|

Exhibit 99.3

|

First-Quarter Fiscal

Year 2017 Financial

Results and Update

November 7, 2016

1

Forward-looking statements and Non-GAAP financial measures

Forward-looking statements Certain statements included in this presentation, including, but not limited to, those related to our financial and business outlook, strategy and growth drivers, member retention and renewal rates and revenue visibility, cross and upsell opportunities, acquisition activities and pipeline, revenue available under contract, 2017 financial guidance and related assumptions, and target growth rate are forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward looking statements. Readers are urged to consider statements in the conditional or future tenses or that include terms such as believes, belief, expects, estimates, intends, anticipates or plans to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside Premier’s control. You should carefully read Premier’s current and future filings with the SEC for more information on potential risks and other factors that could affect Premier’s financial results. Forward-looking statements speak only as of the date they are made. Premier undertakes no obligation to publicly update or revise any forward-looking statements.

Non-GAAP financial measures This presentation includes certain non-GAAP financial measures as defined in Regulation G under the

Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the

United States. You should carefully read Premier’s current and future filings with the SEC for definitions and further explanation and disclosure regarding our use of non-GAAP financial measures and such filings should be read in conjunction with this presentation.

2

Overview and Business Update

Susan DeVore President & CEO

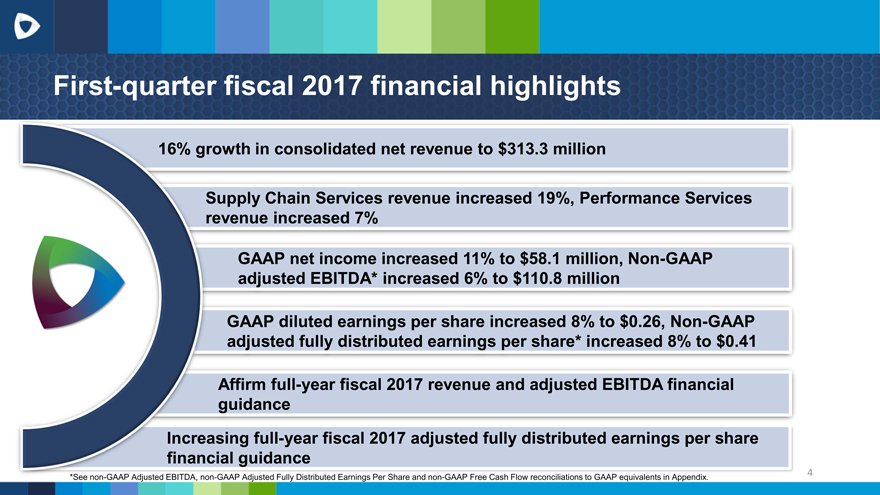

First-quarter fiscal 2017 financial highlights

growth in consolidated net revenue to $313.3 million

Supply Chain Services revenue increased 19%, Performance Services

revenue increased 7%

GAAP net income increased 11% to $58.1 million, Non-GAAP

adjusted EBITDA* increased 6% to $110.8 million

GAAP diluted earnings per share increased 8% to $0.26, Non-GAAP

adjusted fully distributed earnings per share* increased 8% to $0.41

Affirm full-year fiscal 2017 revenue and adjusted EBITDA financial

guidance

sing full-year fiscal 2017 adjusted fully distributed earnings per share

ial guidance

4

*See non-GAAP Adjusted EBITDA, non-GAAP Adjusted Fully Distributed Earnings Per Share and non-GAAP Free Cash Flow reconciliations to GAAP equivalents in Appendix.

Operations Update

Michael Alkire

Chief Operating Officer

Select business wins

Northern Arizona Healthcare contracts for broad cost-reduction, quality-

improvement engagement, including Premier’s group purchasing services, SaaS-

based supply chain analytics and advisory services.

Verity Health System engages Premier for all-in total cost-reduction project, including technology and a large advisory services component focusing on improving supply expense, pharmacy, physician preference, and overall purchasing practices.

Premier develops High Reliable Care dashboard for progressive, academic health system, allowing system’s executive team to measure and reduce total cost while improving quality and outcomes.

6

Integrated Pharmacy opportunities

Drive down Create Drive

costs pricing competitive

transparency friction

7

Financial Review

Craig McKasson Chief Financial Officer

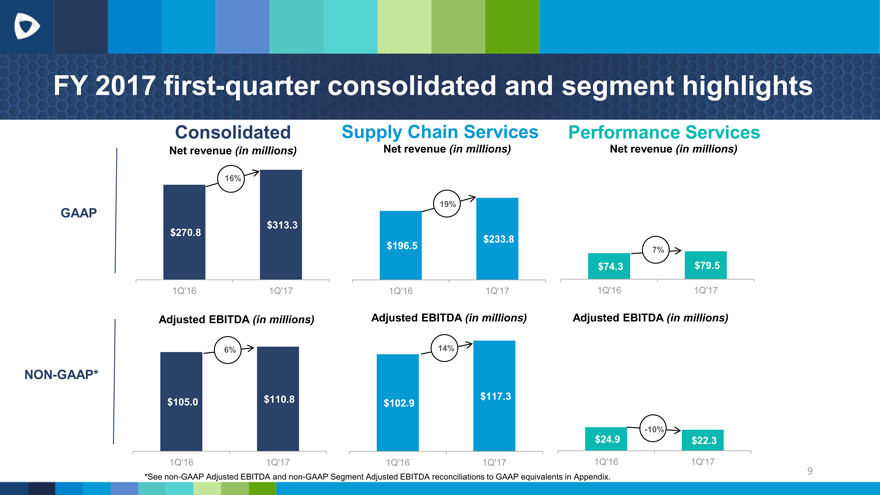

FY 2017 first-quarterconsolidated andsegment highlights

ConsolidatedSupply Chain ServicesPerformance Services

Net revenue (in millions)Net revenue (in millions)Net revenue (in millions)

16%

19%

GAAP

$313.3 $270.8 $233.8 $196.5 7% $74.3 $79.5

1Q’16 1Q’17 1Q’16 1Q’17 1Q’16 1Q’17

Adjusted EBITDA (in millions) Adjusted EBITDA (in millions) Adjusted EBITDA (in millions)

6% 14%

NON-GAAP*

$110.8 $117.3

$105.0 $102.9

-10%

$24.9 $22.3

1Q’16 1Q’17 1Q’16 1Q’17 1Q’16 1Q’17

9

*See non-GAAP Adjusted EBITDA and non-GAAP Segment Adjusted EBITDA reconciliations to GAAP equivalents in Appendix.

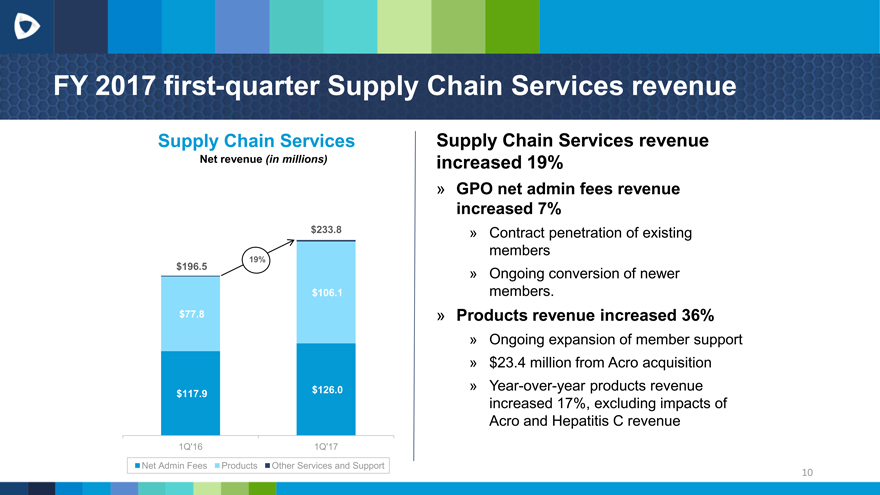

FY 2017 first-quarter Supply Chain Services revenue

Supply Chain Services

Net revenue (in millions)

$233.8

19%

$196.5 $106.1 $77.8

$117.9 $126.0

1Q’16 1Q’17

Net Admin Fees Products Other Services and Support

Supply Chain Services revenue

increased 19%

GPO net admin fees revenue

increased 7%

Contract penetration of existing

members

Ongoing conversion of newer

members.

Products revenue increased 36%

Ongoing expansion of member support

$23.4 million from Acro acquisition

Year-over-year products revenue

increased 17%, excluding impacts of

Acro and Hepatitis C revenue

10

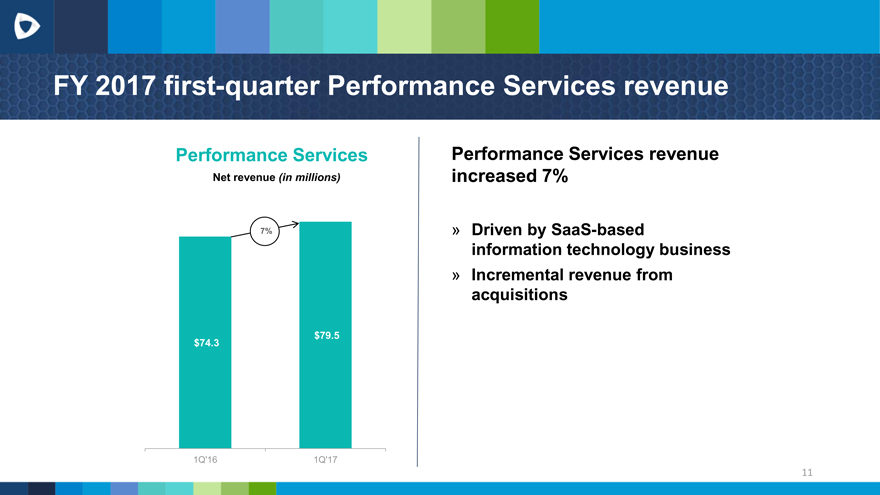

FY 2017 first-quarter Performance Services revenue

Performance Services Performance Services revenue

Net revenue (in millions) increased 7%

7% Driven by SaaS-based

information technology business

Incremental revenue from

acquisitions

$74.3

$79.5

1Q’16

1Q’17

11

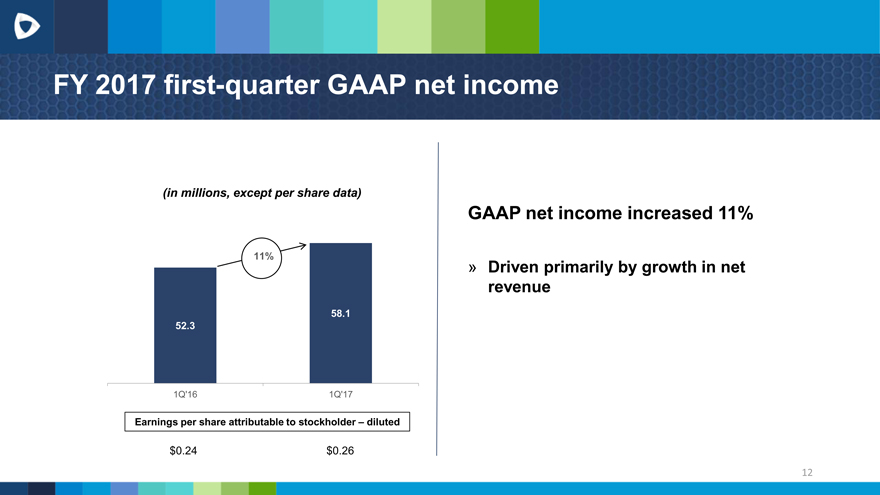

FY 2017 first-quarter GAAP net income

(in millions, except per share data)

11%

58.1

52.3

1Q’16

1Q’17

Earnings per share attributable to stockholder diluted

$0.24 $0.26

GAAP net income increased 11%

Driven primarily by growth in net

revenue

12

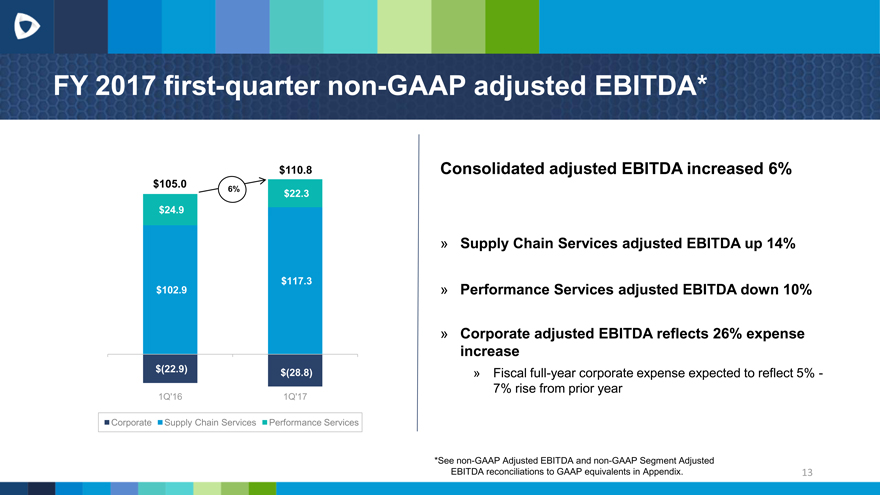

FY 2017 first-quarter non-GAAP adjusted EBITDA*

$110.8 $105.0

6% $22.3 $24.9

$102.9 $117.3

$(22.9) $(28.8)

1Q’16 1Q’17

Corporate Supply Chain Services Performance Services

Consolidated adjusted EBITDA increased 6%

Supply Chain Services adjusted EBITDA up 14%

Performance Services adjusted EBITDA down 10%

Corporate adjusted EBITDA reflects 26% expense

increase

Fiscal full-year corporate expense expected to reflect 5% -

7% rise from prior year

*See non-GAAP Adjusted EBITDA and non-GAAP Segment Adjusted

EBITDA reconciliations to GAAP equivalents in Appendix. 13

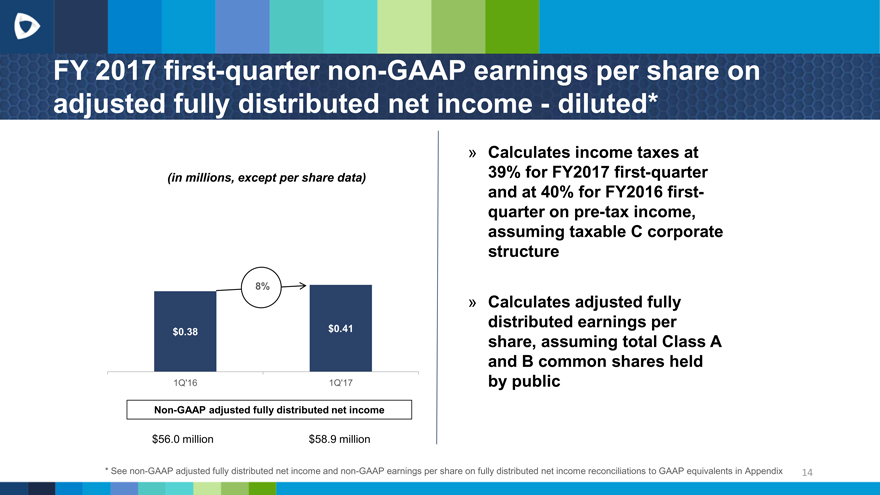

FY 2017 first-quarter non-GAAP earnings per share on adjusted fully distributed net income—diluted*

Calculates income taxes at

(in millions, except per share data) 39% for FY2017 first-quarter

and at 40% for FY2016 first-

quarter on pre-tax income,

assuming taxable C corporate

structure

8%

Calculates adjusted fully

distributed earnings per

$0.38 $0.41

share, assuming total Class A

and B common shares held

1Q’16 1Q’17 by public

Non-GAAP adjusted fully distributed net income

$56.0 million $58.9 million

* See non-GAAP adjusted fully distributed net income and non-GAAP earnings per share on fully distributed net income reconciliations to GAAP equivalents in Appendix 14

Cash flow and capital flexibility at September 30, 2016

Fiscal 2017 first-quarter cash flow from operations of

$41.8 million

Cash, cash equivalents & marketable securities of $156.0

million at September 30, 2016

No outstanding borrowings on $750 million five-year unsecured

revolving credit facility at September 30, 2016; $50 million

borrowed November 1, 2016

*Company defines free cash flow as cash provided by operating activities less distributions to limited partners, tax receivable agreement payments to limited partners and purchases of property and equipment. See non-GAAP free cash flow reconciliation to GAAP equivalent in Appendix. 15

Fiscal 2017 affirmed and updated guidance (for year ending June 30, 2017)

Full-year fiscal 2017 revenue and adjusted EBITDA financial guidance affirmed.

Increasing full year fiscal 2017 guidance range for non-GAAP adjusted fully distributed earnings per share by five cents to $1.76 to $1.87, from the previous range of $1.71 to $1.82.

New range reflects a 9% to 16% increase from the prior year.

$0.05 increase in guidance range due to:

Retirement of approximately 3 million Class B common shares in

connection with partial cash settlement of October 31, 2016 member

share exchange.

Impact of statutory 1% reduction in the North Carolina corporate

income tax rate.

Affirm assumptions underlying initial guidance issued August 22, 2016.

16

Exchange update

On October 31, 2016, approximately 5.0 million Class B units were exchanged in the most recent Class B unit exchange.

Approximately 3.0 million Class B units were exchanged for an aggregate of $100.0 million

Approximately 2.0 million Class B units were exchanged for a like number of Class A shares.

Approximately 5.0 million Class B shares were retired and approximately 2.0 million Class A shares were issued, which reduced our overall outstanding share count.

17

Questions

Appendix

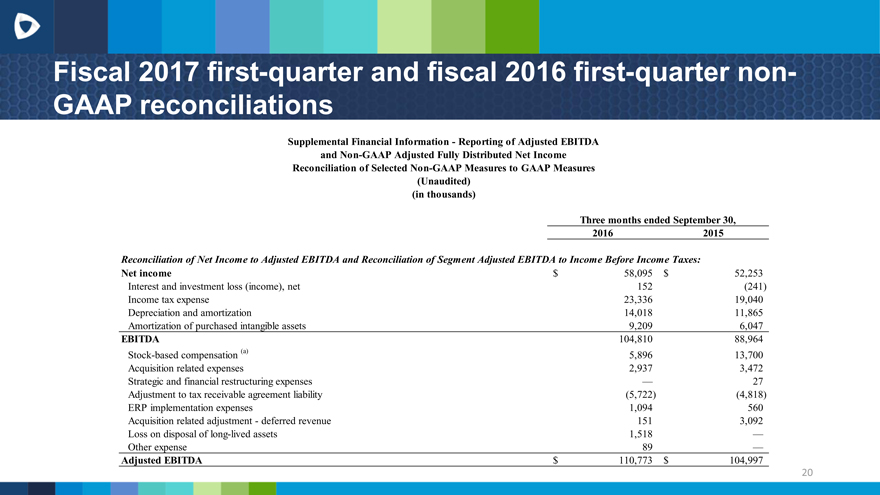

Fiscal 2017 first-quarter and fiscal 2016 first-quarter non-GAAP reconciliations

Supplemental Financial Information—Reporting of Adjusted EBITDA

and Non-GAAP Adjusted Fully Distributed Net Income

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited)

(in thousands)

Three months ended September 30,

2016

2015

Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of Segment Adjusted EBITDA to Income Before Income Taxes:

Net income $ 58,095 $52,253

Interest and investment loss (income), net 152 (241)

Income tax expense 23,336 19,040

Depreciation and amortization 14,018 11,865

Amortization of purchased intangible assets 9,209 6,047

EBITDA 104,810 88,964

Stock-based compensation (a) 5,896 13,700

Acquisition related expenses 2,937 3,472

Strategic and financial restructuring expenses 27

Adjustment to tax receivable agreement liability (5,722) (4,818)

ERP implementation expenses 1,094 560

Acquisition related adjustment—deferred revenue 151 3,092

Loss on disposal of long-lived assets 1,518

Other expense 89

Adjusted EBITDA $ 110,773 $104,997

20

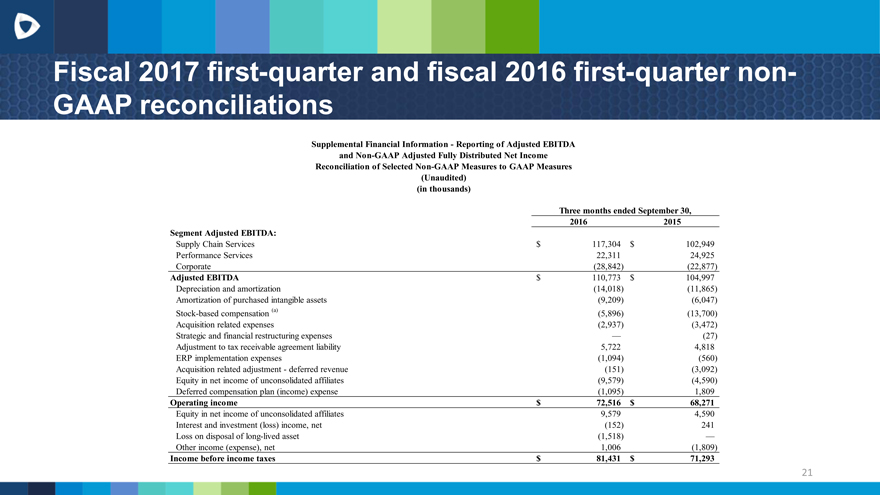

Fiscal 2017 first-quarter and fiscal 2016 first-quarter non-GAAP reconciliations

Supplemental Financial Information—Reporting of Adjusted EBITDA

and Non-GAAP Adjusted Fully Distributed Net Income

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited)

(in thousands)

Three months ended September 30,

2016 2015

Segment Adjusted EBITDA:

Supply Chain Services $117,304$102,949

Performance Services 22,31124,925

Corporate (28,842)(22,877)

Adjusted EBITDA $110,773$104,997

Depreciation and amortization (14,018)(11,865)

Amortization of purchased intangible assets (9,209)(6,047)

Stock-based compensation (a) (5,896)(13,700)

Acquisition related expenses (2,937)(3,472)

Strategic and financial restructuring expenses (27)

Adjustment to tax receivable agreement liability 5,7224,818

ERP implementation expenses (1,094)(560)

Acquisition related adjustment—deferred revenue (151)(3,092)

Equity in net income of unconsolidated affiliates (9,579)(4,590)

Deferred compensation plan (income) expense (1,095)1,809

Operating income $72,516$68,271

Equity in net income of unconsolidated affiliates 9,5794,590

Interest and investment (loss) income, net (152)241

Loss on disposal of long-lived asset (1,518)

Other income (expense), net 1,006(1,809)

Income before income taxes $81,431$71,293

21

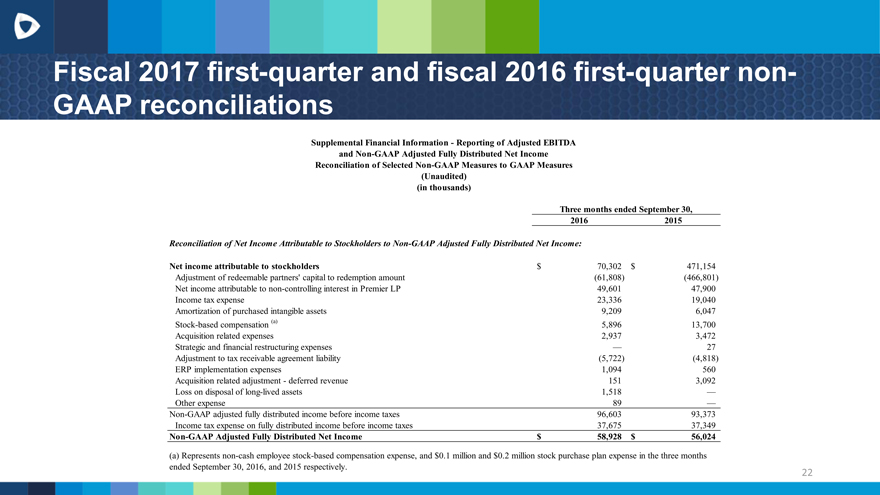

Fiscal 2017 first-quarter and fiscal 2016 first-quarter non-GAAP reconciliations

Supplemental Financial Information—Reporting of Adjusted EBITDA

and Non-GAAP Adjusted Fully Distributed Net Income

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited)

(in thousands)

Three months ended September 30, 2016 2015

Reconciliation of Net Income Attributable to Stockholders to Non-GAAP Adjusted Fully Distributed Net Income:

Net income attributable to stockholders $70,302$471,154

Adjustment of redeemable partners’ capital to redemption amount (61,808)(466,801)

Net income attributable to non-controlling interest in Premier LP 49,60147,900

Income tax expense 23,33619,040

Amortization of purchased intangible assets 9,2096,047

Stock-based compensation (a) 5,89613,700

Acquisition related expenses 2,9373,472

Strategic and financial restructuring expenses 27

Adjustment to tax receivable agreement liability (5,722)(4,818)

ERP implementation expenses 1,094560

Acquisition related adjustment—deferred revenue 1513,092

Loss on disposal of long-lived assets 1,518

Other expense 89

Non-GAAP adjusted fully distributed income before income taxes 96,60393,373

Income tax expense on fully distributed income before income taxes 37,67537,349

Non-GAAP Adjusted Fully Distributed Net Income $58,928$56,024

(a) Represents non-cash employee stock-based compensation expense, and $0.1 million and $0.2 million stock purchase plan expense in the three months

ended September 30, 2016, and 2015 respectively.

22

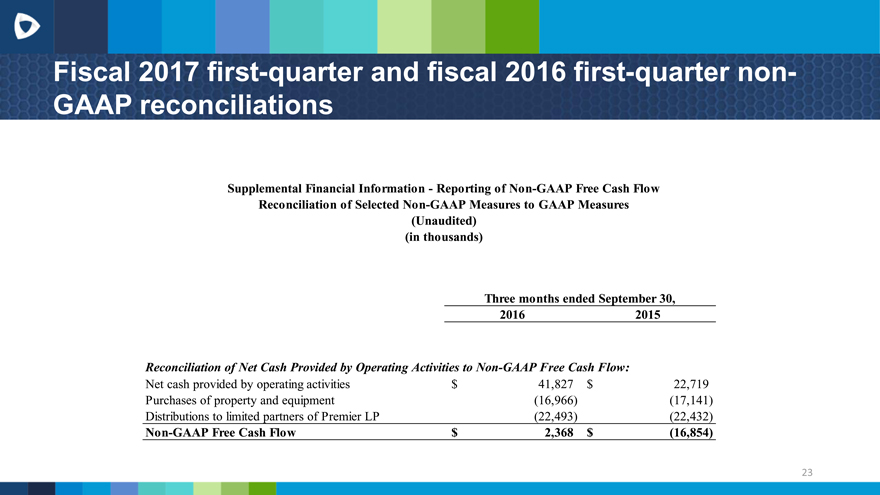

Fiscal 2017 first-quarter and fiscal 2016 first-quarter non-GAAP reconciliations

Supplemental Financial Information—Reporting of Non-GAAP Free Cash Flow Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (in thousands)

Three months ended September 30, 2016 2015

Reconciliation of Net Cash Provided by Operating Activities to Non-GAAP Free Cash Flow:

Net cash provided by operating activities $41,827$22,719

Purchases of property and equipment (16,966)(17,141)

Distributions to limited partners of Premier LP (22,493)(22,432)

Non-GAAP Free Cash Flow $2,368$(16,854)

23

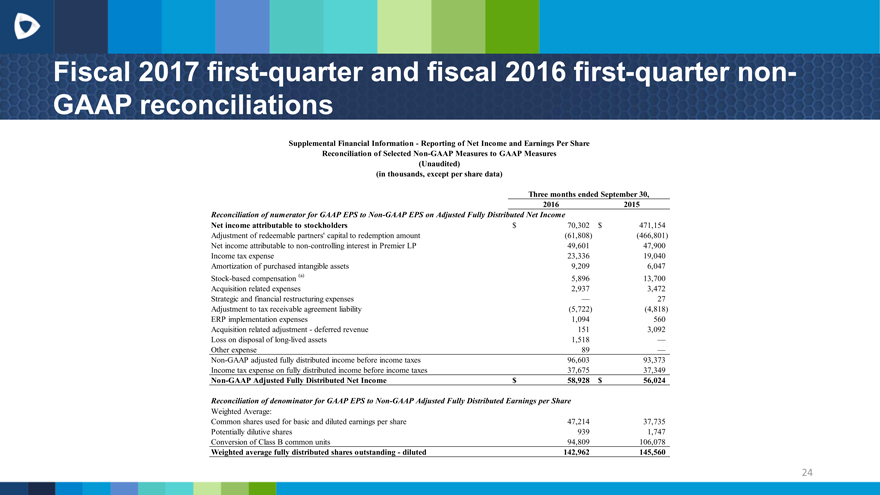

Fiscal 2017 first-quarter and fiscal 2016 first-quarter non-GAAP reconciliations

Supplemental Financial Information—Reporting of Net Income and Earnings Per Share

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited)

(in thousands, except per share data)

Three months ended September 30,

2016 2015

Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Adjusted Fully Distributed Net Income

Net income attributable to stockholders $70,302$471,154

Adjustment of redeemable partners’ capital to redemption amount (61,808)(466,801)

Net income attributable to non-controlling interest in Premier LP 49,60147,900

Income tax expense 23,33619,040

Amortization of purchased intangible assets 9,2096,047

Stock-based compensation (a) 5,89613,700

Acquisition related expenses 2,9373,472

Strategic and financial restructuring expenses 27

Adjustment to tax receivable agreement liability (5,722)(4,818)

ERP implementation expenses 1,094560

Acquisition related adjustment—deferred revenue 1513,092

Loss on disposal of long-lived assets 1,518

Other expense 89

Non-GAAP adjusted fully distributed income before income taxes 96,60393,373

Income tax expense on fully distributed income before income taxes 37,67537,349

Non-GAAP Adjusted Fully Distributed Net Income $58,928$56,024

Reconciliation of denominator for GAAP EPS to Non-GAAP Adjusted Fully Distributed Earnings per Share

Weighted Average:

Common shares used for basic and diluted earnings per share 47,21437,735

Potentially dilutive shares 9391,747

Conversion of Class B common units 94,809106,078

Weighted average fully distributed shares outstanding—diluted 142,962145,560

24

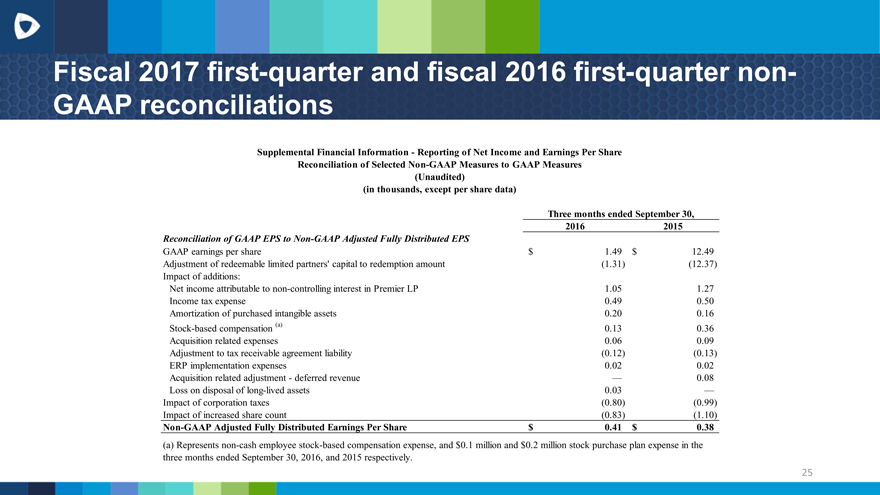

Fiscal 2017 first-quarter and fiscal 2016 first-quarter non-GAAP reconciliations

Supplemental Financial Information—Reporting of Net Income and Earnings Per Share

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited)

(in thousands, except per share data)

Three months ended September 30,

2016 2015

Reconciliation of GAAP EPS to Non-GAAP Adjusted Fully Distributed EPS

GAAP earnings per share $1.49$12.49

Adjustment of redeemable limited partners’ capital to redemption amount (1.31)(12.37)

Impact of additions:

Net income attributable to non-controlling interest in Premier LP 1.051.27

Income tax expense 0.490.50

Amortization of purchased intangible assets 0.200.16

Stock-based compensation (a) 0.130.36

Acquisition related expenses 0.060.09

Adjustment to tax receivable agreement liability (0.12)(0.13)

ERP implementation expenses 0.020.02

Acquisition related adjustment—deferred revenue 0.08

Loss on disposal of long-lived assets 0.03

Impact of corporation taxes (0.80)(0.99)

Impact of increased share count (0.83)(1.10)

Non-GAAP Adjusted Fully Distributed Earnings Per Share $0.41$0.38

(a) Represents non-cash employee stock-based compensation expense, and $0.1 million and $0.2 million stock purchase plan expense in the three months ended September 30, 2016, and 2015 respectively.

25