1 FISCAL 2016 Q1 PERFORMANCE April 27, 2016

2 CAUTIONARY STATEMENTS Forward-Looking Statements Certain statements in this presentation may be considered forward-looking statements. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations, including, but not limited to, various factors beyond management's control adversely affecting discretionary spending, membership count and facility usage and other risks, uncertainties and factors set forth in the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in the Company's Annual Report on Form 10-K for the fiscal year ended December 29, 2015 and its Quarterly Report on Form 10- Q for the period ended March 22, 2016. Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company undertakes no duty to update these forward-looking statements. Non-GAAP Financial Measures In our presentation, we may refer to certain non-GAAP financial measures. To the extent we disclose non-GAAP financial measures, please refer to footnotes where presented on each page of this presentation or to the appendix found at the end of this presentation for a reconciliation of these measures to what we believe are the most directly comparable measure evaluated in accordance with generally accepted accounting principles in the U.S. (“GAAP”). The Company has not reconciled Adjusted EBITDA guidance in this presentation to the most directly comparable GAAP measure because this cannot be done without unreasonable effort.

3 BUSINESS OVERVIEW

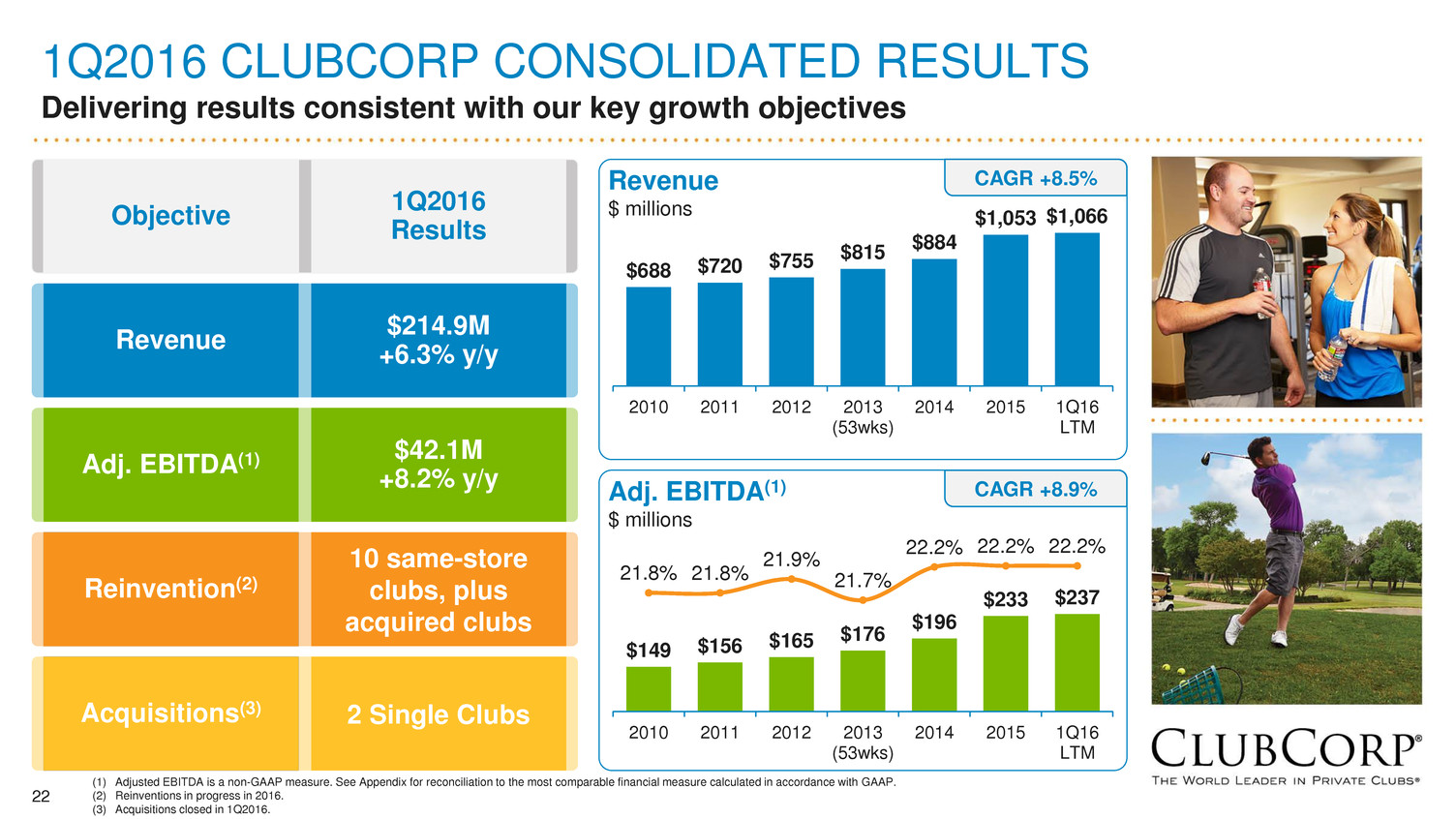

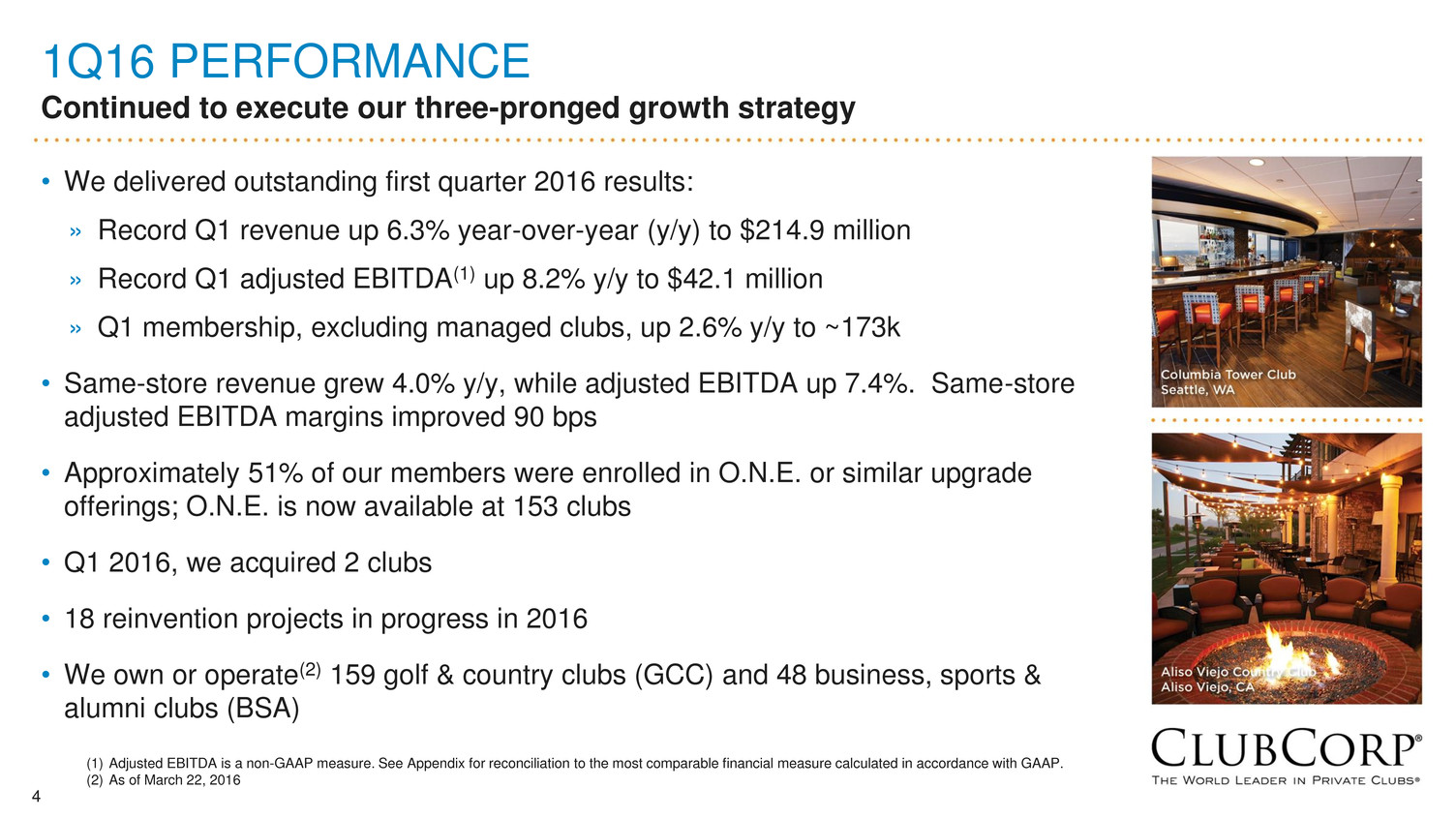

4 1Q16 PERFORMANCE Continued to execute our three-pronged growth strategy • We delivered outstanding first quarter 2016 results: » Record Q1 revenue up 6.3% year-over-year (y/y) to $214.9 million » Record Q1 adjusted EBITDA(1) up 8.2% y/y to $42.1 million » Q1 membership, excluding managed clubs, up 2.6% y/y to ~173k • Same-store revenue grew 4.0% y/y, while adjusted EBITDA up 7.4%. Same-store adjusted EBITDA margins improved 90 bps • Approximately 51% of our members were enrolled in O.N.E. or similar upgrade offerings; O.N.E. is now available at 153 clubs • Q1 2016, we acquired 2 clubs • 18 reinvention projects in progress in 2016 • We own or operate(2) 159 golf & country clubs (GCC) and 48 business, sports & alumni clubs (BSA) (1) Adjusted EBITDA is a non-GAAP measure. See Appendix for reconciliation to the most comparable financial measure calculated in accordance with GAAP. (2) As of March 22, 2016

5 WHY INVEST IN CLUBCORP? Predictable and stable dues-based membership business resilient to swings in economy, weather and daily fee golf trends Operate clubs in economically stable neighborhoods superior demographics tied to mass affluent consumer Our clubs are located in in-fill locations high barriers to entry with few local competitors Differentiated leisure product that resonates with today’s lifestyles multi-faceted clubs with spectrum of leisure and social activities that appeal to entire family Efficient club operator with scope, scale and expertise lower operating expenses and lower maintenance Capex requirements Solid organic growth & attractive returns on expansion capital unique opportunities for additional growth via reinvention and acquisition Generate significant FCF & strong balance sheet no near term maturities and ample liquidity to fund our growth strategies for multiple years

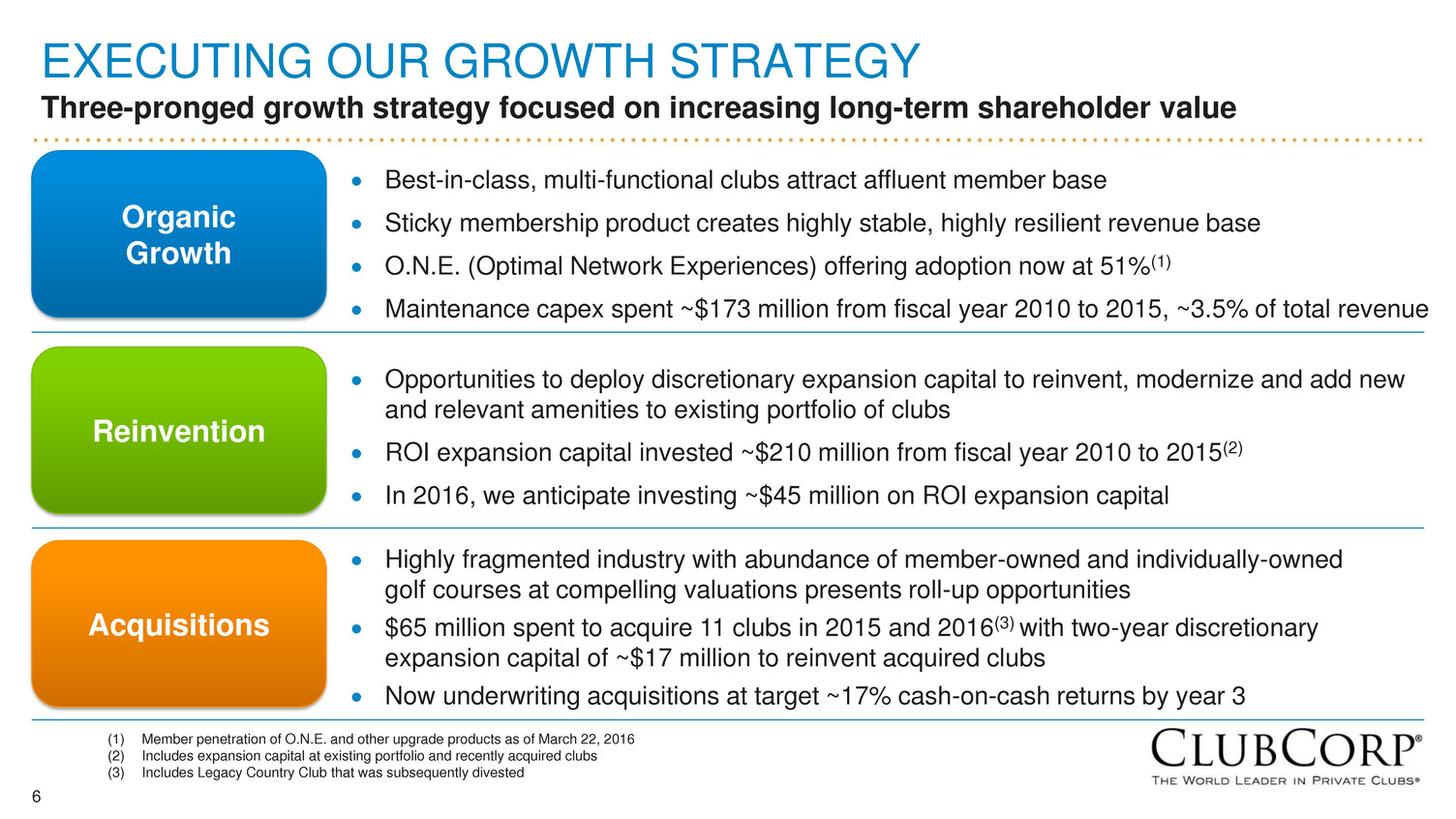

6 EXECUTING OUR GROWTH STRATEGY Three-pronged growth strategy focused on increasing long-term shareholder value Organic Growth Best-in-class, multi-functional clubs attract affluent member base Sticky membership product creates highly stable, highly resilient revenue base O.N.E. (Optimal Network Experiences) offering adoption now at 51%(1) Maintenance capex spent ~$173 million from fiscal year 2010 to 2015, ~3.5% of total revenue Reinvention Highly fragmented industry with abundance of member-owned and individually-owned golf courses at compelling valuations presents roll-up opportunities $65 million spent to acquire 11 clubs in 2015 and 2016(3) with two-year discretionary expansion capital of ~$17 million to reinvent acquired clubs Now underwriting acquisitions at target ~17% cash-on-cash returns by year 3 Acquisitions (1) Member penetration of O.N.E. and other upgrade products as of March 22, 2016 (2) Includes expansion capital at existing portfolio and recently acquired clubs (3) Includes Legacy Country Club that was subsequently divested Opportunities to deploy discretionary expansion capital to reinvent, modernize and add new and relevant amenities to existing portfolio of clubs ROI expansion capital invested ~$210 million from fiscal year 2010 to 2015(2) In 2016, we anticipate investing ~$45 million on ROI expansion capital

7 ORGANIC GROWTH

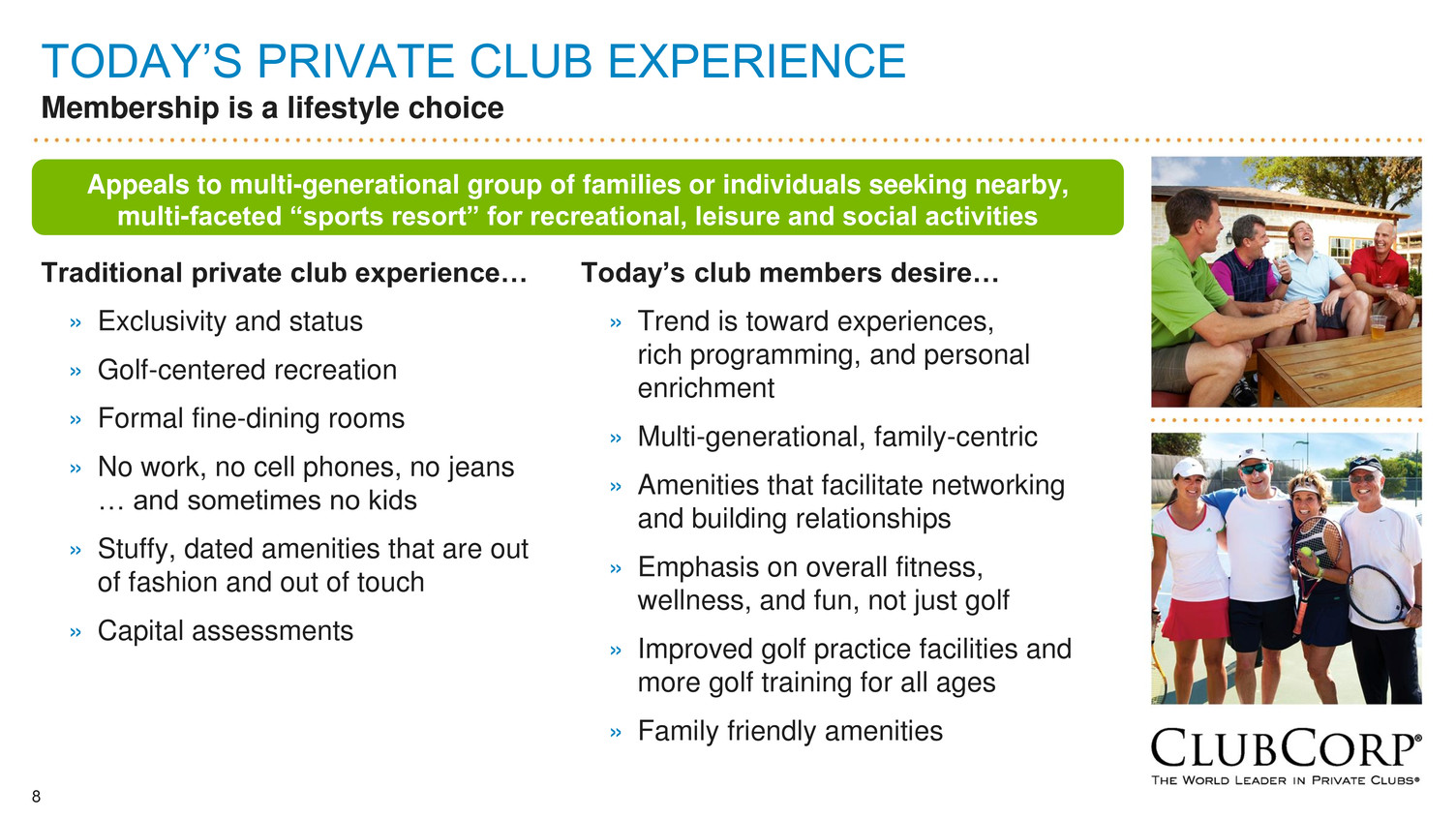

TODAY’S PRIVATE CLUB EXPERIENCE Membership is a lifestyle choice Appeals to multi-generational group of families or individuals seeking nearby, multi-faceted “sports resort” for recreational, leisure and social activities Traditional private club experience… » Exclusivity and status » Golf-centered recreation » Formal fine-dining rooms » No work, no cell phones, no jeans … and sometimes no kids » Stuffy, dated amenities that are out of fashion and out of touch » Capital assessments Today’s club members desire… » Trend is toward experiences, rich programming, and personal enrichment » Multi-generational, family-centric » Amenities that facilitate networking and building relationships » Emphasis on overall fitness, wellness, and fun, not just golf » Improved golf practice facilities and more golf training for all ages » Family friendly amenities 8

THE CLUBCORP ADVANTAGE The ClubCorp Network … delivers superior and differentiated value proposition ClubCorp Membership Benefits… » We give you access to our network » We focus on building relationships and enriching lives » We welcome families » We offer unrivaled golf and dining benefits » We invest in our clubs » We don’t assess members for capital improvements » We enhance the club experience with technology » We host the best events » We bring you unique experiences O.N.E. (Optimal Network Experiences) My Club Benefits at home club » 50% off á la carte dining at home club(1) My Community Benefits at clubs in your local area » Preferred access and golf benefits at local Country clubs » Preferred access and dining benefits at local Business clubs » Private invitations to HUB special events My World Benefits when you travel » 2 free rounds of golf per golf & country club, per month(1) » 2 free meals per business club, per month(1) » Access and special offerings or discounts to more than 300 private and public clubs and over 1,000 alliance partners (1) Restrictions apply9

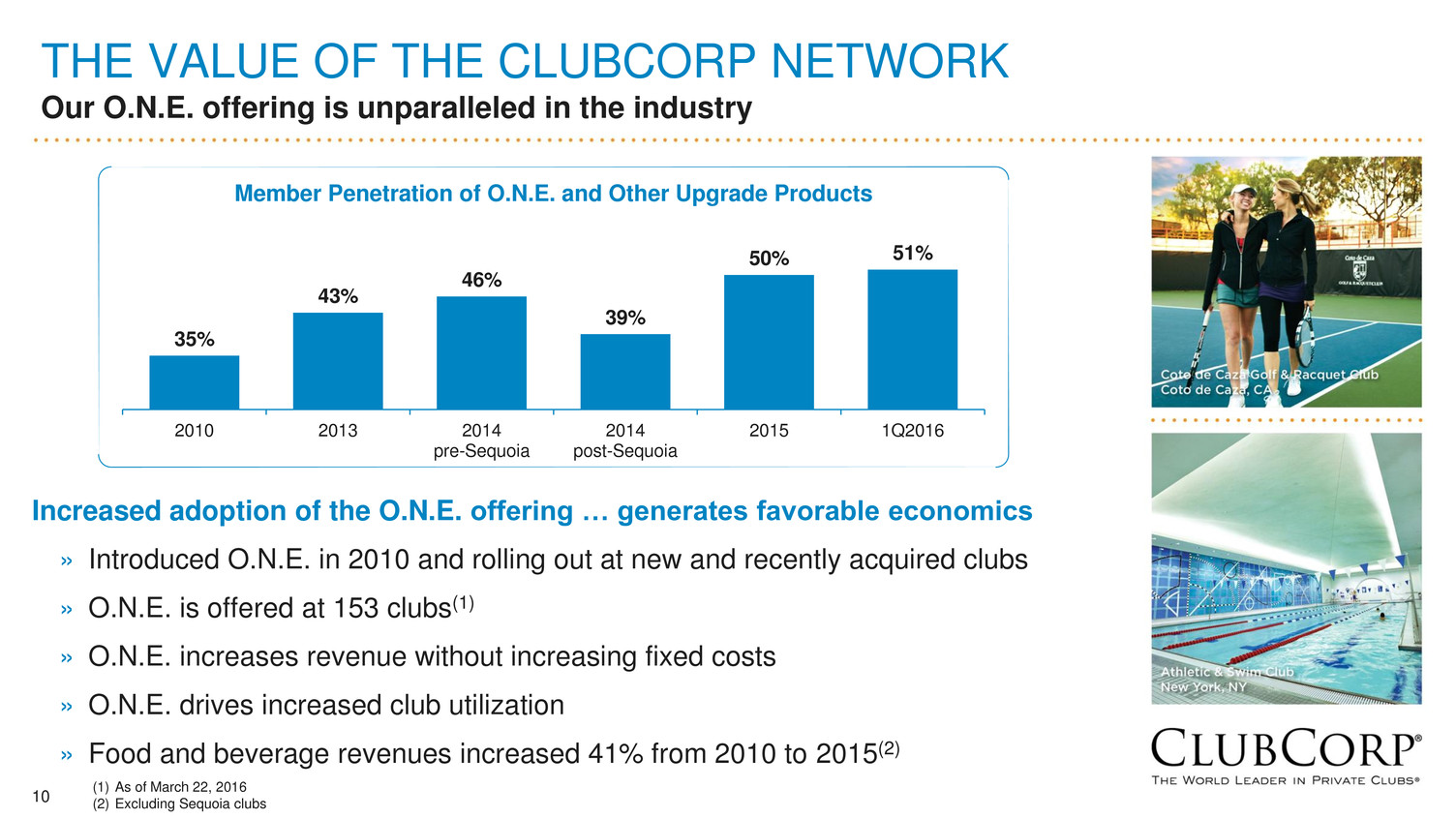

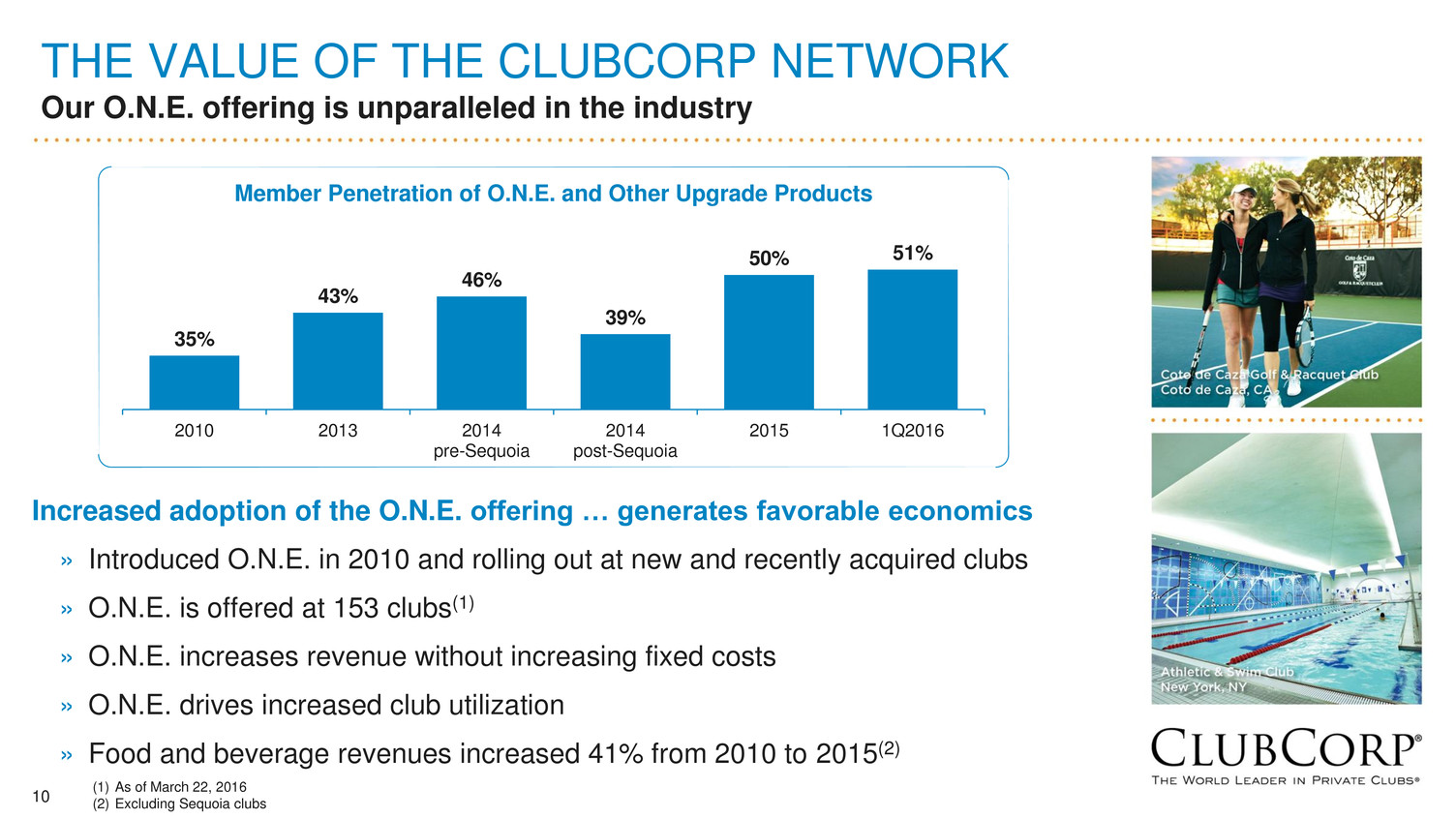

10 THE VALUE OF THE CLUBCORP NETWORK Our O.N.E. offering is unparalleled in the industry Increased adoption of the O.N.E. offering … generates favorable economics » Introduced O.N.E. in 2010 and rolling out at new and recently acquired clubs » O.N.E. is offered at 153 clubs(1) » O.N.E. increases revenue without increasing fixed costs » O.N.E. drives increased club utilization » Food and beverage revenues increased 41% from 2010 to 2015(2) 35% 43% 46% 39% 50% 51% 2010 2013 2014 pre-Sequoia 2014 post-Sequoia 2015 1Q2016 (1) As of March 22, 2016 (2) Excluding Sequoia clubs Member Penetration of O.N.E. and Other Upgrade Products

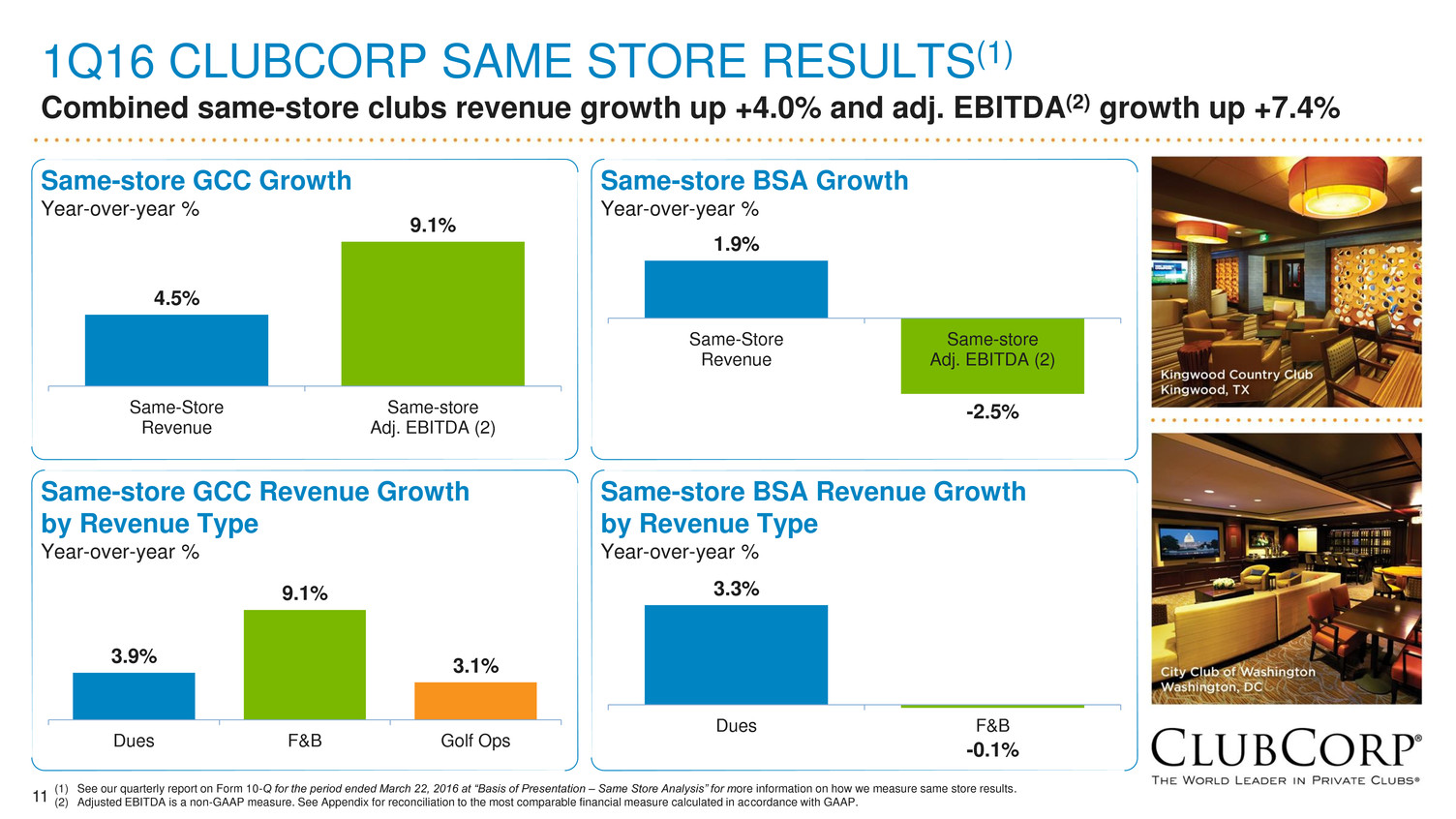

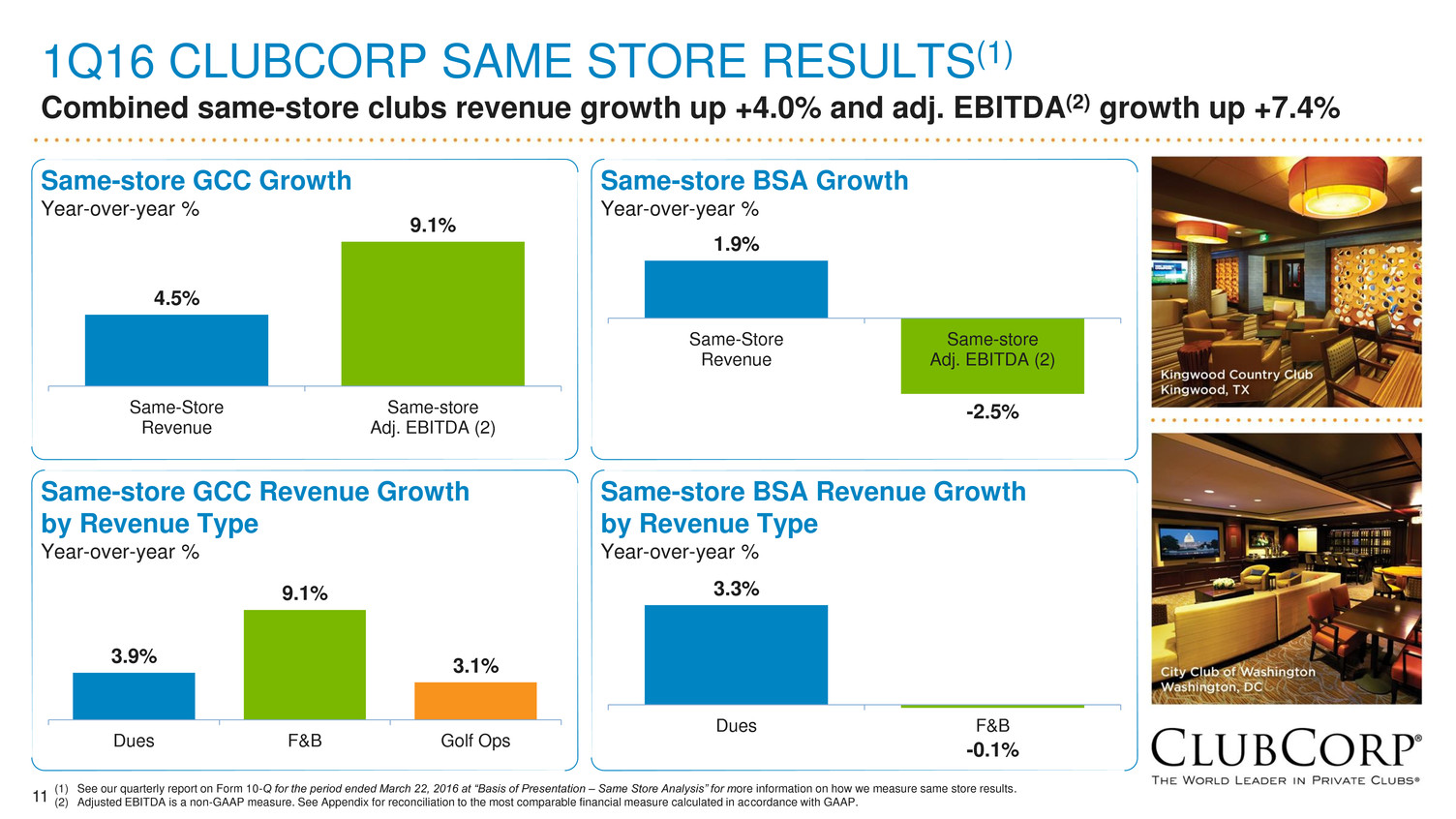

11 1Q16 CLUBCORP SAME STORE RESULTS(1) Combined same-store clubs revenue growth up +4.0% and adj. EBITDA(2) growth up +7.4% 4.5% 9.1% Same-Store Revenue Same-store Adj. EBITDA (2) Same-store GCC Growth Year-over-year % (1) See our quarterly report on Form 10-Q for the period ended March 22, 2016 at “Basis of Presentation – Same Store Analysis” for more information on how we measure same store results. (2) Adjusted EBITDA is a non-GAAP measure. See Appendix for reconciliation to the most comparable financial measure calculated in accordance with GAAP. 1.9% -2.5% Same-Store Revenue Same-store Adj. EBITDA (2) Same-store BSA Growth Year-over-year % 3.9% 9.1% 3.1% Dues F&B Golf Ops Same-store GCC Revenue Growth by Revenue Type Year-over-year % 3.3% -0.1% Dues F&B Same-store BSA Revenue Growth by Revenue Type Year-over-year %

12 REINVENTION

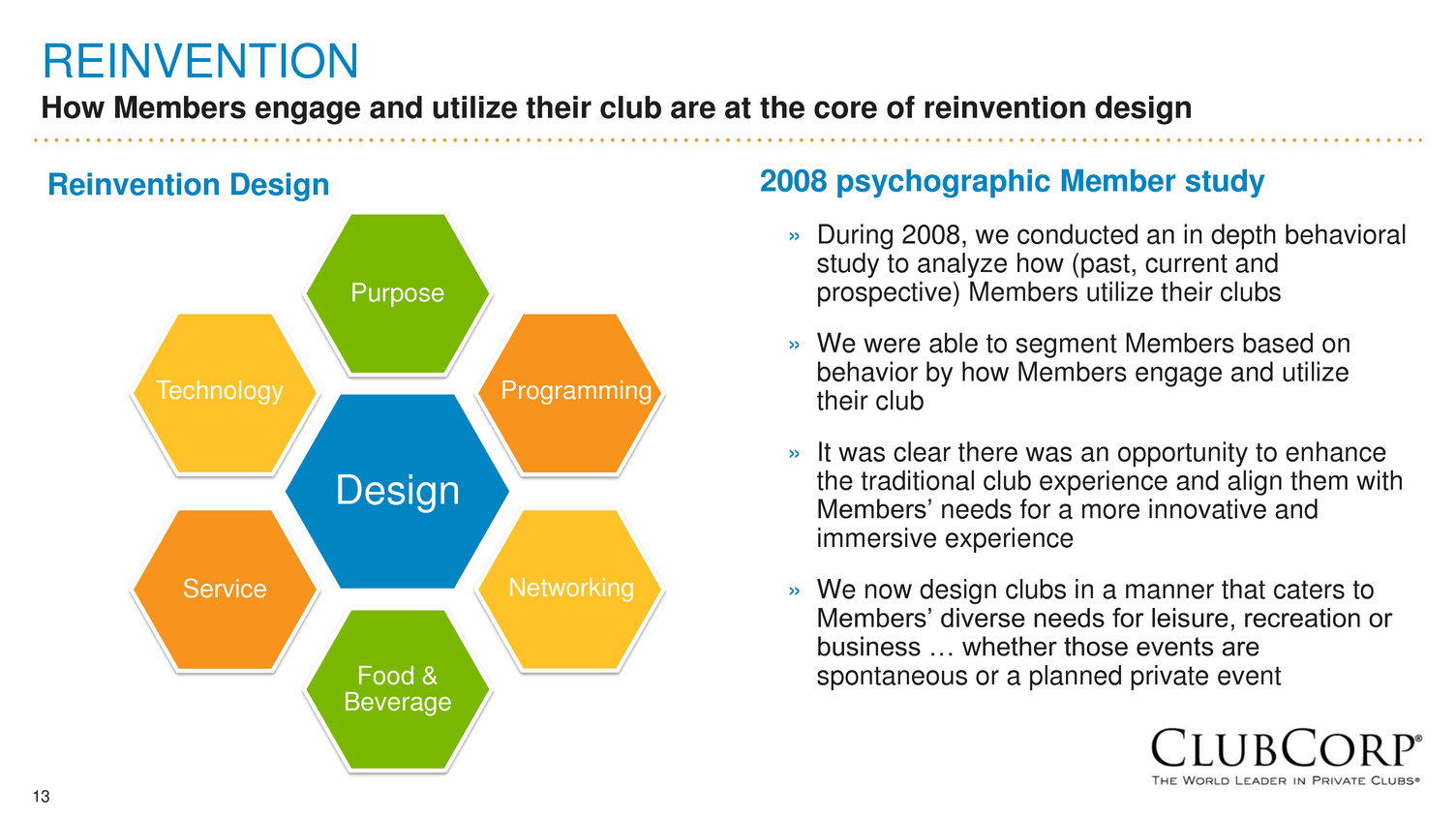

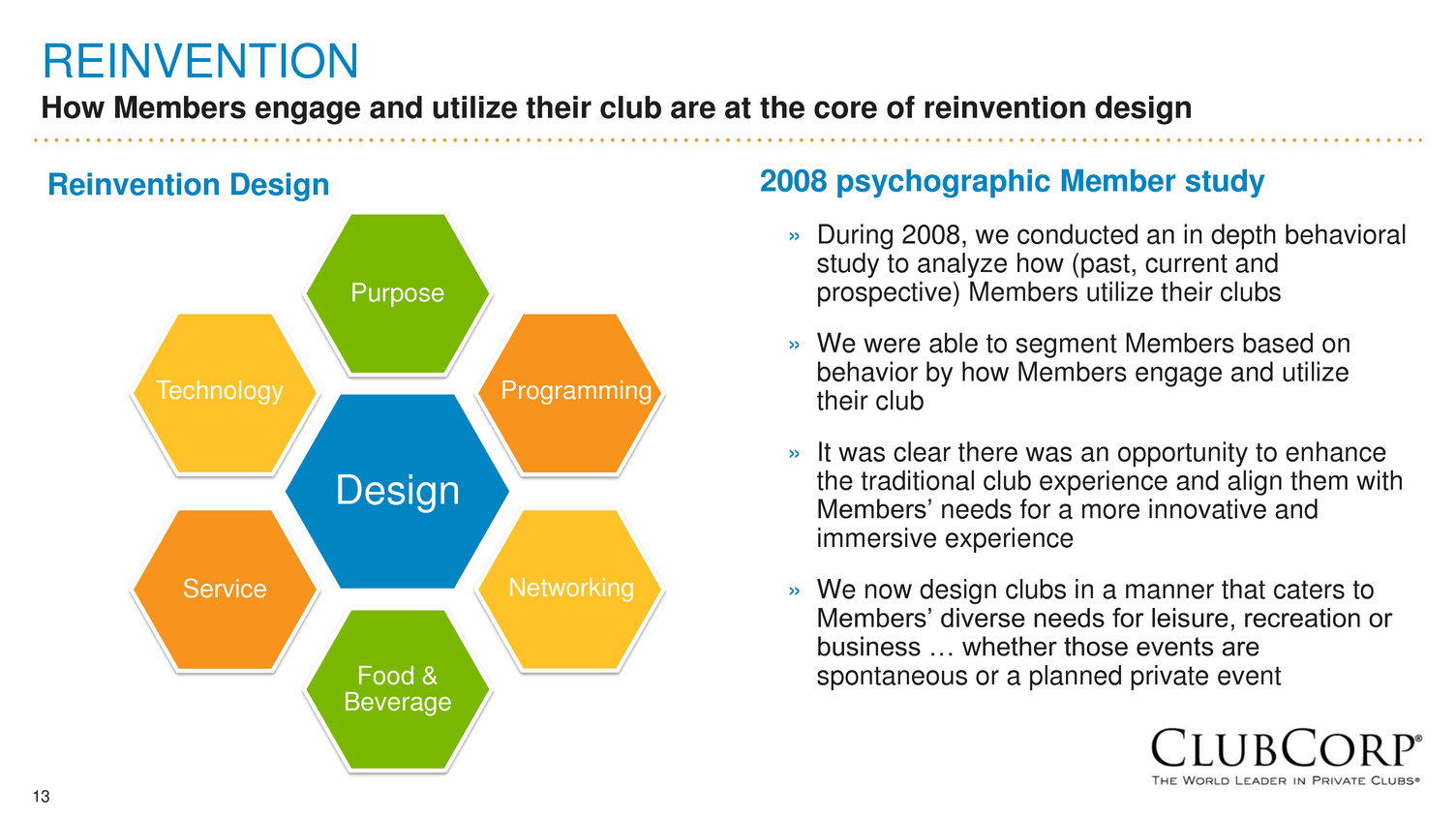

REINVENTION How Members engage and utilize their club are at the core of reinvention design Design Purpose Food & Beverage Service Programming Networking Technology 2008 psychographic Member study » During 2008, we conducted an in depth behavioral study to analyze how (past, current and prospective) Members utilize their clubs » We were able to segment Members based on behavior by how Members engage and utilize their club » It was clear there was an opportunity to enhance the traditional club experience and align them with Members’ needs for a more innovative and immersive experience » We now design clubs in a manner that caters to Members’ diverse needs for leisure, recreation or business … whether those events are spontaneous or a planned private event Reinvention Design 13

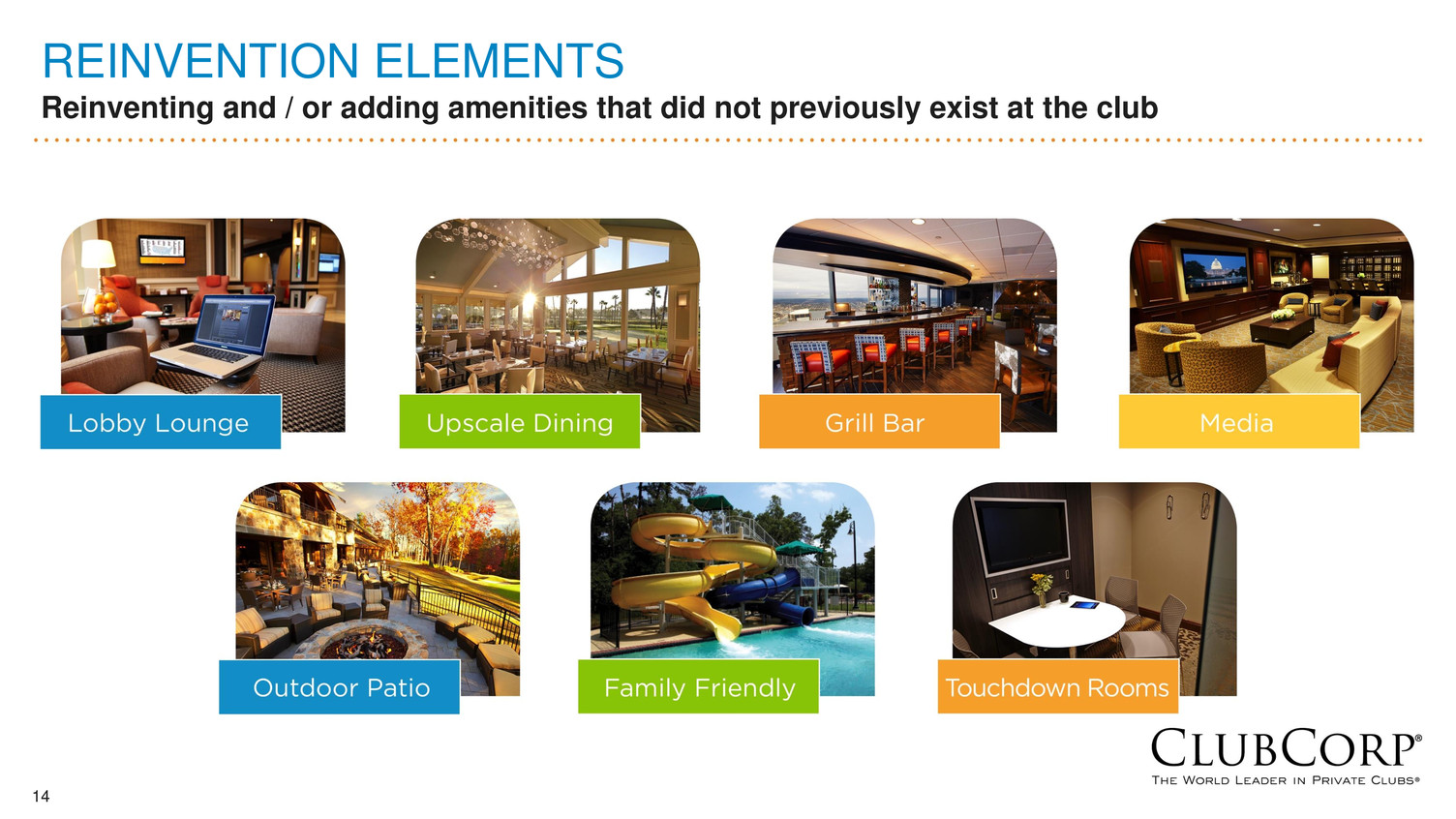

14 REINVENTION ELEMENTS Reinventing and / or adding amenities that did not previously exist at the club

15

16

17

18 ACQUISITIONS

ACQUISITION STRATEGY Scope, scale and expertise to successfully acquire and consolidate fragmented industry Successful acquisitions = sourcing strategy + post−acquisition synergies Sourcing… » Population density within a 10-15 mile radius » Affluence within 10-15 mile radius » Existing membership and revenue base » Other intangibles: ─ Undermanaged ─ Undercapitalized ─ Unnatural owner (lender, developer, equity clubs) Post-acquisition synergies… » Introduce ClubCorp leadership familiar with ClubCorp standards » Apply ClubCorp economies of scale ─ Avendra procurement ─ Adopt ClubCorp menu mgmt ─ Largest purchaser of turf equipment and golf carts » Immediately invest in reinvention » Introduce O.N.E. product – unmatched portfolio advantage » Invest in new member programming 19

20 2015 & 2016 ACQUISITIONS Eleven new properties added since 2015, more than 3x our next closest competitor Bernardo Heights Country Club, San Diego, CA Marsh Creek Country Club, St. Augustine, FL 2016 Acquisitions » Santa Rosa Country Club, Santa Rosa, California – 18-hole, private » Marsh Creek Country Club, St. Augustine, Florida – 18-hole, private 2015 Acquisitions » Bernardo Heights Country Club, San Diego, California – 18-hole, private » Bermuda Run Country Club, Bermuda Run, North Carolina – 36-holes, private » Brookfield Country Club, Roswell, Georgia – 18-hole, private » Firethorne Country Club, Marvin, North Carolina – 18-hole, private » Ford's Colony Country Club, Williamsburg, Virginia – 54-holes, semi-private » Legacy Golf Club at Lakewood Ranch, Bradenton, Florida – 18-hole, public (subsequently divested) » Temple Hills Country Club, Franklin, Tennessee – 27-holes, private » Rolling Green Country Club, Arlington Heights, Illinois – 18-hole, private » Ravinia Green Country Club, Riverwoods, Illinois – 18-hole, private Santa Rosa Country Club, Santa Rosa, CA

21 FINANCIAL OVERVIEW

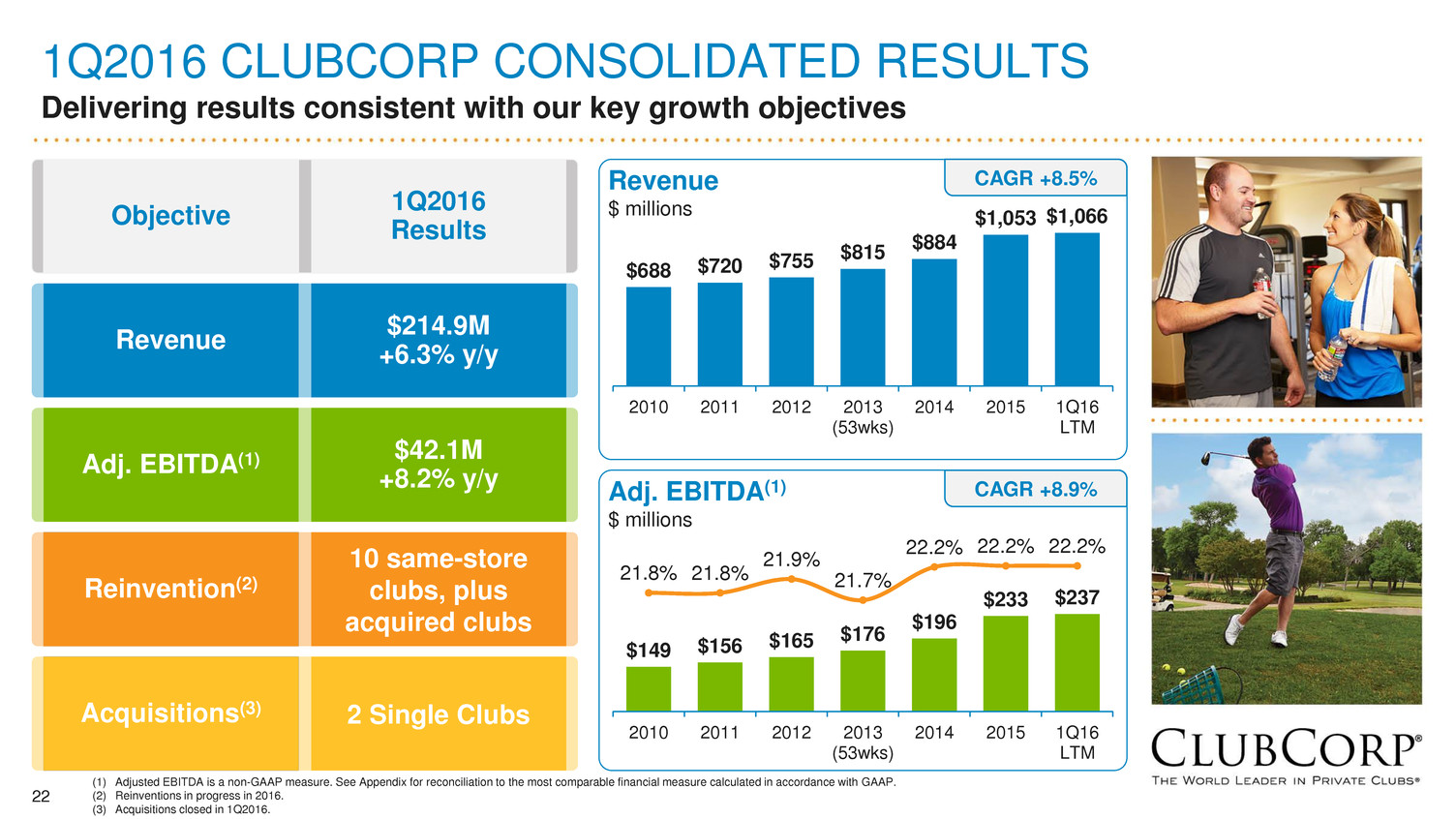

22 1Q2016 CLUBCORP CONSOLIDATED RESULTS Delivering results consistent with our key growth objectives $688 $720 $755 $815 $884 $1,053 $1,066 2010 2011 2012 2013 (53wks) 2014 2015 1Q16 LTM $149 $156 $165 $176 $196 $233 $237 21.8% 21.8% 21.9% 21.7% 22.2% 22.2% 22.2% 2010 2011 2012 2013 (53wks) 2014 2015 1Q16 LTM Adj. EBITDA(1) $42.1M +8.2% y/y Reinvention(2) 10 same-store clubs, plus acquired clubs Revenue $214.9M +6.3% y/y Objective 1Q2016 Results Acquisitions(3) 2 Single Clubs (1) Adjusted EBITDA is a non-GAAP measure. See Appendix for reconciliation to the most comparable financial measure calculated in accordance with GAAP. (2) Reinventions in progress in 2016. (3) Acquisitions closed in 1Q2016. Revenue $ millions CAGR +8.5% Adj. EBITDA(1) $ millions CAGR +8.9%

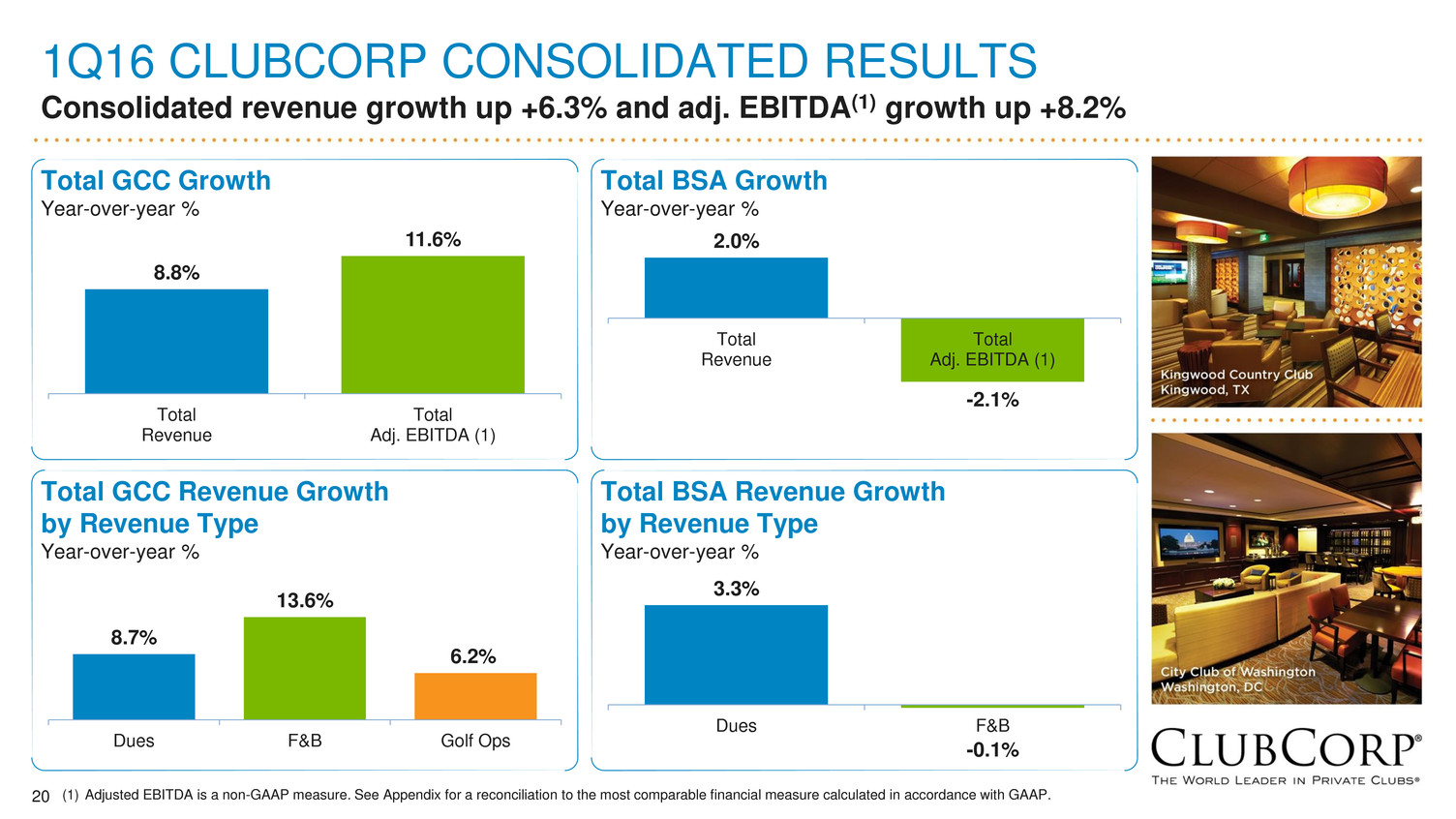

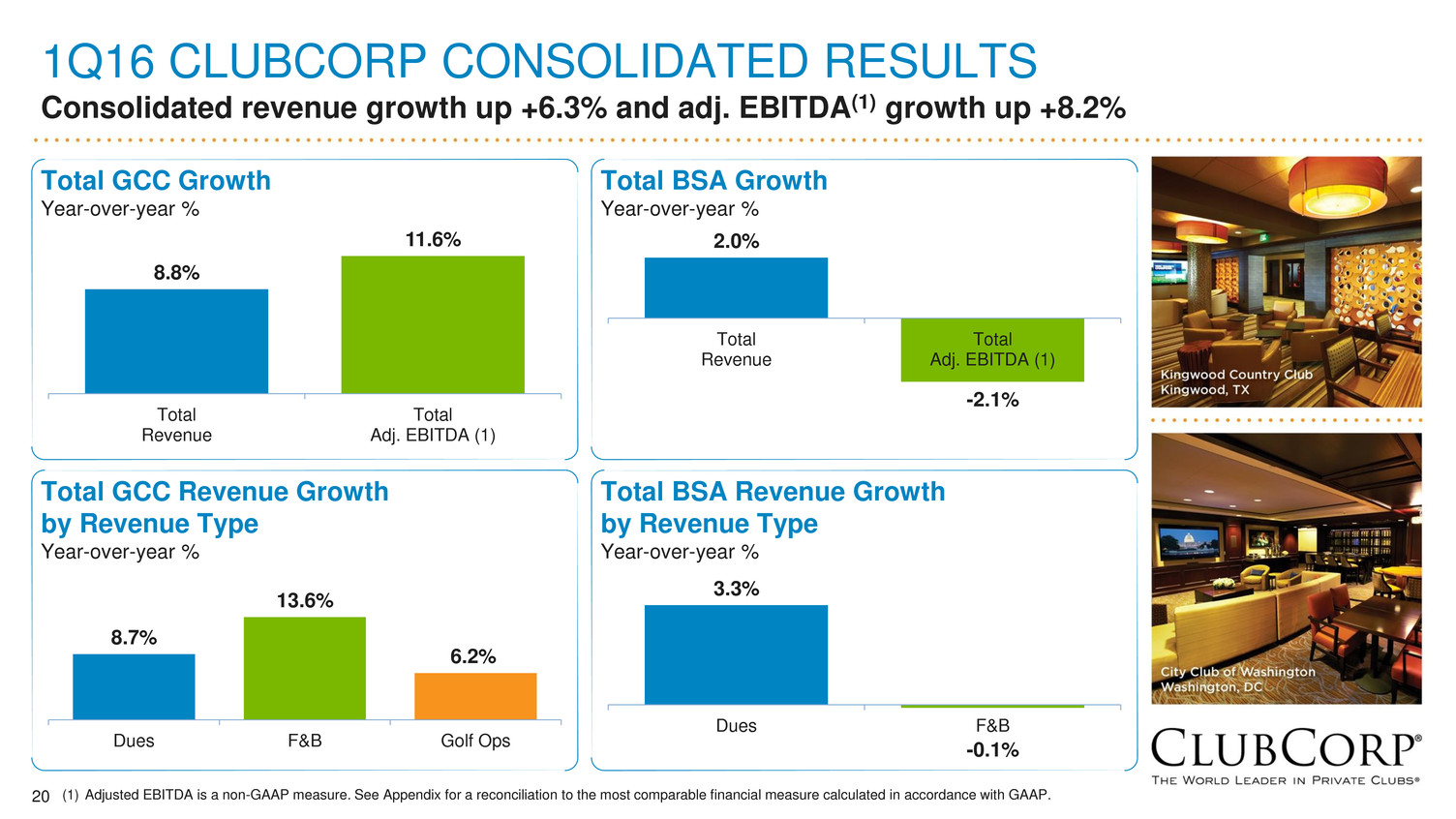

23 1Q16 CLUBCORP CONSOLIDATED RESULTS Consolidated revenue growth up +6.3% and adj. EBITDA(1) growth up +8.2% 8.8% 11.6% Total Revenue Total Adj. EBITDA (1) Total GCC Growth Year-over-year % (1) Adjusted EBITDA is a non-GAAP measure. See Appendix for a reconciliation to the most comparable financial measure calculated in accordance with GAAP. 2.0% -2.1% Total Revenue Total Adj. EBITDA (1) Total BSA Growth Year-over-year % 8.7% 13.6% 6.2% Dues F&B Golf Ops Total GCC Revenue Growth by Revenue Type Year-over-year % 3.3% -0.1% Dues F&B Total BSA Revenue Growth by Revenue Type Year-over-year % 0

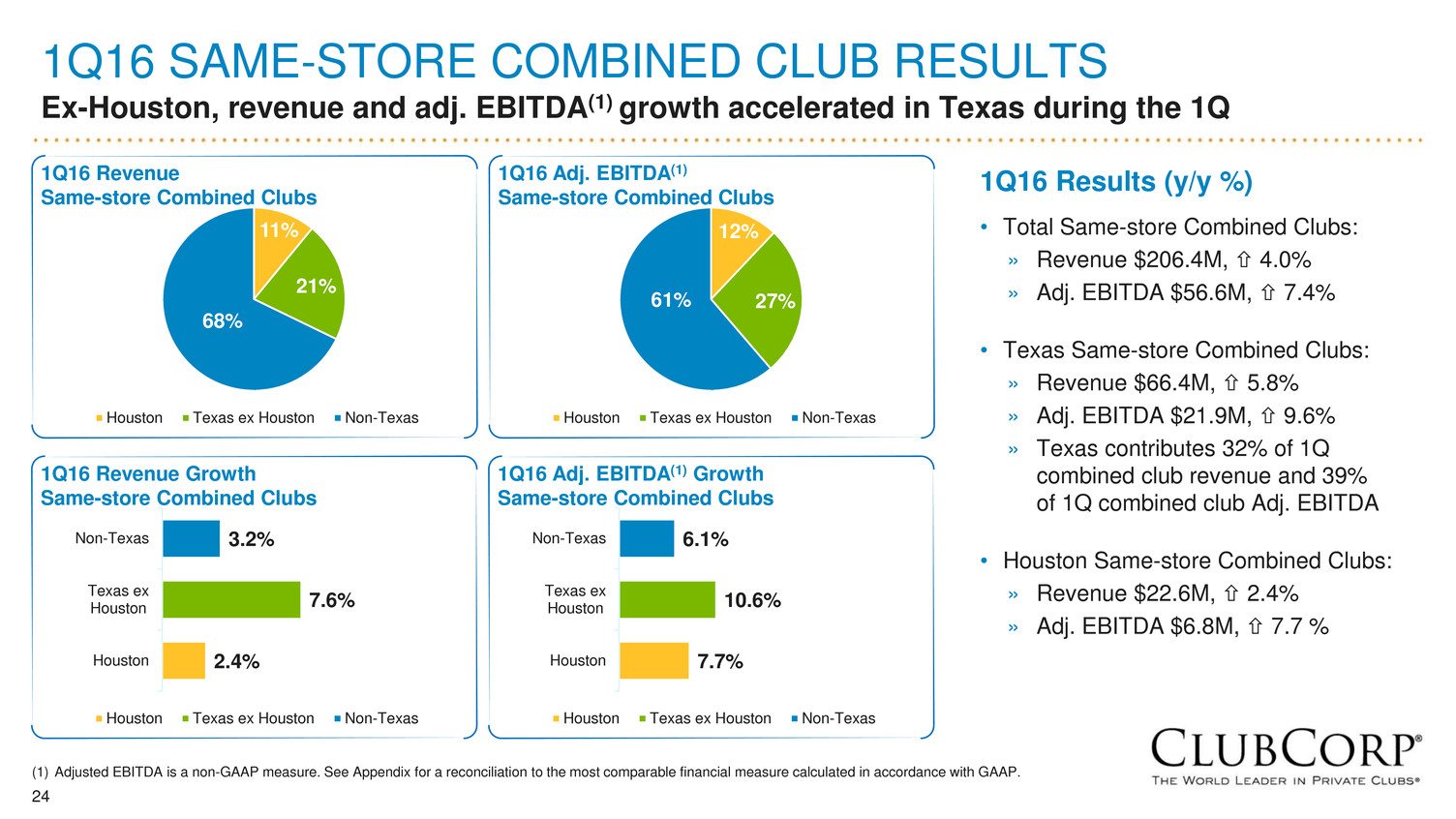

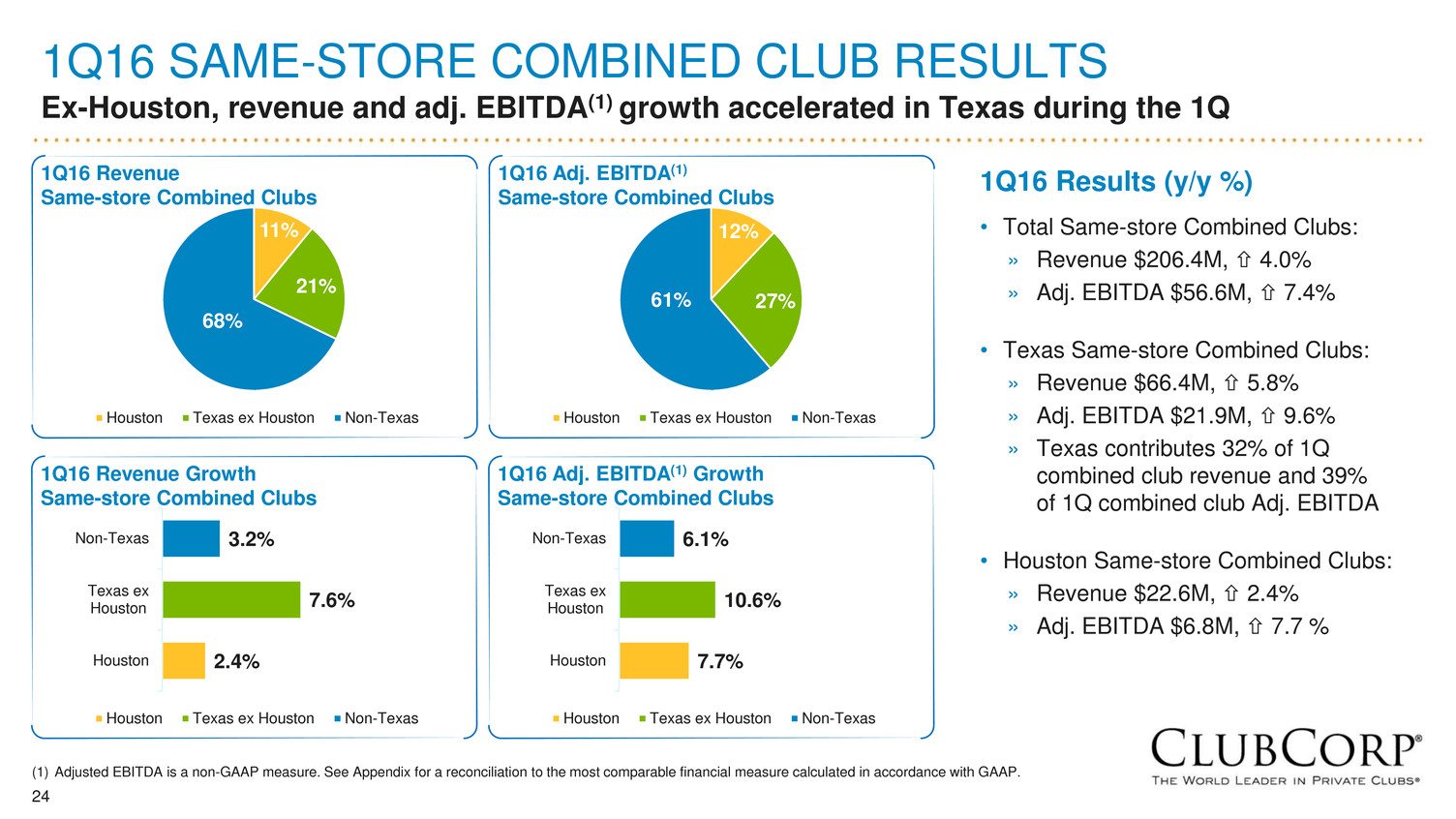

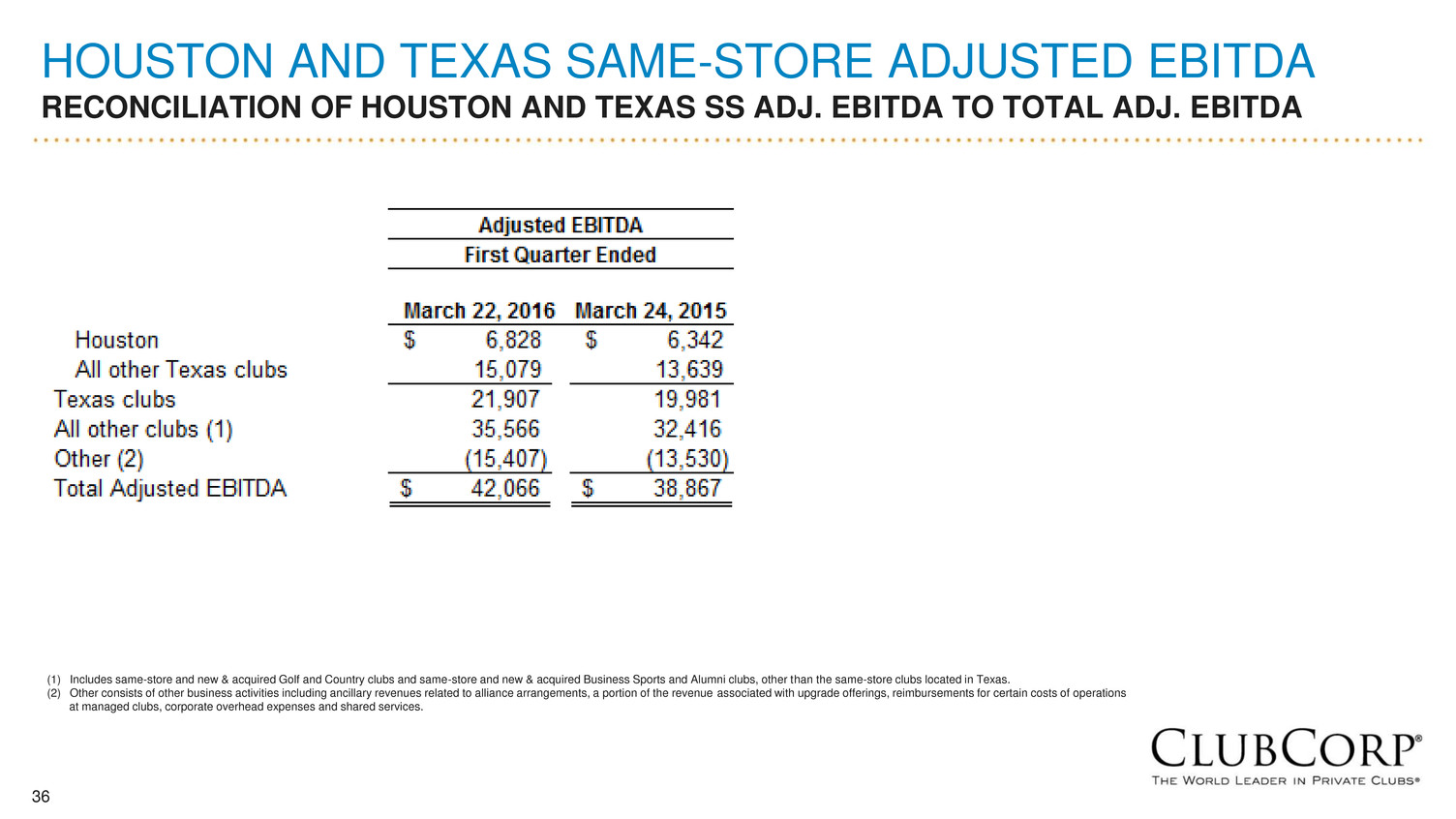

24 1Q16 SAME-STORE COMBINED CLUB RESULTS Ex-Houston, revenue and adj. EBITDA(1) growth accelerated in Texas during the 1Q 1Q16 Results (y/y %) • Total Same-store Combined Clubs: » Revenue $206.4M, 4.0% » Adj. EBITDA $56.6M, 7.4% • Texas Same-store Combined Clubs: » Revenue $66.4M, 5.8% » Adj. EBITDA $21.9M, 9.6% » Texas contributes 32% of 1Q combined club revenue and 39% of 1Q combined club Adj. EBITDA • Houston Same-store Combined Clubs: » Revenue $22.6M, 2.4% » Adj. EBITDA $6.8M, 7.7 % (1) Adjusted EBITDA is a non-GAAP measure. See Appendix for a reconciliation to the most comparable financial measure calculated in accordance with GAAP. 11% 21% 68% Houston Texas ex Houston Non-Texas 1Q16 Revenue Same-store Combined Clubs 12% 27%61% Houston Texas ex Houston Non-Texas 1Q16 Adj. EBITDA(1) Same-store Combined Clubs 2.4% 7.6% 3.2% Houston Texas ex Houston Non-Texas Houston Texas ex Houston Non-Texas 1Q16 Revenue Growth Same-store Combined Clubs 7.7% 10.6% 6.1% Houston Texas ex Houston Non-Texas Houston Texas ex Houston Non-Texas 1Q16 Adj. EBITDA(1) Growth Same-store Combined Clubs

25 1Q16 GOLF & COUNTRY CLUBS (GCC) Solid growth across key operating metrics 80,035 80,916 83,528 111,458 116,303 117,602 2011 Total 2012 Total 2013 Total 2014 Total 2015 Total 1Q16 55% Dues 20% F&B 18% Golf Ops 7% Other 1Q16 $172.8M Revenue Mix Memberships(2) 1.1% (1) Adjusted EBITDA is a non-GAAP measure. See Appendix for a reconciliation to the most comparable financial measure calculated in accordance with GAAP. (2) Total memberships includes same-store, and new and acquired clubs, but excludes managed clubs. $532 $556 $586 $628 $695 $842 $856 2010 2011 2012 2013 (53wks) 2014 2015 1Q16 LTM GCC Revenue $ millions $151 $156 $168 $180 $203 $246 $251 28.4% 28.1% 28.7% 28.7% 29.2% 29.2% 29.3% 2010 2011 2012 2013 (53wks) 2014 2015 1Q16 LTM GCC Adj. EBITDA(1) $ millions CAGR +9.7% CAGR +9.2% Key operating metrics (y/y %) • Total GCC Results: » Revenue $172.8M, 8.8% » Adj. EBITDA $50.1M, 11.6% » Adj. EBITDA 29.0%, 70 bps • Same-store GCC Results: » Revenue $165.1M, 4.5% » Adj. EBITDA $49.3M, 9.1% » Adj. EBITDA 29.9%, 130 bps • Same-store Revenue Growth by Revenue Type: » Dues 3.9% » Food & Beverage 9.1% » Golf Ops 3.1% • New or Acquired GCC Results: » Revenue $7.7M » Adj. EBITDA $0.9M

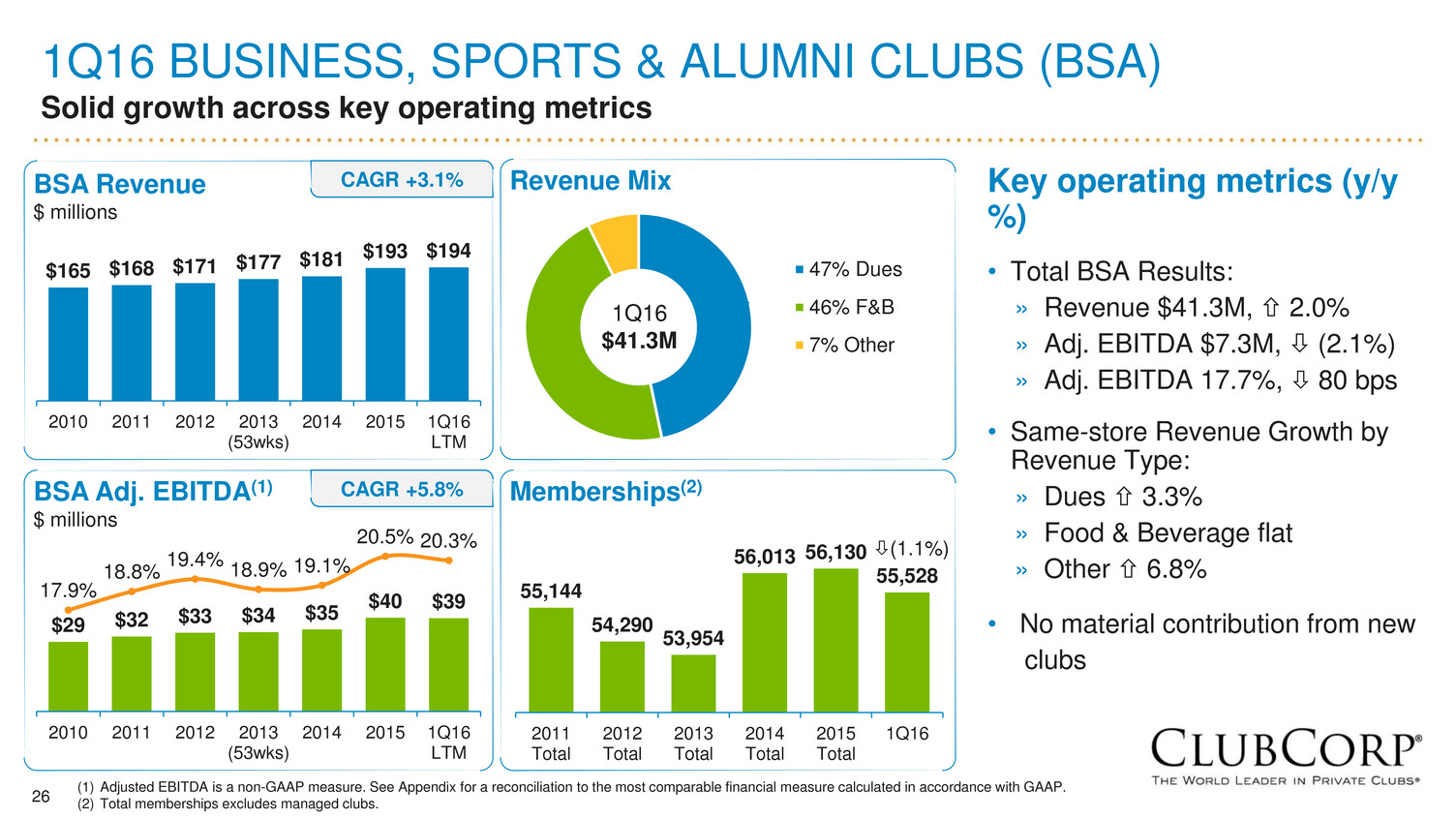

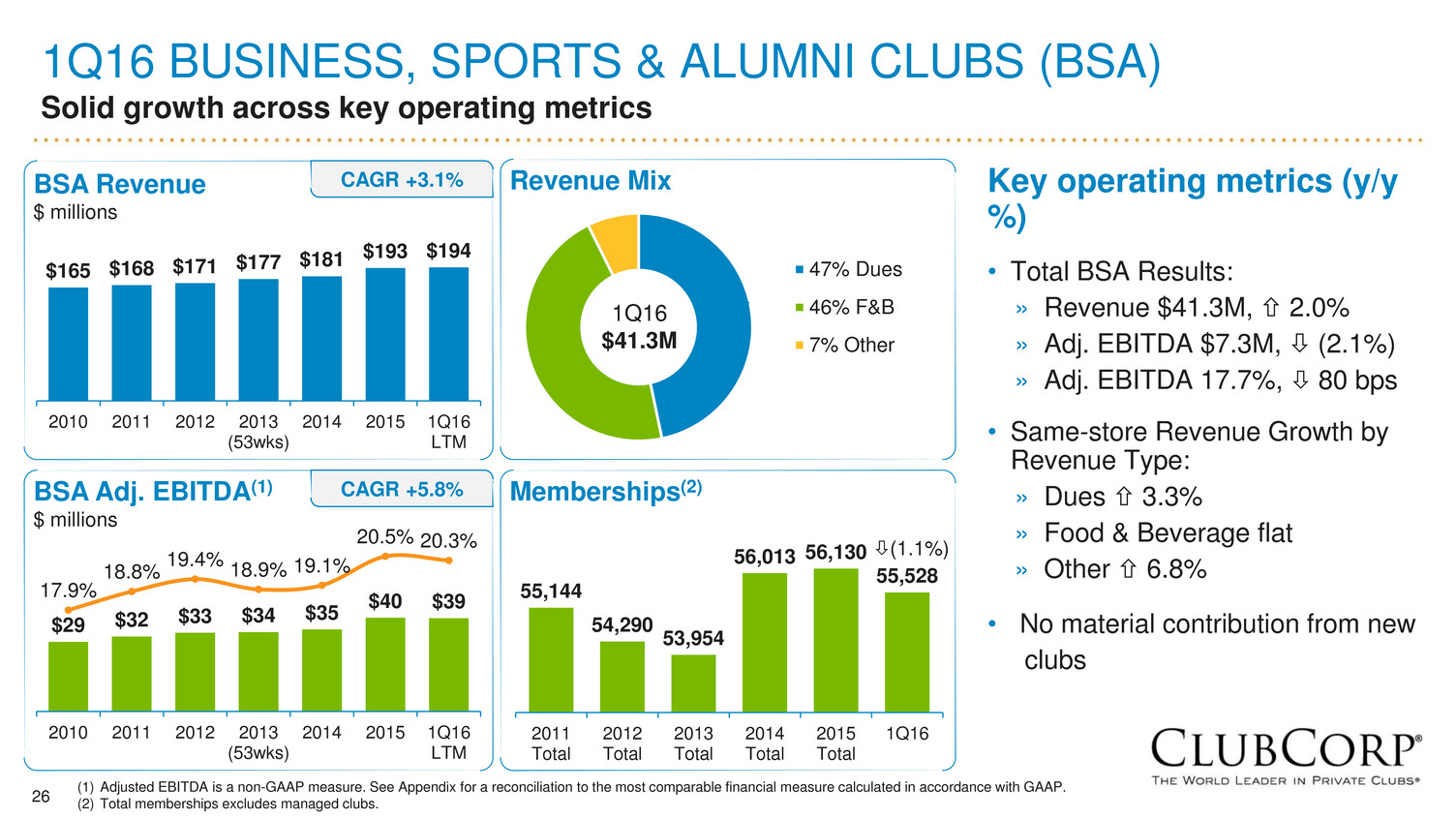

26 1Q16 BUSINESS, SPORTS & ALUMNI CLUBS (BSA) Solid growth across key operating metrics 55,144 54,290 53,954 56,013 56,130 55,528 2011 Total 2012 Total 2013 Total 2014 Total 2015 Total 1Q16 47% Dues 46% F&B 7% Other 1Q16 $41.3M Revenue Mix Memberships(2) (1.1%) (1) Adjusted EBITDA is a non-GAAP measure. See Appendix for a reconciliation to the most comparable financial measure calculated in accordance with GAAP. (2) Total memberships excludes managed clubs. $165 $168 $171 $177 $181 $193 $194 2010 2011 2012 2013 (53wks) 2014 2015 1Q16 LTM BSA Revenue $ millions $29 $32 $33 $34 $35 $40 $39 17.9% 18.8% 19.4% 18.9% 19.1% 20.5% 20.3% 2010 2011 2012 2013 (53wks) 2014 2015 1Q16 LTM BSA Adj. EBITDA(1) $ millions CAGR +3.1% CAGR +5.8% Key operating metrics (y/y %) • Total BSA Results: » Revenue $41.3M, 2.0% » Adj. EBITDA $7.3M, (2.1%) » Adj. EBITDA 17.7%, 80 bps • Same-store Revenue Growth by Revenue Type: » Dues 3.3% » Food & Beverage flat » Other 6.8% • No material contribution from new clubs

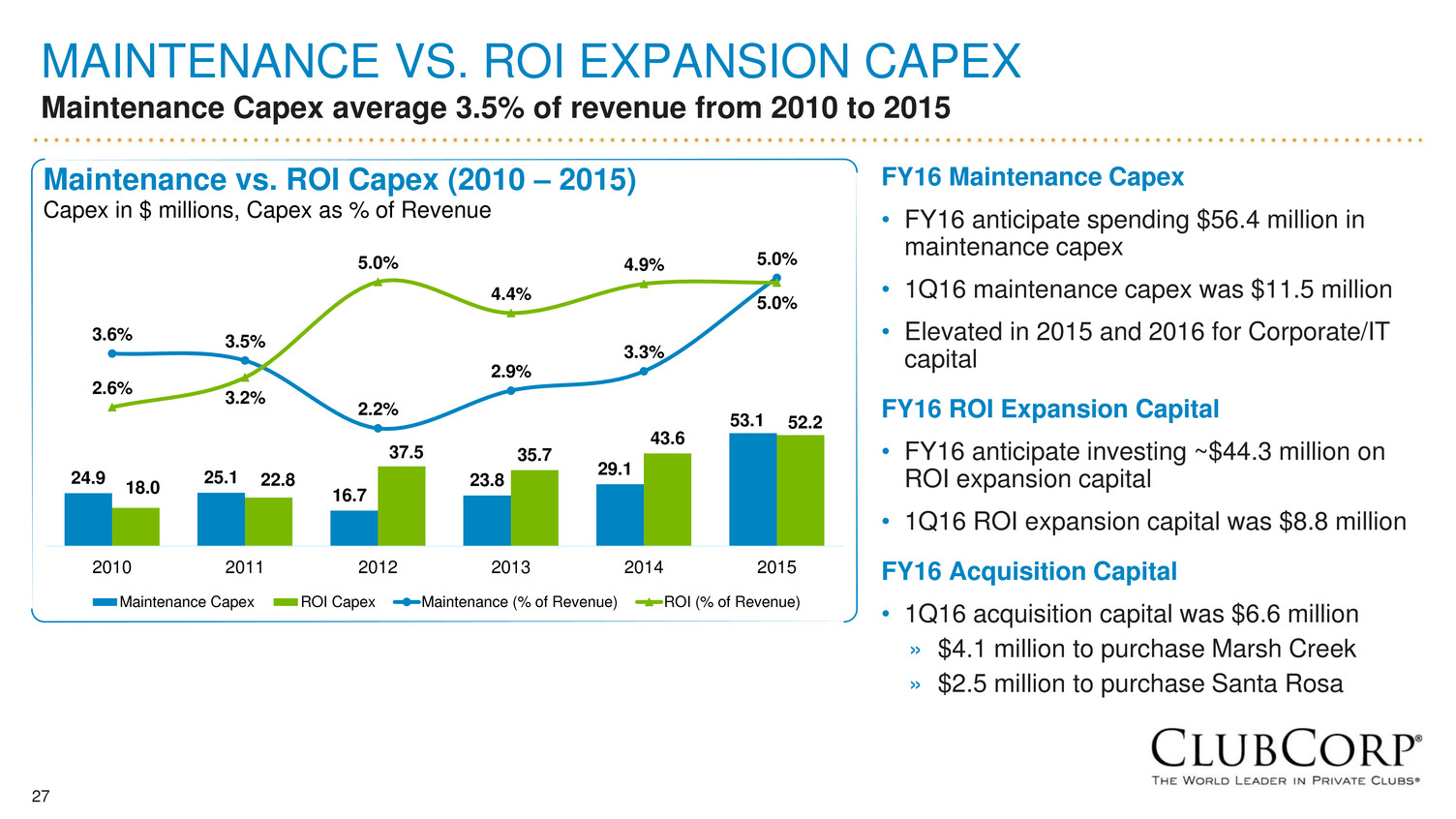

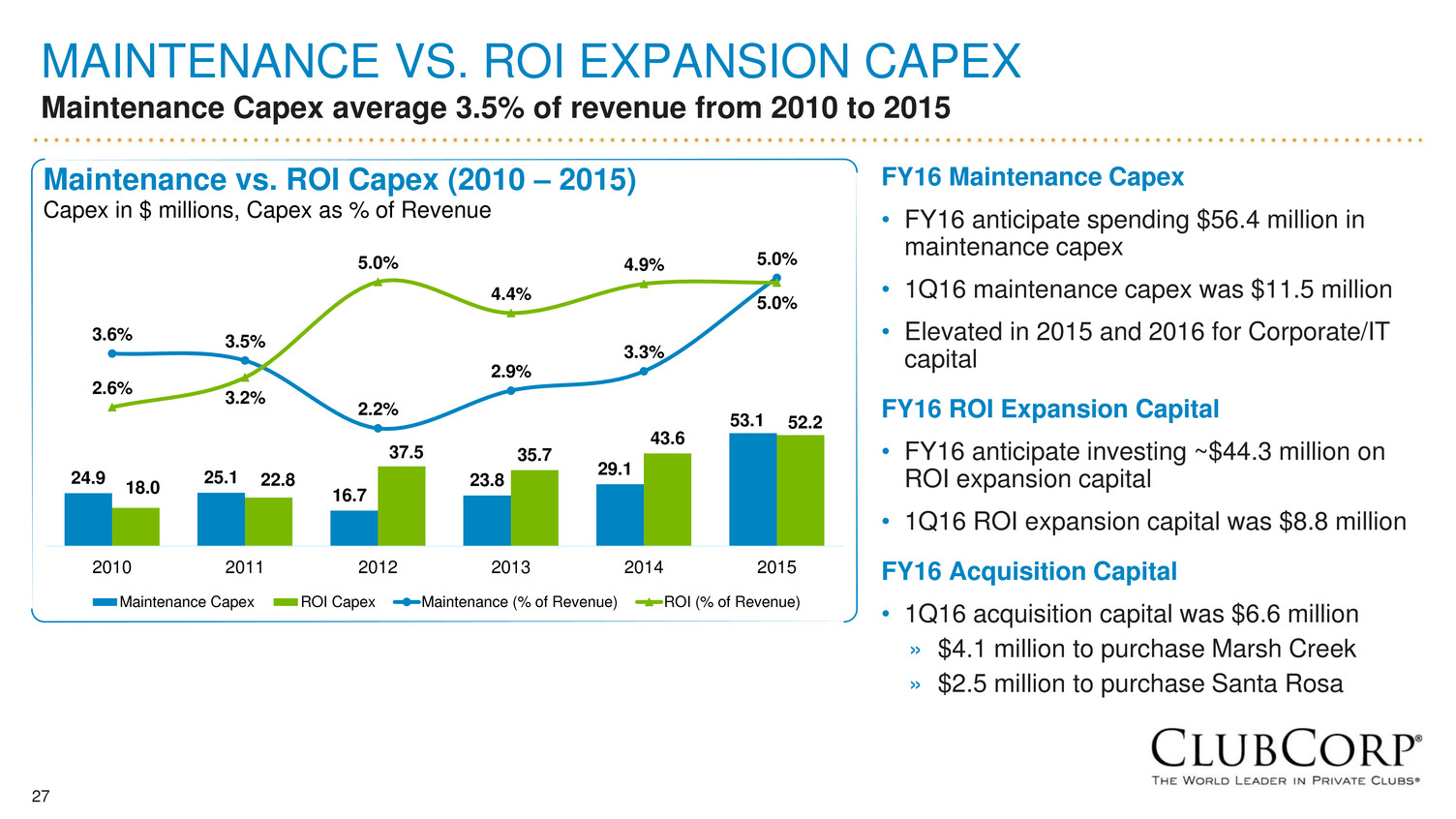

27 MAINTENANCE VS. ROI EXPANSION CAPEX Maintenance Capex average 3.5% of revenue from 2010 to 2015 24.9 25.1 16.7 23.8 29.1 53.1 18.0 22.8 37.5 35.7 43.6 52.2 3.6% 3.5% 2.2% 2.9% 3.3% 5.0% 2.6% 3.2% 5.0% 4.4% 4.9% 5.0% 2010 2011 2012 2013 2014 2015 Maintenance vs. ROI Capex (2010 – 2015) Capex in $ millions, Capex as % of Revenue Maintenance Capex ROI Capex Maintenance (% of Revenue) ROI (% of Revenue) FY16 Maintenance Capex • FY16 anticipate spending $56.4 million in maintenance capex • 1Q16 maintenance capex was $11.5 million • Elevated in 2015 and 2016 for Corporate/IT capital FY16 ROI Expansion Capital • FY16 anticipate investing ~$44.3 million on ROI expansion capital • 1Q16 ROI expansion capital was $8.8 million FY16 Acquisition Capital • 1Q16 acquisition capital was $6.6 million » $4.1 million to purchase Marsh Creek » $2.5 million to purchase Santa Rosa

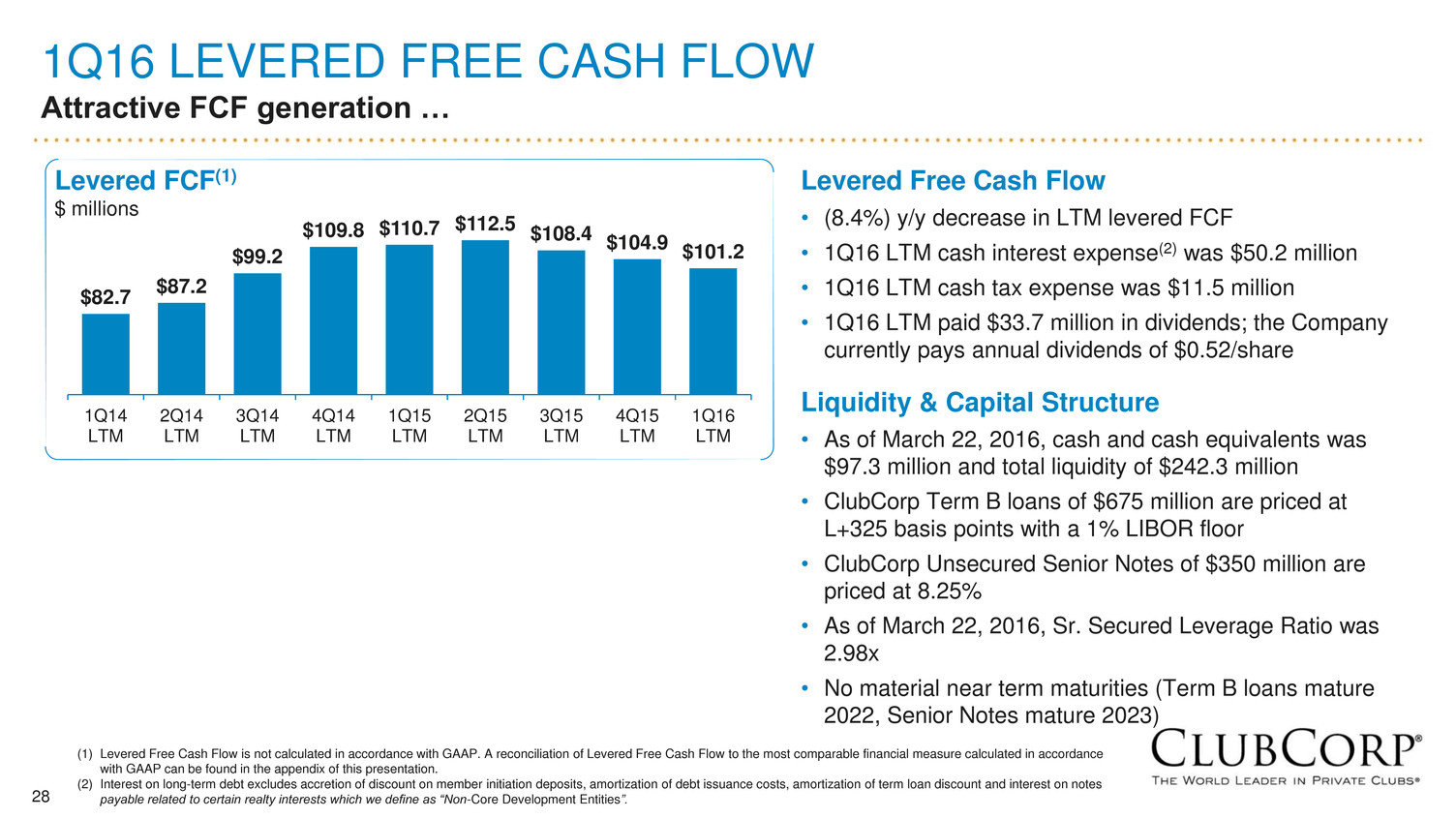

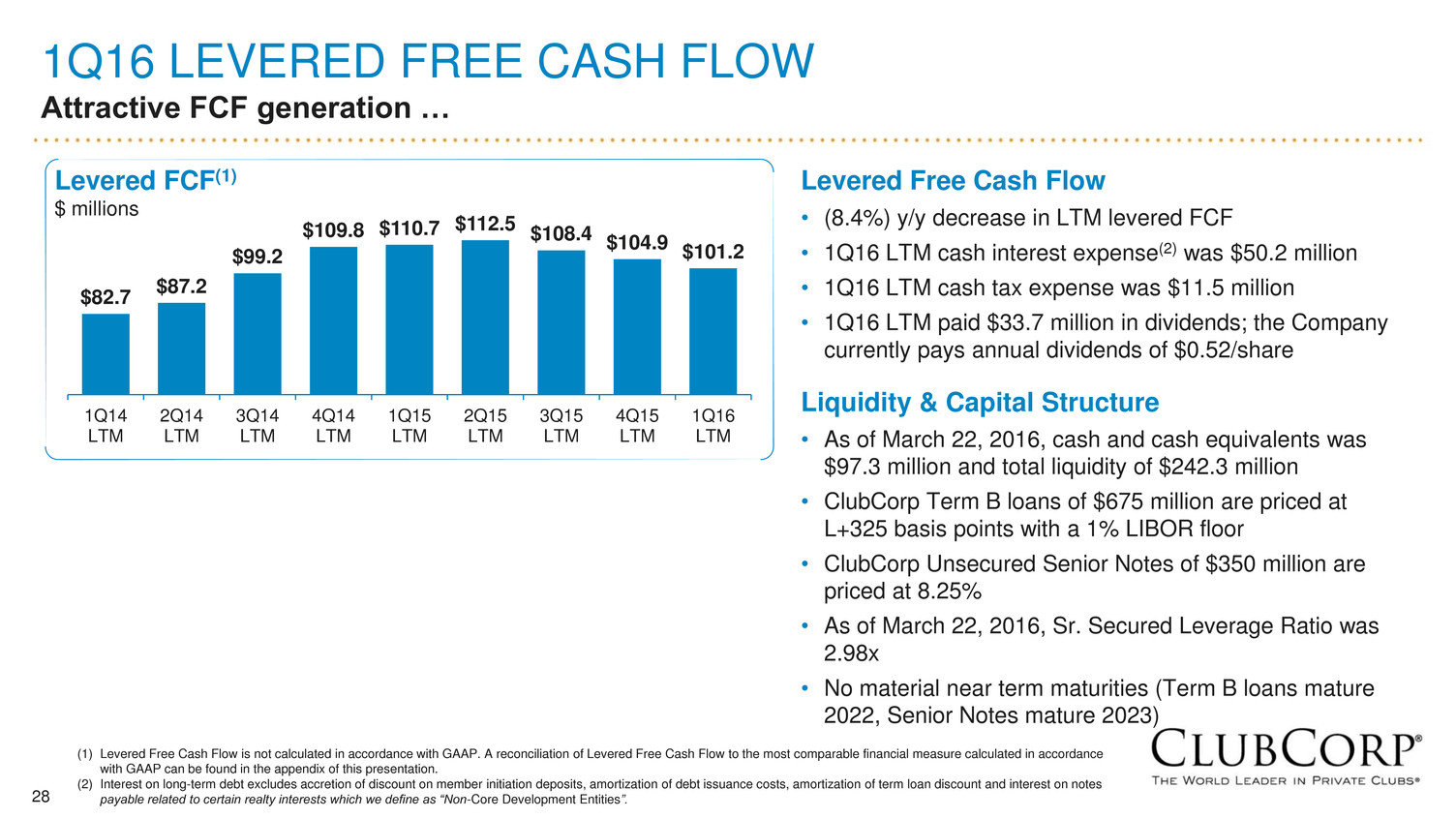

28 1Q16 LEVERED FREE CASH FLOW Attractive FCF generation … $82.7 $87.2 $99.2 $109.8 $110.7 $112.5 $108.4 $104.9 $101.2 1Q14 LTM 2Q14 LTM 3Q14 LTM 4Q14 LTM 1Q15 LTM 2Q15 LTM 3Q15 LTM 4Q15 LTM 1Q16 LTM Levered Free Cash Flow • (8.4%) y/y decrease in LTM levered FCF • 1Q16 LTM cash interest expense(2) was $50.2 million • 1Q16 LTM cash tax expense was $11.5 million • 1Q16 LTM paid $33.7 million in dividends; the Company currently pays annual dividends of $0.52/share Liquidity & Capital Structure • As of March 22, 2016, cash and cash equivalents was $97.3 million and total liquidity of $242.3 million • ClubCorp Term B loans of $675 million are priced at L+325 basis points with a 1% LIBOR floor • ClubCorp Unsecured Senior Notes of $350 million are priced at 8.25% • As of March 22, 2016, Sr. Secured Leverage Ratio was 2.98x • No material near term maturities (Term B loans mature 2022, Senior Notes mature 2023) Levered FCF(1) $ millions (1) Levered Free Cash Flow is not calculated in accordance with GAAP. A reconciliation of Levered Free Cash Flow to the most comparable financial measure calculated in accordance with GAAP can be found in the appendix of this presentation. (2) Interest on long-term debt excludes accretion of discount on member initiation deposits, amortization of debt issuance costs, amortization of term loan discount and interest on notes payable related to certain realty interests which we define as “Non-Core Development Entities”.

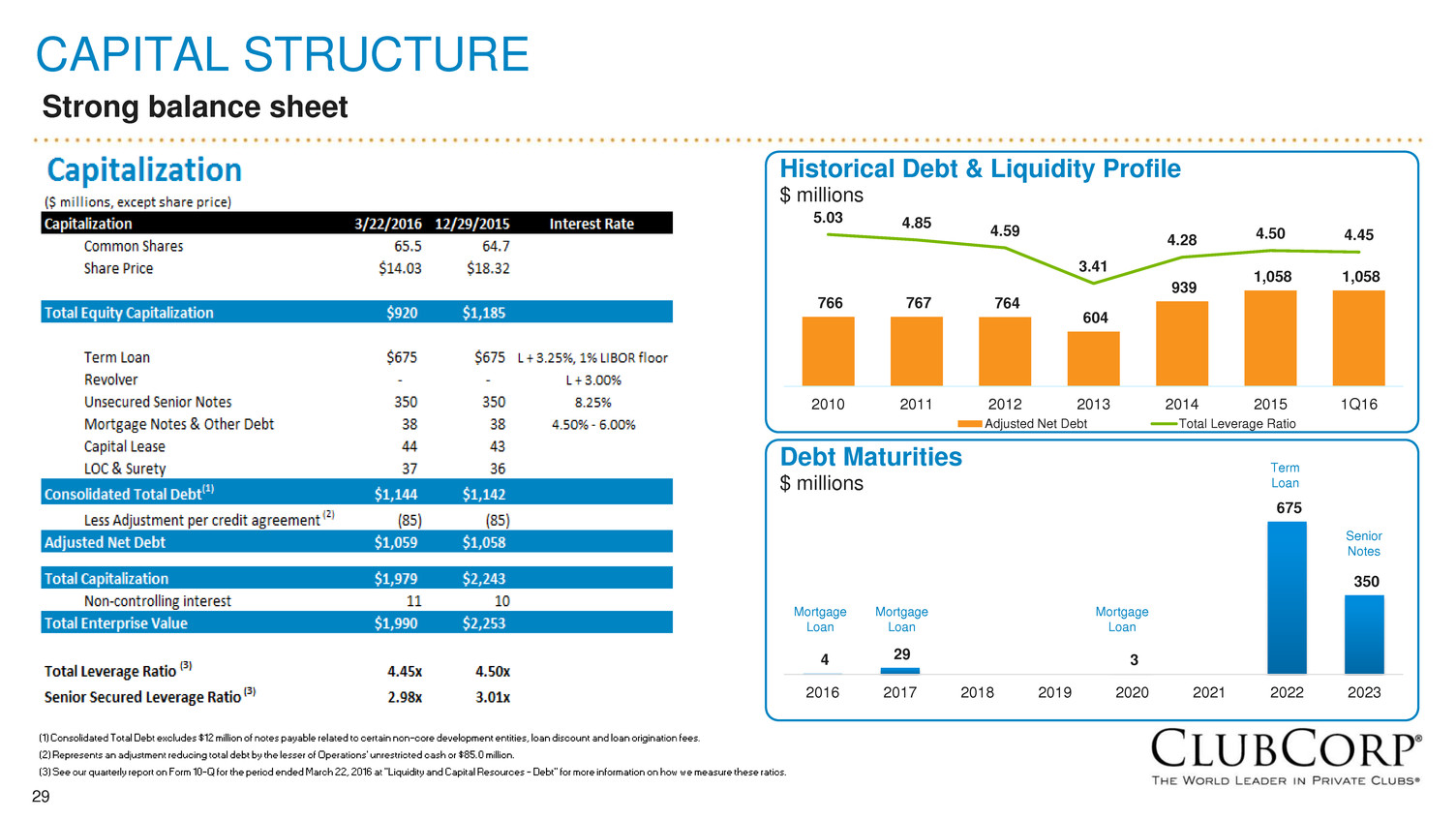

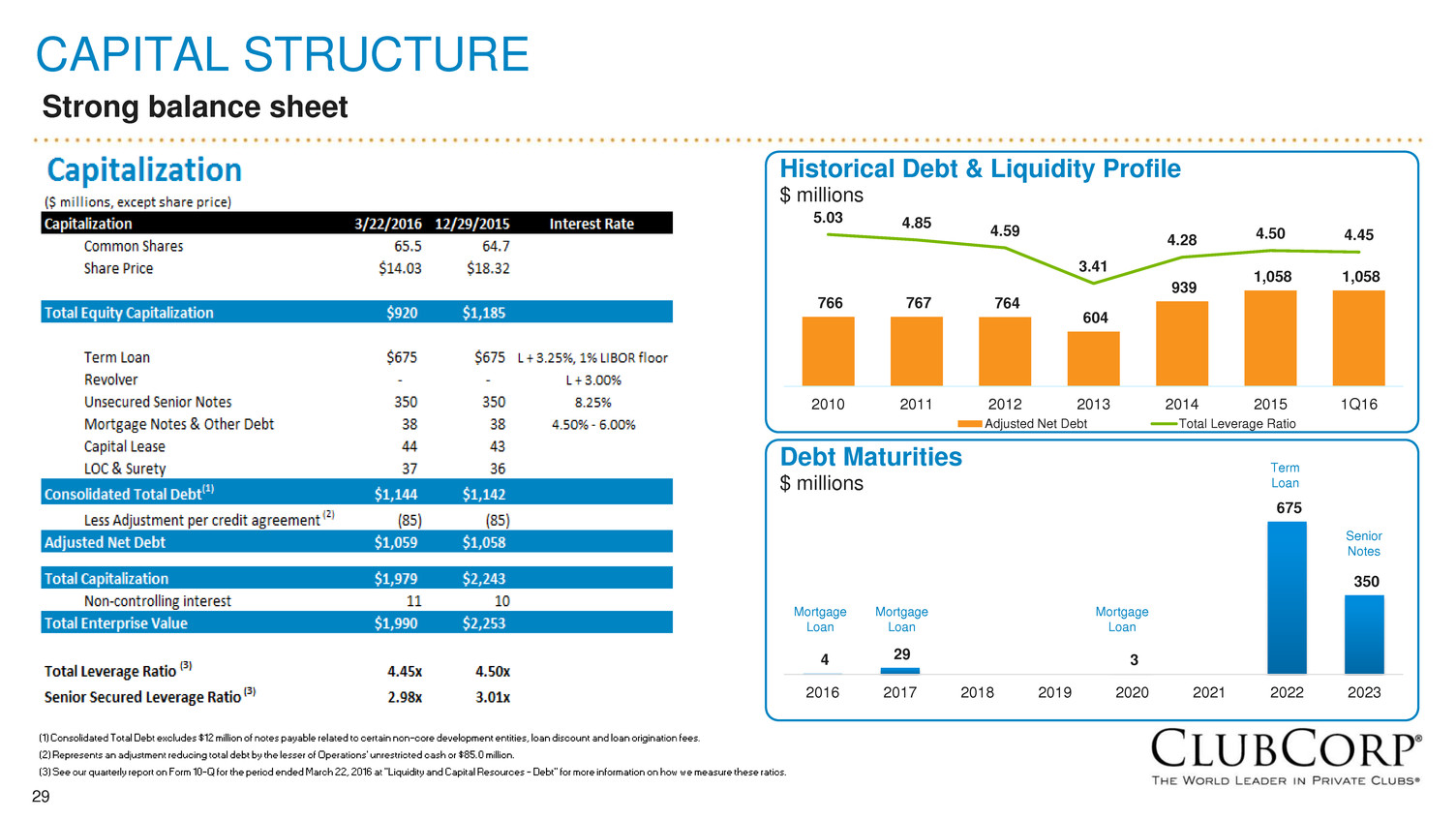

29 CAPITAL STRUCTURE Strong balance sheet 766 767 764 604 939 1,058 1,058 5.03 4.85 4.59 3.41 4.28 4.50 4.45 2010 2011 2012 2013 2014 2015 1Q16 Historical Debt & Liquidity Profile $ millions Adjusted Net Debt Total Leverage Ratio 4 29 3 675 350 2016 2017 2018 2019 2020 2021 2022 2023 Debt Maturities $ millions Senior Notes Mortgage Loan Mortgage Loan Mortgage Loan Term Loan

30 2016 OUTLOOK The Company is positioned for excellent results again in 2016 Keys to achieving 2016 outlook … » Solid Same-store growth and operational execution » Strong revenue growth across all three primary revenue streams: dues, F&B and golf operations » Economy continues to grow, with no significant macroeconomic event » Acceptance of our O.N.E. offering continues to climb » Reinvention continues to drive dues revenue, member usage and ancillary spend » Continued execution of our cost and revenue synergies at newly acquired clubs $1,085M - $1,105M (+3-5% y/y) Revenue $242M - $252M (+4-8% y/y) Adj. EBITDA ~$45M (10 same-store clubs, plus acquired clubs) ROI Capital Annualized $0.52 / share (~4% yield) Dividend

31 APPENDIX

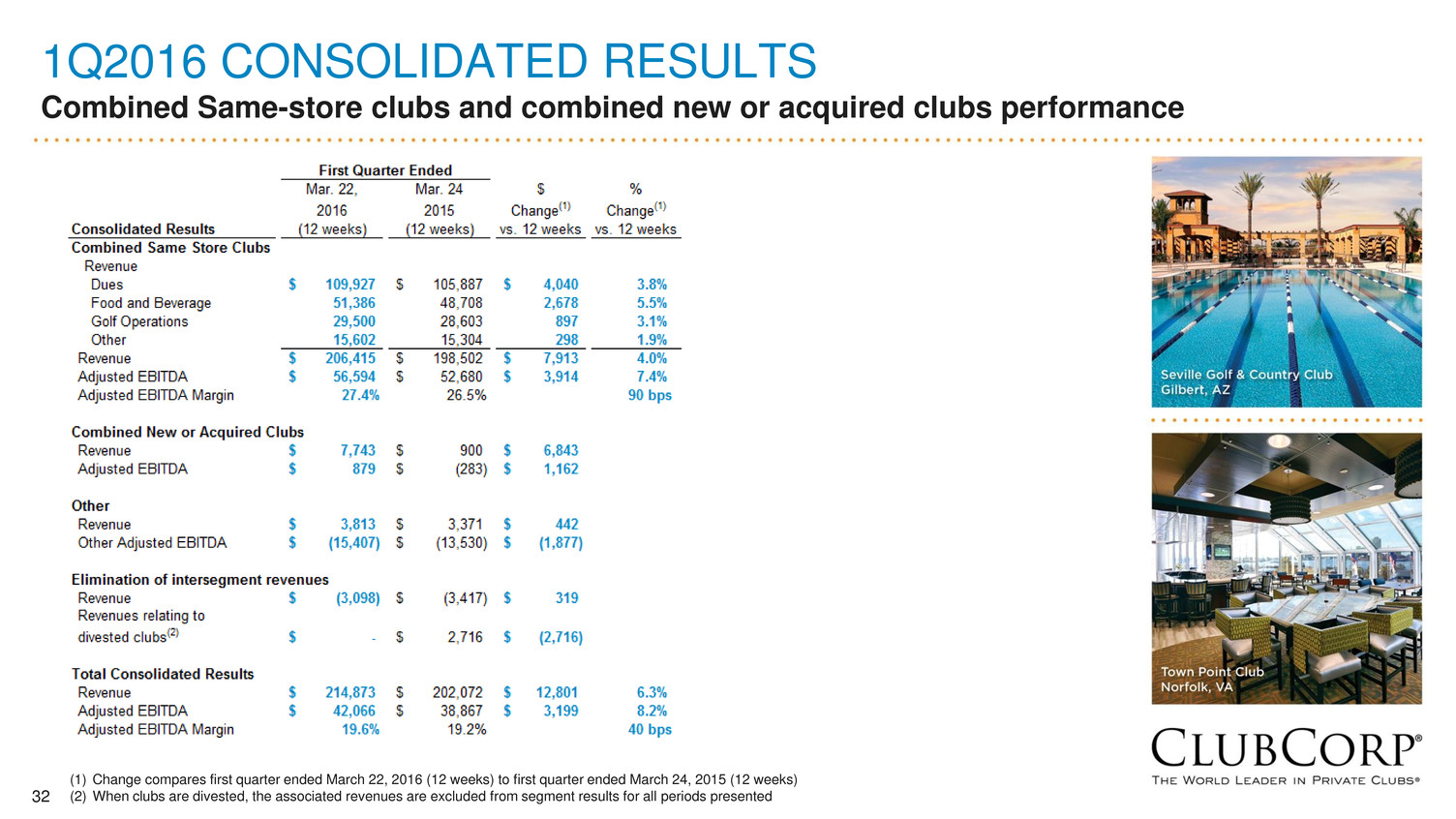

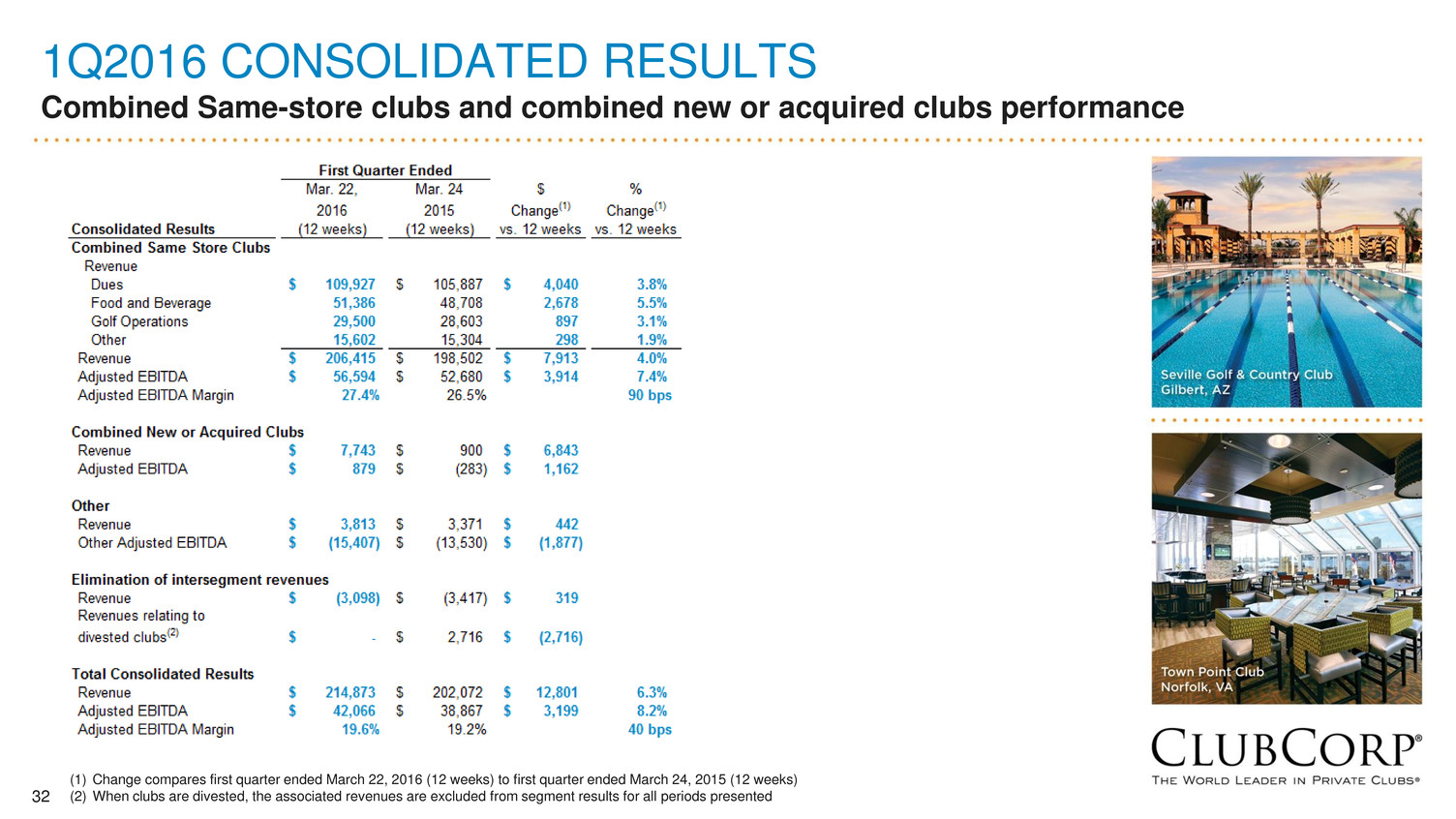

32 1Q2016 CONSOLIDATED RESULTS Combined Same-store clubs and combined new or acquired clubs performance (1) Change compares first quarter ended March 22, 2016 (12 weeks) to first quarter ended March 24, 2015 (12 weeks) (2) When clubs are divested, the associated revenues are excluded from segment results for all periods presented

33 1Q2016 GOLF & COUNTRY CLUBS (GCC) GCC Same-store clubs and GCC new or acquired clubs performance (1) Change compares first quarter ended March 22, 2016 (12 weeks) to first quarter ended March 24, 2015 (12 weeks)

34 1Q2016 BUSINESS, SPORTS & ALUMNI CLUBS (BSA) BSA Same-store clubs and BSA new or acquired clubs performance (1) Change compares first quarter ended March 22, 2016 (12 weeks) to first quarter ended March 24, 2015 (12 weeks)

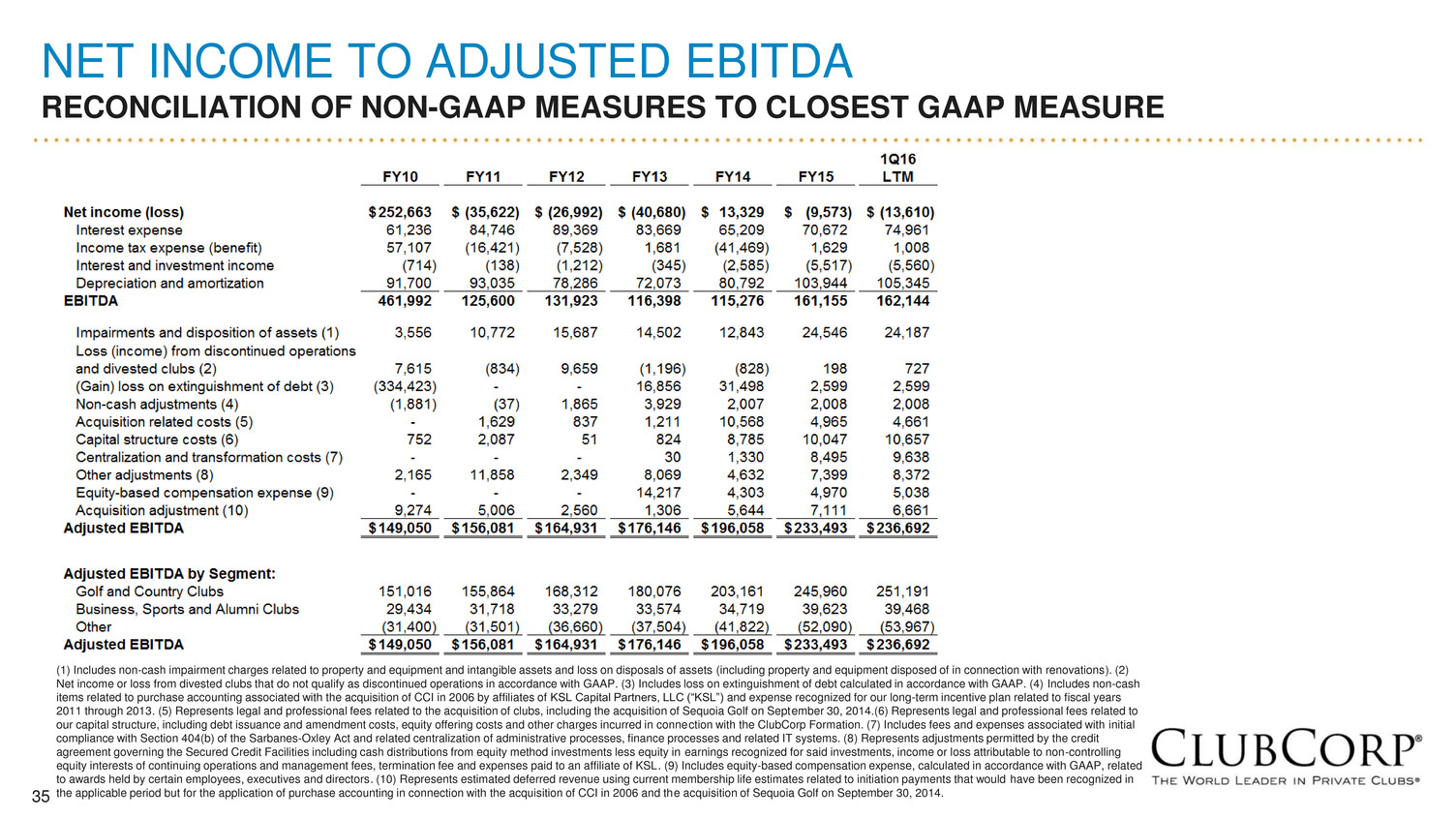

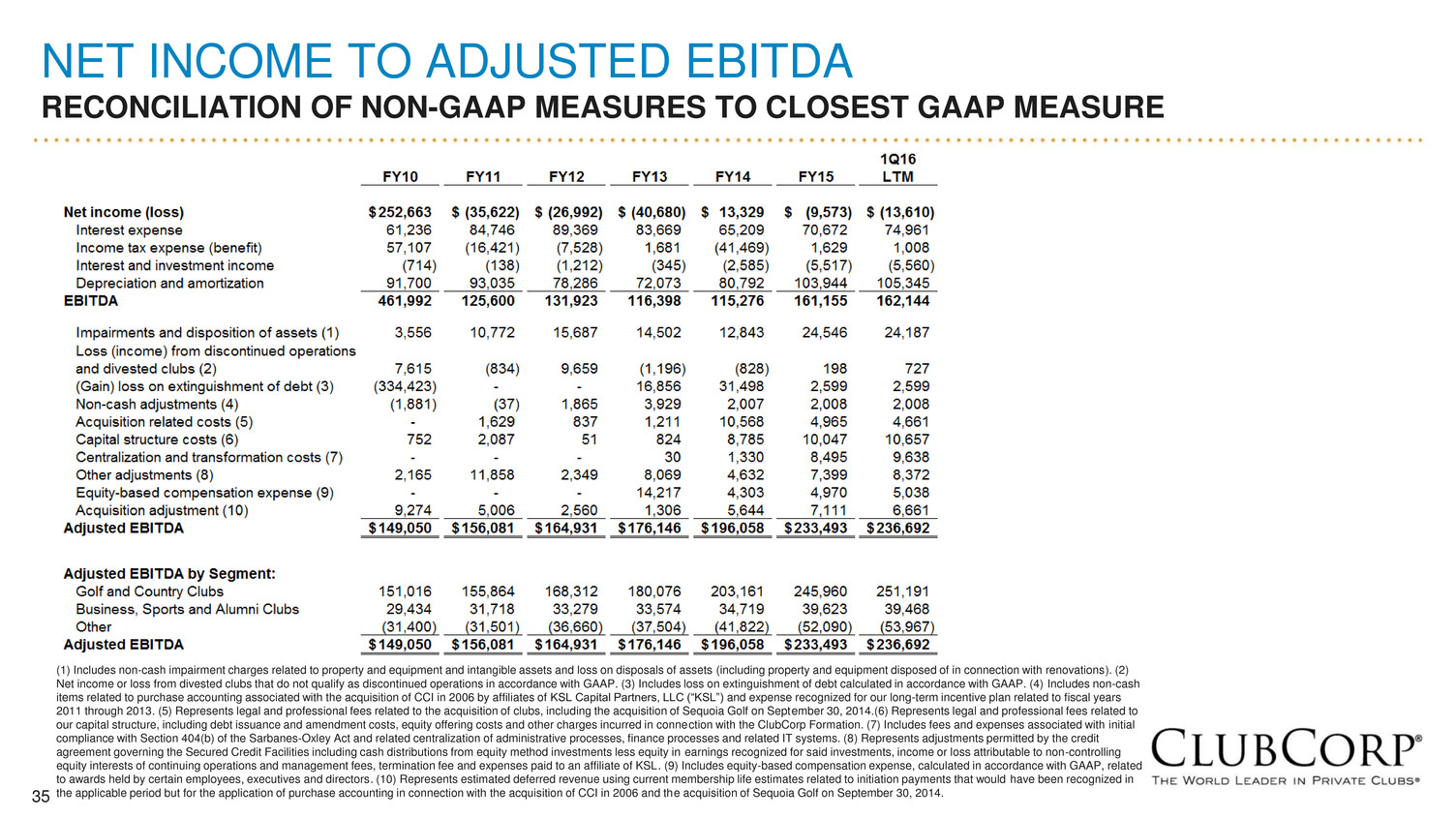

35 NET INCOME TO ADJUSTED EBITDA RECONCILIATION OF NON-GAAP MEASURES TO CLOSEST GAAP MEASURE (1) Includes non-cash impairment charges related to property and equipment and intangible assets and loss on disposals of assets (including property and equipment disposed of in connection with renovations). (2) Net income or loss from divested clubs that do not qualify as discontinued operations in accordance with GAAP. (3) Includes loss on extinguishment of debt calculated in accordance with GAAP. (4) Includes non-cash items related to purchase accounting associated with the acquisition of CCI in 2006 by affiliates of KSL Capital Partners, LLC (“KSL”) and expense recognized for our long-term incentive plan related to fiscal years 2011 through 2013. (5) Represents legal and professional fees related to the acquisition of clubs, including the acquisition of Sequoia Golf on September 30, 2014.(6) Represents legal and professional fees related to our capital structure, including debt issuance and amendment costs, equity offering costs and other charges incurred in connection with the ClubCorp Formation. (7) Includes fees and expenses associated with initial compliance with Section 404(b) of the Sarbanes-Oxley Act and related centralization of administrative processes, finance processes and related IT systems. (8) Represents adjustments permitted by the credit agreement governing the Secured Credit Facilities including cash distributions from equity method investments less equity in earnings recognized for said investments, income or loss attributable to non-controlling equity interests of continuing operations and management fees, termination fee and expenses paid to an affiliate of KSL. (9) Includes equity-based compensation expense, calculated in accordance with GAAP, related to awards held by certain employees, executives and directors. (10) Represents estimated deferred revenue using current membership life estimates related to initiation payments that would have been recognized in the applicable period but for the application of purchase accounting in connection with the acquisition of CCI in 2006 and the acquisition of Sequoia Golf on September 30, 2014.

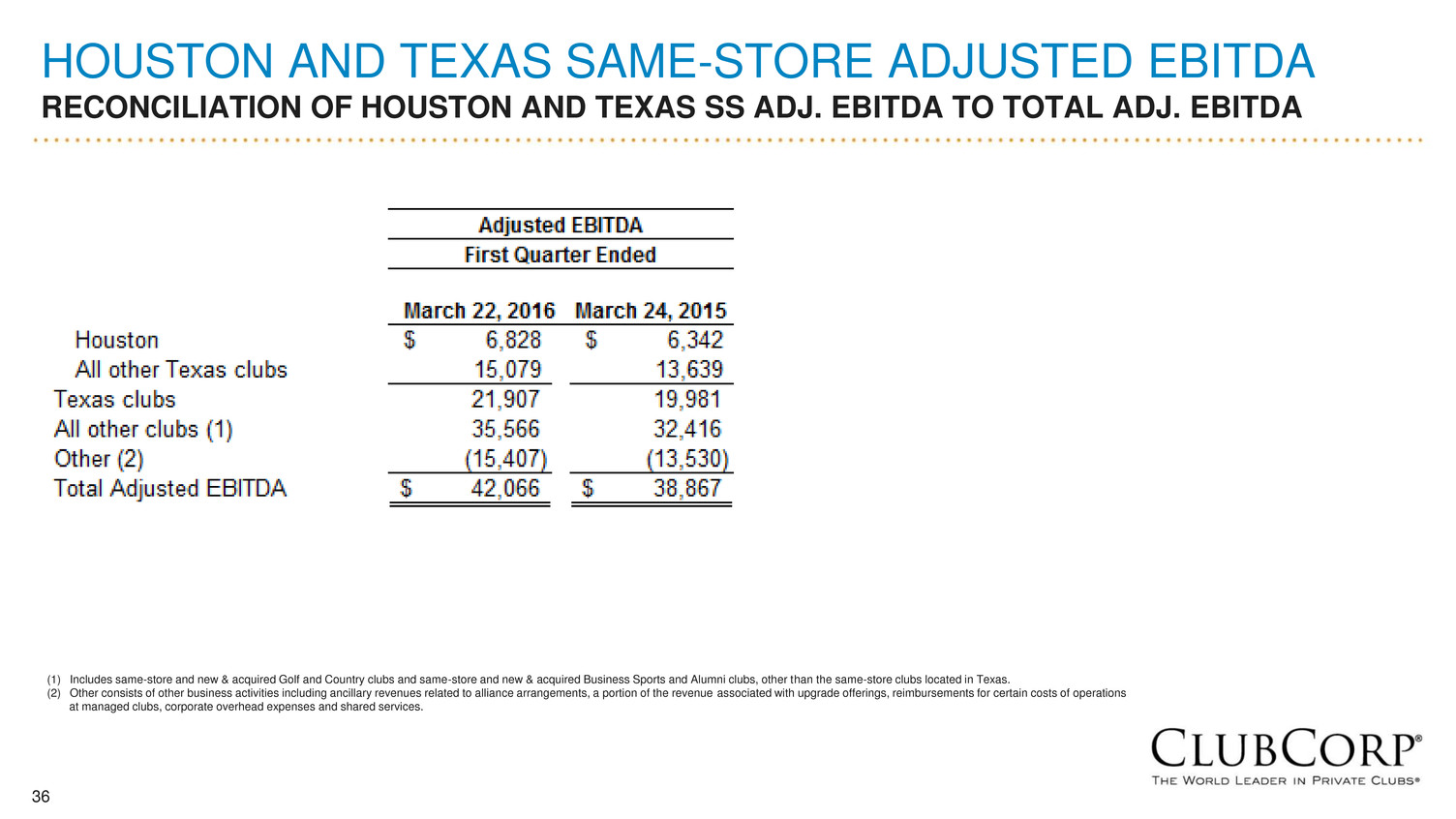

36 HOUSTON AND TEXAS SAME-STORE ADJUSTED EBITDA RECONCILIATION OF HOUSTON AND TEXAS SS ADJ. EBITDA TO TOTAL ADJ. EBITDA (1) Includes same-store and new & acquired Golf and Country clubs and same-store and new & acquired Business Sports and Alumni clubs, other than the same-store clubs located in Texas. (2) Other consists of other business activities including ancillary revenues related to alliance arrangements, a portion of the revenue associated with upgrade offerings, reimbursements for certain costs of operations at managed clubs, corporate overhead expenses and shared services.

37 CALCULATION OF LEVERED FREE CASH FLOW RECONCILIATION OF NON-GAAP MEASURES TO CLOSEST GAAP MEASURE (1) See the Adjusted EBITDA reconciliation in the preceding "Reconciliation of Non-GAAP Measures to Closest GAAP Measure" table. (2) Interest on long-term debt excludes accretion of discount on member deposits, amortization of debt issuance costs, amortization of term loan discount and interest on notes payable related to certain realty interests which we define as “Non-Core Development Entities”.

38