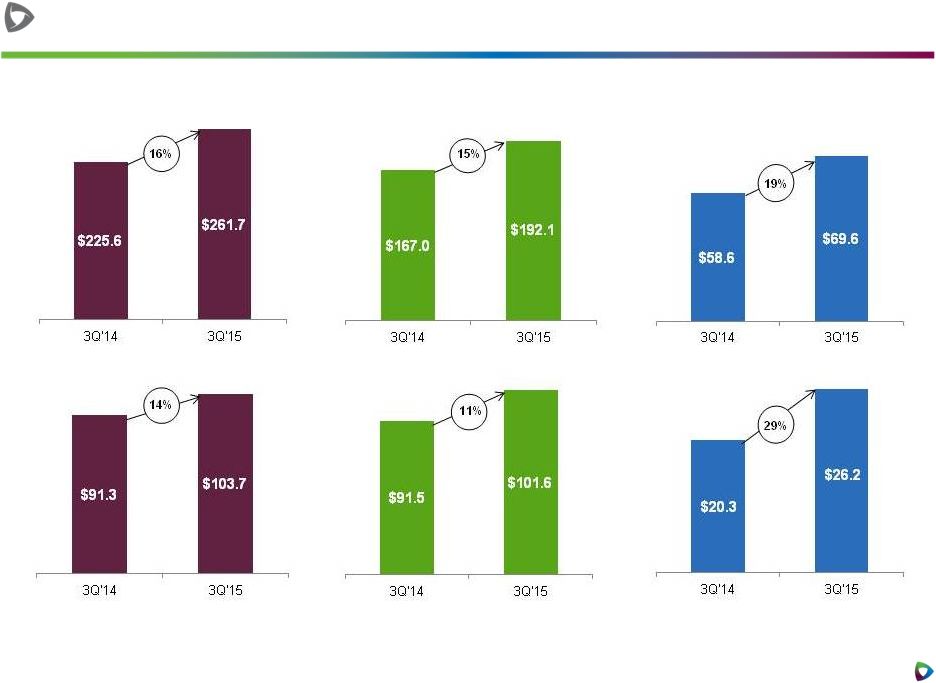

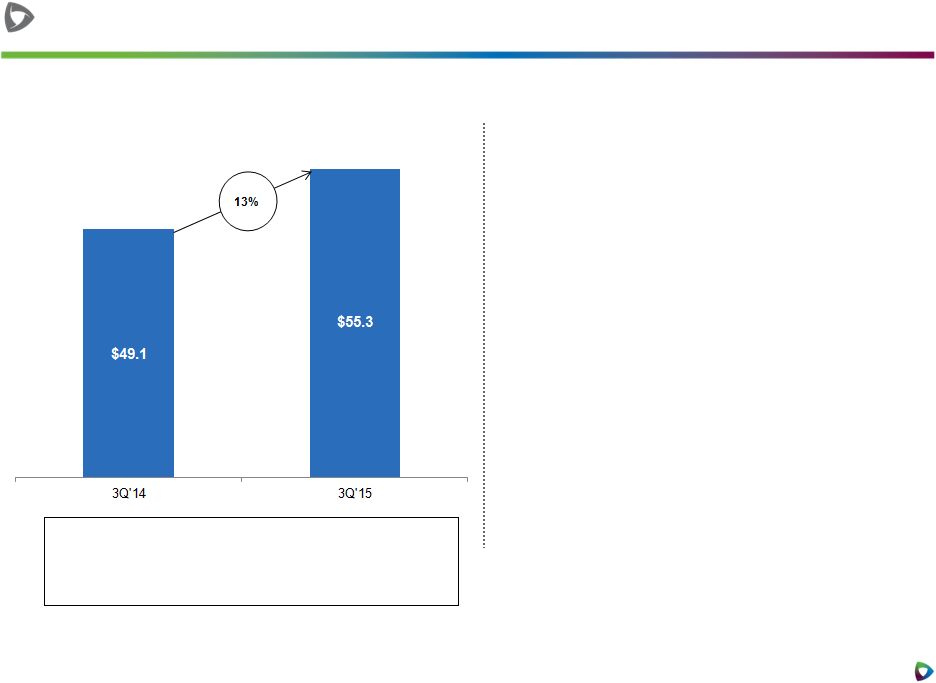

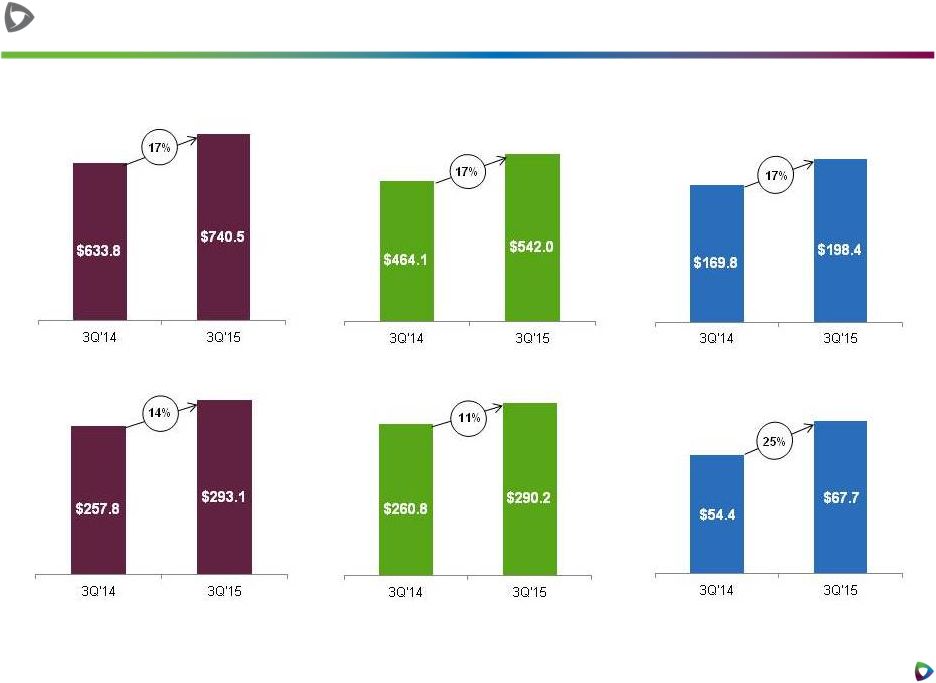

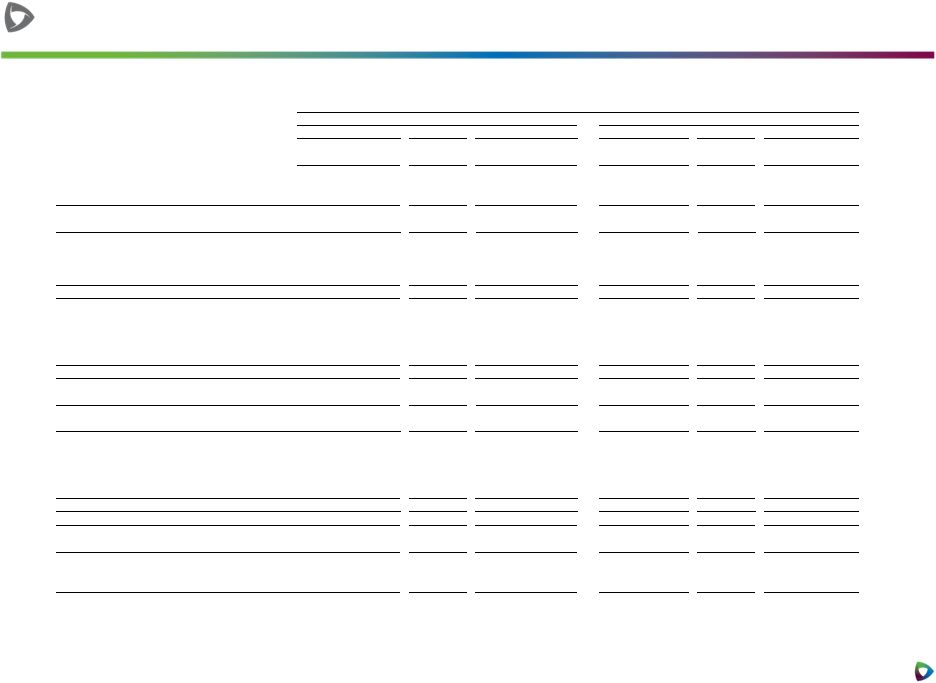

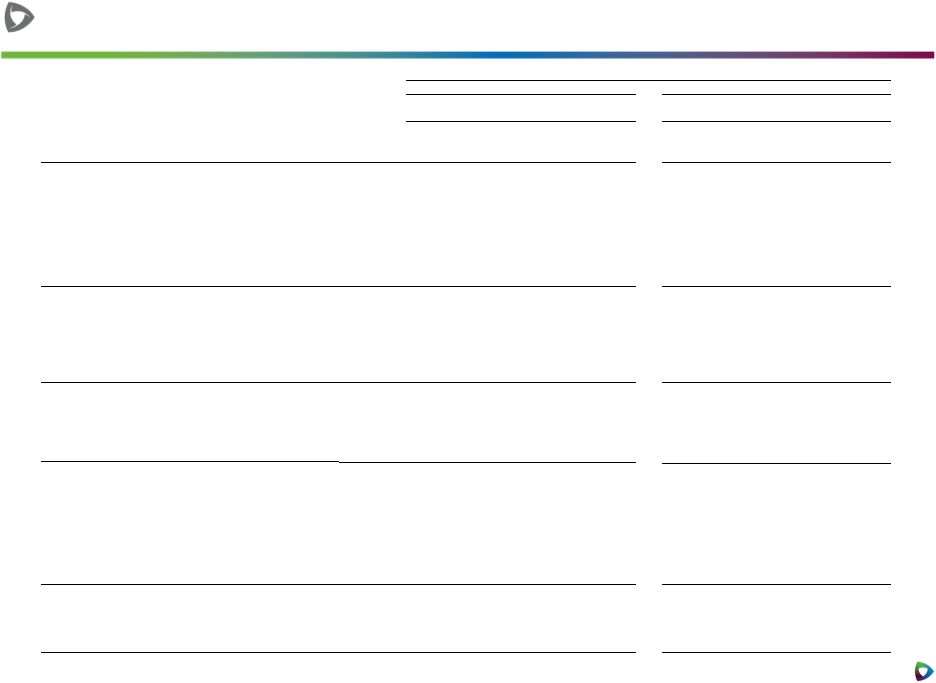

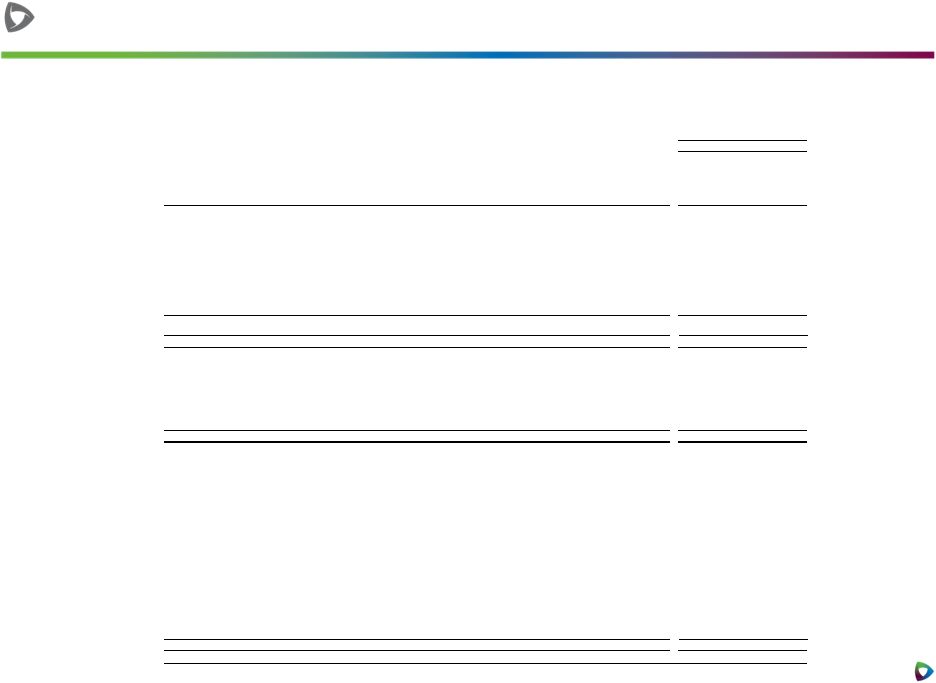

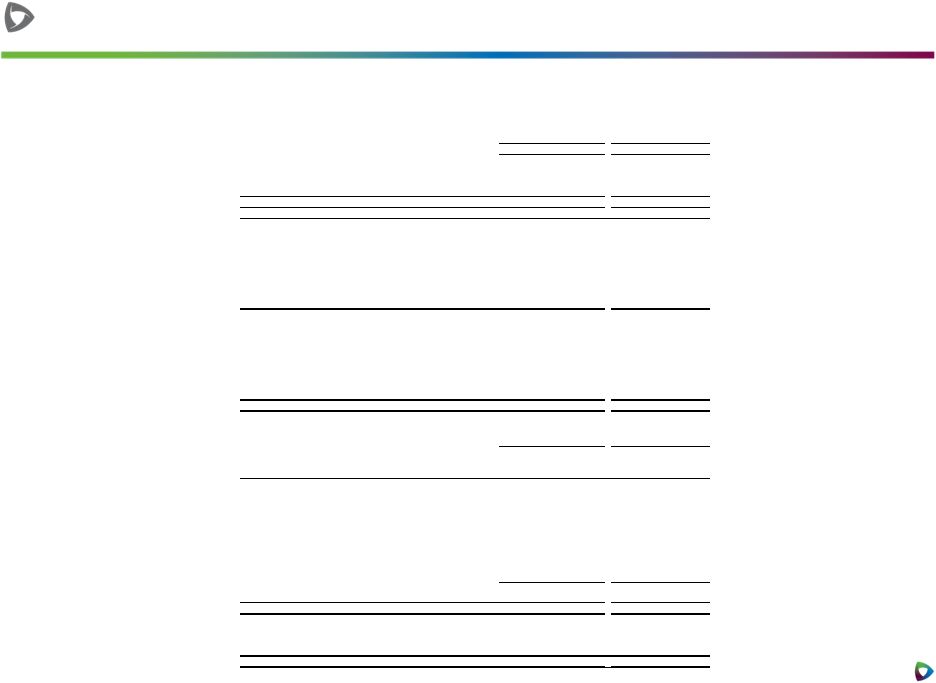

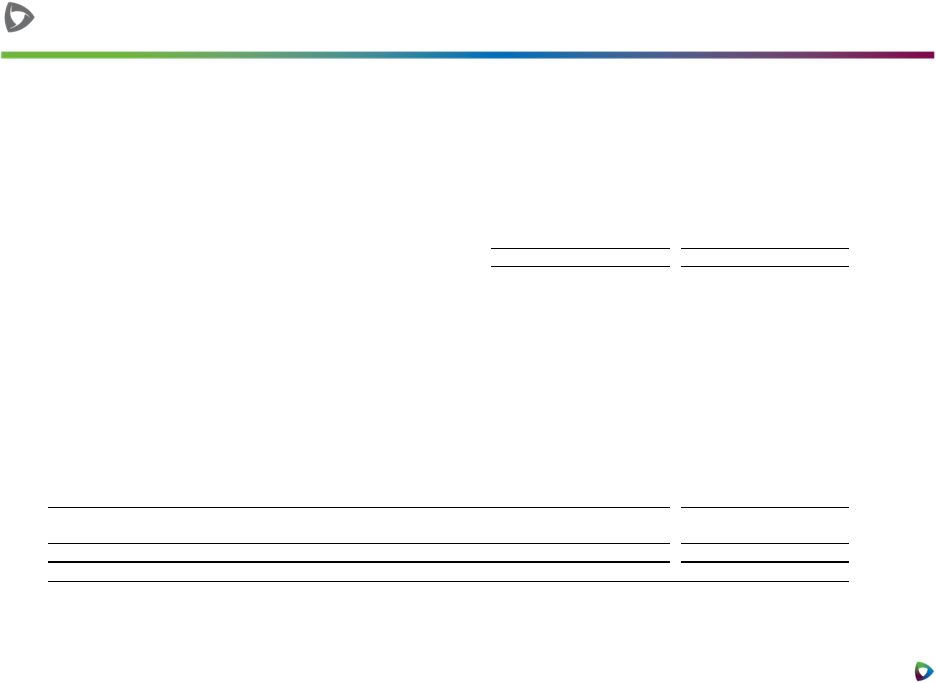

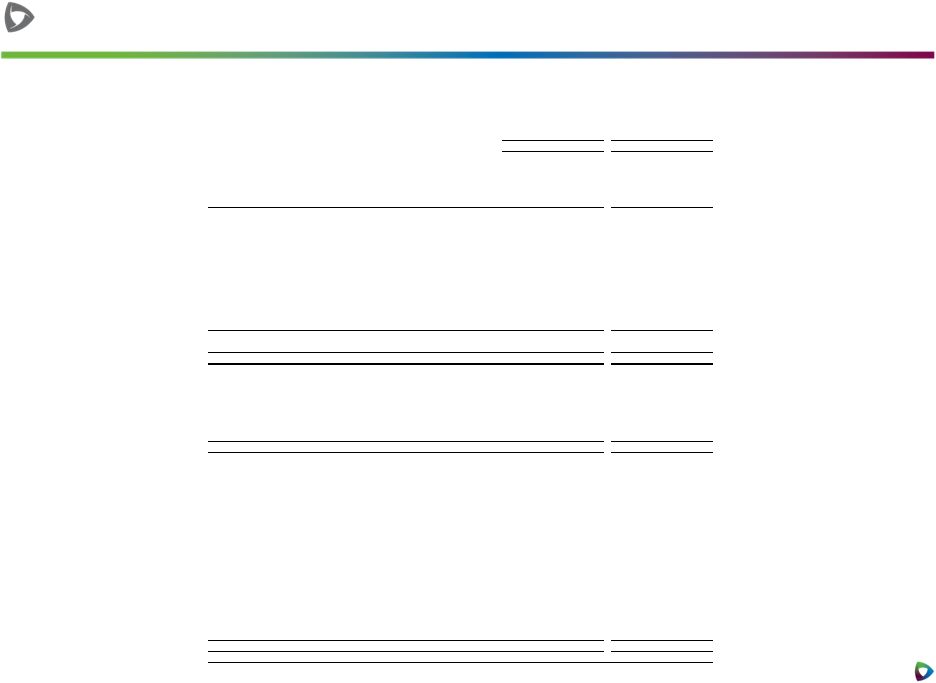

28 © 2015 PREMIER, INC. Fiscal 2015 and fiscal 2014 non-GAAP reconciliations 2015* 2014* 2015* 2014 Reconciliation of Pro Forma Net Revenue to Net Revenue: Pro Forma Net Revenue 261,723 $ 225,598 $ 740,476 $ 633,820 $ Pro forma adjustment for revenue share post-IPO — — — 41,263 Net Revenue 261,723 $ 225,598 $ 740,476 $ 675,083 $ Net income 72,029 $ 101,980 $ 202,724 $ 265,985 $ Pro forma adjustment for revenue share post-IPO — — — (41,263) Interest and investment income, net (204) (400) (517) (641) Income tax expense 2,026 9,413 12,107 24,461 Depreciation and amortization 11,538 9,396 33,107 26,952 Amortization of purchased intangible assets 2,554 802 6,598 2,158 EBITDA 87,943 121,191 254,019 277,652 Stock-based compensation 7,285 6,299 21,129 13,118 Acquisition related expenses 2,863 984 6,408 1,303 Strategic and financial restructuring expenses 2 733 1,281 3,614 Loss (gain) on investment 1,000 (37,850) 1,000 (37,850) Adjustment to tax receivable agreement liability 1,073 — — — Acquisition related adjustment - deferred revenue 3,563 — 9,224 — Other expense (income), net 16 (52) 10 (56) Adjusted EBITDA 103,745 $ 91,305 $ 293,071 $ 257,781 $ Segment Adjusted EBITDA: Supply Chain Services 101,600 $ 91,477 $ 290,210 $ 302,076 $ Pro forma adjustment for revenue share post-IPO — — — (41,263) Supply Chain Services (including pro forma adjustment) 101,600 $ 91,477 $ 290,210 $ 260,813 $ Performance Services 26,166 20,307 67,717 54,367 Corporate (24,021) (20,479) (64,856) (57,399) Adjusted EBITDA 103,745 $ 91,305 $ 293,071 $ 257,781 $ Depreciation and amortization (11,538) (9,396) (33,107) (26,952) Amortization of purchased intangible assets (2,554) (802) (6,598) (2,158) Stock-based compensation (7,285) (6,299) (21,129) (13,118) Acquisition related expenses (2,863) (984) (6,408) (1,303) Strategic and financial restructuring expenses (2) (733) (1,281) (3,614) Adjustment to tax receivable agreement liability (1,073) — — — Acquisition related adjustment - deferred revenue (3,563) — (9,224) — Equity in net income of unconsolidated affiliates (5,197) (3,566) (14,812) (12,171) Deferred compensation plan (income) expense (759) — 209 — 68,911 69,525 200,721 198,465 Pro forma adjustment for revenue share post-IPO — — — 41,263 Operating income 68,911 $ 69,525 $ 200,721 $ 239,728 $ Equity in net income of unconsolidated affiliates 5,197 3,566 14,812 12,171 Interest and investment income, net 204 400 517 641 (Loss) gain on investment (1,000) 37,850 (1,000) 37,850 Other income (expense), net 743 52 (219) 56 Income before income taxes 74,055 $ 111,393 $ 214,831 $ 290,446 $ * Note that no pro forma adjustments were made for the three and nine months ended March 31, 2015 and the three months ended March 31, 2014; as such, actual results are presented for each of these periods. Three Months Ended March 31, Nine Months Ended March 31, Supplemental Financial Information - Reporting of Pro Forma Adjusted EBITDA (Unaudited) (In thousands) Reconciliation of Selected Non-GAAP Measures to GAAP Measures and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of Segment Adjusted EBITDA to Income Before Income Taxes: |