Exhibit 99.2

Anne Holland Ventures, Inc.

AND SUBSIDIARY

condensed CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

nine months ENDED september 30, 2021 and 2020

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | |

CONDENSED CONSOLIDATED BALANCE SHEETS | 2 |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | 3 |

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY | 4 |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | 5 |

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | 6 |

Anne Holland Ventures, Inc. AND SUBSIDIARY

condensed CONSOLIDATED balance sheets

(unaudited)

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

(2)

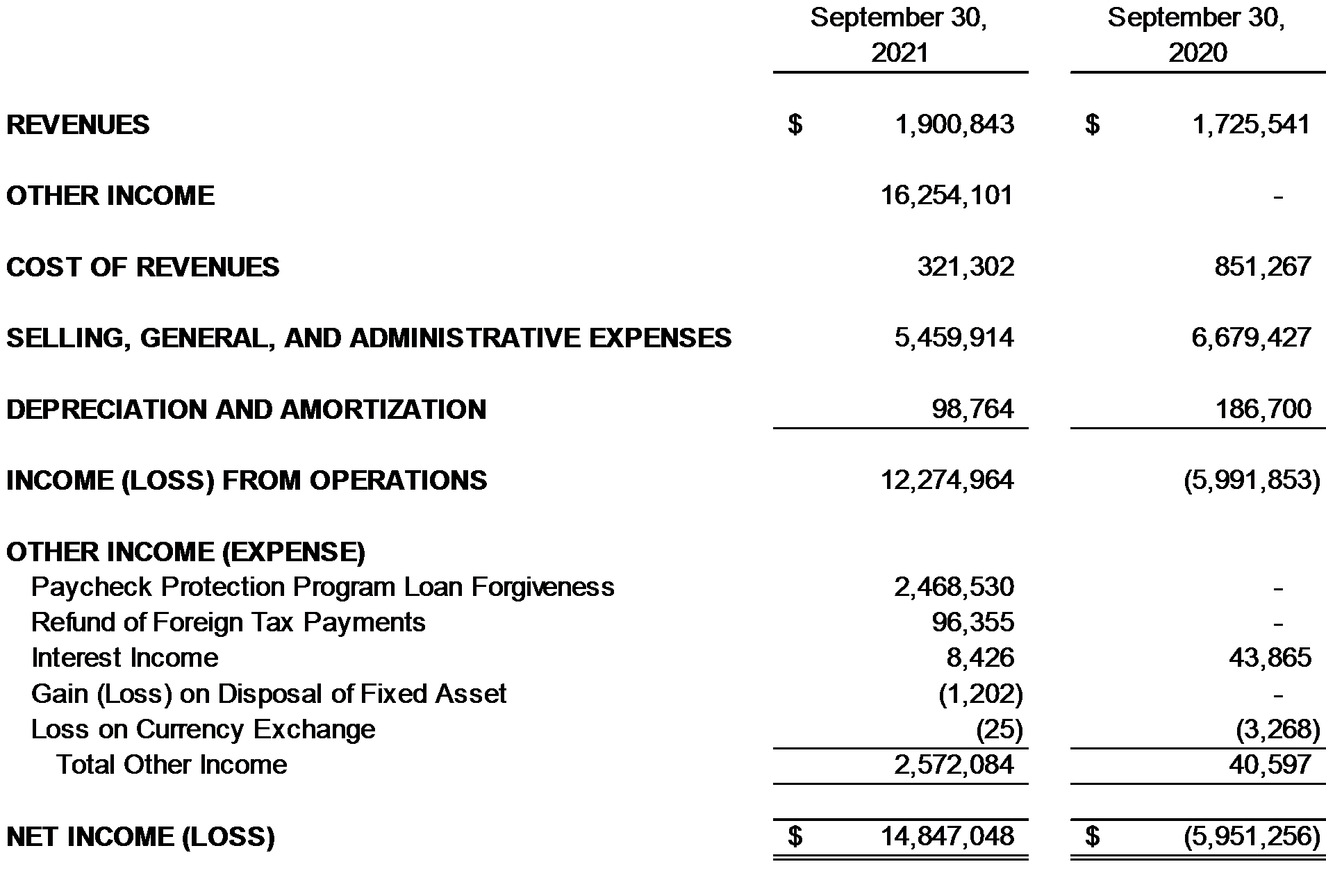

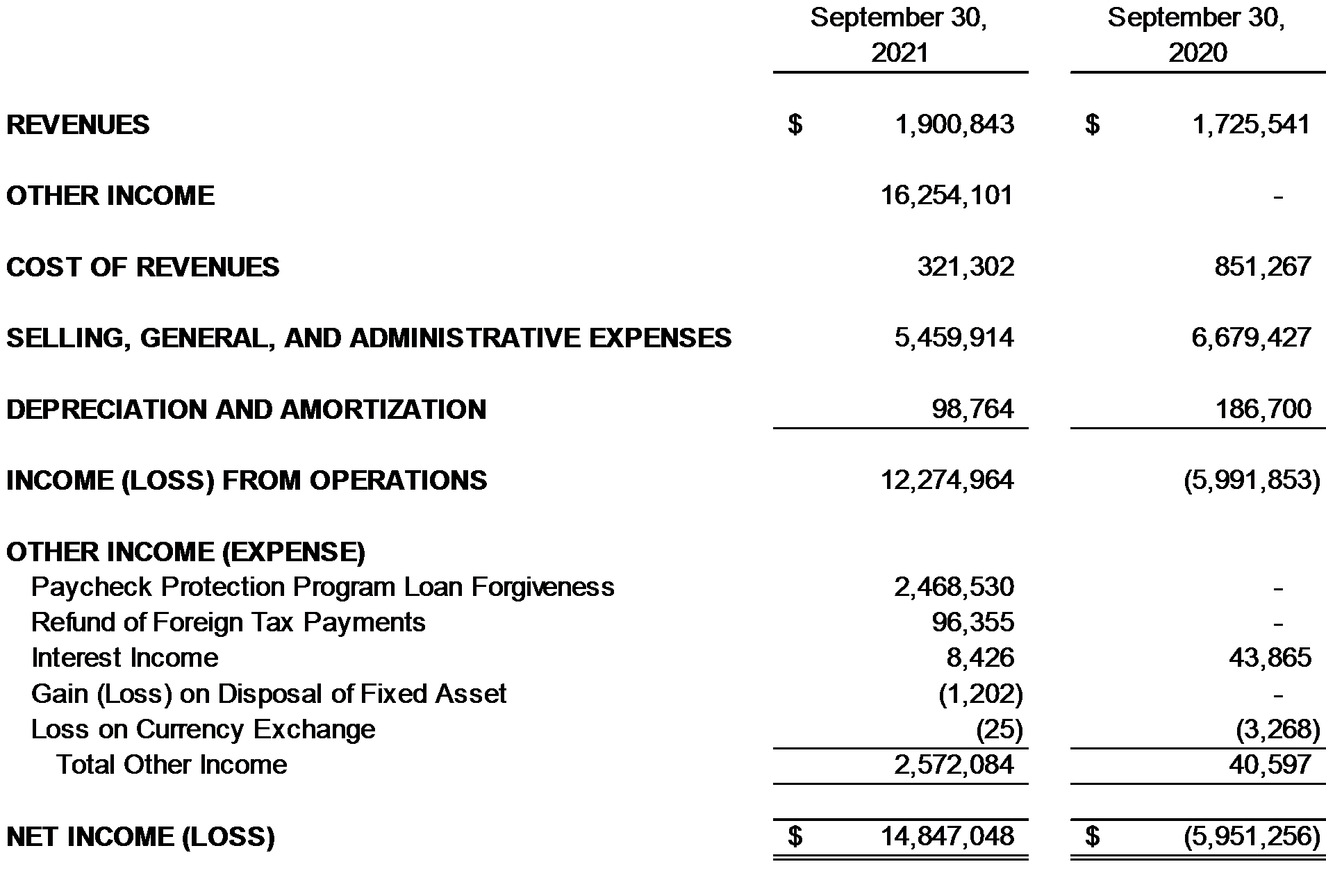

Anne Holland Ventures, iNC. AND SUBSIDIARY

condensed CONSOLIDATED STATEMENTS OF operations

nine months ENDED september 30, 2021 and 2020

(unaudited)

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

(3)

Anne Holland Ventures, INC. AND SUBSIDIARY

condensed CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

nine months ended september 30, 2021 and 2020

(unaudited)

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

(4)

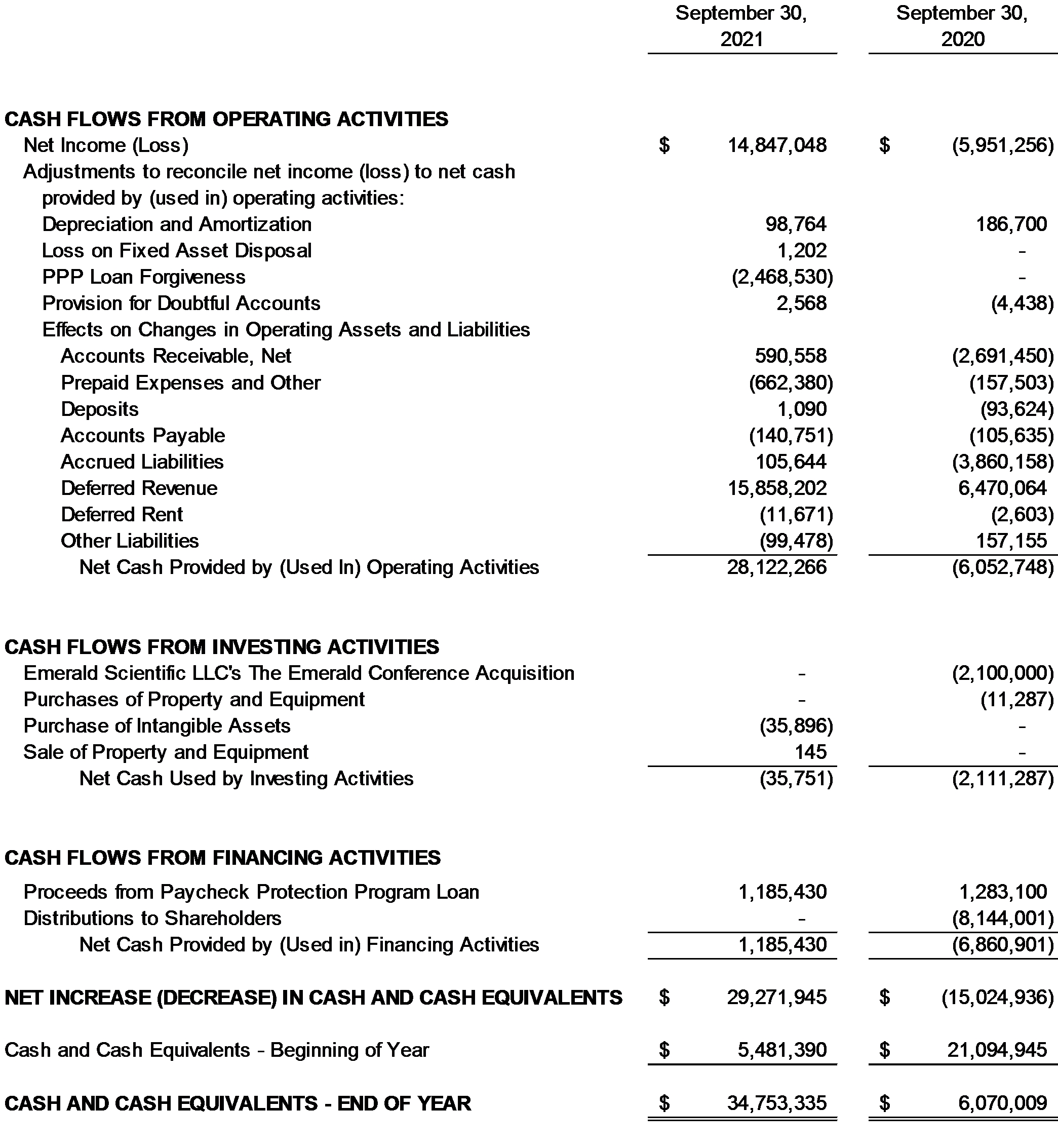

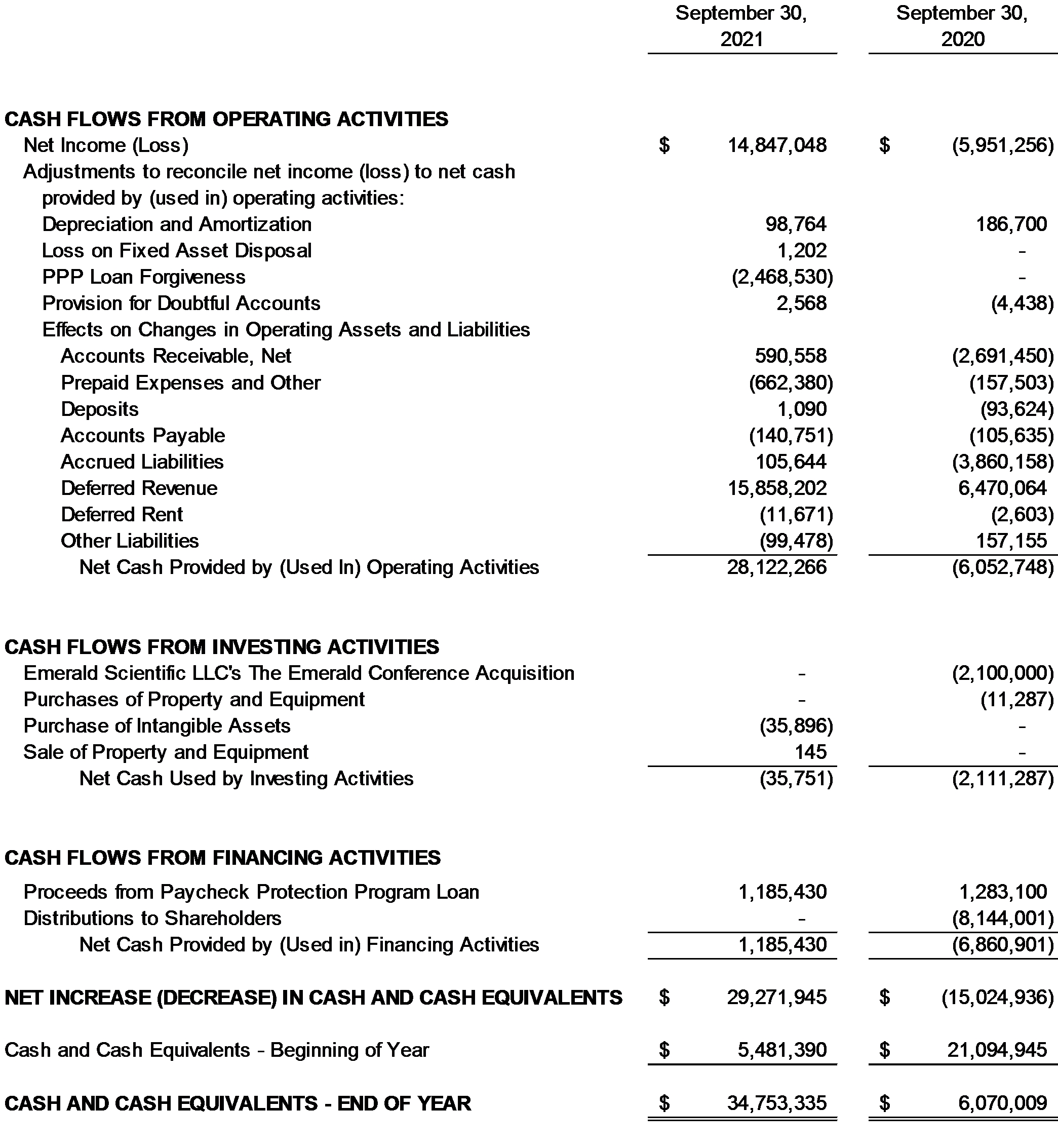

Anne Holland Ventures, INC. AND SUBSIDIARY

condensed CONSOLIDATED STATEMENTS OF CASH FLOWS

nine months ended september 30, 2021 and 2020

(Unaudited)

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

(5)

Anne Holland Ventures, INC. AND SUBSIDIARY

Notes to condensed CONSOLIDATED financial statements

(unaudited)

NOTE 1 | summary of significant accounting policies |

Nature of Operations

Anne Holland Ventures, Inc. (“AHV”) was formed on April 6, 2009 under the laws of the State of Rhode Island. AHV operates as a business-to-business media company with internally produced editorial platforms, including the online trade publication, MJBizDaily, and trade shows serving the global cannabis industry, MJBizCon (collectively "MJBiz"). On August 28, 2020, AHV formed a wholly owned subsidiary in Germany, AHV Media GmbH, to comply with German labor laws. The financial results of AHV Media GmbH are immaterial to the consolidated financial statements.

Principles of Consolidation

The consolidated financial statements include the accounts of AHV and its wholly owned subsidiary, AHV Media GmbH (together, the “Company”), from the date of its respective formation. All intercompany balances and transactions have been eliminated for purposes of consolidation.

Risks and Uncertainties

In March 2020, the World Health Organization categorized the Coronavirus Disease 2019 (“COVID-19”) as a pandemic, and the President of the United States declared the COVID-19 outbreak a national emergency. In conjunction with this declaration and the spread of COVID-19 across the United States, recommendations and mandates were handed down by various local, state and federal government agencies regarding social distancing, containment areas and mandates against large gatherings, as well as quarantine requirements. In addition, travel restrictions were imposed by the United States and foreign governments, and by companies with respect to their employees, and various event venues announced indefinite closures. As a result of these and various other factors, management made the decision to cancel substantially all of the Company’s face-to-face events scheduled through the end of 2020. Additionally, management made the decision to cancel the Emerald Conference tradeshow originally scheduled to stage in the first quarter of 2021. The ongoing effects of COVID-19 on the Company’s operations and event calendar have had a material negative impact on its financial results and liquidity during 2020, and such negative impact may continue beyond the containment of such outbreak.

The Company maintains event cancellation insurance to protect against losses due to the unavoidable cancellation, postponement, relocation and enforced reduced attendance at events due to certain covered events. Specifically, the Company is insured for losses due to event cancellations caused by the outbreak of communicable diseases, including COVID-19.

The Company is in the process of pursuing claims under these insurance policies to offset the financial impact of cancelled events as a result of COVID-19.

As of December 31, 2020, the Company’s management concluded that receipt of insurance payments could not be estimated as the claims filing process began in the first quarter of 2021. The Company received payments of $16,254,101 from its insurance carrier to recover the lost revenues of the affected trade shows during the nine months ended September 30, 2021. Additionally, management concluded that the receipt of additional insurance payments could not be estimated as of September 30, 2021. As a result, during the nine months ended September 30, 2021 and 2020, the Company reported other income of $16,254,101 and

(6)

Anne Holland Ventures, INC. AND SUBSIDIARY

Notes to condensed CONSOLIDATED financial statements

(unaudited)

$-0-, respectively, to recognize the amount that was recovered from the insurance company in the statement of operations.

Use of Estimates

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Significant estimates include, but are not limited to, allowances for doubtful accounts, useful lives of intangible assets, long-lived asset and goodwill impairments and assumptions used in valuing the Company’s allocation of purchase price, including acquired intangible assets and goodwill. Actual results could differ from those estimates

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash and cash equivalents.

Concentrations

The Company maintains its cash in several bank deposit accounts which, at times, exceeded federally insured limits. The Company has not experienced any losses in such accounts. The Company believes it is not exposed to any significant credit risk on cash and cash equivalents.

There were no vendor concentrations for the nine months ended September 30, 2021 and the year ended December 31, 2020.

The Company’s core business is content and audience development through publishing various business magazines and hosting trade shows for the cannabis industry, which is regulated by state and federal agencies. Changes in the state and federal laws impacting the cannabis industry could have a significant effect (positive or negative) on the Company’s operations.

Accounts Receivable

Accounts receivable are recorded at the invoiced amount and do not bear interest. The allowance for doubtful accounts is the Company’s best estimate of the amount of probable credit losses in the Company’s existing accounts receivable. The Company determines the allowance for doubtful accounts based upon an aging of accounts receivable, historical experience and management judgment. Accounts receivable balances are reviewed individually for collectability. The allowance for doubtful accounts is $-0- and $5,729 on September 30, 2021 and December 31, 2020, respectively.

Property and Equipment

Property and equipment are recorded at cost. Depreciation is calculated using the straight-line method over the estimated useful lives of the assets, which range from three to five years. Leasehold improvements are amortized over the term of the lease.

(7)

Anne Holland Ventures, INC. AND SUBSIDIARY

Notes to condensed CONSOLIDATED financial statements

(unaudited)

Phantom Stock

The Company has a Phantom Stock Plan that is accounted for as a liability in accordance with ASC Topic 718, Compensation – Stock Compensation. The Phantom Stock contains a performance condition based upon a change in control at the Company and, as such, a liability would not be recorded until that change of control was determined to be probable, or when the change of control occurs. As of September 30, 2021 and December 31, 2020, no liability has been recorded.

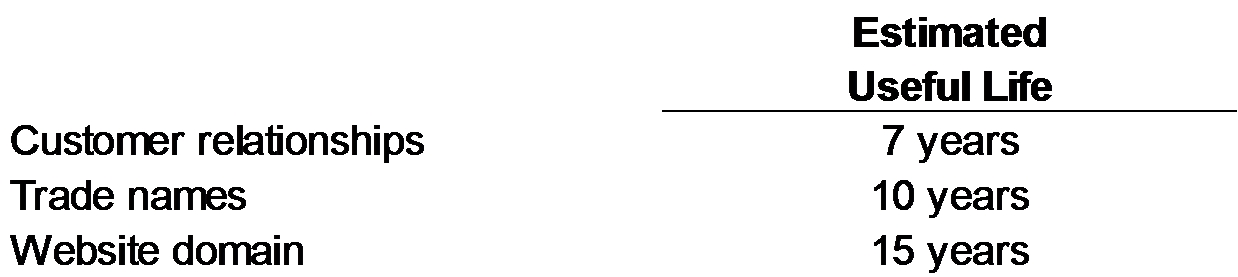

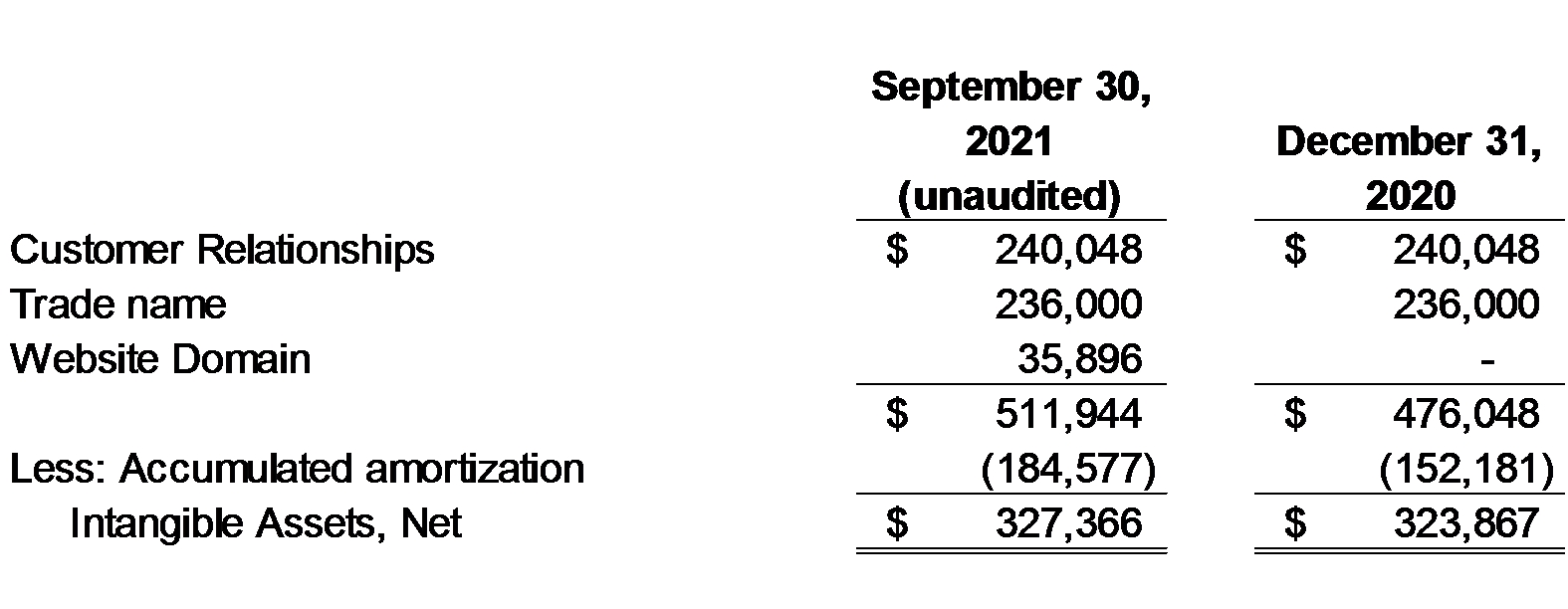

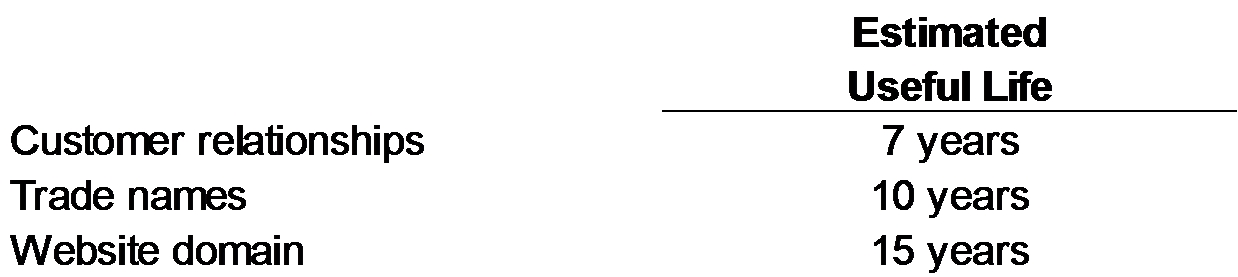

Definite-Lived Intangible Assets

Definite-lived intangible assets consist of customer relationships and certain trade names. Intangible assets with finite lives are stated at cost, less accumulated amortization and impairment losses, if any. These intangible assets are amortized on a straight-line basis over the following estimated useful lives, which are reviewed each reporting period:

Refer to Note 5, Intangible Assets and Goodwill, for definite-lived intangible asset impairments recorded during the year ended December 31, 2020.

Goodwill

Goodwill represents the excess of the cost to acquire a business over the estimated fair value of the net assets acquired. Goodwill is not amortized. Instead, it is measured for impairment at least annually or when events indicate that impairment exists. When evaluating goodwill for impairment, the Company first assesses qualitative factors to determine whether the existence of events or circumstances leads to a determination that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If the carrying amount of the reporting unit exceeds its fair value, then the amount of impairment loss must be measured. The Company did not identify a goodwill impairment charge for the year ended December 31, 2020. Additionally, there were no triggering events for the nine months ended September 30, 2021. Refer to Note 5, Intangible Assets and Goodwill, for further discussion on the impairment analysis performed during the year ended December 31, 2020.

Fair Value Measurements

The Company’s financial instruments consist primarily of cash and cash equivalents, accounts receivable, accounts payable, accrued liabilities and long-term debt. Accounts receivable, accounts payable, and accrued liabilities are short-term in nature; therefore the carrying value approximates fair value as of September 30, 2021 and December 31, 2020. The following describes the hierarchy of inputs used to measure fair value and the primary valuation methodologies used by the Company for amounts measured at fair value. The three levels of inputs are as follows:

Level 1: Quoted prices in active markets for identical assets or liabilities that the entity has the ability to access.

Level 2: Observable inputs other than prices included in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and

(8)

Anne Holland Ventures, INC. AND SUBSIDIARY

Notes to condensed CONSOLIDATED financial statements

(unaudited)

liabilities in markets that are not active; or other inputs that are observable or can be corroborated with observable market data.

Level 3: Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets and liabilities. This includes certain pricing models, discounted cash flow methodologies and similar techniques that use significant unobservable inputs.

A financial instrument’s categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

Accrued Liabilities

Accrued liabilities consist of costs incurred and not paid as of year-end for the Company’s MJBizCon trade show and normal operating expenses. Amounts are paid within one year and are considered current.

Other Noncurrent Liabilities

Other noncurrent liabilities consist of deferred payments of the employer portion of social security taxes between March 27, 2020 and December 31, 2020, as allowed under the Coronavirus Aid, Relief, and Economic Security Act ("CARES Act") with 50% of the deferred amount due December 31, 2021 and the remaining 50% due December 31, 2022. The Company began deferring the employer portion of social security taxes in mid-May 2020. As of September 30, 2021 and December 31, 2020, 50% of the balance is recorded as other noncurrent liabilities. Amounts due within one year are recorded as accrued liabilities in current liabilities.

Distributions

Distributions consist of distributions to stockholders. Distributions are $-0- and $8,144,001 for the periods ended September 30, 2021 and 2020, respectively.

Income Taxes

The Company has elected to be taxed as an S corporation under the Internal Revenue Code. Consequently, the stockholders report their share of the Company’s taxable income in their individual income tax returns. Therefore, no provision for income taxes has been included in the accompanying financial statements. The Company’s state taxes are immaterial to these financial statements.

AHV Media GmbH files taxes in Germany. The taxes are not material to these consolidated financial statements.

The Company follows the guidance of ASC Topic 740, Accounting for Uncertainty in Income Taxes. ASC 740 prescribes a more-likely-than-not measurement methodology to reflect the financial statement impact of uncertain tax positions taken or expected to be taken in a tax return. If taxing authorities were to disallow any tax positions taken by the Company, the additional income taxes, if any, would be imposed on the stockholders rather than the Company. Accordingly, there would be no effect on the Company’s financial statements.

(9)

Anne Holland Ventures, INC. AND SUBSIDIARY

Notes to condensed CONSOLIDATED financial statements

(unaudited)

Revenue Recognition

The Financial Accounting Standards Board (“FASB”) issued new guidance that created Topic ASC 606, Revenue from Contracts with Customers. This guidance supersedes the revenue recognition requirements in ASC 605, Revenue Recognition, and requires the recognition of revenue when promised goods or services are transferred to customers in an amount that reflects the consideration to which an entity expects to be entitled in exchange for those goods or services.

The Company adopted the requirements of the new guidance as of January 1, 2019 and determined that there was no significant change under ASC 606 compared to how it was previously recognizing revenue. As a result, management determined that there was no cumulative adjustment that was required upon adoption of the new standard.

The Company recognizes revenue when its customer obtains control of promised goods or services in an amount that reflects the consideration which the Company expects to receive in exchange for those goods or services. To determine revenue recognition for the arrangements that are within the scope of ASC 606, the Company performs the following five steps: (1) identify the contract(s) with a customer, (2) identify the performance obligations in the contract, (3) determine the transaction price, (4) allocate the transaction price to the performance obligations in the contract and (5) recognize revenue when (or as) the Company satisfies a performance obligation.

The Company’s primary source of revenue consists of trade shows which includes revenue from registration, exhibitor booths and sponsors. This revenue stream is classified as event income on the accompanying statements of operations. The other source of revenue is referred to as publishing income and consists primarily of advertising and sponsorship in the Company’s online trade publications, MJBizDaily, and the Marijuana Business Magazine.

Event Income

Revenue is recognized from trade shows when the event takes place. Registration, exhibitor and sponsorship fees that are received in advance of the event are deferred until the event takes place. Discounts related to the trade shows are recognized as a reduction of revenue.

Content & Audience Development Income

Revenue from advertising and sponsorship is recognized upon publication. Subscriptions to the online trade publication, MJBizDaily, and the Marijuana Business Magazine are generally provided at no cost.

Contract Balances

Amounts paid in advance for an event are considered contract assets and are included in prepaid expenses and other, and deposits in other assets based on the timing of the event. The Company had $796,589 and $12,800 of contract assets as of September 30, 2021 and December 31, 2020, respectively. Contract liabilities consist of payments received in advance of an event or publication and are classified as deferred revenue. The Company had $20,001,588 and $4,143,386 of deferred revenue as of September 30, 2021 and December 31, 2020, respectively.

There are no significant judgments applied to the timing of recognition of revenue.

(10)

Anne Holland Ventures, INC. AND SUBSIDIARY

Notes to condensed CONSOLIDATED financial statements

(unaudited)

Pre-contract costs, which consist primarily of commissions, are generally charged to expense as incurred due to the short-term nature of the contracts associated with trade shows and publication advertising. The Company had no significant deferred pre-contract costs for the nine months ended September 30, 2021 and the year ended December 31, 2020.

Impairment of Long-Lived Assets

The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future undiscounted net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of carrying amount or the fair value less costs to sell.

Recent Accounting Pronouncements

In February 2016, the FASB issued amended guidance for the treatment of leases. The guidance requires lessees to recognize a right-of-use asset and a corresponding lease liability for all operating and finance leases with lease terms greater than one year. The accounting for lessors will remain relatively unchanged. The guidance changes the accounting for sale and leaseback transactions to conform to the new revenue recognition standards. The guidance also requires both qualitative and quantitative disclosures regarding the nature of the entity’s leasing activities. The amendments in this guidance are effective for fiscal years beginning after December 15, 2021. Early adoption is permitted. Management is evaluating the impact of the amended lease guidance on the Company’s financial statements.

In June 2016, the FASB issued Accounting Standards Update (“ASU”) 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which includes provisions that require financial assets measured at amortized cost basis to be presented at the net amount expected to be collected and credit losses relating to available-for-sale debt securities to be recorded through an allowance for credit losses, which requires recognition of an estimate of all current expected credit losses. The guidance is effective for nonpublic entities for fiscal years beginning after December 15, 2022, including interim periods within those years. The Company does not expect the adoption of this ASU will have a significant impact on its consolidated financial statements.

NOTE 2 | STOCKHOLDERS’ EQUITY |

During September 2018, the Company approved and adopted a Phantom Stock Plan (PS Plan). The Company created a pool of 980 phantom shares to make awards under the PS Plan as determined by the Board of Directors. These 980 phantom shares represent a phantom ownership of approximately 7% of the 14,000 issued and outstanding shares of common stock. As part of the PS Plan adoption, each stockholder was issued an additional 6,950 shares of common stock in a stock split, which brought the total number of issued shares of common stock to 14,000. During the nine months ended September 30, 2021, the Company granted 420 additional shares of Phantom Stock. As of September 30, 2021 and 2020, the Company had granted certain executives a total of 420 and 840 shares of phantom stock, respectively. The shares of phantom stock vest immediately upon granting, however, realizing the value of the phantom stock is contingent upon a change in control event as

(11)

Anne Holland Ventures, INC. AND SUBSIDIARY

Notes to condensed CONSOLIDATED financial statements

(unaudited)

defined in the PS Plan. Compensation expense and a related liability will be recognized for the fair value of the phantom stock when the change in control event has occurred.

NOTE 3 | property and equipment |

Property and equipment, net, consisted of the following:

Depreciation and amortization expense related to property and equipment was $66,367 and $67,729 for the nine months ended September 30, 2021 and 2020, respectively. Losses on disposals were not immaterial for the nine months ended September 30, 2021 and 2020.

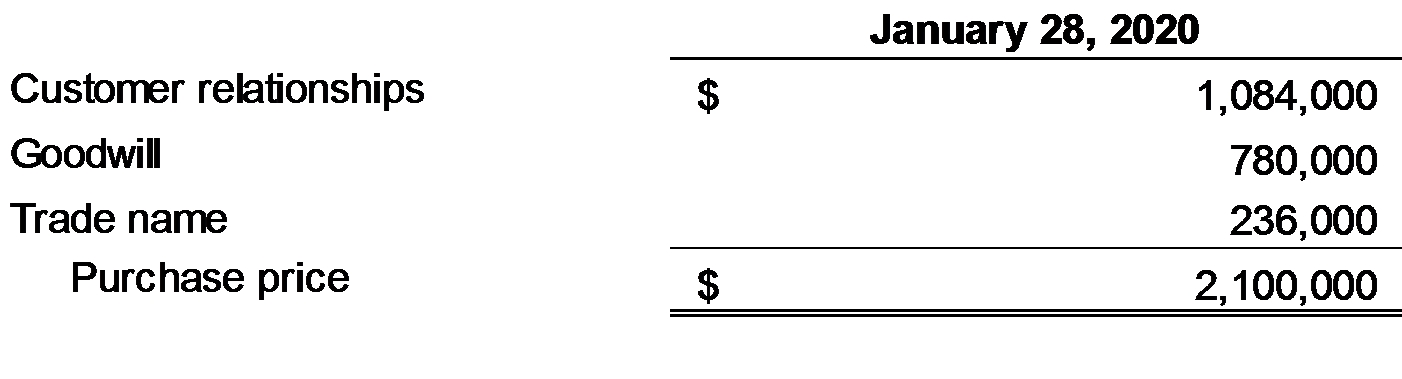

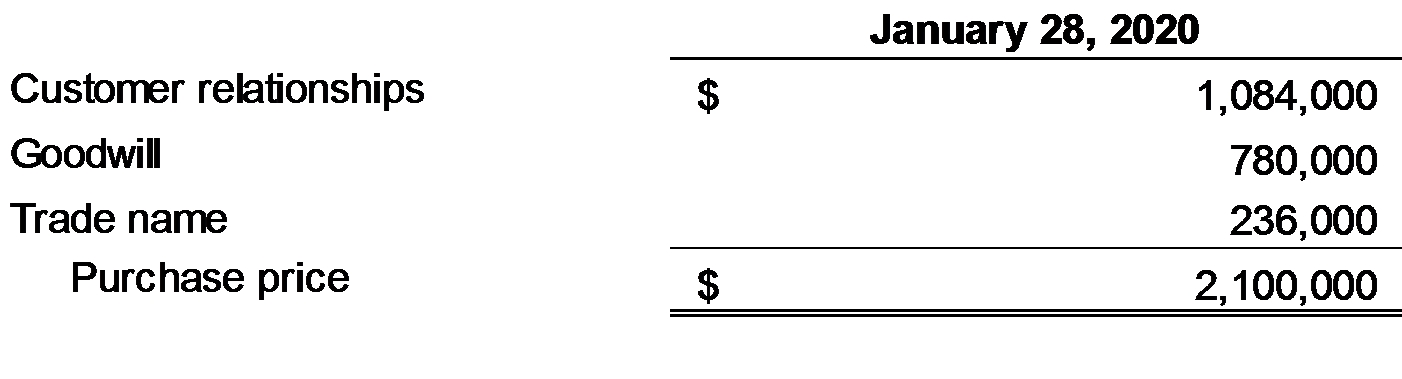

On January 28, 2020, the Company acquired substantially all the assets of Emerald Scientific LLC’s The Emerald Conference, for $2,100,000 in cash. The Emerald Conference is a technical and science conference in the cannabis industry. The acquisition was used to expand the Company’s portfolio of events into the cannabis-related science sector. The purchase price included a hold back of $300,000 which was subject to exceeding minimum revenue targets and was paid on April 3, 2020. The Company will account for the purchase in accordance with guidelines for business combinations under ASC 805, as applicable. The acquisition was financed with cash from operations, and no material external acquisition costs were incurred. The purchase price was allocated as follows at the time of the acquisition:

(12)

Anne Holland Ventures, INC. AND SUBSIDIARY

Notes to condensed CONSOLIDATED financial statements

(unaudited)

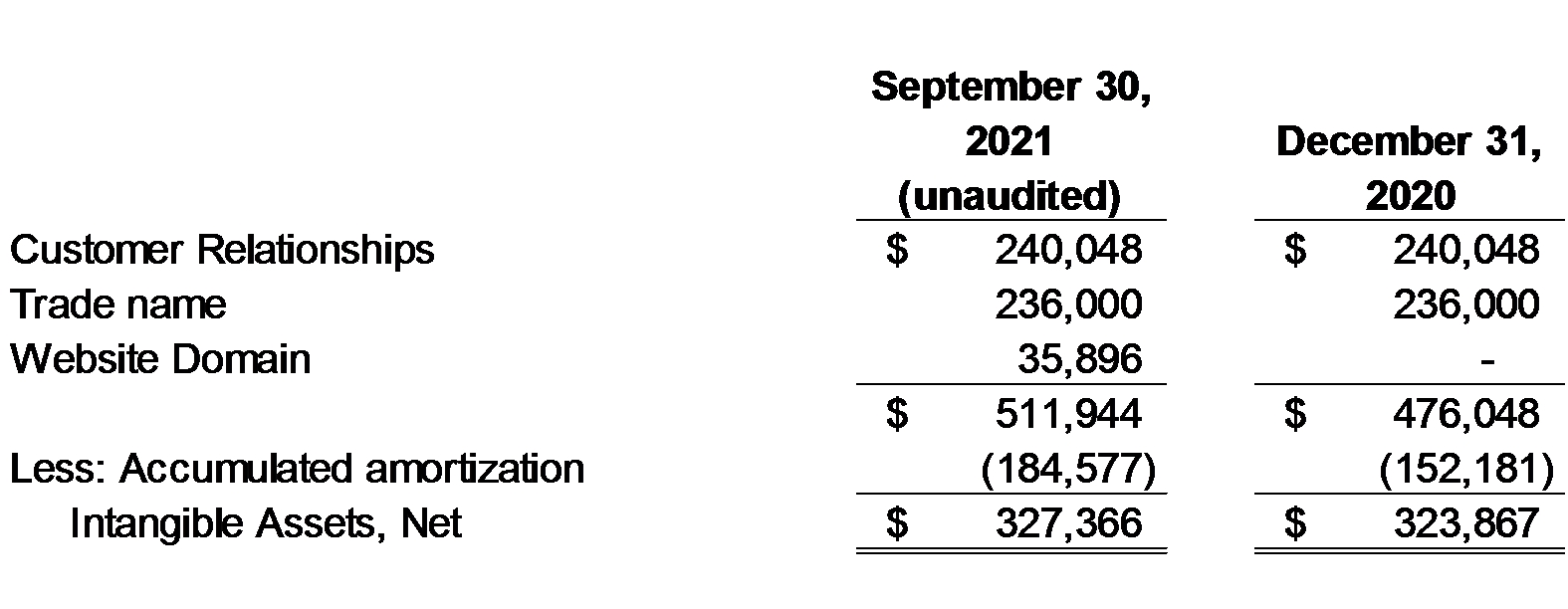

Intangible assets consist of the following:

Amortization expense for the periods ended September 30, 2021 and 2020 was $32,397 and $118,971, respectively.

Future amortization expense is estimated to be as follows for each of the five following years and thereafter ending September 30:

NOTE 6 | commitments and contingencies |

Operating Lease

In October 2018, the Company entered into a lease agreement for office space in Colorado which expires in November 2022. In August 2019, the Company amended its lease agreement for additional space in the same building. The total amount of rental payments due over the lease term is being charged to rent expense on the straight-line method over the term of the lease. The difference between rent expense recorded and the amount paid is credited or charged to deferred rent. Rent expense for the nine months ended September 30, 2021 and 2020 was $266,877 and $307,886, respectively.

Future minimum lease payments under this lease are as follows for the periods ending September 30:

(13)

Anne Holland Ventures, INC. AND SUBSIDIARY

Notes to condensed CONSOLIDATED financial statements

(unaudited)

Litigation

In the normal course of business, the Company is party to litigation from time to time. The Company maintains insurance to cover certain actions and believes that resolution of such litigation will not have a material adverse effect on the Company.

NOTE 7 | PAYCHECK PROTECTION program LOAN PAYABLE |

On April 8, 2020, the Company entered into a $1,283,100 note payable with FirstBank pursuant to the Paycheck Protection Program (“PPP Loan”) under the CARES Act, which is guaranteed by the U.S. Small Business Administration (“SBA”). The PPP Loan may be forgiven, in whole or in part, if the Company was eligible for the PPP Loan at the time of application, used the loan proceeds for eligible expenses within a defined period and otherwise satisfied PPP requirements. On April 21, 2021, the Company received full forgiveness of the PPP Loan in accordance with the CARES Act based on eligible payroll costs incurred during the covered period. As of December 31, 2020, the outstanding unpaid principal balance was $1,283,100 of which $712,833 and $570,267 are recorded in current liabilities and noncurrent liabilities, respectively.

The Company recognized $2,468,530 of loan forgiveness during the nine months ended September 30, 2021 as other income in the statement of operations.

As of September 30, 2021, the outstanding loan balance is $-0-.

NOTE 8 | Stockholder LOANs PAYABLE |

On September 30, 2020, the owners of the Company loaned $500,000 each to the Company equaling a total loan amount of $1,000,000. Pursuant to the loan agreement, the Company’s Board of Directors will determine repayment of the principal amount based on the Company’s financial position. Interest is payable at 0.13% per annum calculated yearly, not in advance, beginning January 6, 2022. As of September 30, 2021, and December 31, 2020, the outstanding loan balance is $1,000,000 and the entire principal amount is recorded as long-term debt. On December 6, 2021, the loan was repaid in full.

In preparing these financial statements, the Company has evaluated events and transactions for potential recognition or disclosure through March 15, 2022, the date these financial statements were available to be issued.

On February 11, 2021, the Company entered into an additional $1,185,430 Paycheck Protection Program Loan payable (“PPP2”) with FirstBank pursuant to PPP guidelines under the CARES Act and is guaranteed by the SBA. On August 27, 2021, the Company received full forgiveness of the PPP2 in accordance with the CARES Act based on eligible payroll costs incurred during the covered period.

In the fourth quarter of 2021, the Company received additional insurance proceeds of $3,490,765, totaling $19,744,865 for the year ended December 31, 2021 (see Note 1).

(14)

Anne Holland Ventures, INC. AND SUBSIDIARY

Notes to condensed CONSOLIDATED financial statements

(unaudited)

On December 31, 2021 (the “Closing Date”), the Company and its stockholders entered into an asset purchase agreement (the “Asset Purchase Agreement”) with Emerald X, LLC (“Emerald”) to sell substantially all of the assets of the Company related to or associated with the business known and operated as MJBiz, including the annual tradeshow, MJBizCon, and all other events, publications and content offerings of the business. The aggregate base purchase price was $120,000,000, subject to certain adjustments as defined in the Asset Purchase Agreement.

Under the Asset Purchase Agreement, Emerald has agreed to pay an additional amount, based on the performance of the acquired business, as earn-out consideration (the "Contingent Payment") in March 2023.

The Contingent Payment, if any, will be an amount equal to (i) the EBITDA growth of the acquired business as defined in the Asset Purchase Agreement minus $13,000,000 multiplied by (ii) 9.3.

In connection with the Asset Purchase Agreement, the performance condition under the Phantom Stock Plan was triggered and compensation expense paid to the holders amounted to $6,516,274.

(15)