors serving on the Board.

Each director holds office for a term of one year or until his or her successor is duly elected and qualified, subject to his or her earlier death, resignation, disqualification, or removal.

Current Directors and Board Nominees

The Board currently consists of the following six members:

| Name | Age | Position with the Company |

| Dale Francescon | 70 | Chairman of the Board and Co-Chief Executive Officer |