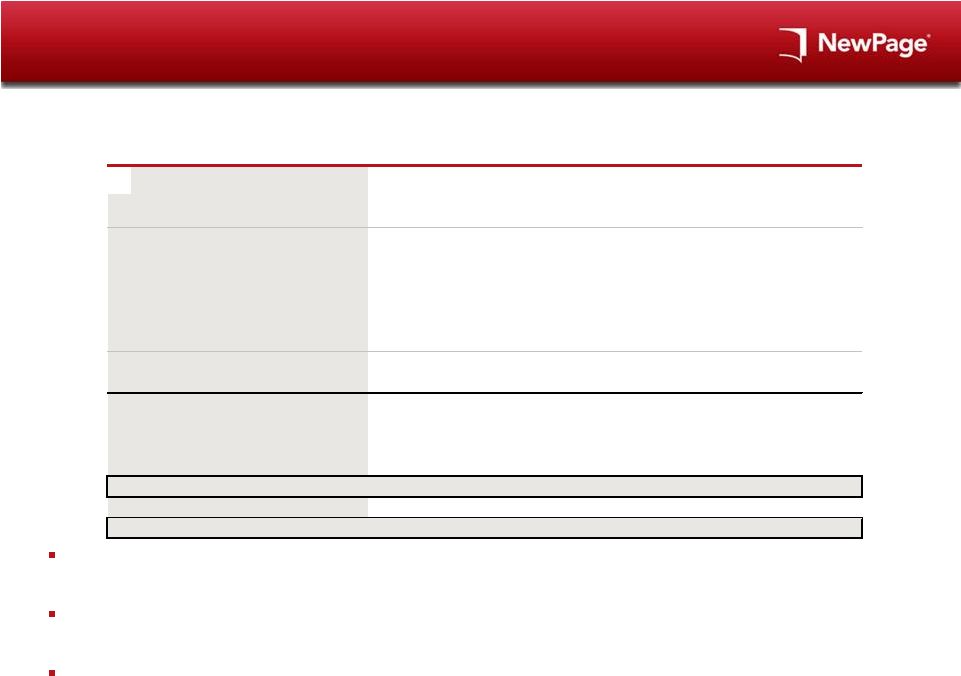

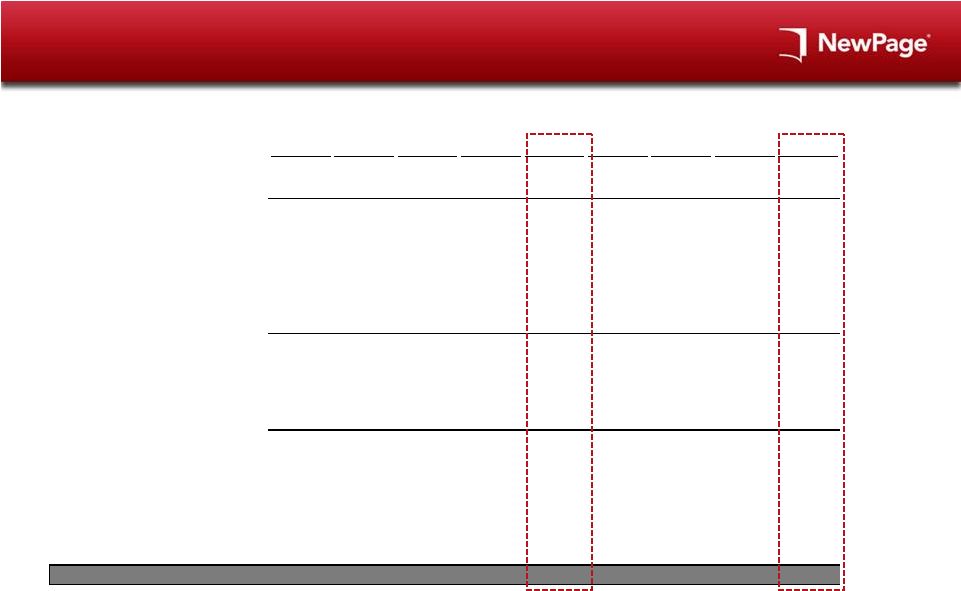

ABL Revolver Indicative Terms 35 Borrower: NewPage Corporation (the “Borrower”) Joint Lead Arrangers, Joint Bookrunners: Barclays, CS, UBS, BMO Admin Agent: Barclays Facilities Offered: $350 million senior secured asset-based revolving credit facility ($200 million through letter of credit subfacility, $30 million swingline facility) Incremental Facilities: Up to the greater of (i) $200 million and (ii) the excess of the borrowing base over the then effective commitments under the facility; incremental facilities shall provide for 50 bps of MFN for the first year post closing Borrowing Base: (a) 85% Eligible Accounts, plus (b) the lesser of (i) 80% of the net book value of Eligible Inventory and (ii) 85% of the net orderly liquidation value of Eligible Inventory, minus (c) reserves against the Borrowing Base as established by the Agent LIBOR Margin: L + 200 bps for the first three full months post closing, thereafter subject to an availability based grid ranging from L + 175-225 bps Commitment Fees: 50 bps for the first three full months post closing, thereafter subject to a utilization based grid ranging from 37.5-50 bps Maturity: 5 years Security: (i) First priority security interests in all accounts receivable, loans receivable, other receivables, inventory, related books and records and general intangibles, deposit accounts, cash and proceeds of the Borrower and Guarantor (“ABL-Priority Collateral”) (ii) Second priority secured interests in the Non-ABL Priority Collateral underlying the term loan Financial Covenant: Should excess availability fall below the greater of (a) 10% of the lesser of (i) the total Facility Commitments and (ii) the Borrowing Base and (b) $20 million at any time (“Covenant triggering event”), FCCR of 1.0x tested on a trailing four-quarter basis Field Exams and Appraisals: One per annum springing to two per annum if Excess Availability falls below the greater of (a) 12.5% of the lesser of (i) the total Facility Commitments and (ii) the Borrowing Base and (b) $35 million for five consecutive business days (an “Excess Availability Triggering Event’) and more frequently during an event of default Reporting: Monthly borrowing base reporting springing to weekly during (i) an Excess Availability Triggering Event or (ii) an event of default Cash Dominion: Springing cash dominion during (i) an Excess Availability Triggering Event or (ii) during an event of default Affirmative Covenants: Customary for facilities of this type Negative Covenants: Customary for facilities of this type, including limitations on indebtedness, liens, sale and lease-back transactions, investments, loans and advances, Mergers, consolidations, sales of assets and acquisitions, restricted payments, etc.; Restricted Payments to Verso: $40m per annum plus any additional amounts subject to satisfaction of the payment conditions Guarantees: Guaranteed by (i) NewPage Investment Company LLC and (ii) all wholly-owned domestic subsidiaries of the Borrower (other than (a) domestic subsidiaries that are subsidiaries of foreign subsidiaries, (b) Unrestricted Subsidiaries and (c) any bankruptcy remote special purpose receivables entities designated by the Borrower (collectively, the “NewPage Subsidiary Guarantors”) |