Management Presentation JANUARY 2021 Exhibit 99.1

DISCLAIMER This Management Presentation (this “Presentation”) is the property of Vince Holding Corp. and its subsidiaries (collectively, “Vince” or the “Company”). By accepting this Presentation, the recipient acknowledges that it has read, understood and accepted the terms of this disclaimer. This Presentation is not a formal offer to sell or solicitation of an offer to buy the Company’s securities. Information contained in this Presentation should not be relied upon as advice to buy or sell or hold such securities or as an offer to sell such securities. No representation or warranty, express or implied, is or will be given by the Company or its affiliates, directors, officers, partners, employees, agents or advisers or any other person as to the accuracy, completeness, reasonableness or fairness of any information contained in this Presentation and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements relating thereto. By acceptance of this Presentation, each recipient agrees not to copy, reproduce or distribute to others the Presentation, in whole or in part, without the prior written consent of the Company, and will promptly return this Presentation to the Company upon request. This Presentation contains the Company’s financial results in conformity with U.S. generally accepted accounting principles (“GAAP”) as well as adjusted results which are non-GAAP financial measures, including adjusted operating income (loss), which eliminates the effect on operating results of various factors. The Company believes the presentation of these non-GAAP measures facilitates an understanding of the Company’s continuing operations without the impact of such factors. The factors excluded to arrive at non-GAAP financial measures included in this Presentation and the reconciliation of GAAP to non-GAAP results are further detailed on page 27 of this Presentation. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information of the Company prepared in accordance with GAAP. This Presentation may contain forward-looking statements under the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact or relating to present facts or current conditions included in this Presentation are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “target,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. These forward-looking statements are not guarantees of actual results, and our actual results may differ materially from those suggested in the forward-looking statements. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control, including those as set forth from time to time in our Securities and Exchange Commission (the “SEC”) filings, including those described in our Annual Report on Form 10-K as well as our Quarterly Reports on Form 10-Q under “Item 1A – Risk Factors” filed with the SEC. Any forward-looking statement made by the Company in this Presentation speaks only as of the date on which it is made. Except as may be required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Market data and industry information used in this presentation are based on independent industry surveys and publications and other publicly available information prepared by third party sources. Although the Company believes that these sources are reliable as of their respective dates, it has not verified the accuracy or completeness of this information from independent sources. 2

KEY INVESTMENT HIGHLIGHTS Strategically positioned with contemporary fashion portfolio consisting of highly recognized and distinct brands Multiple actionable growth opportunities across brands Potential to achieve meaningfully higher operating margin Experienced management team, with strong track record, to execute long term plan Financial flexibility to execute growth initiatives 3

2020 ACCOMPLISHMENTS 4 During 2020, our top priority was navigating the pandemic: Implemented health and safety measures to protect associates and customers Reduced costs through furloughs, salary reductions, and streamlined/tightly managed expense structure Optimized liquidity Amended revolving credit facility and term loan agreements Closed $20M Third Lien Credit Facility Rebecca Taylor Relaunched brand with Spring 2021 collection Realigned distribution strategy to drive full price selling Began achieving synergies Vince Launched inclusive sizing Implemented first phase of Omni channel inventory creating efficiencies to better meet customer demand Increased market leadership position within the contemporary luxury space in wholesale partner doors

5 We have a portfolio of brands that each: Cater to a high-end consumer Complement each other with their own unique aesthetic Have strong brand equity PORTFOLIO OF BRANDS Benefit from leveraging talent and economies of scale including: Distribution centers E-Commerce platform synergies Third party vendors Streamlined organizational structure

COMPANY OVERVIEW 6

VINCE BRAND OVERVIEW 7 Well-positioned in the luxury market with a sophisticated, effortless, California-inspired fashion assortment

VINCE TURNAROUND RESULTS 8 Re-established strong brand positioning in contemporary fashion luxury market Pre-COVID: Sales increased 10% for the 2-year period ended February 1, 2020 DTC grew 25% Wholesale growth was flat due to successful refined distribution strategy Gross Margin expanded over several hundred basis points for the 2-year period ended February 1, 2020 Recaptured market share leadership position in wholesale channel Expanded retail store base with primarily short-term leases and highly favorable terms Acquired Rebecca Taylor and Parker

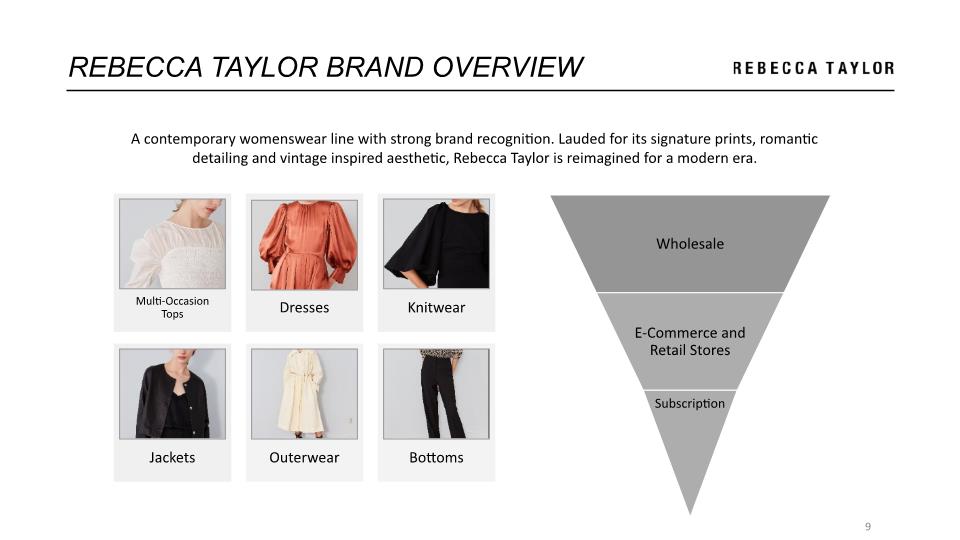

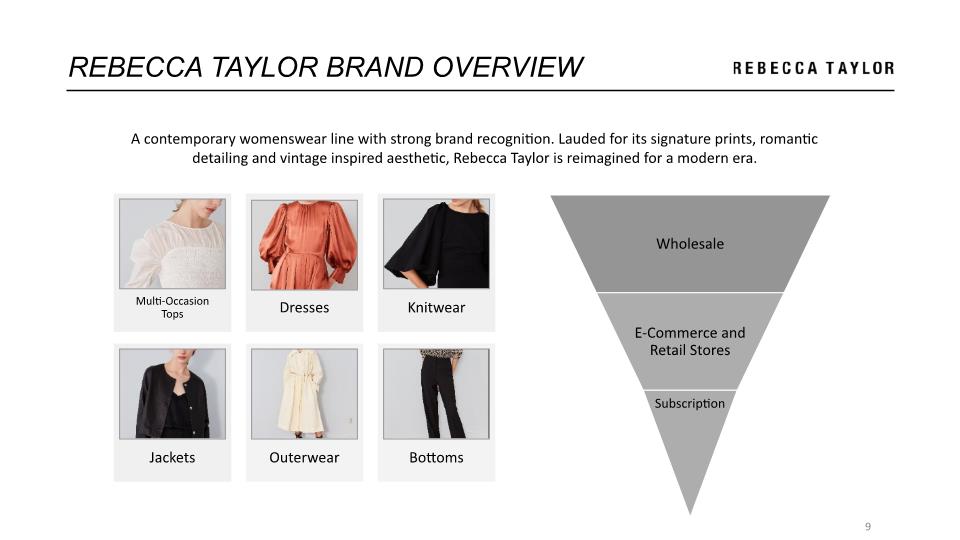

9 REBECCA TAYLOR BRAND OVERVIEW A contemporary womenswear line with strong brand recognition. Lauded for its signature prints, romantic detailing and vintage inspired aesthetic, Rebecca Taylor is reimagined for a modern era.

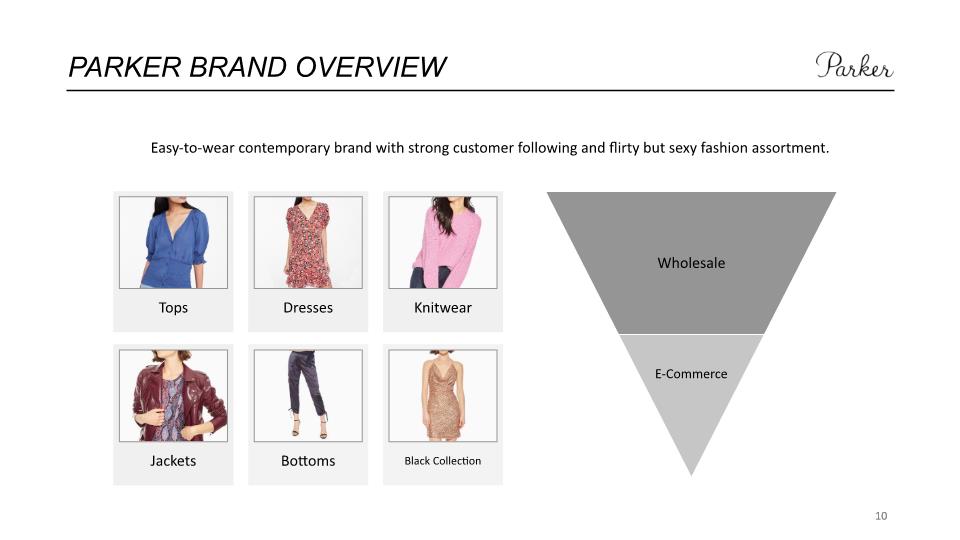

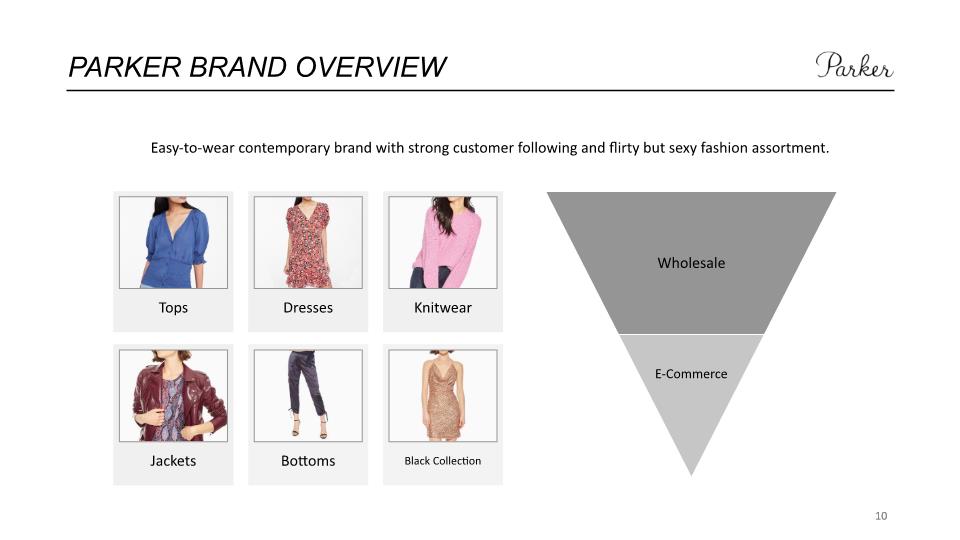

10 PARKER BRAND OVERVIEW 10 Easy-to-wear contemporary brand with strong customer following and flirty but sexy fashion assortment.

STRATEGIC GROWTH INITIATIVES 11

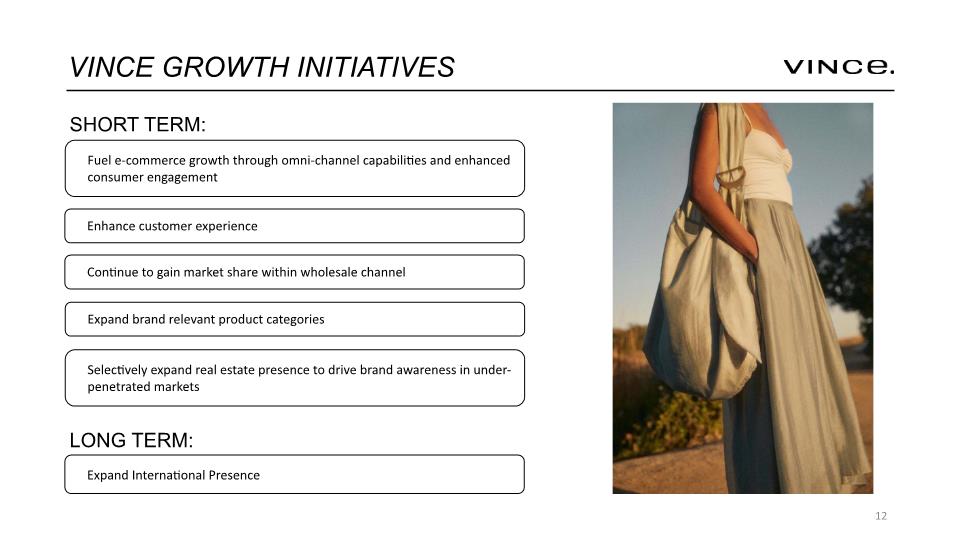

12 VINCE GROWTH INITIATIVES SHORT TERM: LONG TERM:

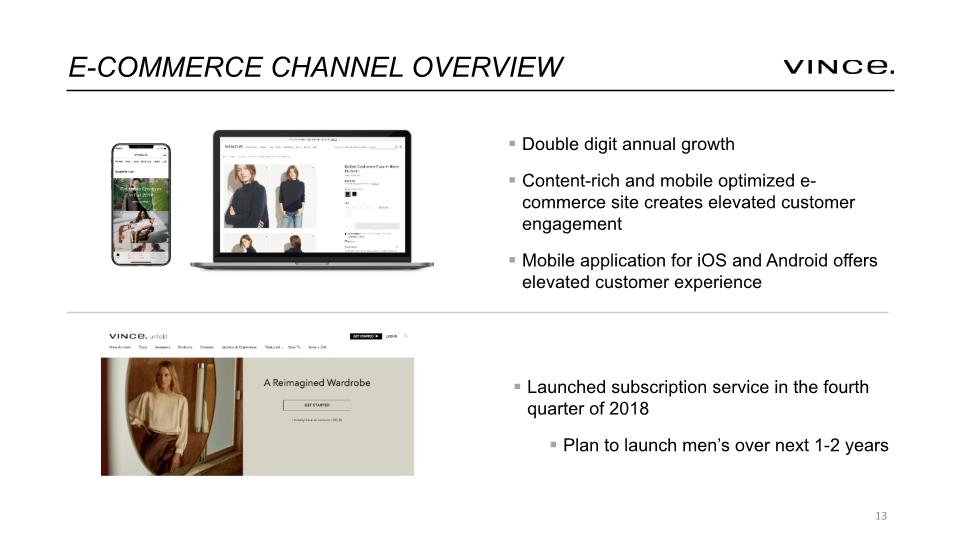

E-COMMERCE CHANNEL OVERVIEW 13 Double digit annual growth Content-rich and mobile optimized e-commerce site creates elevated customer engagement Mobile application for iOS and Android offers elevated customer experience Launched subscription service in the fourth quarter of 2018 Plan to launch men’s over next 1-2 years

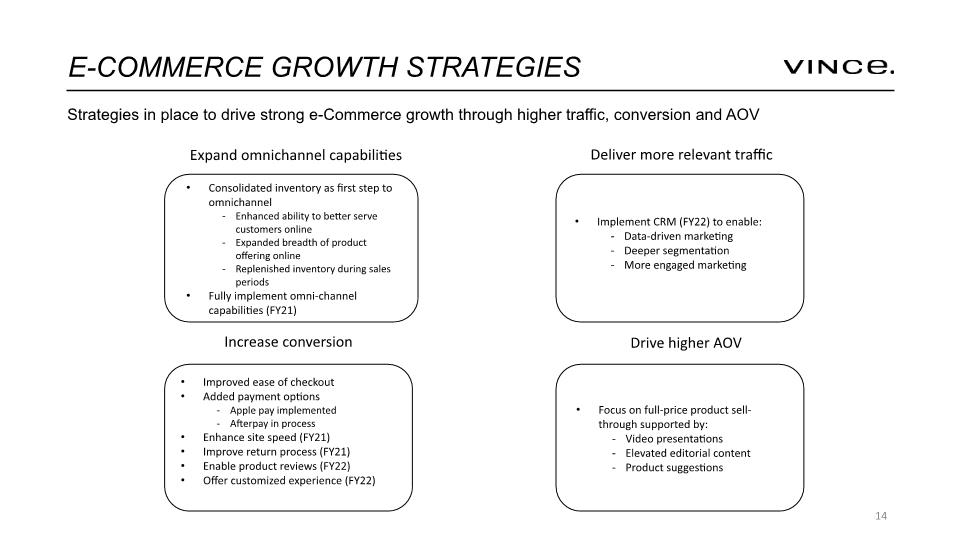

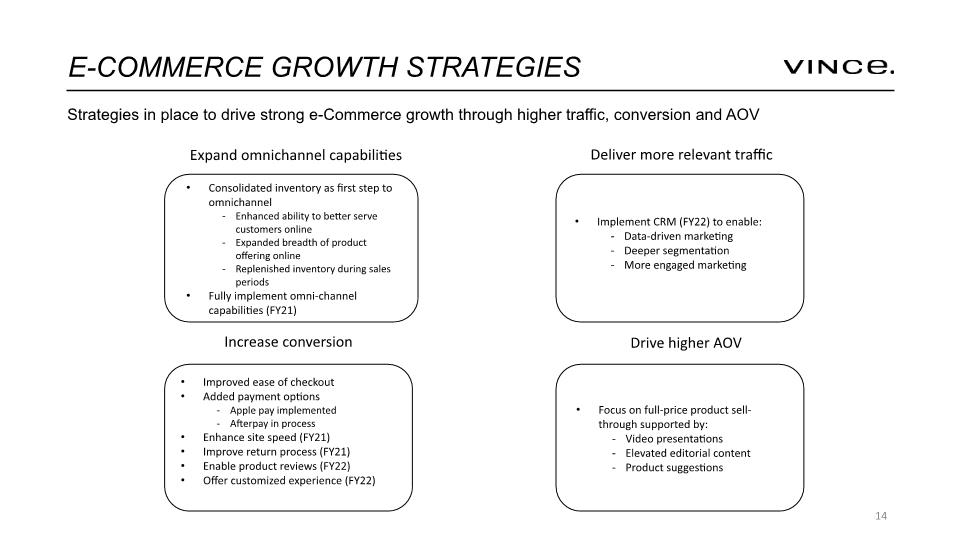

14 E-COMMERCE GROWTH STRATEGIES Strategies in place to drive strong e-Commerce growth through higher traffic, conversion and AOV Expand omnichannel capabilities Increase conversion Deliver more relevant traffic Drive higher AOV

ELEVATE CUSTOMER JOURNEY 15 Deliver a more impactful, customer-centric experience Invest in technology to elevate all touch-points of the customer journey Deliver more personalized engagement to drive higher customer retention Invest in both CRM technology and resources to improve clienteling through enhanced customer data Communicate a clear, consistent and relevant brand story across all channels and all customer interactions

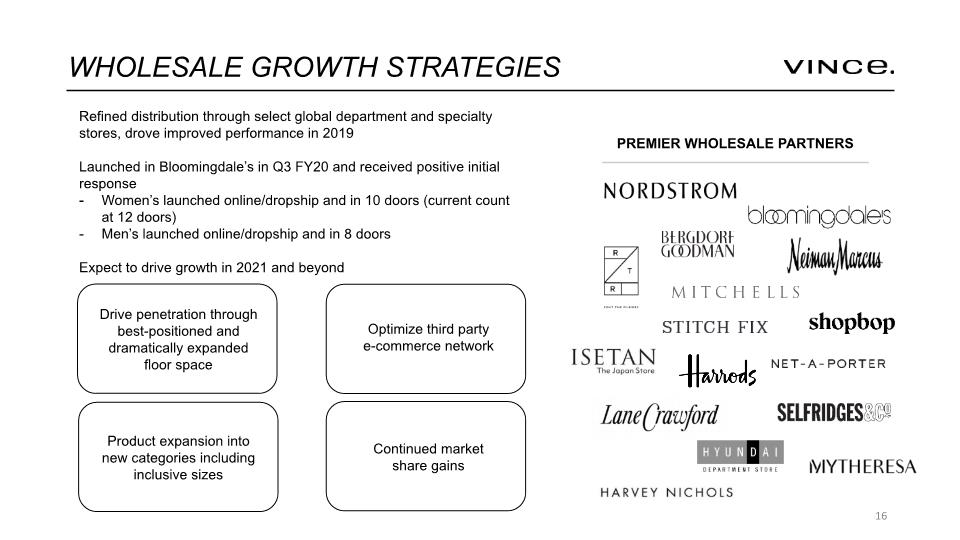

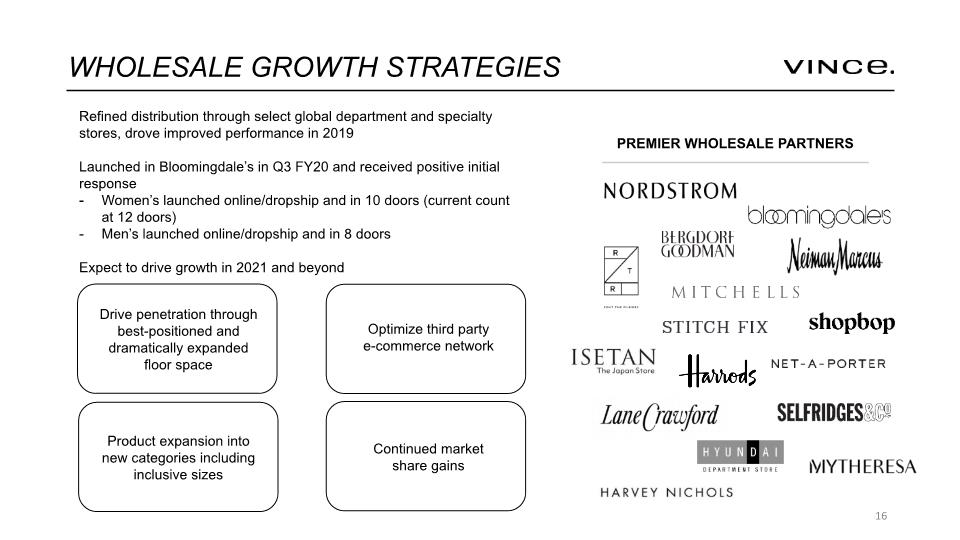

WHOLESALE GROWTH STRATEGIES PREMIER WHOLESALE PARTNERS 16 Refined distribution through select global department and specialty stores, drove improved performance in 2019 Launched in Bloomingdale’s in Q3 FY20 and received positive initial response Women’s launched online/dropship and in 10 doors (current count at 12 doors) Men’s launched online/dropship and in 8 doors Expect to drive growth in 2021 and beyond

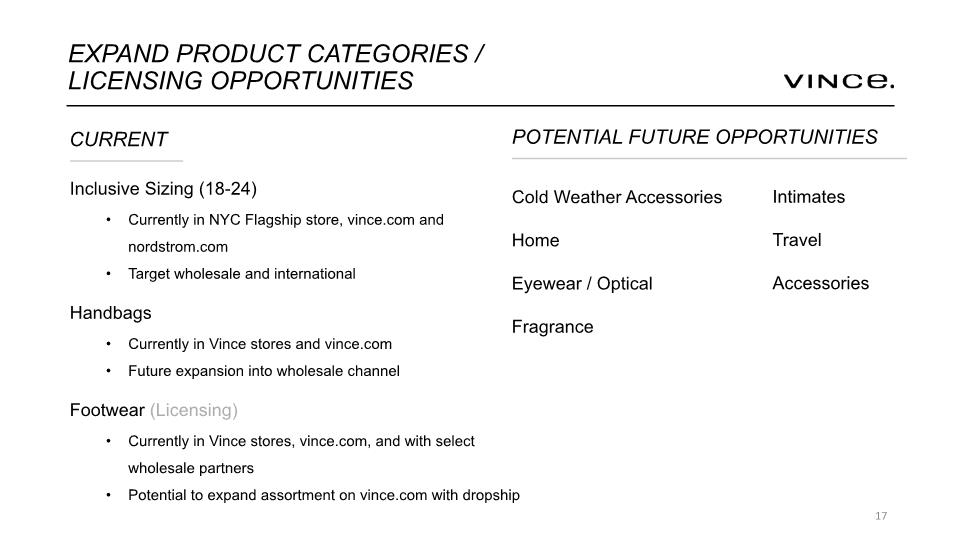

EXPAND PRODUCT CATEGORIES / LICENSING OPPORTUNITIES Cold Weather Accessories Home Eyewear / Optical Fragrance Intimates Travel Accessories 17 Inclusive Sizing (18-24) Currently in NYC Flagship store, vince.com and nordstrom.com Target wholesale and international Handbags Currently in Vince stores and vince.com Future expansion into wholesale channel Footwear (Licensing) Currently in Vince stores, vince.com, and with select wholesale partners Potential to expand assortment on vince.com with dropship

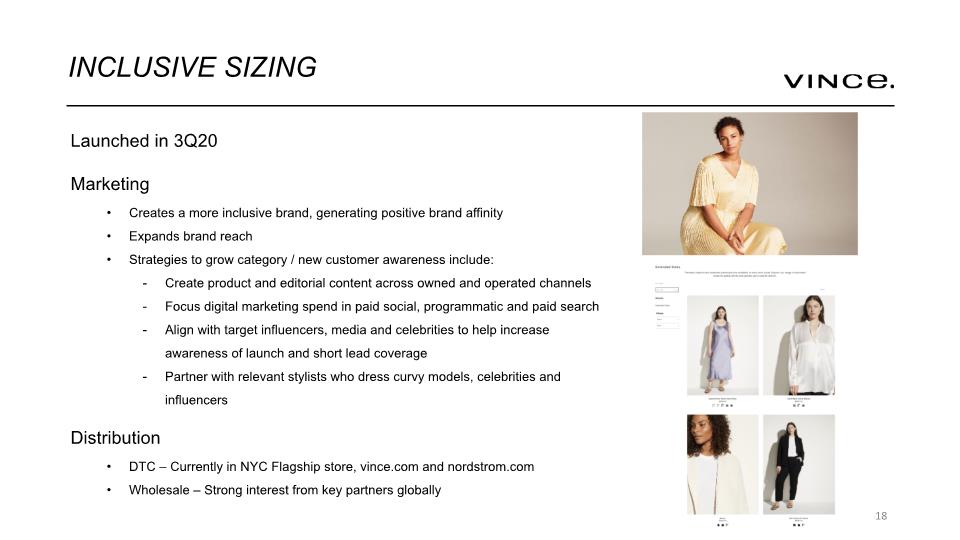

INCLUSIVE SIZING 18 Launched in 3Q20 Marketing Creates a more inclusive brand, generating positive brand affinity Expands brand reach Strategies to grow category / new customer awareness include: Create product and editorial content across owned and operated channels Focus digital marketing spend in paid social, programmatic and paid search Align with target influencers, media and celebrities to help increase awareness of launch and short lead coverage Partner with relevant stylists who dress curvy models, celebrities and influencers Distribution DTC – Currently in NYC Flagship store, vince.com and nordstrom.com Wholesale – Strong interest from key partners globally

RETAIL EXPANSION STRATEGIES 19 Market disruption created opportunistic short-term leases for 2021 Longer term, expect to return to cadence of opening 2-3 stores annually Disciplined retail expansion strategy in non-gateway cities Focus on flexible leases Reduces risk Attractive returns Increased real estate flexibility Focus on profitability with minimal investment and favorable lease terms Optimize retail fleet Relocating, renegotiating or exiting locations upon kick-out or expiration

INTERNATIONAL EXPANSION STRATEGY GREATER CHINA: EUROPE: Distributed across more than 40 countries through premier department stores and specialty retailers around the world 20 Company operates 3PL distribution centers in Europe and Hong Kong First London store opened September 2019 Exploring potential new locations Influencer programs in London and Paris driving brand awareness and engagement Launched shop-in-shop in: U.K.: Harrods, Harvey Nichols, and Selfridges Paris: Printemps and Galeries Lafayette Potential to expand product categories Launched collection in Alibaba Tmall Luxury Pavilion Potential partner initiated long-term roadmap for retail stores Exploring e-commerce launch Plan to target other 3P eCommerce platforms following success in Lane Crawford Strong demand for fashion luxury creates meaningful market opportunity Luxury peers operate 45-60 stores (i.e. Tory Burch, Theory)

21 REBECCA TAYLOR ACCOMPLISHMENTS

22 REBECCA TAYLOR GROWTH INITIATIVES Run Vince playbook across acquired brands

23 RESPONSIBILITY Responsible Raw Materials Investigate mill practices and current certifications Use sustainable raw material options without compromising quality/cost Sustainability Practices Investigate and participate in existing practices within our current supply chain/new suppliers Social Responsibility Ensure that socially responsible protocols are being met within our supply chain workforce Marketing Platform Share our responsibility practices with our customer In addition to our strategic initiatives, we are committed to being part of a conscious community

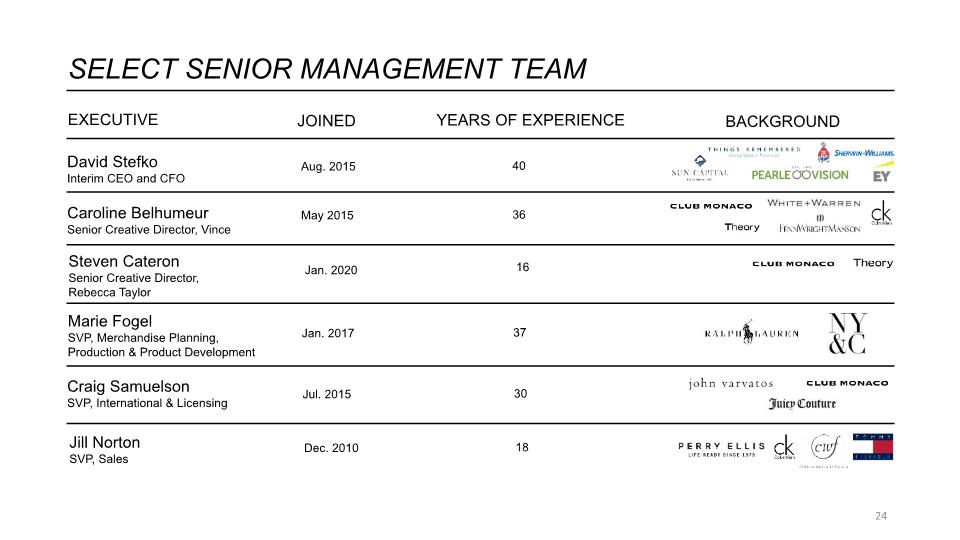

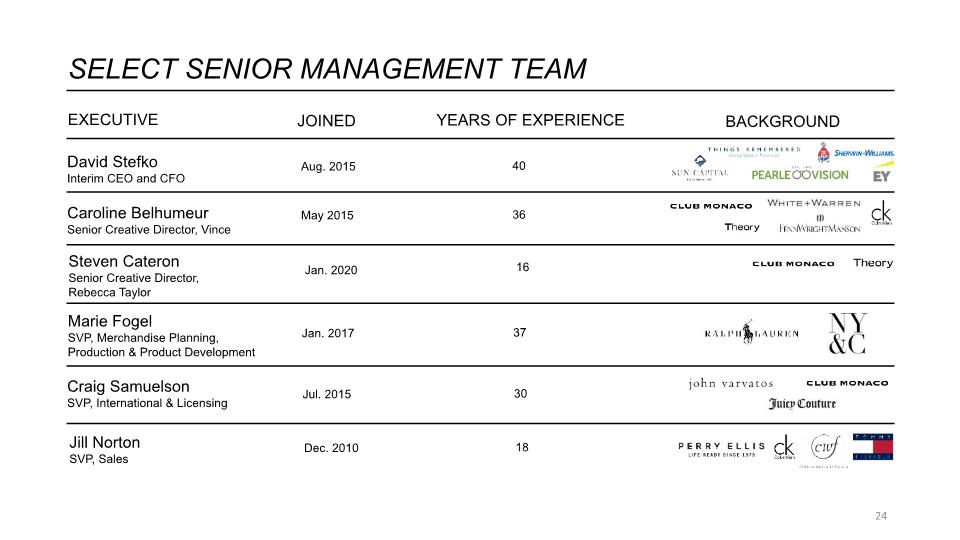

SELECT SENIOR MANAGEMENT TEAM EXECUTIVE JOINED BACKGROUND David Stefko Interim CEO and CFO Caroline Belhumeur Senior Creative Director, Vince Marie Fogel SVP, Merchandise Planning, Production & Product Development Craig Samuelson SVP, International & Licensing Aug. 2015 May 2015 Jan. 2017 Jul. 2015 24 Jill Norton SVP, Sales Dec. 2010 YEARS OF EXPERIENCE 40 36 37 30 18

FINANCIAL OVERVIEW 25

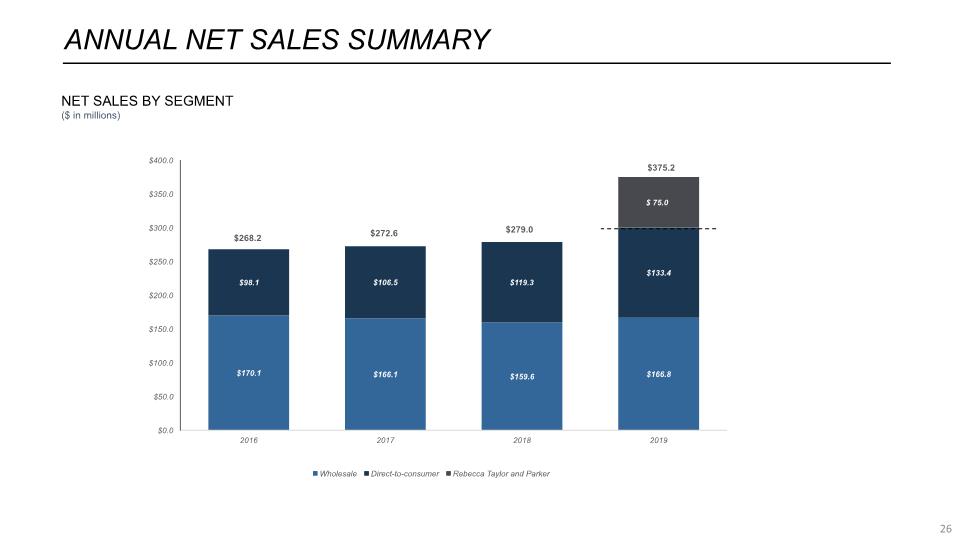

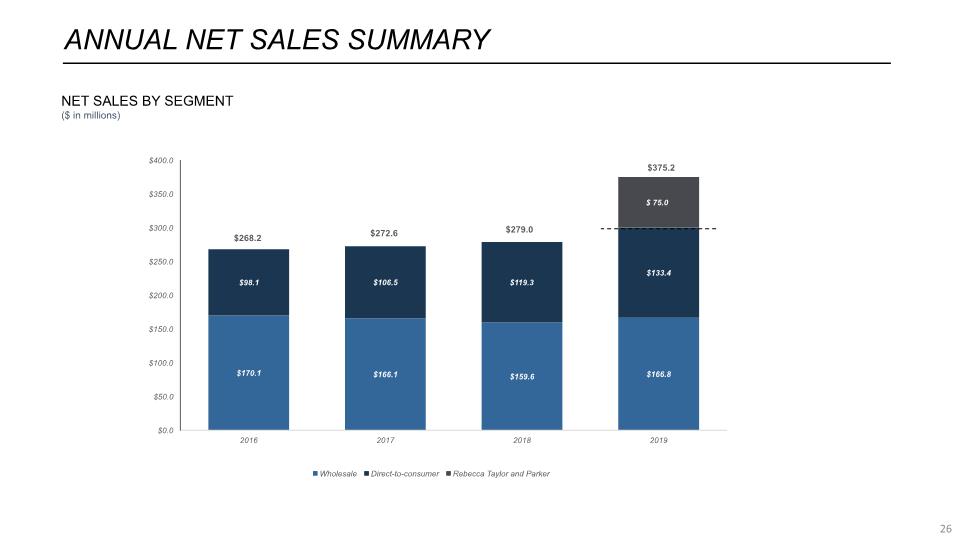

ANNUAL NET SALES SUMMARY NET SALES BY SEGMENT ($ in millions) 26

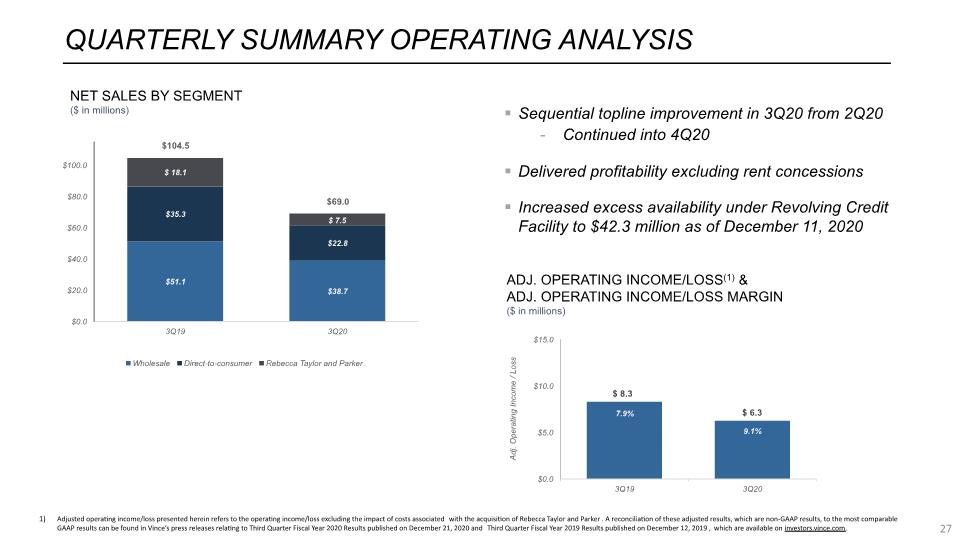

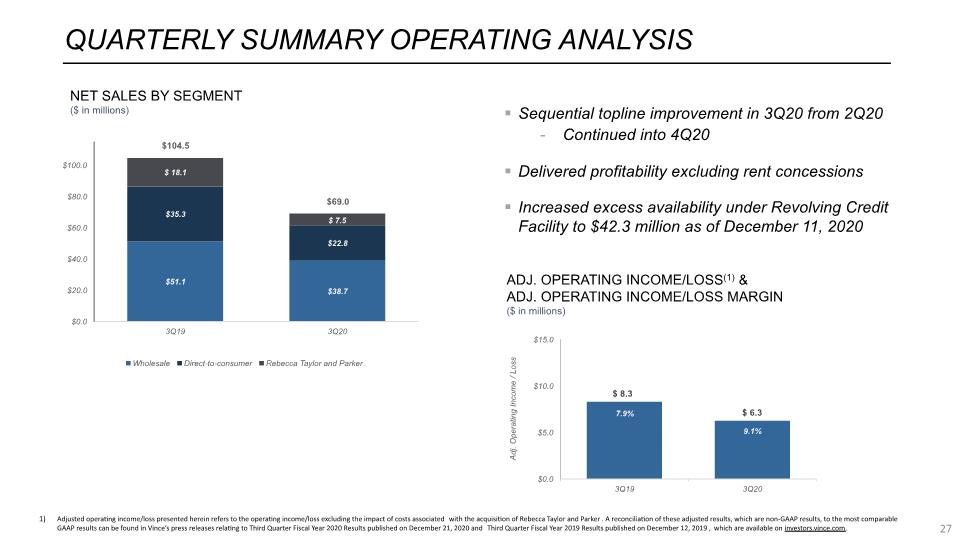

QUARTERLY SUMMARY OPERATING ANALYSIS NET SALES BY SEGMENT ($ in millions) 27 ADJ. OPERATING INCOME/LOSS(1) & ADJ. OPERATING INCOME/LOSS MARGIN ($ in millions) Adjusted operating income/loss presented herein refers to the operating income/loss excluding the impact of costs associated with the acquisition of Rebecca Taylor and Parker. A reconciliation of these adjusted results, which are non-GAAP results, to the most comparable GAAP results can be found in Vince’s press releases relating to Third Quarter Fiscal Year 2020 Results published on December 21, 2020 and Third Quarter Fiscal Year 2019 Results published on December 12, 2019 , which are available on investors.vince.com. Sequential topline improvement in 3Q20 from 2Q20 Continued into 4Q20 Delivered profitability excluding rent concessions Increased excess availability under Revolving Credit Facility to $42.3 million as of December 11, 2020

Enhanced capital structure on December 11, 2020 with completion of amendments to existing Term Loan and Revolving Credit Facilities simultaneous with close of a $20M 3rd Lien Term Loan Facility Among others, the amendments: Extended the period during which the testing under a financial covenant is suspended Lowered the FCCR to be maintained thereafter Extended the applicability of certain revised eligibility criteria for trade receivables Waived certain term loan amortization payments Term Loan Facility (Matures August 2023) Balance of $24.8M as of Q3 2020 Current Interest rate of Libor + 900 bps Revolving Credit Facility (Matures August 2023) Currently $100 million revolving credit facility Borrowings of $51.2 million as of Q3 2020 YTD weighted average interest rate of 2.8% as of Q3 2020 Third Lien Loan (Matures February 2024) Balance of $20.0M as of December 11, 2020 “Paid in Kind” current interest rate of Libor + 1100 bps $42.3 million of excess availability under revolving credit facility as of December 11, 2020 CAPITAL STRUCTURE 28

29