Q3 EARNINGS CALL NOVEMBER 5, 2019 Exhibit 99.3

Legal Disclaimers Special Note Regarding Forward-Looking Statements This presentation (the “Presentation”) contains statements that express Emerald Expositions Events, Inc.’s (the “Company,” “Emerald,” “we,” “us” or “our”) opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results. These forward-looking statements can generally be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “forecast,” “intend,” “continue,” “target,” “plan,” “potential” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. The information and projections contained in this presentation are accurate only as of their date, may have changed and are based on assumptions believed to be reasonable in light of the information presently available and no representations are made by the Company or any of its affiliates or advisors as to the accuracy of any such information or projections. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. For discussion of some of the important risks, please consult the “Risk Factors” section of our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, as well as other SEC reports filed by the Company from time to time. The Company, its affiliates and advisors assume no obligation to update any forward-looking statements or projections. COMPANY’S Use of Non-GAAP Measures The non-GAAP financial measures contained in this Presentation (including, without limitation, Organic revenue growth or decline, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income and Free Cash Flow) are not GAAP measures of the Company’s financial performance or liquidity and should not be considered as alternatives to net (loss) income as a measure of financial performance or cash flows from operations as measures of liquidity, or any other performance or liquidity measure derived in accordance with GAAP. You are encouraged to evaluate each adjustment to non-GAAP financial measures and the reasons the Company considers them appropriate for supplemental analysis. In addition, in evaluating Organic revenue growth or decline, Adjusted EBITDA, Adjusted EBITDA margin and Free Cash Flow, you should be aware that in the future, the Company may incur expenses similar to the adjustments in the presentation of Adjusted EBITDA and Adjusted EBITDA margin. The Company’s presentation of Adjusted EBITDA and Adjusted EBITDA margin should not be construed as an inference that its future results will be unaffected by unusual or non-recurring items. In addition, Organic revenue growth or decline, Adjusted EBITDA, Adjusted EBITDA margin and Free Cash Flow may not be comparable to similarly titled measures used by other companies in the Company’s industry or across different industries. Market and Industry Data This Presentation also contains market data and other statistical information that are based on independent industry publications, reports by market research firms or published independent sources. Some market data and statistical information are also based on the Company’s good faith estimates, which are derived from management’s knowledge of its industry and such independent sources referred to above. While the Company is not aware of any misstatements regarding its market and industry data presented herein, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Long-Term Goals Disclaimer This Presentation includes long-term goals that are forward-looking, are subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section of our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Nothing in this Presentation should be regarded as a representation by any person that these goals will be achieved and the Company undertakes no duty to update its goals.

Speakers Sally Shankland President & Chief Executive Officer CEO of Emerald Expositions since June 2019 President of McGraw-Hill Higher Education from 2015 to 2017 27 year career with UBM; most recently CEO of UBM Americas from 2012 to 2015 30+ years’ experience growing events and marketing services businesses Philip Evans Chief Financial Officer CFO of Emerald Expositions since October 2013 CFO of ProQuest from 2009 to 2013 Previous roles at Reed Elsevier (RELX) and EY 30+ years' experience in financial roles Brian Field Chief Operating Officer COO of Emerald Exhibitions since June 2019 COO of UBM Americas from 2014 to 2019 20+ years’ experience driving business success through the application of rigorous execution, technology, and data to the areas of marketing, customer experience, data-informed product development, operations, data services and sales operations

Strategy Update

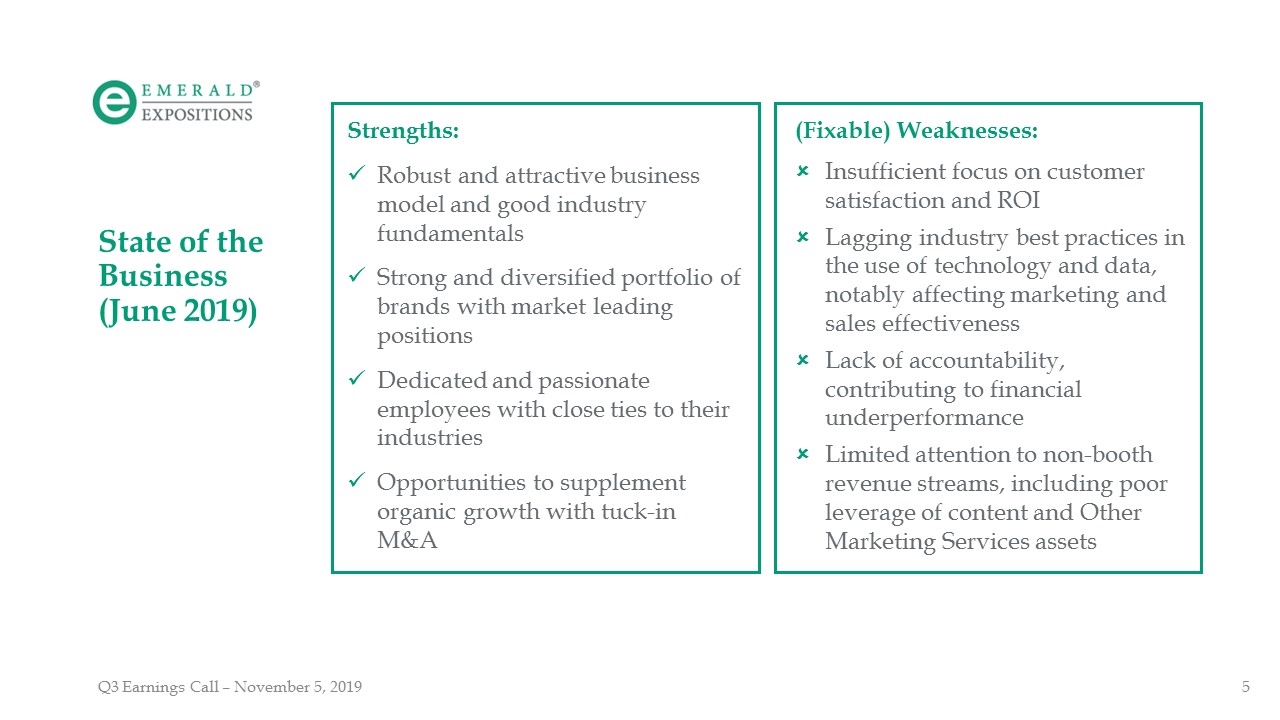

Strengths: Robust and attractive business model and good industry fundamentals Strong and diversified portfolio of brands with market leading positions Dedicated and passionate employees with close ties to their industries Opportunities to supplement organic growth with tuck-in M&A State of the Business (June 2019) (Fixable) Weaknesses: Insufficient focus on customer satisfaction and ROI Lagging industry best practices in the use of technology and data, notably affecting marketing and sales effectiveness Lack of accountability, contributing to financial underperformance Limited attention to non-booth revenue streams, including poor leverage of content and Other Marketing Services assets

The transition is well underway New management team Redefined Vision and Mission Strategy reset, driven by data and technology, focused on: Improved customer satisfaction and engagement Diversification of revenue streams and increased innovation Greater discipline and accountability Employees are engaged and enthusiastic Initiatives in place to return Emerald to organic growth Management team is confident that our strategy reset and renewed focus on execution will drive improved financial performance over time Resetting the Table

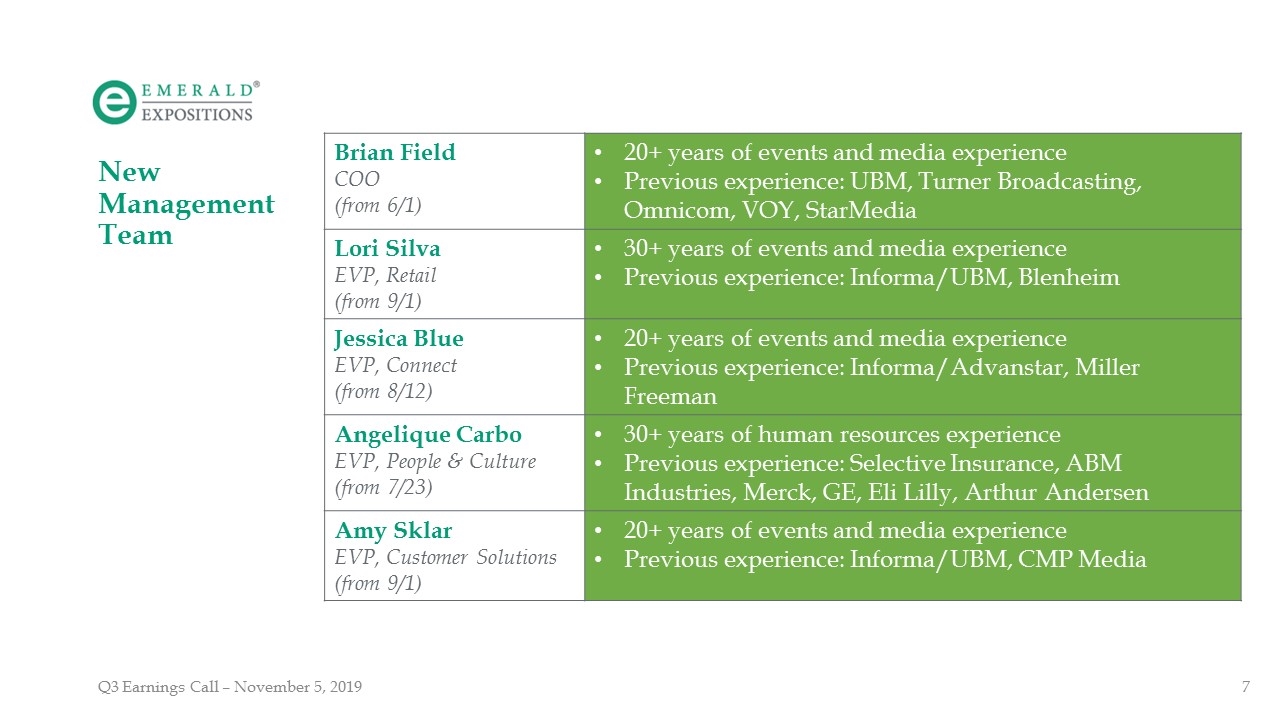

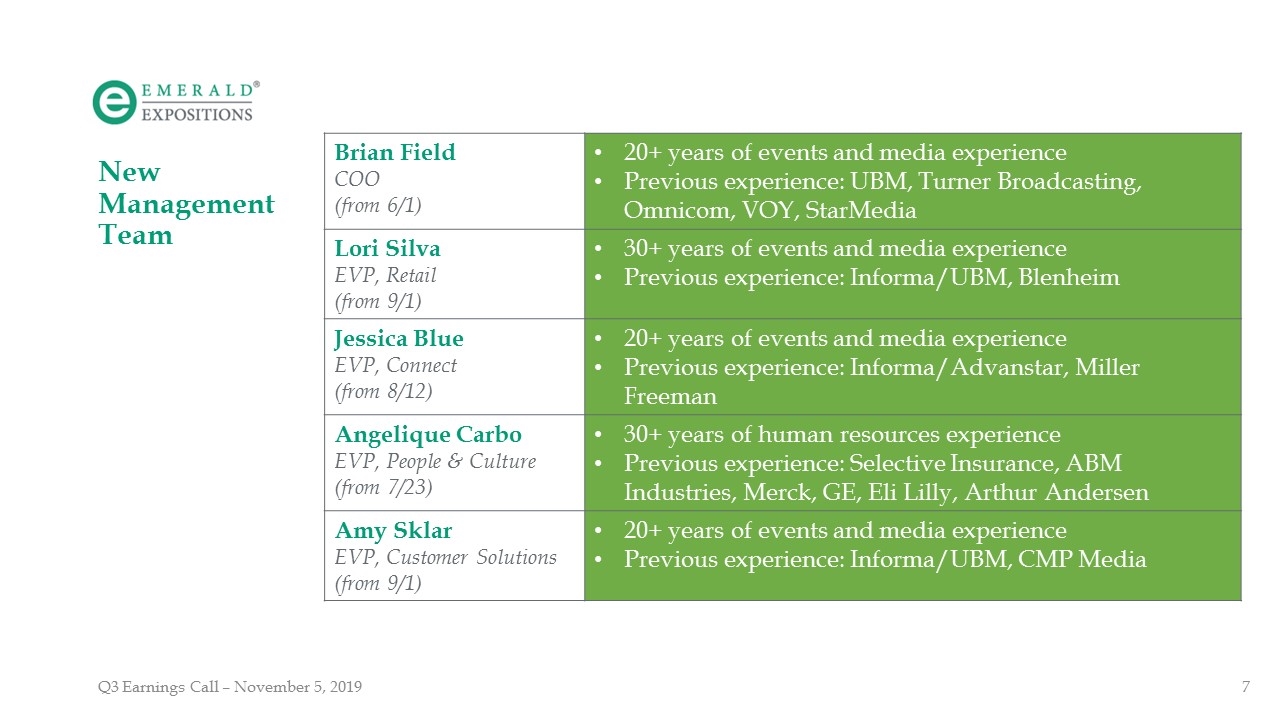

New Management Team Brian Field COO (from 6/1) 20+ years of events and media experience Previous experience: UBM, Turner Broadcasting, Omnicom, VOY, StarMedia Lori Silva EVP, Retail (from 9/1) 30+ years of events and media experience Previous experience: Informa/UBM, Blenheim Jessica Blue EVP, Connect (from 8/12) 20+ years of events and media experience Previous experience: Informa/Advanstar, Miller Freeman Angelique Carbo EVP, People & Culture (from 7/23) 30+ years of human resources experience Previous experience: Selective Insurance, ABM Industries, Merck, GE, Eli Lilly, Arthur Andersen Amy Sklar EVP, Customer Solutions (from 9/1) 20+ years of events and media experience Previous experience: Informa/UBM, CMP Media

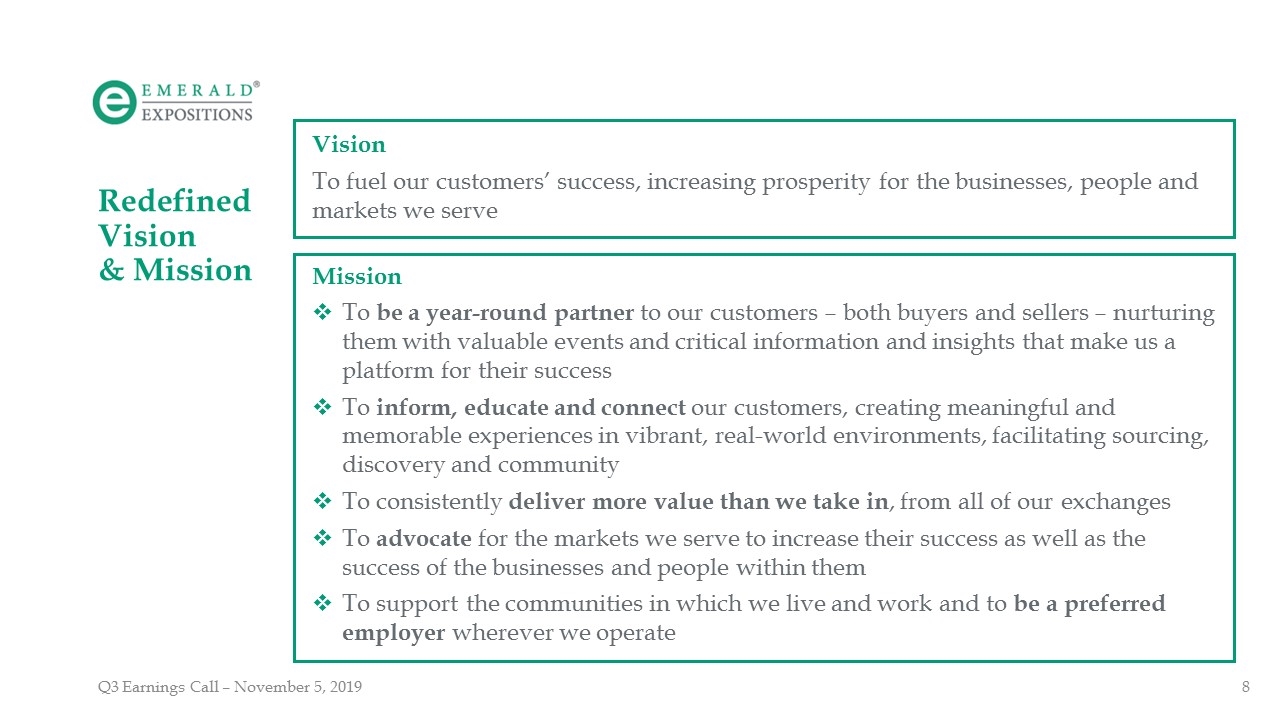

Redefined Vision & Mission Vision To fuel our customers’ success, increasing prosperity for the businesses, people and markets we serve Mission To be a year-round partner to our customers – both buyers and sellers – nurturing them with valuable events and critical information and insights that make us a platform for their success To inform, educate and connect our customers, creating meaningful and memorable experiences in vibrant, real-world environments, facilitating sourcing, discovery and community To consistently deliver more value than we take in, from all of our exchanges To advocate for the markets we serve to increase their success as well as the success of the businesses and people within them To support the communities in which we live and work and to be a preferred employer wherever we operate

Focus on Customer Satisfaction Strategy Reset Financial Goals: Sustainable organic revenue growth, at or above industry levels Solid and consistent growth in Adjusted EBITDA at attractive profit margins Diversify Revenue Streams Operate Efficiently and Cost Effectively Pursue Attractive Tuck-in Acquisitions ❶ ❷ ❸ ❹

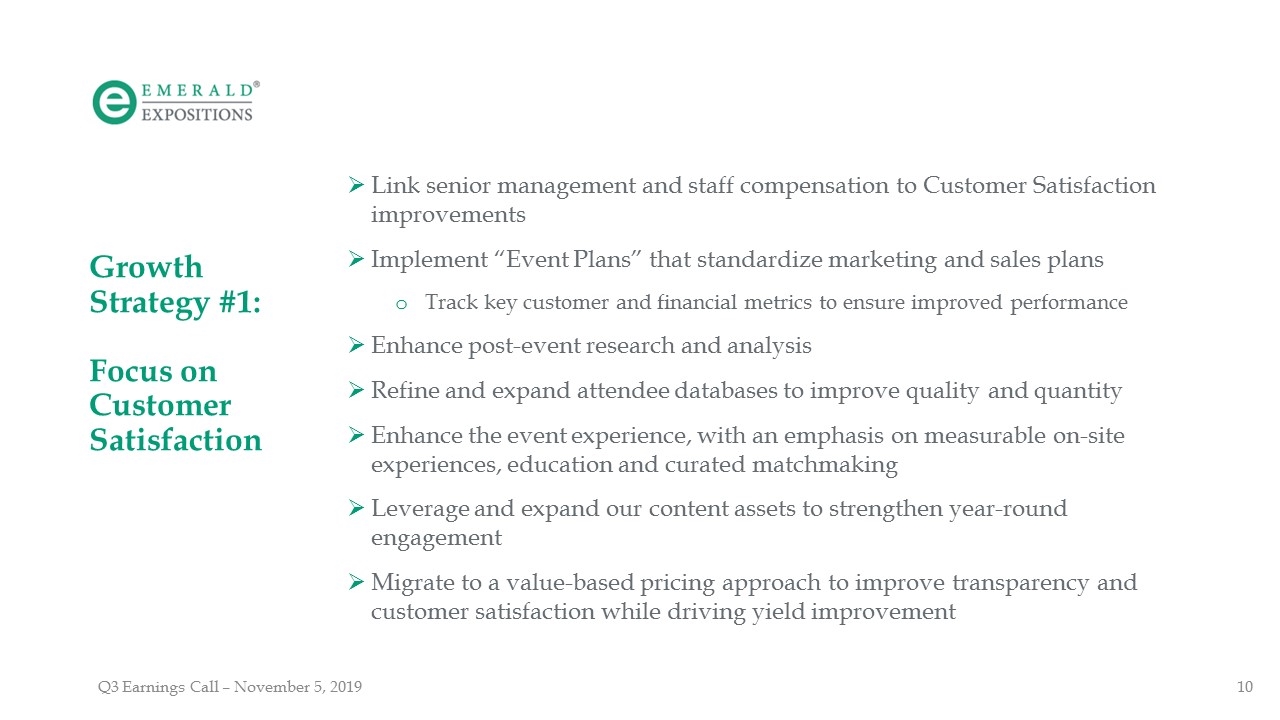

Growth Strategy #1: Focus on Customer Satisfaction Link senior management and staff compensation to Customer Satisfaction improvements Implement “Event Plans” that standardize marketing and sales plans Track key customer and financial metrics to ensure improved performance Enhance post-event research and analysis Refine and expand attendee databases to improve quality and quantity Enhance the event experience, with an emphasis on measurable on-site experiences, education and curated matchmaking Leverage and expand our content assets to strengthen year-round engagement Migrate to a value-based pricing approach to improve transparency and customer satisfaction while driving yield improvement

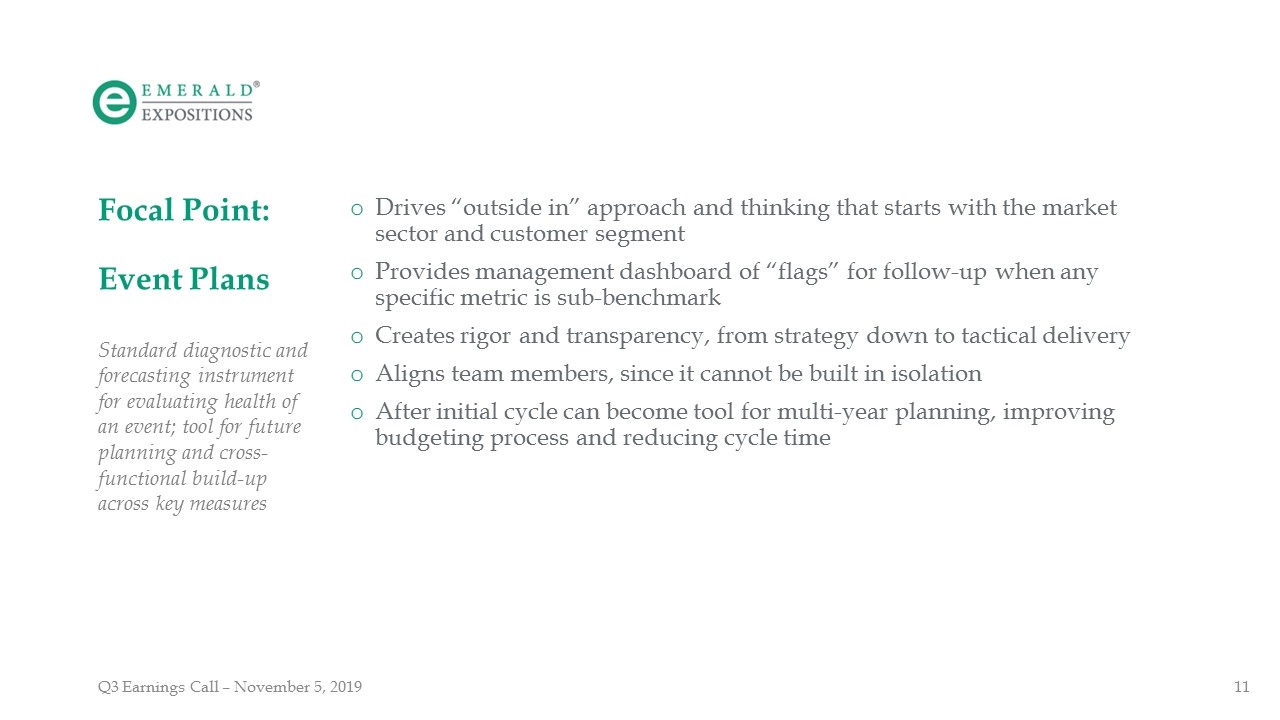

Focal Point: Event Plans Drives “outside in” approach and thinking that starts with the market sector and customer segment Provides management dashboard of “flags” for follow-up when any specific metric is sub-benchmark Creates rigor and transparency, from strategy down to tactical delivery Aligns team members, since it cannot be built in isolation After initial cycle can become tool for multi-year planning, improving budgeting process and reducing cycle time Standard diagnostic and forecasting instrument for evaluating health of an event; tool for future planning and cross-functional build-up across key measures

Focal Point: Value-Based Pricing (“VBP”) Pricing methodology beyond flat-rate increases to align with perceived customer value Based on detailed data analysis of historical prices, customer behaviors and NPS scores Initial phase occurring across six shows (Outdoor Retailer, ASD, NY NOW, CEDIA Expo, Surf Expo and RetailX), with first implementations, based upon show cycles, for 2021 shows Rollout of program presents opportunity to deliver +4-8% on show revenue; which equates to a potential $5-$10 million in incremental yield just on above-named shows (based on 2019 revenues) Research and analysis of live event pricing and promotion based on customers’ perceived values of available locations / packages

Focal Point: Enhanced Post-Show Research Ensures key customer sentiment questions are uniformly asked Provides continuity in edition-to-edition survey design and access to customer data Establishes more robust sentiment scoring overall, with integration of NPS, satisfaction, loyalty and importance metrics, plus internal and industry benchmarking across sentiment scores Individual customer sentiment tied to customer record in Salesforce (Q1 2020 implementation), enabling more meaningful customer conversations Facilitates accelerated research-to-action based upon collected data and industry knowledge, allowing us to identify key areas for change/development Currently 27 events integrated into platform; will be fully adopted by all events and media products by end of 2020 Standardized process and toolset to design, deploy and measure customer surveys, coupled with post-event research

Focal Point: Data Enrichment Emerald currently uses basic demographic and firmographic information in its marketing practices, such as: name, title, company information and size, and company revenues While helpful for broad segmentation, this is limited to what customers explicitly tell us and can create incomplete views and mismatched marketing messages Emerald houses a trove of deep information on customer activity that is unlinked and under-utilized, such as: publishing/subscribing histories and online content behaviors Bringing these types of data together allows for refinement in messaging, segmentation strategy and customer insights We are currently designing the integration path for these data sets and expect to roll out the enriched data to our marketing teams over the course of 2020 Augmenting customer-profile information through fusion of data sources to inform enhanced customer-led offerings

Growth Strategy #2: Diversify Revenue Streams Increase sponsorship and advertising revenues Apply best practices and develop new products and packages Increase conference revenues Improve quality, marketing effectiveness and operating efficiency Increase hosted buyer revenues Continue to launch new and spin-off hosted buyer events Leverage CPMG as the center of excellence for launches in other Emerald markets Add new categories and launch new events More aggressive approach on developing new events/categories/products in existing and adjacent markets, potentially including B2C extensions

Focal Point: Integrated Customer Solutions Blending sponsorship programs with digital and print solutions to reach desired customer targets Means of extending beyond “event days” to year-round opportunities for our customers (and us) Focused on standardization and scale vs one-off bespoke efforts to maximize opportunity for new, profitable-revenue growth Examples include: At show, sponsorship of Show guide Content track in educational conference Speed-dating pavilion Non-show period / year-round opportunities Section “take-over” of all display ads and digital wall-paper on website Sponsored “belly band” of print magazine & ad pages Extension of customer’s content as part of sponsored webinar series Curated topical series sponsored year-round on website Focused effort on driving increased value for customers by creating integrated solutions beyond pure booth or conference programs

Growth Strategy #3: Operate Efficiently & Cost Effectively Improve financial rigor Introduce zero-based budgeting for 2020 Budget Critically assess the impact/ROI of all spending and investments Centralize activities to drive efficiencies Review and renegotiate all major cost items Standardize procedures and share best practices Increase marketing and sales effectiveness through application of best practices, enhanced tools and skill upgrades

Growth Strategy #4: Pursue Attractive Tuck-in Acquisitions Confidential - Emerald Expositions Focus on acquisitions that either: meaningfully strengthen one or more of our existing brands, or where we bring considerable incremental value that will enhance the acquisition’s rate of growth Develop rigorous acquisition theses, financial projections and integration plans to minimize integration risk and performance surprises Apply disciplined financial hurdles

Case Study: G3 Communications Announced 11/4/19 Leading owner of conferences, online media, research and custom marketing services for the retail industry and the B2B marketing industry G3 is ideally situated to continue to provide essential information to an audience of both retailers and B2B marketers who are rapidly acknowledging their increasing educational and engagement needs In addition to the independent attractiveness of the G3 business, the acquisition provides Emerald with: a cutting edge critical educational component regarding retail transformation for RetailX a foundation for high value Emerald educational offerings to our collective audience of retailers across our entire portfolio of vertical retail events strong B2B demand generation marketing events, content and expertise to leverage across our entire B2B exhibitor base an online media model driving revenue through content projects, lead gen campaigns and special reports a well-established scalable engine for the creation of custom content marketing programs for B2B clients

Financial Objectives Confidential - Emerald Expositions Return to sustainable organic revenue growth, at or above industry levels Our target is mid single-digit percentage organic revenue growth by 2021 Deliver solid and consistent growth in Adjusted EBITDA over time Operate at strong profit margins Pursue a disciplined capital allocation strategy Enhance organic growth through selective, accretive acquisitions Reduce leverage, over time

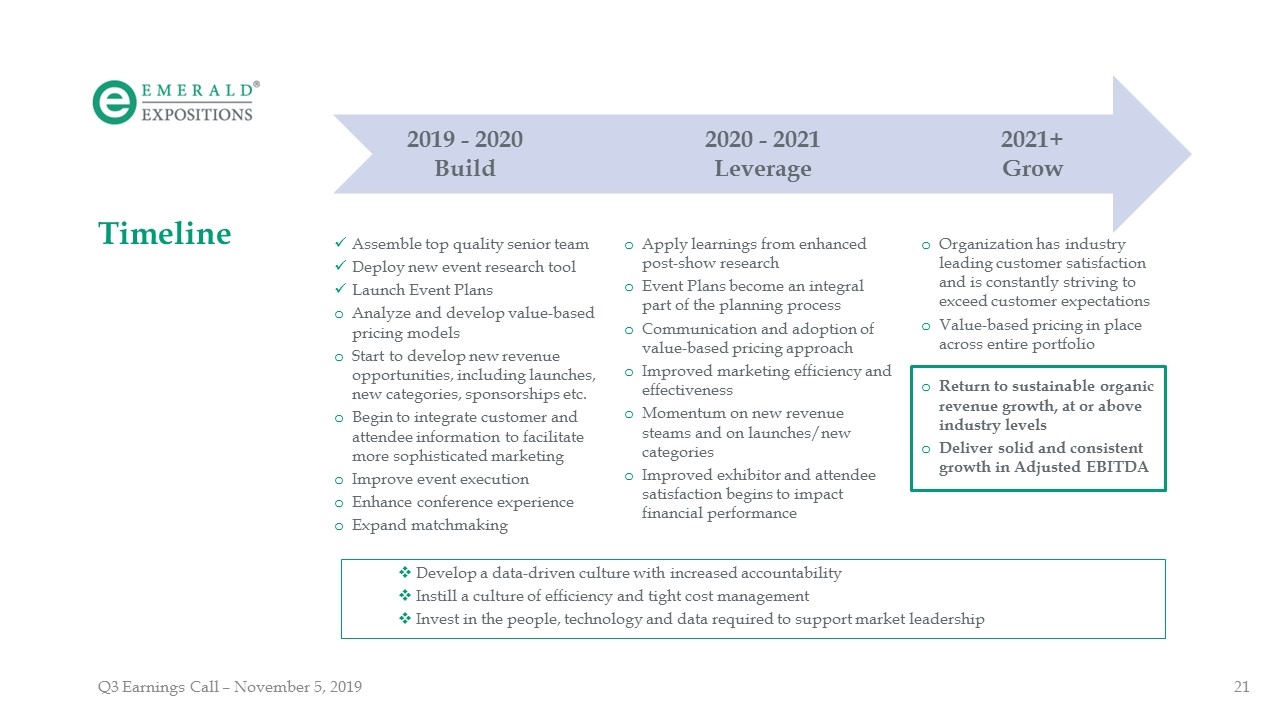

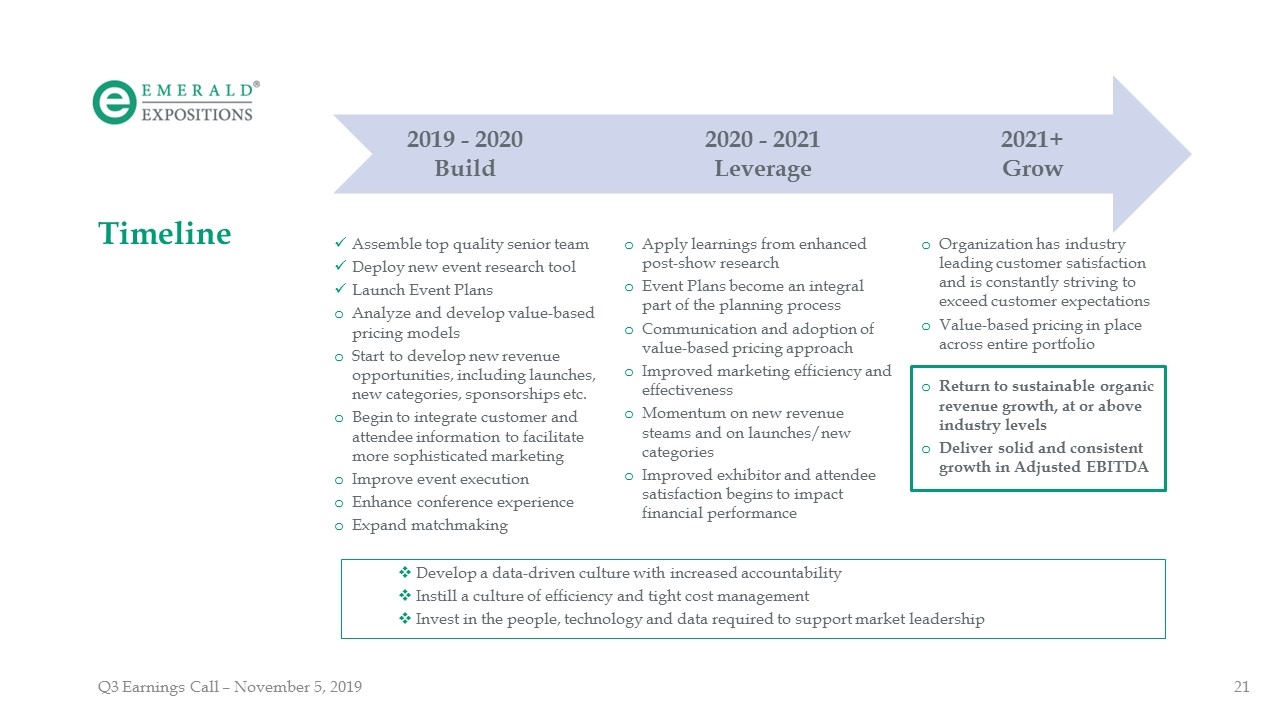

Timeline Assemble top quality senior team Deploy new event research tool Launch Event Plans Analyze and develop value-based pricing models Start to develop new revenue opportunities, including launches, new categories, sponsorships etc. Begin to integrate customer and attendee information to facilitate more sophisticated marketing Improve event execution Enhance conference experience Expand matchmaking 2019 - 2020 Build 2020 - 2021 Leverage 2021+ Grow Develop a data-driven culture with increased accountability Instill a culture of efficiency and tight cost management Invest in the people, technology and data required to support market leadership Apply learnings from enhanced post-show research Event Plans become an integral part of the planning process Communication and adoption of value-based pricing approach Improved marketing efficiency and effectiveness Momentum on new revenue steams and on launches/new categories Improved exhibitor and attendee satisfaction begins to impact financial performance Organization has industry leading customer satisfaction and is constantly striving to exceed customer expectations Value-based pricing in place across entire portfolio Return to sustainable organic revenue growth, at or above industry levels Deliver solid and consistent growth in Adjusted EBITDA

Addressing the Four Key Constituencies needed for Success Communities Shareholders Customers Employees

Q3 2019 Performance

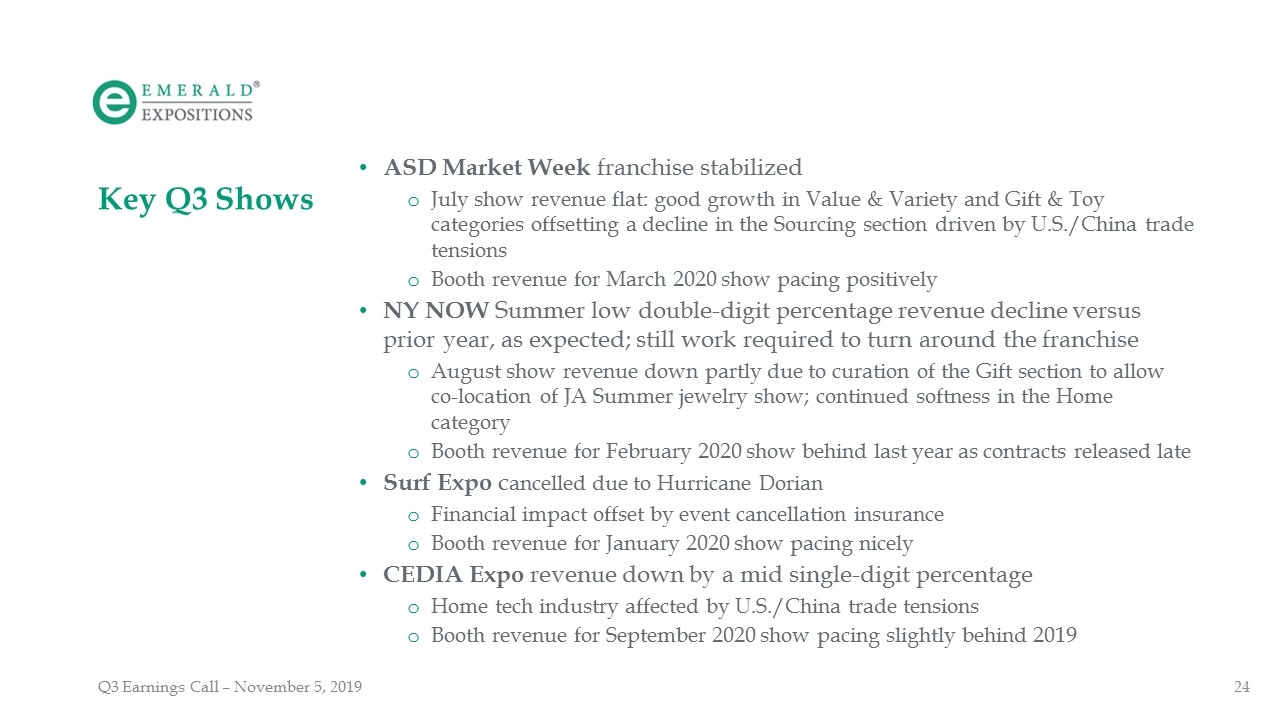

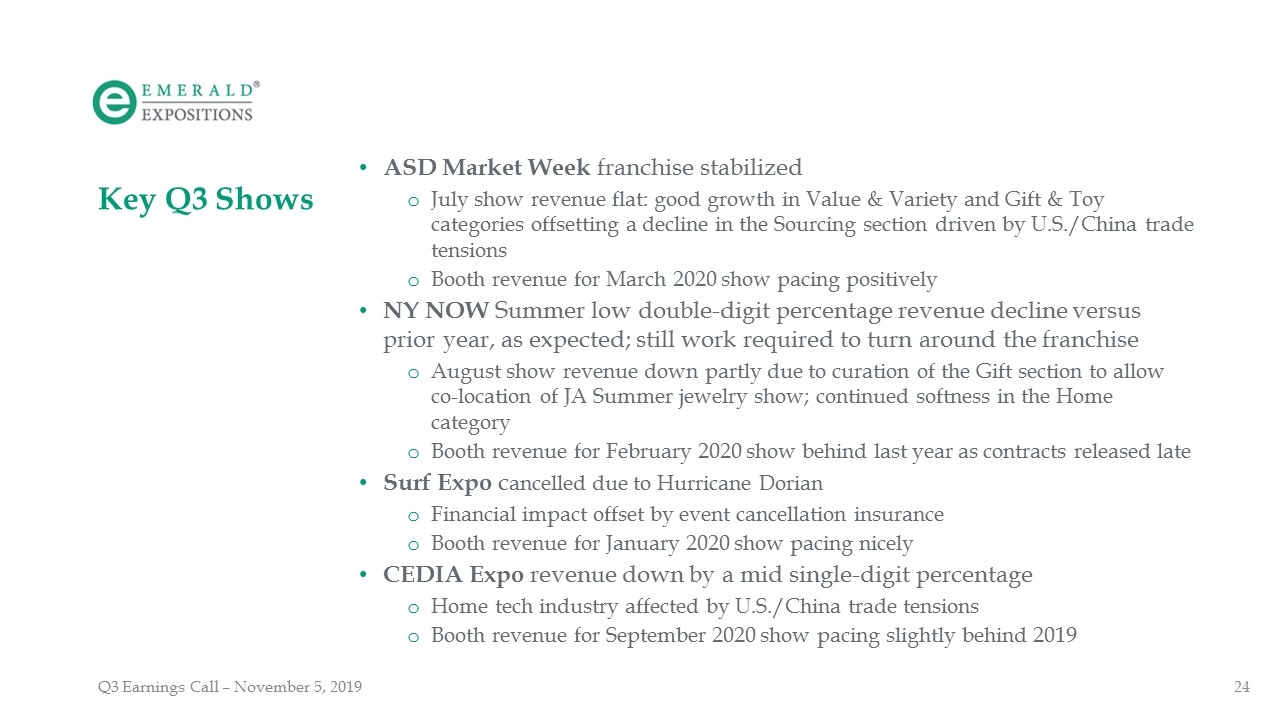

Key Q3 Shows ASD Market Week franchise stabilized July show revenue flat: good growth in Value & Variety and Gift & Toy categories offsetting a decline in the Sourcing section driven by U.S./China trade tensions Booth revenue for March 2020 show pacing positively NY NOW Summer low double-digit percentage revenue decline versus prior year, as expected; still work required to turn around the franchise August show revenue down partly due to curation of the Gift section to allow co-location of JA Summer jewelry show; continued softness in the Home category Booth revenue for February 2020 show behind last year as contracts released late Surf Expo cancelled due to Hurricane Dorian Financial impact offset by event cancellation insurance Booth revenue for January 2020 show pacing nicely CEDIA Expo revenue down by a mid single-digit percentage Home tech industry affected by U.S./China trade tensions Booth revenue for September 2020 show pacing slightly behind 2019

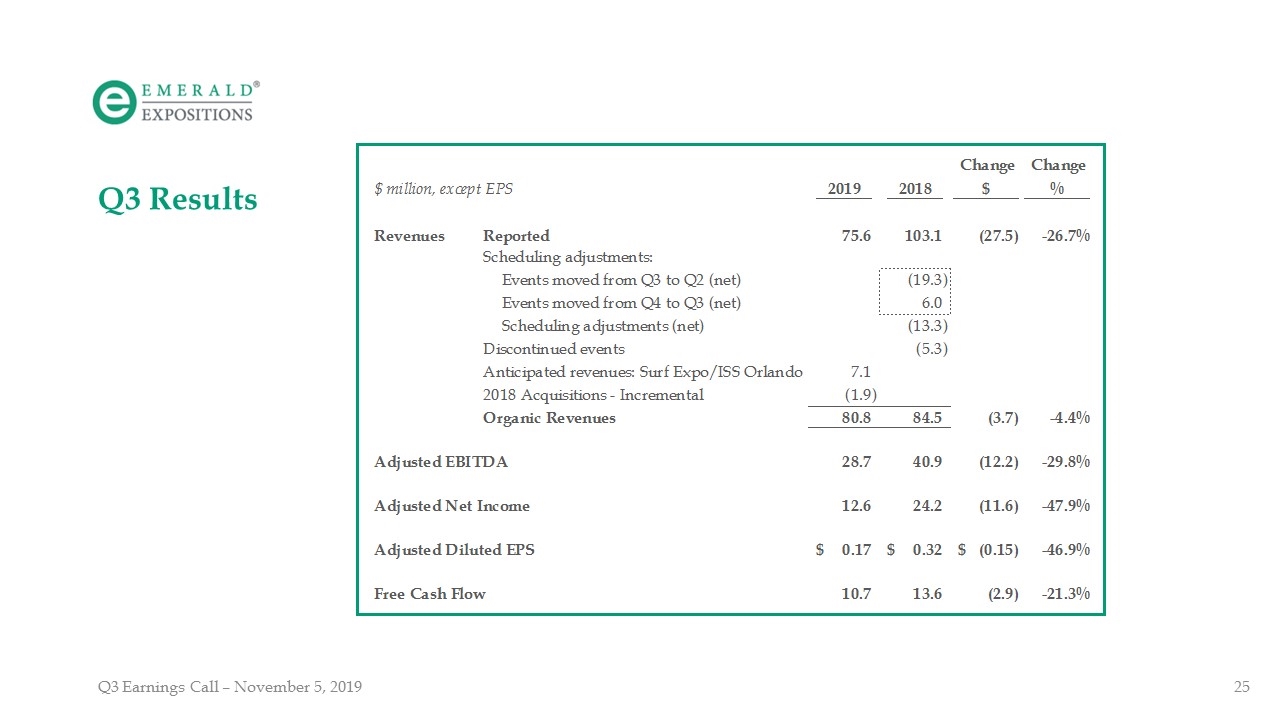

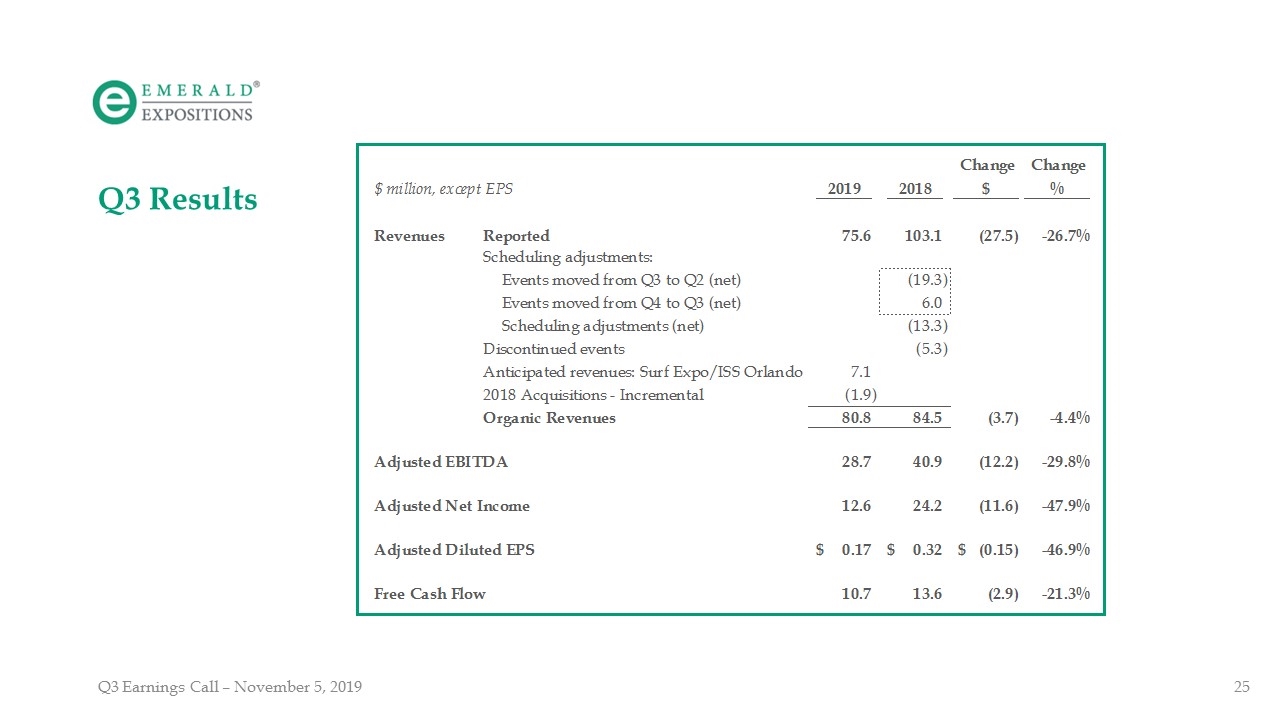

Q3 Results

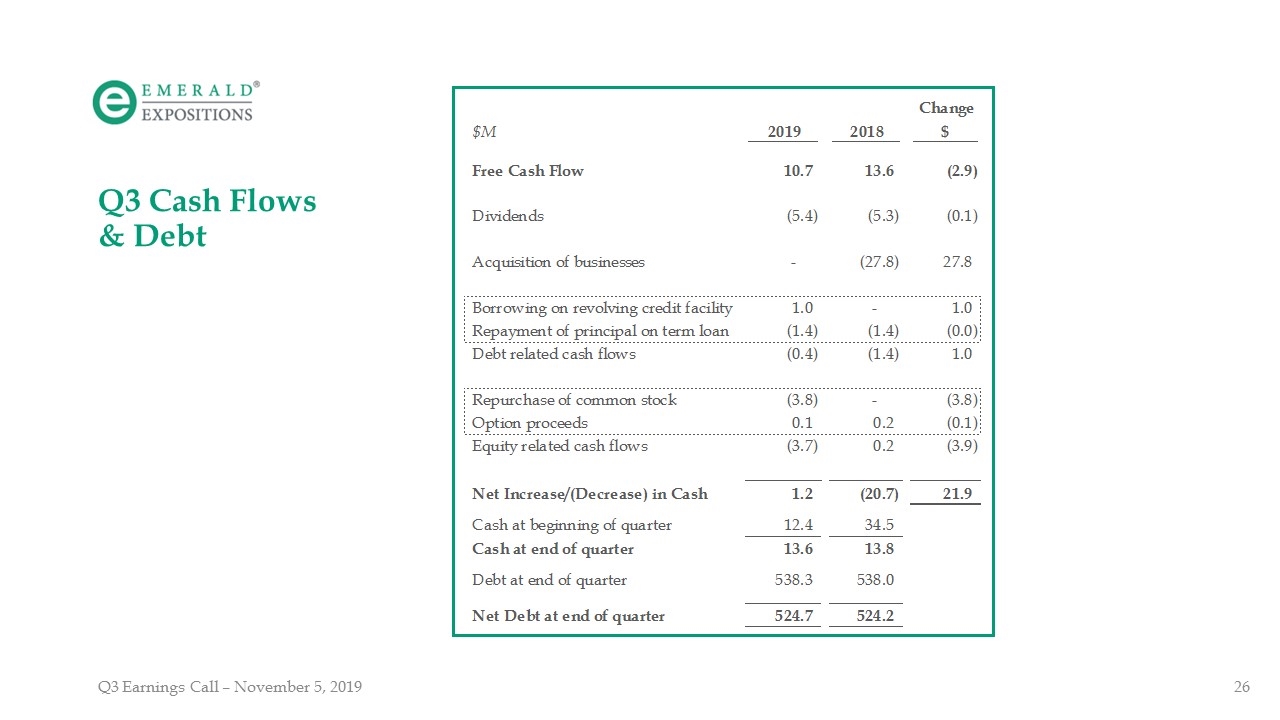

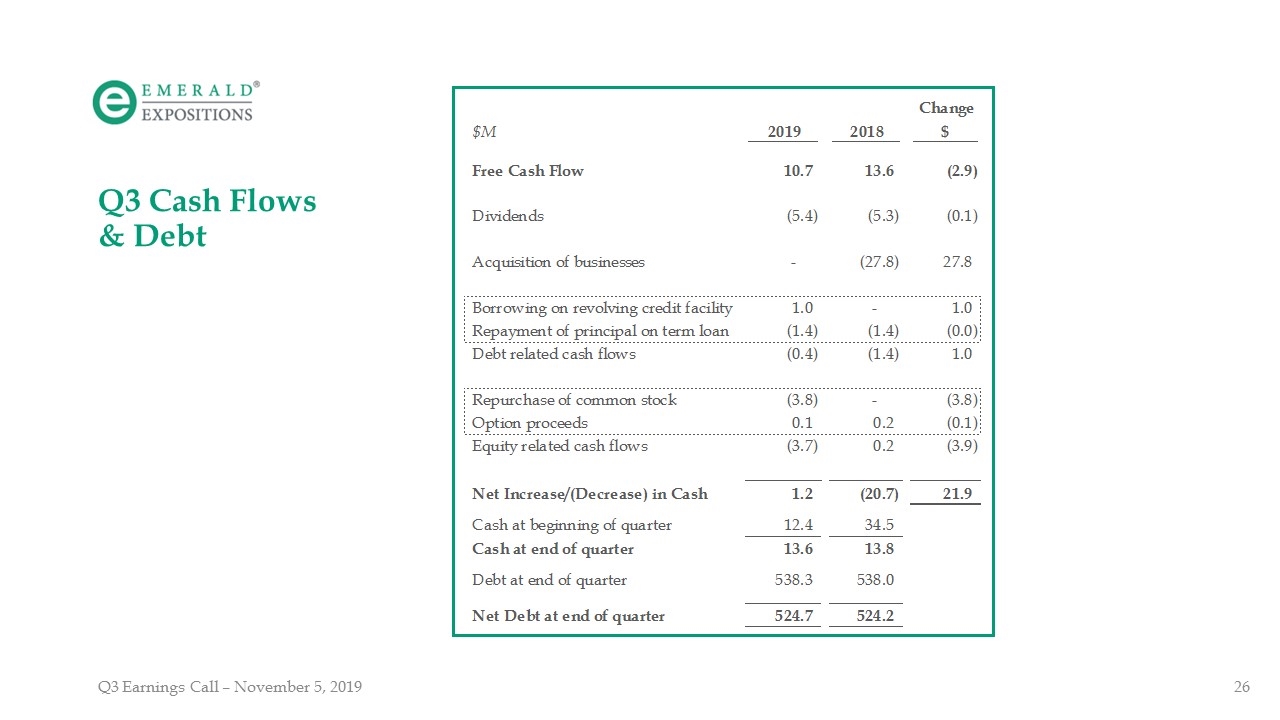

Q3 Cash Flows & Debt

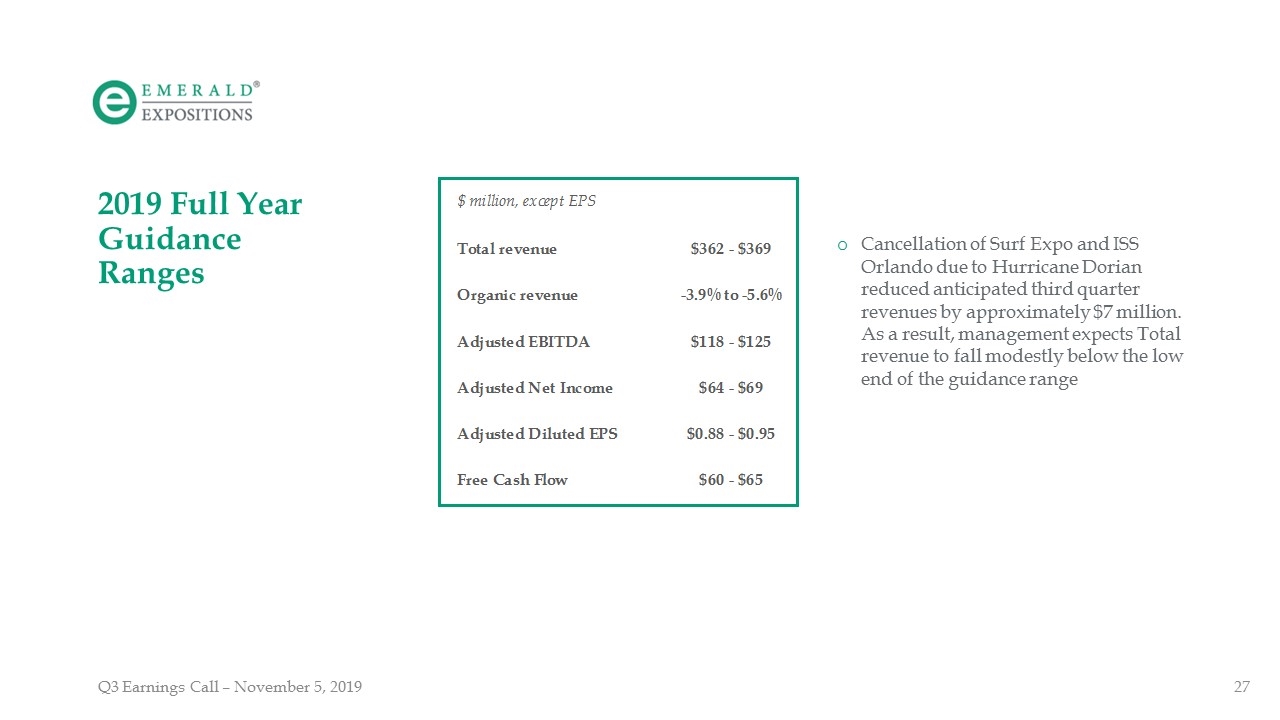

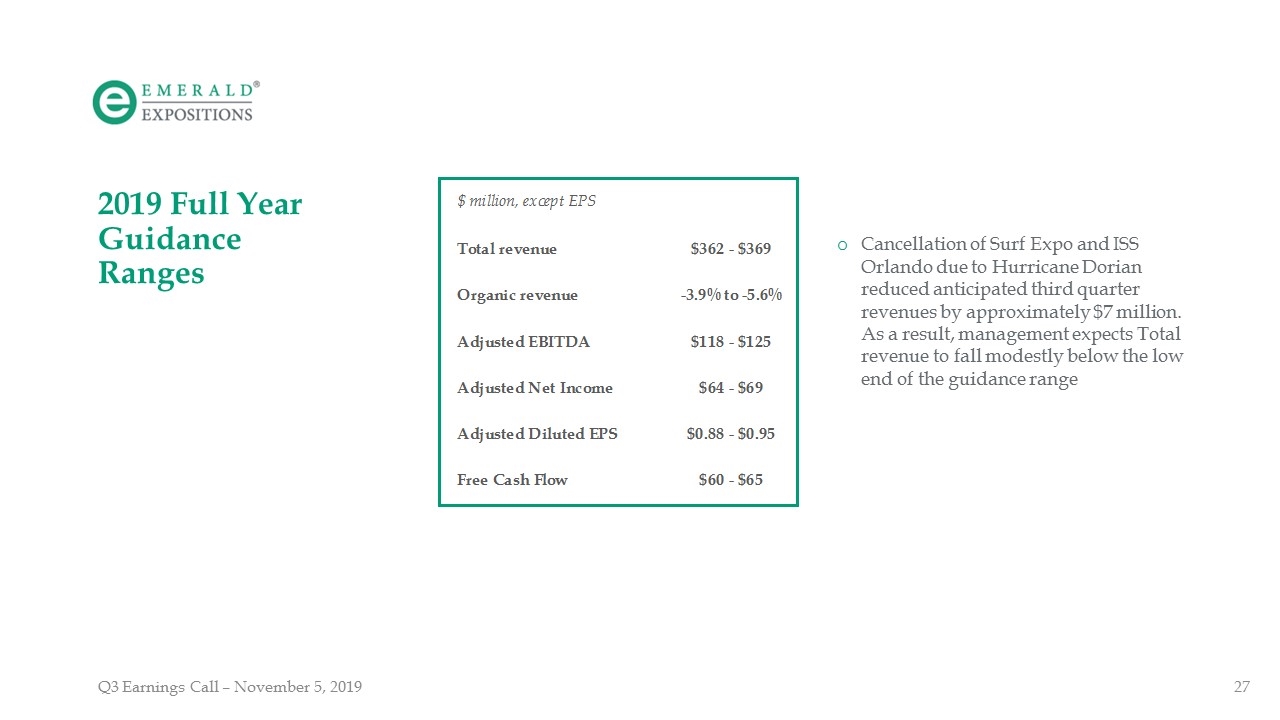

2019 Full Year Guidance Ranges Cancellation of Surf Expo and ISS Orlando due to Hurricane Dorian reduced anticipated third quarter revenues by approximately $7 million. As a result, management expects Total revenue to fall modestly below the low end of the guidance range

Concluding Remarks

Despite recent disappointing financial performance, this business has significant potential over the medium to long term Portfolio is diversified and we have leading market positions Key is to deliver more value to our customers and to increase their satisfaction and ROI We will achieve this by applying proven approaches, including extensive use of data and technology, increasing accountability and by simply executing better Our growth strategies and financial objectives are set Our employees are engaged and enthusiastic While it will not change overnight, we are highly confident that Emerald can achieve its financial objectives The Table is Reset

Q&A