Fiscal 2022 Third Quarter Earnings Conference Call /////// May 3, 2022 Exhibit 99.3

Forward-looking Statements and Non-GAAP Financial Measures Forward-looking statements – Statements made in this presentation and the accompanying webcast that are not statements of historical or current facts, such as those related to our ability to advance our long-term strategies, our ability to achieve fiscal 2022 guidance and multi-year compound annual growth targets for total net revenue, adjusted EBITDA and adjusted EPS, our continued ability to address the evolving healthcare trends in supply chain, staffing, technology-enablement and artificial intelligence, the impact of a shift to enterprise-level analytics agreements and our ability to replace converted SaaS-based revenue from existing members, the impact of our investments in adjacent markets businesses, our future organic growth and acquisition strategies, the impact of our subsidiary reorganization on our expected effective income tax rate, the payment of dividends at current levels, or at all, the timing and number of shares repurchased under our share repurchase program, the statements under the heading “Fiscal 2022 Guidance” and the key assumptions underlying fiscal 2022 guidance, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward-looking statements. In addition to statements that explicitly describe such risks and uncertainties, readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “remains committed to,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside Premier’s control. More information on potential factors that could affect Premier’s financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Premier’s periodic and current filings with the SEC, including those discussed under the “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” section of Premier’s Form 10-K for the year ended June 30, 2021 and Form 10-Q for the quarter ended March 31, 2022, expected to be filed with the SEC shortly after the date of this presentation, and also available on Premier’s website at investors.premierinc.com. Forward-looking statements speak only as of the date they are made, and Premier undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events that occur after that date, or otherwise. Non-GAAP financial measures – This presentation and accompanying webcast includes certain “adjusted” or “non-GAAP” financial measures as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. You should carefully read Premier’s periodic and current filings with the SEC for definitions and further explanation and disclosure regarding our use of non-GAAP financial measures and such filings should be read in conjunction with this presentation.

Overview Michael J. Alkire President and Chief Executive Officer Financial and Operational Review Craig McKasson Chief Administrative and Chief Financial Officer

Executive Summary Results reflect continued normalization to pre-COVID-19 pandemic levels in Supply Chain Services and timing of revenue in Performance Services Updated fiscal 2022 guidance and increased full-year adjusted EPS guidance to range of $2.48 to $2.58* *See “Fiscal 2022 Guidance” on page 8 and “Forward-looking Statements and Non-GAAP Financial Measures” on page 1 for details. Continue to generate strong free cash flow and maintain flexible balance sheet Remain committed to achieving multi-year CAGR targets, adjusted for impact of COVID-19 pandemic, of mid-to-high single digits for total net revenue, adjusted EBITDA and adjusted EPS Returning capital to stockholders through share repurchase and cash dividends

Well-Positioned to Help Members Navigate Evolving Macro Environment Remain in close contact with supplier base to monitor potential impact of Russia-Ukraine war on supply chain Delivering critically needed solutions to help mitigate impact of labor shortages for member healthcare providers Closely monitoring potential impact of COVID-19 pandemic on healthcare supply chain due to lockdowns in China Continue to focus on proactively addressing drug shortages in partnership with healthcare providers and suppliers

Progress in Advancing Adjacent Markets Growth Strategies On track with roadmap to expand capabilities for invoice and payment automation for providers and suppliers Applied Sciences Continue to partner with life science companies to leverage PINC AI’s artificial intelligence, machine learning and natural language processing technology to help close gap in cancer diagnosis and care Foundational capabilities in advanced imaging are being used by several payers today Continue to explore partnership opportunities to help accelerate ability to automate prior authorization process Clinical Decision Support

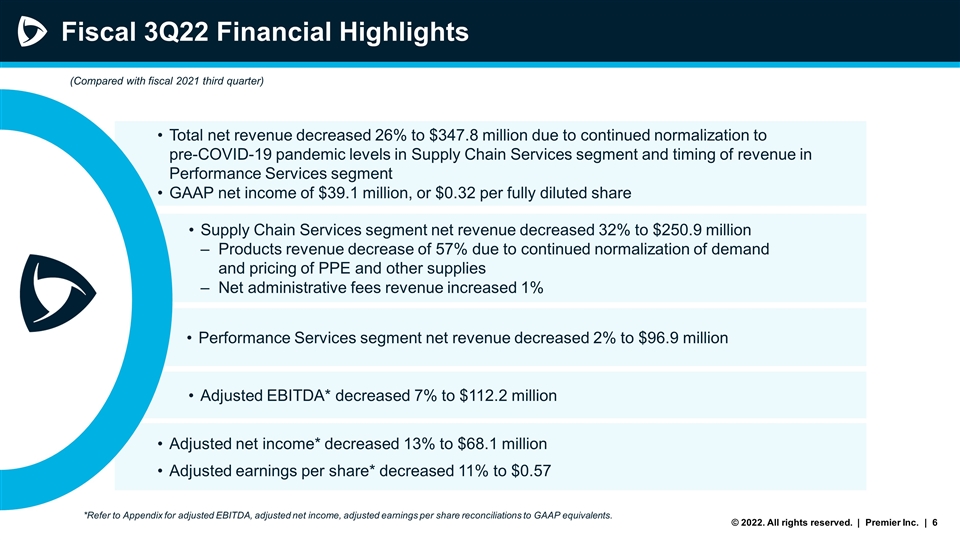

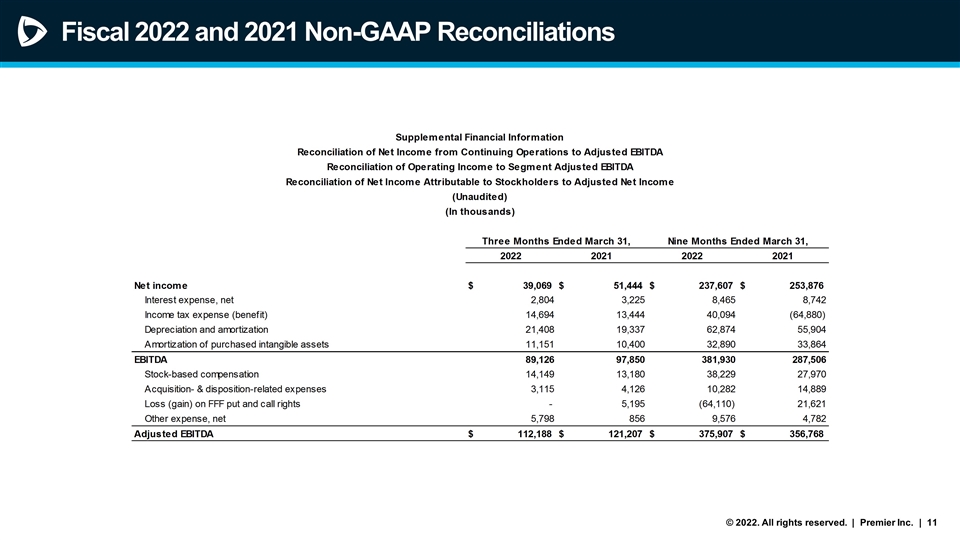

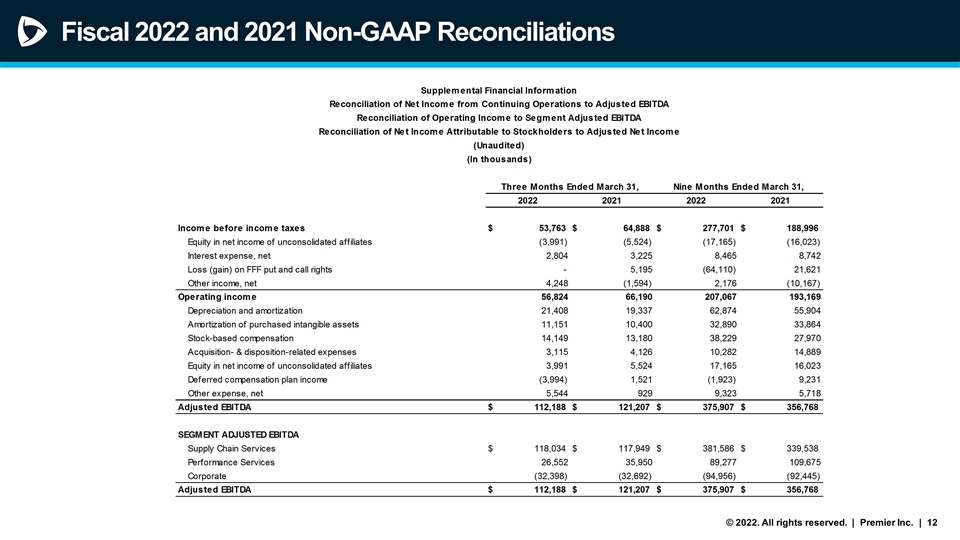

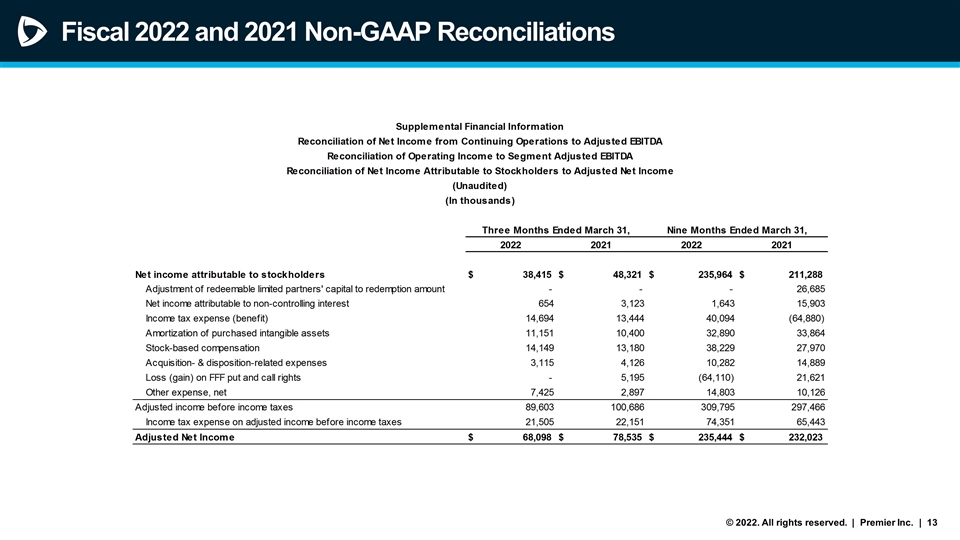

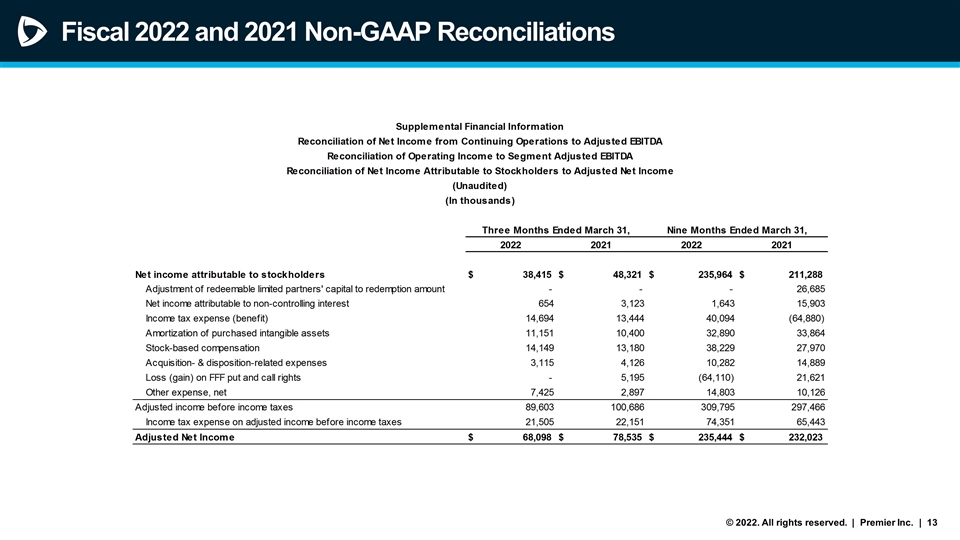

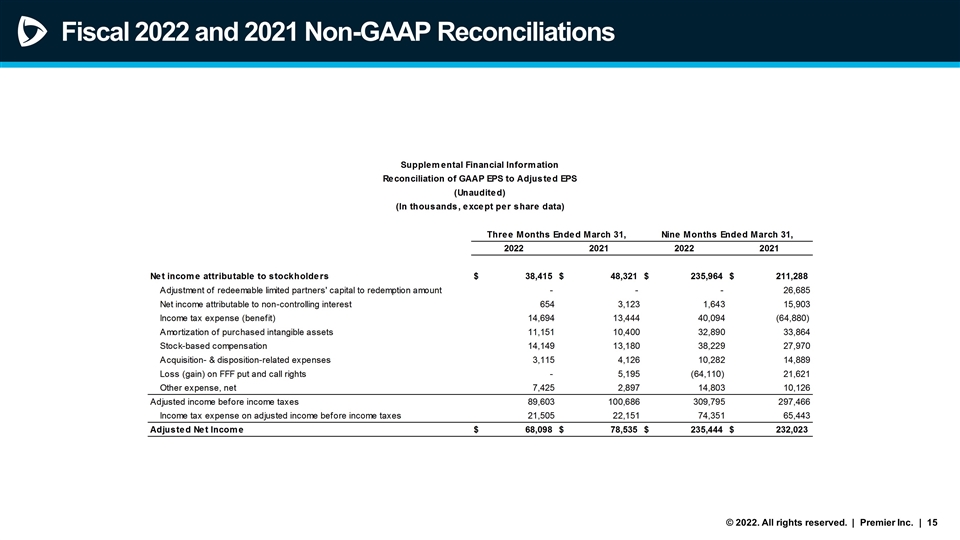

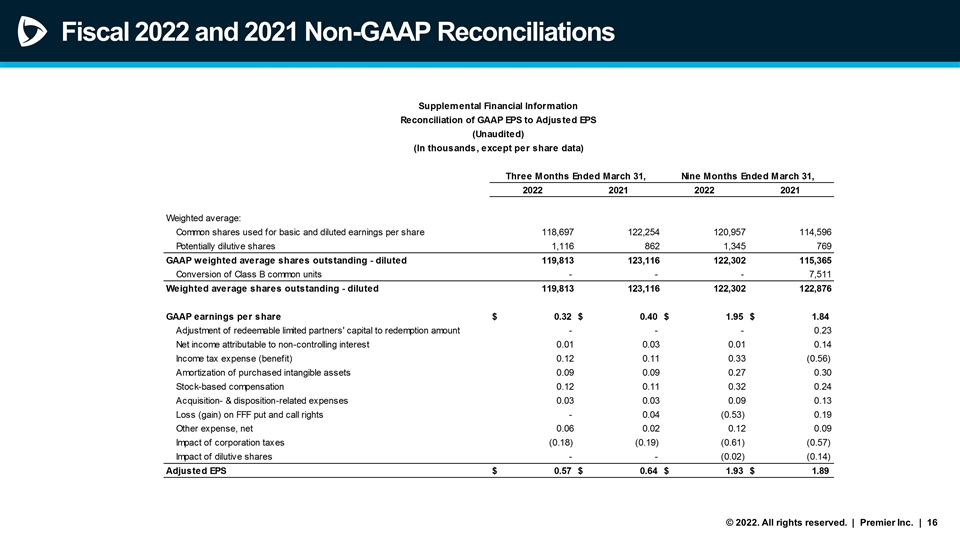

Fiscal 3Q22 Financial Highlights Performance Services segment net revenue decreased 2% to $96.9 million Supply Chain Services segment net revenue decreased 32% to $250.9 million Products revenue decrease of 57% due to continued normalization of demand and pricing of PPE and other supplies Net administrative fees revenue increased 1% Adjusted EBITDA* decreased 7% to $112.2 million Adjusted net income* decreased 13% to $68.1 million Adjusted earnings per share* decreased 11% to $0.57 Total net revenue decreased 26% to $347.8 million due to continued normalization to pre-COVID-19 pandemic levels in Supply Chain Services segment and timing of revenue in Performance Services segment GAAP net income of $39.1 million, or $0.32 per fully diluted share *Refer to Appendix for adjusted EBITDA, adjusted net income, adjusted earnings per share reconciliations to GAAP equivalents. (Compared with fiscal 2021 third quarter)

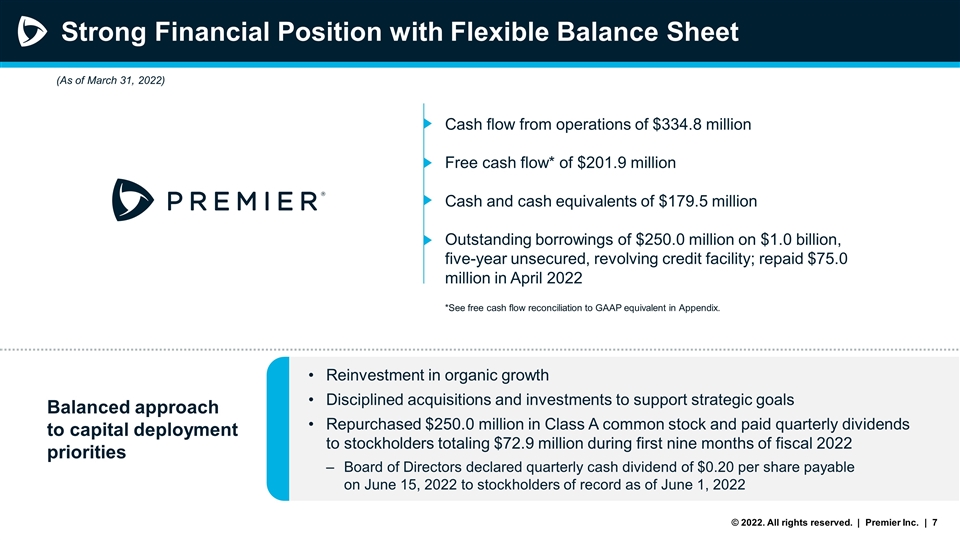

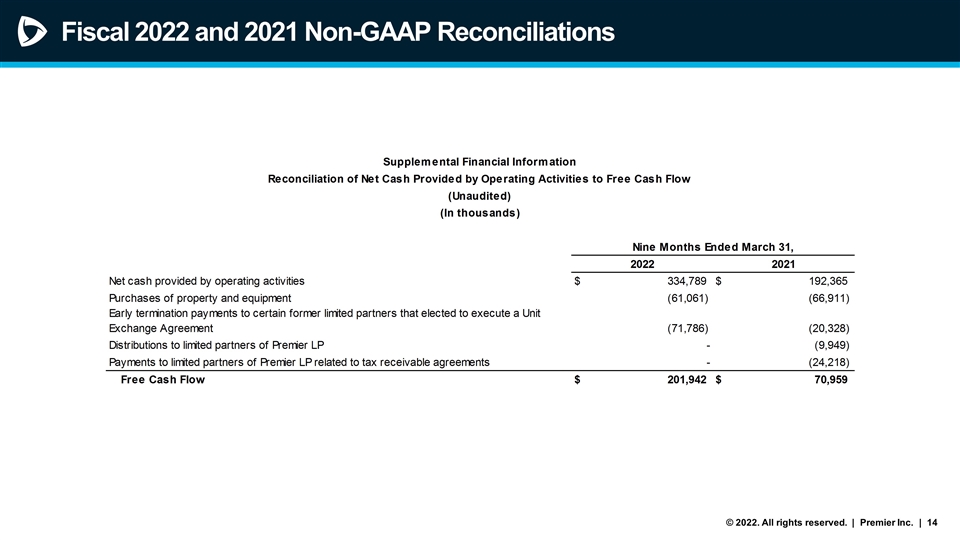

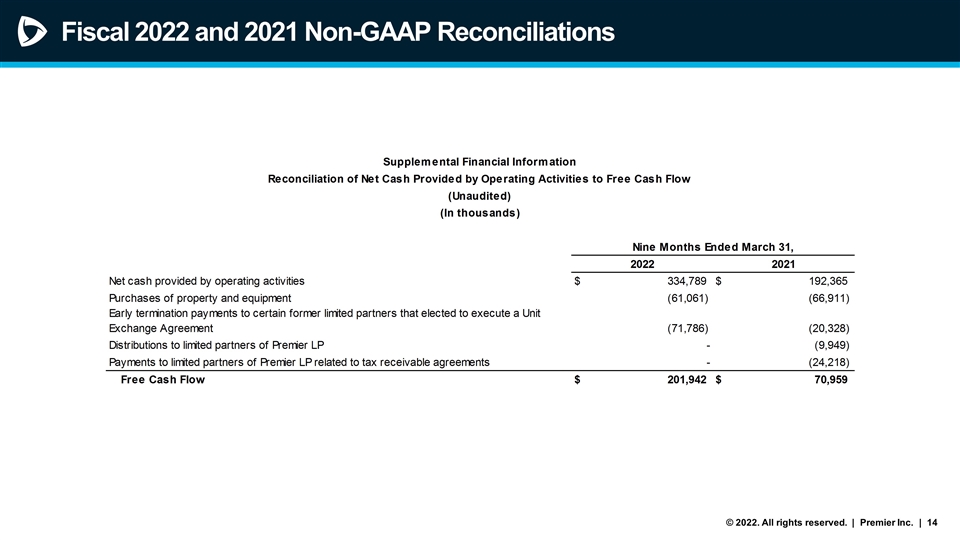

Strong Financial Position with Flexible Balance Sheet Cash flow from operations of $334.8 million Free cash flow* of $201.9 million Cash and cash equivalents of $179.5 million Outstanding borrowings of $250.0 million on $1.0 billion, five-year unsecured, revolving credit facility; repaid $75.0 million in April 2022 Balanced approach to capital deployment priorities *See free cash flow reconciliation to GAAP equivalent in Appendix. (As of March 31, 2022) Reinvestment in organic growth Disciplined acquisitions and investments to support strategic goals Repurchased $250.0 million in Class A common stock and paid quarterly dividends to stockholders totaling $72.9 million during first nine months of fiscal 2022 Board of Directors declared quarterly cash dividend of $0.20 per share payable on June 15, 2022 to stockholders of record as of June 1, 2022

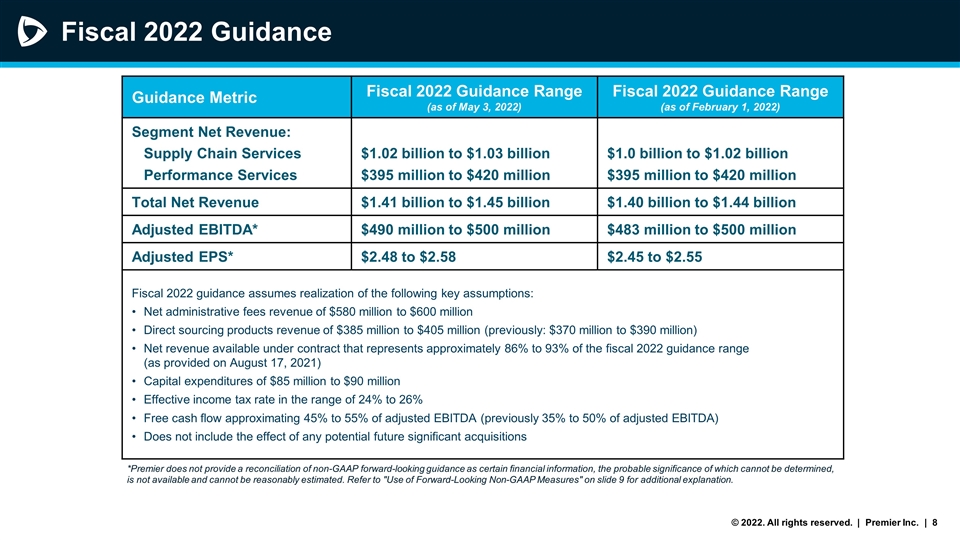

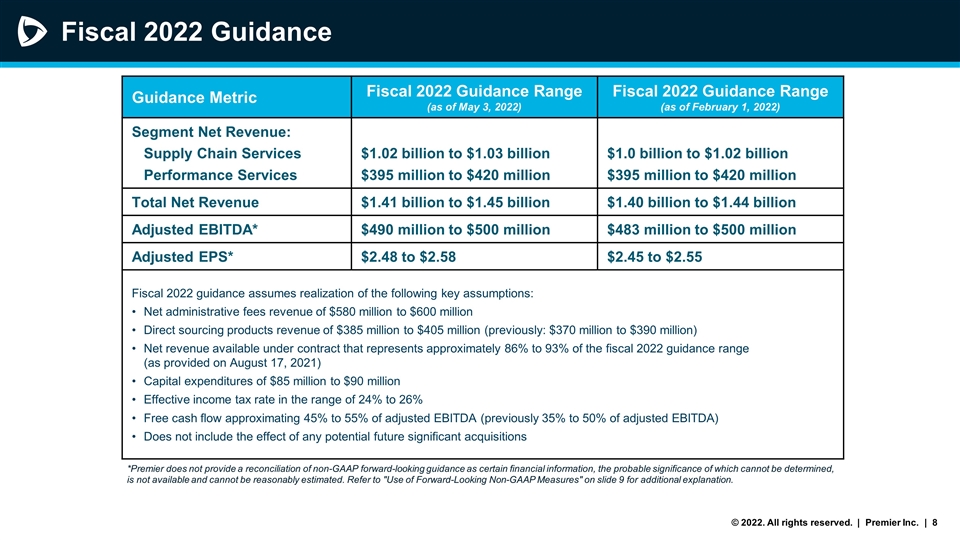

Fiscal 2022 Guidance *Premier does not provide a reconciliation of non-GAAP forward-looking guidance as certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated. Refer to "Use of Forward-Looking Non-GAAP Measures" on slide 9 for additional explanation. Guidance Metric Fiscal 2022 Guidance Range (as of May 3, 2022) Fiscal 2022 Guidance Range (as of February 1, 2022) Segment Net Revenue: Supply Chain Services Performance Services $1.02 billion to $1.03 billion $395 million to $420 million $1.0 billion to $1.02 billion $395 million to $420 million Total Net Revenue $1.41 billion to $1.45 billion $1.40 billion to $1.44 billion Adjusted EBITDA* $490 million to $500 million $483 million to $500 million Adjusted EPS* $2.48 to $2.58 $2.45 to $2.55 Fiscal 2022 guidance assumes realization of the following key assumptions: Net administrative fees revenue of $580 million to $600 million Direct sourcing products revenue of $385 million to $405 million (previously: $370 million to $390 million) Net revenue available under contract that represents approximately 86% to 93% of the fiscal 2022 guidance range (as provided on August 17, 2021) Capital expenditures of $85 million to $90 million Effective income tax rate in the range of 24% to 26% Free cash flow approximating 45% to 55% of adjusted EBITDA (previously 35% to 50% of adjusted EBITDA) Does not include the effect of any potential future significant acquisitions

Use of Forward-looking Non-GAAP Financial Measures The company does not believe it can meaningfully reconcile guidance for non-GAAP adjusted EBITDA and non-GAAP adjusted earnings per share to net income attributable to stockholders or earnings per share attributable to stockholders because the company cannot provide guidance for the more significant reconciling items between net income attributable to stockholders and adjusted EBITDA and between earnings per share attributable to stockholders and non-GAAP adjusted earnings per share without unreasonable effort. This is due to the fact that future period non-GAAP guidance includes adjustments for items not indicative of our core operations, which may include, without limitation, items included in the supplemental financial information for reconciliation of reported GAAP results to non-GAAP results. Such items may, from time to time, include merger- and acquisition-related expenses for professional fees; mark to market adjustments for put options and contingent liabilities; gains and losses on stock-based performance shares; adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims); items such as strategic initiative and financial restructuring-related expenses; and certain other items the company believes to be non-indicative of its ongoing operations. Such adjustments may be affected by changes in ongoing assumptions, judgements, as well as nonrecurring, unusual or unanticipated charges, expenses or gains/losses or other items that may not directly correlate to the underlying performance of our business operations. The exact amount of these adjustments are not currently determinable but may be significant.

Appendix

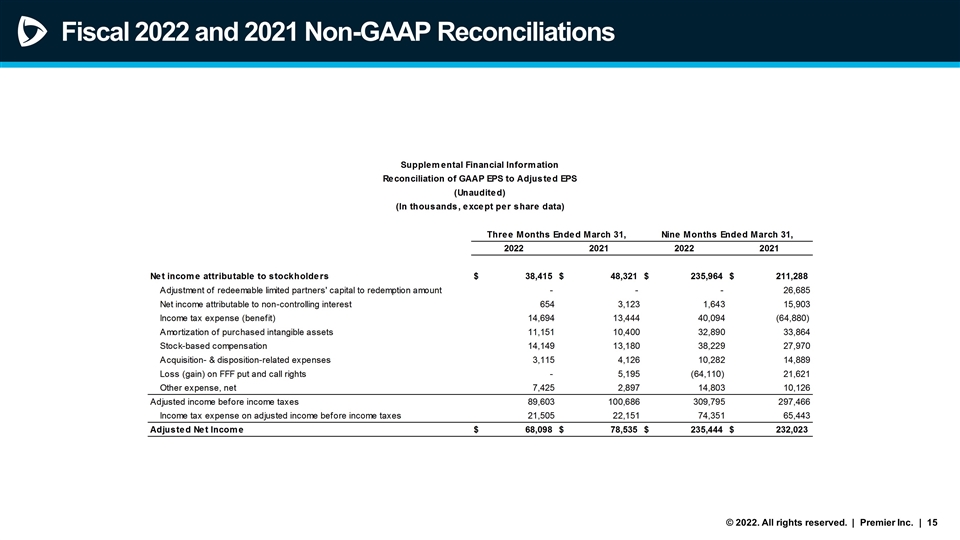

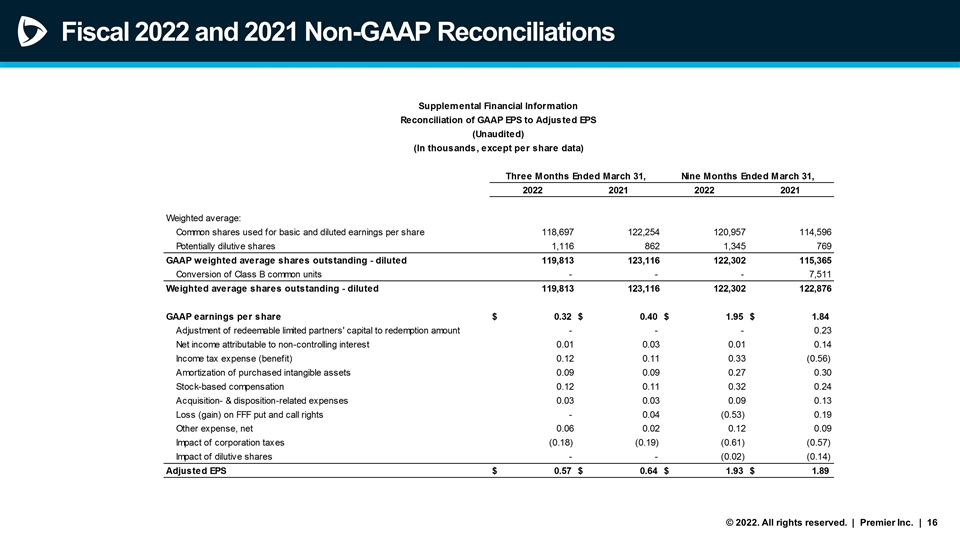

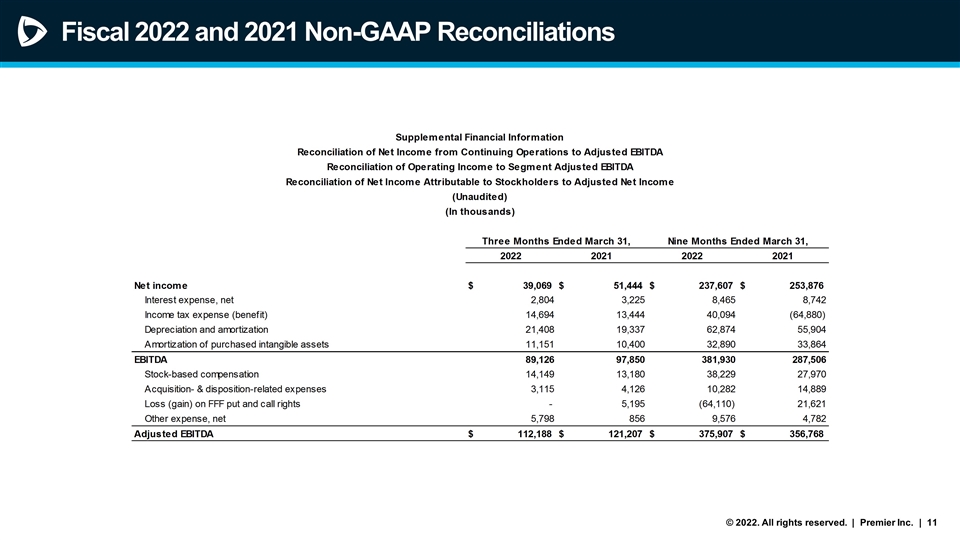

Fiscal 2022 and 2021 Non-GAAP Reconciliations

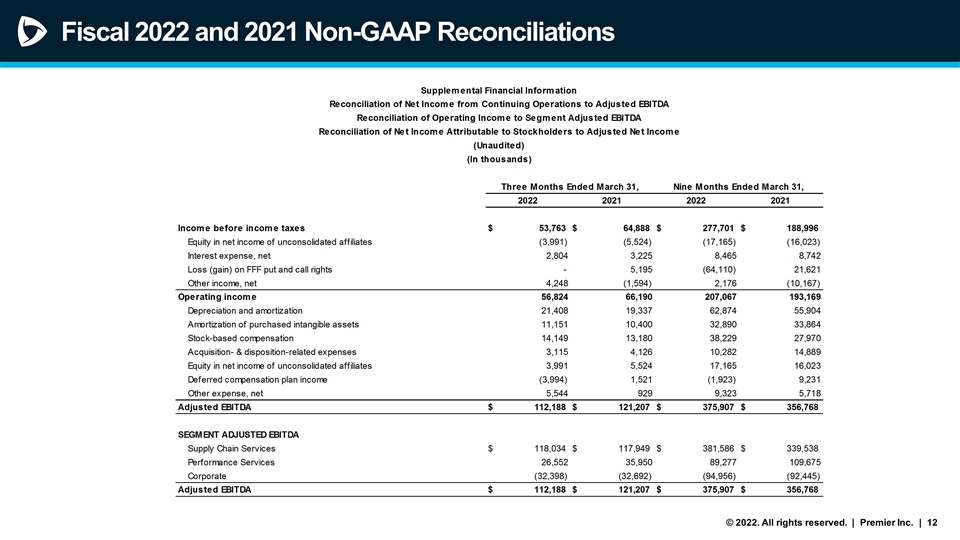

Fiscal 2022 and 2021 Non-GAAP Reconciliations

Fiscal 2022 and 2021 Non-GAAP Reconciliations

Fiscal 2022 and 2021 Non-GAAP Reconciliations

Fiscal 2022 and 2021 Non-GAAP Reconciliations

Fiscal 2022 and 2021 Non-GAAP Reconciliations