- BABA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Alibaba Group Holding Limited (BABA) CORRESPCorrespondence with SEC

Filed: 11 Jan 23, 12:00am

Simpson Thacher & Bartlett

| |||

icbc tower, 35th floor 3 garden road, central hong kong

____________ | |||

telephone: +852-2514-7600 facsimile: +852-2869-7694 | |||

Direct Dial Number +852-2514-7660 | E-mail Address dfertig@stblaw.com | ||

January 11, 2023 | |||

VIA EDGAR

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Attention: | Nicholas Nalbantian |

| Donald Field |

| Re: | Alibaba Group Holding Ltd | |

| Form 20-F for the Fiscal Year Ended March 31, 2022 | ||

| Response Dated October 3, 2022 | ||

| File No. 001-36614 |

Ladies and Gentlemen:

On behalf of our client, Alibaba Group Holding Limited, a company organized under the laws of the Cayman Islands (together with its subsidiaries, the “Company” or “Alibaba”), we respond to the comments contained in the letter from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), dated December 12, 2022 (the “December 12 Comment Letter”), relating to the Company’s response letter, dated October 3, 2022 (the “October 3 Response”), to the Commission’s comment letter dated September 7, 2022 regarding the Company’s annual report on Form 20-F for the fiscal year ended March 31, 2022 filed with the Commission on July 26, 2022 (the “2022 20-F”).

| michael j.c.M. ceulen | marjory j. ding | daniel fertig | adam C. furber | YI GAO | MAKIKO HARUNARI | Ian C. Ho | JONATHAN HWANG | anthony d. king | jin hYUK park | christopher k.s. wong |

resident partners

simpson thacher & bartlett, hong kong is an affiliate of simpson thacher & bartlett llp with offices in: | |||||||||

| New York | Beijing | Brussels | Houston | LONDON | Los Angeles | Palo Alto | SÃO PAULO | TOKYO | Washington, D.C. |

Simpson Thacher & Bartlett

| ||

| January 11, 2023 | -2- | |

Set forth below are the Company’s responses to the Staff’s comments in the December 12 Comment Letter. The Staff’s comments are retyped below for ease of reference. In amending the proposed disclosure, the Company has also made certain additional clarifications and amendments. The Company respectfully advises the Staff that where the Company proposes to add or revise disclosure to its future filings on Form 20-F in response to the Staff’s comments, the changes to be made will be subject to relevant factual updates and changes in relevant laws or regulations, or in interpretations thereof.

* * * *

Item 3. Key Information, page 1

| 1. | We note your response to comment 1 and reissue in part. Please refer to the proposed revised disclosure contained in Annex A and in the section captioned "Risks Related to the VIE Structure." Please revise to more clearly disclose that your VIE structure involves unique risks to investors. Additionally, please disclose more directly that investors may never hold equity interests in any Chinese operating companies. |

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company will revise its disclosure consistent with the changes set forth in the section captioned “Risks Related to the VIE Structure” in the revised Annex A, in its annual report on Form 20-F for the fiscal year ending March 31, 2023 (the “2023 20-F”).

| 2. | We note your response to comment 5 and reissue in part. Please refer to the proposed revised disclosure contained in Annex A and in the section captioned "Cash Flows through Our Company." Please revise to provide cross-references to the condensed consolidating schedule and the consolidated financial statements. |

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company will revise its disclosure to provide cross-references consistent with the changes set forth in the section captioned “Cash Flows through Our Company” in the revised Annex A, in its 2023 20-F.

To make the cross-references more reader-friendly, the Company will also add notes to the cash flow tables consistent with the changes set forth in the section captioned “Variable Interest Entity Financial Information” in the revised Annex A.

Simpson Thacher & Bartlett

| ||

| January 11, 2023 | -3- | |

| 3. | We note your response to comment 6 and reissue in part. Please refer to the proposed revised disclosures contained in Annex A and in the section captioned "Cash Flows through Our Company" and in Annex B. Please amend the proposed revised disclosures to state that, to the extent cash or assets in the business is in the PRC or a PRC entity, the funds or assets may not be available to fund operations or for other use outside of the PRC due to interventions in or the imposition of restrictions and limitations on the ability of you, your subsidiaries, or the consolidated VIEs by the PRC government to transfer cash or assets. In the section captioned "Cash Flows through Our Company," provide cross references to other discussions of this issue in the annual report. |

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company will revise its disclosure consistent with the changes set forth in the revised Annex A, under the section captioned “Cash Flows through Our Company,” and revised Annex B in its 2023 20-F.

The Company further advises the Staff that the requested disclosure regarding the addition of relevant cross-references to the section captioned “Cash Flows through Our Company” has been addressed in the proposed revised disclosure. For details, see the end of the third paragraph under the section captioned “Cash Flows through Our Company.”

| 4. | We note your response to comment 10 and reissue in part. Please refer to the proposed revised disclosure contained in Annex A and in the section captioned "Permissions and Approvals Required to be Obtained from PRC Authorities for our Business Operations." We note your disclosure that you "believe that [your] consolidated subsidiaries and the VIEs in China have received the material licenses, permissions and approvals from the PRC authorities as are necessary for [your] business operations in China." The disclosure here should not be qualified by materiality. Please make appropriate revisions to your proposed revised disclosure. |

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company will revise its disclosure to remove the materiality qualification, consistent with the changes set forth in the section captioned “Permissions and Approvals Required to be Obtained from PRC Authorities for our Business Operations” in the revised Annex A in its 2023 20-F.

Simpson Thacher & Bartlett

| ||

| January 11, 2023 | -4- | |

| 5. | We note your response to comment 16 and reissue in part. Please refer to the proposed revised disclosure contained in Annex A and in the section captioned "Permissions and Approvals Required to be Obtained from PRC Authorities for our Business Operations." With respect to the proposed revised disclosure, we note that you do not appear to have relied upon an opinion of counsel with respect to your conclusions that you do not need any additional permissions and approvals to operate your business and your response which indicates that the company believes that obtaining an opinion of counsel would be excessively burdensome for the purpose of an annual report. Please revise the proposed revise disclosure in the referenced section to disclose that an opinion was not obtained and explain why such an opinion was not obtained. |

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company will revise its disclosure consistent with the changes set forth in the section captioned “Permissions and Approvals Required to be Obtained from PRC Authorities for our Business Operations” in the revised Annex A in its 2023 20-F.

To support the statement that the Company believes that its consolidated subsidiaries and the variable interest entities in China have received the requisite licenses, permissions and approvals from the PRC authorities as are necessary for its business operations in China, the Company plans to obtain a legal opinion from PRC legal counsel that its consolidated subsidiaries and the variable interest entities in China have obtained all major licenses, permissions and approval from the competent PRC authorities that are necessary to the operations of the Company’s China commerce and cloud businesses, which account for a significant majority of the Company’s revenue. This will be in addition to the Company’s own internal compliance procedures and processes that also help to ensure that the Company obtains the licenses, permissions and approvals necessary for its business operations in China.

D. Risk Factors

Summary of Risk Factors, page 1

| 6. | We note your response to comment 12 and reissue in part. Please refer to the proposed revised disclosure contained in Annex B. Please revise to specifically discuss risks arising from the legal system in China, including that rules and regulations in China can change quickly with little advance notice. Additionally, please revise to acknowledge any risks that any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could result in a material change in your operations and could significantly limit or completely hinder your ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Lastly, please revise to include specific cross-references (titles and page numbers) to the more detailed discussion of these risks in the annual report. |

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company will revise its disclosure consistent with the changes set forth in the revised Annex B in its 2023 20-F.

Simpson Thacher & Bartlett

| ||

| January 11, 2023 | -5- | |

Our business is subject to complex and evolving domestic and international laws and regulations regarding privacy and data protection, page 23

| 7. | We note your response to comment 13 and acknowledge the substantial uncertainties of these new or proposed laws and regulations and how they will impact the company. However, in light of recent events indicating greater oversight by the Cyberspace Administration of China (CAC) over data security, please revise your risk factor disclosure to explain in greater detail how you believe this oversight impacts the company and its business and to what extent you believe that you are compliant with the regulations or policies that have been issued by the CAC to date. In this regard, we note that the revised risk factor continues to generally describe the new or proposed laws and regulations but doesn't evaluate how the company will actually be impacted by the new or proposed laws and regulations. Revise to clarify and specifically address if you believe you will be subject to a cybersecurity review. To the extent you do not believe you will be subject to a cybersecurity review, discuss how you came to that conclusion including the underlying facts and circumstances which support that determination. For example, the third paragraph discusses operators of critical information infrastructure, network platform operators and data processors but doesn't provide any analysis regarding whether the company will be captured by these new or proposed laws and regulations based upon the company's number of users or the type of data that the company collects. Please revise as applicable so investors can clearly understand how these new or proposed laws and regulations will impact the company and its business and any future offerings. Lastly, please revise the company's permissions and approvals discussions, as applicable. |

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company will revise its disclosure consistent with the changes set forth in the revised Annex C in its 2023 20-F.

Risks Related to Doing Business in China

If our auditor is sanctioned or otherwise penalized by the PCAOB or the SEC as a result of failure to comply with inspection or..., page 48

| 8. | We note your response to comment 14 and reissue in part. Please supplementally provide us with your proposed revised risk factor |

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company will revise its disclosure consistent with the changes set forth in the section captioned “Holding Foreign Companies Accountable Act” in the revised Annex A and will add the requested risk factor consistent with the changes set forth in the revised Annex D in its 2023 20-F.

* * * *

Simpson Thacher & Bartlett

| ||

| January 11, 2023 | -6- | |

If you have any question regarding the responses contained in this letter, please do not hesitate to contact me at +852-2514-7660 or dfertig@stblaw.com.

| Very truly yours, | |

| /s/ Daniel Fertig | |

| Daniel Fertig |

Enclosures

| cc: | Daniel Yong Zhang, Chief Executive Officer |

| Toby Hong Xu, Chief Financial Officer | |

| Sara Siying Yu, General Counsel | |

| Alibaba Group Holding Limited | |

| Ricky Shin, Partner | |

| Daniel Chan, Partner | |

| Cynthia Ning, Partner | |

| PricewaterhouseCoopers |

Annex A

To be added to Item 3. “Key Information” before “B. Capitalization and Indebtedness” in the 2023 20-F:

The VIE Structure Adopted by Our Company

Risks Related to the VIE Structure

Alibaba Group Holding Limited is a Cayman Islands holding company. It does not directly engage in business operations itself. Due to PRC legal restrictions on foreign ownership and investment in certain industries, we, similar to all other entities with foreign-incorporated holding company structures operating in our industry in China, operatethrough VIEsour Internet businesses and other businesses in which foreign investment is restricted or prohibited in the PRC through variable interest entities, or VIEs. The VIEs are incorporated and owned by PRC citizens or by PRC entities owned and/or controlled by PRC citizens, and not by our company. Wehave entered into certain contractual arrangements which collectively enable us to exercise effective control over the VIEs and realize substantially all of the economic risks and benefits arising from the VIEs. As a result, we include the financial results of each ofand, through us, our shareholders do not own any equity interests in the VIEs. Investors in our ADSs and Shares are purchasing equity securities of a Cayman Islands holding company rather than equity securities issued by our consolidated subsidiaries and the VIEs, and investors may never hold equity interests in the VIEs under current PRC laws and regulations.

Investing in our company involves uniquecertainrisks related to the VIE structure adopted by our company. In particular, if the PRC government deems that the contractual arrangements in relation to the VIEs do not comply with PRC regulations on foreign investment, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to penalties, or be forced to relinquish our interests in the operation of the VIEs, and we would no longer be able to consolidate the financial results of the VIEs in our consolidated financial statements. This would likely materially and adversely affect our business, financial results and the trading prices of our ADSs, Shares and/or other securities, including causing the value of such securities to significantly decline or become worthless. Contractual arrangements in relation to the VIEs have not been tested in a court of law. See “ — Risks Related to Our Corporate Structure” for more details on the risks relating to the VIE structure.

1

Our Corporate Structure

Like many large scale, multinational companies with businesses around the world and across industries, we conduct our business through a large number of Chinese and foreign operating entitiesas we continue to expand through organic growth and acquisitions and consolidations of new businesses, including VIEs. The chart below summarizes our corporate structure as of March 31, 2022 and identifies the subsidiaries andvariable interest entitiesVIEs that together are representative ofourthe major businesses operated by our group, including our significant subsidiaries, as that term is defined under Section 1-02 of Regulation S-X under the U.S. Securities Act, and other representative subsidiaries, which we collectively refer to as our major subsidiaries, as well the corresponding representative VIEs, which we refer to as the representative VIEs:

VIE Structure

The contractual relationships with the VIEs provide us the power to direct the activities of the VIEs and the obligation to absorb losses or the right to receive benefits from the VIEs, such that we are the primary beneficiary for accounting purposes and therefore consolidate the VIEs. As a result, we include the financial results of each of the VIEs in our consolidated financial statements in accordance with U.S. GAAP.

2

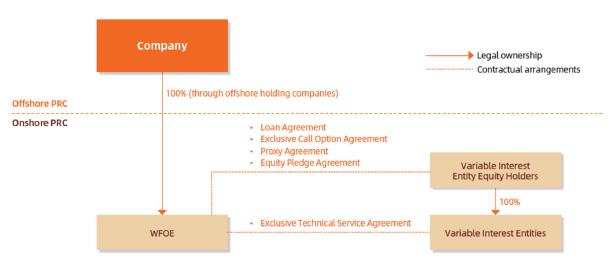

The following diagram is a simplified illustration of the typical ownership structure and contractual arrangements for VIEs:

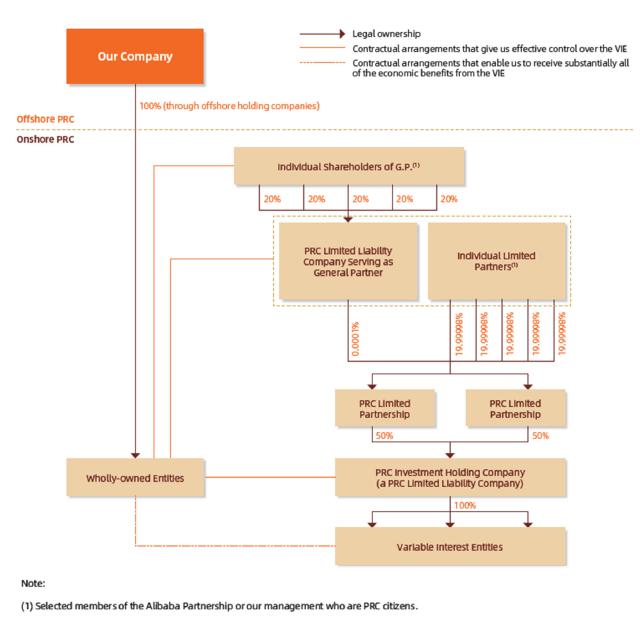

For most of thevariable interest entitiesVIEs,weour group uses a different structure, or the Enhanced VIE Structure. The Enhanced VIE Structure maintains the primary legal framework that we and many peer companies in our industry have adopted to operate businesses in which foreign investment is restricted or prohibited in the PRC. We may also create additional holding structures in the futureto further enhance the VIE structure.

Under the Enhanced VIE Structure, avariable interest entityVIE is typically held by a PRC limited liability company, instead of individuals. This PRC limited liability company is directly or indirectly owned by two PRC limited partnerships, each of which holds 50% of the equity interest. Each of these partnerships is comprised of (i) a PRC limited liability company, as general partner (which is formed by a number of selected members of the Alibaba Partnership and our management who are PRC citizens), and (ii) the same group of natural persons, as limited partners. Under the terms of the relevant partnership agreements, the natural person limited partners must be members of the Alibaba Partnership or our management who are PRC citizens and as designated by the general partner of the partnership.

For our representative VIEs, these individuals are Daniel Yong Zhang, Jessie Junfang Zheng, Xiaofeng Shao, Zeming Wu and Angel Ying Zhao (with respect to each of Zhejiang Taobao Network Co., Ltd., Zhejiang Tmall Network Co., Ltd., Hangzhou Alibaba Advertising Co., Ltd., Hangzhou Ali Venture Capital Co., Ltd., Shanghai Rajax Information Technology Co., Ltd. and Alibaba Cloud Computing Ltd.), and Sophie Minzhi Wu, Li Cheng, Jeff Jianfeng Zhang, Fang Jiang and Winnie Jia Wen (with respect to Alibaba Culture Entertainment Co., Ltd.). Because Angel Ying Zhao and Sophie Minzhi Wu are no longer member of the Alibaba Partnership, we are in the process of replacing these two individuals.

Under the Enhanced VIE Structure, the designated subsidiary, on the one hand, and the corresponding VIE and the multiple layers of legal entities above the VIE, as well as the natural persons described above, on the other hand, enter into contractual arrangements, which are substantially similar to the contractual arrangements we have historically used for variable interest entities.

3

The following diagram is a simplified illustration of the typical ownership structure and contractual arrangements of the VIEs under the Enhanced VIE Structure:

Contracts that Give UsEffective Control of the Variable Interest Entities

Loan Agreements

Pursuant to the relevant loan agreement, our respective subsidiary has granted a loan to the relevant variable interest entity equity holders, which may only be used for the purpose of its business operation activities agreed by our subsidiary or the acquisition of the relevant variable interest entity.

4

Exclusive Call Option Agreements

Under the Enhanced VIE Structure, each relevant variable interest entity and its equity holders has jointly granted our relevant subsidiary (A) an exclusive call option to request the relevant variable interest entity to decrease its registered capital and (B) an exclusive call option to subscribe for the increased capital of relevant variable interest entity.

Proxy Agreements

Pursuant to the relevant proxy agreement, each of the variable interest entity equity holders irrevocably authorizes any person designated by our subsidiary to exercise the rights of the equity holder of the variable interest entity, including without limitation the right to vote and appoint directors.

Equity Pledge Agreements

Pursuant to the relevant equity pledge agreement, the relevant variable interest entity equity holders have pledged all of their interests in the equity of the variable interest entity as a continuing first priority security interest in favor of the corresponding subsidiary to secure the outstanding amounts advanced under the relevant loan agreements described above and to secure the performance of obligations by the variable interest entity and/or its equity holders under the other structure contracts. Each subsidiary is entitled to exercise its right to dispose of the variable interest entity equity holders’ pledged interests in the equity of the variable interest entity and has priority in receiving payment by the application of proceeds from the auction or sale of the pledged interests, in the event of any breach or default under the loan agreement or other structure contracts, if applicable.

Contracts that Enable Us to Receive Substantially All of the Economic Benefits from the Variable Interest Entities

Exclusive Services Agreements

Under the Enhanced VIE Structure, each relevant variable interest entity has entered into an exclusive service agreement with the respective subsidiary, pursuant to which our relevant subsidiary provides exclusive services to the variable interest entity. In exchange, the variable interest entity pays a service fee to our subsidiary, the amount of which shall be determined, to the extent permitted by applicable PRC laws as proposed by our subsidiary, resulting in a transfer of substantially all of the profits from the variable interest entity to our subsidiary.

For a more detailed summary of such contractual arrangements, see “Item 4. Information on the Company — C. Organizational Structure— Contracts that Give Us the Power to Direct the Activities of the Variable Interest Entities for Accounting Purpose” and “— Contracts that Give Us the Obligation to Absorb Losses or the Rights to Receive Benefits from the Variable Interest Entities for Accounting Purpose.”

5

If the VIEs or their equity holders fail to perform their respective obligations under the contractual arrangements, we will have to enforce our rights under the contractual arrangements through the operations of PRC law and arbitral or judicial agencies, which may be costly and time-consuming and will be subject to uncertainties in the PRC legal system, including the uncertainty resulting from the fact that these VIE contracts have not been tested in a PRC court. Consequently, the contractual arrangements may not be as effective in ensuring our control over the relevant portion of our business operations as direct ownership. The contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration or court proceedings in China. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. Uncertainties regarding the interpretation and enforcement of the relevant PRC laws and regulations could limit our ability to enforce the contractual arrangements. Under PRC law, if the losing parties fail to carry out the arbitration awards or court judgments within a prescribed time limit, the prevailing parties may only enforce the arbitration awards or court judgments in PRC courts, which would require additional expense and delay. In the event we are unable to enforce the contractual arrangements, we may not be able to exert effective control over the VIEs, and our ability to conduct our business, as well as our financial condition and results of operations, may be materially and adversely affected. See “— D. Risk Factors — Risks Related to Our Corporate Structure — Our contractual arrangements may not be as effective in providing control over the VIEs as direct ownership” and “— Any failure by the VIEs or their equity holders to perform their obligations under the contractual arrangements would have a material adverse effect on our business, financial condition and results of operations. ”

Variable Interest Entity Financial Information

The following tables present the condensed consolidating schedule of operations and cash flows information for the fiscal years ended March 31, 2020, 2021 and 2022, and condensed consolidating schedule of balance sheet information as of March 31, 2021 and 2022 for:

| · | Alibaba Group Holding Limited (“Parent”); |

| · | the variable interest entities, including their subsidiaries, that together account for a significant majority of total revenue and assets of the variable interest entities as a group, which we collectively refer to as the “major variable interest entities and their subsidiaries”; |

| · | subsidiaries that are, for accounting purposes only, the primary beneficiaries of the major variable interest entities; and |

| · | other subsidiaries and consolidated entities, which include variable interest entities that are not major variable interest entities. |

6

We conduct our business through a large number of subsidiaries and consolidated entities. We are presenting the condensed consolidating information for the major variable interest entities only. We believe this presentation provides a reasonably adequate basis for investors to evaluate the assets, operations and overall significance of the variable interest entities as a group, as well as the nature and amounts associated with intercompany transactions. The large number of variable interest entities not included as major variable interest entities are individually, and in the aggregate, not material for our company taken as a whole. To include them in the presentation would require tremendous time and efforts to prepare condensed consolidating schedules for them, which we do not believe would provide meaningful additional information to investors.

The amounts shown in the tables do not reconcile directly to financial information presented for the variable interest entities in our audited consolidated financial statements.

Although the variable interest entities hold licenses and approvals and assets for regulated activities that are necessary for our business operations, as well as certain equity investments in businesses, to which foreign investments are typically restricted or prohibited under applicable PRC law, we hold the significant majority of assets and operations in our subsidiaries and the significant majority of our revenue is captured directly by our subsidiaries. Therefore, our subsidiaries directly capture the significant majority of the profits and associated cash flow from operations, without having to rely on contractual arrangements to transfer cash flow from the variable interest entities to our subsidiaries.

| For the year ended March 31, 2022 | ||||||||||||||||||||||||||||

| Parent | Other Subsidiaries and Consolidated Entities | Major VIEs and their subsidiaries | Primary Beneficiaries of Major VIEs | Eliminations | Consolidated Total | |||||||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | RMB | US$ | ||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||||

| Revenue from third parties | — | 691,997 | 87,337 | 73,728 | — | 853,062 | 134,567 | |||||||||||||||||||||

| Revenue from group companies | — | 75,610 | 8,485 | 160,947 | (245,042 | ) | — | — | ||||||||||||||||||||

| Total cost and expenses | (444 | ) | (771,883 | ) | (96,262 | )(1) | (189,014 | ) | 274,179 | (783,424 | ) | (123,582 | ) | |||||||||||||||

| Income from subsidiaries and VIEs | 63,745 | 81,515 | — | 5,284 | (150,544 | ) | — | — | ||||||||||||||||||||

| Income (loss) from operations | 63,301 | 77,239 | (440 | ) | 50,945 | (121,407 | ) | 69,638 | 10,985 | |||||||||||||||||||

| Other income and expenses | (1,342 | ) | (27,923 | ) | 5,227 | 43,087 | (29,137 | ) | (10,088 | ) | (1,591 | ) | ||||||||||||||||

| Income tax expenses | — | (15,506 | ) | (258 | ) | (11,051 | ) | — | (26,815 | ) | (4,230 | ) | ||||||||||||||||

| Share of results of equity method investees | — | 15,055 | 755 | (1,466 | ) | — | 14,344 | 2,263 | ||||||||||||||||||||

| Net income | 61,959 | 48,865 | 5,284 | 81,515 | (150,544 | ) | 47,079 | 7,427 | ||||||||||||||||||||

| Net loss attributable to noncontrolling interests | — | 15,170 | — | — | — | 15,170 | 2,393 | |||||||||||||||||||||

| Accretion of mezzanine equity | — | (290 | ) | — | — | — | (290 | ) | (46 | ) | ||||||||||||||||||

| Net income attributable to ordinary shareholders | 61,959 | 63,745 | 5,284 | 81,515 | (150,544 | ) | 61,959 | 9,774 | ||||||||||||||||||||

7

| For the year ended March 31, 2021 | ||||||||||||||||||||||||

| Parent | Other Subsidiaries and Consolidated Entities | Major VIEs and their subsidiaries | Primary Beneficiaries of Major VIEs | Eliminations | Consolidated Total | |||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | RMB | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Revenue from third parties | — | 563,077 | 71,455 | 82,757 | — | 717,289 | ||||||||||||||||||

| Revenue from group companies | — | 85,667 | 10,854 | 165,263 | (261,784 | ) | — | |||||||||||||||||

| Total cost and expenses | (614 | ) | (658,139 | ) | (83,164 | )(1) | (178,855 | ) | 293,161 | (627,611 | ) | |||||||||||||

| Income from subsidiaries and VIEs | 150,515 | 107,740 | — | 3,362 | (261,617 | ) | — | |||||||||||||||||

| Income (loss) from operations | 149,901 | 98,345 | (855 | ) | 72,527 | (230,240 | ) | 89,678 | ||||||||||||||||

| Other income and expenses | 407 | 47,377 | 5,940 | 53,553 | (31,377 | ) | 75,900 | |||||||||||||||||

| Income tax expenses | — | (16,959 | ) | (1,249 | ) | (11,070 | ) | — | (29,278 | ) | ||||||||||||||

| Share of results of equity method investees | — | 14,825 | (571 | ) | (7,270 | ) | — | 6,984 | ||||||||||||||||

| Net income | 150,308 | 143,588 | 3,265 | 107,740 | (261,617 | ) | 143,284 | |||||||||||||||||

| Net loss attributable to noncontrolling interests | — | 7,197 | 97 | — | — | 7,294 | ||||||||||||||||||

| Accretion of mezzanine equity | — | (270 | ) | — | — | — | (270 | ) | ||||||||||||||||

| Net income attributable to ordinary shareholders | 150,308 | 150,515 | 3,362 | 107,740 | (261,617 | ) | 150,308 | |||||||||||||||||

| For the year ended March 31, 2020 | ||||||||||||||||||||||||

| Parent | Other Subsidiaries and Consolidated Entities | Major VIEs and their subsidiaries | Primary Beneficiaries of Major VIEs | Eliminations | Consolidated Total | |||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | RMB | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Revenue from third parties | — | 383,771 | 69,027 | 56,913 | — | 509,711 | ||||||||||||||||||

| Revenue from group companies | — | 49,927 | 7,558 | 141,438 | (198,923 | ) | — | |||||||||||||||||

| Total cost and expenses | (973 | ) | (447,920 | ) | (77,666 | )(1) | (117,645 | ) | 225,923 | (418,281 | ) | |||||||||||||

| Income from subsidiaries and VIEs | 155,175 | 81,261 | — | (976 | ) | (235,460 | ) | — | ||||||||||||||||

| Income (loss) from operations | 154,202 | 67,039 | (1,081 | ) | 79,730 | (208,460 | ) | 91,430 | ||||||||||||||||

| Other income and expenses | (4,939 | ) | 84,422 | 35 | 22,697 | (27,000 | ) | 75,215 | ||||||||||||||||

| Income tax expenses | — | (9,169 | ) | 73 | (11,466 | ) | — | (20,562 | ) | |||||||||||||||

| Share of results of equity method investees | — | 4,118 | (151 | ) | (9,700 | ) | — | (5,733 | ) | |||||||||||||||

| Net income (loss) | 149,263 | 146,410 | (1,124 | ) | 81,261 | (235,460 | ) | 140,350 | ||||||||||||||||

| Net loss attributable to noncontrolling interests | — | 8,935 | 148 | — | — | 9,083 | ||||||||||||||||||

| Accretion of mezzanine equity | — | (170 | ) | — | — | — | (170 | ) | ||||||||||||||||

| Net income (loss) attributable to ordinary shareholders | 149,263 | 155,175 | (976 | ) | 81,261 | (235,460 | ) | 149,263 | ||||||||||||||||

Note:

| (1) | These include technical service fee incurred by major VIEs and their subsidiaries for exclusive technical service provided by primary beneficiaries of major VIEs to major VIEs and their subsidiaries in the amounts of RMB21,257 million, RMB18,698 million and RMB17,225 million for the years ended March 31, 2020, 2021 and 2022, respectively. |

8

| For the year ended March 31, 2022 | ||||||||||||||||||||||||||||

| Parent | Other Subsidiaries and Consolidated Entities | Major VIEs and their subsidiaries | Primary Beneficiaries of Major VIEs | Eliminations | Consolidated Total | |||||||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | RMB | US$ | ||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||||

| Net cash (used in) provided by operating activities | (4,739 | ) | 219,750 | 18,811 | 21,498 | (112,561 | ) | 142,759 | 22,520 | |||||||||||||||||||

| Net cash used in investing activities | (20,188 | )(1) | (235,528 | ) | (15,672 | )(2) | (32,365 | ) | 105,161 | (198,592 | ) | (31,327 | ) | |||||||||||||||

| Net cash provided by (used in) financing activities | 24,920 | (1) | (51,502 | ) | (9,099 | )(2) | (36,168 | ) | 7,400 | (64,449 | ) | (10,167 | ) | |||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents, restricted cash and escrow receivables | (36 | ) | (8,798 | ) | — | — | — | (8,834 | ) | (1,394 | ) | |||||||||||||||||

| Net decrease in cash and cash equivalents, restricted cash and escrow receivables | (43 | ) | (76,078 | ) | (5,960 | ) | (47,035 | ) | — | (129,116 | ) | (20,368 | ) | |||||||||||||||

| Cash and Cash equivalents, restricted cash and escrow receivables at the beginning of the year | 430 | 251,944 | 10,497 | 93,598 | — | 356,469 | 56,232 | |||||||||||||||||||||

| Cash and Cash equivalents, restricted cash and escrow receivables at the end of the year | 387 | 175,866 | 4,537 | 46,563 | — | 227,353 | 35,864 | |||||||||||||||||||||

Notes:

| (1) | For the year ended March 31, 2022, the cash transfer from the parent to our subsidiaries amounting to RMB20,188 million (US$3,185 million) was included in the parent’s net cash used in investing activities. |

For the year ended March 31, 2022, the cash transfer from our subsidiaries to the parent amounting to RMB95,621 million (US$15,084 million) was included in the parent’s net cash provided by financing activities.

| (2) | For the year ended March 31, 2022, the cash transfer from our subsidiaries and consolidated entities to the major VIEs and their subsidiaries amounting to RMB2,539 million (US$401 million), of which RMB35 million (US$6 million) and RMB2,504 million (US$395 million) were included in the major VIEs and their subsidiaries’ net cash used in investing activities and financing activities, respectively. |

For the year ended March 31,2022, the cash transfer from the major VIEs and their subsidiaries to our subsidiaries and consolidated entities amounting to RMB24,404 million (US$3,850 million), of which RMB11,774 million (US$1,857 million) and RMB12,630 million (US$1,993) were included in the major VIEs and their subsidiaries’ net cash used in investing activities and financing activities, respectively.

| (3) | See “Item 3. Key Information — Cash Flows through Our Company” for nature of cash transfers mentioned above. |

| For the year ended March 31, 2021 | ||||||||||||||||||||||||

| Parent | Other Subsidiaries and Consolidated Entities | Major VIEs and their subsidiaries | Primary Beneficiaries of Major VIEs | Eliminations | Consolidated Total | |||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | RMB | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Net cash provided by operating activities | 33,796 | (1) | 210,082 | 808 | 56,727 | (69,627 | ) | 231,786 | ||||||||||||||||

| Net cash used in investing activities | (70,623 | )(1) | (147,242 | ) | (17,764 | )(2) | (70,138 | ) | 61,573 | (244,194 | ) | |||||||||||||

| Net cash provided by (used in) financing activities | 36,570 | (1) | (31,875 | ) | 13,726 | (2) | 3,607 | 8,054 | 30,082 | |||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents, restricted cash and escrow receivables | (114 | ) | (7,073 | ) | — | — | — | (7,187 | ) | |||||||||||||||

| Net (decrease) increase in cash and cash equivalents, restricted cash and escrow receivables | (371 | ) | 23,892 | (3,230 | ) | (9,804 | ) | — | 10,487 | |||||||||||||||

| Cash and Cash equivalents, restricted cash and escrow receivables at the beginning of the year | 801 | 228,052 | 13,727 | 103,402 | — | 345,982 | ||||||||||||||||||

| Cash and Cash equivalents, restricted cash and escrow receivables at the end of the year | 430 | 251,944 | 10,497 | 93,598 | — | 356,469 | ||||||||||||||||||

Notes:

| (1) | For the year ended March 31, 2021, the cash transfer from the parent to our subsidiaries amounting to RMB70,623 was included in the parent’s net cash used in investing activities. |

For the year ended March 31, 2021, the cash transfer from our subsidiaries to the parent amounting to RMB43,078 million, of which RMB37,918 million and RMB5,160 million were included in the parent’s net cash provided by operating activities and financing activities, respectively.

| (2) | For the year ended March 31,2021, the cash transfer from our subsidiaries and consolidated entities to the major VIEs and their subsidiaries amounting to RMB20,865 million, of which RMB175 million and RMB20,690 million were included in the major VIEs and their subsidiaries’ net cash used in investing activities and net cash provided by financing activities, respectively. |

For the year ended March 31,2021, the cash transfer from the major VIEs and their subsidiaries to our subsidiaries and consolidated entities amounting to RMB5,575 million, of which RMB682 million and RMB4,893 million were included in the major VIEs and their subsidiaries’ net cash used in investing activities and net cash provided by financing activities, respectively.

9

| For the year ended March 31, 2020 | ||||||||||||||||||||||||

| Parent | Other Subsidiaries and Consolidated Entities | Major VIEs and their subsidiaries | Primary Beneficiaries of Major VIEs | Eliminations | Consolidated Total | |||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | RMB | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Net cash provided by operating activities | 22,792 | (1) | 147,191 | 325 | 125,754 | (115,455 | ) | 180,607 | ||||||||||||||||

| Net cash used in investing activities | (104,463 | )(1) | (98,820 | ) | (6,627 | )(2) | (16,830 | ) | 118,668 | (108,072 | ) | |||||||||||||

| Net cash provided by (used in) financing activities | 75,493 | (1) | 79,794 | 7,757 | (2) | (88,978 | ) | (3,213 | ) | 70,853 | ||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents, restricted cash and escrow receivables | 361 | 3,739 | — | — | — | 4,100 | ||||||||||||||||||

| Net (decrease) increase in cash and cash equivalents, restricted cash and escrow receivables | (5,817 | ) | 131,904 | 1,455 | 19,946 | — | 147,488 | |||||||||||||||||

| Cash and Cash equivalents, restricted cash and escrow receivables at the beginning of the year | 6,618 | 96,148 | 12,272 | 83,456 | — | 198,494 | ||||||||||||||||||

| Cash and Cash equivalents, restricted cash and escrow receivables at the end of the year | 801 | 228,052 | 13,727 | 103,402 | — | 345,982 | ||||||||||||||||||

| Notes: |

| (1) | For the year ended March 31, 2020, the cash transfer from the parent to our subsidiaries amounting to RMB168,348 million, of which RMB164,042 million and RMB4,306 million were included in the parent’s net cash used in investing activities and net cash provided by financing activities, respectively. |

For the year ended March 31, 2020, the cash transfer from our subsidiaries to the parent amounting to RMB79,306 million, of which RMB27,030 million, RMB48,116 million and RMB4,160 million were included in the parent’s net cash provided by operating activities, net cash used in investing activities and net cash provided by financing activities, respectively.

| (2) | For the year ended March 31,2020, the cash transfer from our subsidiaries and consolidated entities to the major VIEs and their subsidiaries amounting to RMB9,358 million, of which RMB545 million and RMB8,813 million were included in the major VIEs and their subsidiaries’ net cash used in investing activities and net cash provided by financing activities, respectively. |

For the year ended March 31,2020, the cash transfer from the major VIEs and their subsidiaries to our subsidiaries and consolidated entities amounting to RMB855 million, of which RMB125 million and RMB730 million were included in the major VIEs and their subsidiaries’ net cash used in investing activities and net cash provided by financing activities, respectively.

10

| As at March 31, 2022 | ||||||||||||||||||||||

| Parent | Other Subsidiaries and Consolidated Entities | Major VIEs and their subsidiaries | Primary Beneficiaries of Major VIEs | Eliminations | Consolidated Total | |||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | RMB | US$ | ||||||||||||||||

| (in millions) | ||||||||||||||||||||||

| Cash and cash equivalents and short-term investments | 387 | 272,254 | 14,208 | 159,563 | — | 446,412 | 70,420 | |||||||||||||||

| Investments in equity method investees and equity securities and other investments | — | 397,390 | 33,989 | 20,547 | — | 451,926 | 71,290 | |||||||||||||||

| Accounts receivable, net of allowance | — | 11,853 | 20,074 | 886 | — | 32,813 | 5,176 | |||||||||||||||

| Amounts due from group companies | 163,476 | 282,817 | 23,556 | 174,120 | (643,969 | ) | — | — | ||||||||||||||

| Prepayments and other assets | 767 | 198,263 | 14,227 | 50,527 | — | 263,784 | 41,611 | |||||||||||||||

| Interest in subsidiaries and VIEs | 994,066 | 114,798 | — | (129 | ) | (1,108,735 | ) | — | — | |||||||||||||

| Property and equipment and intangible assets | — | 198,691 | 6,972 | 25,374 | — | 231,037 | 36,445 | |||||||||||||||

| Goodwill | — | 267,548 | 2,033 | — | — | 269,581 | 42,525 | |||||||||||||||

| Total assets | 1,158,696 | 1,743,614 | 115,059 | 430,888 | (1,752,704 | ) | 1,695,553 | 267,467 | ||||||||||||||

| Amounts due to group companies | 88,887 | 253,725 | 71,038 | 230,319 | (643,969 | ) | — | — | ||||||||||||||

| Accrued and other liabilities | 121,330 | 308,763 | 31,024 | 81,770 | — | 542,887 | 85,638 | |||||||||||||||

| Deferred revenue and customer advances | — | 53,501 | 12,971 | 4,001 | — | 70,473 | 11,117 | |||||||||||||||

| Total liabilities | 210,217 | 615,989 | 115,033 | 316,090 | (643,969 | ) | 613,360 | 96,755 | ||||||||||||||

| Mezzanine equity | — | 9,655 | — | — | — | 9,655 | 1,523 | |||||||||||||||

| Total shareholders’ equity | 948,479 | 994,066 | (129 | ) | 114,798 | (1,108,735 | ) | 948,479 | 149,619 | |||||||||||||

| Noncontrolling interests | — | 123,904 | 155 | — | — | 124,059 | 19,570 | |||||||||||||||

| Total liabilities, mezzanine equity and equity | 1,158,696 | 1,743,614 | 115,059 | 430,888 | (1,752,704 | ) | 1,695,553 | 267,467 | ||||||||||||||

| As at March 31, 2021 | ||||||||||||||||||||||||

| Parent | Other Subsidiaries and Consolidated Entities | Major VIEs and their Subsidiaries | Primary Beneficiaries of Major VIEs | Eliminations | Consolidated Total | |||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | RMB | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Cash and cash equivalents and short-term investments | 430 | 294,463 | 14,847 | 163,898 | — | 473,638 | ||||||||||||||||||

| Investments in equity method investees and equity securities and other investments | — | 383,001 | 40,212 | 24,004 | — | 447,217 | ||||||||||||||||||

| Accounts receivable, net of allowance | — | 9,828 | 16,658 | 590 | — | 27,076 | ||||||||||||||||||

| Amounts due from group companies | 162,927 | 132,221 | 16,128 | 144,430 | (455,706 | ) | — | |||||||||||||||||

| Prepayments and other assets | 187 | 172,266 | 11,111 | 47,707 | — | 231,271 | ||||||||||||||||||

| Interest in subsidiaries and VIEs | 917,878 | 157,331 | — | (6,577 | ) | (1,068,632 | ) | — | ||||||||||||||||

| Property and equipment and intangible assets | — | 188,107 | 6,577 | 23,561 | — | 218,245 | ||||||||||||||||||

| Goodwill | — | 290,715 | 2,056 | — | — | 292,771 | ||||||||||||||||||

| Total assets | 1,081,422 | 1,627,932 | 107,589 | 397,613 | (1,524,338 | ) | 1,690,218 | |||||||||||||||||

| Amounts due to group companies | 9,320 | 227,775 | 76,792 | 141,819 | (455,706 | ) | — | |||||||||||||||||

| Accrued and other liabilities | 134,632 | 286,351 | 24,764 | 95,190 | — | 540,937 | ||||||||||||||||||

| Deferred revenue and customer advances | — | 49,669 | 12,705 | 3,273 | — | 65,647 | ||||||||||||||||||

| Total liabilities | 143,952 | 563,795 | 114,261 | 240,282 | (455,706 | ) | 606,584 | |||||||||||||||||

| Mezzanine equity | — | 8,673 | — | — | — | 8,673 | ||||||||||||||||||

| Total shareholders’ equity | 937,470 | 917,878 | (6,577 | ) | 157,331 | (1,068,632 | ) | 937,470 | ||||||||||||||||

| Noncontrolling interests | — | 137,586 | (95 | ) | — | — | 137,491 | |||||||||||||||||

| Total liabilities, mezzanine equity and equity | 1,081,422 | 1,627,932 | 107,589 | 397,613 | (1,524,338 | ) | 1,690,218 | |||||||||||||||||

11

Key Information Related to Doing Business in the People’s Republic of China

Risks and Uncertainties Related to Doing Business in the People’s Republic of China

We face various legal and operational risks and uncertainties as a company based in and primarily operating in China. Most of our operations are conducted in the PRC, and are governed by PRC laws, rules and regulations. Our PRC subsidiaries are subject to laws, rules and regulations applicable to foreign investment in China. Because PRC laws, rules and regulations are relatively new and quickly evolving, and because of the limited number of published decisions and the non-precedential nature of these decisions, and because the laws, rules and regulations often give the relevant regulator certain discretion in how to enforce them, the interpretation and enforcement of these laws, rules and regulations involve uncertainties and can be inconsistent and unpredictable. Therefore, it is possible that our existing operations may be found not to be in full compliance with relevant laws and regulations in the future. In addition, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all, and which may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until after the occurrence of the violation. See “— D. Risk Factors — Risks Related to Doing Business in the People’s Republic of China — There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations, and changes in policies, laws, rules and regulations in the PRC could adversely affect us.”

The PRC government has significant oversight and discretion over the conduct of our business, and may intervene in or influence our operations through adopting and enforcing rules and regulatory requirements. For example, in recent years the PRC government, has enhanced regulation in areas such as anti-monopoly, anti-unfair competition, cybersecurity and data privacy. See “— D. Risk Factors — Risks Related to Our Business and Industry — We are subject to a broad range of laws and regulations, and future laws and regulations may impose additional requirements and other obligations that could materially and adversely affect our business, financial condition and results of operations, as well as the trading prices of our ADSs, Shares and/or other securities.”; “— Claims or regulatory actions under competition laws against us may result in our being subject to fines, constraints on our business and damage to our reputation.”; “— PRC regulations regarding acquisitions impose significant regulatory approval and review requirements, which could make it more difficult for us to pursue growth through acquisitions and subject us to fines or other administrative penalties.”; and “— Our business is subject to complex and evolving domestic and international laws and regulations regarding privacy and data protection. These laws and regulations can be complex and stringent, and many are subject to change and uncertain interpretation, which could result in claims, changes to our data and other business practices, regulatory investigations, litigation, penalties, increased cost of operations, or declines in user growth or engagement, or otherwise affect our business.” The Chinese government may further promulgate relevant laws, rules and regulations that may impose additional and significant obligations and liabilities on Chinese companies. These laws and regulations can be complex and stringent, and many are subject to change and uncertain interpretation, which could result in claims, change to our data and other business practices, regulatory investigations, penalties, increased cost of operations, or declines in user growth or engagement, or otherwise affect our business. As a result, the trading prices of our ADSs and Shares could significantly decline or become worthless.

12

In addition, the PRC government has announced its plans to enhance its regulatory oversight of Chinese companies listing overseas, including enhanced oversight of overseas equity financing and listing by Chinese companies. Such new regulatory requirements could significantly limit or completely hinder our ability and the ability of our subsidiaries to obtain external financing through the issuance of equity securities overseas and cause the value of our securities, including our ADSs and Shares, to significantly decline or become worthless. See “— D. Risk Factors — Risks Related to Doing Business in the People’s Republic of China — There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations, and changes in policies, laws, rules and regulations in the PRC could adversely affect us.”; and “— D. Risk Factors — Risks Related to Our Business and Industry — We may need additional capital but may not be able to obtain it on favorable terms or at all.”

Permissions and Approvals Required to be Obtained from PRC Authorities for our Business Operations

In the opinion of Fangda Partners, our PRC legal counsel, our consolidated subsidiaries and the VIEs in China have obtained all major licenses, permissions and approvals from the competent PRC authorities that are necessary to the operations of our China commerce and cloud businesses, which accounted for a significant majority of our revenue in fiscal year 2023. In addition, we have implemented policies and control procedures to obtain and maintain the necessary licenses, permission and approvals to conduct our businesses. On the basis of the legal opinion issued by our PRC legal counsel and our internal policies and procedures, we believe that our consolidated subsidiaries and the VIEs in China have received the requisite licenses, permissions and approvals from the PRC authorities as are necessary for ourmaterial business operations in China. Please see “— D. Risk Factors — Risks Related to Our Business and Industry — We are subject to a broad range of laws and regulations, and future laws and regulations may impose additional requirements and other obligations that could materially and adversely affect our business, financial condition and results of operations, as well as the trading prices of our ADSs, Shares and/or other securities” and “— We rely on Alipay to conduct substantially all of the payment processing and all of the escrow services on our marketplaces. If services and products provided by Alipay or Ant Group’s other businesses are limited, restricted, curtailed or degraded in any way, or become unavailable to us or our users for any reason, our business may be materially and adversely affected.” Such licenses, permits, registrations and filings include, among others, Value-added Telecommunication License, License for Online Transmission of Audio-Visual Programs, Network Cultural Business License, Online Publishing Service License and License for Surveying and Mapping.

If we, our consolidated subsidiaries or the VIEs in China (i) do not maintain such permissions or approvals, (ii) inadvertently conclude that such permissions or approvals are not required, or (iii) applicable laws, regulations, or interpretations change, and we or the VIEs are required to obtain such permissions or approvals in the future, we may be unable to obtain such necessary approvals, permits, registrations or filings in a timely manner, or at all, and such approvals, permits, registrations or filings may be rescinded even if obtained. Any such circumstance may subject us to fines and other regulatory, civil or criminal liabilities, and we may be ordered by the competent PRC authorities to suspend relevant operations, which could materially and adversely affect our business, financial condition, results of operations and prospects.

Furthermore, if the PRC government determines that the contractual arrangements constituting part ofourthe VIE structure adopted by us do not comply with PRC regulations, or if these regulations change or are interpreted differently in the future, our securities may decline in value or become worthless if the determinations, changes, or interpretations result in our inability to assert contractual control over the assets of our consolidated subsidiaries and the VIEs in China that conduct a significant portion of our business operations.

13

In addition, there are substantial uncertainties as to whetherourthe VIE structure adopted by us may be deemed as a method of foreign investment in the future. If the VIE structure adopted by us were to be deemed as a method of foreign investment under any future laws, regulations and rules, and if any of our business operations were to fall under the “Negative List” for foreign investment, we would need to take further actions in order to comply with these laws, regulations and rules, which may materially and adversely affect our current corporate structure, business, financial condition and results of operations. See “— D. Risk Factors — Risks Related to Our Corporate Structure — Substantial uncertainties exist with respect to the interpretation and implementation of the PRC Foreign Investment Law and its implementing rules and other regulations and how they may impact the viability of our current corporate structure, business, financial condition and results of operations.”

Given the uncertainties relating to the interpretation and enforcement of PRC laws, rules and regulations, it is possible that our existing operations may be found not to be in full compliance with relevant laws and regulations in the future. In addition, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all, and which may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until after the occurrence of the violation. For more detailed information, see “— D. Risk Factors — Risks Related to Doing Business in the People’s Republic of China — There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations, and changes in policies, laws, rules and regulations in the PRC could adversely affect us.”

Permissions and Approvals Required to be Obtained from PRC Authorities for our Securities Offerings

The PRC government has announced its plans to enhance its regulatory oversight of Chinese companies listing overseas. In connection with our prior securities offerings and overseas listings, under PRC laws and regulations in effect as of the date of this annual report, after consulting our PRC legal counsel, Fangda Partners, we are not aware of any PRC laws or regulations which explicitly require us to obtain any permission from the CSRC or other Chinese authorities, and we, our consolidated subsidiaries and the VIEs in China (i) have not been required to obtain any permission from or complete any filing with,and(ii) have not been required to go through a cybersecurity review byPRC authoritiesthe Cyberspace Administration of China, and (iii) have not received or been denied such requisite permissions by any PRC authority. There are uncertainties with respect to how PRC authorities will regulate overseas securities offerings and overseas listings in general, as well as the interpretation and implementation of any related regulations. Although we intend to fully comply with the then effective relevant laws and regulations applicable to any securities offerings we may conduct, there are uncertainties with respect to whether we will be able to fully comply with requirements to obtain any permissions and approvals from, or complete any reporting or filing procedures with, PRC authorities that may be in effect in the future. If we, our consolidated subsidiaries or the VIEs in China (i) do not maintain such permissions or approvals, (ii) inadvertently conclude that such permissions, approvals or filing or reporting are not required, or (iii) applicable laws, regulations, or interpretations change, and we or the VIEs are required to obtain such permissions, approvals or filing or reporting in the future, we may be unable to obtain such necessary approvals, permits, registrations or filings in a timely manner, or at all, and such approvals, permits, registrations or filings may be rescinded even if obtained. Any such circumstance could subject us to penalties, including fines, suspension of business and revocation of required licenses, significantly limit or completely hinder our ability to continue to offer securities to investors and cause our securities to decline in value or become worthless. For more detailed information, see “— D. Risk Factors — Risks Related to Doing Business in the People’s Republic of China — There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations, and changes in policies, laws, rules and regulations in the PRC could adversely affect us” and “— We may need additional capital but may not be able to obtain it on favorable terms or at all.”

14

Holding Foreign Companies Accountable Act

In recent years, U.S. regulators have continued to express their concerns about challenges in their oversight of financial statement audits of U.S.-listed companies with significant operations in China. More recently, as part of increased regulatory focus in the United States on access to audit information, the United States enacted the Holding Foreign Companies Accountable Act, or the HFCA Act, in December 2020. The HFCA Act includes requirements for the SEC to identify issuers whose audit reports are prepared by auditors that the PCAOB is unable to inspect or investigate completely because of a restriction imposed by a non-U.S. authority in the auditor’s local jurisdiction. In addition, if the auditor of a U.S. listed company’s financial statements is not subject to PCAOB inspections for three consecutive “non-inspection” years after the law becomes effective, the SEC is required to prohibit the securities of such issuer from being traded on a U.S. national securities exchange, such as the NYSE, or in U.S. over-the-counter markets. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which if enacted into law would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive “non-inspection” years instead of three.On February 4, 2022, the U.S. House of Representatives passed the America Creating Opportunities for Manufacturing, Pre-Eminence in Technology, and Economic Strength Act of 2022, which also includes the accelerating provisions of the Accelerating Holding Foreign Companies Accountable Act.On December 29, 2022, the legislation entitled “Consolidated Appropriations Act, 2023”, which also contains such accelerating provision was signed into law, and the number of consecutive non-inspection years triggering the prohibitions under the HFCA Act was reduced from three years to two.

On December 16, 2021, the PCAOB issued its report notifying the SEC of its determination that it is unable to inspect or investigate completely accounting firms headquartered in China or Hong Kong, including our independent registered public accounting firm, PricewaterhouseCoopers.In March On August 22, 2022, the SECbegan identifying “commission-identified issuers” that are not in compliance with the accounting-related procedures of the HFCA Act and could be subject to potential delisting from U.S. exchanges over time. Based on the HFCA Act, PCAOB Rule 6100 and the implementing rules of the SEC, we expect that we will be identified as a “commission-identified issuer” added us to its conclusive list of issuers identified under the HFCA Act, following the filing ofthisour annual report on Form 20-F with the SEC on July 26, 2022. Accordingly, if the PCAOB is not able to inspect our auditor As a result, our securities may be prohibited from trading on or delisted from the NYSE or other U.S. stock exchange under the HFCA Actby 2024, or 2023 if the Accelerating Foreign Companies Accountable Act is enacted into law. On August 26, 2022, the PCAOB signed a Statement of Protocol, or the PCAOB Statement of Protocol, with the CSRC and the MOF, taking the first step toward opening access for the PCAOB to inspect and investigate completely registered public accounting firms headquartered in China and Hong Kong. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in China and Hong Kong in 2022. The PCAOB Board vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in China and Hong Kong. For this reason, we do not expect to be identified as a Commission-Identified Issuer following the filing of our annual report for the fiscal year ending March 31, 2023. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in China and Hong Kong in 2022 and beyond is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control. If the PCAOB is unable to continue to inspect or investigate completely accounting firms headquartered in China or Hong Kong, including our independent registered public accounting firm, our securities may be prohibited from trading on or delisted from the NYSE or other U.S. stock exchange under the HFCA Act.

Delisting of our ADSs would force our U.S.-based shareholders to sell their ADSs or convert them into Shares listed in Hong Kong. Although we are listed in Hong Kong, investors may face difficulties in migrating their underlying ordinary shares to Hong Kong, or may have to incur increased costs or suffer losses in order to do so. The market prices of our ADSs and/or other securities could be adversely affected as a result of anticipated negative impacts of the HFCA Act upon, as well as negative investor sentiment towards, China-based companies listed in the United States, regardless of our actual operating performance. “— D. Risk Factors — Risks Related to Doing Business in the People’s Republic of China — The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections over our auditor has deprived our investors of the benefits of such inspections” and “— Our ADSs will be delisted and our ADSs and shares prohibited from trading in the United States under the Holding Foreign Companies Accountable Act, or the HFCA Act, if the PCAOB is unable to inspect or investigate completely auditors located in China.”

15

Cash Flows through Our Company

We are a holding company with no operation other than ownership of operating subsidiaries in mainland China, Hong Kong S.A.R., and elsewhere that own and operate our marketplaces and other businesses as well as a portfolio of intellectual property rights. As a result, we rely on dividends and other distributions paid by our operating subsidiaries for our cash and financing requirements, including the funds necessary to pay dividends and other cash distribution to our shareholders, fund inter-company loans, service outstanding debts and pay our expenses. If our operating subsidiaries incur additional debt on their own, the instruments governing the debt may restrict the ability of our operating subsidiaries to pay dividends or make other distributions or remittances, including loans, to us.

Our holding company structure differs from some of our peers in that, although the variable interest entities hold licenses and approvals and assets for regulated activities that are necessary for our business operations, as well as certain equity interests in businesses, to which foreign investments are typically restricted or prohibited under applicable PRC law, we hold the significant majority of assets and operations in our subsidiaries and the significant majority of our revenue is captured directly by our subsidiaries. Therefore, our subsidiaries directly capture the significant majority of profits and associated cash flow from operations, without having to rely on contractual arrangements to transfer cash flow from the variable interest entities to our subsidiaries. In fiscal years 2020, 2021 and 2022, the significant majority of our revenues were generated by our subsidiaries. See “Item 4. Information on the Company — C. Organizational Structure” for a description of these contractual arrangements and the structure of our company. Also see “ — Variable Interest Entity Financial Information” for further financial information of Alibaba Group Holding Limited, the major variable interest entities and their subsidiaries, our subsidiaries that are, for accounting purposes only, the primary beneficiaries of the major variable interest entities, and other subsidiaries and consolidated entities.

Investors in our securities, including our ADSs, Shares and notes, should note that, to the extent cash or assets in our business is in the PRC or a PRC entity, the funds or assets may not be available to fund operations or for other use outside of the PRC due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries, or the VIEs by the PRC government to transfer cash or assets. Under PRC laws and regulations, our PRC subsidiaries are subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets to us. Applicable PRC law permits payment of dividends to us by our operating subsidiaries in China only out of their retained earnings, if any, determined in accordance with PRC accounting standards and regulations. Our operating subsidiaries in China are also required to set aside a portion of their net income, if any, each year to fund general reserves for appropriations until this reserve has reached 50% of the related subsidiary’s registered capital. These reserves are not distributable as cash dividends. In addition, registered share capital and capital reserve accounts are also restricted from distribution. As of March 31, 2022, these restricted net assets totaled RMB165.6 billion (US$26.1 billion). See note 23 to our audited consolidated financial statements included in this annual report. Also see “Item 3. Key Information — D. Risk Factors — We rely to a significant extent on dividends, loans and other distributions on equity paid by our operating subsidiaries in China.” Remittance of dividends by a wholly foreign-owned enterprise out of China is also subject to certain restrictions on currency exchange or outbound capital flows. See “Item 3. Key Information — D. Risk Factors — Restrictions on currency exchange or outbound capital flows may limit our ability to utilize our PRC revenue effectively.”

Under the PRC Enterprise Income Tax Law, a withholding tax of 5% to 10% is generally levied on dividends declared by companies in China to their non-resident enterprise investors. As of March 31, 2022, we have accrued the withholding tax on substantially all of the earnings distributable by our subsidiaries in China, except for those being reserved for permanent reinvestment in China of RMB176.4 billion (US$27.8 billion). See “ — Component of Results of Operations — Taxation — PRC Withholding Tax.”

16

We do not have specific cash management policies in place that dictate how funds are transferred between Alibaba Group Holding Limited, our subsidiaries, the VIEs or our investors. However, we have implemented procedures and control mechanisms to manage the transfer of funds within our organization to support our business needs and in compliance with applicable laws and regulations.

For the years ended March 31, 2020, 2021 and 2022, Alibaba Group Holding Limited provided capital contributions and loans, and repaid loans, in the aggregate amounts of RMB168,348 million, RMB70,623 million and RMB20,188 million (US$3,185 million), respectively, to our subsidiaries, and our subsidiaries provided dividends and loans, and repaid loans, in the aggregate amounts of RMB79,306 million, RMB43,078 million and RMB95,621 million (US$15,084 million), respectively, to Alibaba Group Holding Limited.

For the years ended March 31, 2020, 2021 and 2022, our subsidiaries and consolidated entities provided loans and repaid loans, in the aggregate amounts of RMB9,358 million, RMB20,865 million and RMB2,539 million (US$401 million) to the major VIEs and their subsidiariesvariable interest entities, and the major VIEs and their subsidiaries variable interest entities provided loans, repaid loans and paid technical service fees to our subsidiaries and consolidated entities in the aggregate amounts of RMB855 million, RMB5,575 million and RMB24,404 million (US$3,850 million), respectively. See “Item 3. Operating and Financial Review and Prospects — A. Operating Results — Variable Interest Entity Financial Information” for classification of cashflow detailed in footnotes to the condensed consolidating schedule. We have settled and will continue to settle fees under the contractual arrangements with the variable interest entities. For a condensed consolidating schedule of financial information that disaggregates the operations and depicts the financial position, cash flows, and results of operations for the same periods for which audited consolidated financial statements are required, see “— The VIE Structure Adopted by Our Company — Variable Interest Entity Financial Information.” Please also see the consolidated financial statements included in this annual report for more financial information.

We have not declared or paid any dividends on our ordinary shares. We have no present plan to pay any dividends on our ordinary shares in the foreseeable future. We intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business. See “Item 8. Financial Information — A. Consolidated Statements and Other Financial Information — Dividend Policy.” For PRC and United States federal income tax considerations of an investment in our ADSs, see “Item 10. Additional Information — E. Taxation.”

17

Annex B

To be revised on the 2023 Form 20-F under “Item 3. Key Information — D. Risk Factors — Summary of Risk Factors”:

Risks and uncertainties related to doing business in the PRC include risks and uncertainties associated with the following:

| · | changes and developments in the political and economic policies of the PRC government, including but not limited to that the PRC government may intervene in or influence our operations through adopting and enforcing rules and regulatory requirements, which may evolve quickly with little advance notice (see “— Risks Related to Doing Business in the People’s Republic of China — There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations, and changes in policies, laws, rules and regulations in the PRC could adversely affect us” on page [·] of this annual report); |

| · | uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations, including but not limited to actions the PRC government may take to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our securities, including our ADSs, to significantly decline or become worthless (see “— There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations, and changes in policies, laws, rules and regulations in the PRC could adversely affect us” on page [·] of this annual report); |

| · | potential delisting of our ADSs from the U.S. pursuant to the HFCA Act; |

| · | PRC regulations relating to investments in offshore companies and employee equity incentive plans; |

| · | our reliance on dividends, loans and other distributions on equity paid by our operating subsidiaries in China, the risk that interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries, or the VIEs by the PRC government to transfer cash or assets that are in a business in the PRC or in a PRC entity may limit our ability to fund operations or for other use outside of the PRC |

| · | the potential impact of PRC laws and regulations related to Internet advertisement; |

| · | the possibility that we may be subject to PRC income tax on our global income, and potential discontinuation of preferential tax treatments we currently enjoy; and |

| · | the possibility that dividends payable to foreign investors and gains on the sale of our securities by our foreign investors may become subject to PRC taxation, and uncertainties with respect to indirect transfers of equity interests in PRC resident enterprises or other assets attributed to a PRC establishment of a non-PRC company. |

18

Annex C

To be revised on the 2023 Form 20-F under “Item 3. Key Information — D. Risk Factors — Risks Related to Our Business and Industry”:

Our business is subject to complex and evolving domestic and international laws and regulations regarding privacy and data protection. These laws and regulations can be complex and stringent, and many are subject to change and uncertain interpretation, which could result in claims, changes to our data and other business practices, regulatory investigations, litigation, penalties, increased cost of operations, or declines in user growth or engagement, or otherwise affect our business.

Regulatory authorities in China and around the world have recently implemented, and may in the future continue to implement, further legislative and regulatory proposals concerning privacy and data protection, including particularly relating to the protection of personal information and cross-border data transmission, which could impose more stringent requirements on us. In addition, the interpretation and application of data protection laws are often uncertain, in flux and complicated. It is possible that existing or newly introduced laws and regulations, or their interpretation, application or enforcement, could significantly affect the value of our data, force us to change our data collection, data use and other business practices, cause us to incur significant compliance costs, and subject us to regulatory investigations, fines, suspension of businesses and revocation of licenses.