Exhibit 3.19

CORPORATIONS LAW

KMCC WESTERN AUSTRALIA PTY LTD

ACN 009 331 195

MEMORANDUM AND

ARTICLES OF ASSOCIATION

CORPORATIONS LAW

MEMORANDUM OF ASSOCIATION

of

KMCC WESTERN AUSTRALIA PTY LTD

| 1. | The name of the Company is KMCC Western Australia Pty. Ltd. |

| 2. | Subject to the Corporations Law, the Company shall have the rights, the powers and the privileges of a natural person and the additional powers specified in section 161 of the Corporations Law. In this paragraph, “the Corporations Law” means the Corporations Law as from time to time amended or re-enacted and in force. |

| 3. | The liability of each member is limited to the amount (if any) unpaid on each share held by him. |

| 4. | The nominal capital of the Company is $15,000,000 divided into 10,000,000 ordinary shares of $1.00 par value each and 5,000,000 Redeemable Preference Shares of $1.00 par value each, to be issued at a premium of $99.00 each, having the rights and being issued on the terms and conditions contained in Article 2.5 of the Articles of Association of the Company. |

ARTICLES OF ASSOCIATION

of

KMCC WESTERN AUSTRALIA PTY. LTD.

ACN 009 331 195

TABLE OF CONTENTS

| | | | | | |

| Clause | | | | Page | |

| | |

| 1. | | TABLE A, INTERPRETATION & PROPRIETARY COMPANY | | | 1 | |

| | |

| 1.1 | | Table A Not Applicable | | | 1 | |

| 1.2 | | Definitions | | | 1 | |

| 1.3 | | Corporations Law Definitions | | | 2 | |

| 1.4 | | Number and Gender | | | 2 | |

| 1.5 | | Headings | | | 2 | |

| 1.6 | | Proprietary Company | | | 2 | |

| | |

| 2. | | SHARE CAPITAL AND VARIATION OF RIGHTS | | | 2 | |

| | |

| 2.1 | | Nominal Capital | | | 2 | |

| 2.2 | | Issue of Shares | | | 3 | |

| 2.3 | | Entitlement to New Shares | | | 3 | |

| 2.4 | | Classes of Shares | | | 3 | |

| 2.5 | | Preference Shares | | | 3 | |

| 2.6 | | Recognition of Trusts | | | 6 | |

| 2.7 | | Unregistered Interests | | | 6 | |

| 2.8 | | Share Certificate | | | 6 | |

| | |

| 3. | | LIEN | | | 6 | |

| | |

| 3.1 | | Unpaid Calls | | | 6 | |

| 3.2 | | Other Moneys Due to the Company | | | 6 | |

| 3.3 | | Exemptions | | | 6 | |

| 3.4 | | Dividends | | | 6 | |

| 3.5 | | Sale of Shares | | | 7 | |

| 3.6 | | Restrictions on Sale | | | 7 | |

| 3.7 | | Person Authorised to Sign Transfers | | | 7 | |

| 3.8 | | Proceeds of Sale | | | 7 | |

| | |

| 4. | | CALLS ON SHARES | | | 7 | |

| | |

| 4.1 | | Calls | | | 7 | |

| 4.2 | | Making of Call | | | 7 | |

| 4.3 | | Joint Liability | | | 8 | |

| 4.4 | | Interest | | | 8 | |

| 4.5 | | Deemed Calls | | | 8 | |

| 4.6 | | Differentiation Between Shareholders | | | 8 | |

| 4.7 | | Payments in Advance of Calls | | | 8 | |

| | |

| 5. | | FORFEITURE OF SHARES | | | 8 | |

| | |

| 5.1 | | Failure to Pay Call | | | 8 | |

| 5.2 | | Forfeiture | | | 8 | |

| 5.3 | | Sale of Forfeited Share | | | 9 | |

| 5.4 | | Continuing Liability | | | 9 | |

| 5.5 | | Officer’s Statement Conclusive | | | 9 | |

| 5.6 | | Procedures | | | 9 | |

| | |

| 6. | | TRANSFER OF SHARES | | | 9 | |

| | |

| 6.1 | | General | | | 9 | |

| 6.2 | | Registration of Transfers | | | 9 | |

| 6.3 | | Form of Transfers | | | 10 | |

| 6.4 | | Procedure for Registration | | | 10 | |

| 6.5 | | Refusal to Register | | | 10 | |

TABLE OF CONTENTS

| | | | | | |

| Clause | | | | Page | |

| | |

| 6.6 | | Suspension of Registrations | | | 10 | |

| | |

| 7. | | TRANSMISSION OF SHARES | | | 10 | |

| | |

| 7.1 | | Death of Shareholder Leaving a Will | | | 10 | |

| 7.2 | | Death or Bankruptcy of Shareholder | | | 10 | |

| 7.3 | | Registration by Transmission or to Beneficiary | | | 10 | |

| 7.4 | | Death of a Joint Holder | | | 11 | |

| 7.5 | | Joint Personal Representatives | | | 11 | |

| | |

| 8. | | CHANGES TO CAPITAL STRUCTURE | | | 11 | |

| | |

| 8.1 | | Alteration of Capital | | | 11 | |

| 8.2 | | Power to Buy Back Shares | | | 11 | |

| | |

| 9. | | GENERAL MEETINGS | | | 12 | |

| | |

| 9.1 | | Convening of General Meetings of Shareholders | | | 12 | |

| 9.2 | | Notice | | | 12 | |

| 9.3 | | Annual General Meeting | | | 12 | |

| | |

| 10. | | PROCEEDINGS AT GENERAL MEETINGS - TWO OR MORE SHAREHOLDERS | | | 12 | |

| | |

| 10.1 | | Quorum | | | 12 | |

| 10.2 | | Persons Entitled to Attend a General Meeting | | | 12 | |

| 10.3 | | Chairman and Casting Vote | | | 13 | |

| 10.4 | | Adjournment | | | 13 | |

| 10.5 | | Notice of Adjourned Meeting | | | 13 | |

| 10.6 | | Voting Rights | | | 13 | |

| 10.7 | | Voting-Show of Hands | | | 13 | |

| 10.8 | | Results of Voting | | | 13 | |

| 10.9 | | Poll | | | 13 | |

| 10.10 | | Voting by Joint Holders | | | 14 | |

| 10.11 | | Shareholder under Disability | | | 14 | |

| 10.12 | | Payment of Calls | | | 14 | |

| 10.13 | | Objection to Voting | | | 14 | |

| 10.14 | | Proxies | | | 14 | |

| 10.15 | | Proxy Votes | | | 15 | |

| 10.16 | | Representatives of Corporate Shareholders | | | 15 | |

| | |

| 11. | | PROCEEDINGS - WHERE A SINGLE SHAREHOLDER | | | 15 | |

| | |

| 12. | | APPOINTMENT, REMOVAL AND REMUNERATION OF DIRECTORS | | | 15 | |

| | |

| 12.1 | | Number of Directors | | | 15 | |

| 12.2 | | Appointment and Removal of Directors | | | 15 | |

| 12.3 | | Additional Directors | | | 16 | |

| 12.4 | | Alternate Directors | | | 16 | |

| 12.5 | | Vacation of Office | | | 17 | |

| 12.6 | | Remuneration | | | 17 | |

| 12.7 | | No Share Qualification | | | 17 | |

| | |

| 13. | | POWERS AND DUTIES OF DIRECTORS | | | 17 | |

| | |

| 13.1 | | Management of the Company | | | 17 | |

| 13.2 | | Borrowing Powers | | | 17 | |

| 13.3 | | Attorneys | | | 17 | |

| 13.4 | | Cheques, etc. | | | 18 | |

TABLE OF CONTENTS

| | | | | | |

| Clause | | | | Page | |

| | |

| 14. | | PROCEEDING OF DIRECTORS - MORE THAN ONE DIRECTOR | | | 18 | |

| | |

| 14.1 | | Convening a Meeting | | | 18 | |

| 14.2 | | Procedure at Meetings | | | 18 | |

| 14.3 | | Chairman | | | 18 | |

| 14.4 | | Quorum | | | 18 | |

| 14.5 | | Majority Decisions | | | 18 | |

| 14.6 | | Casting Vote | | | 18 | |

| 14.7 | | Continuing Directors May Act | | | 18 | |

| 14.8 | | Committees | | | 19 | |

| 14.9 | | Written Resolutions | | | 19 | |

| 14.10 | | Meeting by Instantaneous Communication Device | | | 19 | |

| 14.11 | | Procedure at Meetings by Instantaneous Communication Device | | | 19 | |

| 14.12 | | Minutes | | | 20 | |

| 14.13 | | Definition | | | 20 | |

| 14.14 | | Defective Appointment | | | 20 | |

| 14.15 | | Executive Directors | | | 20 | |

| 14.16 | | Directors’ Other Interests | | | 20 | |

| 14.17 | | Accountability of Directors | | | 20 | |

| 14.18 | | Contracts Involving Directors | | | 20 | |

| 14.19 | | Extent of Interests in Contracts | | | 20 | |

| 14.20 | | Section 231 of Corporations Law | | | 21 | |

| 14.21 | | Voting of Directors | | | 21 | |

| | |

| 15. | | PROCEEDINGS OF DIRECTORS - WHERE ONE DIRECTOR | | | 21 | |

| | |

| 16. | | MANAGING DIRECTOR | | | 21 | |

| | |

| 16.1 | | Appointment | | | 21 | |

| 16.2 | | Remuneration | | | 21 | |

| 16.3 | | Powers | | | 21 | |

| | |

| 17. | | SECRETARY | | | 21 | |

| | |

| 18. | | SEAL | | | 22 | |

| | |

| 19. | | ACCOUNTS AND RECORDS | | | 22 | |

| | |

| 19.1 | | Accounting Records to be Kept | | | 22 | |

| 19.2 | | Inspection | | | 22 | |

| | |

| 20. | | MINUTES | | | 22 | |

| | |

| 20.1 | | Minutes to be Kept | | | 22 | |

| 20.2 | | Signature of Minutes | | | 22 | |

| 20.3 | | Requirements of the Corporations Law | | | 23 | |

| | |

| 21. | | DIVIDENDS AND RESERVES | | | 23 | |

| | |

| 21.1 | | Dividends | | | 23 | |

| 21.2 | | Interim Dividend | | | 23 | |

| 21.3 | | Dividends Only Payable from Profits | | | 23 | |

| 21.4 | | No Interest | | | 23 | |

| 21.5 | | Reserves | | | 23 | |

TABLE OF CONTENTS

| | | | | | |

| Clause | | | | Page | |

| | |

| 22. | | CAPITALISATION OF PROFITS | | | 23 | |

| | |

| 22.1 | | Capitalisation | | | 23 | |

| 22.2 | | Application of Capitalised Amounts | | | 23 | |

| 22.3 | | Procedures | | | 24 | |

| | |

| 23. | | NOTICES | | | 24 | |

| | |

| 23.1 | | Service | | | 24 | |

| 23.2 | | Service by Post | | | 24 | |

| 23.3 | | Notice to Joint Holders | | | 24 | |

| 23.4 | | Notices to Personal Representatives and Others | | | 24 | |

| 23.5 | | Persons Entitled to Notice of General Meetings | | | 24 | |

| | |

| 24. | | WINDING UP | | | 25 | |

| | |

| 24.1 | | Distribution in Kind | | | 25 | |

| 24.2 | | Distribution to be in Proportion to Nominal Share Capital Paid-Up | | | 25 | |

| 24.3 | | Trust for Shareholders | | | 25 | |

| | |

| 25. | | OFFICERS: INDEMNITIES AND INSURANCE | | | 25 | |

| | |

| 25.1 | | Indemnities | | | 25 | |

| 25.2 | | Insurance | | | 26 | |

| 25.3 | | Interpretation | | | 26 | |

CORPORATIONS LAW

ARTICLES OF ASSOCIATION

of

KMCC WESTERN AUSTRALIA PTY LTD

| 1. | TABLE A, INTERPRETATION & PROPRIETARY COMPANY |

| 1.1 | Table A Not Applicable |

The regulations contained in Table A of Schedule 1 to the Corporations Law shall not apply to this Company.

In these Articles, unless the context otherwise requires -

“Articles” means these Articles as altered or added to from time to time.

“Corporations Law” and “Corporations Regulations” have the meanings given to them by Part 3 of the Corporations (Western Australia) Act 1990 and references to the Corporations Law and the Corporations Regulations have the effect given to them by section 13 of that Act.

“the Company” means this company as it is from time to time named in accordance with the Corporations Law.

“the Directors” means the director or directors of the Company from time to time or such number of them as have authority to act for the Company (including any alternate director duly acting as such).

“Memorandum” means the Company’s Memorandum of Association as altered from time to time.

“Officer” means any Director or Secretary of the Company.

“Prescribed Rate” means, for the purposes of the interest rate referred to in Articles and, the rate of 18% per annum, or such other rate as may from time to time be fixed by the Directors.

“Register of Shareholders” means the register of Shareholders kept by the Company as required by the Corporations Law.

“Registered Office” means the registered office of the Company in the State of Western Australia.

“Related Company” means a company which, by virtue of the provisions of section 50 of the Corporations Law, is deemed to be related to the Company, and related has a corresponding meaning.

“Representative” means a person authorised to act as a representative of a corporation under Article 10.16.

1

“Share” means a share in the capital of the Company.

“Shareholder” means a person or company registered in the Register of Shareholders as the holder of one or more shares, and includes any person who or company that is a member of the Company in accordance with or for the purposes of the Corporations Law.

“Seal” means the common seal of the Company.

“Secretary” means any person appointed to perform the duties of a secretary of the Company.

“State” means the State of Western Australia.

| 1.3 | Corporations Law Definitions |

Any word or expression defined in or for the purposes of the Corporations Law shall, unless otherwise defined in Article 1.2 or the context otherwise requires, have the same meaning when used in these Articles, and the rules of interpretation specified in or applicable for the purposes of the Corporations Law shall, unless the context otherwise requires, apply in the interpretation of these Articles.

Words in the singular include the plural and vice versa, and words importing any gender shall include each other gender.

Headings are inserted in these Articles for convenience only and shall not affect the interpretation of these Articles.

The Company is a proprietary company, and accordingly:-

| | (a) | the number of its Shareholders for the time being is limited to not more than 50, counting joint holders of shares as one person, and not counting any person in the employment of the Company or any of its subsidiaries, or any person who, while so employed and thereafter has continued to be, a Shareholder of the Company; and |

| | (b) | must not engage in any activity that would require the lodgment of a prospectus under Part 7.12 of the Corporations Law or a corresponding law. |

| 2. | SHARE CAPITAL AND VARIATION OF RIGHTS |

The nominal capital of the Company is $15,000,000 divided into 10,000,000 ordinary shares of $1.00 par value each and 5,000,000 Redeemable Preference Shares of $1.00 par value each, to be issued at a premium of $99.00 each, having the rights and being issued on the terms and conditions contained in Article 2.5 of the Articles of Association of the Company.

2

Subject to Article 2.3, and without prejudice to any special rights previously conferred on the holders of any existing Shares or class of Shares, all unissued Shares shall, until their issue, be under the control of the Directors. Subject to the Corporations Law and these Articles, the Directors may at any time and from time to time issue such number of Shares, either as ordinary Shares or Shares of a named class or classes (being either an existing class or a new class), and with such preferred, deferred, or other special rights or such restrictions, whether with regard to dividend, voting, return of capital or otherwise, and whether as preference Shares that are or at the option of the Company are liable to be redeemed, as the Directors shall in their absolute discretion determine.

| 2.3 | Entitlement to New Shares |

Except when all the Directors otherwise agree or the Company in general meeting by resolution otherwise decides, all Shares shall, before issue, be offered to existing Shareholders in proportion, as nearly as circumstances admit, to the Shares already held by them. The offer shall be made by notice specifying the number of Shares offered, and limiting the time (not being less than seven days) within which the offer, if not accepted, will be deemed to be declined. After expiration of that time, or on receipt of an intimation from the person to whom the offer is made that he declines to accept the Shares offered, the Directors may dispose of those Shares in such manner as they shall in their absolute discretion determine.

If at any time the share capital is divided into different classes of Shares:-

| | (a) | unless otherwise provided by the terms of issue of the Shares of that class the rights attached to any class, may be varied with the consent in writing of the holders of three-quarters of the issued Shares of that class, or if authorised by a special resolution passed at a separate meeting of the holders of the Shares of the class, whether or not the Company is being wound up; and |

| | (b) | the provisions of these Articles relating to general meetings shall apply, so far as they are capable of application, and with necessary alterations, to every such separate meeting, except that a quorum shall be constituted by two persons who together hold or represent by proxy one-third of the issued Shares of the same class. |

The Company may create Preference Shares with such rights and upon such terms as shall be incorporated in those Articles by a duly passed amendment thereto. The Company may at any time issue further Preference Shares ranking equally in all respects with other Preference Shares already issued, in which event the rights of the Preference Shares already issued shall be deemed not to have been varied by the further issue.

| | (a) | In this Article, except to the extent that such interpretation shall be excluded by or be repugnant to the context: |

“Business Day” means a business day on which banks (as defined in section 5(1) of the Banking Act 1959, as amended, of the Commonwealth of Australia) in Perth are open for business.

3

“Preference Shares” means the Redeemable Preference Shares of $1.00 par value each in the capital of the Company.

“Premium” means a premium of $99.00 payable in respect of each Preference Share upon issue.

“Redemption Amount” means an amount per Preference Share equal to the par value and premium paid up in respect of such Preference Share.

“Redemption Date” means the date, if it is not a Business Day, the first Business Day after such date, fifty (50) years from the date of issue of the Preference Shares.

| | (b) | Subject to this Article, Preference Shares shall be under the control of the directors who may allot or otherwise dispose of the same to such persons and otherwise on such terms and conditions and at such times as the directors think fit. |

| | | Pursuant to section 197(8) of the Corporations Law, the rights conferred by each Preference Share, irrespective of its date of issue, shall rank pari passu with each other Preference Share and any allotment or further allotment of the Preference Shares shall not be deemed to be a variation or abrogation of the rights attached to any existing Preference Shares or other existing redeemable Preference Shares in the capital of the Company. |

| | (c) | The Preference Shares shall confer upon the holders thereof such rights and shall be issued upon such terms and conditions as are set out in this Article notwithstanding anything to the contrary contained in the Articles of Association of the Company. |

| | (d) | The Preference Shares shall confer on the holders thereof the rights on redemption and in a winding up to payment in cash of the capital for the time being paid up thereon together with Premium paid in respect thereof and any dividends payable in respect of the Preference Shares in priority to any other class of shares. The Preference Shares shall confer on the holders thereof the right to be paid dividends in accordance with this Article out of the profits of the Company in priority to any other class of shares. The Preference Shares shall not confer on the holders thereof any further right to participate in surplus assets or profits. |

| | (e) | The certificate issued by the Company for each Preference Share shall specify in respect of that Preference Share: |

| | (i) | the Redemption Amount; |

| | (iii) | such other matters as the directors may require. |

| | (f) | The holder of each Preference Share shall upon redemption be bound to surrender such certificate to the Company and the Company shall thereupon pay to him or at his direction the Redemption Amount together with any dividends payable in respect of the preference shares then due or accrued or unpaid. |

| | (g) | The Company shall, in accordance with section 191 of the Corporations Law, transfer to an account to be called the “share premium account” a sum equal to the aggregate amount of the Premiums received by the Company in respect of each |

4

| | Preference Share and the Company shall not apply such share premium account so long as there are any Preference Shares on issue other than in providing for repayment on redemption of the Premiums raised in respect of such Preference Shares as provided in this regulation. |

| | (h) | The Preference Shares shall not entitle the holders thereof to vote at any general meeting of the Company except: |

| | (i) | upon a proposal to reduce the share capital of the Company; |

| | (ii) | upon a proposal that affects rights attached to the Preference Shares; |

| | (iii) | upon a proposal to wind up the Company; |

| | (iv) | during the winding up of the Company; |

| | (v) | during a period after Dividends have been in arrears for more than 30 days; or |

| | (vi) | during a period after the Company has failed to redeem Preference Shares in accordance with sub-Article (i) or (k). |

In the event that the holders of the Preference Shares shall be entitled to vote, every such holder present in person or by proxy or attorney shall have one vote by a show of hands. In the case of a poll every such holder present in person or by proxy or attorney shall have one vote for every Preference Share held by him. Where a corporation being such a holder is present by attorney or proxy or representative, such attorney or proxy or representative shall be entitled to vote for such corporation on a show of hands.

| | (i) | Notwithstanding that each certificate shall contain the Redemption Date relevant to the Preference Shares referred to therein and any other provision contained in these Articles regarding early redemption of the Preference Shares, the Company will forthwith redeem all Preference Shares on issue upon the occurrences of any of the following events: |

| | (i) | the Company by any act or omission causing a material breach of any of the provisions of its Articles of Association which might or would adversely affect or materially endanger the rights of the holders of the Preference Shares; |

| | (ii) | the appointment of a liquidator, receiver or official manager to the Company. |

| | (j) | The holders of the Preference Shares shall be entitled to the payment of such dividends as the directors shall determine. |

| | (k) | Subject to the provisions of the Corporations Law, Company shall redeem each Preference Share on the Redemption Date or on such other date stipulated by resolution of the directors in their absolute discretion, whichever is the earlier in time. |

| | (l) | Each holder of a Preference Share shall upon redemption thereof be bound to surrender to the Company the certificate for the Preference Shares to be redeemed. Failure by any holder of a Preference Share to surrender a certificate upon redemption shall not prejudice or affect the redemption of that Preference Share |

5

| | but the amount payable to that holder upon redemption shall immediately be paid by the Company into a bank account established for the purpose of holding such monies and be held by the Company in trust for that holder and be paid to him forthwith after the certificate (or if it has been lost, misplaced or destroyed, satisfactory evidence of such fact and an indemnity and release in favour of the Company in respect thereof) is delivered to the Company, payment of such monies into such bank account to constitute redemption. |

Except as permitted or required by the Corporations Law, the Company shall not recognise a person as holding a share upon any trust.

| 2.7 | Unregistered Interests |

The Company is not bound by or compelled in any way to recognise any equitable, contingent, future or partial right or interest in any Share, whether or not it has notice of the interest or right concerned, unless otherwise provided by these Articles or by law, except an absolute right of ownership in the registered holder of the Share.

A person whose name is entered as a Shareholder in the Register of Shareholders is entitled, without payment, to receive a share certificate in respect of the Share under the Seal in accordance with the Corporations Law but, in respect of a Share or Shares held jointly by several persons, the Company is not bound to issue more than one certificate. Delivery of a certificate for a Share to one of several joint Shareholders is sufficient delivery to all such holders. Where a share certificate is lost, worn out or destroyed, the Company shall issue a duplicate certificate in accordance with the requirements of section 1089 of the Corporations Law.

The Company has a first and paramount lien on every Share, other than fully paid Shares, for all money, whether presently payable or not, which is called or payable at a fixed time in respect of that Share.

| 3.2 | Other Moneys Due to the Company |

The Company also has a first and paramount lien on all Shares, other than fully paid Shares, registered in the name of a sole holder for all money presently payable by him or his estate to the Company.

The Directors may at any time exempt a Share wholly or in part from the provisions of this Article.

Any lien which the Company has on a Share extends to all dividends payable in respect of the Share and to all proceeds of sale of such Share.

6

Subject to Article 3.6, the Company may sell, in such manner as the Directors think fit, any Shares on which the Company has a lien.

| | A Share on which the Company has a lien shall not be sold pursuant to Article 3.5 unless - |

| | (a) | a sum in respect of which the lien exists is presently due and payable; and |

| | (b) | the Company has, not less than 14 days before the date of the sale, given to the registered holder for the time being of the Share, or the person entitled to the Share by reason of the death or bankruptcy of the registered holder, a notice in writing setting out, and demanding payment of, such part of the amount in respect of which the lien exists as is presently due and payable. |

| 3.7 | Person Authorised to Sign Transfers |

For the purpose of giving effect to a sale of a Share under Article 3.5, the Directors may authorise a person to transfer the Shares sold to the purchaser of the Shares. The Company shall register the purchaser as the holder of the Shares comprised in any such transfer and no such purchaser shall be bound to see to the proper application of the purchase money. The title of the purchaser to the Shares shall not be affected by any irregularity or invalidity in connection with the sale.

The proceeds of a sale under Article 3.5 shall be applied by the Company in payment of such part of the amount in respect of which the lien exists as is presently due and payable, and the residue, if any, shall, subject to any like lien for sums not presently due and payable that existed upon the Shares before the sale, be paid to the person registered as the holder of the Shares at the date of the sale or the person entitled to the Shares by reason of the death or bankruptcy of the registered holder.

The Directors may make calls upon the Shareholders in respect of any money unpaid on their respective Shares, whether on account of the nominal value of the Shares or any premium payable thereon, which is, by the terms of issue of those Shares, made payable at fixed times, except that no call shall be payable earlier than one month from the date fixed for the payment of the last preceding call. Each Shareholder shall, upon receiving at least 14 days’ notice specifying the time or times and place of payment, pay to the Company, at the time or times and place so specified, the amount called on his Shares. A call may be required or permitted to be paid by instalments.

A call shall be deemed to have been made at the time when the resolution of the Directors authorising the call was passed. The Directors may revoke or postpone a call.

7

Where there are joint holders of a Share, they are jointly and severally liable to pay all calls in respect of the Share.

If an amount called in respect of a Share is not paid on or before the date, the person from whom the call is due shall pay interest on the amount called from the due date to the time of actual payment at such rate not exceeding the Prescribed Rate as the Directors determine, but the Directors may waive payment of that interest wholly or in part.

Any amount that, by the terms of issue of a Share, becomes payable on allotment or at a fixed date, whether on account of the nominal value of the Share or any premium thereon, shall, for the purposes of these Articles be deemed to be a call duly made and payable on the date on which by the terms of issue the amount becomes payable, and, in case of non-payment, all the relevant provisions of these Articles as to payment of interest and expenses, forfeiture or otherwise shall apply as if the amount had become payable by virtue of a call duly made and notified.

| 4.6 | Differentiation Between Shareholders |

The Directors may, on the issue of Shares, differentiate between the holders as to the amount of calls to be paid and the times of payment.

| 4.7 | Payments in Advance of Calls |

The Directors may:

| | (a) | accept from a Shareholder the whole or a part of the amount unpaid on a Share although no part of that amount has then been called up; and |

| | (b) | authorise payment by the Company of interest upon the whole or any part of an amount so accepted until the amount becomes payable on a call at such rate, not exceeding the Prescribed Rate, as is agreed between the Directors and the Shareholder paying the amount. |

If a Shareholder fails to pay a call or instalment of a call on the due date, the Directors may, at any time thereafter during such time as any part of the call or instalment remains unpaid, serve a notice on him requiring payment of so much of the call or instalment as is unpaid, together with any interest that has accrued. The notice shall name a further day (not earlier than the expiration of 14 days from the date of service of the notice) on or before which the payment required by the notice is to be made and shall state that, in the event of non-payment at or before the time appointed, the Shares in respect of which the call was made will be liable to be forfeited.

If the requirements of a notice served under Article 5.1 are not complied with, any Share in respect of which the notice has been given may at any time thereafter, but before the

8

payment required by the notice has been made, be forfeited by a resolution of the Directors to that effect. Such a forfeiture shall include all dividends declared in respect of the forfeited Shares and not actually paid before the forfeiture.

| 5.3 | Sale of Forfeited Share |

A forfeited Share may be sold or otherwise disposed of on such terms and in such manner as the Directors may determine, and, at any time before a sale or disposition, the forfeiture may be cancelled on such terms as the Directors may determine.

A person whose Shares have been forfeited ceases to be a Shareholder in respect of the forfeited Shares, but remains liable to pay to the Company all money that, at the date of forfeiture, was payable by him to the Company in respect of the Shares (including interest at the Prescribed Rate from the date of forfeiture on the money for the time being unpaid if the Directors decide to enforce payment of the interest), but his liability ceases if and when the Company receives payment in full of all the money (including interest) so payable in respect of the Shares.

| 5.5 | Officer’s Statement Conclusive |

A statement in writing declaring that the person making the statement is a Director or a Secretary of the Company, and that a Share in the Company has been duly forfeited on a date stated in the statement, is prima facie evidence of the facts stated in the statement as against all persons claiming to be entitled to the Share.

The Company may receive the consideration, if any given for a forfeited Share on any sale or disposition of the Share, and may execute a transfer of the Share in favour of the person to whom the Share is sold or disposed of. Upon the execution of the transfer, the transferee shall be registered as the holder of the Share. No such transferee shall be bound to see to the proper application of any money paid by him as consideration. The title of the transferee to the Share is not affected by any irregularity or invalidity in connection with the forfeiture, sale or disposal of the Share.

| | (a) | If there is only one Shareholder at any particular time, the Shareholder may transfer any Shares he holds to any person, in his absolute discretion. |

| | (b) | If there is more than one Shareholder at any particular time, even in those circumstances, a Shareholder may transfer any Shares he holds to any person, in his absolute discretion. |

| 6.2 | Registration of Transfers |

The Directors shall be bound to register the transfer of any Shares disposed of in terms of this Article 6.

9

The instrument or transfer of any Shares shall be in writing in any usual or common form or in any other form which the Directors may approve. The instrument shall be executed by or on behalf of both the Transferor and the transferee; and the Transferor shall remain the holder of the Shares transferred until the transfer is registered and the name of the transferee is entered in the register of Shareholders in respect thereof.

| 6.4 | Procedure for Registration |

The instrument of transfer must be left for registration at the registered office of the company, together with such fee (if any) not exceeding $1.00 as the Directors from time to time may require, accompanied by the certificate of the Shares to which it relates and such other evidence as the Directors may reasonably require to show the right of the Transferor to make the transfer, and thereupon the Company shall, subject to the powers vested in the Directors by these Articles, register the transferee as a shareholder and retain the instrument of transfer.

The Directors may decline to register any transfer of Shares, and except in the case of transmission, without assigning any reason therefor. In such a case, the Directors shall send notice of the refusal to the transferee as required by section 1093 of the Corporations Law.

| 6.6 | Suspension of Registrations |

The registration of transfers may be suspended at such times and for such periods as the Directors from time to time determine not exceeding in the whole 30 days in any year.

| 7.1 | Death of Shareholder Leaving a Will |

An executor duly appointed under the will of a deceased Shareholder, shall be entitled, as from the date of the Shareholder’s death, and on behalf of the deceased Shareholder’s estate, to the same dividends and other advantages and to the same rights whether in relation to meetings of the Company, or voting or otherwise, as the Shareholder would have been entitled to if he had not died, whether or not probate of the will has been granted. Nevertheless, if probate of the will is granted to a person or persons other than the executor first referred to in this Article, the executor’s rights shall cease, and thereafter such rights shall only be exercisable by the person or persons to whom probate is granted as provided in Articles 7.2 and 7.3.

| 7.2 | Death or Bankruptcy of Shareholder |

Subject to Article 7.1, where the registered holder of a Share dies or becomes bankrupt, his personal representative or the trustee of his estate, as the case may be, shall be entitled, upon the production of such information as is properly required by the Directors, to the same dividends and other advantages, and to the same rights, whether in relation to meetings of the Company, or to voting or otherwise, as the registered holder would have been entitled to if he had not died or become bankrupt.

| 7.3 | Registration by Transmission or to Beneficiary |

A person becoming entitled to a Share in consequence of the death or, subject to the Bankruptcy Act 1966, the bankruptcy of a Shareholder may, upon such information being

10

produced as is properly required by the Directors, elect by written notice to the Company either to be registered himself as holder of the Share or to have some other person nominated by him registered as the transferee of the Share. If he elects to have another person registered, he shall execute a transfer of the Share to that other person. All the limitations, restrictions and provisions of these Articles relating to the right to transfer Shares, and the registration of a transfer of Shares, are applicable to any such notice or transfer as if the death or bankruptcy of the Shareholder had not occurred and the notice or transfer were a transfer signed by that Shareholder.

| 7.4 | Death of a Joint Holder |

In the case of the death of a Shareholder who was a joint holder of a Share, his survivor or survivors shall be the only persons recognised by the Company as having any title to the deceased’s interest in the Shares, but this Article 7.4 does not release the estate of a deceased joint holder from any liability in respect of a Share that had been jointly held by him with one or more other persons.

| 7.5 | Joint Personal Representatives |

Where two or more persons are jointly entitled to any Share in consequence of the death of the registered holder, they shall, for the purpose of these Articles, be deemed to be joint holders of the Share.

| 8. | CHANGES TO CAPITAL STRUCTURE |

| | The Company, may by special resolution of its Shareholders or, where the Company has only one Shareholder, by that Shareholder recording his decision: |

| | (a) | increase its nominal Share capital by the creation of new Shares of such amount as is specified in the resolution; |

| | (b) | consolidate and divide all or any of its nominal Share capital into Shares of larger nominal value than its existing Shares; |

| | (c) | sub-divide all or any of its Shares into Shares of smaller nominal value than is fixed by the Memorandum, but so that in the sub-division the proportion between the amount paid and the amount, if any, unpaid on each such Share of a smaller nominal value is the same as it was in the case of the Share from which the Share of a smaller nominal value is derived; |

| | (d) | cancel Shares that, at the date of the passing of the resolution, have not been taken or agreed to be taken by any person, or have been forfeited and, subject to the Corporations Law, reduce its nominal Share capital by the amount of the Shares so cancelled; and |

| | (e) | reduce its Share capital, any capital redemption reserve fund or any Share premium account. |

| 8.2 | Power to Buy Back Shares |

The Company may buy ordinary shares or any class of ordinary shares in itself by any means authorised by the Corporations Law, subject to the provisions of that Law and, where applicable, the Listing Rules.

11

| 9.1 | Convening of General Meetings of Shareholders |

Subject to Article 11, any Director may, whenever he thinks fit, convene a general meeting of Shareholders, and a general meeting shall be convened on such requisition, or in default, may be convened by such requisitionists, as is provided by the Corporations Law.

Subject to Article 11, a notice of a general meeting shall be given in accordance with the requirements of section 247 of the Corporations Law, and shall specify the place, the day and the time of the meeting and state the general nature of the business to be transacted at the meeting. The non-receipt of a notice of a general meeting by a Shareholder, or the accidental omission to give such a notice to a Shareholder, shall not invalidate any resolution passed at any such meeting or any other proceedings thereat.

| 9.3 | Annual General Meeting |

Subject to Article 11, annual general meetings shall be held in accordance with the requirements of section 245 of the Corporations Law.

| 10. | PROCEEDINGS AT GENERAL MEETINGS - TWO OR MORE SHAREHOLDERS |

| | (a) | No business shall be transacted at any general meeting unless a quorum of Shareholders is present, comprising two Shareholders present in person, by proxy or Representative. |

| | (b) | For the purpose of determining whether a quorum is present, a person attending as a proxy, or as a Representative, shall be deemed to be a Shareholder present in person, but no person shall be counted twice. |

| | (c) | If a quorum is not present within 15 minutes after the time appointed for a general meeting, the meeting, if convened upon a requisition, shall be dissolved, but in any other case, it shall stand adjourned to the same day in the next week at the same time and place. |

| | (d) | If on the resumption of the meeting, a quorum is not present, the Shareholders present shall constitute a quorum. |

| 10.2 | Persons Entitled to Attend a General Meeting |

The persons entitled to attend a general meeting shall be:-

| | (a) | Shareholders, in person, by proxy or by Representative; |

| | (c) | the Company’s auditor (if any); and |

| | (d) | such other person or persons as the meeting may approve. |

12

| 10.3 | Chairman and Casting Vote |

If the Directors have elected one of their number as chairman of their meetings, he shall preside as chairman at every general meeting. Where a general meeting is held and a chairman has not been so elected or the chairman is not present within 15 minutes after the time appointed for the holding of the meeting or is unwilling to act, the Shareholders present shall elect one of their number to be chairman of the meeting. In the case of an equality of votes, the chairman of a general meeting shall have a second or casting vote.

The chairman may, with the consent of the meeting, and shall if so directed by the meeting, adjourn the meeting from time to time and from place to place, but no business shall be transacted at any adjourned meeting other than the business left unfinished at the meeting from which the adjournment took place.

| 10.5 | Notice of Adjourned Meeting |

When a meeting is adjourned for 30 days or more, notice of the adjourned meeting shall be given in the same manner as for the original meeting, but otherwise, it is not necessary to give any notice of an adjournment or of the business to be transacted at an adjourned meeting.

Subject to any rights or restrictions for the time being attached to any class or classes of Shares:-

| | (a) | at meetings of Shareholders or classes of Shareholders each Shareholder entitled to vote may vote in person or by proxy or by Representative and on a show of hands every person present who is a Shareholder or a proxy or Representative of a Shareholder, has one vote and on a poll every Shareholder present in person or by proxy or by Representative has one vote for each Share he or she holds. |

| 10.7 | Voting - Show of Hands |

At any general meeting a resolution put to the vote of the meeting shall be decided on a show of hands unless (before or on the declaration of the result of the show of hands) a poll is demanded in accordance with Article 10.9.

Unless a poll is so demanded, a declaration by the chairman that a resolution has been carried or carried unanimously or by a particular majority on a show of hands, or lost, and an entry to that effect in the book containing the minutes of the proceedings of general meetings of the Company, is conclusive evidence of the fact without proof of the number or proportion of the votes recorded in favour of or against the resolution.

| | A poll may be demanded by:- |

| | (a) | the chairman of the general meeting; |

| | (b) | at least 5 Shareholders present in person or by proxy or Representative; or |

13

| | (c) | any one or more Shareholders holding not less than 10% of the total voting rights of all Shareholders having the right to vote at the meeting. |

If a poll is duly demanded, it shall be taken in such manner and either at once or after an interval or adjournment or otherwise as the chairman directs, and the result of the poll shall be the resolution of the meeting at which the poll was demanded. A poll demanded on the election of a chairman or on a question of adjournment shall be taken forthwith. A demand for a poll shall not prevent the continuation of the meeting for the transaction of other business.

| 10.10 | Voting by Joint Holders |

In the case of joint holders of Shares, the vote of the senior of them who tenders a vote, whether in person or by proxy or by Representative, shall be accepted to the exclusion of the votes of the other joint holders. Seniority shall be determined by the order in which their names stand in the Register of Shareholders.

| 10.11 | Shareholder under Disability |

If a Shareholder is of unsound mind or is a person whose person or estate is liable to be dealt with in any way under the law relating to mental health, his committee or trustee or such other person as properly has the management of his estate may exercise any rights of the Shareholder in relation to a general meeting as if the committee, trustee or other person were the Shareholder.

A Shareholder is not entitled to any vote at a general meeting unless all calls and other sums presently due and payable by him in respect of Shares in the Company have been paid.

An objection may be raised to the qualification of a voter only at the meeting at which the vote objected to is given or tendered. Any such objection shall be referred to the chairman, whose decision on it shall be final. A vote not disallowed pursuant to such an objection is valid for all purposes.

An instrument appointing a proxy -

| | (a) | shall be in writing under the hand of the appointor or of his attorney or, if the appointor is a corporation, either under seal or under the hand of a duly authorised officer or attorney; |

| | (b) | may specify the manner in which the proxy is to vote in respect of a particular resolution and, where an instrument of proxy so provides, the proxy is not entitled to vote on the resolution except as specified in the instrument; |

| | (c) | shall be deemed to confer authority to demand or join in demanding a poll; |

| | (d) | shall be in such form as the Directors determine and which complies with Section 250 of the Corporations Law; |

| | (e) | shall not be valid unless the original instrument, and the power of attorney or other authority (if any) under which the instrument is signed (duly stamped where |

14

| | necessary) or a copy or facsimile which appears on its face to be an authentic copy of that proxy, power or authority, is or are deposited at or sent by facsimile transmission to the Registered Office, or deposited at or sent by facsimile transmission to such other place as is specified for that purpose in the notice convening the general meeting, no later than 48 hours prior to the time of the commencement of the general meeting in the place that the general meeting is adjourned and notice is given in accordance with Article 10.5) as shall be specified in the notice convening the general meeting (or the notice under Article 10.5, as the case may be). |

A vote given in accordance with the terms of an instrument of proxy is valid notwithstanding the previous death or unsoundness of mind of the principal, the revocation of the instrument (or of the authority under which the instrument was executed) or the transfer of the Share in respect of which the instrument or power is given, if no intimation in writing of the death, unsoundness of mind, revocation or transfer has been received by the Company at the Registered Office before the commencement of the meeting or resumed meeting at which the instrument is used or the power is exercised.

| 10.16 | Representatives of Corporate Shareholders |

Any company or other corporation or unincorporated body (“the appointor”) that is a Shareholder may by resolution of its Directors or other governing body authorise, in accordance with section 249 of the Corporations Law, such person or persons as it may determine to act as its representative at any general meeting of the Company or of any class of Shareholders of the Company. A person so authorised shall be entitled to exercise all the rights and privileges of the appointor as a Shareholder. When a Representative is present at a general meeting of the Company, the appointor shall be deemed to be personally present at the meeting unless the Representative is otherwise entitled to be present at the meeting.

| 11. | PROCEEDINGS - WHERE A SINGLE SHAREHOLDER |

Notwithstanding Article 10, if the Company has only one Shareholder and the Shareholder records his decision to a particular effect, the recording of the decision in writing counts as the passing by the Shareholder of a resolution to that effect and as a minute of the passing of that resolution.

| 12. | APPOINTMENT, REMOVAL AND REMUNERATION OF DIRECTORS |

The Company shall at all times have at least one Director. At least one Director must ordinarily reside in Australia.

| 12.2 | Appointment and Removal of Directors |

| | (a) | The holders of a majority of the issued Shares for the time being may, at any time and from time to time: |

| | (i) | appoint one or more persons as Directors either as an additional Director, or in the place of a Director who has been removed; and |

| | (ii) | remove any Director from office, whether appointed under this Article 12.2 or Article 12.3. |

15

| | (b) | Where the Company only has one person as the sole Director and sole Shareholder: |

| | (i) | where that person dies or cannot manage the Company because of his mental incapacity and a personal representative or trustee is appointed to administer the person’s estate or property, the personal representative or trustee may appoint a person as the Director; and |

| | (ii) | where the office of director is vacated pursuant to Article 12.5(b) and a trustee in bankruptcy is appointed to the person’s property, the trustee may appoint a person as the Director. |

| | (c) | An appointment or removal under this Article 12.2 shall be made by written notice to the Company signed by: |

| | (i) | the relevant Shareholders; or |

| | (ii) | in the case of a corporate Shareholder, by any director or secretary of the Shareholder; or |

| | (iii) | in the case of the death or mental incapacity of a sole Director and sole shareholder, by a personal representative or trustee administering the estate or property of that sole director and sole shareholder. |

| | (d) | Any removal or appointment made pursuant to this Article 12.2 shall take effect immediately on delivery of the notice to the Registered Office or on presentation at a duly constituted Directors meeting. |

The Director(s) may at any time appoint any person to be an additional Director.

A Director may, with the approval of the other Directors (if there are any), appoint any person to be an alternate director in his place during such period as he thinks fit, and the following provisions shall apply with respect to any alternate director -

| | (a) | he is entitled to notice of meetings of the Directors and, if his appointor is not present at such a meeting, he is entitled to attend and vote in the place of the absent Director; |

| | (b) | he may exercise any powers that the appointor may exercise, and the exercise of any such power by him shall be deemed to be the exercise of the power by his appointor; |

| | (c) | he is not required to have any Share qualification; |

| | (d) | his appointment may be terminated at any time by his appointor, notwithstanding that the period of his appointment has not expired, and his appointment shall terminate in any event if his appointor vacates office as a Director; and |

| | (e) | his appointment, or the termination of his appointment, shall be effected by a written notice signed by the Director who made the appointment and served on the Company. |

16

The office of Director shall automatically become vacant if the Director -

| | (a) | ceases to be a Director by virtue of section 224 or any other provision of the Corporations Law; or |

| | (b) | becomes bankrupt or makes any arrangement or composition with his creditors generally; or |

| | (c) | becomes prohibited from being a Director by reason of any order made under the Corporations Law; or |

| | (d) | becomes of unsound mind or a person whose person or estate is liable to be dealt with in any way under the law relating to mental health; or |

| | (e) | resigns his office by notice in writing to the Company; or |

| | (f) | is removed from office under Article 12.2. |

The remuneration of Directors shall be determined from time to time by the Directors. That remuneration shall be deemed to accrue from day to day. The Directors may also be paid all travelling and other expenses properly incurred by them in attending and returning from meetings of the Directors or any committee of the Directors or general meetings of the Company, or otherwise in connection with the business of the Company.

| 12.7 | NoShare Qualification |

A Director is not required to hold any Shares.

| 13. | POWERS AND DUTIES OF DIRECTORS |

| 13.1 | Management of the Company |

Subject to the Corporations Law and to any other provision of these Articles, the business of the Company shall be managed by the Directors, who may pay all expenses incurred in promoting and forming the Company, and may exercise all such powers of the Company as are not, by the Corporations Law or by these Articles, required to be exercised by the Company in general meeting.

Without limiting the generality of Article 13.1, the Directors may exercise all the powers of the Company to borrow money, to charge any property or business of the Company or all or any of its uncalled capital, and to issue debentures or give any other security for a debt, liability or obligation of the Company or of any other person.

The Directors may, by power of attorney, appoint any person or persons to be the attorney or attorneys of the Company for such purposes, with such powers, authorities and discretions (being powers, authorities and discretions vested in or exercisable by the Directors), for such period and subject to such conditions as they think fit. Any such power of attorney may contain such provisions for the protection and convenience of persons dealing with the attorney as the Directors may determine, and may also authorise the attorney to delegate all or any of the powers, authorities and discretions vested in him.

17

All cheques, promissory notes, bankers drafts, bills of exchange and other negotiable instruments, and all receipts for money paid to the Company, shall be signed, drawn, accepted, endorsed or otherwise executed, as the case may be:

| | (a) | where there are two or more Directors, by any two Directors or in such other manner as the Directors determine; or |

| | (b) | where there is only one person who is the sole Director, by that Director, |

| 14. | PROCEEDING OF DIRECTORS - MORE THAN ONE DIRECTOR |

A Director may at any time, and a Secretary shall at the request of a Director, convene a meeting of the Directors.

| 14.2 | Procedure at Meetings |

The Directors may meet together for the despatch of business and adjourn and, subject to this Article 14, may otherwise regulate their meetings as they think fit.

The Directors shall elect one of their number as chairman of their meetings, and may determine the period for which he is to hold office. Where a Directors meeting is held and a chairman has not been elected or the chairman is not present within 10 minutes after the time appointed for the holding of the meeting, or is unwilling to act, the Directors present shall elect one of their number to be the chairman of the meeting.

No business shall be transacted at any meeting of Directors unless a quorum is present, comprising two Directors,

Questions arising at any meeting of Directors shall be decided by a majority of votes of those Directors. A resolution passed by a majority of Directors shall for all purposes be deemed a determination of “the Directors”.

In case of any equality of votes, the chairman of the meeting shall have a second or casting vote.

| 14.7 | Continuing Directors May Act |

In the event of a vacancy or vacancies in the office of a Director, the remaining Directors may act but, if the number of remaining Directors is not sufficient to constitute a quorum at a meeting of Directors, they may act only for the purpose of increasing the number of Directors to a number sufficient to constitute such a quorum or of convening a general meeting of the Company.

18

The Directors may delegate any of their powers to a committee or committees, consisting of such of their number as they think fit. A committee to which any powers have been so delegated shall exercise the powers delegated in accordance with any directions of the Directors, and a power so exercised shall be deemed to have been exercised by the Directors. The members of such a committee may elect one of their number as chairperson of their meetings. A committee may meet and adjourn as it thinks proper. Questions arising at a meeting of a committee shall be determined by a majority of votes of the members present and voting. In the case of an equality of votes, the chairperson shall have a casting vote.

A resolution in writing signed by all the Directors for the time being, or their respective alternate Directors, except those who expressly indicate their abstention in writing, shall be as valid and effectual as if it had been passed at a Directors’ meeting duly convened and held. Any such resolution may consist of several documents in like form, each signed by one or more Directors or their respective alternates. A telex, telegram, facsimile transmission or other document produced by mechanical means and bearing the signature of the Director, printed mechanically and with his authority, shall be deemed to be a document in writing signed by the Director.

| 14.10 | Meeting by Instantaneous Communication Device |

For the purposes of these Articles, the contemporaneous linking together by instantaneous communication device of a number of consenting Directors not less than the quorum, whether or not any one or more of the Directors is out of Australia, shall be deemed to constitute a meeting of the Directors and all the provisions of these Articles as to the meetings of the Directors shall apply to such meetings held by instantaneous communication device so long as the following conditions are met:

| | (a) | all the Directors for the time being entitled to receive notice of the meeting of Directors (including any alternate for any Director) shall be entitled to notice of a meeting by instantaneous communication device for the purposes of such meeting. Notice of any such meeting shall be given on the instantaneous communication device or in any other manner permitted by these Articles; |

| | (b) | each of the Directors taking part in the meeting by instantaneous communication device must be able to hear each of the other Directors taking part at the commencement of the meeting; and |

| | (c) | at the commencement of the meeting each Director must acknowledge his presence for the purpose of a meeting of the Directors of the Company to all the other Directors taking part. |

| 14.11 | Procedure at Meetings by Instantaneous Communication Device |

A Director may not leave a meeting held under Article 14.10 by disconnecting his instantaneous device unless he has previously obtained the express consent of the chairman of the meeting and a Director shall be conclusively presumed to have been present and to have formed part of the quorum at all times during the meeting by instantaneous communication device unless he has previously obtained the express consent of the chairman of the meeting to leave the meeting as aforesaid.

19

A minute of the proceedings at a meeting held under Article 14.10 shall be sufficient evidence of such proceedings and of the observance of all necessary formalities if certified as a correct minute by the chairman or the person taking the chair at the meeting under Article 14.3.

For the purpose of these Articles, “instantaneous communication device” shall include telephone, television or any other audio or visual device which permits instantaneous communication.

| 14.14 | Defective Appointment |

All acts done by any meeting of the Directors or of a committee of Directors or by any person acting as a Director are, notwithstanding that it is afterwards discovered that there was some defect in the appointment of a person to be, or to act as, a Director, or that a person so appointed was disqualified, as valid as if the person had been duly appointed and was qualified to be a Director or to be a member of the committee.

A Director may hold any other office or place of profit in or in relation to the Company (except that of auditor) in conjunction with his office of Director and on such terms as to remuneration or otherwise as the Directors shall approve.

| 14.16 | Directors’ Other Interests |

A Director may be or become a shareholder in or director of or hold any other office or place of profit in or in relation to any other company promoted by the Company or in which the Company may be interested, whether as a vendor, shareholder or otherwise.

| 14.17 | Accountability of Directors |

No Director shall be accountable for any benefits received as the holder of any other office or place of profit in or in relation to the Company or any other company referred to in this Article 14 or as a shareholder in or director of any such other company.

| 14.18 | Contracts Involving Directors |

No Director shall be disqualified by his office from contracting or entering into any arrangement with the Company either as vendor, purchaser, or otherwise and no contract or arrangement entered into by or on behalf of the Company in which the Director shall be in any way interested shall be prejudiced or avoided on that account. No Director shall be liable to account to the Company for any profit realised from or by any contract or arrangement entered into by or on behalf of the Company by reason of his holding that office or of the fiduciary relationship thereby established.

| 14.19 | Extent of Interests in Contracts |

A Director shall be deemed not to be interested or to have been at any time interested in any contract or arrangement by reason only that in a case where the contract or arrangement has been or will be made with, for the benefit of, or on behalf of a Related Company, that he is a shareholder in that Related Company.

20

| 14.20 | Section 231 of Corporations Law |

Every Director shall observe the provisions of section 231 of the Corporations Law relating to the declaration of interests.

A Director may vote as a Director and in all respects act as a Director in relation to any contract or arrangement in which he is interested, including, without limiting the generality of the foregoing, in relation to the use of the Seal.

| 15. | PROCEEDINGS OF DIRECTORS - WHERE ONE DIRECTOR |

| | (a) | Where there is only one person who is the sole Director then, notwithstanding Articles 14.1 to 14,3, the Director may record in writing his decision to a particular effect and the recording of the decision counts as the passing by the Director of a resolution to that effect and as the minutes of the passing of the resolution. |

| | (b) | Where there is only one person who is the sole Director and sole Shareholder, Article 14.20 does not apply. |

| | (c) | Articles 14.16 to 14.19 inclusive and Article 14.21 continue to apply where there is only one Director. |

The Directors may from time to time appoint one or more of their number to the office of managing director of the Company for such period and on such terms as they may determine, and, subject to the terms of any agreement entered into in a particular case, may revoke any such appointment. The appointment of a managing director so appointed automatically terminates if he ceases for any reason to be a Director.

A managing director shall, subject to the terms of any agreement entered into in a particular case, receive such remuneration, whether by way of salary, commission or participation in profits, or partly in one way and partly in another, as the Directors may determine.

The Directors may, upon such terms and conditions and with such restrictions as they think fit, confer upon a managing director any of the powers exercisable by them. Any powers so conferred may be concurrent with, or be to the exclusion of, the powers of the Directors. The Directors may at any time withdraw or vary any of the powers so conferred on a managing director.

A Secretary of the Company shall hold office on such terms and conditions, as to remuneration and otherwise, as the Directors determine. A person appointed as Secretary of the Company may also be a Director.

21

| | (a) | The Directors shall provide for the safe custody of the Seal. |

| | (b) | The Seal shall comply with section 219(1) of the Corporations Law with respect to the Company’s Australian Company Number. |

| | (c) | The Seal shall only be used by the authority of the Directors, or of a committee of the Directors authorised by the Directors to authorise the use of the Seal. |

| | (d) | Where the Company has more than one person acting as Director and Secretary, every document to which the Seal is affixed shall be signed by a Director and countersigned by another Director, (including an alternate Director) a Secretary or another person appointed by the Directors to countersign that document or a class of documents in which that document is included. |

| | (e) | Where the Company has only one person acting as Director and Secretary, every document to which the Seal is affixed shall be signed by that person stating that he witnessed the affixation of the Seal in his capacity as sole Director and sole Secretary. |

| 19.1 | Accounting Records to be Kept |

Where required by the Corporations Law, the Directors shall cause proper accounting and other records to be kept by the Company and shall distribute copies of the Company’s accounts and reports.

The Directors shall determine whether, to what extent, at what times and places and under what conditions, the accounting records and other documents of the Company or any of them will be open to the inspection of Shareholders other than Directors. A Shareholder other than a Director shall not be entitled to inspect any document of the Company except as provided by law or authorised by the Directors or by the Company in general meeting.

Subject to Articles 11 and 15, the Directors shall cause minutes to be kept of:-

| | (a) | all proceedings of general meetings and Directors meetings; and |

| | (b) | all appointments of Officers and persons ceasing to be Officers, |

in accordance with sections 258 and 1306 of the Corporations Law.

Subject to Articles 11 and 15, all minutes shall be signed by the person who chaired the meeting at which the proceedings took place, or by the person chairing the next succeeding meeting in accordance with section 258 of the Corporations Law.

22

| 20.3 | Requirements of the Corporations Law |

The Company and the Officers shall comply with the requirements of section 259 of the Corporations Law which relates generally to rights of inspection of minute books.

| 21. | DIVIDENDS AND RESERVES |

The Directors may from time to time declare and pay to the Shareholders such dividends as they may determine.

The Directors may from time to time pay to the Shareholders such interim dividends as they may determine.

| 21.3 | Dividends Only Payable from Profits |

No dividend shall be payable except out of profits. A determination by the Directors as to the profits of the Company shall be conclusive.

No dividend shall carry interest as against the Company.

The Directors may set aside out of the profits of the Company such amounts as they may determine as reserves, to be applied at the discretion of the Directors, for any purpose for which the profits of the Company may be properly applied.

| 22. | CAPITALISATION OF PROFITS |

Subject to Article 11, the Company in general meeting may resolve that it is desirable to capitalise any amount, being the whole or a part of the amount for the time being standing to the credit of any reserve account or the profit and loss account, or otherwise available for distribution to Shareholders, and that that amount be applied in any of the ways mentioned in Article 22.2 for the benefit of Shareholders in the proportions to which those Shareholders would have been entitled in a distribution of that amount by way of dividend by paying up in full unissued shares or debentures to be issued to Shareholders as fully paid.

| 22.2 | Application of Capitalised Amounts |

The ways in which an amount may be applied for the benefit of Shareholders under Article 22.1 are:-

| | (a) | in paying up any amounts unpaid on any Shares; |

| | (b) | in paying up in full unissued Shares or debentures to be issued to Shareholders as fully paid; or |

| | (c) | partly as mentioned in paragraph (a) and partly as mentioned in paragraph (b). |

23

The Directors shall do all things necessary to give effect to the resolution referred to in Article 22.1 and, in particular, to the extent necessary to adjust the rights of the Shareholders among themselves, may -

| | (a) | issue fractional certificates or make cash payments in cases where Shares or debentures could only be issued in fractions; and |

| | (b) | authorise any person to make, on behalf of all the Shareholders entitled to any further Shares or debentures upon the capitalisation, an agreement with the Company providing for the issue to them, credited as fully paid up, of any such further Shares or debentures, or for the payment up by the Company on their behalf of the amounts or any part of the amounts remaining unpaid on their existing Shares by the application of their respective proportions of the sum resolved to be capitalised; |

and any agreement made under an authority referred to in paragraph (b) is effective and binding on all the Shareholders concerned.

A notice may be given by the Company to any Shareholder either by serving it on him personally or by sending it by post to him at his address as shown in the Register of Shareholders or the address supplied by him to the Company for the giving of notices to him.

Where a notice is sent by post, service of the notice shall be deemed to be effected by properly addressing, prepaying, and posting a letter containing the notice, and to have been effected, in the case of a notice of a meeting, on the day after the date of its posting and, in any other case, at the time at which the letter would be delivered in the ordinary course of post.

| 23.3 | Notice to Joint Holders |

A notice may be given by the Company to the joint holders of a Share by giving the notice to the joint holder first named in the Register of Shareholders in respect of the Share.

| 23.4 | Notices to Personal Representatives and Others |

A notice may be given by the Company to a person entitled to a Share in consequence of the death or bankruptcy of a Shareholder by serving it on him or by sending it to him by post addressed to him by name, or by the title of representative of the deceased or assignee of the bankrupt, or by any like description, at the address (if any) supplied for the purpose by the person or, if such an address has not been supplied, at the address to which the notice might have been sent if the death or bankruptcy had not occurred.

| 23.5 | Persons Entitled to Notice of General Meetings |

Subject to Article 11, notice of every general meeting shall be given to -

24

| | (c) | every person entitled to a Share in consequence of any law relating to the death, insolvency of a Shareholder who, but for his death or insolvency, would be entitled to receive notice of the meeting; and |

| | (d) | the auditor for the time being of the Company. |

No other person is entitled to receive notices of general meetings.

If the Company is wound up, the liquidator may, with the authority of a special resolution of Shareholders, divide among the Shareholders in kind the whole or any part of the property of the Company, and may for that purpose set such value as he considers fair upon any property to be so divided, and may determine how the division is to be carried out as between the Shareholders or different classes of Shareholders.

| 24.2 | Distribution to be in Proportion to Nominal Share Capital Paid-Up |

If on a winding up of the Company there remains a surplus, that surplus will be divided amongst the Shareholders in proportion to the nominal share capital paid up on their Shares, whether or not the liquidator exercises the power under Article 24.1.

| 24.3 | Trust for Shareholders |

The liquidator may, with the authority of a special resolution of Shareholders, vest the whole or any part of any such property in trustees upon such trusts for the benefit of the contributories as the liquidator thinks fit, but so that no Shareholder is compelled to accept any Shares or other securities in respect of which there is any liability.

| 25. | OFFICERS: INDEMNITIES AND INSURANCE |

To the extent permitted by law:

| | (a) | the Company indemnifies every person who is or has been an Officer of the Company or of a wholly-owned subsidiary of the Company against any liability for costs and expenses incurred by that person in defending any Proceedings in which judgement is given in that person’s favour, or in which the person is acquitted, or in connection with an application in relation to any Proceedings in which the Court grants relief to the person under the Corporations Law; and |

| | (b) | the Company indemnifies every person who is or has been an Officer of the Company or of a wholly-owned subsidiary of the Company against any liability incurred by the person, as an Officer of the Company or of a wholly-owned subsidiary of the Company, to another person (other than the Company or a related body corporate of the Company) unless the liability arises out of conduct involving a lack of good faith. |

25

To the extent permitted by law the Company may pay, or agree to pay, a premium in respect of a contract insuring a person who is or has been an Officer of the Company or of a subsidiary of the Company against a liability:

| | (a) | incurred by the person in his or her capacity as an Officer of the Company or a subsidiary of the Company or in the course of acting in connection with the affairs of the Company or a subsidiary of the Company or otherwise arising out of the Officer’s holding such office PROVIDED THAT the liability does not arise out of conduct involving a wilful breach of duty in relation to the Company or a subsidiary of the Company or a contravention of sections 232(5) or (6) of the Corporations Law; or |

| | (b) | for costs and expenses incurred by that person in defending Proceedings, whatever their outcome. |

In Articles 25.1 and 25.2:

| | (a) | the term “Proceedings” means any proceedings, whether civil or criminal, being proceedings in which it is alleged that the person has done or omitted to do some act, matter or thing in his or her capacity as such an Officer or in the course of acting in connection with the affairs of the Company or a wholly-owned subsidiary (in Article 25.1) or subsidiary (in Article 25.2) of the Company or otherwise arising out of the Officer’s holding such office (including proceedings alleging that he or she was guilty of negligence, default, breach of trust or breach of duty in relation to the Company or a wholly-owned subsidiary (in Article 25.1) or subsidiary (in Article 25.2) of the Company). |

| | (b) | the term “Officer” has the meaning given to that term in section 241(4) of the Corporations Law. |

26

| | | | |

DATED the day of 1998 | | | | |

| | |

Subscribers | | | | Witnesses |

| | | | (Full name. |

| | |

address and | | | | signature) |

27

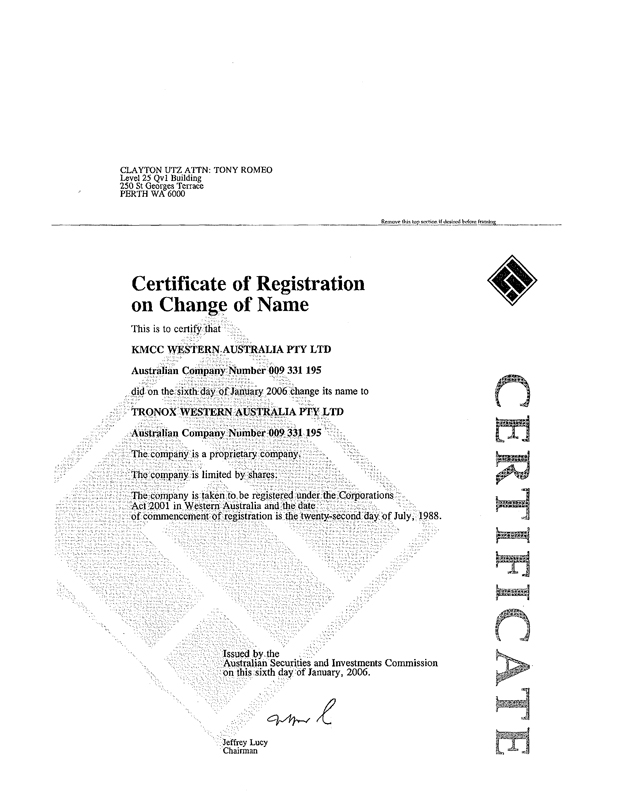

CLAYTON UTZ ATTN: TONY ROMEO

Level 25 Qvl Building

250 St Georges Terrace

PERTH WA 6000

Remove this top section if desired before framing

Certificate

Certificate of Registration

on Change of Name

This is to certify that

KMCC WESTERN AUSTRALIA PTY LTD

Australian Company Number 009 331 195

did on the sixth day of January 2006 change its name to

TRONOX WESTERN AUSTRALIA PTY LTD

Australian Company Number 009 331 195

The company is a proprietary company.

The company is limited by shares.

The company is taken to be registered under the corporations

Act 2001 in Western Australia and the date

of commencement of registration is the twenty-second day of July, 1988

Issued by the

Australian Securities and Investments Commission

on this sixth day of January, 2006.

Jeffrey Lucy

Chairman