|

Exhibit 99.2

|

Exhibit 99.2

Van Wagner Acquisition

July 21, 2014

Safe Harbor Disclaimer

Forward-Looking Statements

We have made statements in this presentation that are forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “might,” “will,” “should,” “seeks,” “likely,” “intends,” “plans,” “predicts,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions relating to the proposed acquisition of certain advertising businesses of Van Wagner Communications, LLC (“the Acquired Business”) and any potential benefits of the acquisition, our real estate investment trust (“REIT”) status and our capital resources and results of operations. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and may not be able to be realized. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: the timing to consummate the proposed acquisition; the Company and Van Wagner being unable to satisfy closing conditions of the acquisition, which could delay or cause the companies to abandon the acquisition; a change, event or occurrence that could give rise to the termination of the definitive acquisition agreement or the proposed acquisition; the failure to obtain necessary regulatory approvals or obtaining regulatory approvals subject to conditions that are not anticipated; the proposed acquisition may prove unprofitable and fail to generate anticipated cash flows or we may fail to realize other benefits or synergies expected from the proposed acquisition; any costs, resource allocations, inefficiencies or operational difficulties involved in effectively integrating the Acquired Business into the Company’s business; the possibility that certain assumptions with respect to the Acquired Business or the proposed acquisition could prove to be inaccurate; any diversion of management time on acquisition-related issues; the effect of the proposed acquisition on the ability of the Company and the Acquired Business to maintain relationships with existing customers and suppliers and retain and hire key personnel; our increased levels of indebtedness as a result of the proposed acquisition, which could limit our operating flexibility and opportunities; our inability to complete the anticipated financing as contemplated by our commitment letter prior to the contractually required time for closing of the proposed acquisition or otherwise secure favorable terms for such financing; declines in advertising and general economic conditions; competition; government regulation; our inability to increase the number of digital advertising displays in our portfolio; taxes, fees and registration requirements; our ability to obtain and renew key municipal concessions on favorable terms; content-based restrictions on outdoor advertising; seasonal variations; future acquisitions and other strategic transactions; time and resources to comply with rules and regulations as a stand-alone public company; charges in connection with the separation and incremental costs as a stand-alone public company; dependence on our management team and advertising executives; we may not realize the expected benefits from the separation of our business from CBS Corporation; we have substantial indebtedness, which could adversely affect our financial condition; the terms of the credit agreement and the indenture governing our debt restrict our current and future operations, particularly our ability to incur additional debt that we may need to fund initiatives in response to changes in our business, the industries in which we operate, the economy and governmental regulations; establishing an operating partnership; diverse risks in our international business; we have a limited right to use the CBS Corporation mark and logo; cash available for distributions; legislative, administrative, regulatory or other actions affecting REITs, including positions taken by the Internal Revenue Service (“IRS”); our failure to qualify, or remain qualified, to be taxed as a REIT; REIT ownership limits; dividends payable by REITs do not qualify for the reduced tax rates available for some dividends; REIT distribution requirements; availability of external sources of capital; we may face other tax liabilities that reduce our cash flows; complying with REIT requirements may cause us to liquidate investments or forgo otherwise attractive opportunities; our ability to contribute certain contracts to a taxable REIT subsidiary (“TRS”); our planned use of TRSs may cause us to fail to qualify to be taxed as a REIT; our ability to hedge effectively; paying the cash portion of the earnings and profits allocated to us by CBS Corporation as a distribution and/or taxable dividends in common stock and cash; failure to meet the REIT income tests as a result of receiving non-qualifying rental income; even if we qualify to be taxed as a REIT, and we sell assets, we could be subject to tax on any unrealized net built-in gains in the assets held before electing to be treated as a REIT; the IRS may deem the gains from sales of our outdoor advertising assets to be subject to a 100% prohibited transaction tax; our lack of an operating history as a REIT; we may not be able to engage in desirable strategic or capital-raising transactions following the split-off from CBS Corporation, and we could be liable for adverse tax consequences resulting from engaging in significant strategic or capital-raising transactions; and other factors described in our filings with the Securities and Exchange Commission (the “SEC”), including but not limited to the section entitled “Risk Factors” of our prospectus filed with the SEC on July 7, 2014. All forward-looking statements in this press release apply as of the date of this press release or as of the date they were made and, except as required by applicable law, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors of new information, data or methods, future events or other changes.

Non-GAAP Measures

This presentation may include certain non-GAAP measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of these non-GAAP measures to GAAP measures can be found in the Appendix of this presentation.

Numbers in this presentation may not sum due to rounding.

Jeremy Male—CEO

Donald Shassian—CFO

Transaction Highlights

Acquiring the largest U.S. private portfolio of outdoor assets

Enhances platform for future growth

Top-DMAs

Highly complementary “top of the pyramid” and iconic locations

National advertiser strategy

Leverages CBSO operating expense infrastructure

Immediately accretive to AFFO/share

Substantially all the assets are REIT qualified

Premium Locations in Top Markets

Los Angeles / San Francisco

Sunset Strip

Hollywood & Vine

Sunset Blvd.

The Mission

New York

34th St & 7th Ave

Long Island Expressway

Times Square

Queensboro Bridge

Other Top-25 DMAs

Boston

Chicago

Miami

Washington, D.C.

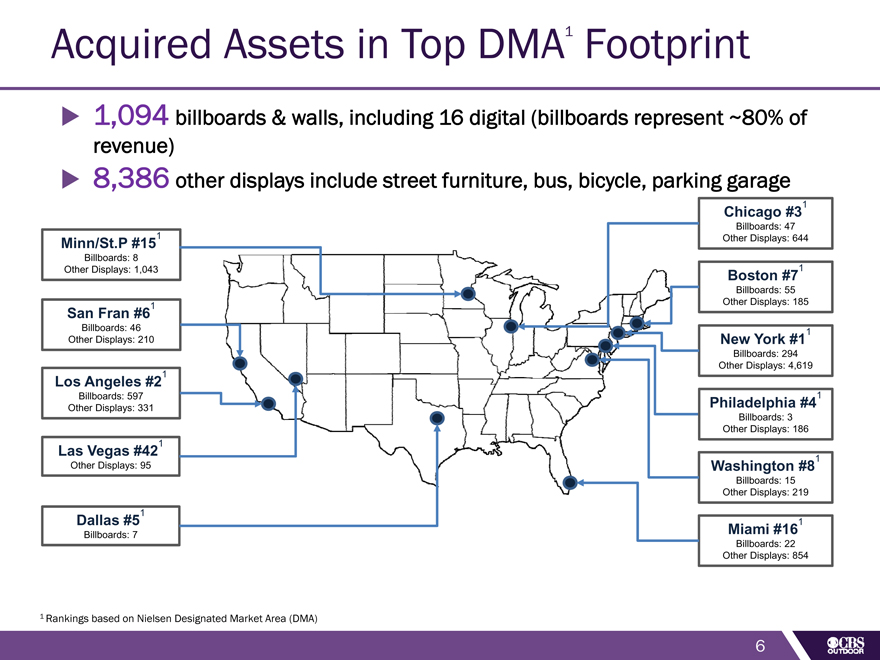

Acquired Assets in Top DMA1 Footprint

1,094 billboards & walls, including 16 digital (billboards represent ~80% of revenue)

8,386 other displays include street furniture, bus, bicycle, parking garage

Minn/St.P #151

Billboards: 8

Other Displays: 1,043

San Fran #61

Billboards: 46

Other Displays: 210

Los Angeles #21

Billboards: 597

Other Displays: 331

Las Vegas #421

Other Displays: 95

Dallas #51

Billboards: 7

Boston #71

Billboards: 55

Other Displays: 185

New York #11

Billboards: 294

Other Displays: 4,619

Philadelphia #41

Billboards: 3

Other Displays: 186

Washington #81

Billboards: 15

Other Displays: 219

Miami #161

Billboards: 22

Other Displays: 854

Chicago #31

Billboards: 47

Other Displays: 644

1 | | Rankings based on Nielsen Designated Market Area (DMA) |

Transaction Overview

Transaction Structure

Acquiring certain Outdoor Advertising businesses of Van Wagner Communications, LLC (the “Acquired Business”): digital, spectacular, bulletins, street furniture, bus, and displays linked to city bicycle programs

Transaction does not include Sports, Experiential, or Aerial businesses

Opportunity to hire Van Wagner personnel

Value

Purchase price of $690 million

Acquired Business 2013 Pro Forma Adjusted OIBDA of $64 million reflects reported revenue, lease and operating costs of Acquired Business, less estimated incremental SG&A expenses to be incurred by CBSO

Represents a purchase multiple of 10.8x Acquired Business 2013 Pro Forma Adjusted OIBDA

Financing

100% cash consideration to be funded with incremental long-term debt

Estimated 4.9x gross leverage, after giving effect to the acquisition, based on combined 2013 Pro Forma Adjusted OIBDA

Capital Allocation

Full tax basis in acquired assets

Use residual free cash flow to deleverage to target range of 3.5x-4.0x gross leverage, after giving effect to the acquisition, in approximately 2 years

No change to 2014 anticipated dividend levels (recurring plus top-up); no impact on timing, amount or composition of E&P purge dividend

Continued focus on sustainability and growth of dividend over time

Timing

Anticipated closing early in 2015

Subject to regulatory review and customary closing conditions

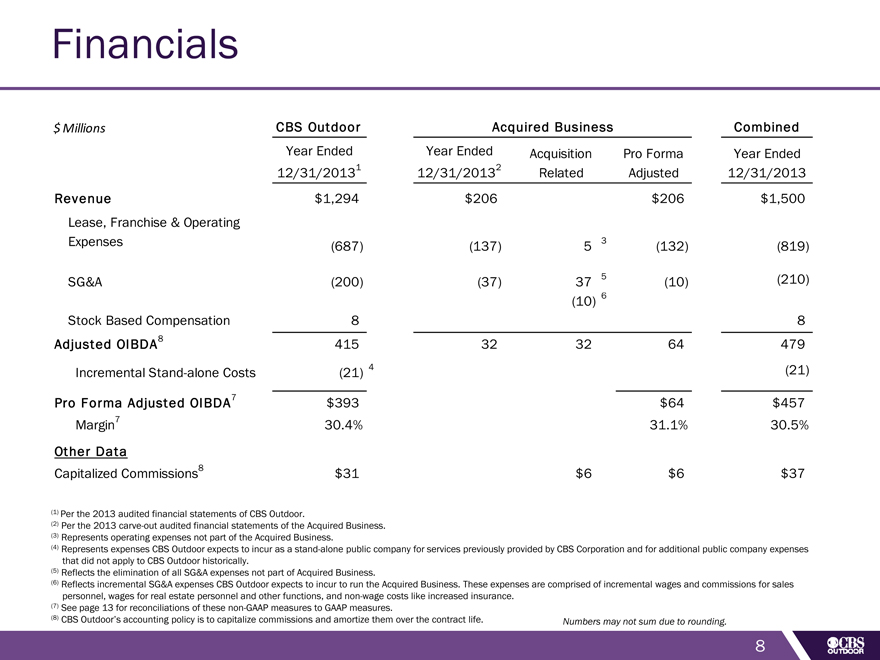

Financials

$ Millions CBS Outdoor Acquired Business Combined Year Ended Year Ended Acquisition Pro Forma Year Ended 12/31/20131 12/31/20132 Related Adjusted 12/31/2013 Revenue $1,294 $206 $206 $1,500 Lease, Franchise & Operating Expenses (687) (137) 5 3 (132) (819) SG&A (200) (37) 37 5 (10) (210) (10) 6 Stock Based Compensation 8 8 Adjusted OIBDA8 415 32 32 64 479 Incremental Stand-alone Costs (21) 4 (21) Pro Forma Adjusted OIBDA7 $393 $64 $457 Margin7 30.4% 31.1% 30.5% Other Data Capitalized Commissions8 $31 $6 $6 $37

(1) | | Per the 2013 audited financial statements of CBS Outdoor. |

(2) Per the 2013 carve-out audited financial statements of the Acquired Business. (3) Represents operating expenses not part of the Acquired Business.

(4) Represents expenses CBS Outdoor expects to incur as a stand-alone public company for services previously provided by CBS Corporation and for additional public company expenses that did not apply to CBS Outdoor historically.

(5) | | Reflects the elimination of all SG&A expenses not part of Acquired Business. |

(6) Reflects incremental SG&A expenses CBS Outdoor expects to incur to run the Acquired Business. These expenses are comprised of incremental wages and commissions for sales personnel, wages for real estate personnel and other functions, and non-wage costs like increased insurance.

(7) | | See page 13 for reconciliations of these non-GAAP measures to GAAP measures. |

(8) CBS Outdoor’s accounting policy is to capitalize commissions and amortize them over the contract life. Numbers may not sum due to rounding.

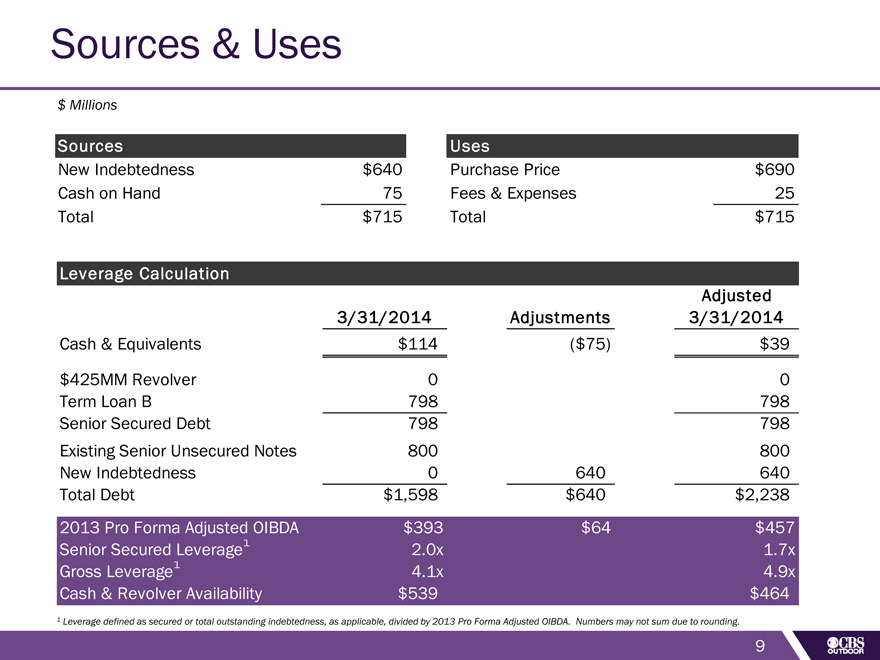

Sources & Uses

$ Millions

Sources Uses

New Indebtedness $640 Purchase Price $690

Cash on Hand 75 Fees & Expenses 25

Total $715 Total $715

Leverage Calculation

Adjusted

3/31/2014 Adjustments 3/31/2014

Cash & Equivalents $114 ($75) $39

$425MM Revolver 0 0

Term Loan B 798 798

Senior Secured Debt 798 798

Existing Senior Unsecured Notes 800 800

New Indebtedness 0 640 640

Total Debt $1,598 $640 $2,238

2013 Pro Forma Adjusted OIBDA $393 $64 $457

Senior Secured Leverage1 2.0x 1.7x

Gross Leverage 1 4.1x 4.9x

Cash & Revolver Availability $539 $464

1 Leverage defined as secured or total outstanding indebtedness, as applicable, divided by 2013 Pro Forma Adjusted OIBDA. Numbers may not sum due to rounding.

9

Executing on Stated Business Objectives

10

Summary

Acquisition of highly complementary major-market billboard portfolio Leverages CBSO operating expense infrastructure Immediately accretive to AFFO per share Enhances platform for future growth

11

Non-GAAP Financial Measures

Non-GAAP Financial Measures

In addition to the results prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) provided throughout this presentation, this presentation and the accompanying tables include non-GAAP measures as described below. We calculate Adjusted OIBDA as operating income before depreciation, amortization, net gains on dispositions and stock-based compensation. We calculate Pro Forma Adjusted OIBDA as Adjusted OIBDA adjusted to include incremental costs associated with operating as a stand-alone public company and exclude expenses of the Acquired Business that are not part of the acquisition offset by estimated incremental expenses associated with operating the Acquired Business. We calculate Pro Forma Adjusted OIBDA margin by dividing Pro Forma Adjusted OIBDA by total revenues. We use Adjusted OIBDA and Adjusted OIBDA margin to evaluate our operating performance. Adjusted OIBDA and Adjusted OIBDA margin are among the primary measures we use for managing our business, and for planning and forecasting future periods, as each is an important indicator of our operational strength and business performance. In this presentation we are using Pro Forma Adjusted OIBDA and Pro Forma Adjusted OIBDA margin to evaluate the operating performance of us and the Acquired Business to reflect certain significant costs arising as a result of our separation from CBS Corporation and estimated costs associated with the proposed acquisition of the Acquired Business. Our management believes users are best served if the information that is made available to them allows them to align their analysis and evaluation of our operating results along the same lines that our management uses in managing, planning and executing our business strategy. Our management also believes that the presentations of Adjusted OIBDA, Pro Forma Adjusted OIBDA and Pro Forma Adjusted OIBDA margin, as supplemental measures, are useful in evaluating our business because eliminating certain non-comparable items and adjusting for incremental and acquisition-related costs highlights underlying operational trends in our business and the Acquired Business that may not otherwise be apparent when relying solely on GAAP financial measures. It is our management’s opinion that these supplemental measures provide users with an important perspective on our operating performance and the Acquired Business’ operating performance, and also make it easier for users to compare our results and the Acquired Business’ results to other companies that have different financing and capital structures or tax rates. Since Adjusted OIBDA, Pro Forma Adjusted OIBDA and Pro Forma Adjusted OIBDA margin are not measures calculated in accordance with GAAP, they should not be considered in isolation of, or as a substitute for, operating income and revenues, the most directly comparable GAAP financial measures, as indicators of operating performance. These measures, as we calculate them, may not be comparable to similarly titled measures employed by other companies. In addition, these measures do not necessarily represent funds available for discretionary use and are not necessarily a measure of our ability to fund our cash needs.

12

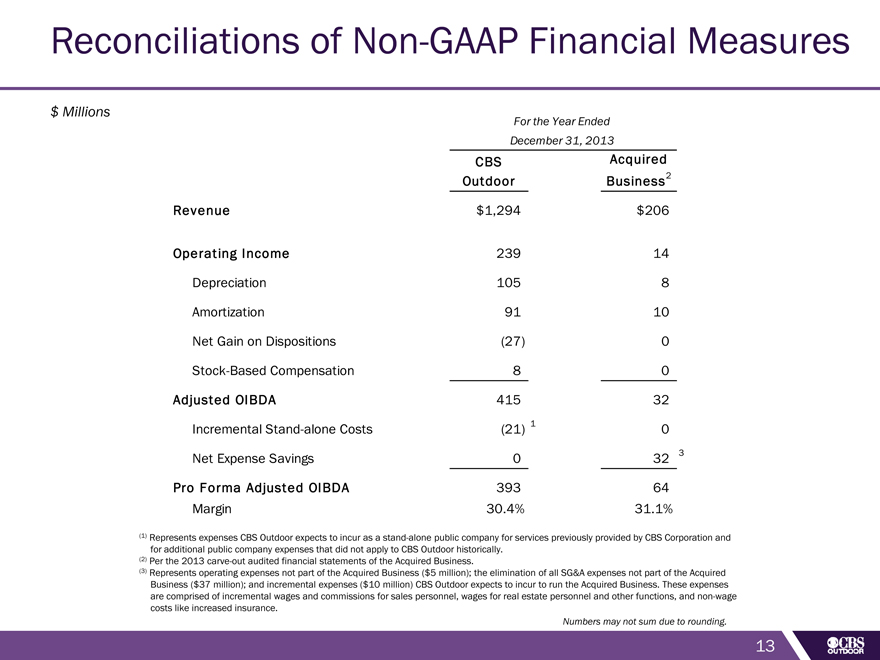

Reconciliations of Non-GAAP Financial Measures

$ Millions

For the Year Ended

December 31, 2013

CBS Acquired

Outdoor Business 2

Revenue $1,294 $206

Operating Income 239 14

Depreciation 105 8

Amortization 91 10

Net Gain on Dispositions (27) 0

Stock-Based Compensation 8 0

Adjusted OIBDA 415 32

Incremental Stand-alone Costs (21) 1 0

Net Expense Savings 0 32 3

Pro Forma Adjusted OIBDA 393 64

Margin 30.4% 31.1%

(1) Represents expenses CBS Outdoor expects to incur as a stand-alone public company for services previously provided by CBS Corporation and for additional public company expenses that did not apply to CBS Outdoor historically.

(2) | | Per the 2013 carve-out audited financial statements of the Acquired Business. |

(3) Represents operating expenses not part of the Acquired Business ($5 million); the elimination of all SG&A expenses not part of the Acquired Business ($37 million); and incremental expenses ($10 million) CBS Outdoor expects to incur to run the Acquired Business. These expenses are comprised of incremental wages and commissions for sales personnel, wages for real estate personnel and other functions, and non-wage costs like increased insurance.

Numbers may not sum due to rounding.

13