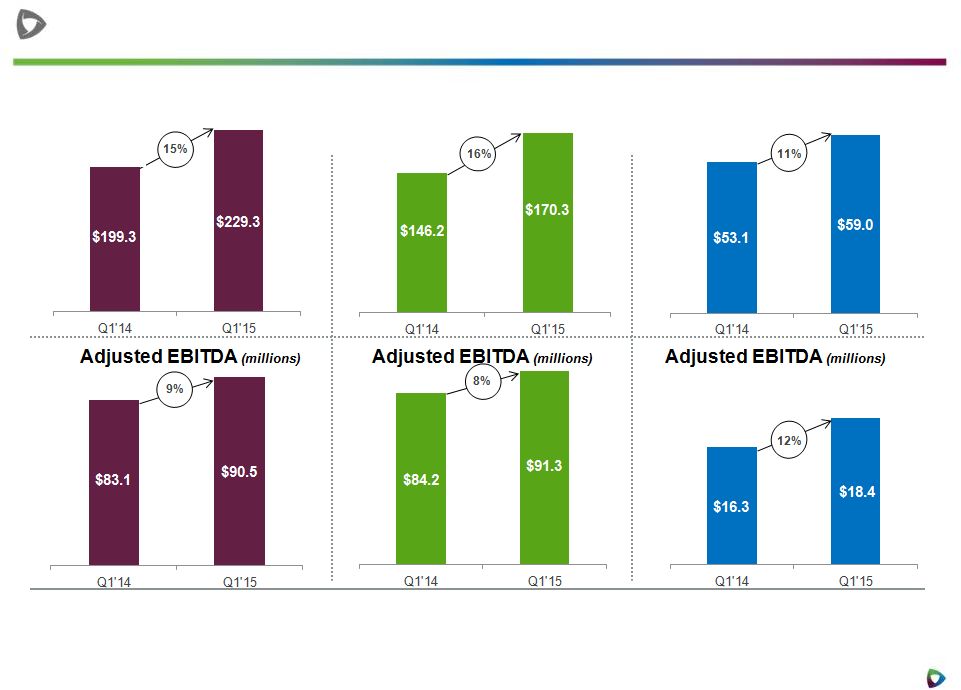

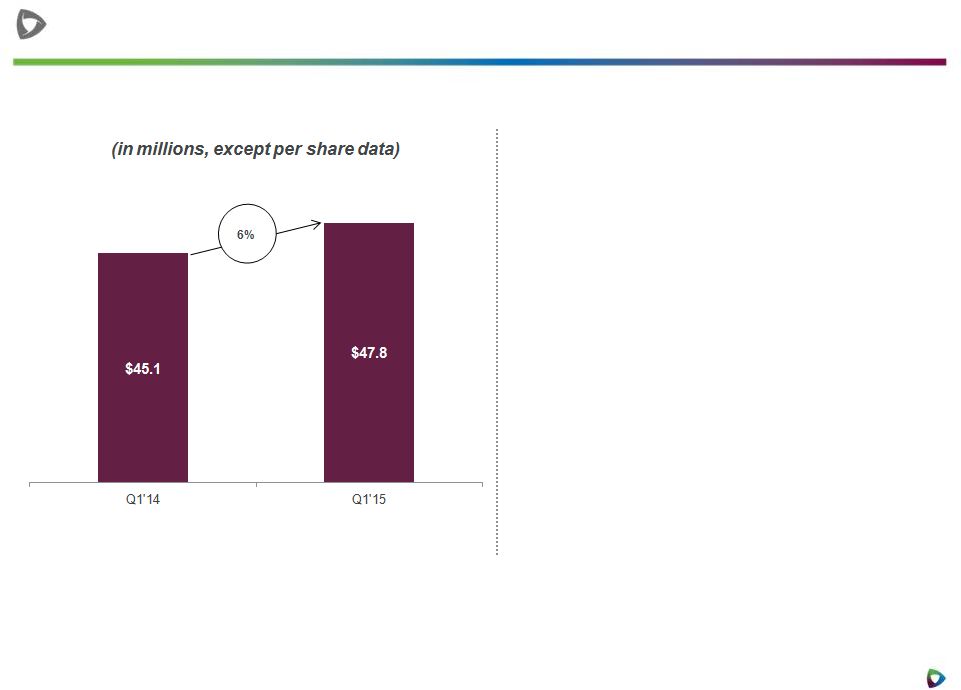

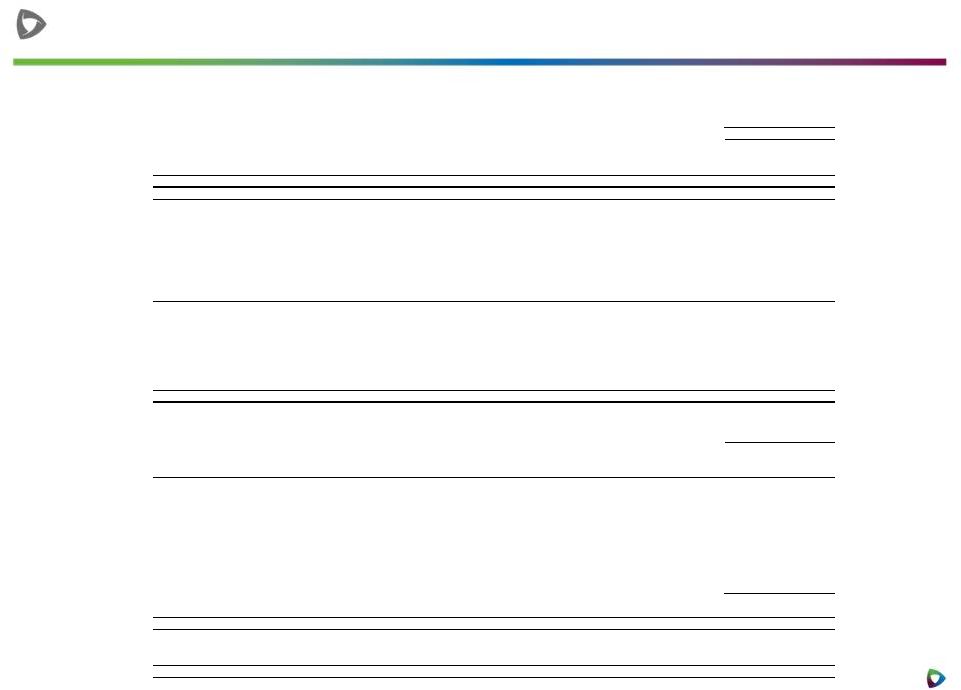

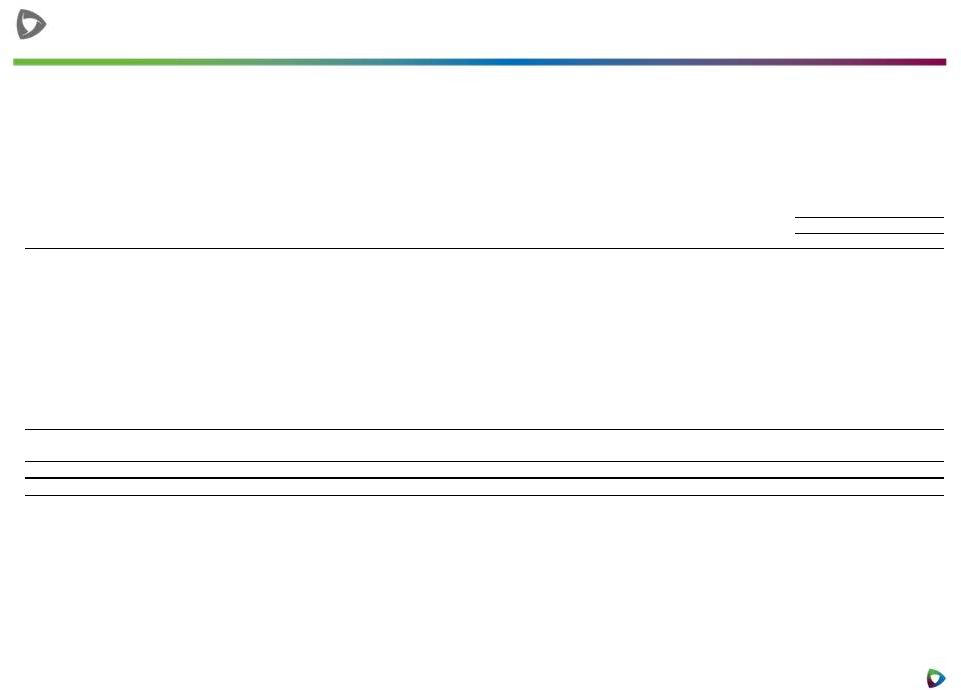

24 Premier, Inc. supplemental financial information (Unaudited, in thousands) 2014* 2013 Reconciliation of Non-GAAP Pro Forma Net Revenue to Net Revenue: Non-GAAP Pro Forma Net Revenue 229,308 $ 199,313 $ Non-GAAP pro forma adjustment for revenue share post-IPO — 41,263 Net Revenue 229,308 $ 240,576 $ Net income 64,887 $ 112,528 $ Non-GAAP pro forma adjustment for revenue share post-IPO — (41,263) Interest and investment income, net (191) (220) Income tax expense 5,811 764 Depreciation and amortization 10,308 8,356 Amortization of purchased intangible assets 903 601 EBITDA 81,718 80,766 Stock-based compensation 6,439 325 Acquisition related expenses 1,278 142 Strategic and financial restructuring expenses 96 1,842 Adjustment to tax receivable agreement liability (1,073) — Acquisition related adjustment - deferred revenue 2,065 — Other (income) expense, net (5) (4) Adjusted EBITDA 90,518 $ 83,071 $ Segment Adjusted EBITDA: Supply Chain Services 91,268 $ 125,480 $ Non-GAAP pro forma adjustment for revenue share post-IPO — (41,263) Supply Chain Services (including non-GAAP pro forma adjustment) 91,268 $ 84,217 $ Performance Services 18,362 16,329 Corporate (19,112) (17,475) Adjusted EBITDA 90,518 $ 83,071 $ Depreciation and amortization (10,308) (8,356) Amortization of purchased intangible assets (903) (601) Stock-based compensation (6,439) (325) Acquisition related expenses (1,278) (142) Strategic and financial restructuring expenses (96) (1,842) Adjustment to tax receivable agreement liability 1,073 — Acquisition related adjustment - deferred revenue (2,065) — Equity in net income of unconsolidated affiliates (4,866) (4,114) Deferred compensation plan expense 509 — 66,145 67,691 Non-GAAP pro forma adjustment for revenue share post-IPO — 41,263 Operating income 66,145 $ 108,954 $ Equity in net income of unconsolidated affiliates 4,866 4,114 Interest and investment income, net 191 220 Other (expense) income, net (504) 4 Income before income taxes 70,698 $ 113,292 $ * Note that no pro forma adjustments were made for the three months ended September 30, 2014; as such, actual results are presented for the three months ended September 30, 2014. Three Months Ended September 30, Supplemental Financial Information - Reporting of Non-GAAP Pro Forma Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Selected Non-GAAP Measures to GAAP Measures Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of Segment Adjusted EBITDA to Income Before Income Taxes: |