Filed by Crescent Capital BDC, Inc. pursuant to Rule 425 under the Securities Act of 1933 and deemed filed under Rule 14a-12 of the Securities Exchange Acet of 1934 Subject Company: Alcentra Capital Corporation Commission File No. 814-01064Filed by Crescent Capital BDC, Inc. pursuant to Rule 425 under the Securities Act of 1933 and deemed filed under Rule 14a-12 of the Securities Exchange Acet of 1934 Subject Company: Alcentra Capital Corporation Commission File No. 814-01064

||

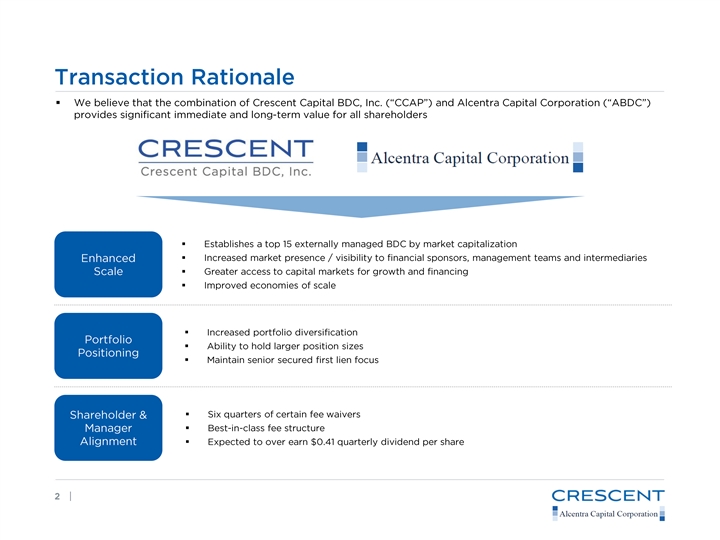

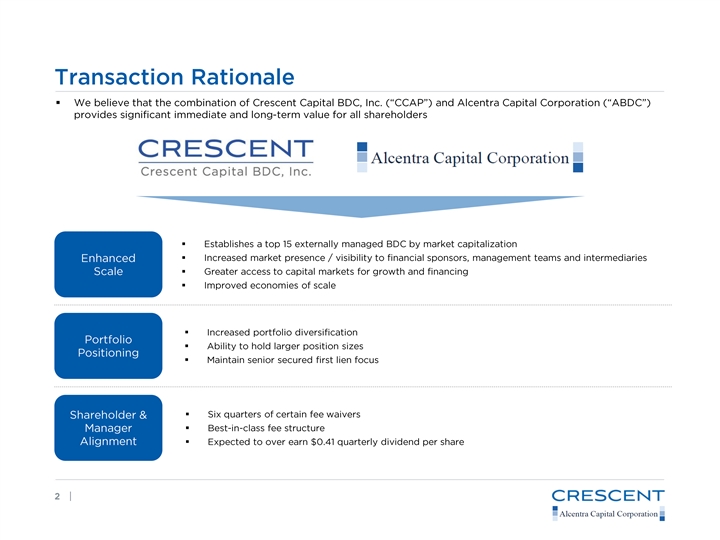

§ § § § § § § § § § § |§ § § § § § § § § § § |

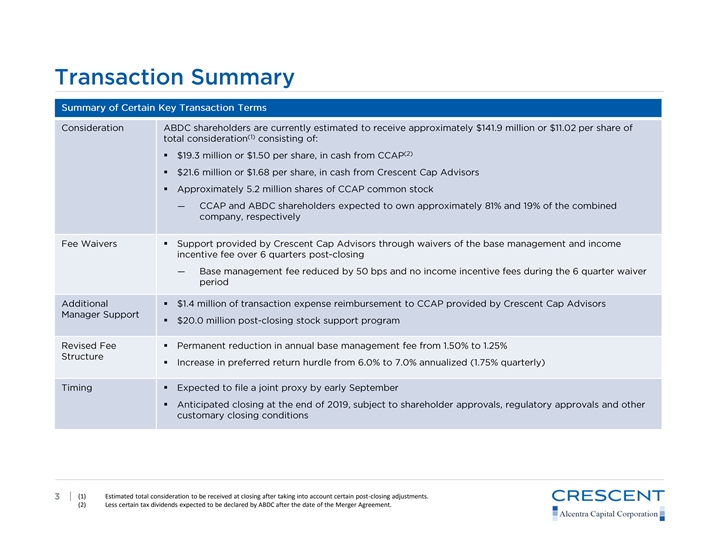

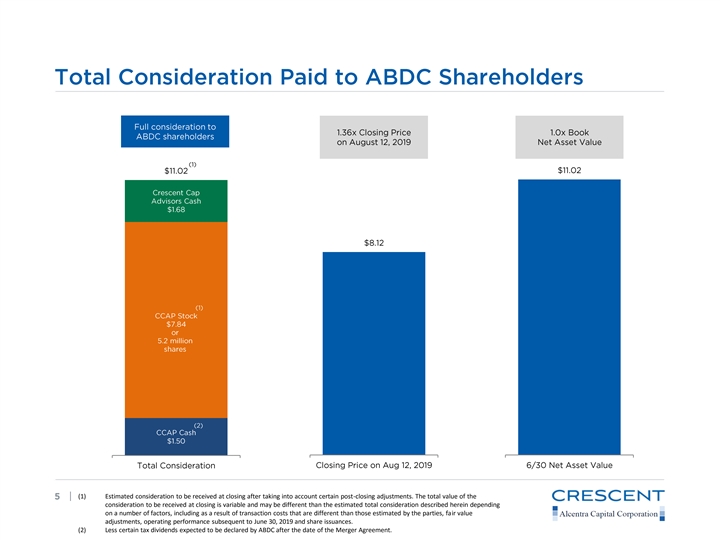

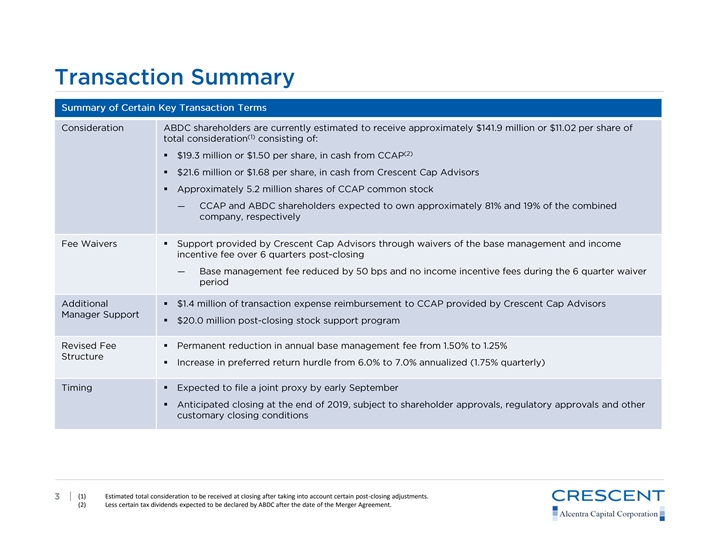

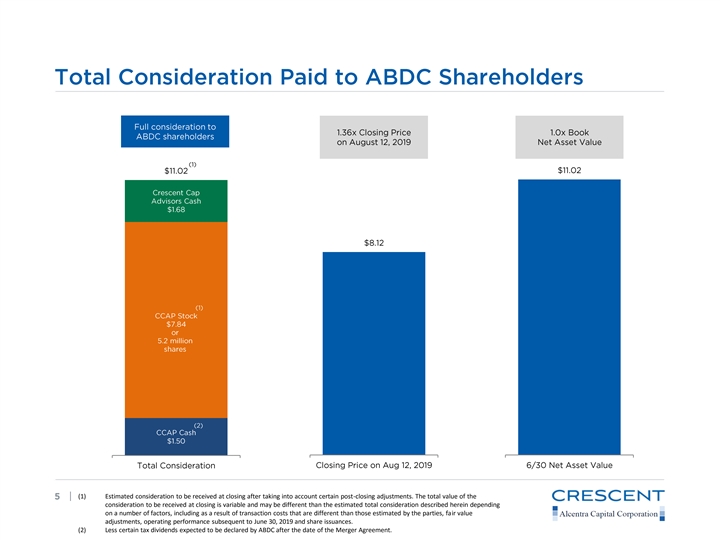

§ § § ― § ― § § § § § § | (1) Estimated total consideration to be received at closing after taking into account certain post-closing adjustments. (2) Less certain tax dividends expected to be declared by ABDC after the date of the Merger Agreement.§ § § ― § ― § § § § § § | (1) Estimated total consideration to be received at closing after taking into account certain post-closing adjustments. (2) Less certain tax dividends expected to be declared by ABDC after the date of the Merger Agreement.

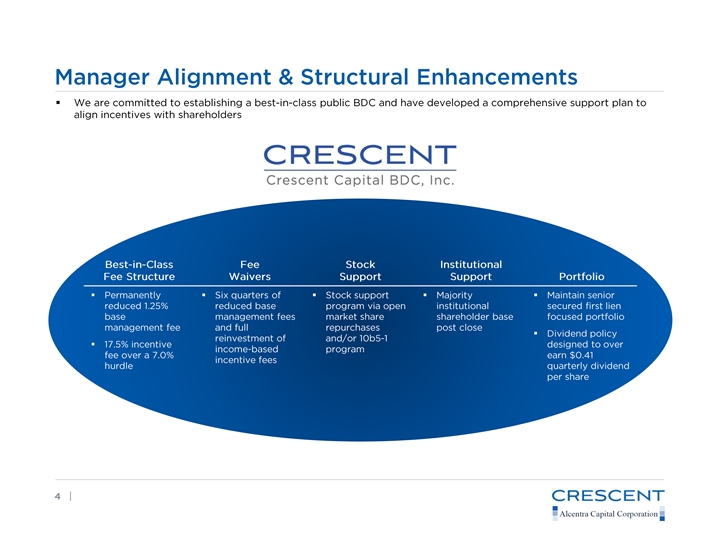

§ §§§§§ § § |§ §§§§§ § § |

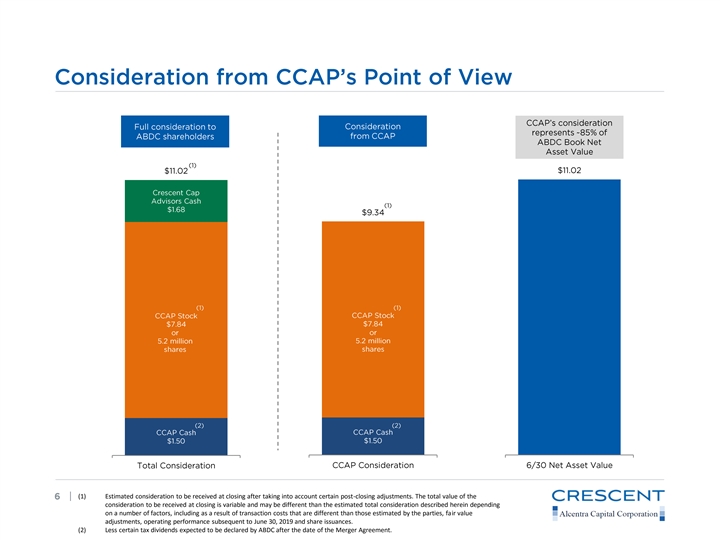

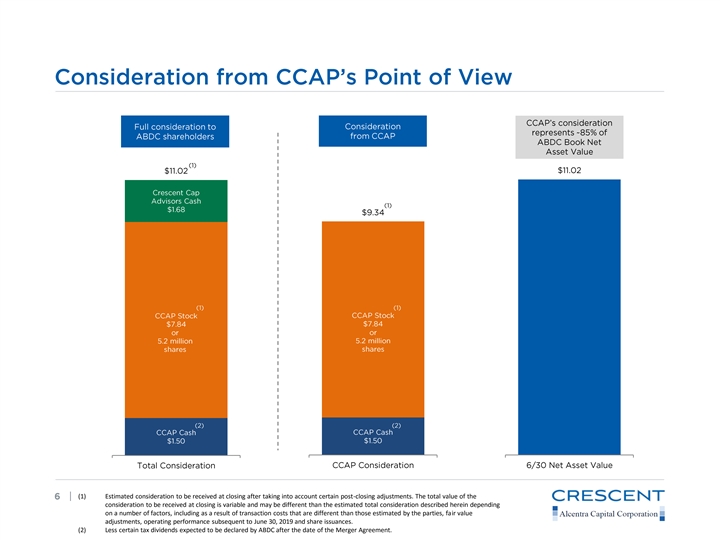

| (1) Estimated consideration to be received at closing after taking into account certain post-closing adjustments. The total value of the consideration to be received at closing is variable and may be different than the estimated total consideration described herein depending on a number of factors, including as a result of transaction costs that are different than those estimated by the parties, fair value adjustments, operating performance subsequent to June 30, 2019 and share issuances. (2) Less certain tax dividends expected to be declared by ABDC after the date of the Merger Agreement.| (1) Estimated consideration to be received at closing after taking into account certain post-closing adjustments. The total value of the consideration to be received at closing is variable and may be different than the estimated total consideration described herein depending on a number of factors, including as a result of transaction costs that are different than those estimated by the parties, fair value adjustments, operating performance subsequent to June 30, 2019 and share issuances. (2) Less certain tax dividends expected to be declared by ABDC after the date of the Merger Agreement.

| (1) Estimated consideration to be received at closing after taking into account certain post-closing adjustments. The total value of the consideration to be received at closing is variable and may be different than the estimated total consideration described herein depending on a number of factors, including as a result of transaction costs that are different than those estimated by the parties, fair value adjustments, operating performance subsequent to June 30, 2019 and share issuances. (2) Less certain tax dividends expected to be declared by ABDC after the date of the Merger Agreement.| (1) Estimated consideration to be received at closing after taking into account certain post-closing adjustments. The total value of the consideration to be received at closing is variable and may be different than the estimated total consideration described herein depending on a number of factors, including as a result of transaction costs that are different than those estimated by the parties, fair value adjustments, operating performance subsequent to June 30, 2019 and share issuances. (2) Less certain tax dividends expected to be declared by ABDC after the date of the Merger Agreement.

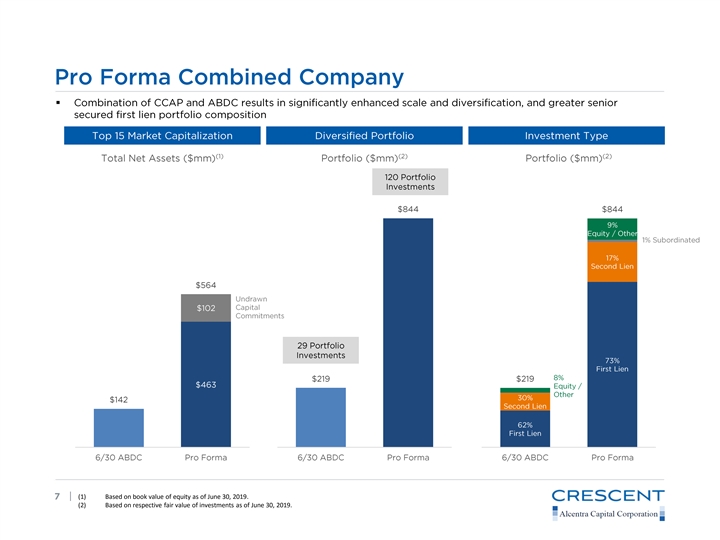

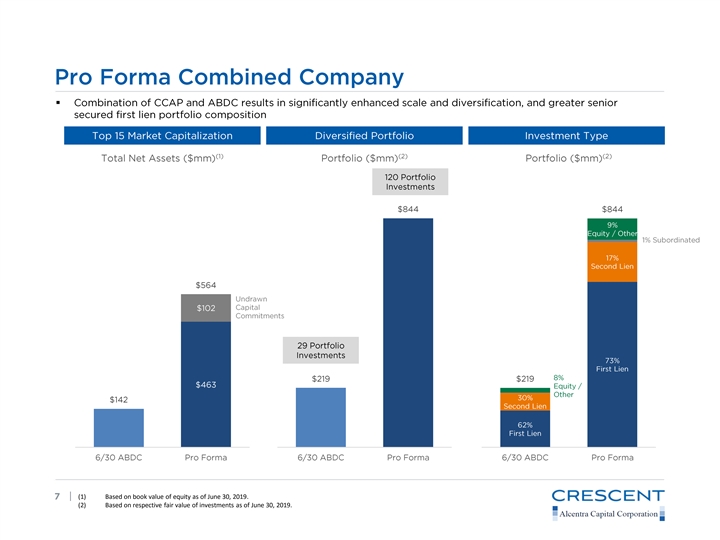

§ | (1) Based on book value of equity as of June 30, 2019. (2) Based on respective fair value of investments as of June 30, 2019. § | (1) Based on book value of equity as of June 30, 2019. (2) Based on respective fair value of investments as of June 30, 2019.

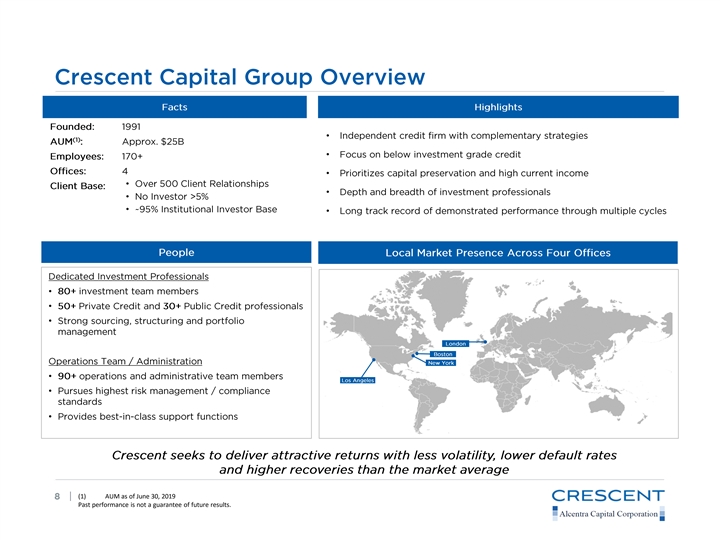

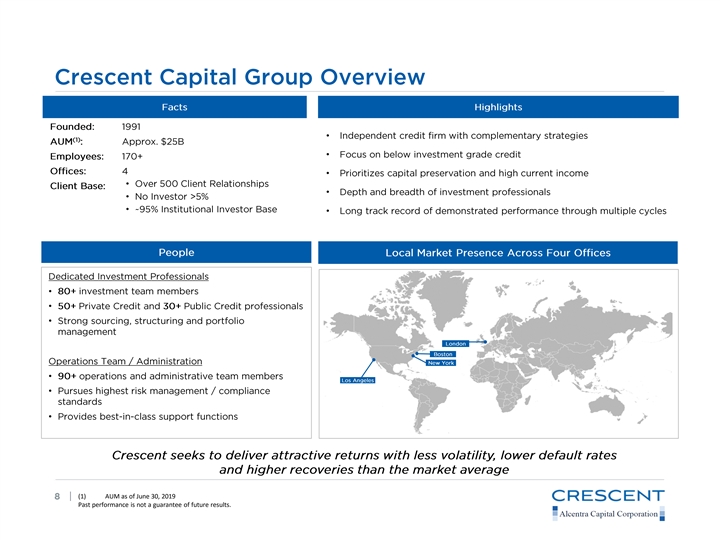

• • • • • • • • • • • • • • | (1) AUM as of June 30, 2019 Past performance is not a guarantee of future results.• • • • • • • • • • • • • • | (1) AUM as of June 30, 2019 Past performance is not a guarantee of future results.

1 • Market presence and relationships 2 • Robust, proprietary sourcing 3 • Disciplined investment approach • Experience across multiple cycles 4 5 • Over 25-year track record | Past performance is not indicative of future results. As used here, Private Credit refers to Crescent’s experience in the asset class generally and not to CCAP specifically1 • Market presence and relationships 2 • Robust, proprietary sourcing 3 • Disciplined investment approach • Experience across multiple cycles 4 5 • Over 25-year track record | Past performance is not indicative of future results. As used here, Private Credit refers to Crescent’s experience in the asset class generally and not to CCAP specifically

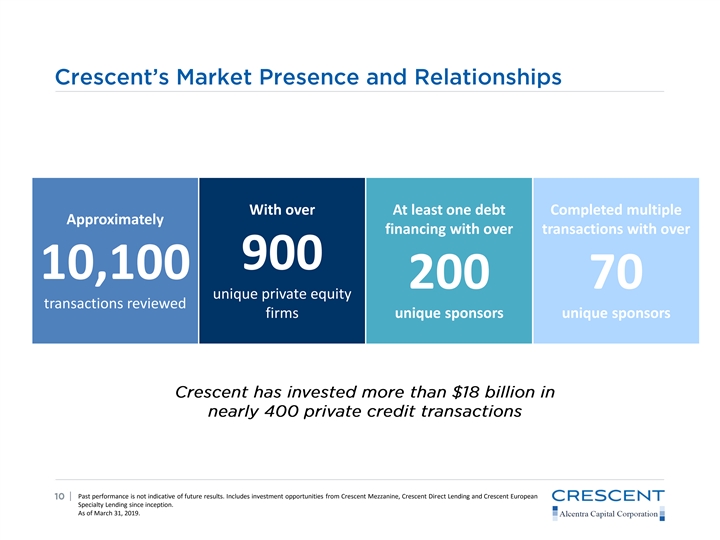

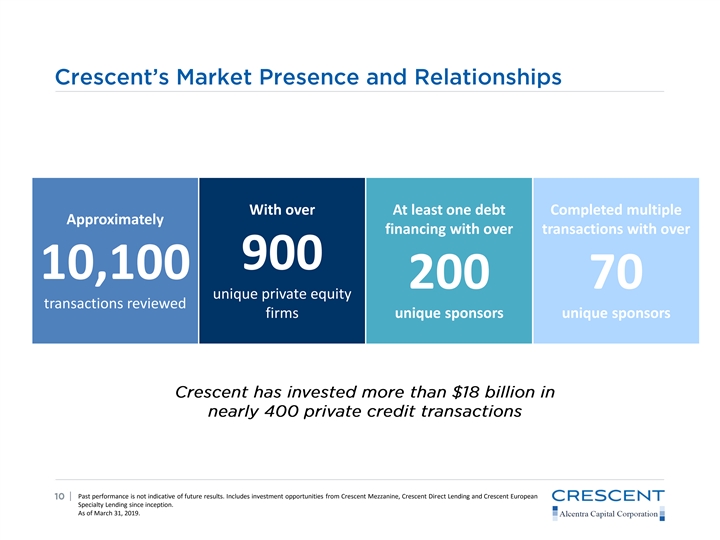

With over At least one debt Completed multiple Approximately financing with over transactions with over 900 10,100 200 70 unique private equity transactions reviewed firms unique sponsors unique sponsors | Past performance is not indicative of future results. Includes investment opportunities from Crescent Mezzanine, Crescent Direct Lending and Crescent European Specialty Lending since inception. As of March 31, 2019.With over At least one debt Completed multiple Approximately financing with over transactions with over 900 10,100 200 70 unique private equity transactions reviewed firms unique sponsors unique sponsors | Past performance is not indicative of future results. Includes investment opportunities from Crescent Mezzanine, Crescent Direct Lending and Crescent European Specialty Lending since inception. As of March 31, 2019.

||