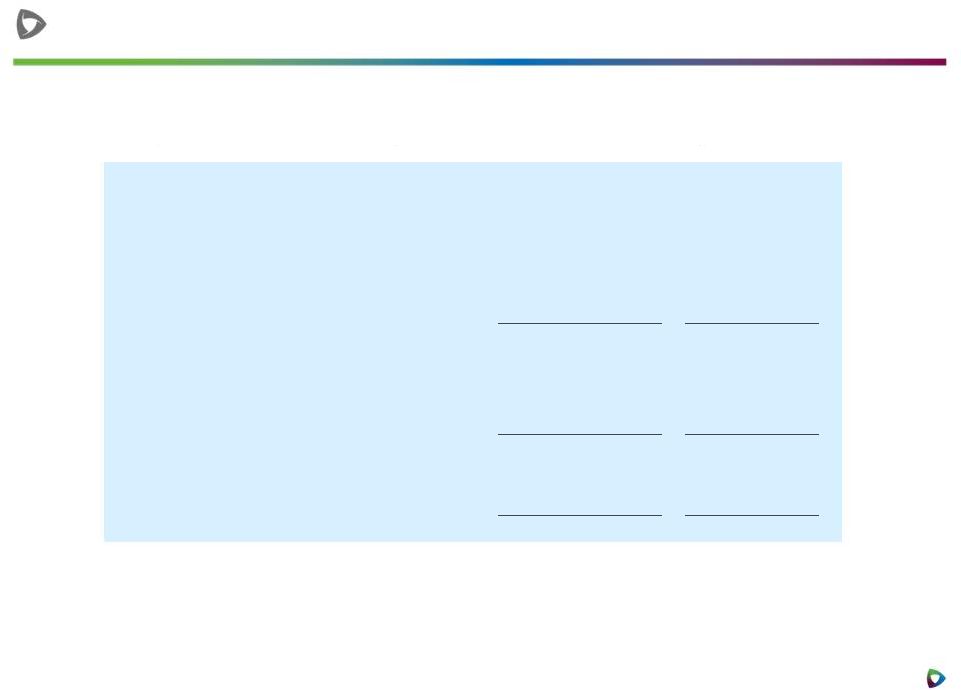

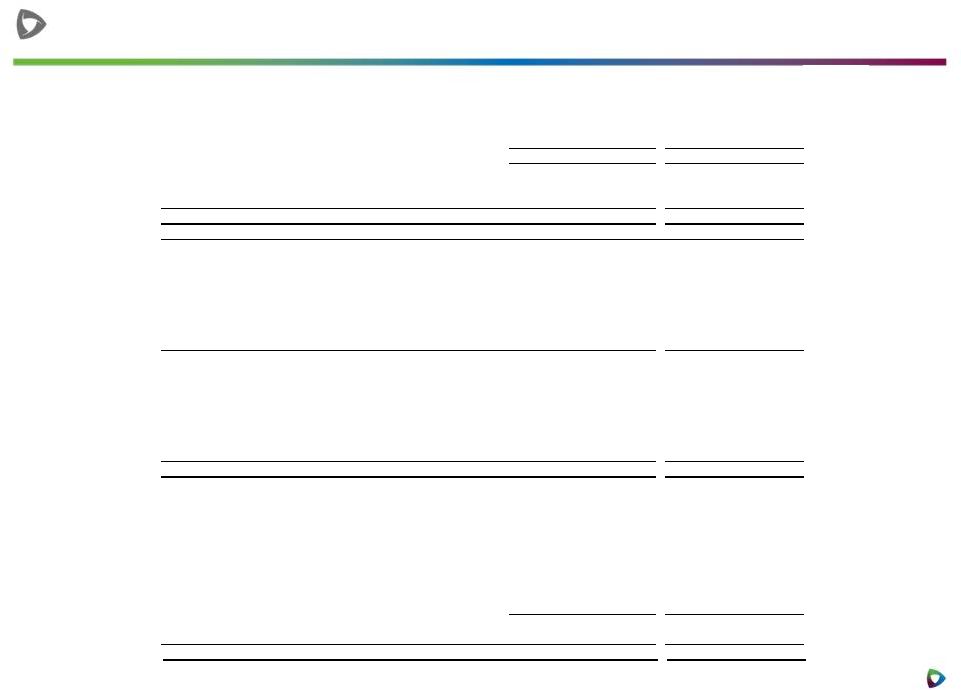

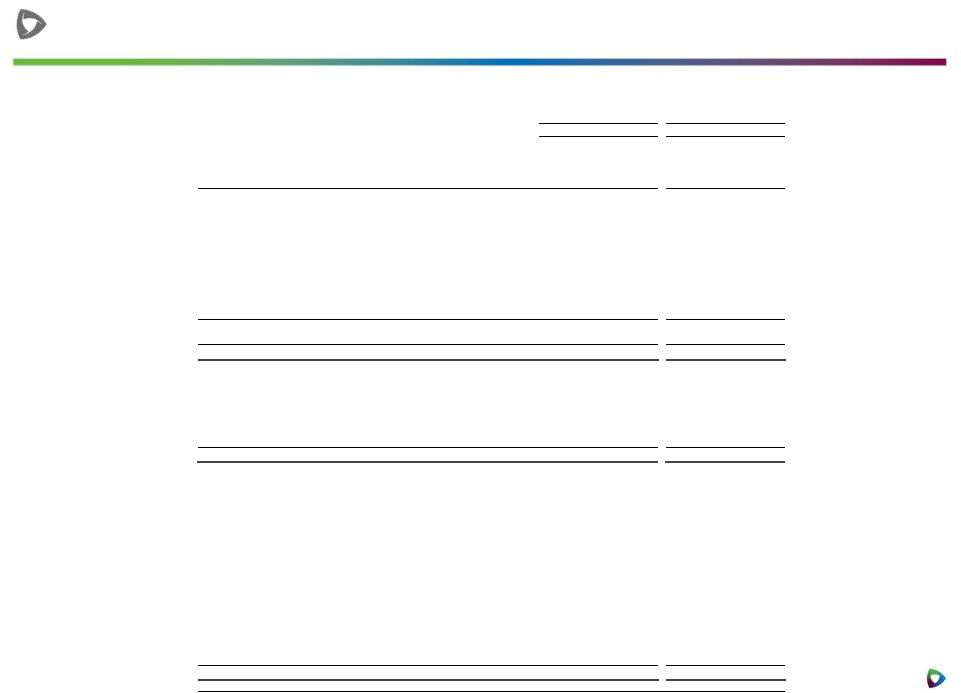

24 Premier, Inc. supplemental financial information (Unaudited, in thousands) 2014* 2013 2014 2013 Reconciliation of Pro Forma Net Revenue to Net Revenue: Pro Forma Net Revenue 235,466 $ 200,938 $ 869,286 $ 764,278 $ Pro forma adjustment for revenue share post-IPO — 39,663 41,263 105,012 Net Revenue 235,466 $ 240,601 $ 910,549 $ 869,290 $ Reconciliation of Pro Forma Adjusted EBITDA and Segment Adjusted EBITDA to Net Income and Operating Income: Net income 66,632 $ 103,496 $ 332,617 $ 375,086 $ Pro forma adjustment for revenue share post-IPO — (39,663) (41,263) (105,012) Interest and investment income, net (378) (366) (1,019) (965) Income tax expense 3,248 3,788 27,709 9,726 Depreciation and amortization 9,809 7,883 36,761 27,681 Amortization of purchased intangible assets 904 385 3,062 1,539 Pro Forma EBITDA 80,215 75,523 357,867 308,055 Stock-based compensation 6,358 — 19,476 — Acquisition related expenses 711 — 2,014 — Strategic and financial restructuring expenses 146 1,823 3,760 5,170 Adjustment to tax receivable agreement liability 6,215 — 6,215 — Gain on sale of investment (522) — (38,372) — Other (income) expense, net 121 783 65 788 Pro Forma Adjusted EBITDA 93,244 $ 78,129 $ 351,025 $ 314,013 $ Pro Forma Adjusted EBITDA 93,244 $ 78,129 $ 351,025 $ 314,013 $ Depreciation and amortization (9,809) (7,883) (36,761) (27,681) Amortization of purchased intangible assets (904) (385) (3,062) (1,539) Stock-based compensation (6,358) — (19,476) — Acquisition related expenses (711) — (2,014) — Strategic and financial restructuring expenses (146) (1,823) (3,760) (5,170) Adjustment to tax receivable agreement liability (6,215) — (6,215) — Equity in net income of unconsolidated affiliates (4,805) (3,636) (16,976) (11,968) Deferred compensation plan expense (1,972) — (1,972) — 62,324 64,402 260,789 267,655 Pro forma adjustment for revenue share post-IPO — 39,663 41,263 105,012 Operating income 62,324 $ 104,065 $ 302,052 $ 372,667 $ * Note that no pro forma adjustments were made for the three months ended June 30, 2014; as such, actual results are presented for the three months ended June 30, 2014. Three Months Ended June 30, Year Ended June 30, Supplemental Financial Information - Reporting of Pro Forma Adjusted EBITDA Reconciliation of Selected Non-GAAP Measures to GAAP Measures and Non-GAAP Adjusted Fully Distributed Net Income |