Exhibit 99.2

Table of Contents

| |

1 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Forward Looking Statements

Some of the statements contained in this document constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In particular, statements pertaining to the Company’s capital resources, portfolio performance, results of operations, anticipated growth in our funds from operations and anticipated market conditions contain forward-looking statements. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You also can identify forward-looking statements by discussions of strategy, plans or intentions.

The forward-looking statements contained in this document reflect the Company’s current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause actual results to differ significantly from those expressed in any forward-looking statement. The Company does not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: adverse economic or real estate developments in the Company’s markets or the technology industry; obsolescence or reduction in marketability of our infrastructure due to changing industry demands; global, national and local economic conditions; our ability to successfully execute our strategic growth plan and realize its expected benefits; risks related to our international operations; difficulties in identifying properties to acquire and completing acquisitions; the Company’s failure to successfully develop, redevelop and operate acquired properties or lines of business; significant increases in construction and development costs; the increasingly competitive environment in which the Company operates; defaults on, or termination or non-renewal of, leases by customers; decreased rental rates or increased vacancy rates; increased interest rates and operating costs, including increased energy costs; financing risks, including the Company’s failure to obtain necessary outside financing; dependence on third parties to provide Internet, telecommunications and network connectivity to the Company’s data centers; the Company’s failure to qualify and maintain its qualification as a real estate investment trust; environmental uncertainties and risks related to natural disasters; financial market fluctuations; and changes in real estate and zoning laws, revaluations for tax purposes and increases in real property tax rates.

While forward-looking statements reflect the Company’s good faith beliefs, they are not guarantees of future performance. Any forward-looking statements speak only as of the date on which they were made. The Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes. For a further discussion of these and other factors that could cause the Company’s future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 and other periodic reports the Company files with the Securities and Exchange Commission.

| |

2 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

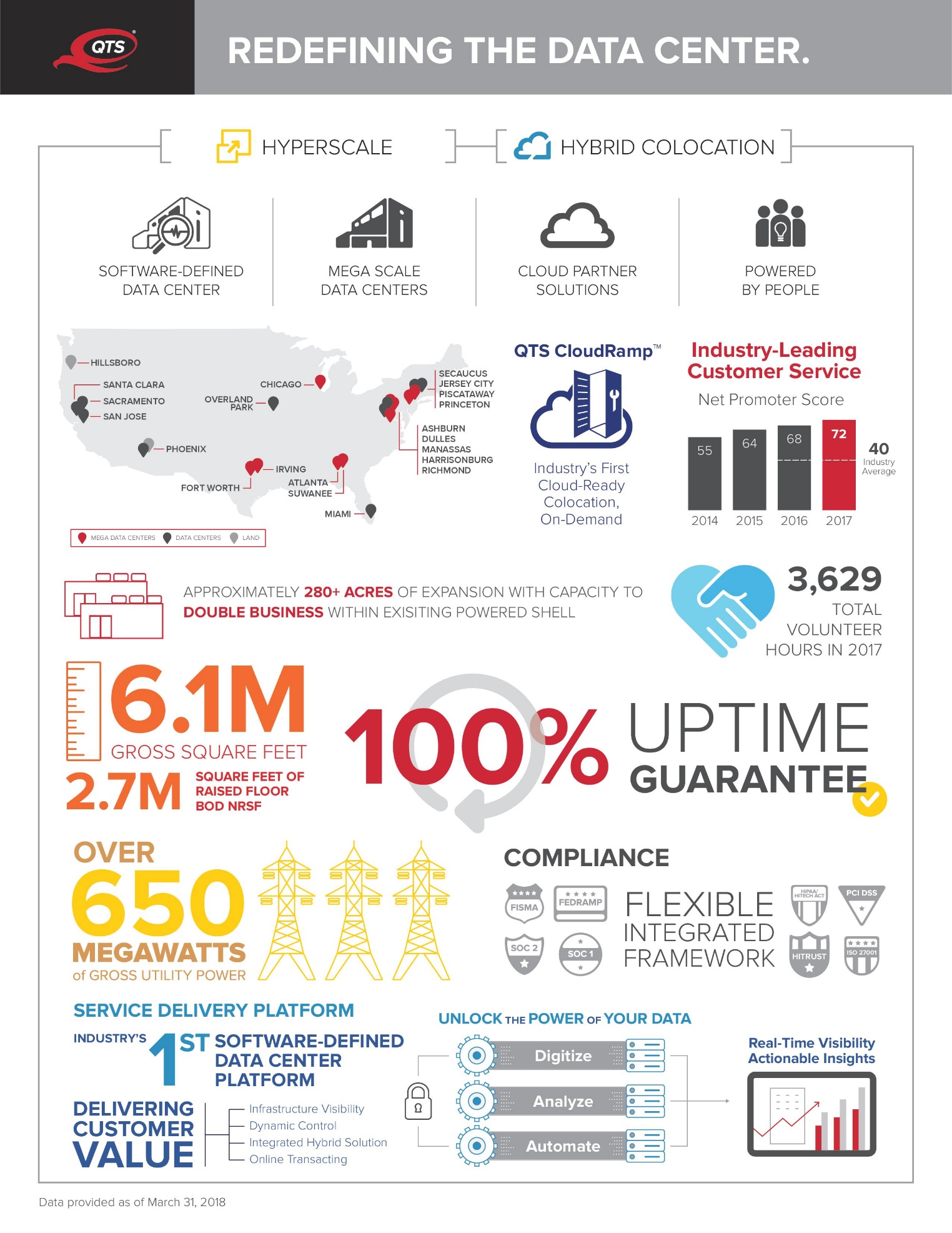

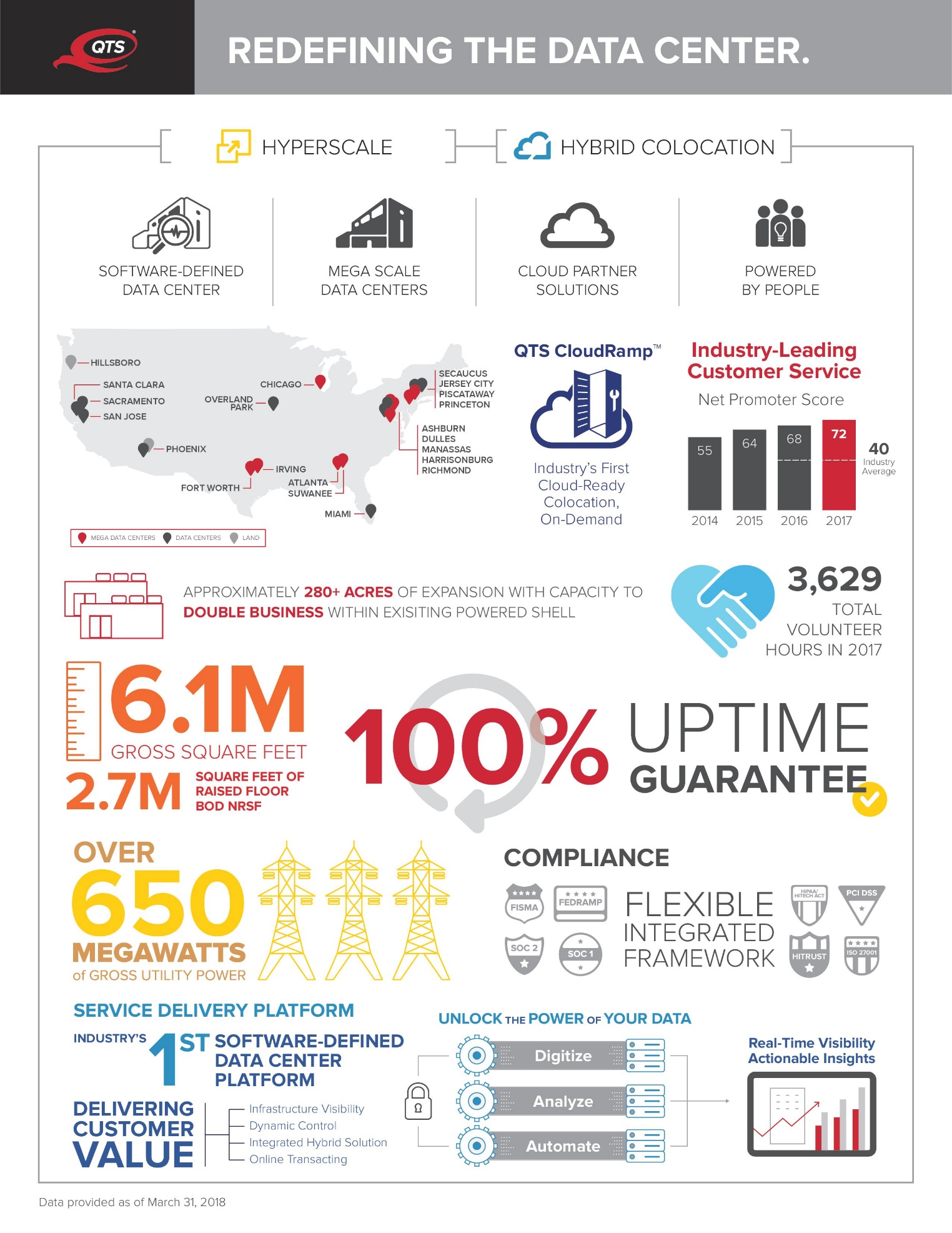

Company Profile

| |

3 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

| |

|

|

Consolidated Balance Sheets | |

| |

4 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

(unaudited and in thousands except share data)

| | | | | | |

| | March 31, | | December 31, |

| | 2018 (1) | | 2017 (1) |

ASSETS | | | | | | |

Real Estate Assets | | | | | | |

Land | | $ | 88,215 | | $ | 88,216 |

Buildings, improvements and equipment | | | 1,778,322 | | | 1,701,287 |

Less: Accumulated depreciation | | | (417,150) | | | (394,823) |

| | | 1,449,387 | | | 1,394,680 |

Construction in progress (2) | | | 636,054 | | | 567,819 |

Real Estate Assets, net | | | 2,085,441 | | | 1,962,499 |

Cash and cash equivalents | | | 15,921 | | | 8,243 |

Rents and other receivables, net | | | 45,057 | | | 47,046 |

Acquired intangibles, net | | | 104,950 | | | 109,451 |

Deferred costs, net (3) (4) | | | 42,398 | | | 41,545 |

Prepaid expenses | | | 10,328 | | | 6,163 |

Goodwill | | | 173,843 | | | 173,843 |

Other assets, net (5) | | | 64,950 | | | 66,266 |

TOTAL ASSETS | | $ | 2,542,888 | | $ | 2,415,056 |

| | | | | | |

LIABILITIES | | | | | | |

Unsecured credit facility, net (4) | | $ | 832,462 | | $ | 825,186 |

Senior notes, net of discount and debt issuance costs (4) | | | 394,333 | | | 394,178 |

Capital lease, lease financing obligations and mortgage notes payable | | | 8,225 | | | 10,565 |

Accounts payable and accrued liabilities | | | 144,616 | | | 113,430 |

Dividends and distributions payable | | | 24,036 | | | 22,222 |

Advance rents, security deposits and other liabilities | | | 28,233 | | | 28,903 |

Deferred income taxes | | | 2,109 | | | 4,611 |

Deferred income | | | 28,679 | | | 25,305 |

TOTAL LIABILITIES | | | 1,462,693 | | | 1,424,400 |

| | | | | | |

EQUITY | | | | | | |

Series A 7.125% cumulative redeemable perpetual preferred stock: $0.01 par value (liquidation preference $25.00 per share), 4,600,000 shares authorized, 4,280,000 shares issued and outstanding as of March 31, 2018; zero shares authorized, issued and outstanding as of December 31, 2017 (6) | | | 103,184 | | | - |

Common stock: $0.01 par value, 450,133,000 shares authorized, 51,135,691 and 50,701,795 shares issued and outstanding as of March 31, 2018 and December 31, 2017, respectively | | | 511 | | | 507 |

Additional paid-in capital | | | 1,052,202 | | | 1,049,176 |

Accumulated other comprehensive income | | | 6,573 | | | 1,283 |

Accumulated dividends in excess of earnings | | | (195,074) | | | (173,552) |

Total stockholders’ equity | | | 967,396 | | | 877,414 |

Noncontrolling interests | | | 112,799 | | | 113,242 |

TOTAL EQUITY | | | 1,080,195 | | | 990,656 |

TOTAL LIABILITIES AND EQUITY | | $ | 2,542,888 | | $ | 2,415,056 |

| (1) | | The balance sheet at March 31, 2018 and December 31, 2017, has been derived from the consolidated financial statements at that date, but does not include all of the information and footnotes required by United States generally accepted accounting principles for complete financial statements. |

| (2) | | As of March 31, 2018, construction in progress included $130.0 million related to land acquisitions whereby the initiation of development activities has begun to prepare the property for its intended use. |

| (3) | | As of March 31, 2018 and December 31, 2017, deferred costs, net included $7.4 million and $7.9 million of deferred financing costs net of amortization, respectively, and $35.0 million and $33.7 million of deferred leasing costs net of amortization, respectively. |

| (4) | | Debt issuance costs, net related to the Senior Notes and term loan portion of the Company’s unsecured credit facility aggregating $11.2 million and $11.6 million at March 31, 2018 and December 31, 2017, respectively, have been netted against the related debt liability line items for both periods presented. |

| (5) | | As of March 31, 2018 and December 31, 2017, other assets, net included $48.7 million and $57.4 million of corporate fixed assets, respectively, primarily relating to construction of corporate offices, leasehold improvements and product related assets. |

| (6) | | As of March 31, 2018, the total liquidation preference of the Series A Preferred Stock was $107.0 million, calculated as $25.00 liquidation preference per share times 4,280,000 shares outstanding. |

| |

5 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

| |

|

|

Consolidated Statements of Operations | |

(unaudited and in thousands except share and per share data)

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

| | 2018 | | 2017 | | 2017 | |

Revenues: | | | | | | | | | | |

Rental | | $ | 85,713 | | $ | 90,078 | | $ | 79,117 | |

Recoveries from customers | | | 11,513 | | | 11,053 | | | 8,361 | |

Cloud and managed services | | | 13,181 | | | 15,421 | | | 16,965 | |

Other (1) | | | 3,290 | | | 2,359 | | | 1,521 | |

Total revenues | | | 113,697 | | | 118,911 | | | 105,964 | |

Operating expenses: | | | | | | | | | | |

Property operating costs | | | 37,740 | | | 41,199 | | | 35,421 | |

Real estate taxes and insurance | | | 2,905 | | | 2,750 | | | 3,147 | |

Depreciation and amortization | | | 35,913 | | | 37,140 | | | 33,948 | |

General and administrative (2) | | | 22,234 | | | 20,820 | | | 22,197 | |

Transaction, integration and impairment costs (3) | | | 920 | | | 9,449 | | | 336 | |

Restructuring (4) | | | 8,530 | | | - | | | - | |

Total operating expenses | | | 108,242 | | | 111,358 | | | 95,049 | |

| | | | | | | | | | |

Operating income | | | 5,455 | | | 7,553 | | | 10,915 | |

| | | | | | | | | | |

Other income and expense: | | | | | | | | | | |

Interest income | | | 1 | | | 1 | | | 1 | |

Interest expense | | | (8,110) | | | (8,049) | | | (6,869) | |

Debt restructuring costs (5) | | | - | | | (19,992) | | | - | |

Income (loss) before taxes | | | (2,654) | | | (20,487) | | | 4,047 | |

Tax benefit of taxable REIT subsidiaries (6) | | | 2,402 | | | 4,374 | | | 1,521 | |

Net income (loss) | | | (252) | | | (16,113) | | | 5,568 | |

Net (income) loss attributable to noncontrolling interests (7) | | | 29 | | | 1,971 | | | (691) | |

Net income (loss) attributable to QTS Realty Trust, Inc. | | $ | (223) | | $ | (14,142) | | $ | 4,877 | |

Preferred stock dividends | | | (328) | | | - | | | - | |

Net income (loss) attributable to common stockholders | | $ | (551) | | $ | (14,142) | | $ | 4,877 | |

| | | | | | | | | | |

Net income (loss) per share attributable to common shares: | | | | | | | | | | |

Basic (8) | | $ | (0.02) | | $ | (0.29) | | $ | 0.10 | |

Diluted (8) | | | (0.02) | | | (0.29) | | | 0.10 | |

| (1) | | Other revenue - Includes straight line rent, sales of scrap metals and other unused materials and various other revenue items. Straight line rent was $2.7 million, $2.3 million and $1.5 million for the three months ended March 31, 2018, December 31, 2017 and March 31, 2017, respectively. |

| (2) | | General and administrative expenses - Includes personnel costs, sales and marketing costs, professional fees, travel costs, product investment costs and other corporate general and administrative expenses. General and administrative expenses were 19.6%, 17.5%, and 20.9% of total revenues for the three months ended March 31, 2018, December 31, 2017 and March 31, 2017, respectively. |

| (3) | | Transaction, integration and impairment costs - For the three months ended March 31, 2018, December 31, 2017, and March 31, 2017, the Company recognized $0.9 million, $0.3 million and $0.3 million, respectively, in transaction and integration costs. The Company also recognized $9.1 million in other non-routine costs for the three months ended December 31, 2017, consisting of $6.5 million related to the write-off of customer specific assets/equipment, $1.8 million related to the impairment of certain product related assets and $0.8 million in other miscellaneous charges. |

| (4) | | Restructuring costs – The Company incurred $8.5 million of restructuring expenses for the three months ended March 31, 2018 associated with its strategic growth plan, of which $4.0 million related to the write-off of certain product related assets, $3.7 million related to employee severance expenses, $0.5 million related to professional fees and $0.3 million related to other miscellaneous restructuring expenses. |

| (5) | | Debt restructuring costs – Primarily includes prepayment fees and write offs of unamortized deferred financing costs associated with the early extinguishment and/or restructuring of certain debt instruments. Amounts for the three months ended December 31, 2017 primarily relate to a prepayment penalty as well as write off of existing unamortized deferred financing costs and debt discount associated with the replacement of the $300 million 5.875% senior notes with the $400 million 4.750% senior notes. |

| (6) | | Tax benefit of taxable REIT subsidiaries - The Company’s non-cash deferred tax benefit, in both the current year and the prior year, relate to recorded operating losses which include certain restructuring, transaction and integration costs. In addition, during the three months ended December 31, 2017, the Company recorded a one-time non-cash tax benefit of $3.4 million attributable to the re-measurement of deferred tax assets (liabilities) as a result of a reduction in the U.S. corporate tax rate from new tax legislation. |

| (7) | | Noncontrolling interest - The noncontrolling ownership interest of QualityTech, LP was 11.5% and 12.4% as of March 31, 2018 and 2017, respectively. |

| (8) | | Basic and diluted net income (loss) per share were calculated using the two-class method. |

| |

6 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

| |

|

|

Consolidated Statements of Comprehensive Income | |

(unaudited and in thousands)

| | | | | | | | | |

| | Three Months Ended |

| | March 31, | | December 31, | | March 31, |

| | 2018 | | 2017 | | 2017 |

Net income (loss) | | $ | (252) | | $ | (16,113) | | $ | 5,568 |

Other comprehensive income (loss): | | | | | | | | | |

Increase (decrease) in fair value of interest rate swaps | | | 5,982 | | | 3,234 | | | — |

Reclassification of other comprehensive income to interest expense | | | 402 | | | — | | | — |

Comprehensive income (loss): | | | 6,132 | | | (12,879) | | | 5,568 |

Comprehensive (income) loss attributable to noncontrolling interests | | | (702) | | | 1,576 | | | (691) |

Comprehensive income (loss) attributable to QTS Realty Trust, Inc. | | $ | 5,430 | | $ | (11,303) | | $ | 4,877 |

| |

7 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Summary of Financial Data

(unaudited and in thousands, except operating portfolio statistics data and per share data)

In conjunction with its previously announced strategic growth plan, QTS is realigning its product offerings around Hyperscale and Hybrid Colocation, while exiting certain of its C3-Cloud and Managed Services offerings, as well as colocation revenue attached to certain customers in the Cloud and Managed Services business that we expect will not remain with QTS post transition (collectively “Non-Core” operations). QTS has realigned information included in this release to focus its guidance and key performance metrics around its Core business, which primarily consists of its Hyperscale and Hybrid Colocation businesses, along with technology and services from its Cloud and Managed Services business that support Hyperscale and Hybrid Colocation customers, which together will be the Company’s primary business following the completion of the strategic growth plan. For informational purposes, QTS has excluded its estimated Non-Core business from certain financial and operating statistics below. A more detailed allocation of Core and Non-Core financial information is presented in the Appendix.

This summary includes certain non-GAAP financial measures that management believes are helpful in understanding the Company’s business, including its core business, as further described in the Appendix. The Company does not, nor does it suggest investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, GAAP financial information or as an expectation of future performance of the Company’s core business. The Company believes that the presentation of non-GAAP financial measures provide meaningful supplemental information to both management and investors that is indicative of the Company’s current operations and its core business. The Company has included a reconciliation of this additional information to the most comparable GAAP measure in the selected financial information below.

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

Summary of Consolidated Results (includes Core and Non-Core) | | 2018 | | 2017 | | 2017 | |

Total revenues | | $ | 113,697 | | $ | 118,911 | | $ | 105,964 | |

Net income (loss) | | $ | (252) | | $ | (16,113) | | $ | 5,568 | |

Fully diluted weighted average shares outstanding | | | 57,946 | | | 57,784 | | | 55,620 | |

Net income (loss) per basic share | | $ | (0.02) | | $ | (0.29) | | $ | 0.10 | |

Net income (loss) per diluted share | | $ | (0.02) | | $ | (0.29) | | $ | 0.10 | |

FFO available to common shareholders & OP unit holders | | $ | 31,477 | | $ | 16,426 | | $ | 35,072 | |

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

Core Financial Summary (1) | | 2018 | | 2017 (2) | | 2017 | |

Core Operating FFO available to common shareholders & OP unit holders | | $ | 36,867 | (3) | $ | 40,960 | (4) | $ | 30,654 | (5) |

Core Operating FFO per diluted share | | $ | 0.64 | (3) | $ | 0.71 | (4) | $ | 0.55 | (5) |

Core MRR (at period end) | | $ | 27,862 | | $ | 27,175 | | $ | 25,361 | |

Core Revenue | | $ | 100,390 | | $ | 100,617 | | $ | 86,876 | |

Core Adjusted EBITDA | | $ | 50,159 | | $ | 50,633 | | $ | 40,644 | |

Core NOI | | $ | 64,792 | | $ | 64,463 | | $ | 55,231 | |

Core NOI as a % of Core revenue | | | 64.5% | | | 64.1% | | | 63.6% | |

Core Adjusted EBITDA as a % of Core revenue | | | 50.0% | | | 50.3% | | | 46.8% | |

Core General and administrative expenses as a % of Core revenue | | | 18.0% | | | 16.7% | | | 19.9% | |

Annualized Core ROIC | | | 12.3% | | | 12.5% | | | 11.6% | |

| (1) | | Represents Core results only. See Appendix for additional information regarding Non-Core reconciliations. |

| (2) | | Results for the three months ended December 31, 2017 included contract modification revenue of $5.2 million attributable to a customer’s location portability rights whereby the customer elected to pay for an option to relocate some of its capacity within other QTS facilities. |

| (3) | | For the three months ended March 31, 2018, excluding the effects of the Company’s deferred tax benefit, Core Operating FFO available to common shareholders & OP unit holders would be $36,100 and Core Operating FFO per diluted share would be $0.62. |

| (4) | | For the three months ended December 31, 2017, excluding the effects of the Company’s deferred tax benefit, Core Operating FFO available to common shareholders & OP unit holders would be $37,081 and Core Operating FFO per diluted share would be $0.64. |

| (5) | | For the three months ended March 31, 2017, excluding the effects of the Company’s deferred tax benefit, Core Operating FFO available to common shareholders & OP unit holders would be $28,761 and Core Operating FFO per diluted share would be $0.52. |

| |

8 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

| | | | | | | |

| | | March 31, | | December 31, | |

Balance Sheet Data - Consolidated Results (includes Core and Non-Core) (1) | | | 2018 | | 2017 | |

Total debt, net of cash and cash equivalents | | | 1,230,304 | (2) | | 1,233,322 | (2) |

Debt to last quarter annualized Adjusted EBITDA | | | 5.7x | (3) | | 5.4x | (3) |

Debt to undepreciated real estate assets | | | 49.2% | (3) | | 52.3% | (3) |

Debt to Implied Enterprise Value | | | 35.8% | (3) | | 28.2% | (3) |

| (1) | | Disclosed on a consolidated basis to conform with debt covenant calculations in accordance with lender requirements. |

| (2) | | The Company has excluded associated debt issuance costs from the Total Debt line item for both periods presented. As a result, the amounts referenced above represent the full amount of debt that will be repaid less the amount of cash and cash equivalents on hand. |

| (3) | | Calculated using total debt, which excludes associated debt issuance costs, less the amount of cash and cash equivalents on hand. |

| | | | | | |

| | | March 31, | | | December 31, |

Operating Portfolio Statistics | | | 2018 | | | 2017 |

Built out square footage: | | | | | | |

Raised floor | | | 1,435,516 | | | 1,403,516 |

Core leasable raised floor (1) | | | 1,159,618 | | | 1,112,350 |

Core leased raised floor (1) | | | 1,001,074 | | | 964,951 |

Core data center % occupied (1) | | | 86.3% | | | 86.7% |

| | | | | | |

Total Raw Shell: | | | | | | |

Total | | | 6,237,837 | | | 6,119,806 |

Basis-of-design raised floor space (2) | | | 2,744,017 | | | 2,677,693 |

| | | | | | |

Data center properties | | | 26 | | | 25 |

Basis of design raised floor % developed | | | 52.3% | | | 52.4% |

| | | | | | |

Data center raised floor % wholly-owned (3) | | | 90.6% | | | 90.4% |

| (1) | | Leasable and leased raised floor includes Core only. Had Non-Core been included consolidated leasable raised floor would be 1,162,739 square feet and 1,116,584 square feet at March 31, 2018 and December 31, 2017, respectively. Had Non-Core been included consolidated leased raised floor would be 1,004,195 square feet and 969,777 square feet at March 31, 2018 and December 31, 2017, respectively. |

| (2) | | See definition in Appendix. |

| (3) | | Wholly owned data centers do not include those subject to capital lease obligations or the Santa Clara facility which is subject to a long-term ground lease. Had the Santa Clara facility been included as a wholly owned facility, the wholly owned data center raised floor percentage would be 94.5% and 94.4% at March 31, 2018 and December 31, 2017, respectively. |

2018 Core Guidance

References to QTS’ “Core” business refers to the Company’s business expected to be retained following the completion of the previously announced strategic growth plan, as further described in the Appendix. The Company is reaffirming its 2018 guidance, as outlined below.

| | | | | | |

| | 2018 (1) |

($ in millions except per share amounts) | | Low | | High |

Core Revenue | | $ | 408 | | $ | 422 |

Core Adjusted EBITDA | | $ | 218 | | $ | 228 |

Core Operating FFO per fully diluted share | | $ | 2.55 | | $ | 2.65 |

Capital Expenditures (2) | | $ | 425 | | $ | 475 |

| (1) | | Guidance for the year ended December 31, 2018 excludes results from the Non-Core business unit. |

| (2) | | Reflects consolidated cash capital expenditures and excludes expenditures from acquisitions. |

The Company expects annual rental churn for the Core business of 3% to 6%. The Company expects capital expenditures of $425 million to $475 million, front end loaded in 2018 related to new development in Ashburn, VA and excluding additional success based development in Hillsboro, OR and Phoenix, AZ.

QTS does not provide reconciliations for the non-GAAP financial measures included in its guidance provided above due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including net income (loss) and adjustments that could be made for restructuring costs, transaction costs, lease exit costs, asset impairments and loss on disposals and other charges as those amounts are subject to significant variability based on future transactions that are not yet known, the amount of which, based on historical experience, could be significant.

| |

9 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Reconciliations of Core Return on Invested Capital (ROIC)

(unaudited and in thousands)

Core Return on Invested Capital (“ROIC”) is a non-GAAP measure that provides additional information to users of the financial statements. Management believes Core ROIC is a helpful metric for users of the financial statements to gauge the Company's performance of its Core business against the capital it has invested in the Core business.

| | | | | | | | | | |

Core Return on Invested Capital (ROIC) | | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

| | 2018 | | 2017 | | 2017 | |

Core NOI (1) | | $ | 64,792 | | $ | 64,463 | | $ | 55,231 | |

Annualized Core NOI | | | 259,168 | | | 257,852 | | | 220,924 | |

Average Core undepreciated real estate assets and other Core net fixed assets placed in service (2) | | | 2,113,788 | | | 2,055,098 | | | 1,908,123 | |

Annualized Core ROIC (2) | | | 12.3% | | | 12.5% | | | 11.6% | |

| (1) | | Includes facility level G&A expense allocation charges of 4% of cash revenue for all facilities, with the exception of the leased facilities acquired in 2015, which include G&A expense allocation charges of 10% of cash revenue. These allocated charges, with respect to Core operations, aggregated to $4.2 million, $4.3 million and $3.8 million for the three months ended March 31, 2018, December 31, 2017 and March 31, 2017 respectively. |

| (2) | | Calculated using Core amounts only. Had the amounts included Non-Core assets and Non-Core NOI, consolidated annualized ROIC for the three months ended March 31, 2018, December 31, 2017 and March 31, 2017 would be 13.5%, 14.3% and 13.8%, respectively. |

| | | | | | | | | | |

| | As of | |

Calculation of Average Core Undepreciated Real Estate Assets and other Core Net Fixed Assets Placed in Service (1) | | March 31, | | December 31, | | March 31, | |

| | 2018 | | 2017 | | 2017 | |

Core Real Estate Assets, net | | $ | 2,053,977 | | $ | 1,930,493 | | $ | 1,650,974 | |

Less: Core Construction in progress | | | (636,054) | | | (563,501) | | | (358,297) | |

Plus: Core Accumulated depreciation | | | 399,802 | | | 378,011 | | | 328,106 | |

Plus: Goodwill | | | 173,843 | | | 173,843 | | | 173,843 | |

Plus: Core Other fixed assets, net | | | 36,236 | | | 34,060 | | | 16,193 | |

Plus: Core Acquired intangibles, net (2) | | | 89,902 | | | 91,586 | | | 96,703 | |

Plus: Core Leasing Commissions, net | | | 33,528 | | | 31,850 | | | 28,667 | |

Total as of period end | | $ | 2,151,234 | | $ | 2,076,342 | | $ | 1,936,189 | |

| | | | | | | | | | |

Average undepreciated real estate assets and other net fixed assets as of reporting period (3) | | $ | 2,113,788 | | $ | 2,055,098 | | $ | 1,908,123 | |

| (1) | | Calculated using Core amounts only, which excludes Non-Core product related assets. Had the amounts included Non-Core assets, consolidated average undepreciated real estate assets and other net fixed assets would be $2,154,999; $2,102,190 and $1.949,323 as of March 31, 2018, December 31, 2017 and March 31, 2017, respectively. |

| (2) | | Net of acquired intangible liabilities and deferred tax liabilities. |

| (3) | | Calculated by using average quarterly balance of each account. |

| |

10 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Implied Enterprise Value and

Weighted Average Shares

| | | | | | | | |

Implied Enterprise Value as of March 31, 2018: | Shares or Equivalents Outstanding | | | Market Price or Liquidation Value as of March 31, 2018 | | | Market capitalization

(in thousands) | |

Class A Common Stock | 51,007,283 | | $ | 36.22 | | $ | 1,847,484 | |

Class B Common Stock | 128,408 | | | 36.22 | | | 4,651 | |

Total Shares Outstanding | 51,135,691 | | | | | | | |

Units of Limited Partnership (1) | 6,711,982 | | | 36.22 | | | 243,108 | |

Options to purchase Class A Common Stock (2) | 205,030 | | | 36.22 | | | 7,426 | |

Fully Diluted Total Shares and Units of Limited Partnership outstanding as of March 31, 2018 | 58,052,703 | | | | | | | |

Liquidation value of Series A Preferred Stock | 4,280,000 | | | 25.00 | | | 107,000 | |

Total Equity | | | | | | $ | 2,209,669 | |

Total Debt | | | | | | | 1,230,304 | (3) |

Implied Enterprise Value | | | | | | $ | 3,439,973 | |

| (1) | | Includes 37,650 of operating partnership units representing the “in the money” value of Class O LTIP units on an “as if” converted basis as of March 31, 2018. |

| (2) | | Represents options to purchase shares of Class A Common Stock of QTS Realty Trust, Inc. representing the “in the money” value of options on an “as if” converted basis as of March 31, 2018. |

| (3) | | Excludes all debt issuance costs reflected as a reduction to liabilities at March 31, 2018 representing the full amount of debt that will be repaid, less the amount of cash and cash equivalents on hand. |

The following table presents the weighted average fully diluted shares for the three months ended March 31, 2018:

| | |

| | Three Months Ended |

| | March 31, 2018 |

Weighted average shares outstanding - basic | | 50,876,837 |

Effect of Class A partnership units (1) | | 6,580,008 |

Effect of Class O units on an "as if" converted basis (1) | | 238,037 |

Effect of options to purchase Class A common stock and restricted Class A common stock on an "as if" converted basis (2) | | 250,963 |

Weighted average shares outstanding - diluted | | 57,945,845 |

| (1) | | The Class A units and Class O units represent limited partnership interests in the Operating Partnership. |

| (2) | | The average share price for the three months ended March 31, 2018 was $42.48. |

| |

11 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Data Center Properties

The table below presents an overview of the portfolio of data center properties that the Company owns or leases, referred to herein as our data center properties, based on information as of March 31, 2018. The table excludes data center development associated with land acquired in Phoenix, AZ which was finalized in the third quarter of 2017, as well as data center development associated with land acquired in the fourth quarter of 2017 in Ashburn, VA and Hillsboro, OR.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Net Rentable Square Feet (Operating NRSF) (3) | | | | | | | | | | | |

Property | | Year

Acquired (1) | | Gross

Square

Feet (2) | | Raised

Floor (4) | | Office &

Other (5) | | Supporting

Infrastructure (6) | | Total | | %

Occupied (Core) (7) | | Annualized

Core Rent (8) | | Available

Utility

Power

(MW) (9) | | Basis of

Design

("BOD")

NRSF | | Current

Raised

Floor as a

% of BOD | |

Richmond, VA | | 2010 | | 1,318,353 | | 167,309 | | 51,093 | | 178,854 | | 397,256 | | 71.4 | % | | $ | 36,957,025 | | 110 | | 557,309 | | 30.0 | % |

Atlanta, GA (Metro) | | 2006 | | 968,695 | | 463,986 | | 36,953 | | 336,266 | | 837,205 | | 96.9 | % | | $ | 94,193,748 | | 72 | | 527,186 | | 88.0 | % |

Irving, TX | | 2013 | | 698,000 | | 168,160 | | 6,981 | | 170,323 | | 345,464 | | 93.0 | % | | $ | 44,100,643 | | 140 | | 275,701 | | 61.0 | % |

Princeton, NJ | | 2014 | | 553,930 | | 58,157 | | 2,229 | | 111,405 | | 171,791 | | 100.0 | % | | $ | 10,035,602 | | 22 | | 158,157 | | 36.8 | % |

Chicago, IL | | 2014 | | 474,979 | | 33,000 | | - | | 35,102 | | 68,102 | | 81.5 | % | | $ | 9,481,996 | | 8 | | 215,855 | | 15.3 | % |

Ashburn, VA | | 2017 | | 445,000 | | - | | - | | - | | - | | 0.0 | % | | $ | - | | 50 | | 178,000 | | - | % |

Manassas, VA | | 2018 | | 118,031 | | - | | - | | - | | - | | 0.0 | % | | $ | - | | 24 | | 66,324 | | - | % |

Suwanee, GA | | 2005 | | 369,822 | | 205,608 | | 8,697 | | 107,128 | | 321,433 | | 92.2 | % | | $ | 54,233,161 | | 36 | | 205,608 | | 100.0 | % |

Piscataway, NJ | | 2016 | | 360,000 | | 88,820 | | 14,311 | | 91,851 | | 194,982 | | 85.3 | % | | $ | 14,244,947 | | 111 | | 176,000 | | 50.5 | % |

Fort Worth, TX | | 2016 | | 261,836 | | 10,600 | | - | | 19,438 | | 30,038 | | 100.1 | % | | $ | 2,004,122 | | 50 | | 80,000 | | 13.3 | % |

Santa Clara, CA* | | 2007 | | 135,322 | | 55,905 | | 944 | | 45,094 | | 101,943 | | 77.5 | % | | $ | 18,466,216 | | 11 | | 80,940 | | 69.1 | % |

Sacramento, CA | | 2012 | | 92,644 | | 54,595 | | 2,794 | | 23,916 | | 81,305 | | 44.9 | % | | $ | 11,635,192 | | 8 | | 54,595 | | 100.0 | % |

Dulles, VA | | 2017 | | 87,159 | | 30,545 | | 5,997 | | 32,892 | | 69,434 | | 53.3 | % | | $ | 13,535,221 | | 13 | | 48,270 | | 63.3 | % |

Leased facilities ** | | 2006 & 2015 | | 206,631 | | 76,451 | | 19,450 | | 42,001 | | 137,902 | | 35.1 | % | | $ | 19,211,559 | | 14 | | 97,692 | | 78.3 | % |

Other *** | | Misc. | | 147,435 | | 22,380 | | 49,337 | | 30,074 | | 101,791 | | 68.2 | % | | $ | 6,247,703 | | 5 | | 22,380 | | 100.0 | % |

Total | | | | 6,237,837 | | 1,435,516 | | 198,786 | | 1,224,344 | | 2,858,646 | | 86.3 | % | | $ | 334,347,135 | | 674 | | 2,744,017 | | 52.3 | % |

| (1) | | Represents the year a property was acquired or, in the case of a property under lease, the year the Company’s initial lease commenced for the property. |

| (2) | | With respect to the Company’s owned properties, gross square feet represents the entire building area. With respect to leased properties, gross square feet represents that portion of the gross |

square feet subject to our lease. This includes 347,261 square feet of QTS office and support space, which is not included in operating NRSF.

| (3) | | Represents the total square feet of a building that is currently leased or available for lease plus developed supporting infrastructure, based on engineering drawings and estimates, but does not |

include space held for redevelopment or space used for the Company’s own office space.

| (4) | | Represents management’s estimate of the portion of NRSF of the facility with available power and cooling capacity that is currently leased or readily available to be leased to customers as data |

center space based on engineering drawings.

| (5) | | Represents the operating NRSF of the facility other than data center space (typically office and storage space) that is currently leased or available to be leased. |

| (6) | | Represents required data center support space, including mechanical, telecommunications and utility rooms, as well as building common areas. |

| (7) | | Calculated as Core data center raised floor that is subject to a signed lease for which space is occupied (1,001,074 square feet as of March 31, 2018), divided by Core leasable raised floor based on the |

current configuration of the properties (1,159,618 square feet as of March 31, 2018), expressed as a percentage. Inclusive of Non-Core space, as of March 31, 2018 consolidated data center

raised floor that is subject to a signed lease for which space is occupied was 1,004,195 square feet and consolidated leasable raised floor based on the current configuration of the properties was

1,162,739 square feet, for an occupancy percentage of 86.4%.

| (8) | | Includes annualized Core rent only. Had the amounts included Non-Core annualized rent, consolidated annualized rent would be $383.0 million as of March 31, 2018. The Company defines annualized rent as MRR multiplied by 12. The Company calculates MRR as monthly contractual revenue under executed contracts as of a particular date, but excludes customer recoveries, deferred set up fees, variable related revenues, non-cash revenues and other one-time revenues. MRR does not include the impact from booked-not-billed contracts as of a particular date, unless otherwise specifically noted. This amount reflects the annualized cash rental payments. It does not reflect the accounting associated with any free rent, rent abatements or future scheduled rent increases and also excludes operating expense and power reimbursements. |

| (9) | | Represents installed utility power and transformation capacity that is available for use by the facility as of March 31, 2018. |

* Subject to long-term ground lease.

** Includes 11 facilities. All facilities are leased, including those subject to capital leases.

*** Consists of Miami, FL; Lenexa, KS; Overland Park, KS; and Duluth, GA facilities.

| |

12 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Redevelopment Costs Summary

(in millions, except NRSF data)

During the first quarter of 2018, the Company brought online approximately nine megawatts of gross power and approximately 32,000 NRSF of raised floor and customer specific capital at its Atlanta-Metro, Chicago, and Irving facilities at an aggregate cost of approximately $67 million.

The under construction table below summarizes the Company’s outlook for development projects which it expects to complete by December 31, 2018 (in millions).

| | | | | | | | | | | |

| | Under Construction Costs (1) |

Property | | Actual (2) | | Estimated Cost to Completion (3) | | Total | | Expected Completion date |

Atlanta, GA (Metro) | | $ | 7 | | $ | 5 | | $ | 12 | | Q3 - Q4 2018 |

Irving, TX | | | 14 | | | 33 | | | 47 | | Q3 - Q4 2018 |

Chicago, IL | | | 17 | | | 10 | | | 27 | | Q3 - Q4 2018 |

Ashburn, VA | | | 68 | | | 20 | | | 88 | | Q2 & Q4 2018 |

Piscataway, NJ | | | 9 | | | 1 | | | 10 | | Q3 - Q4 2018 |

Fort Worth, TX | | | 14 | | | 2 | | | 16 | | Q4 2018 |

Totals | | $ | 129 | | $ | 71 | | $ | 200 | | |

| (1) | | In addition to projects currently under construction, the Company’s near-term redevelopment projects are expected to be delivered in a modular manner, and the Company currently expects to invest additional capital to complete these near term projects. The ultimate timing and completion of, and the commitment of capital to, the Company’s future redevelopment projects are within the Company’s discretion and will depend upon a variety of factors, including the actual contracts executed, availability of financing and the Company’s estimation of the future market for data center space in each particular market. |

| (2) | | Represents actual costs under construction through March 31, 2018. In addition to the $129 million of construction costs incurred through March 31, 2018 for redevelopment expected to be completed by December 31, 2018, as of March 31, 2018 the Company had incurred $507 million of additional costs (including acquisition costs and other capitalized costs) for other redevelopment projects that are expected to be completed after December 31, 2018. |

| (3) | | Represents management’s estimate of the additional costs required to complete the current NRSF under development. There may be an increase in costs if customers’ requirements exceed the Company’s current basis of design. |

| |

13 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Redevelopment Summary

(in millions, except NRSF data)

The following redevelopment table presents an overview of the Company’s redevelopment pipeline, based on information as of March 31, 2018. This table shows the Company’s ability to increase its raised floor of 1,435,516 square feet as of March 31, 2018 by approximately 1.9 times to 2.7 million square feet, exclusive of acquired land parcels in Phoenix, AZ; Ashburn, VA; and Hillsboro, OR.

| | | | | | | | | | |

| | Raised Floor NRSF |

| | Overview as of March 31, 2018 |

Property | | Current

NRSF in

Service | | Under

Construction (1) | | Future

Available (2) | | Basis of

Design NRSF | | Approximate

Adjacent Acreage

of Land (3) |

Richmond, VA | | 167,309 | | - | | 390,000 | | 557,309 | | 111.1 |

Atlanta, GA (Metro) | | 463,986 | | 14,000 | | 49,200 | | 527,186 | | 16.7 |

Irving, TX | | 168,160 | | 14,000 | | 93,541 | | 275,701 | | 29.4 |

Princeton, NJ | | 58,157 | | - | | 100,000 | | 158,157 | | 65.0 |

Chicago, IL | | 33,000 | | 14,000 | | 168,855 | | 215,855 | | 23.0 |

Ashburn, VA | | - | | 19,530 | | 158,470 | | 178,000 | | 35.3 |

Manassas, VA | | - | | - | | 66,324 | | 66,324 | | 45.7 |

Suwanee, GA | | 205,608 | | - | | - | | 205,608 | | 15.4 |

Piscataway, NJ | | 88,820 | | 10,000 | | 77,180 | | 176,000 | | - |

Fort Worth, TX | | 10,600 | | 10,000 | | 59,400 | | 80,000 | | 26.5 |

Santa Clara, CA | | 55,905 | | - | | 25,035 | | 80,940 | | - |

Sacramento, CA | | 54,595 | | - | | - | | 54,595 | | - |

Dulles, VA | | 30,545 | | - | | 17,725 | | 48,270 | | - |

Leased facilities (4) | | 76,451 | | - | | 21,241 | | 97,692 | | - |

Phoenix, AZ | | - | | - | | - | | - | | 84.2 |

Hillsboro, OR | | - | | - | | - | | - | | 92.0 |

Other (5) | | 22,380 | | - | | - | | 22,380 | | - |

Totals as of March 31, 2018 | | 1,435,516 | | 81,530 | | 1,226,971 | | 2,744,017 | | 544.3 |

| (1) | | Reflects NRSF at a facility for which the initiation of substantial activities has begun to prepare the property for its intended use on or before December 31, 2018. |

| (2) | | Reflects NRSF at a facility for which the initiation of substantial activities has begun to prepare the property for its intended use after December 31, 2018. |

| (3) | | The total cost basis of adjacent land, which is land available for the future development, is approximately $145.2 million, of which $111.9 million is included in Construction in Progress on the consolidated balance sheet. The Basis of Design NRSF does not include any build-out on the available land. |

| (4) | | Includes 11 facilities. All facilities are leased, including those subject to capital leases. |

| (5) | | Consists of Miami, FL; Lenexa, KS; and Overland Park, KS facilities. |

| |

14 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Core NOI by Facility and Consolidated Capital Expenditure Summary

(unaudited and in thousands)

The Company calculates Core net operating income, or Core NOI, as net income (loss), excluding: interest expense, interest income, tax expense (benefit) of taxable REIT subsidiaries, depreciation and amortization, write-off of unamortized deferred financing costs, gain (loss) on extinguishment of debt, transaction and integration costs, gain (loss) on sale of real estate, restructuring costs and general and administrative expenses, in each case attributable to the Company’s Core business. The Company believes that core NOI is another metric that is often utilized to evaluate returns on operating real estate from period to period and also, in part, to assess the value of the operating real estate.

Core NOI was calculated in the following manner: For revenue, QTS identified the specific products that it expects to divest of in 2018 and allocated the specific revenue to Non-Core operations. For customers that had Non-Core managed service revenue and also had colocation revenue, the Company performed an analysis on a customer-by-customer basis to determine colocation revenue attached to certain customers in the Cloud and Managed Services business that we expect will not remain with QTS post transition. For operating costs, the Company identified costs such as rent expense and repairs and maintenance costs associated with servicing the aforementioned Non-Core revenue and classified those costs as Non-Core. The breakdown of Core NOI by facility is shown below:

| | | | | | | | |

| Three Months Ended |

| March 31, | | December 31, | | March 31, |

| 2018 | | 2017 | | 2017 |

Breakdown of Core NOI by facility: | | | | | | | | |

Atlanta-Metro data center | $ | 20,404 | | $ | 19,896 | | $ | 19,529 |

Atlanta-Suwanee data center | | 11,407 | | | 11,081 | | | 9,809 |

Richmond data center | | 7,370 | | | 12,472 | | | 7,146 |

Irving data center | | 9,837 | | | 9,624 | | | 6,459 |

Dulles data center | | 1,952 | | | 1,553 | | | 1,530 |

Leased data centers (1) | | 1,412 | | | (438) | | | 841 |

Santa Clara data center | | 2,123 | | | 1,668 | | | 1,768 |

Piscataway data center | | 2,951 | | | 2,319 | | | 2,412 |

Princeton data center | | 2,416 | | | 2,394 | | | 2,404 |

Sacramento data center | | 1,895 | | | 1,712 | | | 1,880 |

Chicago data center | | 1,994 | | | 1,482 | | | 716 |

Fort Worth data center | | 271 | | | 21 | | | 124 |

Other facilities (2) | | 760 | | | 679 | | | 613 |

Core NOI (3) | | 64,792 | | | 64,463 | | | 55,231 |

Add: Non-Core NOI (4) | | 8,260 | | | 10,499 | | | 12,165 |

NOI | $ | 73,052 | | $ | 74,962 | | $ | 67,396 |

| (1) | | Includes 11 facilities. All facilities are leased, including those subject to capital leases. |

| (2) | | Consists of Miami, FL; Lenexa, KS; Overland Park, KS; and Duluth, GA facilities. |

| (3) | | Includes facility level G&A expense allocation charges of 4% of cash revenue for all facilities, with the exception of the leased facilities acquired in 2015, which include G&A expense allocation charges of 10% of cash revenue. These allocated charges, with respect to Core operations, aggregated to $4.2 million, $4.3 million and $3.8 million for the three months ended March 31, 2018, December 31, 2017 and March 31, 2017, respectively. |

| (4) | | Represents NOI associated with Non-Core operations. Non-Core definition is presented in the Appendix. |

Our cash paid for capital expenditures is summarized as follows:

| | | | | | | | | |

| Capital Expenditures |

| Three Months Ended | |

| March 31, | | December 31, | | March 31, | |

| 2018 | | 2017 | | 2017 | |

Development | $ | 84,163 | | $ | 45,346 | | $ | 46,618 | |

Acquisitions | | 24,626 | | | 80,025 | | | - | |

Maintenance capital expenditures | | 930 | | | 848 | | | 796 | |

Other capital expenditures (1) | | 18,843 | | | 24,149 | | | 18,705 | |

Total capital expenditures | $ | 128,562 | | $ | 150,368 | | $ | 66,119 | |

| (1) | | Represents capital expenditures for capitalized interest, commissions, personal property, overhead costs and corporate fixed assets. Corporate fixed assets primarily relate to construction of corporate offices, leasehold improvements and product related assets. |

| |

15 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Leasing Statistics – Core Signed Leases

The mix of leasing activity has a significant impact on quarterly rates, both within major product segments and for overall blended leasing rates. The pricing on new and modified leases signed varies quarter to quarter based on the mix of Core deals leased as Hyperscale and Hybrid Colocation vary on a rate per square foot basis. The amounts below include renewals when there was a change in square footage rented, but exclude renewals where square footage remained consistent before and after renewal. (See renewal table on page 17 for such renewals). The amounts below also exclude leases signed related to Non-Core products and services.

During the first quarter of 2018, the Company entered into 413 new and modified Core leases aggregating to $36.0 million of annualized rent which includes new leased revenue plus revenue from modified renewals. Removing non-incremental annualized MRR from modified renewals and deducting downgrades during the period resulted in $21.0 million in Core incremental annualized rent for the quarter ended March 31, 2018. Pricing on new and modified leases signed during the first quarter was lower than the prior four quarter average, which was driven by a higher proportion of larger footprint deals compared to prior periods.

Annualized rent per leased square foot is computed using the total rent associated with all new and modified Core leases for the respective periods. Incremental Annualized Rent, Net of Downgrades reflects net incremental MRR signed during the period for purposes of tracking incremental revenue contribution.

| | | | | | | | | | | | | | | | | |

| | Period | | | Number of Leases | | | Total Leased

sq ft | | | Annualized rent

per leased sq ft (1) | | | Annualized

Rent of New

and Modified

Leases | | | Incremental

Annualized

Rent, Net of

Downgrades (2) |

| | | | | | | | | | | | | | | | | |

New/modified leases signed - Core (3) | | Q1 2018 | | | 413 | | | 90,294 | | $ | 399 | | $ | 35,982,816 | | $ | 21,039,069 |

| | P4QA* | | | 357 | | | 35,947 | | | 584 | | | 21,003,801 | | | 10,249,429 |

| | Q4 2017 | | | 357 | | | 25,697 | | | 657 | | | 16,879,032 | | | 8,573,152 |

| | Q3 2017 | | | 376 | | | 79,662 | | | 452 | | | 36,043,560 | | | 17,100,790 |

| | Q2 2017 | | | 377 | | | 20,799 | | | 870 | | | 18,090,456 | | | 11,661,116 |

| | Q1 2017 | | | 318 | | | 17,631 | | | 737 | | | 13,002,156 | | | 3,662,659 |

| * | | Average of prior 4 quarters |

| (1) | | Calculated using all Core revenue including new lease MRR and modified renewal MRR. |

| (2) | | Amounts include Core incremental MRR only, net of downgrades. |

| (3) | | Includes leases of Core products only. Had the incremental annualized rent, net of downgrades included Non-Core leases, consolidated incremental annualized rent net of downgrades would be $16,735,105, $8,719,465, $15,329,139, $13,134,696, and $4,333,697 for the three months ended March 31, 2018, December 31, 2017, September 30, 2017, June 30, 2017 and March 31, 2017, respectively, and the prior four quarter average would be $10,379,249. |

NOTE: Figures above do not include cost recoveries.

| |

16 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

The following table outlines the Core booked-not-billed (“BNB”) balance as of March 31, 2018 and how that will affect revenue in 2018 and subsequent years:

| | | | | | | | | | | |

Core Booked-not-billed ("BNB") | 2018 | | 2019 | | Thereafter | | Total |

Core MRR | $ | 2,094,542 | | $ | 1,440,757 | | $ | 960,132 | | $ | 4,495,431 |

Core incremental revenue (1) | | 14,750,532 | | | 13,390,918 | | | 11,521,584 | | | |

Core annualized revenue (2) | | 25,134,504 | | | 17,289,084 | | | 11,521,584 | | | 53,945,172 |

| (1) | | Core incremental revenue represents the expected amount of recognized MRR for the Core business in the period based on when the Core booked-not-billed leases commence throughout the period. |

| (2) | | Core annualized revenue represents the Core booked-not-billed MRR multiplied by 12, demonstrating how much recognized MRR for the Core business might have been recognized if the Core booked-not-billed leases commencing in the period were in place for an entire year. Had the BNB annualized revenue included Non-Core leases, consolidated annualized BNB revenue would be $57,368,640. |

The Company estimates the remaining cost to provide the space, power, connectivity and other services to the customer contracts which had not billed as of March 31, 2018 to be approximately $106 million. This estimate generally includes customers with newly contracted space of more than 3,300 square feet of raised floor space. The space, power, connectivity and other services provided to customers that contract for smaller amounts of space is generally provided by existing space which was previously developed.

| |

17 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Leasing Statistics – Core Renewed and Commenced Leases and Core Rental Churn

The mix of leasing activity has a significant impact on quarterly rates, both within major product segments and for overall blended renewal rates. The Company’s rate performance will vary quarter to quarter based on the mix of Core deals leased as Hyperscale and Hybrid Colocation vary on a rate per square foot basis.

Consistent with the Company’s strategy and business model, the renewal rates below reflect total Core MRR per square foot including all subscribed services. The amounts below exclude leases of Non-Core products. For comparability, the Company includes only those customers that have maintained consistent space footprints in the computations below. All customers with space changes are incorporated into new/modified leasing statistics and rates.

The overall blended rate for Core renewals signed in the first quarter of 2018 was 5.4% higher than the rates for those customers immediately prior to renewal. The Company expects renewal rates will generally increase in the low to mid-single digits.

Core Rental Churn (which the Company defines as Core MRR lost in the period to a customer intending to fully exit the QTS platform in the near term compared to total Core MRR at the beginning of the period) was 1.0% for the first quarter of 2018. Consolidated Rental Churn (which the Company defines as consolidated MRR lost in the period to a customer intending to fully exit the QTS platform in the near term compared to consolidated MRR at the beginning of the period) was 1.8% for the first quarter of 2018.

| | | | | | | | | | | | | | | |

| | Period | | Number of renewed leases | | Total Leased

sq ft | | Annualized rent

per leased sq ft | | Annualized Rent | | Rent Change (1) |

| | | | | | | | | | | | | | | |

Renewed Leases - Core (2) | | Q1 2018 | | 65 | | 99,716 | | $ | 234 | | $ | 23,365,848 | | 5.4 | % |

| | P4QA* | | 75 | | 15,789 | | | 822 | | | 12,985,932 | | 1.6 | % |

| | Q4 2017 | | 71 | | 16,601 | | | 911 | | | 15,126,576 | | 1.1 | % |

| | Q3 2017 | | 81 | | 17,257 | | | 652 | | | 11,252,952 | | 2.2 | % |

| | Q2 2017 | | 89 | | 17,491 | | | 1,033 | | | 18,068,760 | | 1.0 | % |

| | Q1 2017 | | 58 | | 11,808 | | | 635 | | | 7,495,440 | | 2.9 | % |

| * | | Average of prior 4 quarters |

| (1) | | Calculated as the percentage change of the rent per square foot immediately before renewal when compared to the rent per square foot immediately after renewal. |

| (2) | | Includes leases of Core products only. Had the rent change percentage included Non-Core leases, consolidated rent changes would be 5.3%, 1.2%, 2.1%, 1.0%, and 2.6% for the three months ended March 31, 2018, December 31, 2017, September 30, 2017, June 30, 2017 and March 31, 2017, respectively, and 1.5% for the prior four quarter average. |

The mix of leasing activity has a significant impact on quarterly rates, both within major product segments and for overall blended commencement rates. The Company’s rate performance will vary quarter to quarter based on the mix of Core deals leased as Hyperscale and Hybrid Colocation vary on a rate per square foot basis.

During the first quarter of 2018, the Company commenced customer leases (which includes both new customers and existing customers that renewed their lease terms) representing approximately $29.8 million of annualized Core rent at $529 per square foot. This compares to customer leases representing an aggregate trailing four quarter average of approximately $23.1 million of annualized Core rent at $480 per square foot. Average pricing on Core commenced leases during the first quarter of 2018 increased compared to the prior four quarter average primarily due to a higher proportion of smaller footprint hybrid colocation deals.

| |

18 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

| | | | | | | | | | | | |

| | Period | | Number of leases | | Total Leased sq ft | | Annualized rent per leased sq ft | | Annualized Rent |

| | | | | | | | | | | | |

Leases commenced - Core (1) | | Q1 2018 | | 402 | | 56,366 | | $ | 529 | | $ | 29,824,080 |

| | P4QA* | | 400 | | 48,238 | | | 480 | | | 23,144,923 |

| | Q4 2017 | | 424 | | 37,251 | | | 570 | | | 21,240,814 |

| | Q3 2017 | | 463 | | 52,513 | | | 517 | | | 27,135,444 |

| | Q2 2017 | | 384 | | 44,007 | | | 544 | | | 23,957,476 |

| | Q1 2017 | | 329 | | 59,181 | | | 342 | | | 20,245,958 |

| * | | Average of prior 4 quarters |

| (1) | | Leases commenced include all Core commenced monthly recurring rent, inclusive of both incremental rent as well as existing rent that was renewed. Includes leases of Core products only. Had the annualized rent per leased square foot included Non-Core leases, consolidated annualized rent per leased square foot would be $691, $718, $617, $778, and $418 for the three months ended March 31, 2018, December 31, 2017, September 30, 2017, June 30, 2017 and March 31, 2017, respectively, and the prior four quarter average would be $613. Had the annualized rent included Non-Core leases, consolidated annualized rent would be $39,508,860; $26,943,658; $32,585,052; $34,787,704 and $24,743,966 for the three months ended March 31, 2018, December 31, 2017, September 30, 2017, June 30, 2017 and March 31, 2017, respectively, and the prior four quarter average would be $29,765,095. |

| |

19 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Core Lease Expirations

Lease expirations information is presented below for the Core business, which primarily consists of the Company’s Hyperscale and Hybrid Colocation businesses, along with technology and services from its Cloud and Managed Services business that support Hyperscale and Hybrid Colocation customers. Hyperscale leases are typically 5-10 years with the majority of Hyperscale lease expirations occurring in 2022 and beyond. Hybrid Colocation leases are typically 3 years in duration, with the majority of Hybrid Colocation lease expirations occurring in 2018 and 2019. The following table sets forth a summary schedule of the Core lease expirations as of March 31, 2018. Unless otherwise stated in the footnotes, the information set forth in the table assumes that customers exercise no renewal options and all early termination rights are exercised.

Note: The lease expirations table below has been calculated proforma for the effects of two Hyperscale anchor tenants’ leases that were signed but not yet commenced as of March 31, 2018. As such, the annualized rent does not reconcile to reported annualized MRR in other locations of this document.

| | | | | | | | | | | | | | | | | | | |

Year of Lease Expiration | | Number of Leases Expiring (1) | | Total Raised Floor of Expiring Leases | | % of Portfolio Leased Raised Floor | | Annualized Core Rent (2) | | % of Portfolio Annualized Rent | | Hyperscale as % of Portfolio Annualized Rent | | Hybrid Colocation as % of Portfolio Annualized Rent |

Month-to-Month (3) | | 988 | | 13,789 | | 1 | % | | $ | 13,872,052 | | 4 | % | | - | % | | 4 | % |

2018 | | 341 | | 141,818 | | 14 | % | | | 58,934,131 | | 17 | % | | 1 | % | | 16 | % |

2019 | | 942 | | 129,952 | | 13 | % | | | 75,440,378 | | 22 | % | | 5 | % | | 17 | % |

2020 | | 738 | | 92,649 | | 9 | % | | | 49,418,394 | | 15 | % | | 1 | % | | 14 | % |

2021 | | 267 | | 133,868 | | 13 | % | | | 33,854,947 | | 10 | % | | 4 | % | | 6 | % |

2022 | | 141 | | 279,687 | | 28 | % | | | 63,465,476 | | 19 | % | | 11 | % | | 8 | % |

After 2022 | | 129 | | 225,406 | | 22 | % | | | 45,778,601 | | 13 | % | | 10 | % | | 3 | % |

Portfolio Total | | 3,546 | | 1,017,169 | | 100 | % | | $ | 340,763,979 | | 100 | % | | 32 | % | | 68 | % |

| (1) | | Represents each agreement with a customer signed as of March 31, 2018 for which billing has commenced; a lease agreement could include multiple spaces and a customer could have multiple leases. |

| (2) | | Includes annualized Core rent only. Had the amounts included Non-Core annualized rent, consolidated annualized rent expiring month to month, in 2018, 2019, 2020, 2021, 2022, and thereafter would have been $25.5 million, $73.6 million, $86.2 million, $56.2 million, $36.7 million, $65.1 million and $46.1 million, respectively. Had the amounts included Non-Core annualized rent, consolidated % of Portfolio Annualized Rent expiring month to month, in 2018, 2019, 2020, 2021, 2022, and thereafter would have been 7%, 19%, 22%, 14%, 9%, 17% and 12%, respectively. The Company defines annualized rent as MRR multiplied by 12. The Company calculates MRR as monthly contractual revenue under executed contracts as of a particular date, but excludes customer recoveries, deferred set up fees, variable related revenues, non-cash revenues and other one-time revenues. MRR does not include the impact from booked-not-billed contracts as of a particular date, unless otherwise specifically noted. This amount reflects the annualized cash rental payments. |

| (3) | | Consists of both customer leases whose original contract terms ended on March 31, 2018 and have yet to commence signed renewals, as well as customers whose leases expired prior to March 31, 2018 and have continued on a month-to-month basis. |

| |

20 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Largest Core Customers

As of March 31, 2018, the Company’s portfolio was leased to over 1,000 Core customers comprised of companies of all sizes representing an array of industries, each with unique and varied business models and needs. The following table sets forth information regarding the ten largest Core customers in the portfolio based on Core annualized rent as of March 31, 2018 (does not include rents or maturities associated with booked-not-billed customers or ramps for existing customers which have not yet commenced billing):

| | | | | | | | | |

Principal Customer Industry | | Number of Locations | | Annualized Rent (1) | | % of Portfolio Annualized Rent | | Weighted Average Remaining Lease Term (Months) (2) |

Content & Digital Media | | 2 | | $ | 50,640,064 | | 14.9% | | 43 |

Cloud & IT Services | | 2 | | | 17,154,691 | | 5.0% | | 71 |

Cloud & IT Services | | 1 | | | 16,806,955 | | 4.9% | | 48 |

Cloud & IT Services | | 3 | | | 12,923,403 | | 3.8% | | 72 |

Cloud & IT Services | | 6 | | | 11,124,594 | | 3.3% | | 29 |

Content & Digital Media | | 3 | | | 10,787,124 | | 3.2% | | 49 |

Cloud & IT Services | | 1 | | | 5,016,774 | | 1.5% | | 37 |

Financial Services | | 1 | | | 4,775,268 | | 1.4% | | 21 |

Financial Services | | 1 | | | 4,655,352 | | 1.4% | | 76 |

Financial Services | | 1 | | | 4,581,550 | | 1.3% | | 10 |

Total / Weighted Average | | | | $ | 138,465,775 | | 40.7% | | 48 |

| (1) | | Annualized rent is presented for leases commenced as of March 31, 2018. We define annualized rent as MRR multiplied by 12. We calculate MRR as monthly contractual revenue under signed leases as of a particular date, but excludes customer recoveries, deferred set-up fees, variable related revenues, non-cash revenues and other one-time revenues. MRR does not include the impact from booked-not-billed leases (which represent customer leases that have been executed but for which lease payments have not commenced) as of a particular date. This amount reflects the annualized cash rental payments. It does not reflect any free rent, rent abatements or future scheduled rent increases and also excludes operating expense and power reimbursements. |

| (2) | | Weighted average based on customer’s percentage of total Core annualized rent expiring and is as of March 31, 2018. The weighted average lease terms have been calculated proforma for the effects of two Hyperscale anchor tenants’ leases that were signed but not yet commenced as of March 31, 2018. |

| |

21 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

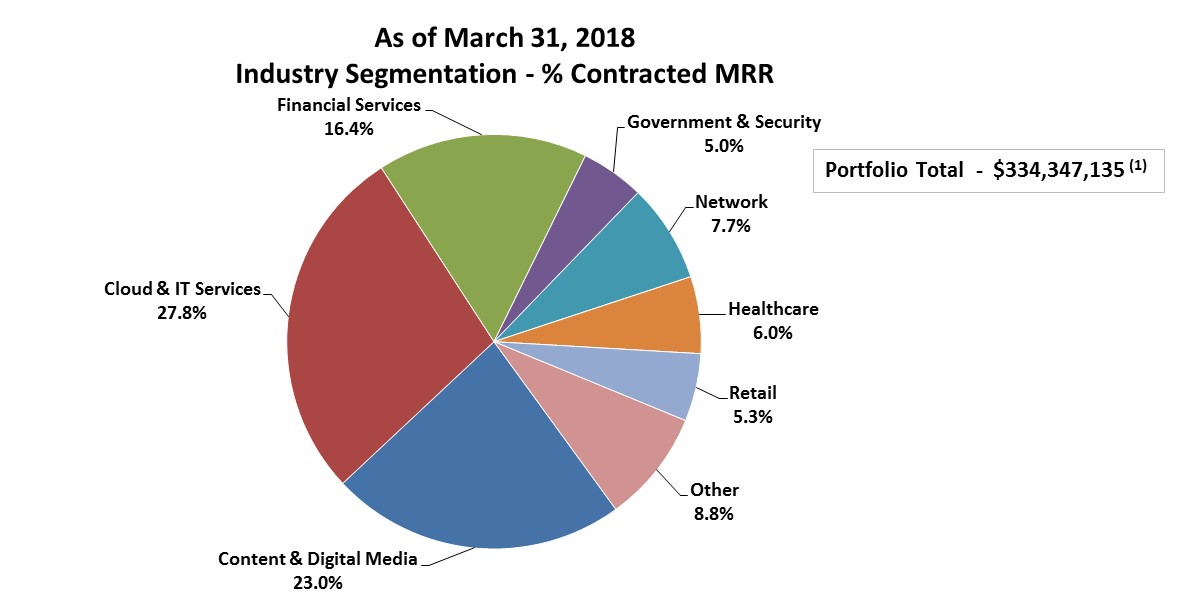

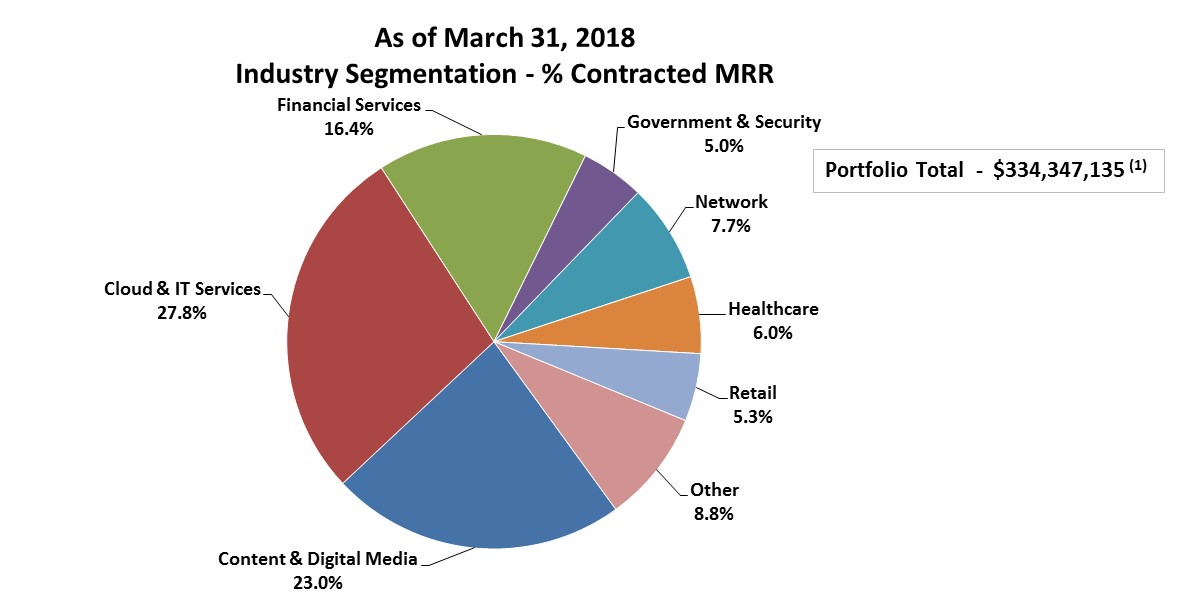

Core Industry Segmentation

The following table sets forth information relating to the Core industry segmentation of customers as of March 31, 2018:

| (1) | | Portfolio Total used for pie chart does not include $48.6 million of Non-Core MRR. |

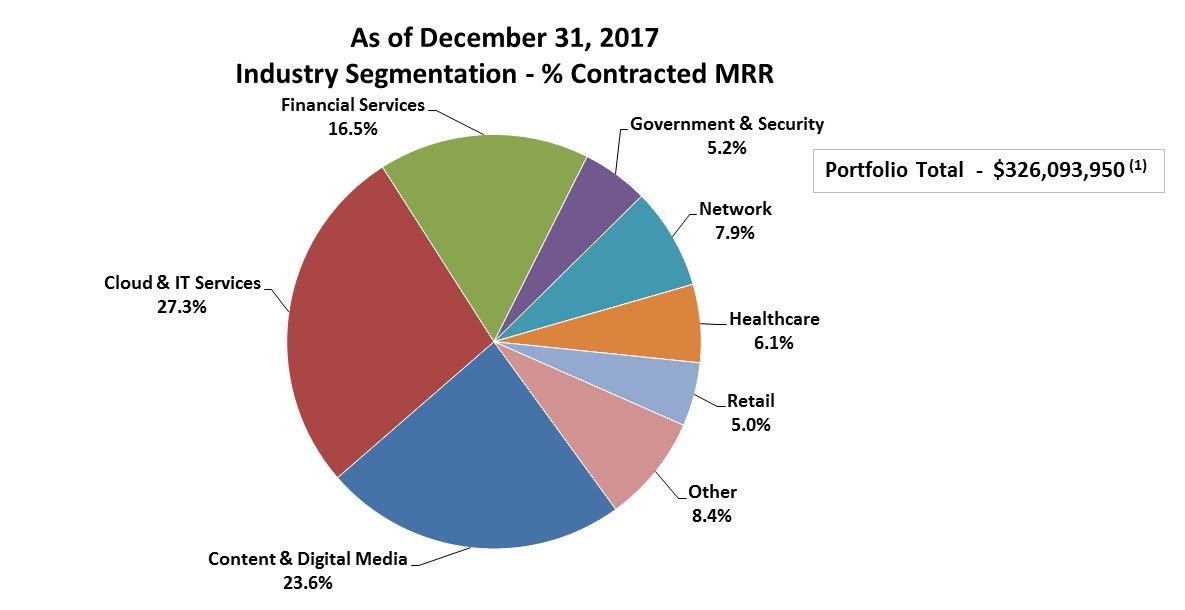

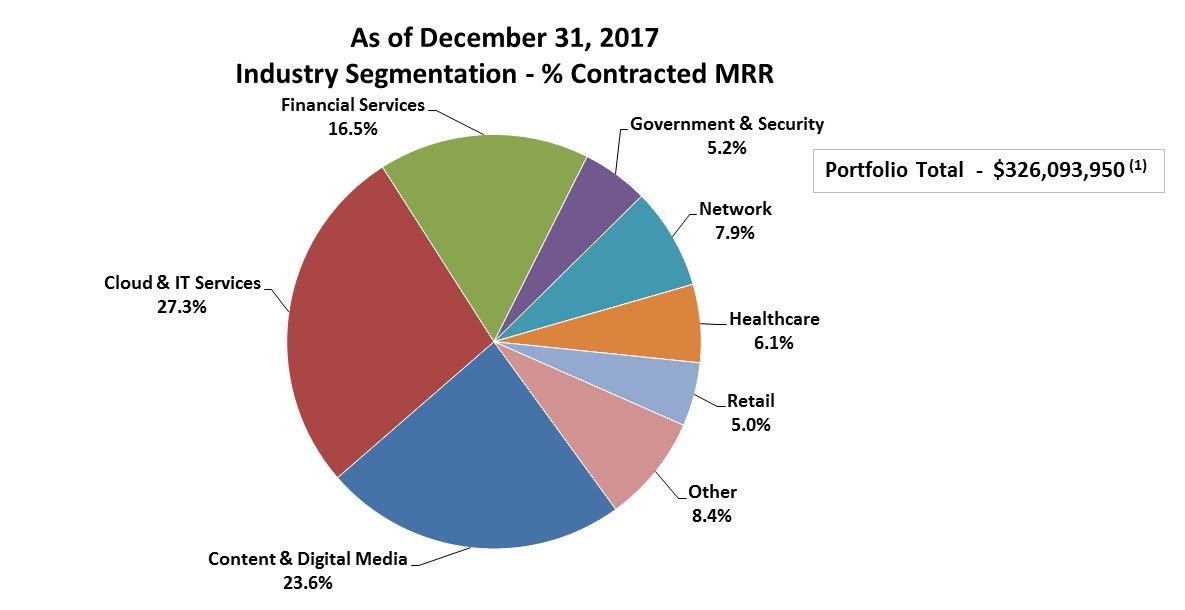

The following table sets forth information relating to the Core industry segmentation of customers as of December 31, 2017:

| (1) | | Portfolio Total used for pie chart does not include $54.4 million of Non-Core MRR. |

| |

22 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

| |

23 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

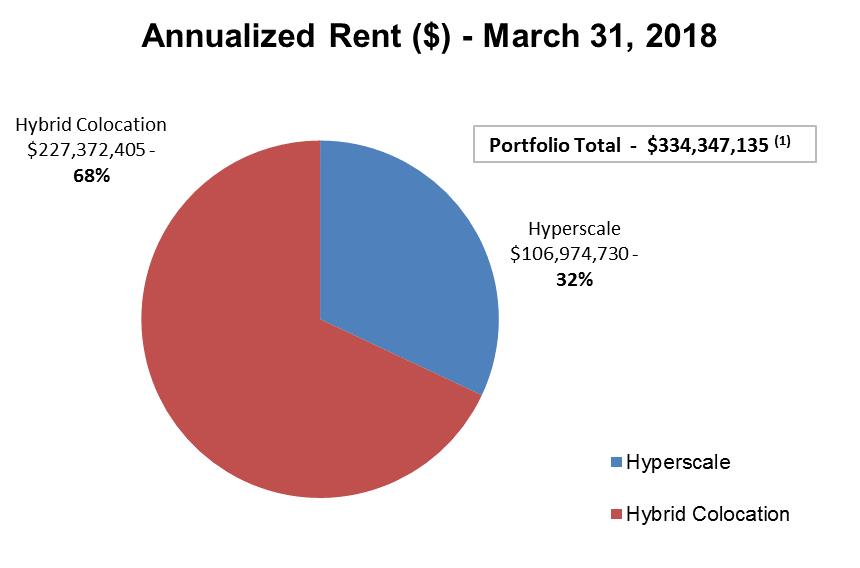

Core Product Diversification

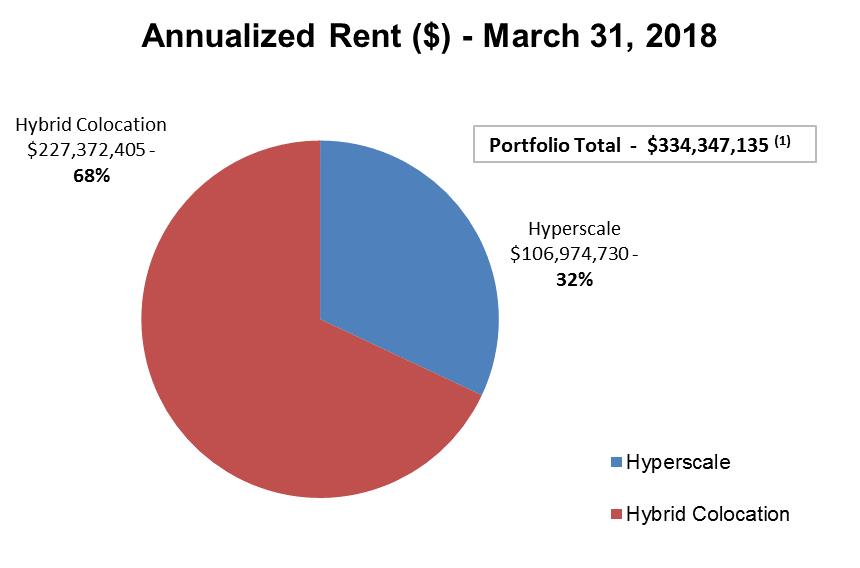

The following table sets forth information relating to the distribution of leases at the properties, by type of Core product offering, as of March 31, 2018:

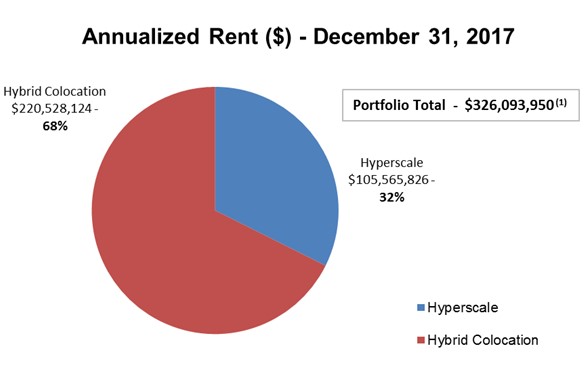

| (1) | | Portfolio Total used for pie chart does not include $48.6 million of Non-Core MRR. |

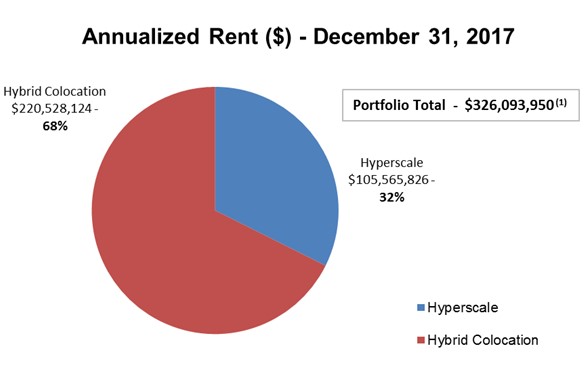

The following table sets forth information relating to the distribution of leases at the properties, by type of Core product offering, as of December 31, 2017:

| (1) | | Portfolio Total used for pie chart does not include $54.4 million of Non-Core MRR. |

| |

24 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Debt Summary and Debt Maturities

(unaudited and in thousands)

The following tables set forth a summary of the Company’s debt instruments:

| | | | | | | | | | | | | | | |

| | | Weighted Average | | | | | | | | |

| | | Coupon Interest Rate at | | Maturities at | | | Outstanding Balance as of: |

| | | March 31, 2018 | | March 31, 2018 | | | March 31, 2018 | | December 31, 2017 |

Unsecured Credit Facility (1) | | | | | | | | | | | | | | | |

Revolving Credit Facility | | | 3.35% | | December 17, 2021 | | | $ | 138,000 | | $ | 131,000 |

Term Loan I | | | 3.35% | | December 17, 2022 | | | | 350,000 | | | 350,000 |

Term Loan II | | | 3.37% | | April 27, 2023 | | | | 350,000 | | | 350,000 |

Senior Notes (2) | | | 4.75% | | November 15, 2025 | | | | 400,000 | | | 400,000 |

Lenexa Mortgage | | | 4.10% | | May 1, 2022 | | | | 1,850 | | | 1,866 |

Capital Lease and Lease Financing Obligations | | | 1.98% | | 2018 - 2019 | | | | 6,375 | | | 8,699 |

Total | | | 3.80% | | | | | | | | $ | 1,246,225 | | $ | 1,241,565 |

| (1) | | Balances exclude debt issuance costs reflected as an offset to liabilities aggregating $5.5 million and $5.8 million at March 31, 2018 and December 31, 2017, respectively. |

| (2) | | Balance excludes debt issuance costs reflected as offsets to liabilities aggregating $5.7 million and $5.8 million at March 31, 2018 and December 31, 2017, respectively. |

| | | | | | | | | | |

| | Outstanding Balance as of: | | % of | | Outstanding Balance as of: | | % of |

| | March 31, 2018 | | total | | December 31, 2017 | | total |

Fixed Rate Debt | | $ | 808,225 | | 64.9% | | $ | 810,565 | | 65.3% |

Floating Rate Debt | | | 438,000 | | 35.1% | | | 431,000 | | 34.7% |

| | $ | 1,246,225 | | 100.0% | | $ | 1,241,565 | | 100.0% |

Scheduled debt maturities as of March 31, 2018:

| | | | | | | | | | | | | | | | | | | | | |

Debt instruments | | 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | Thereafter | | Total |

Unsecured Credit Facility (1) | | $ | - | | $ | - | | $ | - | | $ | 138,000 | | $ | 350,000 | | $ | 350,000 | | $ | 838,000 |

Senior Notes (2) | | | - | | | - | | | - | | | - | | | - | | | 400,000 | | | 400,000 |

Lenexa Mortgage | | | 44 | | | 68 | | | 71 | | | 74 | | | 77 | | | 1,516 | | | 1,850 |

Capital Lease and Lease Financing Obligations | | | 5,293 | | | 956 | | | 117 | | | 9 | | | - | | | - | | | 6,375 |

Total | | $ | 5,337 | | $ | 1,024 | | $ | 188 | | $ | 138,083 | | $ | 350,077 | | $ | 751,516 | | $ | 1,246,225 |

| (1) | | Balances exclude debt issuance costs reflected as liabilities aggregating $5.5 million at March 31, 2018. |

| (2) | | Balance excludes debt issuance costs reflected as liabilities aggregating $5.7 million at March 31, 2018. |

| |

25 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Interest Summary

(unaudited and in thousands)

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

| | 2018 | | 2017 | | 2017 | |

Interest expense and fees | | $ | 12,515 | | $ | 11,471 | | $ | 9,031 | |

Amortization of deferred financing costs and bond discount | | | 962 | | | 926 | | | 980 | |

Capitalized interest (1) | | | (5,367) | | | (4,348) | | | (3,142) | |

Total interest expense | | $ | 8,110 | | $ | 8,049 | | $ | 6,869 | |

| (1) | | The weighted average interest rate for the three months ended March 31, 2018, December 31, 2017, and March 31, 2017 was 4.19%, 4.03%, and 3.90%, respectively. As of March 31, 2018 and December 31, 2017 our weighted average coupon interest rate was 3.80% and 3.49%, respectively. |

| |

26 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

Appendix

Non-GAAP Financial Measures

This document includes certain non-GAAP financial measures that management believes are helpful in understanding the Company’s business, as further described below.

The Company considers the following non-GAAP financial measures to be useful to investors as key supplemental measures of the Company’s performance: (1) Core Revenue; (2) FFO, Operating FFO, Adjusted Operating FFO, Core Operating FFO and Adjusted Core Operating FFO (3) MRR, Recognized MRR and Core MMR; (4) NOI and Core NOI; and (5) EBITDAre, Adjusted EBITDA, Core Adjusted EBITDA. These non-GAAP financial measures should be considered along with, but not as alternatives to, net income or loss and cash flows from operating activities as a measure of the Company’s operating performance. Core Revenue, FFO, Operating FFO, Adjusted Operating FFO, MRR, NOI, EBITDA and Adjusted EBITDA, as calculated by us, including on a Core and Non-Core basis, may not be comparable to FFO, Operating FFO, Adjusted Operating FFO, MRR, NOI, EBITDA and Adjusted EBITDA as reported by other companies that do not use the same definition or implementation guidelines or interpret the standards differently from us.

Definitions

Booked-not-billed (“BNB”). The Company defines booked-not-billed as customer leases that have been signed, but for which lease payments have not yet commenced.

Core. Core represents the Company’s business expected to remain following disposition of the Company’s “Non-Core” business in accordance with its previously announced strategic growth plan. The Core business consists primarily of the Company’s Hyperscale and Hybrid Colocation business, along with technology and services from the Company’s Cloud and Managed Services business that support Hyperscale and Hybrid Colocation customers. Core financial measures and operating statistics represent the financial results or operating statistics, as applicable, of the Company’s Core business.

Leasable raised floor. The Company defines leasable raised floor as the amount of raised floor square footage that the Company has leased plus the available capacity of raised floor square footage that is in a leasable format as of a particular date and according to a particular product configuration. The amount of leasable raised floor may change even without completion of new redevelopment projects due to changes in the Company’s configuration of product space.

Non-Core. Non-core represents the portion of the Company’s business that the Company expects to exit in accordance with its previously announced strategic growth plan. The Non-Core business consists of the products of services within the Company’s Cloud and Managed Services business, as well as colocation revenue attached to certain customers in the Cloud and Managed Services business. Non-core financial measures and operating statistics represent the financial results or operating statistics, as applicable, of the Company’s Con-Core business.

Basis-of-design floor space. The Company defines basis-of-design floor space as the total data center raised floor potential of its existing data center facilities.

Operating NRSF. Represents the total square feet of a building that is currently leased or available for lease plus developed supporting infrastructure, based on engineering drawings and estimates, but does not include space held for redevelopment or space used for the Company’s own office space.

The Company. Refers to QTS Realty Trust, Inc., a Maryland corporation, together with its consolidated subsidiaries, including QualityTech, LP (the “Operating Partnership” or “OP”).

| |

27 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

FFO, Operating FFO, Adjusted Operating FFO, Core Operating FFO and Adjusted Core Operating FFO

The Company considers funds from operations (“FFO”), to be a supplemental measure of its performance which should be considered along with, but not as an alternative to, net income (loss) and cash provided by operating activities as a measure of operating performance. The Company calculates FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts (“NAREIT”). FFO represents net income (loss) (computed in accordance with GAAP), adjusted to exclude gains (or losses) from sales of property, real estate-related depreciation and amortization and similar adjustments for unconsolidated partnerships and joint ventures. The Company’s management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs.

Due to the volatility and nature of certain significant charges and gains recorded in the Company’s operating results that management believes are not reflective of its core operating performance, management computes an adjusted measure of FFO, which the Company refers to as Operating FFO. The Company generally calculates Operating FFO as FFO excluding certain non-routine charges and gains and losses that management believes are not indicative of the results of the Company’s operating real estate portfolio. The Company believes that Operating FFO provides investors with another financial measure that may facilitate comparisons of operating performance between periods and, to the extent other REITs calculate Operating FFO on a comparable basis, between REITs.

Operating FFO and Adjusted Operating Funds From Operations (“Adjusted Operating FFO”) are non-GAAP measures that are used as supplemental operating measures and to provide additional information to users of the financial statements. The Company calculates Adjusted Operating FFO by adding or subtracting from Operating FFO items such as: maintenance capital investment, paid leasing commissions, amortization of deferred financing costs and bond discount, non-real estate depreciation, straight line rent adjustments, deferred taxes and non-cash compensation.

The Company offers these measures because it recognizes that FFO, Operating FFO and Adjusted Operating FFO will be used by investors as a basis to compare its operating performance with that of other REITs. However, because FFO, Operating FFO and Adjusted Operating FFO exclude real estate depreciation and amortization and capture neither the changes in the value of the Company’s properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of its properties, all of which have real economic effect and could materially impact its financial condition, cash flows and results of operations, the utility of FFO, Operating FFO and Adjusted Operating FFO as measures of its operating performance is limited. The Company’s calculation of FFO may not be comparable to measures calculated by other companies who do not use the NAREIT definition of FFO or do not calculate FFO in accordance with NAREIT guidance. In addition, the Company’s calculations of FFO, Operating FFO and Adjusted Operating FFO are not necessarily comparable to FFO, Operating FFO and Adjusted Operating FFO as calculated by other REITs that do not use the same definition or implementation guidelines or interpret the standards differently from us. FFO, Operating FFO and Adjusted Operating FFO are non-GAAP measures and should not be considered a measure of the Company’s results of operations or liquidity or as a substitute for, or an alternative to, net income (loss), cash provided by operating activities or any other performance measure determined in accordance with GAAP, nor is it indicative of funds available to fund its cash needs, including its ability to make distributions to its stockholders.

Core Operating FFO and Adjusted Core Operating FFO represent Operating FFO and Adjusted Operating FFO of the Company’s Core business, respectively, and are used as supplemental performance measures because they reflect results of the portion of the business the Company expects to retain following completion of the strategic growth plan.

| |

28 QTS Q1 Earnings 2018 | Contact: IR@qtsdatacenters.com |

A reconciliation of net income to FFO, Operating FFO and Adjusted Operating FFO on a Core and Non-Core basis is presented below (unaudited and in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| March 31, 2018 | | December 31, 2017 | | March 31, 2017 |

| Core | | Non-Core | | Total | | Core | | Non-Core | | Total | | Core | | Non-Core | | Total |

FFO | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | $ | 5,083 | | $ | (5,335) | | $ | (252) | | $ | (11,011) | | $ | (5,102) | | $ | (16,113) | | $ | 1,621 | | $ | 3,947 | | $ | 5,568 |

Real estate depreciation and amortization | | 31,192 | | | 865 | | | 32,057 | | | 31,676 | | | 863 | | | 32,539 | | | 28,697 | | | 807 | | | 29,504 |