Exhibit 99.3 VINCE HOLDING CORP. TO ENTER INTO A TRANSFORMATIVE STRATEGIC PARTNERSHIP WITH AUTHENTIC BRANDS GROUP INVESTOR PRESENTATION APRIL 2023

Disclaimer This Management Presentation (this “Presentation”) is the property of Vince Holding Corp. and its subsidiaries (collectively, “Vince” or the “Company”). By accepting this Presentation, the recipient acknowledges that it has read, understood and accepted the terms of this disclaimer. This Presentation is not a formal offer to sell or solicitation of an offer to buy the Company’s securities. Information contained in this Presentation should not be relied upon as advice to buy or sell or hold such securities or as an offer to sell such securities. No representation or warranty, express or implied, is or will be given by the Company or its affiliates, directors, officers, partners, employees, agents or advisers or any other person as to the accuracy, completeness, reasonableness or fairness of any information contained in this Presentation and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements relating thereto. By acceptance of this Presentation, each recipient agrees not to copy, reproduce or distribute to others the Presentation, in whole or in part, without the prior written consent of the Company, and will promptly return this Presentation to the Company upon request. This Presentation may contain forward-looking statements under the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact or relating to present facts or current conditions included in this presentation are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements include statements regarding, among other things, our current expectations about possible or assumed future results of operations of the Company, the expected completion and timing of the ABG Transaction and other information relating to the ABG Transaction and may include words such as “anticipate,” “estimate,” “expect,” “project,” “target,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. These forward-looking statements are not guarantees of actual results, and our actual results may differ materially from those suggested in the forward-looking statements. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control, including those as set forth from time to time in our Securities and Exchange Commission (the “SEC”) filings, including those described in our Annual Report on Form 10-K under “Item 1A – Risk Factors” filed with the SEC on April 29, 2022. Any forward-looking statement made by the Company in this Presentation speaks only as of the date on which it is made. Except as may be required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Market data and industry information used in this presentation are based on independent industry surveys and publications and other publicly available information prepared by third party sources. Although the Company believes that these sources are reliable as of their respective dates, it has not verified the accuracy or completeness of this information from independent sources.

4 Transformative Strategic Partnership to Position Vince for Long-Term Success • Vince Holding Corp. (“VNCE”) and Authentic Brands Group (“Authentic”) to enter into a licensing arrangement whereby VNCE contributes its intellectual property to a newly formed “ABG Vince” entity for a total consideration of $76.5 million in cash from Authentic and a 25% membership interest in ABG Vince. • In connection with the Transaction, VNCE will enter into an exclusive, long-term license agreement to use the contributed intellectual property for VNCE’s existing business in a manner consistent with the Company’s current wholesale, retail and e-commerce operations. The License Agreement contains an initial ten-year term and eight ten- year renewal options allowing VNCE to renew the agreement. • Transaction strengthens and deleverages VNCE’s balance sheet allowing for greater flexibility to accelerate strategic growth initiatives.

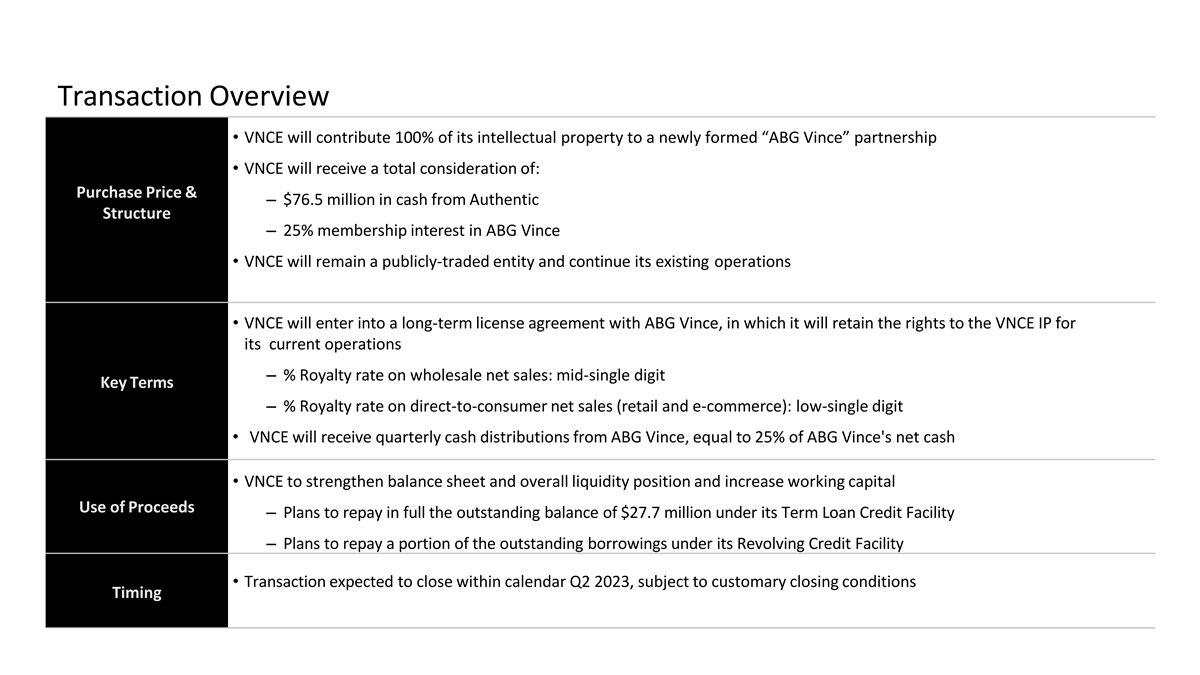

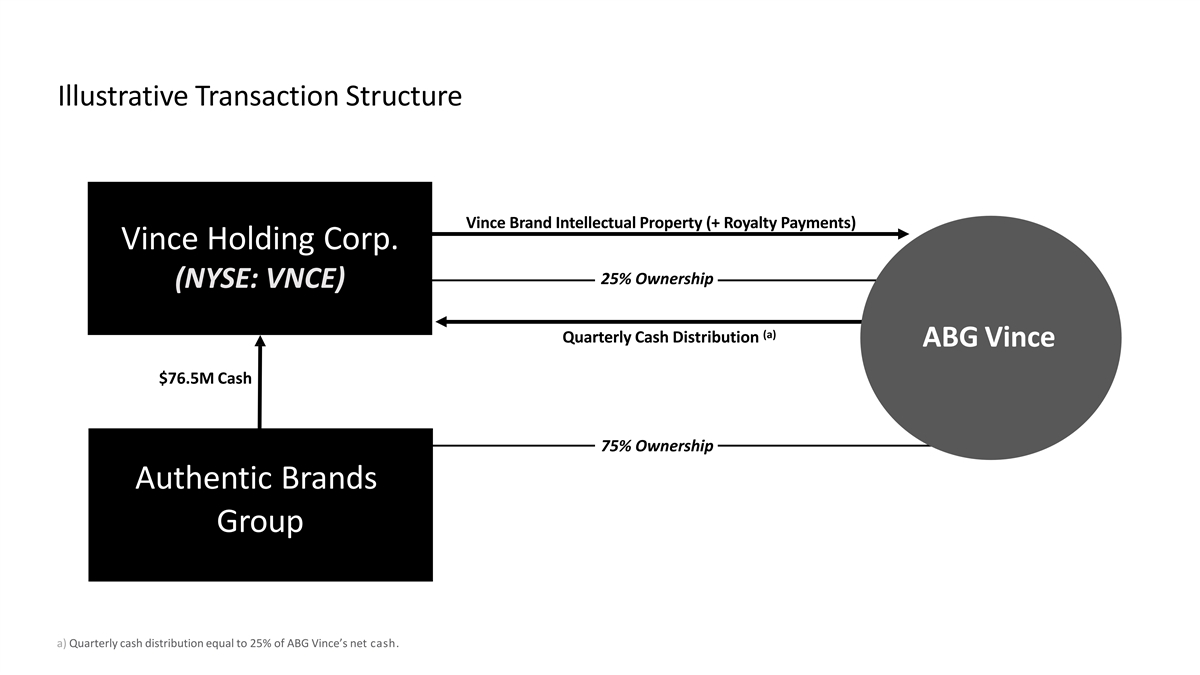

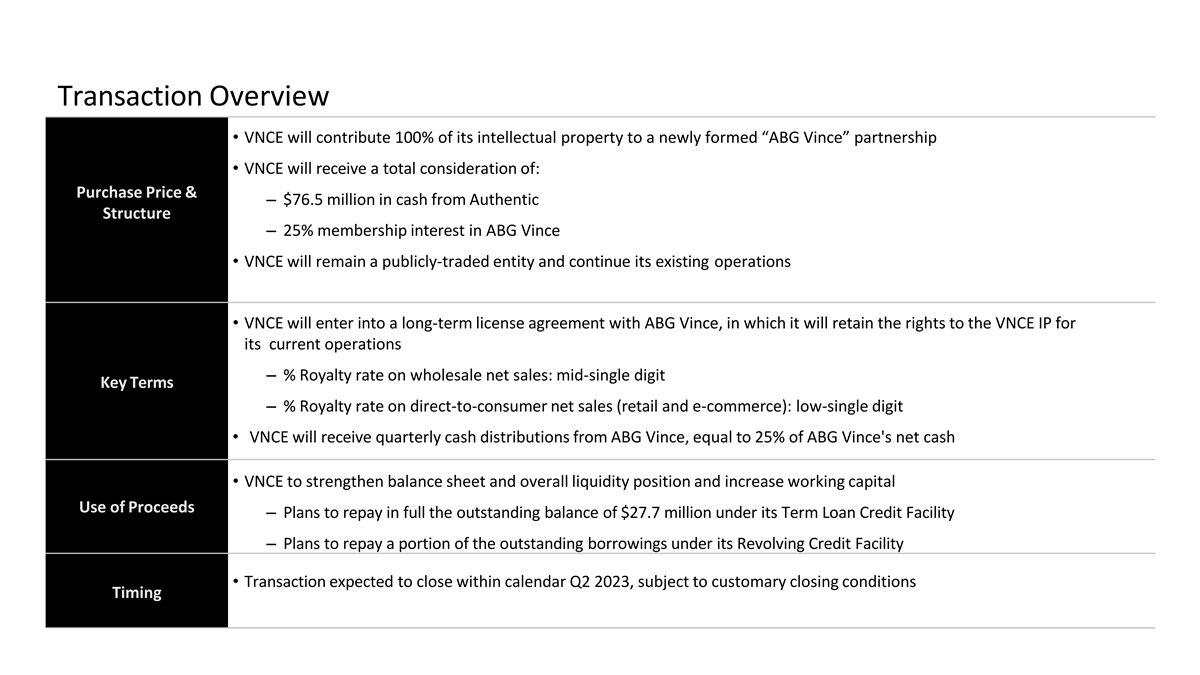

Transaction Overview • VNCE will contribute 100% of its intellectual property to a newly formed “ABG Vince” partnership • VNCE will receive a total consideration of: Purchase Price & – $76.5 million in cash from Authentic Structure – 25% membership interest in ABG Vince • VNCE will remain a publicly-traded entity and continue its existing operations • VNCE will enter into a long-term license agreement with ABG Vince, in which it will retain the rights to the VNCE IP for its current operations – % Royalty rate on wholesale net sales: mid-single digit Key Terms – % Royalty rate on direct-to-consumer net sales (retail and e-commerce): low-single digit • VNCE will receive quarterly cash distributions from ABG Vince, equal to 25% of ABG Vince's net cash • VNCE to strengthen balance sheet and overall liquidity position and increase working capital Use of Proceeds – Plans to repay in full the outstanding balance of $27.7 million under its Term Loan Credit Facility – Plans to repay a portion of the outstanding borrowings under its Revolving Credit Facility • Transaction expected to close within calendar Q2 2023, subject to customary closing conditions Timing

* 551M+ S O CI AL M EDI A F OLLOWERS 10B+ AN N U AL S O CIAL M EDI A I MPR ES SIO NS 1B+ AN N U AL WEB VI SI TO RS 198B+ AN N U AL PR I M PR ESSI ONS Authentic Brands Group (Authentic) is a global brand development, marketing and entertainment platform, which owns a portfolio of more than 40 iconic and world-renowned Lifestyle, Entertainment and Media brands. * * 40+ $28.5B+ 11,300+ B R AN DS, I CO NS & GLO B AL AN N UAL S TO R ES & S HO P-IN-SHO PS LEGEN DS R ETAIL S ALES 1,300+ 379K+ 150+ PAR TN ER N ETWOR K PO I N TS OF S ALE CO U N TRI ES * Pending acquisition in Q3 2023

L I F E STYL E LUXE FASHION CLASSIC BOARD SPORTS HOME ACTIVE & OUTDOOR * * * * * * * E N T E R TA I N M E N T MEDIA STUDIOS FINE ART EVENTS & EXPERIENCES FOOD & BEVERAGE ICONS LIVING LEGENDS TERRY O’NEILL ED CARAEFF SEA RCH TED WILLIAMS EVA SERENY GERED MANKOWITZ

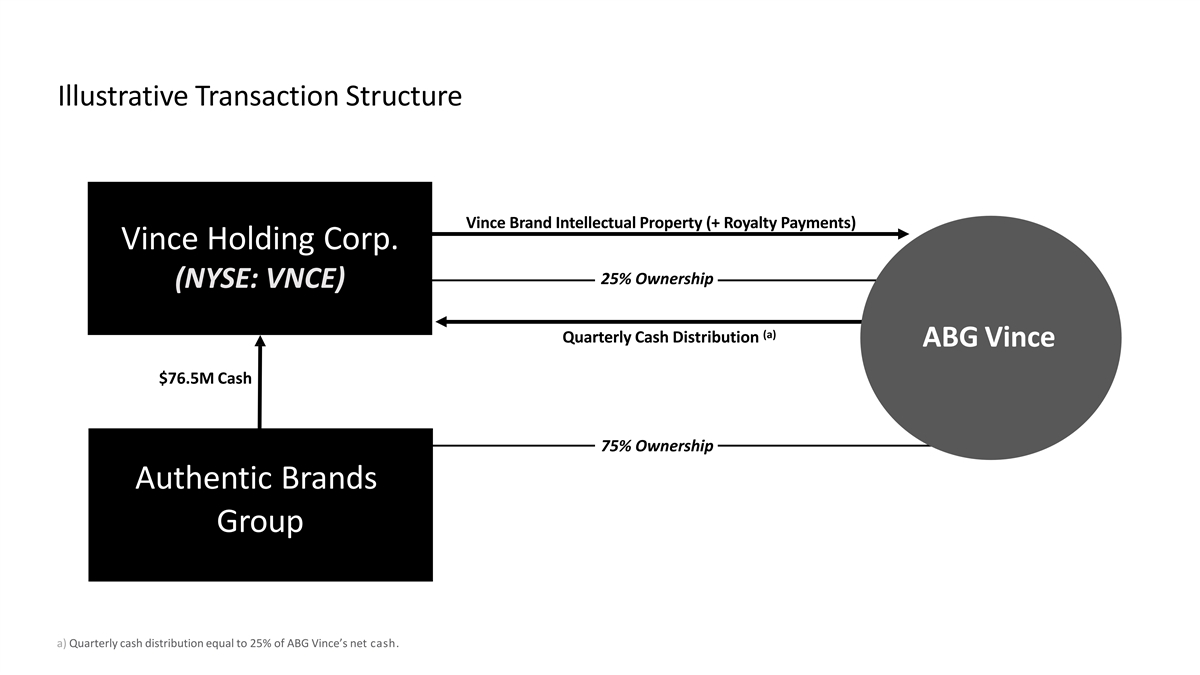

Illustrative Transaction Structure Vince Brand Intellectual Property (+ Royalty Payments) Vince Holding Corp. 25%Ownership (NYSE:VNCE) (a) Quarterly Cash Distribution ABG Vince $76.5M Cash 75%Ownership Authentic Brands Group a) Quarterly cash distribution equal to 25% of ABG Vince’s net cash.

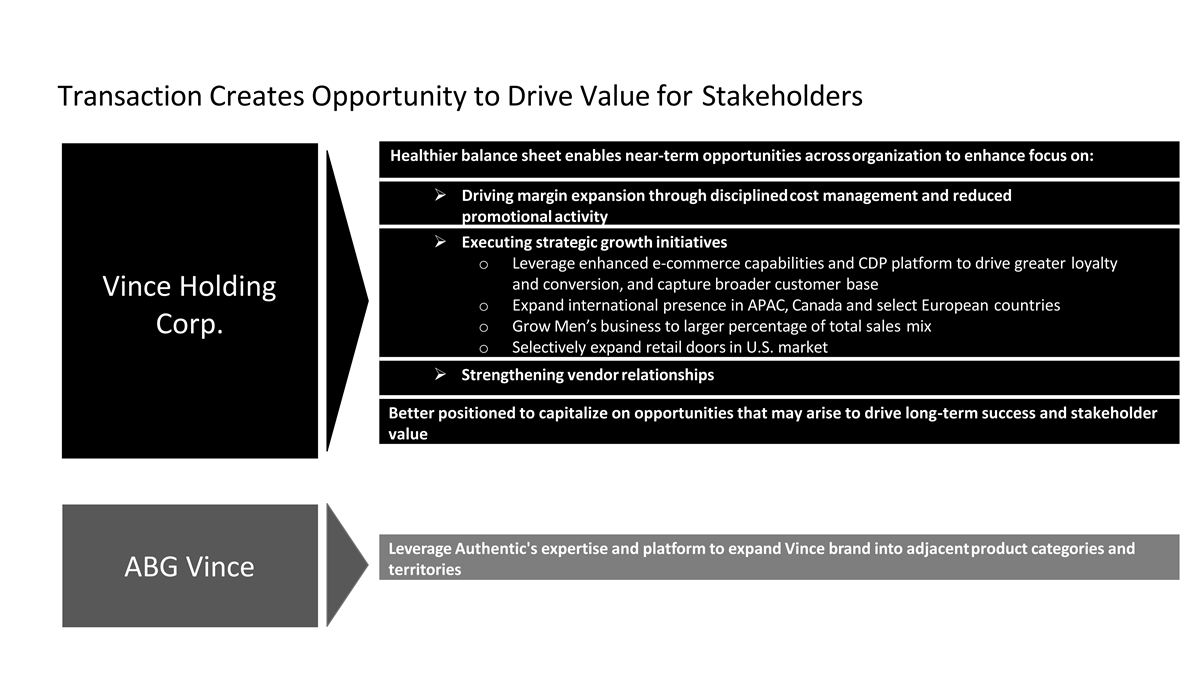

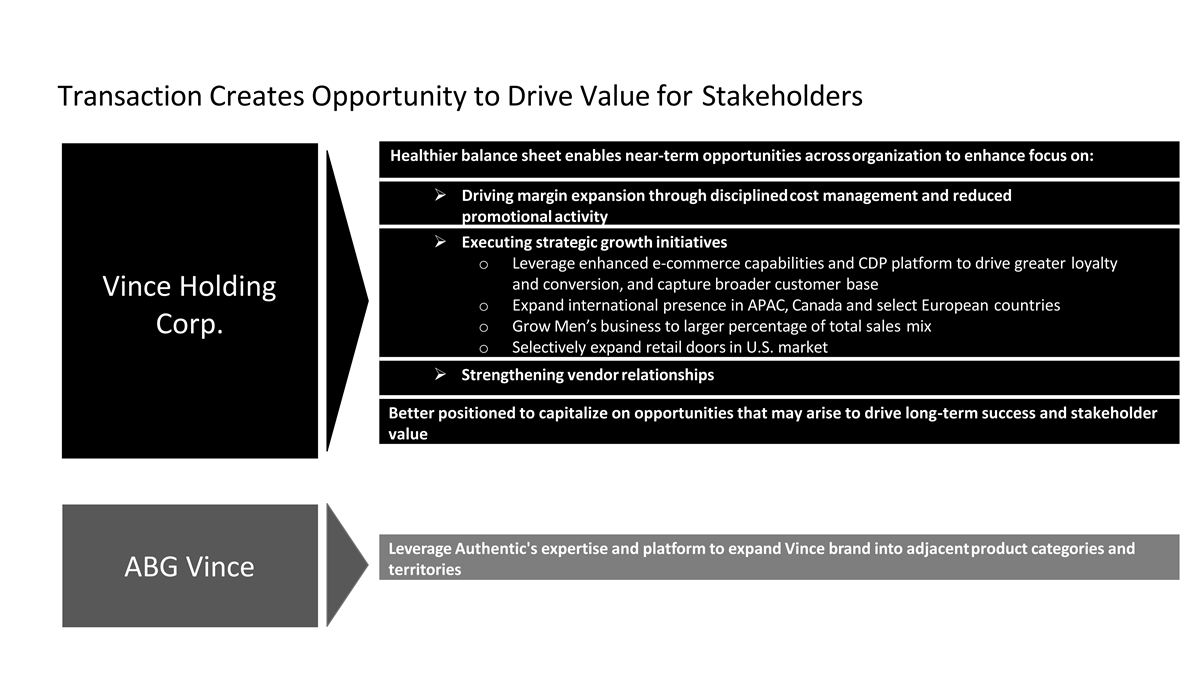

Transaction Creates Opportunity to Drive Value for Stakeholders Healthier balance sheet enables near-term opportunities acrossorganization to enhance focus on: ➢ Driving margin expansion through disciplinedcost management and reduced promotional activity ➢ Executing strategic growth initiatives o Leverage enhanced e-commerce capabilities and CDP platform to drive greater loyalty and conversion, and capture broader customer base Vince Holding o Expand international presence in APAC, Canada and select European countries o Grow Men’s business to larger percentage of total sales mix Corp. o Selectively expand retail doors in U.S. market ➢ Strengthening vendor relationships Better positioned to capitalize on opportunities that may arise to drive long-term success and stakeholder value Leverage Authentic's expertise and platform to expand Vince brand into adjacentproduct categories and territories ABG Vince