UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under §240.14a-12 |

COLONY STARWOOD HOMES

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

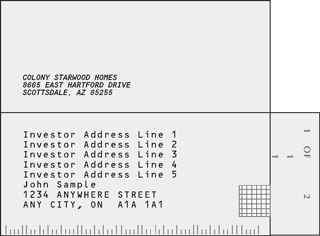

Colony Starwood Homes

8665 East Hartford Drive

Scottsdale, Arizona 85255

April 6, 2016

Dear Colony Starwood Homes Shareholder:

The trustees and officers of Colony Starwood Homes (“we,” “our” or “us”) join me in extending to you a cordial invitation to attend our 2016 annual meeting of shareholders (the “Annual Meeting”). The Annual Meeting will be held on May 6, 2016 at 11:00 a.m., local time, at our offices located at 9305 E. Via de Ventura, Scottsdale, Arizona 85258.

Enclosed you will find the notice of meeting, proxy statement and proxy card. At the Annual Meeting, we are seeking to elect the twelve nominees for trustee named in the accompanying proxy statement. The shareholders will also be asked to vote on an advisory basis to approve our executive compensation as disclosed in the accompanying proxy statement and to determine the frequency with which an advisory vote on executive compensation should be held and to vote to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current calendar year.

Your management and Board of Trustees unanimously recommend that you voteFORthe election of each of the twelve nominees for trustee identified in the proxy statement,FOR the approval, on an advisory basis, of the compensation of our named executive officers as disclosed in the accompanying proxy statement, “ONE YEAR” with respect to the advisory vote on the frequency of future advisory votes on executive compensation andFORthe ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current calendar year.

It is very important that your shares be represented at the Annual Meeting, whether or not you plan to attend personally. Therefore, please submit your proxy as promptly as possible—by telephone, via the Internet or by completing, signing and returning the enclosed proxy card in the postage-prepaid envelope provided. This will ensure that your shares are represented at the Annual Meeting.

Thank you for your continuing support.

| | |

Yours very truly, | | |

| |  |

Thomas J. Barrack, Jr. Co-Chairman of Our Board of Trustees | | Barry S. Sternlicht Co-Chairman of Our Board of Trustees |

NOTICE OF 2016 ANNUAL MEETING OF

SHAREHOLDERS

TO BE HELD ON MAY 6, 2016

To the Shareholders of Colony Starwood Homes:

NOTICE IS HEREBY GIVEN that the 2016 annual meeting of shareholders (the “Annual Meeting”) of Colony Starwood Homes, a Maryland real estate investment trust (“we,” “our” or “us”), will be held at our offices located at 9305 E. Via de Ventura, Scottsdale, Arizona 85258 on May 6, 2016 at 11:00 a.m., local time, to consider and vote on the following matters:

| | 1. | the election of the twelve trustee nominees identified in the accompanying proxy statement, each to serve until the next annual meeting of shareholders and until his successor is duly elected and qualified; |

| | 2. | the approval, on an advisory basis, of our executive compensation as disclosed in the accompanying proxy statement; |

| | 3. | to hold an advisory vote on the frequency of future advisory votes on executive compensation; |

| | 4. | the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the calendar year ending December 31, 2016; and |

| | 5. | the transaction of such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Details concerning those matters to come before the Annual Meeting are set forth in the accompanying proxy statement for your inspection.

The proxy statement, proxy card and Notice of Annual Meeting are first being mailed to holders of our common shares, $0.01 par value per share (“Common Shares”), on or about April 6, 2016. We have also enclosed our Annual Report on Form10-K for the calendar year ended December 31, 2015. We hope you will find it informative.

Our Board of Trustees has fixed March 9, 2016 as the record date for the Annual Meeting. Only the holders of record of the Common Shares as of the close of business on March 9, 2016 are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

Shareholders are cordially invited to attend the meeting in person. The presence at the meeting, in person or by proxy, of shareholders entitled to cast a majority of all the votes entitled to be cast at the meeting shall constitute a quorum. Your vote is important. Whether or not you plan to attend the meeting, please authorize proxies to cast your votes today by following the easy instructions on the proxy card.

|

| By Order of Our Board of Trustees, |

|

|

Ryan A. Berry Executive Vice President, General Counsel and Secretary |

Date: April 6, 2016

Scottsdale, Arizona

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING IN PERSON OR BY PROXY; PLEASE PROMPTLY VOTE BY TELEPHONE OR VIA THE INTERNET, OR MARK, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE POSTAGE-PREPAID ENVELOPE PROVIDED. IF YOU HAVE ANY QUESTIONS OR NEED ASSISTANCE IN VOTING YOUR SHARES, PLEASE CALL BROADRIDGE FINANCIAL SOLUTIONS, INC. TOLL-FREE AT1-800-579-1639.

Important Notice Regarding Internet Availability of Proxy Materials for the 2016 Annual Meeting to

Be Held on May 6, 2016

Our proxy materials relating to the Annual Meeting (notice, proxy statement and annual report) are available on our website atwww.colonystarwood.com.

TABLE OF CONTENTS

i

Colony Starwood Homes

8665 East Hartford Drive

Scottsdale, Arizona 85255

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

INFORMATION CONCERNING ANNUAL MEETING, SOLICITATION AND VOTING

This Proxy Statement and the accompanying proxy card and Notice of Annual Meeting are being provided in connection with the solicitation of proxies by the Board of Trustees of Colony Starwood Homes, a Maryland real estate investment trust (“we,” “our” or “us”), for use at the 2016 annual meeting of shareholders (the “Annual Meeting”) to be held on May 6, 2016 at 11:00 a.m., local time at our offices located at 9305 E. Via de Ventura, Scottsdale, Arizona 85258, and any adjournments or postponements thereof. The mailing address of our principal executive offices is Colony Starwood Homes, 8665 East Hartford Drive, Scottsdale, Arizona 85255. This Proxy Statement, the accompanying proxy card and the Notice of Annual Meeting are first being mailed to holders of our common shares, $0.01 par value per share (“Common Shares”), on or about April 6, 2016.

Matters to Be Voted on at the Annual Meeting

At the Annual Meeting, the following matters will be voted on:

| | 1. | the election of the twelve trustee nominees identified in this Proxy Statement, each to serve until the next annual meeting of shareholders and until his successor is duly elected and qualified; |

| | 2. | the approval, on an advisory basis, of our executive compensation as disclosed in this Proxy Statement; |

| | 3. | to hold an advisory vote on the frequency of future advisory votes on executive compensation; |

| | 4. | the ratification of the appointment of Ernst & Young LLP (“E&Y”) as our independent registered public accounting firm for the calendar year ending December 31, 2016; and |

| | 5. | the transaction of such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

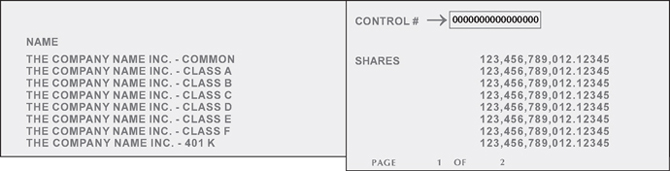

Shareholders Entitled to Vote

Our Board of Trustees has fixed March 9, 2016 as the record date for the determination of shareholders entitled to notice of and to vote their Common Shares at the Annual Meeting. As of March 9, 2016, we had outstanding 101,517,567 Common Shares. Each Common Share entitles its holder to one vote.

Voting at the Annual Meeting

If the accompanying proxy card is properly executed and returned to us in time to be voted at the Annual Meeting, it will be voted as specified on the proxy, unless it is properly revoked prior thereto. If no specification is made on the proxy card as to any one or more of the proposals, the Common Shares represented by the proxy will be voted as follows:

FORthe election of each of the twelve trustee nominees identified in this Proxy Statement; and

FOR the approval, on an advisory basis, of our executive compensation as disclosed in this Proxy Statement;

“ONE YEAR” for the frequency of the advisory vote on our compensation for executive officers as set forth in Proposal 3; and

1

FORthe ratification of the appointment of E&Y as our independent registered public accounting firm for the calendar year ending December 31, 2016.

Voting on Other Matters

If any other matters are properly presented at the Annual Meeting for consideration, the persons named in the proxy will have the discretion to vote on those matters for you. As of the date this Proxy Statement was finalized, we did not know of any other matter to be raised at the Annual Meeting.

Required Vote

The presence in person or by proxy of shareholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting constitutes a quorum for purposes of transacting business at the Annual Meeting. Abstentions and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum. A “broker non-vote” occurs when a bank, broker or other holder that holds shares for a beneficial owner in “street name” (each, a “record holder”) does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

Election of each nominee named in this proxy statement for the twelve trustee positions (Proposal 1) requires the affirmativeFORvote of a plurality of all votes cast at the Annual Meeting. This means that the trustee nominee with the most votes for a particular seat is elected for that seat. Votes “withheld” from one or more trustee nominees therefore will have no effect on the outcome of the vote with respect to the election of trustees. For additional details, see the section of this Proxy Statement entitled “Proposal 1 Election of Trustees.”

The affirmativeFORvote of a majority of votes cast at the Annual Meeting is required to approve, on an advisory basis, our executive compensation as disclosed in this Proxy Statement (Proposal 2) and the ratification of the appointment of E&Y as our independent registered public accounting firm (Proposal 4). In tabulating the voting result for these proposals, abstentions and broker non-votes are not counted as votesFORorAGAINSTthe proposals.

The advisory vote to approve the frequency of the advisory vote on executive compensation (Proposal 3) requires the affirmative vote of at least a majority of the votes cast at the Annual Meeting. However, because shareholders may select one of four options, it is possible that no option will receive a majority of the votes. Although this proposal is not binding on our Board of Trustees, our Board of Trustees will consider the results of the shareholder vote. In tabulating the voting result for this proposal, abstentions and broker non-votes will not affect the vote.

Although the advisory votes on Proposals 2 and 3 are non-binding, our Board of Trustees will review the results of the vote and will take them into account as appropriate when making decisions regarding executive compensation.

Under the rules of the New York Stock Exchange (the “NYSE”), a record holder has the authority to vote your shares on certain matters when it does not receive voting instructions from you. Record holders that do not receive voting instructions are entitled to vote on the ratification of the appointment of E&Y as our independent registered public accounting firm (Proposal 4). Absent instructions from you, record holders may not vote on the proposal regarding the election of trustees (Proposal 1) or on the advisory proposals regarding executive compensation (Proposal 2) and the frequency of future advisory votes on executive compensation (Proposal 3), and broker non-votes will occur.

2

How to Vote

You may vote at the Annual Meeting in any of the following ways:

Submitting a Proxy by Telephone or via the Internet

If you are a shareholder of record, you may appoint your proxy by telephone, or electronically via the Internet, by following the instructions on your proxy card. Easy-to-follow prompts allow you to submit a proxy for your shares and confirm that your instructions have been properly recorded. Our telephone and Internet proxy submission procedures are designed to authenticate shareholders by using individual control numbers. If you hold your shares in street name, please check your voting instruction card or contact your bank or broker to determine whether you will be able to provide your voting instructions by telephone or via the Internet.

Submitting a Proxy by Mail

If you are a shareholder of record, you can appoint your proxy by marking, dating and signing your proxy card and returning it by mail in the postage-prepaid envelope provided. If you hold your shares in street name, you can instruct your bank or broker to vote by following the directions on your voting instruction card.

By casting your vote in any of the ways listed above, you are authorizing the individuals listed on the proxy to vote your shares in accordance with your instructions.

Voting in Person at the Annual Meeting

Shareholders of record may vote in person by ballot at the Annual Meeting. Shareholders who own their shares in street name may vote in person at the Annual Meeting only if they provide a legal proxy, executed in their favor, from the holder of record of their shares.

Please note that even if you plan to attend the Annual Meeting, we encourage you to submit a proxy in advance to ensure your shares are represented. Your vote in person at the Annual Meeting will revoke any previously submitted proxy.

Revocation of Proxies

A person submitting a proxy has the power to revoke it at any time before it is exercised by (a) attending the Annual Meeting and voting in person, (b) duly executing and delivering a proxy bearing a later date prior to the Annual Meeting or (c) sending written notice of revocation to our Secretary at Colony Starwood Homes, 8665 East Hartford Drive, Scottsdale, Arizona 85255, which written notice must be received by our Secretary by 5:00 p.m., local time, on May 5, 2016.

Confidentiality of Voting

We keep all proxies, ballots and voting tabulations confidential as a matter of practice. We only let our inspector of election and tabulating agent, Broadridge Financial Solutions, Inc. (“Broadridge”), examine these documents.

Voting Results

Broadridge, our independent tabulating agent, will count the votes and act as the inspector of election at the Annual Meeting.

Solicitation of Proxies

We will pay the expenses of soliciting proxies in connection with this Proxy Statement. Proxies may be solicited in person or by mail, telephone, electronic transmission and facsimile transmission on our behalf by our trustees, officers or employees or trustees, officers or employees of our subsidiaries, without additional compensation. We ask brokerage houses and other custodians, nominees and fiduciaries to forward soliciting

3

materials to the beneficial owners of the shares held of record by such persons and to obtain authority to execute proxies, for which we will reimburse such persons. When recording solicited votes by telephone or via the Internet, we will use procedures designed to authenticate shareholders’ identities, which will allow shareholders to authorize the voting of their shares in accordance with their instructions and confirm that their instructions have been recorded properly.

Attendance at the Annual Meeting

All shareholders of record as of the close of business on the record date, March 9, 2016, may attend the Annual Meeting. Institutional or entity shareholders are permitted to bring one representative. The opportunity to attend the Annual Meeting will be on a first-come, first-served basis upon arrival at the meeting. Proof of share ownership as of the record date, such as a bank or brokerage statement, and a government-issued photo identification, such as a valid driver’s license or passport, will be required for admission to the Annual Meeting.

Recommendations of our Board of Trustees

Our Board of Trustees recommends a voteFORthe election of each of the twelve nominees for trustee identified in this Proxy Statement,FOR the approval, on an advisory basis, of our executive compensation as disclosed in this Proxy Statement, “ONE YEAR” with respect to the advisory vote on the frequency of future advisory votes on executive compensation andFORthe ratification of the appointment of E&Y as out independent registered public accounting firm for the calendar year ending December 31, 2016.

4

PROPOSAL 1

ELECTION OF TRUSTEES

Our Bylaws provide that our Board of Trustees may establish, increase or decrease the number of trustees, provided that the number of trustees shall never be less than the minimum required by Maryland law, nor more than 15. Our Board of Trustees is currently comprised of twelve members.

At the Annual Meeting, the twelve trustee nominees named in this Proxy Statement will be up for election to serve on our Board of Trustees, each for a one-year term expiring in 2017 and each until his successor is duly elected and qualified. The Common Shares represented by the accompanying proxy will be voted for the election as trustees of the twelve nominees named below, unless a vote is withheld from any of the twelve individual nominees. Each nominee has agreed to serve as trustee if elected and our Board of Trustees expects that each nominee will be available for election as a trustee. However, if any nominee becomes unavailable or unwilling to serve as a trustee for any reason, Common Shares represented by the accompanying proxy will be voted for such other person as our Board of Trustees may nominate.

Election of each nominee named in this Proxy Statement for the twelve trustee positions requires the affirmativeFORvote of a plurality of all votes cast at the Annual Meeting. This means that the trustee nominee with the most votes for a particular seat is elected for that seat.

Information Concerning the Trustee Nominees

Our Board of Trustees has unanimously proposed Thomas J. Barrack, Jr., Barry S. Sternlicht, Robert T. Best, Thomas M. Bowers, Richard D. Bronson, Justin T. Chang, Michael D. Fascitelli, Jeffrey E. Kelter, Thomas W. Knapp, Richard B. Saltzman, John L. Steffens and J. Ronald Terwilliger as nominees for election as our trustees, each to serve for a one-year term expiring at the annual meeting of shareholders in 2017 and each until his respective successor is duly elected and qualified. Each nominee is currently one of our trustees, although Thomas J. Barrack, Jr., Robert T. Best, Thomas M. Bowers, Justin T. Chang, Thomas W. Knapp, Richard B. Saltzman, John L. Steffens and J. Ronald Terwilliger joined our Board of Trustees by appointment by our Board of Trustees on January 5, 2016 in connection with the Merger (as defined below).

On January 5, 2016, we completed the transactions contemplated by (1) that certain Agreement and Plan of Merger, dated as of September 21, 2015 (the “Merger Agreement”), by and among us and Colony American Homes, Inc., a Maryland corporation (“CAH”), CAH Operating Partnership, L.P., a Delaware Limited Partnership, and the parties identified therein as the Company Stockholders, the Company Unitholders and the Company Investors (collectively, the “CAH Investors”), that resulted in CAH merging with and into SWAY Holdco, LLC, our wholly owned subsidiary formed for the purpose of effecting the merger (the “Merger”), on January 5, 2016 and (2) that certain Contribution Agreement, dated as of September 21, 2015, as amended (the “Contribution Agreement”), among us, Starwood Capital Group Global, L.P. (“Starwood Capital Group”), Starwood Waypoint Residential Partnership, L.P. (now known as Colony Starwood Homes Partnership, L.P.) (our “Operating Partnership”) and SWAY Management LLC (now known as Colony Starwood Homes Management, LLC) (the “Manager”), that resulted in the internalization of the Company’s management (the “Internalization”) on January 5, 2016. The Merger Agreement provided that, upon the completion of the Merger, Thomas J. Barrack, Jr., Barry S. Sternlicht, six designees of CAH and four of our designees would be appointed to our Board of Trustees. Robert T. Best, Justin T. Chang, Thomas W. Knapp, Richard B. Saltzman, John L. Steffens and J. Ronald Terwilliger were CAH’s designees, and Thomas M. Bowers, Richard D. Bronson, Michael D. Fascitelli and Jeffrey E. Kelter were our designees.

Information concerning the names, ages, terms and positions with us and business experience of the nominees for election as trustees, each of whom is currently a trustee, is set forth below. This information includes each nominee’s principal occupation as well as a discussion of the specific experience, qualifications, attributes and skills of each nominee that led to our Board of Trustees’ conclusion that the particular nominee

5

should serve as a trustee. In addition, set forth below is the period during which each nominee has served as one of our trustees. Ages shown for all trustees are as of April 6, 2016. The information presented below has been confirmed by each nominee for purposes of its inclusion in this Proxy Statement.

| | | | | | | | |

Name | | Age | | | Position(s) | | Committee Membership |

Thomas J. Barrack, Jr. | | | 68 | | | Co-Chairman of our Board of Trustees | | |

Barry S. Sternlicht | | | 55 | | | Co-Chairman of our Board of Trustees | | |

Robert T. Best | | | 69 | | | Trustee | | Compensation; Nominating and Corporate Governance |

Thomas M. Bowers | | | 51 | | | Trustee | | |

Richard D. Bronson | | | 71 | | | Trustee | | Nominating and Corporate Governance |

Justin T. Chang | | | 48 | | | Trustee | | |

Michael D. Fascitelli | | | 59 | | | Trustee | | Compensation |

Jeffrey E. Kelter | | | 61 | | | Trustee | | Audit |

Thomas W. Knapp | | | 51 | | | Trustee | | Audit; Compensation |

Richard B. Saltzman | | | 59 | | | Trustee | | |

John L. Steffens | | | 74 | | | Trustee | | Audit |

J. Ronald Terwilliger | | | 75 | | | Trustee | | Nominating and Corporate Governance |

Thomas J. Barrack, Jr.has been a Co-Chairman of our Board of Trustees since January 2016. Mr. Barrack served as the chairman of CAH’s board of directors from July 2012 until the closing of the Internalization and the Merger. Mr. Barrack is the founder and executive chairman of Colony Capital, Inc. (“Colony Capital”). Prior to founding the Colony Capital business in 1991, Mr. Barrack was a principal with the Robert M. Bass Group, the principal investment vehicle of the Fort Worth, Texas investor Robert M. Bass. Prior to joining the Robert M. Bass Group, Mr. Barrack also served in the Reagan administration as Deputy Undersecretary of the Department of the Interior. Additionally, in 2010, French president Nicolas Sarkozy awarded him France’s Chevalier de la Légion d’honneur. Since January 2014, Mr. Barrack has served on the board of directors of Carrefour S.A., a French multinational retailer and the second largest retailer in the world. Since June 2010, Mr. Barrack has served on the board of directors of First Republic Bank, a full service bank and wealth management firm. From January 2006 to April 2013, Mr. Barrack served on the public board of directors of Accor, S.A., a major global hotel group listed on Euronext Paris. Mr. Barrack served on the public board of Challenger Financial Services Group Limited, a diversified financial services organization listed on the Australian Securities Exchange from November 2007 to October 2010. From August 1994 to September 2007, Mr. Barrack served on the board of Continental Airlines, Inc., one of the largest passenger airlines in the United States, including as a member of its Corporate Governance Committee, Executive Committee and HR Committee. Mr. Barrack received a B.A. in 1969 from the University of Southern California. He attended law school at the University of San Diego and the University of Southern California, where he was an editor of the law review, and received a J.D. in 1972 from the University of San Diego. Mr. Barrack is the recipient of an Honorary Doctorate of Jurisprudence degree from Pepperdine University and a trustee at the University of Southern California. Mr. Barrack possesses significant vision and understanding of our strategies and future direction. Mr. Barrack has a long track record and experience managing and investing in commercial mortgage loans and other commercial real estate and real estate-related investments, including single-family rental, multifamily, performing, sub-performing and non-performing loan portfolios and real estate owned properties, through a variety of credit cycles and market conditions. Mr. Barrack’s extensive investmentexperience in our target assets are key to our Board of Trustees’ oversight of our investment strategy andmanagement of its investment portfolio. Mr. Barrack’s prior service as Deputy Undersecretary of the Department of the Interior also provides a unique government perspective to our Board of Trustees.

Barry S. Sternlichthas been a Co-Chairman of our Board of Trustees since January 2016 and prior to that was the Chairman of our Board of Trustees since 2012. He has been the president and chief executive officer of Starwood Capital Group, a privately-held global investment firm, since its formation in 1991. He is also the

6

chairman and chief executive officer of Starwood Capital Group Management, L.L.C., a registered investment advisor and. He was also the chairman of the board of directors of the Manager until the closing of the Internalization. Over the past 24 years, Mr. Sternlicht has structured investment transactions with an aggregate asset value of approximately $63 billion. From 1995 to 2005, he was the chairman and chief executive officer of Starwood Hotels & Resorts Worldwide, Inc., a NYSE-listed hotel and leisure company that he founded. Mr. Sternlicht is the chairman of the board of TRI Pointe Homes, Inc., Starwood Property Trust, Inc. (“Starwood Property Trust”) and Baccarat S.A., a crystal maker. He also serves on the board of directors of The Estée Lauder Companies, A.S. Roma, the Pension Real Estate Association and the Real Estate Roundtable and previously served on the board of directors of Restoration Hardware. Mr. Sternlicht is a trustee of Brown University. Additionally, he serves on the boards of The Robin Hood Foundation (of which he is the former chairman), the Dreamland Film & Performing Arts Center and the executive advisory board of Americans for the Arts. He is a member of the World Presidents Organization and the Urban Land Institute. Mr. Sternlicht received a B.A. degree, magna cum laude, with honors from Brown University. He later earned a M.B.A. with distinction from Harvard Business School. Mr. Sternlicht’s extensive experience in both the real estate markets and as a senior executive and director of other publicly traded corporations enables him to provide our Board of Trustees with leadership and financial expertise as well as insight into the current status of the global financial markets.

Robert T. Best has been a member of our Board of Trustees since January 2016. He served on the board of directors of CAH until the closing of the Internalization and the Merger. Mr. Best is the founder, chairman, and chief executive officer of Westar Associates, a private real estate development company established in 1980 and headquartered in Costa Mesa, California. As chief executive officer, Mr. Best developed over 50 projects exceeding $1 billion across various commercial and residential product types throughout Southern California. Prior to founding Westar, Mr. Best was a partner with Carver Companies where he was responsible for the acquisition, entitlement, leasing, finance, management, and disposition of shopping center development projects. Mr. Best currently serves on the board of directors of the University of Southern California’s Lusk Center for Real Estate, Catholic Center, and Athletics Commission. He is also secretary and a founding board member of A Better LA, a community outreach program that works with inner-city groups to decrease violence. Previously, he served on the board of directors of Coast Newport Properties and several non-profit organizations, including Harbor Day School, and Newport Sports Museum. Mr. Best is also a member of the Urban Land Institute, and the International Council of Shopping Centers. Mr. Best received a B.S. and an M.B.A. from the Marshall School of Business, University of Southern California. Mr. Best’s real estate development experience allows him to provide sound advice on our real estate investment objectives, including acquisitions and management. As founder, chairman, and chief executive officer of Westar Associates, Mr. Best gained extensive insight into the real estate asset management industry that provides constructive perspective to our Board of Trustees.

Thomas M. Bowers has been a member of our Board of Trustees since January 2016. Mr. Bowers is a managing director and chief operating officer at Starwood Capital Group. He serves on Starwood Capital Group’s Executive and Investment Committees and was previously a member of our Board of Trustees and our Lead Independent Trustee from January 2014 through February 2015. Prior to joining Starwood Capital Group in 2015, Mr. Bowers was co-head of Asset and Wealth Management-Americas at Deutsche Bank, where he was responsible for managing the U.S. and Latin American wealth management businesses, and jointly responsible for the integration of Deutsche Bank’s wealth and institutional asset management businesses in the Americas. Mr. Bowers was a member of Deutsche Bank’s Global Asset and Wealth Management Executive Committee and a board member of Deutsche Bank Securities. Mr. Bowers previously held a number of senior roles at Citigroup Private Bank, including global chief operating officer; head of Strategy and Corporate Development; chiefoperating officer-Europe, Middle East and Africa; chief operating officer-U.S.; and Head of Banking and Structured Lending. Mr. Bowers holds a B.S. degree in business administration from the Boston University School of Management and a J.D. and LL.M. (taxation) from Boston University School of Law. Mr. Bower’s knowledge, skill, expertise and experience as described above provide valuable perspectives to our Board of Trustees.

Richard D. Bronsonhas been a member of our Board of Trustees since January 2014. Since 2000, Mr. Bronson has been the chief executive officer of The Bronson Companies, LLC, a real estate development

7

company, based in Beverly Hills, California. Mr. Bronson has been involved in the development of several shopping centers and office buildings throughout the United States. Mr. Bronson serves as the chairman of U.S. Digital Gaming, an online gaming technology provider based in Beverly Hills, California, and as a director of Starwood Property Trust. Mr. Bronson previously served as a director of TRI Pointe Homes, Inc. and Mirage Resorts and was president of New City Development, an affiliate of Mirage Resorts, where he oversaw many of their new business initiatives and activities outside Nevada. Mr. Bronson is on the board of the Neurosurgery Division at UCLA Medical Center. He is a member of the Western Real Estate Business Editorial Board. Mr. Bronson has also served as vice president of the International Council of Shopping Centers (ICSC), an association representing 50,000 industry professionals in more than 80 countries. Mr. Bronson is the founder and president of Native American Empowerment, LLC, a private company dedicated to monitoring, advocating and pursuing Native American gaming opportunities and tribal economic advancement. Mr. Bronson’s experience and knowledge in the real estate industry provides our Board of Trustees with valuable insight into potential investments and the current state of the real estate markets.

Justin T. Changhas been a member of our Board of Trustees since January 2016. He served as chief executive officer and as a director of CAH from July 2012 until the closing of the Internalization and the Merger. Mr. Chang had overall responsibility for setting CAH’s strategic direction and leading its operations on a national basis. Mr. Chang is an executive director at Colony Capital. Prior to joining the Colony Capital business in 2010, Mr. Chang was a partner with TPG Capital, L.P. (“TPG”), an international private equity investment firm, from 1993 to 2009. At TPG, Mr. Chang led private equity investments across a broad range of industries and in multiple geographies. He has served on the board of directors of Beringer Wine Estates Holdings Inc., Crystal Decisions, Inc., Lenovo Group Ltd., On Semiconductor Corp., Shenzhen Development Bank, Silverado Premium Properties LLC and UTAC Holdings. Mr. Chang received his M.B.A. from Harvard Business School and his B.A., cum laude, in Economics and Political Science from Yale University. Mr. Chang is qualified to serve on our Board of Trustees due to his familiarity with CAH’s history and operations and his experience as an early leader in the institutionalization of the single-family rental sector. Mr. Chang’s extensive experience in the investment management industry also provides our Board of Trustees with critical insights and perspectives on asset management and strategic planning, and his service on other public company boards lends understanding and perspective on public company operations, practices and governance.

Michael D. Fascitelli has been a member of our Board of Trustees since January 2014. Mr. Fascitelli has been a managing member of MDF Capital LLC, an investment firm, since April 2013. Mr. Fascitelli has served as a member of the board of trustees of Vornado Realty Trust, an NYSE-listed real estate investment trust (“REIT”), since December 1996. He served as Vornado Realty Trust’s president from December 1996 and as its chief executive officer from May 2009 until his resignation from both positions effective April 15, 2013. From December 1992 to December 1996, Mr. Fascitelli was a partner at Goldman, Sachs & Co. in charge of its real estate practice and was a vice president prior thereto. From 2004 until 2013 he also served as a director of Toys “R” Us, Inc. In addition, from August 2005 through June 2008, Mr. Fascitelli was a member of the board of trustees of GMH Communities Trust, a REIT. Mr. Fascitelli holds a B.S. in Industrial Engineering from the University of Rhode Island and a M.B.A. from the Harvard University School of Business Administration. Mr. Fascitelli’s executive experience as president and chief executive officer of Vornado Realty Trust and his extensive knowledge of and experience in the real estate industry led our Board of Trustees to conclude that Mr. Fascitelli should serve as a trustee.

Jeffrey E. Kelterhas been a member of our Board of Trustees since January 2014. Mr. Kelter is the founding partner of CSH Capital Management. Prior to founding CSH Capital Management, Mr. Kelter was a founding partner and chief executive officer of KTR Capital Partners, a private equity firm investing in real estate, from 2004 through May 2015. From 1997 to 2004, Mr. Kelter was president and chief executive officer and a trustee of Keystone Property Trust (“Keystone”), an industrial REIT. Keystone merged during the third quarter of 2004 with and into a joint venture between ProLogis and affiliates of investment companies managedby Eaton Vance Management. Mr. Kelter had been president and a trustee of Keystone from its formation in December 1997 and was appointed chief executive officer in December 1998. He has over 20 years of experience

8

in all phases of commercial real estate including development and third-party management. Prior to forming Keystone, he served as president and chief executive officer of Penn Square Properties, Inc. (“Penn Square”) in Philadelphia, Pennsylvania, a real estate company which he founded in 1982. At Penn Square, he developed, owned, managed and leased more than 4.5 million square feet of office and warehouse projects throughout the Pennsylvania and New Jersey markets. Mr. Kelter also serves on the board of directors of Gramercy Property Trust Inc., and he is a trustee of The Urban Land Institute, Cold Spring Harbor Laboratory, Westminster School and Trinity College, Mr. Kelter received a B.A. from Trinity College. Mr. Kelter’s qualifications to serve on our Board of Trustees include his executive experience as president and chief executive officer of Keystone and Penn Square, and his vast experience of over 20 years in commercial real estate.

Thomas W. Knapphas been a member of our Board of Trustees since January 2016. He served on the board of directors of CAH until the closing of the Internalization and the Merger. Mr. Knapp is the academic director for the Masters of Science in Entrepreneurship and Innovation and is an assistant professor of Clinical Entrepreneurship and former associate director of the Lloyd Greif Center for Entrepreneurial Studies at the Marshall School of Business, University of Southern California, where he has lectured since 2008. Mr. Knapp also serves as president of Club Sportswear, Inc., a leader in the beach apparel industry, which he founded in 1984. He has consulted for Billabong International, LTD, an Australia-based company engaged in the wholesaling and retailing of surf, skate, snow and sports apparel, where he previously served as president of GSM Investments for three years. Prior to his time at Billabong and Club Sportswear, Mr. Knapp founded and held senior management roles with other successful companies in the apparel industry such as Honolua Surf Co., where he served as president, and True Textiles, Inc., where he served as chairman. Mr. Knapp was also a partner of Mad Dog Enterprises, LLC, a start-up eyewear and sunglass manufacturer. Mr. Knapp currently serves on the board of trustees of the Institute for Shipboard Education Semester at Sea and the Challenged Athletes Foundation, a charity providing grants to athletes with physical disabilities. Previously, he served on the board of directors of the Orange County Marine Institute and the American Oceans Campaign. Mr. Knapp graduated from the University of Southern California with a B.S. and Masters in Business Administration. Mr. Knapp’s many years of experience as president of Club Sportswear, Inc., along with his wide-ranging corporate experience in other senior leadership, advisory and academic positions, allow him to provide seasoned insight and business acumen to our Board of Trustees as we position ourselves for future growth and development. Mr. Knapp’s extensive business background also lends our Board of Trustees perspective on our corporate objectives and governance matters.

Richard B. Saltzmanhas been a member of our Board of Trustees since January 2016. He served as vice chairman of CAH’s board of directors from July 2012 until the closing of the Internalization and the Merger. Since June 2009, Mr. Saltzman has served as chief executive officer, president and as a director of Colony Capital. Prior to joining the Colony Capital business in 2003, Mr. Saltzman spent 24 years in the investment banking business primarily specializing in real estate-related businesses and investments. Most recently, he was a managing director and vice chairman of Merrill Lynch’s investment banking division. As a member of the investment banking operating committee, he oversaw the firm’s global real estate, hospitality and restaurant businesses. Previously, he also served as chief operating officer of Investment Banking, had responsibility for Merrill Lynch’s Global Leveraged Finance business, and was also responsible for various real estate-related principal investments including the Zell/Merrill Lynch series of funds which acquired more than $3.0 billion of commercial real estate assets and where Mr. Saltzman was a member of the investment committee. Since July 2003, Mr. Saltzman has served on the board of directors of Kimco Realty Corporation (“Kimco”), a publiclytraded REIT, and as a member of Kimco’s Compensation Committee. Previously, he was also a member of the board of governors of the National Association of Real Estate Investment Trusts, the board of directors of the Real Estate Roundtable and a member of the board of trustees of the Urban Land Institute, treasurer of the Pension Real Estate Association, a director of the Association of Foreign Investors in Real Estate, a vice chairman of the National Realty Committee and a past chairman of the NRC Real Estate Capital Policy Advisory Committee. Mr. Saltzman received his B.A. from Swarthmore College in 1977 and an M.S. in Industrial Administration from Carnegie Mellon University in 1979.Mr. Saltzman’s expertise in real estate-related businesses, investments and capital markets, developed through years of real estate principal investing and investment banking experience, provide avaluableperspective to our Board of Trustees in

9

developing, leadingandoverseeing our investment strategy and management of its portfolio. Mr. Saltzman’s current and past service on the boards of a REIT and other real estate-based organizations also provide our Board of Trustees with valuable perspectives into the real estate industry.

John L. Steffens has been a member of our Board of Trustees since January 2016. Mr. Steffens served on the board of directors of CAH until the closing of the Internalization and the Merger. In addition, he has served as a director of Colony Capital since its initial public offering in September 2009 and currently serves as chairman of its Nominating and Corporate Governance Committee. Mr. Steffens is the founder of Spring Mountain Capital, L.P. Founded in 2001, Spring Mountain Capital, L.P. specializes in providing advisory services and alternative investments for institutional and private investors. Prior to establishing Spring Mountain Capital, L.P., Mr. Steffens spent 38 years at Merrill Lynch & Co., Inc., where he held numerous senior management positions, including president of Merrill Lynch Consumer Markets (which was later named the Private Client Group) from July 1985 until April 1997, and both vice chairman of Merrill Lynch & Co., Inc. (the parent company) and chairman of its U.S. Private Client Group from April 1997 until July 2001. Mr. Steffens served on the board of directors of Merrill Lynch & Co., Inc. from April 1986 until July 2001. He also served as a member of the board of directors of Merrill Lynch Ventures, LLC (a $1.8 billion private equity fund for key employees). Mr. Steffens currently serves on the advisory board of Star Vest Partners, the advisory board of Wicks Communication & Media Partners, L.P., the board of directors of HealthPoint Capital, a global medical device company, and as chairman of the board of directors of Cicero, Inc., a publicly traded provider of business integration software, since May 2007. Also, Mr. Steffens serves on the Dartmouth Medical School board of overseers, which he was appointed to on October 1, 2011. From June 2004 to February 2009, Mr. Steffens served on the public board of Aozora Bank, Ltd., a financial services institution in Japan. Mr. Steffens has served as chairman of the Securities Industry Association, as a trustee of the Committee for Economic Development, and is currently National Chairman Emeritus of the Alliance for Aging Research. Mr. Steffens graduated from Dartmouth College in 1963 with a B.A. in Economics. He also attended the Advanced Management Program of the Harvard Business School in 1979. Mr. Steffens’s years of investment experience, advisory work and senior leadership positions at Merrill Lynch devoted to private client work provide us with an investor perspective. Mr. Steffens’s extensive contacts developed through his service with a significant number of securities and financial firms provide use with a view into markets that is invaluable. Mr. Steffens’s service as a director of other public companies also help provide us with different perspectives on corporate governance matters and best practices.

J. Ronald Terwilligerhas been a member of our Board of Trustees since January 2016. He served on the board of directors of CAH until the closing of the Internalization and the Merger. Mr. Terwilliger currently serves as chairman emeritus of the board of Trammell Crow Residential Company, the largest developer of multi-family housing in the United States, which he joined in 1979 and served as chief executive officer from 1986 to 2008. In addition to his post at Trammell Crow Residential Company, Mr. Terwilliger is both the chairman of the board of trustees of Enterprise Community Partners, a not-for-profit organization geared toward building and preserving affordable rental and for-sale housing, and vice chair of an affiliated company. Mr. Terwilliger’s current leadership roles also include chairman emeritus of the Wharton Real Estate Center, chairman of the board of directors of I Have a Dream Foundation, Commissioner on the Bipartisan Policy Center Housing Commission and co-chairman of the Bipartisan Policy Center Economic Policy Advisory Council. Previously, Mr. Terwilliger was the chairman of the international board of directors of Habitat forHumanity; he currently serves as an ex-officio member of the board and chairs Habitat for Humanity’s $4 billion Global Capital Campaign. Mr. Terwilliger has also served as Chairman of the Urban Land Institute and remains a trustee, and previously served as chairman of the National Association of Homebuilders Multifamily Leadership board. Mr. Terwilliger is an honor graduate of the United States Naval Academy. After serving five years in the Navy, he received his M.B.A. with High Distinction from the Harvard Graduate School of Business where he was elected a Baker Scholar. Mr. Terwilliger’s years of experience with Trammell Crow ResidentialCompany both as chief executive officer and as chairman enhance our Board of Trustee’s awareness of the residential real estate market and experience with managing a large portfolio of real estate assets.Mr. Terwilliger’s service on the boards of other real estate-based organizations also provide our Board of Trustees with important perspectives into the real estate industry generally.

10

Recommendation of Our Board of Trustees

Our Board of Trustees recommends a voteFOR the election of each of the nominees for trustee named above.

Compensation of Trustees

Each Independent Trustee (as defined below) receives an annual fee for his services of $50,000, payable in quarterly installments in conjunction with quarterly meetings of our Board of Trustees, and an annual award of $50,000 in our restricted Common Shares, calculated based on the closing price of our Common Shares on the date of the grant, which fully vests on the first anniversary of the grant date, subject to the trustee’s continued service on our Board of Trustees. Independent Trustees also receive the following compensation for service as members of committees of our Board of Trustees: (1) committee chairperson annual cash retainers of $15,000 (Audit Committee), $7,500 (Compensation Committee) and $7,500 (Nominating and Corporate Governance Committee); and (2) committee membership annual cash retainers of $7,500 (Audit Committee), $3,750 (Compensation Committee) and $3,750 (Nominating and Corporate Governance Committee). The Lead Independent Trustee, if any, receives an additional annual cash retainer of $15,000. Our Independent Trustees may elect to receive their fees by issuance of Common Shares, calculated based on the closing price of our Common Shares on the date of grant, rather than in cash, provided that any such issuance does not prevent such trustee from being determined to be independent and such shares are granted pursuant to our Non-Executive Trustee Share Plan (our “Non-Executive Trustee Share Plan”) or the issuance is otherwise made in a manner consistent with NYSE listing requirements.

In connection with their service on the special committee of the Board of Trustees formed in connection with the evaluation and negotiation of the Internalization (the “Special Committee”), Michael D. Fascitelli, Jeffrey E. Kelter and Stephen H. Simon received 8,952, 4,476 and 4,476 Common Shares, respectively, on January 12, 2016.

As of April 6, 2016, 134,849 Common Shares were available for issuance under the Non-Executive Trustee Share Plan, and 15,344 Common Shares were subject to unvested awards granted under the Non-Executive Trustee Share Plan.

Each of our Independent Trustees may elect to forego receipt of all or any portion of the cash or equity compensation payable to them for service as one of our trustees and direct that we pay such amounts to a charitable cause or institution designated by such trustee. We reimburse each of our trustees for their reasonable travel expenses incurred in connection with their attendance at full Board of Trustees and committee meetings.

The table below summarizes the compensation we paid to our Independent Trustees for the year ended December 31, 2015. Thomas J. Barrack, Jr., Robert T. Best, Justin T. Chang, Thomas W. Knapp, Richard B. Saltzman, John L. Steffens and J. Ronald Terwilliger are not included in the below table because they were not our trustees during the calendar year ended December 31, 2015.

| | | | | | | | | | | | |

Name | | Fees Earned

or Paid

in Cash | | | Share

Awards(1) | | | Total | |

Thomas M. Bowers(2) | | $ | — | | | $ | — | | | $ | — | |

Richard D. Bronson(3) | | $ | 57,500 | | | $ | 49,982 | | | $ | 107,482 | |

Michael D. Fascitelli(3)(4) | | $ | 61,250 | | | $ | 243,972 | | | $ | 305,222 | |

Jeffrey E. Kelter(3)(5) | | $ | — | | | $ | 211,956 | | | $ | 211,956 | |

Stephen H. Simon(3)(6) | | $ | — | | | $ | 190,069 | | | $ | 190,069 | |

Christopher B. Woodward(3)(7) | | $ | 48,750 | | | $ | 49,982 | | | $ | 98,732 | |

| (1) | The amounts reported relating to these Common Shares is the grant date fair value of these shares in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, which was based on the closing price per Common Share on the date of issue. |

11

| (2) | Mr. Bowers resigned as one of our trustees on February 2, 2015. On January 7, 2015, he received 765 Common Shares as the remainder of his fees for his services as a trustee in 2014, and the closing price per Common Share on the date of issue was $26.12. These Common Shares are not included in the above table as they related to his services as a trustee in 2014 and were reflected in the table in last year’s annual Proxy Statement. |

| (3) | On March 9, 2015, we granted the trustee his annual award of 1,985 Common Shares. This award of restricted shares was scheduled to vest on January 31, 2016, subject to the trustee’s continued service on our Board of Trustees. This amount is based on a closing price of $25.18 per Common Share on March 9, 2015, the date of the grant. All the outstanding restricted share awards vested upon the closing of the Merger on January 5, 2016. |

| (4) | In connection with his service on the Special Committee, Mr. Fascitelli received 8,952 Common Shares. The amount reported related to these Common Shares is based on a closing price of $21.67 per Common Share on January 12, 2016, the date of issue. |

| (5) | Mr. Kelter elected to receive his fees for his service as a trustee in 2015 in Common Shares. The amounts reported relating to these Common Shares are based on the closing prices per Common Share on the dates of issue, or $24.76 for the 656 Common Shares issued on February 26, 2015, $25.63 for the 634 Common Shares issued on May 11, 2015, $25.00 for the 650 Common Shares issued on August 6, 2015 and $24.98 for the 650 Common Shares issued on November 2, 2015. In connection with his service on the Special Committee, Mr. Kelter received 4,476 Common Shares. The amount reported related to these Common Shares is based on a closing price of $21.67 per Common Share on January 12, 2016, the date of issue. In addition, on January 7, 2015, Mr. Kelter received 622 Common Shares as the remainder of his fees for his services as a trustee in 2014, and the closing price per Common Share on the date of issue was $26.12. These 622 Common Shares are not included in the above table as they related to his services as a trustee in 2014 and were reflected in the table in last year’s annual Proxy Statement. |

| (6) | Mr. Simon elected to receive his fees for his service as a trustee in 2015 in Common Shares. The amounts reported relating to these Common Shares are based on the closing prices per Common Share on the dates of issue, or $25.63 for the 560 Common Shares issued on May 11, 2015, $25.00 for the 575 Common Shares issued on August 6, 2015 and $24.98 for the 575 Common Shares issued on November 2, 2015. In connection with his service on the Special Committee, Mr. Simon received 4,476 Common Shares. The amount reported related to these Common Shares is based on a closing price of $21.67 per Common Share on January 12, 2016, the date of issue. |

| (7) | Mr. Woodward passed away on July 30, 2015. All of his restricted share awards vested upon Mr. Woodward’s passing. |

12

CORPORATE GOVERNANCE

Determination of Trustee Independence

Pursuant to our Corporate Governance Guidelines, our Board of Trustees must be comprised of a majority of trustees who qualify as independent trustees under the listing standards of the NYSE (“Independent Trustees”). Our Board of Trustees reviews annually the relationships that each trustee has with us (either directly or as a partner, shareholder or officer of an organization that has a relationship with us). Following such annual review, only those trustees who our Board of Trustees affirmatively determines have no material relationship with us (either directly or as a partner, shareholder or officer of an organization that has a relationship with us) will be considered Independent Trustees, subject to additional qualifications prescribed under the listing standards of the NYSE or under applicable law. Our Board of Trustees may adopt and disclose categorical standards to assist it in determining trustee independence. In the event that a trustee becomes aware of any change in circumstances that may result in such trustee no longer being considered independent under the listing standards of the NYSE or under applicable law, the trustee must promptly inform the chairperson of the Nominating and Corporate Governance Committee.

Our Board of Trustees considered all relevant facts and circumstances in assessing trustee independence and has determined that each of Robert T. Best, Richard D. Bronson, Michael D. Fascitelli, Jeffrey E. Kelter, Thomas W. Knapp, John L. Steffens and J. Ronald Terwilliger is an Independent Trustee under the listing standards of the NYSE.

Board Leadership Structure and Role in Risk Oversight

We have separate individuals serving as Co-Chairmen of our Board of Trustees and as Chief Executive Officer. Messrs. Barrack and Sternlicht serve as our Co-Chairmen. Frederick C. Tuomi serves as our Chief Executive Officer.

We do not have a policy against one individual holding the position of Co-Chairman and Chief Executive Officer. Rather, our Board of Trustees evaluates the desirability of having a combined or separate roles for the Co-Chairmen and Chief Executive Officer from time-to-time and adopts a structure based on what it believes is in our best interests and our shareholders. Currently, our Board of Trustees believes that having separate Co-Chairmen and Chief Executive Officer serves our interests and our shareholders well.

Our Corporate Governance Guidelines provide that, if a Co-Chairman of our Board of Trustees is not an Independent Trustee, the Independent Trustees may designate one of the Independent Trustees to serve as Lead Independent Trustee. Currently, no Lead Independent Trustee has been appointed. The Lead Independent Trustee, if any, will work with the Co-Chairmen to ensure that our Board of Trustees discharges its responsibilities, has structures and procedures in place to enable it to function independently of management and clearly understands the respective roles and responsibilities of our Board of Trustees and management. The role of the Lead Independent Trustee, if any, will be to review and approve matters such as meeting agendas, meeting schedule sufficiency and, where appropriate, other information provided to the other trustees. All trustees are encouraged to, and in fact do, consult with the Co-Chairmen on each of the above topics. Each of the trustees communicates regularly with the Co-Chairmen regarding appropriate agenda topics and other matters related to our Board of Trustees.

The members of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee of our Board of Trustees, including their respective chairpersons, are comprised entirely of Independent Trustees who serve in oversight roles. Through these committees and directly, our Board of Trustees is actively involved in oversight of risk, compliance, possible conflicts of interest and related party transactions, and business results. Members of our Board of Trustees have access to management and outside advisors; thus, the Co-Chairmen are not the sole source of information for our Board of Trustees.

13

Management is responsible for the day-to-day management of the risks we face, while our Board of Trustees, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board of Trustees has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. To do this, the Co-Chairmen of our Board of Trustees meet regularly with management to discuss strategy and risks facing us. Senior management attends our Board of Trustees meetings and is available to address any questions or concerns raised by our Board of Trustees on risk management and any other matters. The Co-Chairmen and independent members of our Board of Trustees work together to provide strong, independent oversight of our management and affairs directly and through the Board’s standing committees and, when necessary, special meetings of Independent Trustees.

Board and Committee Meetings

Our Board of Trustees has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The current charters for each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are available on our website,www.colonystarwood.com, under the heading “Investors” and the subheading “Corporate Governance—Governance Documents.” Further, we will provide a copy of these charters without charge to each shareholder upon written request. Requests for copies should be addressed to our Secretary at Colony Starwood Homes, 8665 East Hartford Drive, Scottsdale, Arizona 85255.

The following descriptions of the functions performed by the committees of our Board of Trustees are general in nature and are qualified in their entirety by reference to the committees’ charters.

Audit Committee

The Audit Committee is comprised of John L. Steffens, Jeffrey E. Kelter and Thomas W. Knapp, each of whom is an Independent Trustee and “financially literate” under the applicable rules of the NYSE and the Securities and Exchange Commission (the “SEC”). John L. Steffens is chairperson of the Audit Committee. Mr. Steffens has been designated as the Audit Committee financial expert, as that term is defined by the SEC. The Audit Committee met six times during the calendar year ended December 31, 2015.

The Audit Committee assists our Board of Trustees in overseeing:

| | • | | our financial reporting, auditing and internal control activities, including the integrity of our financial statements; |

| | • | | our compliance with legal and regulatory requirements; |

| | • | | the independent registered public accounting firm’s qualifications and independence; and |

| | • | | the performance of our internal audit function and independent registered public accounting firm. |

The Audit Committee also prepares the report required to be prepared by the Audit Committee pursuant to the rules of the SEC for inclusion in our annual Proxy Statement. The Audit Committee is also responsible for engaging our independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, approving professional services provided by the independent registered public accounting firm, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is comprised of J. Ronald Terwilliger, Robert T. Best and Richard D. Bronson, each of whom is an Independent Trustee under the applicable rules of the NYSE.

14

Mr. Terwilliger is chairperson of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee acted pursuant to written consent one time during the calendar year ended December 31, 2015.

The Nominating and Corporate Governance Committee is responsible for the following:

| | • | | providing counsel to our Board of Trustees with respect to the organization, function and composition of our Board of Trustees and its committees; |

| | • | | overseeing the self-evaluation of our Board of Trustees; |

| | • | | periodically reviewing and, if appropriate, recommending to our Board of Trustees changes to, our corporate governance policies and procedures; and |

| | • | | identifying and recommending to our Board of Trustees potential trustee candidates for nomination. |

Our Bylaws provide certain procedures that a shareholder must follow to nominate persons for election to our Board of Trustees. Nominations for trustee at an annual meeting of shareholders must be submitted in writing to our Secretary at Colony Starwood Homes, 8665 East Hartford Drive, Scottsdale, Arizona 85255. The Secretary must receive the notice of a shareholder’s intention to introduce a nomination or proposed item of business at an annual meeting of shareholders not earlier than 5:00 p.m., Eastern time, on the 150th day nor later than 5:00 p.m., Eastern time, on the 120th day prior to the first anniversary of the date of the proxy statement for the preceding year’s annual meeting of shareholders. However, in the event that the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary, in order for notice by the shareholder to be timely, such notice must be so delivered not earlier than 5:00 p.m., Eastern time, on the 150th day prior to the date of such annual meeting of shareholders and not later than 5:00 p.m., Eastern time, on the later of the 120th day prior to the date of such annual meeting of shareholders, as originally convened, or the 10th day after the day on which public announcement of the date of such meeting is first made.

The deadline for such notice of a shareholder nomination is the same as the deadline for notice of a shareholder proposal submitted outside of Rule 14a-8 with respect to the 2017 annual meeting of shareholders, which is discussed in the section of this Proxy Statement entitled “Shareholder Proposals for the 2017 Annual Meeting.” The Bylaws also provide that the shareholder nomination notice must contain all information relating to such nominee that is required to be disclosed in solicitations of proxies for elections of trustees in an election contest, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (including such person’s written consent to being named in the proxy statement as a nominee and to serve as trustee if elected).

In considering the qualifications for serving as our trustee, the Nominating and Corporate Governance Committee examines a candidate’s experience, skills, expertise, diversity, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest and such other relevant factors that the committee considers appropriate in the context of the needs of our Board of Trustees. Although there is no specific policy on diversity, the Nominating and Corporate Governance Committee also may seek to have our Board of Trustees represent a diversity of backgrounds and experience.

The Nominating and Corporate Governance Committee identifies potential nominees by asking current trustees and executive officers to notify the Nominating and Corporate Governance Committee if they become aware of suitable candidates. The Nominating and Corporate Governance Committee also may, from time to time, engage firms that specialize in identifying trustee candidates. The Nominating and Corporate Governance Committee will also consider trustee candidates recommended by shareholders. The Nominating and Corporate Governance Committee’s evaluation process does not vary based on whether a candidate is recommended by a shareholder. However, in addition to taking into consideration the needs of our Board of Trustees and the qualifications of the candidate, the committee may also consider the number of shares held by the recommending shareholder and the length of time that such shares have been held.

15

Compensation Committee

The Compensation Committee is comprised of Michael D. Fascitelli, Robert T. Best and Thomas W. Knapp, each of whom is an Independent Trustee under the applicable rules of the NYSE and the SEC. Michael D. Fascitelli is chairperson of the Compensation Committee. The Compensation Committee met two times and acted pursuant to written consent five times during the calendar year ended December 31, 2015.

The principal functions of the Compensation Committee are to:

| | • | | review and approve on an annual basis the corporate goals and objectives relevant to chief executive officer compensation, evaluate our Chief Executive Officer’s performance in light of such goals and objectives and, if applicable, either as a committee or together with our Independent Trustees (as directed by our Board of Trustees), determine and approve the remuneration of our Chief Executive Officer based on such evaluation; |

| | • | | review and oversee management’s annual process for evaluating the performance of our officers and review and approve on an annual basis the remuneration of our officers, if applicable; |

| | • | | review and discuss with management our compensation discussion and analysis (the “CD&A”) to be included in our annual Proxy Statement or Annual Report on Form10-K filed with the SEC; |

| | • | | prepare the Compensation Committee Report as required by the rules of the SEC; |

| | • | | administer our equity plans; |

| | • | | administer our related party transaction policy; |

| | • | | assist our Board of Trustees and the Co-Chairmen in overseeing the development of executive succession plans; and |

| | • | | evaluate annually the appropriate level of compensation for Board and committee service by our non-executive trustees. |

Compensation Committee Interlocks and Insider Participation

There were no compensation committee interlocks required to be disclosed during the calendar year ended December 31, 2015. The trustees who were members of the Compensation Committee during the calendar year ended December 31, 2015 included Mr. Fascitelli, Mr. Bronson and Mr. Kelter, none of whom were our officers or employees during the calendar year ended December 31, 2015, and none of whom had any relationship requiring disclosure by us under Item 404 of Regulation S-K under the Securities Act of 1933, as amended (“Regulation S-K”).

Executive Sessions of the Independent Trustees

Executive sessions of the Independent Trustees occur regularly during the course of the year. The Independent Trustee presiding at those sessions rotates from meeting to meeting among the chairperson of each of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee, to the extent the trustee is present at the session.

Number of Meetings of Our Board of Trustees and Attendance in 2015

Our Board of Trustees met seven times and acted pursuant to written consent six times during the calendar year ended December 31, 2015, including both regularly scheduled and special meetings. All of the incumbent trustees attended at least 75% of the meetings of our Board of Trustees and of the committees of our Board of Trustees on which such trustee served during the period in the calendar year ended December 31, 2015 for which such trustee served as a member. We expect each trustee serving on our Board of Trustees to regularly attend meetings of our Board of Trustees and the committees on which such trustee serves, and to review, prior to meetings, material distributed in advance of such meetings. A trustee who is unable to attend a meeting is

16

expected to notify the Co-Chairmen of our Board of Trustees or the chairperson of the appropriate committee in advance of such meeting. Our policy regarding trustee attendance at the annual meetings of shareholders is to encourage trustees to attend such meetings, and six of our nine trustees serving on the date of last year’s annual meeting attended that meeting.

Report of the Audit Committee

Our Board of Trustees has appointed an Audit Committee consisting of three trustees. All of the members of the Audit Committee are “independent” as defined in the NYSE listing standards.

The Audit Committee’s job is one of oversight, as set forth in its charter. It is not the duty of the Audit Committee to prepare our financial statements, to plan or conduct audits or to determine that our financial statements are complete and accurate and are in accordance with generally accepted accounting principles (“GAAP”). The independent registered public accounting firm is responsible for auditing the financial statements and expressing an opinion as to whether those audited financial statements fairly present our financial position, results of operations and cash flows in conformity with GAAP.

The Audit Committee has reviewed and discussed our audited financial statements with management and with Deloitte & Touche LLP (“Deloitte”), our independent registered public accounting firm for the calendar year ended December 31, 2015. The Audit Committee has also discussed with Deloitte the matters required to be discussed by Auditing Standard No. 16, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board.

The Audit Committee has received from Deloitte the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding Deloitte’s communications with the Audit Committee concerning independence, has discussed Deloitte’s independence with Deloitte and has considered the compatibility of non-audit services with the independence of the independent registered public accounting firm.

Based on the review and discussions referred to above, the Audit Committee recommended to our Board of Trustees that the audited financial statements be included in our Annual Report on Form10-K for the calendar year ended December 31, 2015 for filing with the SEC.

Respectfully submitted by the Audit Committee of our Board of Trustees.

John L. Steffens (Chairperson)

Jeffrey E. Kelter

Thomas W. Knapp

Information on Corporate Governance and Communications with Our Board of Trustees

We maintain a corporate governance section on our website to provide relevant information to shareholders and other interested parties. Corporate governance information available on the website includes (1) the chartersof the Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee of our Board of Trustees, (2) the Corporate Governance Guidelines, (3) the Code of Business Conduct and Ethics and (4) the Code of Ethics for Principal Executive Officers and Senior Financial Officers. This information is available on our website,www.colonystarwood.com, under the heading “Investors” and the subheading “Corporate Governance—Governance Documents,” and the information is available in print without charge to any shareholder upon written request to our Secretary at Colony Starwood Homes, 8665 East Hartford Drive, Scottsdale, Arizona 85255.

17

Any shareholder or other interested party may initiate communications with our Board of Trustees, the Co-Chairmen, the Independent Trustees as a group or any individual trustee or trustees by writing to our Secretary at the address set forth above. You should indicate on the outside of the envelope the intended recipient of your communication (i.e., the full Board of Trustees, the Independent Trustees as a group or any individual trustee or trustees). Our Board of Trustees has instructed our Secretary to review such correspondence and, at his discretion, not to forward items if he deems them to be of a commercial or frivolous nature or otherwise inappropriate for the recipient’s consideration.

18

EXECUTIVE OFFICERS

Information concerning the names, ages, terms and positions with us and business experience of our executive officers is set forth below. Ages shown for all executive officers are as of April 6, 2015.

| | | | | | |

Name | | Age | | | Position(s) |

Frederick C. Tuomi | | | 61 | | | Chief Executive Officer |

Charles D. Young | | | 47 | | | Chief Operating Officer |

Arik Prawer | | | 50 | | | Chief Financial Officer |

Lucas Haldeman | | | 38 | | | Chief Technology & Marketing Officer |

Ryan A. Berry | | | 39 | | | Executive Vice President, General Counsel and Secretary |

Justin M. Iannacone | | | 39 | | | Executive Vice President, Construction |

Joshua Swift | | | 34 | | | Senior Vice President of Investments |