UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantx |

| |

| Filed by a Party other than the Registranto |

| |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

ClubCorp Holdings, Inc. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

April 15, 2016

Dear Fellow Stockholder:

We cordially invite you to the 2016 Annual Meeting of Stockholders of ClubCorp Holdings, Inc. The meeting is at 8:00 a.m., Central Time, on Friday, June 10, 2016 at La Cima Club, 5215 North O’Connor Boulevard, The Tower at Williams Square, Suite 2600, Irving, Texas 75039.

At the meeting, we will elect four members to our board of directors and vote on the other matters set forth in the enclosed notice of the meeting and proxy statement. Upon the completion of the business matters to be conducted at the annual meeting, we will report on our business.

YOUR VOTE IS IMPORTANT. We urge you to read this proxy statement carefully. Whether or not you plan to attend the annual meeting in person, it is important that your shares be represented and voted at the meeting. You may vote your shares by proxy on the Internet, by telephone or by completing, signing and promptly returning your proxy card or you may vote in person at the annual meeting.

We are pleased to furnish proxy materials to our stockholders on the Internet. We believe that this allows us to provide you with the information that you need while lowering the costs of delivery and reducing the environmental impact of the 2016 Annual Meeting of Stockholders.

We extend our thanks for your continued investment in ClubCorp Holdings, Inc. and look forward to seeing you at the annual meeting.

|  |

| John A. Beckert | Eric L. Affeldt |

| Chairman of the Board of Directors | President and Chief Executive Officer |

HOW TO VOTE

There are four ways you may vote, as explained in the detailed instructions on your proxy card.

| • | Internet.If you have Internet access, you may submit your proxy by going to www.proxyvote.com and by following the instructions on how to complete an electronic proxy card. You will need the 12-digit number included on your Notice or your proxy card in order to vote by Internet. |

| • | Telephone.If you have access to a touch-tone telephone, you may submit your proxy by dialing 1-800-690-6903 and by following the recorded instructions. You will need the 12-digit number included on your Notice or your proxy card in order to vote by telephone. |

| • | Proxy Card.You may vote by mail by requesting a proxy card from us, indicating your vote by completing, signing and dating the card where indicated and by mailing or otherwise returning the card in the envelope that will be provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity. |

| • | In Person at the Annual Meeting.Vote in person by attending the annual meeting. |

If you vote on the Internet or by telephone, you do not need to return a proxy card. Please see your proxy card for more detailed information on how to vote your shares.

ANNUAL MEETING ADMISSION

Proof of ownership of ClubCorp Holdings, Inc. stock at the close of business on April 15, 2016 must be presented in order to be admitted to the annual meeting. You may also be asked to present valid picture identification.

If you are a stockholder of record, please bring the Notice of Internet Availability of Proxy Materials that was mailed to you or, if you received your proxy materials by mail or email, please bring a copy of your proxy card.

If your shares are held in the name of a bank, broker or other holder of record, please bring any of the following with you to the annual meeting: (1) the notice or voting instruction form you received from your bank, brokerage firm or other nominee; (2) a brokerage statement; or (3) other proof evidencing your ownership at the close of business on April 15, 2016. Alternatively, you may make arrangements in advance by contacting our Investor Relations Department at (972) 888-7495 or by email at clubcorp.investor.relations@clubcorp.com.

CLUBCORP HOLDINGS, INC.

3030 LBJ Freeway, Suite 600

Dallas, Texas 75234

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Time and Date | 8:00 a.m. (Central Time) on Friday, June 10, 2016 |

| | |

| Place | La Cima Club

5215 North O’Connor Boulevard The Tower at Williams Square, Suite 2600

Irving, Texas 75039 |

| | | |

| Purpose | 1. | To elect four Class III directors to serve for a term of three years. |

| | | |

| | 2. | To approve, in a non-binding advisory vote, the compensation paid to the named executive officers. |

| | | |

| | 3. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2016. |

| | | |

| | 4. | To conduct other business properly raised before the meeting and any adjournment or postponement of the meeting. |

| | |

| Record Date | You may vote if you were a stockholder of record at the close of business on April 15, 2016. |

| | |

| Proxy Voting | Your vote is important. You may vote in one of four ways: |

| | | |

| | • | via the Internet using instructions on your proxy card; |

| | | |

| | • | by calling the toll-free number on your proxy card; |

| | | |

| | • | by signing, dating and returning your proxy card; or |

| | | |

| | • | in person by attending the annual meeting. |

| | On behalf of the Board of Directors, |

| |  |

| | Ingrid J. Keiser

General Counsel, Secretary and

Executive Vice President of People Strategy |

Dallas, Texas

April 15, 2016

Important Notice Regarding the Availability of Proxy Materials

For the Annual Meeting of Stockholders to be Held on June 10, 2016

The Notice of Annual Meeting of Stockholders and Proxy Statement and the 2015 Annual Report are available at

ir.clubcorp.com under Financial Information/SEC Filings. The information contained on our website is not part of this document.

CLUBCORP HOLDINGS, INC.

PROXY STATEMENT FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS

To be held on Friday, June 10, 2016

TABLE OF CONTENTS

PROXY STATEMENT

The board of directors of ClubCorp Holdings, Inc. (the “Company”) is soliciting proxies for the 2016 Annual Meeting of Stockholders. This proxy statement and the accompanying proxy card contain information about the proposals that will be voted on at the annual meeting. This proxy statement and the Annual Report on Form 10-K for the year ended December 29, 2015 are first being mailed or made available on the Internet on or about April 26, 2016.

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

Who may vote and how many votes do I have?

Common stockholders of record at the close of business on April 15, 2016 may vote. As of that date there were outstanding and entitled to vote 65,541,922 shares of our common stock. For each matter presented for a vote, you have one vote for each share you own as of close of business on April 15, 2016, including shares:

| • | held directly in your name as “stockholder of record” (also referred to as “registered stockholder”); |

| • | held for you in an account with a broker, bank or other nominee (shares held in “street name”)—street name holders generally cannot vote their shares directly and instead must instruct the broker, bank or nominee how to vote their shares; and |

| • | held for you by us as shares of restricted stock under any of our equity incentive plans. |

How do proxies work?

The board of directors of the Company (the “Board of Directors”) is asking for your proxy. Giving your proxy means you authorize the persons named as proxies to vote your shares at the meeting in the manner you direct. You may vote for all, some or none of our director nominees, and you may vote for or against, or abstain from voting with regard to Proposal 2 and Proposal 3 set forth below. If you sign and return the proxy card but do not specify how to vote, the persons named as proxies will vote your shares as follows:

Proposal 1—for the election of the director nominees;

Proposal 2—for approval of the advisory vote on named executive officer compensation;

Proposal 3—for ratification of Deloitte & Touche LLP as our independent registered public accounting firm for 2016.

How do I vote?

If you were a stockholder of record on April 15, 2016, there are four ways you may vote, as explained in the detailed instructions on your proxy card. You may:

| • | vote via the Internet by going to www.proxyvote.com and following the instructions on how to complete an electronic proxy card. You will need the 12-digit number included on your Notice or your proxy card in order to vote by Internet; |

| • | vote by calling 1-800-690-6903 and by following the recorded instructions. You will need the 12-digit number included on your Notice or your proxy card in order to vote by telephone; |

| • | vote by signing, dating and returning your proxy card in the enclosed envelope; or |

| • | vote in person by attending the annual meeting. |

Please help us save time and postage costs by voting through the Internet or by telephone. Please follow the instructions on your proxy card for voting by mail or in person.

If your shares are held by a broker or other nominee, you will receive instructions from the broker or other nominee that you must follow in order to vote your shares.

Whether you plan to attend the meeting or not, we encourage you to vote as soon as possible.

Internet and telephone voting facilities will close at 11:59 p.m. (Eastern Daylight Time) on June 9, 2016 for the voting of shares held by stockholders of record or held in street name.

Mailed proxy cards with respect to shares held of record or in street name must be received no later than June 9, 2016.

Will anyone at the Company know how I vote?

Broadridge Investor Communication Solutions, Inc., the independent proxy tabulator we use, will count the votes and act as the inspector of election for the annual meeting. Your individual vote will be kept confidential from our directors, officers and employees.

What does it mean if I receive more than one proxy card?

You may receive more than one proxy card depending on how you hold your shares and how your shares are registered. If you hold shares through someone else, such as a bank, broker or other nominee, you may also receive proxy materials from them asking how you want to vote. If the names on your accounts are different, you will receive more than one proxy card.

If you receive more than one proxy card, we encourage you to complete and return all proxy cards delivered to you to vote all shares registered to you.

Can I change my vote?

You can revoke a proxy before the time for voting at the annual meeting in several ways:

| • | by voting again via the Internet or by telephone; |

| • | by mailing a new proxy card with a more recent date than the prior proxy; or |

| • | by notifying our Secretary in writing that you are revoking your proxy. |

You may also revoke your proxy by voting in person at the annual meeting.

How do I attend the annual meeting? What do I need to bring?

You need to bring a valid picture identification (such as a driver’s license or passport).

You also need to bring documentation showing that you owned shares in the Company at the close of business on April 15, 2016.

If you are a stockholder of record, please bring either:

| • | the Notice Regarding the Availability of Proxy Materials that was mailed to you; or |

| • | a copy of your proxy card, if you received your proxy materials by mail or email. |

If you own your shares through your bank, brokerage firm or other nominee, please bring either:

| • | the notice or voting instruction form you received from your bank, brokerage firm or other nominee; or |

| • | a brokerage statement reflecting your ownership of shares in the Company at the close of business on April 15, 2016. |

Alternatively, you may make arrangements in advance by contacting our Investor Relations Department at (972) 888-7495 or by email at clubcorp.investor.relations@clubcorp.com.

Please note that upon admission to the meeting, you will not be able to vote your shares at the meeting without a legal proxy from your bank, brokerage firm or other nominee.

No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the annual meeting.

What constitutes a “quorum” for the meeting?

A quorum is necessary to conduct business at the annual meeting. A quorum requires the presence, in person or by proxy (regardless of whether the proxy has authority to vote on all matters), of the holders of a majority of the outstanding voting power of the Company’s common stock. Broker “non-votes” and abstentions will be counted for purposes of determining whether a quorum is present at the meeting.

What is a broker “non-vote”?

If a broker holds your shares in street name and you fail to provide voting instructions to your broker, the broker has the discretion to vote your shares on routine matters, such as ratification of our independent registered public accounting firm, but not on non-routine matters, such as the election of the director nominees, advisory vote to approve the compensation of executive officers or certain stockholder proposals. Broker “non-votes” on non-routine matters occur when you fail to provide voting instructions to your broker for shares you hold through your broker. As explained below (see “How many votes are needed?”), broker “non-votes” do not count as votes cast. As a consequence, it is important that you provide voting instructions to your broker for shares you hold through your broker.

How many votes are needed?

If a quorum is present, directors will be elected by a plurality of the votes cast. Any other proposal being considered will be approved only if the number of votes cast in favor of the proposal exceeds the number of votes cast in opposition to the proposal. Abstentions and broker non-votes will not be counted as votes cast on an item and therefore will not affect the outcome of these proposals.

If you hold your shares through a broker and you do not instruct the broker on how to vote, your broker may exercise its discretionary authority to vote your shares regarding Item 3, but cannot exercise its discretionary authority to vote your shares regarding any other item.

The outcome of Item 2 (non-binding advisory vote to approve the compensation paid to our named executive officers) will not be binding on the Board of Directors. Therefore, there is no “required vote” on these resolutions. The Board of Directors will consider the outcomes of these advisory votes in determining how to proceed following the annual meeting.

Who pays for the solicitation of proxies?

We pay the cost of soliciting proxies. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for sending proxy materials to stockholders. In addition to the use of the mail, proxies may be solicited personally or by telephone or electronic media by our employees, who will not receive any additional compensation for this.

What is “householding”?

Householding is a procedure that permits us, with your prior permission, to send a single set of our annual report and proxy statement to any household at which two or more stockholders reside. Each stockholder will continue to receive a separate proxy card for voting and attendance purposes. Householding reduces the volume of duplicate information you receive, as well as our expenses.

Please see “Additional Information—Householding” below or contact our Investor Relations Department at (972) 888-7495 or by email at clubcorp.investor.relations@clubcorp.com for more information on this important stockholder program.

How does the Board of Directors recommend that I vote?

Our Board of Directors recommends that you vote your shares:

| • | for the election of the director nominees; |

| • | for approval of the advisory vote on named executive officer compensation; and |

| • | for ratification of Deloitte & Touche LLP as our independent registered public accounting firm for 2016. |

Could other matters be decided at the Annual Meeting?

At the date this Proxy Statement went to print, we did not know of any matters to be raised at the annual meeting other than those referred to in this Proxy Statement.

If other matters are properly presented at the annual meeting for consideration and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

ITEM 1 ON THE PROXY CARD

ELECTION OF DIRECTORS

Directors and Nominees for Election as Directors

Our business and affairs are managed under the direction of our Board of Directors. Our Board of Directors consists of seven (7) directors. Subject to certain provisions in our amended and restated articles of incorporation, our amended and restated bylaws establish a range for the authorized number of directors comprising our Board of Directors of not less than three but not more than fifteen, with the actual number to be fixed from time to time by resolution of our Board of Directors.

In accordance with our amended and restated articles of incorporation and our amended and restated bylaws, our Board of Directors is divided into three classes with staggered three-year terms. At each annual meeting of stockholders after the initial classification, the successors to the directors whose terms will then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election. Our directors are divided among the three classes as follows:

| • | Our class I director is Margaret M. Spellings and her term will expire at the annual meeting of stockholders to be held in 2017. |

| • | Our class II directors are Louis J. Grabowsky and Janet E. Grove and their term will expire at the annual meeting of stockholders to be held in 2018. |

| • | Our class III directors are Eric L. Affeldt, John A. Beckert, Douglas H. Brooks and William E. Sullivan and their term will expire at the annual meeting of stockholders to be held in 2016. |

Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. This classification of our Board of Directors may have the effect of delaying or preventing a change of our management or a change in control.

The Board of Directors, acting upon the unanimous recommendation of its Nominating and Corporate Governance Committee, has unanimously nominated Eric L. Affeldt, John A. Beckert, Douglas H. Brooks and William E. Sullivan for election as Class III directors. Each nominee has consented to being named as a nominee and to serve if elected. While it is not expected that any of the nominees will be unable or unwilling to serve, if for any reason one or more are unable or unwilling to do so, the proxies will be voted for substitute nominees selected by our Board of Directors or the Board of Directors may reduce the number of directors.

Director Nominees

Set forth below are the names, ages and backgrounds of the four director nominees and the other directors continuing in office, as well as the specific experiences, qualifications, attributes and skills that led our Board of Directors to conclude that these individuals should serve or continue serving as directors of the Company at this time.

If Mr. Affeldt is re-elected at the 2016 Annual Meeting of Stockholders, the Board of Directors intends to thereafter re-classify him as a class I director, pursuant to our amended and restated articles of incorporation, in order to achieve greater parity in the number of directors among the three classes. The term of our class I directors will expire at the annual meeting of stockholders to be held in 2017, and therefore Mr. Affeldt will again stand for election as a director at such meeting if so nominated.

Class III—Term Expiring in 2016

Eric L. Affeldt, age 58, has served as our Chief Executive Officer since December 2006 and as a director since 2006. Prior to joining us, he served as a principal of KSL from 2005 to 2007. Mr. Affeldt also previously served as president and chief executive officer of KSL Fairways Golf Corporation from January 1995 to June 1998, vice president and general manager of Doral Golf Resort and Spa in Miami and the combined PGA West and La Quinta Resort and Club in California from June 1998 to June 2000 and was a founding partner of KSL Recreation Corporation. In addition, Mr. Affeldt was president of General Aviation Holdings, Inc. from January 2000 to March 2005. He is currently a national vice president of the Muscular Dystrophy Association, a member of the World Presidents’ Organization, and also serves on the board of directors and as the non-executive chairman for Cedar Fair LP. He holds a B.A. in political science and religion from Claremont McKenna College. As a member of the Board of Directors, Mr. Affeldt contributes his knowledge of the resort and recreation industry, as well as substantial experience developing corporate strategy and assessing emerging industry trends and business operations. Mr. Affeldt also brings his insight into the proper functioning and role of corporate boards of directors, gained through his years of service on various boards of directors.

John A. Beckert, age 62, has served as a director and the Chairman of our Board of Directors since August 2013. Mr. Beckert has been an operating partner for Highlander Partners, L.P., a private equity firm, since March 2012 and served as a special advisor to Highlander Partners, L.P. from October 2010 to March 2012. Mr. Beckert served as the chairman of the board of the Composites Group from December 2010 until November 2014. Previously, from August 2004 to December 2006, Mr. Beckert was ClubCorp, Inc.’s chief executive officer and president and its chief operating officer and president from August 2002 to August 2004. He also served as a member of the Board of Directors. Prior to that, he was a partner in Seneca Advisors L.L.P. from 2000 to 2002 and president and chief operating officer of Bristol Hotels & Resorts from 1998 to 2000. Mr. Beckert served as vice president of operations of Bristol Hotels & Resorts from 1985 to 1998. Mr. Beckert serves on the board of directors of A.H. Belo Corporation, where he is a member of the audit, compensation and nominating and governance committees, and has served as a consultant to our Board of Directors. Mr. Beckert holds a B.S. in hotel administration from Cornell University. Mr. Beckert’s prior experience with our company and his background in finance and the resort and hotel industries give him the qualifications and skills to serve as a member of our Board of Directors.

Douglas H. Brooks, age 63, has served as a director since August 2013. Mr. Brooks served as chairman of the board of directors of Brinker International, Inc. from November 2004 to December 2013 and currently serves as a consultant to Brinker International. Mr. Brooks served as Brinker International’s chief executive officer from January 2004 to January 2013 and as its president from January 1999 to January 2013. Mr. Brooks has also served in other capacities for Brinker International including as its chief operating officer and as president of Chili’s Grill & Bar. Mr. Brooks also serves on the board of directors of Southwest Airlines Co., where he is a member of the nominating and corporate governance committee as well as the safety committee, and Auto Zone, Inc., where he is a member of the compensation committee. He earned a B.S. in Hotel and Restaurant Management from the University of Houston in 1975. As a member of our Board of Directors, Mr. Brooks brings his knowledge of the hotel and restaurant industries, as well as substantial insight into successful compensation and incentive structures.

William E. Sullivan, age 61, has served as a director since August 2013. Since June 2014, Mr. Sullivan has served as the Chief Financial Officer and Treasurer of Purdue University. From March 2007 to May 2012, Mr. Sullivan served as chief financial officer of Prologis, Inc. Prior to joining Prologis, Mr. Sullivan was the founder and president of Greenwood Advisors, Inc. from 2005 to 2007. He served as chief executive officer of SiteStuff, Inc. from 2001 to 2005 and chairman of SiteStuff, Inc. from 2001 until the company was sold in June 2007. Mr. Sullivan served as chief financial officer of Jones Lang LaSalle from 1997 to 2001 and in various other capacities with Jones Lang LaSalle since 1984. Prior to joining Jones Lang LaSalle, he was a member of the Communications Lending Group of the First National Bank of Chicago and also served as a member of the tax division of Ernst & Ernst LLP, a predecessor to Ernst & Young LLP. Mr. Sullivan serves on the board of directors of CyrusOne Inc., where he is a member of the audit committee and chair of its nomination and governance committee, and on the board of directors of Jones Lang LaSalle Income Property Trust, Inc., where he is chair of the audit committee. Mr. Sullivan holds a M.B.A. in Management and Finance from Northwestern University’s Kellogg School of Management and a B.S.B.A. in Accounting and Marketing from Georgetown University. He also is a member of the American Institute of Certified Public Accountants. As a member of our Board of Directors, Mr. Sullivan contributes his financial literacy gained through his years of service as a chief financial officer and as the founder and president of a financial consulting and advisory firm.

The Board of Directors recommends that you voteFOR each of the above nominees.

Continuing Directors

Class I—Term Expiring in 2017

Margaret M. Spellings, age 58, has served as President of the University of North Carolina since March 2016. From September 2013 through February 2016, Ms. Spellings served as President of the George W. Bush Presidential Center. Ms. Spellings served as United States Secretary of Education from January 2005 to January 2009 and as Assistant to the President of the United States of America, Domestic Policy, from January 2001 to January 2005. From February 2009 to July 2013, Ms. Spellings served as President and CEO of Margaret Spellings and Company. From June 2010 to July 2013, Ms. Spellings served as President of the U.S. Chamber of Commerce Foundation. Ms. Spellings serves on the board of directors of eight funds in the American Funds family managed by the Capital Research and Management Company, as well as on various committees including the audit committee and nominating and governance committee of several such funds. She earned a B.A. in political science from the University of Houston in 1979 and was awarded an Honorary Doctorate from the University of Houston in 2006. As a member of our Board of Directors, Ms. Spellings contributes her significant executive and board experience providing strategic guidance and leadership to large organizations and her expertise in a broad range of subject matters.

Class II—Term Expiring in 2018

Louis J. Grabowsky, age 64, is a founder and principal of Juniper Capital Management. Prior to founding Juniper Capital, Mr. Grabowsky served as partner at Grant Thornton LLP from August 2002 to July 2014 and as Chief Operating Officer from January 2010 to July 2013. He also served as Senior Advisor, Operations from August 2013 until his retirement in July 2014. Prior to joining Grant Thornton, Mr. Grabowsky served for a total of 27 years in various positions with Arthur Andersen LLP, including in the role of Partner In Charge of the Assurance Practice for the firm’s Dallas office from September 1991 to February 1997. Mr. Grabowsky serves on the board of directors of Griffon Corporation, where he is a member of the audit committee, and Cambrex Corporation. Mr. Grabowsky holds a B.S. in Accounting from the Pennsylvania State University. He is a Member of the American Institute of Certified Public Accountants and Texas Society of Certified Public Accountants. As a member of our Board of Directors, Mr. Grabowsky contributes his financial literacy and auditing expertise gained through his years as an audit partner, managing partner and officer at a global audit, tax and advisory firm.

Janet E. Grove, age 65, has served as a director since August 2013. Prior to joining us, Ms. Grove served as corporate vice chairman from February 2003 to June 2011 for Macys, Inc., and as chairman and chief executive officer from December 1999 to February 2009 and chairman from February 1998 to December 1999 for Macy’s Merchandising Group. From October 2004 to January 2015, Ms. Grove served on the board of directors for Safeway, Inc. She currently serves on the board of directors for Aeropostale, Inc., where she serves on the audit committee, and in an advisory role to the chief executive officer and senior management for Karstadt Department Stores and has served as a consultant to our Board of Directors from December 2012 to August 2013. Ms. Grove holds a Bachelor’s Degree in Marketing from California State University in Hayward. Ms. Grove’s in-depth retail and management experience and her historic knowledge of our company qualify her to be a member of our Board of Directors.

Role and Responsibility of the Board of Directors

The Board of Directors directs and oversees the management of the business and affairs of the Company in a manner consistent with the best interests of the Company and its stockholders. In this oversight role, the Board of Directors serves as the ultimate decision-making body of the Company, except for those matters reserved to or shared with our stockholders. The Board of Directors selects and oversees the members of senior management, who are charged by the Board of Directors with conducting the business of the Company.

Corporate Governance Matters

Corporate Governance Guidelines and Independence

Our Board of Directors has adopted Corporate Governance Guidelines, which describe the principles and practices that the Board follows in carrying out its responsibilities. The Corporate Governance Guidelines provide a framework for our corporate governance efforts and cover topics including, but not limited to, board and committee composition, structure and policies, director qualification standards, expectations of directors, and director compensation. The Nominating and Corporate Governance Committee is responsible for reviewing the Corporate Governance Guidelines and reporting and recommending to the Board of Directors any changes to the Corporate Governance Guidelines. Our Corporate Governance Guidelines are available, free of charge, from our Secretary and on the Corporate Governance page of our Investor Relations website atir.clubcorp.com.

Board of Directors Leadership

As set forth in our Corporate Governance Guidelines, the Company does not have a policy on whether the role of Chairperson of the Board of Directors (the “Chairperson”) and Chief Executive Officer should be separate or combined and, if separate, whether the Chairperson should be selected from the independent directors or should be an employee of the Company. The Company believes that it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairperson and the Chief Executive Officer in any way that is in the best interests of the Company. These roles are currently separate. The Board of Directors believes that separate roles provide, at present, the best balance between the Chairperson’s role of leading the Board of Directors in its oversight of management, and the Chief Executive Officer’s role of focusing on developing and implementing the strategy approved by the Board of Directors and managing the Company’s day to day business.

Role of Board of Directors in Risk Oversight

The Board of Directors has responsibility for the oversight of the Company’s enterprise risk management practices. This responsibility has not been delegated to any of the Board of Directors’ standing board committees. However, the audit committee of the Board of Directors (the “Audit Committee”) is responsible for discussing with management and the Company’s independent registered public accounting firm the Company’s guidelines and policies with respect to risk assessment and risk management, as well as the Company’s major financial risk exposures and the monitoring and control of such exposures. The Audit Committee periodically reports to the Board of Directors on these matters. In addition, each the nominating and corporate governance committee of the Board of Directors (the “Nominating and Corporate Governance Committee”) and the compensation committee of the Board of Directors (the “Compensation Committee”) helps oversee risk in areas over which it has responsibility and periodically reports to the Board of Directors. Management is responsible for developing and implementing appropriate risk management practices on a day to day basis. The Board of Directors receives periodic detailed operating performance reviews from management.

Our President and Chief Executive Officer and other executive officers regularly report to the non-executive directors and the Audit, Compensation and Nominating and Corporate Governance Committees to ensure effective and efficient oversight of our activities and to assist in proper risk management and the ongoing evaluation of management controls. The director of internal audit reports functionally and administratively to our Chief Financial Officer and directly to the Audit Committee. We believe that the leadership structure of our Board of Directors provides appropriate risk oversight of our activities.

Committees of the Board of Directors

The standing committees of our Board of Directors consist of an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The chairperson of each committee is recommended by the Nominating and Corporate Governance Committee and approved by the Board of Directors.

Audit Committee

Our Audit Committee consists of William E. Sullivan, who serves as the Chair, John A. Beckert, Douglas H. Brooks and Louis J. Grabowsky. All members of our Audit Committee are financially literate under the standards of the NYSE. Our Board of Directors has determined that two members of the Audit Committee possess the qualifications of an audit committee financial expert as determined under Regulation S-K Item 407(d) of the Exchange Act and has designated Mr. Sullivan and Mr. Grabowsky as those experts.

Our Board of Directors has also determined that each director serving on the Audit Committee is independent under the corporate governance standards of the NYSE applicable to members of audit committees, including the independence requirements of Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). No member of the committee serves on the audit committee of more than three public companies.

The purpose of the Audit Committee is to assist our Board of Directors in overseeing and monitoring (1) the quality and integrity of our financial statements, (2) our compliance with legal and regulatory requirements, (3) our independent registered public accounting firm��s qualifications and independence, (4) the performance of our internal audit function and (5) the performance of our independent registered public accounting firm. The Audit Committee also prepares the audit committee report required to be included in our proxy statement under the rules and regulations of the Securities and Exchange Commission (the “SEC”).

Our Board of Directors has adopted a written charter for the Audit Committee which is available, free of charge, from our Secretary and on the Corporate Governance page of our Investor Relations website atir.clubcorp.com.

Compensation Committee

Our Compensation Committee consists of Douglas H. Brooks, who serves as the Chair, Janet E. Grove, Margaret M. Spellings and William E. Sullivan. The purpose of the Compensation Committee is to assist our Board of Directors in discharging its responsibilities relating to (1) setting our compensation program and compensation of our executive officers and directors, (2) monitoring our incentive and equity-based compensation plans and (3) preparing the compensation committee report required to be included in our proxy statement under the rules and regulations of the SEC.

Our Board of Directors has adopted a written charter for the Compensation Committee which is available, free of charge, from our Secretary and on the Corporate Governance page of our Investor Relations website atir.clubcorp.com. Under its charter, the Compensation Committee has sole authority to retain, obtain the advice of and terminate any compensation consultant, independent legal counsel or other adviser. This includes authority to approve all such consultants’ fees and other retention terms. The Compensation Committee may also form subcommittees composed of one or more of its members for any purpose that the Compensation Committee deems appropriate and may delegate to such subcommittees such authority as the Compensation Committee deems appropriate. The Compensation Committee may also delegate to one or more officers of the Company the authority to make grants and awards of cash or options or other equity securities to Company personnel who are not “officers” of the Company within the meaning of Rule 16a-1 under the Exchange Act.

The Board of Directors has determined that each director serving on the Compensation Committee is independent under the corporate governance standards of the New York Stock Exchange (the “NYSE”) applicable to members of compensation committees, and that each member of the Compensation Committee is a “non-employee director” for purposes of the Exchange Act and an “outside director” for purposes of Section 162(m) of the Internal Revenue Code.

Compensation Committee Interlocks and Insider Participation

During the 2015 fiscal year, the members of the Compensation Committee were Mr. Brooks, Ms. Grove, Ms. Spellings and Mr. Sullivan. Martin J. Newburger and Bryan J. Traficanti also served as members of the Compensation Committee prior to their resignations from our Board of Directors on October 21, 2015. None of the current or past members of our Compensation Committee is, or has at any time during the past year been, an officer or employee of our Company and none was formerly an officer of the Company. None of our executive officers currently serve, or in the past year has served, as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving on our Board of Directors or Compensation Committee.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Janet E. Grove, who serves as the Chair, John A. Beckert, Louis J. Grabowsky and Margaret M. Spellings. The purpose of our Nominating and Corporate Governance Committee is to assist our Board of Directors in discharging its responsibilities relating to (1) identifying individuals qualified to become new Board of Directors members, consistent with criteria approved by the Board of Directors, subject to our amended and restated articles of incorporation and amended and restated bylaws, (2) reviewing the qualifications of incumbent directors to determine whether to recommend them for reelection and selecting, or recommending that the Board of Directors select, the director nominees for the next annual meeting of stockholders, (3) identifying Board of Directors members qualified to fill vacancies on the Board of Directors or any Board of Directors committee and recommending that the Board of Directors appoint the identified member or members to the Board of Directors or the applicable committee, subject to our amended and restated articles of incorporation and amended and restated bylaws, (4) reviewing and recommending to the Board of Directors corporate governance principles applicable to us, (5) overseeing the evaluation of the Board of Directors and management, and (6) handling such other matters that are specifically delegated to the committee by the Board of Directors from time to time.

Our Board of Directors has adopted a written charter for the Nominating and Corporate Governance Committee which is available on the Corporate Governance page of our Investor Relations website atir.clubcorp.com.

In its assessment of each candidate, the Nominating and Corporate Governance Committee considers many factors including the candidate’s strength of character, the maturity of judgment, familiarity with the Company’s business and industry, independence of thought and the ability to work collegially. While the Nominating and Corporate Governance Committee does not have a formal policy regarding director diversity, such committee may consider other factors that it deems appropriate, which may include ensuring that the Board of Directors, as a whole, is appropriately diverse and consists of individuals with various and relevant experience, as well as the candidate’s technical skills, industry knowledge and experience, and financial expertise.

You may nominate a director at the annual meeting of stockholders and have your nominee’s name included on the ballot distributed at the meeting by providing our Secretary written notice of your intention to do so within the time limits prescribed in our amended and restated bylaws. Your notice must include certain information regarding yourself and your nominee, including, among other items, the nominee’s name, address, occupation and qualifications. Please see “Additional Information” below for more information regarding your ability to nominate directors and to bring other business before stockholder meetings.

Additionally, the Nominating and Corporate Governance Committee will consider a candidate for director suggested by a stockholder by applying the criteria described above and the independence standards attached as Annex A to our Corporate Governance Guidelines. Please see “Additional Information” below for more information regarding your ability to submit director candidates to the Nominating and Corporate Governance Committee for its consideration.

Director Independence

Pursuant to the corporate governance listing standards of the NYSE, a director employed by us cannot be deemed to be an “independent director”, and each other director will qualify as “independent” only if our Board of Directors affirmatively determines that he or she has no material relationship with us, either directly or as a partner, stockholder or officer of an organization that has a relationship with us. Our Corporate Governance Guidelines require that a majority of the Board of Directors must meet the independence standards established by the NYSE.

Our Board of Directors has affirmatively determined that each of Mr. Beckert, Mr. Brooks, Mr. Grabowsky, Ms. Grove, Ms. Spellings and Mr. Sullivan is an “independent” member of our Board of Directors in accordance with NYSE rules. In making that determination, the Board of Directors applied the independence standards established by the NYSE and, if applicable, the categorical standards included in our Corporate Governance Guidelines, which are based on the independence standards established by the NYSE. In addition, the Board of Directors considered any other relevant facts and circumstances. Our Corporate Governance Guidelines may be found on the Corporate Governance page of our Investor Relations website atir.clubcorp.com.

Code of Business Conduct and Ethics

Our Board of Directors has adopted an Amended and Restated Code of Business Conduct and Ethics (the “Code of Ethics”) applicable to all employees, executive officers and directors that addresses legal and ethical issues that may be encountered in carrying out their duties and responsibilities, including the requirement to report any conduct they believe to be a violation of the Code of Ethics. The Code of Ethics is available, free of charge, from our Secretary and on the Corporate Governance page of our Investor Relations website atir.clubcorp.com. If we were to further amend or waive any provision of our Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or any person performing similar functions, we intend to satisfy our disclosure obligations with respect to any such waiver or amendment by posting such information on our website rather than by filing a Form 8-K.

Securities Trading Policy

Our Board of Directors has adopted a Securities Trading Policy providing that directors, officers and employees may not buy or sell the Company’s securities at any time when such persons have material non-public information concerning the Company.

Succession Planning

The Board of Directors periodically reviews management succession and development plans with our Chief Executive Officer. These plans include Chief Executive Officer succession in the event of an emergency or retirement, as well as the succession plan for the Chief Executive Officer’s direct reports and other key employees critical to our operations and success.

Policies and Procedures for Approval of Related Party Transactions

Our Board of Directors has adopted a Related Person Transaction Policy to establish procedures pursuant to which such transactions are reviewed, approved or ratified. The policy applies to any transaction in which the Company is a participant, any related person has a direct or indirect material interest and the amount involved exceeds $120,000, but excludes any transaction that does not require disclosure under Item 404(a) of Regulation S-K. The Audit Committee is responsible for reviewing, approving and ratifying any related person transaction.

Related Party Transactions

Martin J. Newburger, Eric C. Resnik, Michael S. Shannon, Steven S. Siegel and Bryan J. Traficanti resigned from our Board of Directors during our 2015 fiscal year. Each of such persons is affiliated with KSL Capital Partners, LLC (“KSL”). Following these resignations and the sale of all remaining shares of our common stock owned by an affiliate of KSL on October 20, 2015, KSL and its affiliates are no longer related parties.

Registration Rights Agreement. Effective August 23, 2013, we entered into a registration rights agreement with certain affiliates of KSL. This agreement provided to KSL’s affiliates an unlimited number of “demand” registrations and customary “piggyback” registration rights. The registration rights agreement also provided that we will pay certain expenses relating to such registrations (excluding underwriting discounts and commissions) and indemnify KSL’s affiliates party thereto against certain liabilities which may arise under the Securities Act of 1933, as amended. In 2015, we directly paid $887,077 in third party expenses relating to such registrations. The agreement terminated upon the sale of all remaining shares of our common stock owned by an affiliate of KSL on October 20, 2015.

Indemnification Agreements

We have entered into an indemnification agreement with each of our directors and officers. The indemnification agreements, together with our amended and restated articles of incorporation and amended and restated bylaws, require us to indemnify our directors and officers to the fullest extent permitted by Nevada law.

Communications with Directors

Stockholders and other interested parties may communicate with, or otherwise make their concerns known directly to the chairperson of any of the Audit, Nominating and Corporate Governance and Compensation Committees, or to the non-management directors as a group, by addressing such communications or concerns to our Secretary at 3030 LBJ Freeway, Suite 600, Dallas, Texas 75234, Attention: Secretary. The Secretary will forward such communications to the appropriate party. Such communications may be submitted confidentially or anonymously.

Meetings and Committees of the Board of Directors

Meetings. Our Board of Directors held four meetings during 2015. Each incumbent director attended a minimum of 75% of the total number of board and committee meetings held while he or she served as a director or member of a standing committee in 2015. All of our directors at the time, other than Mr. Resnick, attended the 2015 Annual Meeting of Stockholders. All of our directors are expected to attend the 2016 Annual Meeting of Stockholders.

Executive Sessions. Executive sessions, or meetings of our non-employee directors without management present, are held periodically at regularly scheduled meetings of the Board of Directors. Each of these sessions is presided over by Mr. Beckert and may be scheduled by any non-management director. Our standing committees also meet periodically in executive sessions presided over by the chairperson of the committee.

BOARD OF DIRECTORS COMMITTEE ASSIGNMENTS

AND MEETINGS HELD DURING FISCAL YEAR 2015

| | | Audit

Committee | | Compensation

Committee | | Nominating and

Corporate

Governance

Committee |

| Number of Meetings Held in 2015 | | 9 | | 5 | | 6 |

| Eric L. Affeldt | | | | | | |

| John A. Beckert(#) | | X | | | | X |

| Douglas H. Brooks(1) | | X | | C | | X |

| Louis J. Grabowsky(2) | | X | | | | X |

| Janet E. Grove | | | | X | | C |

| Martin J. Newburger(3)* | | | | X* | | X* |

| Eric C. Resnick(3)* | | | | | | |

| Michael S. Shannon(3) | | | | | | |

| Steven S. Siegel(3)* | | | | | | X* |

| Margaret M. Spellings(4) | | | | X | | X |

| William E. Sullivan | | C | | X | | |

| Bryan J. Traficanti(3)* | | | | X* | | |

| # | Chairman of the Board. |

| C | Chairperson. |

| * | No longer a member of our Board of Directors or any of its committees. |

| (1) | Mr. Brooks served on the Nominating and Corporate Governance Committee until September 3, 2015. |

| (2) | Mr. Grabowsky was appointed to the Board of Directors on August 4, 2015 and to the Audit Committee and the Nominating and Corporate Governance Committee on September 3, 2015. |

| (3) | Mr. Resnick resigned from our Board of Directors on August 4, 2015. Messrs. Newburger, Shannon, Siegel and Traficanti resigned from on our Board of Directors on October 21, 2015. |

| (4) | Ms. Spellings was appointed to our Board of Directors, and to the Compensation Committee and the Nominating and Corporate Governance Committee, on September 15, 2015. |

Reimbursements

We reimburse directors for travel and other out-of-pocket expenses incurred by them that are incidental to attending meetings.

Board of Directors’ Self-Evaluation

Our Board of Directors conducted a self-evaluation of its performance in our fiscal year 2015. The evaluation includes a review of the Board’s composition, responsibilities, structure, processes and effectiveness. Each committee of the Board of Directors conducted a similar self-evaluation with respect to such committee in our fiscal year 2015.

AUDIT COMMITTEE REPORT

All members of the Audit Committee are independent under the NYSE listing standards. In addition, each member has the accounting or related financial management experience required under the NYSE listing standards. Our board of directors has determined that two members of the Committee possess the qualifications of an audit committee financial expert as determined under Regulation S-K Item 407(d) of the Exchange Act and has designated Mr. Sullivan and Mr. Grabowsky as those experts. Our Board of Directors has also determined that each director serving on the Audit Committee is independent under the corporate governance standards of the NYSE and the independence requirements of Rule 10A-3 of the Exchange Act. The Audit Committee operates under a written charter adopted by the Board of Directors that was last amended by the Audit Committee and approved by the Board of Directors on December 3, 2013. A copy of the Audit Committee’s charter is available from the Company’s Secretary and made available on the Corporate Governance page of our Investor Relations website atir.clubcorp.com. As required by the charter, the Audit Committee reviews and reassesses the charter annually and recommends any changes to the Board of Directors for approval.

The Audit Committee was formed on August 29, 2013. Periodically, the Audit Committee meets separately with management, the Company’s independent registered public accounting firm and the Company’s internal auditors. The Audit Committee held nine meetings in fiscal year 2015. At six of these meetings, the Audit Committee met in separate private sessions with the Company’s chief audit executive and the Company’s independent registered public accounting firm. An executive session with only the members of the Audit Committee (and occasionally, other members of the Board of Directors) in attendance was also held at six of these meetings. The Audit Committee’s agenda is established by the Audit Committee’s chairperson and the Company’s chief audit executive and chief financial officer.

Under the Audit Committee’s charter, the Audit Committee has the responsibility to, among other tasks, review the integrity of the Company’s financial reporting processes. The Audit Committee also has the responsibility to review, at least annually, the qualifications, independence and performance of the Company’s independent registered public accounting firm. The independent registered public accounting firm is responsible for auditing the Company’s consolidated financial statements and expressing an opinion as to whether they are presented fairly, in all material respects, in conformity with accounting principles generally accepted in the United States of America; and for auditing the Company’s internal control over financial reporting and expressing an opinion whether the Company maintained, in all material respects, effective internal control over financial reporting. These opinions are based on an audit conducted by the independent registered public accounting firm in accordance with the standards of the Public Company Accounting Oversight Board. During 2015, the Company’s independent registered public accounting firm was Deloitte & Touche LLP.

In performing its functions, the Audit Committee acts only in an oversight capacity and relies necessarily on the work and assurances provided to it by management and on opinions made to the Company by its independent registered public accounting firm in its report. Accordingly, the oversight provided by the Audit Committee should not be considered as providing an independent basis for determining that management has established and maintained appropriate internal controls related to the financial reporting process, that the financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, or that the audit of the Company’s financial statements by the independent registered public accounting firm has been carried out in accordance with the standards of the Public Company Accounting Oversight Board.

In fulfilling its responsibilities for the fiscal year ended December 29, 2015, the Audit Committee met with the Company’s management, the Company’s chief audit executive and the Company’s independent registered public accounting firm to review the audited financial statements that are included in the Annual Report on Form 10-K for the fiscal year ended December 29, 2015, including a discussion of the reasonableness of significant accounting judgments and estimates, the overall quality and adequacy of the Company’s internal controls over financial reporting, and the organizational structure and responsibilities of the Company’s internal audit function.

The Audit Committee and members of the Company’s management discussed with the independent registered public accounting firm matters required to be discussed by the auditor with the Audit Committee and others charged with governance responsibilities under PCAOB Standard No. 16 (Communication with Audit Committees), and other regulations. The Audit Committee received and discussed with the independent registered public accounting firm its annual written report on the auditor’s independence from the Company, which is required by applicable requirements of the Public Company Accounting Oversight Board, regarding the firm’s communications with the Audit Committee concerning independence.

The Audit Committee has selected Deloitte & Touche LLP to act as the Company’s independent registered public accounting firm and to examine the Company’s consolidated financial statements for the 2016 fiscal year and the effectiveness of the Company’s internal control over financial reporting as of December 27, 2016. The Audit Committee’s selection of Deloitte & Touche LLP took into account the Audit Committee’s review of Deloitte & Touche LLP’s qualifications as the independent registered public accounting firm for the Company. In addition, the review included matters required to be considered under the SEC’s rules on auditor independence, including the nature and extent of non-audit services. In the Audit Committee’s business judgment, the nature and extent of non-audit services performed by Deloitte & Touche LLP during 2015 did not impair the firm’s independence.

In reliance on the reviews and discussions detailed in this report and the report of the independent registered public accounting firm, the Audit Committee has recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 29, 2015 and that such report be filed with the SEC.

The Audit Committee

William E. Sullivan, Chairman

John A. Beckert

Douglas H. Brooks

Louis J. Grabowsky

BENEFICIAL OWNERSHIP OF VOTING SECURITIES

Principal Stockholders

The following table and accompanying footnotes set forth information with respect to the beneficial ownership of our common stock, as of April 8, 2016, for:

| • | each person known by us to own beneficially more than 5% of our outstanding shares of common stock; |

| • | each of our directors and director nominees; |

| • | each of our named executive officers; and |

| • | all of our directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities.

Unless otherwise noted in the footnotes to the following table, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to their beneficially owned common stock. Unless otherwise specified, the address of each beneficial owner is c/o ClubCorp Holdings, Inc., 3030 LBJ Freeway, Suite 600, Dallas, Texas 75234.

| | | Shares of Common

Stock Beneficially

Owned |

| Name and Address of Beneficial Owner | | Number | | %** |

| 5% Stockholders | | | | |

| BAMCO, Inc.(1) | | | 4,216,179 | | | | 6.4 | % |

| The Vanguard Group(2) | | | 4,124,670 | | | | 6.3 | % |

| BlackRock, Inc.(3) | | | 3,566,830 | | | | 5.4 | % |

| RS Investment Management Co. LLC(4) | | | 3,300,413 | | | | 5.0 | % |

| Citadel Advisors LLC(5) | | | 2,616,511 | | | | 4.0 | % |

| Directors and Named Executive Officers | | | | | | | | |

| John A. Beckert | | | 100,622 | | | | * | |

| Douglas H. Brooks | | | 24,452 | | | | * | |

| Louis J. Grabowsky | | | 5,028 | | | | * | |

| Janet E. Grove | | | 22,815 | | | | * | |

| Margaret M. Spellings | | | 4,399 | | | | * | |

| William E. Sullivan | | | 16,652 | | | | * | |

| Eric L. Affeldt(6) | | | 789,378 | | | | 1.2 | % |

| Curtis D. McClellan(6) | | | 127,775 | | | | * | |

| Mark A. Burnett(6) | | | 388,231 | | | | * | |

| James K. Walters(7) | | | 136,365 | | | | * | |

| Ingrid J. Keiser(6) | | | 160,528 | | | | * | |

| All directors and executive officers as a group (15 individuals) | | | 1,917,134 | | | | 2.9 | % |

| | | | | | | | | |

| * | Less than 1%. |

| ** | Based on 65,541,922 shares outstanding as of April 8, 2016. |

| (1) | This information is based solely on a Schedule 13G/A jointly filed with the SEC on February 16, 2016 by BAMCO, Inc. (“BAMCO”), Baron Capital Group, Inc. (“BCG”), Baron Capital Management, Inc. (“BCM”) and Ronald Baron. BAMCO and BCM are subsidiaries of BCG. Ronald Baron owns a controlling interest in BCG. The address for the holders is 767 Fifth Avenue, 49th Floor, New York, NY 10153. |

| (2) | This information is based solely on a Schedule 13G jointly filed with the SEC on February 11, 2016 by The Vanguard Group. The address for The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. |

| (3) | This information is based solely on a Schedule 13G filed with the SEC by BlackRock, Inc. on January 28, 2016. The address for BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055. |

| (4) | This information is based solely on a Schedule 13G filed with the SEC on February 12, 2016 by RS Investment Management Co. LLC. The address for RS Investment Management Co. LLC is One Bush Street, Suite 900, San Francisco, CA 94104. |

| (5) | This information is based solely on a Form 13G/A jointly filed with the SEC on February 16, 2016 on behalf of Citadel Advisors LLC (“Citadel Advisors”), Citadel Advisors Holdings II LP (“CAH2”), Citadel GP LLC (“CGP”) and Mr. Kenneth Griffin (collectively with Citadel Advisors, CAH2 and CGP, the “Reporting Persons”) with respect to shares of our common stock (and options to purchase such common stock) owned by Citadel Global Equities Master Fund Ltd., a Cayman Islands limited company (“CG”), Surveyor Capital Ltd., a Cayman Islands limited company (“SC”), Citadel Quantitative Strategies Master Fund Ltd., a Cayman Islands limited company (“CQ”), and Citadel Securities LLC, a Delaware limited liability company (“Citadel Securities”). Citadel Advisors is the portfolio manager for CG and SC. Citadel Advisors II LLC, a Delaware limited liability company (“CA2”), is the portfolio manager of CQ. CAH2 is the managing member of Citadel Advisors and CA2. CALC III LP, a Delaware limited partnership (“CALC3”), is the non-member manager of Citadel Securities. CGP is the general partner of CALC3 and CAH2. Mr. Griffin is the President and Chief Executive officer of, and owns a controlling interest in, CGP. The address of the Reporting Persons is c/o Citadel LLC, 131 S. Dearborn Street, 32nd Floor, Chicago, IL 60603. |

| (6) | Includes 146,468, 38,747, 50,912 and 26,620 shares of unvested restricted stock with respect to Messrs. Affeldt, McClellan and Burnett and Ms. Keiser, respectively. |

| (7) | Mr. Walters resigned from this position effective January 11, 2016. |

DIRECTORS AND EXECUTIVE OFFICERS

The following sets forth information regarding our executive officers. Biographical information pertaining to our directors, including Mr. Affeldt, who is both a director and an executive officer, can be found above in “Election of Directors.”

| Name | | Age | | Position |

| Eric L. Affeldt | | 58 | | President, Chief Executive Officer and Director |

| Curtis D. McClellan | | 49 | | Chief Financial Officer and Treasurer |

| Mark A. Burnett | | 51 | | Chief Operating Officer |

| Ingrid J. Keiser | | 55 | | General Counsel, Secretary and Executive Vice President of People Strategy |

| Charles H. Feddersen | | 49 | | Executive Vice President of Golf & Country Clubs |

| Patrick A. Droesch | | 52 | | Executive Vice President of Business, Sports & Alumni Clubs |

| Andrew V. Miller | | 54 | | Executive Vice President of Membership |

| Todd M. Dupuis | | 53 | | Chief Accounting Officer |

| John A. Beckert | | 62 | | Director and Chairman of the Board of Directors |

| Douglas H. Brooks | | 63 | | Director |

| Louis J. Grabowsky | | 64 | | Director |

| Janet E. Grove | | 65 | | Director |

| Margaret M. Spellings | | 58 | | Director |

| William E. Sullivan | | 61 | | Director |

Curtis D. McClellan has served as our Chief Financial Officer and Treasurer since November 2008. Prior to that, he served as vice president of finance and controller for FedEx Office and Print Services, Inc. from March 2003 to November 2008. Mr. McClellan has worked in a number of retail-oriented, multi-store companies, including Digital Generation Systems, Inc. from January 2002 to March 2003, GroceryWorks.com, LLC from May 2000 to December 2001, and Randall’s Food Markets, Inc. from March 1991 to May 2000. He currently serves on the board of managers and as chair of the audit committee for Avendra, LLC. Mr. McClellan holds a B.S. in accounting from Abilene Christian University and is a Certified Public Accountant.

Mark A. Burnett has served as our Chief Operating Officer since October 2013 and previously served as Executive Vice President of Golf & Country Clubs from December 2006 to October 2013. From December 2004 to December 2006, Mr. Burnett was the owner and operator of a multi-unit territory of Five Guys Enterprises, LLC franchises. Prior to that, he served as chief operating officer for American Golf Corporation from January 2000 to December 2004. Mr. Burnett previously served as president and chief executive officer from June 1998 to December 1999 and chief operating officer from September 1996 to June 1998 for KSL Fairways Golf Corporation, and as vice president of operations for Golf Enterprises, Inc. from January 1993 to August 1996. Mr. Burnett holds a B.S. in business management from Indiana University.

Ingrid J. Keiser has served as our General Counsel, Secretary, and Executive Vice President of People Strategy since July 2008 and previously as Chief Legal Officer from July 2007 to July 2008. Prior to that, Ms. Keiser served as an attorney at American Airlines from August 2004 to July 2007. She previously served as assistant general counsel and assistant secretary for Vail Resorts, Inc. from January 1997 to August 2004, and as senior counsel and secretary for Ralston Resorts, Inc. (formerly known as Keystone Resorts Management, Inc.) from May 1992 to January 1997 and as associate counsel from May 1989 to May 1992. Ms. Keiser holds a J.D. from the University of Wisconsin Law School, and a B.A. in international relations from University of California at Davis.

Charles H. Feddersen has served as our Executive Vice President of Golf & Country Clubs since November 2015. Previously, he served as our Senior Vice President, Business, Sports & Alumni Clubs from January 2014 to November 2015, and as our Regional Vice President, North Texas from January 2010 to December 2013. Mr. Feddersen attended the University of Phoenix and served as a Sergeant in the U.S. Army.

Patrick A. Droesch has served as our Executive Vice President of Business, Sports & Alumni Clubs since November 2014. Prior to joining us, he served as Chief Operating Officer and President of Front Burner Restaurants from March 2013 to June 2014, and Chief Operating Officer and President of Lone Star Management (owner of Lone Star Steakhouse and Texas Land & Cattle Steakhouse) from June 2010 to February 2013. He has served as a board member of Real Mex Restaurants since November 2014. Mr. Droesch holds a B.A. in Communications from California State University.

Andrew V. Miller has served as our Executive Vice President of Membership since January 2016. Previously, he served as our Senior Vice President, Membership Sales – Golf and Country Club Division from October 2007 to January 2016, and as our Regional Vice President, Operations from June 2004 to October 2007. Mr. Miller holds an MBA from Southern Methodist University, a BAAS in education from the University of North Texas and an AAAS in Business Management from the University of Minnesota.

Todd M. Dupuis has served as our Chief Accounting Officer since June 2015. He had previously served as our Vice President and Controller since May 2008. Mr. Dupuis holds a BBA in Accounting from Lamar University and is a Certified Public Accountant.

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

Our compensation discussion and analysis discusses the compensation programs and policies in place for our named executive officers (or “NEOs”). For the fiscal year ended December 29, 2015, our NEOs were as follows:

| • | Eric L. Affeldt, our President and Chief Executive Officer; |

| • | Curt D. McClellan, our Chief Financial Officer; |

| • | Mark A. Burnett, our Chief Operating Officer; |

| • | James K. Walters, our former Executive Vice President, Sales & Marketing(1); and |

| • | Ingrid J. Keiser, our General Counsel, Secretary and Executive Vice President of People Strategy. |

____________

| (1) | Mr. Walters resigned from his position as Executive Vice President, Sales & Marketing on January 11, 2016 and his employment with us terminated on March 15, 2016. |

Our compensation discussion and analysis provides an overview of the objectives of our executive compensation program and explains our compensation decision-making process. The compensation provided to our NEOs for fiscal year 2015 is set forth in detail in the Summary Compensation Table and the other tables appearing under “Compensation of Executive Officers.”

Executive Summary

2015 Financial Performance

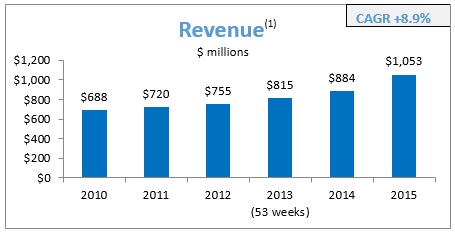

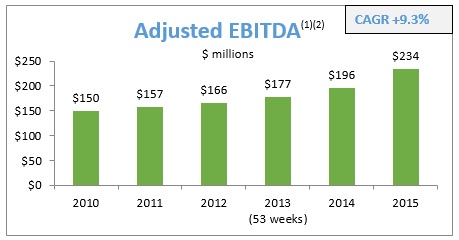

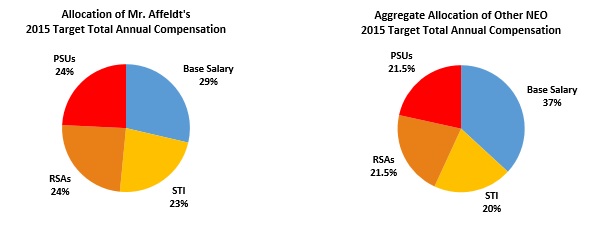

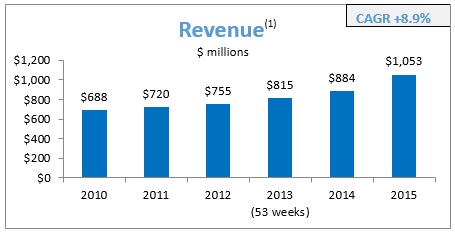

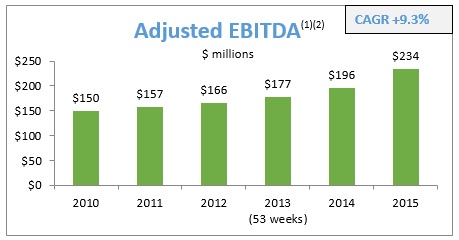

The charts below illustrate some of the key indicators of our financial health and performance over the six year fiscal period from 2010 to 2015.

____________

| (1) | Includes results from clubs acquired in the Sequoia Golf acquisition on September 30, 2014. |

| (2) | See Annex A to this Proxy Statement for additional information regarding Adjusted EBITDA, as well as a reconciliation from net (loss) income. |

Highlights of our fiscal year 2015 accomplishments include the following:

| • | Revenue was up 19% over fiscal year 2014, to $1,053 million. |

| • | Adjusted EBITDA was up 19% over fiscal year 2014, to $234 million. |

| • | Membership, excluding managed clubs, was up 2.8% over fiscal year 2014, to approximately 173,000. |

| • | Approximately 50% of our memberships were enrolled in our Optimal Network Experience (O.N.E.) or similar upgrade programs as of the end of fiscal year 2015, compared to approximately 39% of memberships as of the end of fiscal year 2014. |

| • | We acquired nine clubs, with one subsequently divested, and completed reinventions at 21 clubs. |

| • | As of the end of fiscal year 2015, we owned, leased or operated through joint ventures 148 golf and country clubs and managed 10 such clubs, and we owned, leased or operated through joint ventures 46 business, sports and alumni clubs and managed three such clubs. |

2015 Executive Compensation Highlights

The key executive compensation decisions for fiscal year 2015 were as follows:

| • | We made no changes to the annual base salaries of our NEOs; |

| • | We continued to place a large percentage of our annual long-term incentive awards “at risk” as 50% of each NEO’s annual long-term incentive grant was in the form of performance-based restricted stock units which vest depending on our achievement of pre-established performance objectives based on total shareholder return over a three-year performance period (as described in further detail in this compensation discussion and analysis). |

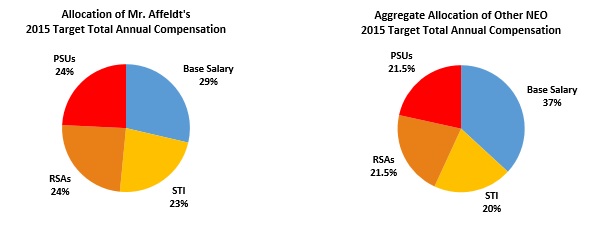

| • | Approximately 71% of the 2015 target total direct compensation (defined as salary plus target annual short-term incentive plus target equity-based awards) approved for Mr. Affeldt was variable or at risk, with 48% in the form of long-term equity incentives tied to the performance of our stock price and 23% in the form of short-term incentives tied to our financial performance and Mr. Affeldt’s individual performance. In the aggregate, approximately 63% of the 2015 target total direct compensation approved for the other NEOs was variable or at risk. |

Pay Practices Aligned with Shareholder Interests

Our compensation philosophy is designed to align our executive compensation programs with long-term shareholder interests, which include the following:

| • | Our annual cash bonus plan requires that we attain a threshold level of Adjusted EBITDA before any portion of the annual bonus may become payable. |

| • | A majority of the NEOs’ compensation is variable or at risk, being tied to incentives based upon our financial performance or to our stock price. |

| • | We do not grant any equity awards that provide for “single trigger” vesting upon a change in control. |

| • | We do not have a defined benefit pension plan or supplemental executive pension plan. |

Impact of 2015 Stockholder Advisory Vote on the Compensation of Named Executive Officers

In June 2015, we provided our stockholders with an advisory vote to approve the compensation of our named executive officers (the “say-on-pay” proposal). At the 2015 Annual Meeting of Stockholders, our stockholders approved the compensation of our NEOs, with over 98% of the votes cast, excluding abstentions and broker non-votes, in favor of the say-on-pay proposal. The Compensation Committee regarded this result as evidence of strong stockholder support of our executive compensation program and considered the results of the say-on-pay proposal and numerous other factors, as discussed in this compensation discussion and analysis, in evaluating our executive compensation program. The Compensation Committee will continue to monitor and assess our executive compensation program and consider the outcome of our say-on-pay proposals when making future compensation decisions for our NEOs.

Overview of Executive Compensation Program Objectives

Our executive compensation program is designed to achieve the following objectives:

| • | alignment between our NEOs’ interests and our stockholders’ interests by tying both annual and long-term incentive compensation to financial and operations performance and, ultimately, to the creation of enterprise value; |

| • | attracting and retaining high caliber executives and key personnel by offering total compensation that is competitive with that offered by similarly situated companies and rewards personal performance; and |

| • | supporting business growth, financial results and the expansion of our portfolio of clubs. |

The 2015 executive compensation program was designed to be competitive with companies with whom we compete for executive talent and to be fair and equitable to us, our executives and our stockholders. We believe that the 2015 executive compensation program provided appropriate alignment between NEOs’ compensation and our stockholders’ interests in the long-term and appropriate compensation opportunities based in part on individual performance in the short-term. In 2014, we modified our executive compensation program to better reflect a performance-based approach, resulting in a higher proportion of NEO compensation that is variable or “at risk,” being tied to incentives based upon our financial performance or to our stock price, with a continuing emphasis on alignment with the interests of our stockholders. The 2015 executive compensation program maintains this structure.

Compensation Decision-Making and Role of the Compensation Committee