Third-Quarter Fiscal 2018 Financial Results & Update May 7, 2018 Exhibit 99.3

Forward-looking statements and non-GAAP financial measures Forward-looking Statements – Certain statements included in this presentation that are not historical or current facts including, but not limited to, those related to our financial and business expectations and outlook, the impact of the evolving and uncertain healthcare environment, strategy and growth drivers, utilization and patient volume trends, revenue visibility, anticipated member renewals of GPO participation agreements, cross and upsell opportunities, acquisition activities and pipeline, revenue available under contract, implementation of purchases under our share repurchase program and the financial impact of share repurchases, tax reform and cost savings efforts, and 2018 financial guidance and related assumptions are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward looking statements. Readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside Premier’s control. You should carefully read Premier’s periodic and current filings with the SEC for more information on potential risks and other factors that could affect Premier’s financial results. Forward-looking statements speak only as of the date they are made. Premier undertakes no obligation to publicly update or revise any forward-looking statements. Non-GAAP Financial Measures – This presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. You should carefully read Premier’s periodic and current filings with the SEC for definitions and further explanation and disclosure regarding our use of non-GAAP financial measures and such filings should be read in conjunction with this presentation.

Susan DeVore President and Chief Executive Officer Premier, Inc. Overview and Business Update

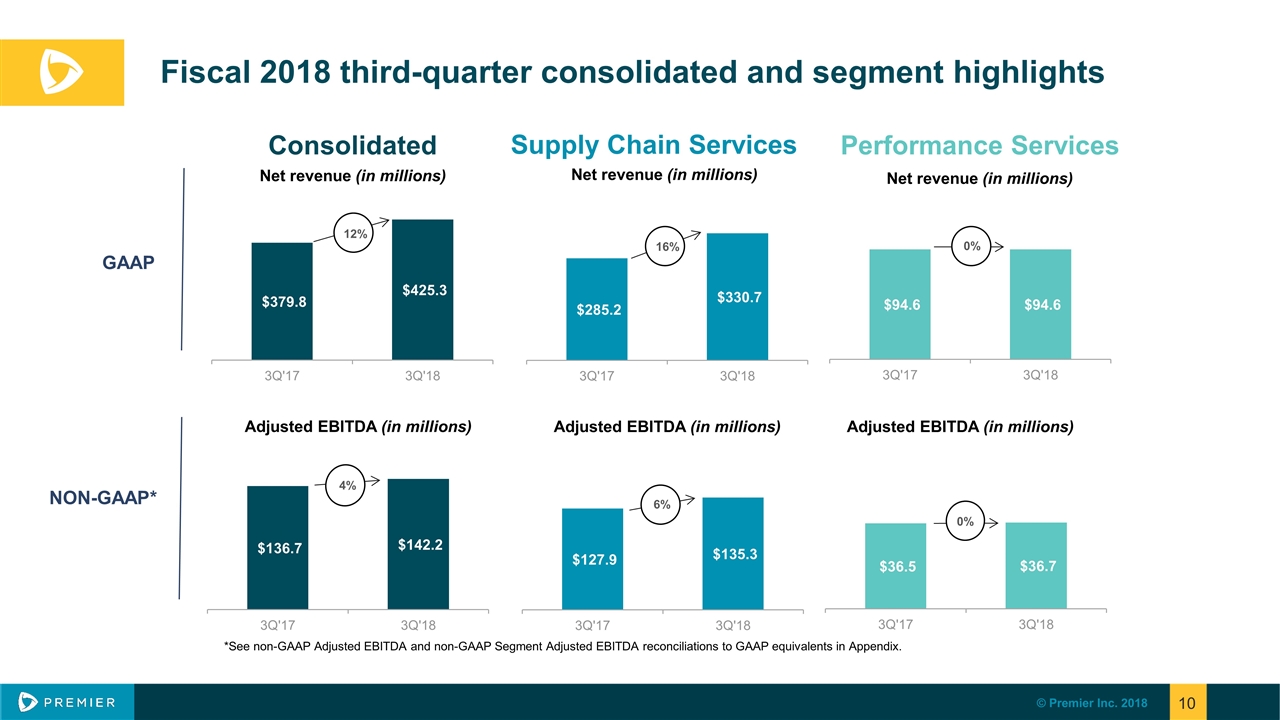

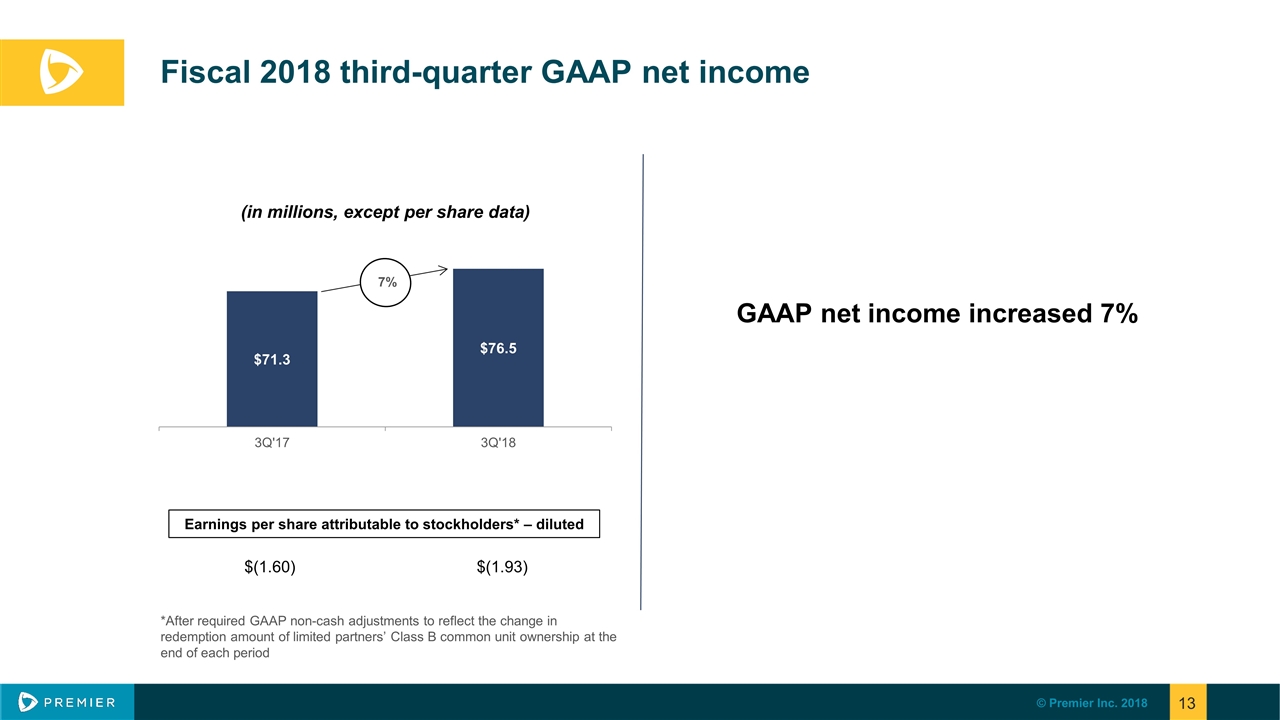

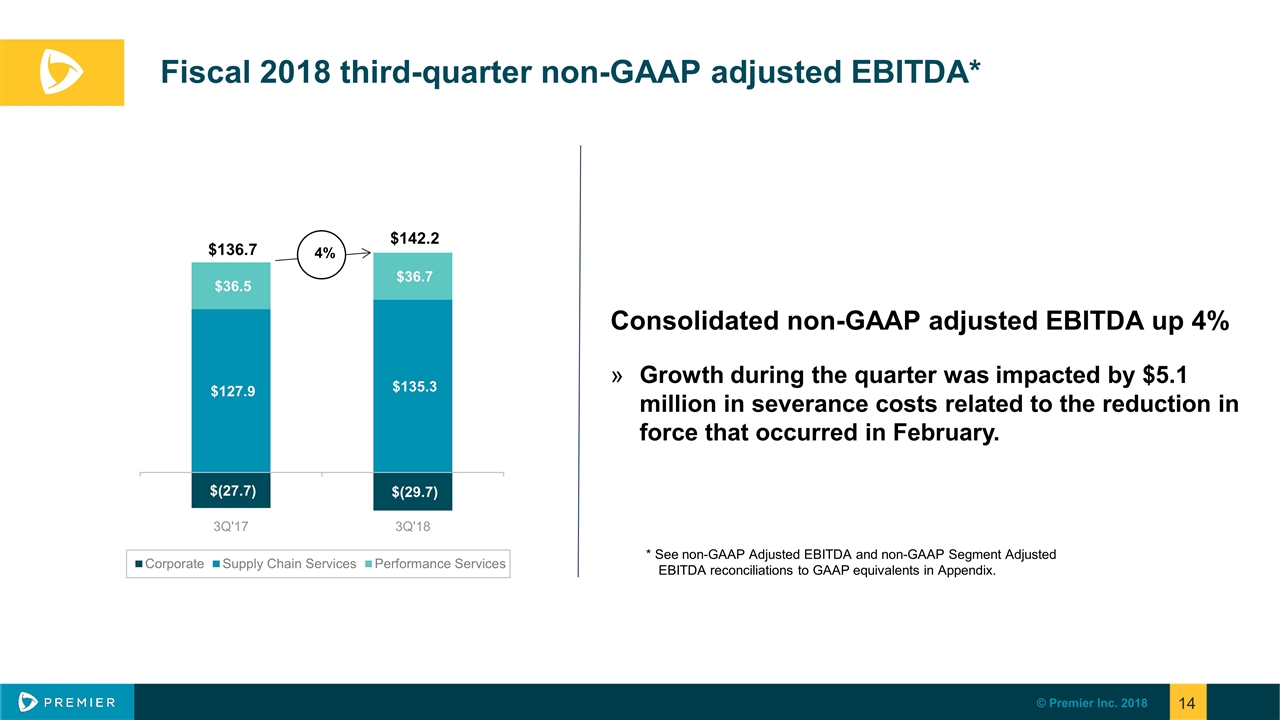

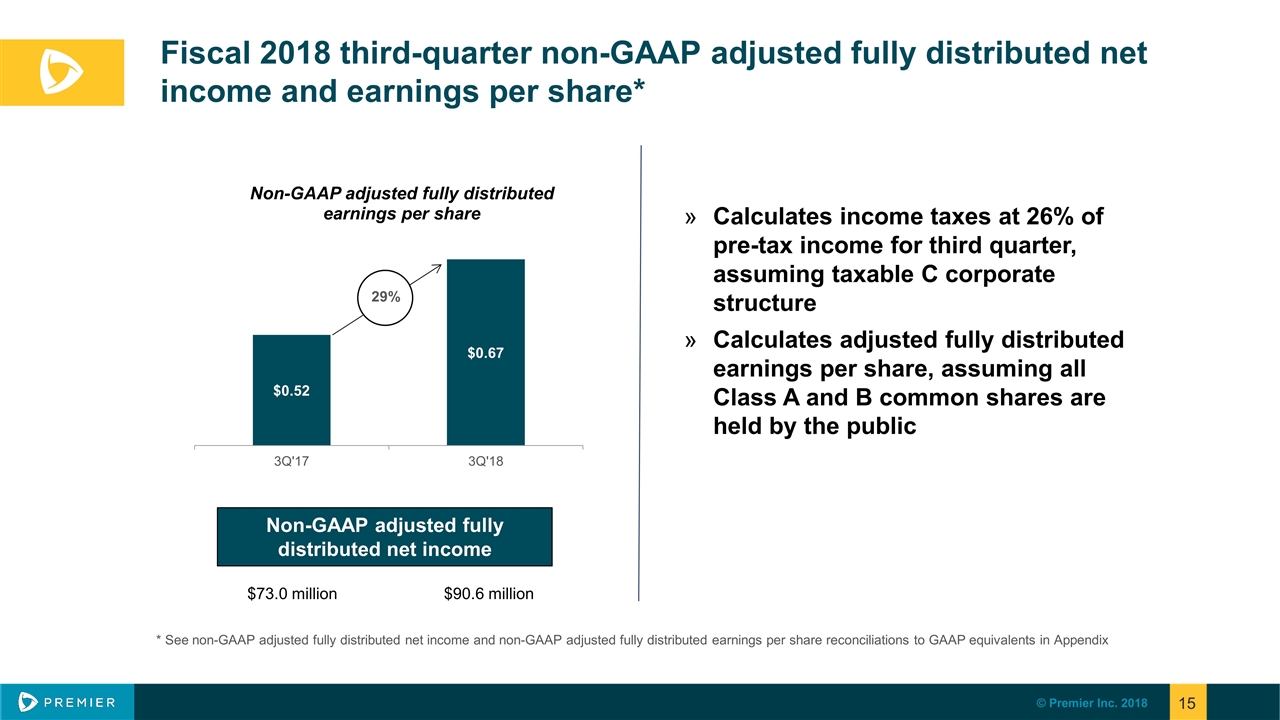

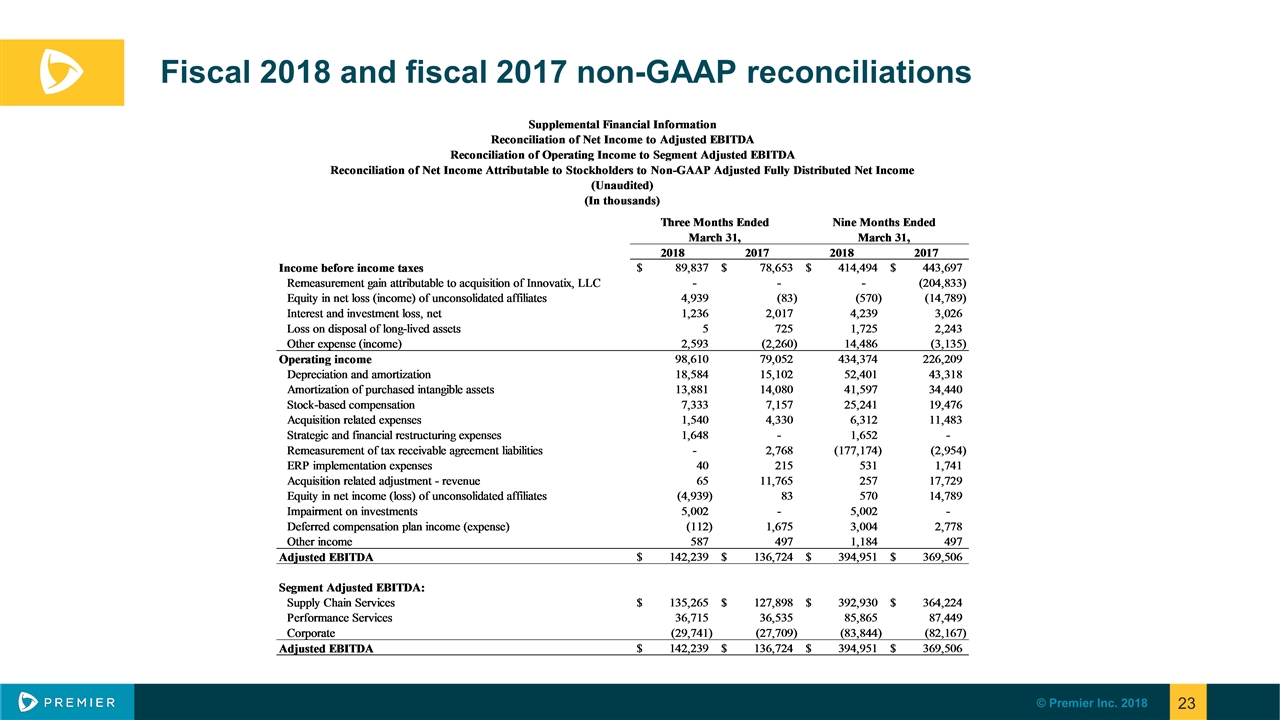

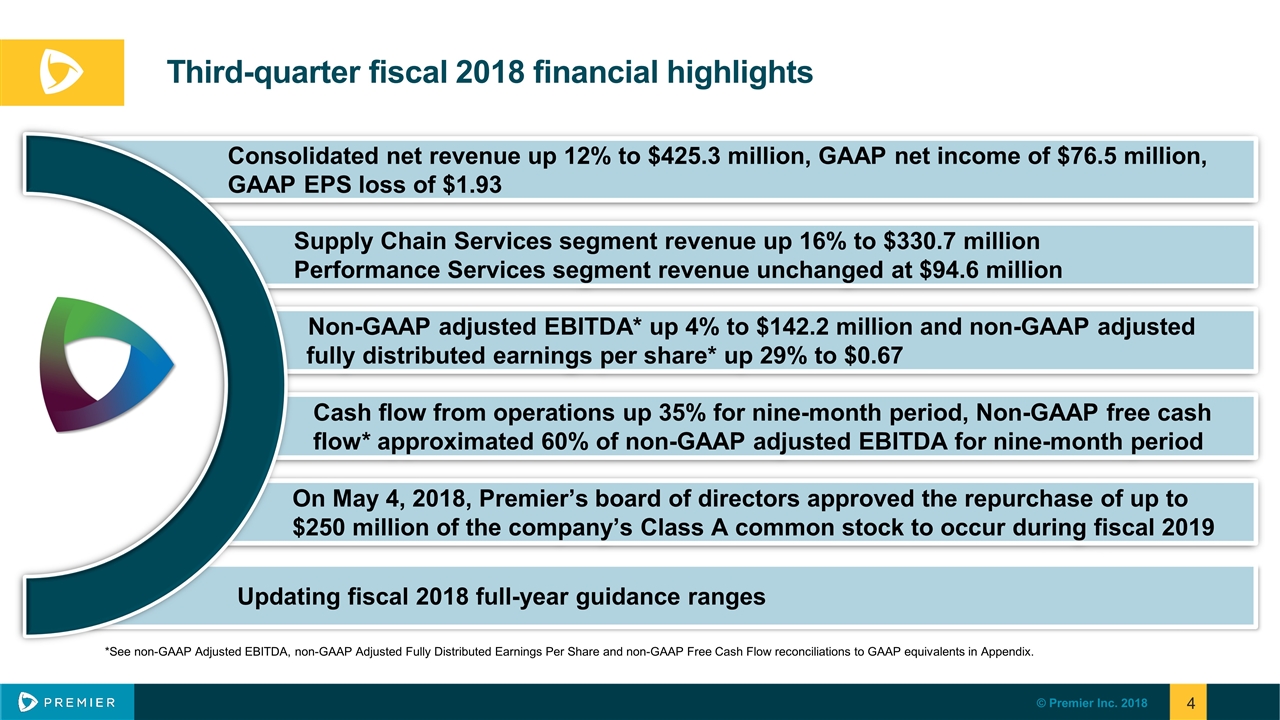

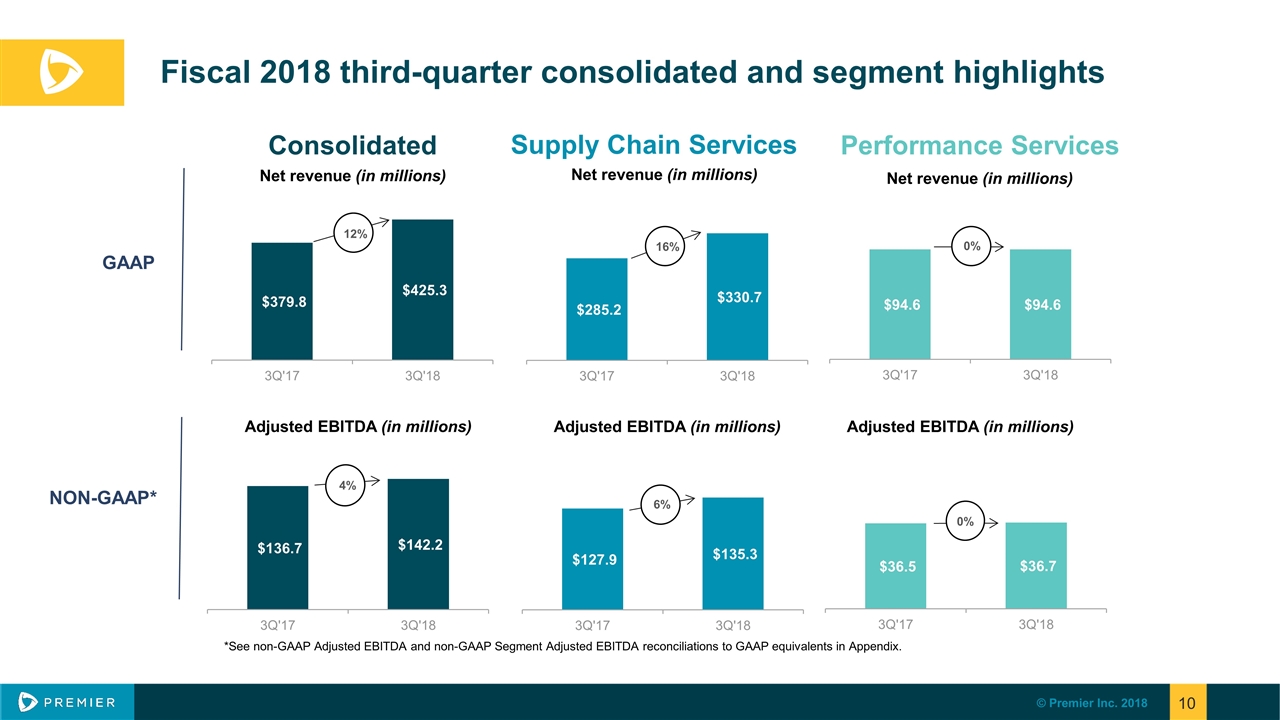

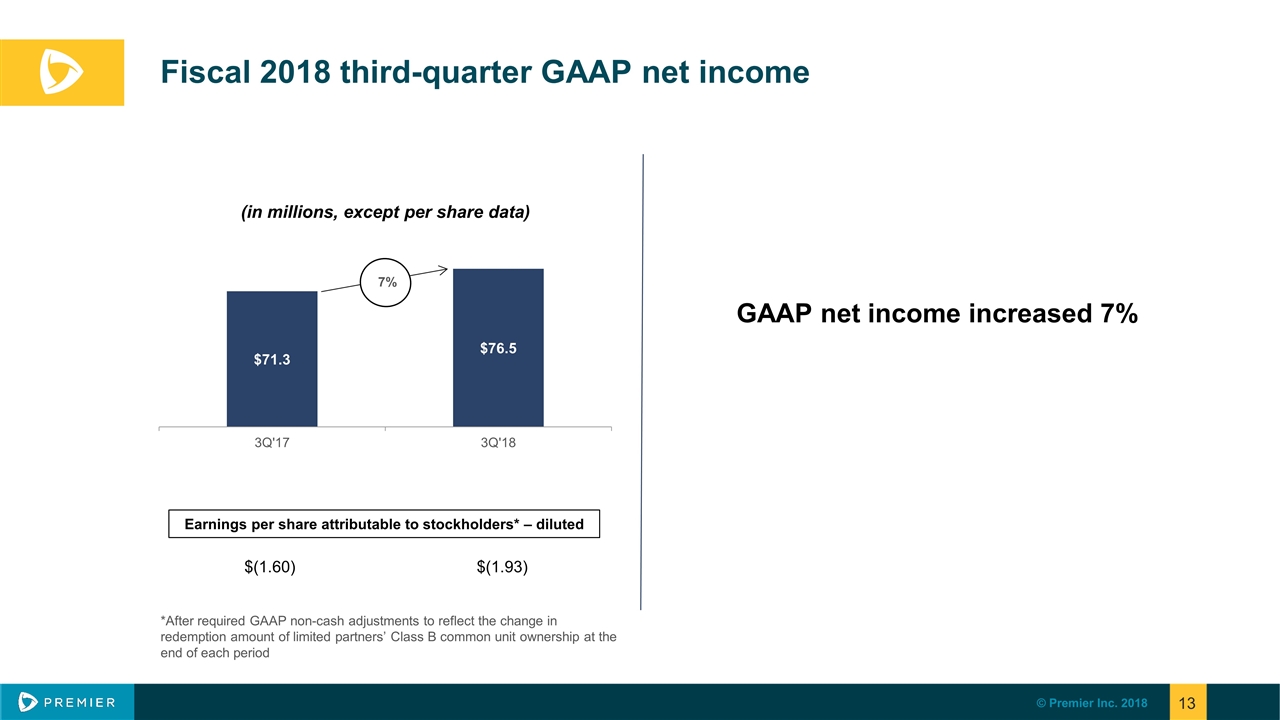

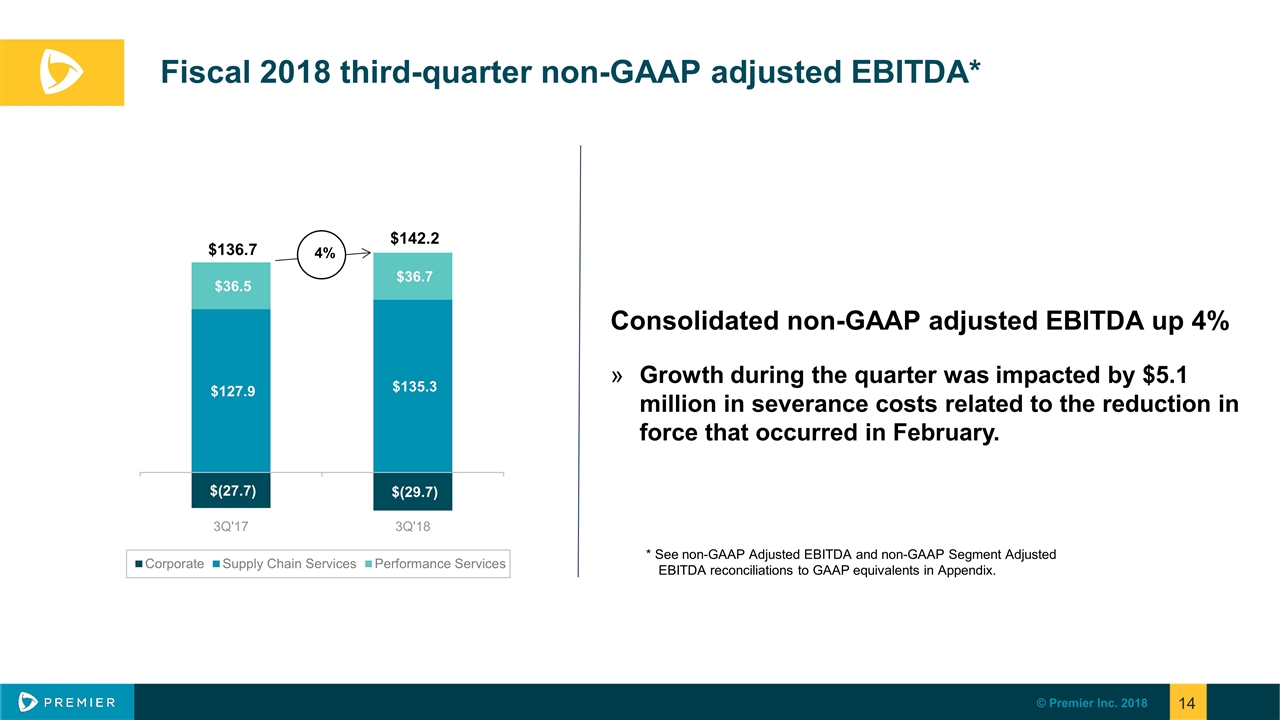

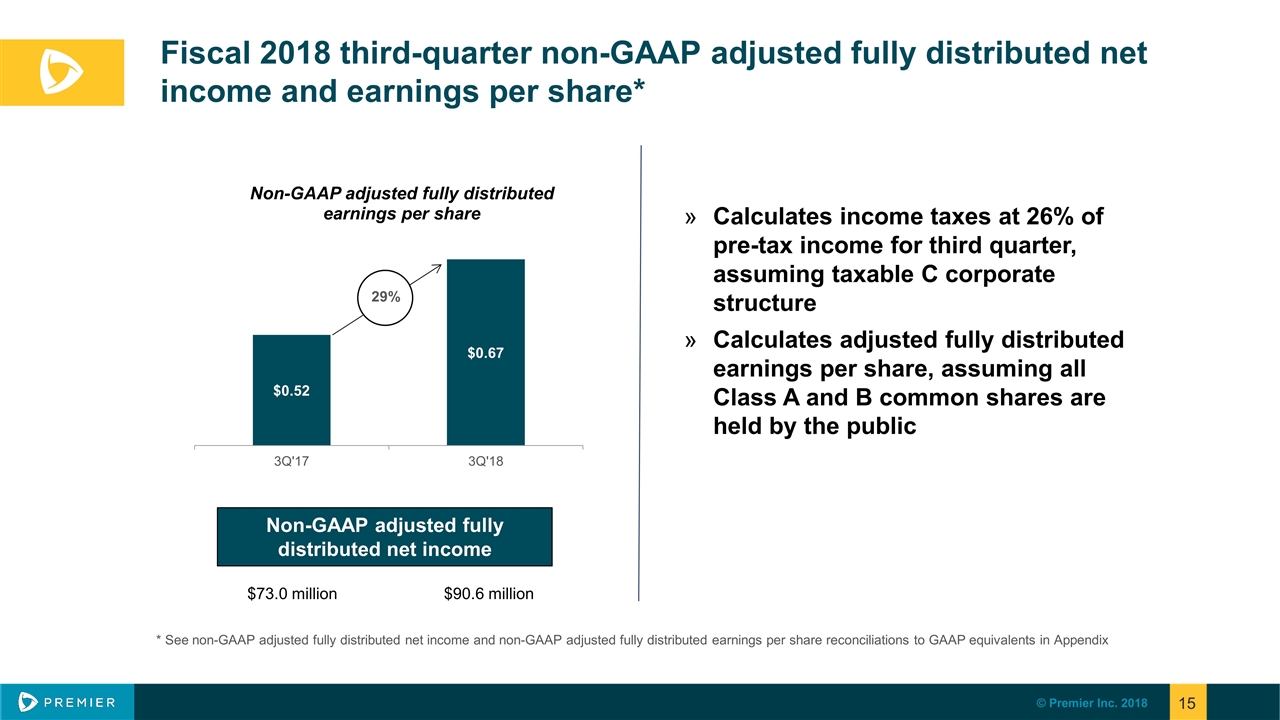

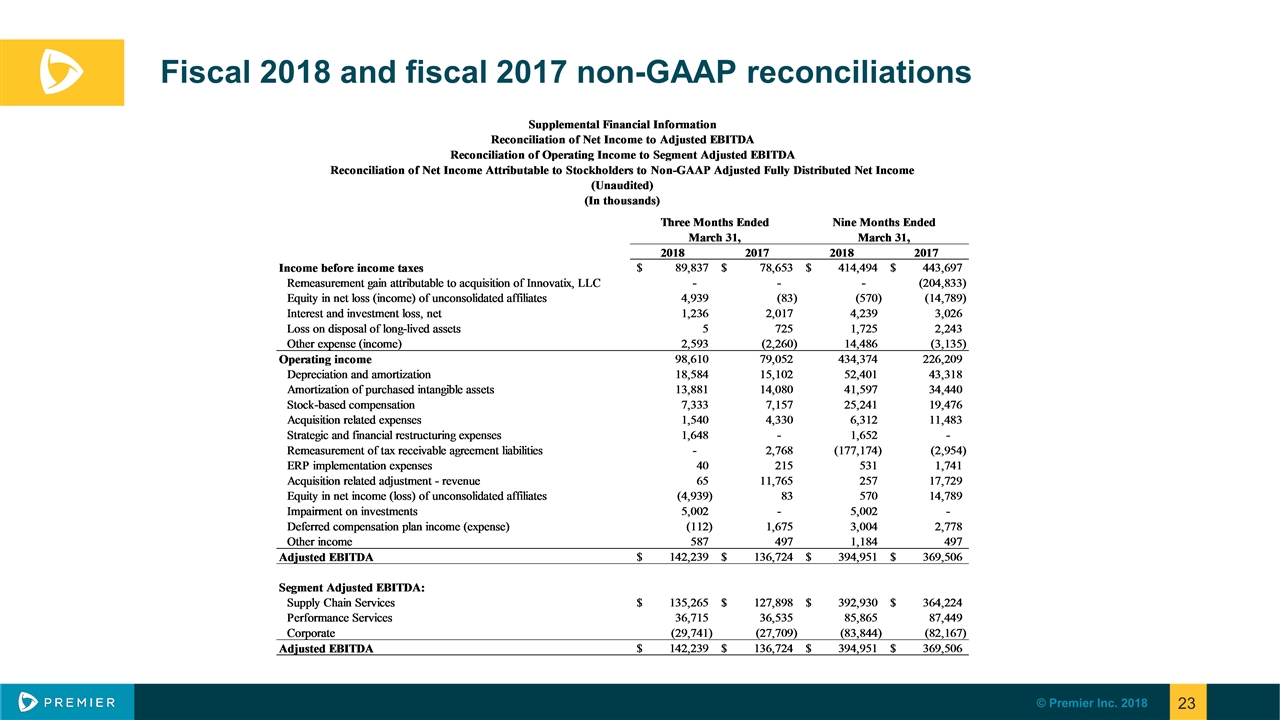

Third-quarter fiscal 2018 financial highlights *See non-GAAP Adjusted EBITDA, non-GAAP Adjusted Fully Distributed Earnings Per Share and non-GAAP Free Cash Flow reconciliations to GAAP equivalents in Appendix. Non-GAAP adjusted EBITDA* up 4% to $142.2 million and non-GAAP adjusted fully distributed earnings per share* up 29% to $0.67 Supply Chain Services segment revenue up 16% to $330.7 million Performance Services segment revenue unchanged at $94.6 million Cash flow from operations up 35% for nine-month period, Non-GAAP free cash flow* approximated 60% of non-GAAP adjusted EBITDA for nine-month period On May 4, 2018, Premier’s board of directors approved the repurchase of up to $250 million of the company’s Class A common stock to occur during fiscal 2019 Updating fiscal 2018 full-year guidance ranges Consolidated net revenue up 12% to $425.3 million, GAAP net income of $76.5 million, GAAP EPS loss of $1.93 *See non-GAAP Adjusted EBITDA, non-GAAP Adjusted Fully Distributed Earnings Per Share and non-GAAP Free Cash Flow reconciliations to GAAP equivalents in Appendix.

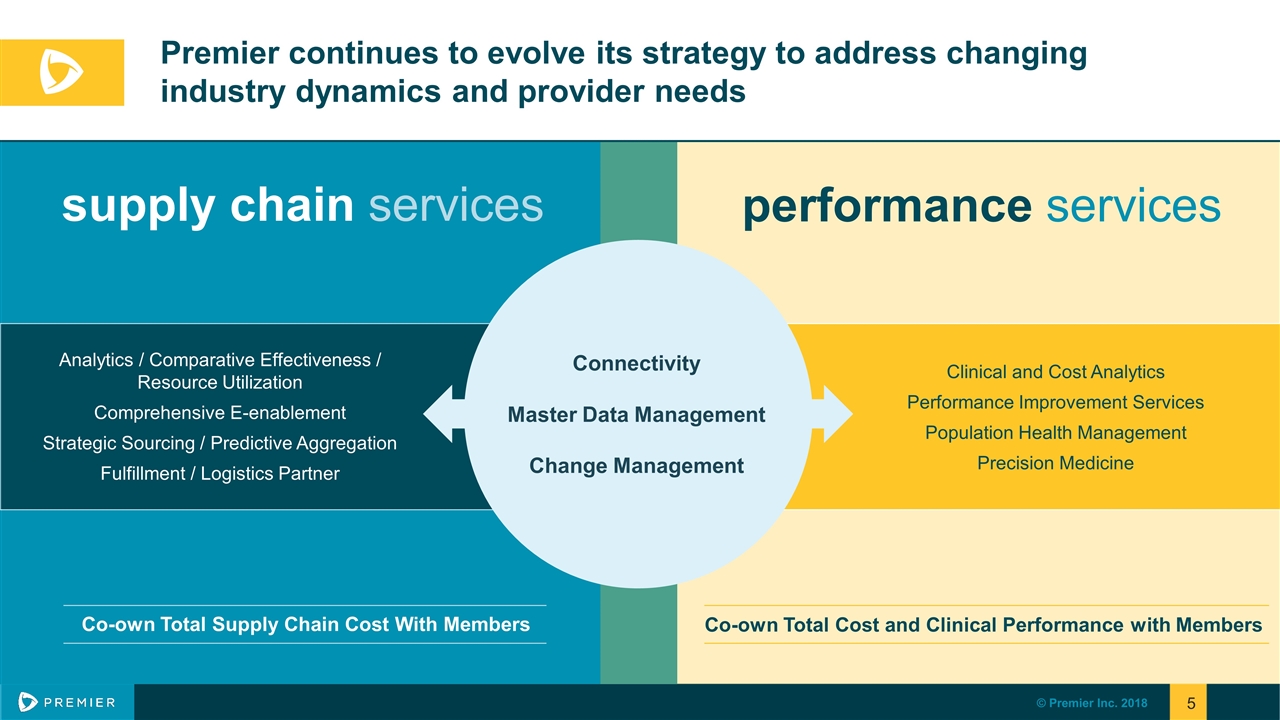

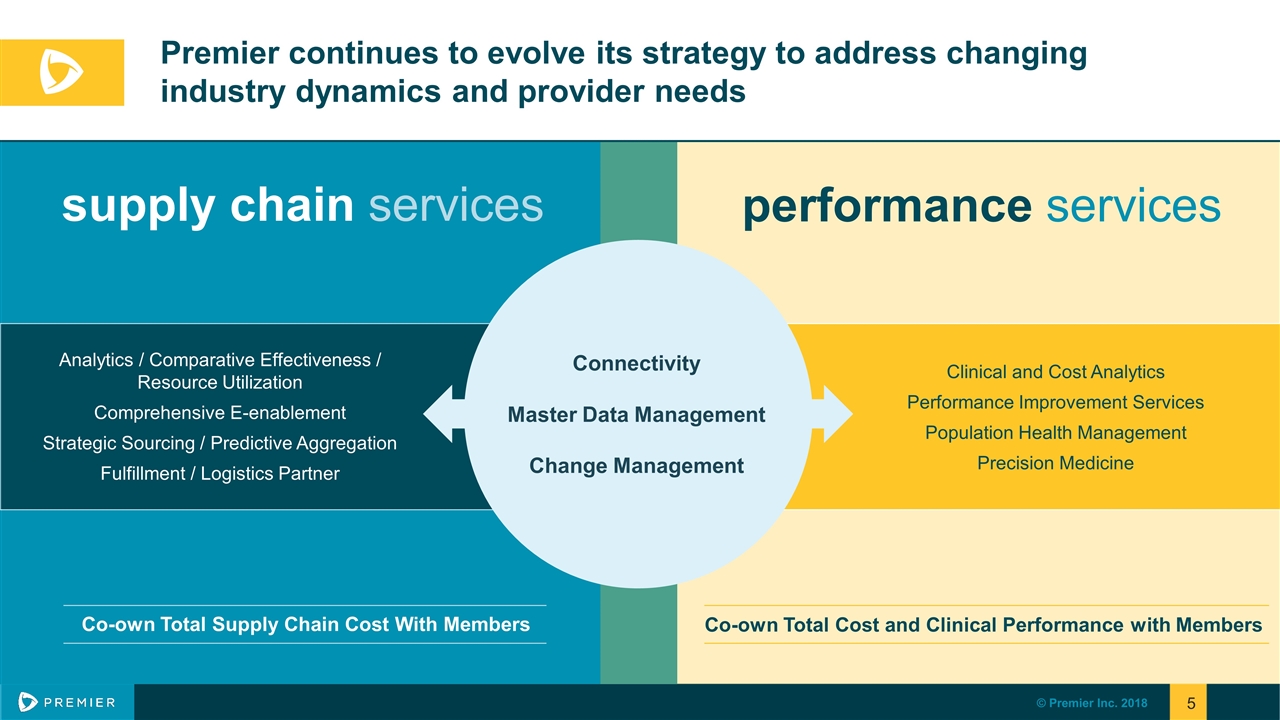

Premier continues to evolve its strategy to address changing industry dynamics and provider needs supply chain services performance services Co-own Total Supply Chain Cost With Members Co-own Total Cost and Clinical Performance with Members Analytics / Comparative Effectiveness / Resource Utilization Comprehensive E-enablement Strategic Sourcing / Predictive Aggregation Fulfillment / Logistics Partner Clinical and Cost Analytics Performance Improvement Services Population Health Management Precision Medicine Connectivity Master Data Management Change Management

Mike Alkire Chief Operating Officer Premier, Inc. Operations Review

Premier continues to gain momentum with academic health systems Large academic health system, which operates more than 30 academic, community, and specialty hospitals, just signed a 10-year agreement with Premier to partner on group purchasing and supply chain analytics. Montefiore Health System, an 11 hospital health system in New York, has signed a multi-year agreement to use PremierConnect analytics platform for system-wide quality reporting and is participating in the QUEST 2020 quality improvement collaborative. New relationship with Howard University Hospital, for a multi-year agreement including supply chain and group purchasing services for Howard University Hospital and Howard University, as well as enterprise-wide performance improvement services and analytics.

Premier continues to demonstrate value Premier is generating strong support for the new highly-committed buying program, called SURPASS™. Launched last month, there are now 10 large health systems representing approximately $8 billion in annualized purchasing volume that have committed to the program. Just signed a large Enterprise Resource Planning (ERP) solution agreement with Coastal Community Health, a contiguous network of three Southeast health systems, to consolidate their individual supply chain systems under our ERP platform. Within consulting services, the capital and construction services team recently engaged with Allegheny Health Network, a 7 hospital health system in western Pennsylvania, to provide equipment planning services to help accommodate rapid growth and development within their system.

Craig McKasson Chief Financial Officer Premier, Inc. Financial Review

Fiscal 2018 third-quarter consolidated and segment highlights Consolidated Net revenue (in millions) Supply Chain Services Net revenue (in millions) Performance Services Net revenue (in millions) Adjusted EBITDA (in millions) Adjusted EBITDA (in millions) Adjusted EBITDA (in millions) *See non-GAAP Adjusted EBITDA and non-GAAP Segment Adjusted EBITDA reconciliations to GAAP equivalents in Appendix. 12% 4% 16% 6% 0% 0% GAAP NON-GAAP*

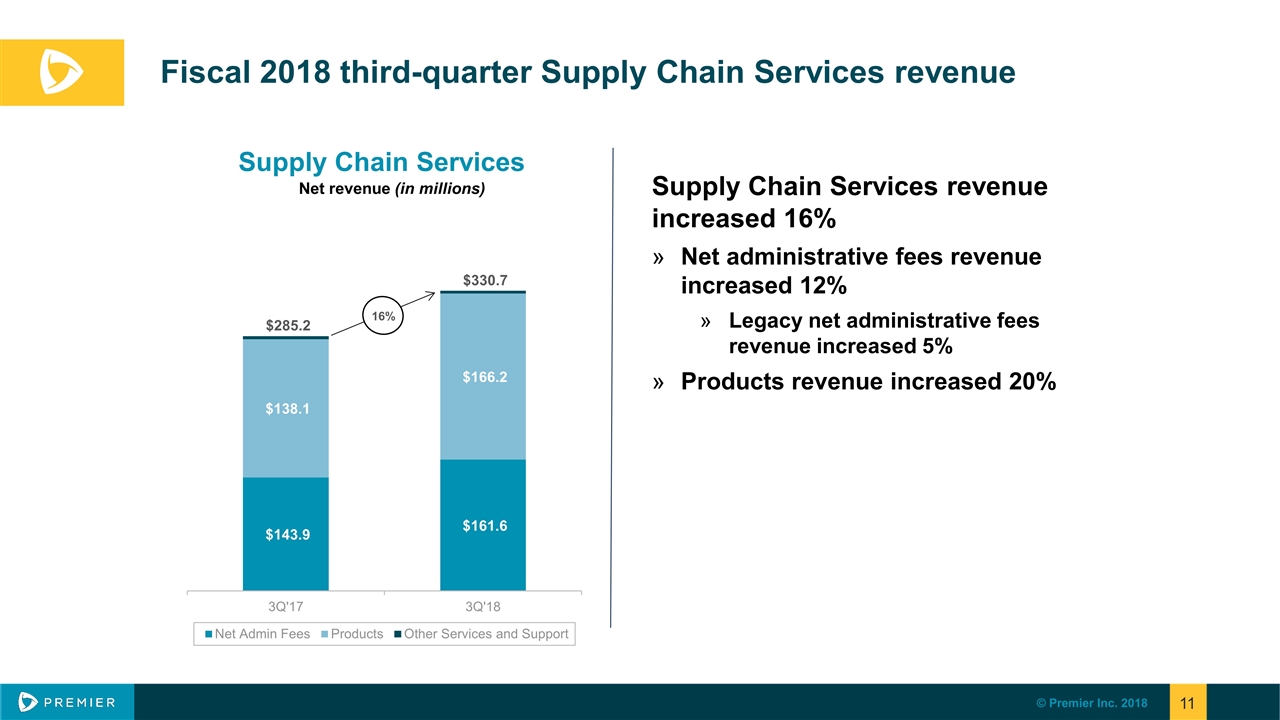

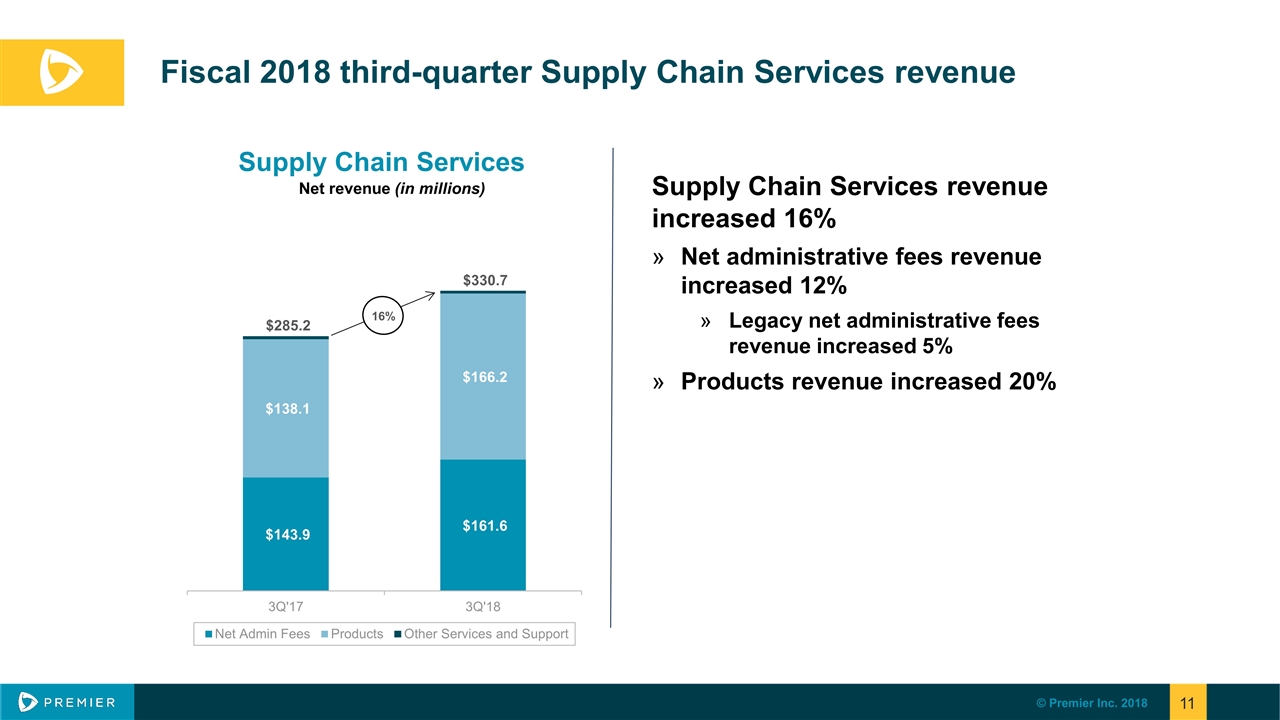

Fiscal 2018 third-quarter Supply Chain Services revenue Supply Chain Services revenue increased 16% Net administrative fees revenue increased 12% Legacy net administrative fees revenue increased 5% Products revenue increased 20% Supply Chain Services Net revenue (in millions) 16% $285.2 $330.7

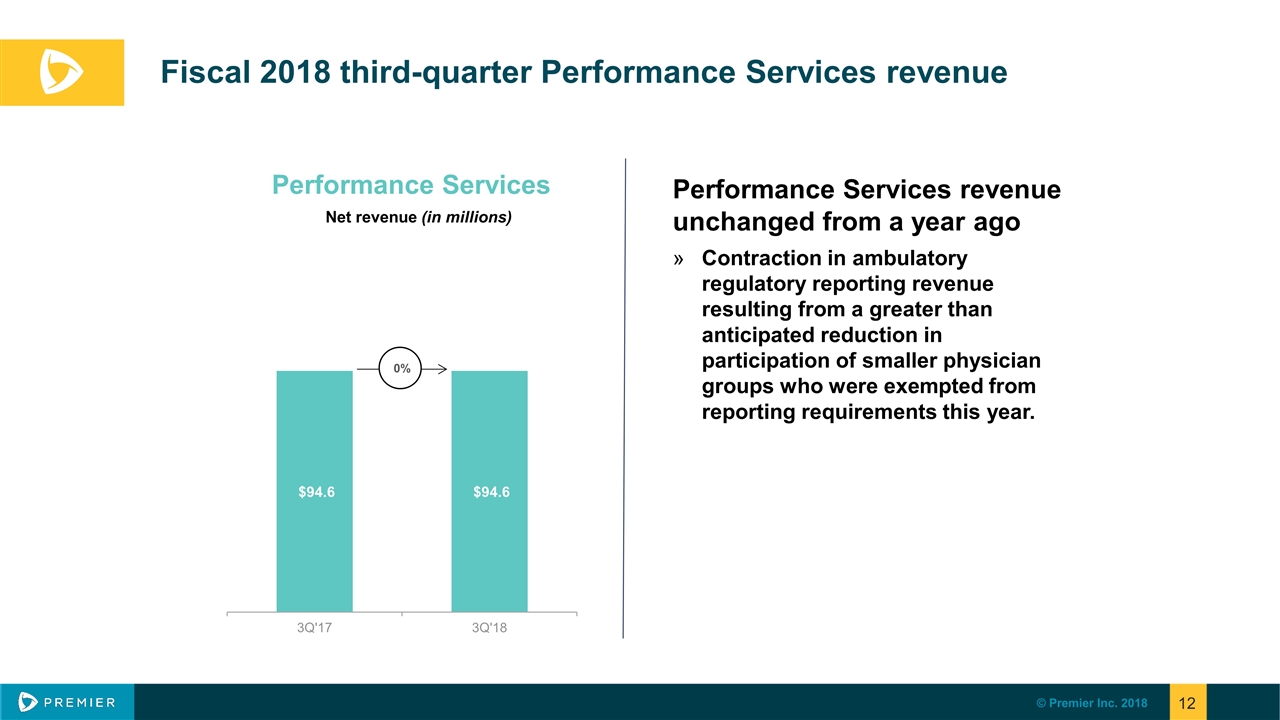

Fiscal 2018 third-quarter Performance Services revenue Performance Services revenue unchanged from a year ago Contraction in ambulatory regulatory reporting revenue resulting from a greater than anticipated reduction in participation of smaller physician groups who were exempted from reporting requirements this year. Performance Services Net revenue (in millions) 0%

Fiscal 2018 third-quarter GAAP net income $(1.60) $(1.93) Earnings per share attributable to stockholders* – diluted *After required GAAP non-cash adjustments to reflect the change in redemption amount of limited partners’ Class B common unit ownership at the end of each period 7% GAAP net income increased 7%

Fiscal 2018 third-quarter non-GAAP adjusted EBITDA* Consolidated non-GAAP adjusted EBITDA up 4% Growth during the quarter was impacted by $5.1 million in severance costs related to the reduction in force that occurred in February. * See non-GAAP Adjusted EBITDA and non-GAAP Segment Adjusted EBITDA reconciliations to GAAP equivalents in Appendix. $142.2 $136.7

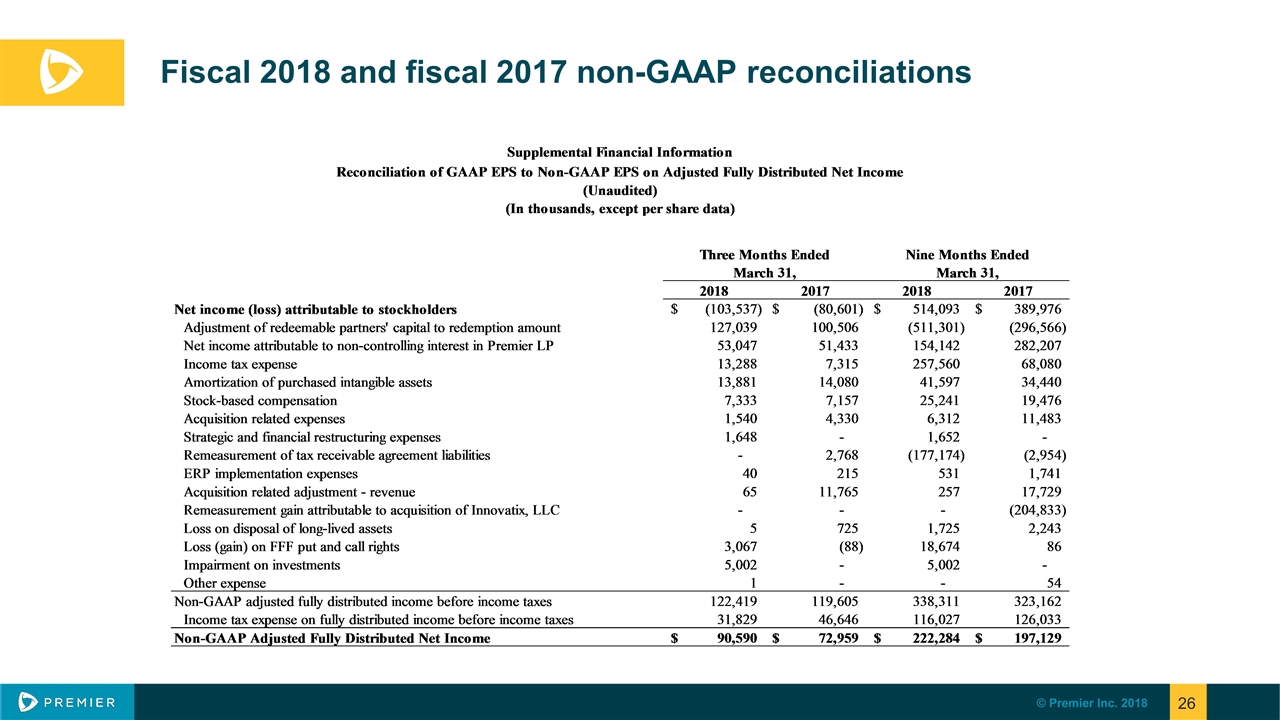

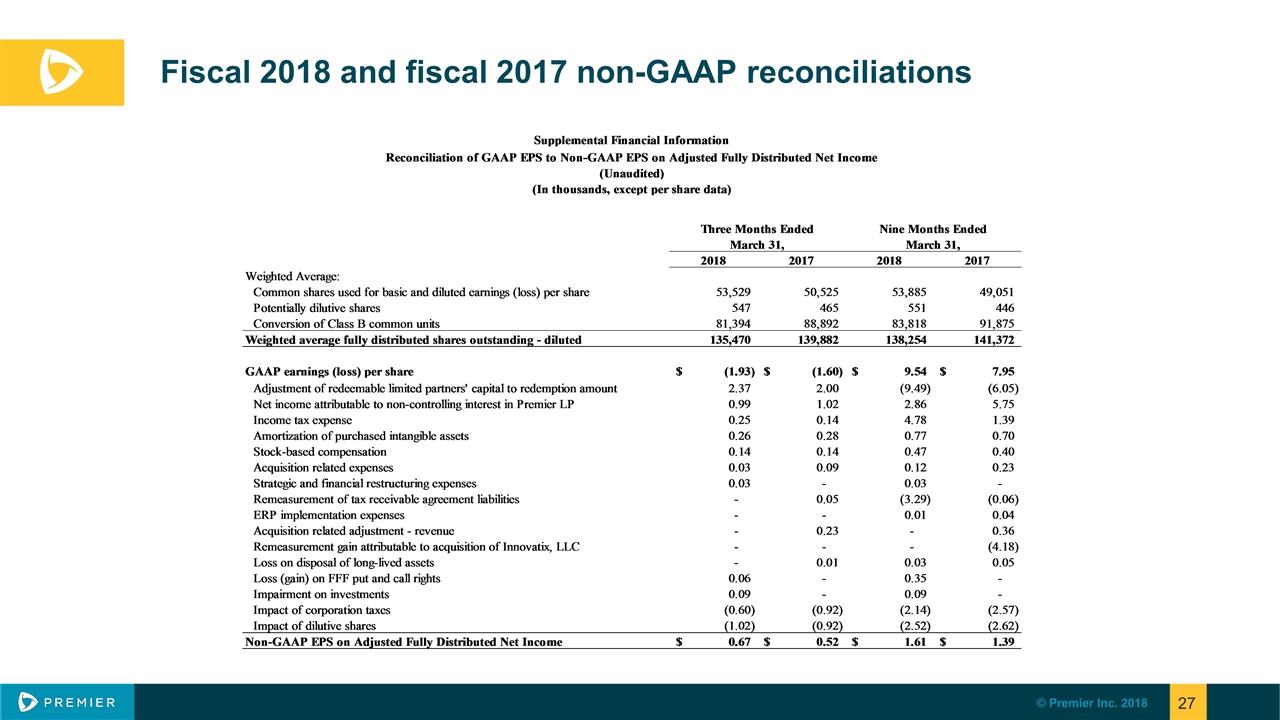

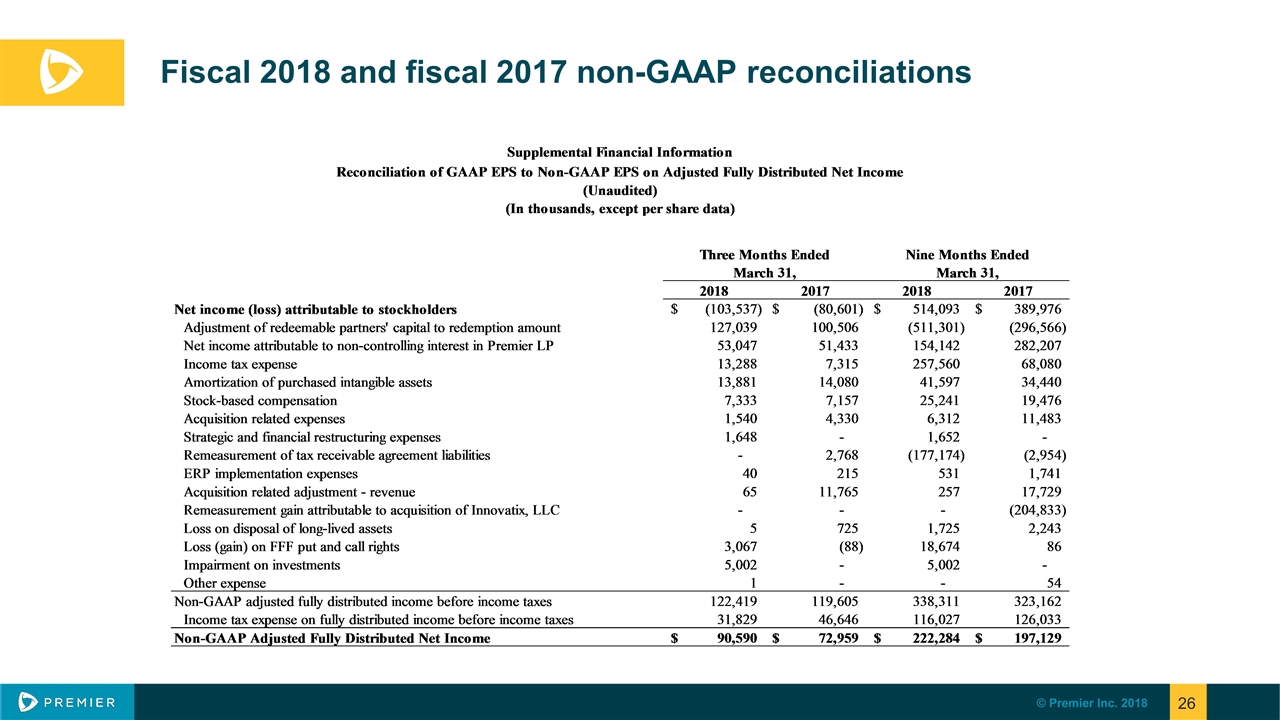

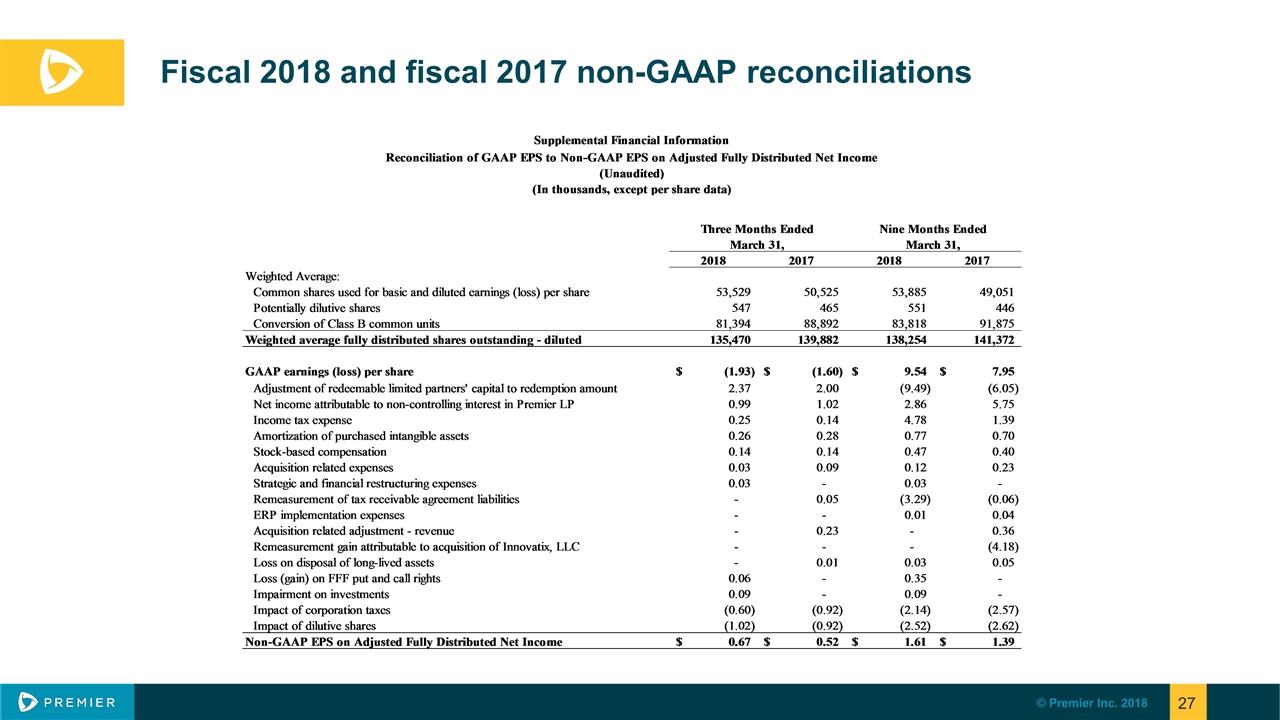

Fiscal 2018 third-quarter non-GAAP adjusted fully distributed net income and earnings per share* Calculates income taxes at 26% of pre-tax income for third quarter, assuming taxable C corporate structure Calculates adjusted fully distributed earnings per share, assuming all Class A and B common shares are held by the public 29% $73.0 million $90.6 million Non-GAAP adjusted fully distributed net income * See non-GAAP adjusted fully distributed net income and non-GAAP adjusted fully distributed earnings per share reconciliations to GAAP equivalents in Appendix

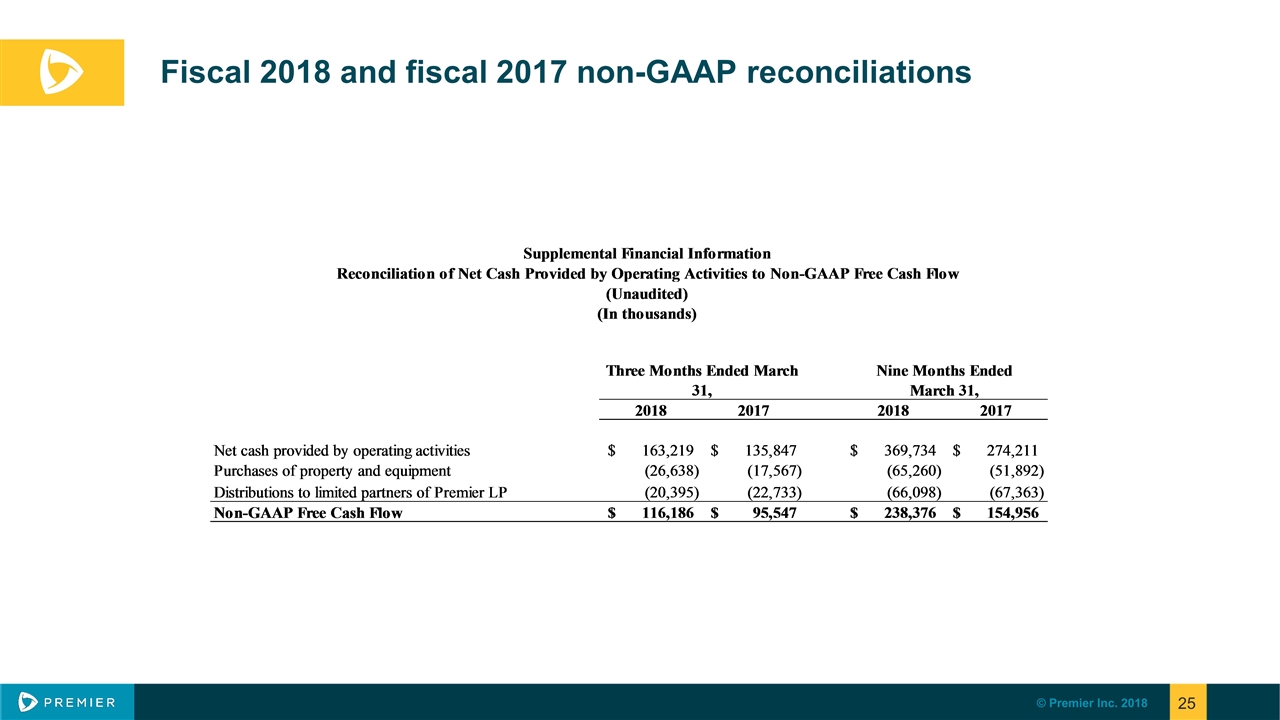

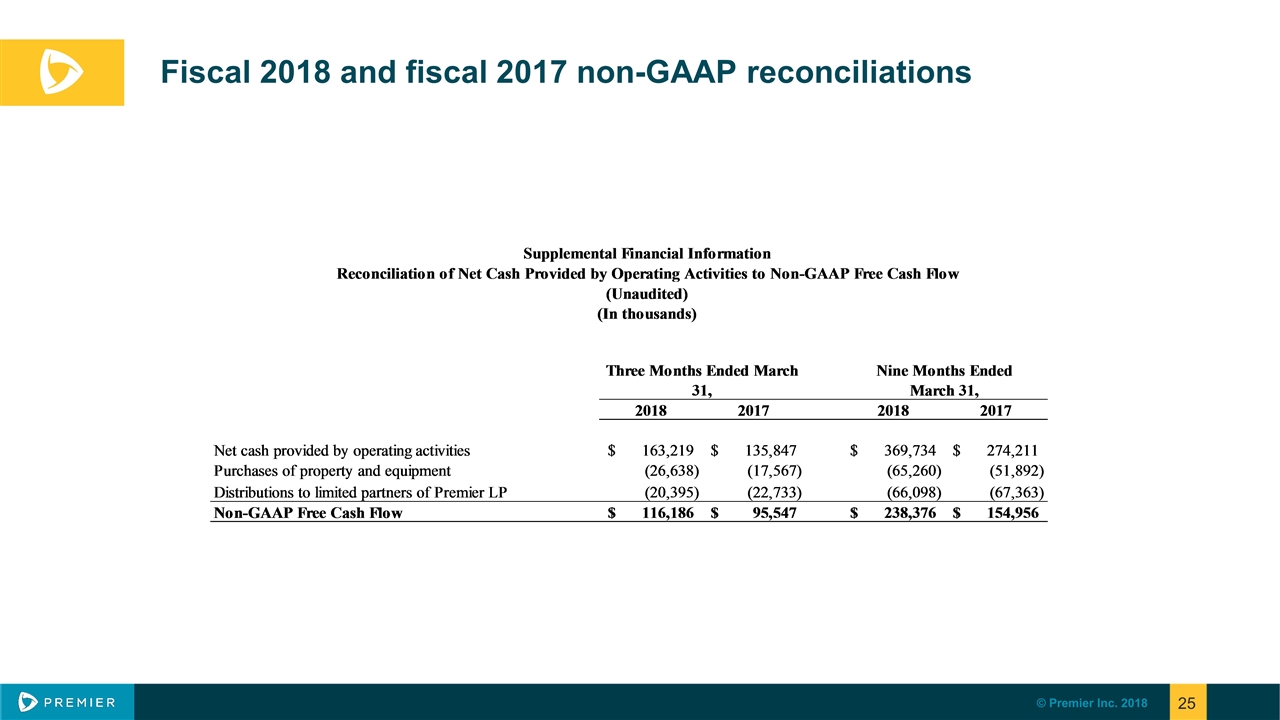

Cash flow and capital flexibility at March 31, 2018 CONSIDERABLE CASH AND DEBT CAPACITY AVAILABLE AMPLE CAPITAL FLEXIBILITY FOR FUTURE ACQUISITIONS AND STOCKHOLDER RETURN Cash flow from operations of $369.7 million and non-GAAP free cash flow* of $238.4 million for the nine months ended March 31, 2018 Expect non-GAAP free cash flow to range from 50% to 60% of non-GAAP adjusted EBITDA for fiscal 2018 Cash and cash equivalents of $149.4 million Outstanding borrowings of $200.0 million on $750.0 million five-year unsecured revolving credit facility *See non-GAAP Free Cash Flow reconciliation to GAAP equivalent in Appendix.

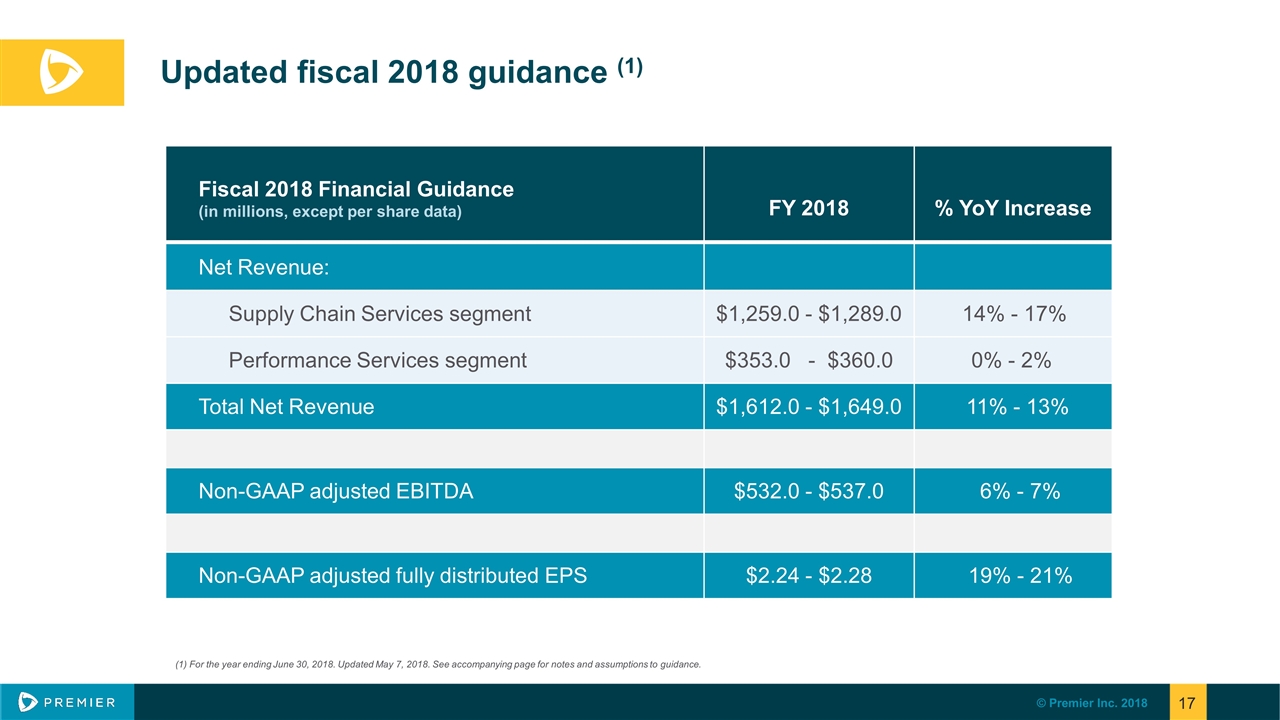

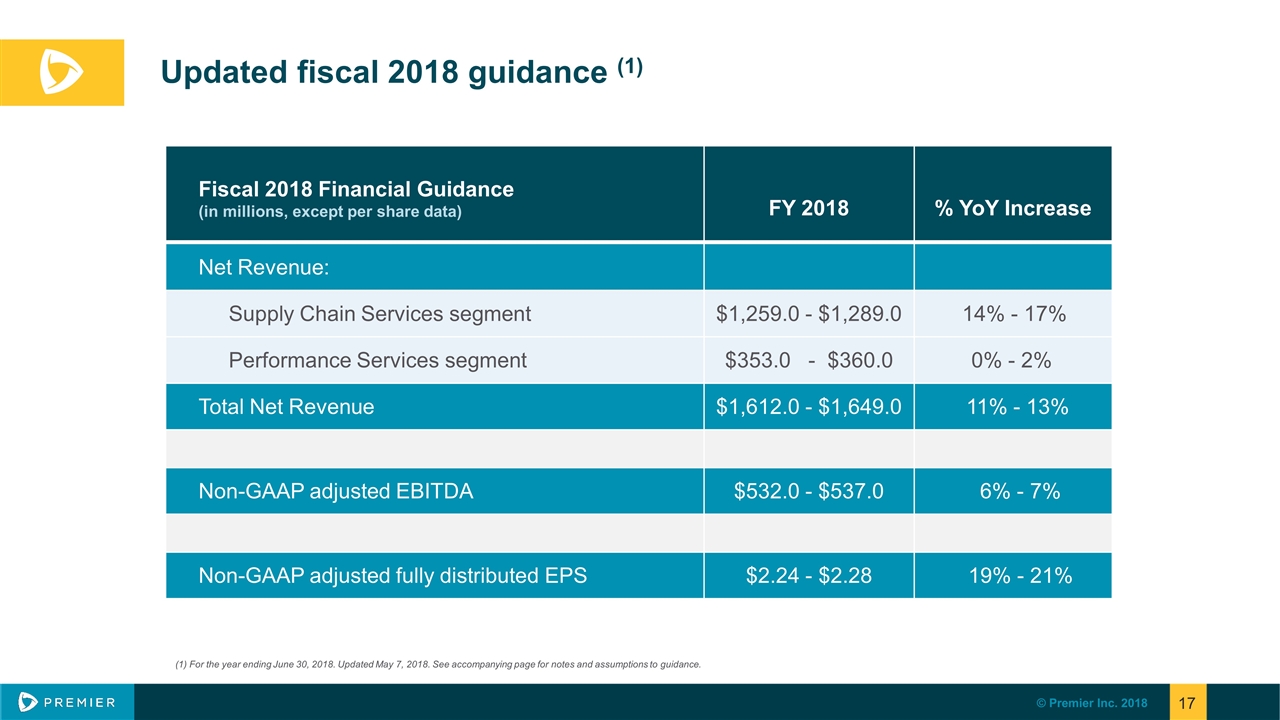

Updated fiscal 2018 guidance (1) Fiscal 2018 Financial Guidance (in millions, except per share data) FY 2018 % YoY Increase Net Revenue: Supply Chain Services segment $1,259.0 - $1,289.0 14% - 17% Performance Services segment $353.0 - $360.0 0% - 2% Total Net Revenue $1,612.0 - $1,649.0 11% - 13% Non-GAAP adjusted EBITDA $532.0 - $537.0 6% - 7% Non-GAAP adjusted fully distributed EPS $2.24 - $2.28 19% - 21% (1) For the year ending June 30, 2018. Updated May 7, 2018. See accompanying page for notes and assumptions to guidance.

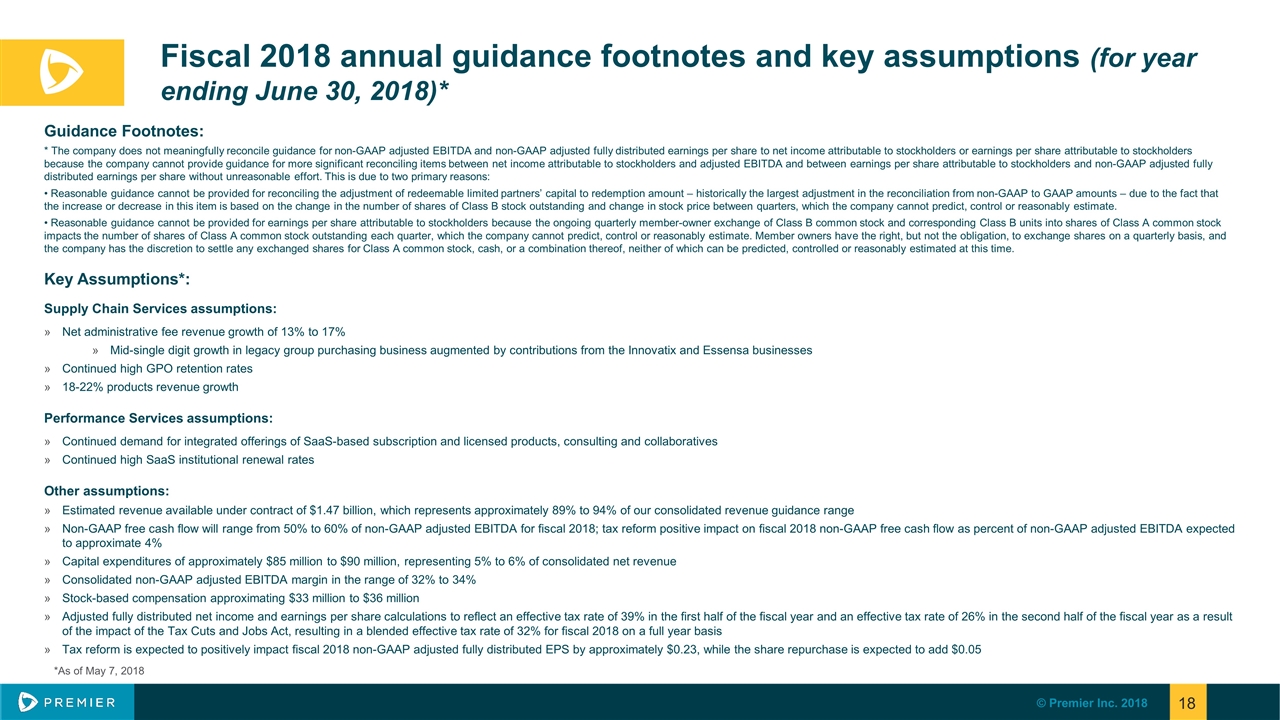

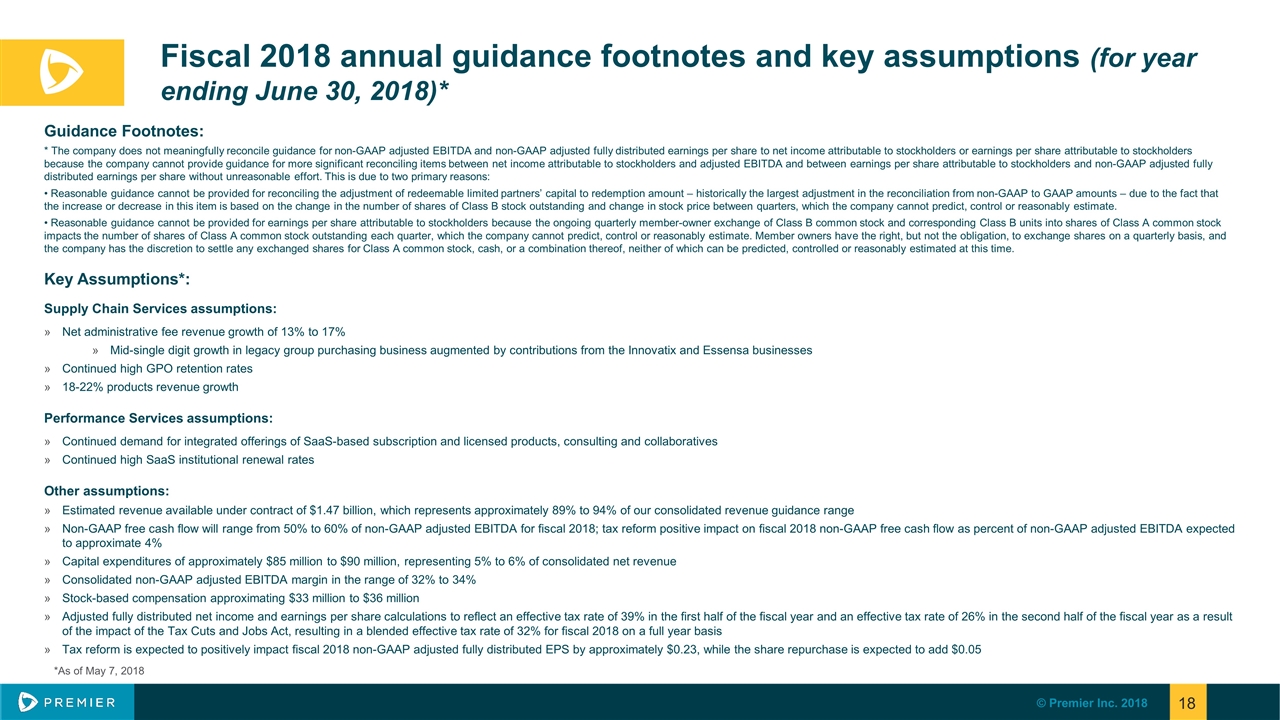

Guidance Footnotes: * The company does not meaningfully reconcile guidance for non-GAAP adjusted EBITDA and non-GAAP adjusted fully distributed earnings per share to net income attributable to stockholders or earnings per share attributable to stockholders because the company cannot provide guidance for more significant reconciling items between net income attributable to stockholders and adjusted EBITDA and between earnings per share attributable to stockholders and non-GAAP adjusted fully distributed earnings per share without unreasonable effort. This is due to two primary reasons: • Reasonable guidance cannot be provided for reconciling the adjustment of redeemable limited partners’ capital to redemption amount – historically the largest adjustment in the reconciliation from non-GAAP to GAAP amounts – due to the fact that the increase or decrease in this item is based on the change in the number of shares of Class B stock outstanding and change in stock price between quarters, which the company cannot predict, control or reasonably estimate. • Reasonable guidance cannot be provided for earnings per share attributable to stockholders because the ongoing quarterly member-owner exchange of Class B common stock and corresponding Class B units into shares of Class A common stock impacts the number of shares of Class A common stock outstanding each quarter, which the company cannot predict, control or reasonably estimate. Member owners have the right, but not the obligation, to exchange shares on a quarterly basis, and the company has the discretion to settle any exchanged shares for Class A common stock, cash, or a combination thereof, neither of which can be predicted, controlled or reasonably estimated at this time. Fiscal 2018 annual guidance footnotes and key assumptions (for year ending June 30, 2018)* Key Assumptions*: Supply Chain Services assumptions: Net administrative fee revenue growth of 13% to 17% Mid-single digit growth in legacy group purchasing business augmented by contributions from the Innovatix and Essensa businesses Continued high GPO retention rates 18-22% products revenue growth Performance Services assumptions: Continued demand for integrated offerings of SaaS-based subscription and licensed products, consulting and collaboratives Continued high SaaS institutional renewal rates Other assumptions: Estimated revenue available under contract of $1.47 billion, which represents approximately 89% to 94% of our consolidated revenue guidance range Non-GAAP free cash flow will range from 50% to 60% of non-GAAP adjusted EBITDA for fiscal 2018; tax reform positive impact on fiscal 2018 non-GAAP free cash flow as percent of non-GAAP adjusted EBITDA expected to approximate 4% Capital expenditures of approximately $85 million to $90 million, representing 5% to 6% of consolidated net revenue Consolidated non-GAAP adjusted EBITDA margin in the range of 32% to 34% Stock-based compensation approximating $33 million to $36 million Adjusted fully distributed net income and earnings per share calculations to reflect an effective tax rate of 39% in the first half of the fiscal year and an effective tax rate of 26% in the second half of the fiscal year as a result of the impact of the Tax Cuts and Jobs Act, resulting in a blended effective tax rate of 32% for fiscal 2018 on a full year basis Tax reform is expected to positively impact fiscal 2018 non-GAAP adjusted fully distributed EPS by approximately $0.23, while the share repurchase is expected to add $0.05 *As of May 7, 2018

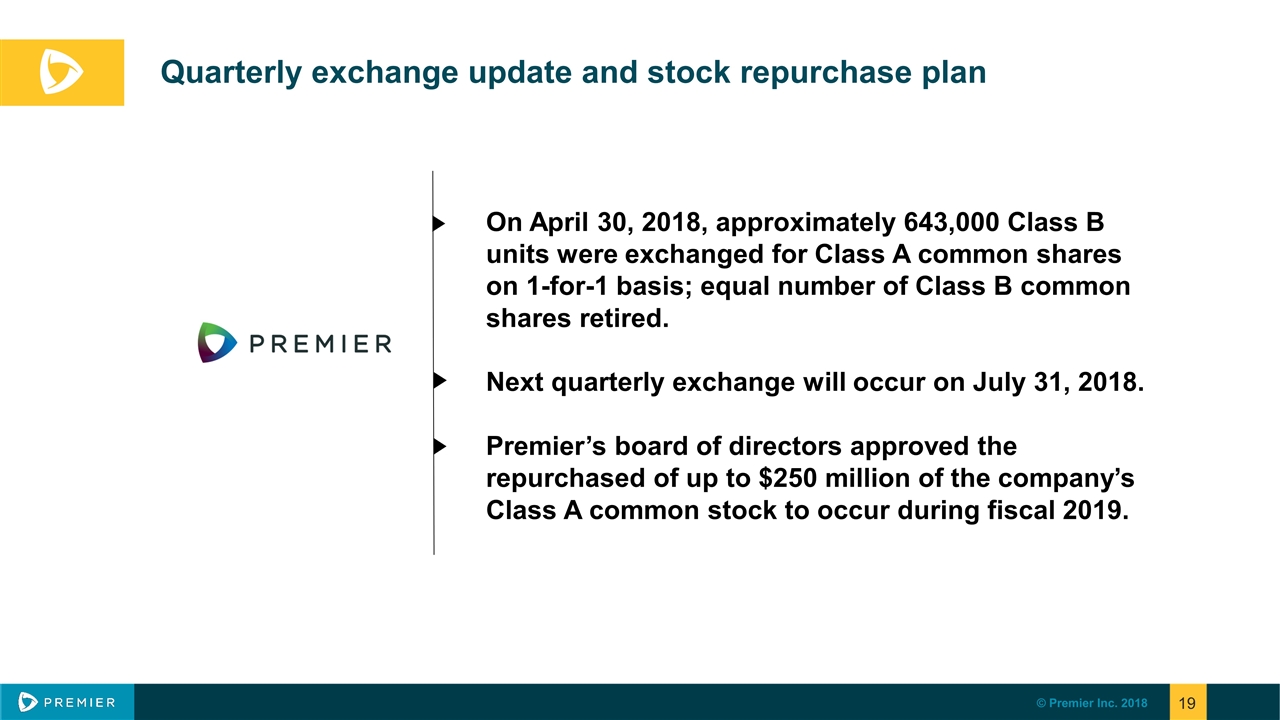

Quarterly exchange update and stock repurchase plan On April 30, 2018, approximately 643,000 Class B units were exchanged for Class A common shares on 1-for-1 basis; equal number of Class B common shares retired. Next quarterly exchange will occur on July 31, 2018. Premier’s board of directors approved the repurchased of up to $250 million of the company’s Class A common stock to occur during fiscal 2019.

Questions

Appendix

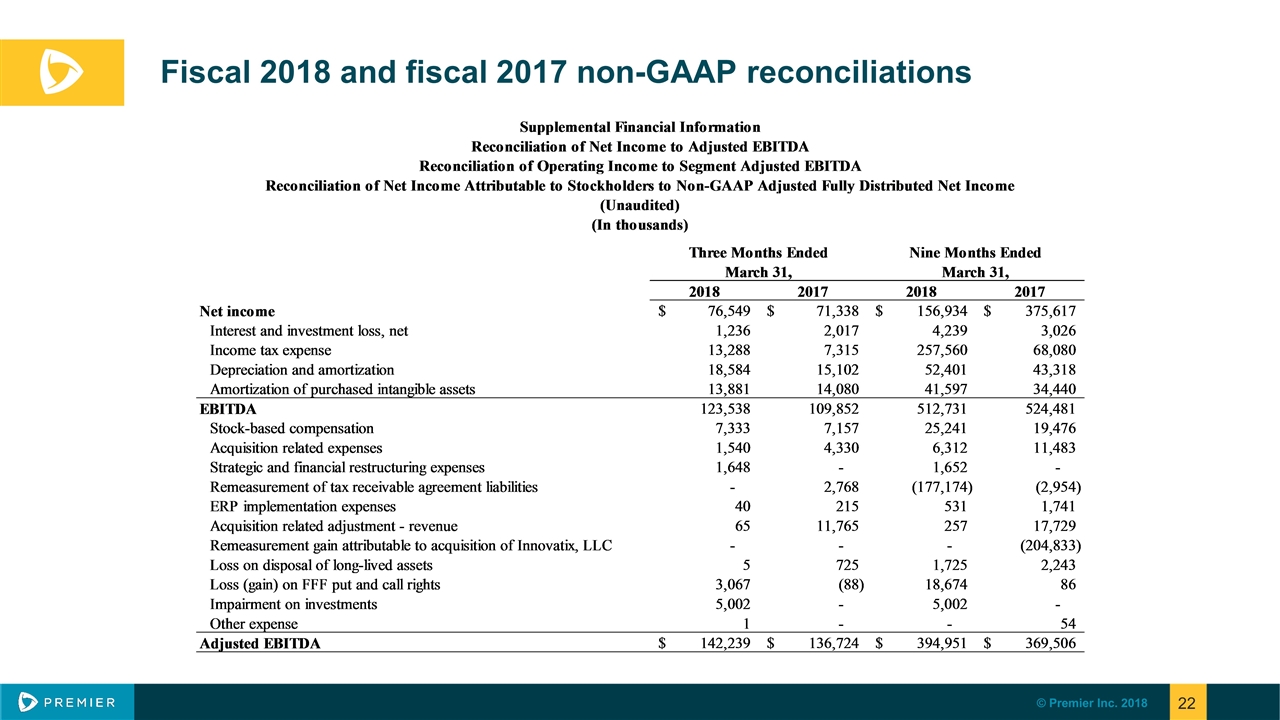

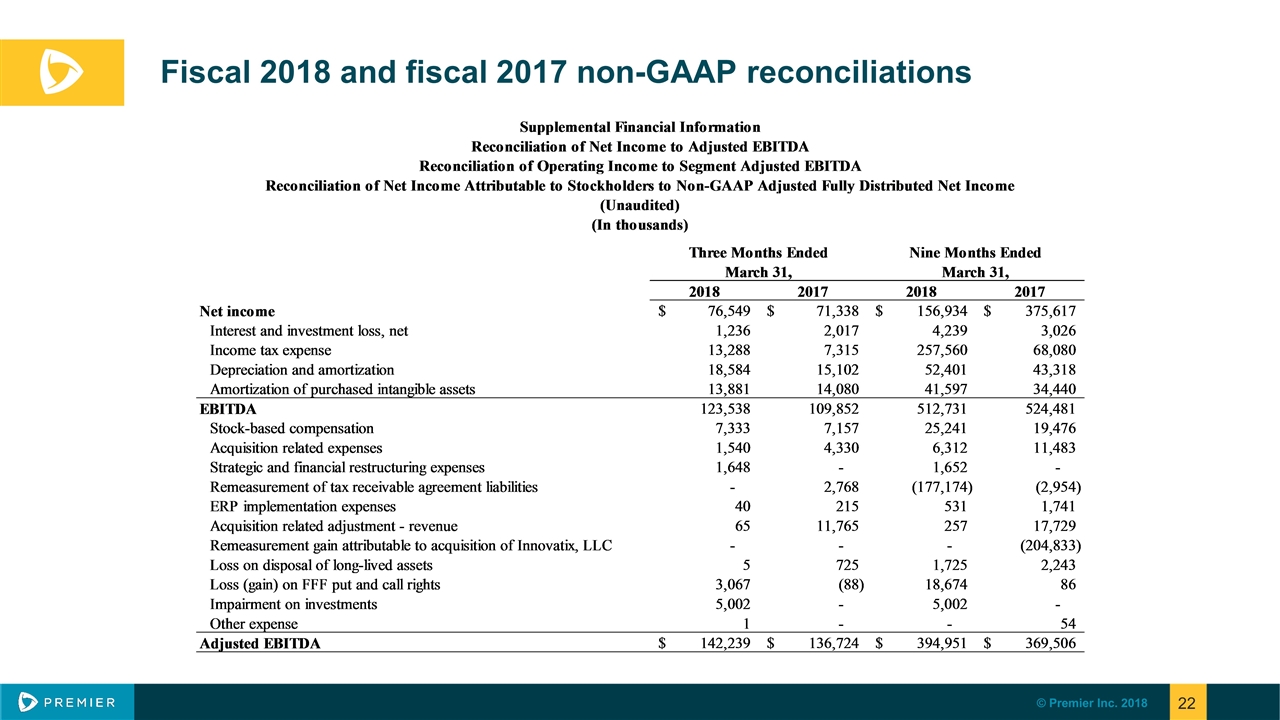

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations