Fourth-Quarter Fiscal 2018 Financial Results & Update August 21, 2018 Exhibit 99.3

Forward-looking statements and non-GAAP financial measures Forward-looking Statements – Certain statements included in this presentation that are not historical or current facts including, but not limited to, those related to expected financial performance, growth trends and market uncertainty in our Supply Chain and Performance Services business segments and their respective business units, our ability to implement our evolving strategy and plans for future growth, the impact of regulatory uncertainty and our ability to manage through these issues, the statements related to fiscal 2019 outlook and guidance and the assumptions underlying such guidance, and Premier’s repurchase activity under its stock repurchase program, including the timing and number of shares repurchased or the possible suspension of or discontinuance of the repurchase program at any time are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward looking statements. Readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside Premier’s control. You should carefully read Premier’s periodic and current filings with the SEC for more information on potential risks and other factors that could affect Premier’s financial results. Forward-looking statements speak only as of the date they are made. Premier undertakes no obligation to publicly update or revise any forward-looking statements. Non-GAAP Financial Measures – This presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. You should carefully read Premier’s periodic and current filings with the SEC for definitions and further explanation and disclosure regarding our use of non-GAAP financial measures and such filings should be read in conjunction with this presentation.

Susan DeVore President and Chief Executive Officer Premier, Inc. Overview and Business Update

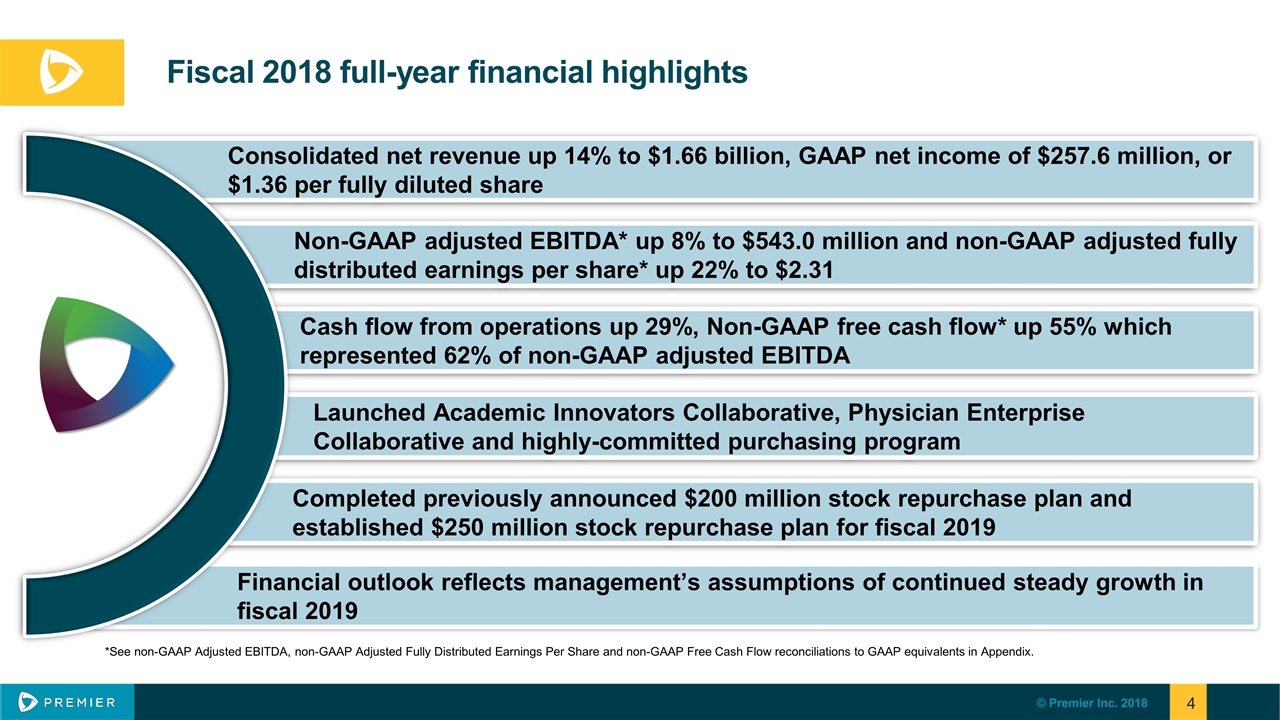

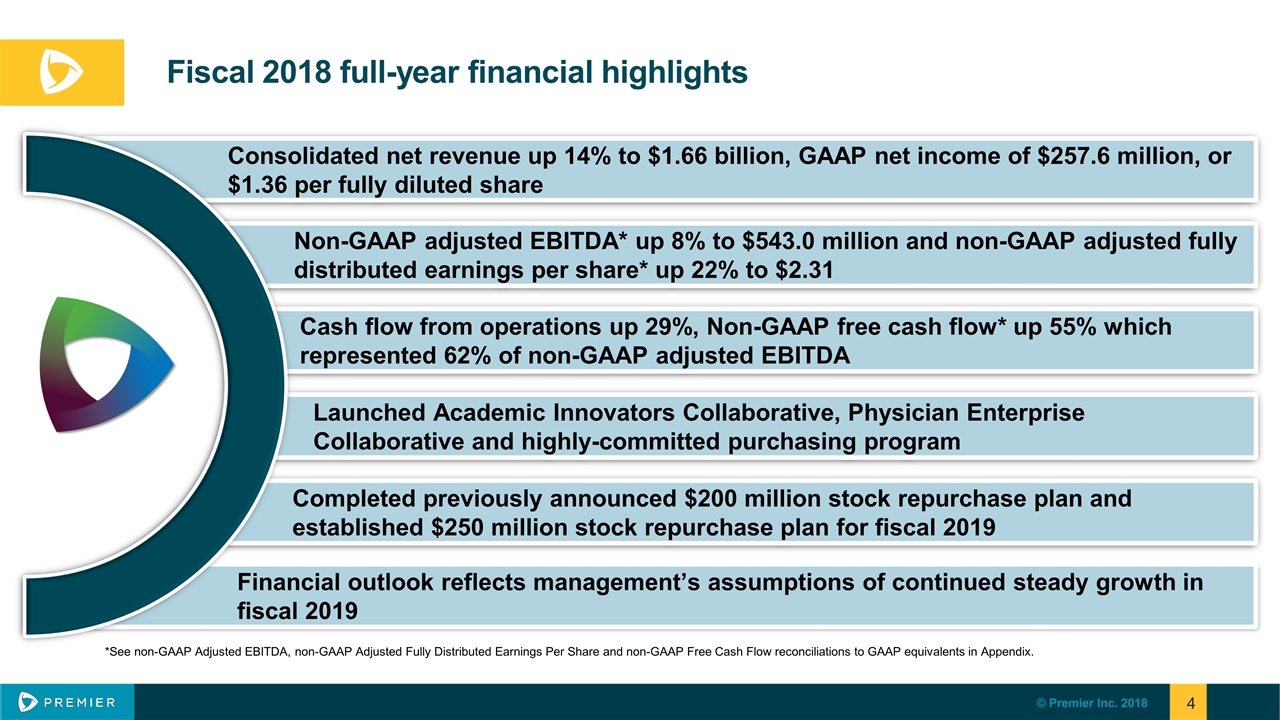

Fiscal 2018 full-year financial highlights *See non-GAAP Adjusted EBITDA, non-GAAP Adjusted Fully Distributed Earnings Per Share and non-GAAP Free Cash Flow reconciliations to GAAP equivalents in Appendix. Cash flow from operations up 29%, Non-GAAP free cash flow* up 55% which represented 62% of non-GAAP adjusted EBITDA Non-GAAP adjusted EBITDA* up 8% to $543.0 million and non-GAAP adjusted fully distributed earnings per share* up 22% to $2.31 Launched Academic Innovators Collaborative, Physician Enterprise Collaborative and highly-committed purchasing program Completed previously announced $200 million stock repurchase plan and established $250 million stock repurchase plan for fiscal 2019 Financial outlook reflects management’s assumptions of continued steady growth in fiscal 2019 Consolidated net revenue up 14% to $1.66 billion, GAAP net income of $257.6 million, or $1.36 per fully diluted share *See non-GAAP Adjusted EBITDA, non-GAAP Adjusted Fully Distributed Earnings Per Share and non-GAAP Free Cash Flow reconciliations to GAAP equivalents in Appendix.

Premier positioned for future growth Initiative to reduce generic drug shortage Designing model for direct relationships between employers and healthcare providers Leveraging assets to build a precision medicine offering

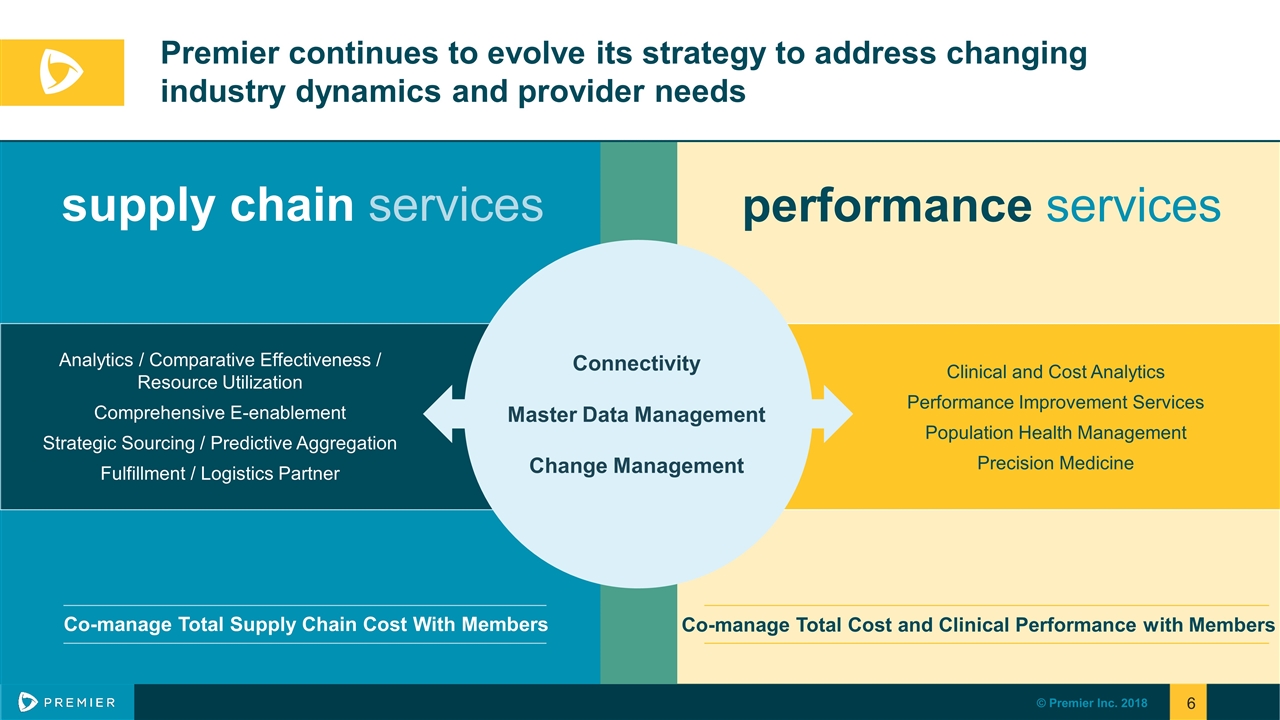

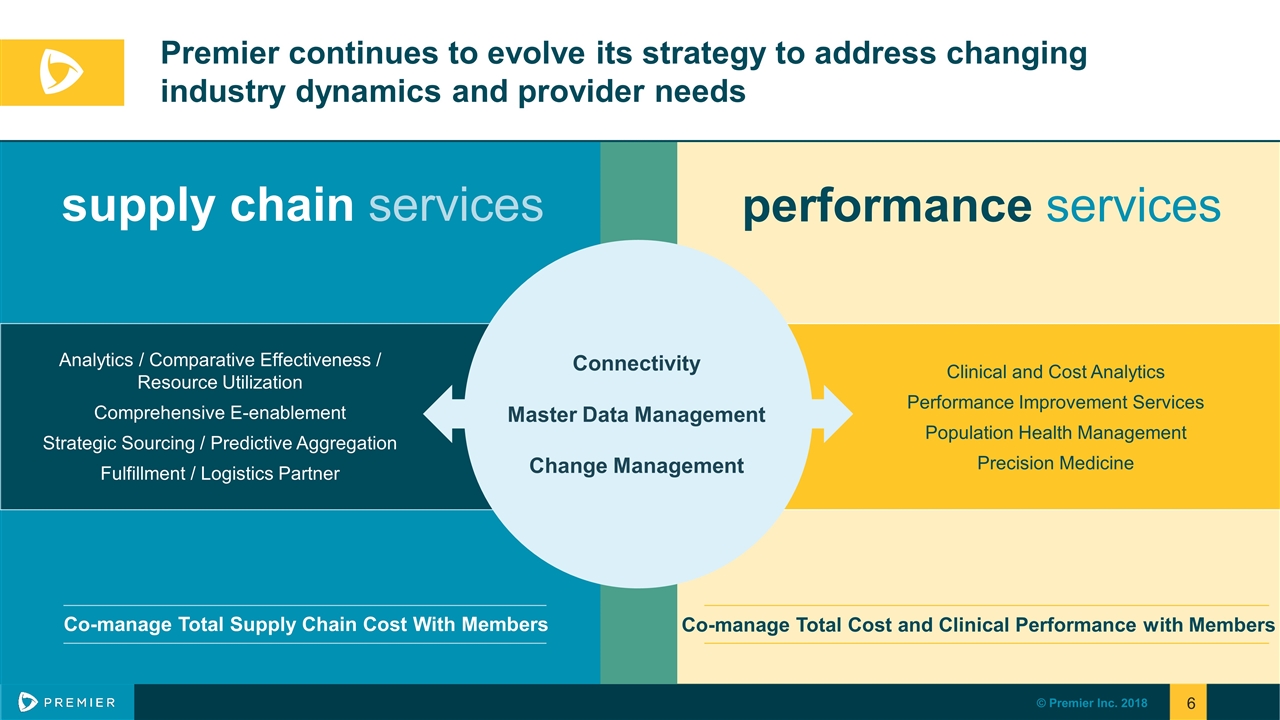

Premier continues to evolve its strategy to address changing industry dynamics and provider needs supply chain services performance services Co-manage Total Supply Chain Cost With Members Co-manage Total Cost and Clinical Performance with Members Analytics / Comparative Effectiveness / Resource Utilization Comprehensive E-enablement Strategic Sourcing / Predictive Aggregation Fulfillment / Logistics Partner Clinical and Cost Analytics Performance Improvement Services Population Health Management Precision Medicine Connectivity Master Data Management Change Management

Mike Alkire Chief Operating Officer Premier, Inc. Operations Review

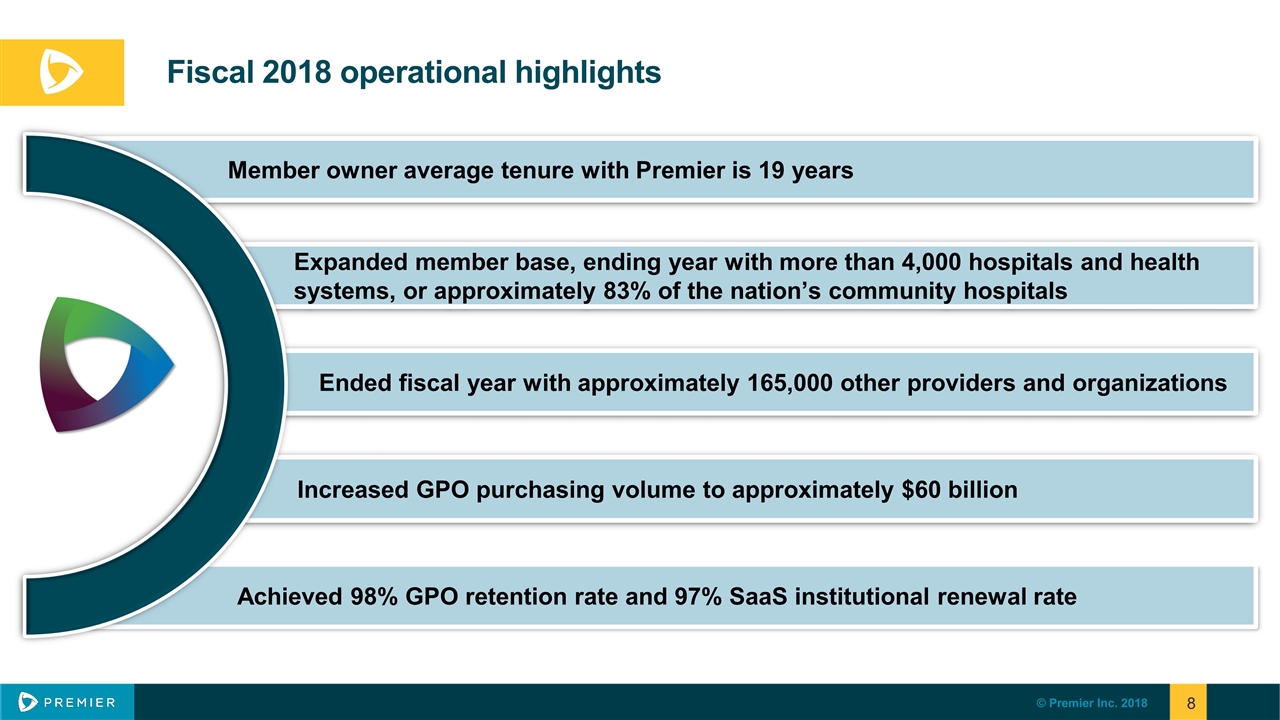

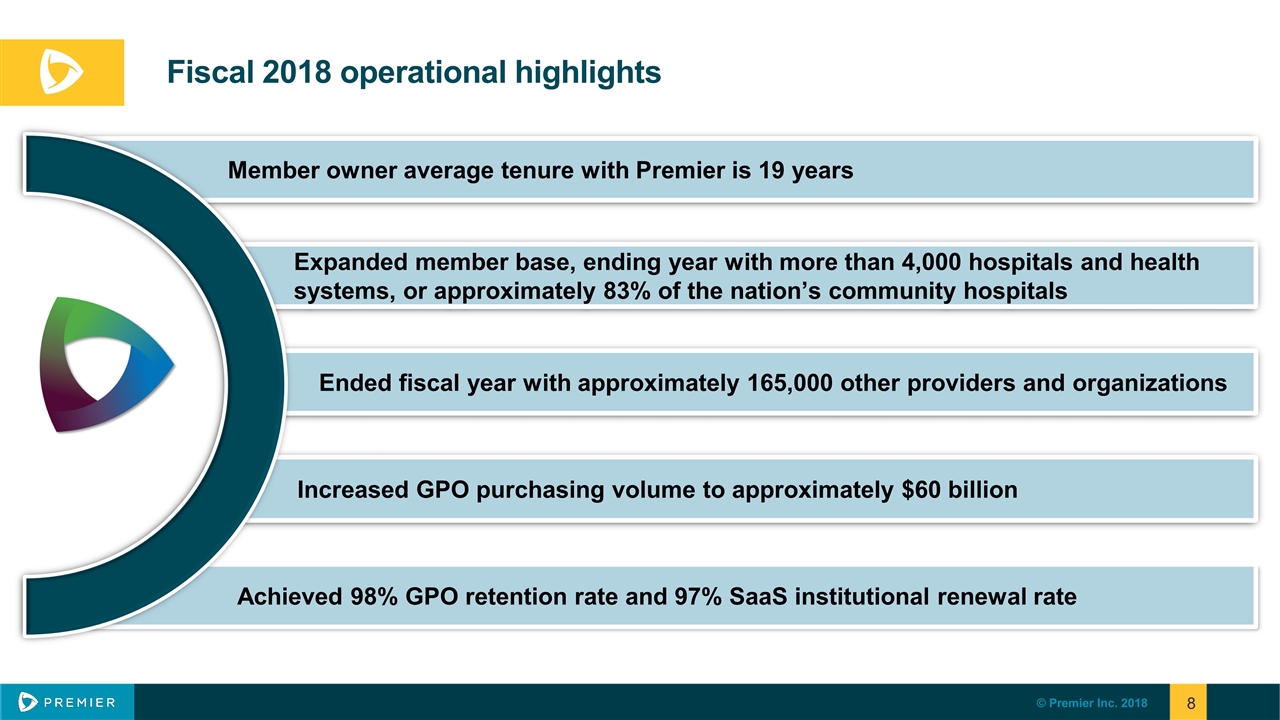

Fiscal 2018 operational highlights *See non-GAAP Adjusted EBITDA, non-GAAP Adjusted Fully Distributed Earnings Per Share and non-GAAP Free Cash Flow reconciliations to GAAP equivalents in Appendix. Ended fiscal year with approximately 165,000 other providers and organizations Expanded member base, ending year with more than 4,000 hospitals and health systems, or approximately 83% of the nation’s community hospitals Increased GPO purchasing volume to approximately $60 billion Achieved 98% GPO retention rate and 97% SaaS institutional renewal rate Member owner average tenure with Premier is 19 years

Member-owner, five-year GPO agreement renewal update Approximately 96% of fiscal 2018 net administrative fees revenue is currently covered by GPO agreement that have been renewed, extended or initially had terms longer than five years. Expect the final member owner renewal rate to be in line with historical GPO retention rates.

Premier continues to demonstrate value through future growth opportunities Premier is leveraging expansive capabilities to further address chronic drug shortages and their associated price hikes. Premier has recently partnered with a startup predictive analytics firm, Progknowse, to develop new predictive analytics capabilities to put precision medicine within reach of almost any health system, regardless of size and budget.

Craig McKasson Chief Financial Officer Premier, Inc. Financial Review

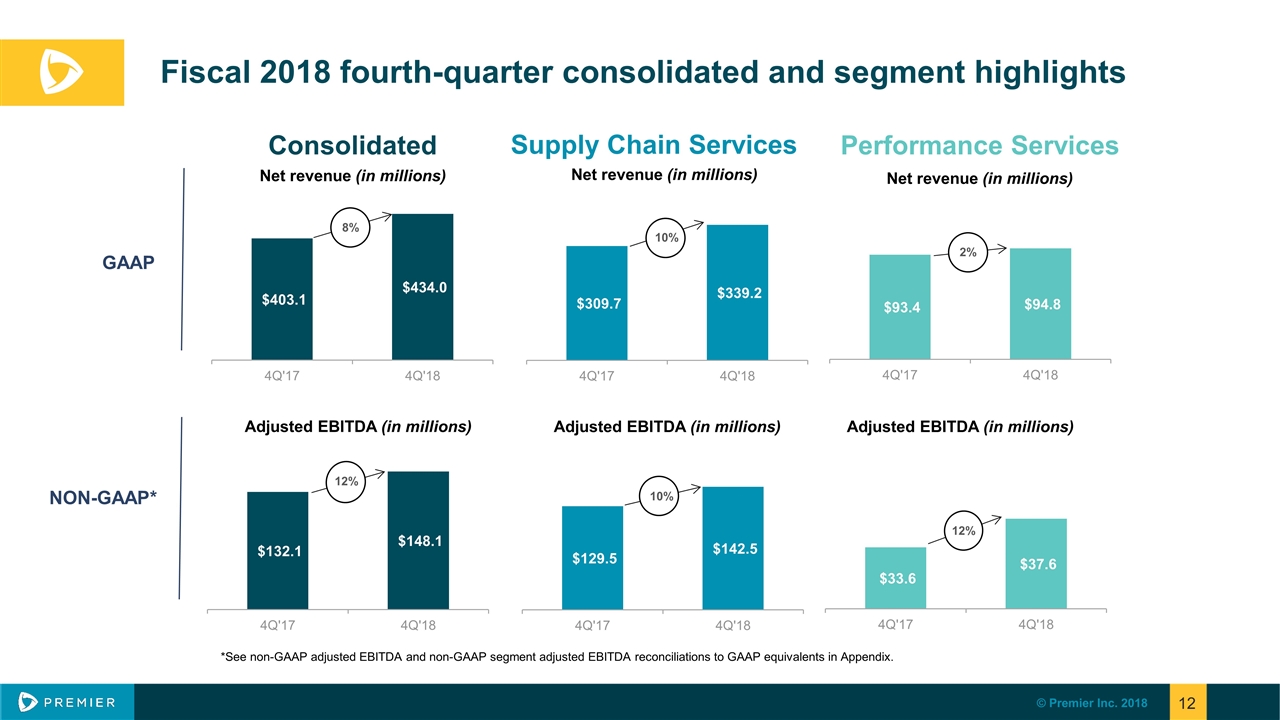

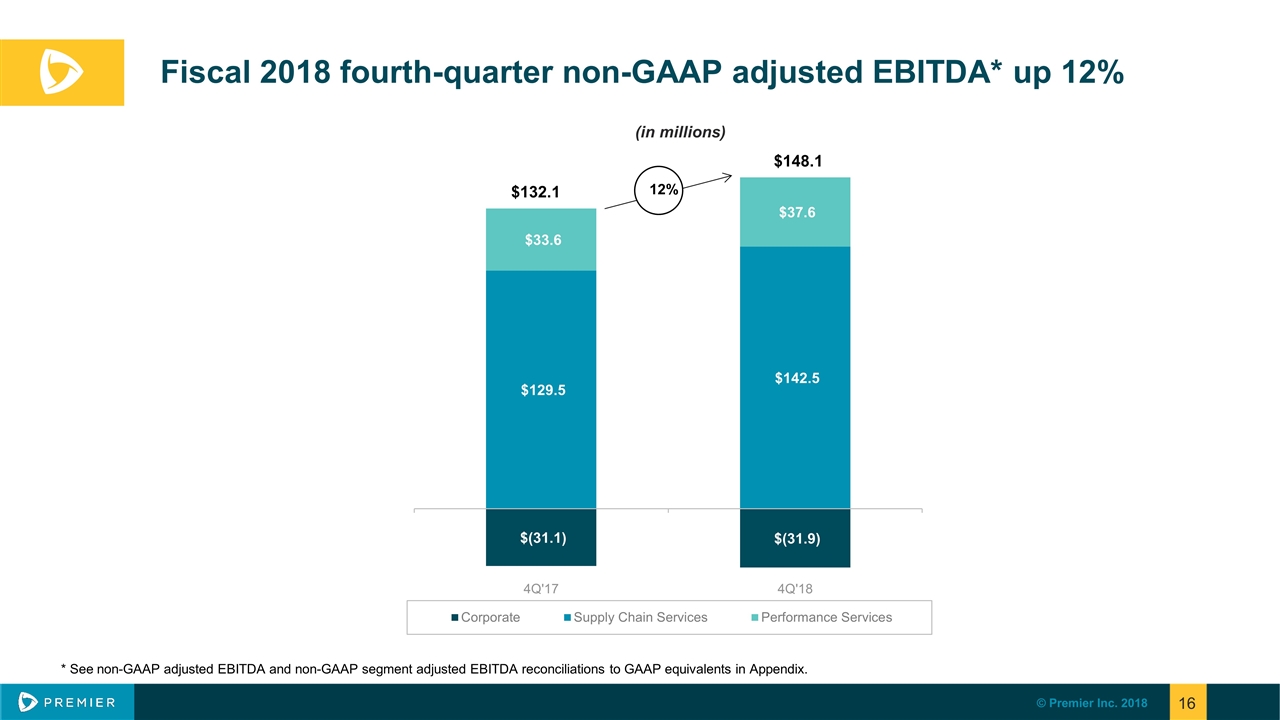

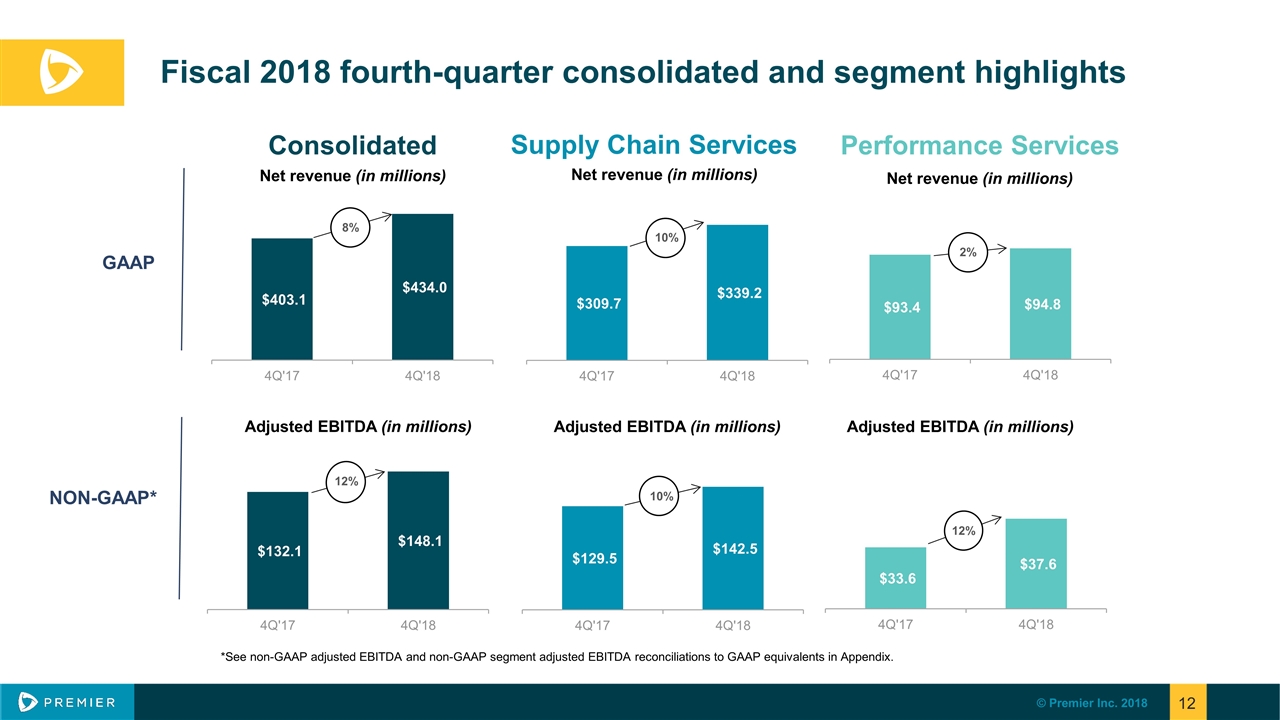

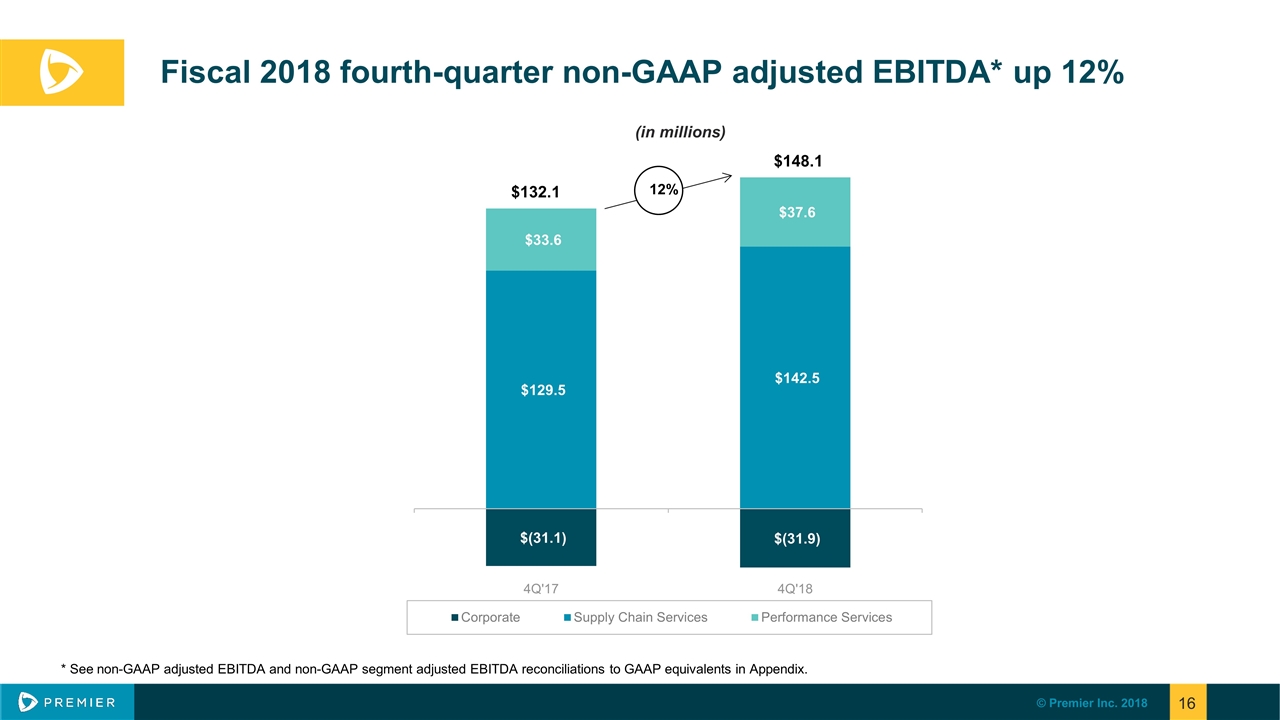

Fiscal 2018 fourth-quarter consolidated and segment highlights Consolidated Net revenue (in millions) Supply Chain Services Net revenue (in millions) Performance Services Net revenue (in millions) Adjusted EBITDA (in millions) Adjusted EBITDA (in millions) Adjusted EBITDA (in millions) *See non-GAAP adjusted EBITDA and non-GAAP segment adjusted EBITDA reconciliations to GAAP equivalents in Appendix. 8% 12% 10% 10% 2% 12% GAAP NON-GAAP*

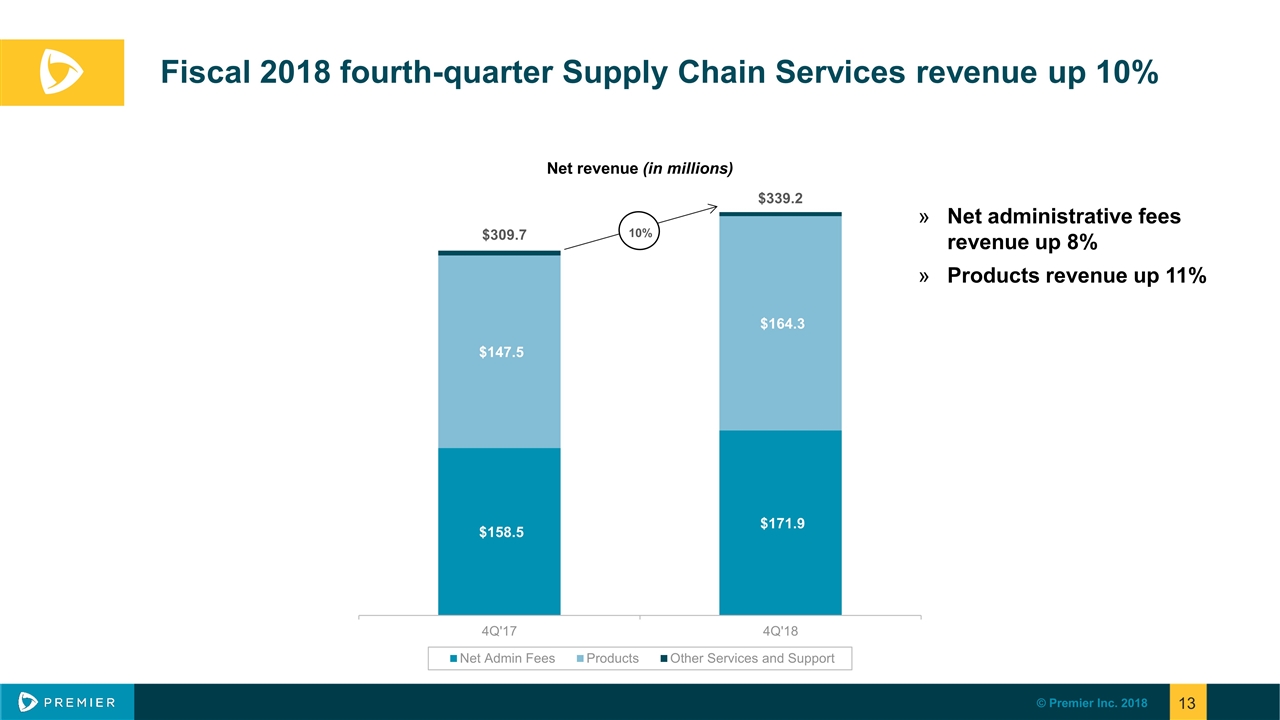

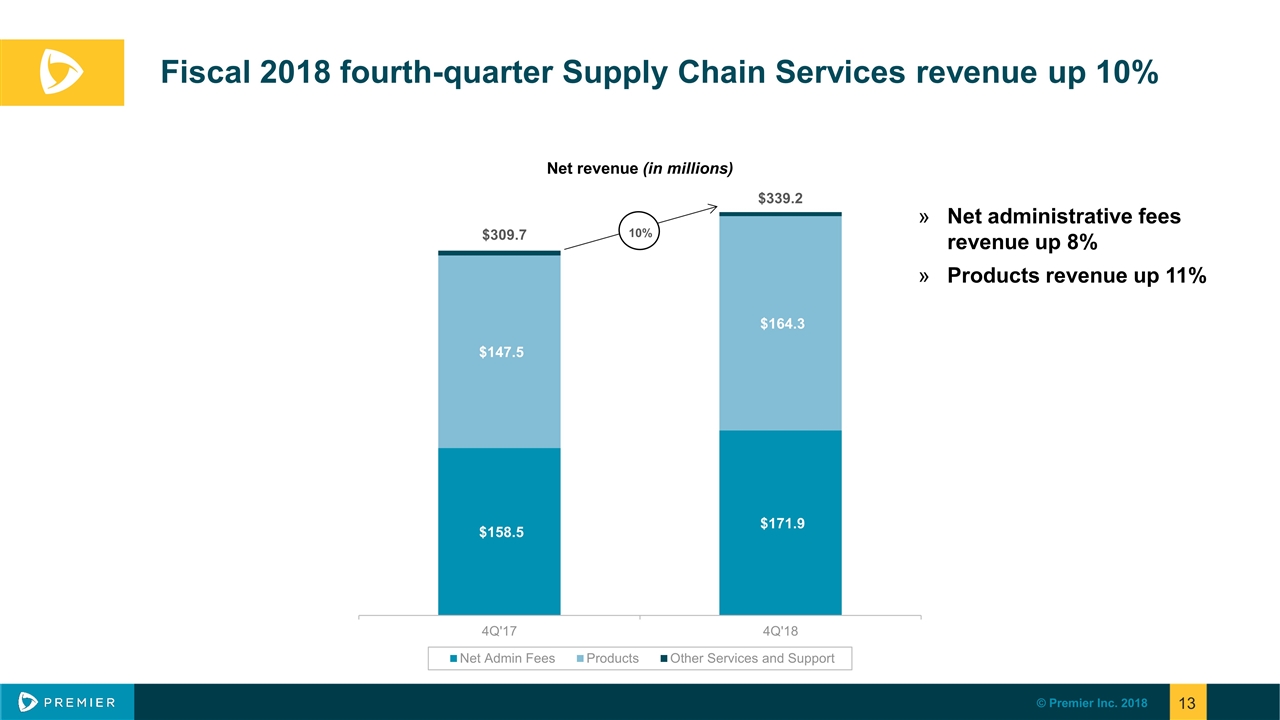

Fiscal 2018 fourth-quarter Supply Chain Services revenue up 10% Net administrative fees revenue up 8% Products revenue up 11% Net revenue (in millions) 10% $309.7 $339.2

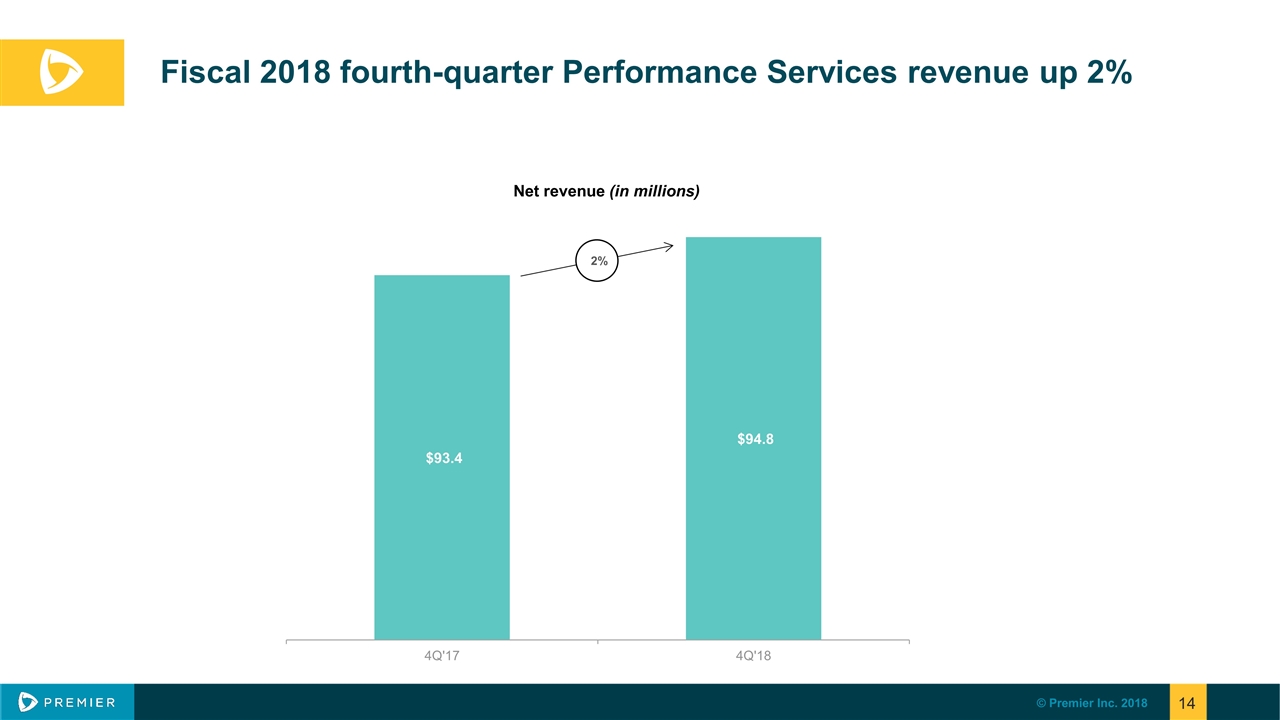

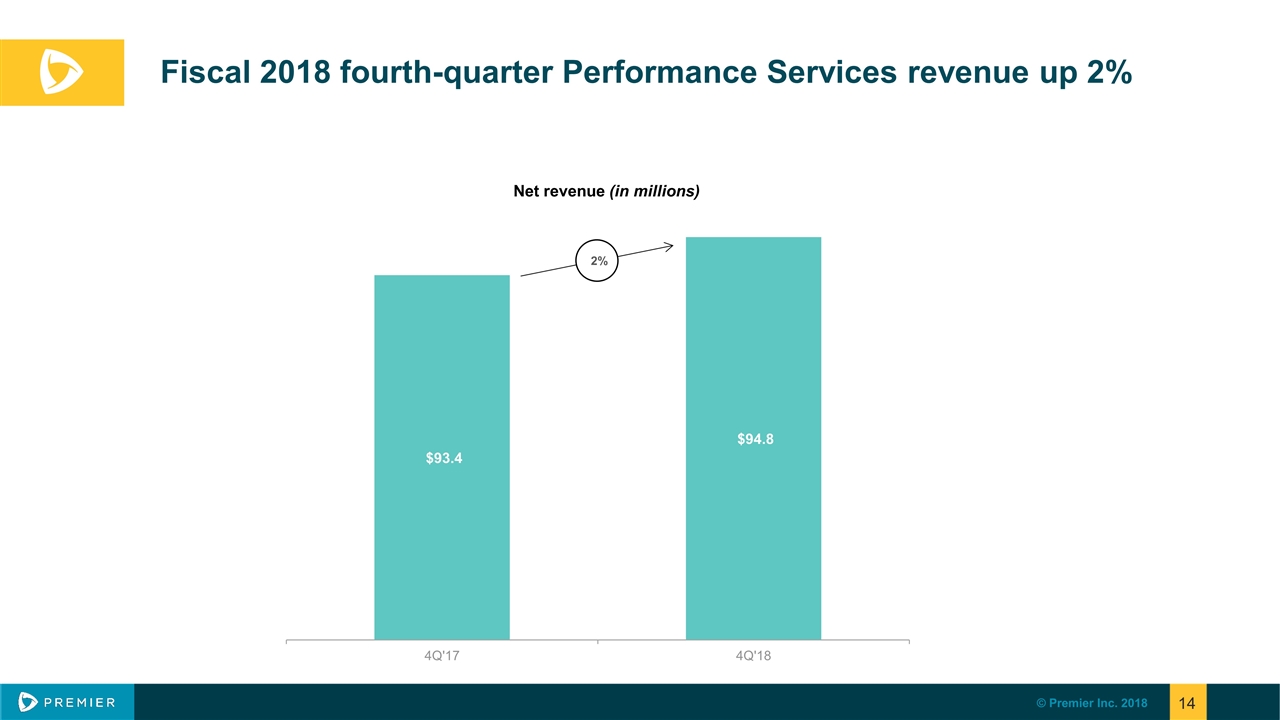

Fiscal 2018 fourth-quarter Performance Services revenue up 2% Net revenue (in millions) 2%

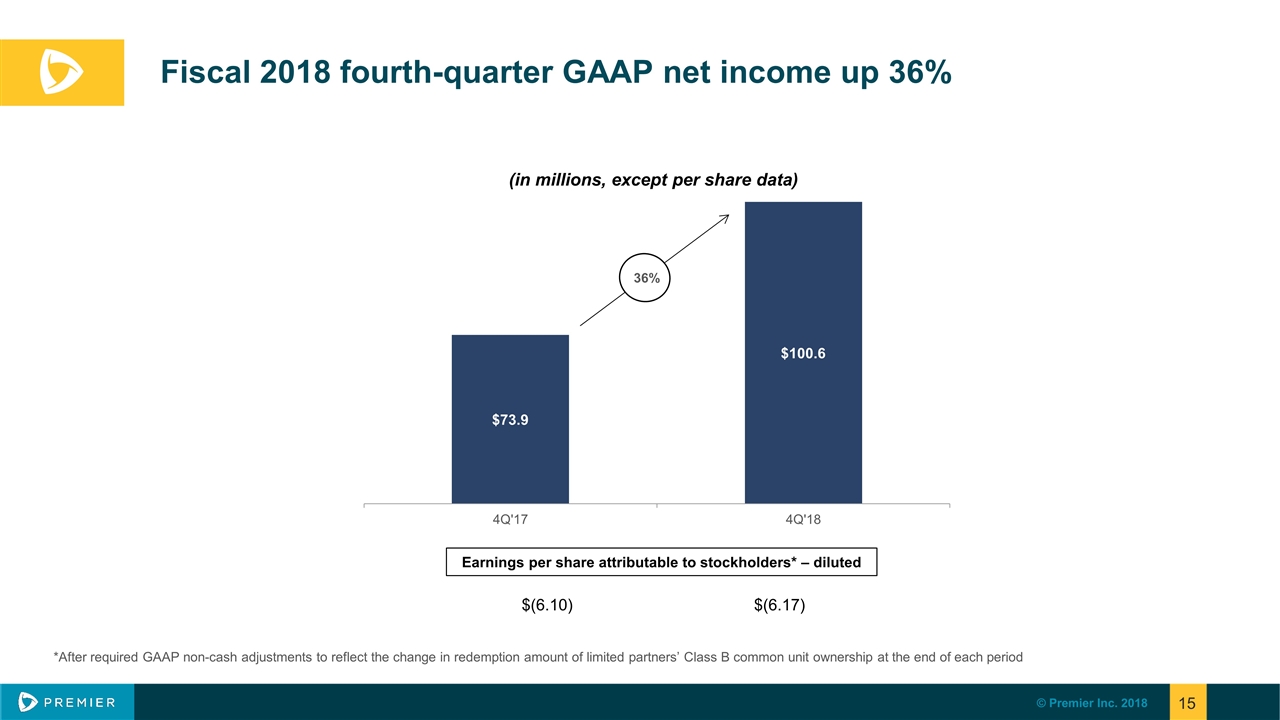

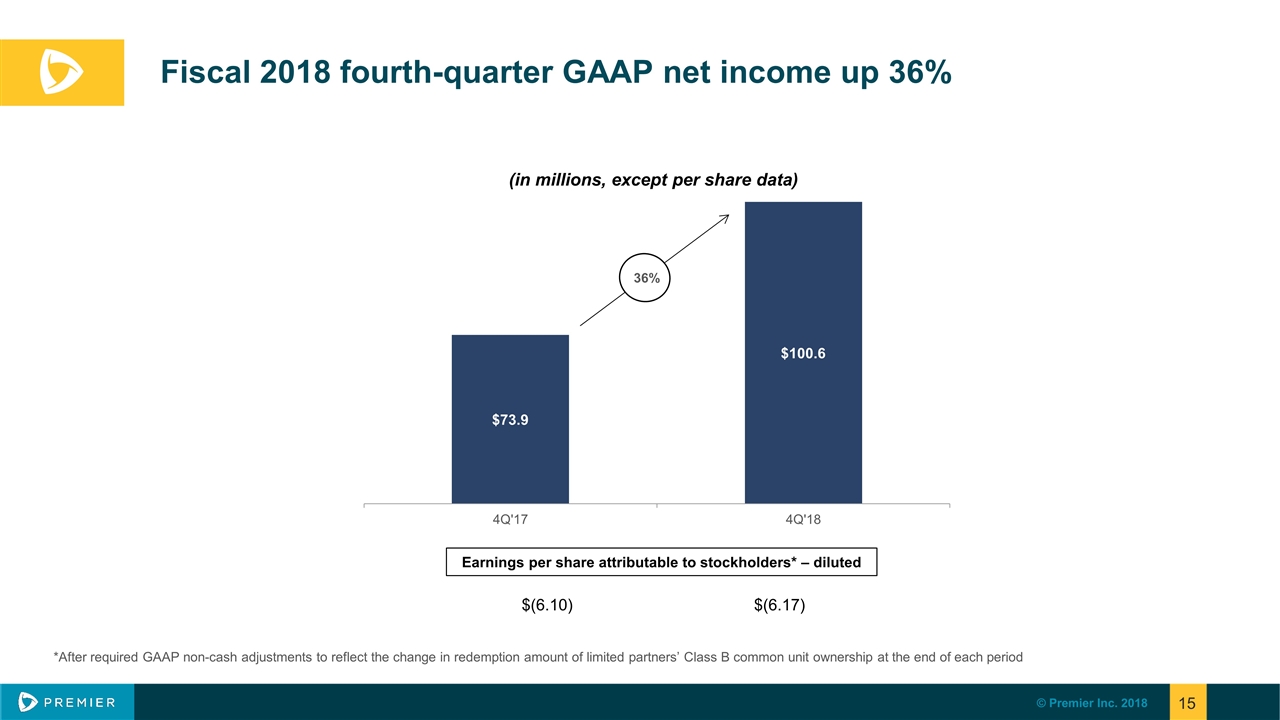

Fiscal 2018 fourth-quarter GAAP net income up 36% $(6.10) $(6.17) Earnings per share attributable to stockholders* – diluted *After required GAAP non-cash adjustments to reflect the change in redemption amount of limited partners’ Class B common unit ownership at the end of each period 36%

Fiscal 2018 fourth-quarter non-GAAP adjusted EBITDA* up 12% * See non-GAAP adjusted EBITDA and non-GAAP segment adjusted EBITDA reconciliations to GAAP equivalents in Appendix. $148.1 $132.1 (in millions)

Fiscal 2018 fourth-quarter non-GAAP adjusted fully distributed net income and earnings per share* Calculated income taxes at an effective rate of 26% of pre-tax income for fourth quarter, assuming taxable C corporate structure Calculated adjusted fully distributed earnings per share, assuming all Class A and B common shares are held by the public 41% $70.2 million $94.8 million Non-GAAP adjusted fully distributed net income * See non-GAAP adjusted fully distributed net income and non-GAAP adjusted fully distributed earnings per share reconciliations to GAAP equivalents in Appendix

Cash flow and capital flexibility at June 30, 2018 CONSIDERABLE CASH AND DEBT CAPACITY AVAILABLE AMPLE CAPITAL FLEXIBILITY FOR FUTURE ACQUISITIONS AND STOCKHOLDER RETURN Cash flow from operations of $507.7 million and non-GAAP free cash flow* of $335.8 million for fiscal 2018, representing 62% of non-GAAP adjusted EBITDA Cash and cash equivalents of $152.4 million Outstanding borrowings of $100.0 million on $750.0 million five-year unsecured revolving credit facility *See non-GAAP free cash flow reconciliation to GAAP equivalent in Appendix.

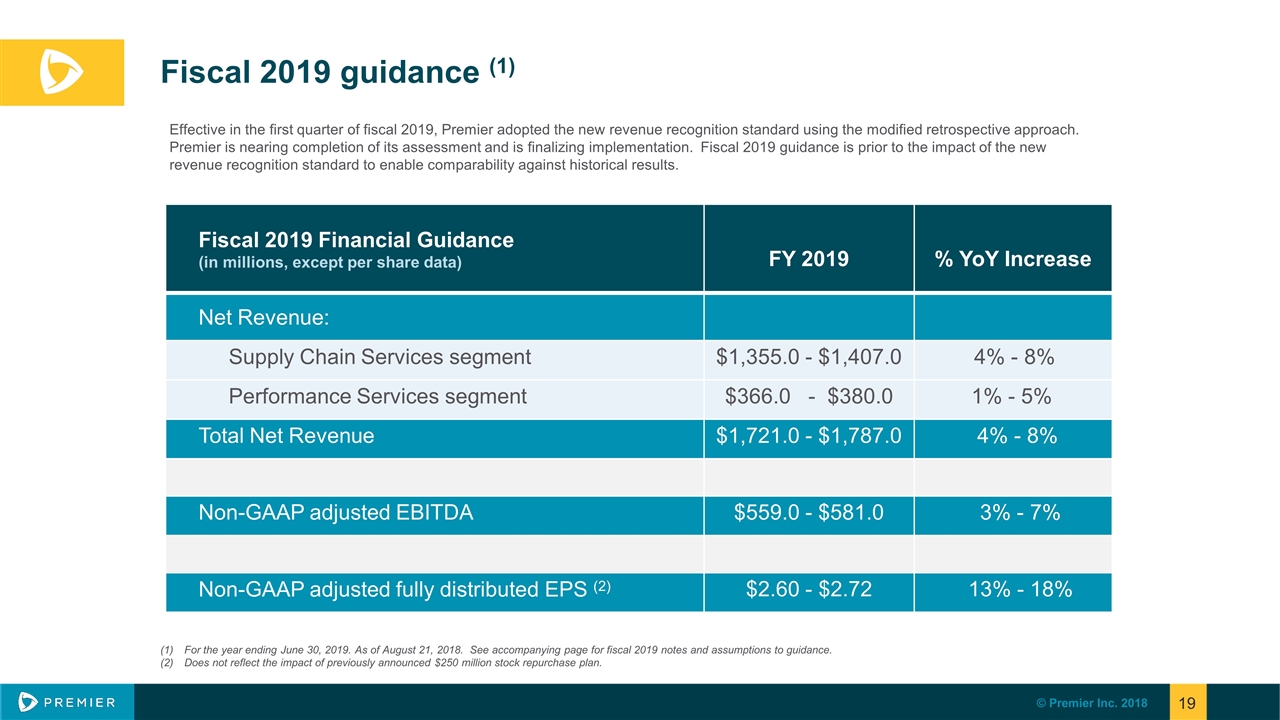

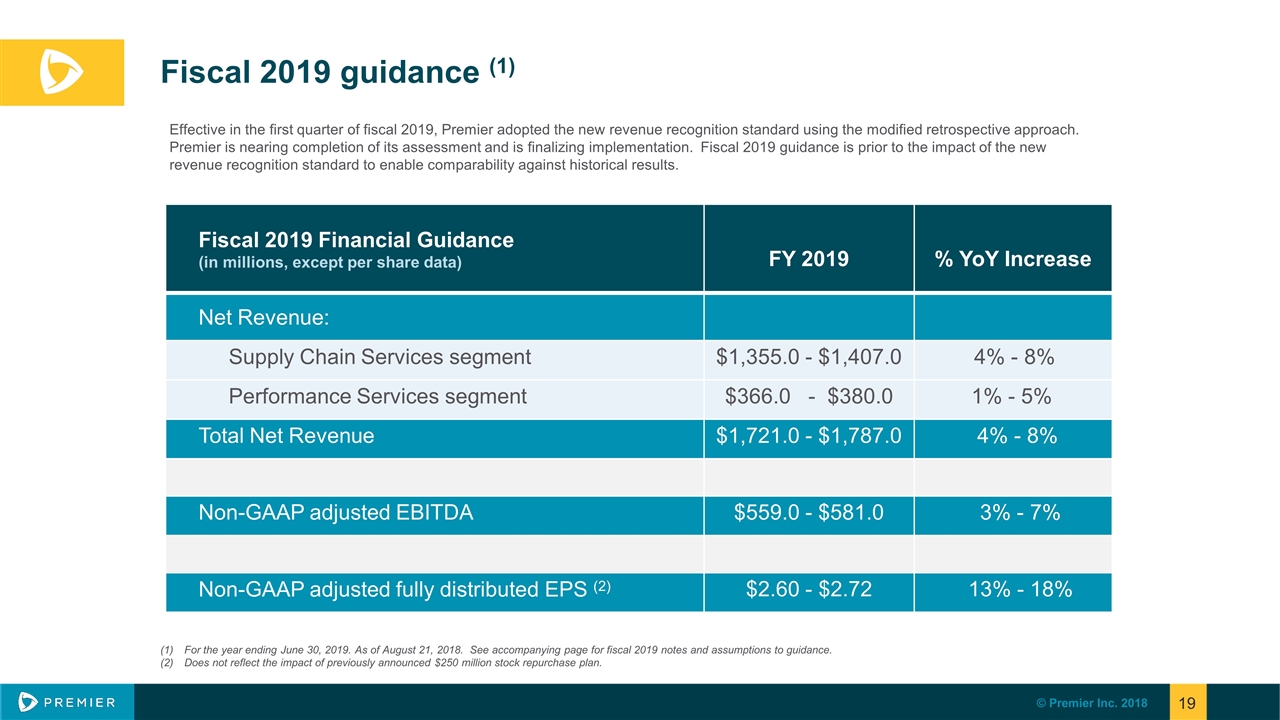

Fiscal 2019 guidance (1) Fiscal 2019 Financial Guidance (in millions, except per share data) FY 2019 % YoY Increase Net Revenue: Supply Chain Services segment $1,355.0 - $1,407.0 4% - 8% Performance Services segment $366.0 - $380.0 1% - 5% Total Net Revenue $1,721.0 - $1,787.0 4% - 8% Non-GAAP adjusted EBITDA $559.0 - $581.0 3% - 7% Non-GAAP adjusted fully distributed EPS (2) $2.60 - $2.72 13% - 18% For the year ending June 30, 2019. As of August 21, 2018. See accompanying page for fiscal 2019 notes and assumptions to guidance. Does not reflect the impact of previously announced $250 million stock repurchase plan. Effective in the first quarter of fiscal 2019, Premier adopted the new revenue recognition standard using the modified retrospective approach. Premier is nearing completion of its assessment and is finalizing implementation. Fiscal 2019 guidance is prior to the impact of the new revenue recognition standard to enable comparability against historical results.

Guidance Footnotes: * The company does not meaningfully reconcile guidance for non-GAAP adjusted EBITDA and non-GAAP adjusted fully distributed earnings per share to net income attributable to stockholders or earnings per share attributable to stockholders because the company cannot provide guidance for more significant reconciling items between net income attributable to stockholders and adjusted EBITDA and between earnings per share attributable to stockholders and non-GAAP adjusted fully distributed earnings per share without unreasonable effort. This is due to two primary reasons: • Reasonable guidance cannot be provided for reconciling the adjustment of redeemable limited partners’ capital to redemption amount – historically the largest adjustment in the reconciliation from non-GAAP to GAAP amounts – due to the fact that the increase or decrease in this item is based on the change in the number of shares of Class B stock outstanding and change in stock price between quarters, which the company cannot predict, control or reasonably estimate. • Reasonable guidance cannot be provided for earnings per share attributable to stockholders because the ongoing quarterly member-owner exchange of Class B common stock and corresponding Class B units into shares of Class A common stock impacts the number of shares of Class A common stock outstanding each quarter, which the company cannot predict, control or reasonably estimate. Member owners have the right, but not the obligation, to exchange shares on a quarterly basis, and the company has the discretion to settle any exchanged shares for Class A common stock, cash, or a combination thereof, neither of which can be predicted, controlled or reasonably estimated at this time. Fiscal 2019 annual guidance footnotes and key assumptions (for year ending June 30, 2019)* Key Assumptions*: Supply Chain Services assumptions: Net administrative fee revenue growth of low to mid-single digits Products revenue growth of 7% to 11% Continued high GPO retention rates Performance Services assumptions: Continued demand for integrated offerings of cloud-based subscription and licensed products, consulting and collaboratives Continued high SaaS institutional renewal rates Other assumptions: Estimated revenue available under contract of approximately $1.6 billion, which represents approximately 89% to 94% of our consolidated revenue guidance range Non-GAAP free cash flow expected to exceed 50% of non-GAAP adjusted EBITDA Capital expenditures of approximately $90 million to $95 million, representing 5% to 6% of consolidated net revenue Consolidated non-GAAP adjusted EBITDA margin in the range of 32% Stock-based compensation approximating $36 million to $38 million Adjusted fully distributed net income and earnings per share calculations to reflect an effective tax rate of 26% Amortization of purchased intangible assets of approximately $54 million Guidance does not contemplate any material acquisitions *As of August 21, 2018

Quarterly exchange update and stock repurchase plan On July 31, 2018, approximately 800,000 Class B units were exchanged for Class A common shares on 1-for-1 basis; equal number of Class B common shares retired. Next quarterly exchange will occur on October 31, 2018. Established a $250 million Class A common stock repurchase plan for fiscal 2019.

Questions

Appendix

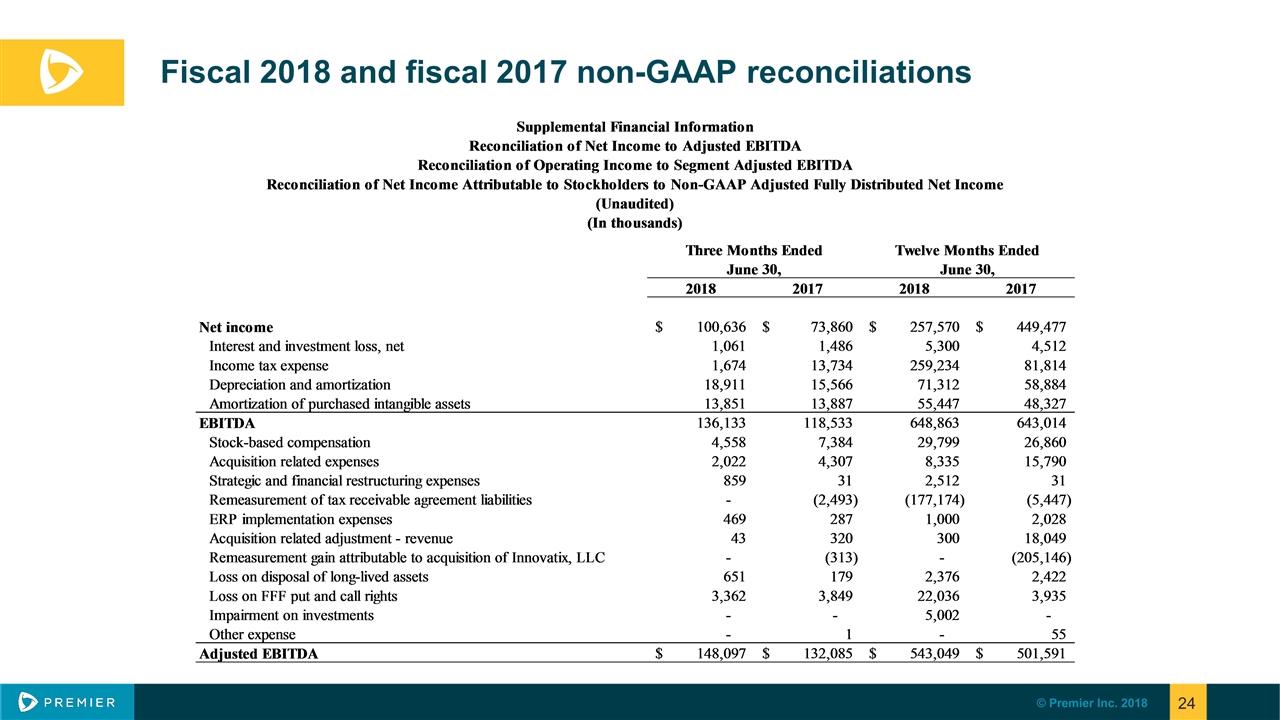

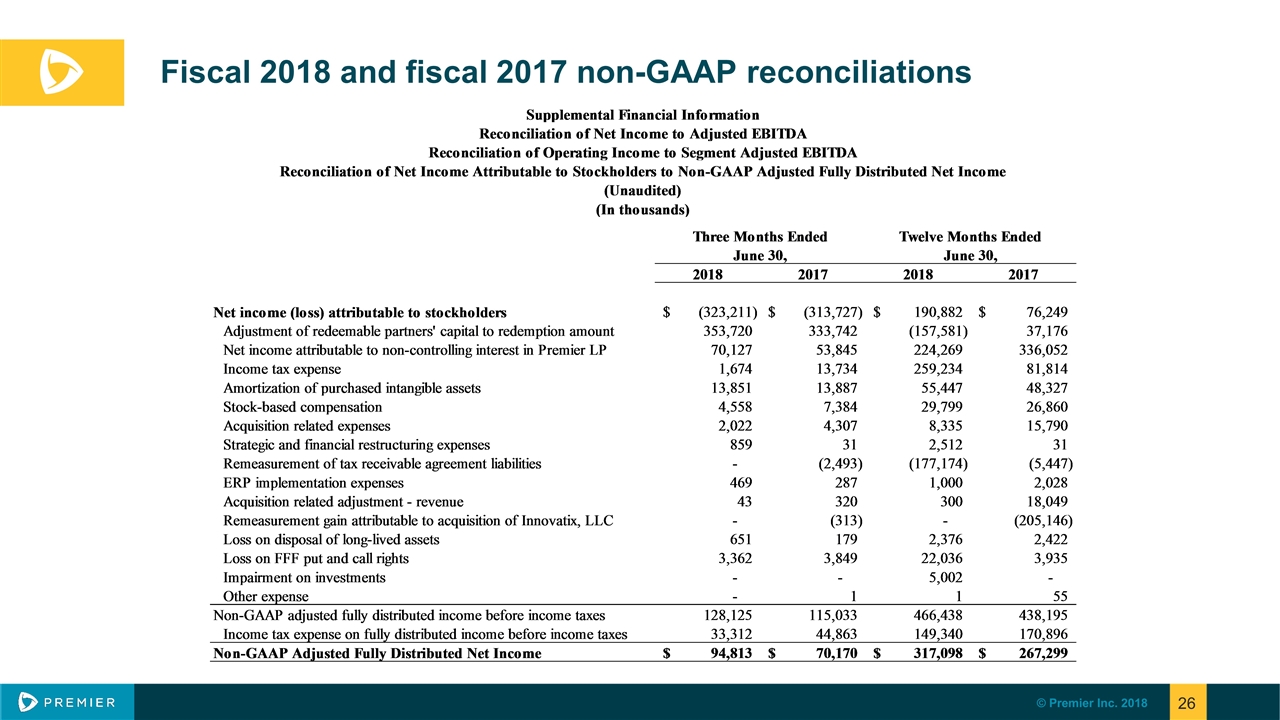

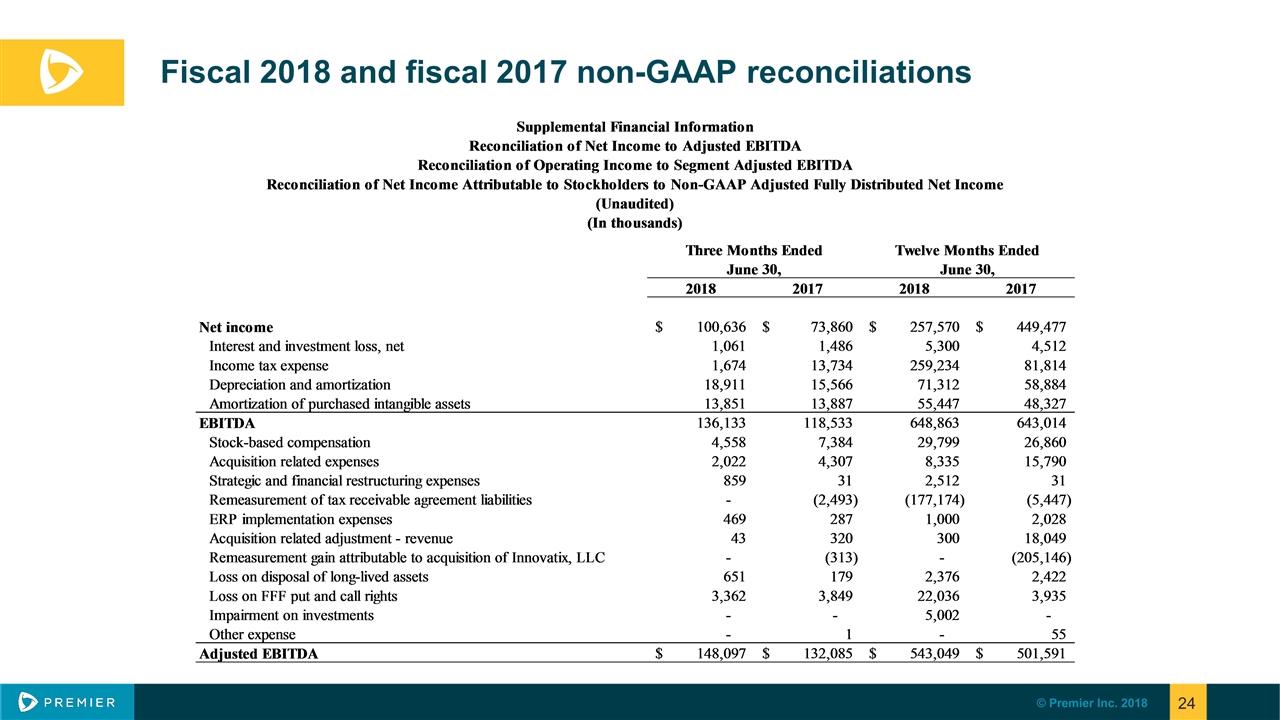

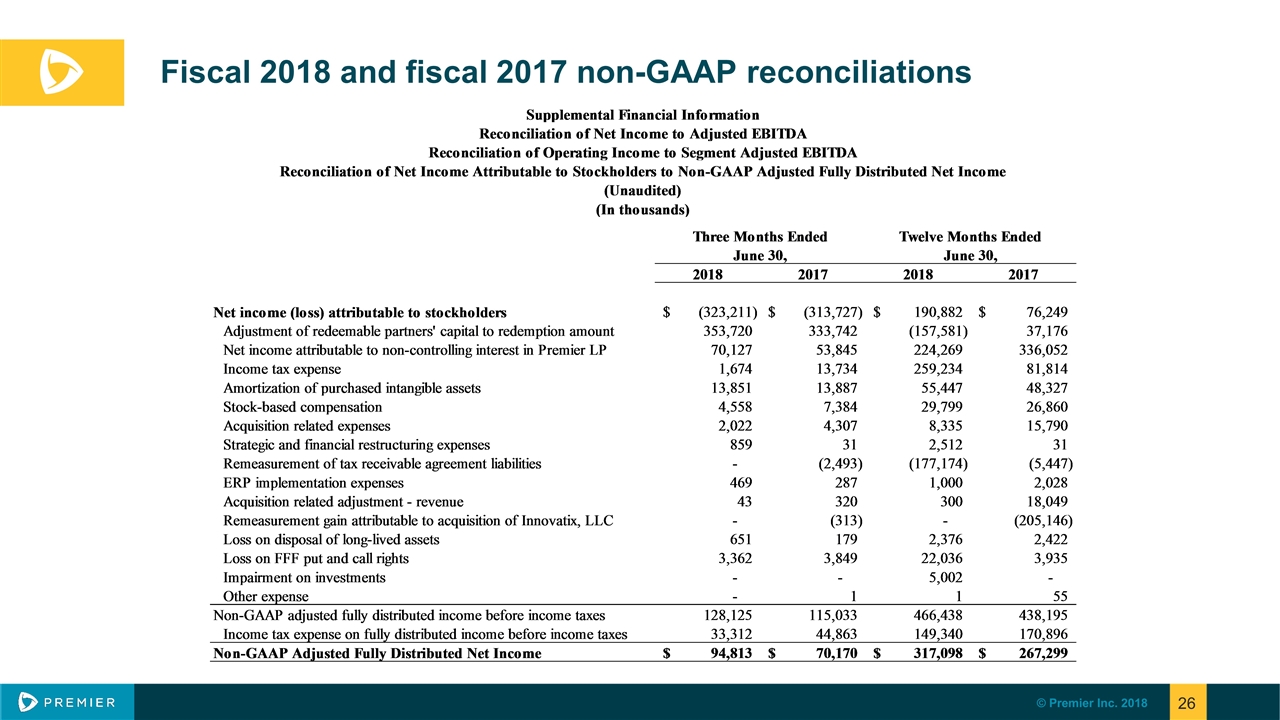

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations

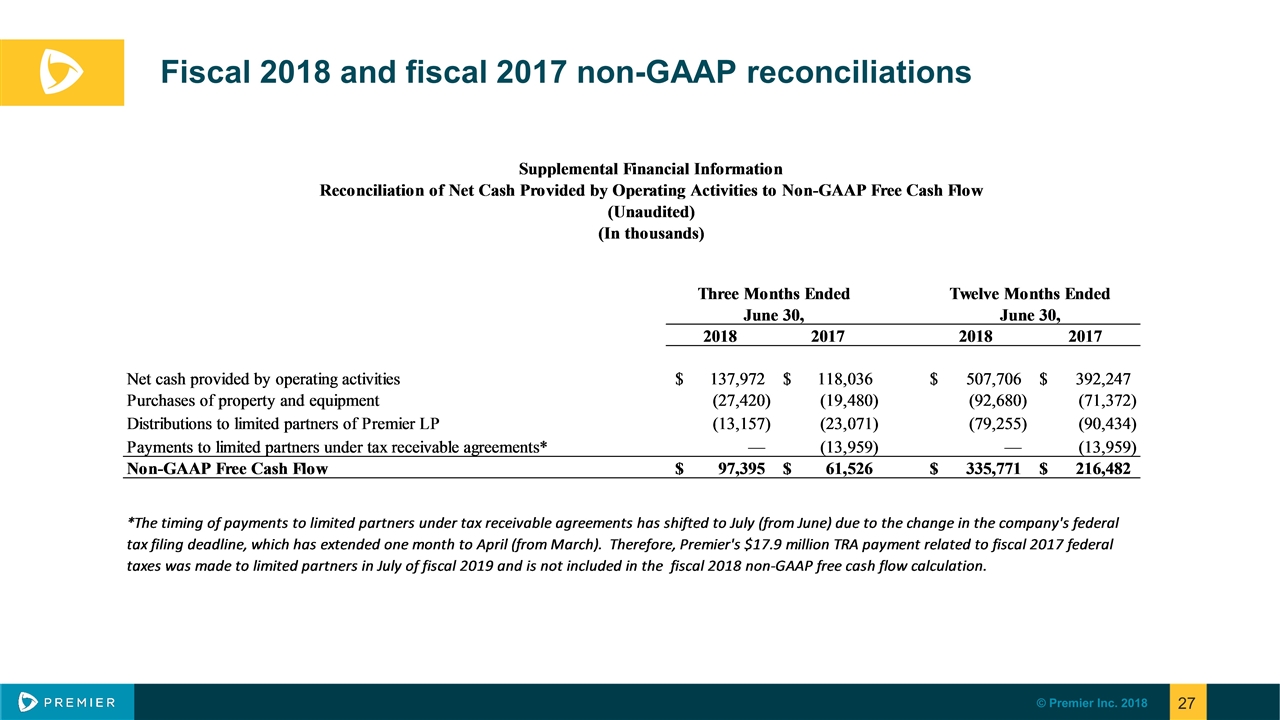

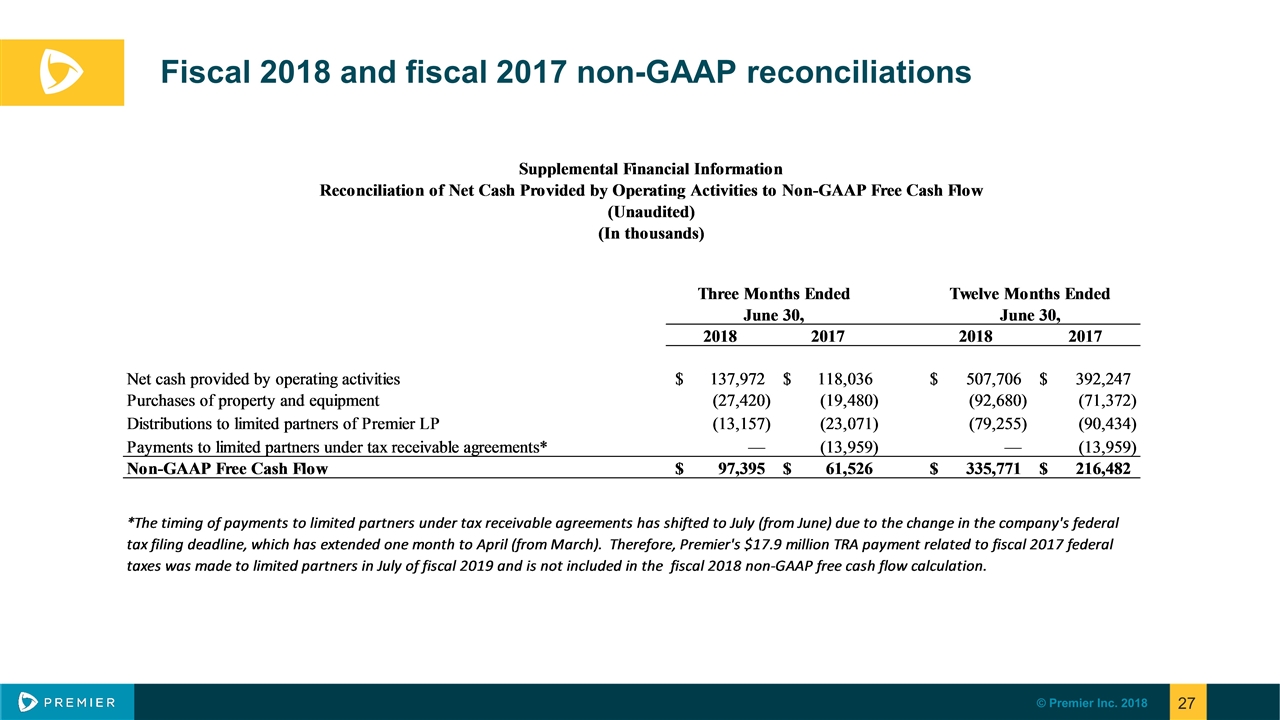

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations

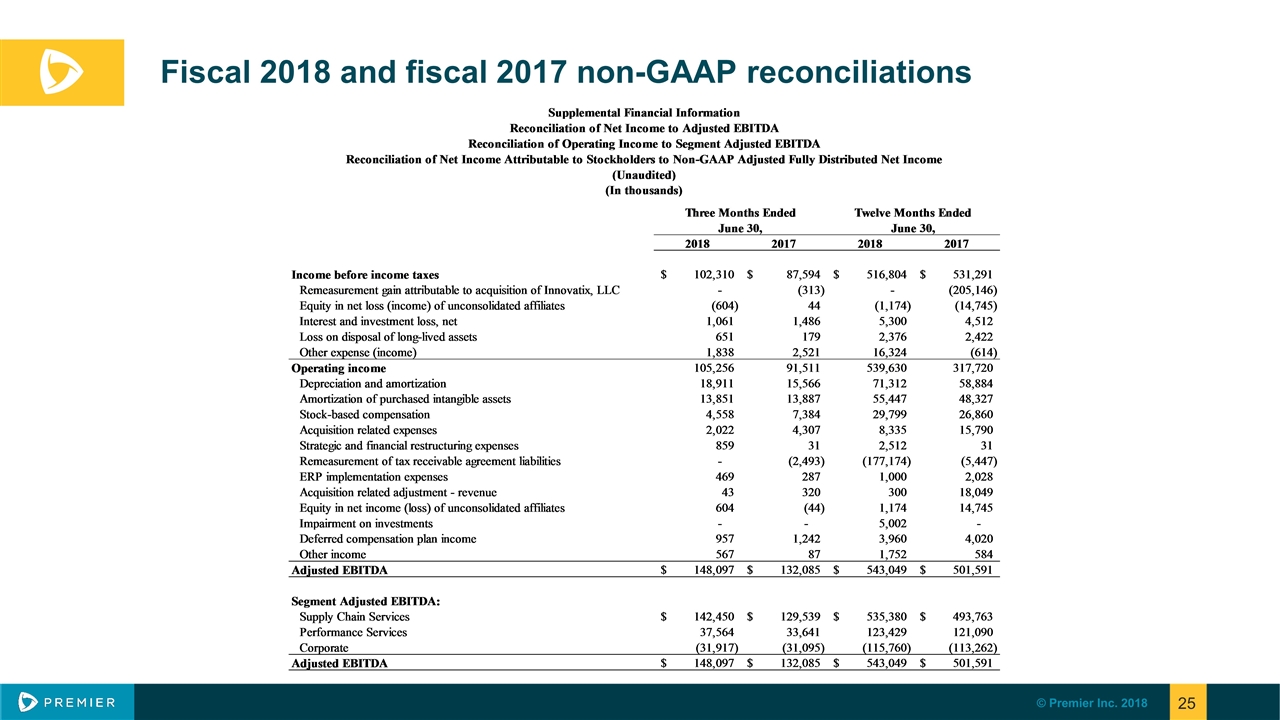

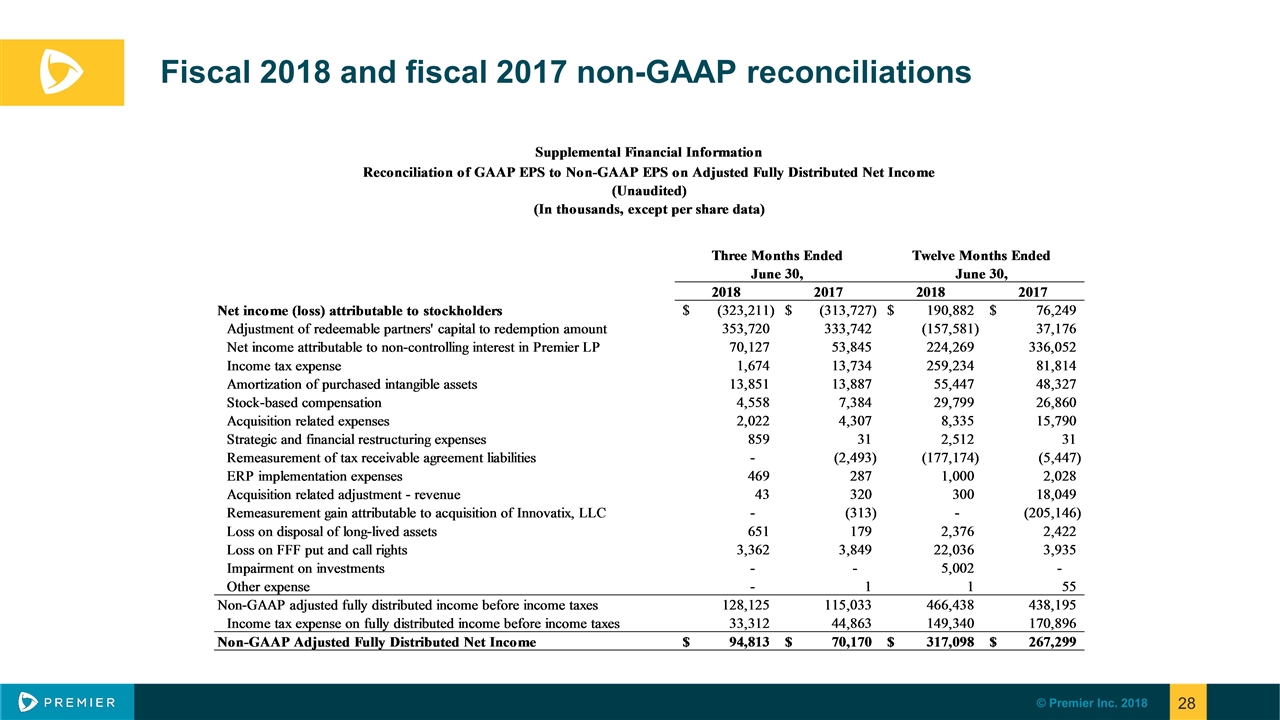

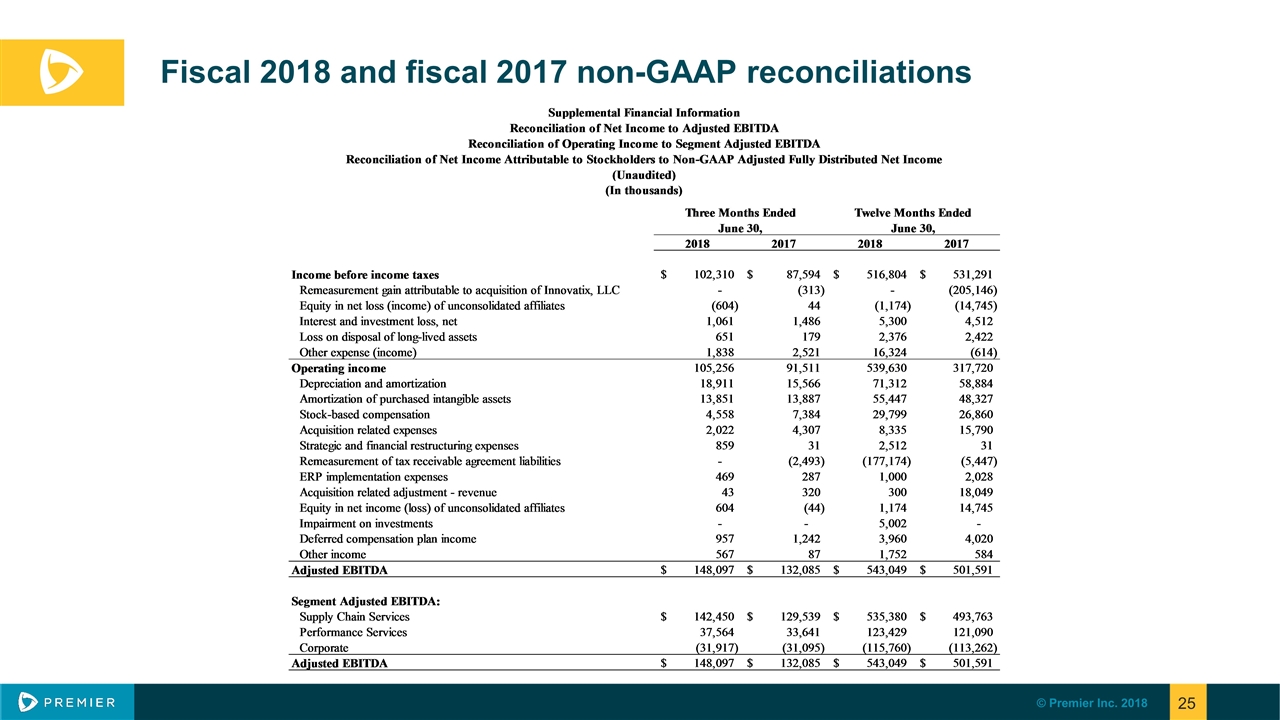

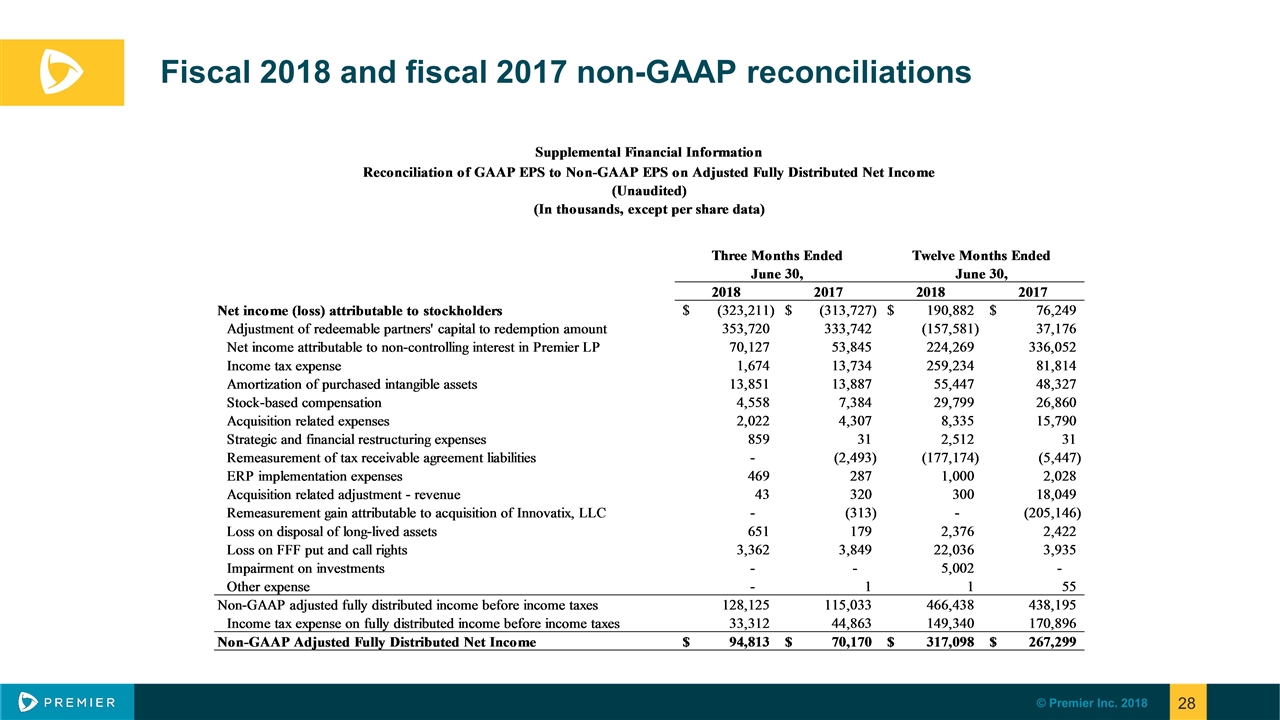

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations

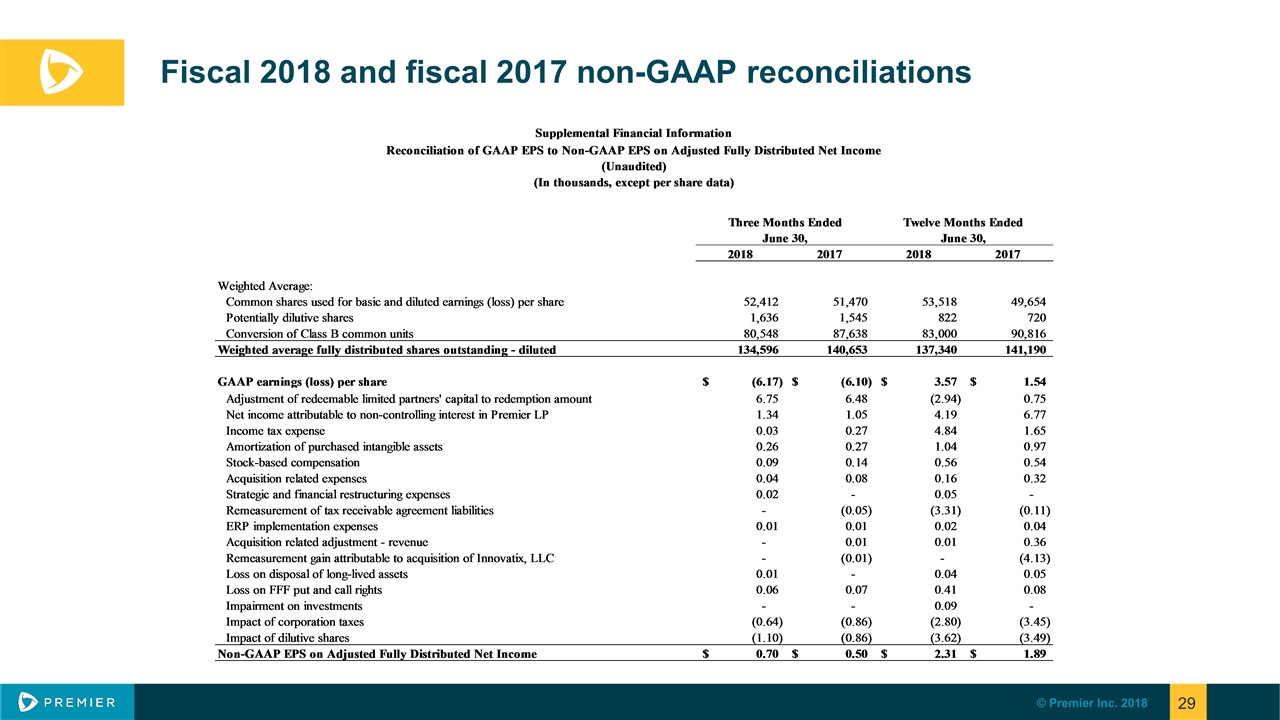

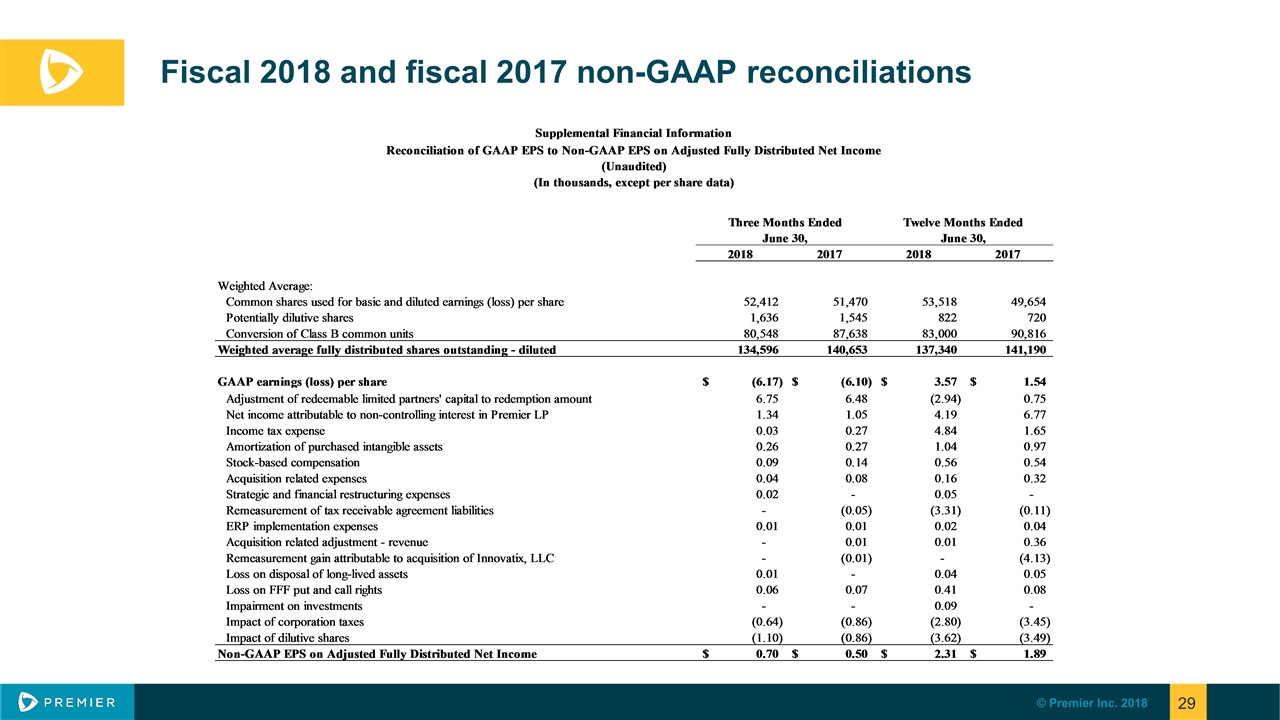

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations

Fiscal 2018 and fiscal 2017 non-GAAP reconciliations