considered an independent director, the Board of Directors must determine that the person does not have any direct or indirect material relationship with Allergan (other than as serving as a director of Allergan). The Board of Directors considers any and all additional relevant facts and circumstances in making an independence determination.

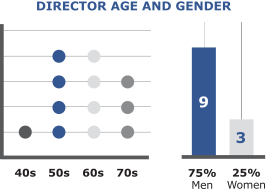

Our Board of Directors has determined that all but two of the people standing for election to our Board, which is at least a majority, have no direct or indirect material relationship with us (other than as our director, as applicable) and that these people are independent within the meaning of the independence standards promulgated by the SEC and the NYSE. The Board of Directors has determined that Nesli Basgoz, M.D., Joseph H. Boccuzi, Christopher W. Bodine, Adriane M. Brown, Carol Anthony (John) Davidson, Christopher J. Coughlin, Catherine M. Klema, Peter J. McDonnell, M.D., Patrick J. O’Sullivan and Fred G. Weiss have no material relationship with the Company and constitute (or, in the case of Mr. Davidson, if elected will constitute) independent directors. Mr. Bisaro has been determined to be not independent because he has been an employee of the Company within the last three years. Mr. Saunders has been determined to be not independent because he is our Chief Executive Officer.

In making its independence determinations, the Board of Directors reviewed transactions and relationships between, on the one hand, each director or any member of his or her immediate family, and, on the other hand, the Company or one of its subsidiaries or affiliates, in each case based on information provided by the director, our records and publicly available information. Each of the reviewed transactions and arrangements were entered into in the ordinary course of business and none of the reviewed business transactions, donations or grants involved an amount that exceeded the greater of $1 million or 2% of either company’s revenues with respect to transactions where a director served as an employee or general partner of the entity party to the transaction or any member of his or her immediate family or spouse served as an executive officer or general partner of any such entity. None of ournon-employee directors directly or indirectly provides any professional or consulting services to us and none of our directors currently has or has had any direct or indirect material interest in any of the transactions and arrangements that exceeded the greater of $1 million or 2% of either company’s revenues.

Additionally, in making its independence determinations, the Board of Directors considered the fact that many of our independent directors currently serve or have previously served within the last three years as a professor, trustee, director, or member of a board, council or committee for one or more charitable organizations (including research or scientific institutions), hospitals, for profit corporations or any other entity with which Allergan has business transactions or to which Allergan may make grants. These business transactions or grants may include, among other things, purchases of services and supplies, licensing transactions, healthcare sponsorships and programs, research and development and clinical trials, activities, and limited consulting services.

The Board of Directors has determined that the transactions and activities described above were made in the ordinary course and did not affect the independence of the directors involved.

Risk Oversight

Risk oversight continues to betop-of-mind for our Board of Directors. How well we manage risk will ultimately determine our success.

Our Company faces a number of risks, including economic, financial, legal, regulatory, competition, compliance and reputational risks. Primaryday-to-day responsibility for the identification, assessment, and prioritization of risks, as well as for the application of resources to minimize, control, and mitigate these risks, lies with senior management. Our Board of Directors’ responsibility with respect to risk is in the area of risk oversight: the Board plays an active role in understanding and overseeing the management of risks that our Company faces and ensures that senior management has the framework and processes in place to effectively and adequately monitor and manage these risks.

Broad risk matters, such as setting the Company’s risk appetite and ensuring its fit with strategy, are matters for the full Board. However, certain risk management oversight responsibilities are delegated to Board Committees. The Board Committees meet regularly and report back to the full Board. All Board Committees foster open communication with the Board, which enables the Board to coordinate its oversight of risk and identify risk interrelationships between Committees.

| | | | |

| | 28 | | |

FOR

FOR AGAINST

AGAINST

Shareholders of Record

Shareholders of Record Beneficial Owners

Beneficial Owners