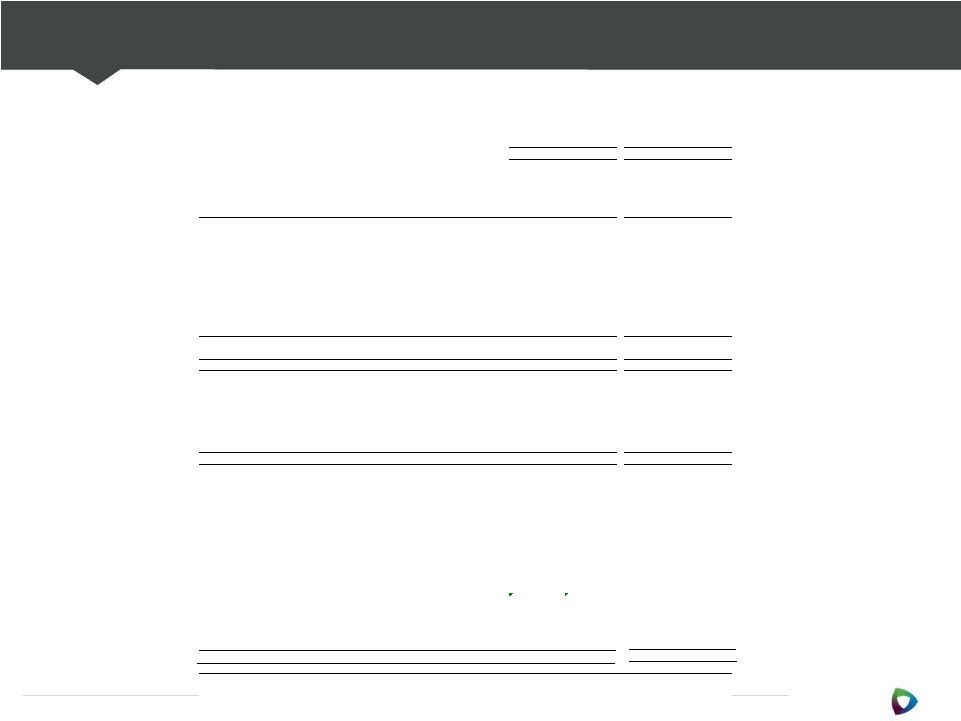

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations PREMIER, INC. 27 2014* 2013* 2014* 2013 Reconciliation of Pro Forma Net Revenue to Net Revenue: Pro Forma Net Revenue 249,445 $ 208,909 $ 478,753 $ 408,222 $ Pro forma adjustment for revenue share post-IPO — — — 41,263 Net Revenue 249,445 $ 208,909 $ 478,753 $ 449,485 $ Net income 65,808 $ 51,477 $ 130,695 $ 164,005 $ Pro forma adjustment for revenue share post-IPO — — — (41,263) Interest and investment income, net (122) (21) (313) (241) Income tax expense 4,270 14,284 10,081 15,048 Depreciation and amortization 11,262 9,198 21,570 17,556 Amortization of purchased intangible assets 3,141 755 4,044 1,356 EBITDA 84,359 75,693 166,077 156,461 Stock-based compensation 7,405 6,494 13,844 6,819 Acquisition related expenses 2,267 177 3,545 319 Strategic and financial restructuring expenses 1,183 1,041 1,279 2,881 Adjustment to tax receivable agreement liability — — (1,073) — Acquisition related adjustment - deferred revenue 3,596 — 5,661 — Other income, net (2) — (7) (4) Adjusted EBITDA 98,808 $ 83,405 $ 189,326 $ 166,476 $ Segment Adjusted EBITDA: Supply Chain Services 97,342 $ 85,119 $ 188,610 $ 210,599 $ Pro forma adjustment for revenue share post-IPO — — — (41,263) Supply Chain Services (including pro forma adjustment) 97,342 $ 85,119 $ 188,610 $ 169,336 $ Performance Services 23,189 17,731 41,551 34,060 Corporate (21,723) (19,445) (40,835) (36,920) Adjusted EBITDA 98,808 $ 83,405 $ 189,326 $ 166,476 $ Depreciation and amortization (11,262) (9,198) (21,570) (17,556) Amortization of purchased intangible assets (3,141) (755) (4,044) (1,356) Stock-based compensation (7,405) (6,494) (13,844) (6,819) Acquisition related expenses (2,267) (177) (3,545) (319) Strategic and financial restructuring expenses (1,183) (1,041) (1,279) (2,881) Adjustment to tax receivable agreement liability — — 1,073 — Acquisition related adjustment - deferred revenue (3,596) — (5,661) — Equity in net income of unconsolidated affiliates (4,749) (4,491) (9,615) (8,605) Deferred compensation plan expense 460 — 969 — 65,665 61,249 131,810 128,940 Pro forma adjustment for revenue share post-IPO — — — 41,263 Operating income 65,665 $ 61,249 $ 131,810 $ 170,203 $ Equity in net income of unconsolidated affiliates 4,749 4,491 9,615 8,605 Interest and investment income, net 122 21 313 241 Other (expense) income, net (458) — (962) 4 Income before income taxes 70,078 $ 65,761 $ 140,776 $ 179,053 $ Three Months Ended December 31, Six Months Ended December 31, Supplemental Financial Information - Reporting of Pro Forma Adjusted EBITDA (Unaudited) (In thousands) Reconciliation of Selected Non-GAAP Measures to GAAP Measures and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of Segment Adjusted EBITDA to Income Before Income Taxes: |