Emerald Expositions Events, Inc.

Notes to Consolidated Financial Statements

December 31, 2016, 2015 and 2014

| 1. | Description of Business, Basis of Presentation and Significant Accounting Policies |

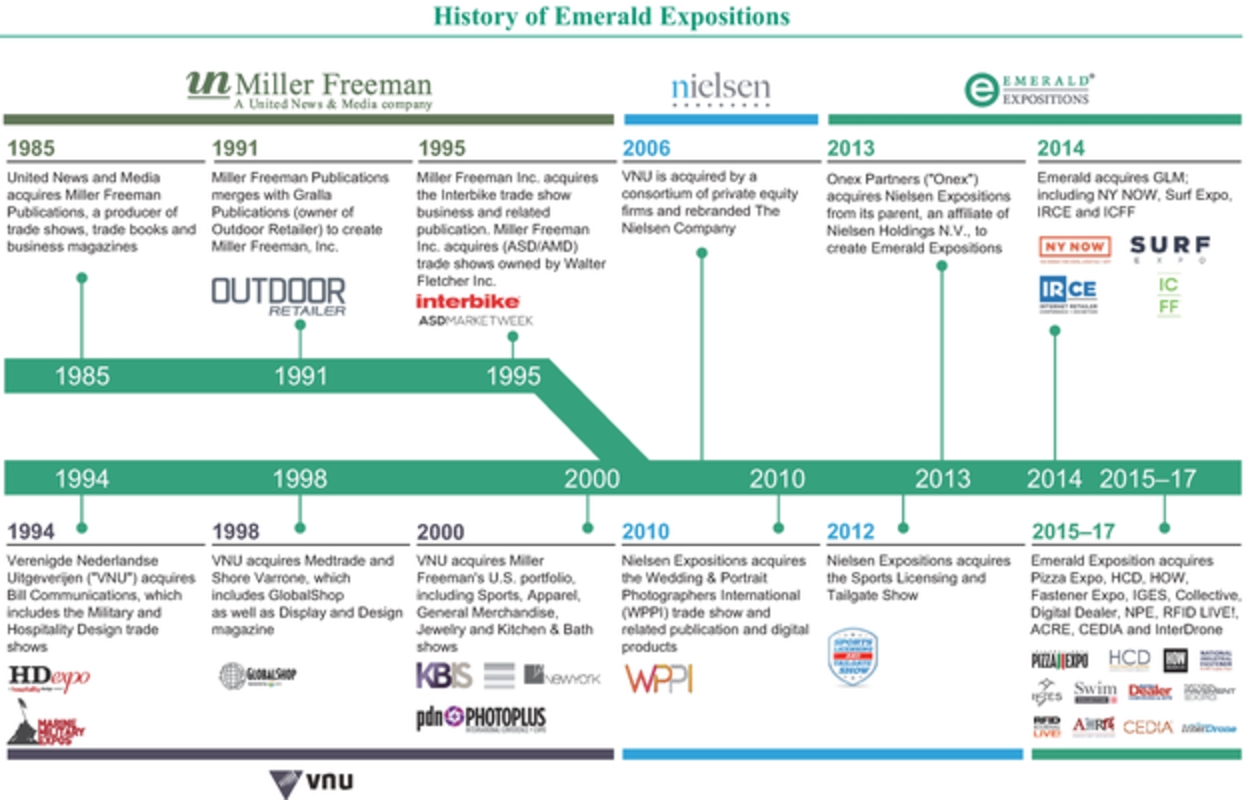

Emerald Expositions Events, Inc. (“Holdco” or “the Company”) is a Corporation formed on April 26, 2013, under the laws of the State of Delaware. Holdco is owned by investment funds managed by an affiliate of Onex Partners Manager LP (“Onex Partners”) as well as certain of the Company’s independent directors, advisors and members of senior management. On April 26, 2013, Holdco formed Expo Event Midco, Inc. (“Midco”) as a wholly owned subsidiary and formed Expo Event Transco, Inc. (“Transco”) as a wholly owned subsidiary of Midco solely for the purpose of the Transaction as discussed below. From April 26, 2013 to June 16, 2013, Holdco, Midco, and Transco were inactive and had no operations. Operations commenced on June 17, 2013.

On June 17, 2013, Transco acquired Nielsen Business Media Holding Company (the “Predecessor”), a Delaware corporation, from The Nielsen Company B.V. (the”Former Parent”) for $948.7 million pursuant to the Stock Purchase Agreement, dated May 4, 2013 by and among Expo Event Transco, Inc. and VNU International, B.V. (an affiliate of Nielsen, or “Seller”) (the “Transaction”). Transco was incorporated on April 26, 2013 and was formed solely for the purpose of the Transaction and did not conduct any prior business. Transco acquired all of the capital stock of the Predecessor (which was merged with and into Transco immediately following such acquisition), with the Predecessor surviving the merger and being renamed Emerald Expositions Holding, Inc. (“Holding”). As of December 31, 2013, the Company had one active wholly-owned subsidiary called Emerald Expositions, Inc. (“Emerald Inc.”), which prior to the Transaction, was called Nielsen Business Media, Inc., as well as two inactive wholly-owned subsidiaries called Rangefinder Publishing Co., Inc. (“Rangefinder”) and Foremost Exhibits, Inc. (“Foremost”).

On December 20, 2013, Emerald Inc. executed a definitive agreement to acquire GLM Superholdings, LLC, a Delaware limited liability company (“Superholdings”), which was the direct parent company of GLM Holdings, LLC, a Delaware limited liability company, which was the direct parent company of George Little Management, LLC (“GLM”). On January 15, 2014, Emerald Inc. paid $335.0 million to Providence Equity Partners (the “GLM Sellers”), subject to certain adjustments at, and after, closing (see Note 3 – “Business Acquisitions”). The purchase price, including transaction expenses, was funded by $200.0 million of incremental term debt and $140.0 million of additional equity investment from Onex Partners.

On January 15, 2014, Emerald Inc. was converted into a limited liability company, Emerald Expositions, LLC (“Emerald”). On December 30, 2014 Rangefinder and Foremost were merged into Emerald.

On February 27, 2014, Superholdings was merged into Emerald (with Superholdings surviving such merger) and on April 26, 2014, Superholdings was dissolved.

As of December 31, 2016, the Company had one active wholly owned subsidiary, Emerald Expositions, LLC, (which, prior to the Transactions, was called Nielsen Business Media, Inc.). The Company also has three inactive wholly owned subsidiaries: GLM, Pizza and GLM Holdings LLC.

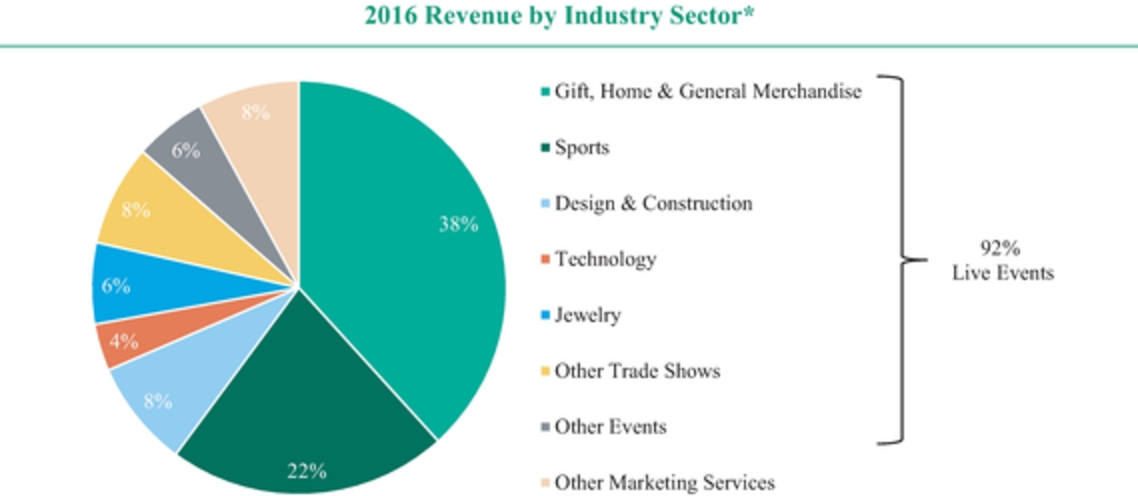

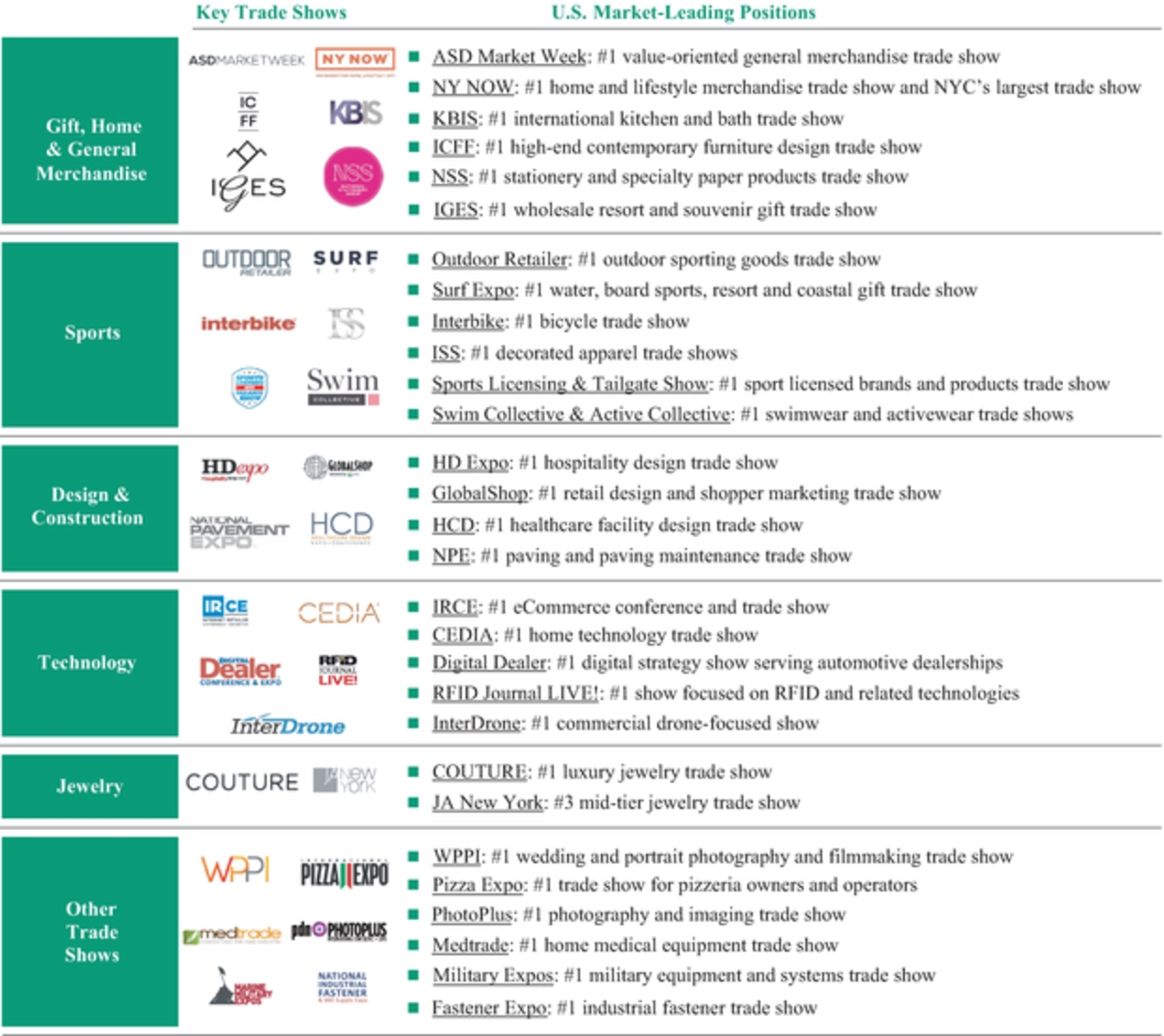

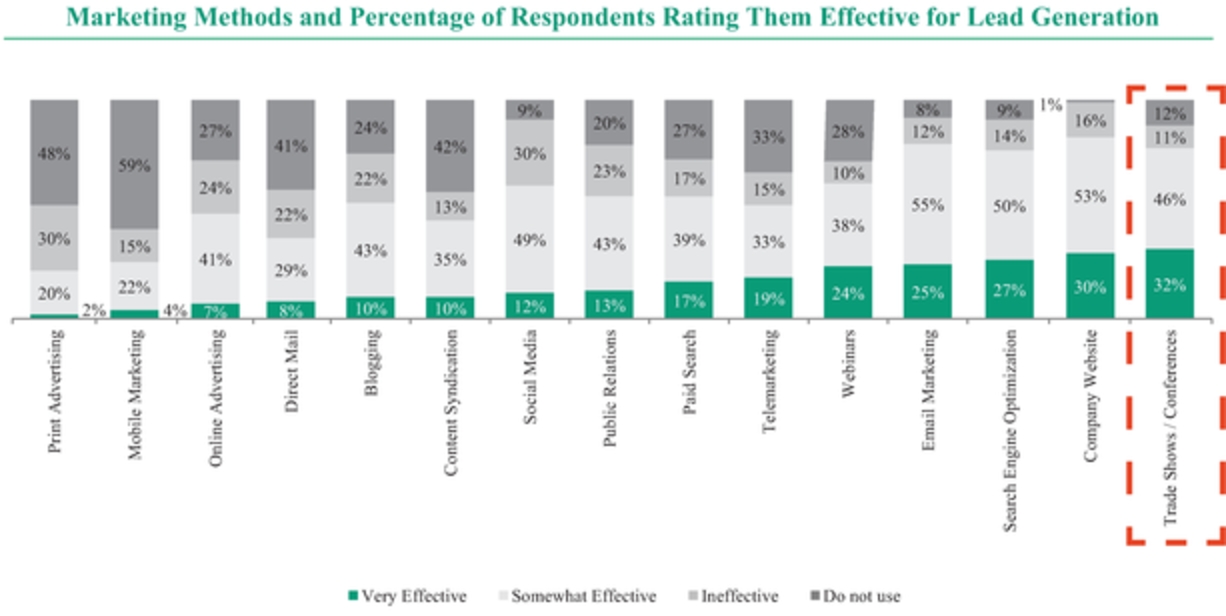

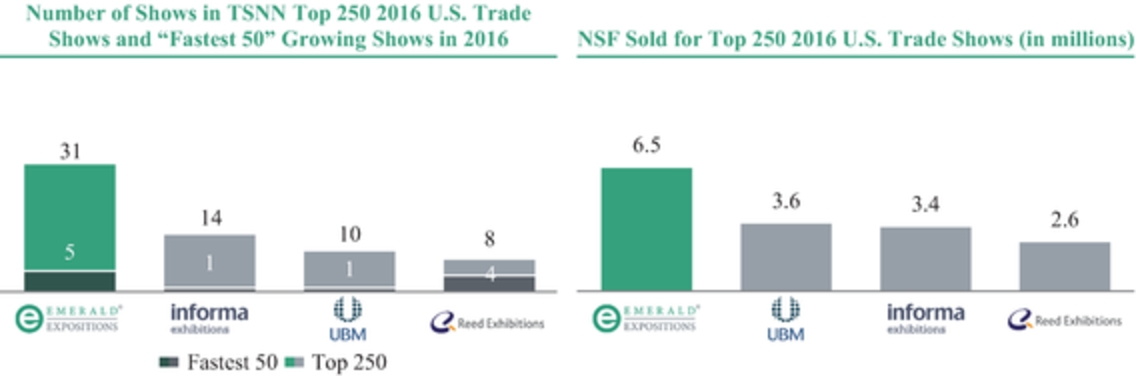

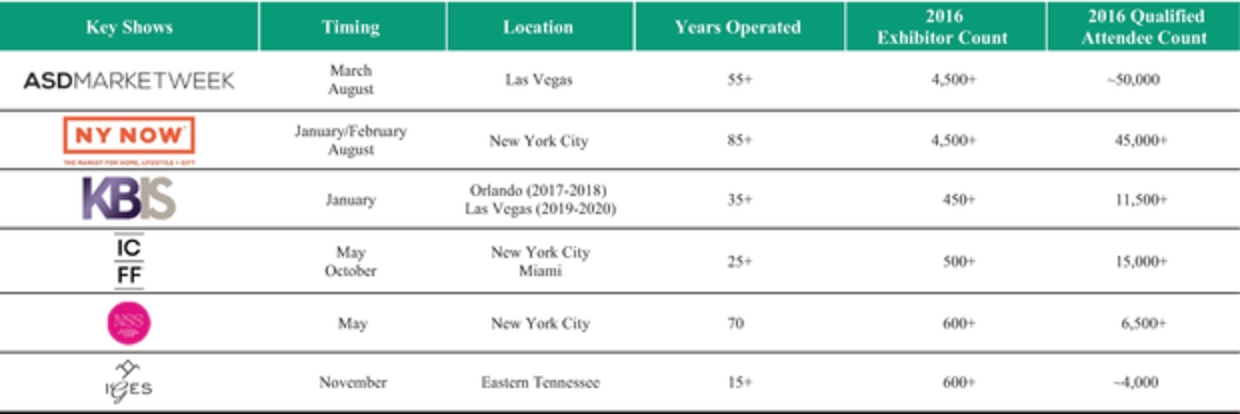

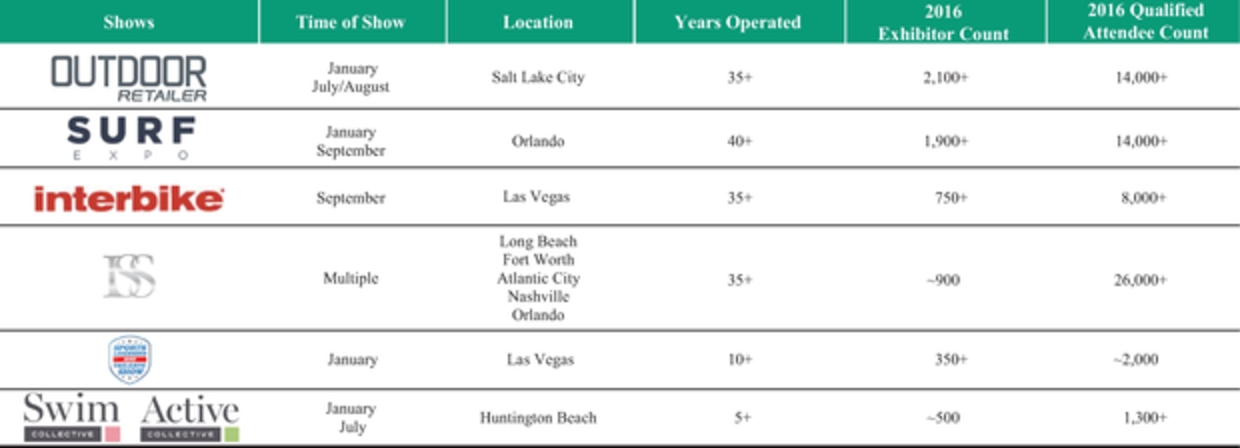

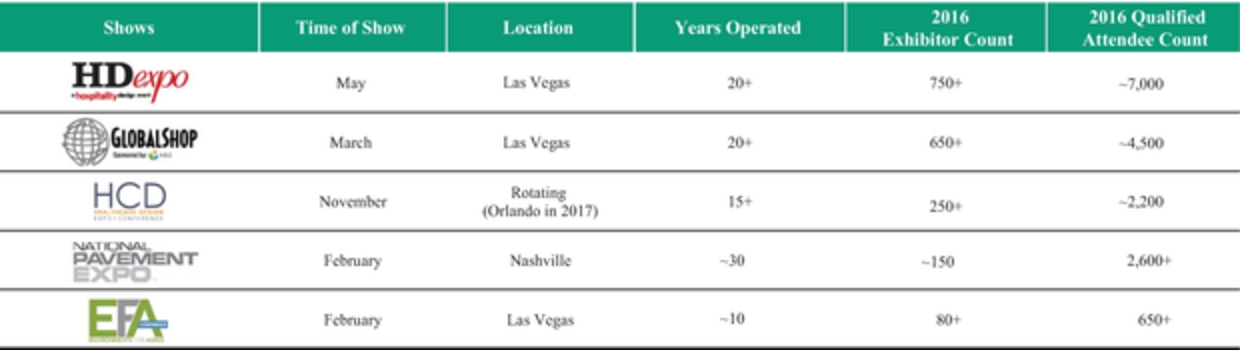

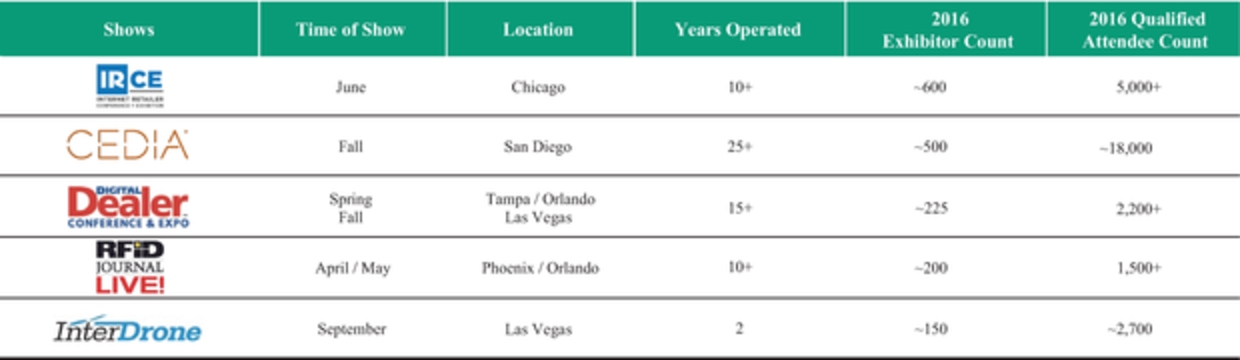

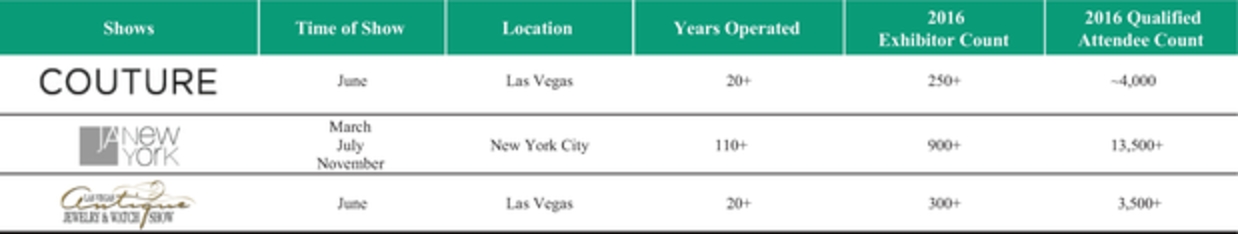

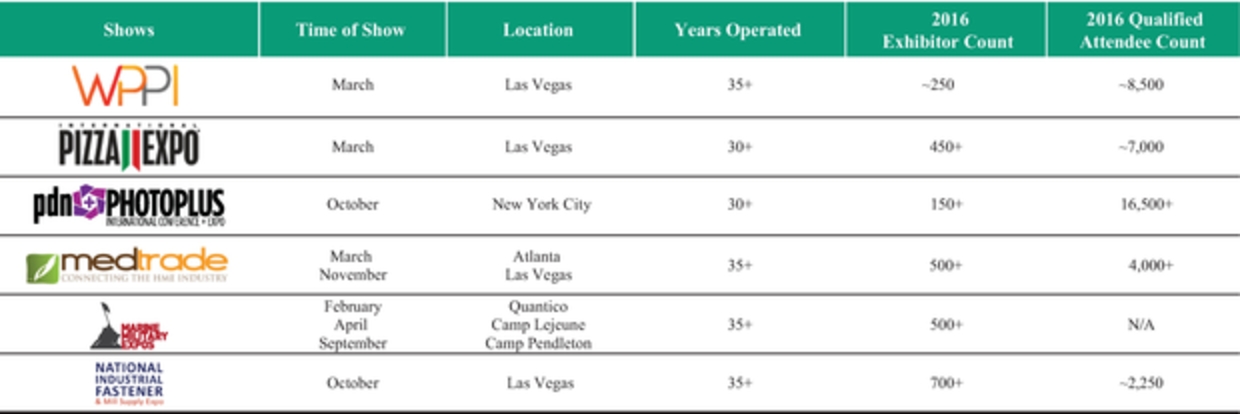

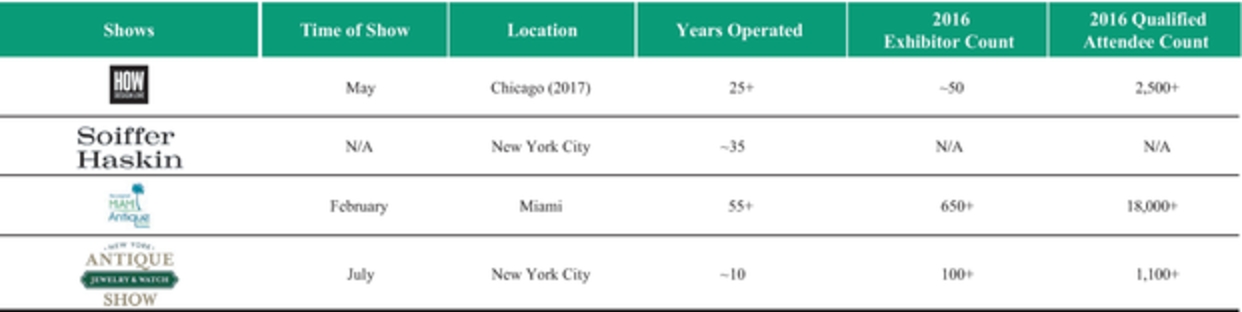

The Company, headquartered in San Juan Capistrano, California, is the holding company of a leading operator of large business-to-business trade shows in the United States (“U.S.”). The Company operates in a number of broadly-defined industry sectors. Gift, Home & General Merchandise; Sports; Design & Construction; Technology; Jewelry; and other trade shows. Each of the Company’s exhibitions are held at least once per year, and provide a venue for exhibitors to launch new products, develop sales leads and promote their brands.

In addition to organizing trade shows and conferences (collectively, “Events”), the Company also operates websites and related digital products, and produces twelve publications, each of which is aligned with a specific sector for which it organizes a trade show. These complementary products allow the Company to better connect and communicate with its preexisting trade show audience.

Basis of Presentation

The consolidated financial statements include the operations of the Company and its wholly-owned subsidiaries. These consolidated financial statements are presented in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). All significant intercompany transactions, accounts and profits, if any, have been eliminated in the consolidated financial statements.