UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| [ ] | Definitive Proxy Statement |

| | |

| [ ] | Definitive Additional Materials |

| | |

| [ ] | Soliciting Material Pursuant to Rule Sec.240.14a-12 |

New Age Beverages Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant

Payment of Filing Fee (Check the appropriate box):

| [X] | | No fee required |

| | | |

| [ ] | | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| [ ] | | Fee paid previously with preliminary materials: |

| | | |

| [ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

September __, 2018

Dear Shareholder,

I am pleased to extend this invitation to attend the 2018 Annual Meeting of Shareholders (the “Annual Meeting”) of New Age Beverages Corporation to be held at 9:00 a.m. MST on October 23, 2018, at the Company’s corporate headquarters at 1700 E. 68th Avenue, Denver, Colorado 80229. The attached notice of Annual Meeting and proxy statement describe the matters to be presented at the Annual Meeting and provide information about us that you should consider when you vote your shares.

We are excited about the opportunities in front of the Company, and believe with what we have accomplished so far, that we are in an excellent position to drive tremendous growth and shareholder value. It has taken time, like all good things, but we are confident that we have the business foundation, the team and organizational capabilities, the brand portfolio, the newly gained distribution, and recently the financial support to achieve success. We look forward to sharing some of the insights into our business and growth prospects for New Age at the meeting.

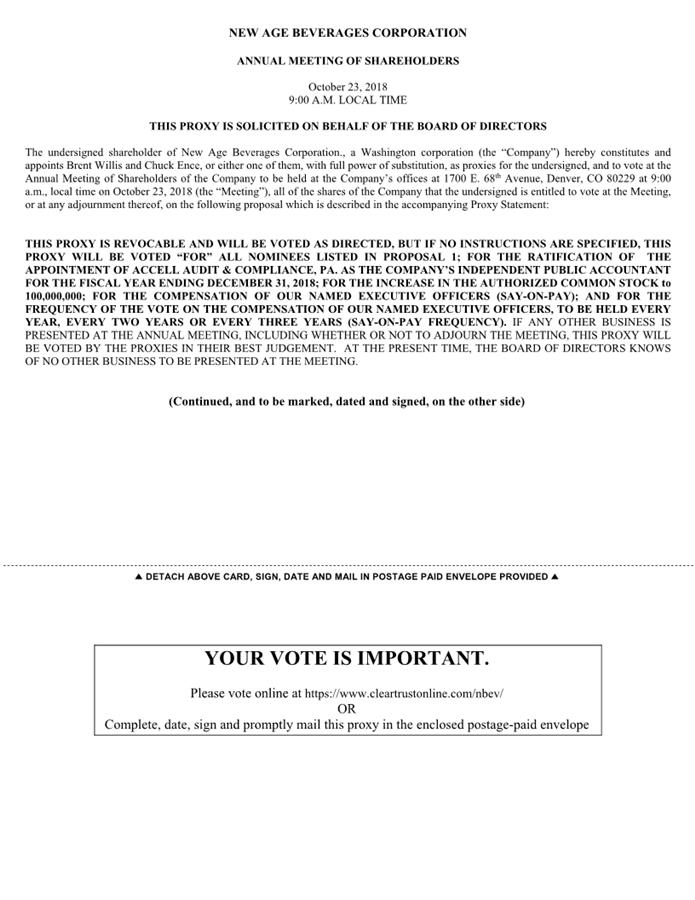

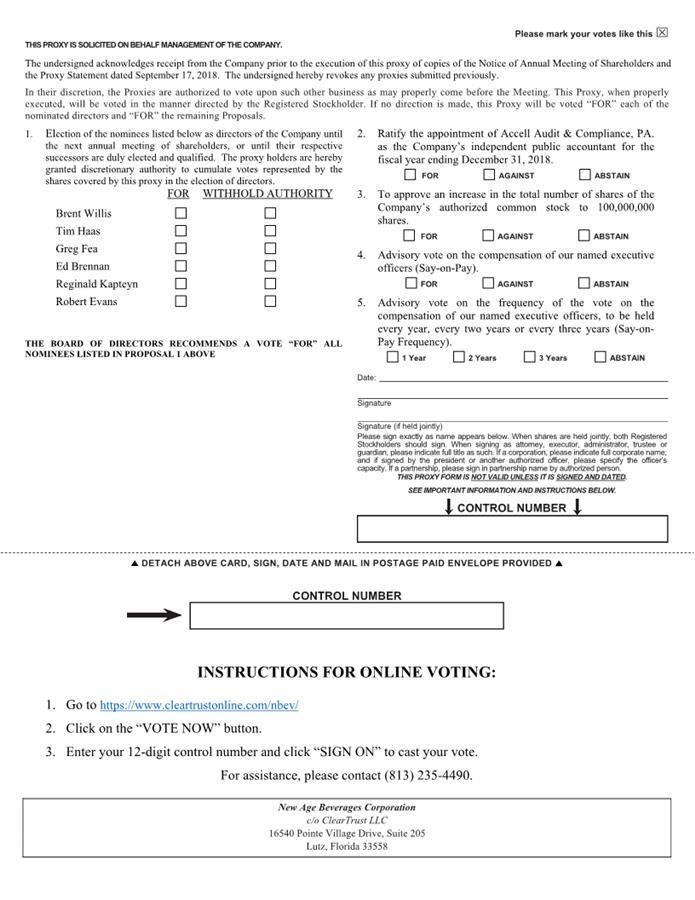

The principal business of the meeting however will be (i) to elect as directors the nominees named in this proxy statement to serve until the 2019 Annual Meeting of Shareholders and until their successors are duly elected and qualified or until the earlier of their resignation or removal, (ii) to ratify the appointment of Accell Audit & Compliance, PA as our independent public accountant for the fiscal year ending December 31, 2018, (iii) to increase the authorized shares of our common stock to 100,000,000 from 50,000,000 shares (iv) to conduct an advisory vote on the compensation of our named executive officers (Say-on-Pay), (v) to conduct an advisory vote as to the frequency of the vote on the compensation of our named executive officers, to be conducted every year, every two years or every three years (Say-on-Pay Frequency), and (vi) to transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof.

We hope you will be able to attend the Annual Meeting. Whether you plan to attend the Annual Meeting or not, it is important that your shares are represented. Therefore, when you have finished reading the proxy statement, you are urged to complete, sign, date and return the enclosed proxy card, or respond via Internet or telephone, promptly in accordance with the instructions set forth on the card. This will ensure your proper representation at the Annual Meeting, whether or not you can attend.

| | Best regards, | |

| | | |

| | | |

| | Brent Willis | |

| | Chief Executive Officer and Director

| |

YOUR VOTE IS IMPORTANT.

PLEASE RETURN YOUR PROXY PROMPTLY.

NEW AGE BEVERAGES CORPORATION

1700 E. 68th Avenue, Denver, CO 80229

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be Held October 23, 2018

To the Shareholders of New Age Beverages Corporation:

NOTICE IS HEREBY GIVEN that the 2018 Annual Meeting of Shareholders (the “Annual Meeting”) of New Age Beverages Corporation a Washington corporation (the “Company”), will be held at 9:00 a.m MST on October 23, 2018, or such later date or dates as such Annual Meeting date may be adjourned, at 1700 E. 68th Avenue, Denver, CO 80229, for the purpose of considering and taking action on the following proposals:

| | 1. | Elect as directors the nominees named in the proxy statement; |

| | 2. | To ratify the appointment of Accell Audit & Compliance, PA. as our independent public accountant for the fiscal year ending December 31, 2018; |

| | 3 | To approve an increase to the total number of shares of the Company’s authorized common stock to 100,000,000 shares from 50,000,000 shares; |

| | 4. | To conduct an advisory vote on the compensation of our named executive officers (Say-on-Pay); |

| | 5. | To conduct an advisory vote on the frequency of the vote on the compensation of our named executive officers, to be held every year, every two years or every three years (Say-on-Pay Frequency); and |

| | 6. | To transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof. |

The foregoing business items are more fully described in the following pages, which are made part of this notice.

The Board recommends that you vote as follows:

| | ● | “FOR” for the election of the Board nominees as directors; |

| | | |

| | ● | “FOR” ratification of the selection of Accell Audit & Compliance, PA. as our independent public accountant for the fiscal year ending December 31, 2018; |

| | | |

| | ● | “FOR” an increase the total number of shares of authorized common stock to 100,000,000 shares from 50,000,000 shares; |

| | | |

| | ● | “FOR” approval of the compensation of our named executive officers as set forth in this proxy statement; and |

| | | |

| | ● | “FOR” a frequency of voting every three years on the compensation of our named executive officers. |

You may vote if you were the record owner of the Company’s common stock at the close of business on September 10, 2018. The Board of Directors of the Company has fixed the close of business on September 10, 2018 as the record date (the “Record Date”) for the determination of shareholders entitled to notice of and to vote at the Annual Meeting and at any adjournments thereof.

As of the Record Date there were ___ shares of common stock outstanding and entitled to vote at the Annual Meeting. A list of shareholders of record will be available at the Annual Meeting and, during the 10 days prior to the Annual Meeting, at the office of the Secretary of the Company at 1700 E. 68th Avenue, Denver, CO 80229.

All shareholders are cordially invited to attend the Annual Meeting. Whether you plan to attend the Annual Meeting or not, you are requested to complete, sign, date and return the enclosed proxy card, or respond via Internet or telephone, as soon as possible in accordance with the instructions on the proxy card. A pre-addressed, postage prepaid return envelope is enclosed for your convenience.

These proxy materials are also available via the internet at https://www.cleartrustonline.com/nbev/. You are encouraged to read the proxy materials carefully in their entirety and submit your proxy as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions.

| Dated: September __, 2018 | By Order of the Board of Directors of New Age Beverages Corporation |

| | | |

| | Sincerely, | |

| | | |

| | | |

| | Brent Willis | |

| | Chief Executive Officer and Director

| |

YOUR VOTE AT THE ANNUAL MEETING IS IMPORTANT

Your vote is important. Please vote as promptly as possible even if you plan to attend the Annual Meeting.

For information on how to vote your shares, please see the instruction from your broker or other fiduciary, as applicable, as well as “General Information About the Annual Meeting” in the proxy statement accompanying this notice.

We encourage you to vote by completing, signing, and dating the proxy card, and returning it in the enclosed envelope.

If you have questions about voting your shares, please contact our Corporate Secretary at New Age Beverages Corporation., at 1700 E. 68th Avenue, Denver, CO 80229, telephone number (303)-289-8655.

If you decide to change your vote, you may revoke your proxy in the manner described in the attached proxy statement at any time before it is voted.

We urge you to review the accompanying materials carefully and to vote as promptly as possible.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON OCTOBER 23, 2018 AT 9:00 A.M MST. The Notice of Annual Meeting of Shareholders, our Proxy Statement and 2017 Annual Report are available at: https://www.cleartrustonline.com/nbev/ |

REFERENCES TO ADDITIONAL INFORMATION

This proxy statement incorporates important business and financial information about New Age Beverages Corporation that is not included in or delivered with this document. You may obtain this information without charge through the Securities and Exchange Commission website (www.sec.gov) or upon your written or oral request by contacting the Chief Financial Officer of New Age Beverages Corporation 1700 E. 68th Avenue, Denver, CO 80229, telephone number (303)-289-8655.

Table of Contents

| | | Page |

| GENERAL INFORMATION ABOUT THE ANNUAL MEETING | | 1 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 6 |

| PROPOSAL NO. 1 - ELECTION OF DIRECTORS | | 6 |

| INFORMATION ABOUT THE BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE | | 10 |

| EXECUTIVE OFFICERS | | 14 |

| EXECUTIVE COMPENSATION | | 15 |

| COMPENSATION OF NEW AGE BEVERAGES DIRECTORS | | 16 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | | 16 |

| PROPOSAL NO. 2 - RATIFICATION OF THE APPOINTMENT OF ACCELL, AUDIT & COMPLIANCE PA AS INDEPENDENT PUBLIC ACCOUNTANT FOR THE FISCAL YEAR ENDING DECEMBER 31, 2018 | | 17 |

| PROPOSAL NO. 3 – INCREASE THE AUTHORIZED COMMON STOCK OF THE COMPANY TO 100,000,000 SHARES FROM 50,000,000 SHARES | | 18 |

| PROPOSAL NO. 4 - ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFIC ERS | | 19 |

| PROPOSAL NO. 5 - ADVISORY VOTE ON THE FREQUENCY OF HOLDING FUTURE ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | | 20 |

| OTHER MATTERS | | 20 |

| APPENDIX A – FORM OF AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION | | 21 |

NEW AGE BEVERAGES CORPORATION

1700 E. 68th Avenue

Denver, CO 80229

303-289-8655

2018 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON OCTOBER 23, 2018

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

This proxy statement, along with the accompanying notice of the 2018 Annual Meeting of Shareholders, contains information about the 2018 Annual Meeting of Shareholders of New Age Beverages Corporation, including any adjournments or postponements thereof (referred to herein as the “Annual Meeting”). We are holding the Annual Meeting at 9:00 a.m MST on October 23, 2018, at 1700 East 68th Avenue, Denver, Colorado, or such later date or dates as such Annual Meeting date may be adjourned. For directions to the meeting, please call 303-289-8655.

This proxy statement has been prepared by the management of New Age Beverages Corporation.

These proxy materials also are available via the Internet at https://www.cleartrustonline.com/nbev/. You are encouraged to read the proxy materials carefully and in their entirety and submit your proxy as soon as possible so that your shares can be voted at the Meeting in accordance with your instructions. Even if you plan to attend the Meeting, you are encouraged to submit your vote promptly. You have a choice of submitting your proxy by Internet, by telephone or by mail, and the proxy card provides instructions (and access number) for each option.

In this proxy statement, we refer to New Age Beverages Corporation as “New Age Beverages,” the “Company,” “we,” “us” or “our.”

Why Did You Send Me This Proxy Statement?

The Board of Directors of the Company (referred to herein as the “Board of Directors” or the “Board”) is soliciting proxies, in the accompanying form, to be used at the Annual Meeting and any adjournments thereof. This proxy statement, along with the accompanying Notice of Annual Meeting of Shareholders, summarizes the purposes of the Annual Meeting and the information you need to know to vote at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on October 23, 2018: The Notice of Annual Meeting of Shareholders, our Proxy Statement and 2017 Annual Report are available at https://www.cleartrustonline.com/nbev/

The following documents are being made available to all shareholders entitled to notice of and to vote at the Annual Meeting:

| | 1) | This proxy statement. |

| | | |

| | 2) | The accompanying proxy. |

| | | |

| | 3) | Our 2017 Annual Report. |

The 2017 Annual Report includes our financial statements for the fiscal year ended December 31, 2017, but is not a part of this proxy statement. You can also find a copy of our 2017 Annual Report on Form 10-K on the Internet through the Securities and Exchange Commission’s electronic data system called EDGAR at www.sec.gov or through the “Investors” section of our website at https://newagebev.com/.

Who Can Vote?

Shareholders who owned common stock at the close of business on September 10, 2018 (the “Record Date”), are entitled to vote at the Annual Meeting. On the Record Date, there were ___ shares of common stock outstanding and entitled to vote.

You do not need to attend the Annual Meeting to vote your shares. Shares represented by valid proxies, received in time for the Annual Meeting and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. A shareholder may revoke a proxy before the proxy is voted by delivering to our Secretary a signed statement of revocation or a duly executed proxy card bearing a later date. Any shareholder who has executed a proxy card but attends the Annual Meeting in person may revoke the proxy and vote at the Annual Meeting.

How Many Votes Do I Have?

Each share of common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your shares should be voted for or withheld for each nominee for director, and how your shares should be voted with respect to each of the other proposals. Except as set forth below, if you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board’s recommendations as noted below. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our stock transfer agent, ClearTrust, LLC, or you have stock certificates, you may vote:

| | ● | By mail. Complete and mail the proxy card in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card, but do not specify how you want your shares voted, they will be voted as recommended by the Board. |

| | | |

| | ● | By Internet. At https://www.cleartrustonline.com/nbev/ |

| | | |

| | ● | In person at the meeting. If you attend the meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting. |

If your shares are held in “street name” (held in the name of a bank, broker or other nominee), you must provide the bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

| | ● | By Internet or by telephone. Follow the instructions you receive from your broker to vote by Internet or telephone. |

| | | |

| | ● | By mail. You will receive instructions from your broker or other nominee explaining how to vote your shares. |

| | | |

| | ● | In person at the meeting. Contact the broker or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the meeting. You will not be able to attend the Annual Meeting unless you have a proxy card from your broker. |

How Does the Board Recommend That I Vote On the Proposals?

The Board recommends that you vote as follows:

| | ● | “FOR” for the election of the Board nominees as directors; |

| | | |

| | ● | “FOR” ratification of the selection of Accell Audit & Compliance, PA. as our independent public accountant for the fiscal year ending December 31, 2018; |

| | | |

| | ● | “FOR” an increase the total number of shares of authorized common stock to 100,000,000 shares from 50,000,000 shares; |

| | | |

| | ● | “FOR” the compensation of our named executive officers as set forth in this proxy statement; and |

| | | |

| | ● | “FOR” a frequency of voting every three years on the compensation of our named executive officers. |

If any other matter is presented, the proxy card provides that your shares will be voted by the proxy holder listed on the proxy card in accordance with his or her best judgment. As of the date of this proxy statement, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

| | ● | signing a new proxy card and submitting it as instructed above; |

| | | |

| | ● | if your shares are held in street name, re-voting by Internet or by telephone as instructed above – only your latest Internet or telephone vote will be counted; |

| | | |

| | ● | if your shares are registered in your name, notifying the Company’s Secretary in writing before the Annual Meeting that you have revoked your proxy; or |

| | | |

| | ● | attending the Annual Meeting in person and voting in person. Attending the Annual Meeting in person will not in and of itself revoke a previously submitted proxy unless you specifically request it. |

What If I Receive More Than One Proxy Card?

You may receive more than one proxy card or voting instruction form if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above or under "Voting Instructions" on the proxy card for each account to ensure that all of your shares are voted.

Will My Shares Be Voted If I Do Not Return My Proxy Card?

If your shares are registered in your name or if you have stock certificates, they will not be voted if you do not return your proxy card by mail or vote at the Annual Meeting as described above under “How Do I Vote?” If your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter, or because your broker chooses not to vote on a matter for which it does have discretionary voting authority, this is referred to as a “broker non-vote.” The New York Stock Exchange (“NYSE”) has rules that govern brokers who have record ownership of listed company stock (including stock such as ours that is listed on The Nasdaq Capital Market) held in brokerage accounts for their clients who beneficially own the shares. Under these rules, brokers who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on certain matters (“routine matters”), but do not have the discretion to vote uninstructed shares as to certain other matters (“non-routine matters”). Under NYSE interpretations, Proposal 1 (election of directors), Proposal 3 (advisory vote to approve executive compensation), and Proposal 4 (advisory vote on frequency to advise us on the compensation of our named executive officers every year, every two years or every three years), are considered non-routine matters, and Proposal 2 (the ratification of our independent public accountant) is considered a routine matter. If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above under “How Do I Vote?,” the bank, broker or other nominee has the authority, even if it does not receive instructions from you, to vote your unvoted shares for Proposal 2 (the ratification of our independent public accountant), but does not have authority to vote your unvoted shares for Proposal 1 (election of directors), Proposal 3 (advisory vote to approve executive compensation), and Proposal 4 (advisory vote on frequency to advise us on the compensation of our named executive officers every year, every two years or every three years). We encourage you to provide voting instructions. This ensures your shares will be voted at the Annual Meeting in the manner you desire.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

Proposal 1: Election of Directors | | The nominees for director who receive the greatest number of votes FOR election (also known as a plurality) will be elected as directors. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of directors. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| | | |

Proposal 2: Ratification of the Appointment of Accell Audit & Compliance, PA as our Independent Public Accountant for the Fiscal Year Ending December 31, 2018 | | The affirmative vote of a majority of the votes cast for this proposal is required to ratify the appointment of the Company’s independent public accountant. Abstentions will be counted towards the tabulation of votes cast on this proposal and will have the same effect as a negative vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our shareholders to appoint the Company’s independent accountant. However, if our shareholders do not ratify the appointment of Accell Audit & Compliance, PA as the Company’s independent public accountant for the fiscal year ending December 31, 2018, the Audit Committee of the Board may reconsider its appointment. |

| | | |

Proposal 3: Approval to increase the number of shares of the Company’s authorized Common Stock to 100,000,000 shares | | The affirmative vote of a majority of the shares entitled to vote at the meeting is required to approve the amendment to the Company’s Articles of Incorporation to increase the number of authorized shares to 100,000,000 shares from 50,000,000 shares. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. |

| | | |

Proposal 4: Advisory Vote to Approve the Compensation of our Named Executive Officers (Say-on-Pay) | | The advisory vote to approve the compensation of our executive officers will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal (Say-on-Pay). Abstentions and broker non-votes will not be counted as either votes cast for or against this proposal. While the results of this advisory vote are non-binding, the Compensation Committee of the Board and the Board values the opinions of our shareholders and will consider the outcome of the vote, along with other relevant factors, in deciding whether any actions are necessary to address the concerns raised by the vote and when making future compensation decisions for executive officers. |

| | | |

Proposal 5: Advisory Vote on Frequency of Voting on Compensation of our Named Executive Officers | | The frequency (one year, two years or three years) that receives the greatest number of votes cast by the shareholders will be deemed the frequency for the advisory Say-on-Pay vote preferred by the shareholders. Shareholders will have the opportunity to choose among four options (holding the vote every one, two or three years, or abstaining). While the results of this advisory vote are non-binding, the Board values the opinions of our shareholders and will review and consider the outcome of the vote, along with other relevant factors, in evaluating the frequency of future advisory votes on executive compensation. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for this proposal. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

What Constitutes a Quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the shares entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Votes of shareholders of record who are present at the Annual Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Householding of Annual Disclosure Documents

The Securities and Exchange Commission (the “SEC”) previously adopted a rule concerning the delivery of annual disclosure documents. The rule allows us or brokers holding our shares on your behalf to send a single set of our annual report and proxy statement to any household at which two or more of our shareholders reside, if either we or the brokers believe that the shareholders are members of the same family. This practice, referred to as “householding,” benefits both shareholders and us. It reduces the volume of duplicate information received by you and helps to reduce our expenses. The rule applies to our annual reports, proxy statements and information statements. Once shareholders receive notice from their brokers or from us that communications to their addresses will be “householded,” the practice will continue until shareholders are otherwise notified or until they revoke their consent to the practice. Each shareholder will continue to receive a separate proxy card or voting instruction card.

Those shareholders who either (i) do not wish to participate in “householding” and would like to receive their own sets of our annual disclosure documents in future years or (ii) who share an address with another one of our shareholders and who would like to receive only a single set of our annual disclosure documents should follow the instructions described below:

| | ● | Shareholders whose shares are registered in their own name should contact our transfer agent, ClearTrust, LLC, 16540 Pointe Village Dr., Ste 205, Lutz, FL 33558.Telephone: (813) 235-4490. |

| | | |

| | ● | Shareholders whose shares are held by a broker or other nominee should contact such broker or other nominee directly and inform them of their request, shareholders should be sure to include their name, the name of their brokerage firm and their account number. |

Who is paying for this proxy solicitation?

In addition to mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone, or by other means of communication. We will not pay our directors, officers and employees any additional compensation for soliciting proxies. We may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

When are shareholder proposals due for next year’s annual meeting?

At our annual meeting each year, our Board of Directors submits to shareholders its nominees for election as directors. In addition, the Board of Directors may submit other matters to the shareholders for action at the annual meeting.

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, shareholders may present proper proposals for inclusion in the Company’s proxy statement for consideration at the 2019 annual meeting of shareholders by submitting their proposals to the Company in a timely manner. These proposals must meet the shareholders eligibility and other requirements of the SEC. To be considered for inclusion in next year’s proxy materials, you must submit your proposal in writing by February 1, 2019 to our Corporate Secretary, 1700 E. 68th Avenue, Denver, CO 80229.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of the date of this proxy statement on Schedule 14A, with respect to the beneficial ownership of the outstanding Common Stock by (i) any holder of more than five (5%) percent; (ii) each of the Company’s executive officers and directors; and (iii) the Company’s directors and executive officers as a group. Except as otherwise indicated, each of the shareholders listed below has sole voting and investment power over the shares beneficially owned.

| | Number of Shares of Common Stock Beneficially | Percentage of Shares of Common Stock Beneficially (1) |

| Beneficial Owner | | |

| | | |

| Executive Officers and Directors: | | |

| Neil Fallon | 5,689,639 | 11.5% |

| Brent Willis (2) | 1,928,546 | 3.9% |

| Chuck Ence | 422,702 | * |

| John Price | 0 | * |

| Reggie Kapteyn | 30,232 | * |

| David Vautrin | 30,232 | * |

| Ed Brennan | 1,225,232 | 2.5% |

| Tim Haas | 300,000 | * |

| Greg Fea | 69,232 | * |

| Robert Evans(3) | 162,190 | * |

| All Officers and Directors as a Group (9 persons) | 9,858,005 | 20% |

| | | |

| Five Percent Shareholders: | | |

| Nuwa Group, LLC(4) | 2,852,311 | 5.8% |

* Less than 1%

(1) Based upon 49,398,537 shares issued and outstanding as of the date of this proxy statement on Schedule 14A.

(2) Incudes 78,000 held by the Corrine Willis Trust of which the wife of Mr. Willis is the trustee.

(3) Includes 130,000 shares held through Pennington Capital of which Mr. Evans is the Managing Director and beneficial owner.

(4) The members of Nuwa Group, LLC are Kevin Fickle and Devin Bosch. The address for Nuwa Group, LLC is 1415 Oakland Blvd, Suite 219, Walnut Creek, 94596.

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

Our Board currently consists of seven members. The Nominating and Governance Committee (the “Governance Committee”) and Board have unanimously approved the recommended slate of six directors.

The following table shows the Company’s nominees for election to the Board. Each nominee, if elected, will serve until the next annual meeting of shareholders and until a successor is named and qualified, or until his earlier resignation or removal. All nominees are members of the present Board of Directors. We have no reason to believe that any of the nominees is unable or will decline to serve as a director if elected. Unless otherwise indicated by the shareholder, the accompanying proxy will be voted for the election of the six persons named under the heading “Nominees for Directors.” Although the Company knows of no reason why any nominee could not serve as a director, if any nominee shall be unable to serve, the accompanying proxy will be voted for a substitute nominee.

Neil Fallon, Chairman of the Board, and Dave Vautrin, Director, will not stand for re-election to the Board.

Nominees for Director

| Name of Nominee | | Age | | Principal Position | | Director Since |

| Brent Willis | | 58 | | Chief Executive Officer and Director | | 2016 |

| Tim Haas | | 71 | | Director | | 2017 |

| Greg Fea | | 58 | | Director | | 2017 |

| Ed Brennan | | 61 | | Director | | 2017 |

| Reginald Kapteyn | | 47 | | Director | | 2017 |

| Robert Evans | | 53 | | Director | | 2018 |

The Governance Committee and the Board seek, and the Board is comprised of, individuals whose characteristics, skills, expertise, and experience complement those of other Board members. We have set out below biographical and professional information about each of the nominees, along with a brief discussion of the experience, qualifications, and skills that the Board considered important in concluding that the individual should serve as a current director and as a nominee for re-election as a member of our Board.

Nominees Biographies

Brent Willis - Chief Executive Officer, Director

Brent Willis was appointed as Chief Executive Officer, and as a member of the board of directors, on March 24, 2016. During the previous five years, Mr. Willis has been a director or officer, serving as Chairman and Chief Executive Officer of a number of majority or minority-owned private-equity backed companies from November 2009 until present. Prior to these companies from 1987 through 2008, Mr. Willis was a C-Level and Senior Executive for Cott Corporation, AB InBev, The Coca-Cola Company, and Kraft Heinz. Mr. Willis obtained a Bachelor’s of Science in Engineering from the United States Military Academy at West Point in 1982 and obtained a Master’s in Business Administration from the University of Chicago in 1991.

Mr. Willis was chosen to serve as a director of the Company due to his extensive executive experience running smaller companies, multinational companies and his experience in the beverage industry.

Tim Haas – Director

Tim Haas has been a Director of the Company since 2017. Mr. Hass is the former Chief Executive Officer of Coca-Cola Foods and The Minute Maid Company, and former Group President Latin America of The Coca-Cola Company. Over the past five years he has not held any formal Board of Directors or other employment positions. He is a graduate of The University of North Dakota.

Mr. Haas was chosen to be a director because of his extensive experience in running major multinational companies, and extensive experience in the beverage industry with major strategic beverage leaders.

Greg Fea – Director

Greg Fea has been a Director of the Company since 2017. Mr. Fea is the former President, Chief Executive Officer and Vice-Chairman of Illy Coffee, and has over twenty plus years of beverage experience in senior leadership roles for E&J Gallo, Cadbury Schweppes, and Danone. From 2015 through present he has been the managing partner of Global Solutions Consulting. From 1998 through 2014 he worked for Illy Coffee, SPA and was President, Chief Executive Officer and Vice Chairman of the firm based in Trieste Italy from 2013 to 2014. He is a graduate of San Diego State University.

Mr. Fea was chosen to be a director because of his extensive experience in running major multinational and mid-sized global companies, and extensive experience in the beverage industry, and experience in the coffee, tea, and other healthy segments.

Ed Brennan – Director

Ed Brennan has been a Director of the Company since 2017. Mr. Brennen is the current Owner and Chief Executive Officer of Beak and Skiff Orchards, a private company, and is also the current Chairman and Chief Executive Officer of Duty Free Stores, and the former CMO at Macy’s. From 2013 through present he has been the Owner and Chief Executive Officer for Beak and Skiff Orchards. From 1999 through 2012 he was the Chairman and Chief Executive Officer for Duty Free Stores (DFS Hong Kong Ltd.). He is a graduate of Niagara University.

Mr. Brennan was chosen to be a director because of extensive experience in running major multinational companies, and extensive experience in the retail industry.

Reggie Kapteyn – Director

Reggie Kapteyn has been a Director of the Company since 2017. Dr. Kapteyn is a published physician at the NIH (National Institutes of Health) and is currently a Board Certified Practicing Physician, a Director of Vivitris Life Sciences, Inc., and a Director of Product Development at HydroCision, Inc. From 2015 through present he has been a Director of Vivitris Life Sciences, Inc. From 2014 through present he has been a Director of Product Development at HydroCision, Inc. From 2013 through present he has been a Practicing Physician and Director of Pain Management at OAM in Michigan. From 2009 to 2012 he was a Medical Director at Drake Hospital, a University of Cincinnati Hospital. He is a graduate of Hope College, West Virginia School of Osteopathic Medicine, with residency at Georgetown University and fellowship at the NIH and the University of Wisconsin.

Dr. Kapteyn was chosen to be a director because of extensive experience in the Health Care field, and the importance of the Company to develop products for the Medical channel.

Robert Evans – Director

Robert Evans has been a Director of the Company since 2018. Mr. Evans has over 25 years of investment and financial management experience. He is the founder of Pennington Capital, a private investment fund, and has served as its managing partner since 2010. Prior to forming Pennington Capital, from 1998 through 2010, Mr. Evans was a co-founder and one of the managing partners of Craig-Hallum Capital Group, which is an institutional research and investment banking firm. Prior to joining Craig-Hallum in 1998, Mr. Evans has served as senior research analyst for other Minneapolis-based investment banking firms. Mr. Evans is a CFA and holds an MBA from the Carlson School of Management at the University of Minnesota.

Unless authority to vote for the nominees named above is withheld, the shares represented by the enclosed proxy will be voted FOR the election of such nominees as directors. In the event that any of the nominees shall become unable or unwilling to serve, the shares represented by the enclosed proxy will be voted for the election of such other person as the Board may recommend in such nominee’s place. The Board has no reason to believe that any of the nominees will be unable or unwilling to serve.

Other Current Directors

Neil Fallon – Executive Chairman

Neil Fallon, 51, has been a Director of the Company since inception on April 26, 2010, and served as Chief Executive Officer and Chief Financial Officer from inception until March 24, 2016. Mr. Fallon previously owned his own residential real estate development company, Neil Fallon Development, Inc. where he developed and built over 100 home sites through California and Washington states from May 2002 to July 2015. He specialized in the development of infill properties averaging in the range of 3050 home sites. Mr. Fallon has a BA in Business Administration with concentrations in Finance and Marketing from Western Washington University.

Mr. Fallon was chosen to serve as a director of the company due to the fact that he is the founder of the company and possesses valuable business experience related to acting in a management role.

David Vautrin – Director

David Vautrin, 47, has been a Director of the Company since 2017. Mr. Vautrin is currently the Chief Executive Officer of XFit Brands, Inc., a public company, and the former CMO of Cott Corporation. From 2013 to present he has been the Chief Executive Officer of XFIT Brands, Inc. From 2009 to 2012 he was the Chief Executive Officer of Throwdown Industries, Inc. He is a graduate of The State University of New York.

Mr. Vautrin was chosen to be a director because of extensive experience in running smaller companies, extensive experience in the beverage industry, and extensive experience in financial matters relevant for a Board Audit committee.

Family Relationships

There are no family relationships among the officers and directors, nor are there any arrangements or understanding between any of the Directors or Officers of our Company or any other person pursuant to which any Officer or Director was or is to be selected as an officer or director.

Involvement in Certain Legal Proceedings

During the past ten years, none of our directors, executive officers, promoters, control persons, or nominees has been:

| | ● | the subject of any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| | | |

| | ● | convicted in a criminal proceeding or is subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| | | |

| | ● | subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or any Federal or State authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; |

| | | |

| | ● | found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law; |

| | | |

| | ● | the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of (a) any Federal or State securities or commodities law or regulation; (b) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or (c) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| | | |

| | ● | the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Vote Required

The nominees for director who receive the greatest number of votes FOR election (also known as a plurality) will be elected as directors. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of directors. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote.

THE BOARD RECOMMENDS A VOTE "FOR" THE ELECTION OF THE NOMINEES NAMED ABOVE AS DIRECTORS, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR THEREOF UNLESS A SHAREHOLDER HAS INDICATED OTHERWISE ON THE PROXY.

INFORMATION ABOUT THE BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE

Independence of Directors

Our Board is currently comprised of seven members. Our Board has affirmatively determined that five directors, Messrs. Brennan, Haas, Fea, Evans and Dr. Kapteyn are “independent” directors as such term is defined under The NASDAQ Capital Market rules and the related rules of the SEC.

The Board, upon recommendation of the Governance Committee, unanimously determined that each of our five non-employee directors is “independent,” as such term is defined in the Nasdaq Stock Market Rules (“Stock Market Rules”).

The definition of “independent director” included in the Stock Market Rules includes a series of objective tests, such as that the director is not an employee of the Company, has not engaged in various types of specified business dealings with the Company, and does not have an affiliation with an organization that has had specified business dealings with the Company. Consistent with the Company’s corporate governance principles, the Board’s determination of independence is made in accordance with the Stock Market Rules, as the Board has not adopted supplemental independence standards. As required by the Stock Market Rules, the Board also has made a subjective determination with respect to each director that such director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company), even if the director otherwise satisfies the objective independence tests included in the definition of an “independent director” included in the Stock Market Rules.

In determining that each individual who served as a member of the Board is independent, the Board considered that, in the ordinary course of business, transactions may occur between the Company and entities with which some of our directors are affiliated. The Board unanimously determined that the relationships discussed below were not material. No unusual discounts or terms were extended.

Board Leadership Structure

The Board has no set policy with respect to the separation of the offices of Chairman and Chief Executive Officer. Currently, Neil Fallon serves as Executive Chairman and Brent Willis serves as Chief Executive Officer. Our board of directors does not have a lead independent director. Our board of directors has determined that its leadership structure is appropriate and effective for us at this time, given our stage of development.

Director Attendance at Board, Committee, and Other Meetings

During the year ended 2017, the Board of Directors held four meetings, the Audit Committee met four times, and the Compensation Committee met four times. The Nominating and Governance Committee met four times. No director attended fewer than 75% of the board or of any committee such director served on. We do not have a formal policy in place with respect to director attendance at the Company’s annual meeting of shareholders.

Board Role in Risk Oversight

The Board is responsible for overseeing our management and operations, including overseeing our risk assessment and risk management functions. We believe that our directors provide effective oversight of risk management functions. On a regular basis we perform a risk review wherein the management team evaluates the risks we expect to face in the upcoming year and over a longer term horizon. From this risk assessment we develop plans to deal with the risks identified. The results of this risk assessment are provided to the Board for their consideration and review. In addition, members of our management periodically present to the Board the strategies, issues and plans for the areas of our business for which they are responsible. While the Board oversees risk management, our management is responsible for day-to-day risk management processes. Additionally, the Board requires that management raise exceptional issues to the Board. We believe this division of responsibilities is the most effective approach for addressing the risks we face and that the Board leadership structure supports this approach.

Committees of the Board

Our Board has three standing committees: Audit, Compensation, and Governance. Each of the committees is solely comprised of and chaired by independent directors, each of whom the Board has affirmatively determined is independent pursuant to the Stock Market Rules. Each of the committees operates pursuant to its charter. The committee charters are reviewed annually by the Governance Committee. If appropriate, and in consultation with the chairs of the other committees, the Governance Committee proposes revisions to the charters. The responsibilities of each committee are described in more detail below. The charters for the three committees are available on the Company’s website at www.newagebev.com.

Audit Committee

We have an Audit Committee comprised of directors who are “independent” within the meaning of Nasdaq Rule 5605(b)(1). The Audit Committee assists our Board in overseeing the financial reporting process and maintaining the integrity of our financial statements, and of our financial reporting processes and systems of internal audit controls, and our compliance with legal and regulatory requirements. The Audit Committee is responsible for reviewing the qualifications, independence and performance of our independent registered public accounting firm and review our internal controls, financial management practices and investment functions and compliance with financial legal and regulatory requirements. The Audit Committee is also responsible for performing risk and risk management assessments as well as preparing any report of the Audit Committee that may be required by the proxy rules of the SEC to be included in the Corporation’s annual proxy statement. Our Board has identified and appointed Mr. Vautrin as its “audit committee financial expert,” as defined by the SEC in Item 407 of Regulation S-K. Mr. Evans serves as the Chair of the Audit Committee, and is joined on the committee by Dr. Kapteyn and Mr. Fea.

Audit Committee Report

Review of our Audited Financial Statements

In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements in our Annual Report on Form 10-K with management and discussed the quality and acceptability of our accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in our financial statements.

The audit committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality and acceptability of our accounting principles and such other matters as are required to be discussed with the committee under the standards of the Public Company Accounting Oversight Board (PCAOB), including Auditing Standard 1301 (Communications with Audit Committees). In addition, the audit committee has discussed with the independent auditors the auditors’ independence from management and us, including the matters in the written disclosures required by Independence Standards Board Standard No. 1 (Independent Discussions with Audit Committees), which were submitted to us, and considered the compatibility of non-audit services with the auditors’ independence.

The audit committee discussed with our independent auditors the overall scope and plans for their audit. The audit committee met with the independent auditors, with and without management present, to discuss the results of their examination, their evaluation of our internal controls, and the overall quality of our financial reporting.

In reliance on these reviews and discussions, the audit committee recommended to our board of directors (and our board has approved) that our audited financial statements for the year ended December 31, 2017 be included in the Annual Report on Form 10-K for the year ended December 31, 2017 for filing with the Securities and Exchange Commission.

The audit committee selects the Company’s independent registered public accounting firm annually and has submitted such selection for the year ending December 31, 2018 for ratification by shareholders at the Company’s annual meeting.

The Audit Committee currently consists of Dr. Kapteyn, Messrs. Evans and Fea.

The material in this report is not deemed to be “soliciting material,” or to be “filed” with the Securities and Exchange Commission and is not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filings.

Compensation Committee

We have a Compensation Committee comprised of members who are “Non-Employee Directors” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and “outside directors” within the meaning of Section 162(m) of the Code. They are also “independent” directors within the meaning of Nasdaq Rule 5605(b)(1). The Compensation Committee is responsible for overseeing the establishment and maintenance of our overall compensation and incentive programs to discharge the Board’s responsibilities relating to compensation of our executive officers and directors, including establishing criteria for evaluating performance and setting appropriate levels of compensation, and to produce an annual report on executive compensation for inclusion in the Corporation’s proxy statement in accordance with the rules and regulations of the SEC. The Compensation Committee advises and makes recommendations to our Board on all matters concerning director compensation. Mr. Brennan serves as Chair of the Compensation Committee and is joined by Mr. Evans, and Dr. Kapteyn.

Nominating and Governance Committee

Our Board has a Governance Committee that (1) reviews and recommends improvements to our governance guidelines and corporate policies; (2) monitors compliance with our Code of Conduct; (3) trains new members of the Board of Directors; (4) reviews the performance of the Board of Directors and its various committees and makes recommendations intended to improve that performance; (5) evaluates and makes recommendations concerning changes in the charters of the various Committees of the Board of Directors; (6) evaluates the performance of the Chief Executive Officer of the Corporation; (7) oversees the development and implementation of succession planning for Corporation senior management positions; (8) identifies and recommends candidates for nomination as members of the Board of Directors and its committees; and (9) such other matters as may be required to ensure compliance with applicable federal and state laws or the requirements of any exchange on which the Company maintains a listing for its securities. The committee is required to be comprised of entirely “independent” directors within the meaning of Nasdaq Rule 5605(b)(1). Mr. Haas currently serves as the Chair of the Nominating and Governance Committee and is joined on the committee by Mr. Fea and Mr. Brennan.

Committee participation by the Chair and other Directors is summarized as follows:

| Name | | Audit Committee | | Compensation Committee | | Nominating and Governance Committee |

| Tim Haas | | | | | | Chair |

| Greg Fea | | Member | | | | Member |

| Ed Brennan | | | | Chair | | Member |

| Reginald Kapteyn | | Member | | Member | | |

| Robert Evans | | Chair | | Member | | |

Consideration of Director Nominees

We seek directors with the highest standards of ethics and integrity, sound business judgment, and the willingness to make a strong commitment to the Company and its success. The Nominating and Governance Committee works with the Board on an annual basis to determine the appropriate and desirable mix of characteristics, skills, expertise, and experience for the full Board and each committee, taking into account both existing directors and all nominees for election as directors, as well as any diversity considerations and the membership criteria applied by the Nominating and Governance Committee. The Nominating and Governance Committee and the Board, which do not have a formal diversity policy, consider diversity in a broad sense when evaluating board composition and nominations; and they seek to include directors with a diversity of experience, professions, viewpoints, skills, and backgrounds that will enable them to make significant contributions to the Board and the Company, both as individuals and as part of a group of directors. The Board evaluates each individual in the context of the full Board, with the objective of recommending a group that can best contribute to the success of the business and represent shareholder interests through the exercise of sound judgment. In determining whether to recommend a director for re-election, the Nominating and Governance Committee also considers the director’s attendance at meetings and participation in and contributions to the activities of the Board and its committees.

The Nominating and Governance Committee will consider director candidates recommended by shareholders, and its process for considering such recommendations is no different than its process for screening and evaluating candidates suggested by directors, management of the Company, or third parties.

Corporate Governance Matters

We are committed to maintaining strong corporate governance practices that benefit the long-term interests of our shareholders by providing for effective oversight and management of the Company. Our governance policies, including our Code of Conduct and Committee Charters can be found on our website at www.newagebev.com by following the link to “Investors” and then to “Corporate Governance.”

The Nominating and Governance Committee regularly reviews our Code of Conduct and Committee Charters to ensure that they take into account developments at the Company, changes in regulations and listing requirements, and the continuing evolution of best practices in the area of corporate governance.

The Board conducts an annual self-evaluation in order to assess whether the directors, the committees, and the Board are functioning effectively.

Code of Conduct

We have adopted a Code of Business Conduct and Ethics that applies to our principal executive, financial and accounting officers (or persons performing similar functions), a copy of which is filed as Exhibit 14.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2017, and filed with the SEC April 17, 2018 and is available on our website at www.newagebev.com.

Communications with the Board of Directors

Shareholders and other parties may communicate directly with the Board of Directors or the relevant board member by addressing communications to:

New Age Beverages Corporation

c/o Corporate Secretary

1700 E. 68th Avenue

Denver, CO 80229

All shareholder correspondence will be compiled by our corporate secretary. Communications will be distributed to the Board of Directors, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communications. Items that are unrelated to the duties and responsibilities of the Board of Directors may be excluded, such as:

| | ● | junk mail and mass mailings; |

| | | |

| | ● | resumes and other forms of job inquiries; |

| | | |

| | ● | surveys; and |

| | | |

| | ● | solicitations and advertisements. |

In addition, any material that is unduly hostile, threatening, or illegal in nature may be excluded, provided that any communication that is filtered out will be made available to any independent director upon request.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers, and shareholders who own more than 10% of the Company’s stock to file forms with the SEC to report their ownership of the Company’s stock and any changes in ownership. The Company assists its directors and executives by identifying reportable transactions of which it is aware and preparing and filing the forms on their behalf. All persons required to file forms with the SEC must also send copies of the forms to the Company. We have reviewed all forms provided to us. Based on that review and on written information given to us by our executive officers and directors, we believe that all Section 16(a) filings during the past fiscal year were filed on a timely basis and that all directors, executive officers and 10% beneficial owners have fully complied with such requirements during the past fiscal year, except as follows:

A Form 4 was filed late by Tim Haas, resulting in two transactions not being reported on a timely basis; a Form 4 was filed late by Gregory Fea, resulting in two transactions not being reported on a timely basis; a Form 4 was filed late by Ed Brennan, resulting in one transaction not being reported on a timely basis; and Form 3s were filed late by Tim Haas, Gregory Fea, Brent Willis, Chuck Ence, Reginald Kapteyn, Ed Brennan, and David Vautrin.

EXECUTIVE OFFICERS

The following persons are our executive officers and hold the offices set forth opposite their names.

| Name | | Age | | Principal Occupation | | Officer Since |

| Brent David Willis | | 58 | | Chief Executive Officer, Director | | 2016 |

John Price

| | 48 | | Chief Financial Officer and Chief Administrative Officer | | 2018 |

| Chuck Ence | | 58 | | Controller | | 2016 |

Brent David Willis, Chief Executive Officer and Member of the Board

The biography for Brent David Willis is contained in the information disclosures relating to the Company’s nominees for director.

John Price, Chief Financial Officer and Chief Administrating Officer

Mr. Price, was appointed Chief Financial Officer effective August 15, 2018. Previously Mr. Price served as Chief Financial Officer of Alliance MMA, a publicly-traded company in the mixed marital arts industry, from August 2016 through August 2018. Prior to joining Alliance MMA in 2016, Mr. Price was Chief Financial Officer of MusclePharm Corporation, a publicly-traded nutritional supplement company. Prior to joining MusclePharm in 2013, Mr. Price served as vice president of finance-North America at Opera Software, a Norwegian public company focused on digital advertising. From 2011 to 2013, he served as VP of Finance & Corporate Controller of GCT Semiconductor. From 2004 to 2011, Mr. Price served in various roles at Tessera Technologies including VP of Finance & Corporate Controller. Prior to Tessera Technologies, Mr. Price served various roles at Ernst &Young LLP. Mr. Price served nearly three years in the San Jose, California office and nearly five years in the Pittsburgh, Pennsylvania office. Mr. Price has been a certified public accountant since 2000 and attended Pennsylvania State University, where he earned a Bachelor’s of Science Degree in Accounting.

Chuck Ence, Controller

Chuck Ence was appointed as Chief Financial Officer on September 15, 2016 and held that title until August 14, 2018. From 2001 through present, Chuck Ence has been the Chief Financial Officer and a minority owner of Xing Beverages, LLC. Mr. Ence obtained a Bachelors of Arts in Business Administration and Accounting from Southern Utah University in 1984, and obtained a Master’s in Business Administration in Finance from Arizona State University School of Business in 1985.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning the compensation of our named executive officers during 2017 and 2016.

Name and Principal Position | Year | | |

| Brent Willis, Chief Executive Officer | 2017 | $200,000 | $200,000 |

| | 2016 | $67,500 | $67,500 |

| Neil Fallon, former Chief Executive Officer (1) | 2017 | $100,000 | $100,000 |

| | 2016 | $100,000 | $100,000 |

(1)

Mr. Fallon served as Chief Executive Officer through March 24, 2016 and is the Chairman.

Employment Agreements

Our board of directors signed a board resolution on March 24, 2016, which provides that Brent Willis, the interim Chief Executive Officer as of the date of the resolution, would receive a base salary of $7,500 per month, benefits and expense reimbursement, and a sign-on incentive bonus of 5% of the outstanding shares of the Company as of the date of the resolution. The 5% of the outstanding shares sign-on bonus was equal to 771,783 shares of common stock valued at $200,663.46, or $0.26 per share based on the market price of the shares on the date of issuance.

We executed an employment agreement on June 1, 2016, which provides that Mr. Willis receive a bonus of 5% of the outstanding shares of the Company upon completion of a first acquisition involving more than 25% of our then current market capitalization. The transaction with Xing met that criteria, and the Company paid the share bonus at the time of closing of the Xing transaction which equaled 1,078,763 shares of common stock valued at $1,736,808.43, or $1.61 per share based on the market price of the shares on the date of issuance.

Outstanding Equity Awards at Fiscal Year End

Chuck Ence, CFO was granted 183,348 stock options in connection with our Equity Compensation Plan. There are no outstanding equity awards for our officers and directors.

Long-Term Incentive Plan

On August 3, 2016, the Company’s approved and implemented the New Age Beverages Corporation 2016--2017 Long- Term Incentive Plan (the “Plan”) pursuant to which the maximum number of shares that can be granted is 1,000,000 shares. Grants under the Plan include options awards. The purpose of the Plan is to provide such individuals with additional incentive and reward opportunities designed to enhance the profitable growth of the Company and its affiliates. The shares of common stock to be issued in connection with the Plan will not be registered under the Securities Act. As of December 31, 2017 and 2016, a total of 438,848 options were granted under the Plan.

Director Compensation

The board of directors has the authority to fix the compensation of directors. On January 27, 2017, we executed offer letters with Mr. Vautrin, Dr. Kapteyn, Mr. Brennan, Mr. Haas and Mr. Fea, which provide that Mr. Vautrin, Dr. Kapteyn, Mr. Brennan, Mr. Haas and Mr. Fea will each receive annual compensation of $10,000 in cash and $65,000 worth of restricted common stock for their services as members of the board of directors. Effective July 2018, the Board approved board compensation of $20,000 in cash and $65,000 worth of restricted common stock to our directors with an additional $5,000 paid to each director who serves as Chairman of a Board committee.

The following table provides the total compensation for each person who served as a non-employee member of our Board of Directors during fiscal year 2017, including all compensation awarded to, earned by or paid to each person who served as a non-employee director for some portion or all of fiscal year 2017:

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) Option Awards ($) (1) | Non-Equity Incentive Plan Compensation ($) | | Nonqualified Deferred Compensation Earnings ($) | | All Other Compensation ($) | | |

| David Vautrin | 10,000 | 65,000 | | | | | | | 75,000 |

| Reginald Kapteyn | 10,000 | 65,000 | | | | | | | 75,000 |

| Ed Brennan | 10,000 | 65,000 | | | | | | | 75,000 |

| Tim Haas | 10,000 | 65,000 | | | | | | | 75,000 |

| Greg Fea | 10,000 | 65,000 | | | | | | | 75,000 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

The Audit Committee has responsibility for reviewing and, if appropriate, for approving any related party transactions that would be required to be disclosed pursuant to applicable SEC rules.

In addition to the executive officer and director compensation arrangements discussed above, the following is a description of each transaction since January 1, 2016 and any currently proposed transaction in which (i) we have been or are to be a participant, (ii) the amount involved exceeded or will exceed the lesser of $120,000 or one percent of the average of our total assets at year-end for the last two completed fiscal years, and (iii) any of our directors, executive officers, holders of more than five percent of our capital stock, or any immediate family member of, or person sharing the household with, any of these individuals, had or will have a direct or indirect material interest.

On May 27, 2016, the Company issued to Nuwa Group, LLC 30,000 shares of Series B preferred stock pursuant to a debt conversion agreement whereby $225,872 owed by us to Nuwa Group, LLC was converted into shares of our Series B preferred stock. Nuwa Group, LLC is a beneficial holder of greater than 5% of our outstanding common stock.

On June 30, 2016, the Company issued 1,579,761 shares of common stock to each of Scott Lebon and Tom Lebon pursuant to our acquisition of Xing. The shares were received as part of a tax free transaction, but were valued for purposes of the transaction at $1.6066 per share, or $2,538,044 for each of Scott and Tom Lebon. The transactions resulted in Scott and Tom Lebon becoming holders of greater than 5% of our common stock.

On June 30, 2016, the Company issued 422,702 shares of common stock to Chuck Ence, our Chief Financial Officer, in connection with our acquisition of Xing. The shares were received as part of a tax free transaction, but were valued for purposes of the transaction at $1.6066 per share, or $679,133.

Review, Approval, or Ratification of Transactions with Related Parties

The Charter of our Governance Committee requires that any transaction with a related person that must be reported under applicable rules of the SEC must be reviewed and either approved, disapproved or ratified by our Governance Committee.

Director Independence

Dr. Kapteyn, Mr. Brennan, Mr. Haas, Mr. Fea and Mr. Evans are each “independent” within the meaning of Nasdaq Rule 5605(b)(1).

PROPOSAL NO. 2 - RATIFICATION OF THE APPOINTMENT OF ACCELL AUDIT & COMPLIANCE, PA AS INDEPENDENT PUBLIC ACCOUNTANT FOR THE FISCAL YEAR ENDING DECEMBER 31, 2018

The Audit Committee has appointed Accell Audit & Compliance, PA (“Accell, Audit & Compliance” or “Accell”), independent public accountant ,to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018. A representative of Accell is expected to be present at the 2018 Annual Meeting and will have an opportunity to make a statement if he desires to do so. It is also expected that such representative will be available to respond to appropriate questions.

Accell has served as our principal auditor since August 2016. Accell did not prepare or provide any financial reports for any periods prior to the date of engagement, nor did it prepare or provide any financial reports for, or prior to the year ended December 31, 2015. Neither the Company, nor any person on behalf of the Company, consulted with Accell during the Company’s two most recent fiscal years or the subsequent interim period prior to the engagement of Accell regarding (i) the application of accounting principles to a specified transaction either completed or proposed or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report not oral advice was provided that Accell concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue, or (ii) any matter that was either the subject of a disagreement between the Company and its predecessor auditor as described in Item 304(a)(1)(iv) of Regulation S-K or a reportable event as described in Item 304(a)(1)(v) of Regulation S-K, prior to the dismissal of MaloneBailey, LLP (“MaloneBailey”). On August 19, 2016, the Company notified MaloneBailey of its dismissal, as the Company’s independent registered public accounting firm. MaloneBailey served as the auditors of the Company’s financial statements for the period from April 27, 2015 through the date of dismissal. The reports of MaloneBailey on the Company’s consolidated financial statements for the Company’s fiscal years ended December 31, 2015 and 2014 did not contain any adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle. The decision to change accountants was approved by the Company’s Board of Directors. During the Company’s fiscal years ended December 31, 2015 and 2014, and during the subsequent interim period through August 19, 2016, there were (i) no disagreements with MaloneBailey on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of MaloneBailey, would have caused MaloneBailey to make reference to the subject matter of the disagreements as defined in Item 304 of Regulation S-K in connection with any of its reports, and (ii) there were no “reportable events” as such term is described in Item 304 of Regulation S-K.

The Audit Committee has considered whether the provision of services, other than services rendered in connection with the audit of our annual financial statements, is compatible with maintaining Accell’s independence. The Audit Committee has determined that the rendering of non-audit services by Accell during 2017 was compatible with maintaining the firm’s independence.

Aggregate fees billed or incurred related to the following years for professional services rendered by our principal accountant for 2017 and 2016 are set forth below.

| | |

| ACCELL | |

| Audit fees | $136,720 |

| Audit related fees | 90,800 |

| Total fees | 227,520 |

| | |

| ACCELL | |

| Audit fees | $37,349 |

| Audit related fees | 122,595 |

| MALONE BAILEY | - |

| All other fees | 5,100 |

| Total fees | $165,044 |

Audit fees consist of fees related to professional services rendered in connection with the audit of our annual financial statements and review of our quarterly financial statements.

Audit Related Fees

Audit relates fees consist of fees related for offerings and acquisitions.

Tax Fees

None.

Our policy is to pre-approve all audit and permissible non-audit services performed by the independent accountants. These services may include audit services, audit-related services, tax services and other services. Under our Audit Committee’s policy, pre-approval is generally provided for particular services or categories of services, including planned services, project based services and routine consultations. In addition, the Audit Committee may also pre-approve particular services on a case-by-case basis. Our Audit Committee approved all services that our independent accountants provided to us in the past two fiscal years.

Vote Required

The affirmative vote of a majority of the votes cast for this proposal is required to ratify the appointment of the Company’s independent public accountant. Abstentions will be counted towards the tabulation of votes cast on this proposal and will have the same effect as a negative vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our shareholders to appoint the Company’s independent accountant. However, if our shareholders do not ratify the appointment of Accell as the Company’s independent public accountant for the fiscal year ending December 31, 2018, the Audit Committee may reconsider its appointment.

THE BOARD RECOMMENDS A VOTE "FOR" THE RATIFICATION OF THE APPOINTMENT OF ACCELL, AUDIT & COMPLIANCE PA AS INDEPENDENT PUBLIC ACCOUNTANT

PROPOSAL NO. 3 – AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO INCREASE THE TOTAL NUMBER OF SHARES OF AUTHORIZED COMMON STOCK TO 100,000,000 SHARES OF COMMON STOCK FROM 50,000,000.

Our board of directors has approved, subject to shareholder approval, an amendment to our Articles of Incorporation (the “Amendment”) increasing our authorized shares of Common Stock from 50,000,000 shares to 100,000,000 shares. The increase in our authorized shares of Common Stock will become effective upon the filing of the Amendment with the Secretary of the State of Washington.

The form of Amendment to be filed with the Secretary of State of Washington is set forth as Appendix A to this proxy statement.

Outstanding Shares and Purpose of the Amendment

Our Articles of Incorporation currently authorize us to issue a maximum of 50,000,000 shares of common stock, par value $0.001 per share and 1,000,000 shares of preferred stock, par value $0.001. As of the Record Date, we had __ shares of Common Stock issued and outstanding and 0 shares of preferred stock issued and outstanding.