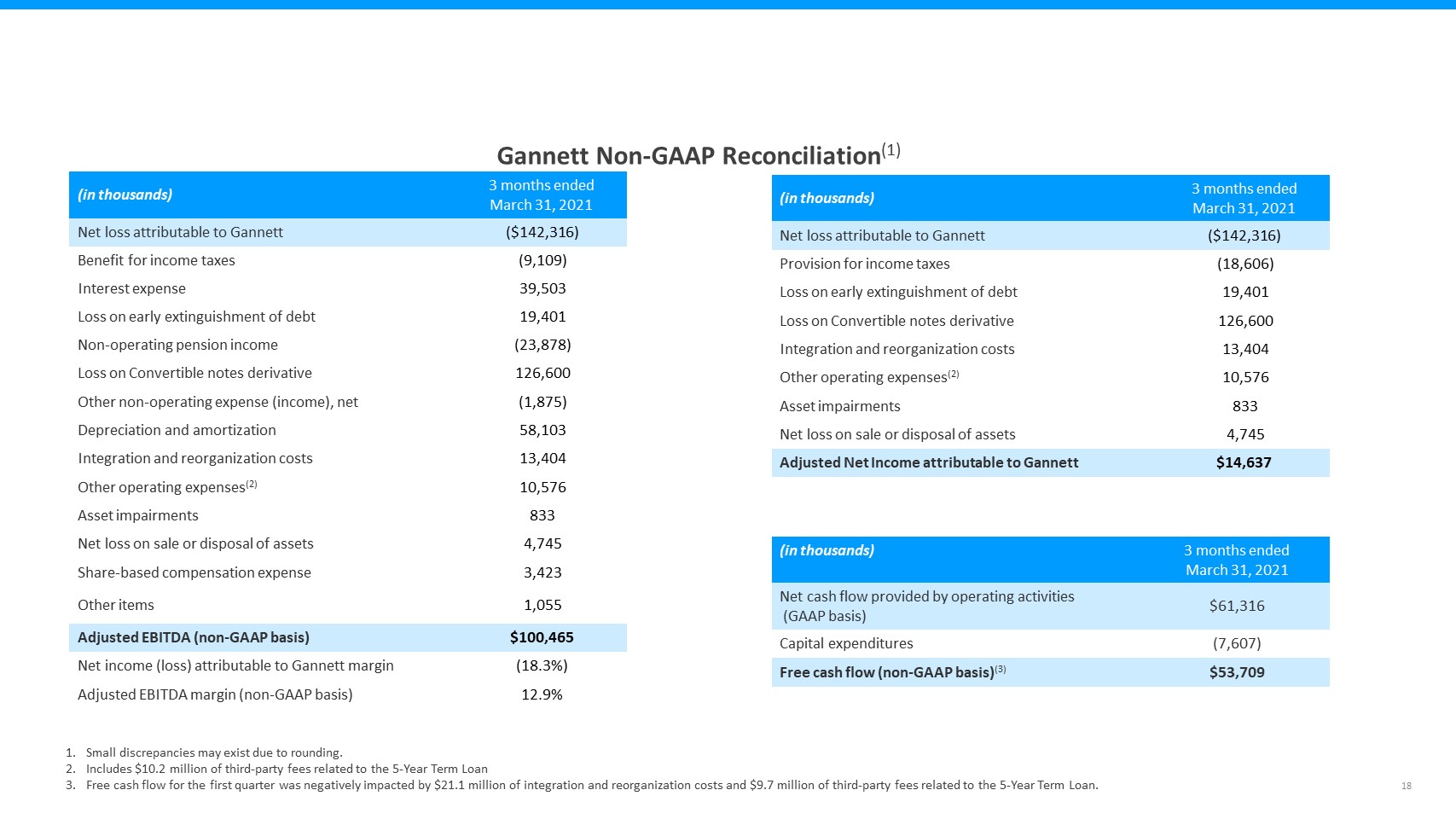

17 Non-GAAP Reconciliation The Company uses non-GAAP financial performance and liquidity measures to supplement the financial information presented on a GAAP basis. These non-GAAP financial measures, which may not be comparable to similarly titled measures reported by other companies, should not be considered in isolation from or as a substitute for the related GAAP measures and should be read together with financial information presented on a GAAP basis.The Company defines its non-GAAP measures as follows:Adjusted EBITDA is a non-GAAP performance measure the Company believes offers a useful view of the overall operations of our business. The Company defines Adjusted EBITDA as Net income (loss) attributable to Gannett before: (1) Income tax expense (benefit), (2) Interest expense, (3) Gains or losses on the early extinguishment of debt, (4) Non-operating pension income (expense), (5) Loss on Convertible notes derivative, (6) Other non-operating items, including equity income, (7) Depreciation and amortization, (8) Integration and reorganization costs, (9) Asset impairments, (10) Goodwill and intangible impairments, (11) Gains or losses on the sale or disposal of assets, (12) Share-based compensation, (13) Other operating expenses, including third-party debt expenses and acquisition costs, (14) Gains or losses on the sale of investments and (15) certain other non-recurring charges. The most directly comparable GAAP measure is Net income (loss) attributable to Gannett. Adjusted EBITDA margin is a non-GAAP performance measure the Company believes offers a useful view of the overall operations of our business. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by total Operating revenues. Adjusted Net Income (loss) attributable to Gannett is a non-GAAP performance measure the Company believes offers a useful view of the overall operations of our business and is useful to analysts and investors in evaluating the results of operations and operational trends. The Company defines Adjusted Net income (loss) attributable to Gannett before: (1) Gains or losses on the early extinguishment of debt, (2) Loss on Convertible notes derivative, (3) Asset impairments, (4) Gains or losses on the sale or disposal of assets and (5) certain other non-recurring charges. The most directly comparable GAAP measure is Net income (loss) attributable to Gannett.Free cash flow is a non-GAAP liquidity measure that adjusts our reported GAAP results for items we believe are critical to the ongoing success of our business. The Company defines Free cash flow as Net cash provided by operating activities as reported on the Statement of Cash Flows less capital expenditures, which results in a figure representing Free cash flow available for use in operations, additional investments, debt obligations, and returns to stockholders. The most directly comparable GAAP financial measure is Net cash from operating activities. Management’s Use of Non-GAAP MeasuresAdjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income (loss) attributable to Gannett and Free cash flow are not measurements of financial performance under GAAP and should not be considered in isolation or as an alternative to income from operations, net income (loss), margin, cash flow from operating activities, or any other measure of performance or liquidity derived in accordance with GAAP. We believe these non-GAAP financial measures as we have defined them are helpful in identifying trends in our day-to-day performance because these items excluded have little or no significance on our day-to-day operations. These measures provide an assessment of controllable expenses and affords management the ability to make decisions which are expected to facilitate meeting current financial goals as well as achieve optimal financial performance. Adjusted EBITDA, Adjusted EBITDA margin and Adjusted Net Income (loss) attributable to Gannett provide us with measures of financial performance, independent of items that are beyond the control of management in the short-term, such as depreciation and amortization, taxation, non-cash impairments, and interest expense associated with our capital structure. These metrics measure our financial performance based on operational factors that management can impact in the short-term, namely the cost structure or expenses of the organization. Adjusted EBITDA and Adjusted EBITDA margin are metrics we use to review the financial performance of our business on a monthly basis.We use Adjusted EBITDA, Adjusted EBITDA margin and Adjusted Net Income (loss) attributable to Gannett as measures of our day-to-day operating performance, which is evidenced by the publishing and delivery of news and other media and excludes certain expenses that may not be indicative of our day-to-day business operating results. Limitations of Non-GAAP MeasuresEach of our non-GAAP measures have limitations as an analytical tool. They should not be viewed in isolation or as a substitute for GAAP measures of earnings or cash flows. Material limitations in making the adjustments to our earnings to calculate Adjusted EBITDA and Adjusted Net Income (loss) attributable to Gannett and using these non-GAAP financial measures as compared to GAAP net income (loss) include: the cash portion of interest / financing expense, income tax (benefit) provision, and charges related to asset impairments, which may significantly affect our financial results.Management believes these items are important in evaluating our performance, results of operations, and financial position. We use non-GAAP financial measures to supplement our GAAP results in order to provide a more complete understanding of the factors and trends affecting our business.Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income (loss) attributable to Gannett and Free Cash Flow are not alternatives to net income (loss), income from operations, or cash flows provided by or used in operations as calculated and presented in accordance with GAAP. As such, they should not be considered or relied upon as a substitute or alternative for any such GAAP financial measure. We strongly urge you to review the reconciliations of Net income (loss) attributable to Gannett to Adjusted EBITDA, Net income (loss) to Adjusted Net Income (loss) attributable to Gannett and Cash provided by operations to Free Cash Flow along with our condensed consolidated financial statements included elsewhere in this report and in our filings with the Securities and Exchange Commission. We also strongly urge you to not rely on any single financial measure to evaluate our business. In addition, because Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net Income (loss) attributable to Gannett and Free Cash Flow are not measures of financial performance under GAAP and are susceptible to varying calculations, the Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income (loss) attributable to Gannett and Free Cash Flow measures as presented in this report may differ from and may not be comparable to similarly titled measures used by other companies.