Advisory Agreement, cash equivalents means U.S. government securities and commercial paper maturing within one year of purchase.

For the three and nine months ended September 30, 2019, the Company incurred management fees, which are net of waived amounts, of $1,249,656 and $3,352,751, respectively, of which $1,249,656 was payable at September 30, 2019. For the three and nine months ended September 30, 2018, the Company incurred management fees, which are net of waived amounts, of $888,973 and $2,421,971, respectively, of which $888,973 was payable at September 30, 2018.

The Advisor has voluntarily waived its right to receive management fees on the investment in GACP II for any period in which GACP II remains in the investment portfolio. For the three and nine months ended September 30, 2019, management fees of $41,175 and $106,892, respectively, were waived attributable to the Company’s investment in GACP II.

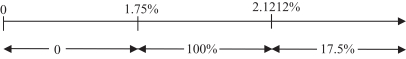

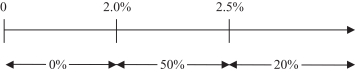

The Incentive Fees consists of two parts. The first part, the income incentive fee, is calculated and payable quarterly in arrears and (a) equals 100% of the excess of thepre-incentive fee net investment income for the immediately preceding calendar quarter, over a preferred return of 1.5% per quarter (6% annualized) (the “Hurdle”), and acatch-up feature until the Advisor has received, (i) prior to a Qualified IPO, 15%, or (ii) after a Qualified IPO, 17.5%, of thepre-incentive fee net investment income for the current quarter up to, (i) prior to a Qualified IPO, 1.7647%, or (ii) after a Qualified IPO, 1.8182% (the“Catch-up”), and (b) (i) prior to a Qualified IPO, 15% or (ii) after a Qualified IPO, 17.5%, of all remainingpre-incentive fee net investment income above the“Catch-up.”

Pre-incentive fee net investment income means interest income, dividend income and any other income (including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, diligence and consulting fees or other fees that the Company receives from portfolio companies) accrued during each calendar quarter, minus operating expenses for such quarter (including the base management fee, expenses payable under the Administration Agreement and any interest expense and distributions paid on any issued and outstanding debt or preferred stock, but excluding the incentive fee).Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as market discount, OID, debt instruments with PIK interest, preferred stock with PIK dividends and zero coupon securities), accrued income that the Company has not yet received in cash.Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.Pre-incentive fee net investment income will be compared to a “Hurdle Amount” equal to the product of (i) the Hurdle rate of 1.50% per quarter (6.00% annualized) and (ii) our net assets (defined as total assets less indebtedness, before taking into account any incentive fees payable during the period), at the end of the immediately preceding calendar quarter, subject to a“catch-up” provision incurred at the end of each calendar quarter.

At the 2018 Annual Meeting of Stockholders, the Company received shareholder approval to extend the end of the Commitment Period to the earlier of (i) a Qualified IPO and (ii) June 30, 2020. In exchange for the Commitment Period extension, the Advisor agreed to waive its rights under the Investment Advisory Agreement to the income incentive fee for the period from April 1, 2018 through the earlier of (i) the date of a Qualified IPO or (ii) the dissolution and wind down of the Company.

Upon a Qualified IPO and the Advisor begins to earn income incentive fees, the Advisor will voluntarily waive the income incentive fees attributable to the investment income accrued by the Company as a result of its investment in GACP II.

For the three and nine months ended September 30, 2019, the Company incurred income incentive fees, which are net of waived amounts, of $0 and $0, respectively, of which $0 was payable at September 30, 2019. For the three and nine months ended September 30, 2018, the Company incurred income incentive fees of $0 and $554,977, respectively, of which $0 was payable at September 30, 2018.

F-80