First-Quarter Fiscal 2020 Financial Results and Update November 5, 2019 Exhibit 99.3

Forward-looking statements and non-GAAP financial measures Forward-looking statements – Statements made in this presentation that are not statements of historical or current facts, such as those related to the current market environment and uncertainties, market competition and the potential for incrementally higher administrative fee share trends over time, expected financial performance, non-GAAP free cash flow generation, share repurchases, if any, under our current and future stock repurchase program, the success of our incremental investments in growth opportunities and the statements related to fiscal 2020 outlook and guidance and the assumptions underlying such guidance, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward-looking statements. In addition to statements that explicitly describe such risks and uncertainties, readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside Premier’s control. More information on potential factors that could affect Premier’s financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Premier’s periodic and current filings with the SEC, including those discussed under the “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” section of Premier’s Form 10-K for the year ended June 30, 2019, as well as the Form 10-Q for the quarter ended September 30, 2019, expected to be filed with the SEC shortly after the date of this presentation, and also made available on Premier’s website at investors.premierinc.com. Forward-looking statements speak only as of the date they are made, and Premier undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events that occur after that date, or otherwise. Non-GAAP financial measures – This presentation and accompanying webcast includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. You should carefully read Premier’s periodic and current filings with the SEC for definitions and further explanation and disclosure regarding our use of non-GAAP financial measures and such filings should be read in conjunction with this presentation.

Susan DeVore Chief Executive Officer Premier, Inc. Q1 Overview and Business Update

Fiscal first-quarter overview Overall financial performance exceeded expectations Steady Supply Chain Services growth largely offset anticipated continued softness in Performance Services Remain focused on technology enablement of supply chain business and expansion of enterprise analytics and performance improvement capabilities

Business update Premier delivers unique, integrated total value proposition Member return on total investment averages 5-to-1 to 20-to-1, generating strong satisfaction and GPO retention Yankee Alliance renews through 2027 Greater New York Hospital Association discussions ongoing with relationship expected to continue Premier welcomes VCU Health as new member in comprehensive relationship that includes supply chain, analytics and insights Premier intends to maintain its leadership position, driving long-term value for members and stockholders

Mike Alkire President Premier, Inc. Operations Review

Technology enablement of purchased services capabilities Acquisition expected to help Premier penetrate largely untapped $160 billion acute care purchased services market Represents a key component of technology-enabled supply chain strategy Enhances and further differentiates core supply chain offering and total value approach for members Expected to deliver incremental SaaS subscription and net administrative fees revenue, as it helps to drive contract penetration and expand our contract portfolio in the area of purchased services.

Strategic and operational initiatives High- value care network stockd, eCommerce platform Applied sciences research Investing in additional sales and consulting professionals ProvideGx, drug shortage program

Craig McKasson Chief Administrative and Financial Officer Premier, Inc. Financial Review

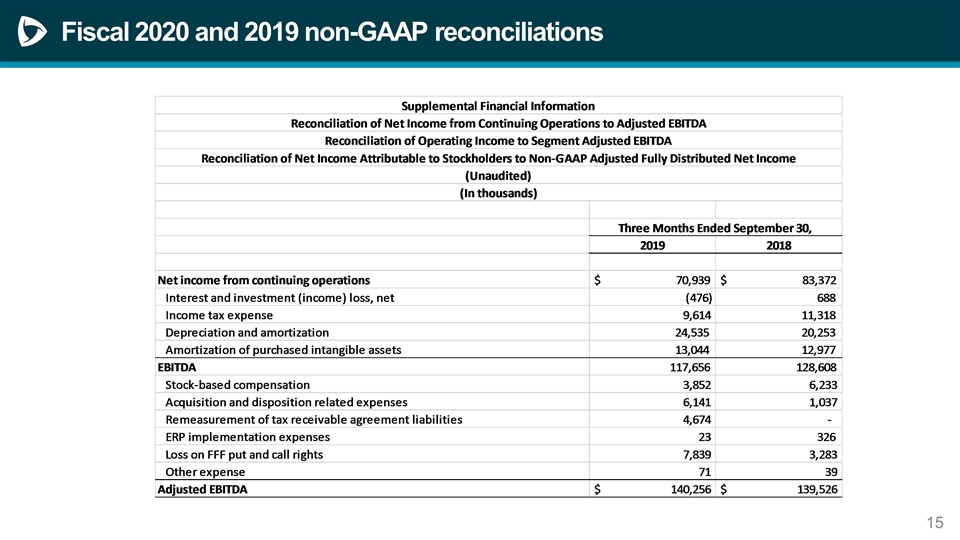

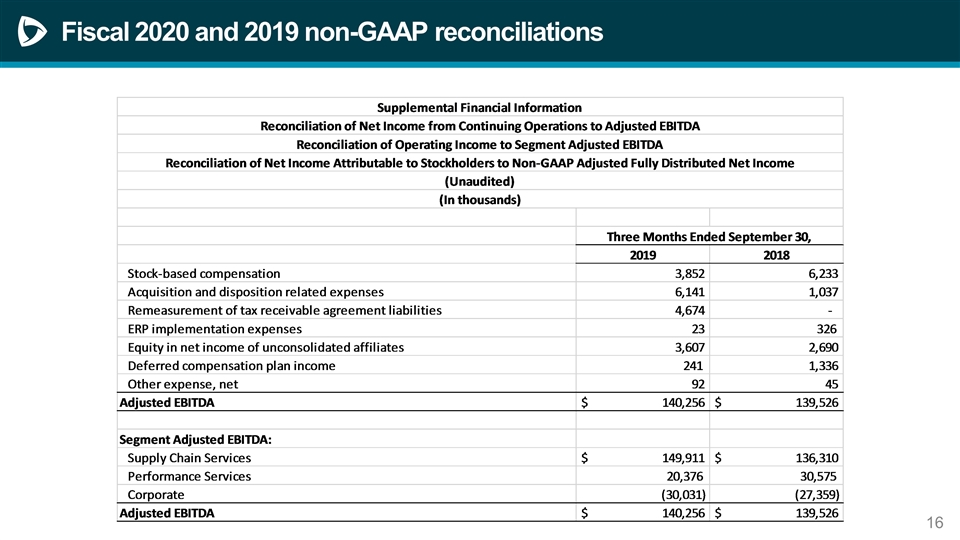

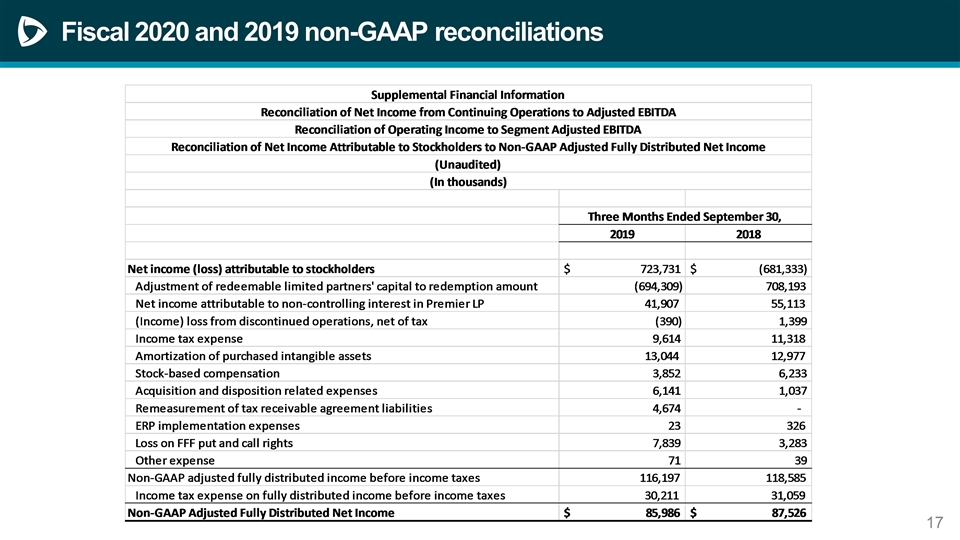

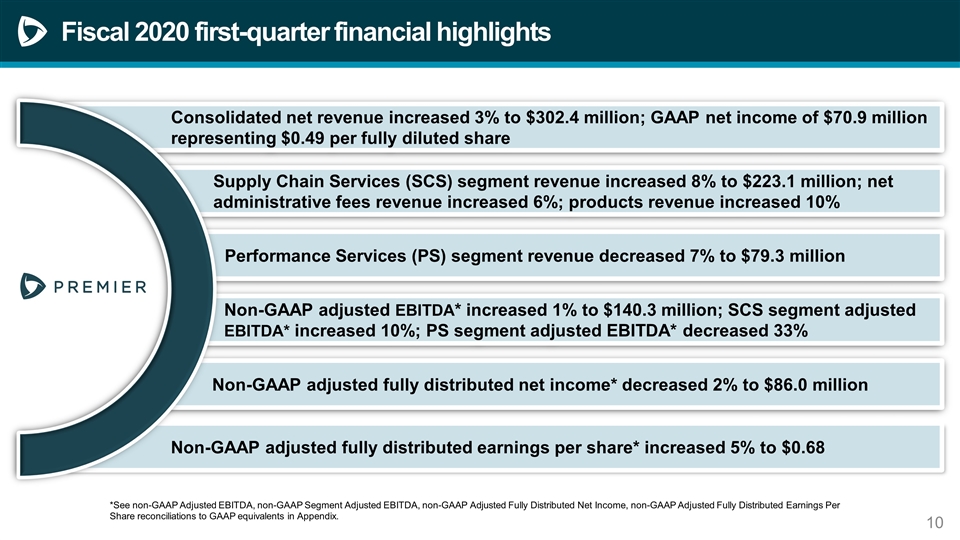

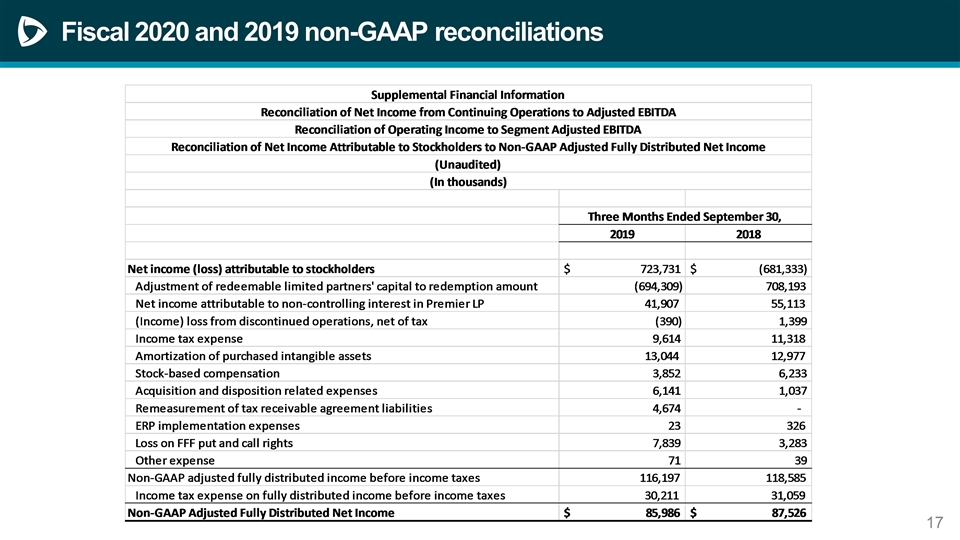

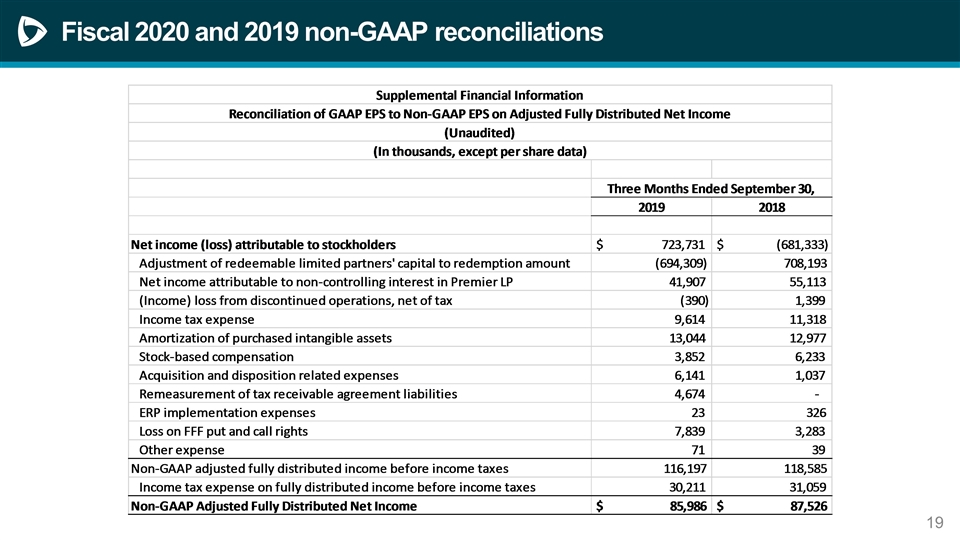

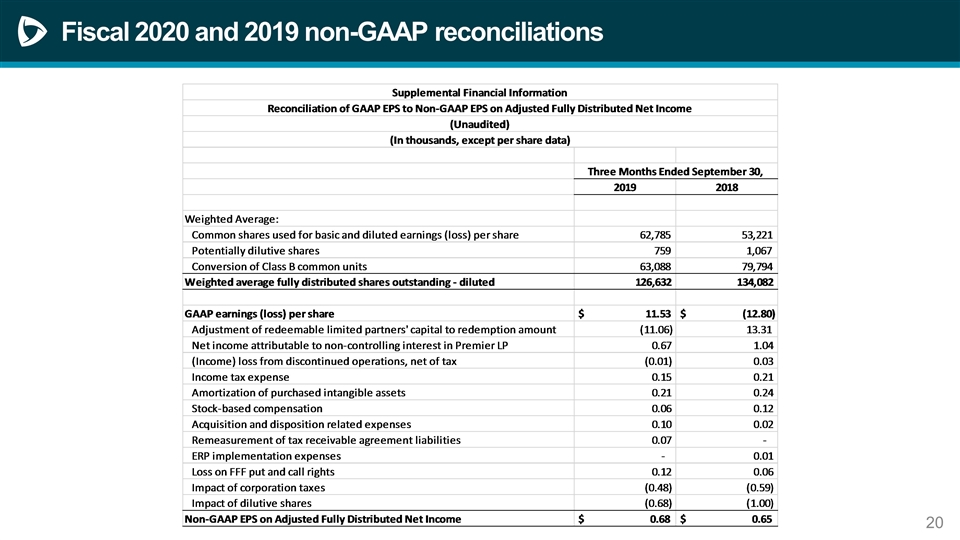

*See non-GAAP Adjusted EBITDA, non-GAAP Adjusted Fully Distributed Earnings Per Share and non-GAAP Free Cash Flow reconciliations to GAAP equivalents in Appendix. Performance Services (PS) segment revenue decreased 7% to $79.3 million Supply Chain Services (SCS) segment revenue increased 8% to $223.1 million; net administrative fees revenue increased 6%; products revenue increased 10% Non-GAAP adjusted EBITDA* increased 1% to $140.3 million; SCS segment adjusted EBITDA* increased 10%; PS segment adjusted EBITDA* decreased 33% Non-GAAP adjusted fully distributed net income* decreased 2% to $86.0 million Non-GAAP adjusted fully distributed earnings per share* increased 5% to $0.68 Consolidated net revenue increased 3% to $302.4 million; GAAP net income of $70.9 million representing $0.49 per fully diluted share *See non-GAAP Adjusted EBITDA, non-GAAP Segment Adjusted EBITDA, non-GAAP Adjusted Fully Distributed Net Income, non-GAAP Adjusted Fully Distributed Earnings Per Share reconciliations to GAAP equivalents in Appendix. Fiscal 2020 first-quarter financial highlights

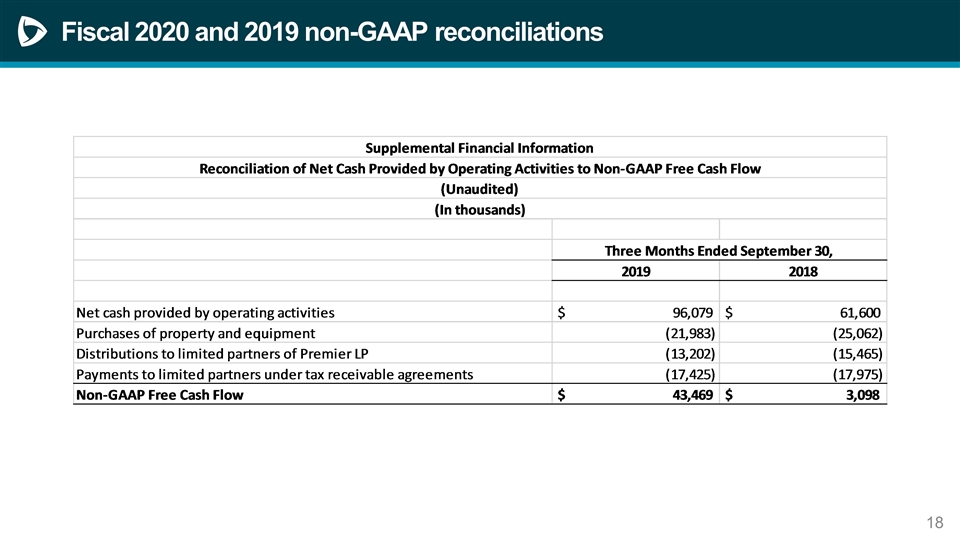

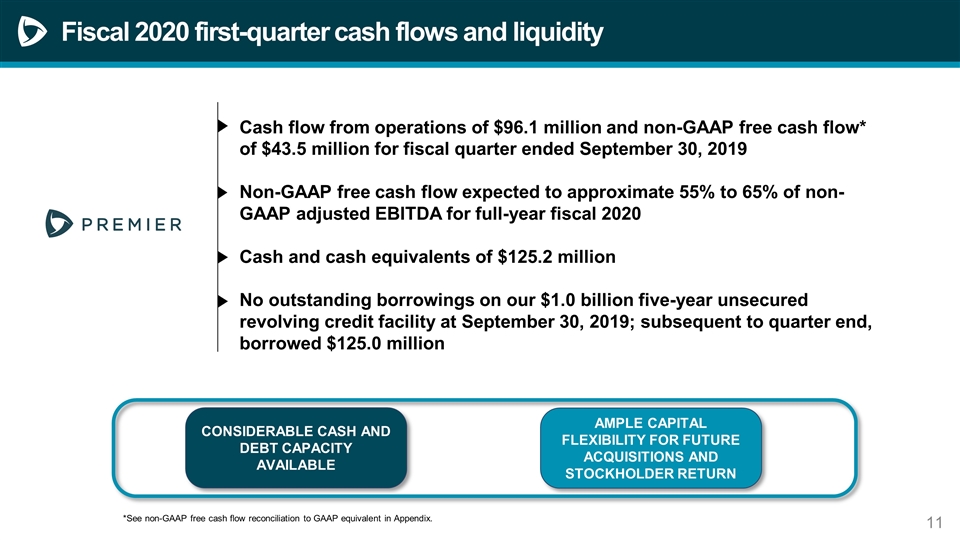

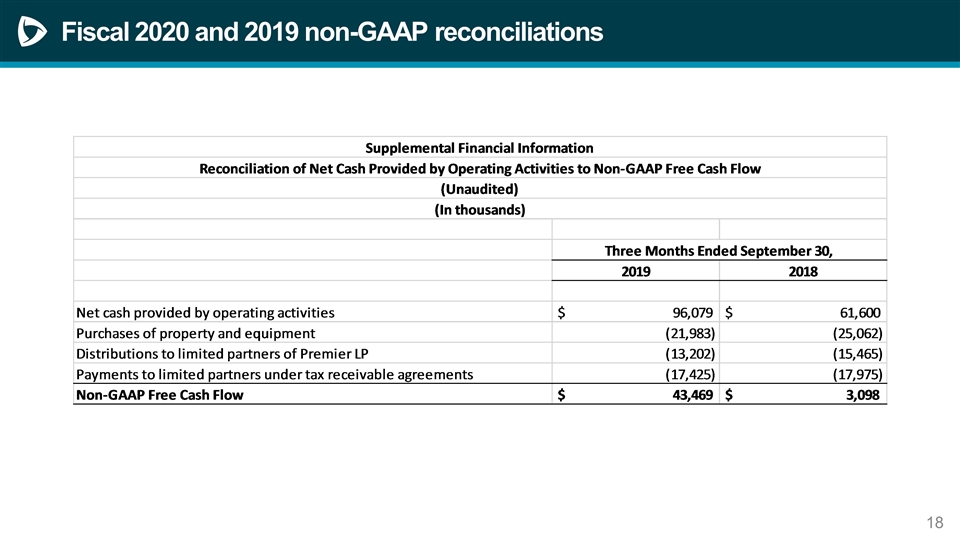

Cash flow from operations of $96.1 million and non-GAAP free cash flow* of $43.5 million for fiscal quarter ended September 30, 2019 Non-GAAP free cash flow expected to approximate 55% to 65% of non-GAAP adjusted EBITDA for full-year fiscal 2020 Cash and cash equivalents of $125.2 million No outstanding borrowings on our $1.0 billion five-year unsecured revolving credit facility at September 30, 2019; subsequent to quarter end, borrowed $125.0 million Fiscal 2020 first-quarter cash flows and liquidity CONSIDERABLE CASH AND DEBT CAPACITY AVAILABLE AMPLE CAPITAL FLEXIBILITY FOR FUTURE ACQUISITIONS AND STOCKHOLDER RETURN *See non-GAAP free cash flow reconciliation to GAAP equivalent in Appendix.

Class A common stock repurchase program and Class B common unit exchange process updates During the first quarter and through October 31, 2019, a total of 4.1 million Class A common shares were repurchased for $130.6 million, or an average price of $31.90 per share, as part of ongoing $300.0 million Class A common stock repurchase program. On October 31, 2019, approximately 6.9 million Class B common units were exchanged for Class A common shares on 1-for-1 basis; equal number of Class B common shares retired. Next quarterly exchange will occur on January 31, 2019.

Questions

Appendix

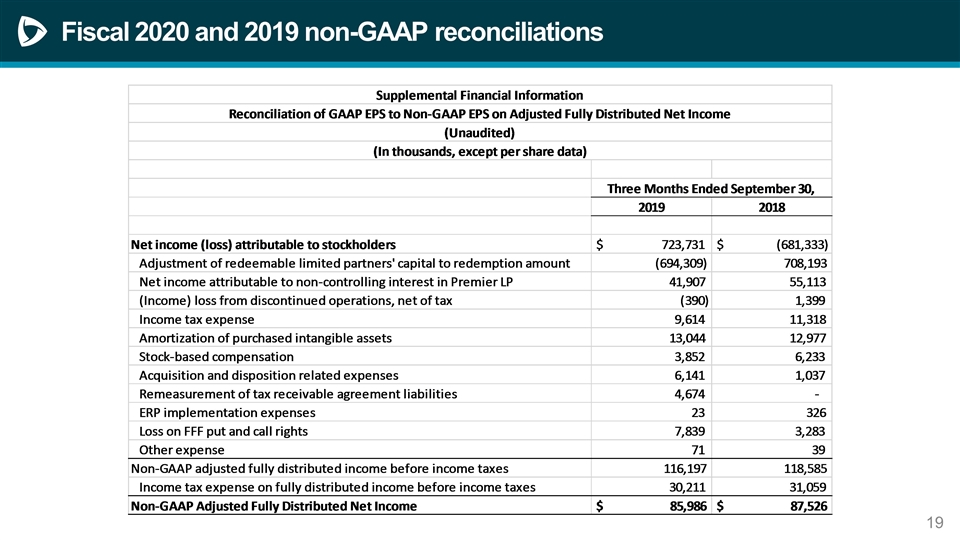

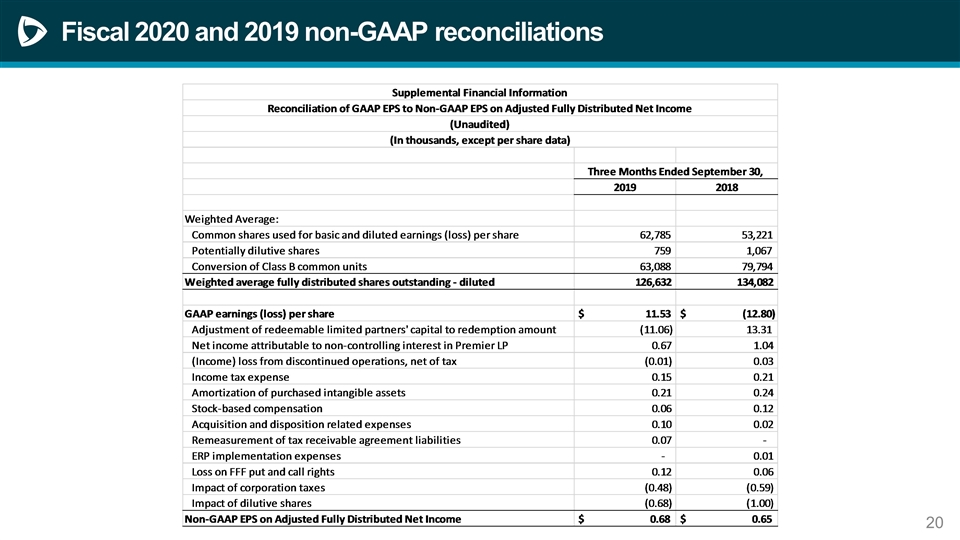

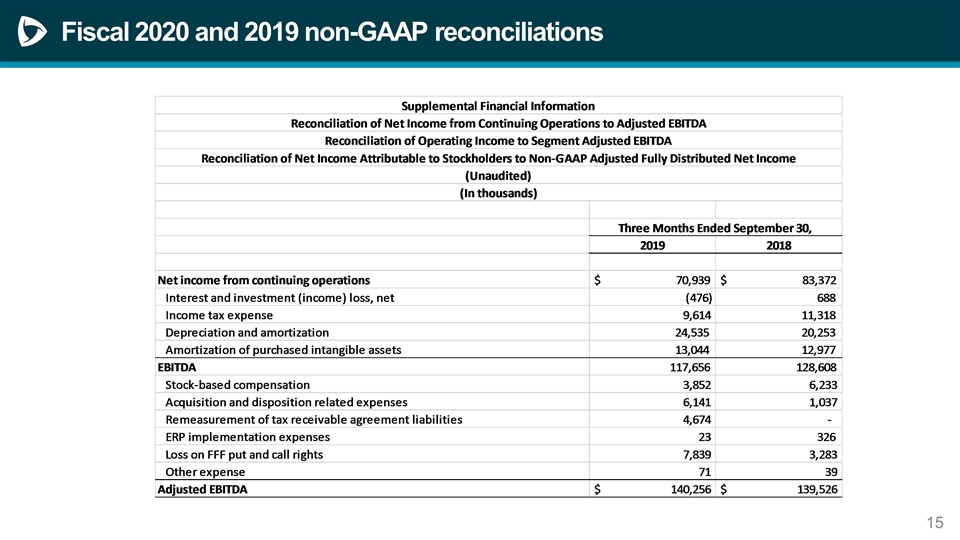

Fiscal 2020 and 2019 non-GAAP reconciliations

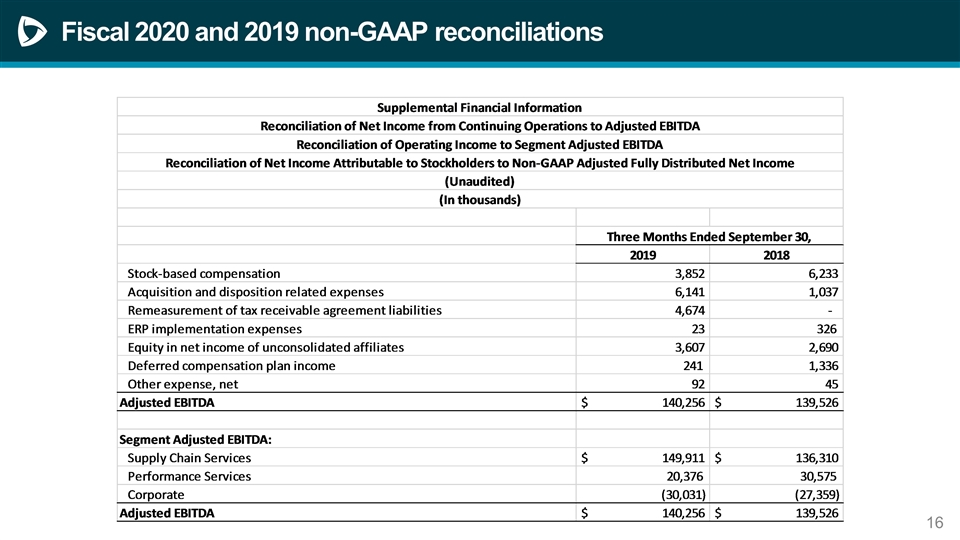

Fiscal 2020 and 2019 non-GAAP reconciliations

Fiscal 2020 and 2019 non-GAAP reconciliations

Fiscal 2020 and 2019 non-GAAP reconciliations

Fiscal 2020 and 2019 non-GAAP reconciliations

Fiscal 2020 and 2019 non-GAAP reconciliations