Filed by Alcentra Capital Corporation

Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Commission File No. 814-01064

Strategic Acquisition of Alcentra Capital Corp. Investor Presentation August 13, 2019

| Important Notices The information in this presentation is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the Proposals (as defined below) or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended . This presentation does not purport to contain all of the information that may be necessary or appropriate to evaluate the proposed business combination and related transactions (collectively, the “Transaction”) between Crescent Capital BDC, Inc . (“CCAP”) and Alcentra Capital Corporation (“ABDC”) and is not a substitute for an investor’s independent evaluation and analysis . The investor should make its own independent assessment of the merits of the Transaction and should consult its own professional advisors . Neither CCAP, ABDC nor any of their respective advisors nor any of their respective affiliates or representatives (including, but not limited to, directors, officers, employees and stockholders) makes any representation or warranty, express or implied, as to the accuracy or completeness of any information contained in this presentation or any other written or oral communication transmitted or made available to any investor or any of its advisors or any of their respective affiliates or representatives . The investor agrees that CCAP, ABDC and their respective advisors and their respective affiliates and representatives shall have no liability based, in whole or in part, on such information, errors or opinions therein or omissions therefrom, and CCAP, ABDC and their respective advisors and their respective affiliates and representatives expressly disclaim any and all liability relating to, in whole or in part, this presentation . Footnotes contain important information about the definition of terms used herein, the composition of the portfolios presented and related performance information as well as unrealized investment valuations and should be carefully reviewed . Market data and information included herein is based on various published and unpublished sources considered to be reliable, but has not been independently verified and there is no guarantee of its accuracy or completeness . Performance information contained herein is based in significant part on unrealized investment valuations which may not be achieved . Past performance does not guarantee future results . Legal, tax and regulatory changes, as well as judicial decisions, both within and outside of the United States, could have an adverse impact on CCAP, ABDC and their respective investments . Instability in the securities markets may increase the risk inherent in CCAP’s and ABDC’s respective investments in that the ability of issuers to refinance or redeem portfolio securities held by CCAP or ABDC may depend on their ability to sell new securities in the market . Future periods of uncertainty in the U . S . economy and the economies of other countries of issuers of securities and loans in which CCAP or ABDC may invest, and the possibility of increased volatility, default rates and deterioration in financial markets, may adversely affect the value of CCAP’s or ABDC’s respective investments . Forward Looking Statement Disclosure : This presentation contains statements that constitute “forward - looking statements,” including statements that include words or phrases such as “is expected to,” “will,” “opportunity,” “estimate,” “forecast” or similar expressions, and other estimates and projections of future performance . These statements, estimates and projections are subject to known and unknown risks, uncertainties and other factors which are difficult to predict and may cause actual results or developments to differ materially from any future results or developments expressed in or implied from any such statements, estimates or projections . For further discussion of the factors that could affect outcomes, please refer to the “Certain Risk Factors” set forth on pg . 11 of this presentation and the “Risk Factors” section of CCAP’s and ABDC’s respective Annual Reports on Form 10 - K for the year ended December 31 , 2018 and in CCAP’s and ABDC’s other filings made with the Securities and Exchange Commission from time to time, including CCAP’s Form 10 - Q for the quarter ended June 30 , 2019 . This presentation relates to the Transaction, along with related proposals for which stockholder approval will be sought (collectively, the “Proposals”) . In connection with the Proposals, ABDC and CCAP will file relevant materials with the Securities and Exchange Commission (the “SEC”), including CCAP’s registration statement on Form N - 14 (the “Registration Statement”), which will include CCAP’s and ABDC’s joint proxy statement on Schedule 14 A that also constitutes a prospectus of CCAP (the “Joint Proxy Statement/Prospectus”) . The Registration Statement and Joint Proxy Statement/Prospectus will each contain important information about ABDC, CCAP, the proposed transactions, the Proposals and related matters . INVESTORS AND SECURITY HOLDERS OF CCAP AND ABDC ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ABDC, CCAP, THE PROPOSED TRANSACTIONS, THE PROPOSALS AND RELATED MATTERS . Investors and security holders will be able to obtain the Registration Statement, the Joint Proxy Statement/Prospectus and other documents filed with the SEC by ABDC and CCAP, free of charge, from the SEC’s web site at www . sec . gov and from either ABDC’s or CCAP’s web sites at www . alcentracapital . com or at www . crescentbdc . com . Investors and security holders may also obtain free copies of the Registration Statement, the Joint Proxy Statement/Prospectus and other documents filed with the SEC from CCAP by contacting Crescent BDC’s Investor Relations Department at bdcir@crescentcap . com or from ABDC by contacting ABDC’s Investor Relations Department at investorrelationsbdc@alcentra . com . This presentation is not a solicitation of a proxy from any investor or security holder . However, ABDC, CCAP and their respective directors and executive officers, other members of their management and employees may be deemed to be participants in the solicitation of proxies in connection with the Proposals . Information regarding ABDC’s directors and executive officers is available in an amendment to its annual report for the year ended December 31 , 2018 on Form 10 - K/A (the “ 2018 Form 10 - K/A”), filed with the SEC on April 30 , 2019 . Information regarding CCAP’s directors and executive officers is available in its definitive proxy statement for its 2019 annual meeting of stockholders filed with the SEC on April 26 , 2019 . To the extent holdings of securities by such directors or executive officers have changed since the amounts printed in ABDC’s 2018 Form 10 - K/A and CCAP’s 2019 proxy statement, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed by such directors or executive officers, as the case may be, with the SEC . More detailed information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the Joint Proxy Statement and the Registration Statement when such documents become available . These documents may be obtained free of charge from the sources indicated above . 1

| ▪ We believe that the combination of Crescent Capital BDC, Inc. (“CCAP”) and Alcentra Capital Corporation (“ABDC”) provides significant immediate and long - term value for all shareholders Transaction Rationale 2 Enhanced Scale Portfolio Positioning Shareholder & Manager Alignment ▪ Establishes a top 15 externally managed BDC by market capitalization ▪ Increased market presence / visibility to financial sponsors, management teams and intermediaries ▪ Greater access to capital markets for growth and financing ▪ Improved economies of scale ▪ Increased portfolio diversification ▪ Ability to hold larger position sizes ▪ Maintain senior secured first lien focus ▪ Six quarters of certain fee waivers ▪ Best - in - class fee structure ▪ Expected to over earn $0.41 quarterly dividend per share

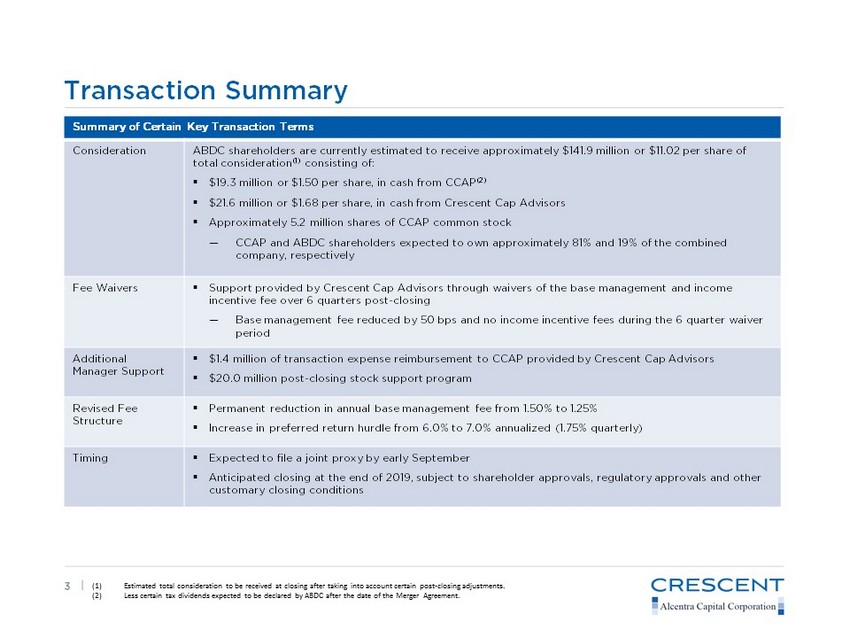

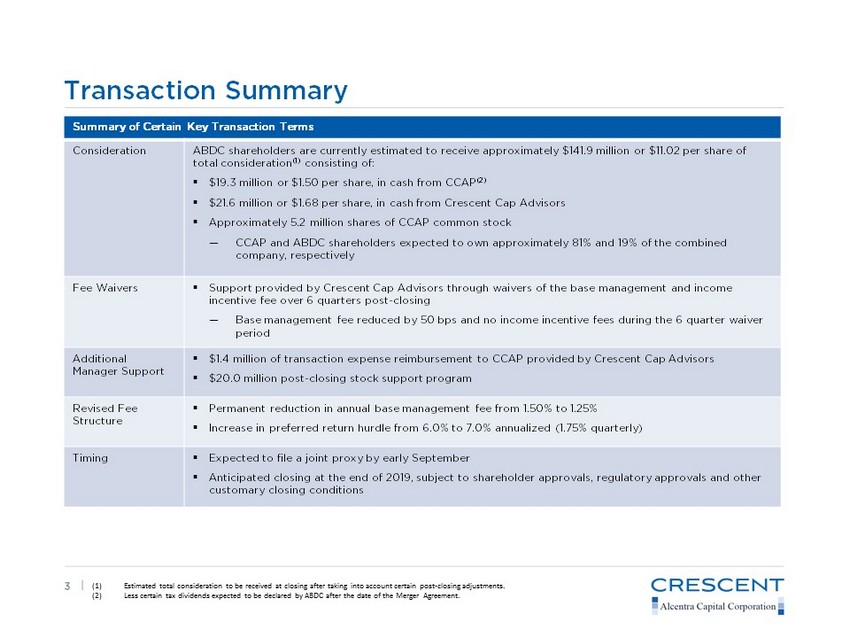

| Transaction Summary 3 Summary of Certain Key Transaction Terms Consideration ABDC shareholders are currently estimated to receive approximately $141.9 million or $11.02 per share of total consideration (1) consisting of: ▪ $19.3 million or $1.50 per share, in cash from CCAP (2) ▪ $21.6 million or $1.68 per share, in cash from Crescent Cap Advisors ▪ Approximately 5.2 million shares of CCAP common stock ― CCAP and ABDC shareholders expected to own approximately 81% and 19% of the combined company, respectively Fee Waivers ▪ S upport provided by Crescent Cap Advisors through waivers of the base management and income incentive fee over 6 quarters post - closing ― Base management fee reduced by 50 bps and no income incentive fees during the 6 quarter waiver period Additional Manager Support ▪ $1.4 million of transaction expense reimbursement to CCAP provided by Crescent Cap Advisors ▪ $20.0 million post - closing stock support program Revised Fee Structure ▪ Permanent reduction in annual base management fee from 1.50% to 1.25% ▪ Increase in preferred return hurdle from 6.0% to 7.0% annualized (1.75% quarterly) Timing ▪ Expected to file a joint proxy by early September ▪ Anticipated closing at the end of 2019, subject to shareholder approvals, regulatory approvals and other customary closing conditions (1) Estimated total consideration to be received at closing after taking into account certain post - closing adjustments. (2) Less certain tax dividends expected to be declared by ABDC after the date of the Merger Agreement.

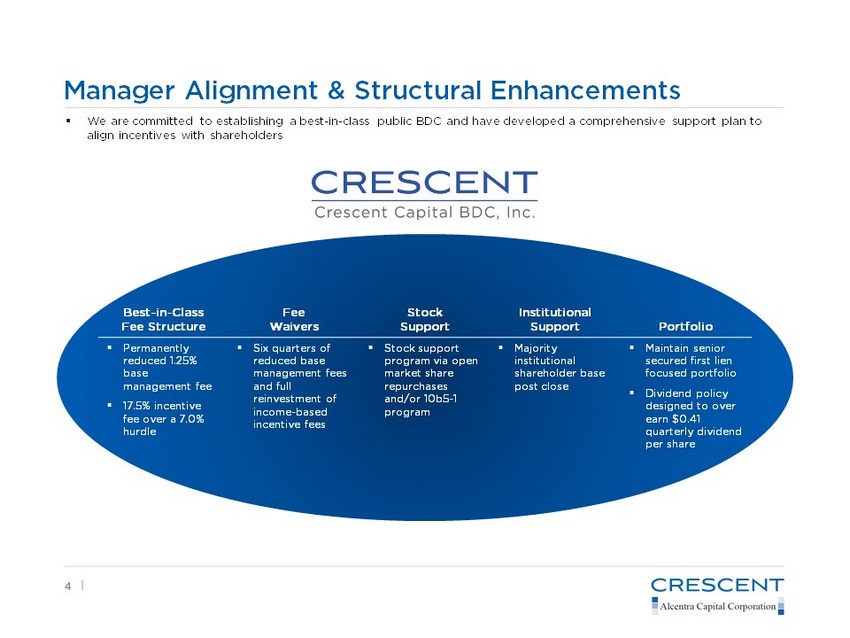

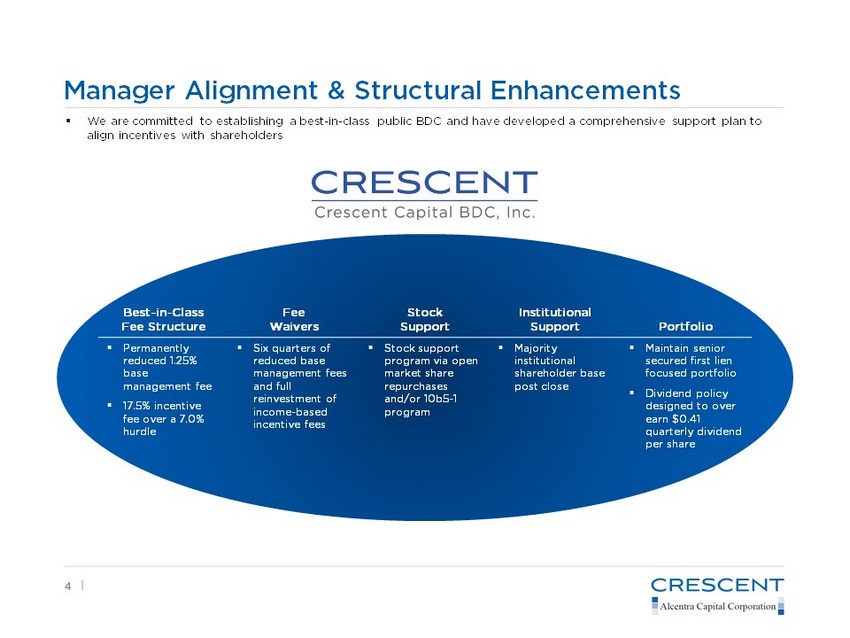

| Manager Alignment & Structural Enhancements 4 ▪ We are committed to establishing a best - in - class public BDC and have developed a comprehensive support plan to align incentives with shareholders Best - in - Class Fee Structure Fee Waivers Stock Support Institutional Support Portfolio ▪ Permanently reduced 1.25% base management fee ▪ 17.5% incentive fee over a 7.0% hurdle ▪ Six quarters of reduced base management fees and full reinvestment of income - based incentive fees ▪ Stock support program via open market share repurchases and/or 10b5 - 1 program ▪ Majority institutional shareholder base post close ▪ Maintain senior secured first lien focused portfolio ▪ Dividend policy designed to over earn $0.41 quarterly dividend per share

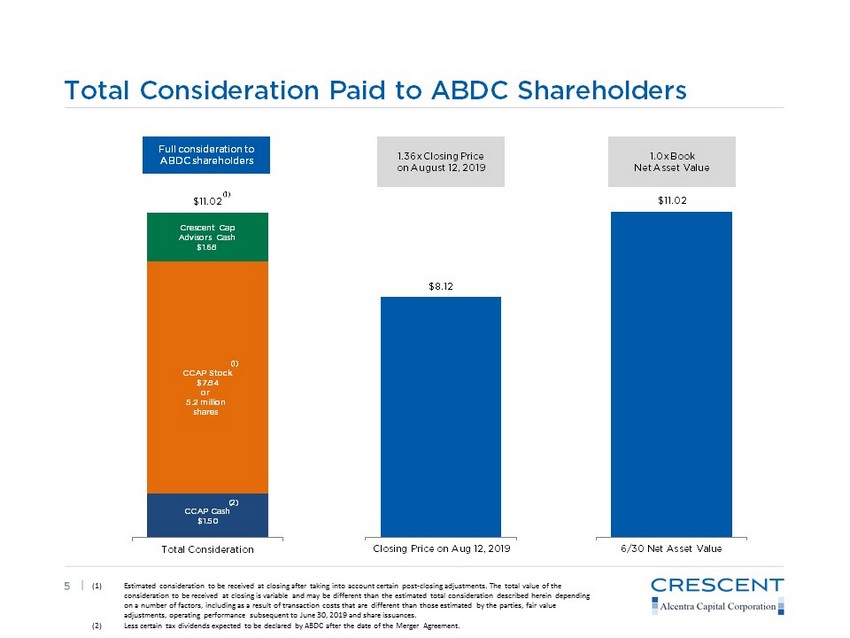

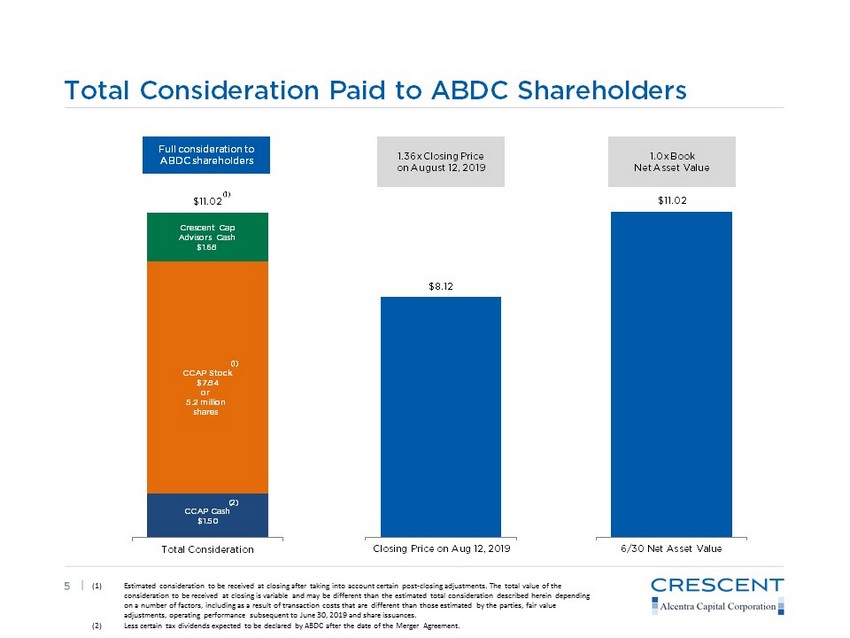

| Full consideration to ABDC shareholders Total Consideration Paid to ABDC Shareholders 5 CCAP Cash $1.50 CCAP Stock $7.84 Crescent Cap Advisors Cash $1.68 $11.02 Total Consideration (2) 1.36x Closing Price on August 12, 2019 1.0x Book Net Asset Value (1) Estimated consideration to be received at closing after taking into account certain post - closing adjustments. The total value of the consideration to be received at closing is variable and may be different than the estimated total consideration described herein depending on a number of factors, including as a result of transaction costs that are different than those estimated by the parties, fa ir value adjustments, operating performance subsequent to June 30, 2019 and share issuances. (2) Less certain tax dividends expected to be declared by ABDC after the date of the Merger Agreement. (1) (1) o r 5.2 million shares $11.02 6/30 Net Asset Value $8.12 Closing Price on Aug 12, 2019

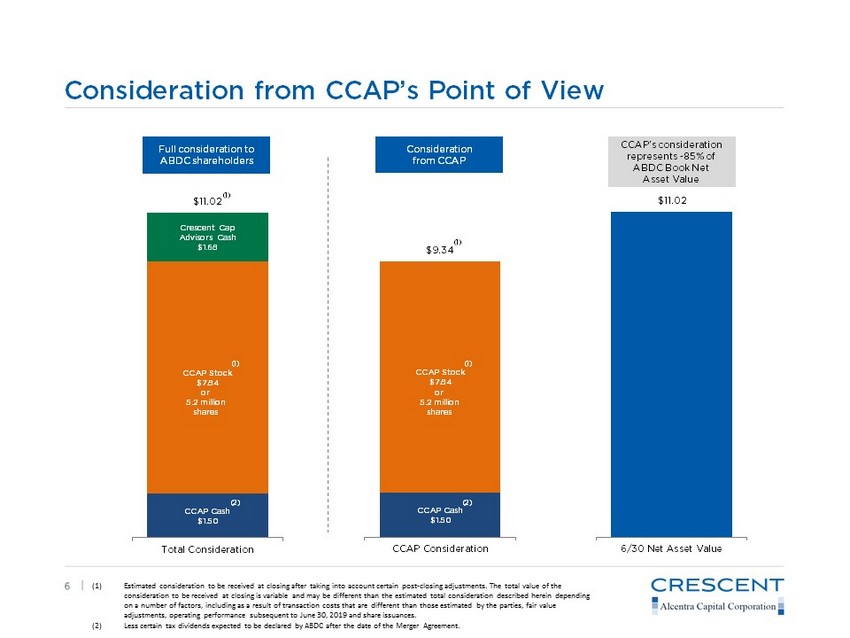

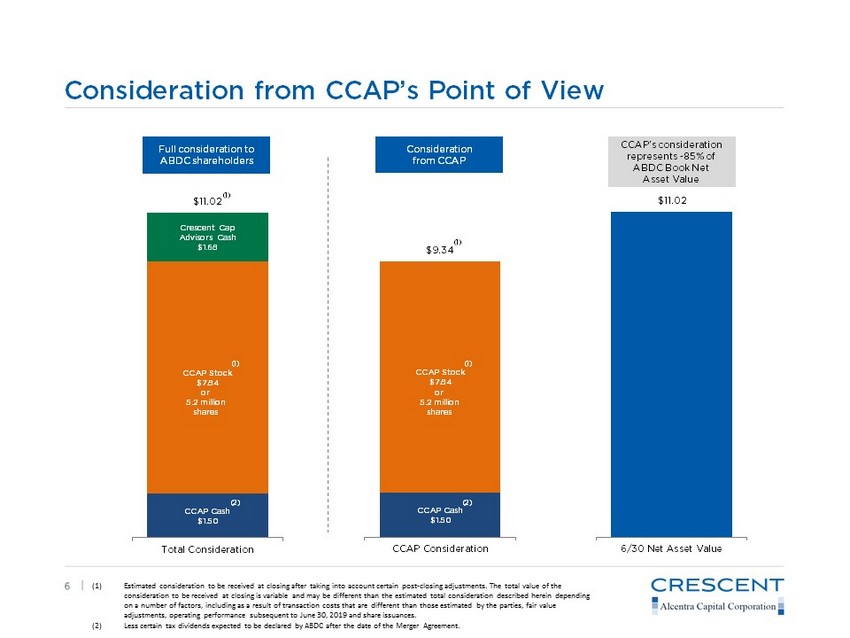

| CCAP’s consideration represents ~85% of ABDC Book Net Asset Value Consideration from CCAP Full consideration to ABDC shareholders Consideration from CCAP’s Point of View 6 CCAP Cash $1.50 CCAP Stock $7.84 Crescent Cap Advisors Cash $1.68 $11.02 Total Consideration (2) (1) CCAP Cash $1.50 CCAP Stock $7.84 $9.34 CCAP Consideration (2) (1) (1) (1) (1) Estimated consideration to be received at closing after taking into account certain post - closing adjustments. The total value of the consideration to be received at closing is variable and may be different than the estimated total consideration described herein depending on a number of factors, including as a result of transaction costs that are different than those estimated by the parties, fa ir value adjustments, operating performance subsequent to June 30, 2019 and share issuances. (2) Less certain tax dividends expected to be declared by ABDC after the date of the Merger Agreement. o r 5.2 million shares (1) o r 5.2 million shares $11.02 6/30 Net Asset Value

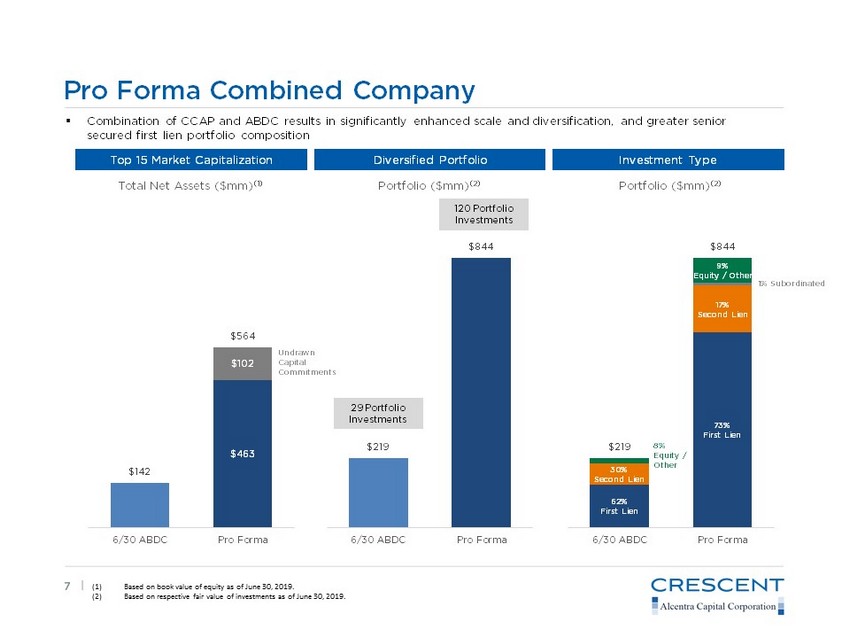

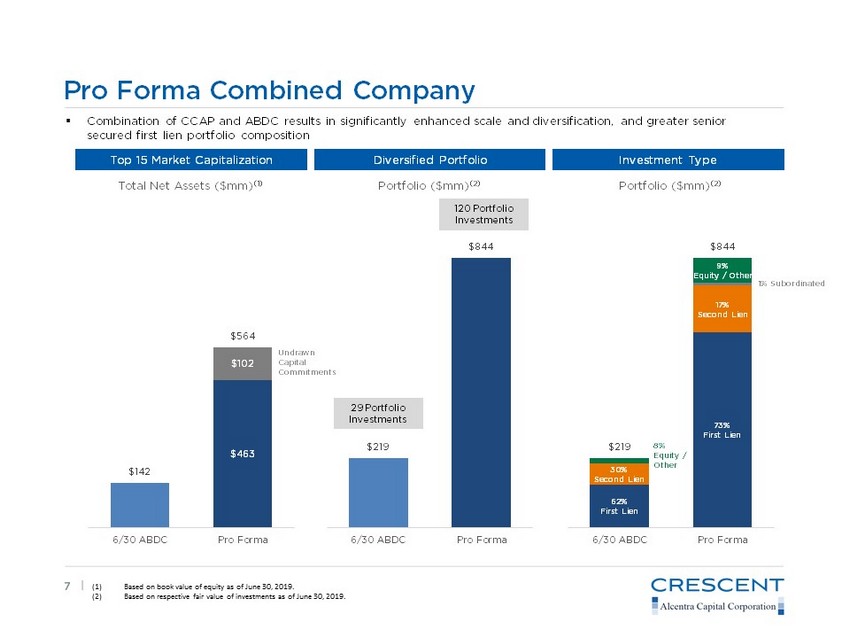

| ▪ Combination of CCAP and ABDC results in significantly enhanced scale and diversification, and greater senior secured first lien portfolio composition Pro Forma Combined Company 7 Top 15 Market Capitalization Diversified Portfolio Investment Type $463 $102 $142 $564 6/30 ABDC Pro Forma Total Net Assets ($mm ) ( 1) $219 $844 6/30 ABDC Pro Forma Portfolio ($mm ) (2) 120 Portfolio Investments 29 Portfolio Investments (1) Based on book value of equity as of June 30, 2019 . (2) Based on respective fair value of investments as of June 30, 2019. 62% First Lien 73% First Lien 30% Second Lien 17% Second Lien 9% Equity / Other $219 $844 6/30 ABDC Pro Forma Portfolio ($mm ) (2) 1% Subordinated 8 % Equity / Other Undrawn Capital Commitments

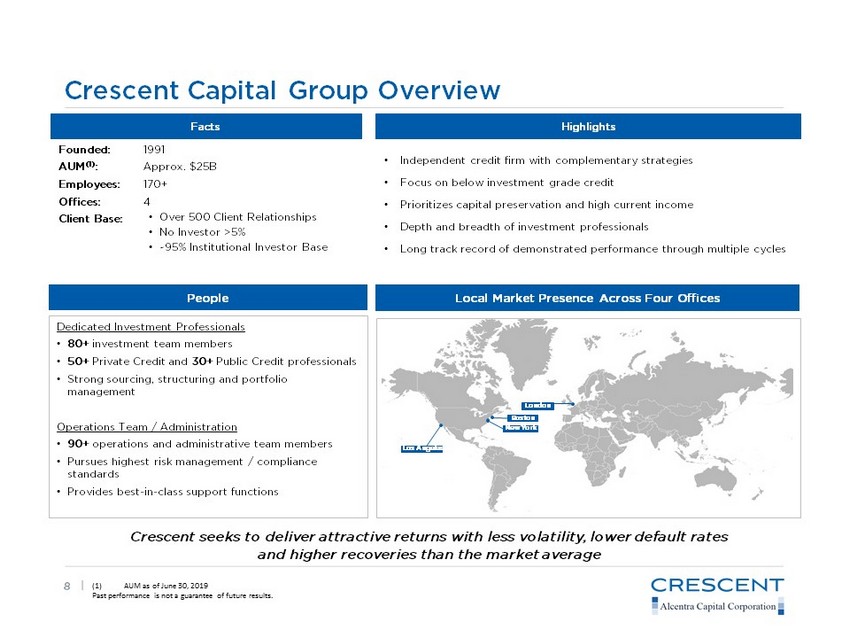

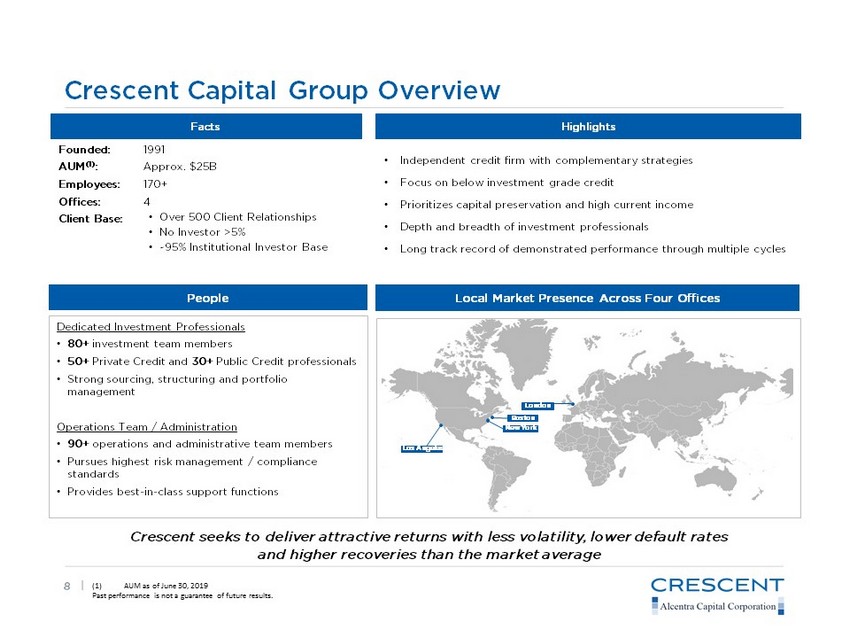

| Crescent Capital Group Overview 8 Crescent seeks to deliver attractive returns with less volatility, lower default rates and higher recoveries than the market average Founded: 1991 AUM (1) : Approx. $25B Employees: 170+ Offices: 4 Client Base: • Independent credit firm with complementary strategies • Focus on below investment grade credit • Prioritizes capital preservation and high current income • Depth and breadth of investment professionals • Long track record of demonstrated performance through multiple cycles Facts Highlights • Over 500 Client Relationships • No Investor >5 % • ~95% Institutional Investor Base (1) AUM as of June 30, 2019 Past performance is not a guarantee of future results. Local Market Presence Across Four Offices London Boston New York Los Angeles People Dedicated Investment Professionals • 80+ investment team members • 50+ Private Credit and 30+ Public Credit professionals • Strong sourcing, structuring and portfolio management Operations Team / Administration • 90+ operations and administrative team members • Pursues highest risk management / compliance standards • Provides best - in - class support functions

| The Crescent Private Credit Platform 9 • Market presence and relationships • Robust, proprietary sourcing • Disciplined investment approach • Experience across multiple cycles • Over 25 - year track record 1 2 3 4 5 Past performance is not indicative of future results. As used here, Private Credit refers to Crescent’s experience in the as set class generally and not to CCAP specifically

| Crescent’s Market Presence and Relationships 10 Past performance is not indicative of future results. Includes investment opportunities from Crescent Mezzanine, Crescent Dir ect Lending and Crescent European Specialty Lending since inception. As of March 31, 2019. With over 900 unique private equity firms Approximately 10,100 transactions reviewed Completed multiple transactions with over 70 unique sponsors At least one debt financing with over 200 unique sponsors Crescent has invested more than $18 billion in n early 400 private credit transactions

| Certain Risk Factors 11 Nature of Debt Securities . Debt and structured equity investments in highly leveraged companies involve a high degree of risk with no certainty of any return of capital . The debt securities in which Crescent Funds and strategies (“Crescent Funds”) and ABDC invest may be unsecured and subordinated to substantial amounts of senior debt, all or a portion which may be secured, may not be protected by financial covenants or limitations on additional debt, may have limited liquidity and may not be rated by a credit rating agency . Financial Markets . Instability in the securities markets may increase the risk inherent in Crescent Funds’ or any Combined Company’s investments in that the ability of portfolio companies to refinance or redeem debt and structured equity securities held by Crescent Funds and any Combined Company may depend on their ability to sell new securities in the market . Conflicts of Interest . Crescent and its affiliates manage multiple funds and accounts . Key personnel will devote some business time to managing those other funds and accounts . Obligations to certain funds and accounts could in certain circumstances adversely affect the price paid or received for investments by Crescent Funds and any Combined Company or the size or the portion of investments purchased by other Crescent Funds . Interest Rate Fluctuations . Interest rate fluctuations may negatively impact Crescent Funds’ investment opportunities and the rate of return on invested capital . An increase in interest rates would make it more expensive for portfolio companies to finance operations and indirectly affect the credit quality of Crescent Funds’ and any Combined Company’s investments . Lack of Diversification and Reliance on Portfolio Company Management . Crescent Funds and any Combined Company may invest in a limited number of investments and may be concentrated in only a few industries . Therefore, the aggregate return of Crescent Funds and any Combined Company may be adversely affected by the negative performance of a relatively few investments . The manager monitors portfolio company performance ; however, it is primarily the responsibility of portfolio company management to operate a portfolio company on a day to day basis and there is no assurance that such management will perform in accordance with Crescent Funds’ or ABDC’s expectations . Trading Market Risk . If the acquisition of ABDC is consummated, CCAP’s shares of common stock will be listed on a national securities exchange . After such listing, CCAP’s shares of common stock may trade at a discount from net asset value, which could limit CCAP’s ability to raise additional equity capital . CCAP cannot assure you that a trading market will develop for CCAP’s common stock after the acquisition of ABDC or, if one develops, that such trading market can be sustained . In addition, CCAP cannot predict the prices at which its common stock will trade, whether at, above or below NAV . Shares of closed - end investment companies, including BDCs, frequently trade at a discount from NAV, and CCAP’s common stock may also be discounted in the market . This characteristic of closed - end investment companies is separate and distinct from the risk that CCAP’s NAV per share may decline . In addition, if CCAP’s common stock trades below its NAV, CCAP will generally not be able to sell additional shares of its common stock to the public at its market price without, among other things, the requisite stockholders approve such a sale . Competitive Debt Environment . Crescent Funds compete with the public debt and equity markets and with other investors for suitable investment opportunities . There can be no assurance that Crescent Funds or the CCAP/ABDC combined company (the “Combined Company”) will be able to locate and complete investments, fully invest its committed capital or satisfy its rate of return objectives . Foreign Investments . Investments in non - U . S . companies involve risks not typically associated with the more developed U . S . capital markets, including risks relating to currency exchange, differences between the U . S . and foreign securities markets, differences in corporate and creditors’ rights laws and economic, and political risks . Dependence Upon Key Personnel . Decisions with respect to the investments and management of Crescent Funds and any Combined Company will be made exclusively by the Crescent management team . Investors generally have no right to take part in the management of Crescent Funds (and will not with respect to any Combined Company) and do not have an opportunity to evaluate the specific investments made by mezzanine funds or their terms . The success of Crescent Funds and any Combined Company depends or will depend significantly upon the skill and expertise of the principal members of the Crescent management team . The departure of any of those principal members could have a material adverse effect on mezzanine funds . No Assurance of Investment Return . There can be no assurance that Crescent Funds and any Combined Company will be able to generate returns for its investors or that the returns will be commensurate with the risks of investing in the type of companies and transactions described herein . Accordingly, an investment in Crescent Funds or any Combined Company should only be considered by persons who can afford a loss of their entire investment . Past activities or investment return results of investment entities associated with the Crescent or ABDC management team or their respective principal members, including their prior funds, provide no assurance of future success or return results . The fees and expenses charged in connection with an investment in Crescent Funds and any Combined Company may be higher than the fees and expenses of other investment alternatives and may offset profits . Use of Leverage . Certain Crescent Funds and any Combined Company may leverage the cost of its investments . To the extent Crescent Funds or any Combined Company purchases securities with borrowed funds, its net assets will tend to increase or decrease at a greater rate than if borrowed funds are not used . If the interest expense on borrowings were to exceed the net return on the portfolio of securities purchased with borrowed funds, Crescent Funds’ and any Combined Company’s use of leverage would result in a lower rate of return than if Crescent Funds were not leveraged . Overall, the use of leverage, while providing the opportunity for higher returns, also increases volatility and the risk of loss . No Regulatory Approval . Neither the Crescent Funds nor ABDC has been approved or disapproved by any securities regulatory authority of any state, by the Securities and Exchange Commission, or any similar authority in another jurisdiction . Potential Acquisition of ABDC . There are a number of risks in connection with the acquisition of ABDC and other transactions contemplated by the merger agreement (the "Proposed Transaction") . The Proposed Transaction may not be completed in the time frame expected by CCAP and ABDC, or at all . The Proposed Transaction may result in unexpected costs, charges or expenses, including as a result of delay in completing the Proposed Transaction . The financial performance of any Combined Company following the Proposed Transaction is uncertain, and the Combined Company may fail to realize the anticipated benefits of the Proposed Transaction . Furthermore, there can be no assurance that any Combined Company following the Proposed Transaction will be able to implement its business strategy . Lastly, there is a risk of stockholder litigation in connection with the Proposed Transaction that may affect the timing or occurrence of the Proposed Transaction, which may result in significant costs of defense, indemnification and liability .