UNIQUELY POSITIONED FOR THE FUTURE May 24, 2017 2017 INVESTOR DAY Exhibit 99.1

NASDAQ: PINC Market Capitalization: ~$4.8B (as of May 19, 2017) Founded: 1996 Publicly-traded: Since 2013 HQ: Charlotte, NC Employees: 2,100 We conduct sales through our embedded field force, our national sales team, and our consulting advisors, collectively comprised of approximately 620 employees [1] Leadership team with over 250 years of combined healthcare experience [1] As of June 30, 2016

Vice President, Investor Relations Premier Inc. Jim Storey

Forward-looking statements and non-GAAP financial measures

Strategic & Operations Review PANEL 1: Increasing Pressure to Manage Costs PANEL 2: Consolidation and Price Pressures in the Pharmaceutical and Device Markets PANEL 3: Physician Alignment Strategies PANEL 4: The Evolution of Value-Based Care and Payment Models Financial Review & Outlook OUR AGENDA

President and Chief Executive Officer Premier Inc. Susan DeVore STRATEGIC REVIEW

GPO CONTRACT RENEWAL PROCESS FY18 PRELIMINARY FINANCIAL OUTLOOK POLITICAL & REGULATORY IMPACT ON OUR BUSINESS AND OUR MEMBERS CAPITAL DEPLOYMENT STRATEGY & RETURN ON INVESTED CAPITAL INTEGRATED PHARMACY STRATEGY TOPICS OF INTEREST

FOR THE FUTURE UNIQUELY POSITIONED

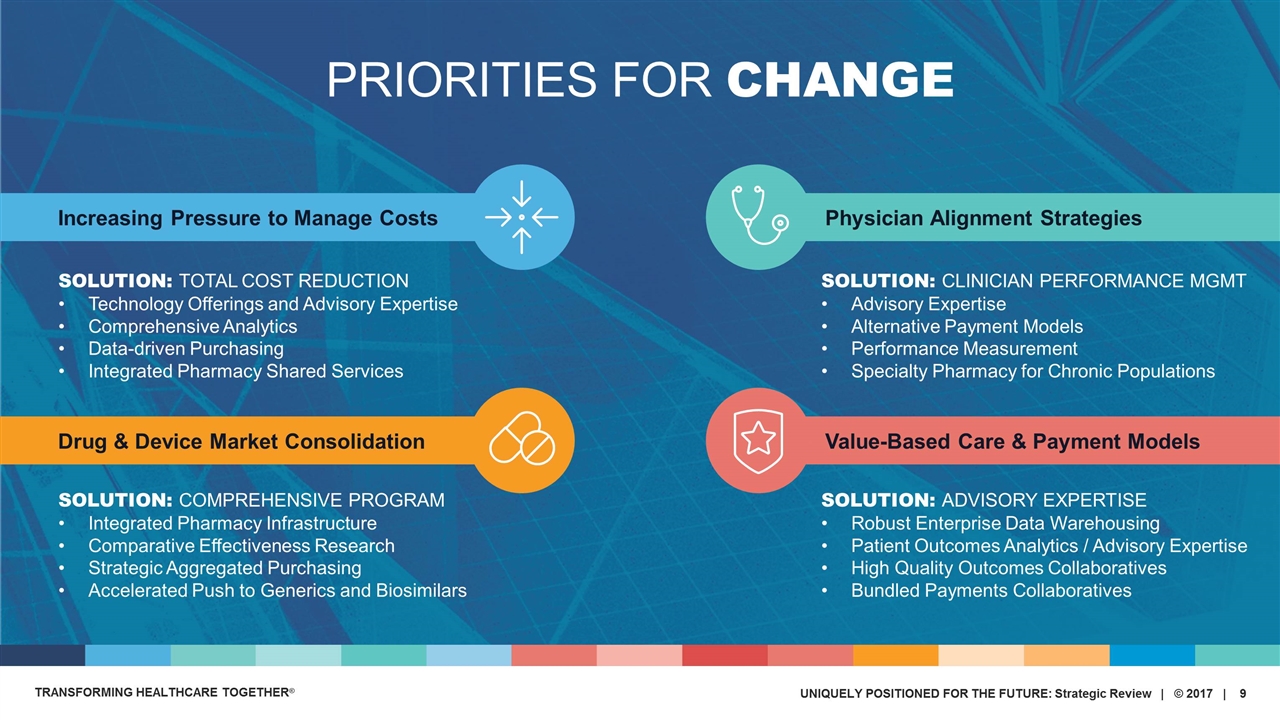

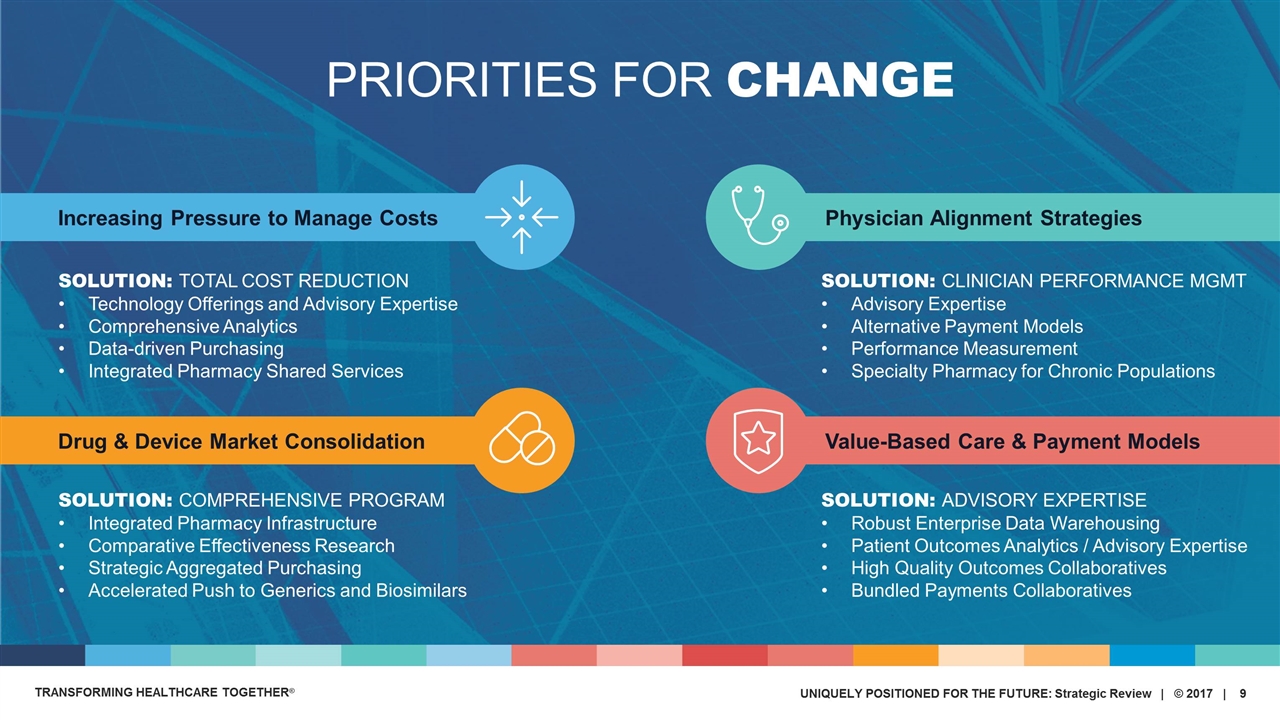

Increasing Pressure to Manage Costs SOLUTION: TOTAL COST REDUCTION Technology Offerings and Advisory Expertise Comprehensive Analytics Data-driven Purchasing Integrated Pharmacy Shared Services Drug & Device Market Consolidation SOLUTION: COMPREHENSIVE PROGRAM Integrated Pharmacy Infrastructure Comparative Effectiveness Research Strategic Aggregated Purchasing Accelerated Push to Generics and Biosimilars Physician Alignment Strategies SOLUTION: CLINICIAN PERFORMANCE MGMT Advisory Expertise Alternative Payment Models Performance Measurement Specialty Pharmacy for Chronic Populations Value-Based Care & Payment Models SOLUTION: ADVISORY EXPERTISE Robust Enterprise Data Warehousing Patient Outcomes Analytics / Advisory Expertise High Quality Outcomes Collaboratives Bundled Payments Collaboratives PRIORITIES FOR CHANGE

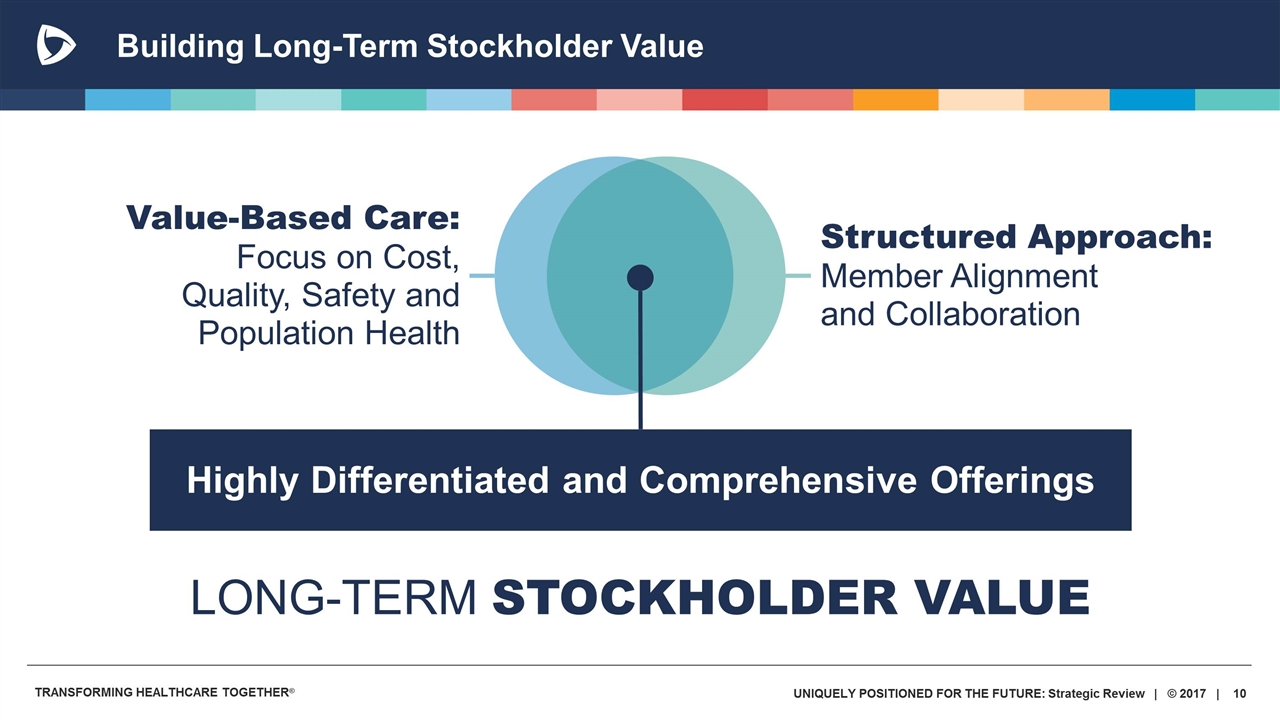

Building Long-Term Stockholder Value Value-Based Care: Focus on Cost, Quality, Safety and Population Health Structured Approach: Member Alignment and Collaboration Highly Differentiated and Comprehensive Offerings LONG-TERM STOCKHOLDER VALUE

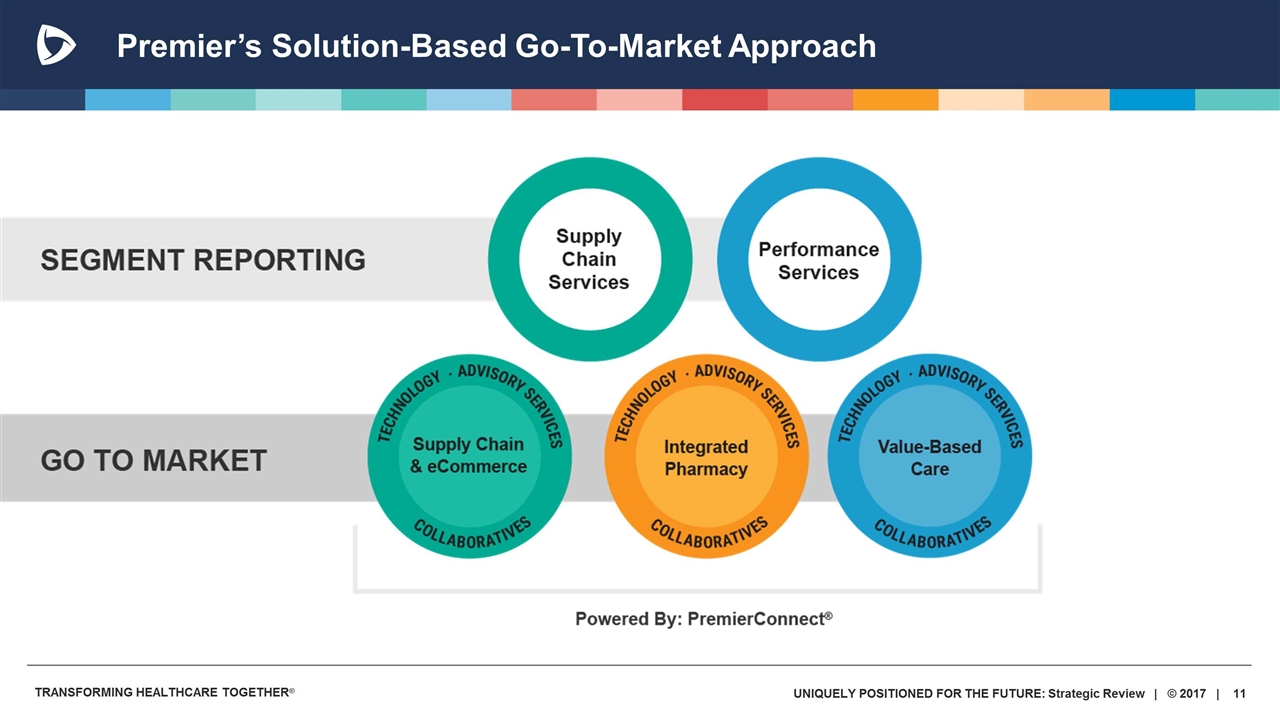

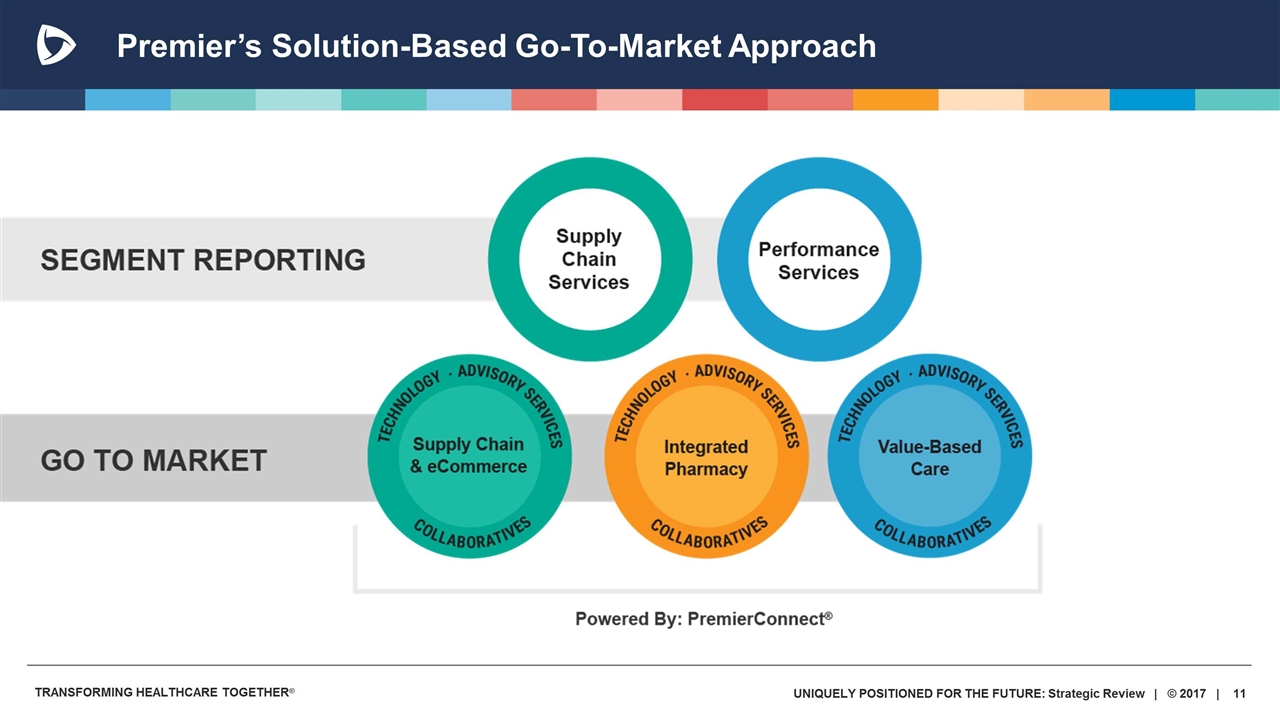

Premier’s Solution-Based Go-To-Market Approach

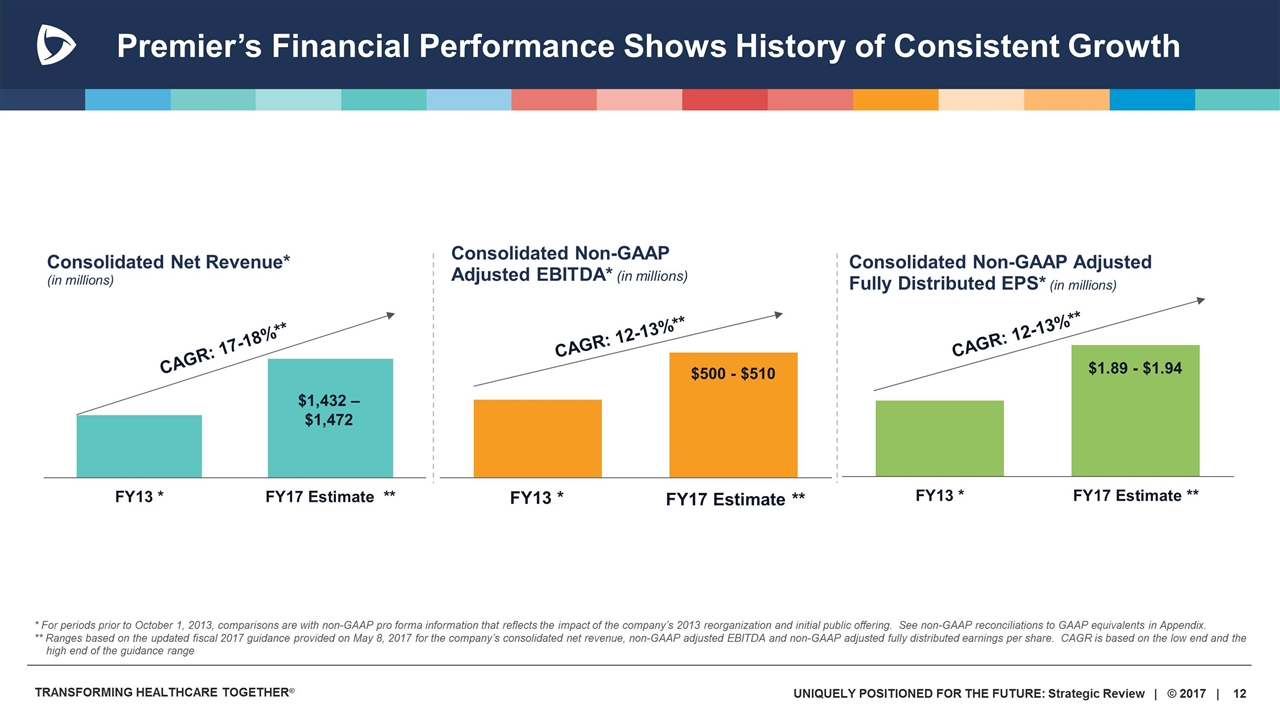

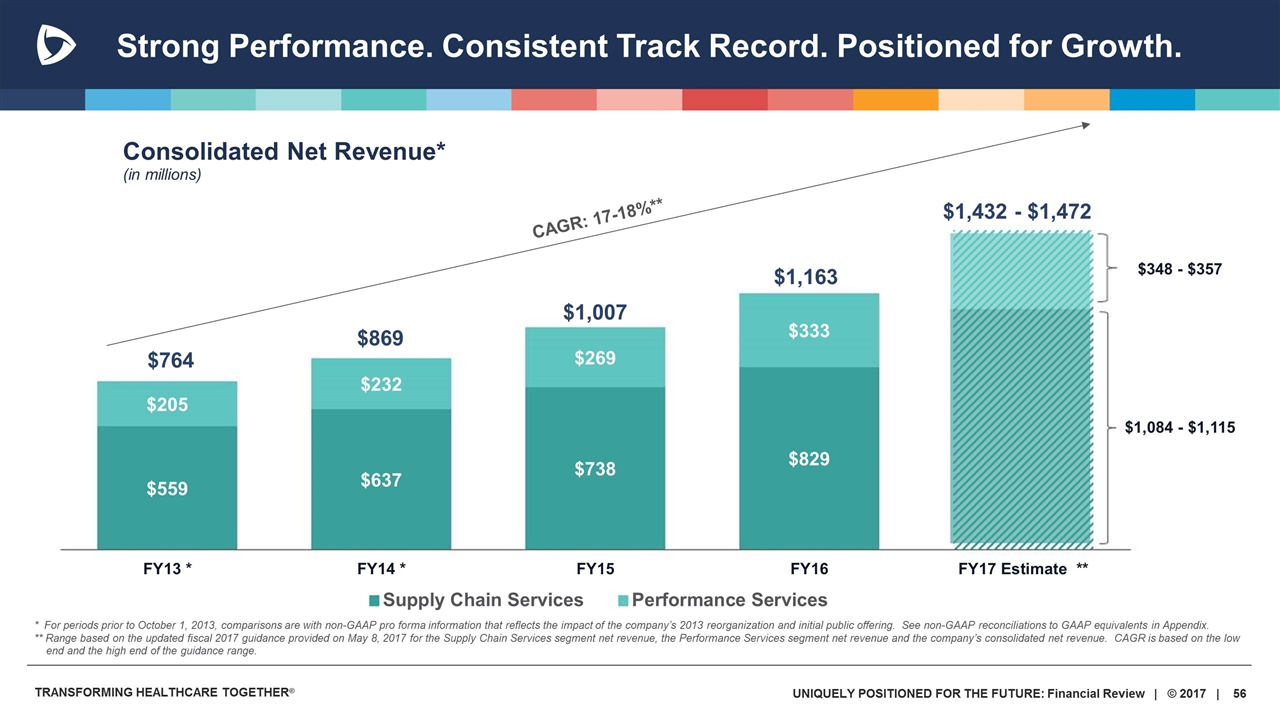

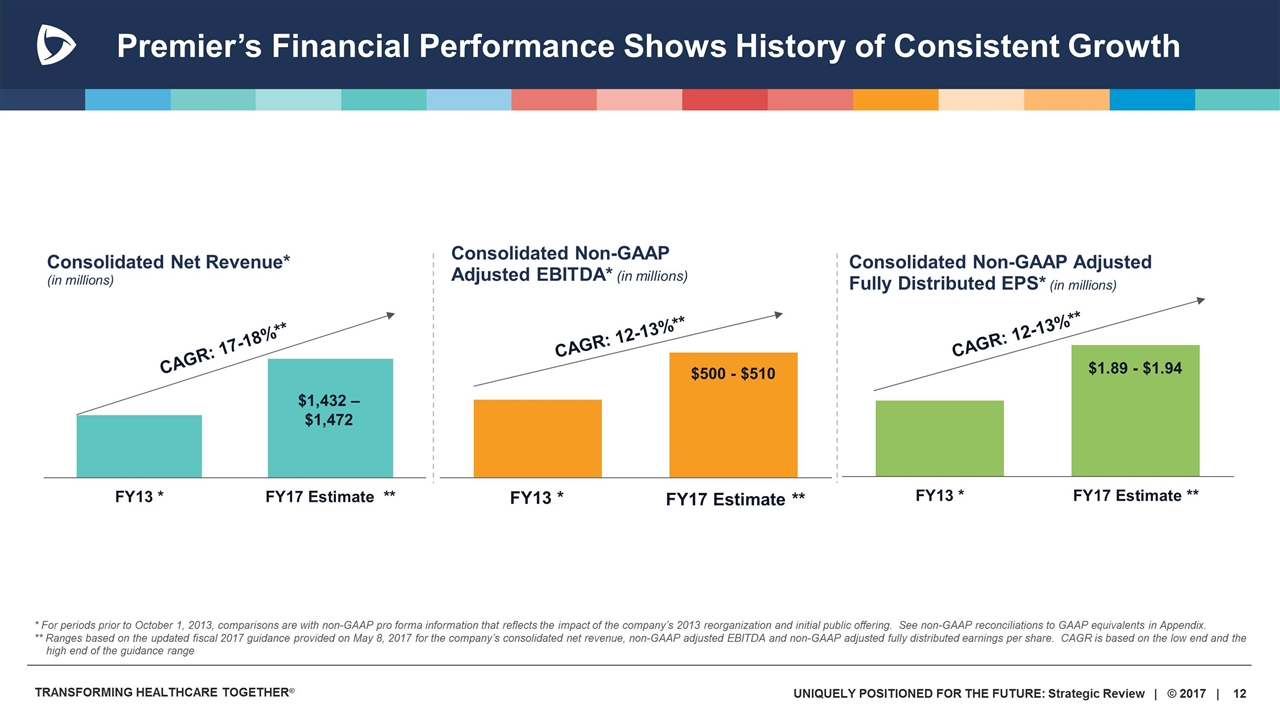

Premier’s Financial Performance Shows History of Consistent Growth * For periods prior to October 1, 2013, comparisons are with non-GAAP pro forma information that reflects the impact of the company’s 2013 reorganization and initial public offering. See non-GAAP reconciliations to GAAP equivalents in Appendix. ** Ranges based on the updated fiscal 2017 guidance provided on May 8, 2017 for the company’s consolidated net revenue, non-GAAP adjusted EBITDA and non-GAAP adjusted fully distributed earnings per share. CAGR is based on the low end and the high end of the guidance range $1,432 – $1,472 CAGR: 17-18%** $500 - $510 CAGR: 12-13%** $1.89 - $1.94 CAGR: 12-13%**

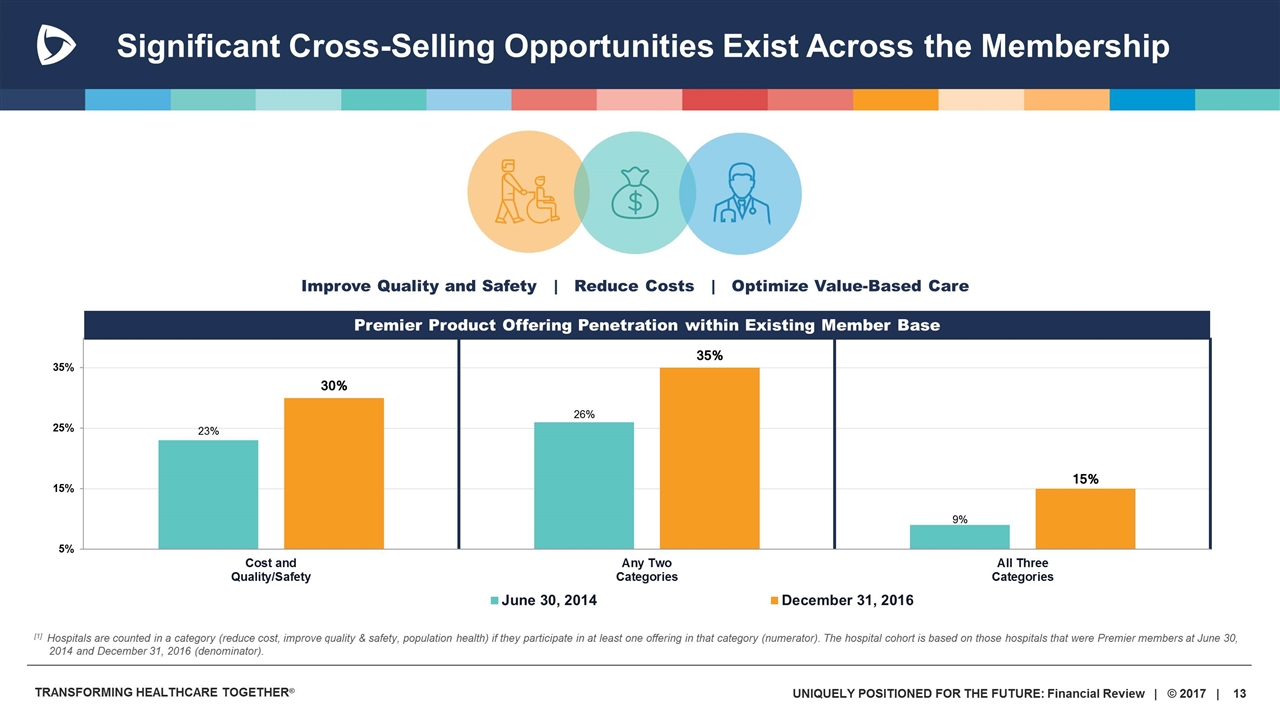

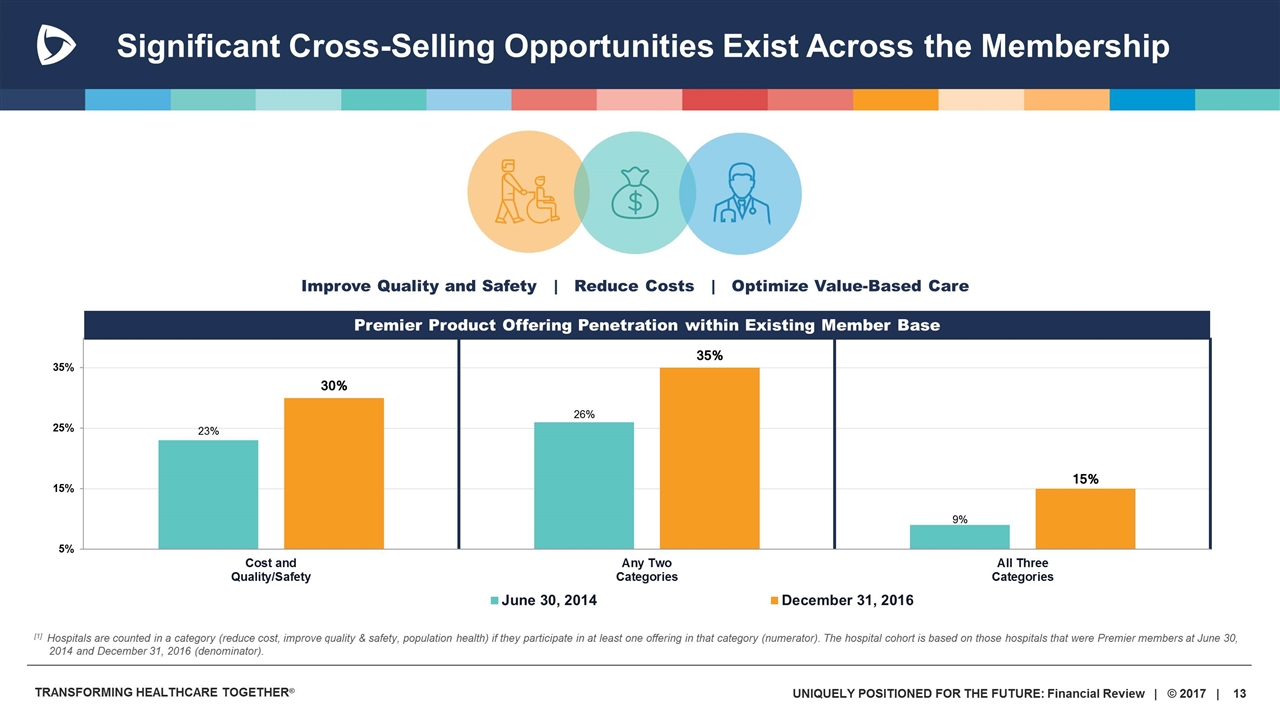

Significant Cross-Selling Opportunities Exist Across the Membership Improve Quality and Safety | Reduce Costs | Optimize Value-Based Care Premier Product Offering Penetration within Existing Member Base [1] Hospitals are counted in a category (reduce cost, improve quality & safety, population health) if they participate in at least one offering in that category (numerator). The hospital cohort is based on those hospitals that were Premier members at June 30, 2014 and December 31, 2016 (denominator).

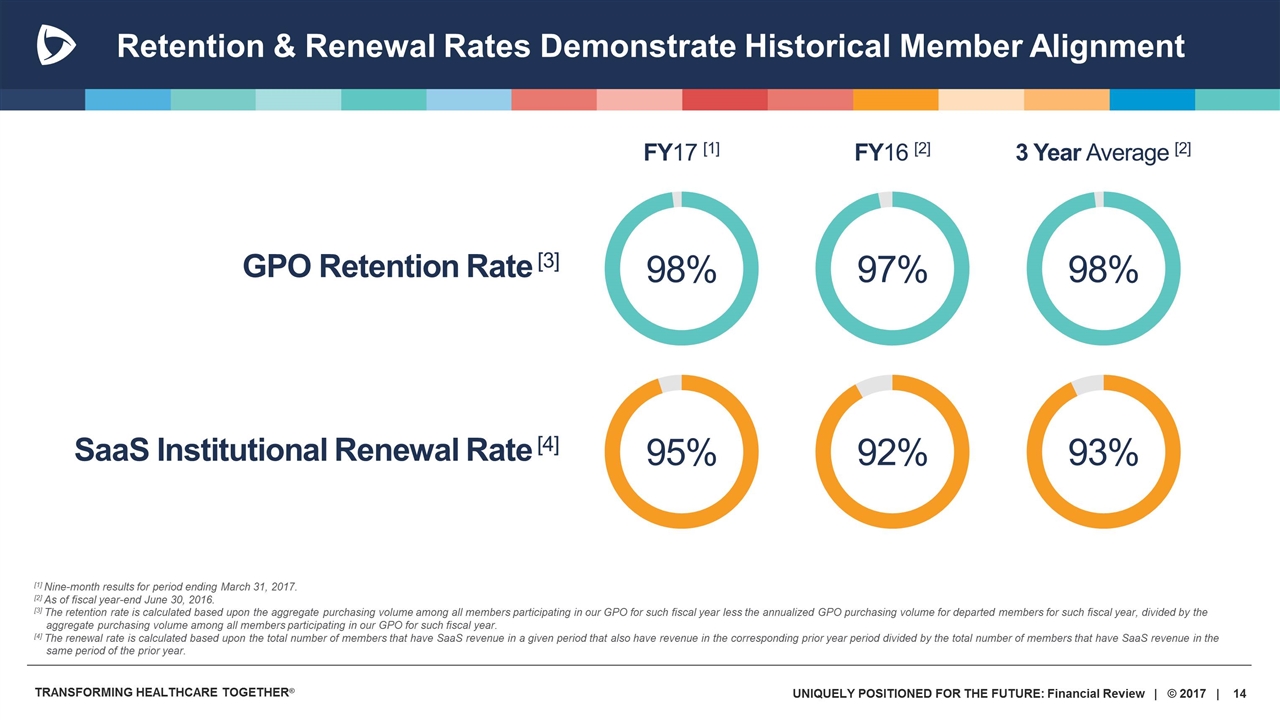

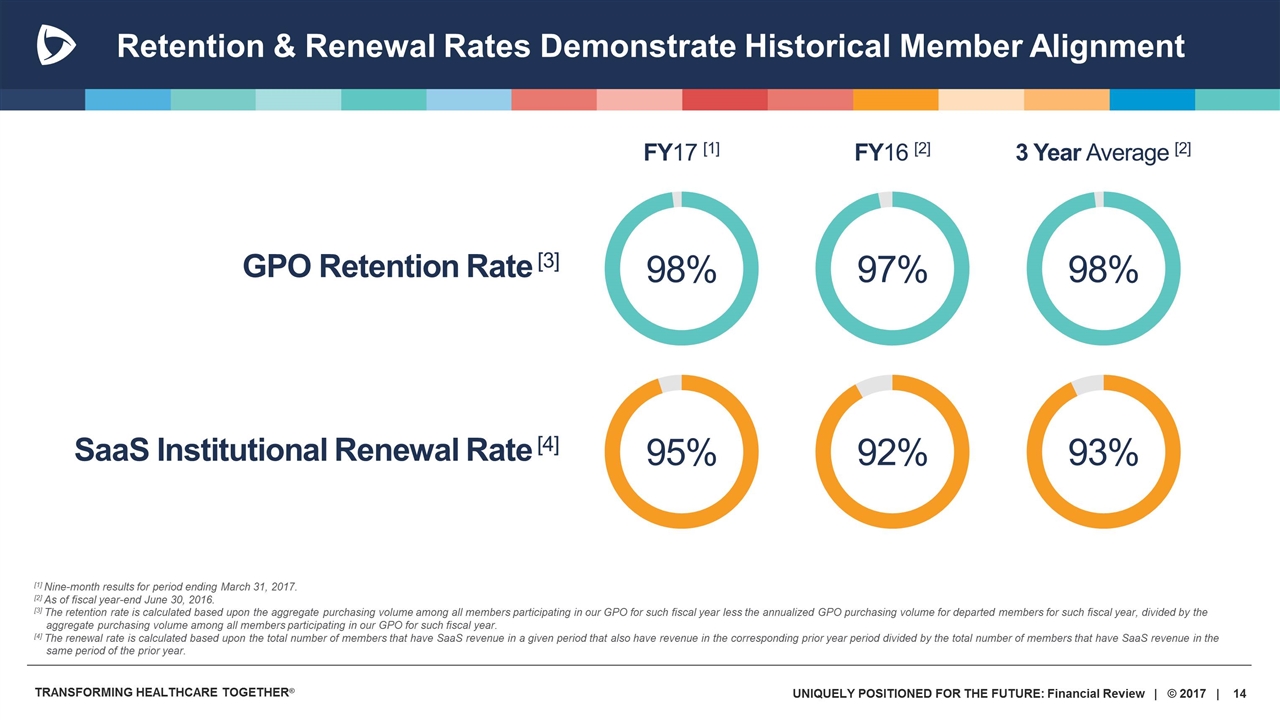

Retention & Renewal Rates Demonstrate Historical Member Alignment [1] Nine-month results for period ending March 31, 2017. [2] As of fiscal year-end June 30, 2016. [3] The retention rate is calculated based upon the aggregate purchasing volume among all members participating in our GPO for such fiscal year less the annualized GPO purchasing volume for departed members for such fiscal year, divided by the aggregate purchasing volume among all members participating in our GPO for such fiscal year. [4] The renewal rate is calculated based upon the total number of members that have SaaS revenue in a given period that also have revenue in the corresponding prior year period divided by the total number of members that have SaaS revenue in the same period of the prior year. FY17 [1] 98% FY16 [2] 97% 3 Year Average [2] 98% 95% 92% 93% GPO Retention Rate [3] SaaS Institutional Renewal Rate [4]

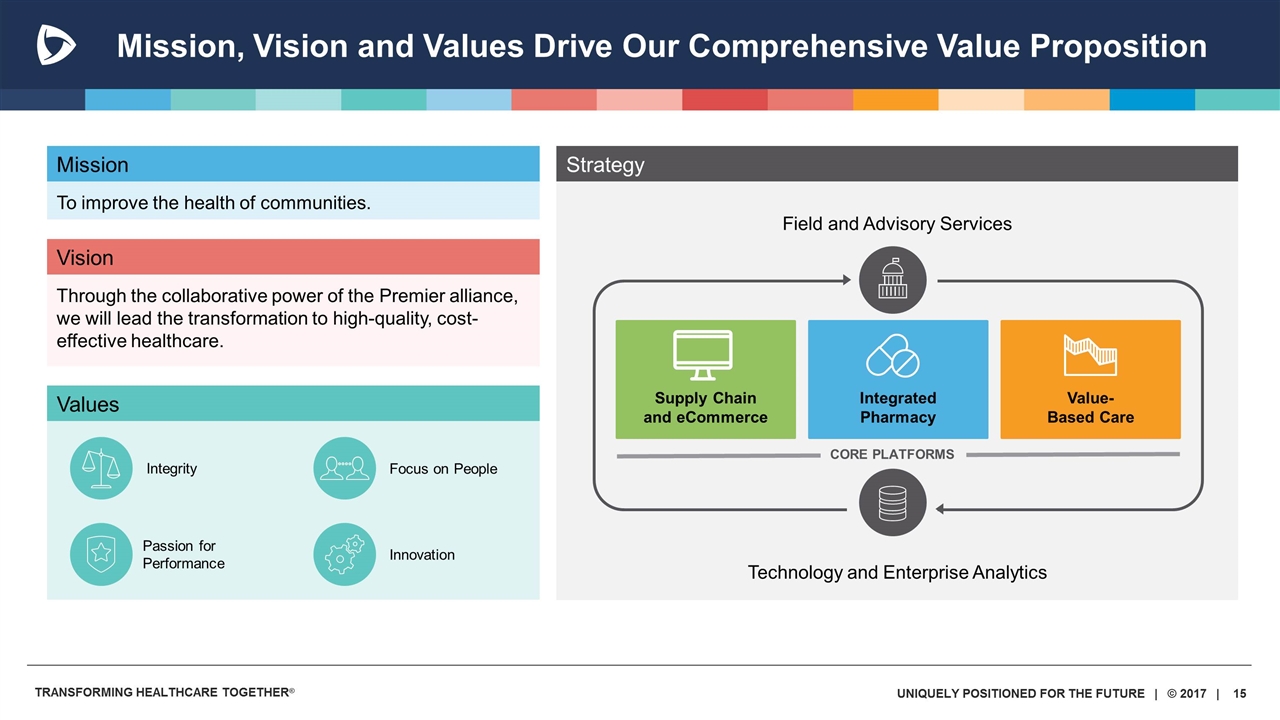

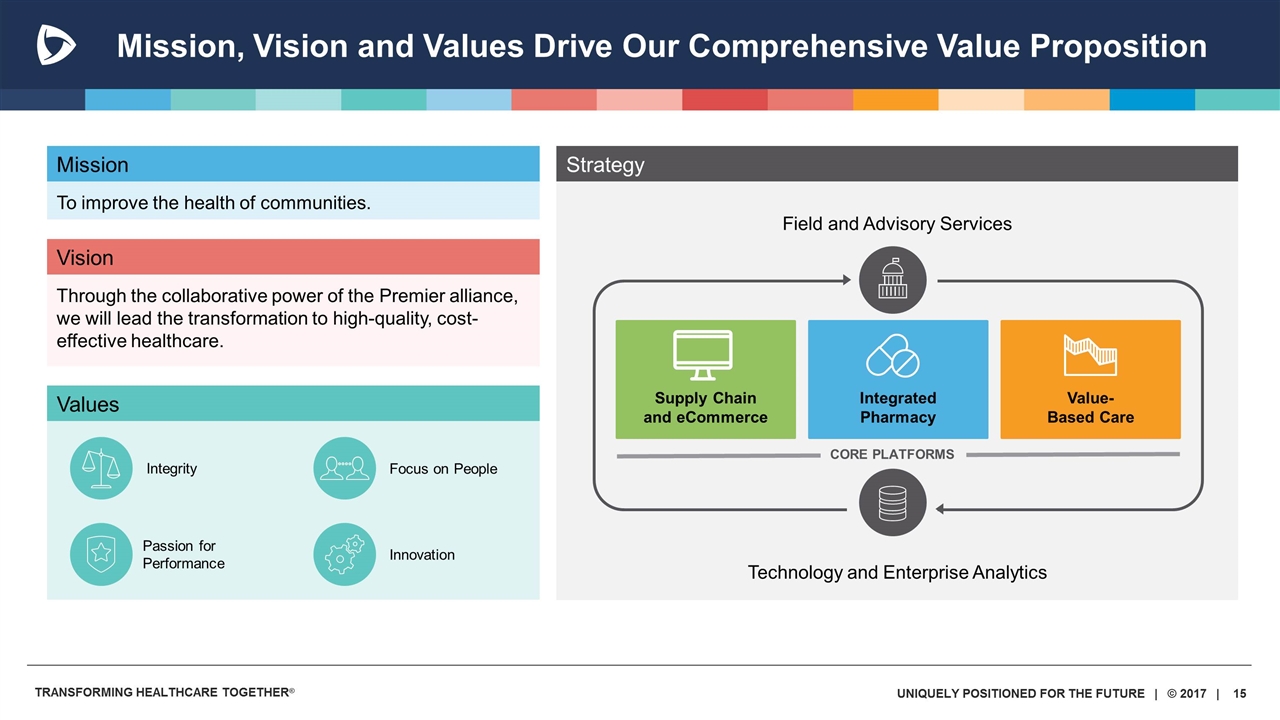

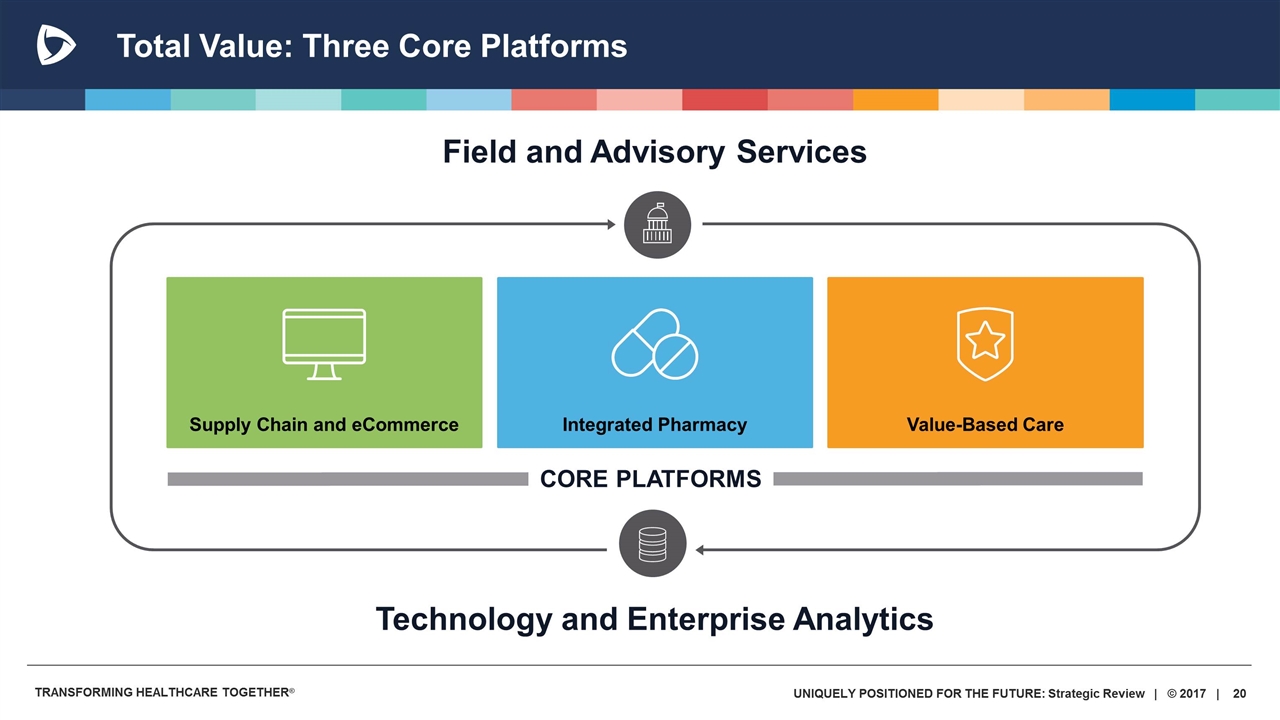

Mission, Vision and Values Drive Our Comprehensive Value Proposition Mission To improve the health of communities. Vision Through the collaborative power of the Premier alliance, we will lead the transformation to high-quality, cost-effective healthcare. Values Technology and Enterprise Analytics Field and Advisory Services Integrated Pharmacy Value- Based Care Supply Chain and eCommerce Focus on People Passion for Performance Innovation Integrity Strategy CORE PLATFORMS

Chief Financial Officer University Hospital Health System (Cleveland, OH) Mike Szubski STRATEGIC REVIEW

TOTAL VALUE PROPOSITION UNIQUELY POSITIONED FOR THE FUTURE Data-Based Analytics | Advisory Services | Supply Chain Capabilities

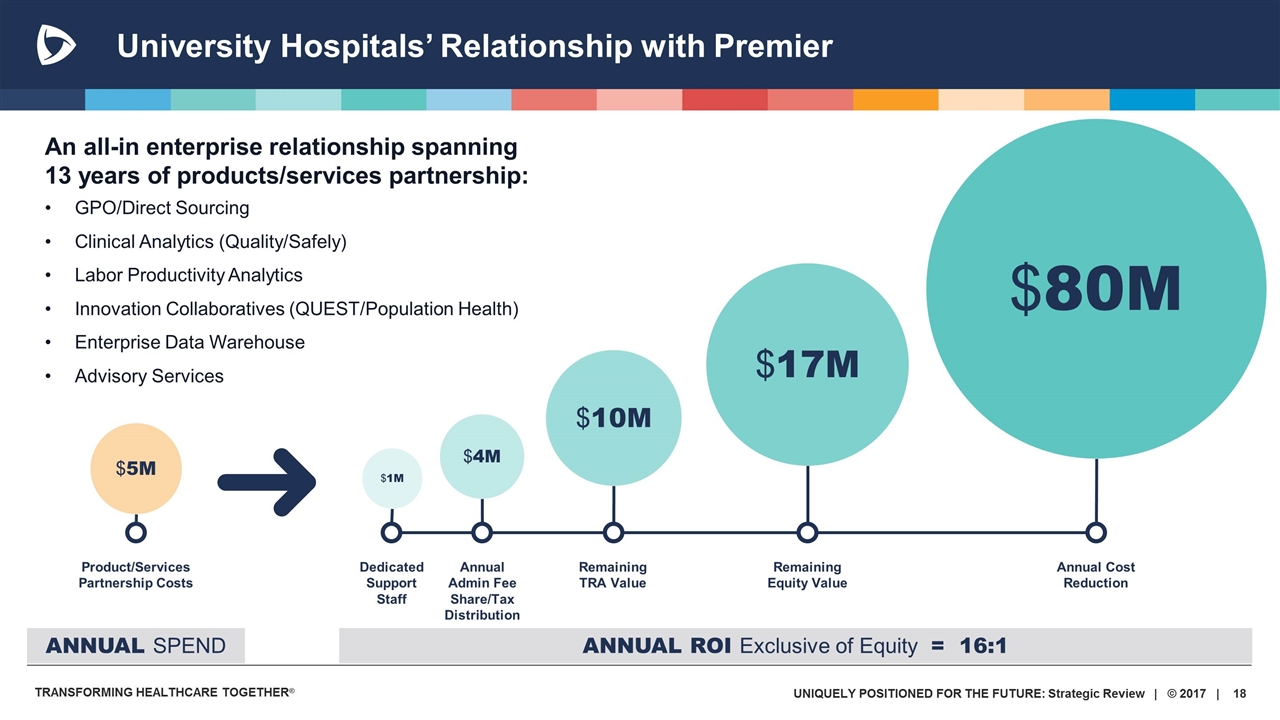

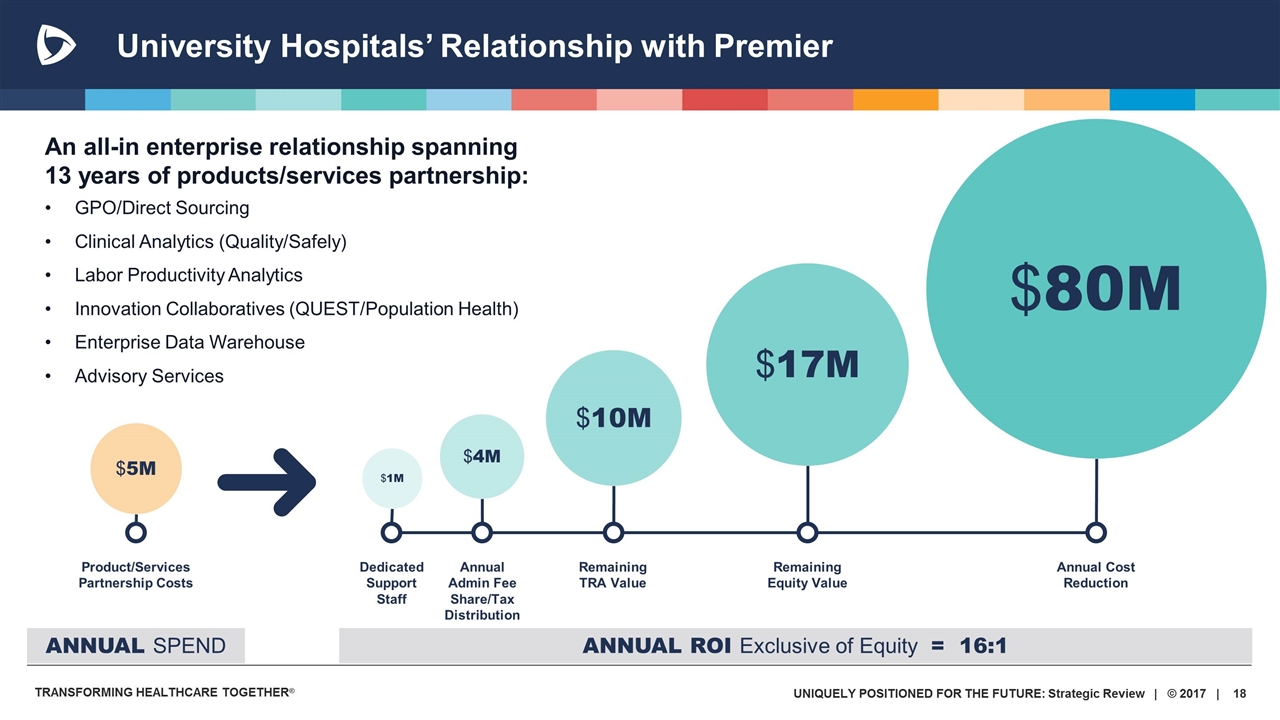

An all-in enterprise relationship spanning 13 years of products/services partnership: GPO/Direct Sourcing Clinical Analytics (Quality/Safely) Labor Productivity Analytics Innovation Collaboratives (QUEST/Population Health) Enterprise Data Warehouse Advisory Services University Hospitals’ Relationship with Premier $1M $4M $10M $17M $80M Dedicated Support Staff Annual Admin Fee Share/Tax Distribution Remaining TRA Value Remaining Equity Value Annual Cost Reduction ANNUAL ROI Exclusive of Equity = 16:1 $5M ANNUAL SPEND Product/Services Partnership Costs

Chief Operating Officer Premier Inc. Mike Alkire OPERATIONS REVIEW

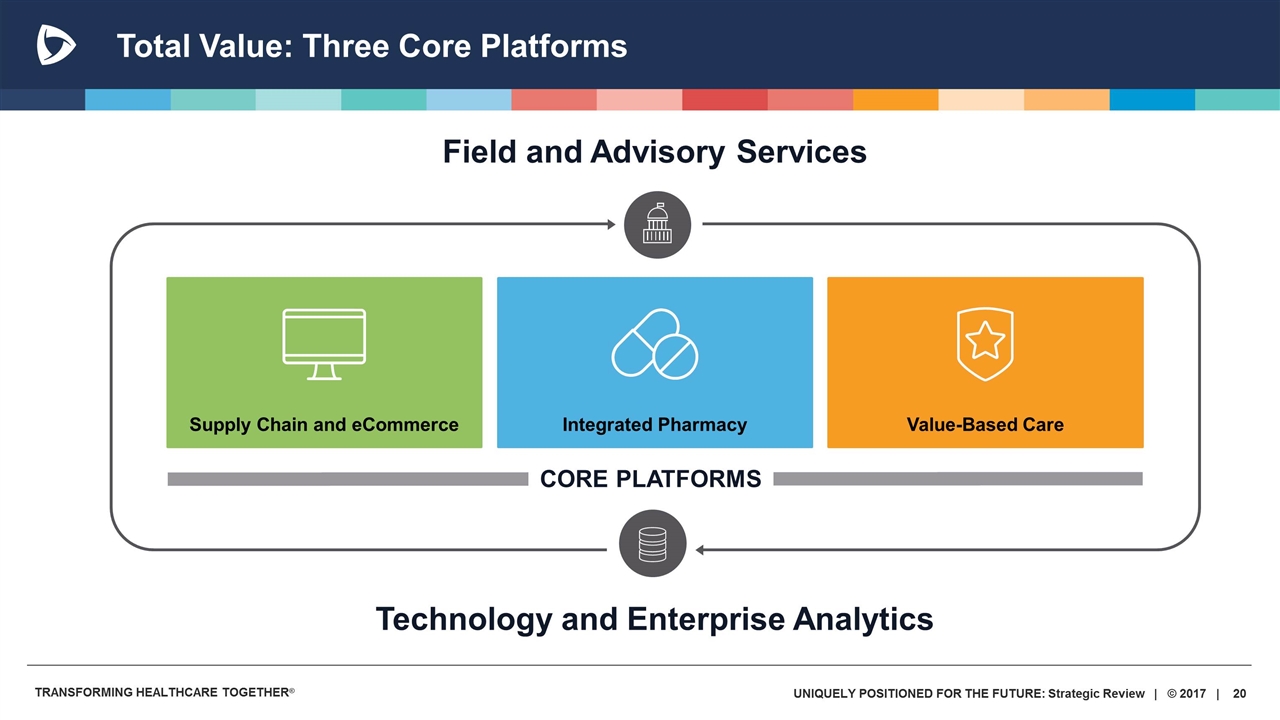

Total Value: Three Core Platforms Technology and Enterprise Analytics Field and Advisory Services Integrated Pharmacy Value-Based Care Supply Chain and eCommerce CORE PLATFORMS

Core Platform Growth and Evolution Since IPO Grew annual GPO purchasing volume 25% to $50B since IPO Increased member owner participation in Direct Sourcing to more than 87% Implemented PremierConnect Supply Chain Analytics at more than 1,800 hospitals Earned top designation from KLAS for Enterprise Resource Planning (ERP) Software Expanded specialty pharmacy to 55 members, representing approximately 320 hospitals Acquired Acro Pharmaceutical Services in Fiscal 2017, adding 11 new limited distribution drugs, including those to treat oncology, multiple sclerosis and Idiopathic Pulmonary Fibrosis Earned top designation from KLAS for Management Consulting and Value-Based Care Consulting Launched Clinician Performance Management to support regulatory reporting for physicians across continuum Launched Service Line Analytics to surface opportunities by integrating cost and quality data SUPPLY CHAIN & eCOMMERCE INTEGRATED PHARMACY VALUE-BASED CARE

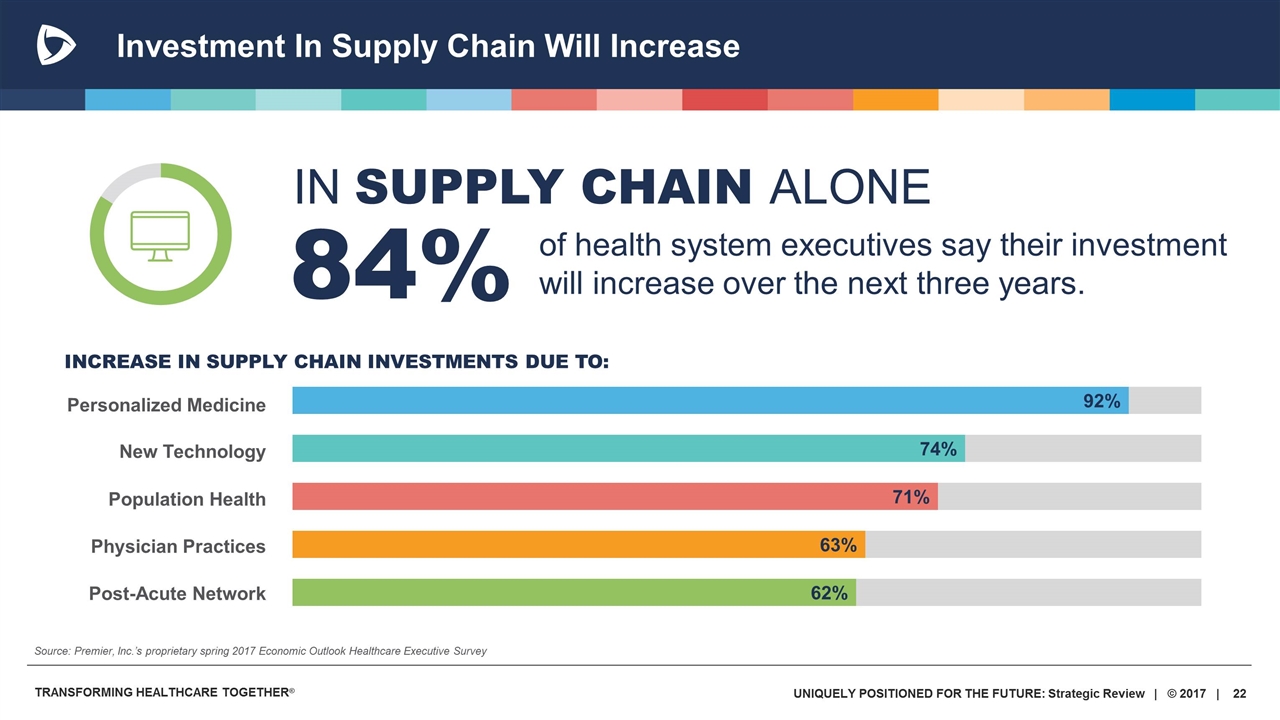

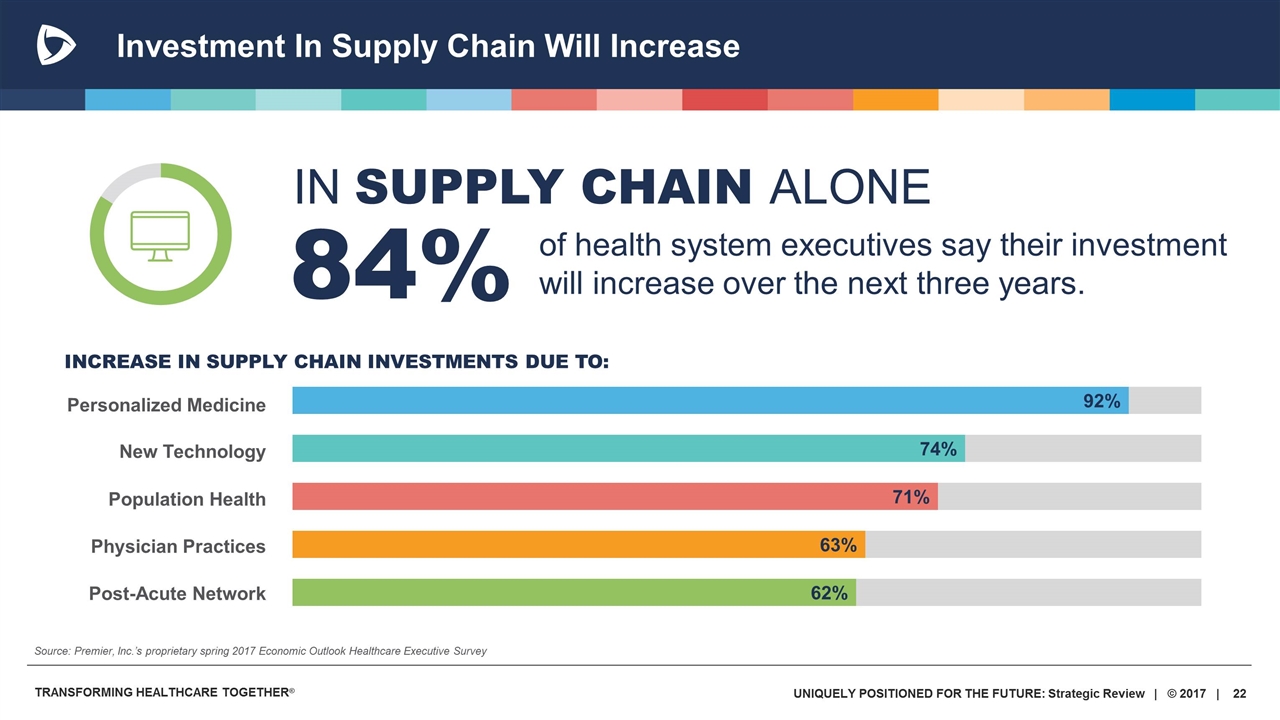

Investment In Supply Chain Will Increase Source: Premier, Inc.’s proprietary spring 2017 Economic Outlook Healthcare Executive Survey 84% of health system executives say their investment will increase over the next three years. IN SUPPLY CHAIN ALONE New Technology Population Health Physician Practices Post-Acute Network Personalized Medicine INCREASE IN SUPPLY CHAIN INVESTMENTS DUE TO:

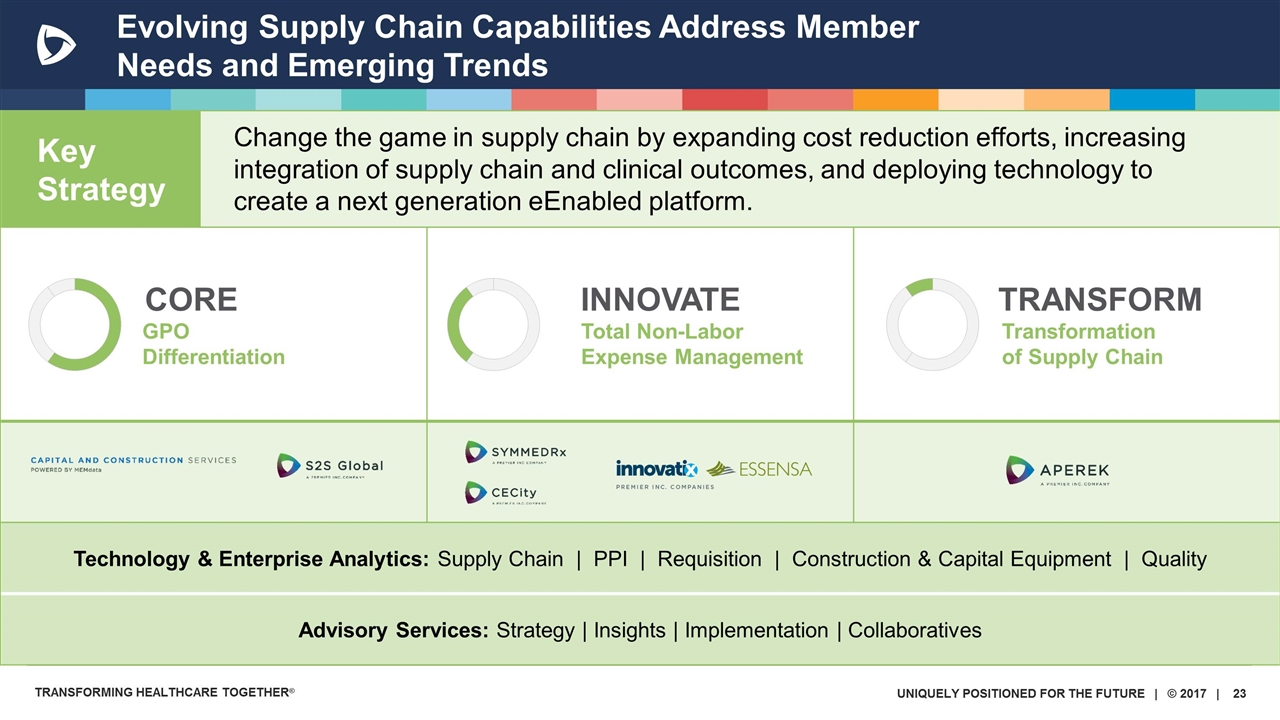

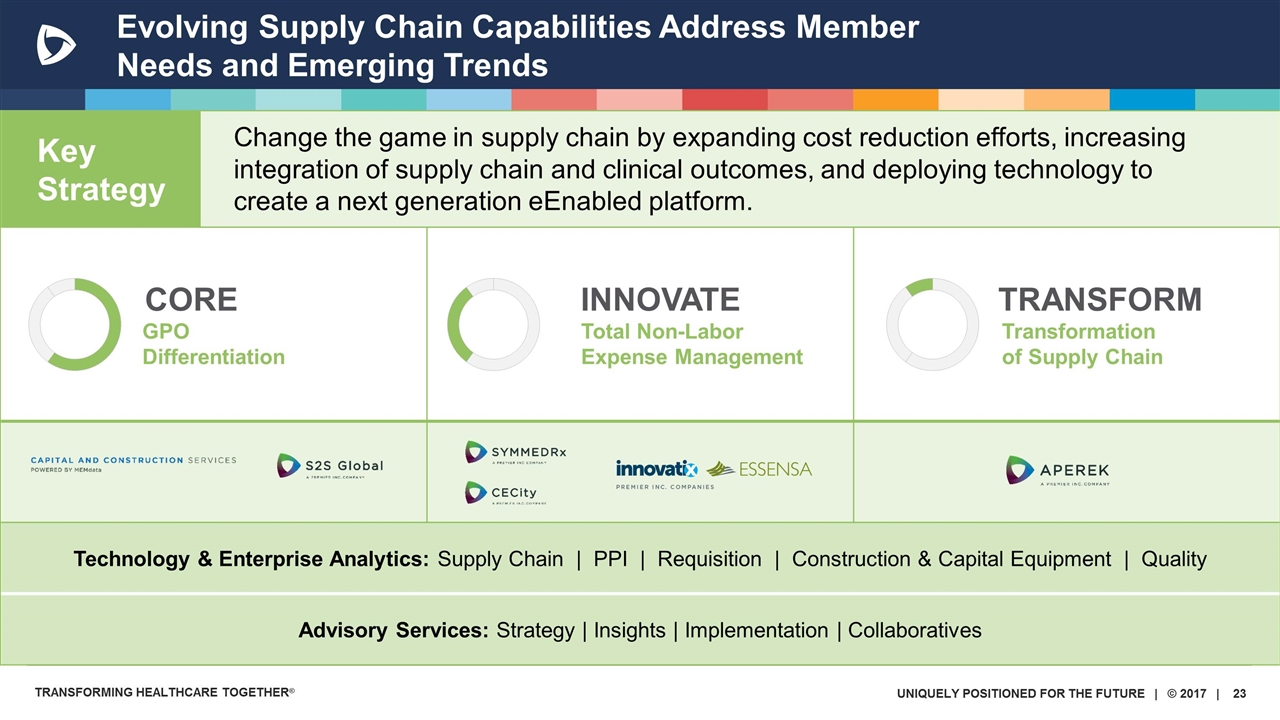

CORE GPO Differentiation INNOVATE Total Non-Labor Expense Management TRANSFORM Transformation of Supply Chain Technology & Enterprise Analytics: Supply Chain | PPI | Requisition | Construction & Capital Equipment | Quality Advisory Services: Strategy | Insights | Implementation | Collaboratives Key Strategy Change the game in supply chain by expanding cost reduction efforts, increasing integration of supply chain and clinical outcomes, and deploying technology to create a next generation eEnabled platform. Evolving Supply Chain Capabilities Address Member Needs and Emerging Trends

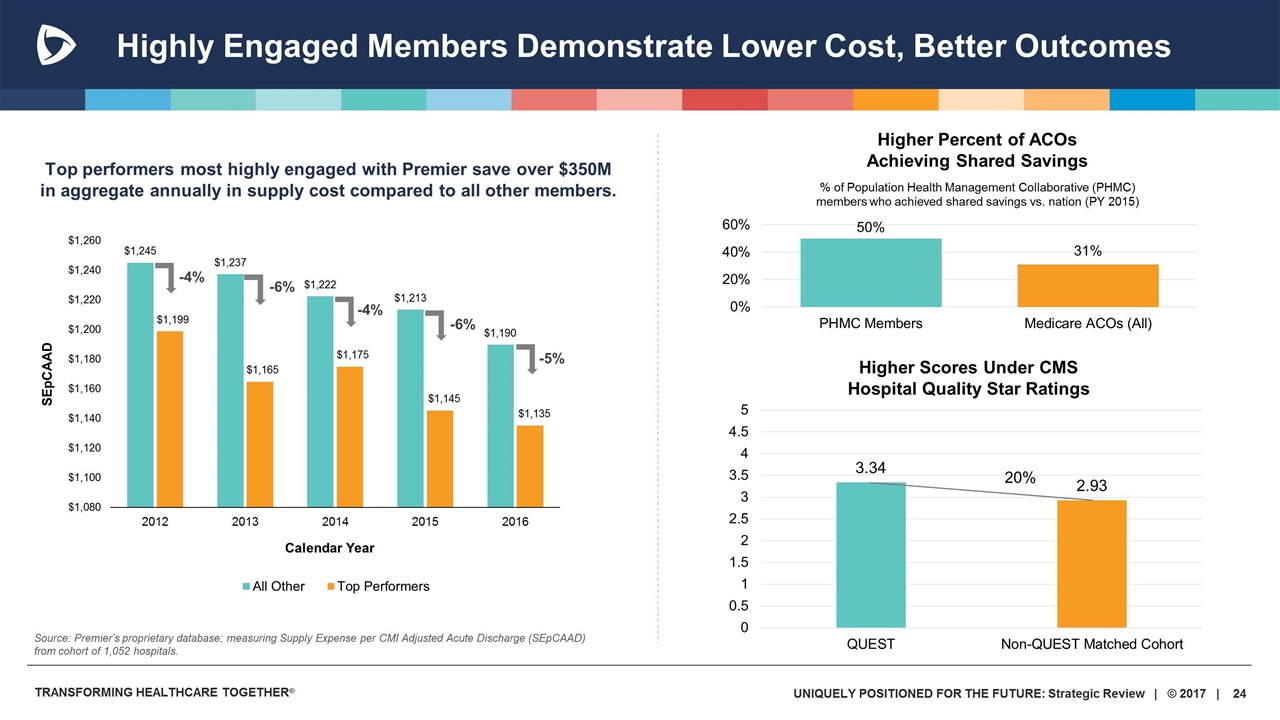

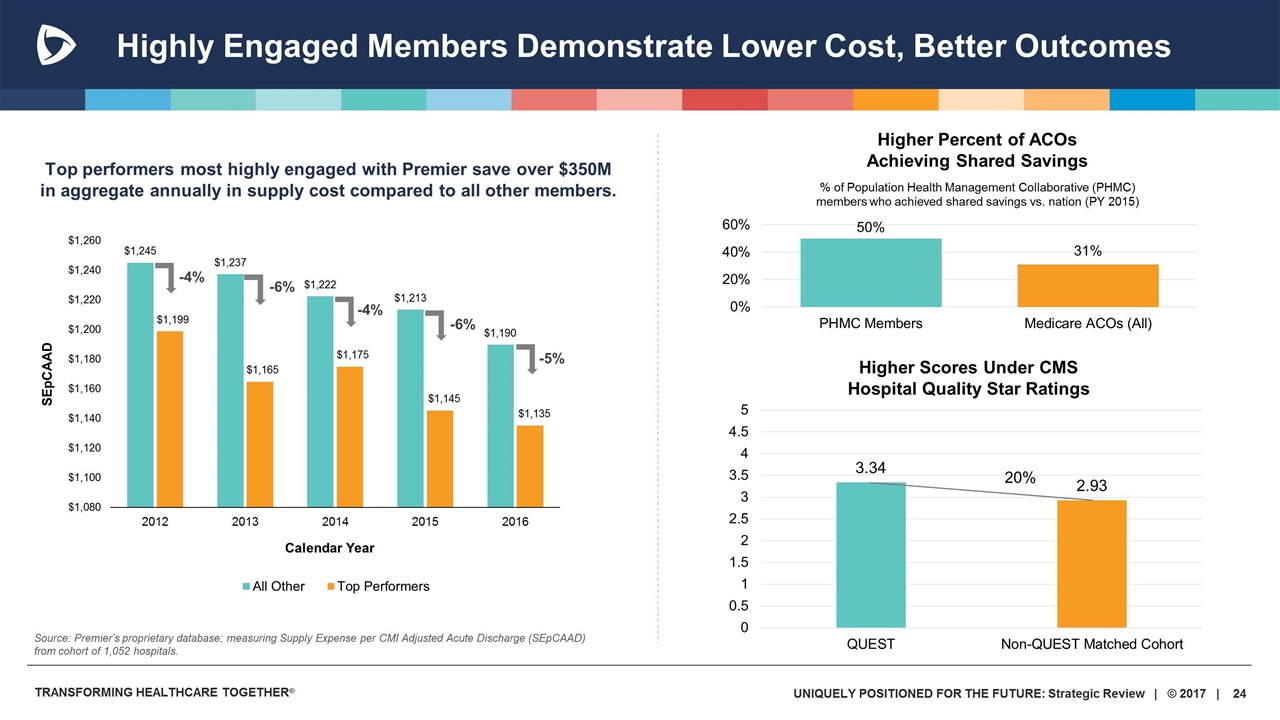

Highly Engaged Members Demonstrate Lower Cost, Better Outcomes Top performers most highly engaged with Premier save over $350M in aggregate annually in supply cost compared to all other members. -4% -6% -4% -6% -5% Source: Premier’s proprietary database; measuring Supply Expense per CMI Adjusted Acute Discharge (SEpCAAD) from cohort of 1,052 hospitals. % of Population Health Management Collaborative (PHMC) members who achieved shared savings vs. nation (PY 2015) Higher Percent of ACOs Achieving Shared Savings Higher Scores Under CMS Hospital Quality Star Ratings 20%

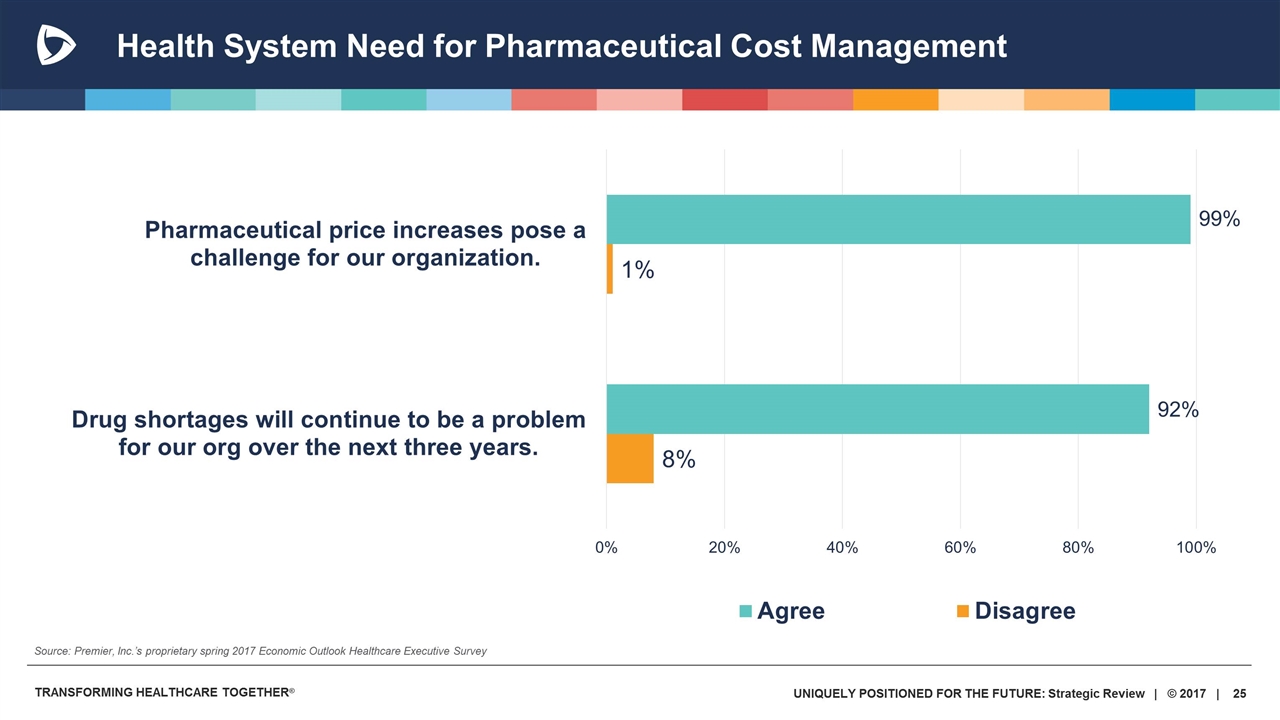

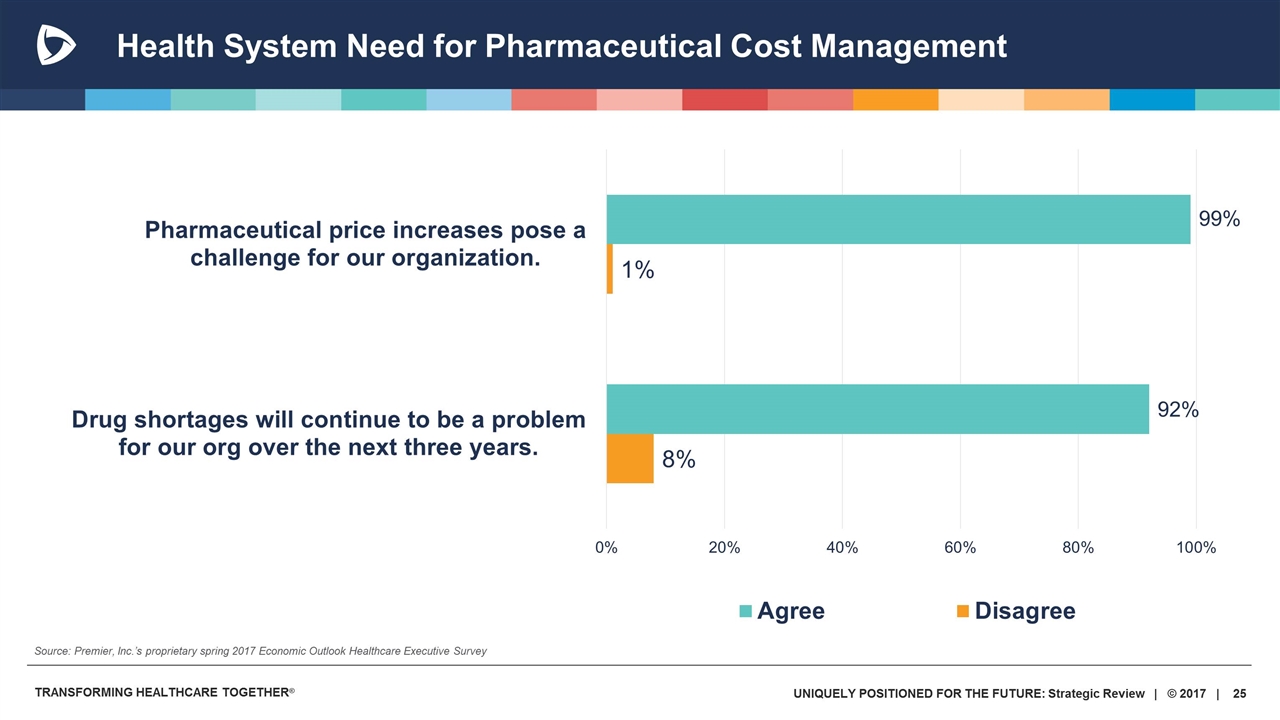

Health System Need for Pharmaceutical Cost Management Source: Premier, Inc.’s proprietary spring 2017 Economic Outlook Healthcare Executive Survey

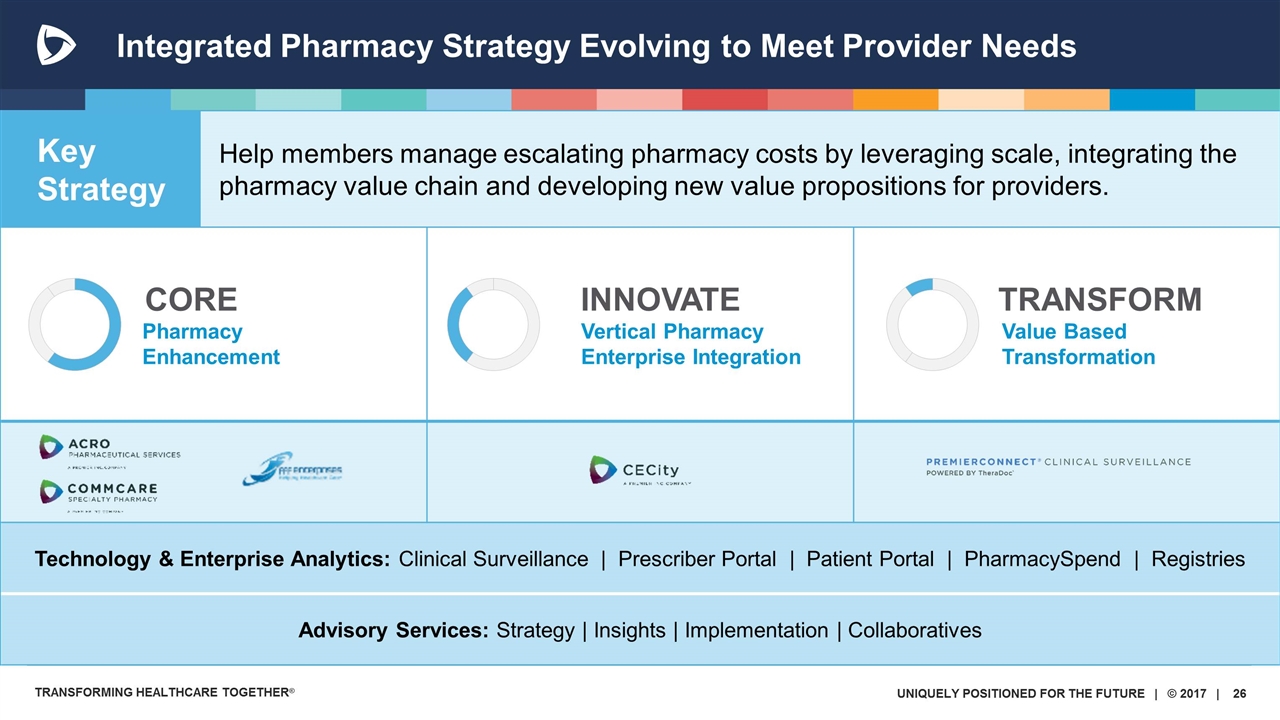

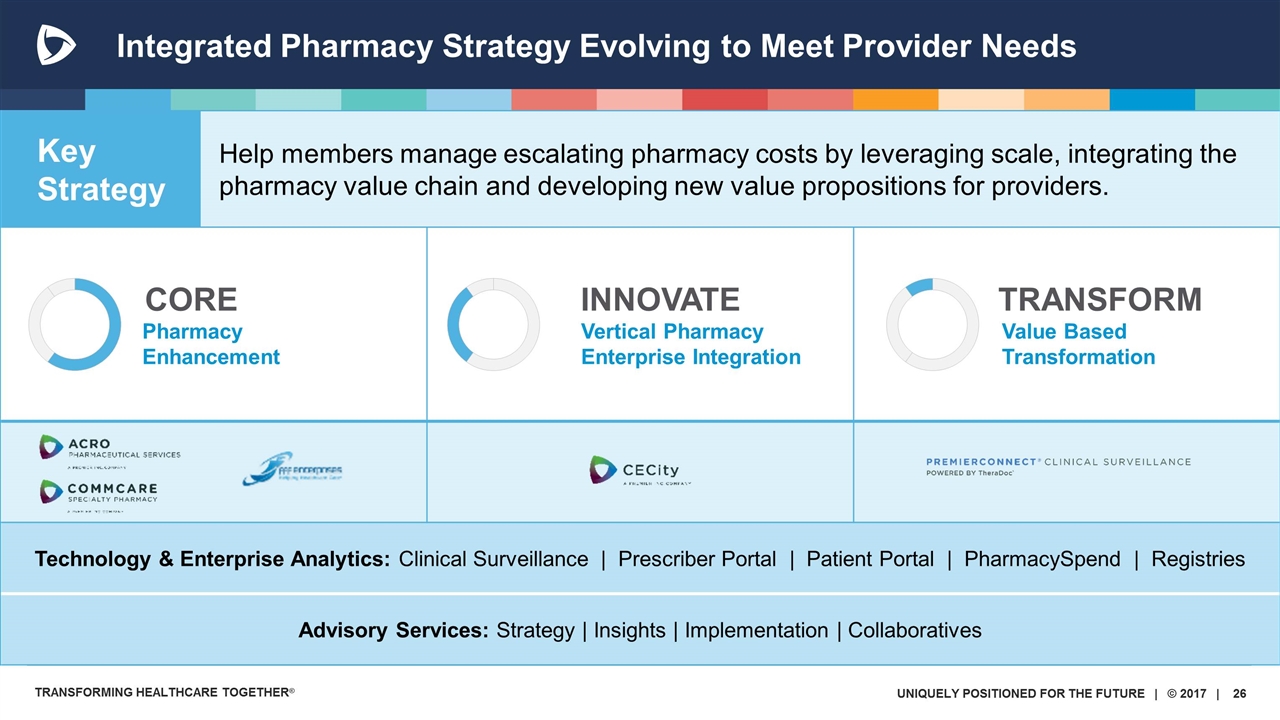

CORE Pharmacy Enhancement INNOVATE Vertical Pharmacy Enterprise Integration TRANSFORM Value Based Transformation Technology & Enterprise Analytics: Clinical Surveillance | Prescriber Portal | Patient Portal | PharmacySpend | Registries Advisory Services: Strategy | Insights | Implementation | Collaboratives Key Strategy Help members manage escalating pharmacy costs by leveraging scale, integrating the pharmacy value chain and developing new value propositions for providers. Integrated Pharmacy Strategy Evolving to Meet Provider Needs

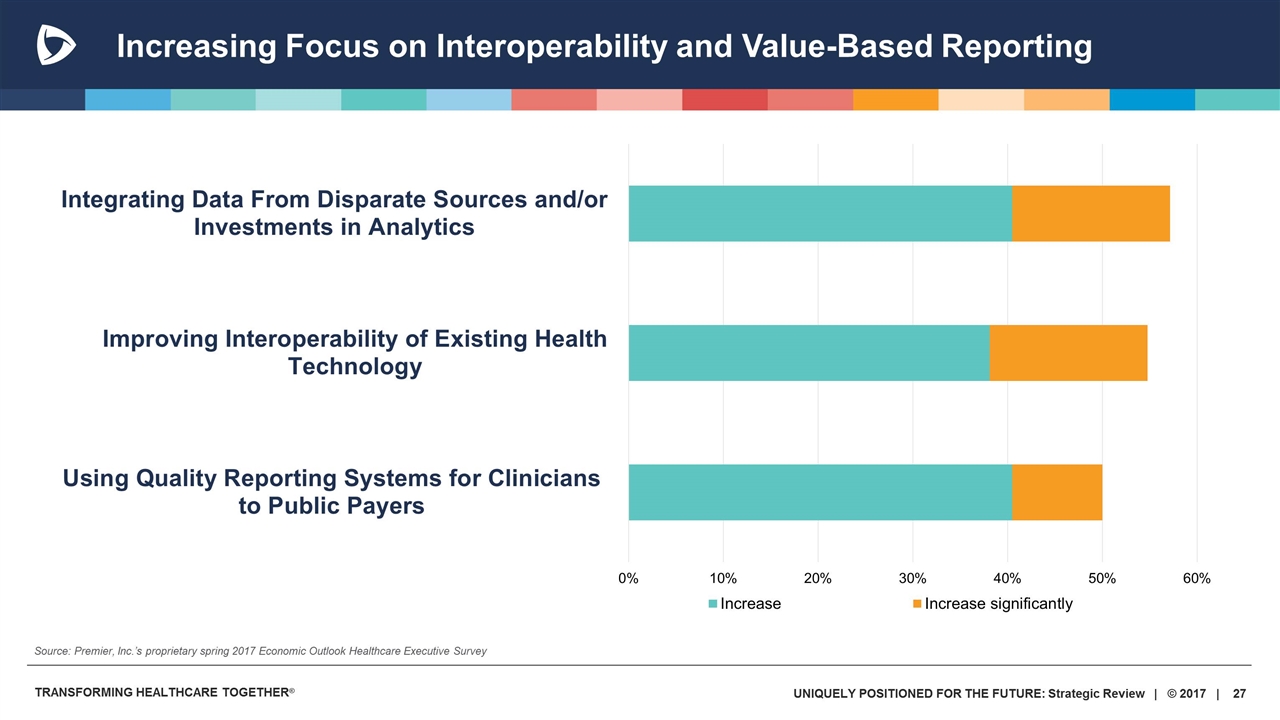

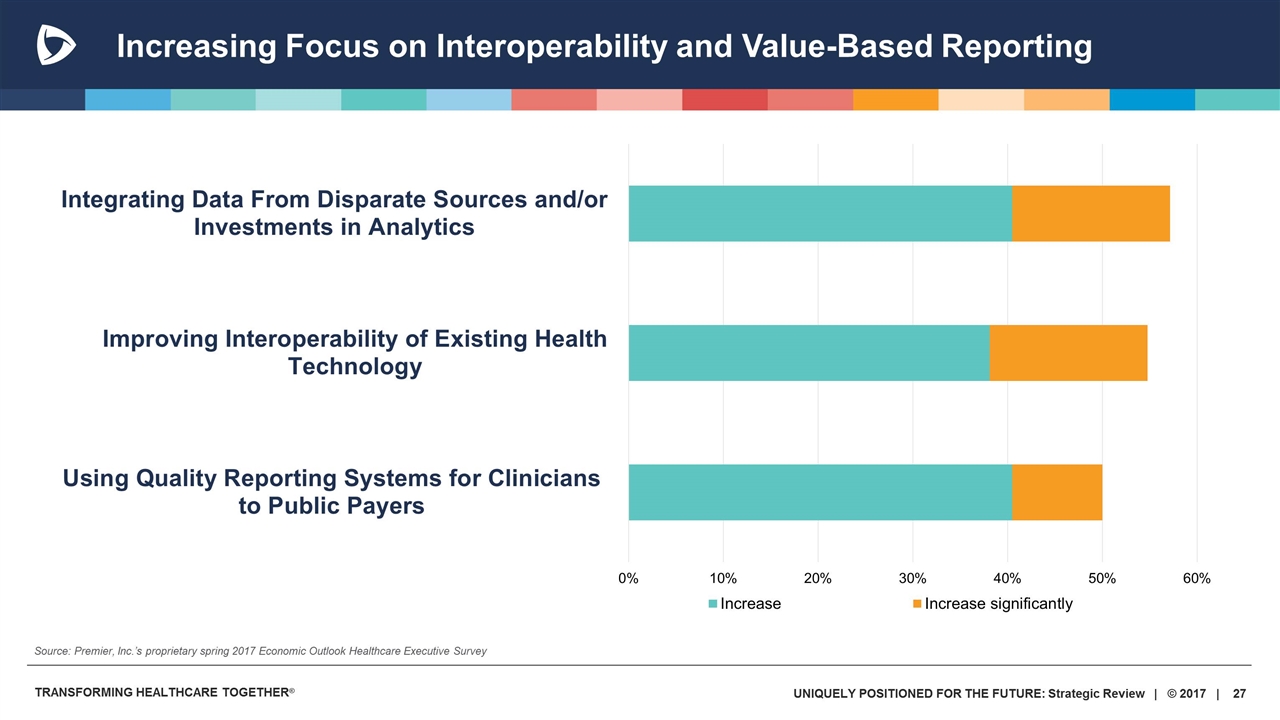

Increasing Focus on Interoperability and Value-Based Reporting Source: Premier, Inc.’s proprietary spring 2017 Economic Outlook Healthcare Executive Survey

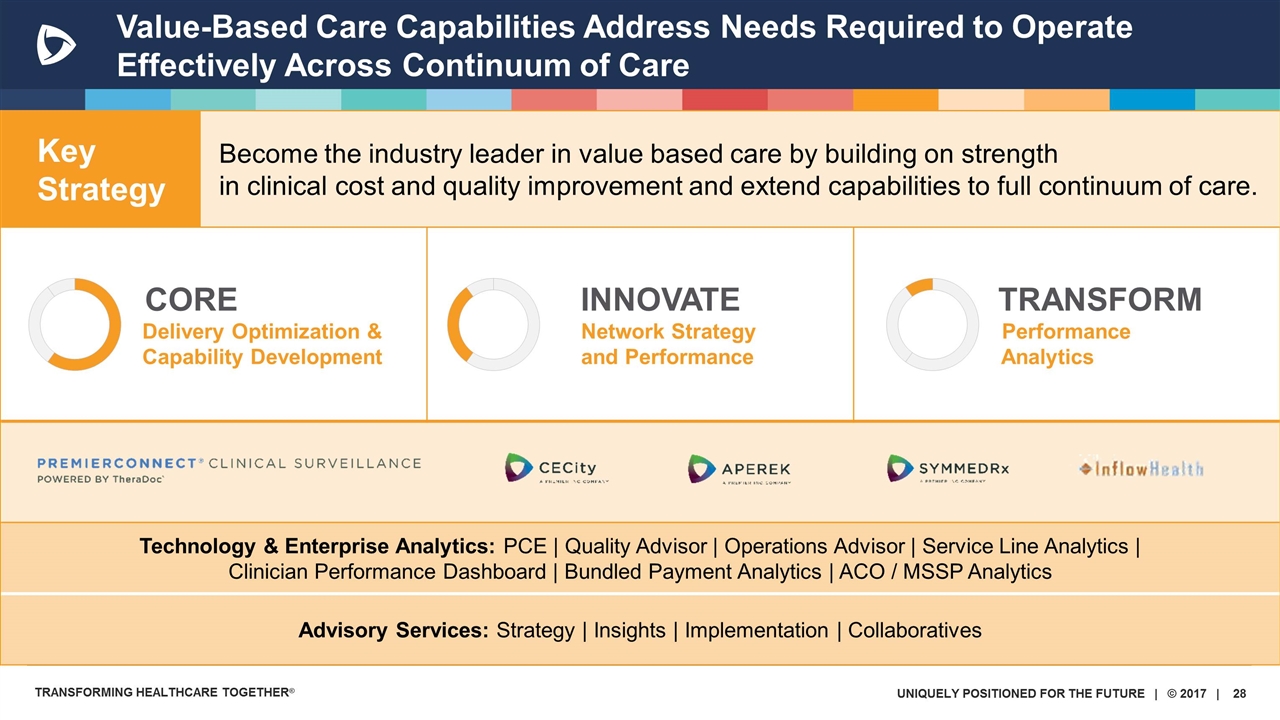

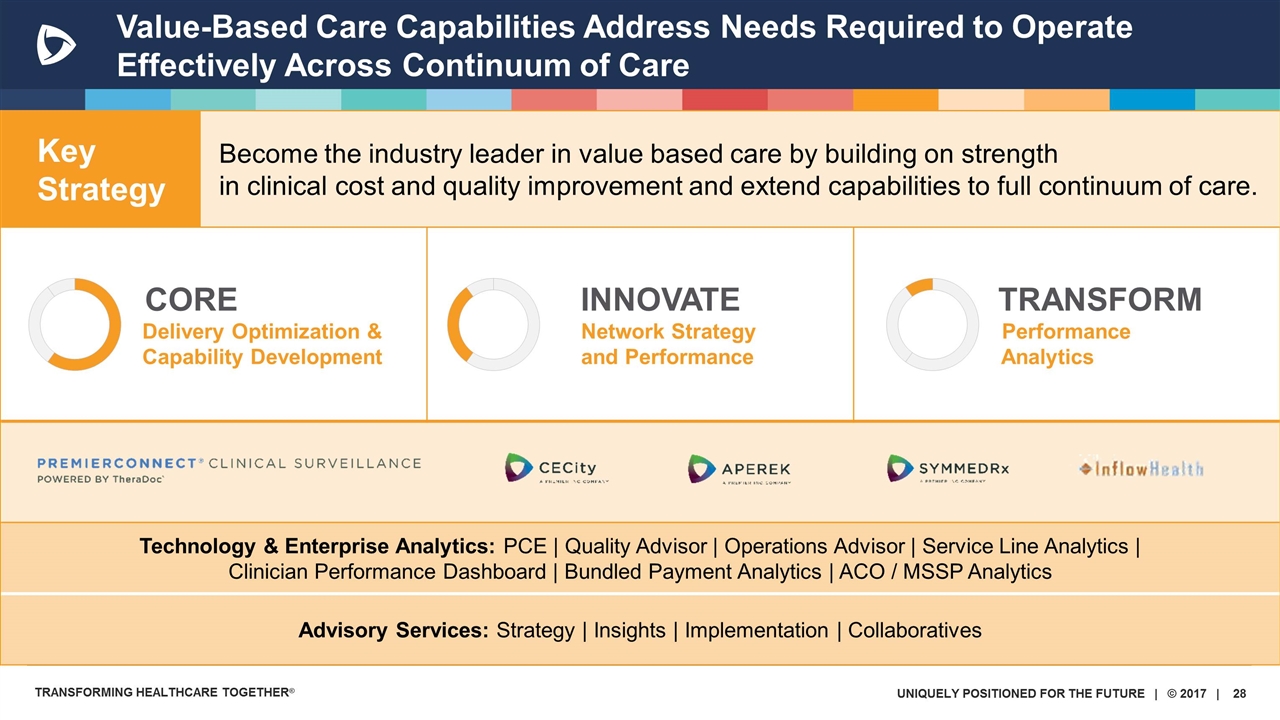

CORE Delivery Optimization & Capability Development INNOVATE Network Strategy and Performance TRANSFORM Performance Analytics Technology & Enterprise Analytics: PCE | Quality Advisor | Operations Advisor | Service Line Analytics | Clinician Performance Dashboard | Bundled Payment Analytics | ACO / MSSP Analytics Advisory Services: Strategy | Insights | Implementation | Collaboratives Key Strategy Become the industry leader in value based care by building on strength in clinical cost and quality improvement and extend capabilities to full continuum of care. Value-Based Care Capabilities Address Needs Required to Operate Effectively Across Continuum of Care

QUESTIONS Strategic and Operations Review

01 Increasing Pressure to Manage Costs 04 Value-Based Care and Payment Model Evolution 03 Physician Alignment Strategies 02 Drug and Device Market Consolidation Panels Address Four Major Focus Areas

INCREASING PRESSURE TO MANAGE COSTS UNIQUELY POSITIONED FOR THE FUTURE Ryan Adams Premier Inc. Kelly Rakowski Premier Inc. Jeffrey Peters, MD University Hospitals Chad A. Eckes Wake Forest Baptist Medical Center David A. Hargraves Premier Inc.

QUESTIONS Increasing Pressure to Manage Costs

CONSOLIDATION & PRICE PRESSURES IN THE PHARMACEUTICAL & DEVICE MARKETS UNIQUELY POSITIONED FOR THE FUTURE Robert A. McKay PharMerica Mimi Huizinga, MD, MPH, FACP Premier Inc. Lisa French Merck Durral R. Gilbert Premier Inc.

QUESTIONS Consolidation and Price Pressures in Pharmaceutical and Device Markets

PHYSICIAN ALIGNMENT STRATEGIES UNIQUELY POSITIONED FOR THE FUTURE Shawn Griffin, MD Premier Inc. Lori Harrington Premier Inc. Andy Ziskind, MD Premier Inc. Marlon L. Priest, MD Bon Secours Health System Evan Benjamin, MD, MS, FACP Baystate Health

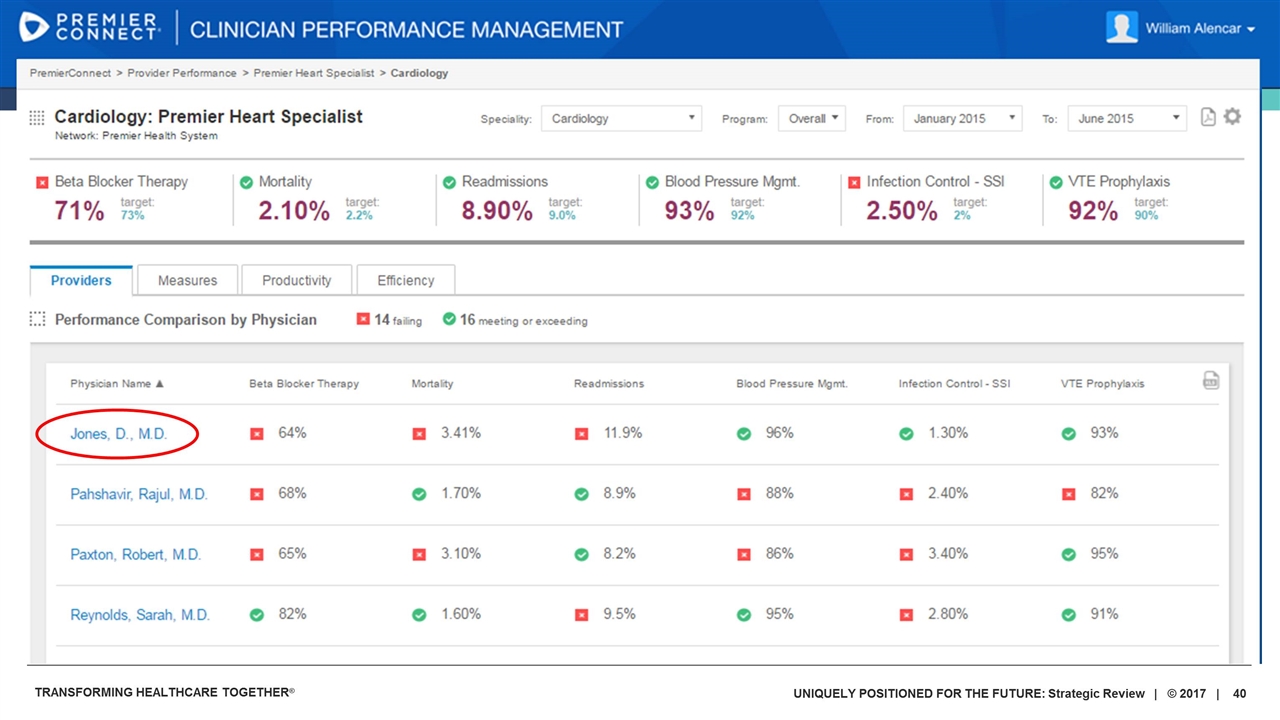

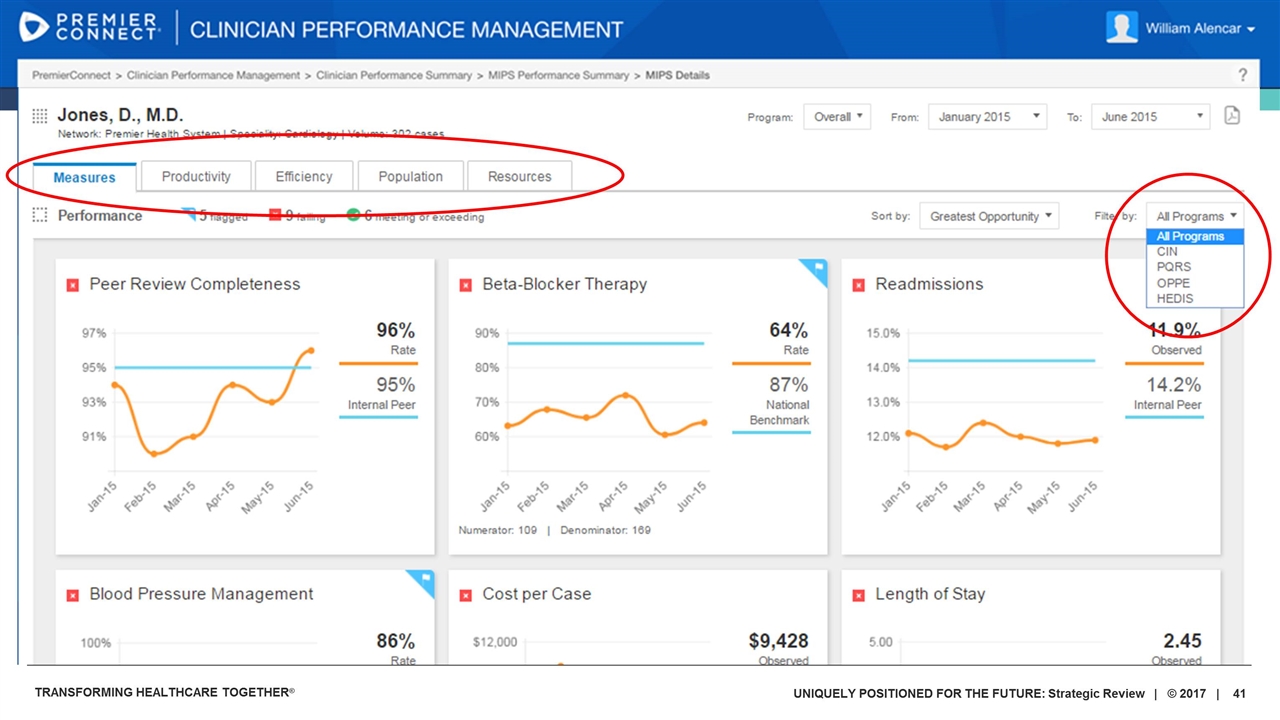

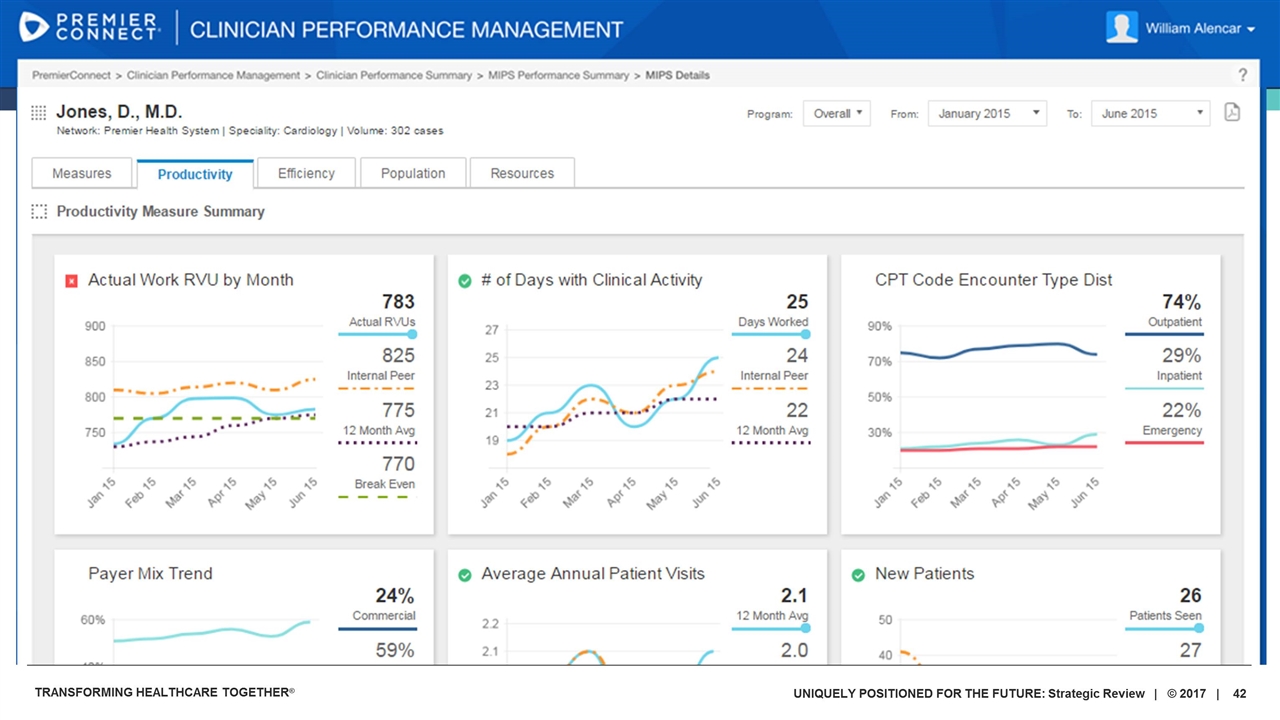

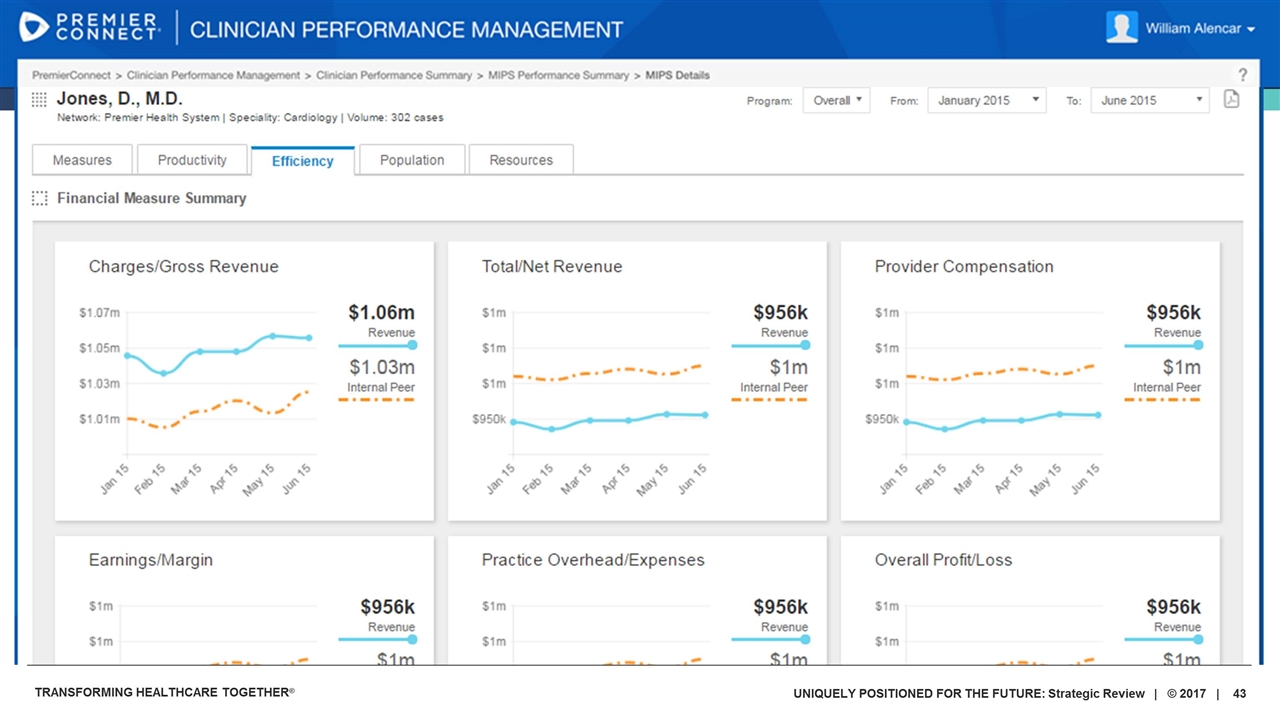

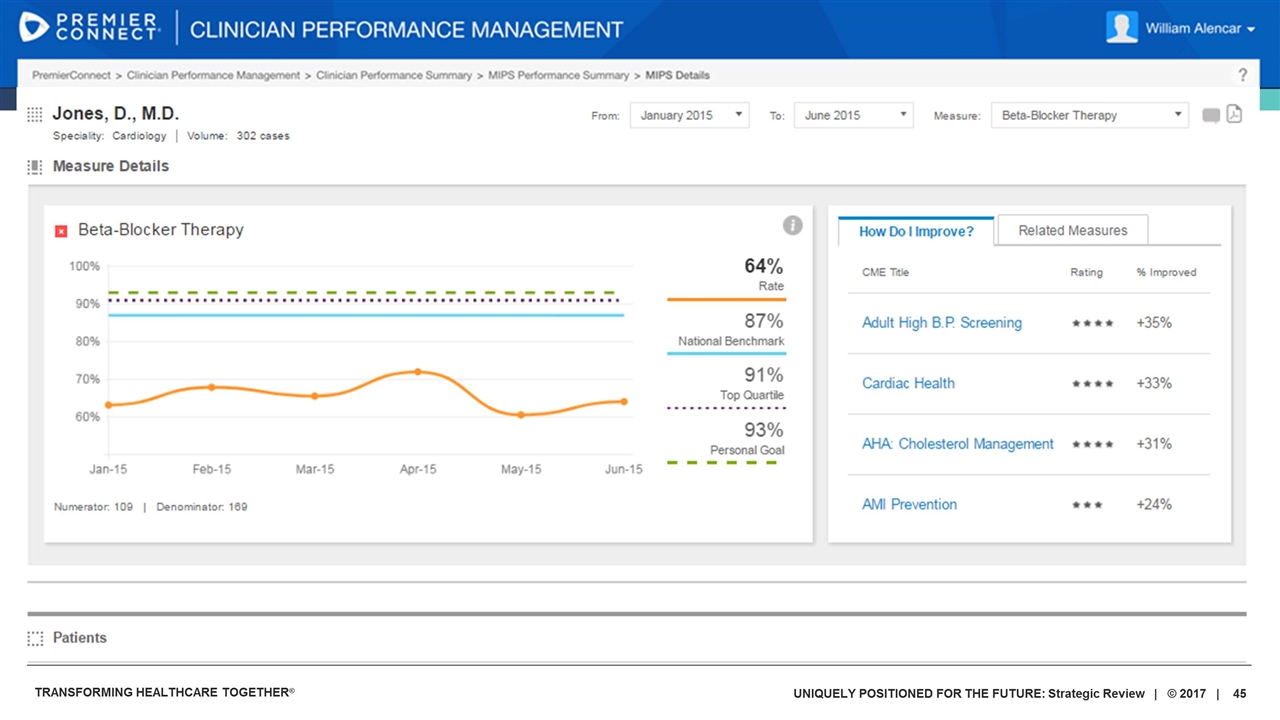

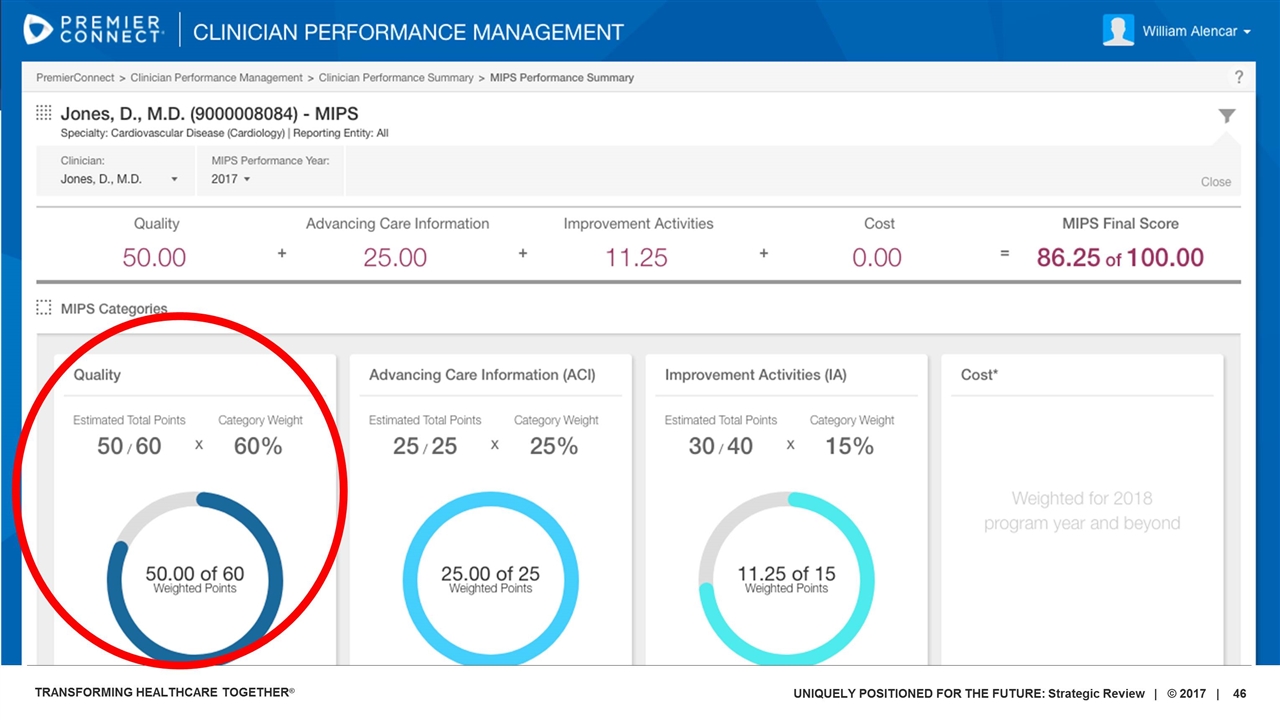

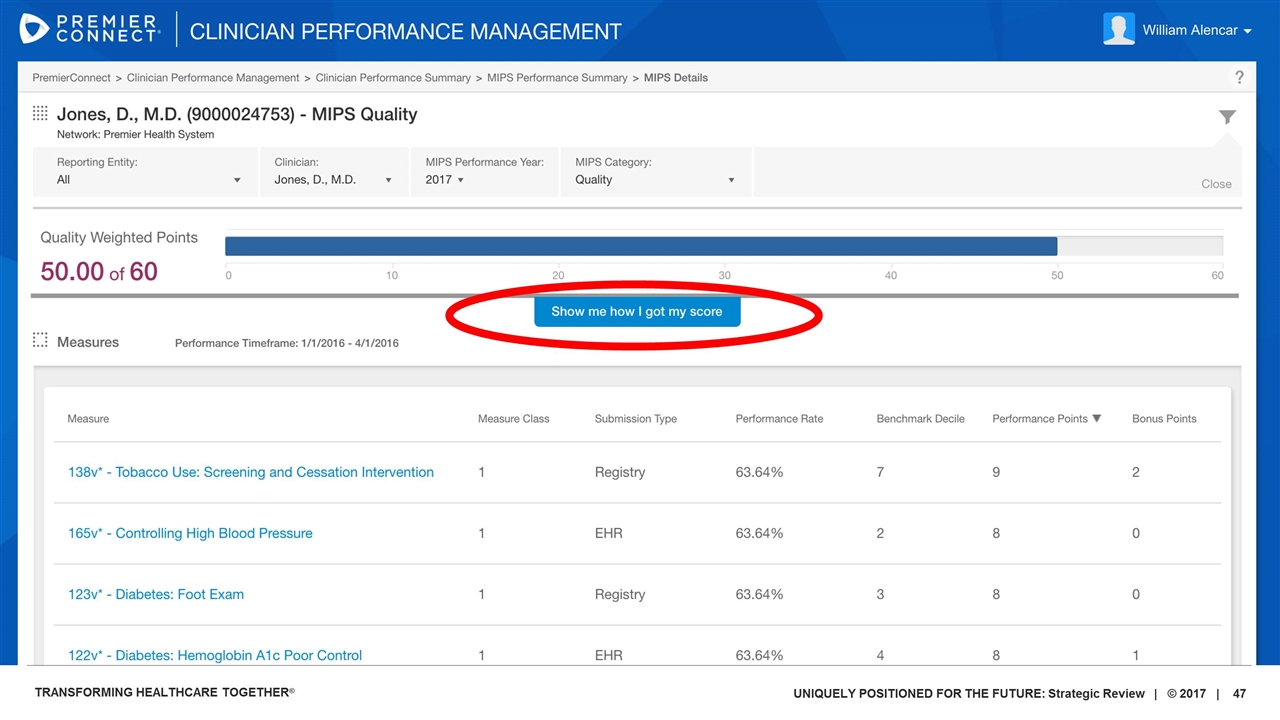

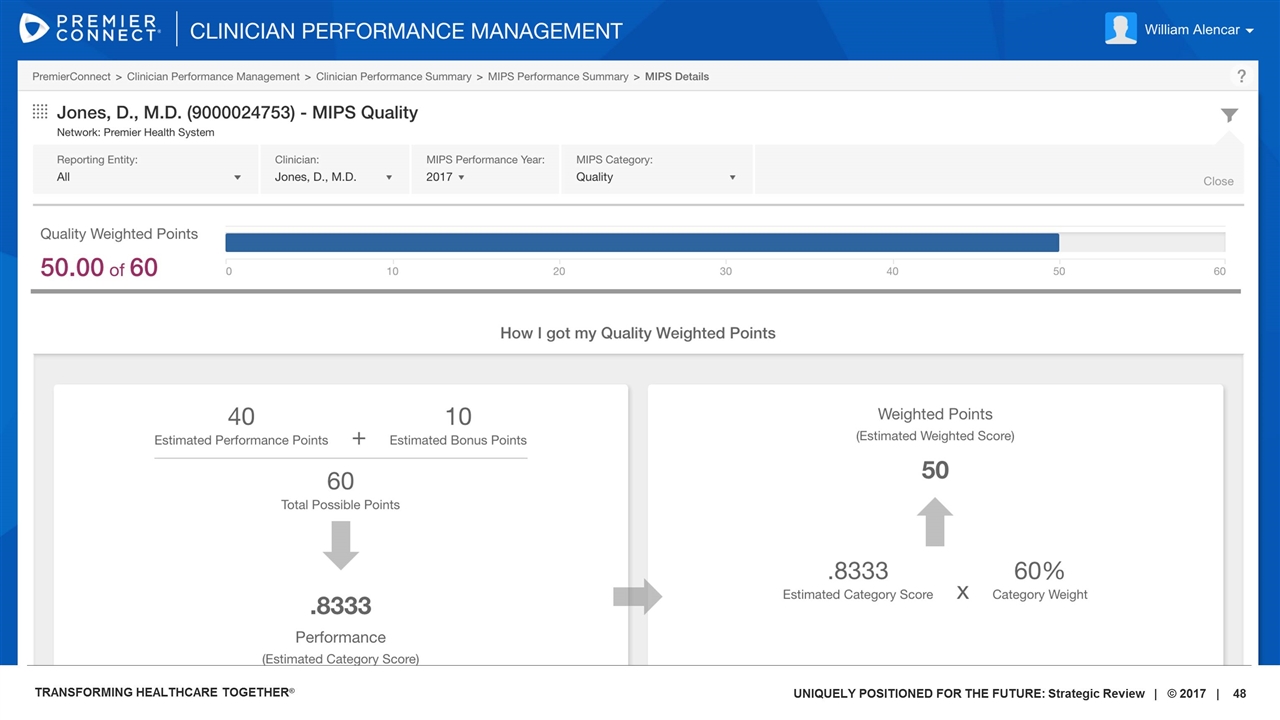

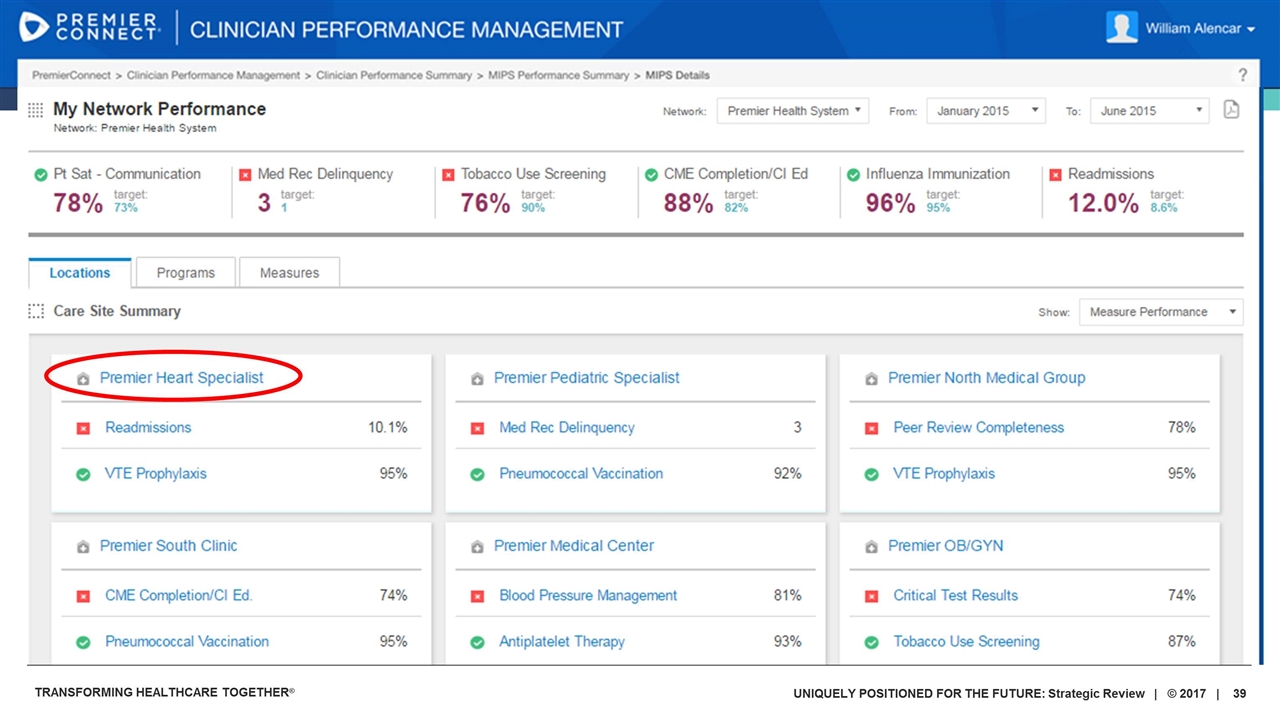

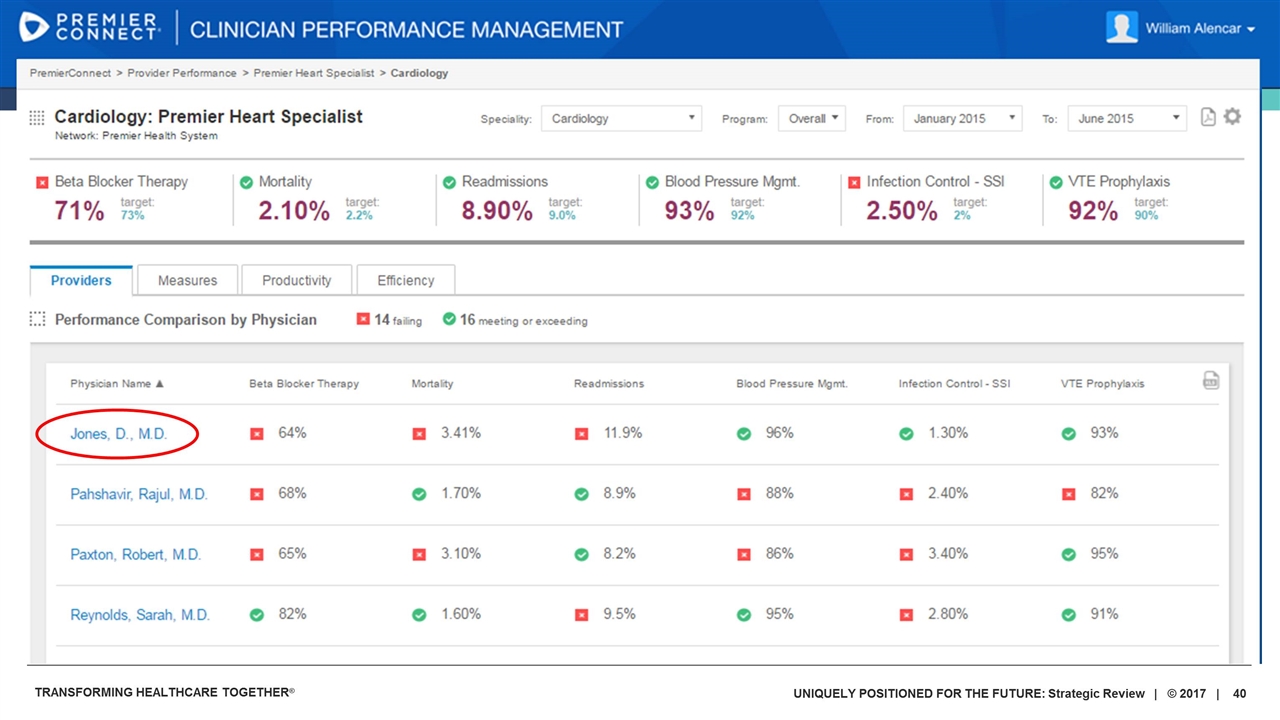

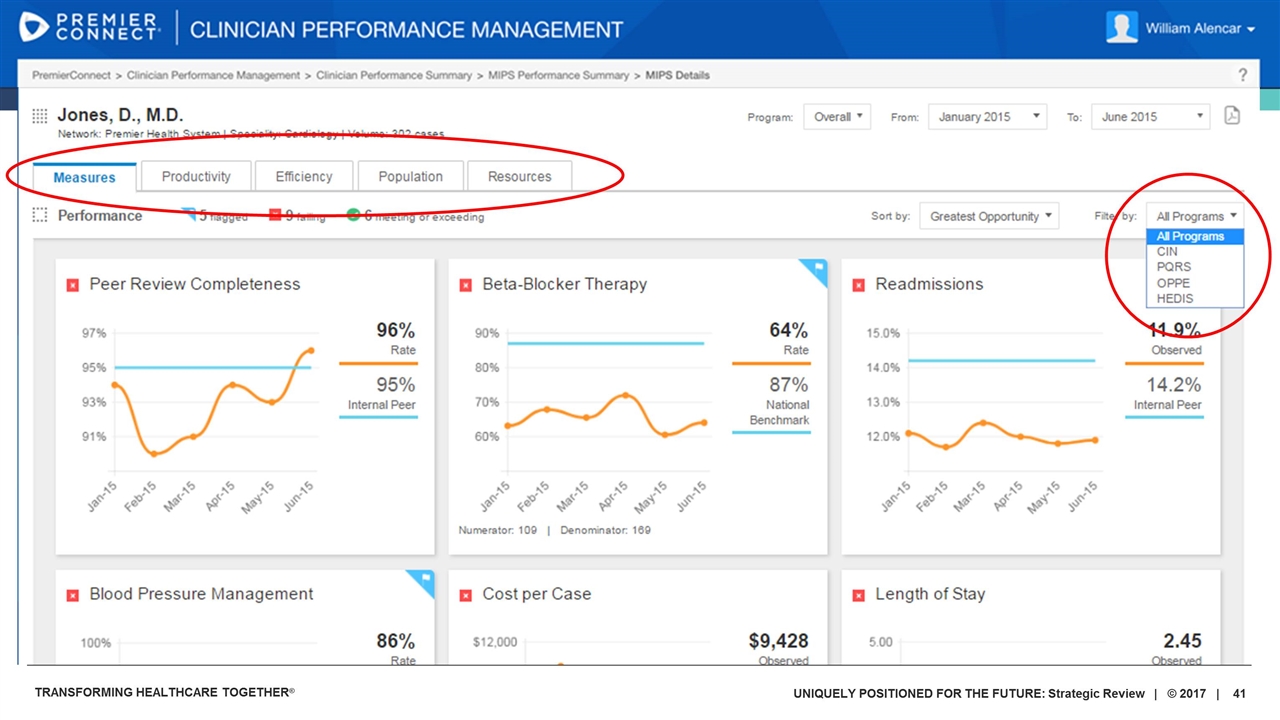

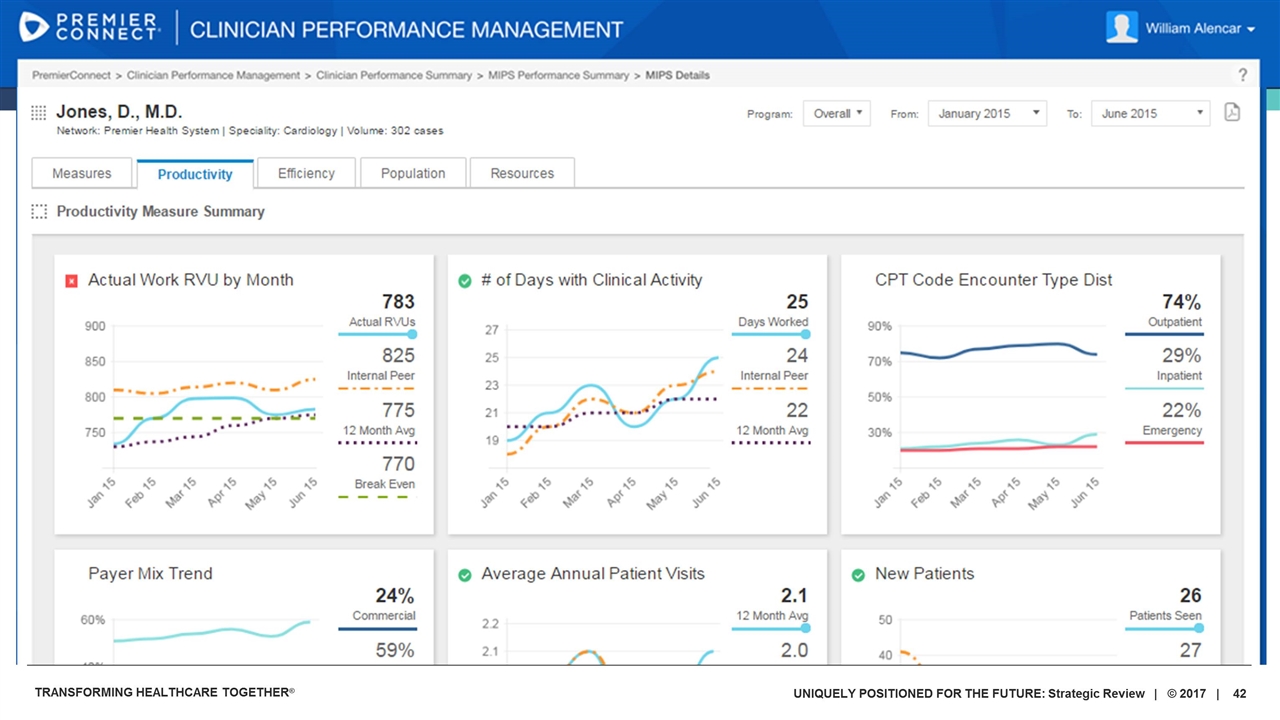

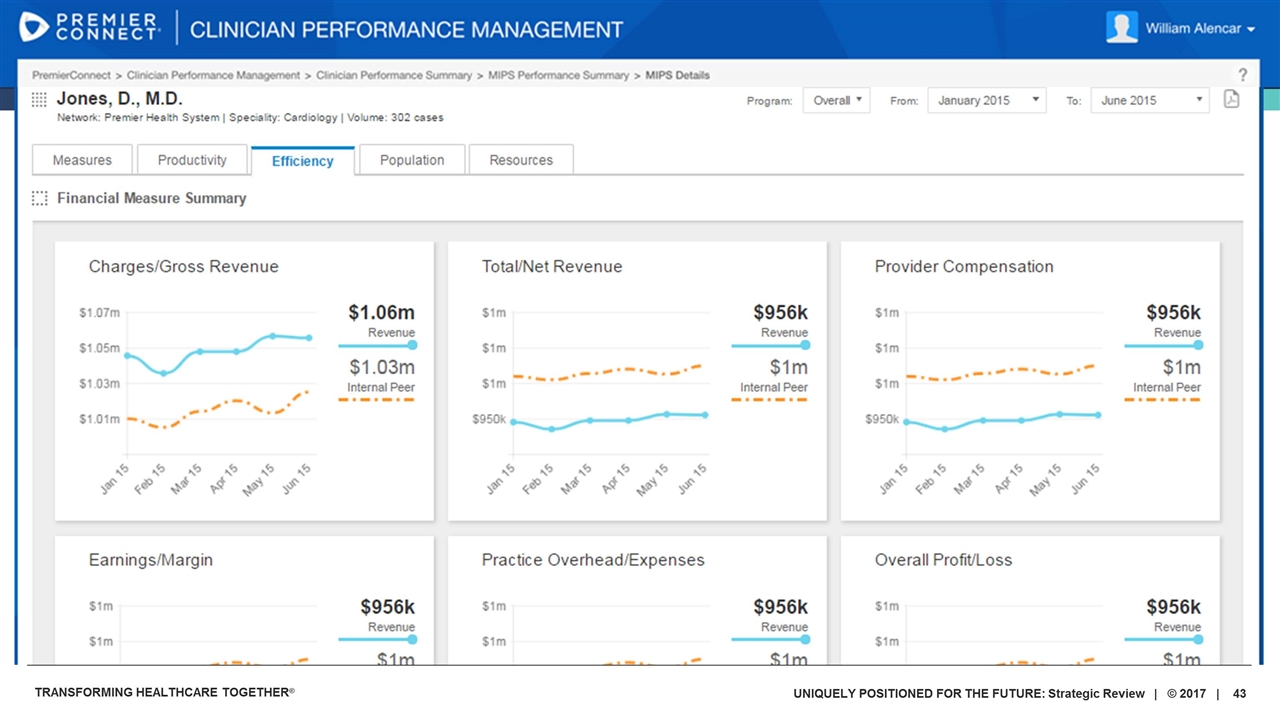

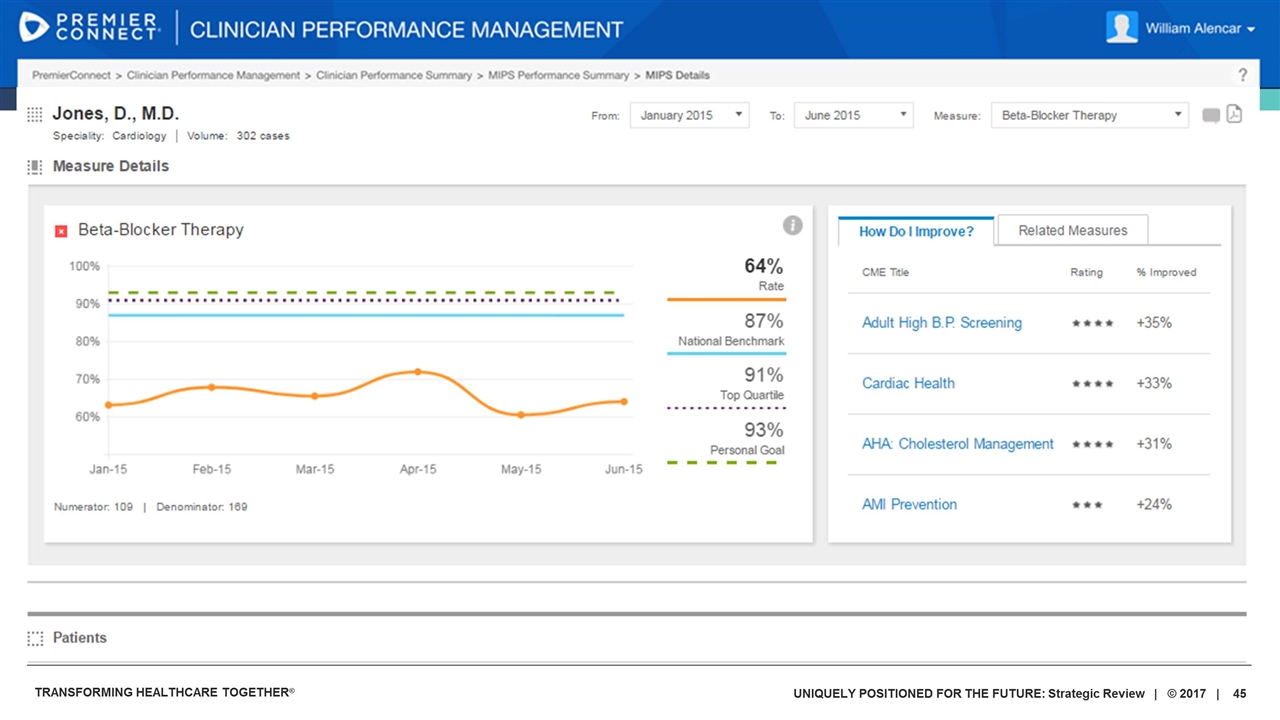

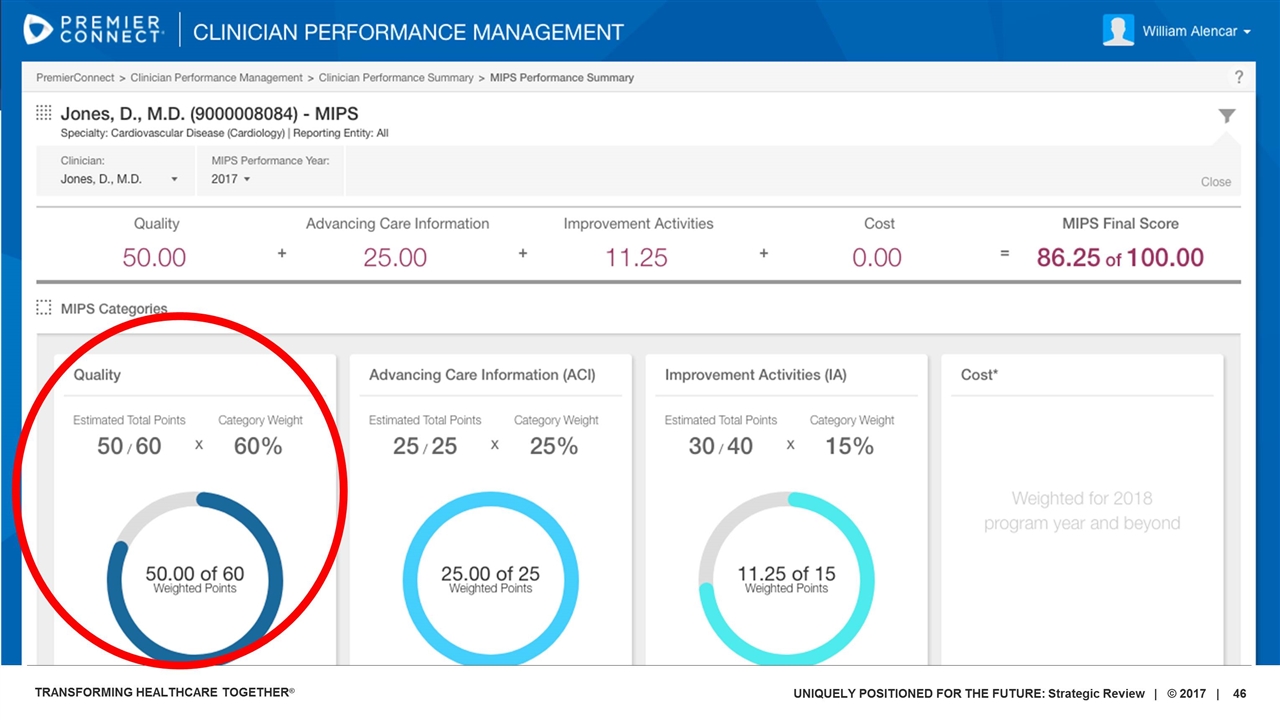

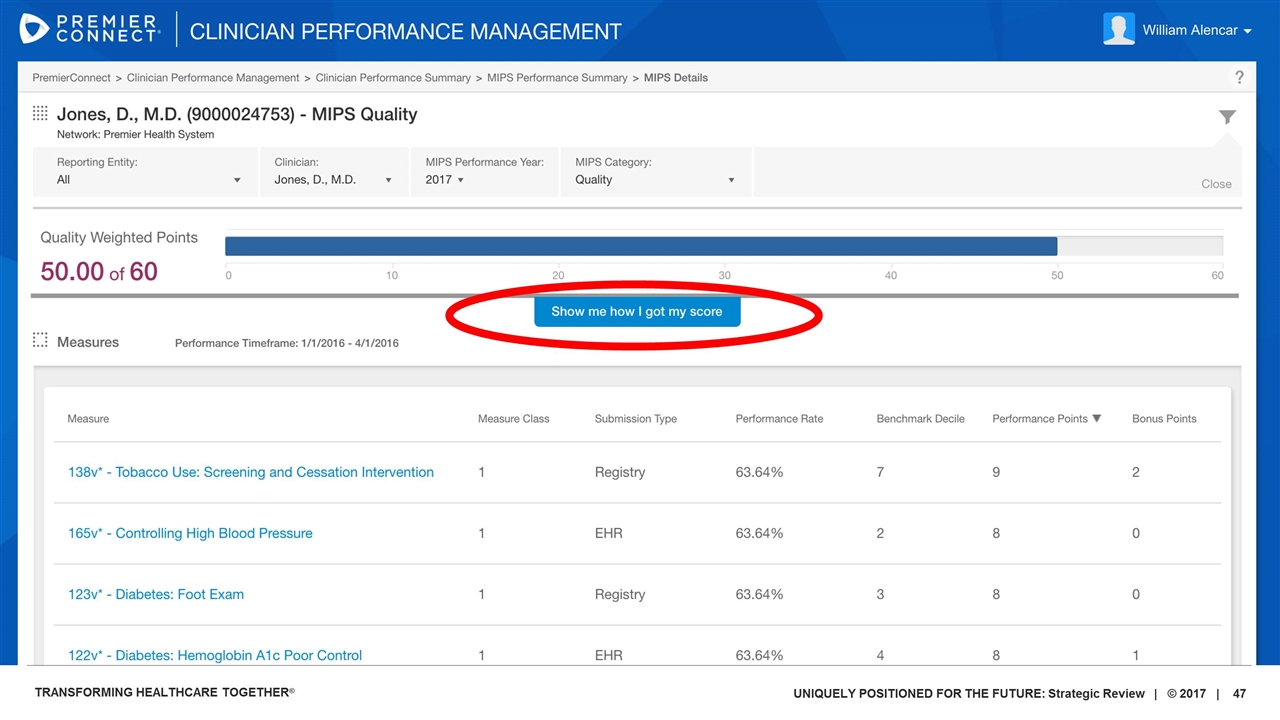

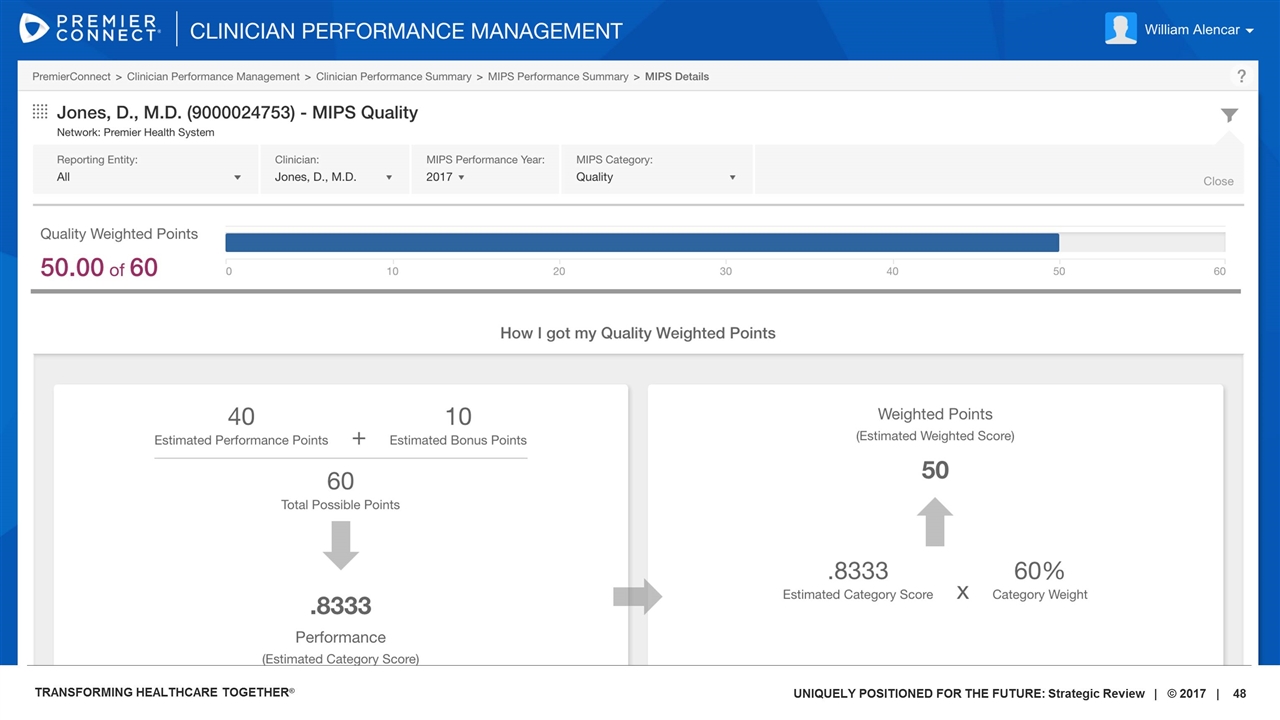

CLINICIAN PERFORMANCE MANAGEMENT Lori Harrington, Premier Inc. DEMO

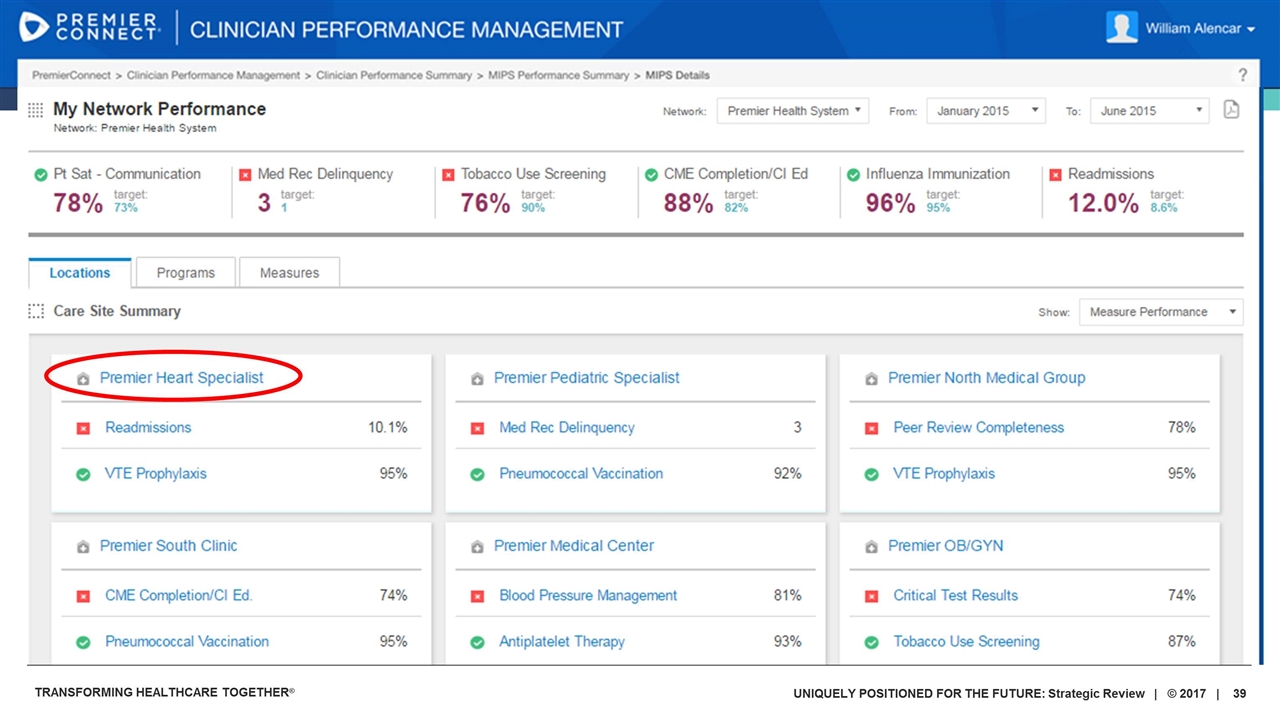

Accelerates Physician Alignment Ability to collect, calculate, attest and submit through Premier’s Qualified Clinical Data Registry (QCDR) Manage performance of compliance measures for MIPS program Maintain oversight of performance for all clinicians regardless of EHR, specialty, location, or practice patterns Physicians and medical staff leaders create alignment as a result of data transparency Integrated solution simplifies the complexity of the program and calculations

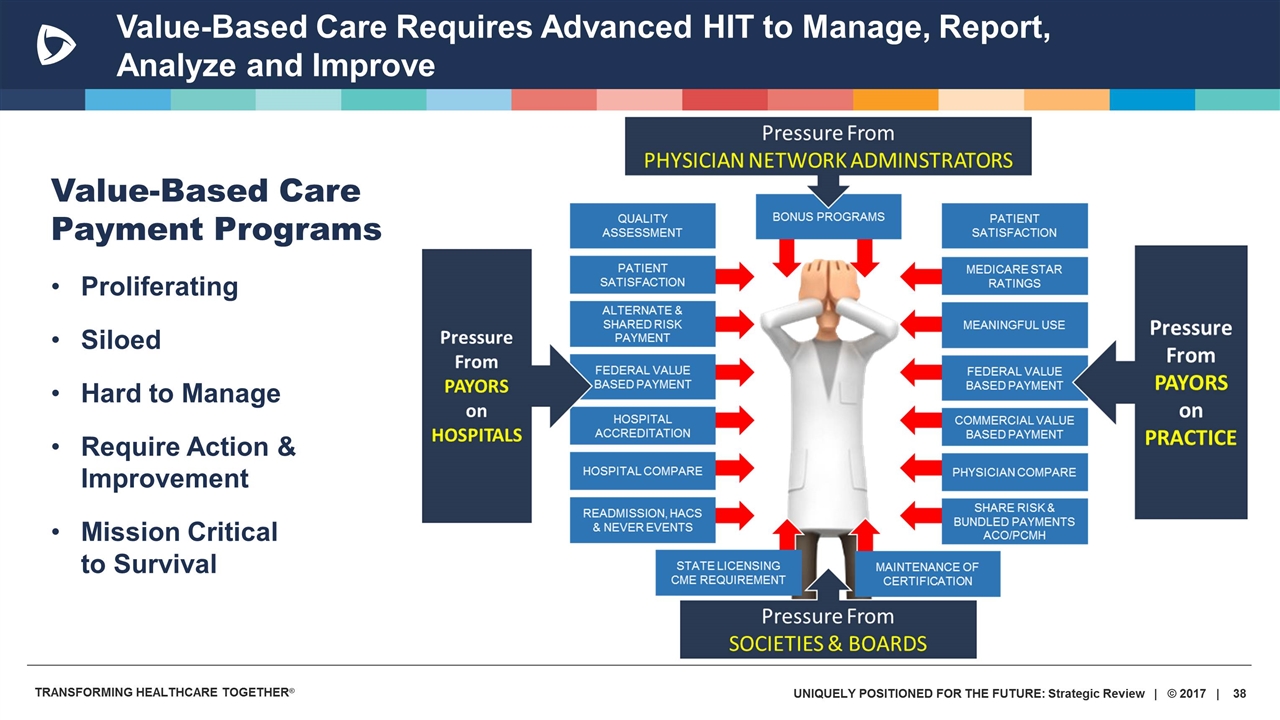

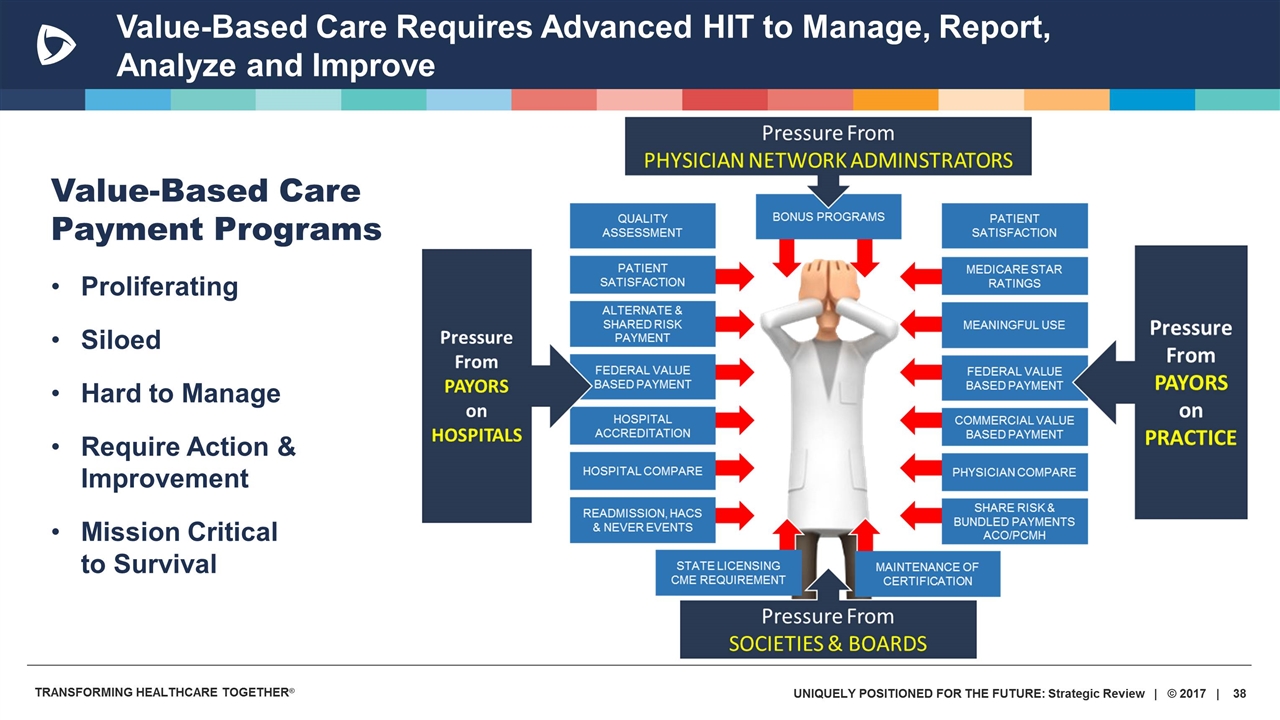

Value-Based Care Requires Advanced HIT to Manage, Report, Analyze and Improve Value-Based Care Payment Programs Proliferating Siloed Hard to Manage Require Action & Improvement Mission Critical to Survival

QUESTIONS Physician Alignment Strategies

THE EVOLUTION TO VALUE-BASED CARE & PAYMENT MODELS UNIQUELY POSITIONED FOR THE FUTURE Joseph F. Damore, FACHE Premier Inc. Leigh Anderson Premier Inc. Marshall Ruffin, MD, MPH, MBA, CPE, FACPE Inova Health Pietro Satriano US Foods

QUESTIONS The Evolution of Value-Based Care and Payment Models

Chief Financial Officer Premier Inc. Craig McKasson FINANCIAL REVIEW

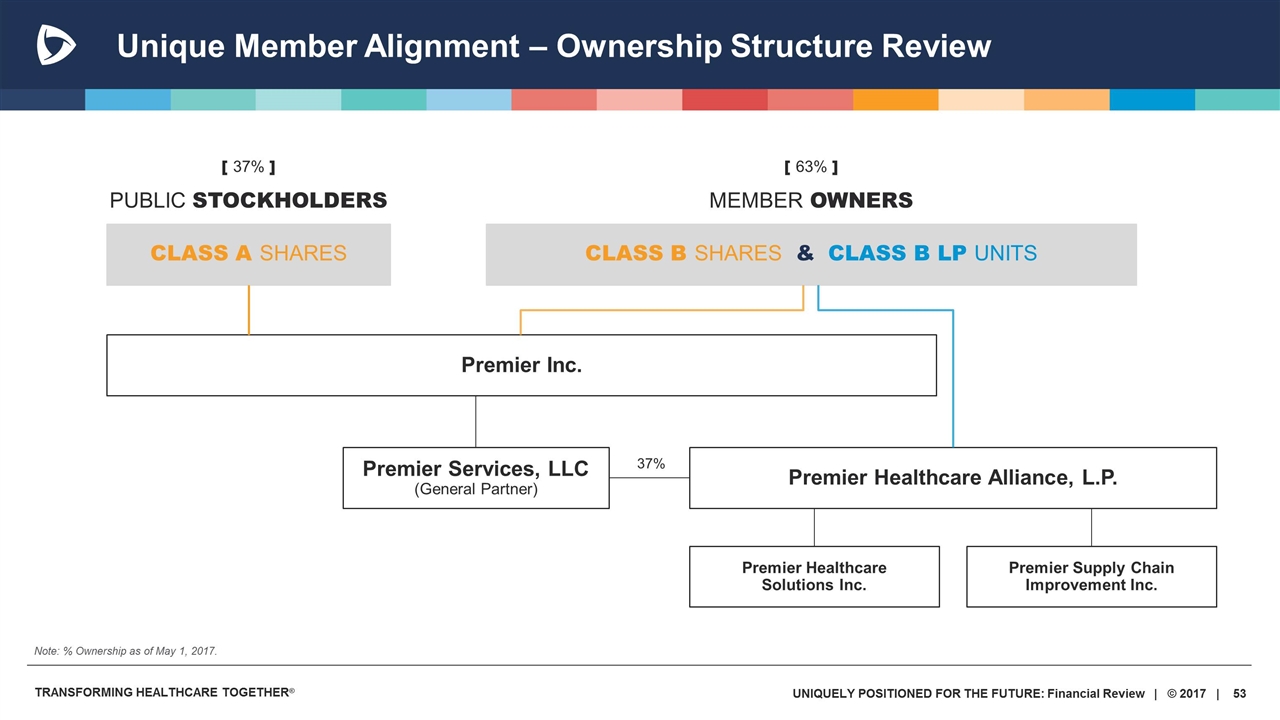

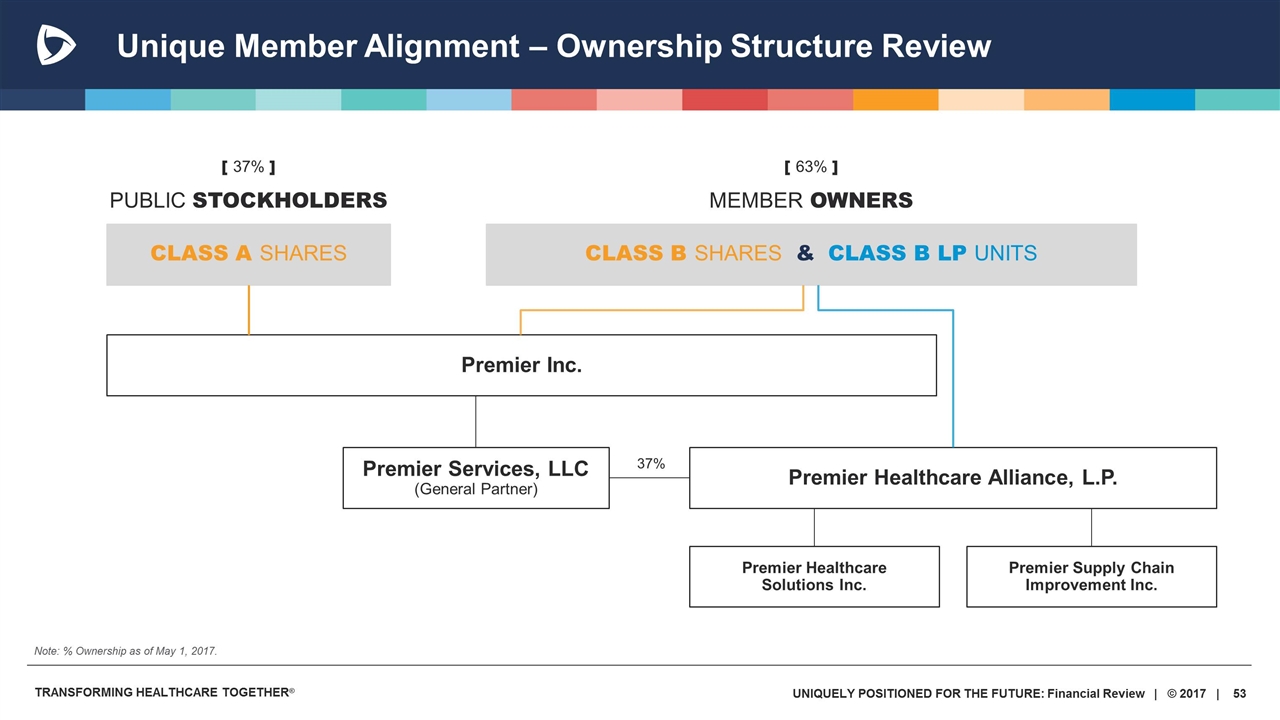

Unique Member Alignment – Ownership Structure Review Premier Services, LLC (General Partner) Premier Healthcare Alliance, L.P. CLASS A SHARES CLASS B SHARES & CLASS B LP UNITS PUBLIC STOCKHOLDERS MEMBER OWNERS Premier Healthcare Solutions Inc. Premier Supply Chain Improvement Inc. [ 63% ] Premier Inc. [ 37% ] Note: % Ownership as of May 1, 2017. 37%

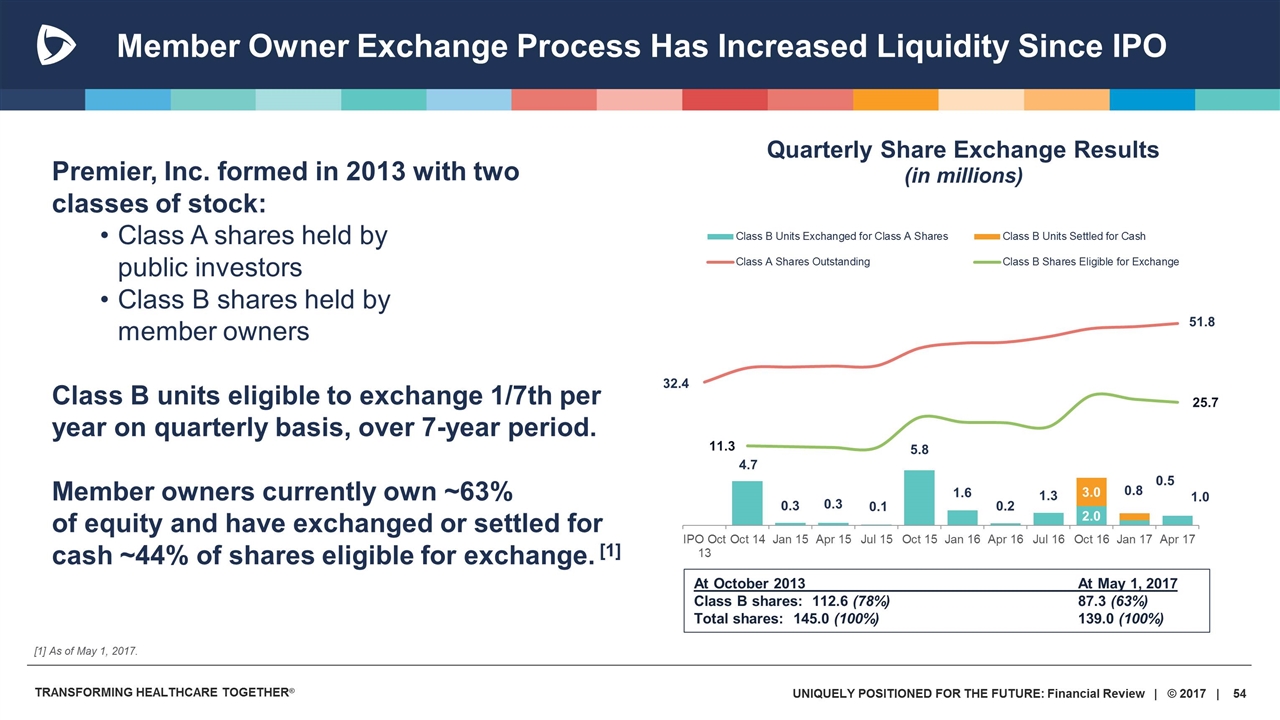

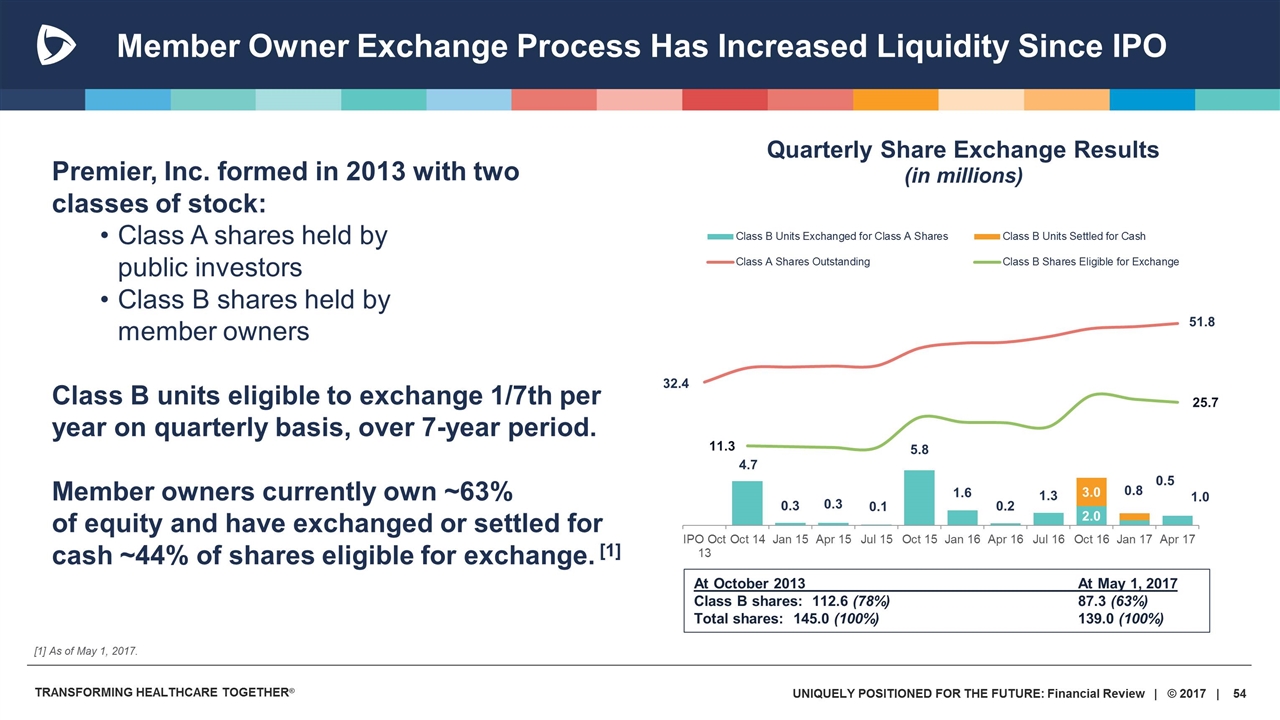

Member Owner Exchange Process Has Increased Liquidity Since IPO Premier, Inc. formed in 2013 with two classes of stock: Class A shares held by public investors Class B shares held by member owners Class B units eligible to exchange 1/7th per year on quarterly basis, over 7-year period. Member owners currently own ~63% of equity and have exchanged or settled for cash ~44% of shares eligible for exchange. [1] At October 2013At May 1, 2017 Class B shares: 112.6 (78%)87.3 (63%) Total shares: 145.0 (100%)139.0 (100%) [1] As of May 1, 2017.

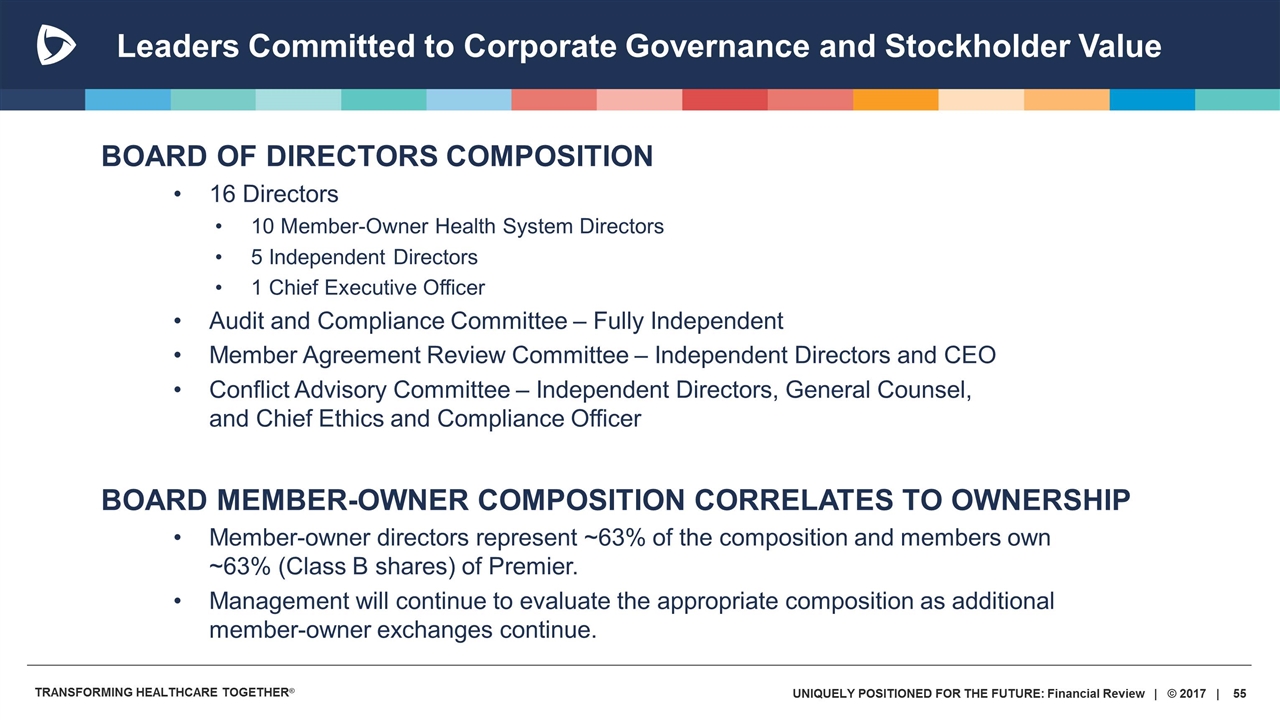

Leaders Committed to Corporate Governance and Stockholder Value BOARD OF DIRECTORS COMPOSITION 16 Directors 10 Member-Owner Health System Directors 5 Independent Directors 1 Chief Executive Officer Audit and Compliance Committee – Fully Independent Member Agreement Review Committee – Independent Directors and CEO Conflict Advisory Committee – Independent Directors, General Counsel, and Chief Ethics and Compliance Officer BOARD MEMBER-OWNER COMPOSITION CORRELATES TO OWNERSHIP Member-owner directors represent ~63% of the composition and members own ~63% (Class B shares) of Premier. Management will continue to evaluate the appropriate composition as additional member-owner exchanges continue.

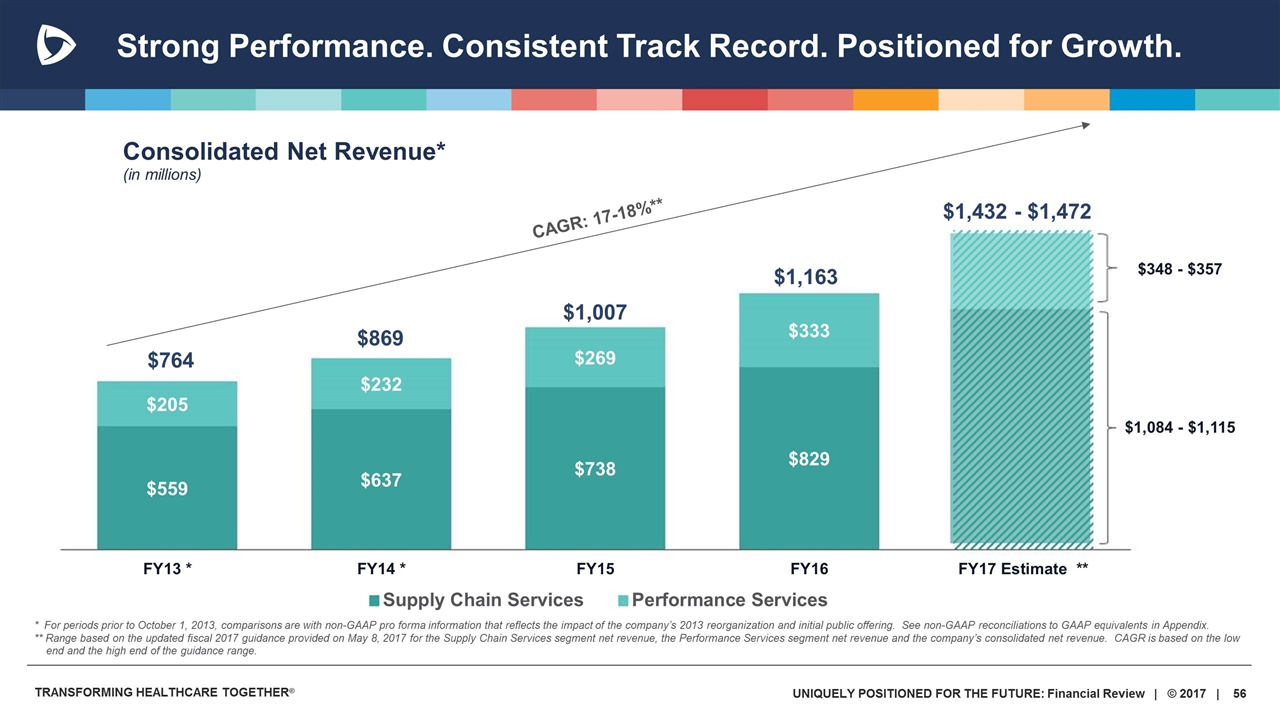

$869 $1,007 CAGR: 17-18%** $1,163 * For periods prior to October 1, 2013, comparisons are with non-GAAP pro forma information that reflects the impact of the company’s 2013 reorganization and initial public offering. See non-GAAP reconciliations to GAAP equivalents in Appendix. ** Range based on the updated fiscal 2017 guidance provided on May 8, 2017 for the Supply Chain Services segment net revenue, the Performance Services segment net revenue and the company’s consolidated net revenue. CAGR is based on the low end and the high end of the guidance range. $764 $1,432 - $1,472 $348 - $357 $1,084 - $1,115 Strong Performance. Consistent Track Record. Positioned for Growth.

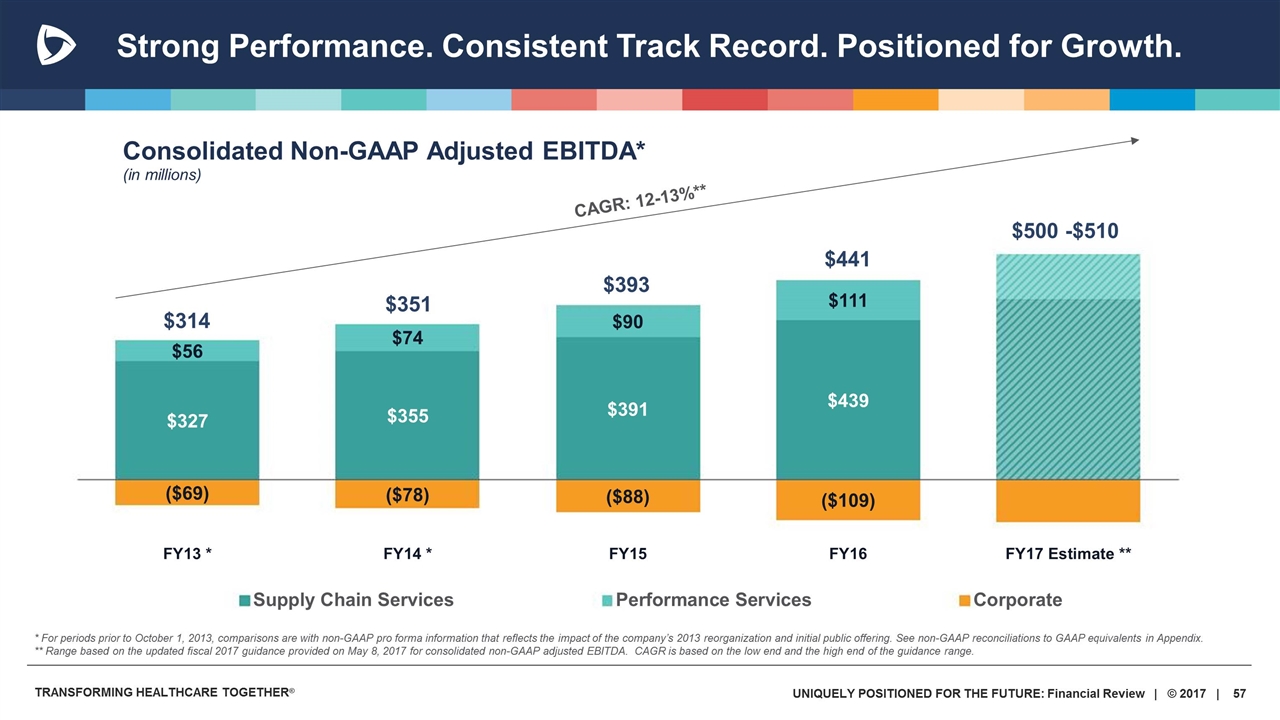

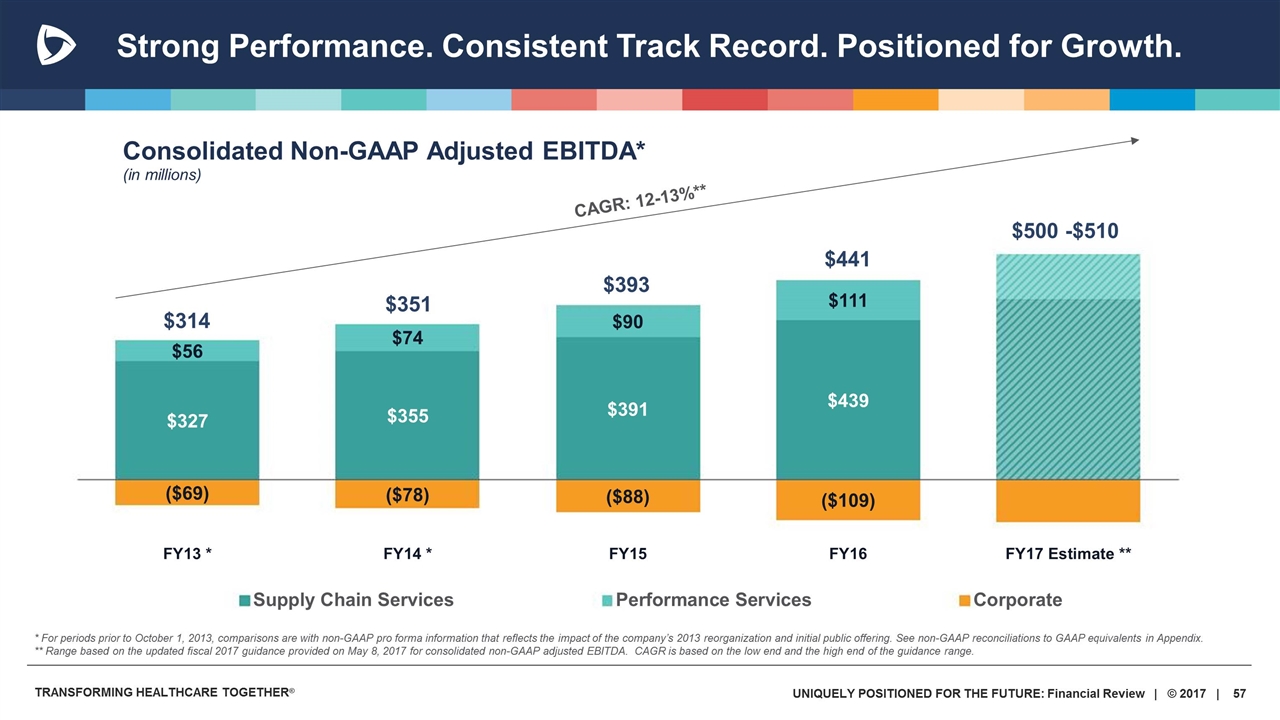

Strong Performance. Consistent Track Record. Positioned for Growth. $351 $393 CAGR: 12-13%** $441 $314 $500 -$510 * For periods prior to October 1, 2013, comparisons are with non-GAAP pro forma information that reflects the impact of the company’s 2013 reorganization and initial public offering. See non-GAAP reconciliations to GAAP equivalents in Appendix. ** Range based on the updated fiscal 2017 guidance provided on May 8, 2017 for consolidated non-GAAP adjusted EBITDA. CAGR is based on the low end and the high end of the guidance range.

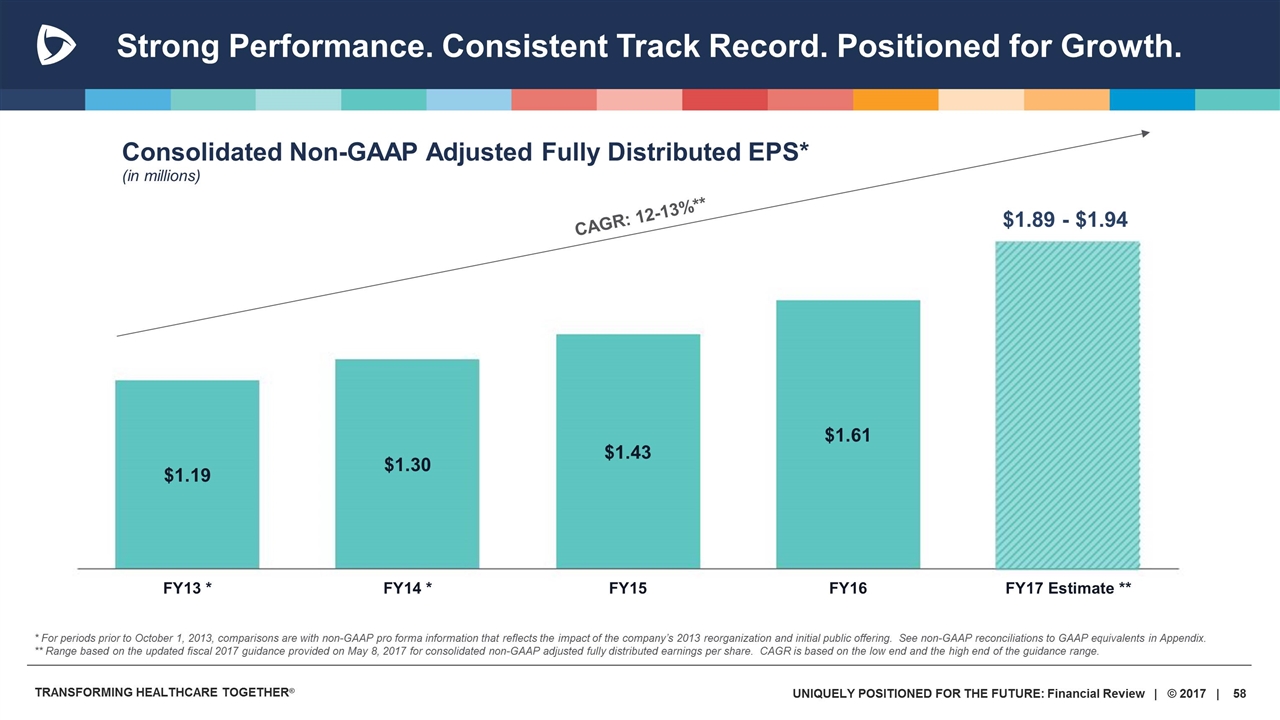

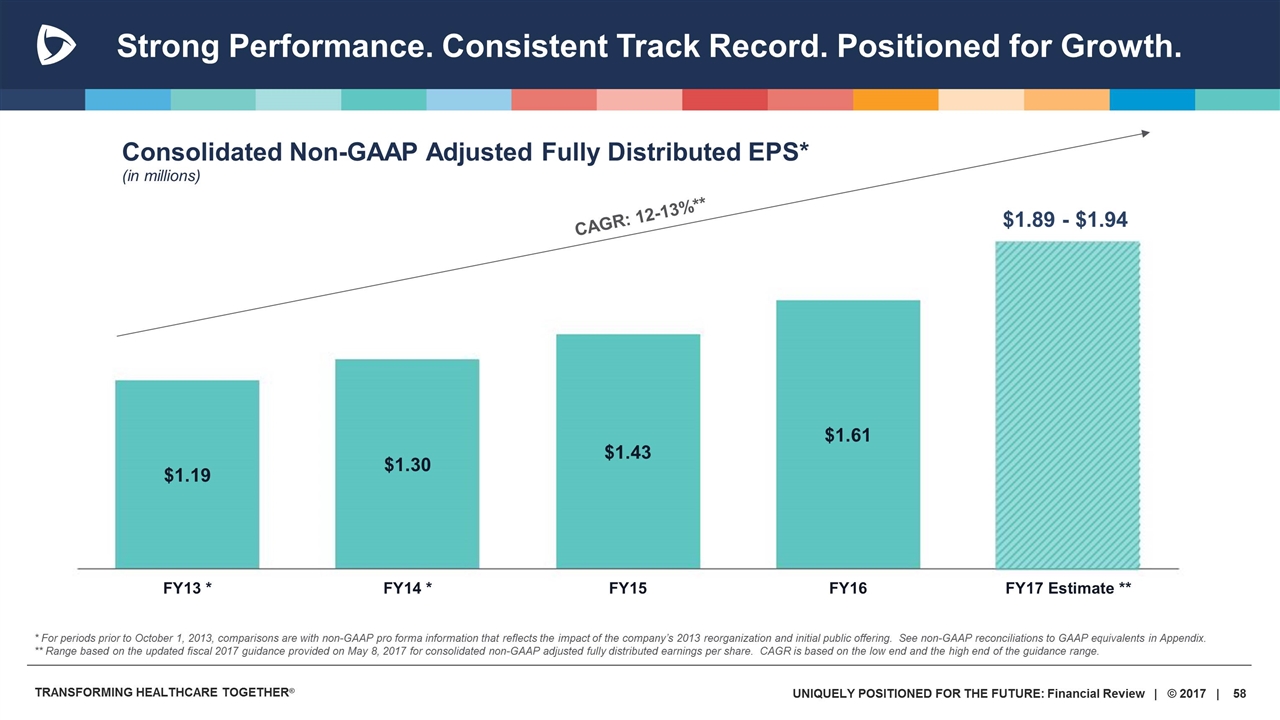

Strong Performance. Consistent Track Record. Positioned for Growth. CAGR: 12-13%** $1.89 - $1.94 * For periods prior to October 1, 2013, comparisons are with non-GAAP pro forma information that reflects the impact of the company’s 2013 reorganization and initial public offering. See non-GAAP reconciliations to GAAP equivalents in Appendix. ** Range based on the updated fiscal 2017 guidance provided on May 8, 2017 for consolidated non-GAAP adjusted fully distributed earnings per share. CAGR is based on the low end and the high end of the guidance range.

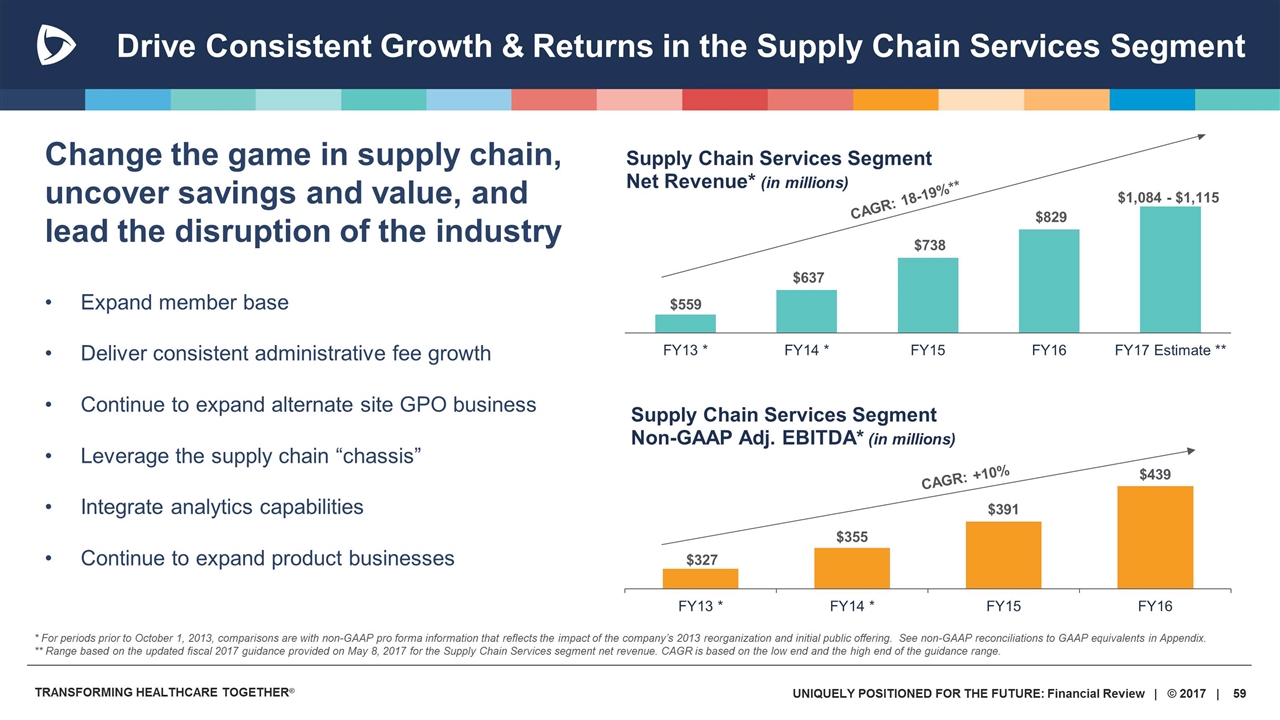

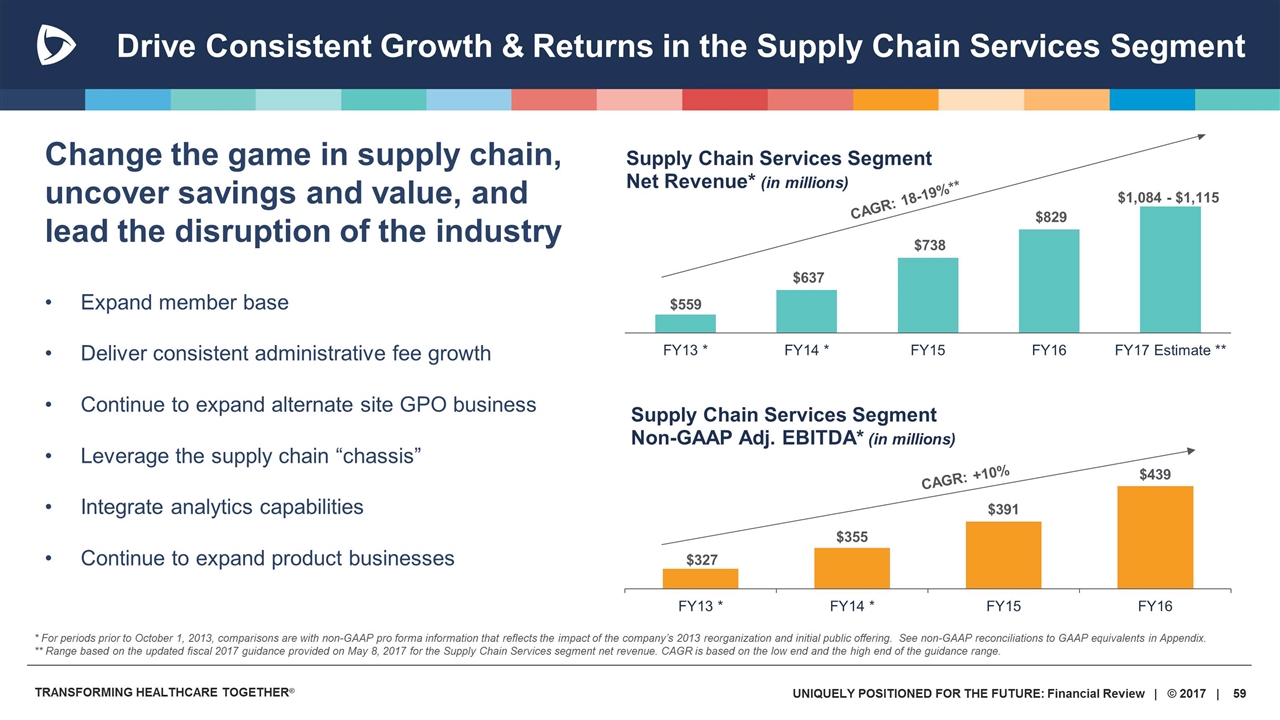

Drive Consistent Growth & Returns in the Supply Chain Services Segment Expand member base Deliver consistent administrative fee growth Continue to expand alternate site GPO business Leverage the supply chain “chassis” Integrate analytics capabilities Continue to expand product businesses CAGR: +10% Change the game in supply chain, uncover savings and value, and lead the disruption of the industry * For periods prior to October 1, 2013, comparisons are with non-GAAP pro forma information that reflects the impact of the company’s 2013 reorganization and initial public offering. See non-GAAP reconciliations to GAAP equivalents in Appendix. ** Range based on the updated fiscal 2017 guidance provided on May 8, 2017 for the Supply Chain Services segment net revenue. CAGR is based on the low end and the high end of the guidance range.

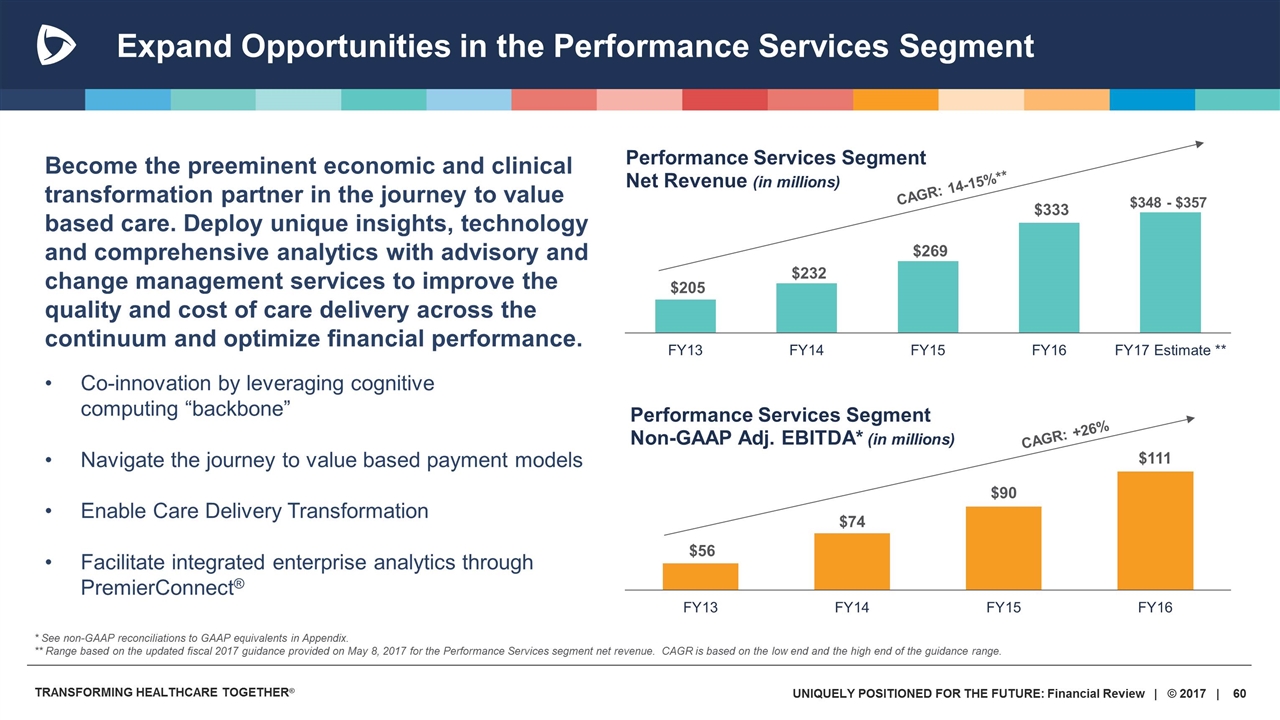

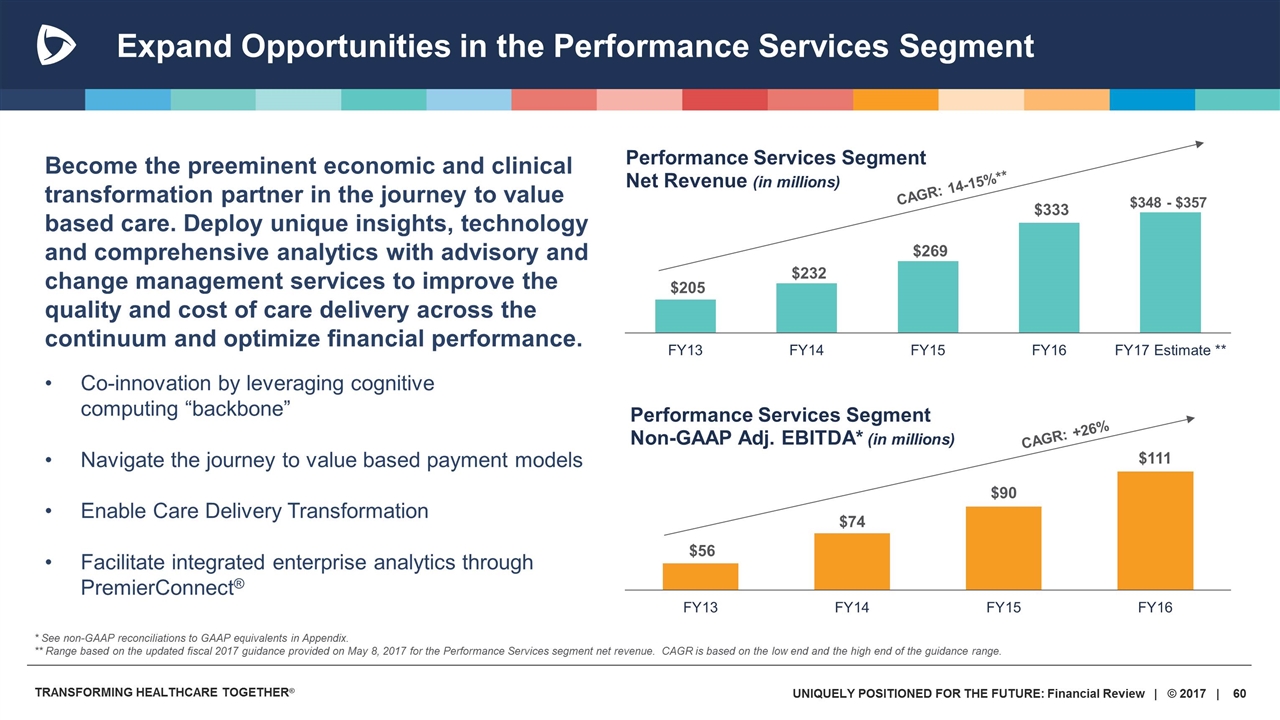

Co-innovation by leveraging cognitive computing “backbone” Navigate the journey to value based payment models Enable Care Delivery Transformation Facilitate integrated enterprise analytics through PremierConnect® Become the preeminent economic and clinical transformation partner in the journey to value based care. Deploy unique insights, technology and comprehensive analytics with advisory and change management services to improve the quality and cost of care delivery across the continuum and optimize financial performance. Expand Opportunities in the Performance Services Segment * See non-GAAP reconciliations to GAAP equivalents in Appendix. ** Range based on the updated fiscal 2017 guidance provided on May 8, 2017 for the Performance Services segment net revenue. CAGR is based on the low end and the high end of the guidance range. $348 - $357 CAGR: +26%

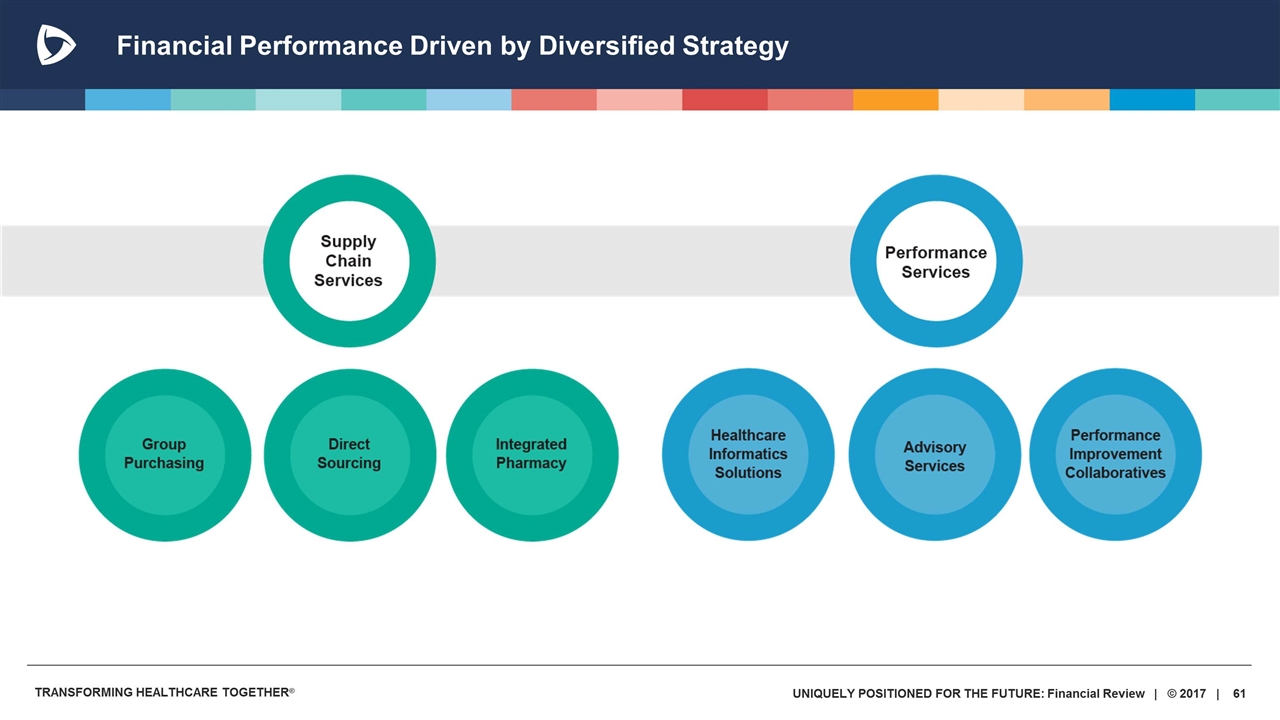

Financial Performance Driven by Diversified Strategy

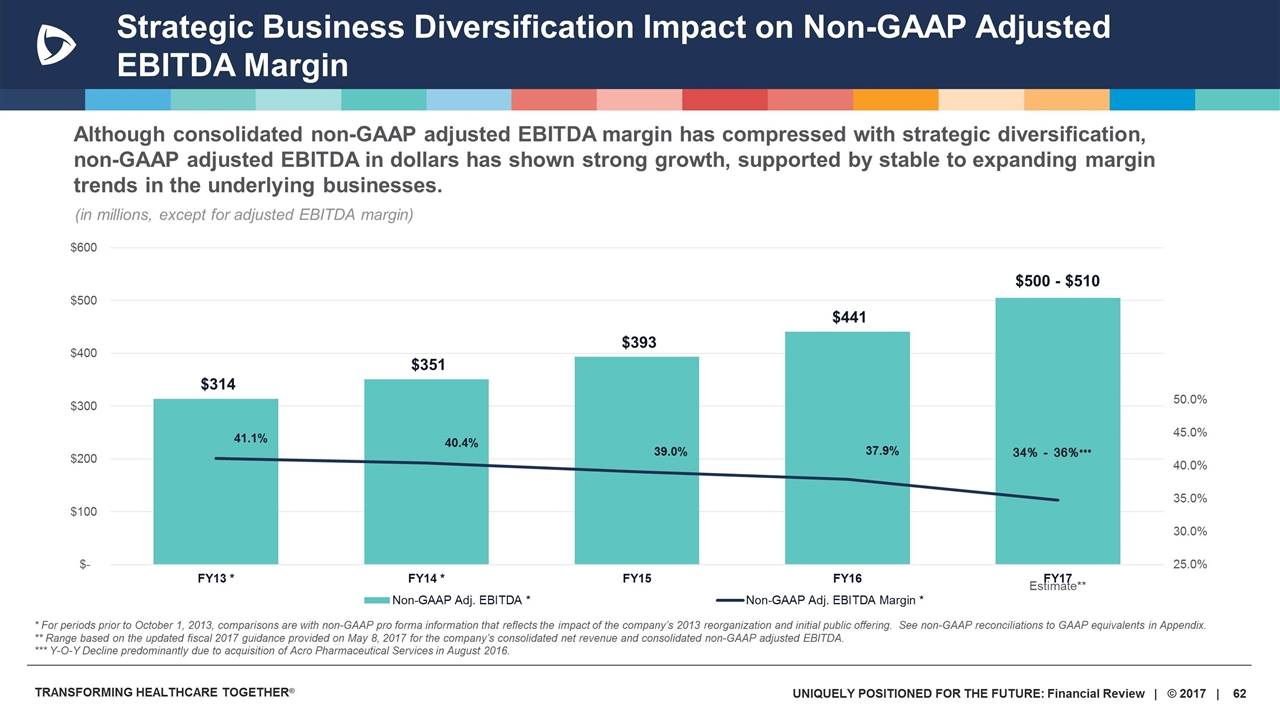

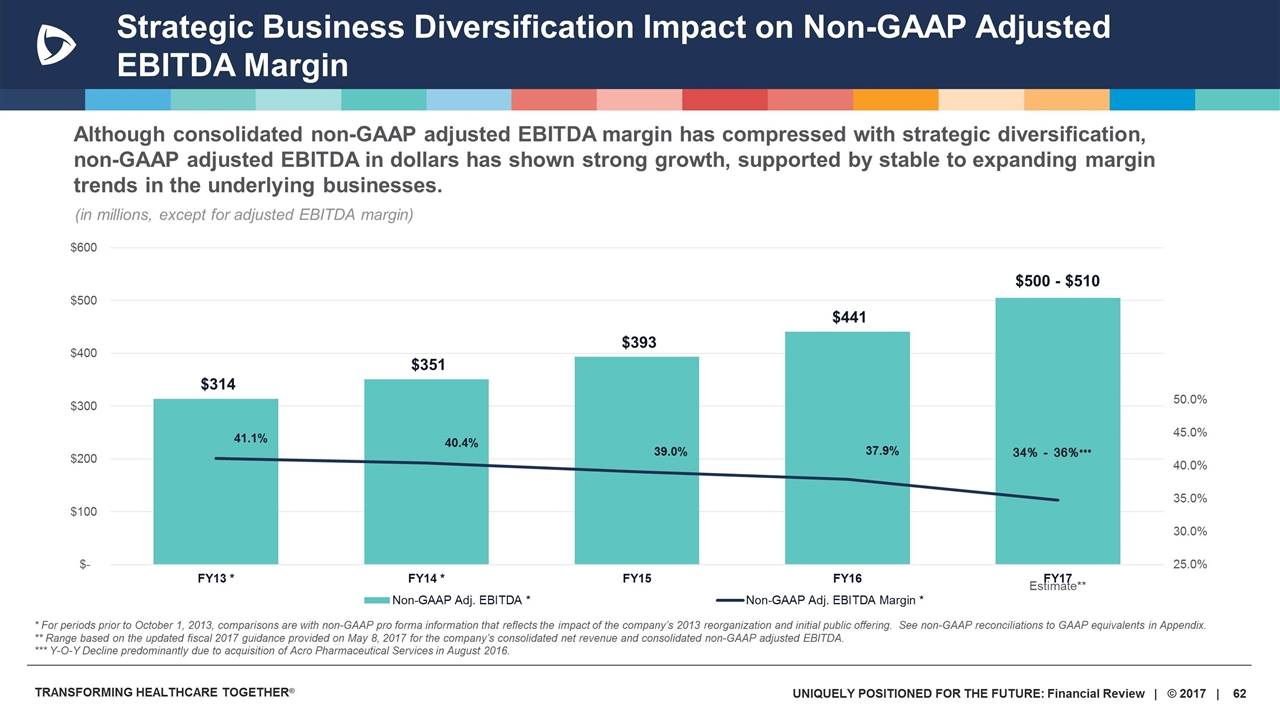

Strategic Business Diversification Impact on Non-GAAP Adjusted EBITDA Margin Although consolidated non-GAAP adjusted EBITDA margin has compressed with strategic diversification, non-GAAP adjusted EBITDA in dollars has shown strong growth, supported by stable to expanding margin trends in the underlying businesses. Estimate** abbb $500 - $510 * For periods prior to October 1, 2013, comparisons are with non-GAAP pro forma information that reflects the impact of the company’s 2013 reorganization and initial public offering. See non-GAAP reconciliations to GAAP equivalents in Appendix. ** Range based on the updated fiscal 2017 guidance provided on May 8, 2017 for the company’s consolidated net revenue and consolidated non-GAAP adjusted EBITDA. *** Y-O-Y Decline predominantly due to acquisition of Acro Pharmaceutical Services in August 2016.

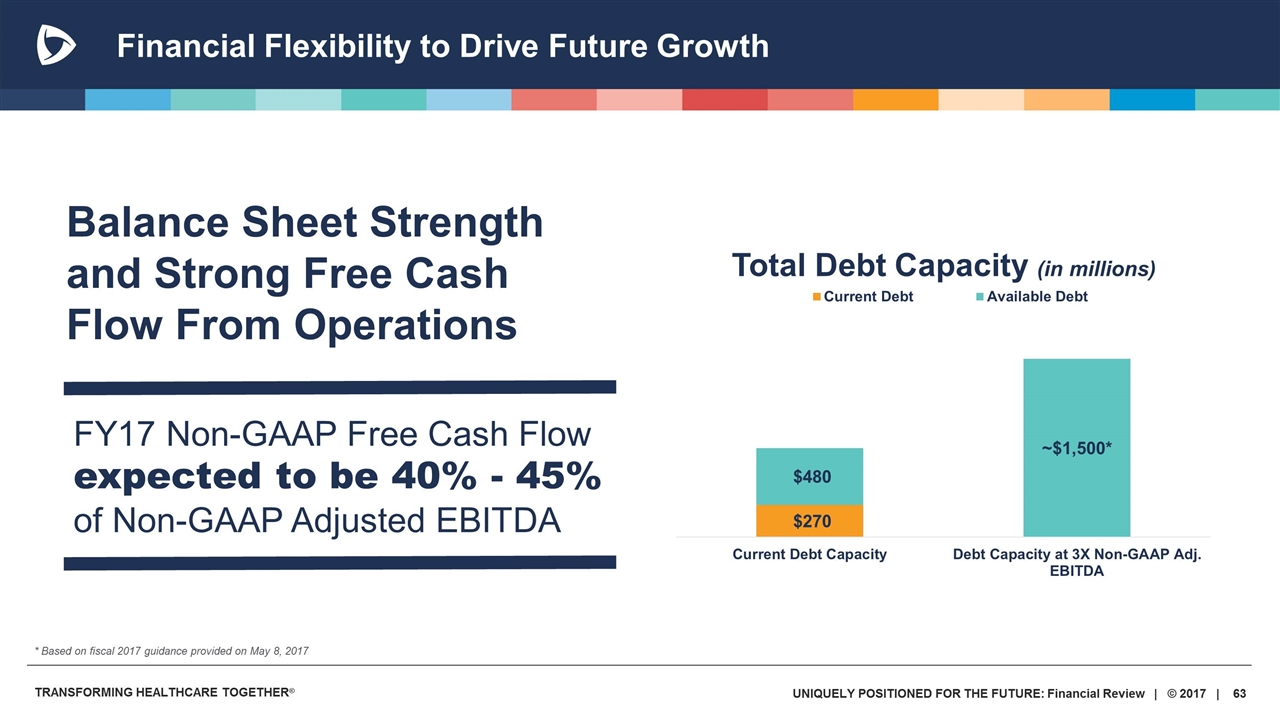

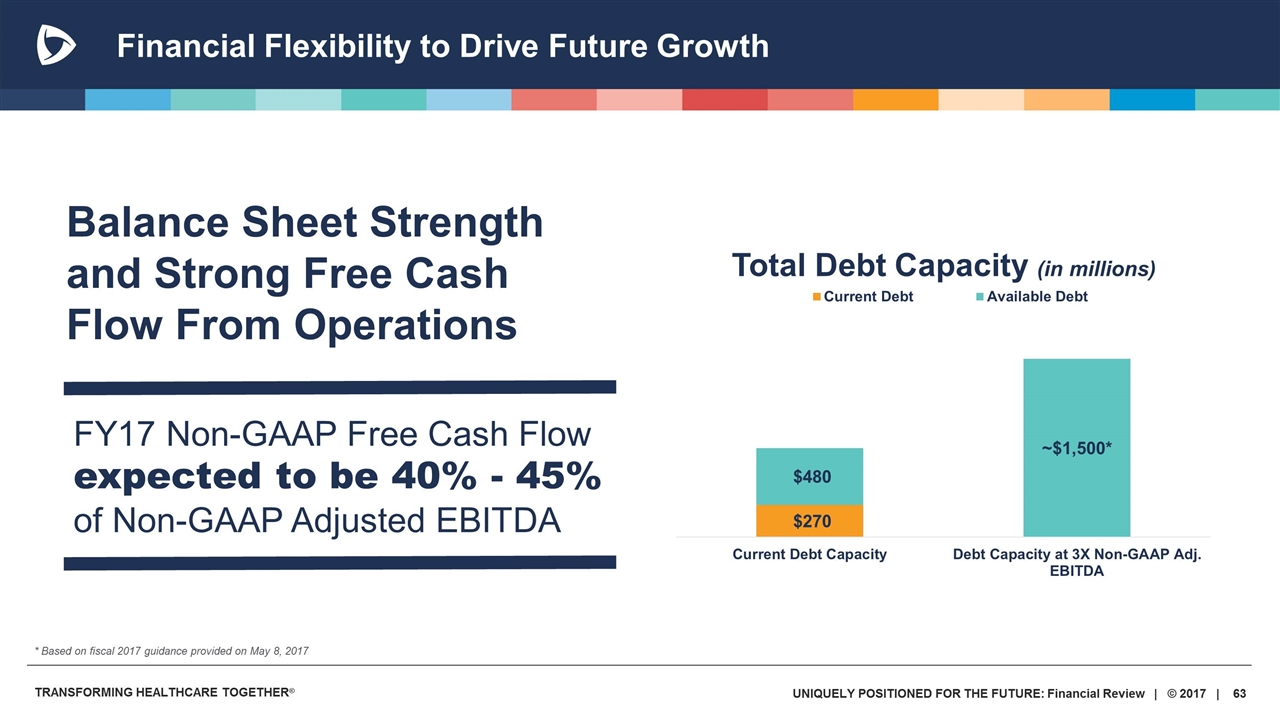

Financial Flexibility to Drive Future Growth FY17 Non-GAAP Free Cash Flow expected to be 40% - 45% of Non-GAAP Adjusted EBITDA Balance Sheet Strength and Strong Free Cash Flow From Operations * Based on fiscal 2017 guidance provided on May 8, 2017

Capital Deployment Strategy Value-Enhancing Investments Balanced With Potential Capital Return to Stockholders as Appropriate Deploy capital to grow organically and through M&A to meet strategic priorities 01 Maintain flexible balance sheet to optimize capital structure over time 02 Continue to assess stockholder return through distribution of capital 03

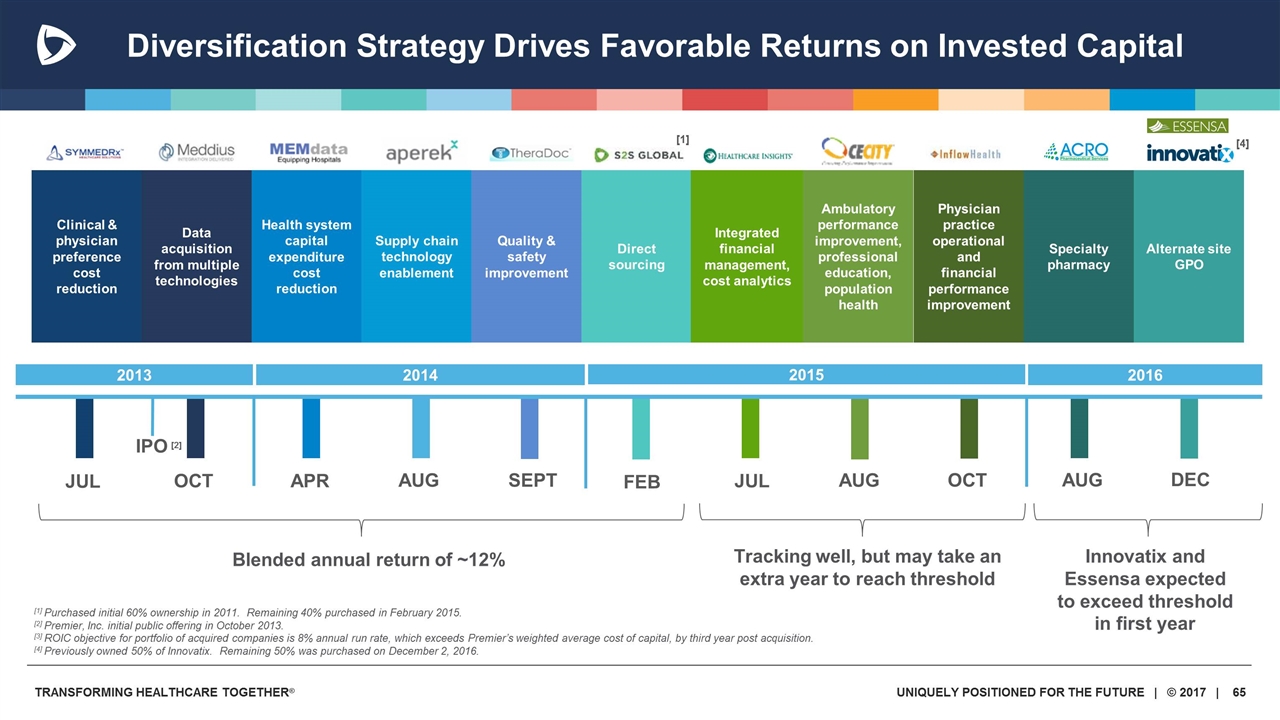

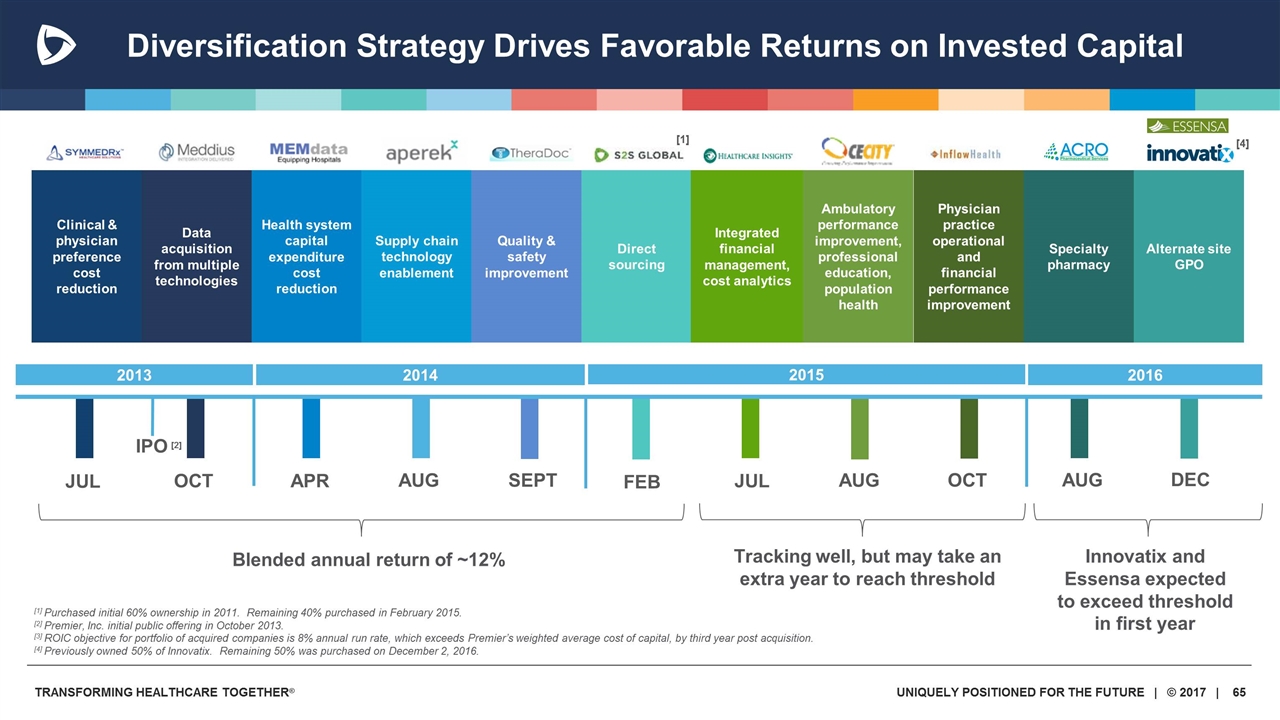

Diversification Strategy Drives Favorable Returns on Invested Capital Clinical & physician preference cost reduction Data acquisition from multiple technologies Health system capital expenditure cost reduction Supply chain technology enablement Quality & safety improvement Direct sourcing Integrated financial management, cost analytics Ambulatory performance improvement, professional education, population health Physician practice operational and financial performance improvement JUL OCT APR AUG SEPT FEB JUL AUG OCT 2013 2014 2015 [1] Specialty pharmacy 2016 AUG Alternate site GPO DEC IPO [2] [4] Blended annual return of ~12% Tracking well, but may take an extra year to reach threshold Innovatix and Essensa expected to exceed threshold in first year [1] Purchased initial 60% ownership in 2011. Remaining 40% purchased in February 2015. [2] Premier, Inc. initial public offering in October 2013. [3] ROIC objective for portfolio of acquired companies is 8% annual run rate, which exceeds Premier’s weighted average cost of capital, by third year post acquisition. [4] Previously owned 50% of Innovatix. Remaining 50% was purchased on December 2, 2016.

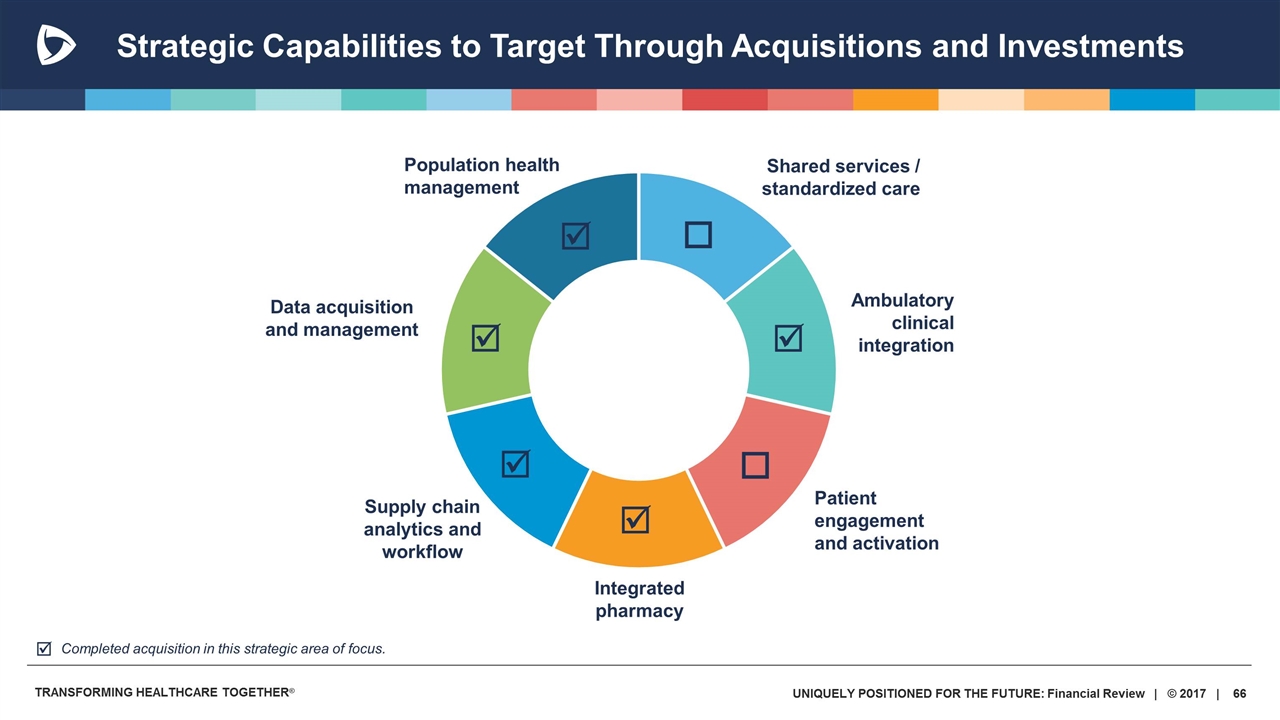

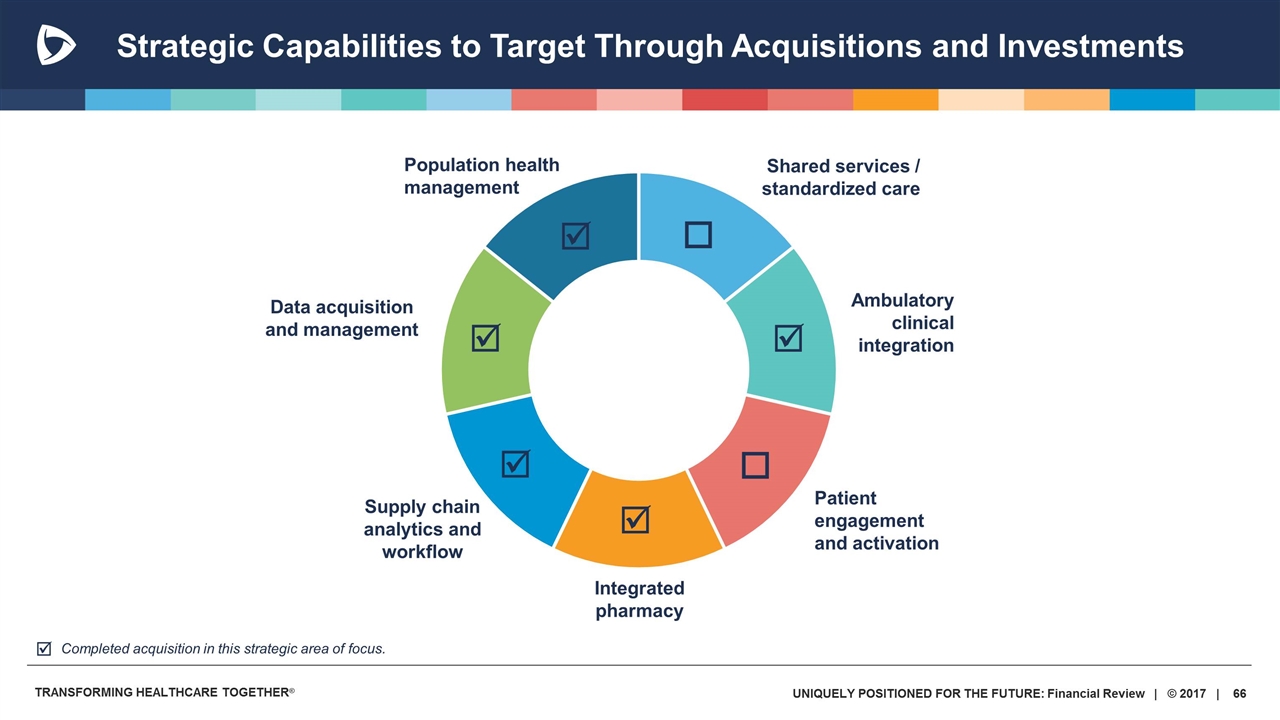

Strategic Capabilities to Target Through Acquisitions and Investments Supply chain analytics and workflow Integrated pharmacy Shared services / standardized care Ambulatory clinical integration Population health management Patient engagement and activation Data acquisition and management þ þ þ þ o þ Completed acquisition in this strategic area of focus.

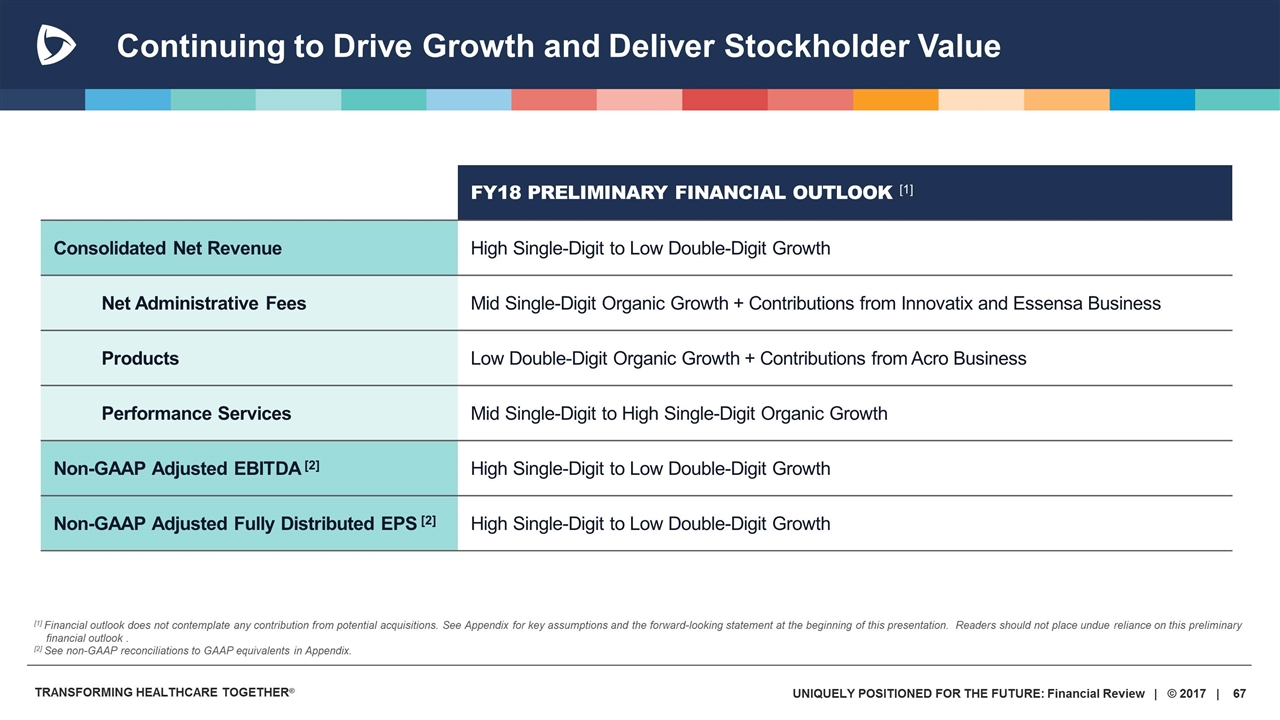

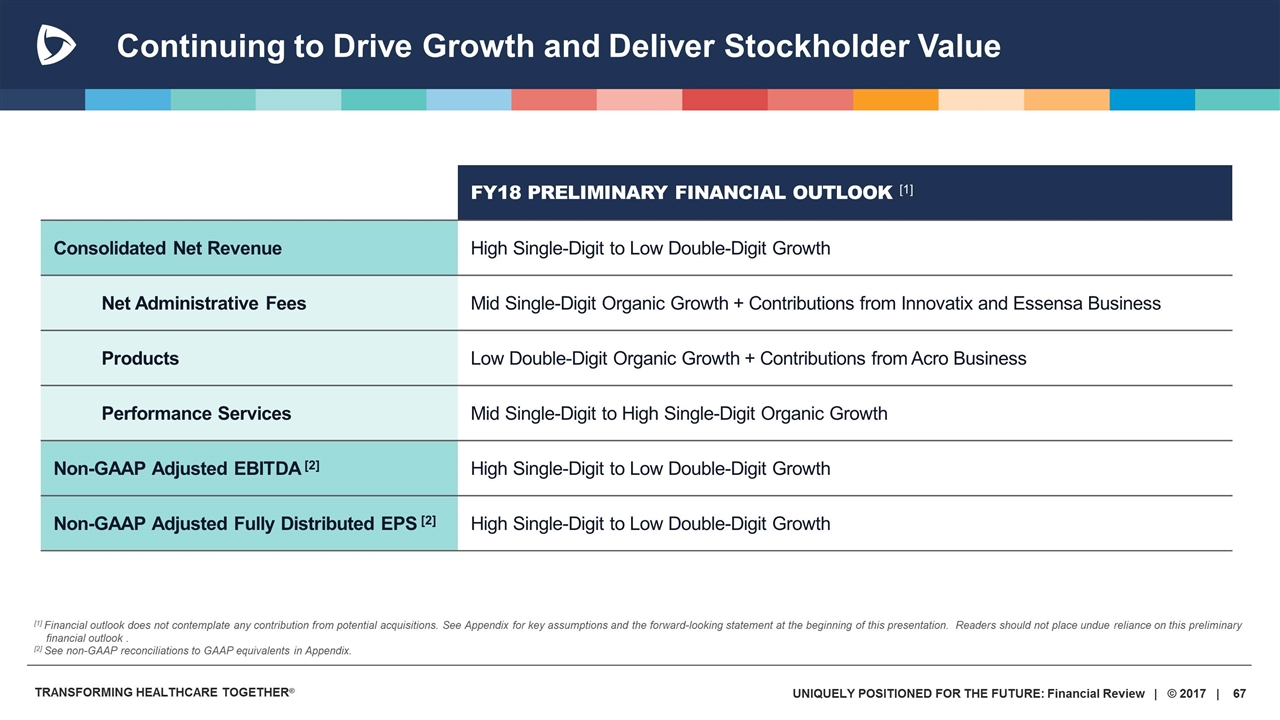

Continuing to Drive Growth and Deliver Stockholder Value FY18 Preliminary FINANCIAL OUTLOOK [1] Consolidated Net Revenue High Single-Digit to Low Double-Digit Growth Net Administrative Fees Mid Single-Digit Organic Growth + Contributions from Innovatix and Essensa Business Products Low Double-Digit Organic Growth + Contributions from Acro Business Performance Services Mid Single-Digit to High Single-Digit Organic Growth Non-GAAP Adjusted EBITDA [2] High Single-Digit to Low Double-Digit Growth Non-GAAP Adjusted Fully Distributed EPS [2] High Single-Digit to Low Double-Digit Growth [1] Financial outlook does not contemplate any contribution from potential acquisitions. See Appendix for key assumptions and the forward-looking statement at the beginning of this presentation. Readers should not place undue reliance on this preliminary financial outlook . [2] See non-GAAP reconciliations to GAAP equivalents in Appendix.

QUESTIONS Financial Review and Outlook

CLOSING REMARKS UNIQUELY POSITIONED FOR THE FUTURE

THANK YOU

APPENDIX

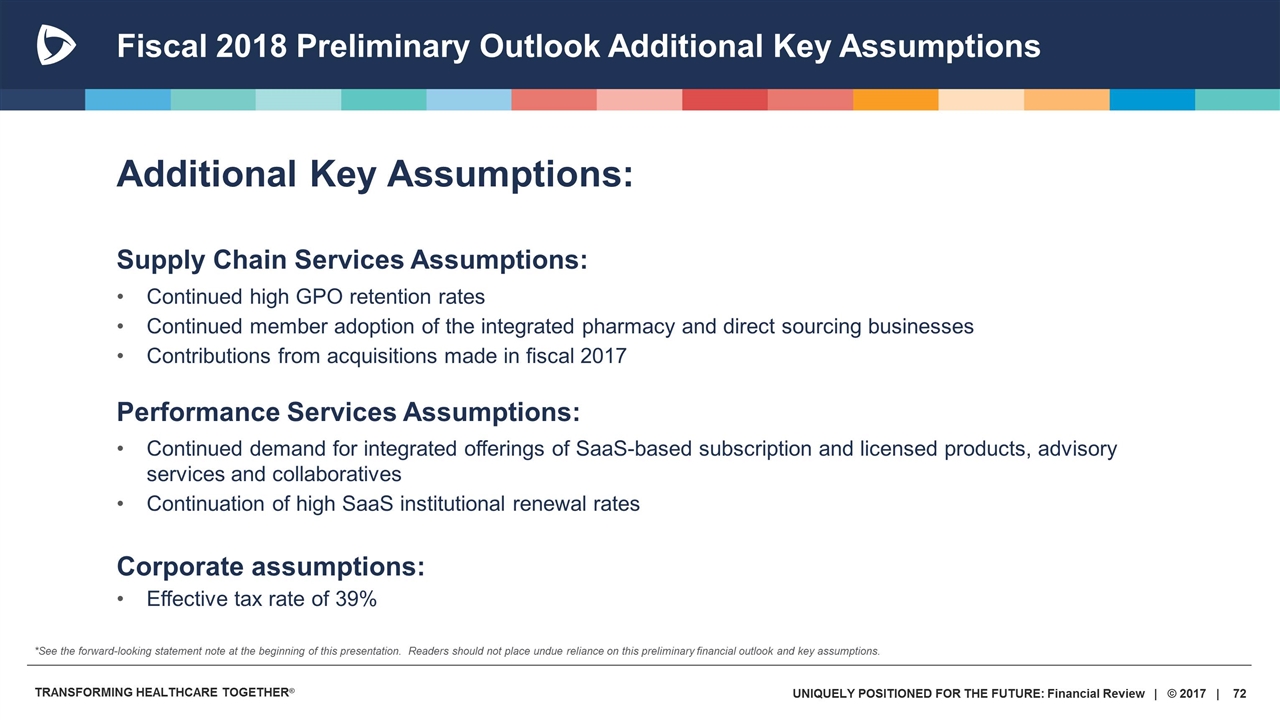

Fiscal 2018 Preliminary Outlook Additional Key Assumptions Additional Key Assumptions: Supply Chain Services Assumptions: Continued high GPO retention rates Continued member adoption of the integrated pharmacy and direct sourcing businesses Contributions from acquisitions made in fiscal 2017 Performance Services Assumptions: Continued demand for integrated offerings of SaaS-based subscription and licensed products, advisory services and collaboratives Continuation of high SaaS institutional renewal rates Corporate assumptions: Effective tax rate of 39% *See the forward-looking statement note at the beginning of this presentation. Readers should not place undue reliance on this preliminary financial outlook and key assumptions.

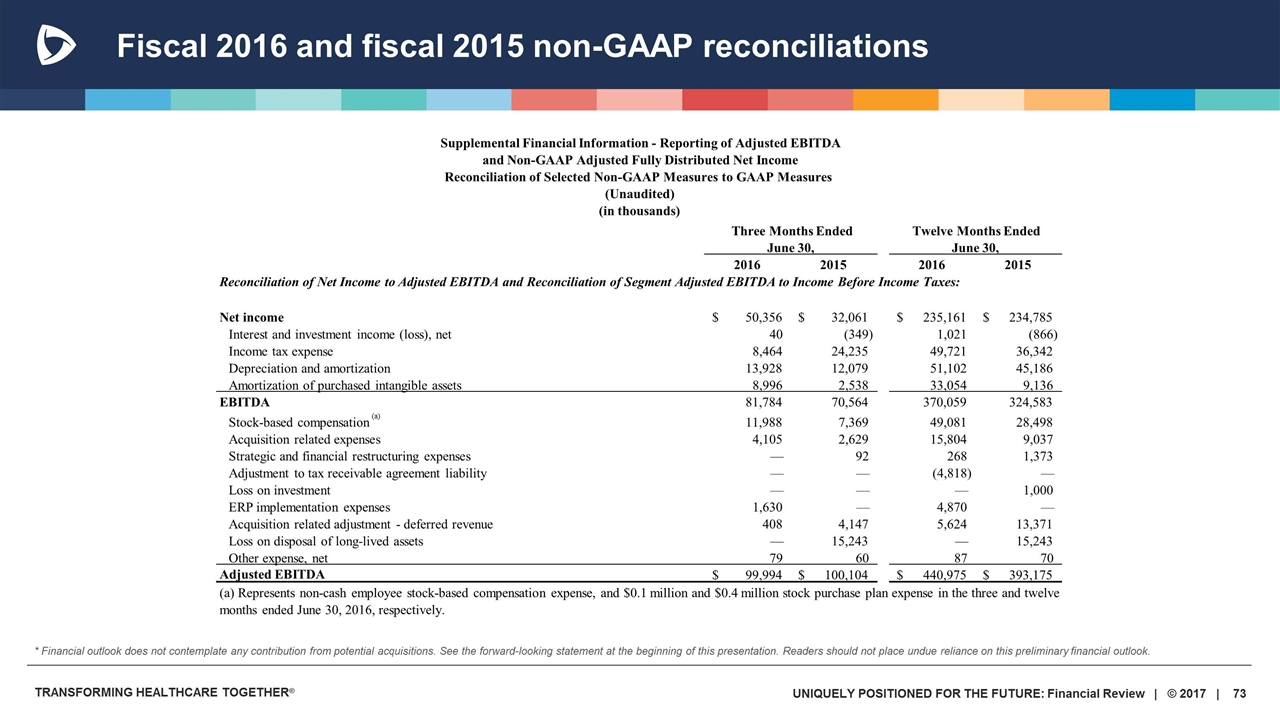

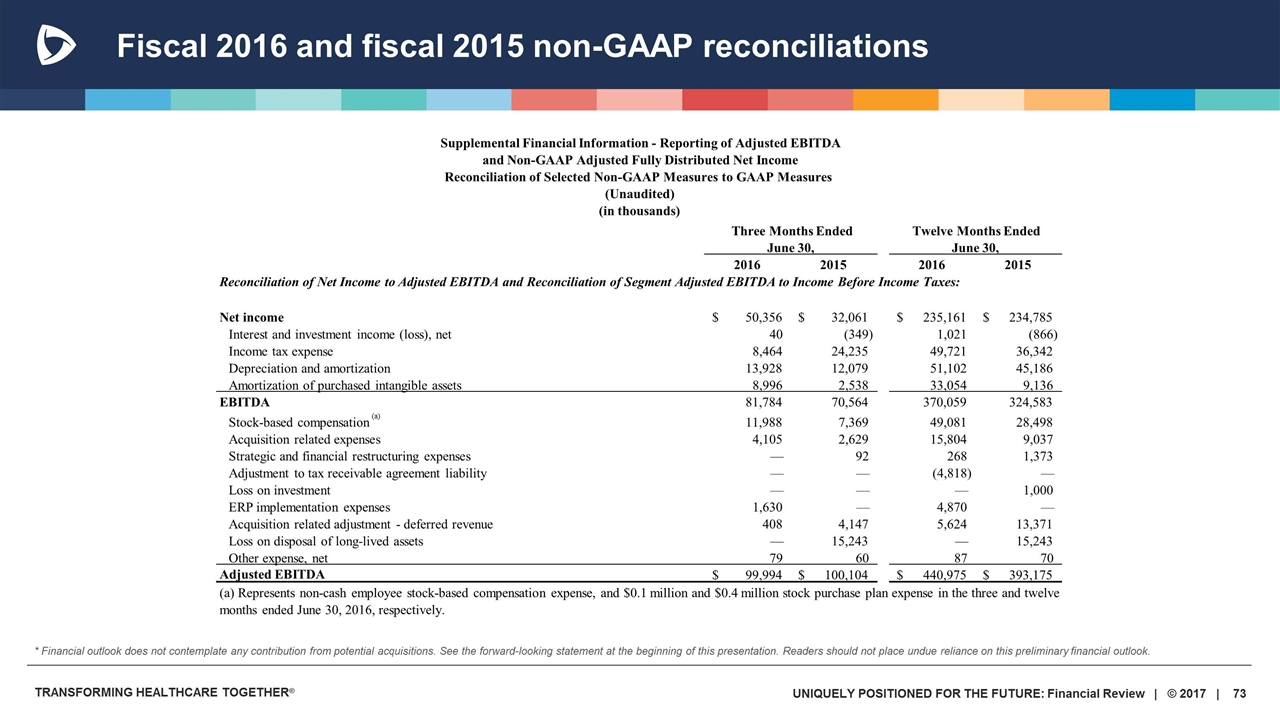

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations * Financial outlook does not contemplate any contribution from potential acquisitions. See the forward-looking statement at the beginning of this presentation. Readers should not place undue reliance on this preliminary financial outlook. 2016 2015 2016 2015 Net income 50,356 $ 32,061 $ 235,161 $ 234,785 $ Interest and investment income (loss), net 40 (349) 1,021 (866) Income tax expense 8,464 24,235 49,721 36,342 Depreciation and amortization 13,928 12,079 51,102 45,186 Amortization of purchased intangible assets 8,996 2,538 33,054 9,136 EBITDA 81,784 70,564 370,059 324,583 Stock-based compensation (a) 11,988 7,369 49,081 28,498 Acquisition related expenses 4,105 2,629 15,804 9,037 Strategic and financial restructuring expenses — 92 268 1,373 Adjustment to tax receivable agreement liability — — (4,818) — Loss on investment — — — 1,000 ERP implementation expenses 1,630 — 4,870 — Acquisition related adjustment - deferred revenue 408 4,147 5,624 13,371 Loss on disposal of long-lived assets — 15,243 — 15,243 Other expense, net 79 60 87 70 Adjusted EBITDA 99,994 $ 100,104 $ 440,975 $ 393,175 $ Three Months Ended June 30, Twelve Months Ended June 30, Supplemental Financial Information - Reporting of Adjusted EBITDA (Unaudited) (in thousands) Reconciliation of Selected Non-GAAP Measures to GAAP Measures and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of Segment Adjusted EBITDA to Income Before Income Taxes: (a) Represents non-cash employee stock-based compensation expense, and $0.1 million and $0.4 million stock purchase plan expense in the three and twelve months ended June 30, 2016, respectively.

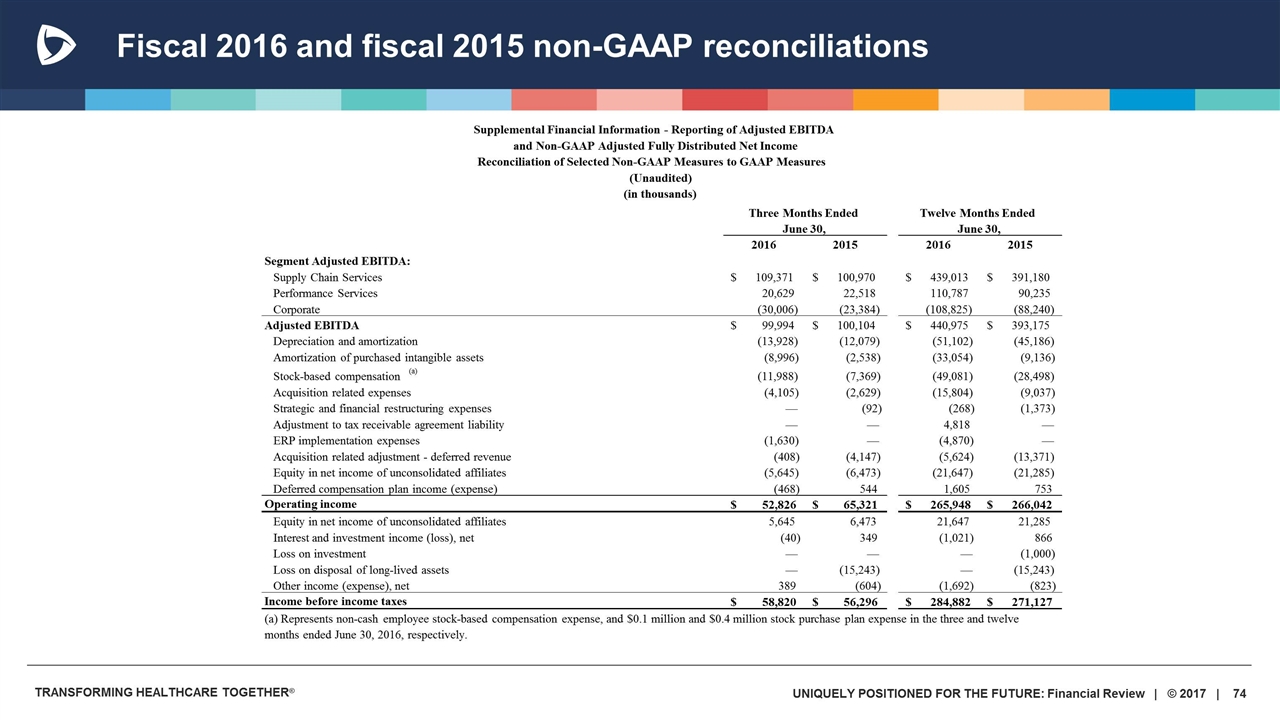

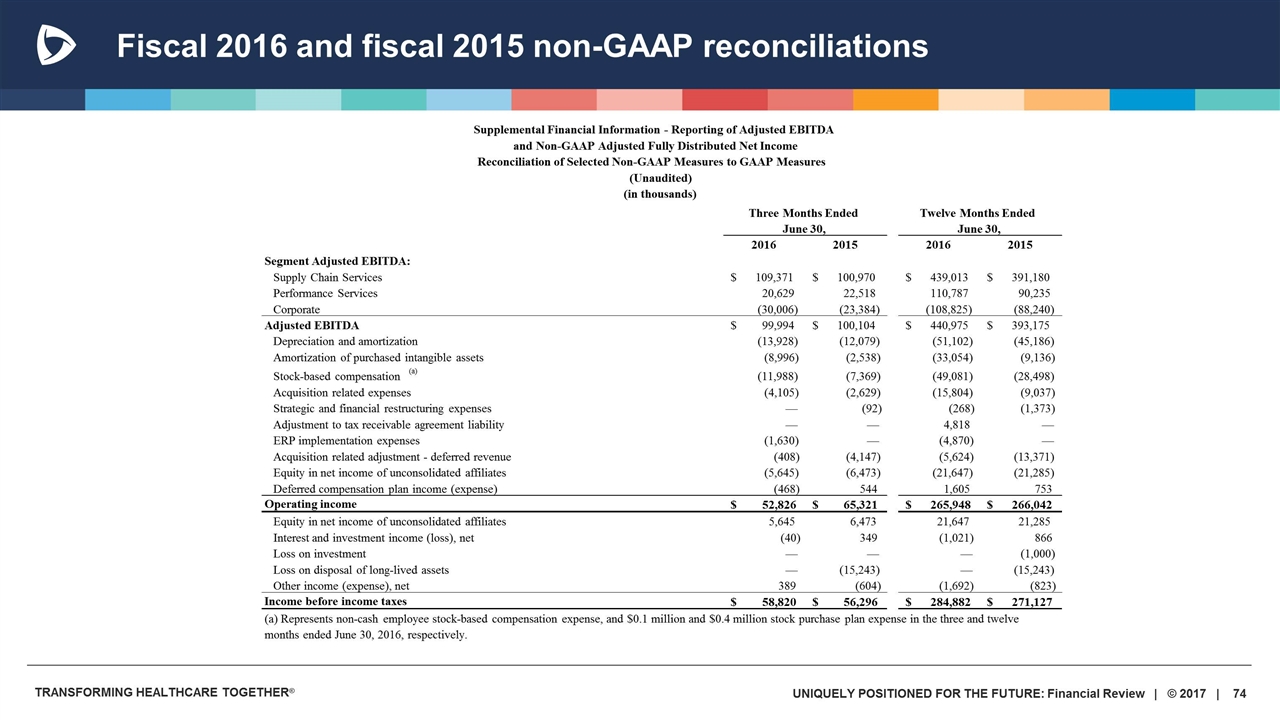

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations 2016 2015 2016 2015 Segment Adjusted EBITDA: Supply Chain Services 109,371 $ 100,970 $ 439,013 $ 391,180 $ Performance Services 20,629 22,518 110,787 90,235 Corporate (30,006) (23,384) (108,825) (88,240) Adjusted EBITDA 99,994 $ 100,104 $ 440,975 $ 393,175 $ Depreciation and amortization (13,928) (12,079) (51,102) (45,186) Amortization of purchased intangible assets (8,996) (2,538) (33,054) (9,136) Stock-based compensation (a) (11,988) (7,369) (49,081) (28,498) Acquisition related expenses (4,105) (2,629) (15,804) (9,037) Strategic and financial restructuring expenses — (92) (268) (1,373) Adjustment to tax receivable agreement liability — — 4,818 — ERP implementation expenses (1,630) — (4,870) — Acquisition related adjustment - deferred revenue (408) (4,147) (5,624) (13,371) Equity in net income of unconsolidated affiliates (5,645) (6,473) (21,647) (21,285) Deferred compensation plan income (expense) (468) 544 1,605 753 Operating income 52,826 $ 65,321 $ 265,948 $ 266,042 $ Equity in net income of unconsolidated affiliates 5,645 6,473 21,647 21,285 Interest and investment income (loss), net (40) 349 (1,021) 866 Loss on investment — — — (1,000) Loss on disposal of long-lived assets — (15,243) — (15,243) Other income (expense), net 389 (604) (1,692) (823) Income before income taxes 58,820 $ 56,296 $ 284,882 $ 271,127 $ Three Months Ended June 30, Twelve Months Ended June 30, (a) Represents non-cash employee stock-based compensation expense, and $0.1 million and $0.4 million stock purchase plan expense in the three and twelve months ended June 30, 2016, respectively. Supplemental Financial Information - Reporting of Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (in thousands)

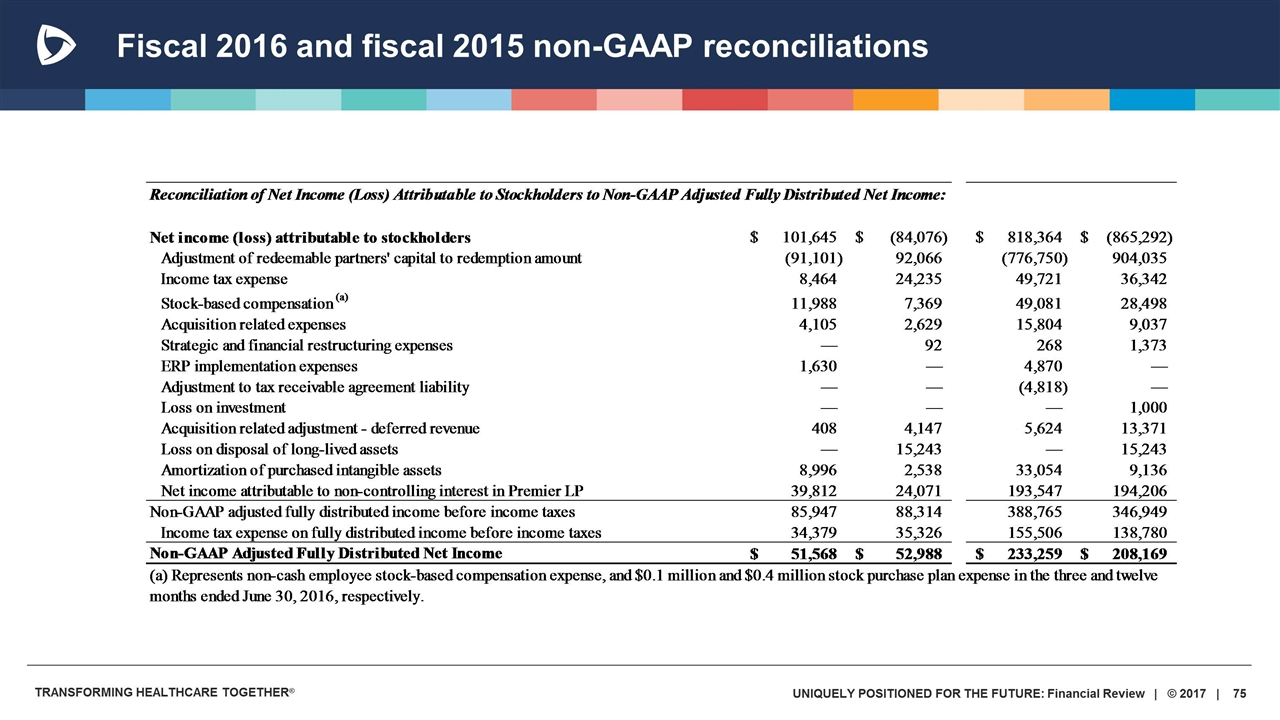

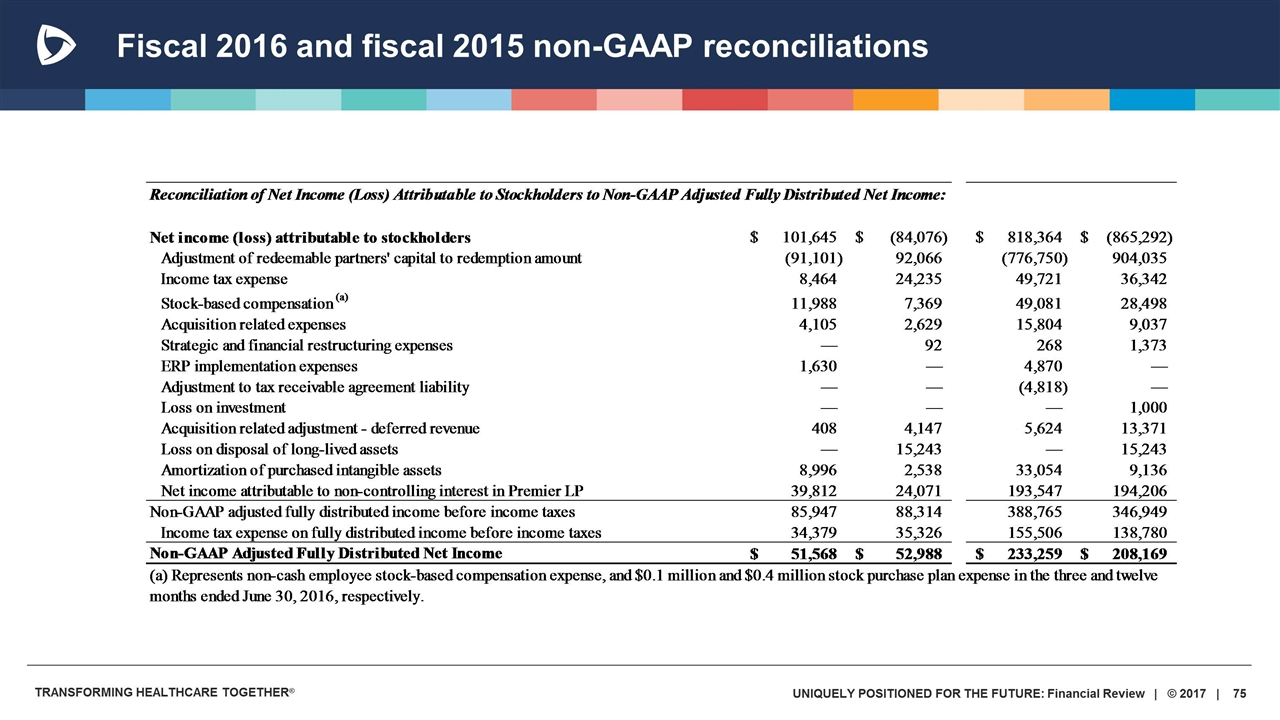

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

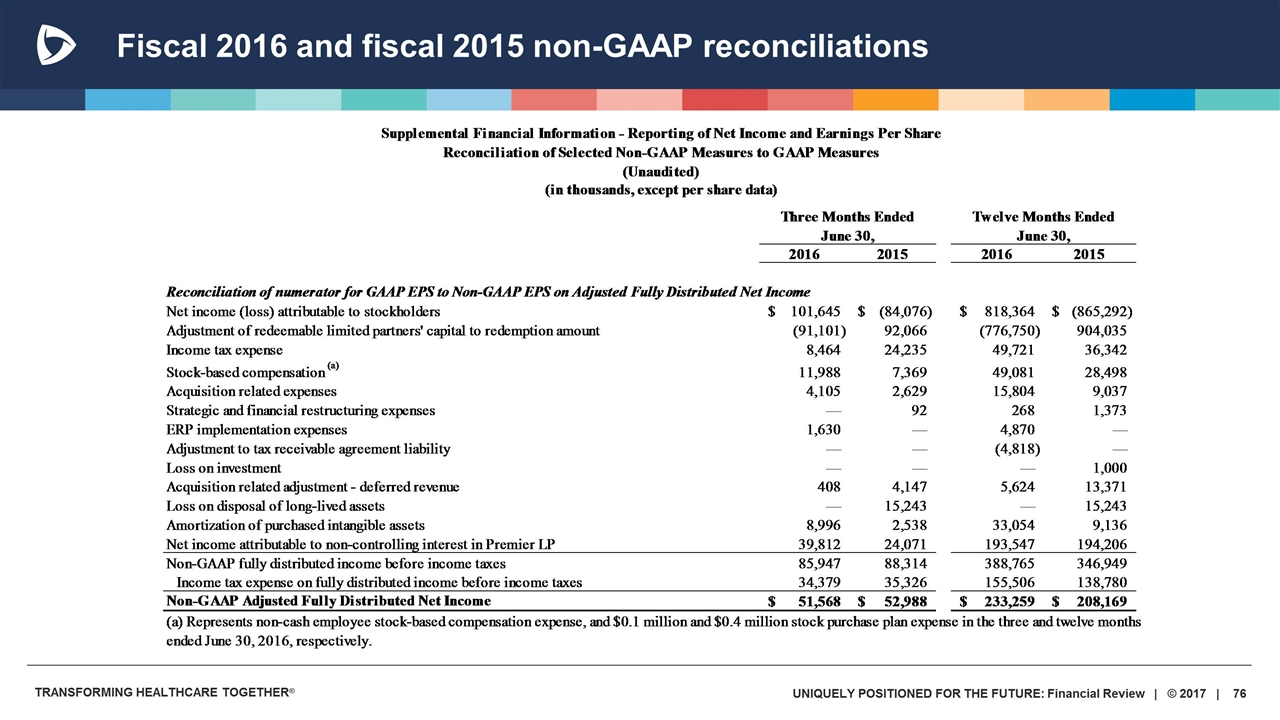

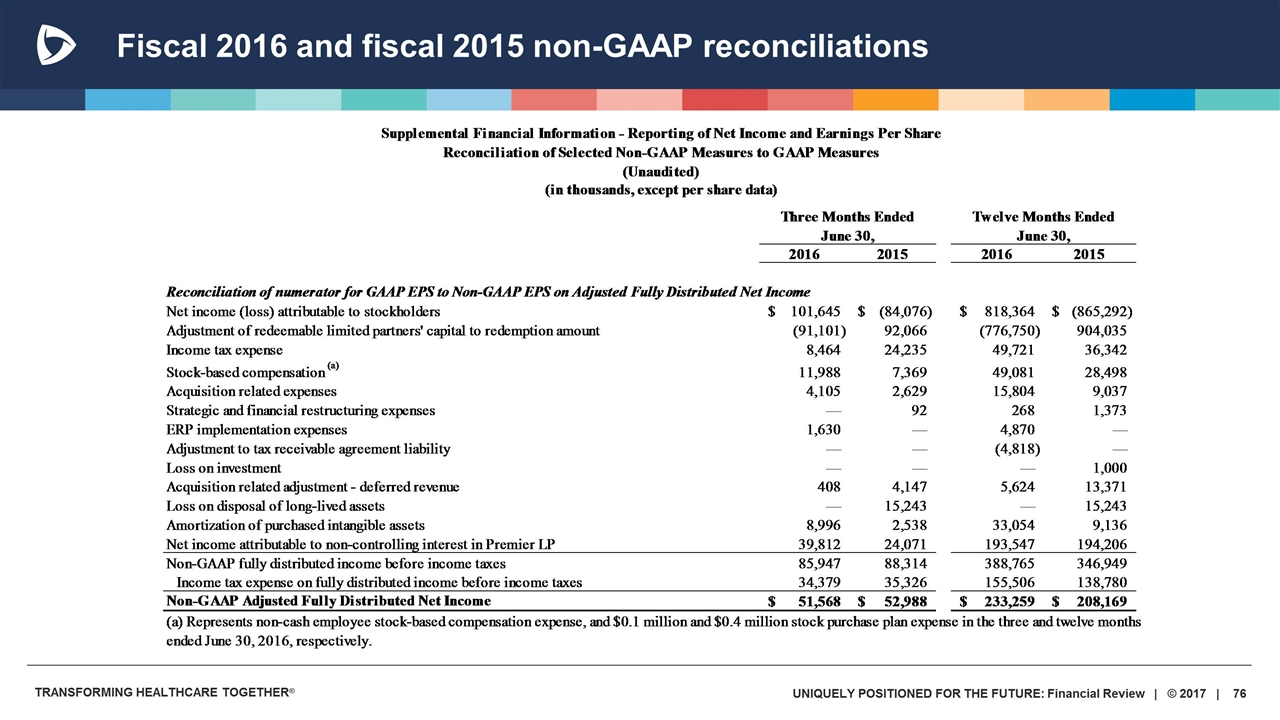

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

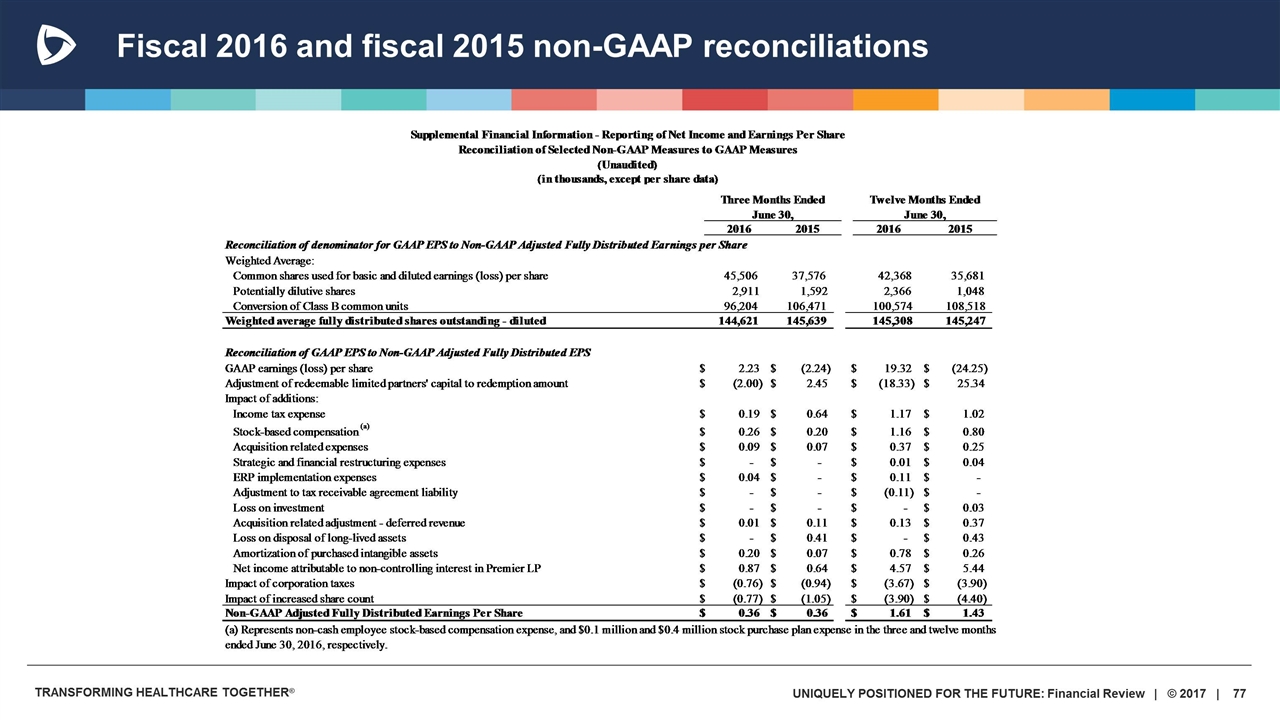

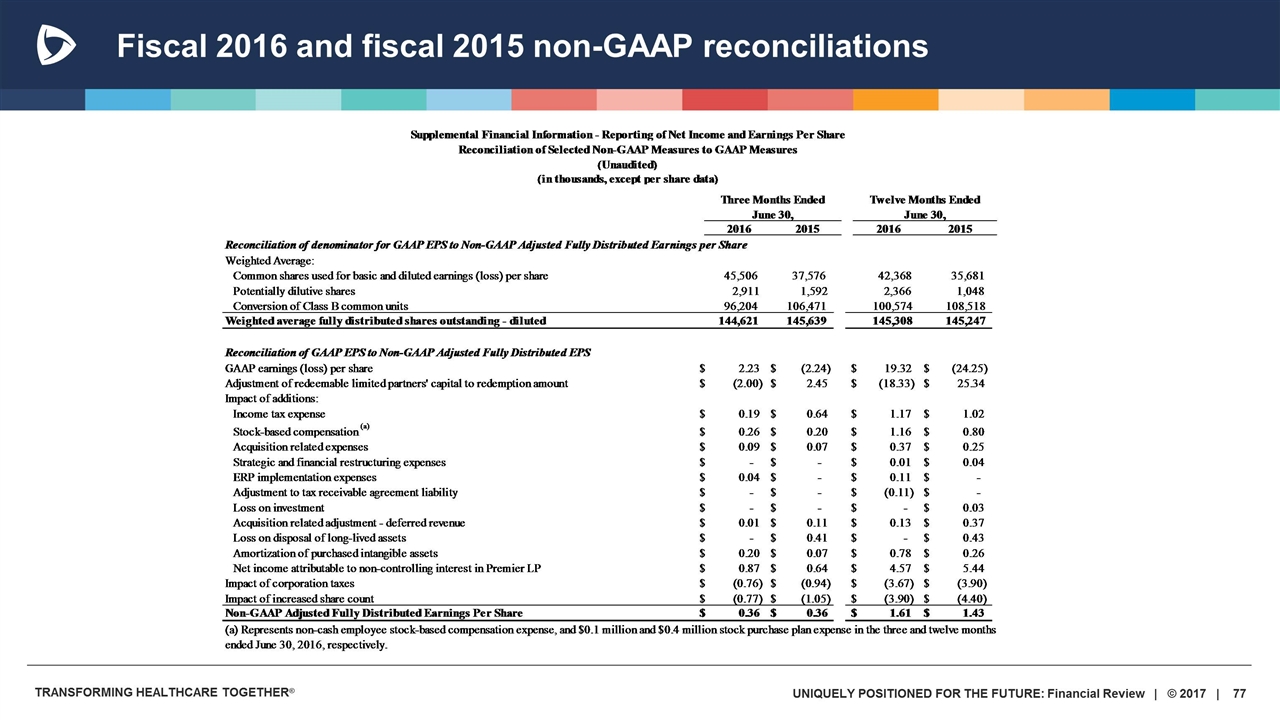

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

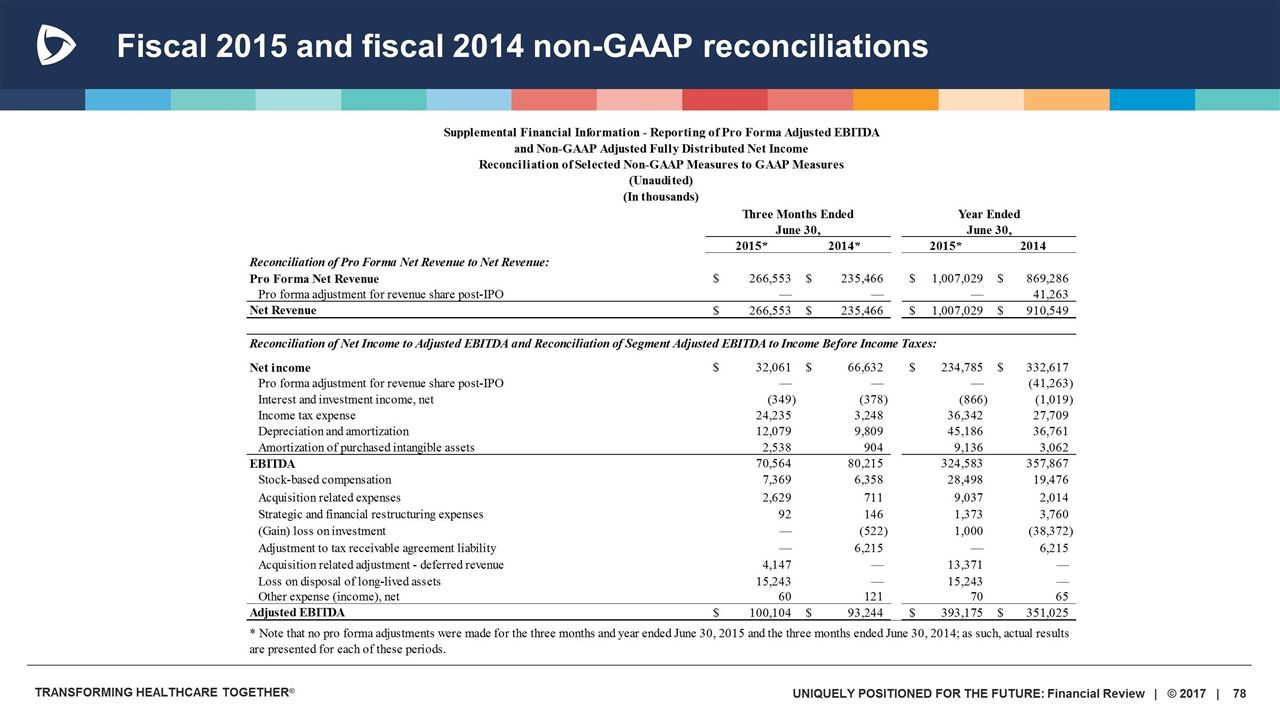

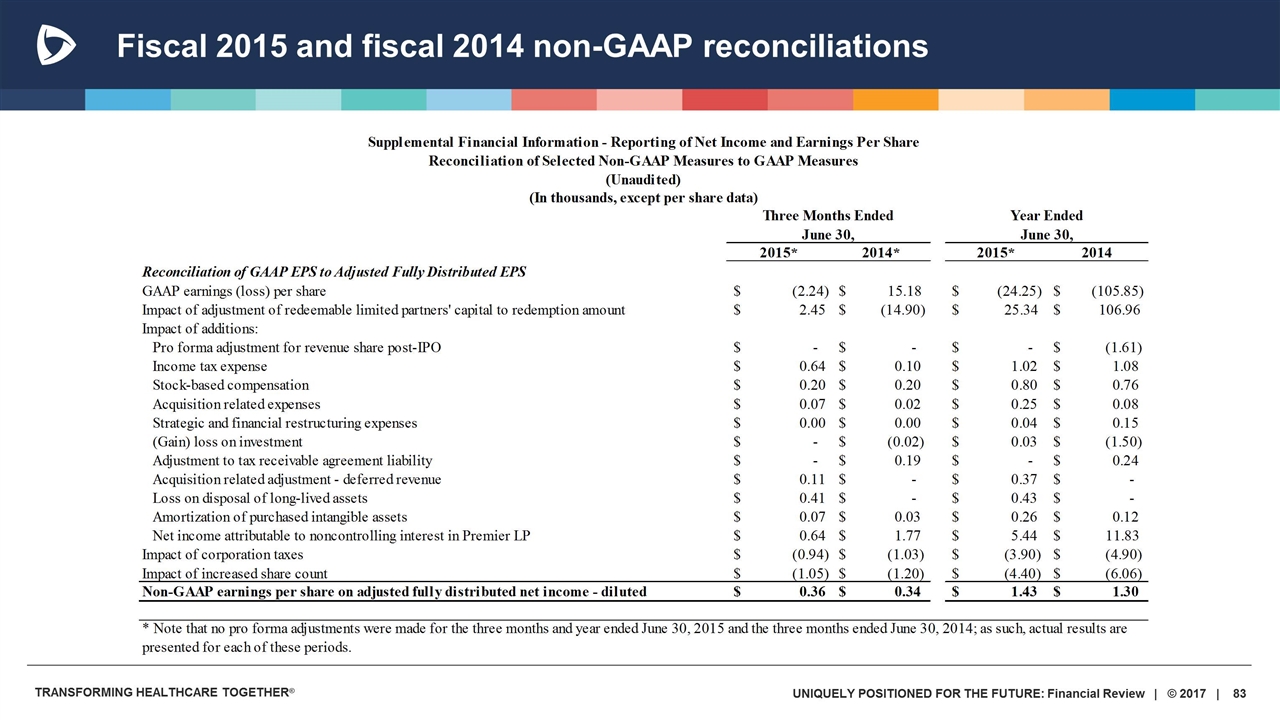

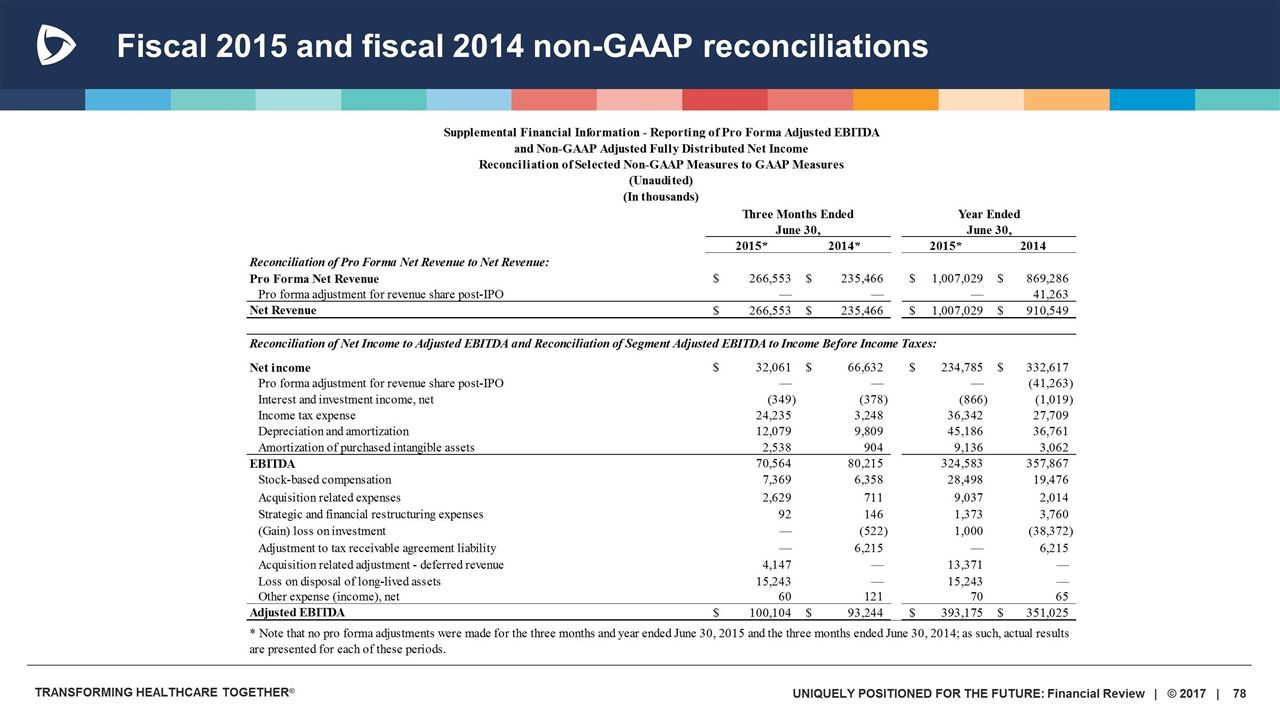

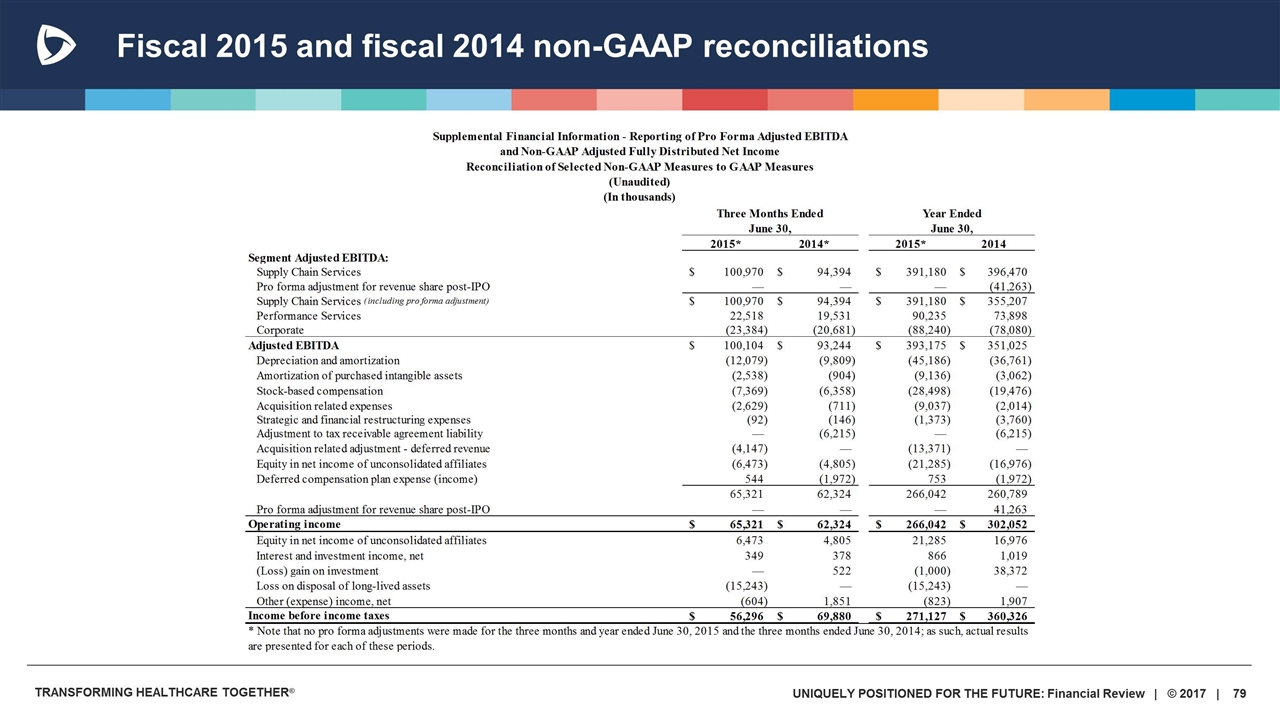

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

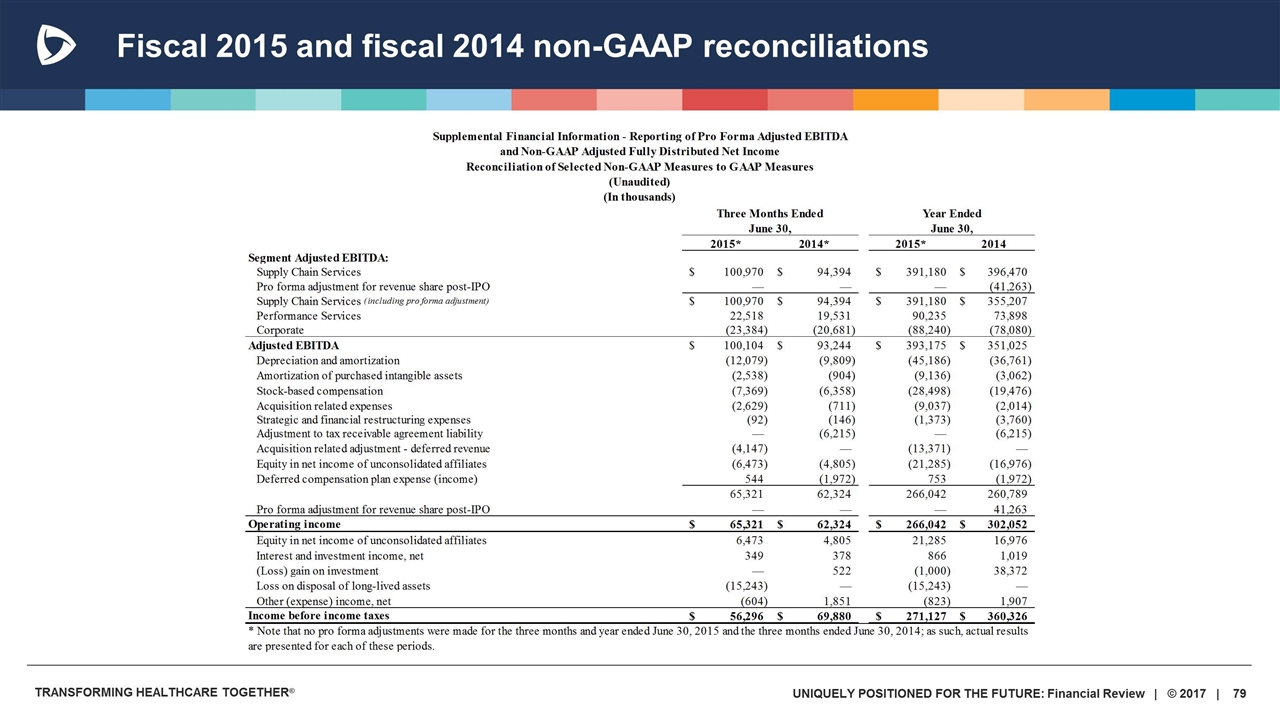

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

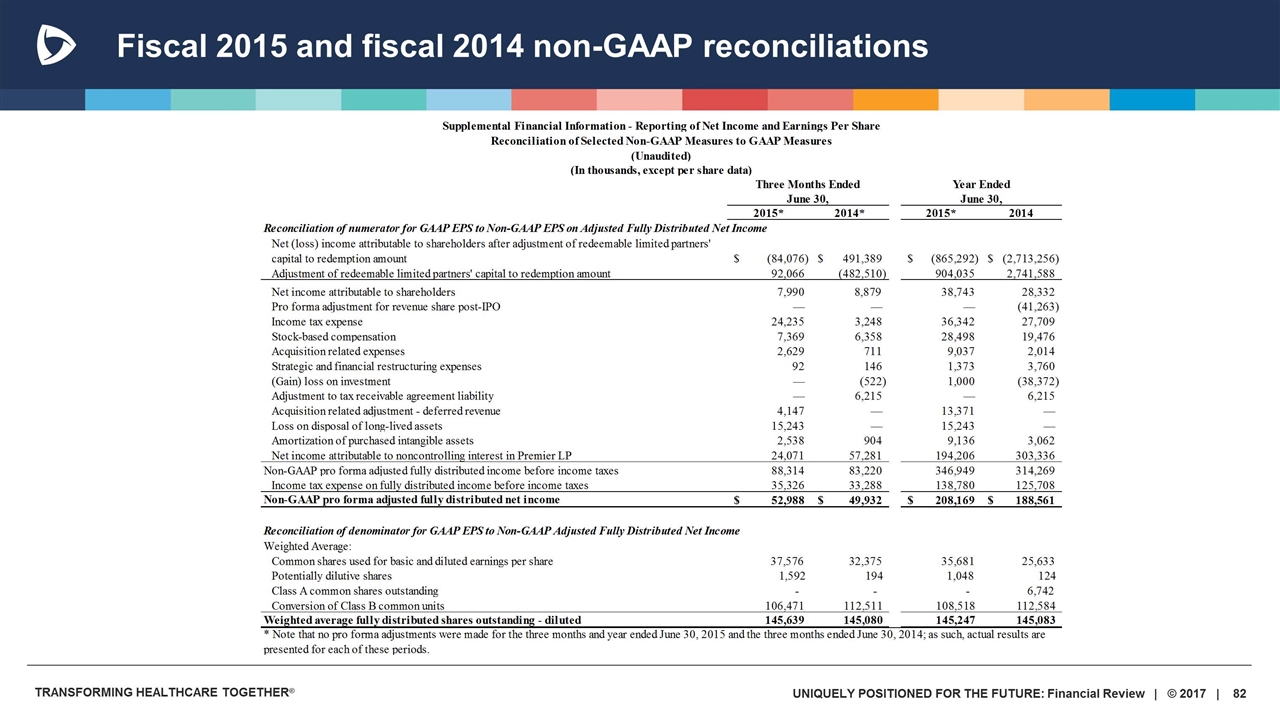

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

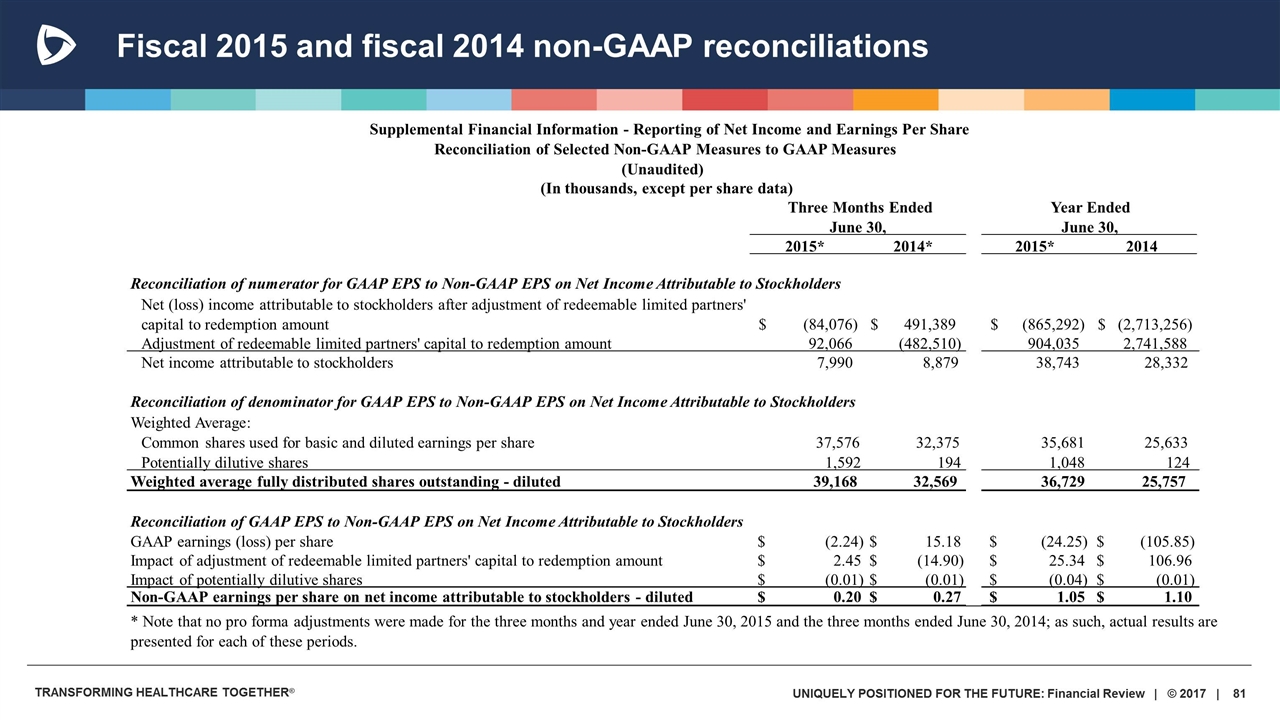

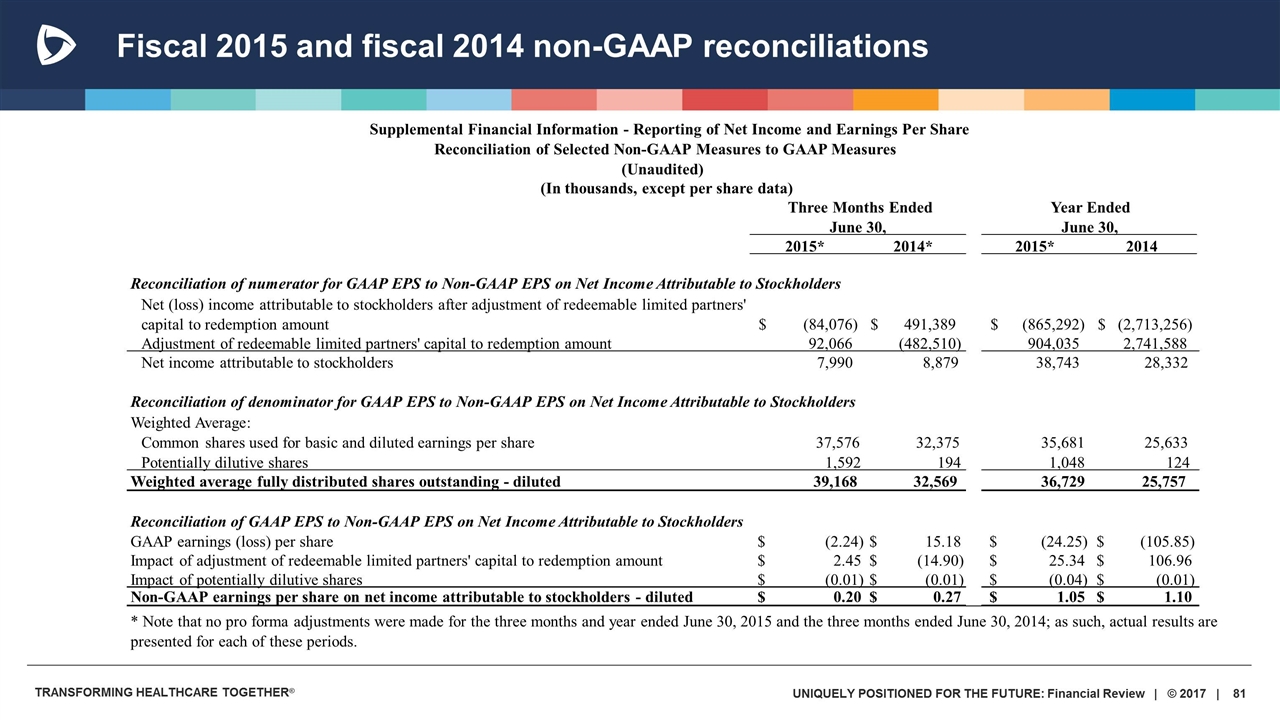

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations 2015* 2014* 2015* 2014 Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Net Income Attributable to Stockholders Net (loss) income attributable to stockholders after adjustment of redeemable limited partners' capital to redemption amount (84,076) $ 491,389 $ (865,292) $ (2,713,256) $ Adjustment of redeemable limited partners' capital to redemption amount 92,066 (482,510) 904,035 2,741,588 Net income attributable to stockholders 7,990 8,879 38,743 28,332 Reconciliation of denominator for GAAP EPS to Non-GAAP EPS on Net Income Attributable to Stockholders Weighted Average: Common shares used for basic and diluted earnings per share 37,576 32,375 35,681 25,633 Potentially dilutive shares 1,592 194 1,048 124 Weighted average fully distributed shares outstanding - diluted 39,168 32,569 36,729 25,757 Reconciliation of GAAP EPS to Non-GAAP EPS on Net Income Attributable to Stockholders GAAP earnings (loss) per share $ (2.24) $ 15.18 $ (24.25) $ (105.85) Impact of adjustment of redeemable limited partners' capital to redemption amount $ 2.45 $ (14.90) $ 25.34 $ 106.96 Impact of potentially dilutive shares $ (0.01) $ (0.01) $ (0.04) $ (0.01) Non-GAAP earnings per share on net income attributable to stockholders - diluted $ 0.20 $ 0.27 $ 1.05 $ 1.10 Three Months Ended June 30, Year Ended June 30, Supplemental Financial Information - Reporting of Net Income and Earnings Per Share (Unaudited) (In thousands, except per share data) Reconciliation of Selected Non-GAAP Measures to GAAP Measures * Note that no pro forma adjustments were made for the three months and year ended June 30, 2015 and the three months ended June 30, 2014; as such, actual results are presented for each of these periods.

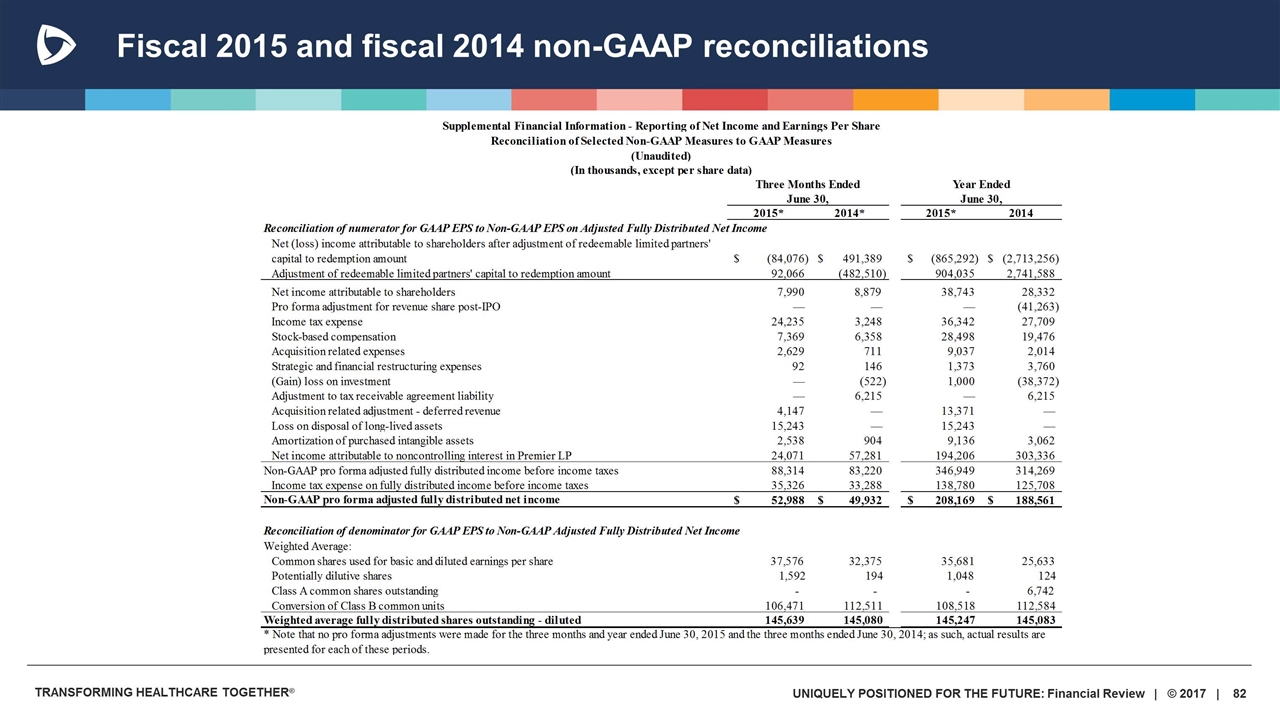

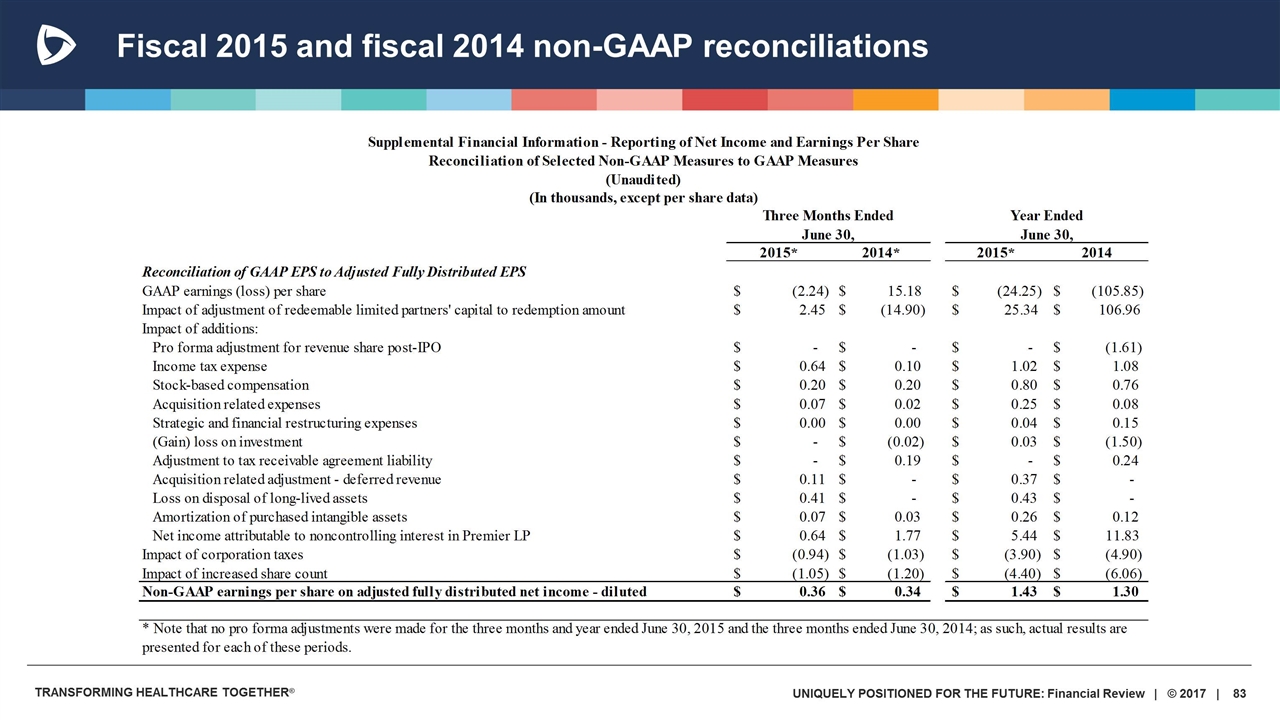

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

Fiscal 2015 and fiscal 2014 non-GAAP reconciliations

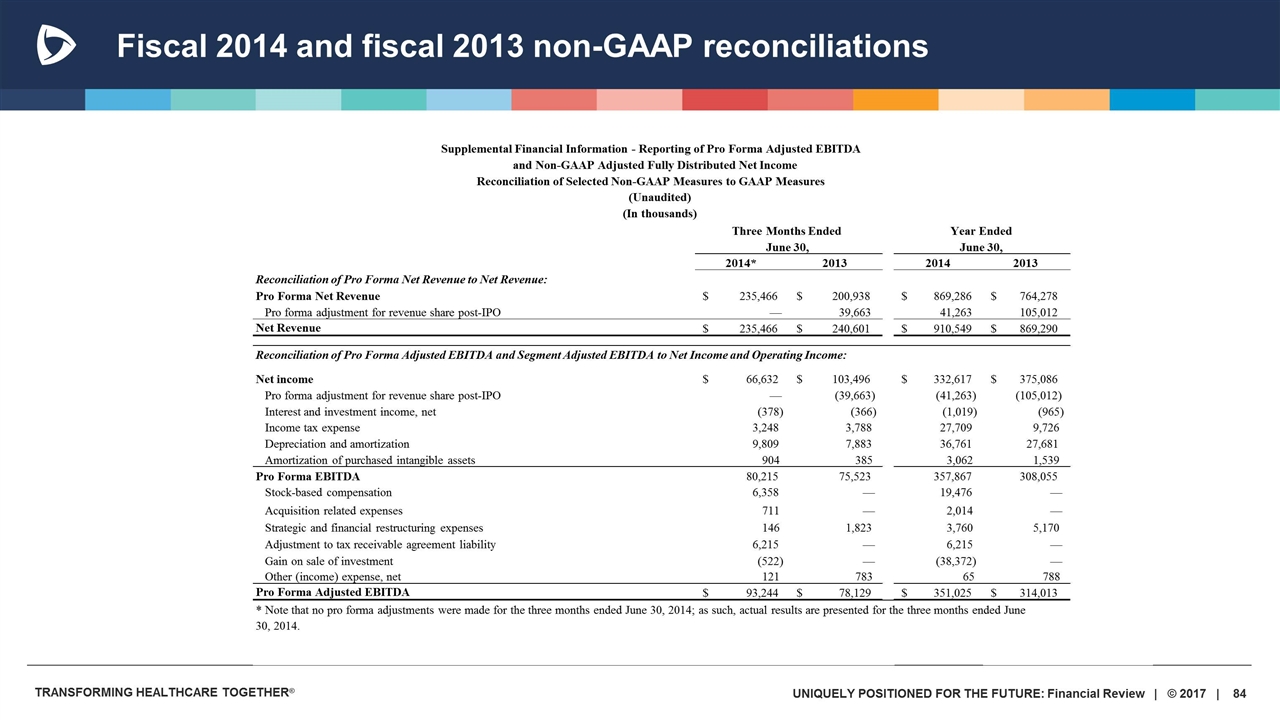

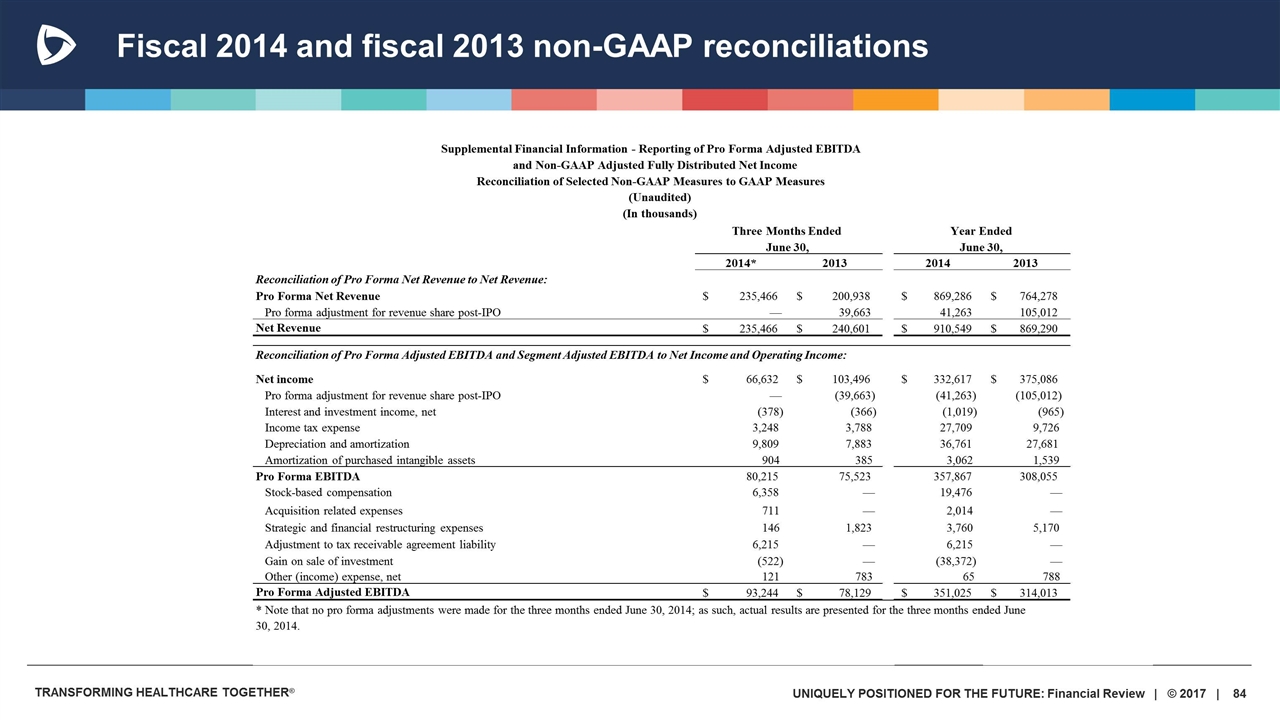

Fiscal 2014 and fiscal 2013 non-GAAP reconciliations 2014* 2013 2014 2013 Reconciliation of Pro Forma Net Revenue to Net Revenue: Pro Forma Net Revenue 235,466 $ 200,938 $ 869,286 $ 764,278 $ Pro forma adjustment for revenue share post-IPO — 39,663 41,263 105,012 Net Revenue 235,466 $ 240,601 $ 910,549 $ 869,290 $ Reconciliation of Pro Forma Adjusted EBITDA and Segment Adjusted EBITDA to Net Income and Operating Income: Net income 66,632 $ 103,496 $ 332,617 $ 375,086 $ Pro forma adjustment for revenue share post-IPO — (39,663) (41,263) (105,012) Interest and investment income, net (378) (366) (1,019) (965) Income tax expense 3,248 3,788 27,709 9,726 Depreciation and amortization 9,809 7,883 36,761 27,681 Amortization of purchased intangible assets 904 385 3,062 1,539 Pro Forma EBITDA 80,215 75,523 357,867 308,055 Stock-based compensation 6,358 — 19,476 — Acquisition related expenses 711 — 2,014 — Strategic and financial restructuring expenses 146 1,823 3,760 5,170 Adjustment to tax receivable agreement liability 6,215 — 6,215 — Gain on sale of investment (522) — (38,372) — Other (income) expense, net 121 783 65 788 Pro Forma Adjusted EBITDA 93,244 $ 78,129 $ 351,025 $ 314,013 $ * Note that no pro forma adjustments were made for the three months ended June 30, 2014; as such, actual results are presented for the three months ended June 30, 2014. Three Months Ended June 30, Year Ended June 30, Supplemental Financial Information - Reporting of Pro Forma Adjusted EBITDA (Unaudited) (In thousands) Reconciliation of Selected Non-GAAP Measures to GAAP Measures and Non-GAAP Adjusted Fully Distributed Net Income

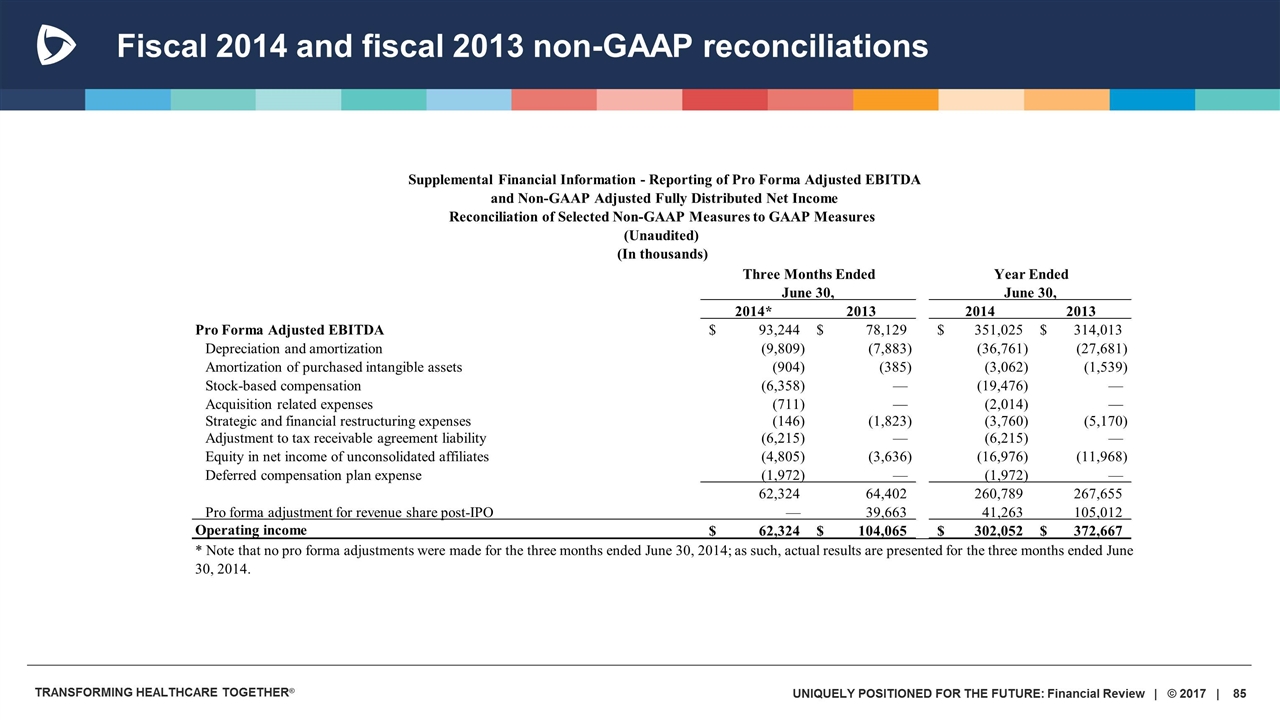

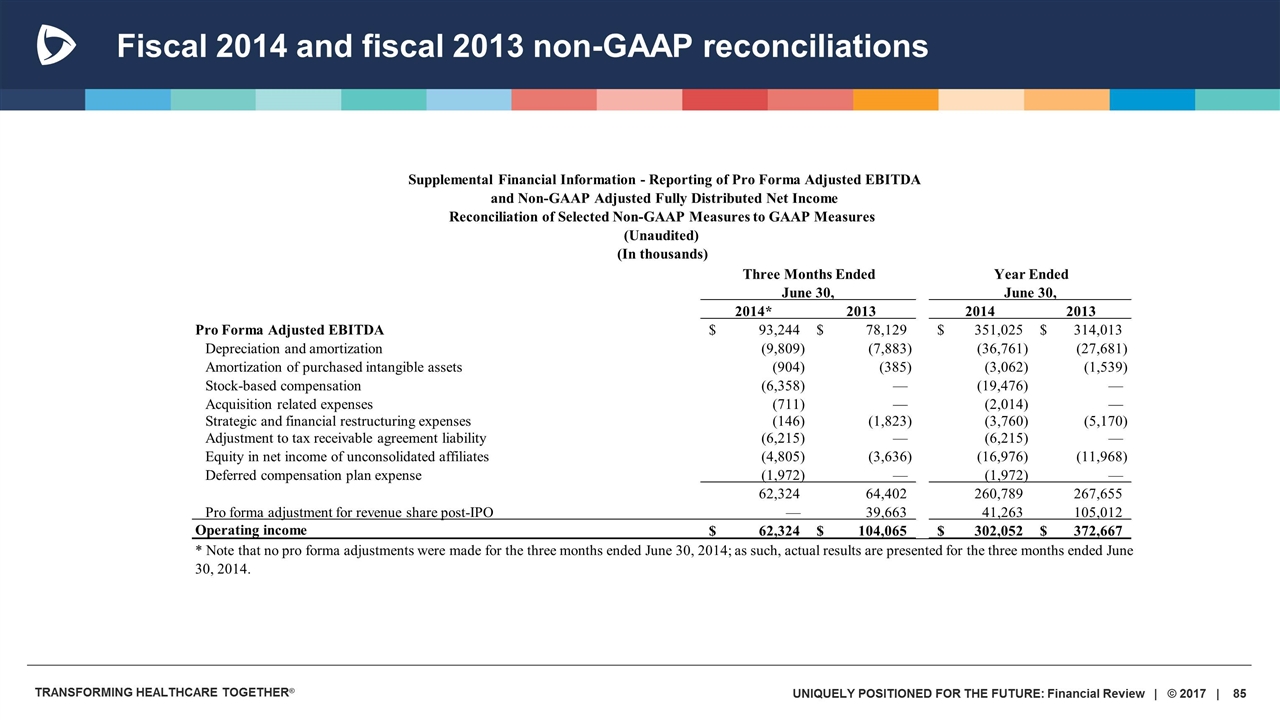

Fiscal 2014 and fiscal 2013 non-GAAP reconciliations 2014* 2013 2014 2013 Pro Forma Adjusted EBITDA 93,244 $ 78,129 $ 351,025 $ 314,013 $ Depreciation and amortization (9,809) (7,883) (36,761) (27,681) Amortization of purchased intangible assets (904) (385) (3,062) (1,539) Stock-based compensation (6,358) — (19,476) — Acquisition related expenses (711) — (2,014) — Strategic and financial restructuring expenses (146) (1,823) (3,760) (5,170) Adjustment to tax receivable agreement liability (6,215) — (6,215) — Equity in net income of unconsolidated affiliates (4,805) (3,636) (16,976) (11,968) Deferred compensation plan expense (1,972) — (1,972) — 62,324 64,402 260,789 267,655 Pro forma adjustment for revenue share post-IPO — 39,663 41,263 105,012 Operating income 62,324 $ 104,065 $ 302,052 $ 372,667 $ Three Months Ended June 30, Year Ended June 30, * Note that no pro forma adjustments were made for the three months ended June 30, 2014; as such, actual results are presented for the three months ended June 30, 2014. Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (In thousands) Supplemental Financial Information - Reporting of Pro Forma Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income

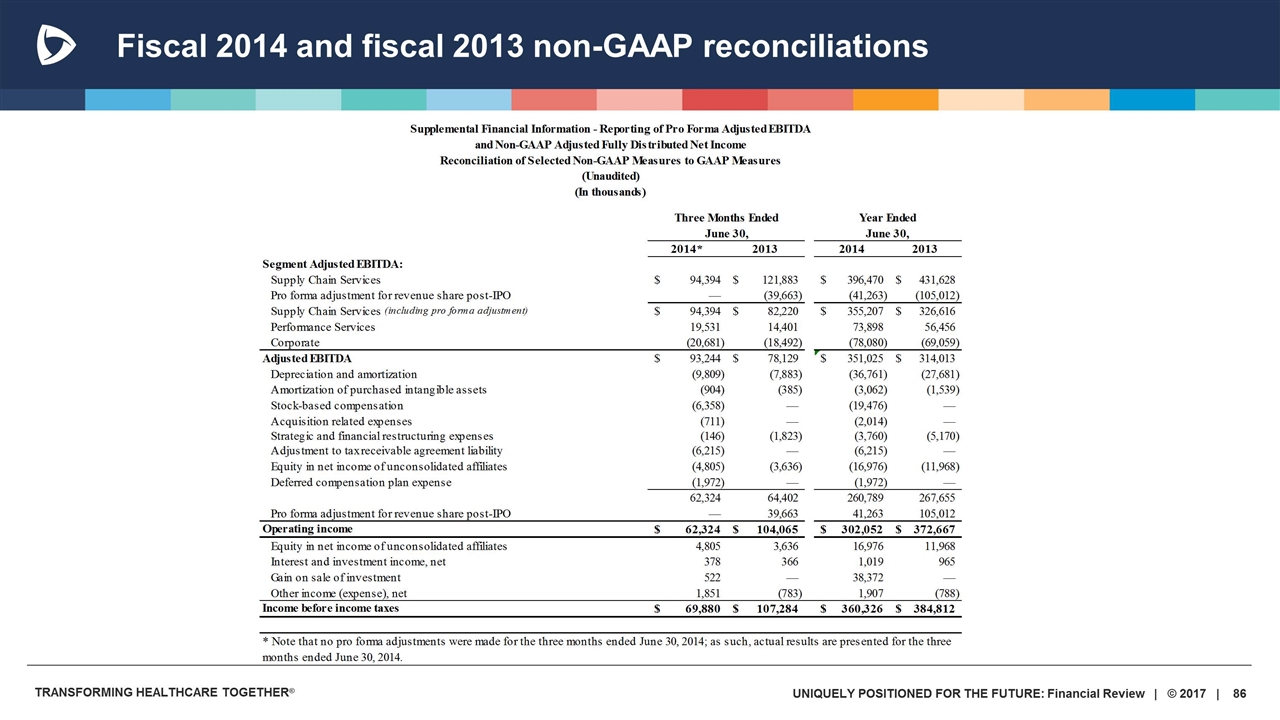

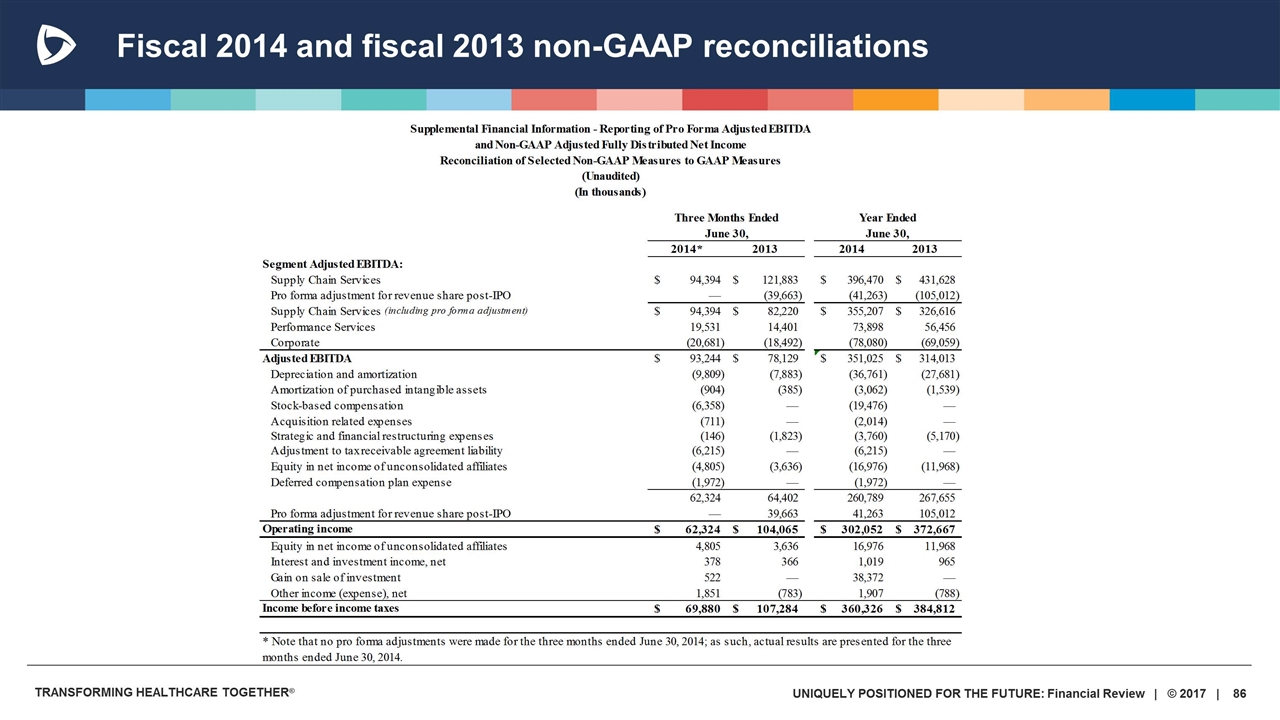

Fiscal 2014 and fiscal 2013 non-GAAP reconciliations

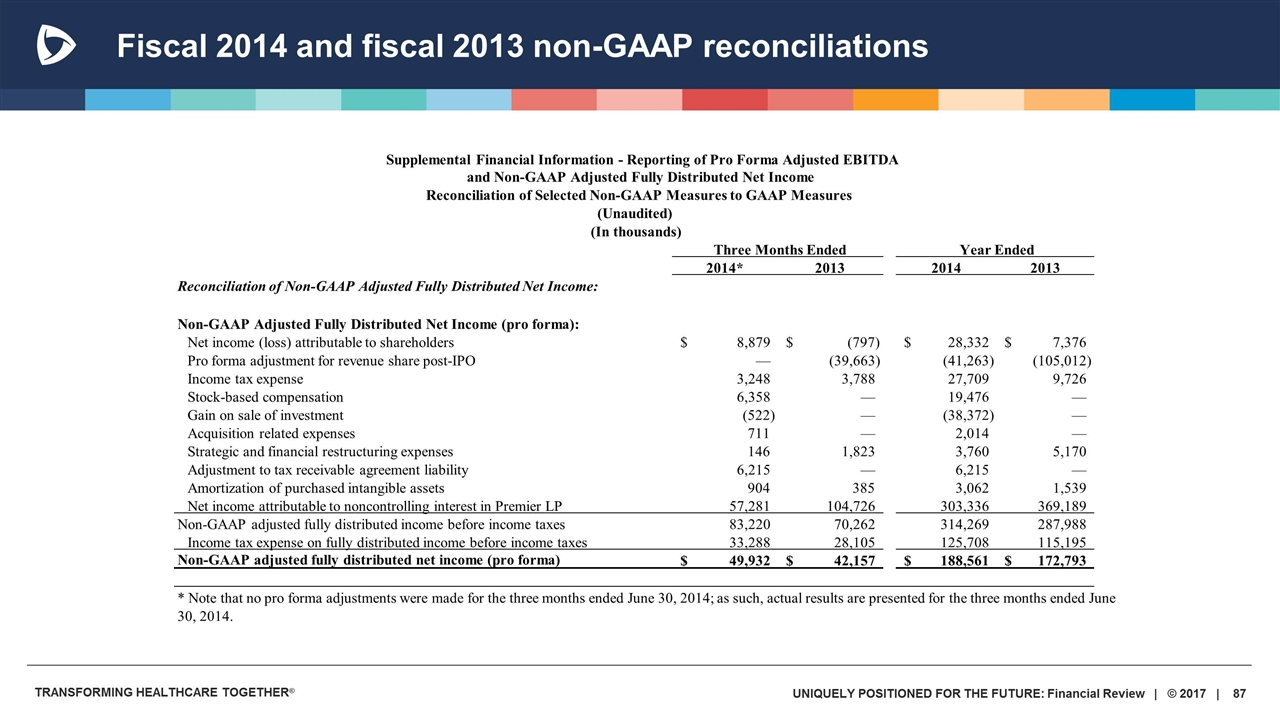

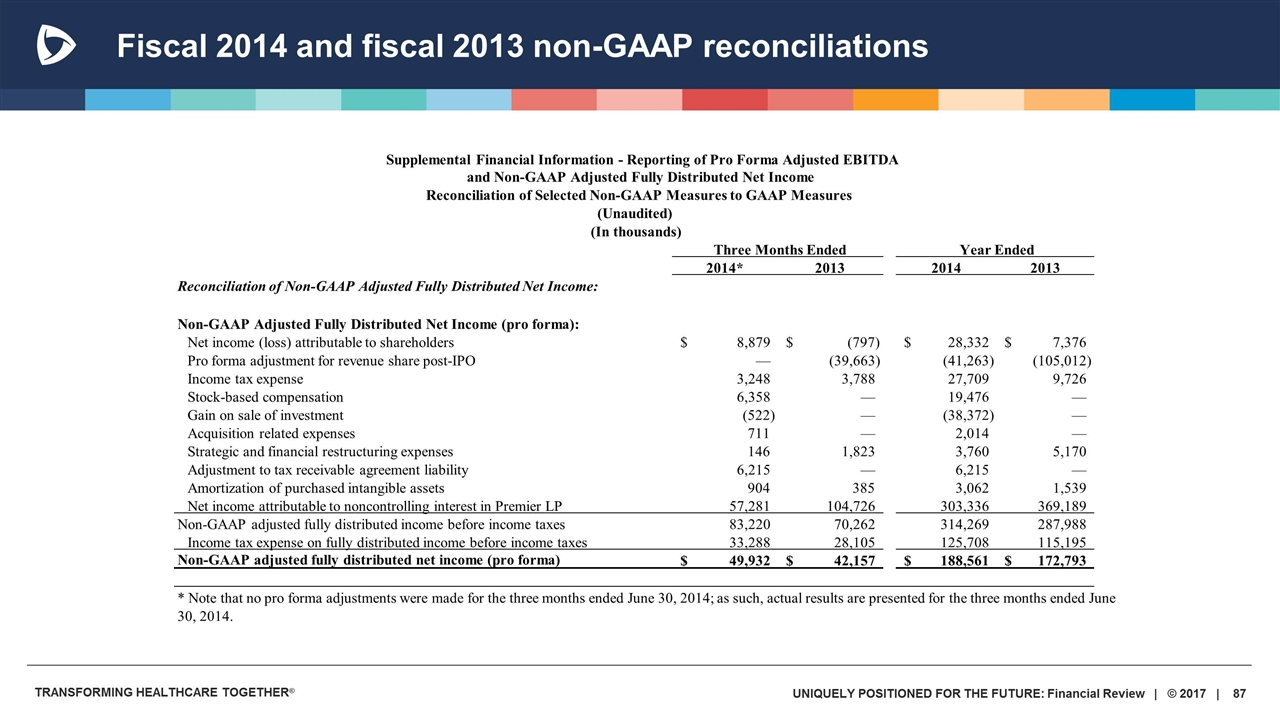

Fiscal 2014 and fiscal 2013 non-GAAP reconciliations 2014* 2013 2014 2013 Reconciliation of Non-GAAP Adjusted Fully Distributed Net Income: Non-GAAP Adjusted Fully Distributed Net Income (pro forma): Net income (loss) attributable to shareholders 8,879 $ (797) $ 28,332 $ 7,376 $ Pro forma adjustment for revenue share post-IPO — (39,663) (41,263) (105,012) Income tax expense 3,248 3,788 27,709 9,726 Stock-based compensation 6,358 — 19,476 — Gain on sale of investment (522) — (38,372) — Acquisition related expenses 711 — 2,014 — Strategic and financial restructuring expenses 146 1,823 3,760 5,170 Adjustment to tax receivable agreement liability 6,215 — 6,215 — Amortization of purchased intangible assets 904 385 3,062 1,539 Net income attributable to noncontrolling interest in Premier LP 57,281 104,726 303,336 369,189 Non-GAAP adjusted fully distributed income before income taxes 83,220 70,262 314,269 287,988 Income tax expense on fully distributed income before income taxes 33,288 28,105 125,708 115,195 Non-GAAP adjusted fully distributed net income (pro forma) 49,932 $ 42,157 $ 188,561 $ 172,793 $ and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (In thousands) Three Months Ended Year Ended * Note that no pro forma adjustments were made for the three months ended June 30, 2014; as such, actual results are presented for the three months ended June 30, 2014. Supplemental Financial Information - Reporting of Pro Forma Adjusted EBITDA

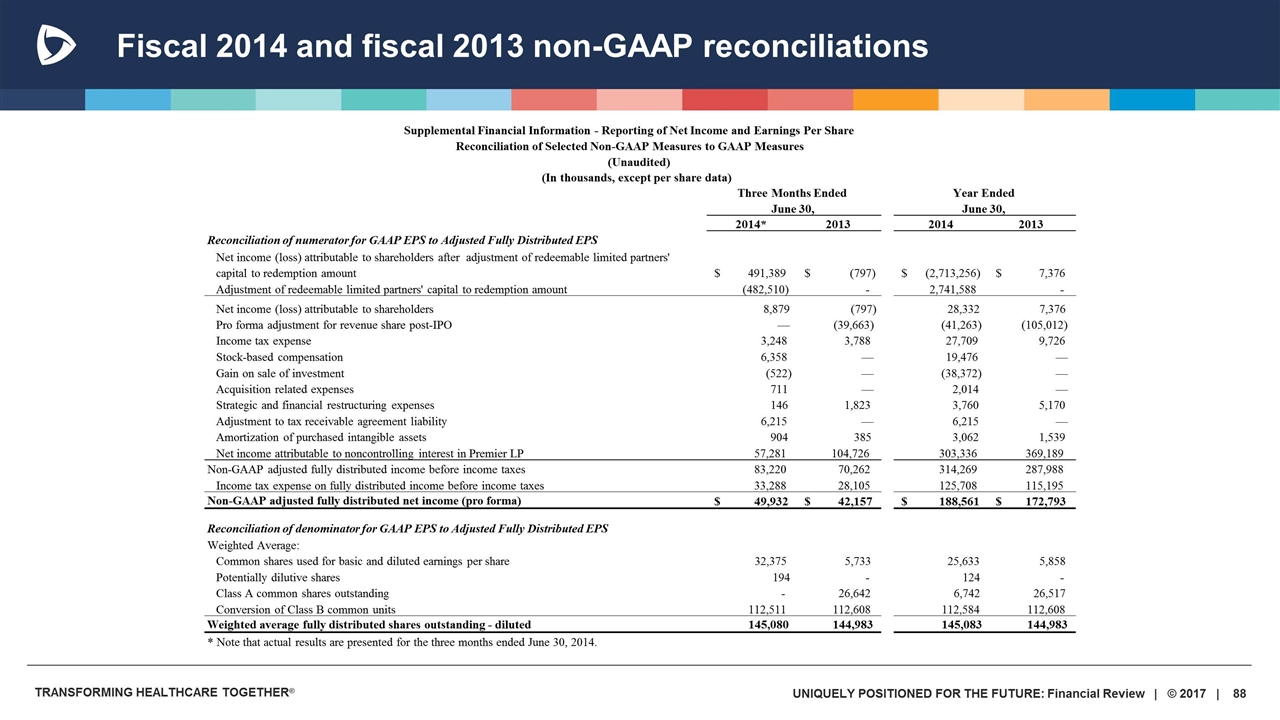

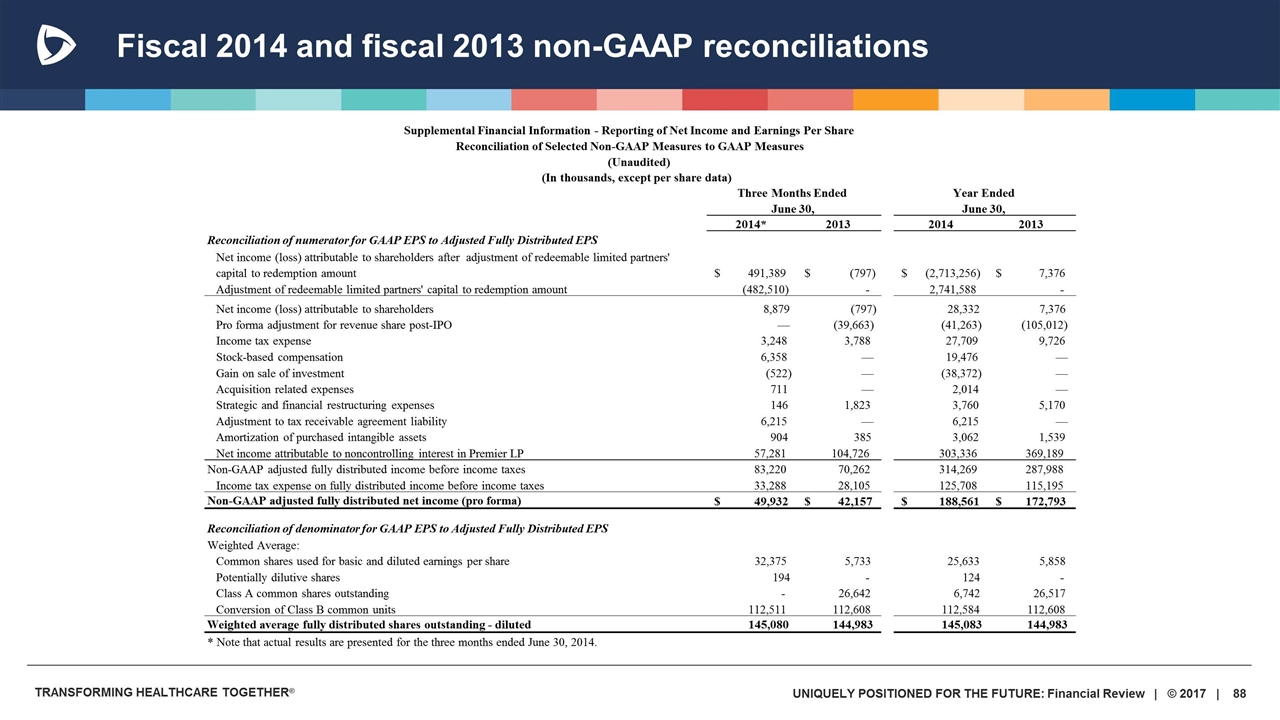

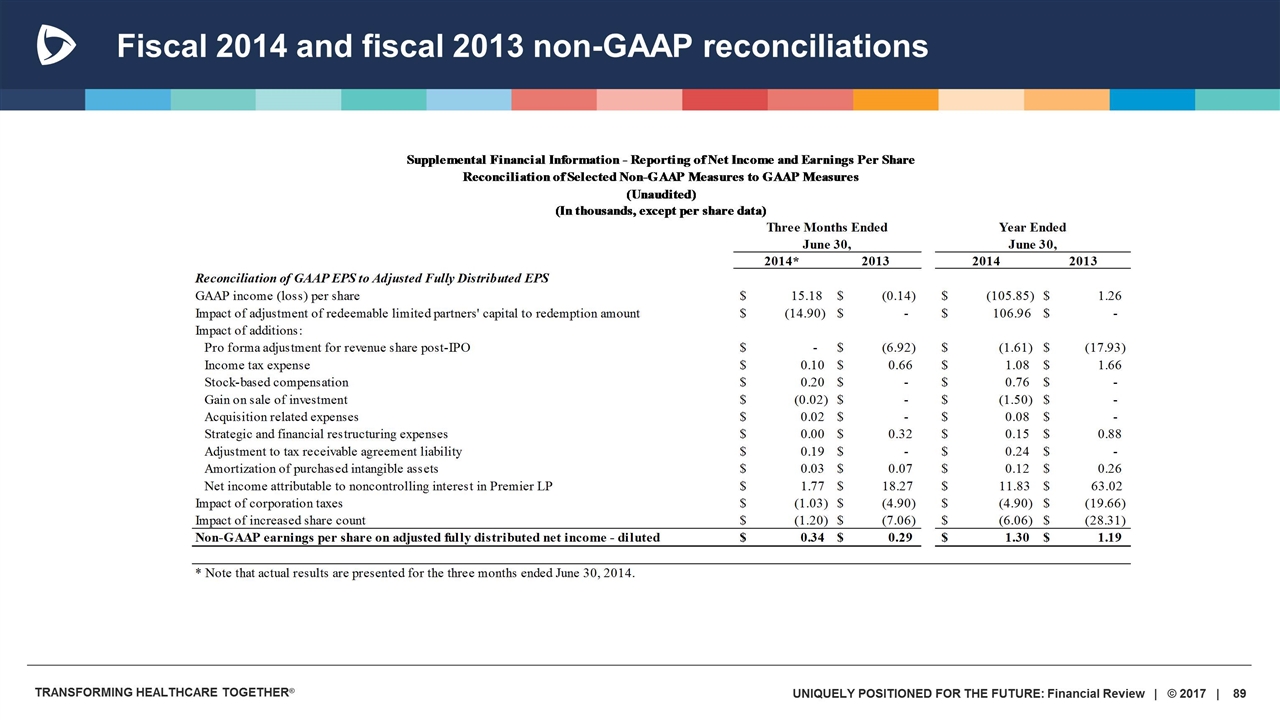

Fiscal 2014 and fiscal 2013 non-GAAP reconciliations 2014* 2013 2014 2013 Reconciliation of numerator for GAAP EPS to Adjusted Fully Distributed EPS Net income (loss) attributable to shareholders after adjustment of redeemable limited partners' capital to redemption amount 491,389 $ (797) $ (2,713,256) $ 7,376 $ Adjustment of redeemable limited partners' capital to redemption amount (482,510) - 2,741,588 - Net income (loss) attributable to shareholders 8,879 (797) 28,332 7,376 Pro forma adjustment for revenue share post-IPO — (39,663) (41,263) (105,012) Income tax expense 3,248 3,788 27,709 9,726 Stock-based compensation 6,358 — 19,476 — Gain on sale of investment (522) — (38,372) — Acquisition related expenses 711 — 2,014 — Strategic and financial restructuring expenses 146 1,823 3,760 5,170 Adjustment to tax receivable agreement liability 6,215 — 6,215 — Amortization of purchased intangible assets 904 385 3,062 1,539 Net income attributable to noncontrolling interest in Premier LP 57,281 104,726 303,336 369,189 Non-GAAP adjusted fully distributed income before income taxes 83,220 70,262 314,269 287,988 Income tax expense on fully distributed income before income taxes 33,288 28,105 125,708 115,195 Non-GAAP adjusted fully distributed net income (pro forma) 49,932 $ 42,157 $ 188,561 $ 172,793 $ Reconciliation of denominator for GAAP EPS to Adjusted Fully Distributed EPS Weighted Average: Common shares used for basic and diluted earnings per share 32,375 5,733 25,633 5,858 Potentially dilutive shares 194 - 124 - Class A common shares outstanding - 26,642 6,742 26,517 Conversion of Class B common units 112,511 112,608 112,584 112,608 Weighted average fully distributed shares outstanding - diluted 145,080 144,983 145,083 144,983 * Note that actual results are presented for the three months ended June 30, 2014. Three Months Ended June 30, Year Ended June 30, Supplemental Financial Information - Reporting of Net Income and Earnings Per Share (Unaudited) (In thousands, except per share data) Reconciliation of Selected Non-GAAP Measures to GAAP Measures

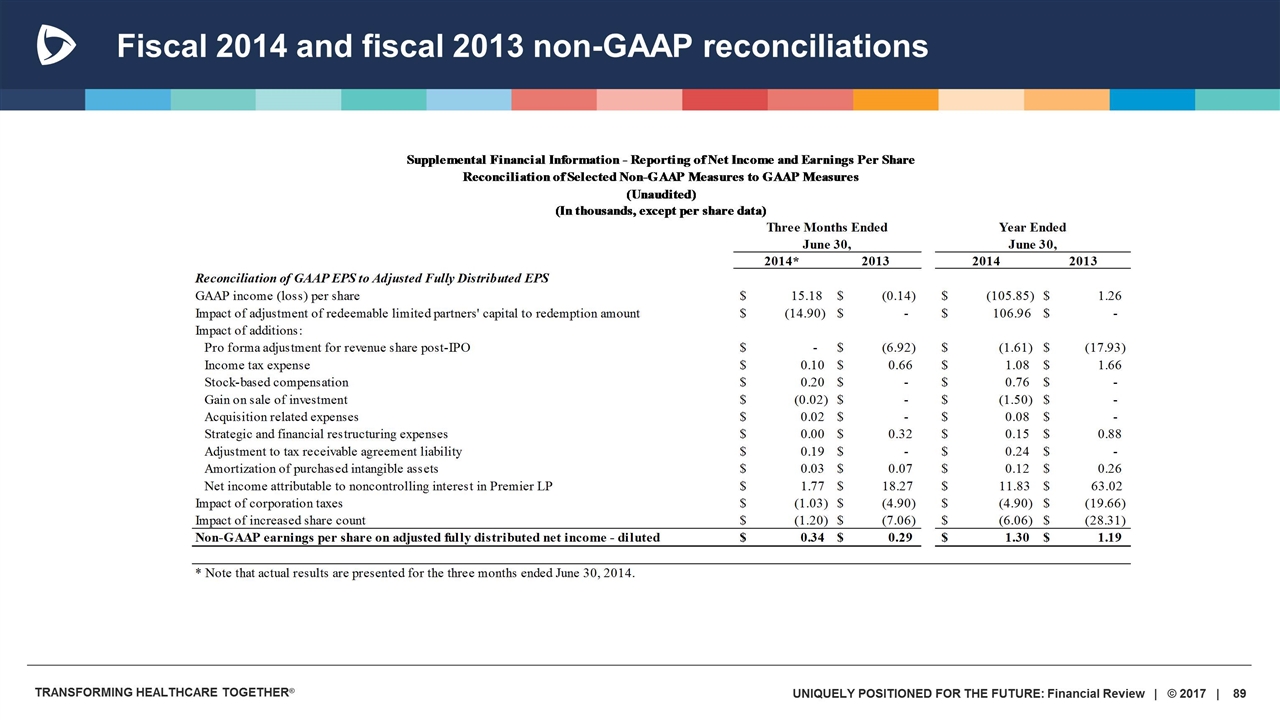

Fiscal 2014 and fiscal 2013 non-GAAP reconciliations