SECOND QUARTER 2021 – FINANCIAL RESULTS August 2021 Exhibit 99.2

FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” within the meaning of the federal securities laws, which statements are subject to substantial risks and uncertainties and are based on estimates and assumptions. All statements, other than statements of historical facts included in this presentation, including statements concerning our plans, objectives, goals, strategies, future events, future revenues or performance, financing needs, plans or intentions relating to product candidates, estimates of market size, estimates of market growth, business trends, expected testing supply and demand, the anticipated timing, design and conduct of our planned clinical trials, the development of our product candidates, including the timing and likelihood of regulatory filings and approvals for our product candidates, our ability to commercialize our product candidates, if approved, the pricing and reimbursement of our product candidates, if approved, the potential to develop future product candidates, the potential benefits of strategic collaborations and our intent to enter into any strategic arrangements, the timing and likelihood of success, plans and objectives of management for future operations and future results of anticipated product development efforts, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “design,” “estimate,” “predict,” “potential,” “plan” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from the forward-looking statements expressed or implied in this presentation, including those described in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, and elsewhere in such filing and in other subsequent disclosure documents, including our Quarterly Reports on Form 10-Q, filed with the U.S. Securities and Exchange Commission (SEC).��We cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. Forward-looking statements are not historical facts and reflect our current views with respect to future events. Given the significant uncertainties, you should evaluate all forward-looking statements made in this presentation in the context of these risks and uncertainties and not place undue reliance on these forward-looking statements as predictions of future events. All forward-looking statements in this presentation apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this presentation. We disclaim any intent to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law. Industry and Market Data: We obtained the industry, market, and competitive position data used throughout this presentation from our own internal estimates and research, as well as from industry and general publications, and research, surveys, and studies conducted by third parties. Internal estimates are derived from publicly available information released by industry analysts and third-party sources, our internal research and our industry experience, and are based on assumptions made by us based on such data and our knowledge of the industry and market, which we believe to be reasonable. In addition, while we believe the industry, market, and competitive position data included in this prospectus is reliable and based on reasonable assumptions, we have not independently verified any third-party information, and all such data involve risks and uncertainties and are subject to change based on various factors. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

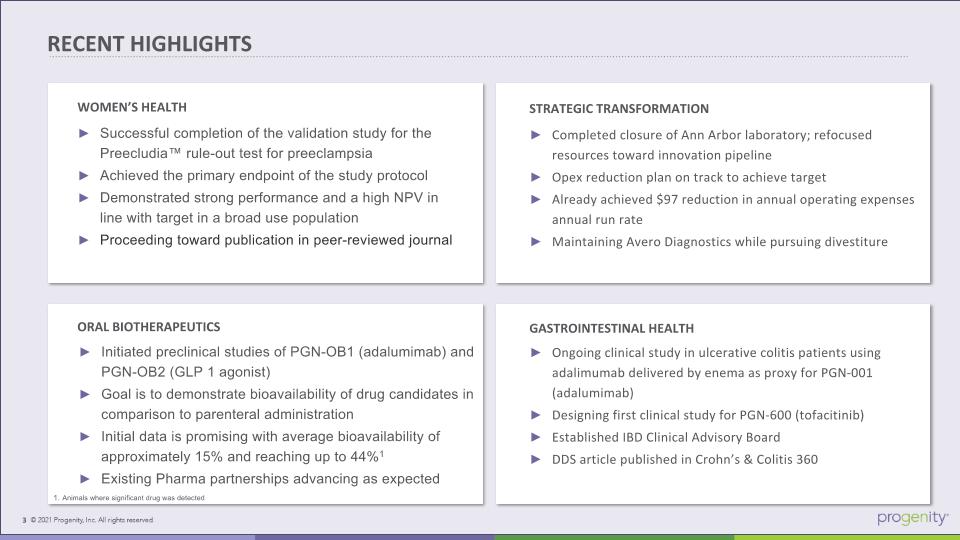

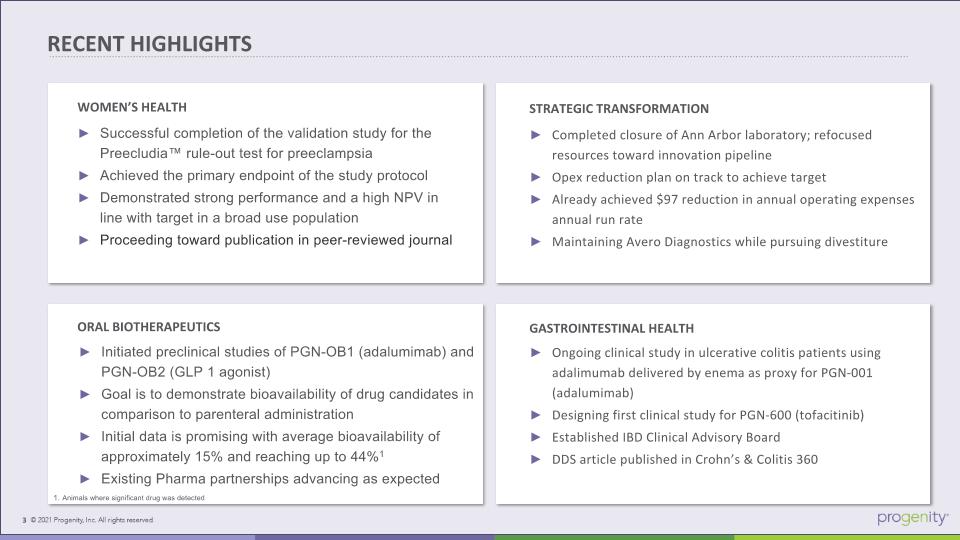

RECENT HIGHLIGHTS Successful completion of the validation study for the Preecludia™ rule-out test for preeclampsia Achieved the primary endpoint of the study protocol Demonstrated strong performance and a high NPV in line with target in a broad use population Proceeding toward publication in peer-reviewed journal Initiated preclinical studies of PGN-OB1 (adalumimab) and PGN-OB2 (GLP 1 agonist) Goal is to demonstrate bioavailability of drug candidates in comparison to parenteral administration Initial data is promising with average bioavailability of approximately 15% and reaching up to 44%1 Existing Pharma partnerships advancing as expected Completed closure of Ann Arbor laboratory; refocused resources toward innovation pipeline Opex reduction plan on track to achieve target Already achieved $97 reduction in annual operating expenses annual run rate Maintaining Avero Diagnostics while pursuing divestiture Ongoing clinical study in ulcerative colitis patients using adalimumab delivered by enema as proxy for PGN-001 (adalumimab) Designing first clinical study for PGN-600 (tofacitinib) Established IBD Clinical Advisory Board DDS article published in Crohn’s & Colitis 360 WOMEN’S HEALTH STRATEGIC TRANSFORMATION ORAL BIOTHERAPEUTICS GASTROINTESTINAL HEALTH Animals where significant drug was detected

INNOVATION PIPELINE UPDATE

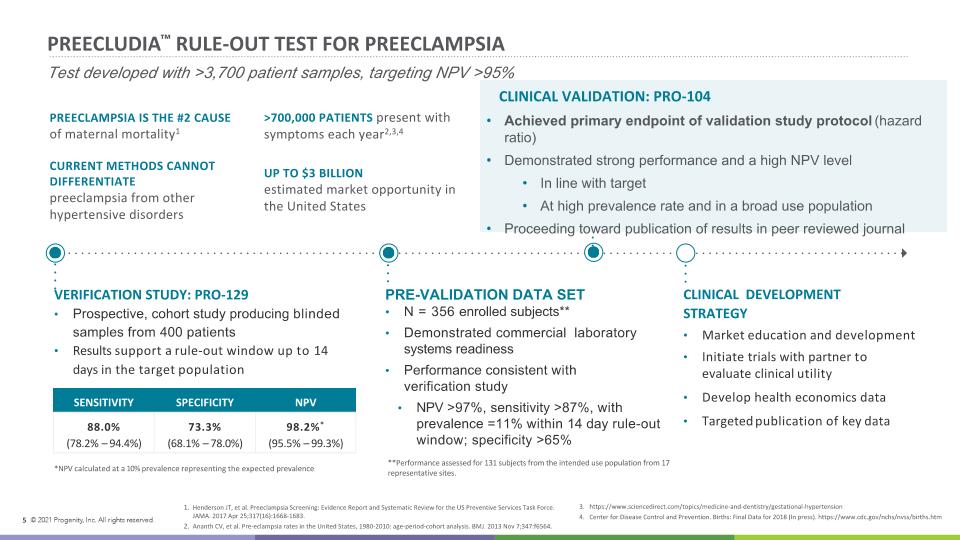

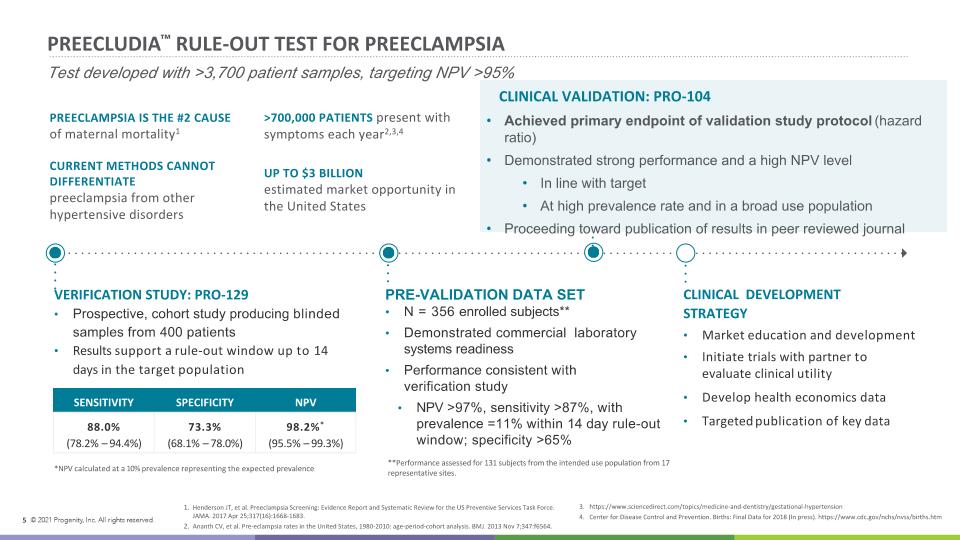

PREECLUDIA™ RULE-OUT TEST FOR PREECLAMPSIA Test developed with >3,700 patient samples, targeting NPV >95% PRE-VALIDATION DATA SET N = 356 enrolled subjects** Demonstrated commercial laboratory systems readiness Performance consistent with verification study NPV >97%, sensitivity >87%, with prevalence =11% within 14 day rule-out window; specificity >65% VERIFICATION STUDY: PRO-129 Prospective, cohort study producing blinded samples from 400 patients Results support a rule-out window up to 14 days in the target population SENSITIVITY SPECIFICITY NPV 88.0% (78.2% – 94.4%) 73.3% (68.1% – 78.0%) 98.2%* (95.5% – 99.3%) *NPV calculated at a 10% prevalence representing the expected prevalence CLINICAL DEVELOPMENT STRATEGY Market education and development Initiate trials with partner to evaluate clinical utility Develop health economics data Targeted publication of key data **Performance assessed for 131 subjects from the intended use population from 17 representative sites. PREECLAMPSIA IS THE #2 CAUSE of maternal mortality1 >700,000 PATIENTS present with symptoms each year2,3,4 UP TO $3 BILLION estimated market opportunity in the United States CURRENT METHODS CANNOT DIFFERENTIATE preeclampsia from other hypertensive disorders Henderson JT, et al. Preeclampsia Screening: Evidence Report and Systematic Review for the US Preventive Services Task Force. JAMA. 2017 Apr 25;317(16):1668-1683. Ananth CV, et al. Pre-eclampsia rates in the United States, 1980-2010: age-period-cohort analysis. BMJ. 2013 Nov 7;347:f6564. 3. https://www.sciencedirect.com/topics/medicine-and-dentistry/gestational-hypertension 4. Center for Disease Control and Prevention. Births: Final Data for 2018 (In press). https://www.cdc.gov/nchs/nvss/births.htm 5 CLINICAL VALIDATION: PRO-104 Achieved primary endpoint of validation study protocol (hazard ratio) Demonstrated strong performance and a high NPV level In line with target At high prevalence rate and in a broad use population Proceeding toward publication of results in peer reviewed journal

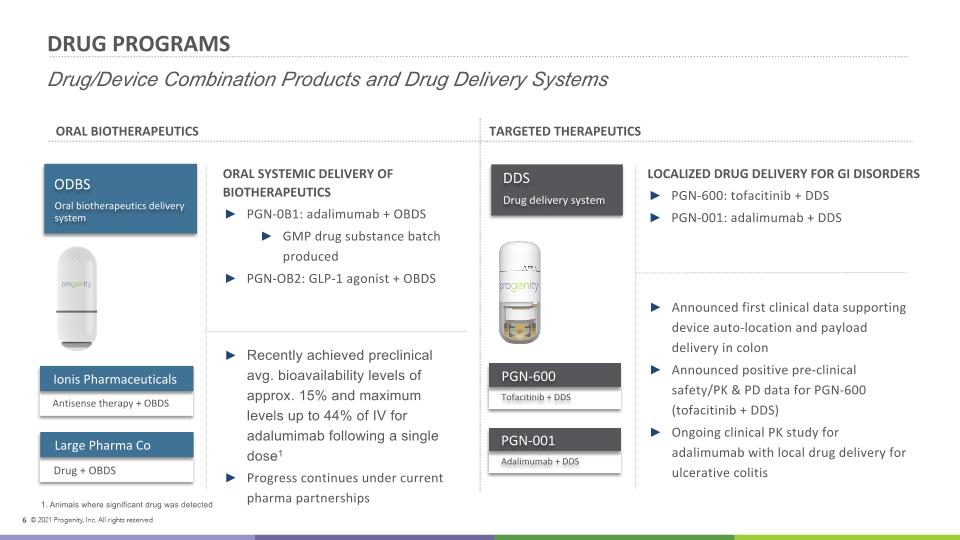

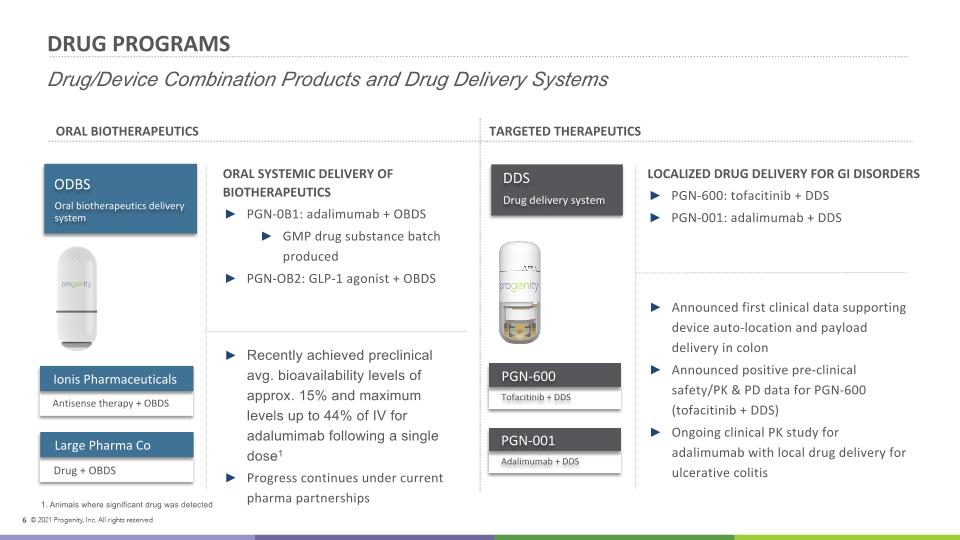

DRUG PROGRAMS Drug/Device Combination Products and Drug Delivery Systems ORAL SYSTEMIC DELIVERY OF BIOTHERAPEUTICS PGN-0B1: adalimumab + OBDS GMP drug substance batch produced PGN-OB2: GLP-1 agonist + OBDS LOCALIZED DRUG DELIVERY FOR GI DISORDERS PGN-600: tofacitinib + DDS PGN-001: adalimumab + DDS ORAL BIOTHERAPEUTICS TARGETED THERAPEUTICS Recently achieved preclinical avg. bioavailability levels of approx. 15% and maximum levels up to 44% of IV for adalumimab following a single dose1 Progress continues under current pharma partnerships Announced first clinical data supporting device auto-location and payload delivery in colon Announced positive pre-clinical safety/PK & PD data for PGN-600 (tofacitinib + DDS) Ongoing clinical PK study for adalimumab with local drug delivery for ulcerative colitis ODBS Oral biotherapeutics delivery system Ionis Pharmaceuticals Antisense therapy + OBDS Large Pharma Co Drug + OBDS Tofacitinib + DDS PGN-600 Adalimumab + DDS PGN-001 DDS Drug delivery system Animals where significant drug was detected

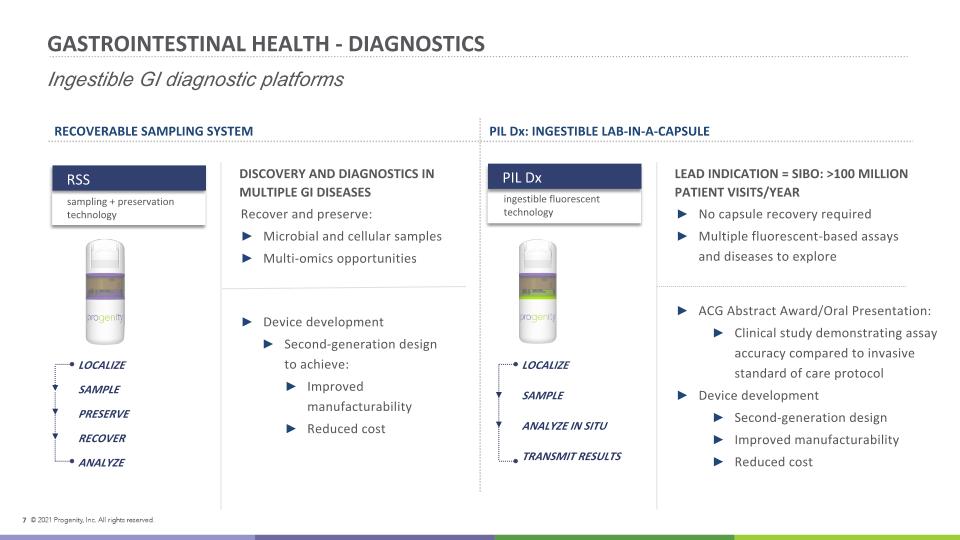

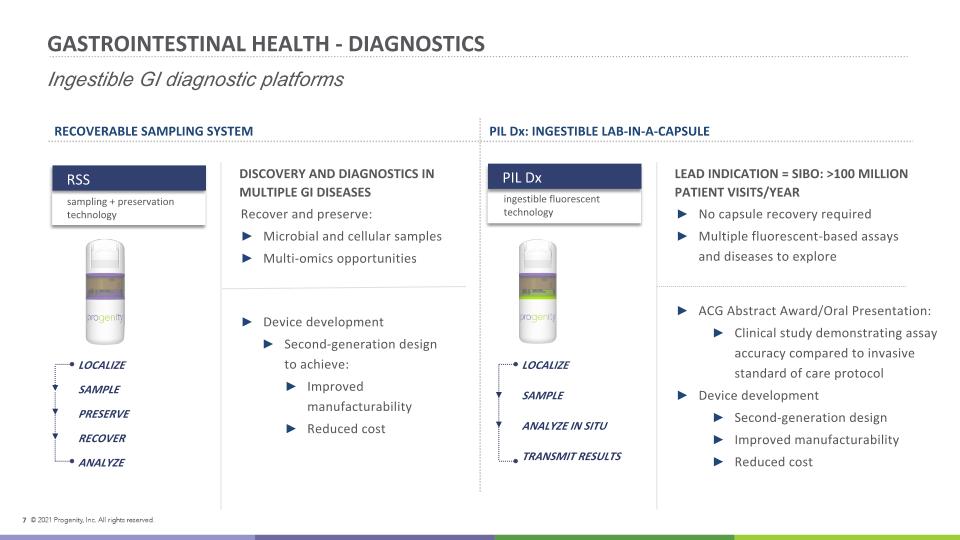

GASTROINTESTINAL HEALTH - DIAGNOSTICS Ingestible GI diagnostic platforms DISCOVERY AND DIAGNOSTICS IN MULTIPLE GI DISEASES Recover and preserve: Microbial and cellular samples Multi-omics opportunities LEAD INDICATION = SIBO: >100 MILLION PATIENT VISITS/YEAR No capsule recovery required Multiple fluorescent-based assays and diseases to explore RECOVERABLE SAMPLING SYSTEM PIL Dx: INGESTIBLE LAB-IN-A-CAPSULE Device development Second-generation design to achieve: Improved manufacturability Reduced cost ACG Abstract Award/Oral Presentation: Clinical study demonstrating assay accuracy compared to invasive standard of care protocol Device development Second-generation design Improved manufacturability Reduced cost Gastrointestinal Health LOCALIZE SAMPLE PRESERVE RECOVER ANALYZE LOCALIZE SAMPLE ANALYZE IN SITU TRANSMIT RESULTS PIL Dx ingestible fluorescent technology RSS sampling + preservation technology

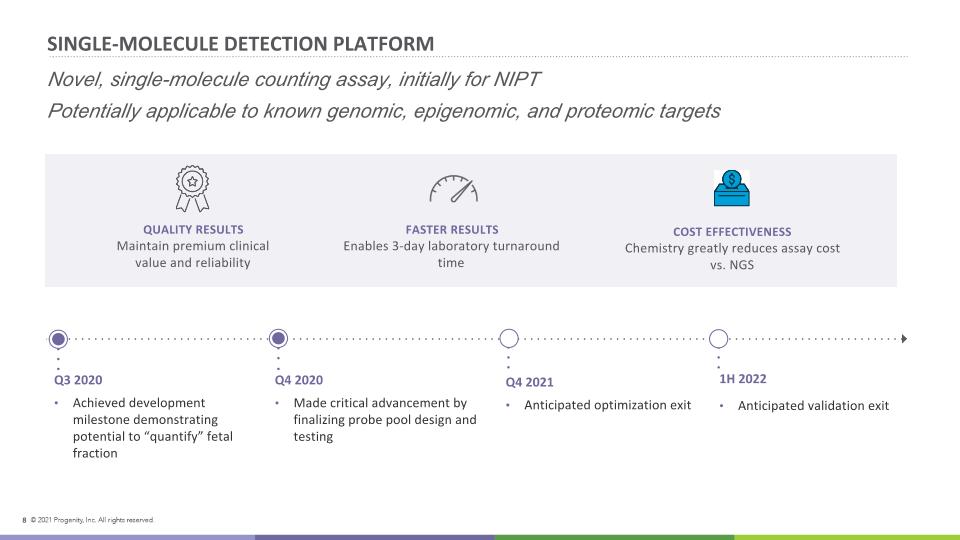

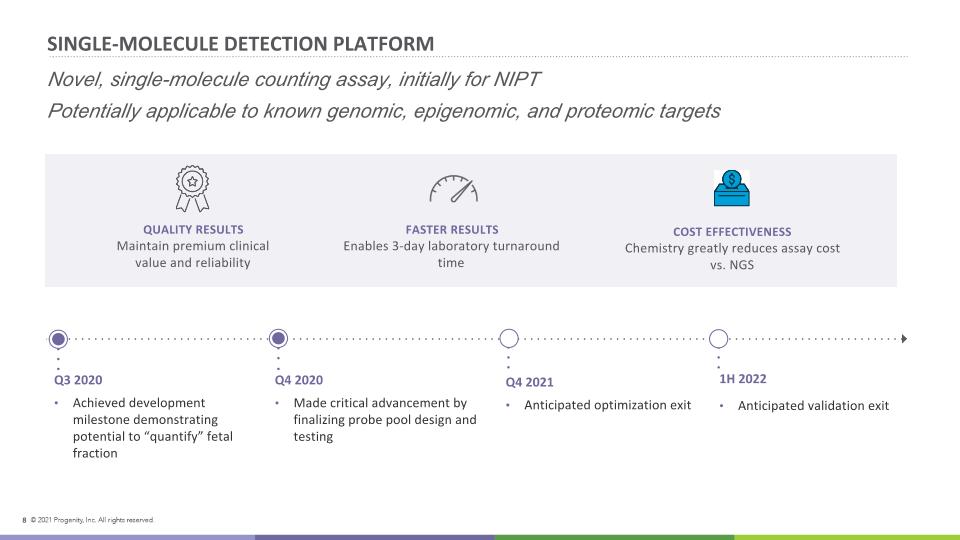

SINGLE-MOLECULE DETECTION PLATFORM Q4 2020 Made critical advancement by finalizing probe pool design and testing Q3 2020 Achieved development milestone demonstrating potential to “quantify” fetal fraction 1H 2022 Anticipated validation exit QUALITY RESULTS Maintain premium clinical value and reliability COST EFFECTIVENESS Chemistry greatly reduces assay cost vs. NGS FASTER RESULTS Enables 3-day laboratory turnaround time 8 Q4 2021 Anticipated optimization exit Novel, single-molecule counting assay, initially for NIPT Potentially applicable to known genomic, epigenomic, and proteomic targets

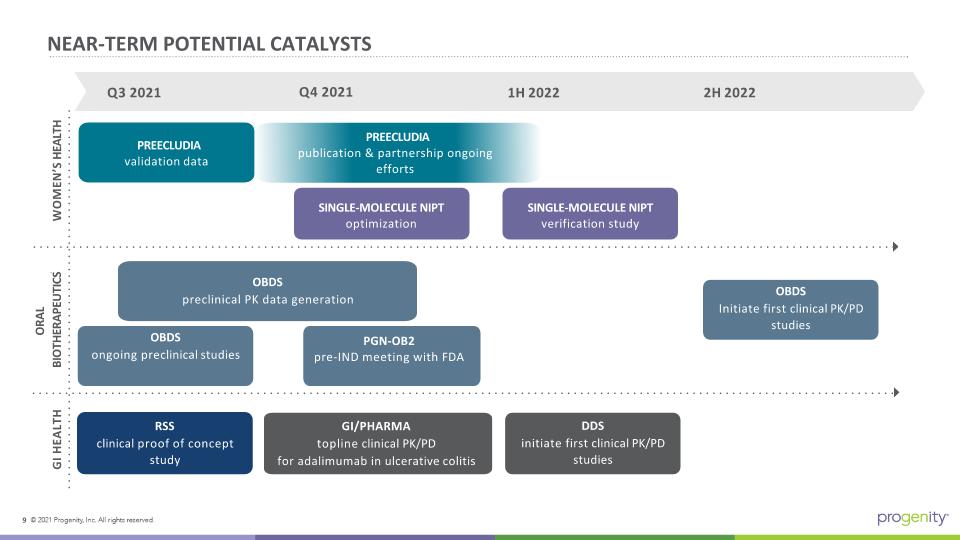

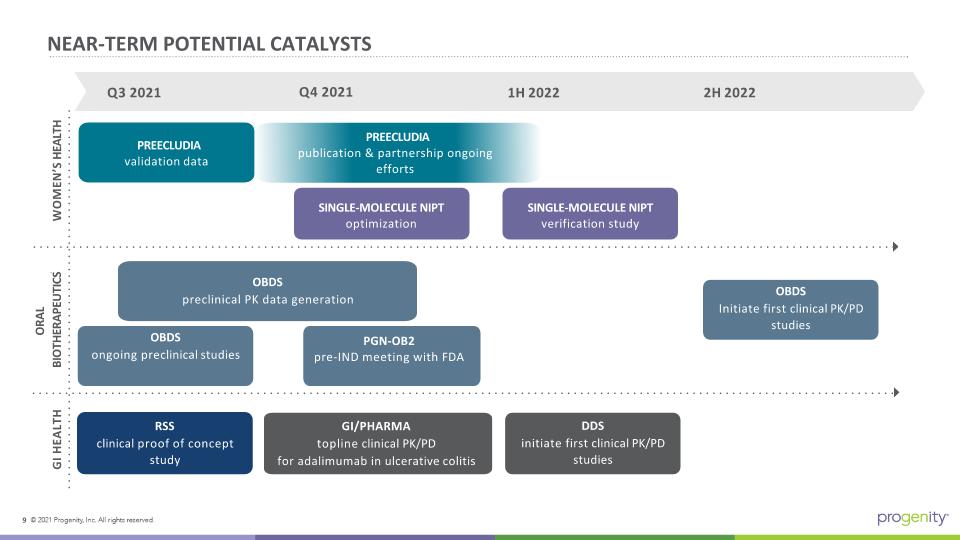

PREECLUDIA publication & partnership ongoing efforts Q3 2021 PREECLUDIA validation data SINGLE-MOLECULE NIPT verification study WOMEN’S HEALTH ORAL BIOTHERAPEUTICS RSS clinical proof of concept study OBDS Initiate first clinical PK/PD studies PGN-OB2 pre-IND meeting with FDA GI/PHARMA topline clinical PK/PD for adalimumab in ulcerative colitis NEAR-TERM POTENTIAL CATALYSTS SINGLE-MOLECULE NIPT optimization Q4 2021 1H 2022 2H 2022 GI HEALTH DDS initiate first clinical PK/PD studies OBDS preclinical PK data generation OBDS ongoing preclinical studies

OPERATING EXPENSES

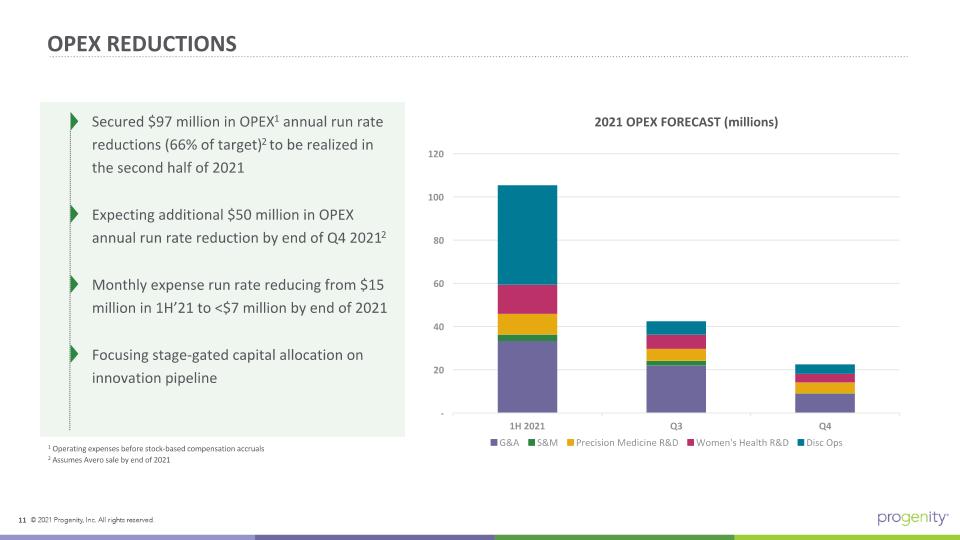

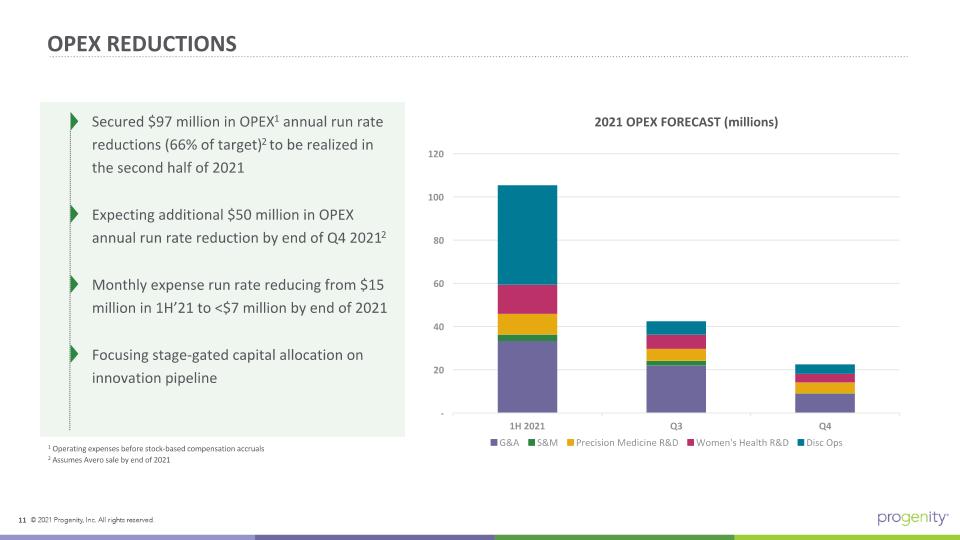

OPEX REDUCTIONS Secured $97 million in OPEX1 annual run rate reductions (66% of target)2 to be realized in the second half of 2021 Expecting additional $50 million in OPEX annual run rate reduction by end of Q4 20212 Monthly expense run rate reducing from $15 million in 1H’21 to <$7 million by end of 2021 Focusing stage-gated capital allocation on innovation pipeline 2021 OPEX FORECAST (millions) 1 Operating expenses before stock-based compensation accruals 2 Assumes Avero sale by end of 2021