- PINC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Premier (PINC) 8-KPremier, Inc. Reports Fiscal-Year 2025 Second-Quarter Results

Filed: 5 Feb 25, 7:01am

Exhibit 99.3

Fiscal 2025 Second-Quarter Earnings Conference Call February 4, 2025

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements – Statements made in this presentation and the accompanying webcast that are not statements of historical or current facts, such as those related to our ability to advance our business strategies and improve healthcare, our ability to find a partner for our Contigo Health business and the potential benefits thereof, our ability to fund and conduct share repurchases pursuant to the outstanding share repurchase authorization and the potential benefits thereof, the payment of dividends at current levels or at all, guidance on expected future financial performance and assumptions underlying that guidance, and our expected effective income tax rate are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward-looking statements, the achievement of which cannot be guarantee. In addition to statements that explicitly describe such risks and uncertainties, readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “remains committed to,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to risks and uncertainties, many of which are outside Premier’s control. More information on risks and uncertainties that could affect Premier’s business, achievements, performance, financial condition, and financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Premier’s periodic and current filings with the SEC, including the information in those sections of Premier’s Form 10-K for the year ended June 30, 2024 as well as Premier’s subsequent Quarterly Reports on Form 10-Q, including the Form 10-Q for the quarter ended December 31, 2024, expected to be filed with the SEC shortly after this presentation. Premier’s periodic and current filings with the SEC are made available on the company’s website at investors.premierinc.com. Forward-looking statements speak only as of the date they are made, and Premier undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events that occur after that date, or otherwise. Non-GAAP financial measures – This presentation and accompanying webcast include certain “adjusted” and other “non-GAAP” financial measures, including free cash flow, as defined in the SEC’s Regulation G. These measures are not in accordance with, or an alternative to, GAAP. This presentation and the Appendix to this presentation include schedules that reconcile the historical non-GAAP financial measures included in this presentation to the most directly comparable GAAP financial measures. You should carefully read Premier’s earnings release and Quarterly Report on Form 10-Q for the quarter ended December 31, 2024, expected to be filed shortly after this presentation, for definitions of Premier’s non-GAAP financial measures and further explanation and disclosure regarding Premier’s use of non-GAAP financial measures, and such information should be read in conjunction with this presentation. These materials are made available on the company’s website at investors.premierinc.com. © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 2

Business Review Financial Review Michael J. Alkire Glenn Coleman President and Chief Administrative and Chief Executive Officer Financial Officer

Key Points Revenue and profitability were in line with overall expectations for the first half of fiscal 2025 • Supply Chain Services segment did better than expected • Performance Services segment did not achieve our objectives Reaffirming the midpoints for total net revenue and adjusted EBITDA guidance ranges and increasing the midpoint for adjusted EPS guidance range Continuing to make progress and provide value in Supply Chain Services • Digital supply chain strategy continues to evolve; new engagement with major partner • Leveraging our capabilities to help manufacturers navigate the 503B program Taking actions to reinvigorate Performance Services • David Zito joined as new President of the segment • Recruiting new talent with a strong track record • Refocusing our solutions and go-to-market strategy around our key areas of differentiation • Leveraging our performance improvement collaboratives more broadly in the market • Extending our unique AI capabilities to new use cases © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 4

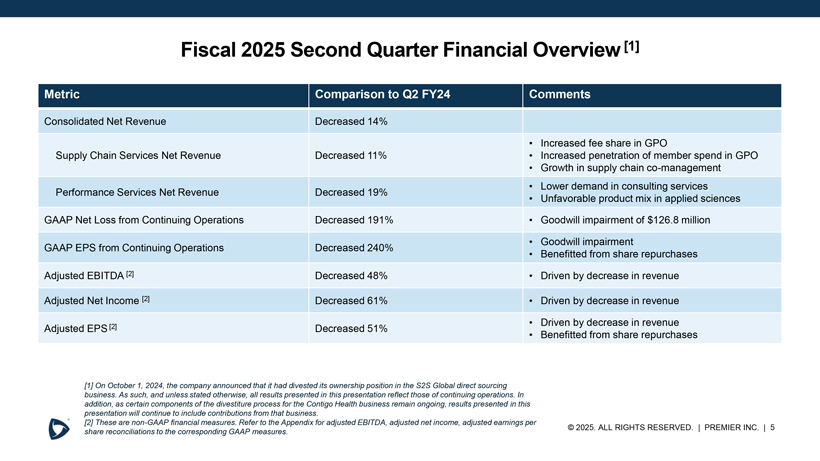

Fiscal 2025 Second Quarter Financial Overview [1] Metric Comparison to Q2 FY24 Comments Consolidated Net Revenue Decreased 14% • Increased fee share in GPO Supply Chain Services Net Revenue Decreased 11% • Increased penetration of member spend in GPO • Growth in supply chain co-management • Lower demand in consulting services Performance Services Net Revenue Decreased 19% • Unfavorable product mix in applied sciences GAAP Net Loss from Continuing Operations Decreased 191% • Goodwill impairment of $126.8 million • Goodwill impairment GAAP EPS from Continuing Operations Decreased 240% • Benefitted from share repurchases Adjusted EBITDA [2] Decreased 48% • Driven by decrease in revenue Adjusted Net Income [2] Decreased 61% • Driven by decrease in revenue • Driven by decrease in revenue Adjusted EPS [2] Decreased 51% • Benefitted from share repurchases [1] On October 1, 2024, the company announced that it had divested its ownership position in the S2S Global direct sourcing business. As such, and unless stated otherwise, all results presented in this presentation reflect those of continuing operations. In addition, as certain components of the divestiture process for the Contigo Health business remain ongoing, results presented in this presentation will continue to include contributions from that business. [2] These are non-GAAP financial measures. Refer to the Appendix for adjusted EBITDA, adjusted net income, adjusted earnings per © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 5 share reconciliations to the corresponding GAAP measures.

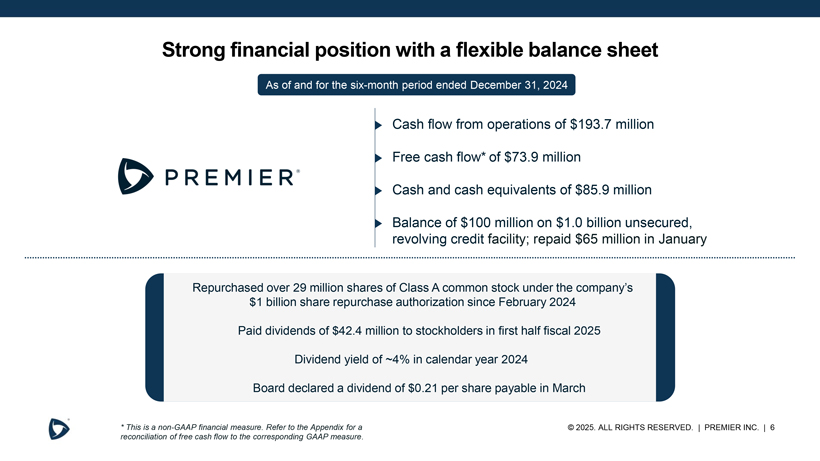

Strong financial position with a flexible balance sheet As of and for the six-month period ended December 31, 2024 Cash flow from operations of $193.7 million Free cash flow* of $73.9 million Cash and cash equivalents of $85.9 million Balance of $100 million on $1.0 billion unsecured, revolving credit facility; repaid $65 million in January Repurchased over 29 million shares of Class A common stock under the company’s $1 billion share repurchase authorization since February 2024 Paid dividends of $42.4 million to stockholders in first half fiscal 2025 Dividend yield of ~4% in calendar year 2024 Board declared a dividend of $0.21 per share payable in March * This is a non-GAAP financial measure. Refer to the Appendix for a © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 6 reconciliation of free cash flow to the corresponding GAAP measure.

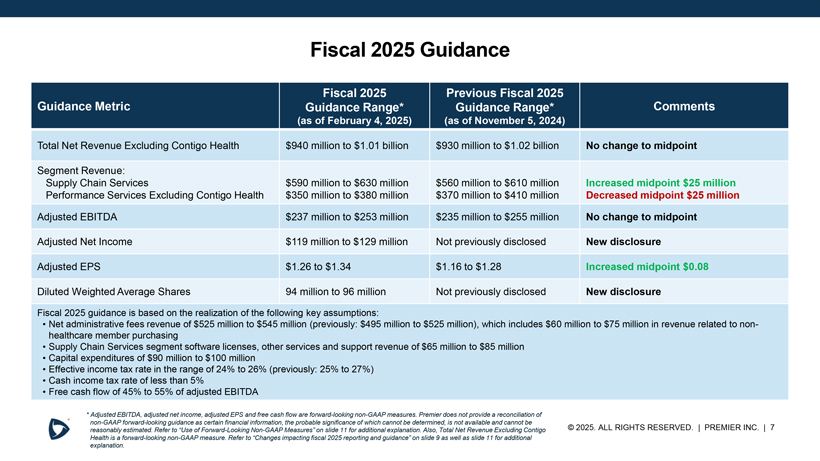

Fiscal 2025 Guidance Fiscal 2025 Previous Fiscal 2025 Guidance Metric Guidance Range* Guidance Range* Comments (as of February 4, 2025) (as of November 5, 2024) Total Net Revenue Excluding Contigo Health $940 million to $1.01 billion $930 million to $1.02 billion No change to midpoint Segment Revenue: Supply Chain Services $590 million to $630 million $560 million to $610 million Increased midpoint $25 million Performance Services Excluding Contigo Health $350 million to $380 million $370 million to $410 million Decreased midpoint $25 million Adjusted EBITDA $237 million to $253 million $235 million to $255 million No change to midpoint Adjusted Net Income $119 million to $129 million Not previously disclosed New disclosure Adjusted EPS $1.26 to $1.34 $1.16 to $1.28 Increased midpoint $0.08 Diluted Weighted Average Shares 94 million to 96 million Not previously disclosed New disclosure Fiscal 2025 guidance is based on the realization of the following key assumptions: • Net administrative fees revenue of $525 million to $545 million (previously: $495 million to $525 million), which includes $60 million to $75 million in revenue related to non- healthcare member purchasing • Supply Chain Services segment software licenses, other services and support revenue of $65 million to $85 million • Capital expenditures of $90 million to $100 million • Effective income tax rate in the range of 24% to 26% (previously: 25% to 27%) • Cash income tax rate of less than 5% • Free cash flow of 45% to 55% of adjusted EBITDA * Adjusted EBITDA, adjusted net income, adjusted EPS and free cash flow are forward-looking non-GAAP measures. Premier does not provide a reconciliation of non-GAAP forward-looking guidance as certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated. Refer to “Use of Forward-Looking Non-GAAP Measures” on slide 11 for additional explanation. Also, Total Net Revenue Excluding Contigo © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 7 Health is a forward-looking non-GAAP measure. Refer to “Changes impacting fiscal 2025 reporting and guidance” on slide 9 as well as slide 11 for additional explanation.

Appendix

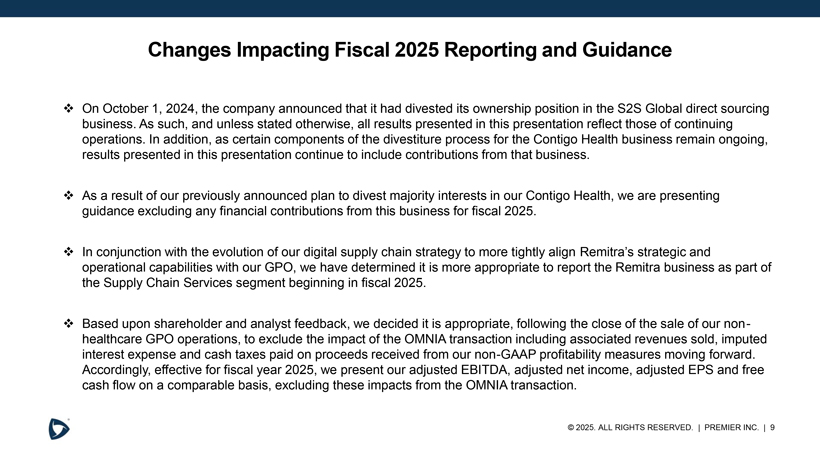

Changes Impacting Fiscal 2025 Reporting and Guidance â– On October 1, 2024, the company announced that it had divested its ownership position in the S2S Global direct sourcing business. As such, and unless stated otherwise, all results presented in this presentation reflect those of continuing operations. In addition, as certain components of the divestiture process for the Contigo Health business remain ongoing, results presented in this presentation continue to include contributions from that business. â– As a result of our previously announced plan to divest majority interests in our Contigo Health, we are presenting guidance excluding any financial contributions from this business for fiscal 2025. â– In conjunction with the evolution of our digital supply chain strategy to more tightly align Remitra’s strategic and operational capabilities with our GPO, we have determined it is more appropriate to report the Remitra business as part of the Supply Chain Services segment beginning in fiscal 2025. â– Based upon shareholder and analyst feedback, we decided it is appropriate, following the close of the sale of our non-healthcare GPO operations, to exclude the impact of the OMNIA transaction including associated revenues sold, imputed interest expense and cash taxes paid on proceeds received from our non-GAAP profitability measures moving forward. Accordingly, effective for fiscal year 2025, we present our adjusted EBITDA, adjusted net income, adjusted EPS and free cash flow on a comparable basis, excluding these impacts from the OMNIA transaction. © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 9

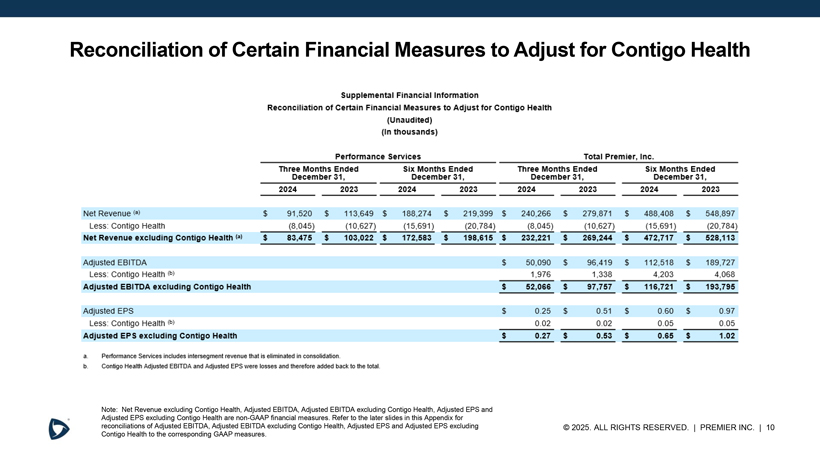

Supplemental Financial Information Reconciliation of Certain Financial Measures to Adjust for Contigo Health (U naudited) (In thousands) Performance Services Total Prem ier, Inc. Three Months Ended Six Months Ended Three Months Ended Six Months Ended December 31, December 31 , December 31 , December 31 , 2024 2023 2024 2023 2024 2023 2024 2023 Net Revenue Cal $ 91 ,520 $ 113,649 $ 188,274 $ 219,399 $ 240,266 $ 279,871 $ 488,408 $ 548,897 Less: Contigo Health (8,045) (10,627) (15,691 ) (20,784) (8,045) (10,627) (15,691 ) (20,784) Net Revenue excluding Contigo Health caJ $ 83,475 $ 103,022 $ 172,583 $ 198,615 $ 232,221 s 269,244 s 472,717 s 528,113 Adjusted EBITDA $ 50,090 $ 96,419 $ 112,518 $ 189,727 Less: contigo Health Cbl 1,976 1,338 4,203 4,068 Adjusted EBITDA excluding Contigo Health $ 52,066 s 97,757 $ 116,721 $ 193,795 Adjusted EPS $ 0 .25 $ 0.51 $ 0 .60 $ 0 .97 Less: Contigo Health !bl 0 .02 0.02 0 .05 0. 05 Adjusted EPS excluding Contigo Health $ 0.27 s 0.53 $ 0.65 $ 1.02 a. Perfonnance Services includes inlersegment revenue that is eliminated in consolidation. b. Contigo HeaHh Adjusted EBITDA and Adjusted EPS were losses and therefore added back to the total. Reconciliation of Certain Financial Measures to Adjust for Contigo Health Note: Net Revenue excluding Contigo Health, Adjusted EBITDA, Adjusted EBITDA excluding Contigo Health, Adjusted EPS and Adjusted EPS excluding Contigo Health are non-GAAP financial measures. Refer to the later slides in this Appendix for reconciliations of Adjusted EBITDA, Adjusted EBITDA excluding Contigo Health, Adjusted EPS and Adjusted EPS excluding © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 10 Contigo Health to the corresponding GAAP measures.

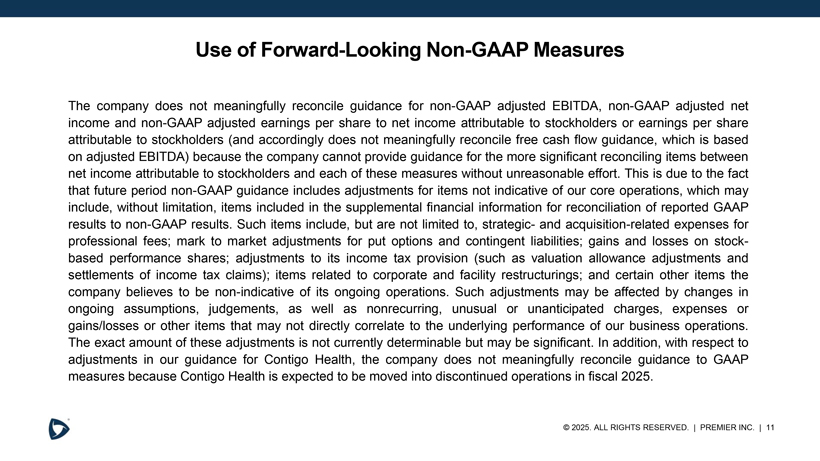

Use of Forward-Looking Non-GAAP Measures The company does not meaningfully reconcile guidance for non-GAAP adjusted EBITDA, non-GAAP adjusted net income and non-GAAP adjusted earnings per share to net income attributable to stockholders or earnings per share attributable to stockholders (and accordingly does not meaningfully reconcile free cash flow guidance, which is based on adjusted EBITDA) because the company cannot provide guidance for the more significant reconciling items between net income attributable to stockholders and each of these measures without unreasonable effort. This is due to the fact that future period non-GAAP guidance includes adjustments for items not indicative of our core operations, which may include, without limitation, items included in the supplemental financial information for reconciliation of reported GAAP results to non-GAAP results. Such items include, but are not limited to, strategic- and acquisition-related expenses for professional fees; mark to market adjustments for put options and contingent liabilities; gains and losses on stock-based performance shares; adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims); items related to corporate and facility restructurings; and certain other items the company believes to be non-indicative of its ongoing operations. Such adjustments may be affected by changes in ongoing assumptions, judgements, as well as nonrecurring, unusual or unanticipated charges, expenses or gains/losses or other items that may not directly correlate to the underlying performance of our business operations. The exact amount of these adjustments is not currently determinable but may be significant. In addition, with respect to adjustments in our guidance for Contigo Health, the company does not meaningfully reconcile guidance to GAAP measures because Contigo Health is expected to be moved into discontinued operations in fiscal 2025. © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 11

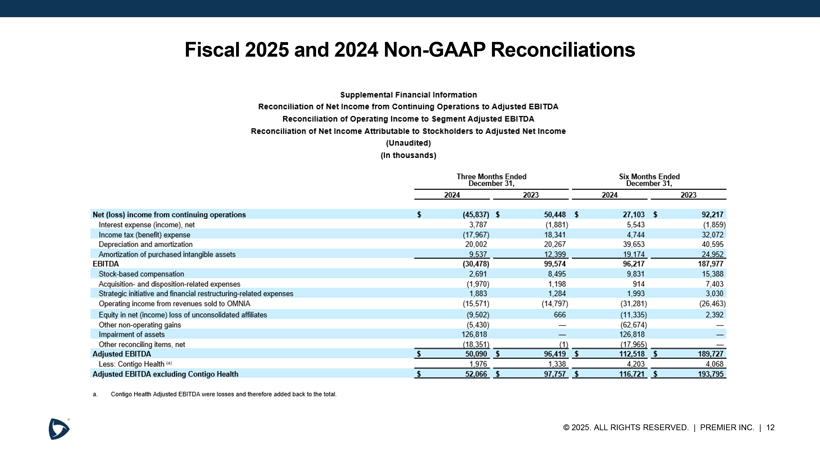

Supplemental Financial Information Reconciliation of Net Income from Conti nuing Operations to Adj usted EBI TDA Reconciliation of Operati ng Incom e to Segment Adjusted EBITDA Reconciliation of Net Income Attributable to Stockholders to Adjusted Net Income (Unaudited) (In thousands) Three Months Ended Six Months Ended December 31, December 31, 2024 2023 2024 2023 Net (loss) income from continuing operations $ (45,837) $ 50,448 $ 27,103 $ 92,217 Interest expense (income), net 3,787 (1,881) 5,543 (1,859) Income tax (benefit) expense (17,967) 18,341 4,744 32,072 Depreciation and amortization 20,002 20,267 39,653 40,595 Amortization of purchased intangible assets 9 537 12 399 19 174 24 952 EB ITDA (30,478) 99,574 96,217 187,9n Stock~based compensation 2,691 8,495 9,831 15,388 Acquisition- and disposition-related expenses (1 ,970) 1,198 914 7,403 Strategic initiative and financial restructuring-related expenses 1,883 1,284 1,993 3,030 Operating income from revenues sold to OMNIA (15,571 ) (14,797) (31 ,281) (26,463) Equity in net (income) loss of unconsolidated affiliates (9,502) 666 (11 ,335) 2,392 Other non-operating gains (5,430) (62,674) Impairment of assets 126,818 126,818 Other reconciling items, net (18.351 ) {1l (17.965) Adjusted EBITDA s 50,090 $ 96 419 $ 112,518 s 189 727 1 Less: Contigo Health l•l 1 976 1 338 4 203 4 068 Adjusted EBITDA excluding Contigo Heah:h $ 52,066 ~ 97,757 $ 116,721 ~ 193,795 a. Contigo Health Adjusted EBITDA were tosses and therefore added back to the total. Fiscal 2025 and 2024 Non-GAAP Reconciliations © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 12

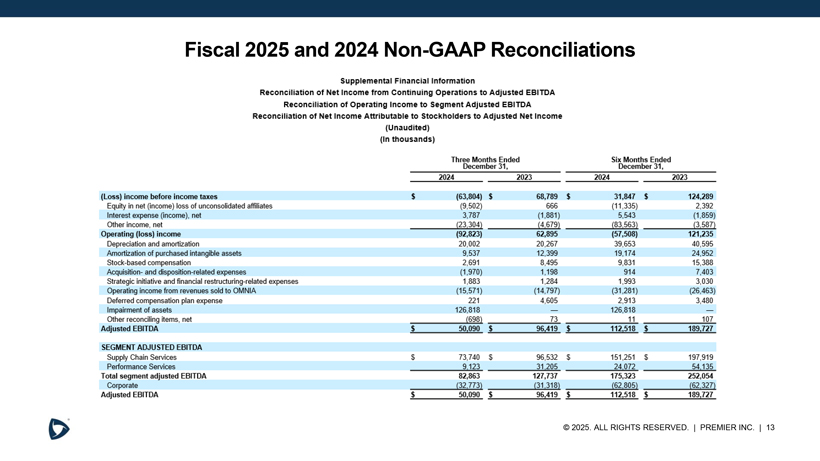

Fiscal 2025 and 2024 Non-GAAP Reconciliations Supplemental Financial Information Reconciliation of Net Income from Conti nuing Operations to Adjusted EBITDA Reconciliation of Operati ng Income to Segment Adjusted EBITDA Reconciliation of Net Income Attributable to Stock holders to Adjusted Net Income (Unaudited) (In thousands) Three Months Ended Six Months Ended December 31, December 31, 2024 2023 2024 2023 (Loss) income before income taxes $ (&3,804) $ 68,789 $ 31,847 $ 124,289 Equity in net (income) loss of unconso~dated affiliates (9,502) 666 (11 ,335) 2,392 Interest expense (income), net 3,787 (1,881) 5,543 (1,859) Other income, net {23.304} {4.679} {83,563) (3,58Z) Operating (loss) income (92,823) 62,895 (57,508) 121,235 Depreciation and amortization 20,002 20,267 39,653 40,595 Amortization of purchased intangible assets 9,537 12,399 19,174 24,952 Stock-based compensation 2,691 8,495 9,831 15,388 Acquisition- and disposition- related expenses (1,970) 1,198 914 7,403 Strategic initiative and financial restructuring-related expenses 1,883 1,284 1,993 3,030 Operating income from revenues sold to OMNIA (15,571) (14,797) (31 ,281 ) (26,463) Deferred compensation plan expense 221 4,605 2,913 3,480 Impairment of assets 126,818 126,818 Other reconciling ~ems, net (698} 73 11 107 Adjusted EBITDA $ 50,090 $ 96 41 9 $ 112 518 $ 189 727 SEGMENT ADJUSTED EBITDA Supply Chain Services $ 73,740 s 96,532 $ 151,251 $ 197,919 Performance Services 9123 31 205 24 072 54135 Total segment adjusted EBITDA 82,863 127,737 175,323 252,054 Corporate (32,773} {31,318} {62,805) {62,32Z) Adjusted EBITDA s 50,090 $ 96419 $ 112 518 $ 189 727 © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 13

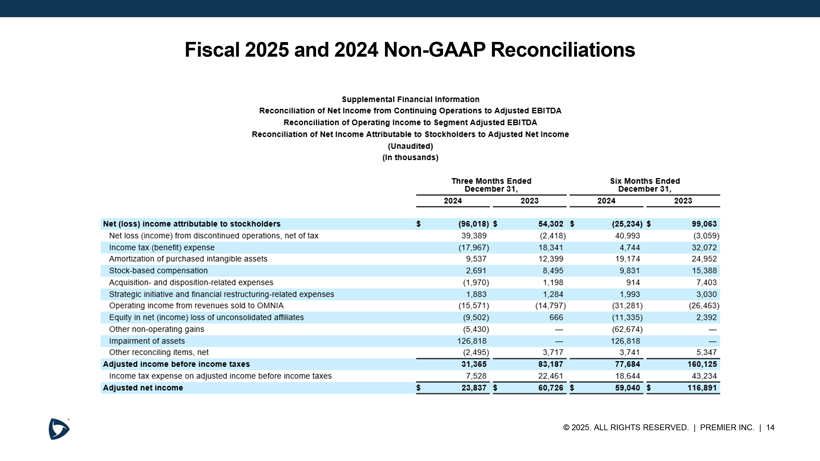

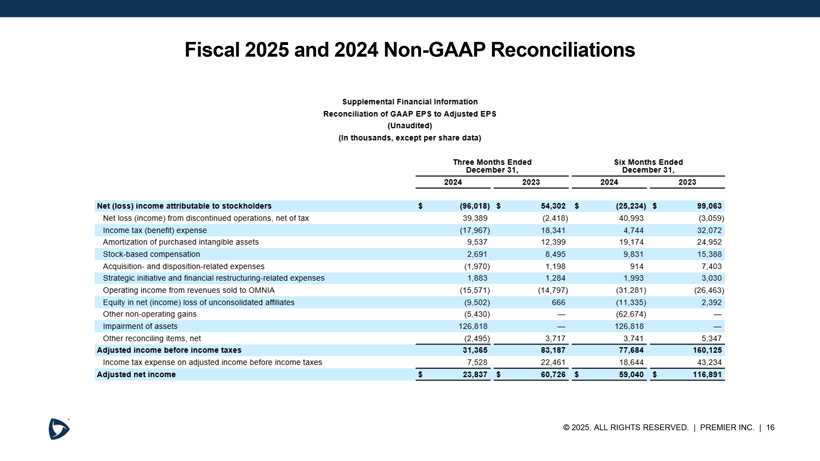

Fiscal 2025 and 2024 Non-GAAP Reconciliations Supplemental Financial Information Reconc iliation of Net Income from Continuing Operations to Adjusted EBITOA Reconciliation of Operating Income to Segment Adjusted EBITOA Reconciliation of Net Income Attributable to Stockholders to Adjusted Net Income (Unaudited) (In thousands) Three Months Ended Six Months Ended December 31 , December 31, 2024 2023 2024 2023 Net (loss) income attributable to stockholders $ (96,018) $ 54,302 $ (25,234) $ 99,063 Net loss (income) from discontinued operations, net of tax 39,389 (2,418) 40,993 (3,059) Income tax (benefit) expense (17,967) 18,341 4,744 32,072 Amortization of purchased intangible assets 9,537 12,399 19,174 24,952 Stock-based compensation 2,691 8,495 9,831 15,388 Acquisition- and disposition-related expenses (1 ,970) 1,198 914 7,403 Strategic initiative and financial restructuring-related expenses 1,883 1,284 1,993 3,030 Operating income from revenues sold to OMNIA (15,571) (14,797) (31,281) (26,463) Equity in net (income) loss of unconsolidated affiliates (9,502) 666 (11 ,335) 2,392 Other non-operating gains (5,430) (62,674) Impairment of assets 126,818 126,818 Other reconciling items, net (2,495) 3,717 3,741 5,347 Adjusted income before income taxes 31 ,365 83,187 77,684 160,125 Income tax expense on adjusted income before income taxes 7,528 22,461 18,644 43,234 Adj usted net income $ 23,837 $ 60,726 _____ $ 59,040 ; ....__ $ 116,891 © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 14

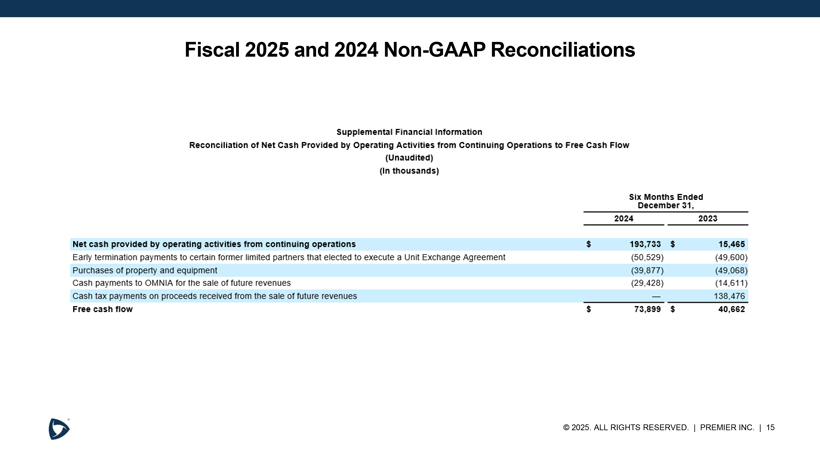

Fiscal 2025 and 2024 Non-GAAP Reconciliations Supplemental Financial Information Reconciliation of Net Cash Provided by Operating Activities from Continuing Operations to Free Cash Flow (Unaudited) (In thousands) Six Months Ended December 31 , 2024 2023 Net cash provided by operating activities from continuing operations $ 193,733 $ 15,465 Early termination payments to certain former limited partners that elected to execute a Unit Exchange Agreement (50,529} (49,600) Purchases of property and equipment (39,877} (49,068) Cash payments to OMNIA for the sale of future revenues (29,428} (14,61 1) Cash tax payments on proceeds received from the sale of future revenues 138,476 Free cash flow $ 73,899 $ 40,662 © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 15

Fiscal 2025 and 2024 Non-GAAP Reconciliations Supplemental Financial Information Reconciliation of GAAP EPS to Adjusted EPS (Unaudited) (In thousands, except per share data) Three Months Ended Six Months Ended December 31 , December 31 , 2024 2023 2024 2023 Net (loss) income attributable to stockholders $ (96,018) $ 54,302 $ (25,234) $ 99,063 Net loss (income) from discontinued operations, net of tax 39,389 (2,418) 40,993 (3,059) Income tax (benefit) expense (17,967) 18,341 4,744 32,072 Amortization of purchased intangible assets 9,537 12,399 19,174 24,952 Stock-based compensation 2,691 8,495 9,831 15,388 Acquisition- and disposition-related expenses (1,970) 1,198 914 7,403 Strategic initiative and financial restructuring-related expenses 1,883 1,284 1,993 3,030 Operating income from revenues sold to OMNIA (15 ,571) (14,797) (31 ,281) (26,463) Equity in net (income) loss of unconsolidated affiliates {9,502) 666 (11 ,335) 2,392 Other non-operating gains (5,430) (62,674) Impairment of assets 126,818 126,818 Other reconciling items. net {2,495) 3,717 3,741 5,347 Adjusted income before income taxes 31 ,365 83,187 77,684 160,125 Income tax expense on adjusted income before income taxes 7,528 22,461 18,644 43,234 Adjusted net income $ 23,837 $ 60,726 $ 59,040 $ 116,891 © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 16

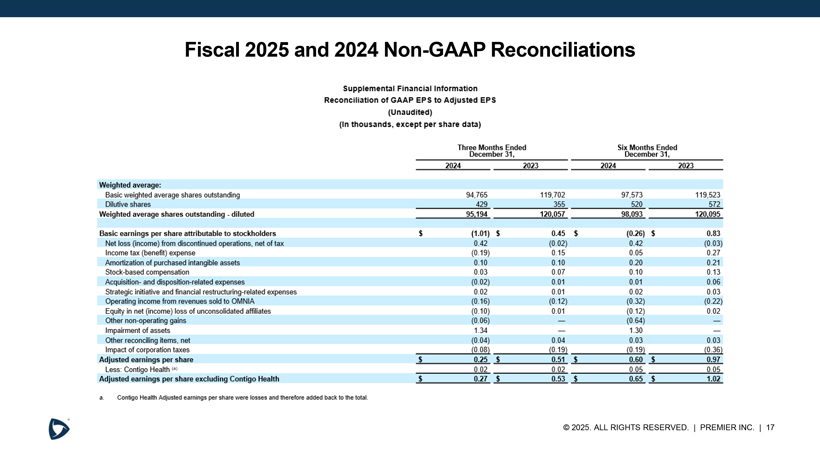

Fiscal 2025 and 2024 Non-GAAP Reconciliations Supplemental Financial Information Reconciliation of GAAP EPS to Adjusted EPS (Unaudited) (I n thousands, except per share data) Three Months Ended Six Months Ended December 31, December 31, 2024 2023 2024 202.3 Weighted average: Basic weighted average shares outstanding 94,765 119,702 97,573 119,523 Dilutive shares 429 355 520 572 Weighted average shares outstanding -diluted 95194 120 057 98 093 120 095 Basic earnings per share attributable to stockholders $ (1 .01) $ 0.45 s (0.26) s 0.83 Net loss (income) from discontinued operations, net of tax 0.42 (0.02) 0.42 (0.03) Income tax (benefrt) expense (0.19) 0.1 5 0.05 0.27 Amortization of purchased intangible assets 0.10 0.10 0.20 0.21 Stock-based compensation 0.03 0.07 0.1 0 0.13 Acquisition- and disposition-related expenses (0.02) 0.01 0.01 0.06 Strategic initiative and financial restructuring-related expenses 0.02 0.01 0.02 0.03 Operating income from revenues sold to OMNIA (0.16) (0.12) (0 .. 32) (0.22) Equity in net (income) loss of unconsolidated affiliates (0.10) 0.01 (0.12) 0.02 Other non-operating gains (0.06) (0.64) Impairment of assets 1.34 1.30 Other reconcmng items, net (0.04) 0.04 0.03 0.03 Impact of corporation taxes _______,l( ::,;0· ::.;08~) ———-l=.:(0.19) :~ ——-....l ::. (0.19) ;~ (0.36} Adjusted earnings per share $ 0.25 _,$’———==-’- 0.51 -’’———==- $ 0.60 ~ 0.97 Less: Contigo Health 1•1 0.02 0.02 0.05 0.05 Adjusted earnings per share excluding Contigo Health $ 0.27 ....::S:....._____ 0. =:: 53 ... ....$ ::: ....._____ 0. =:: 65 ... ....s ::: ....._____ 1. .: :.02 :::; a. Contigo Health Adjusted earnings per share were losses and therefore added back to the total. © 2025. ALL RIGHTS RESERVED. | PREMIER INC. | 17