- EEX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Emerald Holding (EEX) DEF 14ADefinitive proxy

Filed: 8 Apr 22, 4:01pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

Emerald Holding, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

April 8, 2022

To the Stockholders of Emerald Holding, Inc.:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Emerald Holding, Inc., on May 18, 2022, at 1:00 p.m. (Eastern Time) via live webcast. You will be able to attend the Annual Meeting online and submit your questions prior to or during the meeting by visiting www.meetnow.global/MMJXP55. You will also be able to vote your shares electronically during the live webcast of the Annual Meeting. To participate in the meeting, you will need your 15-digit control number included on your Notice of Internet Availability of the Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials.

During the live webcast of the Annual Meeting, holders of our common stock and holders of our Series A Preferred Stock voting on an as-converted basis as a single class with holders of our common stock will be asked to (i) re-elect three Class II directors to our Board of Directors, (ii) ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2022, and (iii) transact any other business that may properly come before the Annual Meeting of Stockholders or any adjournment or postponement thereof. Holders of our Series A Preferred Stock will also be asked to re-elect two Preferred Stock directors to our Board of Directors. In addition, management will report on the progress of our business and respond to comments and questions of general interest to our stockholders.

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting virtually. You may vote on the Internet, by telephone or by completing and mailing a proxy card. Voting over the Internet, by telephone or by written proxy will ensure your shares are represented at the Annual Meeting. If you attend the meeting virtually, you may revoke your proxy, if you wish, and vote electronically.

Securities and Exchange Commission rules allow companies to furnish proxy materials to their stockholders on the Internet. We are pleased to take advantage of these rules and believe that they enable us to provide you with the information you need, while making delivery more efficient and more environmentally friendly. In accordance with these rules, on or about April 8, 2022, we will begin sending a Notice of Internet Availability of Proxy Materials to each of our stockholders providing instructions on how to access our proxy materials and 2021 Annual Report over the Internet. The Notice of Internet Availability of Proxy Materials also provides instructions on how to vote online and includes instructions on how to request a printed set of the proxy materials.

We thank you for your continued support and interest in Emerald Holding, Inc.

Sincerely, |

|

Hervé Sedky President and Chief Executive Officer |

Emerald Holding, Inc.

100 Broadway, 14th Floor

New York, NY 10005

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 18, 2022

NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Emerald Holding, Inc., will be held virtually, via live webcast at www.meetnow.global/MMJXP55 on May 18, 2022, at 1:00 p.m. (Eastern Time), for the following purposes:

Holders of our common stock and holders of our Series A Preferred Stock voting on an as-converted basis as a single class with holders of our common stock will consider:

| • | Proposal 1: To re-elect three Class II directors to our Board of Directors to hold office until the 2025 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified; |

| • | Proposal 2: To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2022; and |

| • | Any other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

In addition to Proposals 1 and 2 above, holders of our Series A Preferred Stock will also be asked to re-elect two Preferred Stock directors to our Board of Directors to hold office until the 2023 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified.

Holders of record of shares of our common stock and shares of our Series A Preferred Stock at the close of business on March 29, 2022 are entitled to receive notice of and to vote during the live webcast of the Annual Meeting and any adjournment or postponement thereof.

A Notice of Internet Availability of Proxy Materials containing instructions on how to access this Proxy Statement and our 2021 Annual Report is being mailed on or about April 8, 2022 to all stockholders entitled to vote during the live webcast of the Annual Meeting.

| By Order of the Board of Directors, |

|

|

| Stacey Sayetta |

| General Counsel and Corporate Secretary |

|

|

New York, NY |

|

April 8, 2022 |

|

IMPORTANT INFORMATION REGARDING THE AVAILABILITY OF PROXY MATERIALS

This Notice of Meeting, Proxy Statement, Proxy Card and our 2021 Annual Report, which includes our annual report on Form 10-K for the fiscal year ended December 31, 2021, are available at www.investorvote.com/EEX.

YOUR VOTE IS VERY IMPORTANT. PLEASE CAREFULLY READ THE ATTACHED PROXY STATEMENT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING VIRTUALLY, WE URGE YOU TO VOTE AND SUBMIT YOUR PROXY OVER THE INTERNET, BY TELEPHONE OR MAIL.

Emerald Holding, Inc.

TABLE OF CONTENTS

Emerald Holding, Inc.

100 Broadway, 14th Floor

New York, NY 10005

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 18, 2022

We are furnishing this Proxy Statement to you as part of a solicitation by the Board of Directors (the “Board”) of Emerald Holding, Inc., a Delaware corporation, of proxies to be voted at our 2022 Annual Meeting of Stockholders and at any reconvened meeting after an adjournment or postponement of the meeting (the “Annual Meeting”). We will hold the Annual Meeting virtually, via live webcast at www.meetnow.global/MMJXP55 on May 18, 2022 at 1:00 p.m. (Eastern Time). Unless the context otherwise requires, all references in this Proxy Statement to “Emerald”, “the Company”, “we”, “us”, and “our” refer to Emerald Holding, Inc., together with its consolidated subsidiaries.

Our mailing address and principal executive office is 100 Broadway, 14th Floor, New York, NY 10005. Our investor website is located at investor.emeraldx.com. The information contained on, or that can be accessed through, our website is not a part of this Proxy Statement.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS

Securities and Exchange Commission (“SEC”) rules allow companies to furnish proxy materials to their stockholders on the Internet. We are pleased to take advantage of these rules and believe that they enable us to provide you with the information you need, while making delivery more efficient and more environmentally friendly. We have saved significant mailing and printing costs by providing proxy materials to you over the Internet in accordance with SEC rules. In accordance with these rules, on or about April 8, 2022, we will begin mailing to each of our stockholders a notice providing instructions on how to access our proxy materials and 2021 Annual Report on the Internet (the “Notice of Internet Availability of Proxy Materials”). The Notice of Internet Availability of Proxy Materials, which cannot itself be used to vote your shares, also provides instructions on how to vote online and includes instructions on how to request a paper copy of the proxy materials, if you so desire. The Notice of Internet Availability of Proxy Materials includes a control number that must be entered at the website provided on the notice in order to view the proxy materials. Whether you received the Notice of Internet Availability of Proxy Materials or paper copies of our proxy materials, the Proxy Statement and 2021 Annual Report are available to you at www.investorvote.com/EEX.

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

At the Annual Meeting, holders of our common stock and holders of our Series A Preferred Stock voting on an as-converted basis as a single class with holders of our common stock will consider and vote upon:

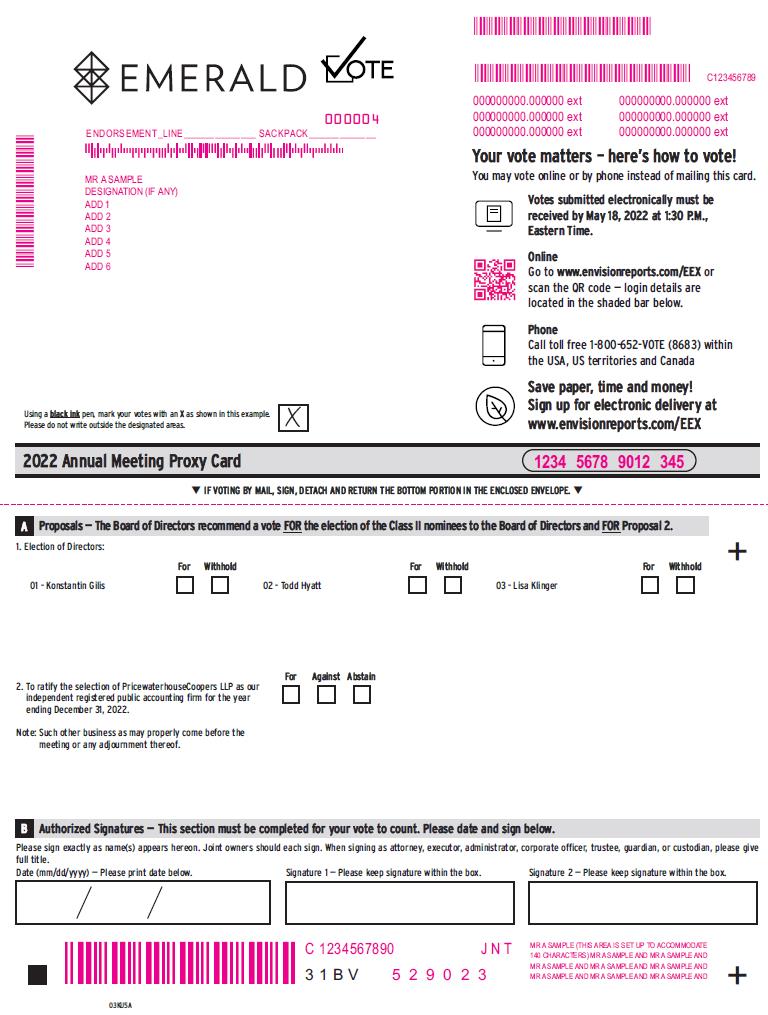

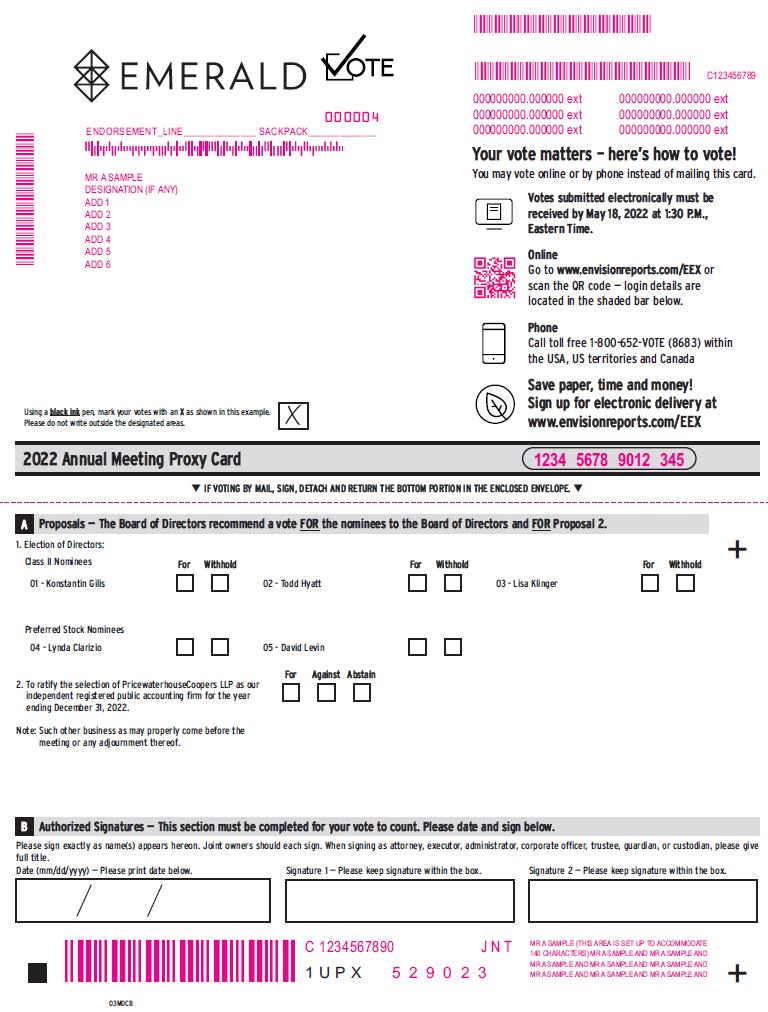

| • | Proposal 1: To re-elect three Class II directors to our Board to hold office until the 2025 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified; |

| • | Proposal 2: To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2022; and |

| • | Any other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

In addition to Proposals 1 and 2 above, holders of our Series A Preferred Stock will also be asked to re-elect two Preferred Stock directors to our Board of Directors to hold office until the 2023 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified.

1

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this Proxy Statement. You should read this entire Proxy Statement carefully. Information contained on, or that can be accessed through, our website is not a part of this Proxy Statement.

What is a proxy?

The Board is asking for your proxy. This means you authorize persons selected by the Company to vote your shares during the live webcast of the Annual Meeting in the way that you instruct. All shares represented by valid proxies received and not revoked before the Annual Meeting will be voted during the live webcast of the Annual Meeting in accordance with the stockholder’s specific voting instructions.

Why am I receiving these materials?

You are receiving these materials because at the close of business on March 29, 2022 (the “Record Date”), you owned shares of the Company’s common stock, $0.01 par value per share, or Series A Preferred Stock, $0.01 par value per share. All stockholders of record on the Record Date are entitled to attend and vote during the live webcast of the Annual Meeting.

How many votes do I have?

Common Stock

Each share of our common stock is entitled to vote during the live webcast of the Annual Meeting. As of the Record Date, we had 70,130,484 shares of common stock outstanding. With respect to all of the matters submitted for vote to holders of common stock during the live webcast of the Annual Meeting, each share of common stock is entitled to one vote. Holders of common stock will not be entitled to vote for the re-election of our Preferred Stock directors.

Series A Preferred Stock

Each share of our Series A Preferred Stock is entitled to vote during the live webcast of the Annual Meeting. As of the Record Date, we had 71,442,407 shares of Series A Preferred Stock outstanding. With respect to the re-election of our Preferred Stock directors, each share of Series A Preferred Stock is entitled to one vote. With respect to the remaining matters submitted for vote during the live webcast of the Annual Meeting, each holder of Series A Preferred Stock is entitled to a number of votes on such matter equal to the number of votes such holder would have been entitled to cast if such holder were the holder of record, as of the Record Date, of a number of shares of common stock equal to the whole number of shares of common stock that would be issuable upon conversion of such Series A Preferred Stock assuming such Series A Preferred Stock were converted to common stock on the Record Date.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted by the SEC, we may furnish proxy materials, including this Proxy Statement and our Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials (the “Notice”), which was mailed to our stockholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. Utilizing this method of proxy delivery expedites receipt of proxy materials by the Company’s stockholders and lowers the Company’s costs. All stockholders will have the ability to access the proxy materials over the Internet, or request a printed set of the proxy materials, if desired, at investorvote.com/EEX. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

What information is contained in this Proxy Statement?

This Proxy Statement includes information about the nominees for Class II and Preferred Stock directors and other matters to be voted on during the live webcast of the Annual Meeting. It also explains the voting process and requirements; describes the compensation of our principal executive officers and our two other most highly compensated executive officers (collectively referred to as our “named executive officers”); describes the compensation of our directors; and provides certain other information required by SEC rules.

2

For a discussion of certain exemptions we may rely upon as an “emerging growth company” please refer to the answer to the question “What are the implications of the Company’s status as an ‘Emerging Growth Company’?” below.

What shares are included on my proxy card?

You will receive one proxy card for all the shares of the Company’s common stock that you hold as a stockholder of record and one proxy card for all the shares of the Series A Preferred Stock that you hold as a stockholder of record.

If you hold your shares in street name, you will receive voting instructions for each account you have with a broker, bank or other nominee.

What matters am I voting on, how may I vote on each matter and how does the Board recommend that I vote on

each matter?

The following table sets forth each of the proposals you are being asked to vote on, how you may vote on each proposal and how the Board recommends that you vote on each proposal:

Proposal

| How may I vote?

| How does the Board recommend that I vote?

| |

1. | Re-election of Class II directors: All stockholders: The re-election of the three Class II director nominees identified in this Proxy Statement, each for a three-year term or until their respective successors are duly elected and qualified. |

All stockholders: You may (i) vote FOR the re-election of all Class II director nominees named herein; (ii) WITHHOLD authority to vote for all such Class II director nominees; or (iii) vote FOR the re-election of all such Class II director nominees other than any nominees with respect to whom your vote is specifically WITHHELD by indicating in the space provided on |

All stockholders: The Board recommends that you vote FOR all of the Class II director nominees. |

|

|

|

|

|

|

|

|

| Holders of Series A Preferred Stock only: The re-election of the two Preferred Stock director nominees identified in this proxy statement, each for a one-year term or until their respective successors are duly elected and qualified. | Holders of Series A Preferred Stock only: You may (i) vote FOR the re-election of all Preferred Stock director nominees named herein; (ii) WITHHOLD authority to vote for all such Preferred Stock director nominees; or (iii) vote FOR the re-election of all such Preferred Stock director nominees other than any nominees with respect to whom your vote is specifically WITHHELD by indicating in the space provided on | Holders of Series A Preferred Stock only: The Board recommends that you vote FOR all of the Preferred Stock director nominees. |

2. | The ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2022. | You may vote FOR or AGAINST the vote to ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm, or you may indicate that you wish to ABSTAIN from voting on the matter. | The Board recommends that you vote FOR the ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022. |

|

|

|

|

3

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with the Company’s transfer agent, Computershare Trust Company, N.A. (“Computershare”), you are considered the “stockholder of record” with respect to those shares. The Notice of Internet Availability of Proxy Materials will be sent directly to stockholders of record beginning on or about April 8, 2022.

If your shares are held with a broker or in an account at a bank, you are considered the “beneficial owner” with respect to those shares. These shares are sometimes referred to as being held “in street name.” The Notice of Internet Availability of Proxy Materials would have been forwarded to you by your broker, bank or other holder of record who is considered the stockholder of record with respect to those shares.

As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote your shares by using the voting instruction card you received. You will not be able to vote these shares directly unless you obtain a signed legal proxy from your broker, bank or other nominee giving you the right to vote the shares.

How do I vote if I am a stockholder of record?

As a stockholder of record, you may vote your shares in any one of the following ways:

| • | Call the toll-free number shown on the proxy card; |

| • | Vote on the Internet on the website shown on the proxy card; |

| • | Mark, sign, date and return the enclosed proxy card in the postage-paid envelope; or |

| • | Vote electronically during the live webcast of the Annual Meeting. |

Please note that you cannot vote by marking up the Notice of Internet Availability of the Proxy Materials and mailing that Notice back. Any votes returned in that manner will not be counted.

Whether or not you plan to attend the Annual Meeting virtually, we urge you to vote. Returning the proxy card or voting by telephone or online will not affect your right to attend the live webcast of the Annual Meeting and vote electronically.

How do I vote if I am a beneficial owner?

As a beneficial owner, you have the right to direct your broker, bank or other nominee how to vote your shares by following the instructions that your broker, bank or other nominee sent to you. You will receive, or be provided access to, proxy materials and voting instructions for each account that you have with a broker, bank or other nominee. As a beneficial owner, if you wish to change the directions that you have provided your broker, bank or other nominee, you should follow the instructions that your broker, bank or other nominee sent to you.

As a beneficial owner, you are also invited to attend the Annual Meeting provided that you register in advance as described in the answer to the question “How do I register to attend the Annual Meeting virtually on the Internet?” below. However, since you are not a stockholder of record, you may not vote your shares electronically during the live webcast of the meeting unless you obtain a signed legal proxy from your broker, bank or other nominee giving you the right to vote the shares.

How can I attend the Annual Meeting, vote my shares and submit questions?

You are entitled to attend the Annual Meeting only if you were a stockholder of record as of the Record Date or you hold a valid proxy for the Annual Meeting. To attend the Annual Meeting and submit your questions prior to or during the Annual Meeting, please visit www.meetnow.global/MMJXP55 . To participate in the Annual Meeting or to submit questions in advance of the meeting, you will need the 15-digit control number included on your notice of Internet Availability of the Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials.

Shares held in your name as the stockholder of record may be voted electronically during the live webcast of the Annual Meeting.

4

Shares for which you are the beneficial owner but not the stockholder of record also may be voted electronically during the live webcast of the Annual Meeting provided that you obtain a signed legal proxy from your broker, bank or other nominee giving you the right to vote the shares as described in the answer to the question “How do I vote if I am a beneficial owner?” above.

Even if you plan to participate in the annual meeting online, we recommend that you also vote by proxy as described below so that your vote will be counted if you later decide not to participate in the annual meeting.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

The online meeting will begin promptly at 1:00 p.m. (Eastern Time). We encourage you to access the meeting prior to the start time leaving ample time for check in. Please follow the registration instructions as outlined in this Proxy Statement.

How do I register to attend the Annual Meeting virtually on the Internet?

If you are a registered stockholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the notice or proxy card that you received.

If you are a beneficial owner, you must register in advance to attend the Annual Meeting virtually on the Internet.

To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your Emerald Holding, Inc. holdings along with your name and email address to Computershare. Requests for registration should be directed to:

Computershare

Emerald Holding, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. (Eastern Time), on

May 13, 2022.

You will receive a confirmation of your registration by email after we receive your registration materials.

Why is the Annual Meeting only virtual?

We are excited to embrace the latest technology to provide ease of access, real-time communication and cost savings for our stockholders and the Company. Hosting a virtual meeting will provide easy access for stockholders and facilitate participation since stockholders can participate from any location around the world.

What can I do if I change my mind after I vote?

If you are a stockholder of record, you can revoke your proxy before it is exercised by:

| • | written notice of revocation to our General Counsel and Corporate Secretary at 100 Broadway, 14th Floor, New York, NY 10005; |

| • | timely delivery of a valid, later-dated proxy or a later-dated online vote or vote by telephone; or |

| • | virtually attending the Annual Meeting and voting electronically. |

If you are a beneficial owner of shares but not the stockholder of record, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also vote electronically during the live webcast of the Annual Meeting if you obtain a signed legal proxy from your broker, bank or other nominee giving you the right to vote the shares as described in the answer to the question “How do I vote if I am a beneficial owner?” above.

All shares represented by valid proxies received and not revoked will be voted during the live webcast of the Annual Meeting in accordance with the stockholder’s specific voting instructions.

5

What if I return my proxy card or vote by Internet or phone but do not specify how I want to vote?

If you are a stockholder of record and sign and return your proxy card or complete the online or telephone voting procedures, but do not specify how you want to vote your shares, we will vote them as follows:

| • | FOR the re-election of all of the Class II and/or Preferred Stock director nominees, as applicable; and |

| • | FOR the ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2022. |

What votes need to be present to hold the Annual Meeting?

Under our Second Amended and Restated Bylaws, (a) with respect to all proposals except for the election of the Preferred Stock nominees, the presence, in person or by proxy, of the holders of a majority of the total voting power of the outstanding shares of our common stock and Series A Preferred Stock, voting on an as-converted basis as a single class with holders of our common stock, will constitute a quorum for purposes of this class vote and (b) with respect to the election of the Preferred Stock nominees, the presence, in person or by proxy, of the holders of a majority of the total voting power of the outstanding shares of our Series A Preferred Stock will constitute a quorum for purposes of this class vote.

If a quorum is not present, the meeting will be adjourned until a quorum is obtained. Shares present virtually during the annual meeting will be considered shares represented in person at the meeting for purposes of determining the presence of a quorum. Abstentions and broker non-votes (where a broker or nominee does not exercise discretionary authority to vote on a proposal) will be treated as present for purposes of determining the presence of a quorum.

How are votes counted?

In the re-election of the Class II and Preferred Stock directors, your vote may be cast “FOR” all of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees. If you withhold your vote with respect to any nominee, your shares will not be considered to have been voted for or against the nominee. For all other proposals, your vote may be cast “FOR” or “AGAINST” or you may “ABSTAIN.” If you “ABSTAIN,” it has the same effect as a vote “AGAINST.” If you sign your proxy card with no further instructions and you are a stockholder of record, then your shares will be voted in accordance with the recommendations of our Board. If you sign your proxy card with no further instructions and you are a beneficial owner, then please see the response to the question immediately below for a description of how your shares will be voted.

What is the effect of broker non-votes?

Under the rules of the New York Stock Exchange (“NYSE”), if you are a beneficial owner, your broker, bank or other nominee only has discretion to vote on certain “routine” matters without your voting instructions. The proposal to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm is a “routine” matter, and as a result, your broker, bank or other nominee will be permitted to vote your shares on that proposal during the live webcast of the Annual Meeting regardless of whether you provide proper instructions. Broker non-votes will have no effect on the results of Proposal 1 regarding the re-election of Class II and Preferred Stock directors.

6

What is the voting requirement to approve each of the proposals?

The following table sets forth the voting requirements with respect to each of the proposals:

Proposal

| Voting Requirement

| |

1. | All stockholders: The re-election of the three Class II nominees identified in this Proxy Statement each for a three-year term or until their respective successors are duly elected and qualified.

Holders of Series A Preferred Stock only: The re-election of the two Preferred Stock director nominees identified in this Proxy Statement each for a one-year term or until their respective successors are duly elected and qualified. | Each Class II director must be elected by a plurality of the votes cast by holders of our common stock and holders of our Series A Preferred Stock voting on an as-converted basis as a single class with holders of our common stock. Each Preferred Stock director must be elected by a plurality of the votes cast by holders of our Series A Preferred Stock . A plurality means that the nominees with the largest number of votes are elected as directors up to the maximum number of directors of the applicable class to be elected at the Annual Meeting.

|

|

|

|

2. | The ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2022. | To be approved, this vote must be approved by a majority of the votes cast by the holders of our common stock and holders of our Series A Preferred Stock voting on an as-converted basis as a single class with holders of our common stock virtually present or by proxy, meaning that the votes cast by the stockholders “FOR” the approval of the proposal must exceed the number of votes cast “AGAINST” the approval of the proposal. If a stockholder votes to “ABSTAIN,” it has the same effect as a vote “AGAINST.”

|

|

|

|

Other matters that may properly come before the Annual Meeting may require more than a majority vote under our Second Amended and Restated Bylaws, our Amended and Restated Certificate of Incorporation (including the Certificate of Designations for the Series A Preferred Stock), the laws of Delaware or other applicable laws.

Who will count the votes?

A representative of Computershare will act as the inspector of elections and count the votes.

What are the implications of the Company’s status as an “Emerging Growth Company”?

We are currently an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and expect to remain an emerging growth company through the end of the calendar year 2022. The JOBS Act contains provisions that, among other things, reduce certain reporting requirements for an “emerging growth company.” For so long as we remain an emerging growth company, we are permitted and plan to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include reduced disclosure obligations regarding executive compensation. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may take advantage of some or all these exemptions until such time as we are no longer an emerging growth company.

Where can I find the voting results?

We will announce the preliminary voting results during the live webcast of the Annual Meeting. We will also publish voting results in a current report on Form 8-K that we will file with the SEC within four business days of the Annual Meeting. If on the date of this Form 8-K filing the inspectors of election for the Annual Meeting have not certified the voting results as final, we will note in the filing that the results are preliminary and publish the final results in a subsequent Form 8-K filing within four business days after the final voting results are known.

7

Who will pay the costs of soliciting these proxies?

We will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of the Notice of Internet Availability of Proxy Materials, or a full set of the proxy materials (including the Proxy Statement, the 2021 Annual Report and proxy card with postage-paid envelope), as applicable, and any additional information furnished to stockholders. Computershare will assist us in distribution of the proxy materials and will provide voting and tabulation services for the Annual Meeting. We may reimburse banks, brokers, custodians and nominees for their reasonable costs of forwarding proxy materials to beneficial owners. Original solicitation of proxies may be supplemented by electronic means, mail, facsimile, telephone or personal solicitation by our directors, officers or other employees. No additional compensation will be paid to our directors, officers or other employees for such services.

Are you “householding” for stockholders sharing the same address?

The SEC’s rules permit us to deliver a single copy of the Notice of Internet Availability of Proxy Materials to an address that two or more stockholders share. This method of delivery is referred to as “householding” and can significantly reduce our printing and mailing costs. It also reduces the volume of mail that you receive. We will deliver only one Notice of Internet Availability of Proxy Materials, or a full set of the proxy materials (including the Proxy Statement, the 2021 Annual Report and proxy card with postage-paid envelope), as applicable, to multiple registered stockholders sharing an address, unless we receive instructions to the contrary from one or more of the stockholders. If printed copies of proxy materials are requested, we will still send each stockholder an individual proxy card.

If you did not receive an individual copy of the Notice of Internet Availability of Proxy Materials, we will send a copy to you if you contact us at 100 Broadway, 14th Floor, New York, NY 10005, Attention: General Counsel and Corporate Secretary, or by telephone at 1-866-339-4688. If you and other residents at your address have been receiving multiple copies of the Notice of Internet Availability of Proxy Materials, and desire to receive only a single copy of these materials, you may contact your broker, bank or other nominee or contact us at the above address or telephone number.

What is the deadline for stockholders to propose actions for consideration at the 2023 Annual Meeting

of Stockholders?

Stockholders who wish to nominate persons for election to our Board or propose other matters to be considered at our 2023 Annual Meeting of Stockholders must provide us advance notice of the director nomination or stockholder proposal, as well as the information specified in our Second Amended and Restated Bylaws, not earlier than January 18, 2023, which is the 120th day before the first anniversary of the 2022 Annual Meeting of Stockholders, and not later than 5:00 P.M. EST on February 17, 2023, which is the 90th day before the first anniversary of the 2022 Annual Meeting of Stockholders, as set forth in the Second Amended and Restated Bylaws. Stockholders are advised to review our Second Amended and Restated Bylaws, which contain the requirements for advance notice of director nominations and stockholder proposals. Notice of director nominations and stockholder proposals must be mailed to our General Counsel and Corporate Secretary at 100 Broadway, 14th Floor, New York, NY 10005. The requirements for advance notice of stockholder proposals under our Second Amended and Restated Bylaws do not apply to proposals properly submitted under Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as those stockholder proposals are governed by Rule 14a-8. We reserve the right to reject, rule out of order or take other appropriate action with respect to any director nomination or stockholder proposal that does not comply with our Second Amended and Restated Bylaws and other applicable requirements.

December 9, 2022, which is 120 days before the first anniversary of the date of our proxy statement released to stockholders in connection with the 2022 Annual Meeting of Stockholders, is the deadline for stockholders to submit proposals to be included in our 2023 proxy statement under Rule 14a-8 under the Exchange Act. However, if the date of the 2023 Annual Meeting of Stockholders is changed by more than 30 days from the date of the previous year’s meeting, then the deadline is a reasonable time before we begin to print and send our proxy statement for the 2023 Annual Meeting of Stockholders. Proposals by stockholders must comply with all requirements of applicable rules of the SEC, including Rule 14a-8, and be mailed to our General Counsel and Corporate Secretary at 100 Broadway, 14th Floor, New York, NY 10005. We reserve the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with Rule 14a-8 and other applicable requirements.

8

Whom should I contact if I have any questions?

If you have any questions about the Annual Meeting or your ownership of Company voting stock, please contact our transfer agent at:

Computershare Trust Company, N.A.

By Regular Mail: | Overnight: |

|

|

Computershare Investor Services PO Box 505000 Louisville, KY 40233-5000 | Computershare Investor Services 462 South 4th Street, Suite 1600 Louisville, KY 40202 |

9

We are a leading operator of business-to-business (“B2B”) trade shows in the United States. Leveraging our shows as key market-driven platforms, we integrate live events and media content including a broad array of industry insights, digital tools, and data-focused solutions to create uniquely rich experiences for our customers. We have been recognized with many awards and accolades that reflect our industry leadership as well as the importance of our shows to the exhibitors and attendees we serve.

Our trade show franchises typically hold market-leading positions within their respective industry verticals, with significant brand value established over a long period of time. Each of our shows is typically held at least annually, with certain franchises offering multiple editions per year. As our shows are frequently the largest and most well attended in their respective industry verticals, we are able to attract high-quality attendees, including those who have the authority to make purchasing decisions on the spot or subsequent to the show. The participation of these qualified attendees makes our trade shows compelling events for our exhibitors, further reinforcing the leading positions of our trade shows within their respective industries. Our attendees use our shows to fulfill procurement needs, source new suppliers, reconnect with existing suppliers, identify trends, learn about new products and network with industry peers, which we believe are factors that make our in-person shows difficult to replace. Our portfolio of trade shows is well-balanced and diversified across both industry sectors and customers. The scale and qualified attendance at our trade shows translates into an exceptional value proposition for participants, resulting in a self-reinforcing “network effect” whereby the participation of high-value attendees and exhibitors drives high participant loyalty and predictable, recurring revenue streams.

In addition to organizing our trade shows, conferences and other events, we also operate content and content-marketing websites and related digital products, and produce publications, each of which is aligned with a specific event sector. We also offer B2B ecommerce and digital merchandising solutions, serving the needs of manufacturers and retailers, through our Elastic Suite platform creating a digital year-round transactional platform for use by Emerald’s customers regardless of location. In addition to their respective revenues, each of these products support our live events by delivering year-round channels for customer acquisition and development.

On December 31, 2021, we purchased substantially all of the assets associated with a business known and operated as MJBiz (“MJBiz”), a leading event producer and content platform serving the wide range of commercial companies operating in the rapidly growing cannabis industry. MJBiz produces MJBizCon, the oldest and leading B2B cannabis trade show in America, the Emerald Conference, focusing on science and data analysis in the cannabis industry and related media brands including MjBizDaily, Hemp Industry Daily and MJBIZ Magazine. MJBizCon is a top trade show in the cannabis industry having featured more than 1,200 exhibiting companies and 27,000 attendees at the October 2021 live event. In addition to diversifying and enhancing Emerald’s portfolio in a high growth industry, the addition of MJBiz further accelerates the Company’s strategy of delivering 365-day customer engagement.

As of March 29, 2022, certain investment funds managed by an affiliate of Onex Corporation (such funds, collectively, “Onex”) owned 47,058,332 shares of our common stock, representing 67.1% of our outstanding common stock. In addition, as of March 29, 2022, Onex owned 69,718,919 shares of our Series A Preferred Stock, representing 125,494,054 shares of our common stock on an as-converted basis, after accounting for the accumulated accreting return at a rate per annum equal to 7% on the accreted liquidation preference and paid in-kind. Onex’s beneficial ownership of our common stock, on an as-converted basis, is approximately 88.2%. As a result, we are a “controlled company,” a company of which more than 50% of the combined voting power is held by an individual, a group or another company, within the meaning of the New York Stock Exchange corporate governance standards.

10

CORPORATE GOVERNANCE AND BOARD PRACTICES

We believe that good corporate governance helps to ensure that the Company is managed for the long-term benefits of our stockholders. We regularly review, analyze and revise our corporate governance policies and practices taking into account the most recent SEC corporate governance rules and regulations as well as the corporate governance listing standards of the NYSE, the stock exchange on which our common stock is listed.

We have adopted our Corporate Governance Guidelines, which provide a framework for the governance of the Company as a whole and describe the principles and practices that the Board follows in carrying out its responsibilities. Our Corporate Governance Guidelines address, among other things:

| • | the composition, structure and qualifications of the Board to ensure the Board has a broad range of skills, experience, industry expertise and diversity of views; |

| • | expectations and responsibilities of directors; |

| • | management succession planning; |

| • | annual Board self-assessments to assess Board performance and diversity of opinions; |

| • | principles of Board compensation and stock ownership; |

| • | regular executive sessions of independent directors; and |

| • | communications with stockholders and non-management directors. |

The full text of our Corporate Governance Guidelines may be viewed on our corporate website at http://www.emeraldx.com under “Investors—Corporate Governance.” Our Corporate Governance Guidelines are regularly reviewed by the Nominating and Corporate Governance Committee to ensure that they effectively promote the best interests of both the Company and the Company’s stockholders and that they comply with all applicable laws, regulations and NYSE requirements.

Code of Business Conduct and Ethics

We have adopted a code of ethics applicable to all of our directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees, known as the Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics addresses conflicts of interest, disclosure obligations, legal compliance, confidentiality, protection and proper use of Company assets, fair dealing and health and safety, among other topics. The Code of Business Conduct and Ethics is available on our website at http://www.emeraldx.com under “Investors—Corporate Governance.” In addition, a copy may be obtained by writing to Emerald Holding, Inc., 100 Broadway, 14th Floor, New York, NY 10121; Attention: Corporate Secretary. In the event that we amend or waive certain provisions of the Code of Business Conduct and Ethics applicable to our principal executive officer, principal financial officer or principal accounting officer in a manner that requires disclosure under applicable SEC rules, we intend to disclose the same on our website.

Our Board consists of nine directors, currently comprising seven common stock directors, divided among three classes with staggered three-year terms, and two Preferred Stock directors, who each serve one-year terms. At each annual general meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting (in the case of common stock directors) or the next annual meeting (in the case of Preferred Stock directors) following such election or until their successors have been duly elected and qualified, subject to the director’s earlier death or resignation or removal.

Our common stock directors are divided among the three classes as follows:

| • | the Class I directors are Anthony Munk and Hervé Sedky, whose terms expire at the Annual Meeting of Stockholders to be held in 2024; |

| • | the Class II directors are Kosty Gilis, Todd Hyatt and Lisa Klinger, whose terms will expire at this Annual Meeting. If re-elected, Messrs. Gilis and Hyatt and Ms. Klinger’s terms will expire at the Annual Meeting of Stockholders to be held in 2025; and |

11

| • | the Class III directors are Michael Alicea and Emmanuelle Skala, whose terms will expire at the Annual Meeting of Stockholders to be held in 2023. |

The Preferred Stock directors are Lynda Clarizio and David Levin, whose terms expire at this Annual Meeting of Stockholders and, if re-elected, will expire at the Annual Meeting of Stockholders to be held in 2023.

We expect that additional directorships resulting from an increase in the number of common stock directors, if any, will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the total number of directors on the Board.

Board of Directors and Director Independence

Controlled Company

Onex owns the majority of our outstanding common stock and Series A Preferred Stock. As a result, we are a “controlled company” within the meaning of the rules of the New York Stock Exchange. Under these rules, a “controlled company” is not subject to certain corporate governance requirements, including:

| • | the requirement that a majority of our Board consist of independent directors; |

| • | the requirement that we have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| • | the requirement that we have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| • | the requirement for an annual performance evaluation of the nominating and corporate governance committee and compensation committee. |

Although we are a controlled company, our Board currently consists of a majority of independent directors and we have a fully independent Audit Committee. Our Compensation Committee is composed of 3 out of 4 independent directors and is also subject to annual performance evaluations. Our Nominating and Corporate Governance Committee has 1 independent director of its 2 members and this committee is not subject to annual evaluations; however, most actions taken by this Committee are also approved by the full Board.

Director Independence and Independence Determinations

Under our Corporate Governance Guidelines and NYSE listing standards, a director is not independent unless our Board affirmatively determines that he or she does not have a material relationship with us or any of our subsidiaries. Our Corporate Governance Guidelines define independence in accordance with the independence definition in the current NYSE corporate governance rules for listed companies. Our Corporate Governance Guidelines require our Board to review the independence of all directors at least annually. In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the objective tests set forth in the NYSE independence definition, our Board will determine, considering all relevant facts and circumstances, whether such relationship is material.

Our Board has reviewed and considered the relationships of each member of the Board with our Company and its affiliates and affirmatively determined that each of Michael Alicea, Lynda Clarizio, Todd Hyatt, Lisa Klinger and Emmanuelle Skala is an independent director under the rules of the New York Stock Exchange and an independent director as such term is defined in Rule 10A-3(b)(1) under the Exchange Act. Our remaining directors, Kosty Gilis and Anthony Munk, are not independent because of their affiliations with Onex, and Hervé Sedky is not independent because of his role as President and Chief Executive Officer of Emerald. David Levin is not considered to be independent as a result of compensation received for his consulting engagement for the Company in 2020.

Our Board has decided to separate the roles of Chief Executive Officer and Chairman. These positions are currently held by Hervé Sedky, as our Chief Executive Officer, and Kosty Gilis, as the Chairman. We believe this leadership structure is appropriate for our company due to the differences between the two roles. The Chief Executive Officer is responsible for setting our strategic direction, providing day-to-day leadership and managing our business, while the Chairman provides guidance to the Chief Executive Officer, chairs Board meetings and provides information to the members of our Board in advance of such meetings. In addition, separating the roles of Chief Executive Officer and Chairman allows the Chairman to provide oversight of our management.

12

Our Board does not currently have a designated lead Independent Director; however, all of our independent directors have direct access to members of senior management. We believe our independent directors are experienced, objective, and well-equipped to exercise oversight over senior management and represent the interests of our stockholders. We are aware of the potential conflicts that may arise when a non-independent director is Chairman of the Board, but we believe these potential conflicts are offset by our strong corporate governance practices.

Board Oversight of Risk Management

Management is responsible for the day-to-day assessment and management of the risks we face, while the Board has ultimate responsibility for the oversight of risk management. Our Board administers its risk oversight function primarily through the Audit Committee, including oversight of cybersecurity risks and compliance with new privacy rules and regulations. To that end, our Audit Committee meets at least quarterly with our Chief Financial Officer and our independent registered public accounting firm where it receives regular updates regarding our management’s assessment of risk exposures including liquidity, credit and operational risks and the process in place to monitor and control such risks. They also review results of operations, financial reporting, and assessments of internal controls over financial reporting. In addition, management also periodically attends Board and committee meetings to discuss the risk management process directly with the Board including discussion of non-financial risks such as cybersecurity, privacy, environmental, social (e.g., human capital management) and other operational risks. Our Board believes that its administration of risk management has not affected the Board’s leadership structure.

In addition, the Chief Executive Officer’s collaboration with the Board allows Mr. Sedky to gauge whether management is providing adequate information for the Board to understand the interrelationships of our various business and financial risks. Mr. Sedky is available to the Board to address any questions from other directors regarding executive management’s ability to identify and mitigate risks and weigh them against potential rewards.

The Nominating and Corporate Governance Committee works with the Board to determine the appropriate makeup of individuals that will result in a Board that is diverse in knowledge, competencies, and experiences. The Nominating and Corporate Governance Committee is responsible for identifying and reviewing the qualifications of potential director nominees and recommending to the Board those candidates to be nominated for election to the Board. We believe that the Nominating and Corporate Governance Committee does not apply any specific minimum qualifications checklist when considering director nominees. Instead, the Nominating and Corporate Governance Committee considers all factors it deems appropriate, which includes, among others (a) ensuring that the Board, as a whole, is appropriately diverse and the extent to which a candidate would fill a present need on the Board, (b) the Board’s size and composition, (c) our corporate governance policies and any applicable laws, (d) individual director performance, expertise, relevant business and financial experience, integrity and willingness to serve actively, (e) the number of other public and private company boards on which a director candidate serves and (f) consideration of director nominees properly proposed by stockholders in accordance with our Second Amended and Restated Bylaws. The Board monitors the mix of specific experience, qualifications and skills of its directors in order to assure that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure. Although the Company does not have a formal policy with respect to diversity, as a matter of practice, the Board considers diversity in the context of the Board as a whole and takes into account considerations relating to ethnicity, gender, cultural diversity and the range of perspectives that the directors bring to their work. Annually, all incumbent directors complete questionnaires to update and confirm their background, experience and skills and to identify any potential conflicts of interest. The Board believes that its current constitution, including three women, multiple directors with international backgrounds, and an overall strong balance of diverse business and financial experience, has an appropriately diverse composition. Moreover, the Board continuously seeks ways to expand the diversity of viewpoints and backgrounds on our Board and at our Company. Stockholders may also nominate directors for election at the Company’s annual stockholders meeting by following the provisions set forth in the Company’s Second Amended and Restated Bylaws, whose qualifications the Nominating and Corporate Governance Committee will consider in the same manner as other nominees.

Our Corporate Governance Guidelines provide that the Board, acting through the Nominating and Corporate Governance Committee, conduct a self-evaluation at least annually to determine whether it and its committees are functioning effectively. The Board’s self-evaluation helps determine whether the directors feel they have the tools and access necessary to perform their oversight, and also solicits suggestions from directors for areas of improvement. In addition, our Corporate Governance Guidelines provide that each committee conduct a self-evaluation and compare its performance to the requirements of its charter.

13

Meetings of the Board and Committees

During the year ended December 31, 2021, the Board held six meetings. In addition, the Board also acted via unanimous written consent on one other occasion and also held additional informal discussions. All of the directors who served during the year ended December 31, 2021 attended at least 75% of the total meetings of the Board and each of the Board committees on which such director served during their respective tenure. Directors are expected to make best efforts to attend all Board meetings, all meetings of the committee or committees of the Board of which they are a member and the Annual Meeting of Stockholders. Attendance by telephone or videoconference is deemed attendance at a meeting. All nine of the Board members attended the 2021 Annual Meeting of Stockholders.

Pursuant to our Corporate Governance Guidelines, our Board currently plans to hold at least four meetings each year, with additional meetings to occur (or action to be taken by unanimous consent, either in writing or by electronic transmission) at the discretion of the Board.

Executive Sessions of Non-Management Directors

Pursuant to our Corporate Governance Guidelines, in order to ensure free and open discussion and communication among the non-management directors of the Board, the non-management directors meet in executive session at most Board meetings with no members of management present. The non-management directors may specify the procedure to designate the director who may preside at any such executive session.

We have policies in place designed to allow our stockholders and other interested parties to communicate with our directors. Any interested parties wishing to communicate with, or otherwise make his or her concerns known directly to the Board or chairperson of any of the Audit, Compensation and Nominating and Corporate Governance Committees, or to the non-management or independent directors as a group, may do so by addressing such communications or concerns to the General Counsel and Corporate Secretary of the Company, 100 Broadway, 14th Floor, New York, NY 10005, Attention: Corporate Secretary. The General Counsel and Corporate Secretary will forward such communications to the appropriate party as soon as practicable. Such communications may be done confidentially or anonymously.

The Board has three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Our Board may establish other committees to facilitate the management of our business. The composition and functions of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are described below. Members will serve on committees until their resignation or until otherwise determined by our Board.

As permitted by the NYSE listing standards, because we qualify as a “controlled company”, our Compensation Committee and our Nominating and Corporate Governance Committee are currently not composed entirely of independent directors. Each committee operates pursuant to a written charter, each of which is available on the investor relations section of our website at http://www.emeraldx.com under “Investors—Corporate Governance.” In addition, copies may be obtained by writing to Emerald Holding, Inc., 100 Broadway, 14th Floor, New York, NY 10121; Attention: Corporate Secretary.

14

The following table shows the membership of each committee of our Board, and the number of meetings held by each committee, during the year ended December 31, 2021.

Director |

| Audit Committee |

| Compensation Committee |

| Nominating and Corporate Governance Committee |

Michael Alicea |

| ✓ |

| Chair |

|

|

Lynda Clarizio |

|

|

| ✓ |

|

|

Konstantin (Kosty) Gilis |

|

|

| ✓ |

| ✓ |

Todd Hyatt |

| ✓ |

|

|

|

|

Lisa Klinger |

| Chair |

|

|

|

|

David Levin |

|

|

|

|

|

|

Anthony Munk |

|

|

|

|

|

|

Emmanuelle Skala |

|

|

| ✓ |

| Chair |

Number of 2021 Committee Meetings |

| 6(1) |

| 5(2) |

| 1(3) |

(1) | In addition, the Audit Committee also held additional informal discussions. |

(2) | Includes the Compensation Committee acting via unanimous written consent on one other occasion. The Compensation Committee also held additional informal discussions. |

(3) | Includes the Nominating and Corporate Governance Committee acting via unanimous written consent on one occasion. Our full Board of Directors undertook some of the responsibilities of the Nominating and Corporate Governance Committee during 2021. The Nominating and Corporate Governance Committee also held additional informal discussions. |

Audit Committee

Currently, the members of the Audit Committee are Lisa Klinger, as Chairperson, Michael Alicea and Todd Hyatt, each of whom have been determined by the Board to qualify as “independent” under Rule 10A-3 and the NYSE listing rules, and “financially literate” under the NYSE listing rules. The Board has determined that each of Ms. Klinger and Mr. Hyatt qualify as an “audit committee financial expert” within the meaning of regulations adopted by the SEC. The Audit Committee recommends the annual appointment and reviews the independence of our independent registered public accounting firm and reviews the scope of audit and non-audit assignments and related fees and the results of the annual audit. In addition, the Audit Committee reviews the accounting principles used in financial reporting, internal auditing procedures, the adequacy of our internal control procedures, related party transactions and investigations into matters related to audit functions. The Audit Committee also prepares any report of the Audit Committee required by rules and regulations of the SEC for inclusion in our proxy statement and reviews and approves related party transactions. The Audit Committee is also responsible for overseeing risk management on behalf of our Board, including cybersecurity and compliance with privacy regulations.

The charter of the Audit Committee permits the committee to, in its discretion, delegate its duties and responsibilities to one or more subcommittees as it deems appropriate.

Compensation Committee

Currently, the members of the compensation committee are Michael Alicea, as Chairman, Lynda Clarizio, Kosty Gilis, and Emmanuelle Skala. The principal responsibilities of the Compensation Committee are to review and approve matters involving executive and director compensation, oversee and recommend changes in employee benefit programs, authorize equity and other incentive arrangements and authorize our company to enter into employment and other employee-related agreements. Because we are a “controlled company” within the meaning of the NYSE listing standards, our Compensation Committee is not yet required to be composed entirely of independent directors, but is currently comprised of 3 out of 4 independent directors.

The charter of the Compensation Committee permits the committee to, in its discretion, delegate its duties and responsibilities to a subcommittee of the Compensation Committee as it deems appropriate and to the extent permitted by applicable law. All proposed delegations of duties must be adopted by a resolution of the Compensation Committee and reviewed for compliance with the corporate governance standards of the NYSE, the rules and regulations of the SEC and Delaware corporate law.

15

The Compensation Committee has engaged and periodically utilizes Semler Brossy Consulting Group LLC (“Semler Brossy”) as its executive compensation consultant to assist the Compensation Committee in evaluating executive and director compensation. When appropriate, Semler Brossy obtains input from management to ensure its advice and recommendations reinforce the Company’s business position and strategy, principles and values.

Nominating and Corporate Governance Committee

Currently, the members of the Nominating and Corporate Governance Committee are Emmanuelle Skala, as Chairperson, and Kosty Gilis. The Nominating and Corporate Governance Committee assists our Board in identifying individuals qualified to become Board members, makes recommendations to the Board regarding directors’ independence, makes recommendations for nominees for committees, and develops, reviews, and recommends changes to our corporate governance principles. Because we are a “controlled company” within the meaning of the NYSE listing standards, our Nominating and Corporate Governance Committee is not yet required to be composed entirely of independent directors.

The charter of the Nominating and Corporate Governance Committee permits the committee to, in its sole discretion, delegate its duties and responsibilities to one or more subcommittees as it deems appropriate.

Compensation Committee Interlocks and Insider Participation

The members of the compensation committee are Michael Alicea as Chairman, Lynda Clarizio, Kosty Gilis and Emmanuelle Skala. None of our executive officers serve, or in the past year have served, as a member of the board of directors or compensation committee (or other committee performing equivalent functions) of any entity that has one or more executive officers serving on our Board or compensation committee. No interlocking relationship exists between any member of the compensation committee (or other committee performing equivalent functions) and any executive, member of the board of directors or member of the compensation committee (or other committee performing equivalent functions) of any other company.

We adopted stock ownership guidelines for our directors and executive officers to help ensure that they each maintain an equity stake in the Company and, by doing so, appropriately link their interests with those of other stockholders. The guideline for executive officers is based on a multiple of the executive’s base salary, ranging from two to five times, with the size of the multiple based on the individual’s position with the Company. Executives are required to achieve these stock ownership levels within five years of becoming an executive officer. Our independent directors are required to hold a number of shares of our common stock with a value equal to four times the annual cash retainer for Board service. Our independent directors are required to achieve this ownership level within five years of our initial public offering or joining the Board, whichever is later. The stock ownership guidelines may be met by the following forms of equity held by the individual subject to the guidelines: (i) shares of Emerald stock owned outright, (ii) unvested time-based RSUs, and (iii) the value of vested, unexercised stock options.

The Company’s Securities Trading Policy prohibits all directors and executive officers of the Company from effecting short sales, put options, call options or other derivative securities, holding securities in a margin account or otherwise pledging securities as collateral for a loan or hedging or similar monetization transactions with respect to the Company’s common stock.

16

BOARD OF DIRECTORS AND MANAGEMENT

The following table sets forth, as of March 29, 2022, the name and age of each executive officer, director and certain significant employees of the Company, indicating all positions and offices with us currently held by such executive officer, director or significant employee:

Name |

| Age |

| Position |

Hervé Sedky |

| 52 |

| Chief Executive Officer and President |

Brian Field |

| 54 |

| Chief Operating Officer |

David Doft |

| 50 |

| Chief Financial Officer |

William Charles |

| 51 |

| Chief Information Officer |

Stacey Sayetta |

| 49 |

| General Counsel and Corporate Secretary |

Eric Lisman (1) |

| 65 |

| Executive Vice President |

Konstantin (Kosty) Gilis |

| 48 |

| Chairman of the Board and Director |

Michael Alicea |

| 54 |

| Director |

Lynda Clarizio |

| 61 |

| Director |

Todd Hyatt |

| 61 |

| Director |

Lisa Klinger |

| 55 |

| Director |

David Levin |

| 60 |

| Director |

Anthony Munk |

| 61 |

| Director |

Emmanuelle Skala |

| 49 |

| Director |

|

|

|

|

|

(1) Mr. Lisman departed Emerald effective March 31, 2022. |

|

| ||

Set forth below are descriptions of the backgrounds of each executive officer, director and certain significant employees of the Company, as of March 29, 2022:

Hervé Sedky. Mr. Sedky joined Emerald as President and Chief Executive Officer in January 2021. Prior to joining Emerald, Mr. Sedky spent six years as President of the Americas for Reed Exhibitions, leading more than 100 sector-leading exhibitions and events in North and South America each year, as well as the company’s global pop culture and lifestyle focused offshoot, ReedPop. Before his time at Reed Exhibitions, Mr. Sedky spent over twenty years at the American Express Company, ultimately serving as Senior Vice President and General Manager of American Express Global Business Travel, as well as on American Express’ senior management team. Mr. Sedky holds a bachelor’s degree from Northeastern University and is a graduate of the Executive Management Program (PMD) at Harvard Business School. Mr. Sedky was selected to serve on our Board as a result of his extensive leadership experience in our industry, and in light of his role as our Chief Executive Officer.

Brian Field. Mr. Field joined Emerald as Chief Operating Officer in June 2019 and served as Interim President and Chief Executive Officer from January 1, 2020 to January 4, 2021. From January 2019 to June 2019, Mr. Field served on the faculty of the Kogod School of Business at American University, prior to which Mr. Field spent eight years at UBM, now part of Informa plc, a UK-based multinational events, academic publishing and business intelligence business. From 2013 to 2018, Mr. Field was COO of UBM Americas, delivering events and marketing services in the technology, fashion, licensing, advanced manufacturing, construction, healthcare, and pharmaceutical industries. Prior to that role, Mr. Field spent three years at UBM Medica, a leading healthcare media, publishing and education company, where he held senior positions overseeing operations, finance, marketing, product, technology and sales efforts for the business’ print and digital products and events. Earlier in his career, Mr. Field held senior positions in operations, product development, marketing and strategy development at Turner Broadcasting and Omnicom, among others. Mr. Field holds a bachelor’s degree from Connecticut College, a master’s degree from The Juilliard School and a doctorate from Columbia University.

David Doft. Mr. Doft joined Emerald as Chief Financial Officer in January 2020. Mr. Doft has more than 25 years of experience in accounting, corporate finance and strategic planning, most recently serving as Executive in Residence at Progress Partners, an M&A advisory firm, from August 2019 to January 2020. Prior to that role, Mr. Doft served as Chief Financial Officer of MDC Partners, a leading global provider of marketing, advertising, activation, communications and strategic consulting solutions, since August 2007, where he was responsible for all aspects of agency operations, financial reporting and compliance, corporate finance, treasury and investor relations. Mr. Doft has also served in senior roles at Cobalt Capital, Level Global Investors, CIBC World Markets and ABN AMRO/ING Barings Furman Selz, and holds a B.S. in Economics from the Wharton School of the University of Pennsylvania.

17

William Charles. Mr. Charles has led our information technology (“IT”) operations since joining us in August 2013 and was promoted to our Chief Information Officer beginning in January 2014. Prior to joining Emerald, Mr. Charles was a senior executive in IT at Pacific Sunwear from 2004 to 2013. Mr. Charles oversees all aspects of our IT infrastructure and systems. Mr. Charles has over 25 years of IT industry experience and has an M.B.A. from Babson College and an undergraduate degree from the University of Connecticut.

Stacey Sayetta. Ms. Sayetta joined Emerald as General Counsel and Corporate Secretary in November 2021. Ms. Sayetta has over 20 years of legal experience, including in the areas of mergers and acquisitions, private equity, securities law and corporate governance. Before joining Emerald, Ms. Sayetta most recently served as the Assistant General Counsel of Trian Fund Management, L.P. from May 2011 to October 2021. Prior to Trian, Ms. Sayetta joined Fortress Investment Group LLC in 2000 as their first in-house counsel. Ms. Sayetta has a B.S. from Cornell University and a J.D. from Harvard University Law School.

Eric Lisman. Mr. Lisman joined us as an Executive Vice President in March 2017. Mr. Lisman is an experienced transaction professional with over 30 years of media industry experience. From September 2013 through March 2017, Mr. Lisman founded and operated Media Front Inc., a strategic and transaction consulting firm serving the trade show and media industries. Mr. Lisman previously served from December 2012 through September 2013 as Chief Executive Officer of ENK International. From September 1997 through December 2012, he served as Executive Vice President — Corporate Development of Advanstar Communications and, prior to that, as Senior Vice President and General Counsel of Reed Publishing USA. Mr. Lisman holds a B.A. from the University of Virginia and a J.D. from Harvard Law School. Mr. Lisman has departed Emerald effective March 31, 2022.

Konstantin (Kosty) Gilis. Mr. Gilis has been Chairman of the Board and a member of the Compensation Committee since June 2013 and has served as a member of the Nominating and Corporate Governance Committee since April 2017. Mr. Gilis is a Managing Director of Onex, focusing on the business services sector. Mr. Gilis currently also serves on the board of directors of Clarivate Analytics and ASM Global and was formerly a director of WireCo WorldGroup, Allison Transmission and Tomkins/Gates. Prior to joining Onex in 2004, Mr. Gilis worked at Willis Stein & Partners, a Chicago-based private equity firm, and was a management consultant at Bain & Company in the firm’s Toronto, Canada and Johannesburg, South Africa offices. Mr. Gilis holds an M.B.A. from Harvard Business School and a B.S. from The Wharton School of the University of Pennsylvania. Mr. Gilis’ experience in a variety of strategic and financing transactions and investments qualifies him to serve as a member of our Board. His high level of financial expertise is a valuable asset to our Board. As an executive with Onex, our controlling stockholder, he has extensive knowledge of our business.

Michael Alicea. Mr. Alicea has been a member of the Board and the Chairman of the Compensation Committee since December 2015 and has served as a member of the Audit Committee since February 2019. Mr. Alicea is presently the Chief Human Resources Officer of Trellix, a leader in global cybersecurity. Mr. Alicea is responsible for all human resources activities across the entire global enterprise. Prior to that Mr. Alicea was Chief People Officer at Nielsen and held a variety of leadership roles within Nielsen in human resources, communications and operations. Overall, he possesses a strong background in a broad range of human resources, communications, operations and M&A disciplines. He holds a B.B.A. in Human Resources & Organizational Management and has completed graduate coursework in Business Policy at Baruch College.