Business Update and Fourth Quarter and FY 2020 Financial Results March 18, 2021 Exhibit 99.2

Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of the federal securities laws, which statements are subject to substantial risks and uncertainties and are based on estimates and assumptions. All statements, other than statements of historical facts included in this presentation, including statements concerning our plans, objectives, goals, strategies, future events, future revenues or performance, financing needs, plans or intentions relating to product candidates, estimates of market size, estimates of market growth, business trends, expected testing supply and demand, the anticipated timing, design and conduct of our planned clinical trials, the development of our product candidates, including the timing and likelihood of regulatory filings and approvals for our product candidates, our ability to commercialize our product candidates, if approved, the pricing and reimbursement of our product candidates, if approved, the potential to develop future product candidates, the potential benefits of strategic collaborations and our intent to enter into any strategic arrangements, the timing and likelihood of success, plans and objectives of management for future operations and future results of anticipated product development efforts, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “design,” “estimate,” “predict,” “potential,” “plan” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from the forward-looking statements expressed or implied in this presentation, including those described in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, and elsewhere in such filings and in other subsequent disclosure documents filed with the U.S. Securities and Exchange Commission (SEC). We cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. Forward-looking statements are not historical facts, and reflect our current views with respect to future events. Given the significant uncertainties, you should evaluate all forward-looking statements made in this presentation in the context of these risks and uncertainties and not place undue reliance on these forward-looking statements as predictions of future events. All forward-looking statements in this presentation apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this presentation. We disclaim any intent to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law. Industry and Market Data: We obtained the industry, market, and competitive position data used throughout this Presentation from our own internal estimates and research, as well as from industry and general publications, and research, surveys, and studies conducted by third parties. Internal estimates are derived from publicly available information released by industry analysts and third-party sources, our internal research and our industry experience, and are based on assumptions made by us based on such data and our knowledge of the industry and market, which we believe to be reasonable. In addition, while we believe the industry, market, and competitive position data included in this prospectus is reliable and based on reasonable assumptions, we have not independently verified any third-party information, and all such data involve risks and uncertainties and are subject to change based on various factors. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

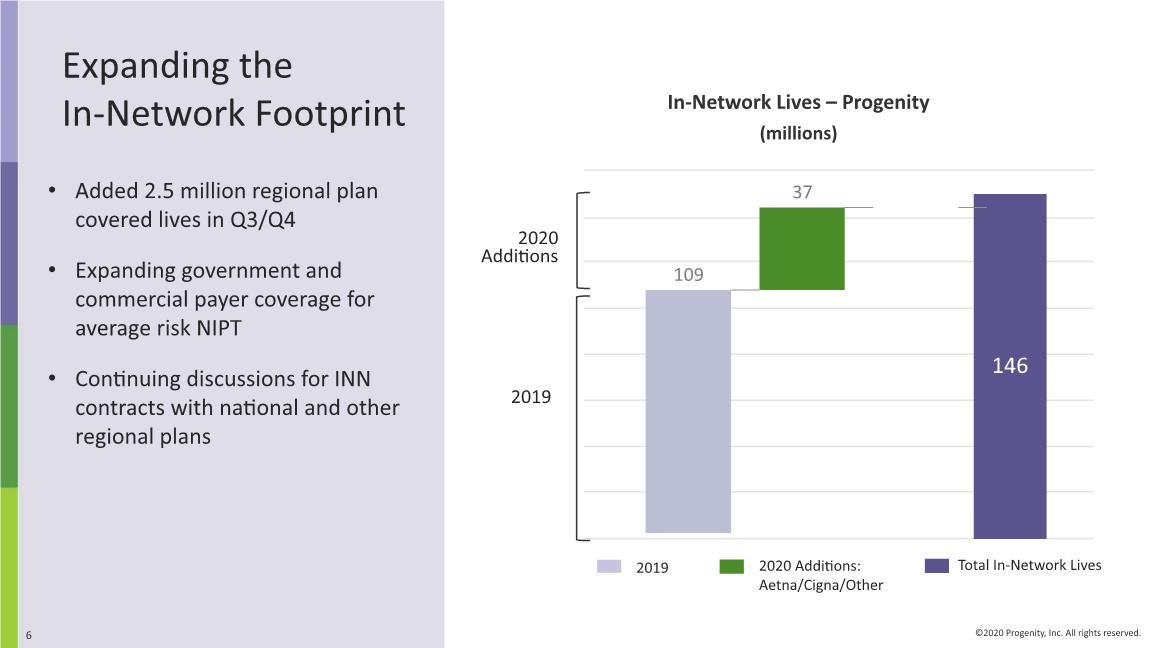

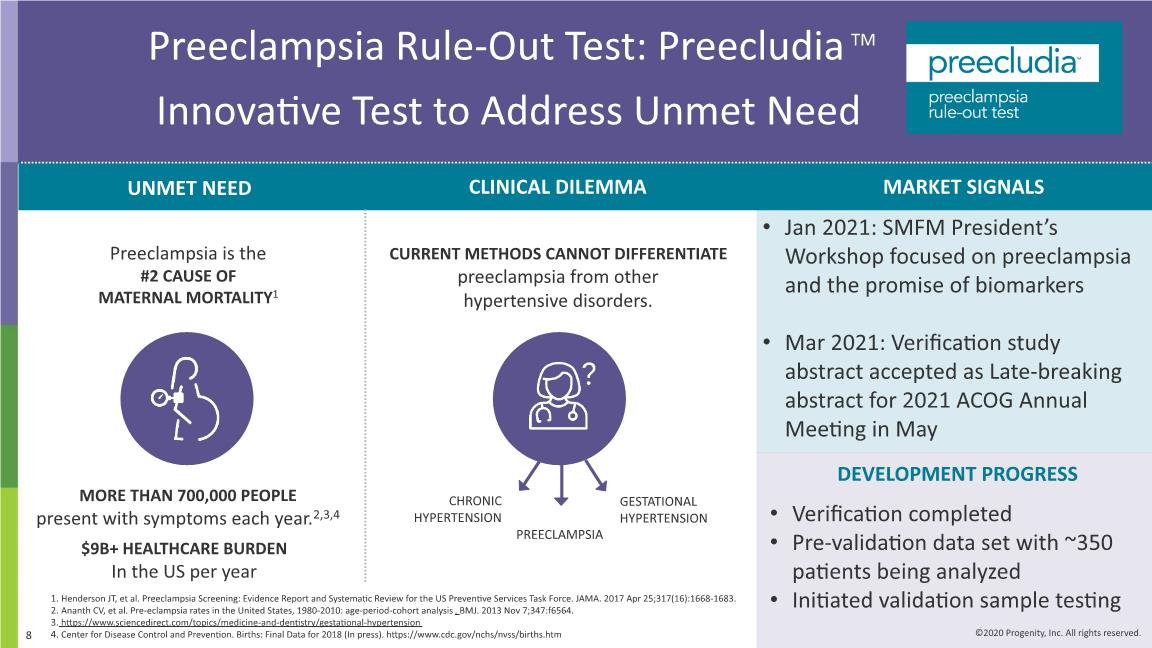

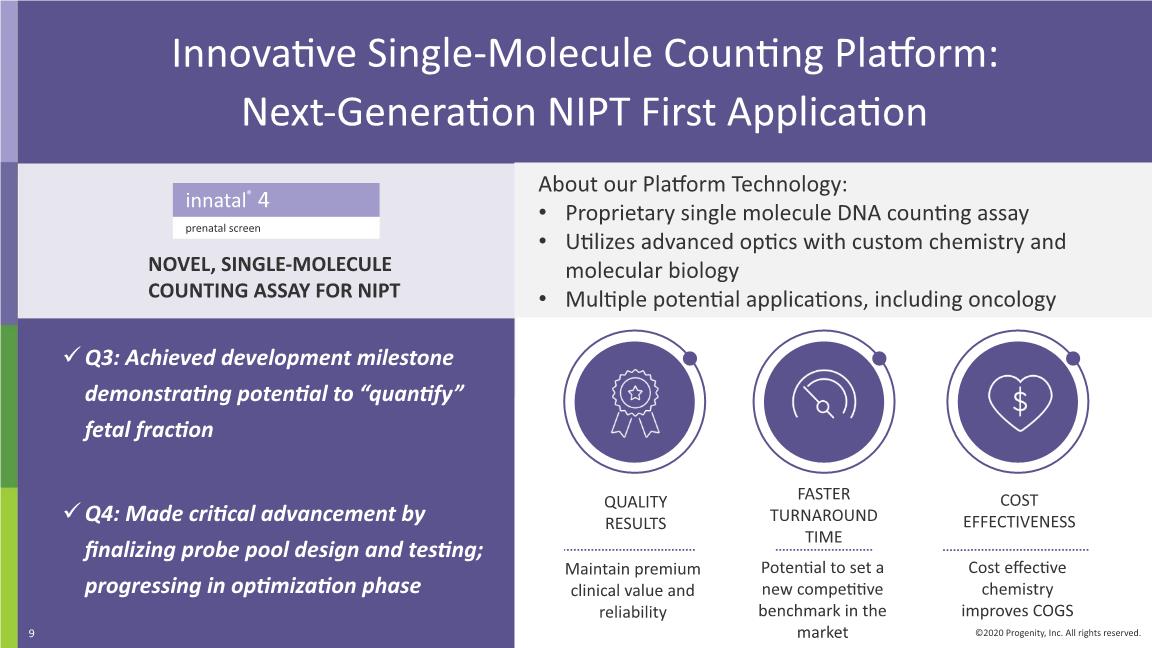

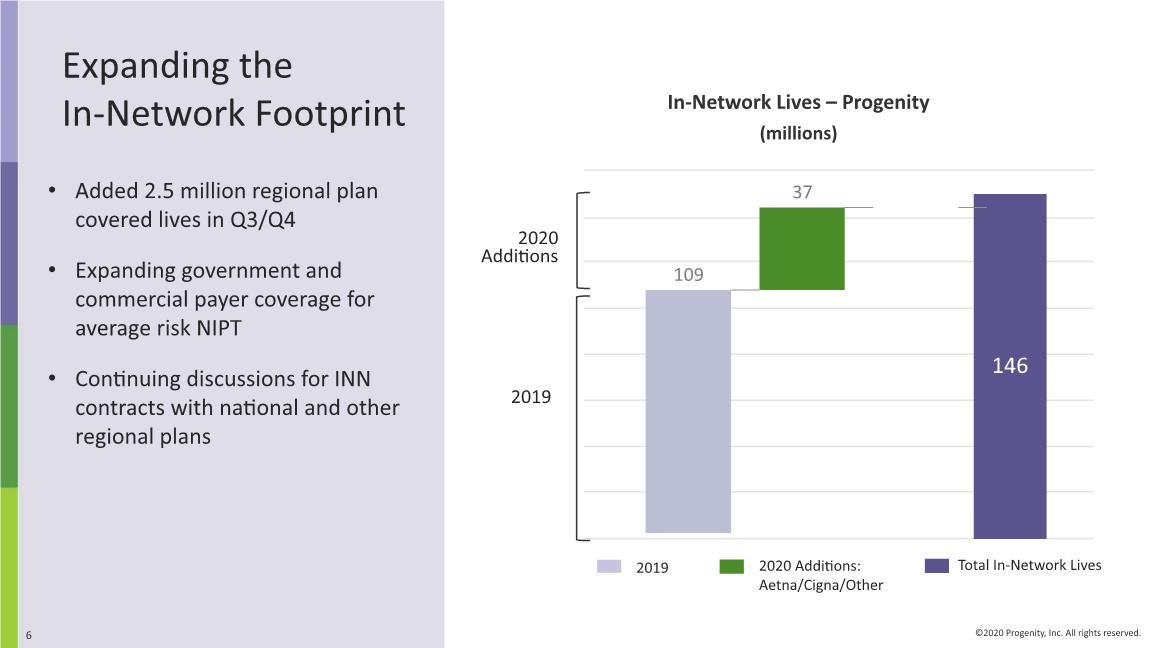

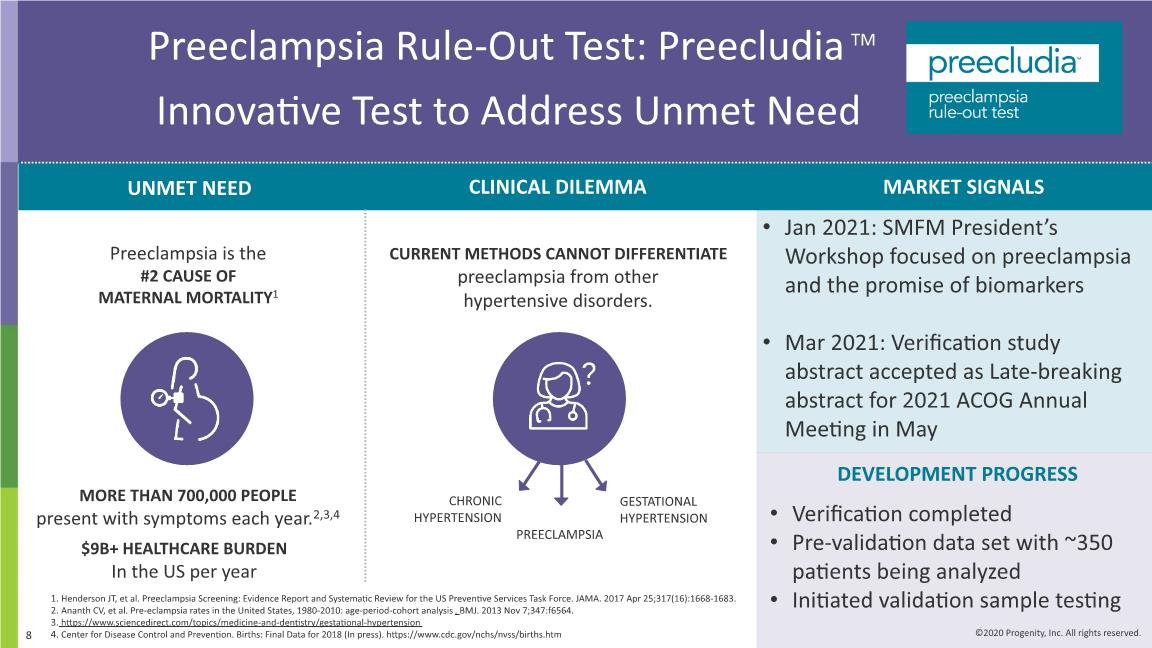

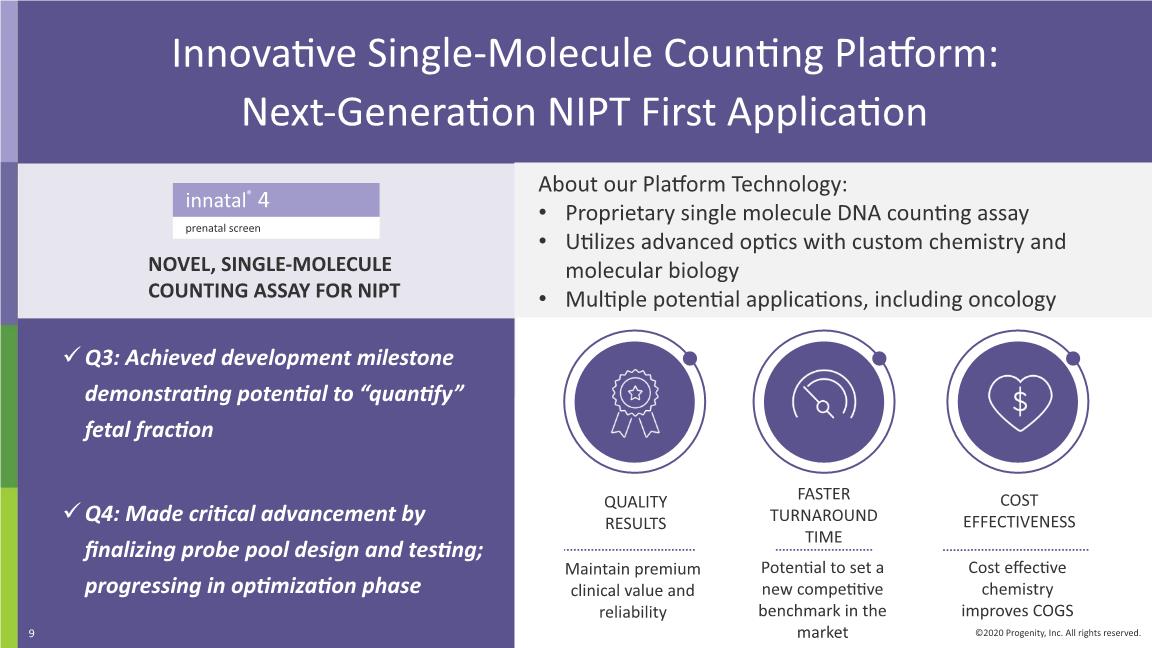

Q4 2020 & Other Recent Corporate Highlights Continued to increase our INN position, reaching 146 M covered lives ASPs of core products returned to growth in Q4 2020, and Q1 to date Introduced key programs aimed at improving customer experience and revenue cycle management Completed analytical and clinical verification for our Preecludia ™ preeclampsia rule-out LDT, and initiated validation samples analysis Work progressing well under precision medicine pharma collaboration; continued engagement with pharma for further potential partnerships Achieved Innatal 4 milestones: fetal fraction quantification & finalized probe pool design and testing; optimization phase advancing Raised $118M gross proceeds from debt/equity offering, rationalized costs; recently completed $25M private placement Initiated clinical study of DDS capsule for safety, tolerability, auto-location and accurate payload delivery in the colon

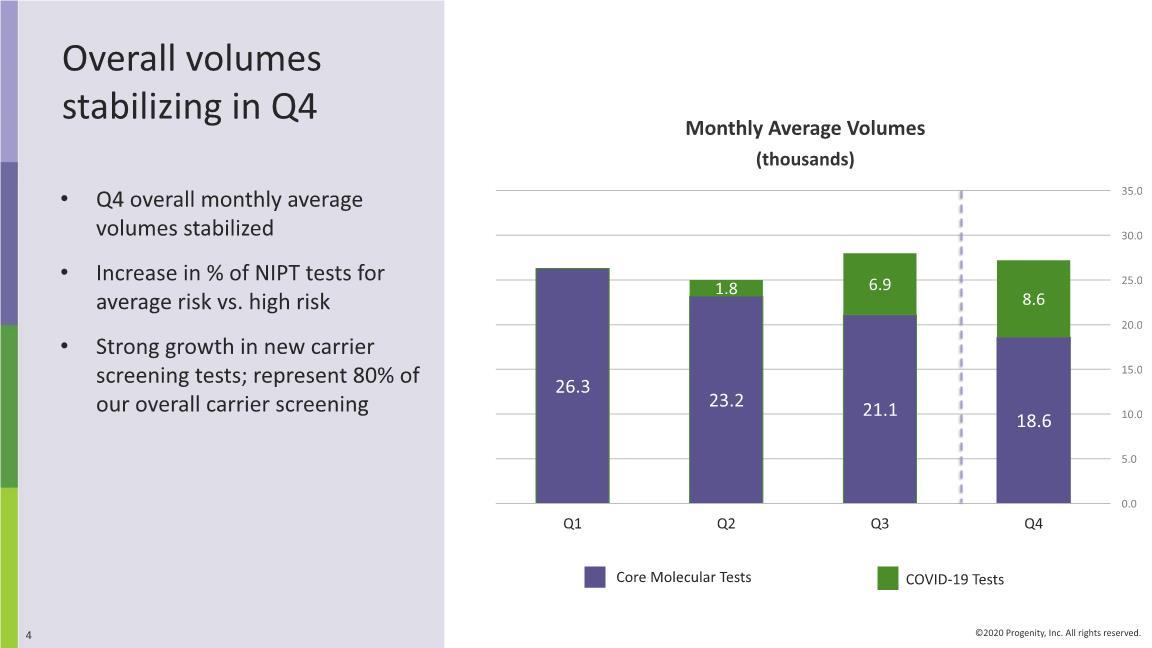

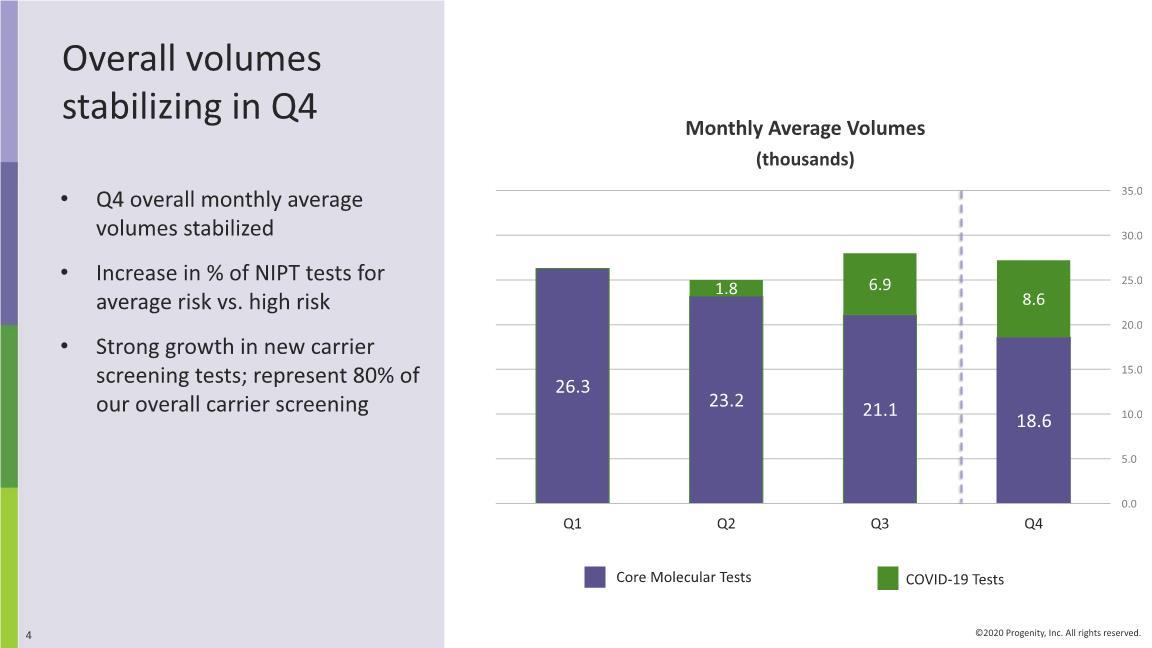

Overall volumes stabilizing in Q4 Q4 overall monthly average volumes stabilized Increase in % of NIPT tests for average risk vs. high risk Strong growth in new carrier screening tests; represent 80% of our overall carrier screening Monthly Average Volumes (thousands) COVID-19 Tests

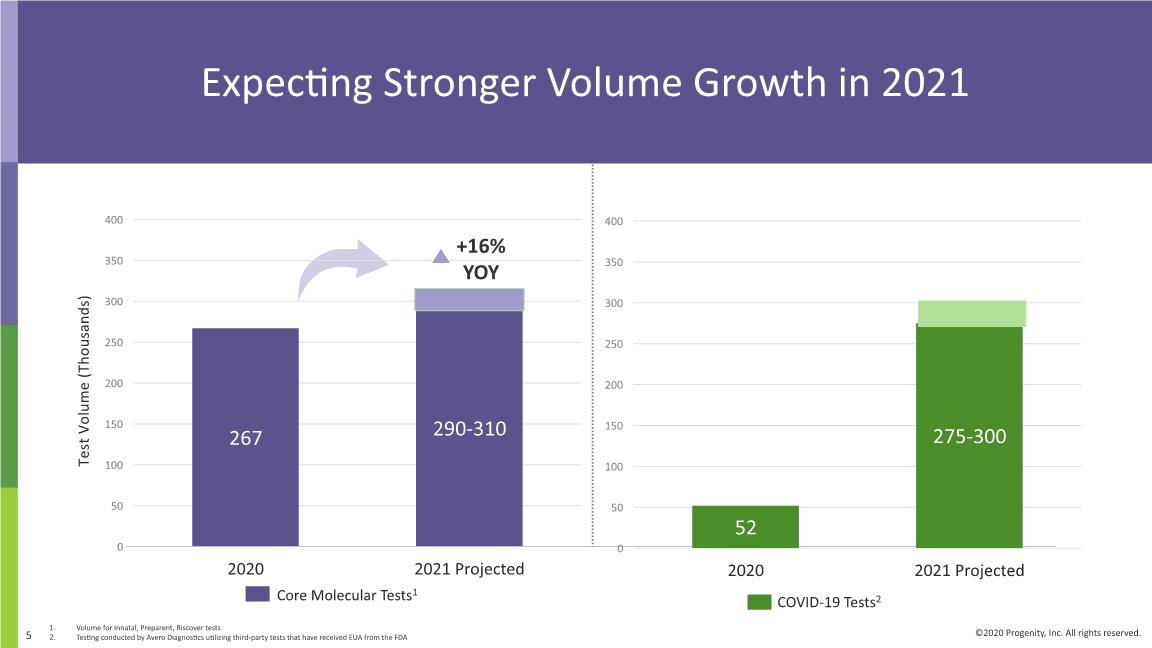

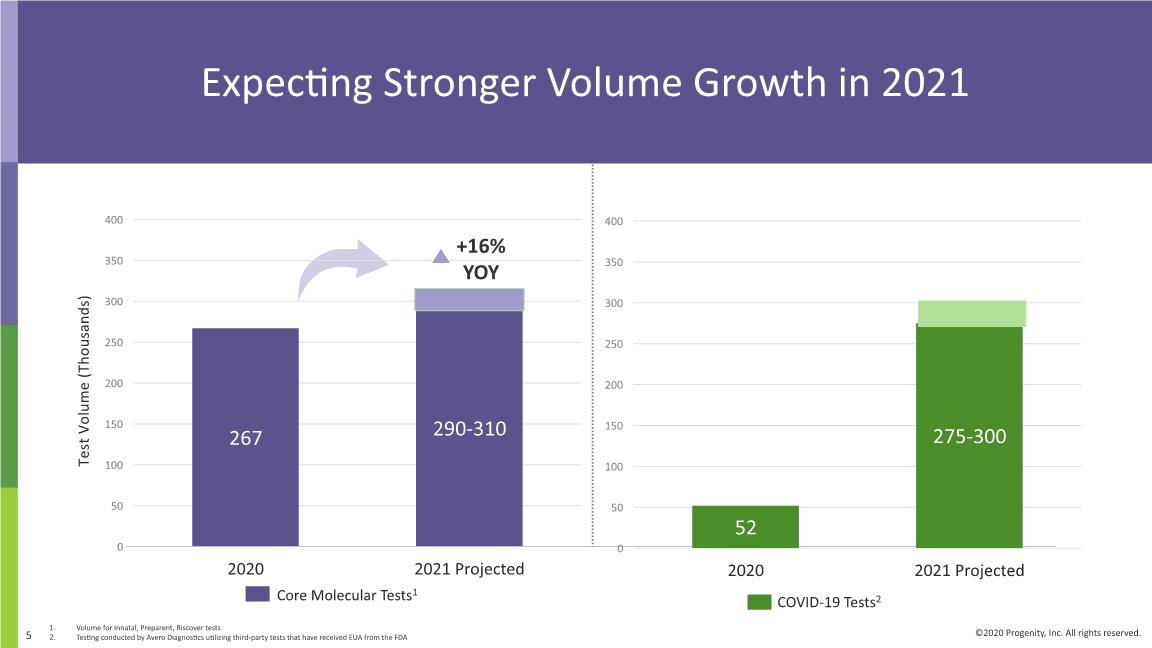

Expecting Stronger Volume Growth in 2021 Strong History of Volume Growth Test Volume (Thousands) 79 75 84 COVID-19 Tests2 Volume for Innatal, Preparent, Riscover tests Testing conducted by Avero Diagnostics utilizing third-party tests that have received EUA from the FDA

Expanding the In-Network Footprint In-Network Lives – Progenity (millions) 2019 2020 Additions + + + 2019 Added 2.5 million regional plan covered lives in Q3/Q4 Expanding government and commercial payer coverage for average risk NIPT Continuing discussions for INN contracts with national and other regional plans

R&D Pipeline Update

Preeclampsia Rule-Out Test: PreecludiaTM Innovative Test to Address Unmet Need Henderson JT, et al. Preeclampsia Screening: Evidence Report and Systematic Review for the US Preventive Services Task Force. JAMA. 2017 Apr 25;317(16):1668-1683. Ananth CV, et al. Pre-eclampsia rates in the United States, 1980-2010: age-period-cohort analysis. BMJ. 2013 Nov 7;347:f6564. https://www.sciencedirect.com/topics/medicine-and-dentistry/gestational-hypertension Center for Disease Control and Prevention. Births: Final Data for 2018 (In press). https://www.cdc.gov/nchs/nvss/births.htm Preeclampsia is the #2 CAUSE OF MATERNAL MORTALITY1 CURRENT METHODS CANNOT DIFFERENTIATE preeclampsia from other hypertensive disorders. MORE THAN 700,000 PEOPLE present with symptoms each year.2,3,4 CHRONIC HYPERTENSION GESTATIONAL HYPERTENSION PREECLAMPSIA UNMET NEED CLINICAL DILEMMA DEVELOPMENT PROGRESS $9B+ HEALTHCARE BURDEN In the US per year Verification completed Pre-validation data set with ~350 patients being analyzed Initiated validation sample testing MARKET SIGNALS Jan 2021: SMFM President’s Workshop focused on preeclampsia and the promise of biomarkers Mar 2021: Verification study abstract accepted as Late-breaking abstract for 2021 ACOG Annual Meeting in May

Innovative Single-Molecule Counting Platform: Next-Generation NIPT First Application COST EFFECTIVENESS QUALITY RESULTS Maintain premium clinical value and reliability FASTER TURNAROUND TIME Potential to set a new competitive benchmark in the market Cost effective chemistry improves COGS Q3: Achieved development milestone demonstrating potential to “quantify” fetal fraction Q4: Made critical advancement by finalizing probe pool design and testing; progressing in optimization phase 9 NOVEL, SINGLE-MOLECULE COUNTING ASSAY FOR NIPT 4 About our Platform Technology: Proprietary single molecule DNA counting assay Utilizes advanced optics with custom chemistry and molecular biology Multiple potential applications, including oncology

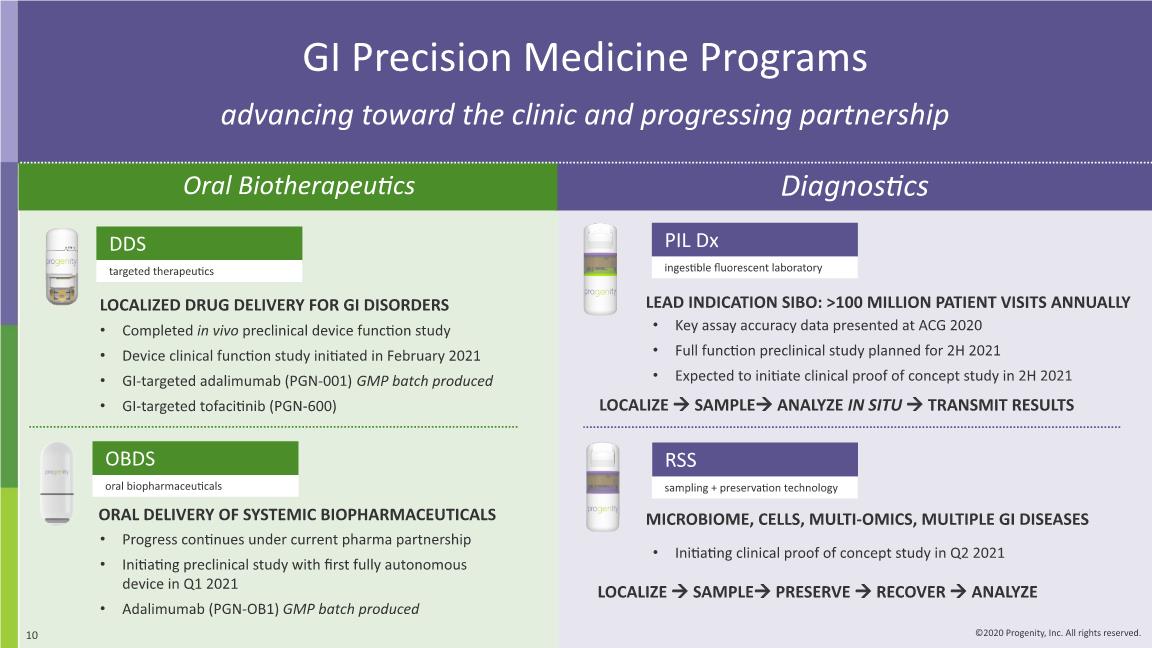

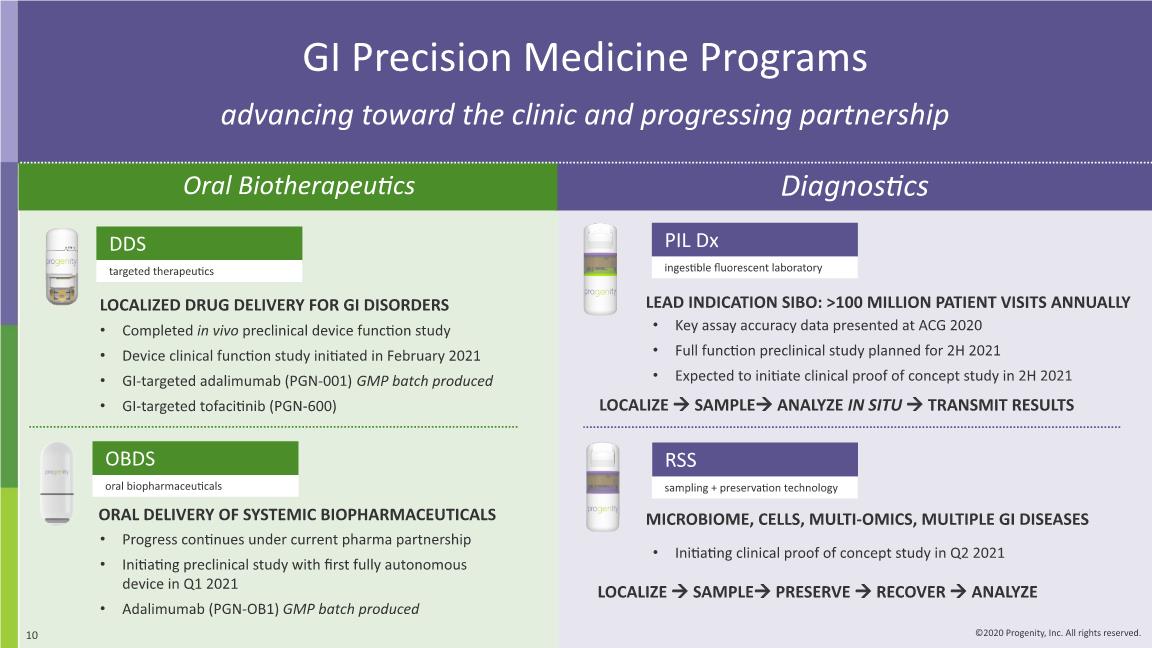

Diagnostics GI Precision Medicine Programs advancing toward the clinic and progressing partnership Oral Biotherapeutics LOCALIZE SAMPLE PRESERVE RECOVER ANALYZE LEAD INDICATION SIBO: >100 MILLION PATIENT VISITS ANNUALLY Key assay accuracy data presented at ACG 2020 Full function preclinical study planned for 2H 2021 Expected to initiate clinical proof of concept study in 2H 2021 LOCALIZE SAMPLE ANALYZE IN SITU TRANSMIT RESULTS MICROBIOME, CELLS, MULTI-OMICS, MULTIPLE GI DISEASES Initiating clinical proof of concept study in Q2 2021

Fourth Quarter Financial Results

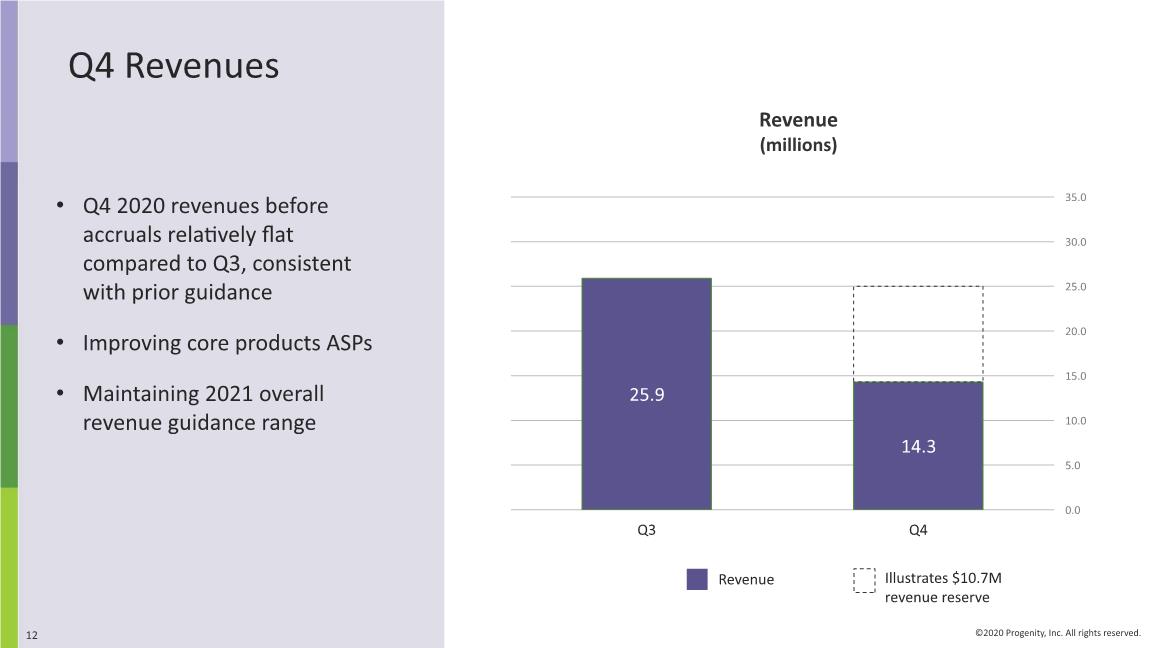

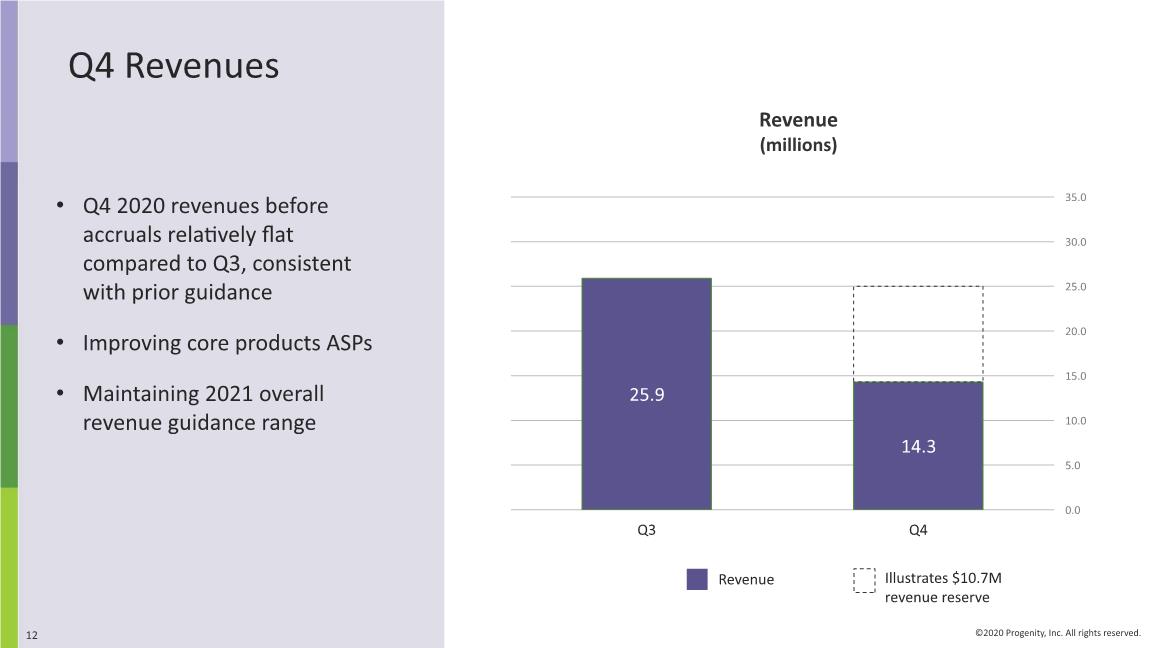

Q4 Revenues Q4 2020 revenues before accruals relatively flat compared to Q3, consistent with prior guidance Improving core products ASPs Maintaining 2021 overall revenue guidance range Revenue (millions) Illustrates $10.7M revenue reserve

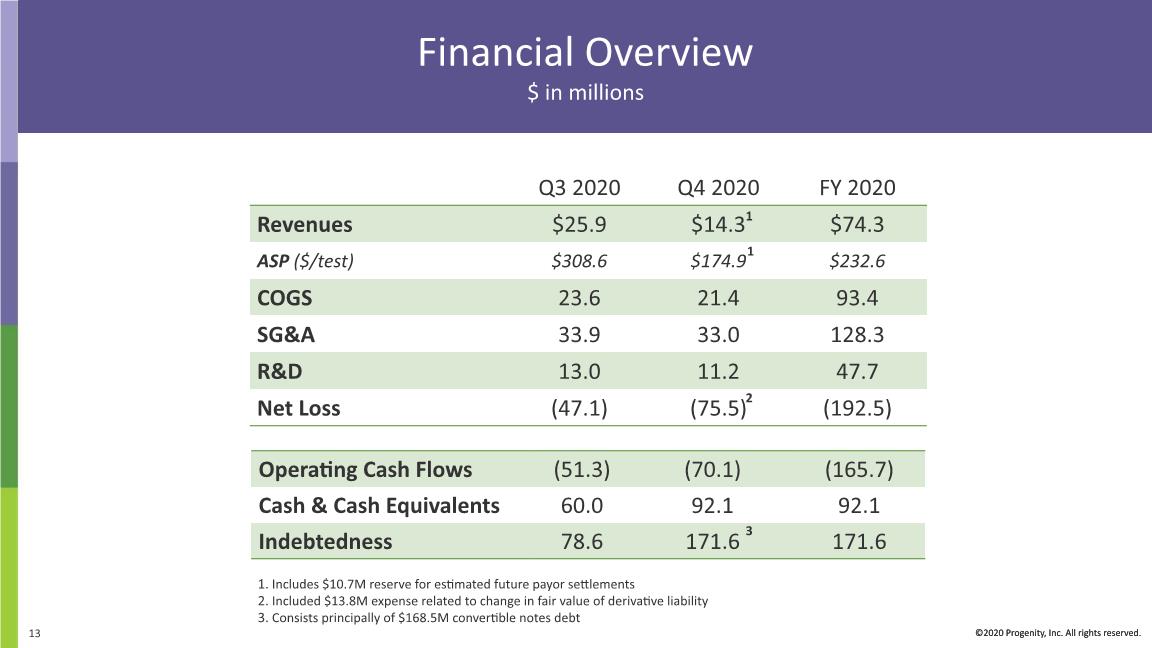

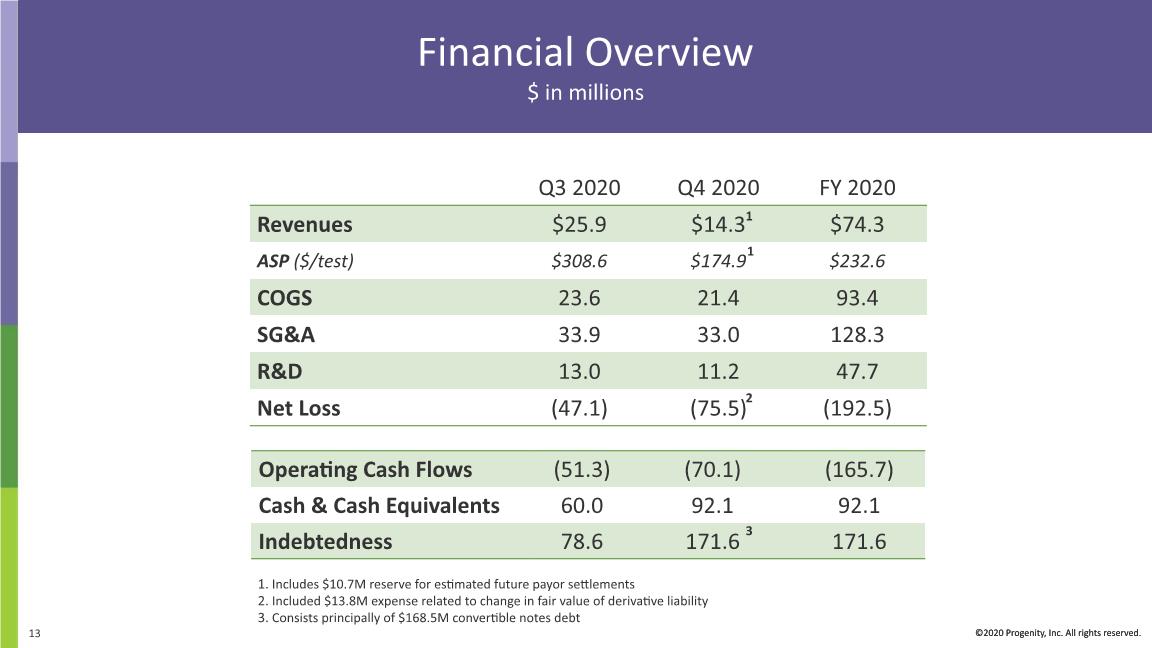

Financial Overview $ in millions ©2020 Progenity, Inc. All rights reserved. Includes $10.7M reserve for estimated future payor settlements Included $13.8M expense related to change in fair value of derivative liability Consists principally of $168.5M convertible notes debt 1 1 3 2

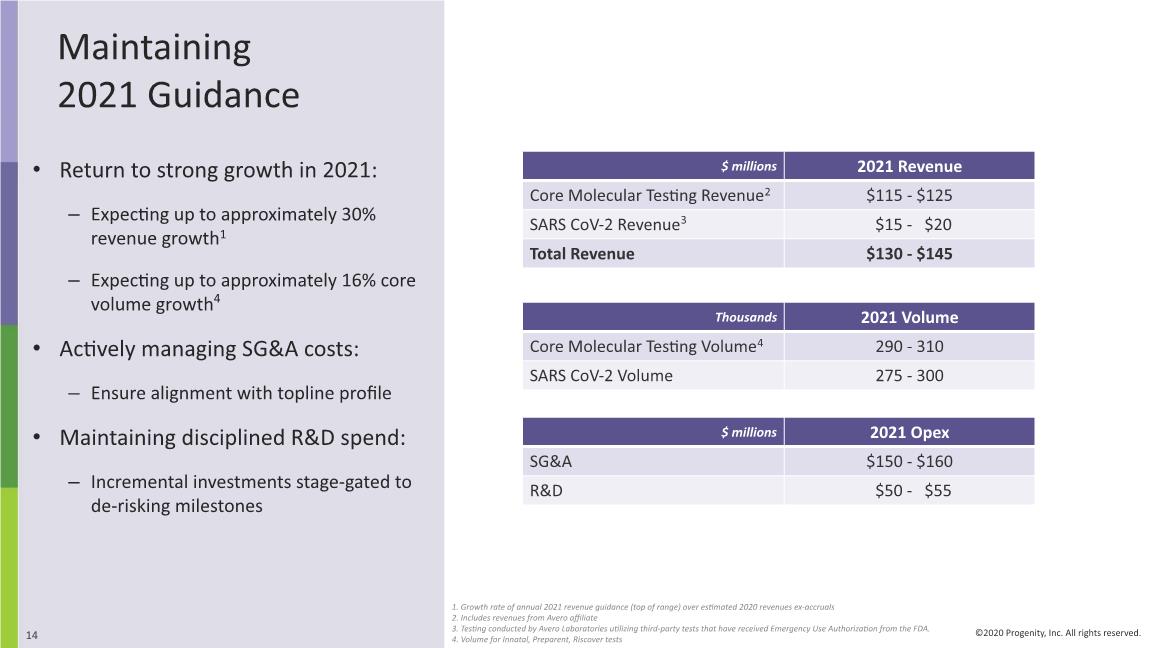

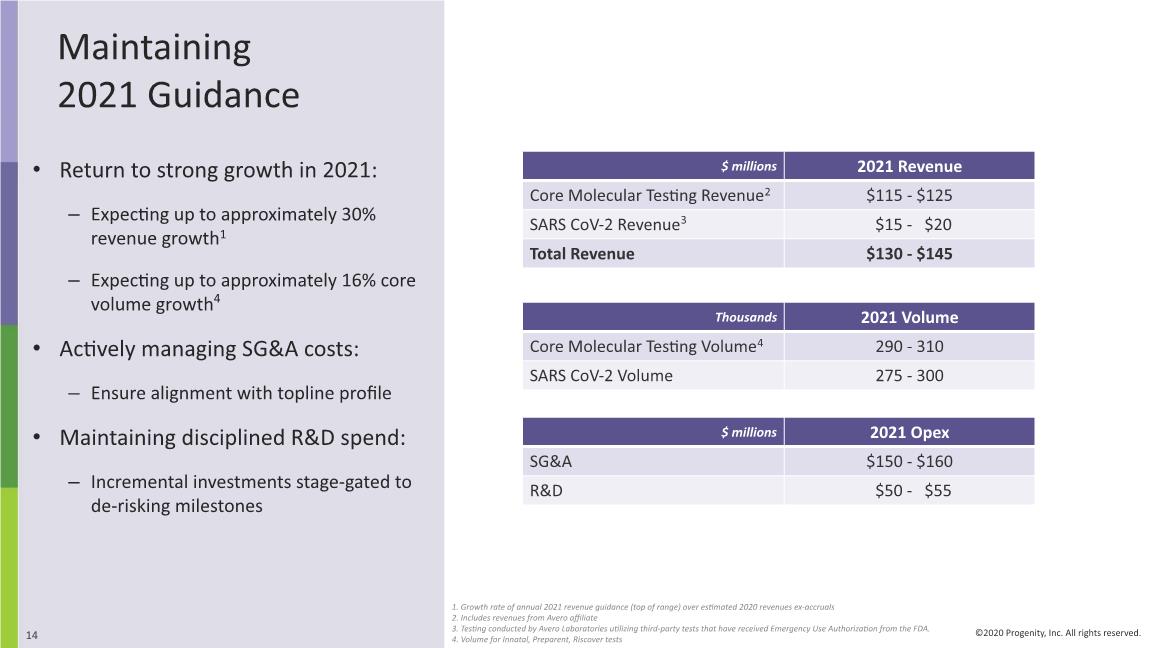

Maintaining 2021 Guidance Return to strong growth in 2021: Expecting up to approximately 30% revenue growth1 Expecting up to approximately 16% core volume growth4 Actively managing SG&A costs: Ensure alignment with topline profile Maintaining disciplined R&D spend: Incremental investments stage-gated to de-risking milestones 1. Growth rate of annual 2021 revenue guidance (top of range) over estimated 2020 revenues ex-accruals 2. Includes revenues from Avero affiliate 3. Testing conducted by Avero Laboratories utilizing third-party tests that have received Emergency Use Authorization from the FDA. 4. Volume for Innatal, Preparent, Riscover tests

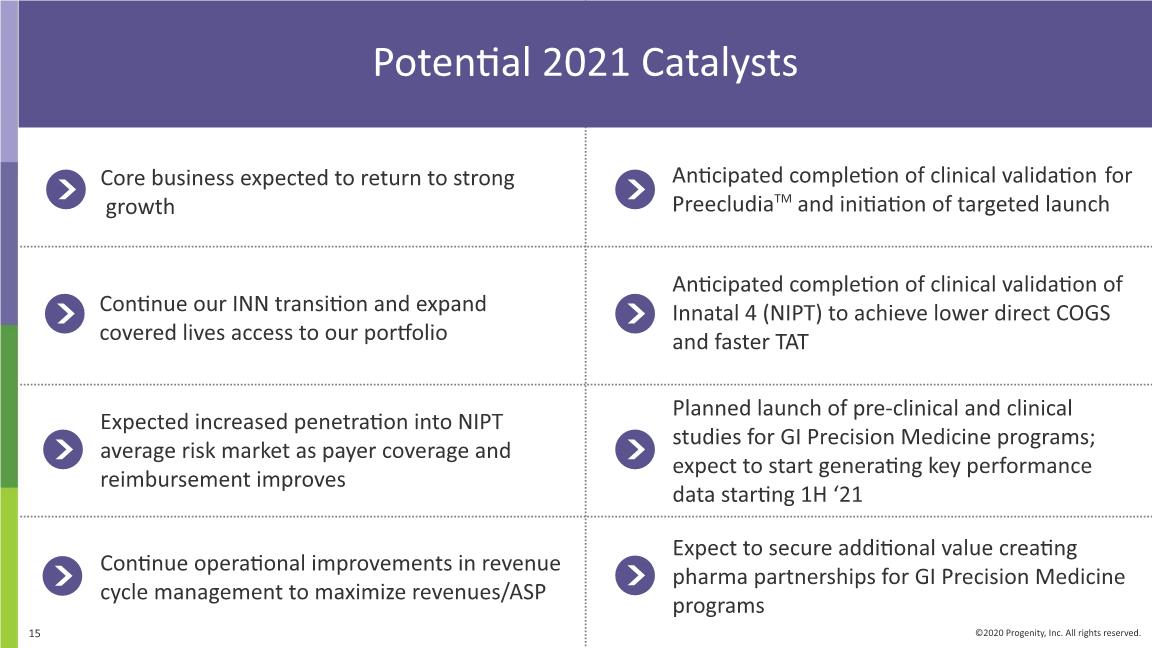

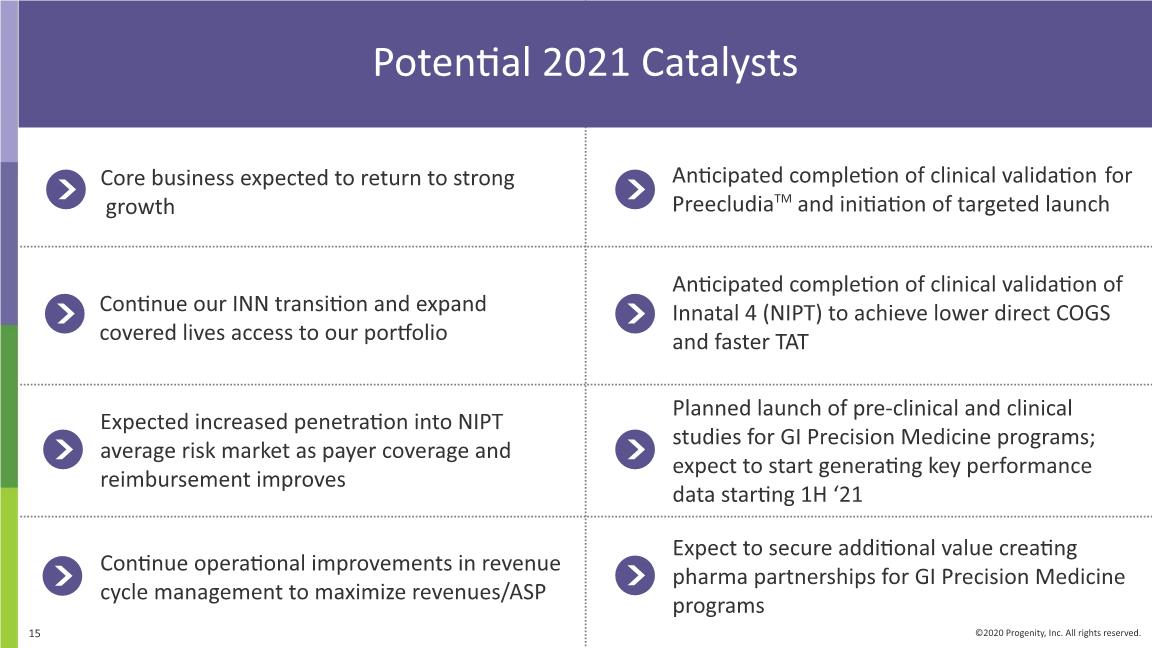

Potential 2021 Catalysts Continue our INN transition and expand covered lives access to our portfolio Expected increased penetration into NIPT average risk market as payer coverage and reimbursement improves Continue operational improvements in revenue cycle management to maximize revenues/ASP Anticipated completion of clinical validation for PreecludiaTM and initiation of targeted launch Expect to secure additional value creating pharma partnerships for GI Precision Medicine programs Anticipated completion of clinical validation of Innatal 4 (NIPT) to achieve lower direct COGS and faster TAT Core business expected to return to strong growth Planned launch of pre-clinical and clinical studies for GI Precision Medicine programs; expect to start generating key performance data starting 1H ‘21

Q&A Session