RIDER ONE RULES (1) Except as otherwise expressly set forth in the Lease, no sign, placard, picture, advertisement, name or notice shall be inscribed, displayed or printed or affixed on or to any part of the outside or inside of the Building or any part of the Premises visible from the exterior of the Premises without the prior written consent of Landlord, which consent may be withheld in Landlord’s sole discretion. Landlord shall have the right to remove, at Tenant's expense and without notice to Tenant, any such sign, placard, picture, advertisement, name or notice that has not been approved by Landlord. All approved signs or lettering on doors and walls shall be printed, painted, affixed or inscribed at the expense of Tenant by a person approved of by Landlord. If Landlord notifies Tenant in writing that Landlord objects to any curtains, blinds, shades or screens attached to or hung in or used in connection with any window or door of the Premises, such use of such curtains, blinds, shades or screens shall be promptly removed by Tenant. No awning shall be permitted on any part of the Premises. (2) No ice, drinking water, towel, or other similar services shall be provided to the Premises, except from persons authorized by Landlord and at the hours and under regulations fixed by Landlord. (3) The bulletin board or directory of the Building will be provided exclusively for the display of the name and location of tenants only and Landlord reserves the right to exclude any other names therefrom. (4) The sidewalks, halls, passages, exits, entrances, elevators and stairways shall not be obstructed or used by Tenant for any purpose other than for ingress to and egress from its Premises. The halls, passages, exits, entrances, elevators, stairways, balconies and roof are not for the use of the general public and Landlord shall in all cases retain the right to control and prevent access thereto by all persons whose presence in the judgment of Landlord shall be prejudicial to the safety, character, reputation and interests of the Building and its tenants. No tenant and no employees or invitees of any tenant shall go upon the roof of the Building. (5) Tenant shall not alter any lock or install any new or additional locks or any bolts on any interior or exterior door of the Premises without the prior written consent of Landlord. (6) The toilet rooms, toilets, urinals, wash bowls and other apparatus shall not be used for any purpose other than that for which they were constructed and no foreign substance of any kind whatsoever shall be thrown therein and the expense of any breakage, stoppage or damage resulting from the violation of this rule shall be borne by the tenant who, or whose employees or invitees, shall have caused it. (7) Tenant shall not overload the floor of the Premises or mark, drive nails, screw or drill into the partitions, woodwork or plaster or in any way deface the Premises or any part thereof (except as needed for approved Alterations). Landlord will provide Tenant, upon request, with floor load specifications for the Premises. (8) No furniture, freight or equipment of any kind shall be brought into the Building without the consent of Landlord and all moving of the same into or out of the Building shall be done at such time and in such manner as Landlord shall designate. Landlord shall have the right to prescribe the weight, size and position of all safes and other heavy equipment brought into the Building and also the times and manner of moving the same in and out of the Building. Safes or other heavy objects shall, if considered necessary by Landlord, stand on a platform of such thickness as is necessary to properly distribute the R1-1

weight. Landlord will not be responsible for loss of or damage to any such safe or property from any cause, and all damage done to the Building by moving or maintaining any such safe or other property shall be repaired at the expense of Tenant. The elevator designated for freight by Landlord shall be available for use by all tenants in the Building during the hours and pursuant to such procedures as Landlord may determine from time to time. The persons employed to move Tenant's equipment, material, furniture or other property in or out of the Building must be acceptable to Landlord. The moving company must be a locally recognized professional mover, whose primary business is the performing of relocation services, and must be fully insured. In no event shall Tenant employ any person or company whose presence may give rise to a labor or other disturbance at the Property. A certificate or other verification of such insurance must be received and approved by Landlord prior to the start of any moving operations. Insurance must be sufficient in Landlord's sole opinion, to cover all personal liability, theft or damage to the Property, including, but not limited to, floor coverings, doors, walls, elevators, stairs, foliage and landscaping. Special care must be taken to prevent damage to foliage and landscaping during adverse weather. All moving operations shall be conducted at such times and in such a manner as Landlord shall direct, and all moving shall take place during non-business hours unless Landlord agrees in writing otherwise. (9) Tenant shall not employ any person or persons other than the janitor of Landlord for the purpose of cleaning the Premises, unless otherwise agreed to by Landlord. Except with the written consent of Landlord, no person or persons other than those approved by Landlord shall be permitted to enter the Building for the purpose of cleaning the Building or the Premises. Tenant shall not cause any unnecessary labor by reason of Tenant's carelessness or indifference in the preservation of good order and cleanliness. Tenant shall have the option to provide supplemental janitorial services through a reputable vendor reasonably approved by Landlord. (10) Tenant shall not use, keep or permit to be used or kept any foul or noxious gas or substance in the Premises, or permit or suffer the Premises to be occupied or used in a manner offensive or objectionable to Landlord or other occupants of the Building by reason of noise, odors and/or vibrations, or interfere in any way with other tenants or those having business therein, nor shall any animals or birds be brought in or kept in or about the Premises or the Building. In no event shall Tenant keep, use, or permit to be used in the Premises or the Building any guns, firearm, explosive devices or ammunition. (11) No cooking shall be done or permitted by Tenant in the Premises, nor shall the Premises be used for the storage of merchandise, for washing clothes, for lodging, or for any improper, objectionable or immoral purposes. Notwithstanding the foregoing, however, Tenant may maintain and use microwave ovens and equipment for brewing coffee, tea, hot chocolate and similar beverages, provided that Tenant shall (i) prevent the emission of any food or cooking odor from leaving the Premises, (ii) be solely responsible for cleaning the areas where such equipment is located and removing food related waste from the Premises and the Building, or shall pay Landlord's standard rate for such service as an addition to cleaning services ordinarily provided, (iii) maintain and use such areas solely for Tenant's employees and business invitees, not as public facilities, and (iv) keep the Premises free of vermin and other pest infestation and shall exterminate, as needed, in a manner and through contractors reasonably approved by Landlord, preventing any emission of odors, due to extermination, from leaving the Premises. (12) Tenant shall not use or keep in the Premises or the Building any kerosene; gasoline, or inflammable or combustible fluid or material, or use any method of heating or air conditioning other than that supplied by Landlord. R1-2

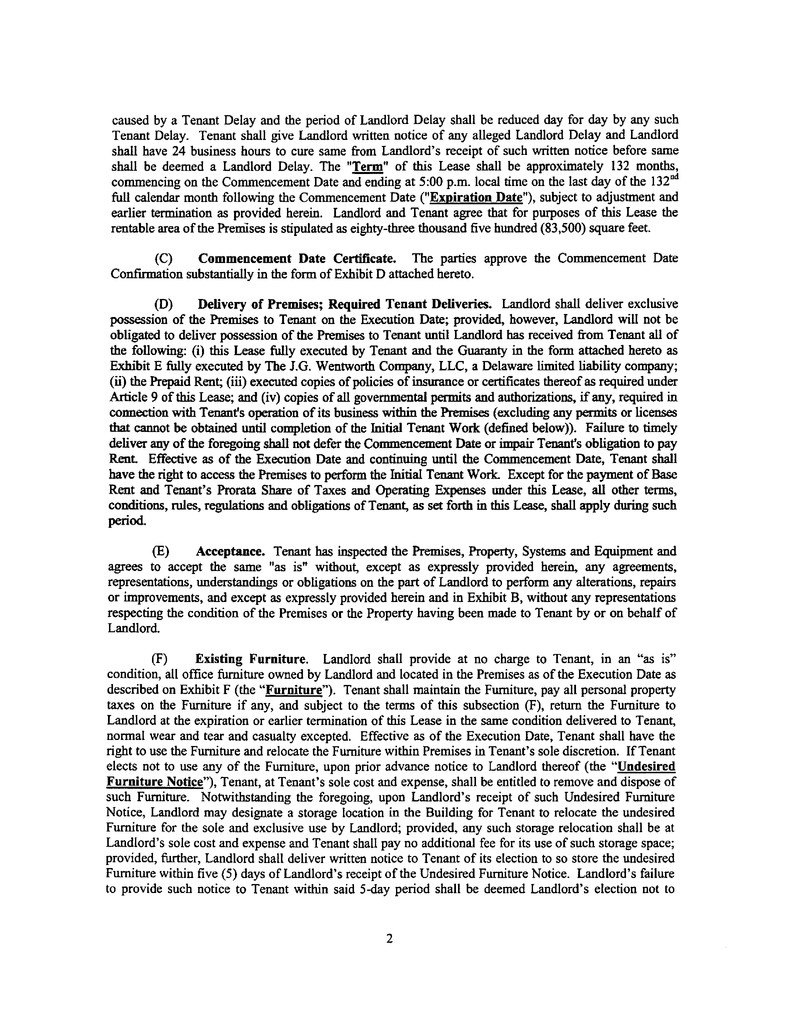

(13) Landlord will direct contractors as to where and how telephone and data wires and cabling are to be introduced into the Premises and the Building. No boring or cutting for wires or cabling will be allowed without the prior consent of Landlord. The location of telephones, call boxes and other office equipment affixed to the Premises shall be subject to the prior approval of Landlord. (14) Upon the expiration or earlier termination of the Lease, Tenant shall deliver to Landlord the keys of offices, rooms and toilet rooms which have been furnished by Landlord to Tenant and any copies of such keys which Tenant has made. In the event Tenant has lost any keys furnished by Landlord, Tenant shall pay Landlord for such keys. (15) Tenant shall not lay linoleum, tile, carpet, carpet tile, or other similar floor covering so that the same shall be affixed to the floor of the Premises, except to the extent and in the manner reasonably approved in advance by Landlord. The expense of repairing any damage resulting from a violation of this rule or removal of any floor covering shall be borne by the tenant by whom, or by whose contractors, employees or invitees, the damage shall have been caused. (16) No furniture, packages, supplies, equipment or merchandise will be received in the Building or carried up or down in the elevators, except between such hours and in such elevators as shall be designated by Landlord, which elevator usage shall be subject to the Building's customary charge therefor as established from time to time by Landlord. (17) On Saturdays, Sundays and legal holidays, and on other days between the hours of 6:00 P.M. and 8:00 A.M., access to the Building, or to the halls, corridors, elevators or stairways in the Building, or to the Premises may be refused unless the person seeking access is known to the person or employee of the Building in charge or has a pass or is properly identified. Landlord shall in no case be liable for damages for any error with regard to the admission to or exclusion from the Building of any person. In case of invasion, mob, riot, public excitement, or other commotion, Landlord reserves the right to prevent access to the Building during the continuance of the same by closing the doors or otherwise, for the safety of the tenants and protection of property in the Building. (18) Tenant shall be responsible for ensuring that the doors of the Premises are closed and securely locked before leaving the Building and must observe strict care and caution that all water faucets or water apparatus are entirely shut off before Tenant or Tenant's employees leave the Building, and that all electricity, gas or air shall likewise be carefully shut off, so as to prevent waste or damage, and for any default or carelessness Tenant shall make good all injuries sustained by other tenants or occupants of the Building or Landlord. Landlord shall not be responsible to Tenant for loss of property on the Premises, however occurring, or for any damage to the property of Tenant caused by the employees or independent contractors of Landlord or by any other person. (19) Landlord reserves the right to exclude or expel from the Building any person who, in the judgment of Landlord, is intoxicated or under the influence of liquor or drugs, or who shall in any manner do any act in violation of any of the rules and regulations of the Building. (20) The requirements of any tenant will be attended to only upon application at the office of the Building. Employees of Landlord shall not perform any work or do anything outside of their regular duties unless under special instructions from Landlord, and no employee will admit any person (tenant or otherwise) to any office without specific instructions from Landlord. (21) Subject to Tenant's right of access to the Premises in accordance with Building security procedures, Landlord reserves the right to close and keep locked all entrance and exit doors of the Building on Saturdays, Sundays and legal holidays and on other days between the hours of 6:00 P.M. and R1-3

8:00 A.M., and during such further hours as Landlord may deem advisable for the adequate protection of the Building and the property of its tenants. (22) So long as Landlord maintains and operates vending machines in the Building’s cafeteria space available for use to all tenants in the Building, then, unless otherwise agreed to in writing by Landlord, Tenant shall contract with the Building café operator for the purchase of the items sold in any vending machine operated upon the Premises. R1-4

EXHIBIT A FLOOR PLAN OF PREMISES A-1

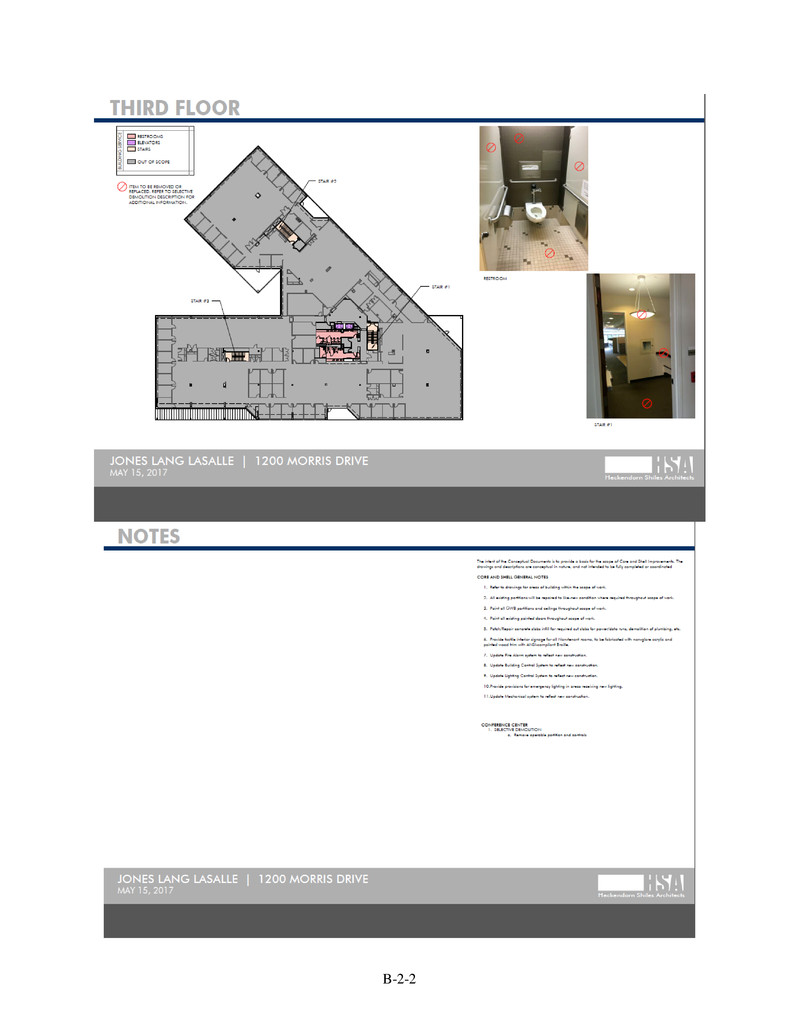

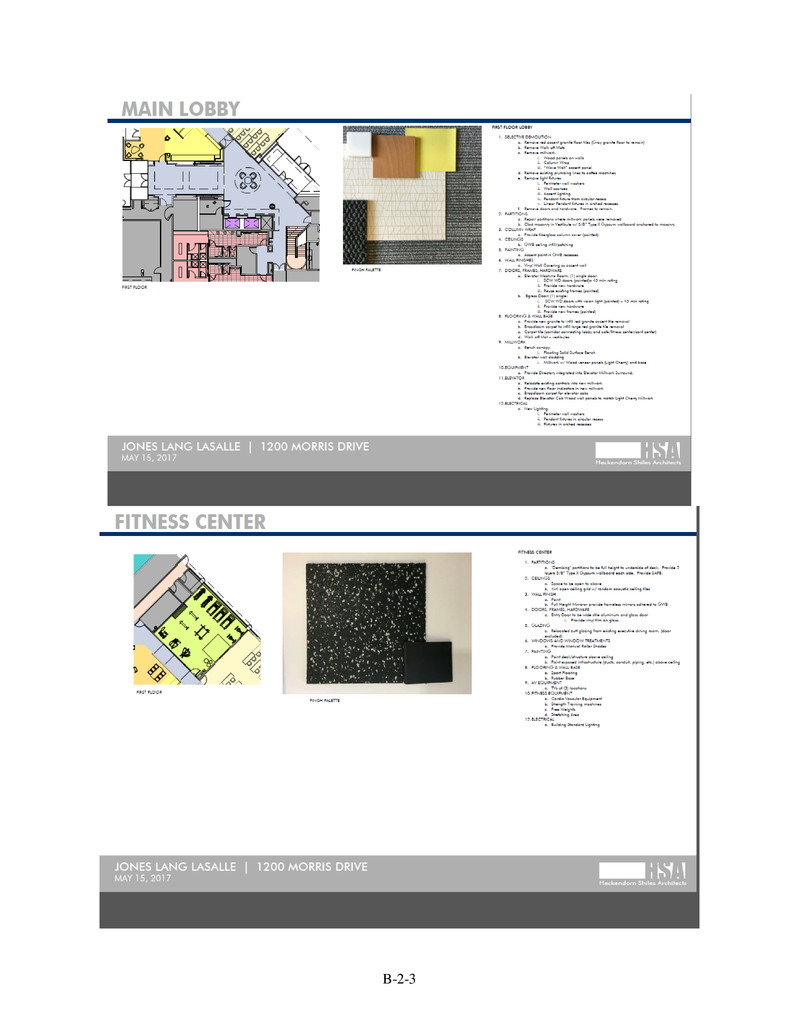

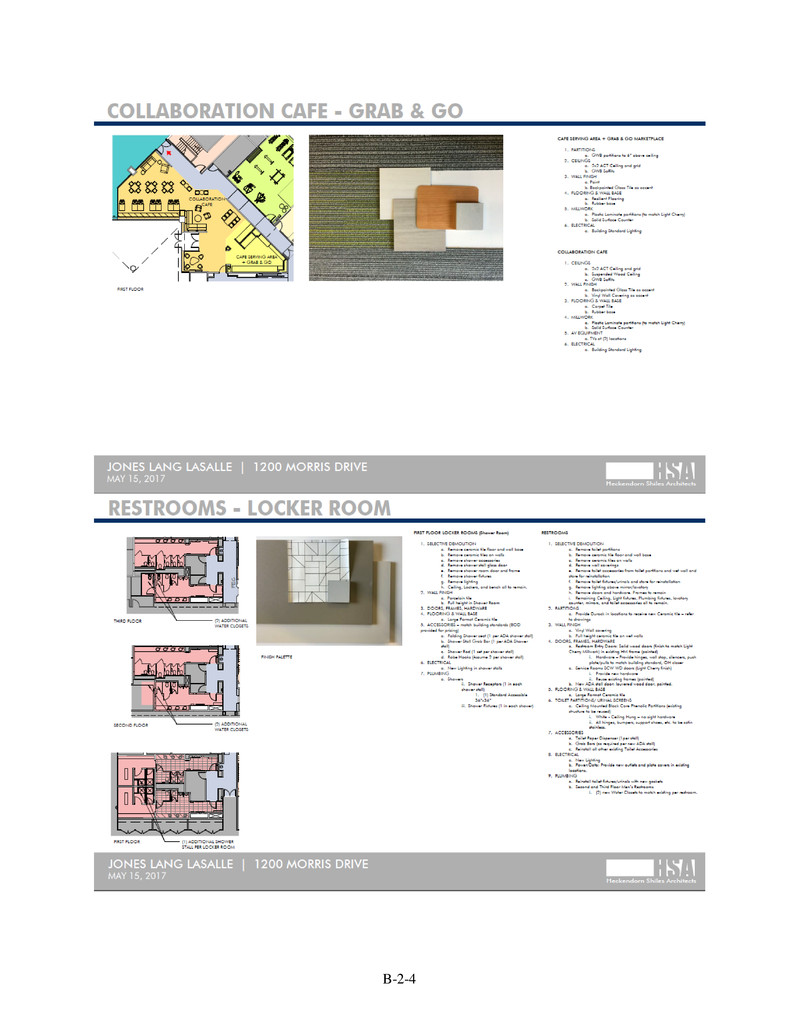

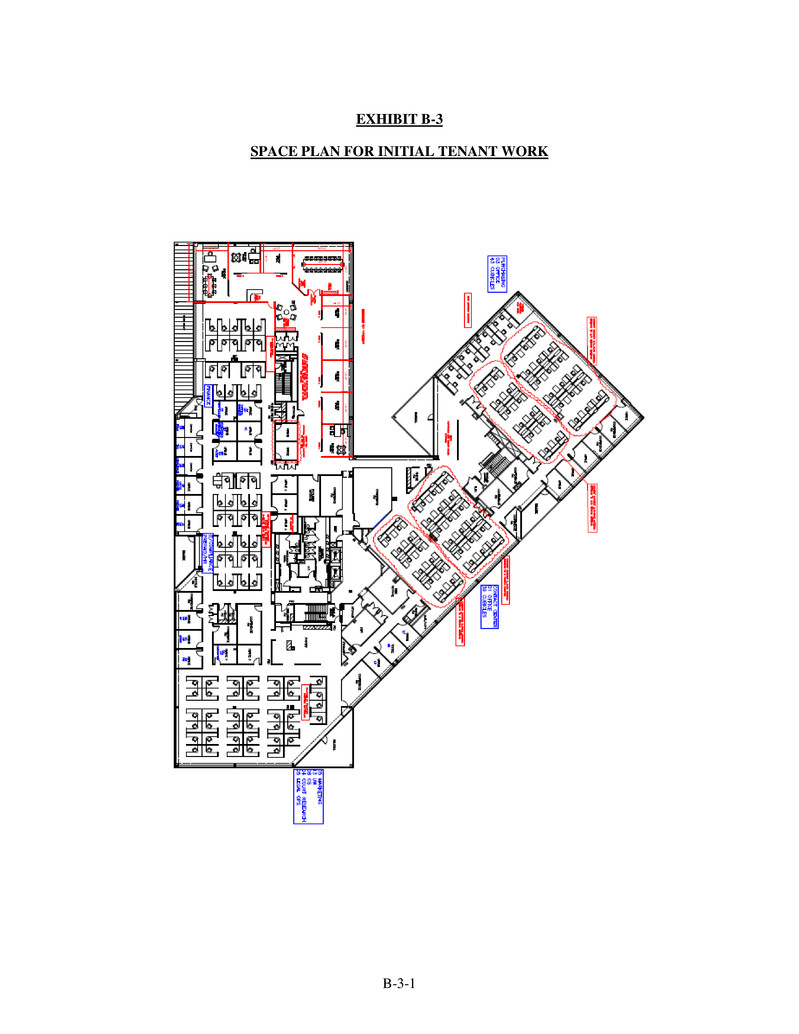

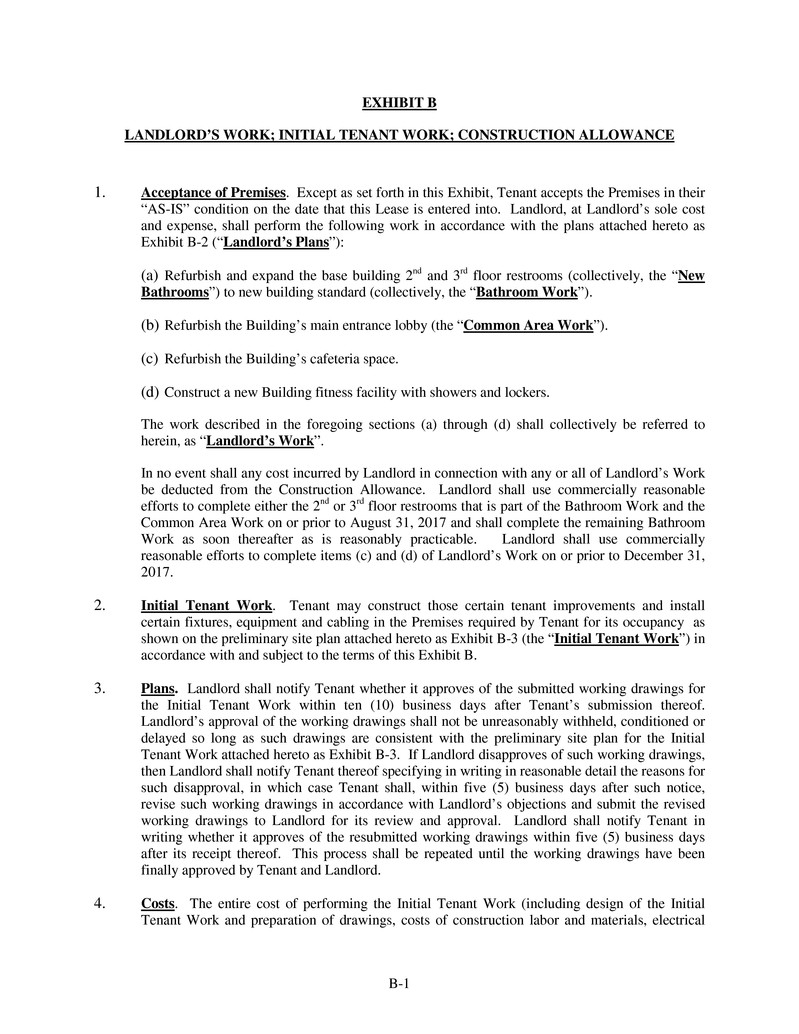

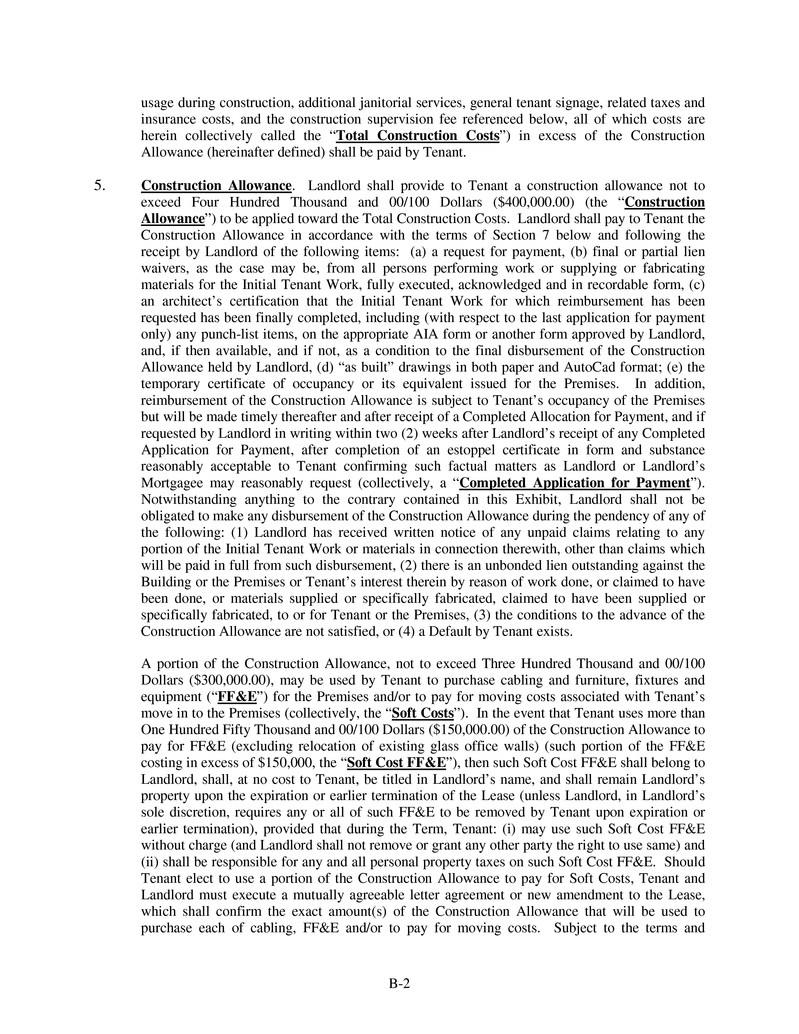

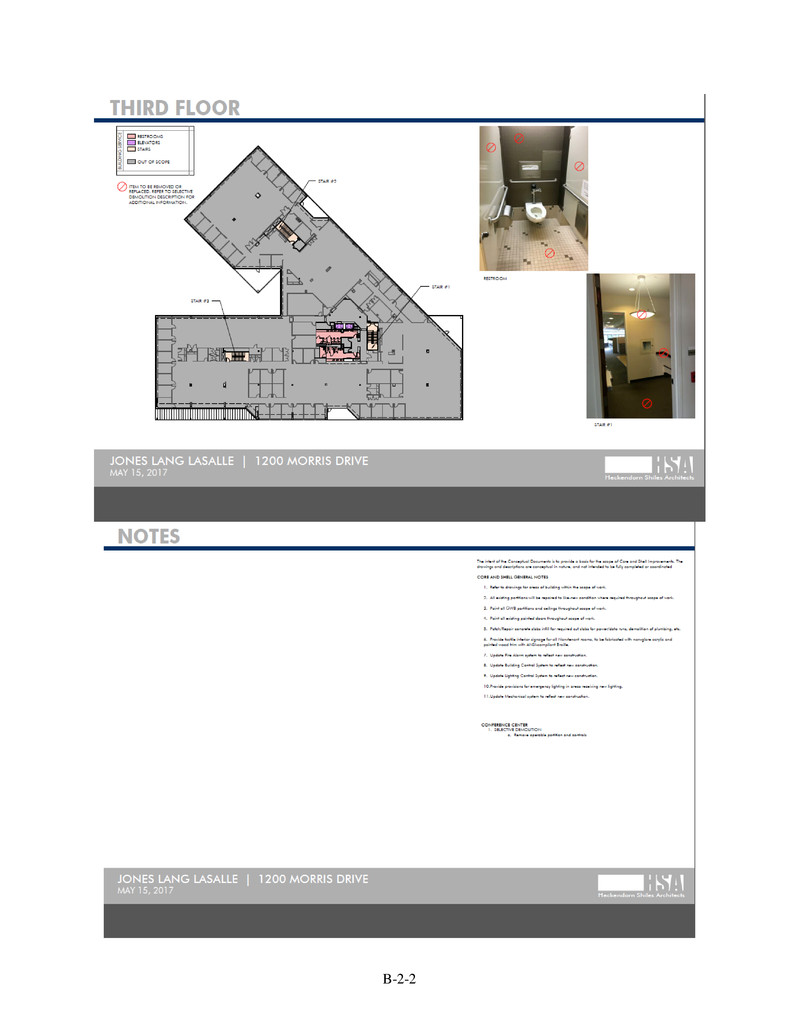

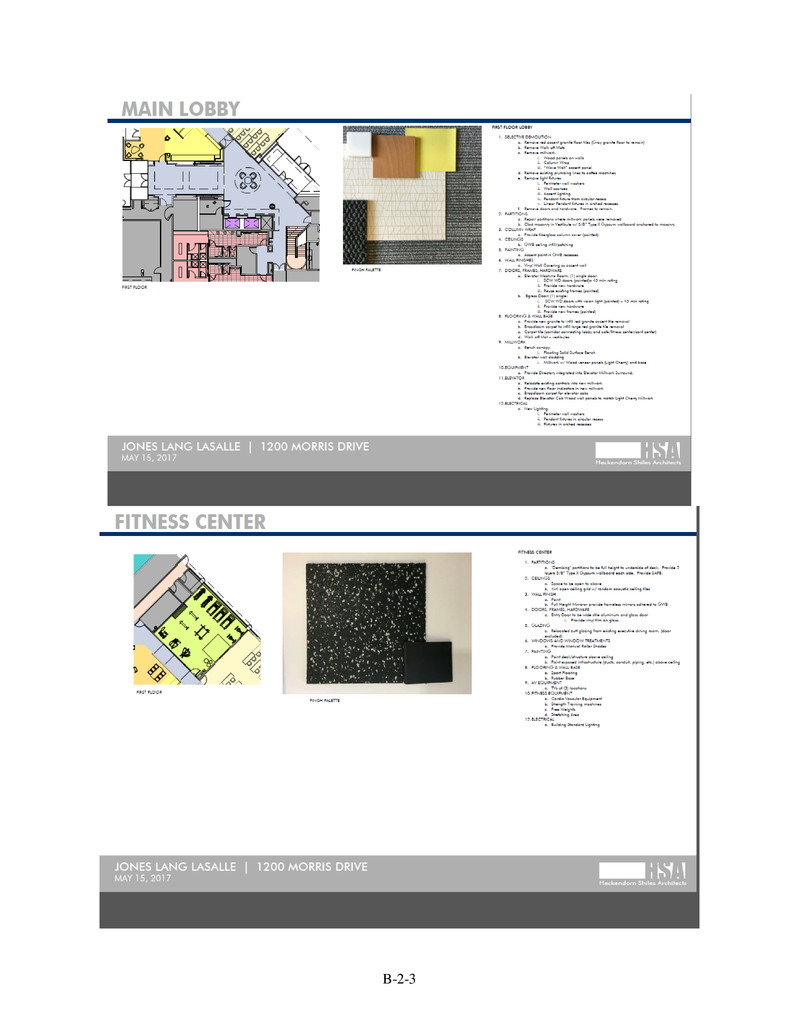

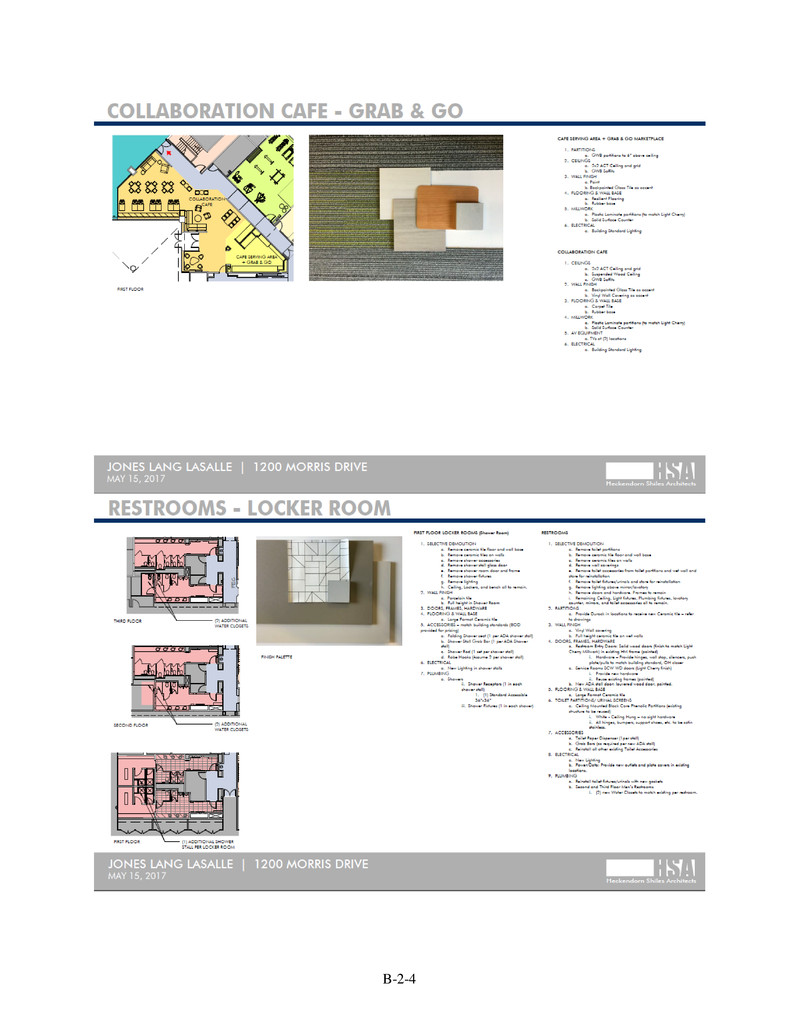

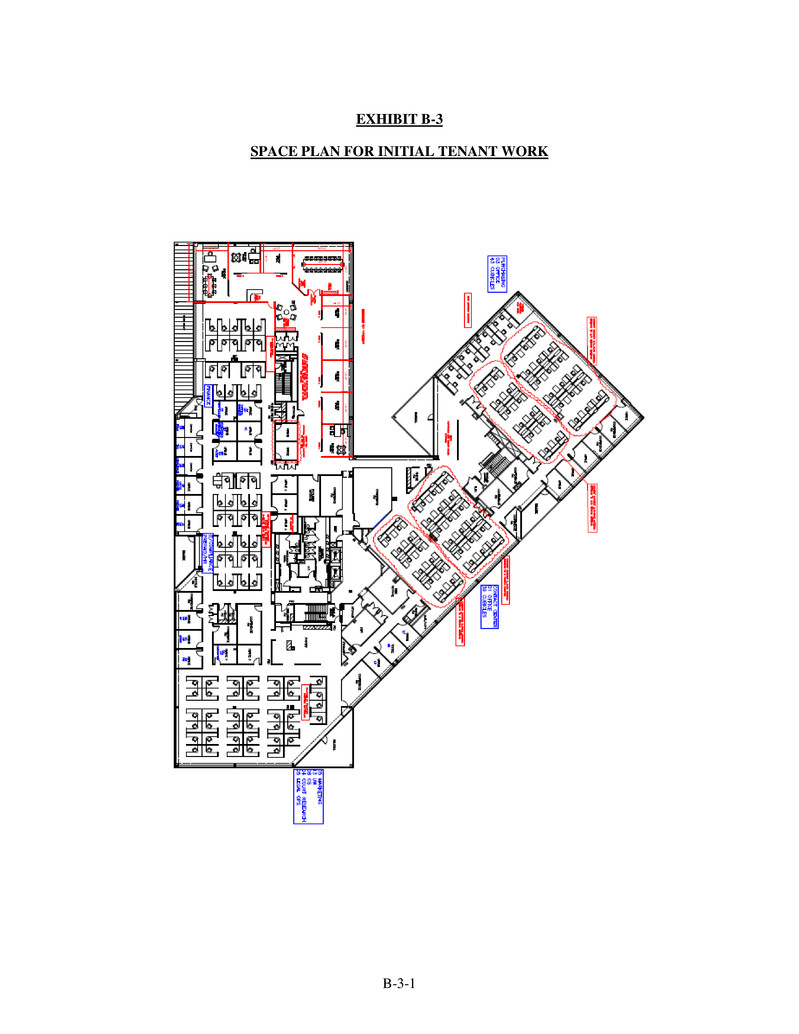

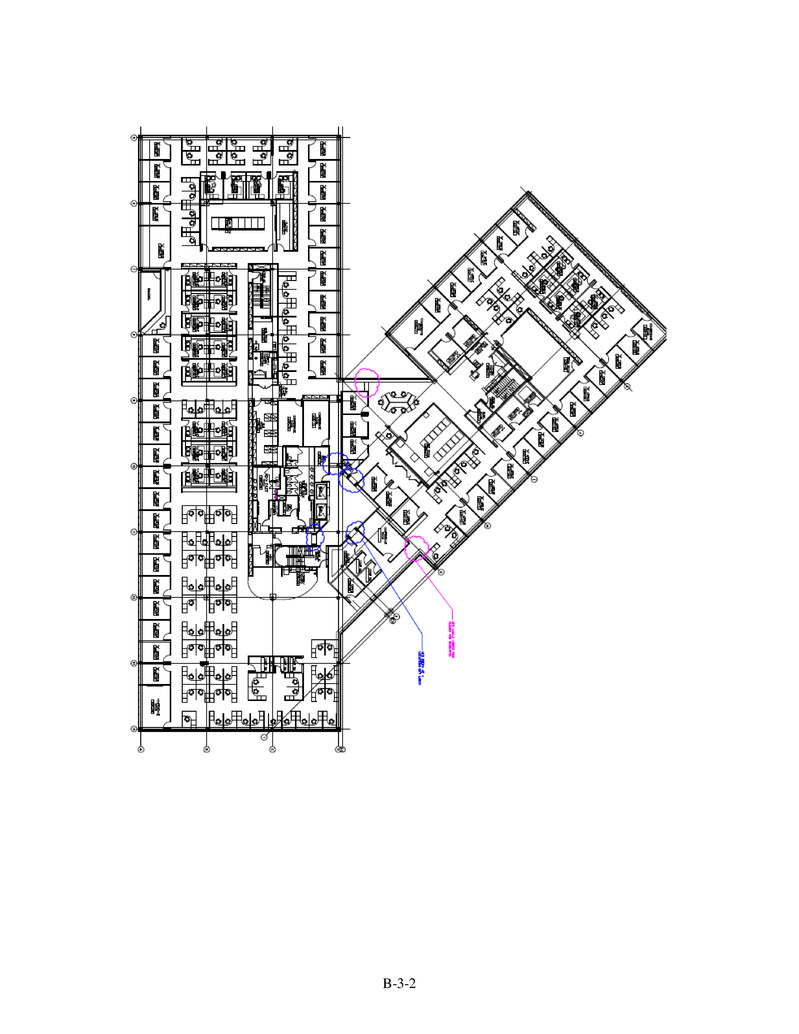

EXHIBIT B LANDLORD’S WORK; INITIAL TENANT WORK; CONSTRUCTION ALLOWANCE 1. Acceptance of Premises. Except as set forth in this Exhibit, Tenant accepts the Premises in their “AS-IS” condition on the date that this Lease is entered into. Landlord, at Landlord’s sole cost and expense, shall perform the following work in accordance with the plans attached hereto as Exhibit B-2 (“Landlord’s Plans”): (a) Refurbish and expand the base building 2nd and 3rd floor restrooms (collectively, the “New Bathrooms”) to new building standard (collectively, the “Bathroom Work”). (b) Refurbish the Building’s main entrance lobby (the “Common Area Work”). (c) Refurbish the Building’s cafeteria space. (d) Construct a new Building fitness facility with showers and lockers. The work described in the foregoing sections (a) through (d) shall collectively be referred to herein, as “Landlord’s Work”. In no event shall any cost incurred by Landlord in connection with any or all of Landlord’s Work be deducted from the Construction Allowance. Landlord shall use commercially reasonable efforts to complete either the 2nd or 3rd floor restrooms that is part of the Bathroom Work and the Common Area Work on or prior to August 31, 2017 and shall complete the remaining Bathroom Work as soon thereafter as is reasonably practicable. Landlord shall use commercially reasonable efforts to complete items (c) and (d) of Landlord’s Work on or prior to December 31, 2017. 2. Initial Tenant Work. Tenant may construct those certain tenant improvements and install certain fixtures, equipment and cabling in the Premises required by Tenant for its occupancy as shown on the preliminary site plan attached hereto as Exhibit B-3 (the “Initial Tenant Work”) in accordance with and subject to the terms of this Exhibit B. 3. Plans. Landlord shall notify Tenant whether it approves of the submitted working drawings for the Initial Tenant Work within ten (10) business days after Tenant’s submission thereof. Landlord’s approval of the working drawings shall not be unreasonably withheld, conditioned or delayed so long as such drawings are consistent with the preliminary site plan for the Initial Tenant Work attached hereto as Exhibit B-3. If Landlord disapproves of such working drawings, then Landlord shall notify Tenant thereof specifying in writing in reasonable detail the reasons for such disapproval, in which case Tenant shall, within five (5) business days after such notice, revise such working drawings in accordance with Landlord’s objections and submit the revised working drawings to Landlord for its review and approval. Landlord shall notify Tenant in writing whether it approves of the resubmitted working drawings within five (5) business days after its receipt thereof. This process shall be repeated until the working drawings have been finally approved by Tenant and Landlord. 4. Costs. The entire cost of performing the Initial Tenant Work (including design of the Initial Tenant Work and preparation of drawings, costs of construction labor and materials, electrical B-1

usage during construction, additional janitorial services, general tenant signage, related taxes and insurance costs, and the construction supervision fee referenced below, all of which costs are herein collectively called the “Total Construction Costs”) in excess of the Construction Allowance (hereinafter defined) shall be paid by Tenant. 5. Construction Allowance. Landlord shall provide to Tenant a construction allowance not to exceed Four Hundred Thousand and 00/100 Dollars ($400,000.00) (the “Construction Allowance”) to be applied toward the Total Construction Costs. Landlord shall pay to Tenant the Construction Allowance in accordance with the terms of Section 7 below and following the receipt by Landlord of the following items: (a) a request for payment, (b) final or partial lien waivers, as the case may be, from all persons performing work or supplying or fabricating materials for the Initial Tenant Work, fully executed, acknowledged and in recordable form, (c) an architect’s certification that the Initial Tenant Work for which reimbursement has been requested has been finally completed, including (with respect to the last application for payment only) any punch-list items, on the appropriate AIA form or another form approved by Landlord, and, if then available, and if not, as a condition to the final disbursement of the Construction Allowance held by Landlord, (d) “as built” drawings in both paper and AutoCad format; (e) the temporary certificate of occupancy or its equivalent issued for the Premises. In addition, reimbursement of the Construction Allowance is subject to Tenant’s occupancy of the Premises but will be made timely thereafter and after receipt of a Completed Allocation for Payment, and if requested by Landlord in writing within two (2) weeks after Landlord’s receipt of any Completed Application for Payment, after completion of an estoppel certificate in form and substance reasonably acceptable to Tenant confirming such factual matters as Landlord or Landlord’s Mortgagee may reasonably request (collectively, a “Completed Application for Payment”). Notwithstanding anything to the contrary contained in this Exhibit, Landlord shall not be obligated to make any disbursement of the Construction Allowance during the pendency of any of the following: (1) Landlord has received written notice of any unpaid claims relating to any portion of the Initial Tenant Work or materials in connection therewith, other than claims which will be paid in full from such disbursement, (2) there is an unbonded lien outstanding against the Building or the Premises or Tenant’s interest therein by reason of work done, or claimed to have been done, or materials supplied or specifically fabricated, claimed to have been supplied or specifically fabricated, to or for Tenant or the Premises, (3) the conditions to the advance of the Construction Allowance are not satisfied, or (4) a Default by Tenant exists. A portion of the Construction Allowance, not to exceed Three Hundred Thousand and 00/100 Dollars ($300,000.00), may be used by Tenant to purchase cabling and furniture, fixtures and equipment (“FF&E”) for the Premises and/or to pay for moving costs associated with Tenant’s move in to the Premises (collectively, the “Soft Costs”). In the event that Tenant uses more than One Hundred Fifty Thousand and 00/100 Dollars ($150,000.00) of the Construction Allowance to pay for FF&E (excluding relocation of existing glass office walls) (such portion of the FF&E costing in excess of $150,000, the “Soft Cost FF&E”), then such Soft Cost FF&E shall belong to Landlord, shall, at no cost to Tenant, be titled in Landlord’s name, and shall remain Landlord’s property upon the expiration or earlier termination of the Lease (unless Landlord, in Landlord’s sole discretion, requires any or all of such FF&E to be removed by Tenant upon expiration or earlier termination), provided that during the Term, Tenant: (i) may use such Soft Cost FF&E without charge (and Landlord shall not remove or grant any other party the right to use same) and (ii) shall be responsible for any and all personal property taxes on such Soft Cost FF&E. Should Tenant elect to use a portion of the Construction Allowance to pay for Soft Costs, Tenant and Landlord must execute a mutually agreeable letter agreement or new amendment to the Lease, which shall confirm the exact amount(s) of the Construction Allowance that will be used to purchase each of cabling, FF&E and/or to pay for moving costs. Subject to the terms and B-2

conditions of Article 8, Tenant be obligated to repair, replace or restore the Soft Cost FF&E in the event of any damage thereto, including, without limitation, casualty or condemnation and (z) Tenant’s obligation to surrender the Soft Cost FF&E to Landlord at the expiration or earlier termination of this Lease shall be subject to reasonable wear and tear. Provided no Default exists, Landlord shall pay for the Soft Costs in accordance with Section 7 below. 6. Additional Construction Allowance. The amount of the Construction Allowance shall be increased by an additional Two Hundred Thousand and 00/100 Dollars ($200,000.00) (the “Additional Construction Allowance”) if and when the Stabilization Event (as defined in Section 7 below) is satisfied. In such event, Landlord and Tenant shall execute an amendment to this Lease confirming the new increased amount of the Construction Allowance. All of the other terms and conditions applicable to the disbursement of the Construction Allowance provided for in Section 5 above shall apply to the disbursement of the Additional Construction Allowance. Notwithstanding anything herein to the contrary, if the total amount of the Construction Allowance and/or the Additional Construction Allowance exceeds the total cost of Initial Tenant Work (such excess, the “Excess Allowance”), then Landlord agrees that, upon Tenant’s written request, Tenant shall have the right to have any such Excess Allowance credited towards the monthly installment(s) of Base Rent becoming due hereunder (until such Excess Allowance available for such credit is exhausted) commencing in the first month subsequent to Substantial Completion of the Initial Tenant Work that a monthly installment of Base Rent becomes due. In the event Tenant desires any such credit, Tenant shall notify Landlord of the amounts that Tenant wants credited within ninety (90) days following Substantial Completion of the Initial Tenant Work. Notwithstanding anything provided herein, in no event shall such credit of Base Rent exceed One Hundred Thousand and 00/100 Dollars ($100,000.00). 7. Payment of Construction Allowance. No advance of the Construction Allowance shall be made by Landlord until Tenant has first paid from its own funds (and provided reasonable evidence thereof to Landlord) the amount of the Construction Allowance sought for reimbursement. Tenant shall promptly pay all contractors, vendors and suppliers as work is performed rather than waiting for Landlord to disburse the Construction Allowance. Provided Tenant has satisfied all of the conditions in Section 5 above, this Lease is in effect and Tenant is not in Default, Landlord shall reimburse Tenant for the Total Construction Costs and/or the Soft Costs from the Construction Allowance as follows: fifty percent (50%) if and when The J.G. Wentworth Company, a Delaware corporation and its subsidiaries, satisfies all of the conditions set forth on Exhibit B-1 (collectively, the “Stabilization Event”) and fifty percent (50%) upon Tenant evidencing to Landlord’s reasonable satisfaction a Term Loan debt reduction of The J.G. Wentworth Company, a Delaware corporation and its subsidiaries, from $449,000,000 to $275,000,000 or less (the “Debt Reduction Event”). If by the first anniversary of the Commencement Date both of the Stabilization Event and Debt Reduction Event have not occurred, but all of the other conditions to disbursement of the Construction Allowance are met, Landlord shall disburse ten percent (10%) of the Construction Allowance on each anniversary of the Commencement Date, unless sooner paid upon achievement of the Stabilization Event and Debt Reduction Event. Landlord shall not be required to disburse more than the total amount of the Construction Allowance then actually expended by Tenant. EXHIBIT B-1 STABILIZATION EVENTS B-3

The Stabilization Event is defined as (1) Debt to EBITDA less than or equal to 6.0 in two consecutive quarters at any point after the Commencement Date and (2) no Debt maturities greater than $50M in forward 36 month period beyond the current maturity of February 2019. Debt = Term Loan Debt (or similar replacement debt) as publicly reported, referenced in the Term Loan Payable Footnote of the J. G. Wentworth Company’s financial statements . This Debt maturity is specific to the Term Loan Debt (or similar replacement debt). EBITDA = Adjusted EBITDA as publicly reported on a historical basis according to the Term Loan Agreement referenced in the Business Segments Section of the 10-Q Footnote 22. B-1-2

EXHIBIT B-2 LANDLORD’S PLANS B-2-1

B-2-2

B-2-3

B-2-4

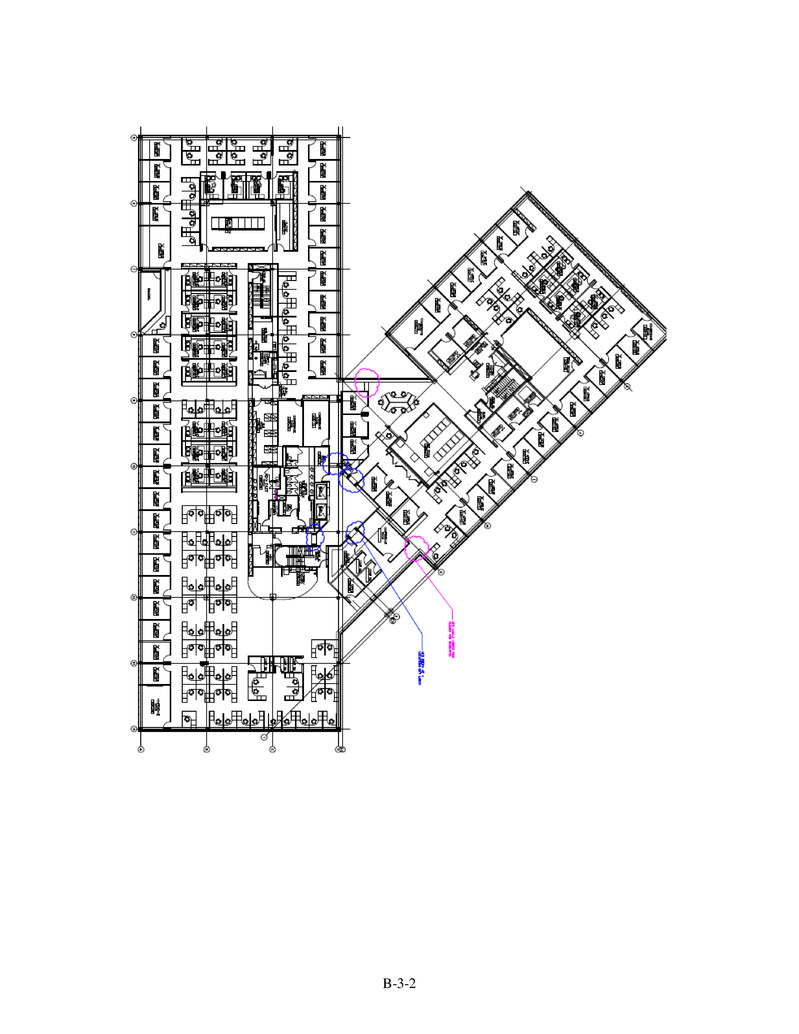

EXHIBIT B-3 SPACE PLAN FOR INITIAL TENANT WORK B-3-1

B-3-2

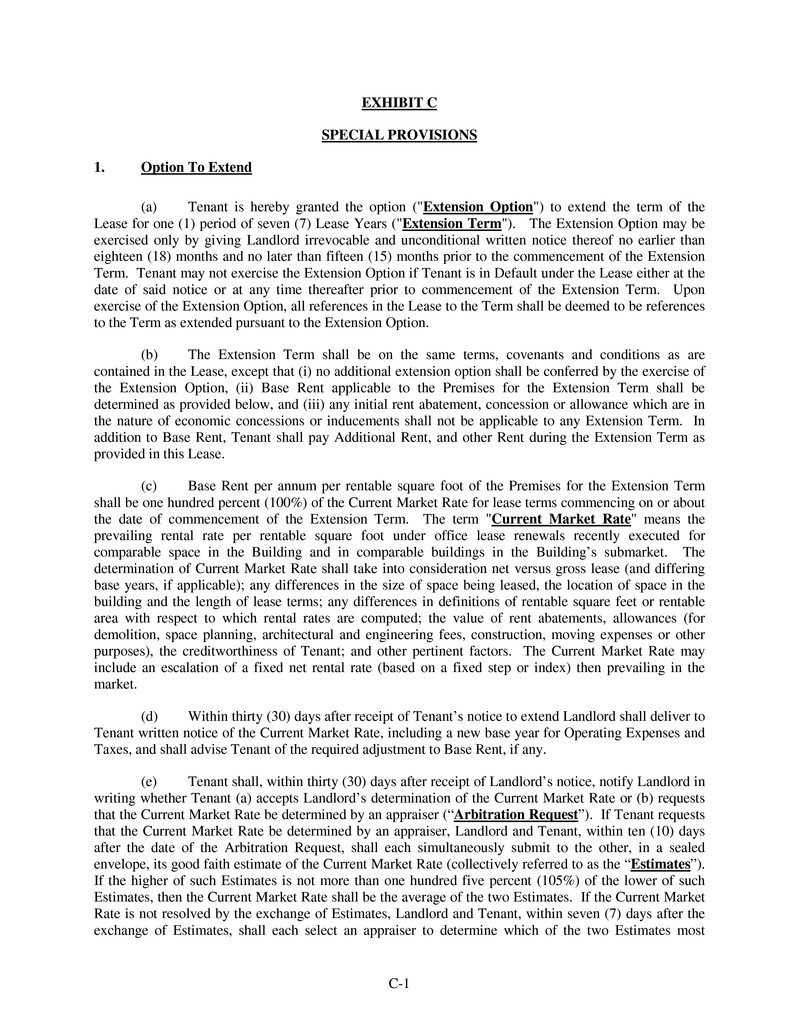

EXHIBIT C SPECIAL PROVISIONS 1. Option To Extend (a) Tenant is hereby granted the option ("Extension Option") to extend the term of the Lease for one (1) period of seven (7) Lease Years ("Extension Term"). The Extension Option may be exercised only by giving Landlord irrevocable and unconditional written notice thereof no earlier than eighteen (18) months and no later than fifteen (15) months prior to the commencement of the Extension Term. Tenant may not exercise the Extension Option if Tenant is in Default under the Lease either at the date of said notice or at any time thereafter prior to commencement of the Extension Term. Upon exercise of the Extension Option, all references in the Lease to the Term shall be deemed to be references to the Term as extended pursuant to the Extension Option. (b) The Extension Term shall be on the same terms, covenants and conditions as are contained in the Lease, except that (i) no additional extension option shall be conferred by the exercise of the Extension Option, (ii) Base Rent applicable to the Premises for the Extension Term shall be determined as provided below, and (iii) any initial rent abatement, concession or allowance which are in the nature of economic concessions or inducements shall not be applicable to any Extension Term. In addition to Base Rent, Tenant shall pay Additional Rent, and other Rent during the Extension Term as provided in this Lease. (c) Base Rent per annum per rentable square foot of the Premises for the Extension Term shall be one hundred percent (100%) of the Current Market Rate for lease terms commencing on or about the date of commencement of the Extension Term. The term "Current Market Rate" means the prevailing rental rate per rentable square foot under office lease renewals recently executed for comparable space in the Building and in comparable buildings in the Building’s submarket. The determination of Current Market Rate shall take into consideration net versus gross lease (and differing base years, if applicable); any differences in the size of space being leased, the location of space in the building and the length of lease terms; any differences in definitions of rentable square feet or rentable area with respect to which rental rates are computed; the value of rent abatements, allowances (for demolition, space planning, architectural and engineering fees, construction, moving expenses or other purposes), the creditworthiness of Tenant; and other pertinent factors. The Current Market Rate may include an escalation of a fixed net rental rate (based on a fixed step or index) then prevailing in the market. (d) Within thirty (30) days after receipt of Tenant’s notice to extend Landlord shall deliver to Tenant written notice of the Current Market Rate, including a new base year for Operating Expenses and Taxes, and shall advise Tenant of the required adjustment to Base Rent, if any. (e) Tenant shall, within thirty (30) days after receipt of Landlord’s notice, notify Landlord in writing whether Tenant (a) accepts Landlord’s determination of the Current Market Rate or (b) requests that the Current Market Rate be determined by an appraiser (“Arbitration Request”). If Tenant requests that the Current Market Rate be determined by an appraiser, Landlord and Tenant, within ten (10) days after the date of the Arbitration Request, shall each simultaneously submit to the other, in a sealed envelope, its good faith estimate of the Current Market Rate (collectively referred to as the “Estimates”). If the higher of such Estimates is not more than one hundred five percent (105%) of the lower of such Estimates, then the Current Market Rate shall be the average of the two Estimates. If the Current Market Rate is not resolved by the exchange of Estimates, Landlord and Tenant, within seven (7) days after the exchange of Estimates, shall each select an appraiser to determine which of the two Estimates most C-1

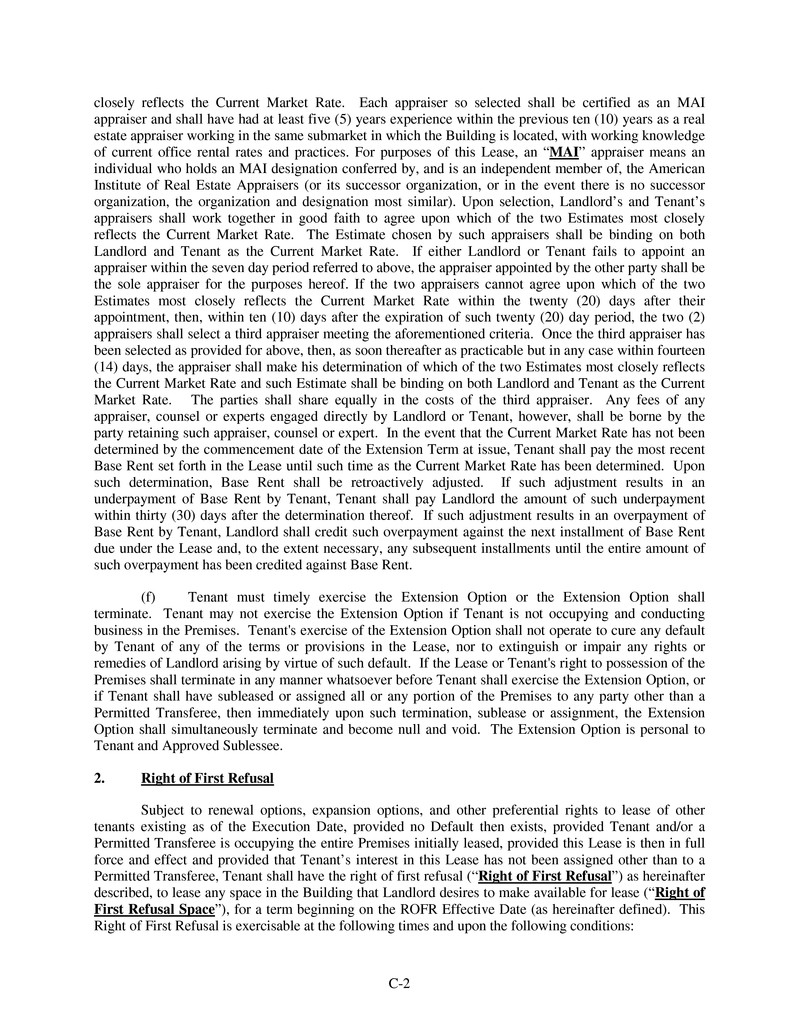

closely reflects the Current Market Rate. Each appraiser so selected shall be certified as an MAI appraiser and shall have had at least five (5) years experience within the previous ten (10) years as a real estate appraiser working in the same submarket in which the Building is located, with working knowledge of current office rental rates and practices. For purposes of this Lease, an “MAI” appraiser means an individual who holds an MAI designation conferred by, and is an independent member of, the American Institute of Real Estate Appraisers (or its successor organization, or in the event there is no successor organization, the organization and designation most similar). Upon selection, Landlord’s and Tenant’s appraisers shall work together in good faith to agree upon which of the two Estimates most closely reflects the Current Market Rate. The Estimate chosen by such appraisers shall be binding on both Landlord and Tenant as the Current Market Rate. If either Landlord or Tenant fails to appoint an appraiser within the seven day period referred to above, the appraiser appointed by the other party shall be the sole appraiser for the purposes hereof. If the two appraisers cannot agree upon which of the two Estimates most closely reflects the Current Market Rate within the twenty (20) days after their appointment, then, within ten (10) days after the expiration of such twenty (20) day period, the two (2) appraisers shall select a third appraiser meeting the aforementioned criteria. Once the third appraiser has been selected as provided for above, then, as soon thereafter as practicable but in any case within fourteen (14) days, the appraiser shall make his determination of which of the two Estimates most closely reflects the Current Market Rate and such Estimate shall be binding on both Landlord and Tenant as the Current Market Rate. The parties shall share equally in the costs of the third appraiser. Any fees of any appraiser, counsel or experts engaged directly by Landlord or Tenant, however, shall be borne by the party retaining such appraiser, counsel or expert. In the event that the Current Market Rate has not been determined by the commencement date of the Extension Term at issue, Tenant shall pay the most recent Base Rent set forth in the Lease until such time as the Current Market Rate has been determined. Upon such determination, Base Rent shall be retroactively adjusted. If such adjustment results in an underpayment of Base Rent by Tenant, Tenant shall pay Landlord the amount of such underpayment within thirty (30) days after the determination thereof. If such adjustment results in an overpayment of Base Rent by Tenant, Landlord shall credit such overpayment against the next installment of Base Rent due under the Lease and, to the extent necessary, any subsequent installments until the entire amount of such overpayment has been credited against Base Rent. (f) Tenant must timely exercise the Extension Option or the Extension Option shall terminate. Tenant may not exercise the Extension Option if Tenant is not occupying and conducting business in the Premises. Tenant's exercise of the Extension Option shall not operate to cure any default by Tenant of any of the terms or provisions in the Lease, nor to extinguish or impair any rights or remedies of Landlord arising by virtue of such default. If the Lease or Tenant's right to possession of the Premises shall terminate in any manner whatsoever before Tenant shall exercise the Extension Option, or if Tenant shall have subleased or assigned all or any portion of the Premises to any party other than a Permitted Transferee, then immediately upon such termination, sublease or assignment, the Extension Option shall simultaneously terminate and become null and void. The Extension Option is personal to Tenant and Approved Sublessee. 2. Right of First Refusal Subject to renewal options, expansion options, and other preferential rights to lease of other tenants existing as of the Execution Date, provided no Default then exists, provided Tenant and/or a Permitted Transferee is occupying the entire Premises initially leased, provided this Lease is then in full force and effect and provided that Tenant’s interest in this Lease has not been assigned other than to a Permitted Transferee, Tenant shall have the right of first refusal (“Right of First Refusal”) as hereinafter described, to lease any space in the Building that Landlord desires to make available for lease (“Right of First Refusal Space”), for a term beginning on the ROFR Effective Date (as hereinafter defined). This Right of First Refusal is exercisable at the following times and upon the following conditions: C-2

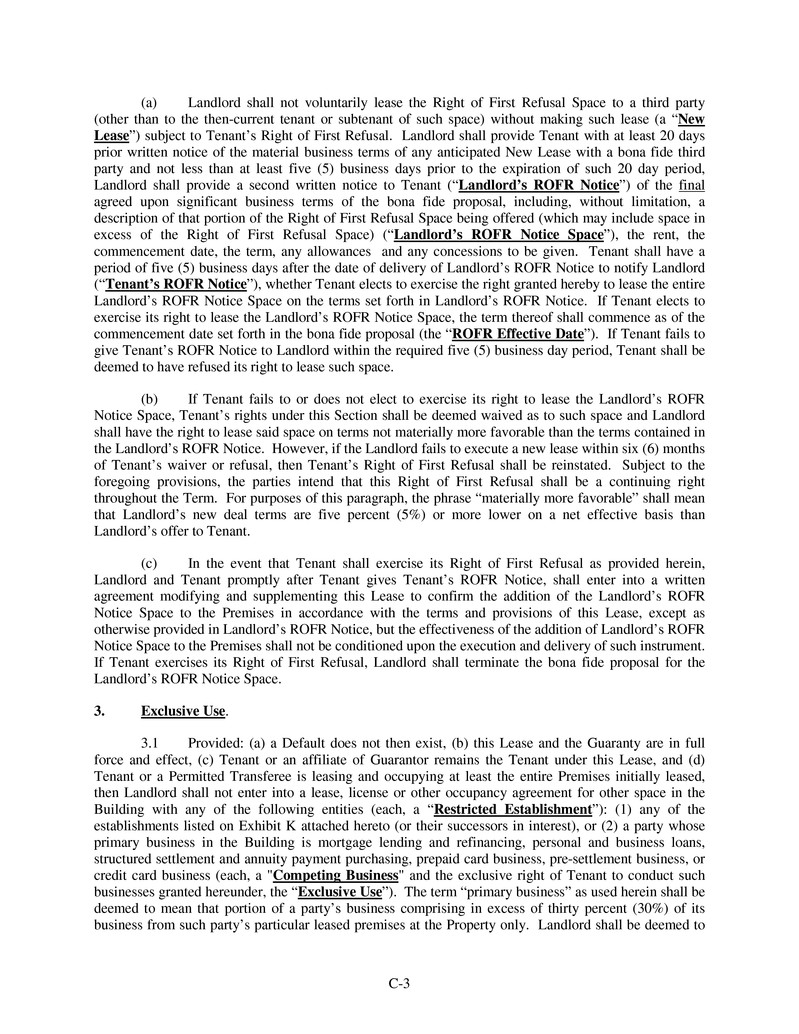

(a) Landlord shall not voluntarily lease the Right of First Refusal Space to a third party (other than to the then-current tenant or subtenant of such space) without making such lease (a “New Lease”) subject to Tenant’s Right of First Refusal. Landlord shall provide Tenant with at least 20 days prior written notice of the material business terms of any anticipated New Lease with a bona fide third party and not less than at least five (5) business days prior to the expiration of such 20 day period, Landlord shall provide a second written notice to Tenant (“Landlord’s ROFR Notice”) of the final agreed upon significant business terms of the bona fide proposal, including, without limitation, a description of that portion of the Right of First Refusal Space being offered (which may include space in excess of the Right of First Refusal Space) (“Landlord’s ROFR Notice Space”), the rent, the commencement date, the term, any allowances and any concessions to be given. Tenant shall have a period of five (5) business days after the date of delivery of Landlord’s ROFR Notice to notify Landlord (“Tenant’s ROFR Notice”), whether Tenant elects to exercise the right granted hereby to lease the entire Landlord’s ROFR Notice Space on the terms set forth in Landlord’s ROFR Notice. If Tenant elects to exercise its right to lease the Landlord’s ROFR Notice Space, the term thereof shall commence as of the commencement date set forth in the bona fide proposal (the “ROFR Effective Date”). If Tenant fails to give Tenant’s ROFR Notice to Landlord within the required five (5) business day period, Tenant shall be deemed to have refused its right to lease such space. (b) If Tenant fails to or does not elect to exercise its right to lease the Landlord’s ROFR Notice Space, Tenant’s rights under this Section shall be deemed waived as to such space and Landlord shall have the right to lease said space on terms not materially more favorable than the terms contained in the Landlord’s ROFR Notice. However, if the Landlord fails to execute a new lease within six (6) months of Tenant’s waiver or refusal, then Tenant’s Right of First Refusal shall be reinstated. Subject to the foregoing provisions, the parties intend that this Right of First Refusal shall be a continuing right throughout the Term. For purposes of this paragraph, the phrase “materially more favorable” shall mean that Landlord’s new deal terms are five percent (5%) or more lower on a net effective basis than Landlord’s offer to Tenant. (c) In the event that Tenant shall exercise its Right of First Refusal as provided herein, Landlord and Tenant promptly after Tenant gives Tenant’s ROFR Notice, shall enter into a written agreement modifying and supplementing this Lease to confirm the addition of the Landlord’s ROFR Notice Space to the Premises in accordance with the terms and provisions of this Lease, except as otherwise provided in Landlord’s ROFR Notice, but the effectiveness of the addition of Landlord’s ROFR Notice Space to the Premises shall not be conditioned upon the execution and delivery of such instrument. If Tenant exercises its Right of First Refusal, Landlord shall terminate the bona fide proposal for the Landlord’s ROFR Notice Space. 3. Exclusive Use. 3.1 Provided: (a) a Default does not then exist, (b) this Lease and the Guaranty are in full force and effect, (c) Tenant or an affiliate of Guarantor remains the Tenant under this Lease, and (d) Tenant or a Permitted Transferee is leasing and occupying at least the entire Premises initially leased, then Landlord shall not enter into a lease, license or other occupancy agreement for other space in the Building with any of the following entities (each, a “Restricted Establishment”): (1) any of the establishments listed on Exhibit K attached hereto (or their successors in interest), or (2) a party whose primary business in the Building is mortgage lending and refinancing, personal and business loans, structured settlement and annuity payment purchasing, prepaid card business, pre-settlement business, or credit card business (each, a "Competing Business" and the exclusive right of Tenant to conduct such businesses granted hereunder, the “Exclusive Use”). The term “primary business” as used herein shall be deemed to mean that portion of a party’s business comprising in excess of thirty percent (30%) of its business from such party’s particular leased premises at the Property only. Landlord shall be deemed to C-3

have leased, licensed or otherwise granted space in the Building only if (i) Landlord after the date of this Lease enters into a lease, license, occupancy or other agreement with (a) a Restricted Establishment, or (b) the tenant, licensee or occupant in question expressly permitting it to engage in the Competing Business, or (ii) Landlord's consent is required for any change to a permitted use, and Landlord consents, after the date of this Lease, to change such use to permit a Competing Business. Landlord shall not be deemed to have leased to a Competing Business if the Competing Business has been permitted to assume a lease or operate its business based upon or as a result of a bankruptcy or as a result of a merger or acquisition, insolvency or similar action or if the Competing Business has been permitted to operate as the result of an action or order by a court. If Landlord is in default of this Section, the terms and conditions of Article 21 shall apply. . C-4

EXHIBIT D COMMENCEMENT DATE CONFIRMATION Landlord: THE GC NET LEASE (WAYNE) INVESTORS, LLC Tenant: GREEN APPLE MANAGEMENT COMPANY, LLC This Commencement Date Confirmation is made pursuant to that certain Lease dated as of ______ ___, 2017 (the “Lease”) for certain premises known as Suites 200 and 300 (the “Premises”) in the building commonly known as 1200 Morris Drive, Wayne, Pennsylvania. This Confirmation is made pursuant to Article 1 of the Lease. 1. Lease Commencement Date, Termination Date. The Commencement Date of the Lease is ___________, 20__, and the Termination Date of the Lease is ______________, 20__. 2. Acceptance of Premises. Subject to Landlord’s obligations under the Lease and Landlord’s Work, Tenant has inspected the Premises and affirms that the Premises are acceptable in all respects in its current “as is” condition. 3. Agreement. Tenant shall advise Landlord in writing of any disagreement with the statements set forth within ten (10) days after Tenant’s receipt of this letter, or else Tenant shall be conclusively deemed to agree with all of the matters set forth in this letter. 4. Incorporation. This Confirmation is incorporated into the Lease, and forms an integral part thereof. This Confirmation shall be construed and interpreted in accordance with the terms of the Lease for all purposes. LANDLORD: The GC Net Lease (Wayne) Investors, LLC, a Delaware limited liability company By: Griffin Capital Essential Asset Operating Partnership, L.P., a Delaware limited partnership, its sole member By: Griffin Capital Essential Asset REIT, Inc., a Maryland corporation, its general partner By: _______________________________________ Name: _________________________________ Title: __________________________________ D-1

EXHIBIT E FORM OF GUARANTY This GUARANTY (“Guaranty”) is given by THE J.G. WENTWORTH COMPANY, LLC, a Delaware limited liability company (“Guarantor”) to The GC Net Lease (Wayne) Investors, LLC, a Delaware limited liability company (“Landlord”), with respect to that certain Lease dated _______________, 2017 (“Lease”), by and between Landlord and Green Apple Management Company, LLC, a Delaware limited liability company (“Tenant”), under which Tenant has leased from Landlord certain premises known as Suites 200 and 300 in 1200 Morris Drive, Wayne, Pennsylvania. To induce Landlord to execute the Lease and for other good and valuable consideration, the receipt and sufficiency of which Guarantor acknowledges, Guarantor promises and agrees as follows: 1. Guarantor absolutely, unconditionally, and irrevocably guarantees the payment and performance of, and will pay and perform as a primary obligor, all of Tenant’s covenants, obligations, liabilities and duties under the Lease (“Guaranteed Obligations”), as if Guarantor had executed the Lease as Tenant. The Guaranteed Obligations include, without limitation, payment of rent and all other amounts required to be paid by Tenant under the Lease. 2. The Guaranteed Obligations are independent of Tenant’s obligations under the Lease. Landlord will not be required to enforce any of the Guaranteed Obligations against Tenant or any other person before seeking or enforcing the Guaranteed Obligations against Guarantor. Landlord may bring an action against Guarantor (or, if Guarantor is more than one party, against any or all of the parties who constitute Guarantor) to enforce any Guaranteed Obligations without joining Tenant, any other Guarantor, or any other person in this action. Landlord may join Guarantor in any action commenced by Landlord against Tenant to enforce any of the Guaranteed Obligations and Guarantor waives any demand by Landlord or any prior action by Landlord against Tenant. 3. Landlord is not obligated to apply any Security Deposit, or other deposit or credit against any default or damages under the Lease before bringing any action or pursuing any remedy available to Landlord against Guarantor. Guarantor’s liability under this Guaranty is not affected in any manner by any Security Deposit, or other deposit or credit, or Landlord’s application of any of these amounts against any obligation of Tenant under the Lease. 4. Guarantor waives notice of any of the following, and the Guaranteed Obligations will remain in full force and effect and will not be affected in any way by either: (a) Any forbearance, indulgence, compromise, settlement or variation of terms which may be extended to Tenant by Landlord; (b) Any modification, amendment or alteration of the Lease, whether prior or subsequent to Lease execution, including any renewal or extension of the Lease, expansion or contraction of the Premises leased; (c) Any subletting of the premises demised under the Lease or any assignment of Tenant’s interest in the Lease; (d) Any termination of the Lease to the extent that Tenant remains liable under the Lease after such termination; (e) The release by Landlord of any party (other than Guarantor) obligated for the Guaranteed Obligations or Landlord’s acquisition, release, return or misapplication of any other collateral (including without limitation, any other guaranties) given now or later as additional security for the Guaranteed Obligations; E-1

(f) The release or discharge of Tenant in any creditors, receivership, bankruptcy or other proceedings; (g) The impairment, limitation or modification of the liability of Tenant or the estate of Tenant in bankruptcy, or of any remedy for the enforcement of Tenant’s liability under the Lease, resulting from the operation of any present or future provision of the Federal Bankruptcy Code or other statute, or from any court decision; (h) The rejection or disaffirmance of the Lease in any proceeding described in (g); or (i) Tenant’s death or any disability, or any other defense of Tenant. 5. Guarantor waives notice of acceptance of this Guaranty and all other notices in connection with this Guaranty or the Guaranteed Obligations, including notices of default by Tenant under the Lease, and waives diligence, presentment and suit by Landlord in the enforcement of any Guaranteed Obligations. 6. Until all Guaranteed Obligations are fully performed and observed, Guarantor has no right of subrogation and waives any right to enforce any remedy against Tenant for any payments or acts performed by Guarantor under this Guaranty, and Guarantor subordinates any liability or indebtedness of Tenant now or later held by Guarantor to the obligations of Tenant to Landlord under the Lease. 7. Guarantor will pay Landlord’s reasonable costs and attorneys’ fees incurred in successfully enforcing Guarantor’s obligations under this Guaranty in any action or proceeding to which Landlord is a party. In any action brought under this Guaranty, Guarantor submits to the jurisdiction of the courts of the State of Pennsylvania, and to venue in the Superior Court of the State of Pennsylvania. 8. GUARANTOR WAIVES TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM BROUGHT BY EITHER PARTY AGAINST THE OTHER CONCERNING ANY MATTER RELATED TO THIS GUARANTY. 9. This Guaranty binds Guarantor and each of its heirs, successors and assigns and will inure to the benefit of Landlord and its successors and assigns. 10. If Guarantor is more than one party, then the obligations of each party as Guarantor under this Guaranty are joint and several. 11. If the Guarantor is a corporation, the undersigned hereby represents and warrants that this Guaranty has been duly authorized, executed and delivered and that the party executing this Guaranty has all requisite corporate authority to execute this Guaranty. 12. If any provision of this Guaranty is found by a court to be invalid for any reason, the remainder of this Guaranty shall continue in full force and effect. EXECUTED THIS ___ DAY OF _______________ 2017. GUARANTOR: THE J.G. WENTWORTH COMPANY, LLC, a Delaware limited liability company By: ________________________ Name: ______________________ Its: _________________________ E-2

EXHIBIT F FURNITURE F-1

EXHIBIT G OPERATING EXPENSE EXCLUSIONS A. Leasing commissions attorney fees costs and disbursements and other expenses incurred in connection with negotiations or disputes with tenants or other occupants or prospective tenants or other occupants, or associated with the enforcement of any leases or the defense of Landlord’s title to or interest in the Building or any part thereof; B. Costs (including permit, license and inspection fees) incurred in renovating or otherwise improving or decorating, painting or redecorating space for tenants or other occupants or in renovating or redecorating vacant space; C. Landlord’s costs of any services sold or provided tenants or other occupants for which Landlord is entitled to be reimbursed by such tenants or other occupants as an additional charge or rental over and above the basic rent (and escalations thereof) payable under the lease with such tenant or other occupant; D. Costs incurred by Landlord for alterations or additions which are considered capital improvements and replacements under generally accepted accounting principles, except those that reduce Operating Expenses or are made to comply with any Laws or other governmental requirements that first become effective after the date of this Lease; provided, all such permitted capital expenditures (together with reasonable financing charges) shall be amortized for purposes of this Lease over the shorter of: (i) their useful lives or (ii) the period during which the reasonably estimated savings in Operating Expenses equals the expenditures; [provided, however, replacement of components of a larger capital improvement investment shall not be considered as capital (if so determined by Landlord in its commercially reasonable discretion) unless they cost in excess of $25,000.00 per component (i.e., replacement of a motor in a cooling tower);] E. Depreciation and amortization; F. Costs incurred due to violation by Landlord or any tenant of the terms and conditions of any lease; G. Overhead and profit paid to subsidiaries or affiliates of Landlord for services on or to the Project and/or Building, to the extent only that the costs of such services exceed competitive costs, or such services where they are not so rendered by a subsidiary or affiliate. Any management fees in excess of four percent (4%) of the Building’s gross revenue are excluded from Operating Expenses; H. Landlord’s general corporate overhead and general administrative expenses; I. Any compensation paid to clerks, attendants or other persons working in or managing commercial concessions operated by Landlord to the extent the concession generates rent or other revenue to the Property; J. Rentals and other related expenses incurred in leasing air conditioning systems, elevators or other equipment ordinarily considered to be of a capital nature, except equipment which is used in providing janitorial services and which is not affixed to the Building on a temporary basis and excluding emergency needs, such as rental of cooling, generator, etc. in the event of power or equipment failure or interruption; K. All items and services for which Tenant or any other tenant or occupant of the Building reimburses Landlord or pays to third parties or which Landlord provides selectively to one or more tenants or occupants of the Building (other than Tenant) without reimbursement; L. Advertising and promotional expenditures related to leasing space in the Building or selling the Building; M. Costs incurred in operating any underground parking garage and other parking facilities within the Building, but the foregoing shall not prevent Landlord for charging for parking; G-1

N. Costs incurred to provide services or other benefits to other tenants or occupants of a type that are not provided or available to Tenant hereunder; O. Repairs or other work occasioned by fire, windstorm or other casualty, or by condemnation, the costs of which are reimbursed or reasonable reimbursable to Landlord by insurers, other parties or by governmental authorities in eminent domain; P. Debt service, interest or other finance charges unless specifically included above; Q. Rental payments to any ground lessor or landlord; R. The costs to correct structural and latent defects in the original construction of the Building; T. Taxes; U. Wages, salaries and benefits of employees above the level of Building manager; and V. Costs incurred to correct violations of Laws existing on the date of this Lease. G-2

EXHIBIT H INTENTIONALLY DELETED H-1

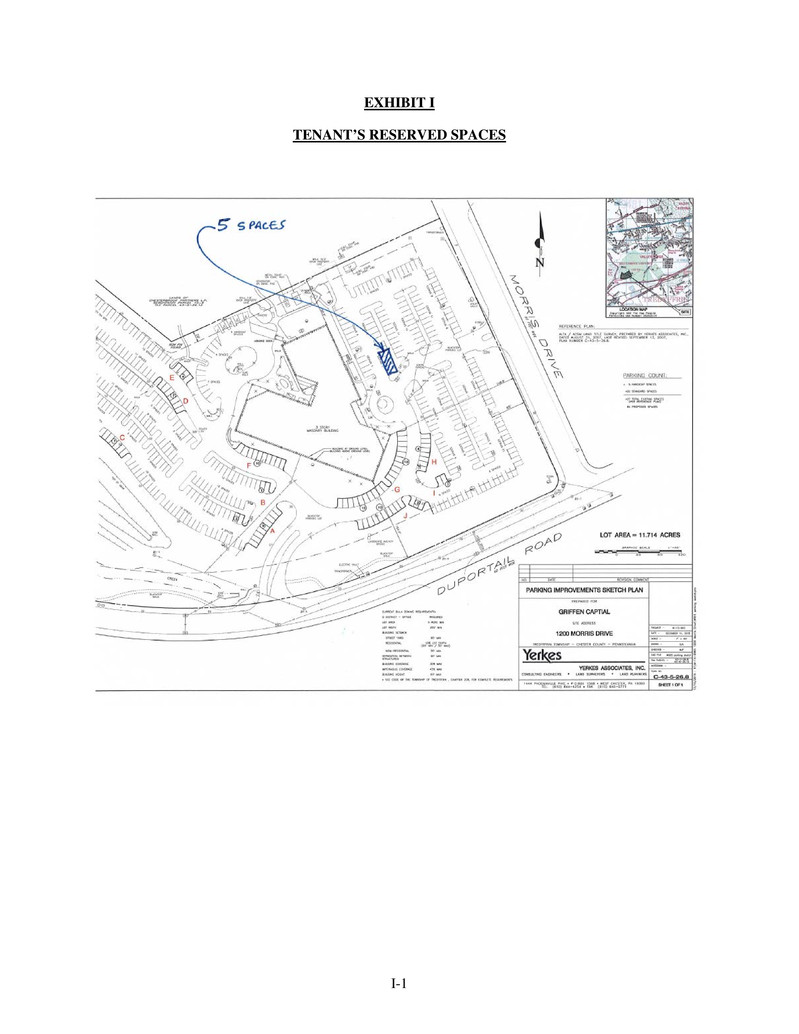

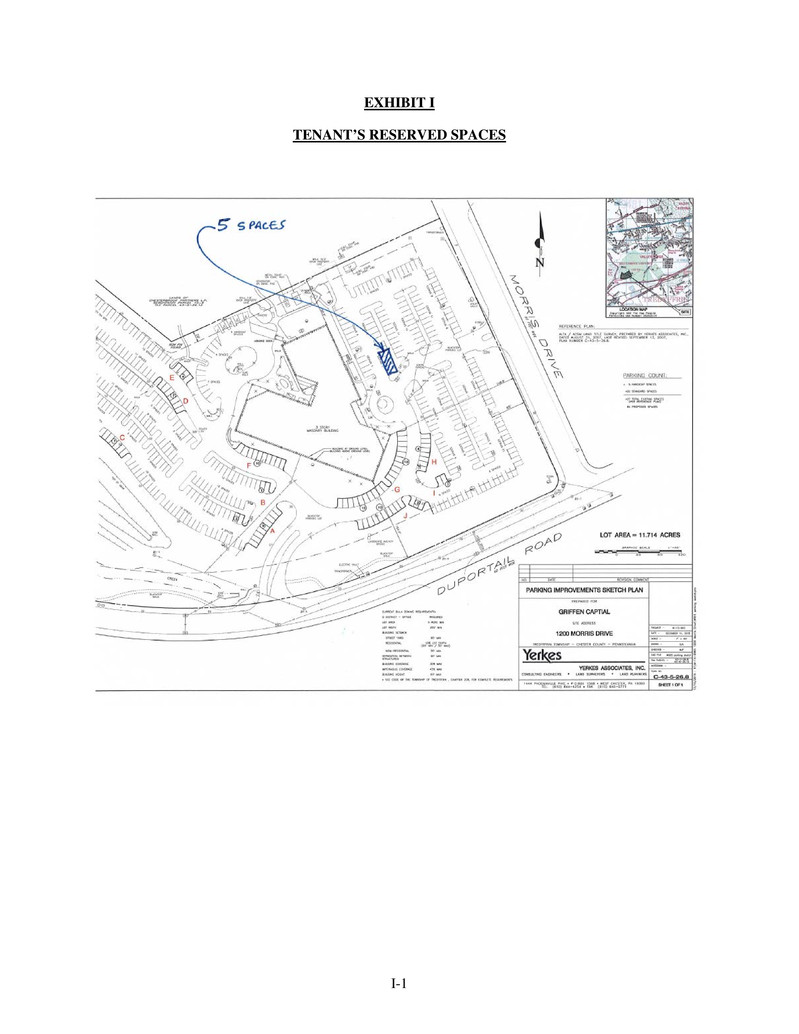

EXHIBIT I TENANT’S RESERVED SPACES I-1

EXHIBIT J JANITORIAL SPECIFICATIONS J-1

J-2

J-3

J-4

EXHIBIT K RESTRICTED ESTABLISHMENTS Advance Funding, LLC American Structured Funding, LLC Annuitants Federal Bank (aka AnFed Bank) Annuity Transfers, LTD Aspyre Settlement Funding, Inc. Bank of Internet Bearberry Square Funding, LLC Bentzen Funding Solutions, LLC BTG Advisors Catalina Structured Funding, Inc. CBC Settlements Clearscape Funding Corporation Clearwater Capital Client First Settlement Funding Corona Capital Group Covered Bridge Capital DRB Capital LLC Encore Financial Services Group, Inc. Encore Funding Einstein Structured Funding Fairfield Funding First Providen/PPI Fortress Funding Genex Capital Global Funding, Inc. Granoff Enterprises Highpoint Imperial Finance & Trading LLC Imperial Structured Settlements JSJ Management Lake Ridge Capital, LLC Liberty Settlement Solutions Liquidating Marketing, Ltd. My Lumpsum New Leaf Structured Settlements No More Waiting LLC Northeastern Capital Novation Capital NuPoint Funding LLC Oasis Legal Finance Pacific Capital Parker Financial Services Patriot Settlement QLS, LLC Quick Lump Sum Quotemeaprice.com K-1

R & P Capital Reliance Funding Rescue Capital Selective Settlements International Seneca One Settlement Capital Corporation Settlement Quotes, LLC Singer Asset Finance Co., LLC Solid Funding Sovereign Funding Group Stone Street Capital Strategic Capital Structured Asset Funding Sunshine Settlement Funding Sutton Park Capital Thrivest Legal Funding True Vision Funding US Settlement Funding U.S. Claims Voyager Financial Group LLC Washington Square Financial Woodbridge Investments Woodbridge Structure Settlement Funding K-2

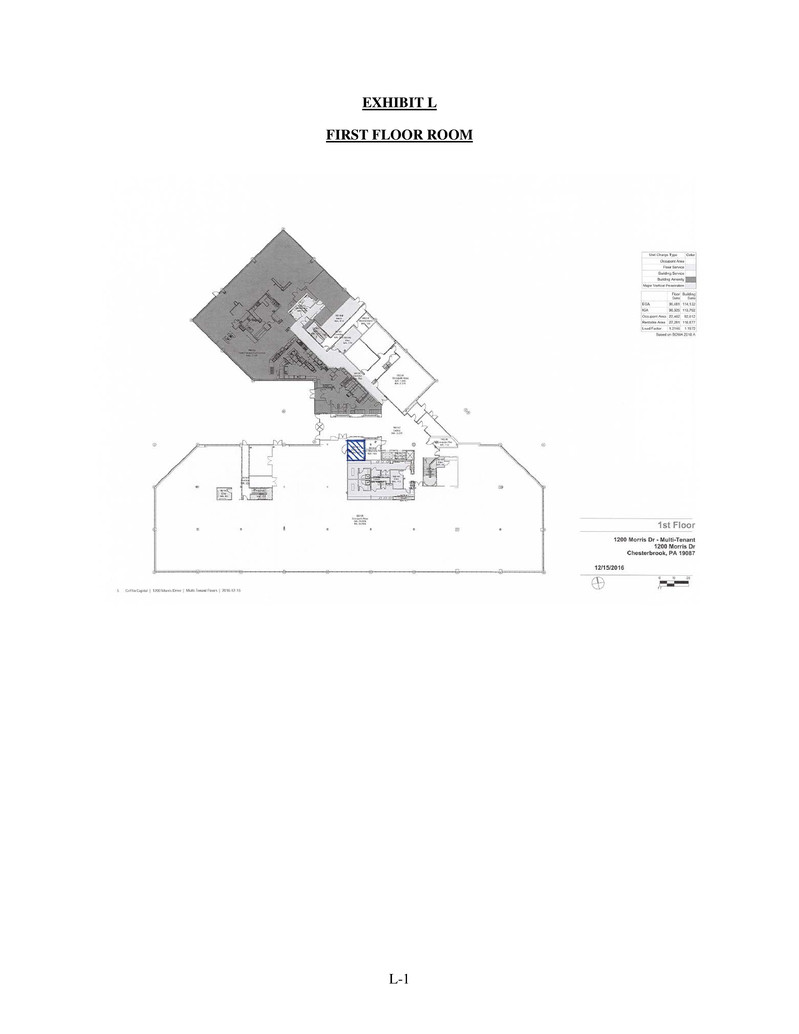

EXHIBIT L FIRST FLOOR ROOM L-1