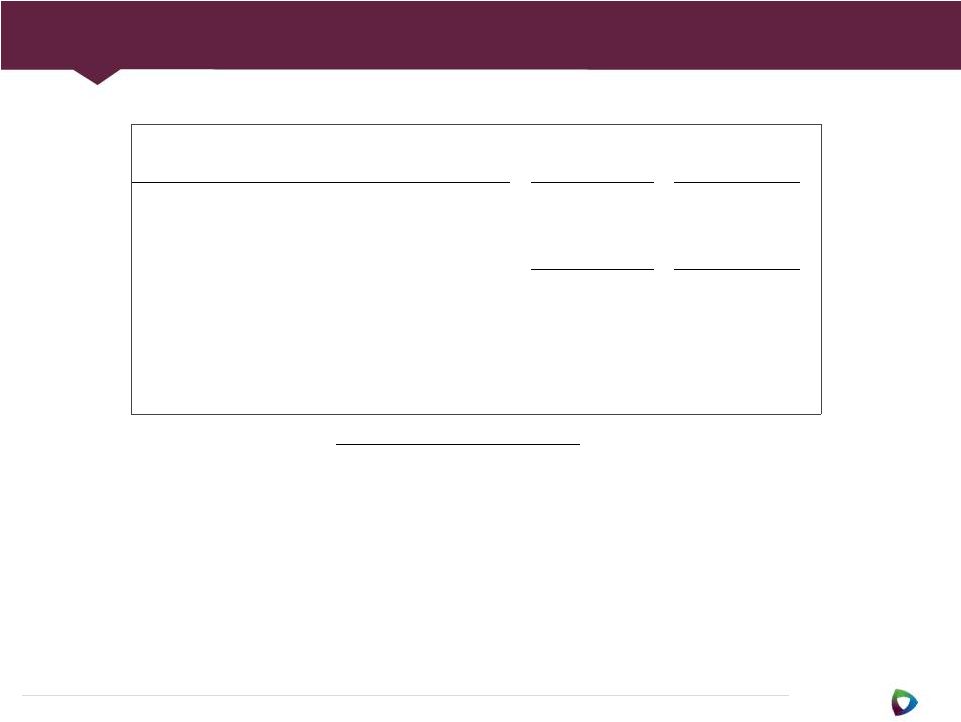

Fiscal 2014 and fiscal 2013 non-GAAP reconciliations (Unaudited, in thousands) Actual Adjustments Non-GAAP Pro Forma Actual Adjustments Non-GAAP Pro Forma Reconciliation of Non-GAAP Pro Forma Net Revenue to Net Revenue: Supply Chain Services 678,141 $ (41,263) $ 636,878 $ 664,076 $ (105,012) $ 559,064 $ Performance Services 232,408 - 232,408 205,214 - 205,214 Net Revenue 910,549 (41,263) 869,286 869,290 (105,012) 764,278 Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of Segment Adjusted EBITDA to Income Before Income Taxes: Net income 332,617 $ (38,024) $ 294,593 $ 375,086 $ (127,825) $ 247,261 $ Interest and investment income, net (1,019) - (1,019) (965) - (965) Income tax expense 27,709 (3,239) 24,470 9,726 22,813 32,539 Depreciation and amortization 36,761 - 36,761 27,681 - 27,681 Amortization of purchased intangible assets 3,062 - 3,062 1,539 - 1,539 EBITDA 399,130 (41,263) 357,867 413,067 (105,012) 308,055 Stock-based compensation expense 19,476 - 19,476 - - - Acquisition related expenses 2,014 - 2,014 - - - Strategic and financial restructuring expenses 3,760 - 3,760 5,170 - 5,170 Gain on sale of investment (38,372) - (38,372) - - - Adjustment to tax receivable agreement liability 6,215 - 6,215 - - - Other (income) expense, net 65 - 65 788 - 788 Adjusted EBITDA 392,288 $ (41,263) $ 351,025 $ 419,025 $ (105,012) $ 314,013 $ Segment Adjusted EBITDA: Supply Chain Services 396,470 $ (41,263) $ 355,207 $ 431,628 $ (105,012) $ 326,616 $ Performance Services 73,898 - 73,898 56,456 - 56,456 Corporate (g) (78,080) - (78,080) (69,059) - (69,059) Adjusted EBITDA 392,288 (41,263) 351,025 419,025 (105,012) 314,013 Depreciation and amortization (36,761) - (36,761) (27,681) - (27,681) Amortization of purchased intangible assets (3,062) - (3,062) (1,539) - (1,539) Stock-based compensation expense (19,476) - (19,476) - - - Acquisition related expenses (2,014) - (2,014) - - - Strategic and financial restructuring expenses (3,760) - (3,760) (5,170) - (5,170) Adjustment to tax receivable agreement liability (6,215) - (6,215) - - - Equity in net income of unconsolidated affiliates (16,976) - (16,976) (11,968) - (11,968) Deferred compensation plan expense (1,972) - (1,972) - - - Operating income 302,052 (41,263) 260,789 372,667 (105,012) 267,655 Equity in net income of unconsolidated affiliates 16,976 - 16,976 11,968 - 11,968 Interest and investment income, net 1,019 - 1,019 965 - 965 Gain on sale of investment 38,372 - 38,372 - - - Other income (expense), net 1,907 - 1,907 (788) - (788) Income before income taxes 360,326 $ (41,263) $ 319,063 $ 384,812 $ (105,012) $ 279,800 $ Year Ended June 30, 2014 2013 PREMIER, INC. 38 |