Exhibit 99.3

Exhibit 99.3

Fourth-Quarter and Fiscal Year 2016 Financial Results and Update August 22, 2016

Forward-looking statements and Non-GAAP financial measures

Forward-looking statements — Certain statements included in this presentation, including, but not limited to, those related to our financial and business outlook, strategy and growth drivers, member retention and renewal rates and revenue visibility, cross and upsell opportunities, acquisition activities and pipeline (including completion of the proposed acquisition of Acro Pharmaceutical Services, LLC and its expected financial contribution), revenue available under contract, 2017 financial guidance and related assumptions, and target growth rate are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward looking statements. Readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside Premier’s control. You should carefully read Premier’s current and future filings with the SEC for more information on potential risks and other factors that could affect Premier’s financial results. Forward-looking statements speak only as of the date they are made. Premier undertakes no obligation to publicly update or revise any forward-looking statements.

Non-GAAP financial measures — This presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. You should carefully read Premier’s current and future filings with the SEC for definitions and further explanation and disclosure regarding our use of non-GAAP financial measures and such filings should be read in conjunction with this presentation.

2

Overview and Business UpdateSusan DeVorePresident & CEO

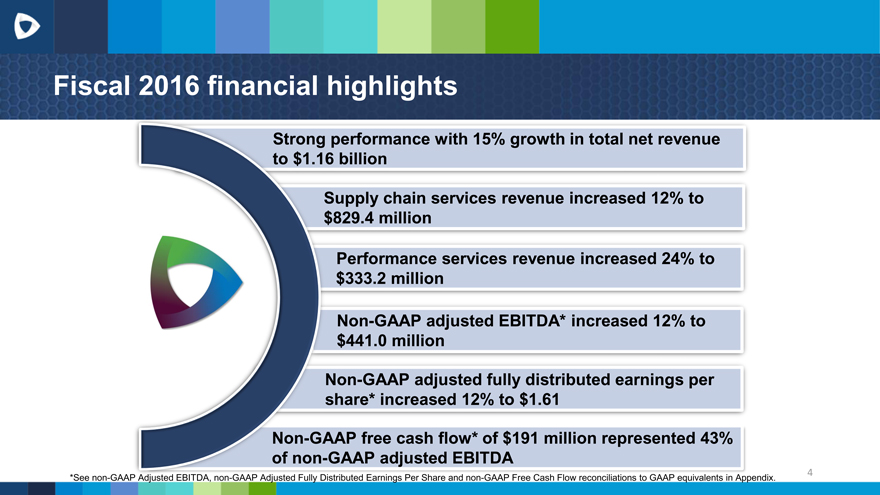

Fiscal 2016 financial highlights

Strong performance with 15% growth in total net revenue to $1.16 billion

Supply chain services revenue increased 12% to $829.4 million

Performance services revenue increased 24% to $333.2 million

Non-GAAP adjusted EBITDA* increased 12% to $441.0 million

Non-GAAP adjusted fully distributed earnings per share* increased 12% to $1.61

Non-GAAP free cash flow* of $191 million represented 43% of non-GAAP adjusted EBITDA

*See non-GAAP Adjusted EBITDA, non-GAAP Adjusted Fully Distributed Earnings Per Share and non-GAAP Free Cash Flow reconciliations to GAAP equivalents in Appendix.

4

Fiscal 2016 operating highlights

Expanded our member base, finishing the year serving ~3,750 hospitals and more than 130,000 other provider organizations

Achieved 97% GPO retention rate and 92% SaaS institutional renewal rate

Supply chain spend through GPO increased 9% to more than $48 billion

Developing and launching new integrated offerings spanning acute and ambulatory continuum

Continued to pursue integrated pharmacy strategy through agreement to acquire Acro*

Successful integration of CECity, Healthcare Insights and InflowHealth acquisitions

*No assurance can be made regarding the actual timing of, or financial contributions from, this pending acquisition.

5

Continuing our momentum into fiscal 2017

Targeting year-over-year double-digit revenue, non-GAAP adjusted EBITDA and non-GAAP adjusted fully distributed earnings per share increases

Provider-centric model focused on serving our members

Developing solutions in close collaboration with members

Positioned to deliver long-term value to stockholders

Provider-centric and co-innovative alignment drives demand for and accelerated roll-out of our solutions

6

What does the future of healthcare look like?

7

Operations UpdateMichael AlkireChief Operating Officer

FY 2016 fourth-quarter new and expanded relationships

Bon Secours partnership with Premier delivers $58 million in savings over 3-year period, also reducing mortality and generating additional advisory services opportunity.

Banner Health expands partnership to include an extension of the group purchasing agreement to 2020, population health advisory services, and the addition of our new PremierConnect Supply Chain analytics and PremierConnect Quality offerings.

Jefferson Health Enterprise chooses Premier to provide primary group purchasing services after a merger of three health systems and a comprehensive review of service providers.

Partnership with a major pharmaceutical company to work alongside providers to develop and assess allergic-reaction solutions that promote appropriate, high quality care to improve outcomes for specific populations of at-risk patients across the continuum.

9

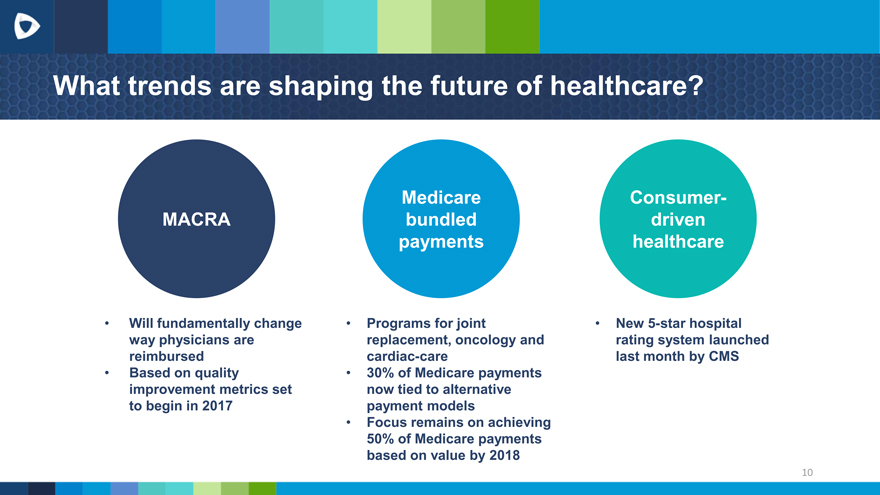

What trends are shaping the future of healthcare?

MACRA

Will fundamentally change way physicians are reimbursed

Based on quality improvement metrics set to begin in 2017

Medicare bundled payments

Programs for joint replacement, oncology and cardiac-care

30% of Medicare payments now tied to alternative payment models

Focus remains on achieving 50% of Medicare payments based on value by 2018

Consumer-driven healthcare

New 5-star hospital rating system launched last month by CMS

10

Financial ReviewCraig McKassonChief Financial Officer

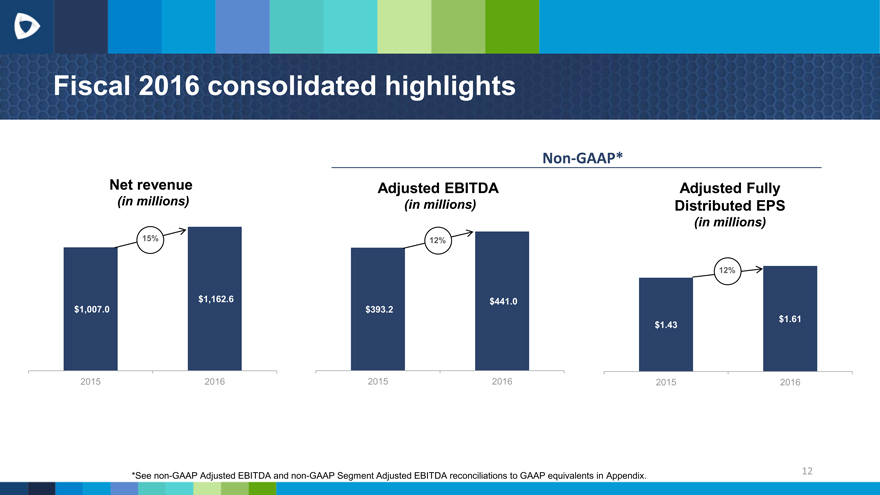

Fiscal 2016 consolidated highlights

Net revenue

(in millions)

Adjusted EBITDA

(in millions)

Non-GAAP*

15%

12%

12%

$1,162.6 $441.0 $1,007.0 $393.2

$1.61

$1.43

2015 2016 2015 2016 2015 2016

*See non-GAAP Adjusted EBITDA and non-GAAP Segment Adjusted EBITDA reconciliations to GAAP equivalents in Appendix.

12

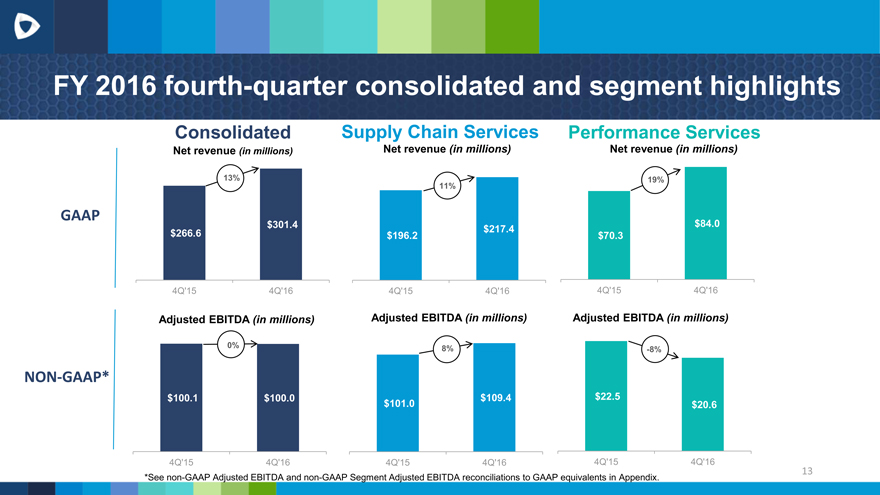

FY 2016 fourth-quarter consolidated and segment highlights

Consolidated Supply Chain Services Performance Services

Net revenue (in millions) Net revenue (in millions) Net revenue (in millions)

13% 19% 11%

GAAP

$301.4 $84.0 $266.6 $217.4 $196.2 $70.3

4Q’15 4Q’16 4Q’15 4Q’16 4Q’15 4Q’16

Adjusted EBITDA (in millions) Adjusted EBITDA (in millions) Adjusted EBITDA (in millions)

0% 8%

-8%

NON-GAAP*

$100.1 $100.0 $109.4 $22.5 $101.0 $20.6

4Q’15 4Q’16 4Q’15 4Q’16 4Q’15 4Q’16 *See non-GAAP Adjusted EBITDA and non-GAAP Segment Adjusted EBITDA reconciliations to GAAP equivalents in Appendix.

13

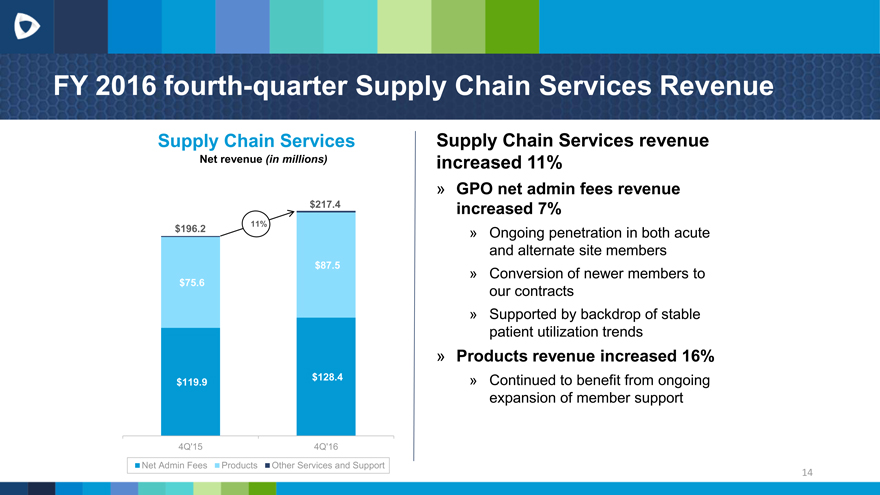

FY 2016 fourth-quarter Supply Chain Services Revenue

Supply Chain Services

Net revenue (in millions)

$217.4

11%

$196.2

$87.5

$75.6

$128.4 $119.9

4Q’15 4Q’16

Net Admin Fees Products Other Services and Support

Supply Chain Services revenue increased 11%

» GPO net admin fees revenue increased 7%

» Ongoing penetration in both acute and alternate site members

» Conversion of newer members to our contracts

» Supported by backdrop of stable patient utilization trends

» Products revenue increased 16%

» Continued to benefit from ongoing expansion of member support

14

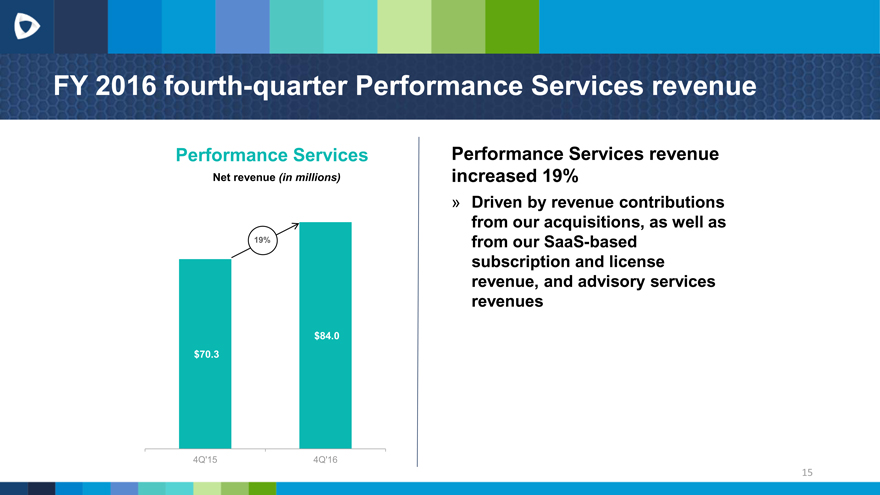

FY 2016 fourth-quarter Performance Services revenue

Performance Services

Net revenue (in millions)

19%

$84.0

$70.3

4Q’15 4Q’16

Performance Services revenue increased 19%

» Driven by revenue contributions from our acquisitions, as well as from our SaaS-based subscription and license revenue, and advisory services revenues

15

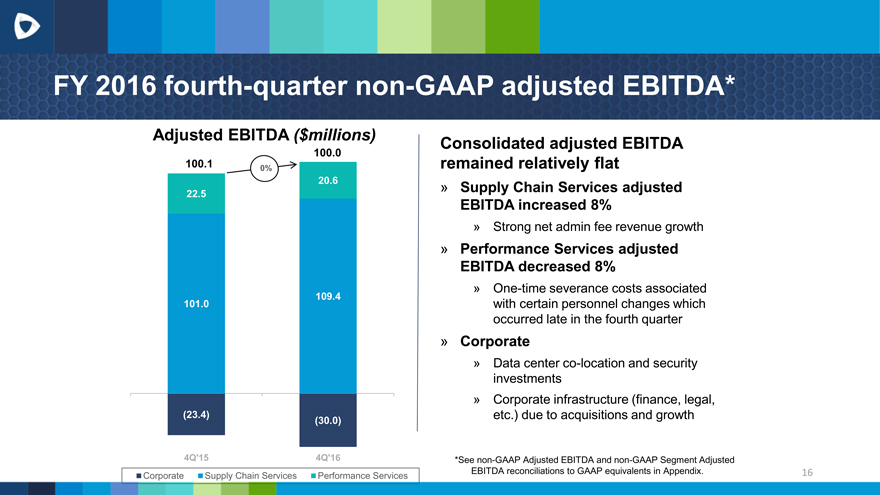

FY 2016 fourth-quarter non-GAAP adjusted EBITDA*

Adjusted EBITDA ($millions)

100.0 100.1 0%

20.6 22.5

109.4 101.0

(23.4)

(30.0)

4Q’15 4Q’16

Corporate Supply Chain Services Performance Services

Consolidated adjusted EBITDA remained relatively flat

» Supply Chain Services adjusted EBITDA increased 8%

» Strong net admin fee revenue growth

» Performance Services adjusted EBITDA decreased 8%

» One-time severance costs associated with certain personnel changes which occurred late in the fourth quarter

» Corporate

» Data center co-location and security investments

» Corporate infrastructure (finance, legal, etc.) due to acquisitions and growth

*See non-GAAP Adjusted EBITDA and non-GAAP Segment Adjusted EBITDA reconciliations to GAAP equivalents in Appendix.

16

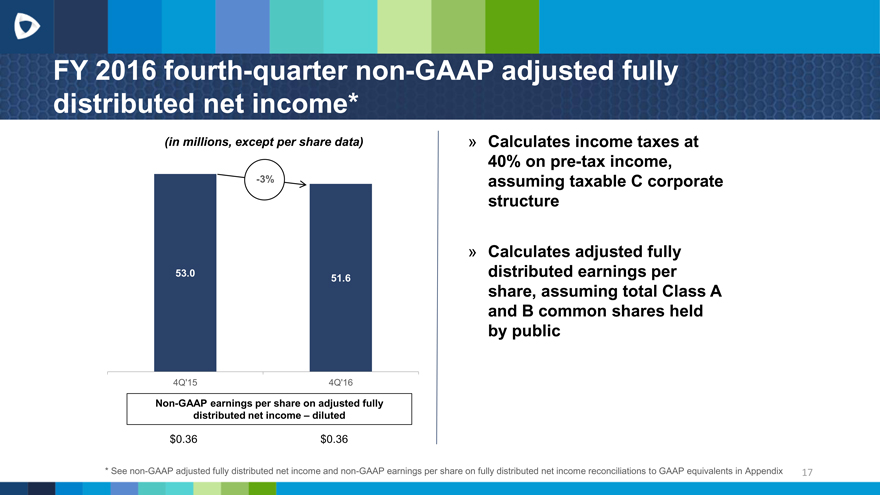

FY 2016 fourth-quarter non-GAAP adjusted fully distributed net income*

(in millions, except per share data)

-3%

53.0

51.6

4Q’15 4Q’16

Non-GAAP earnings per share on adjusted fully distributed net income – diluted

$0.36 $0.36

» Calculates income taxes at 40% on pre-tax income, assuming taxable C corporate structure

» Calculates adjusted fully distributed earnings per share, assuming total Class A and B common shares held by public

* See non-GAAP adjusted fully distributed net income and non-GAAP earnings per share on fully distributed net income reconciliations to GAAP equivalents in Appendix 17

17

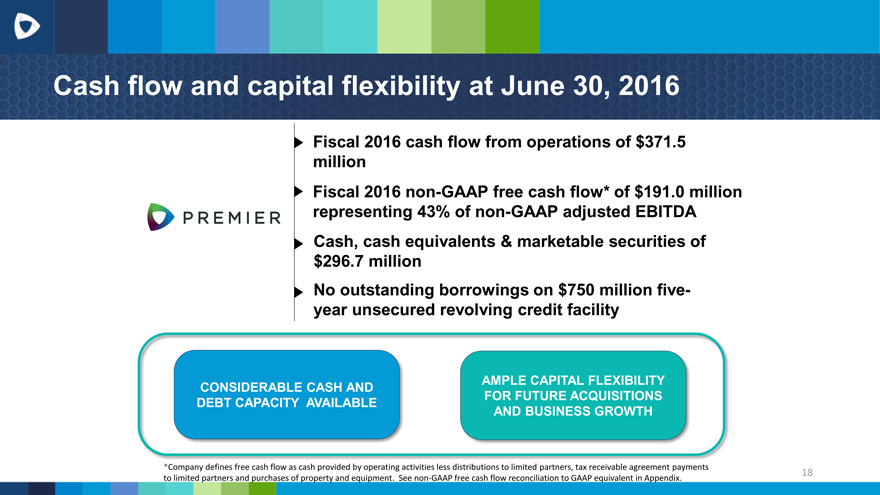

Cash flow and capital flexibility at June 30, 2016

Fiscal 2016 cash flow from operations of $371.5 million

Fiscal 2016 non-GAAP free cash flow* of $191.0 million representing 43% of non-GAAP adjusted EBITDA

Cash, cash equivalents & marketable securities of $296.7 million No outstanding borrowings on $750 million five-year unsecured revolving credit facility

CONSIDERABLE CASH AND DEBT CAPACITY AVAILABLE

AMPLE CAPITAL FLEXIBILITY FOR FUTURE ACQUISITIONS AND BUSINESS GROWTH

*Company defines free cash flow as cash provided by operating activities less distributions to limited partners, tax receivable agreement payments to limited partners and purchases of property and equipment. See non-GAAP free cash flow reconciliation to GAAP equivalent in Appendix.

18

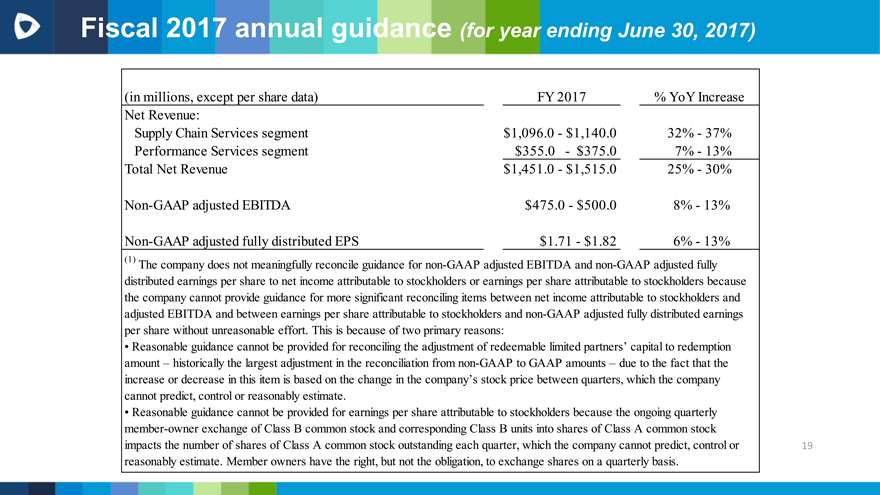

Fiscal 2017 annual guidance (for year ending June 30, 2017)

(in millions, except per share data) FY 2017 % YoY Increase

Net Revenue:

Supply Chain Services segment $1,096.0 -$1,140.032%-37%

Performance Services segment $355.0 - $375.07%-13%

Total Net Revenue $1,451.0 -$1,515.025%-30%

Non-GAAP adjusted EBITDA $475.0—$500.0 8%-13%

Non-GAAP adjusted fully distributed EPS $1.71—$1.82 6%-13%

(1) The company does not meaningfully reconcile guidance for non-GAAP adjusted EBITDA and non-GAAP adjusted fully distributed earnings per share to net income attributable to stockholders or earnings per share attributable to stockholders because the company cannot provide guidance for more significant reconciling items between net income attributable to stockholders and adjusted EBITDA and between earnings per share attributable to stockholders and non-GAAP adjusted fully distributed earnings per share without unreasonable effort. This is because of two primary reasons:

• Reasonable guidance cannot be provided for reconciling the adjustment of redeemable limited partners’ capital to redemption amount – historically the largest adjustment in the reconciliation from non-GAAP to GAAP amounts – due to the fact that the increase or decrease in this item is based on the change in the company’s stock price between quarters, which the company cannot predict, control or reasonably estimate.

• Reasonable guidance cannot be provided for earnings per share attributable to stockholders because the ongoing quarterly member-owner exchange of Class B common stock and corresponding Class B units into shares of Class A common stock impacts the number of shares of Class A common stock outstanding each quarter, which the company cannot predict, control or reasonably estimate. Member owners have the right, but not the obligation, to exchange shares on a quarterly basis.

19

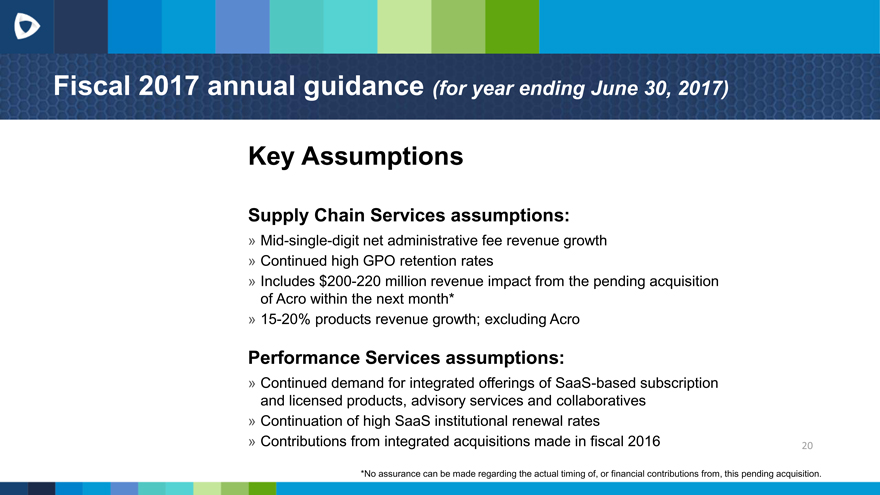

Fiscal 2017 annual guidance (for year ending June 30, 2017)

Key Assumptions

Supply Chain Services assumptions:

» Mid-single-digit net administrative fee revenue growth

» Continued high GPO retention rates

» Includes $200-220 million revenue impact from the pending acquisition of Acro within the next month*

» 15-20% products revenue growth; excluding Acro

Performance Services assumptions:

» Continued demand for integrated offerings of SaaS-based subscription and licensed products, advisory services and collaboratives

» Continuation of high SaaS institutional renewal rates

» Contributions from integrated acquisitions made in fiscal 2016

*No assurance can be made regarding the actual timing of, or financial contributions from, this pending acquisition.

20

Additional fiscal 2017 guidance assumptions

Capital expenditures of ~$70 million for the year

2017 adjusted EBITDA margin from existing business of 37-38% will become approximately 32-33% of net revenue, including Acro Pharmaceutical Services*

Effective tax rate of 40%

*No assurance can be made regarding the actual timing of, or financial contributions from, this pending acquisition. 21

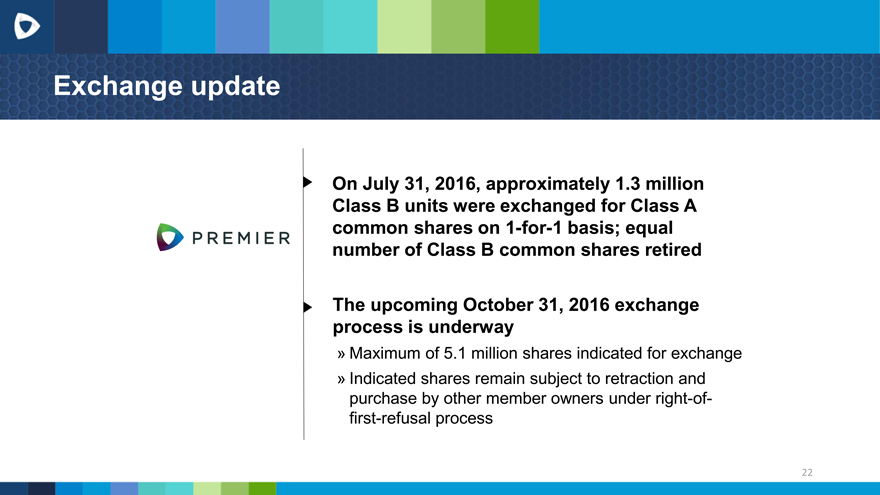

Exchange update

On July 31, 2016, approximately 1.3 million Class B units were exchanged for Class A common shares on 1-for-1 basis; equal number of Class B common shares retired

The upcoming October 31, 2016 exchange process is underway

» Maximum of 5.1 million shares indicated for exchange

» Indicated shares remain subject to retraction and purchase by other member owners under right-of-first-refusal process

22

Questions

Appendix

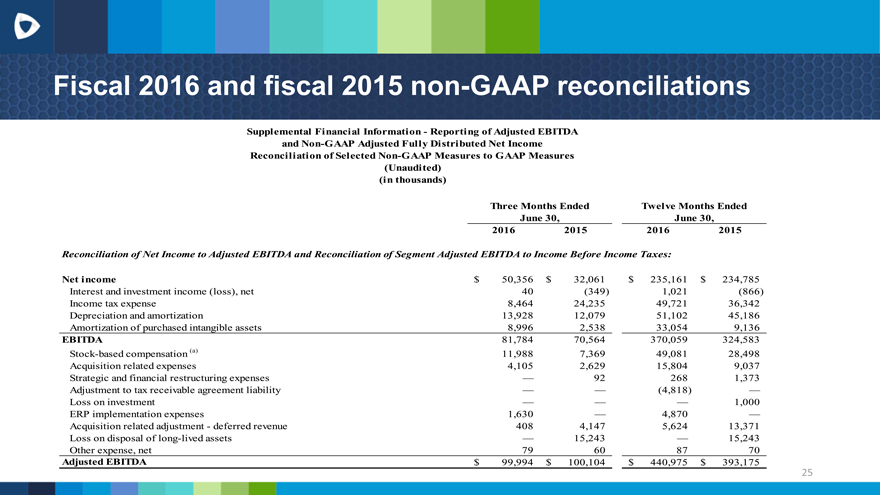

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (in thousands)

Three Months Ended Twelve Months Ended

June 30, June 30,

2016 201520162015

Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of Segment Adjusted EBITDA to Income Before Income Taxes:

Net income $ 50,356 $32,061$235,161$234,785

Interest and investment income (loss), net 40 (349)1,021(866)

Income tax expense 8,464 24,23549,72136,342

Depreciation and amortization 13,928 12,07951,10245,186

Amortization of purchased intangible assets 8,996 2,53833,0549,136

EBITDA 81,784 70,564370,059324,583

Stock-based compensation (a) 11,988 7,36949,08128,498

Acquisition related expenses 4,105 2,62915,8049,037

Strategic and financial restructuring expenses — 922681,373

Adjustment to tax receivable agreement liability — —(4,818)—

Loss on investment — ——1,000

ERP implementation expenses 1,630 —4,870—

Acquisition related adjustment—deferred revenue 408 4,1475,62413,371

Loss on disposal of long-lived assets — 15,243—15,243

Other expense, net 79 608770

Adjusted EBITDA $ 99,994 $100,104$440,975$393,175

25

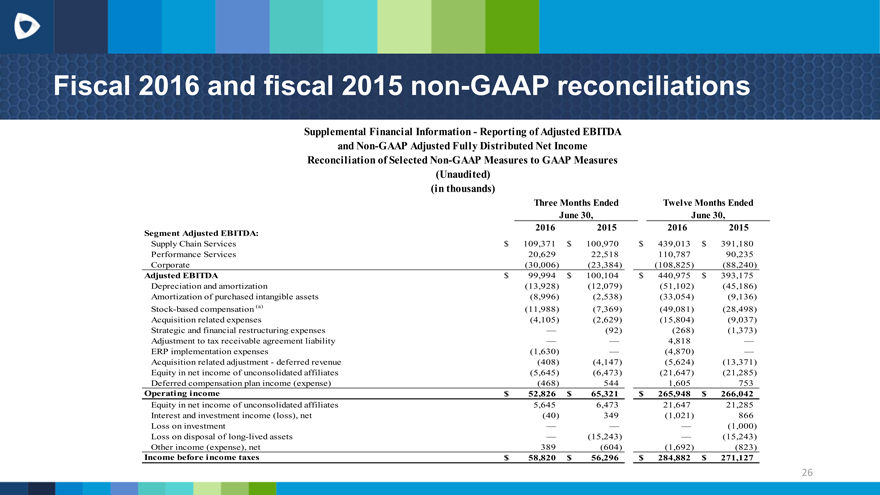

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (in thousands)

Three Months Ended Twelve Months Ended

June 30,June 30,

2016 201520162015

Segment Adjusted EBITDA:

Supply Chain Services $ 109,371 $100,970$ 439,013$391,180

Performance Services 20,629 22,518110,78790,235

Corporate (30,006) (23,384)(108,825)(88,240)

Adjusted EBITDA $ 99,994 $100,104$ 440,975$393,175

Depreciation and amortization (13,928) (12,079)(51,102)(45,186)

Amortization of purchased intangible assets (8,996) (2,538)(33,054)(9,136)

Stock-based compensation (a) (11,988) (7,369)(49,081)(28,498)

Acquisition related expenses (4,105) (2,629)(15,804)(9,037)

Strategic and financial restructuring expenses — (92)(268)(1,373)

Adjustment to tax receivable agreement liability — —4,818—

ERP implementation expenses (1,630) —(4,870)—

Acquisition related adjustment—deferred revenue (408) (4,147)(5,624)(13,371)

Equity in net income of unconsolidated affiliates (5,645) (6,473)(21,647)(21,285)

Deferred compensation plan income (expense) (468) 5441,605753

Operating income $ 52,826 $65,321$ 265,948$266,042

Equity in net income of unconsolidated affiliates 5,645 6,47321,64721,285

Interest and investment income (loss), net (40) 349(1,021)866

Loss on investment — ——(1,000)

Loss on disposal of long-lived assets — (15,243)—(15,243)

Other income (expense), net 389 (604)(1,692)(823)

Income before income taxes $ 58,820 $56,296$ 284,882$271,127

26

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

Reconciliation of Net Income (Loss) Attributable to Stockholders to Non-GAAP Adjusted Fully Distributed Net Income:

Net income (loss) attributable to stockholders $101,645$(84,076)$ 818,364$(865,292)

Adjustment of redeemable partners’ capital to redemption amount (91,101)92,066(776,750)904,035

Income tax expense 8,46424,23549,72136,342

Stock-based compensation (a) 11,9887,36949,08128,498

Acquisition related expenses 4,1052,62915,8049,037

Strategic and financial restructuring expenses —922681,373

ERP implementation expenses 1,630—4,870—

Adjustment to tax receivable agreement liability ——(4,818)—

Loss on investment ———1,000

Acquisition related adjustment—deferred revenue 4084,1475,62413,371

Loss on disposal of long-lived assets —15,243—15,243

Amortization of purchased intangible assets 8,9962,53833,0549,136

Net income attributable to non-controlling interest in Premier LP 39,81224,071193,547194,206

Non-GAAP adjusted fully distributed income before income taxes 85,94788,314388,765346,949

Income tax expense on fully distributed income before income taxes 34,37935,326155,506138,780

Non-GAAP Adjusted Fully Distributed Net Income $51,568$52,988$ 233,259$208,169

(a) Represents non-cash employee stock-based compensation expense, and $0.1 million and $0.4 million stock purchase plan expense in the three and twelve

(a) Represents non-cash employee stock-based compensation expense, and $0.1 million and $0.4 million stock purchase plan expense in the three and twelve

27

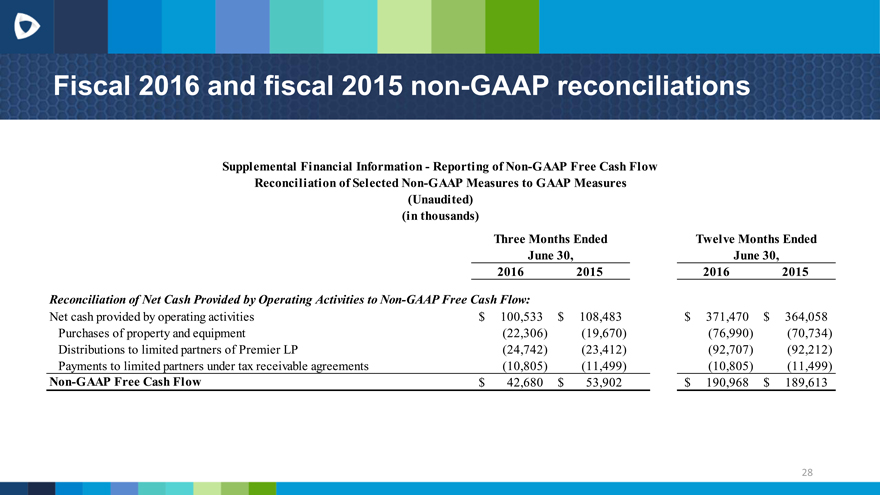

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Non-GAAP Free Cash Flow Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (in thousands)

Three Months Ended Twelve Months Ended

June 30,June 30,

2016201520162015

Reconciliation of Net Cash Provided by Operating Activities to Non-GAAP Free Cash Flow:

Net cash provided by operating activities $100,533$108,483$ 371,470$364,058

Purchases of property and equipment (22,306)(19,670)(76,990)(70,734)

Distributions to limited partners of Premier LP (24,742)(23,412)(92,707)(92,212)

Payments to limited partners under tax receivable agreements (10,805)(11,499)(10,805)(11,499)

Non-GAAP Free Cash Flow $42,680$53,902$ 190,968$189,613

28

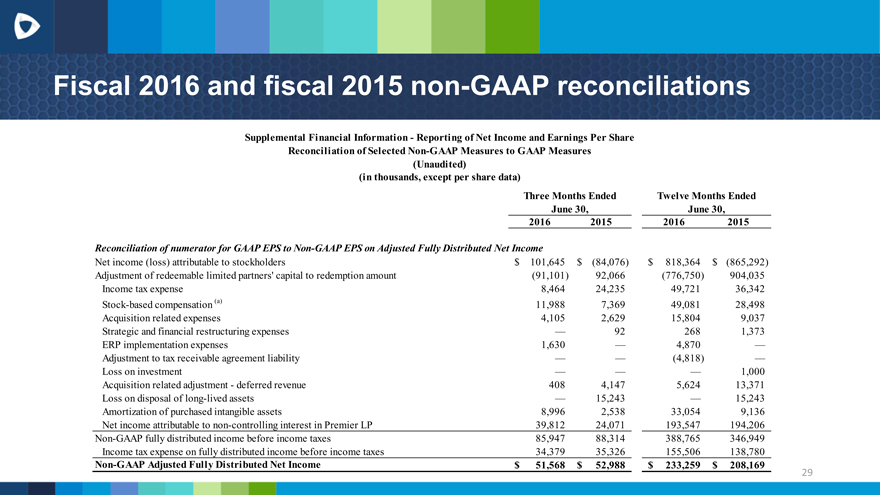

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Net Income and Earnings Per Share Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (in thousands, except per share data)

Three Months Ended Twelve Months Ended

June 30, June 30,

2016 201520162015

Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Adjusted Fully Distributed Net Income

Net income (loss) attributable to stockholders $ 101,645 $(84,076)$ 818,364$(865,292)

Adjustment of redeemable limited partners’ capital to redemption amount (91,101) 92,066(776,750)904,035

Income tax expense 8,464 24,23549,72136,342

Stock-based compensation (a) 11,988 7,36949,08128,498

Acquisition related expenses 4,105 2,62915,8049,037

Strategic and financial restructuring expenses — 922681,373

ERP implementation expenses 1,630 —4,870—

Adjustment to tax receivable agreement liability — —(4,818)—

Loss on investment — ——1,000

Acquisition related adjustment—deferred revenue 408 4,1475,62413,371

Loss on disposal of long-lived assets — 15,243—15,243

Amortization of purchased intangible assets 8,996 2,53833,0549,136

Net income attributable to non-controlling interest in Premier LP 39,812 24,071193,547194,206

Non-GAAP fully distributed income before income taxes 85,947 88,314388,765346,949

Income tax expense on fully distributed income before income taxes 34,379 35,326155,506138,780

Non-GAAP Adjusted Fully Distributed Net Income $ 51,568 $52,988$ 233,259$208,169

29

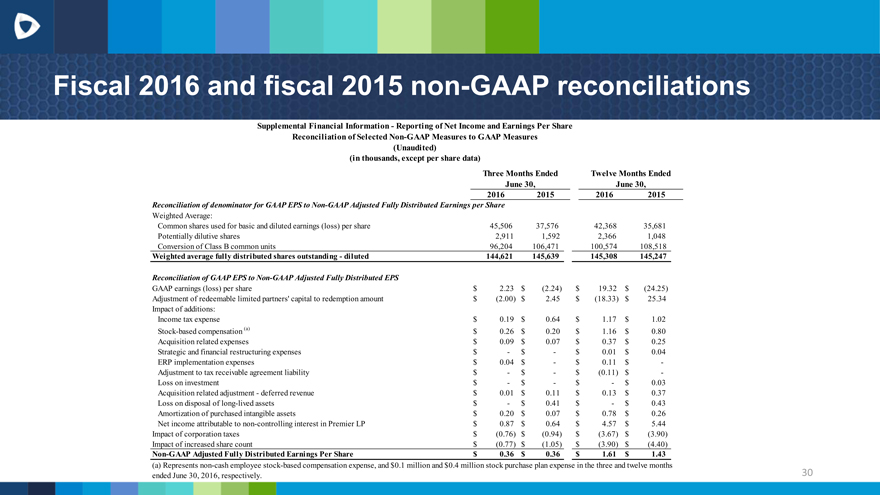

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Net Income and Earnings Per Share Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (in thousands, except per share data)

Three Months Ended Twelve Months Ended

June 30,June 30,

2016201520162015

Reconciliation of denominator for GAAP EPS to Non-GAAP Adjusted Fully Distributed Earnings per Share

Weighted Average:

Common shares used for basic and diluted earnings (loss) per share 45,50637,57642,36835,681

Potentially dilutive shares 2,9111,5922,3661,048

Conversion of Class B common units 96,204106,471100,574108,518

Weighted average fully distributed shares outstanding—diluted 144,621145,639145,308145,247

Reconciliation of GAAP EPS to Non-GAAP Adjusted Fully Distributed EPS

GAAP earnings (loss) per share $2.23$(2.24)$19.32$(24.25)

Adjustment of redeemable limited partners’ capital to redemption amount $(2.00)$2.45$(18.33)$25.34

Impact of additions:

Income tax expense $0.19$0.64$1.17$1.02

Stock-based compensation (a) $0.26$0.20$1.16$0.80

Acquisition related expenses $0.09$0.07$0.37$0.25

Strategic and financial restructuring expenses $-$-$0.01$0.04

ERP implementation expenses $0.04$-$0.11$-

Adjustment to tax receivable agreement liability $-$-$(0.11)$-

Loss on investment $-$-$-$0.03

Acquisition related adjustment—deferred revenue $0.01$0.11$0.13$0.37

Loss on disposal of long-lived assets $-$0.41$-$0.43

Amortization of purchased intangible assets $0.20$0.07$0.78$0.26

Net income attributable to non-controlling interest in Premier LP $0.87$0.64$4.57$5.44

Impact of corporation taxes $(0.76)$(0.94)$(3.67)$(3.90)

Impact of increased share count $(0.77)$(1.05)$(3.90)$(4.40)

Non-GAAP Adjusted Fully Distributed Earnings Per Share $0.36$0.36$1.61$1.43

(a) Represents non-cash employee stock-based compensation expense, and $0.1 million and $0.4 million stock purchase plan expense in the three and twelve months

ended June 30, 2016, respectively.

30