- TPVG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

TriplePoint Venture Growth BDC (TPVG) DEF 14ADefinitive proxy

Filed: 17 Apr 15, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 | |

TRIPLEPOINT VENTURE GROWTH BDC CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

TRIPLEPOINT VENTURE GROWTH BDC CORP.

2755 Sand Hill Road, Suite 150, Menlo Park, California 94025

April 17, 2015

Dear Stockholder:

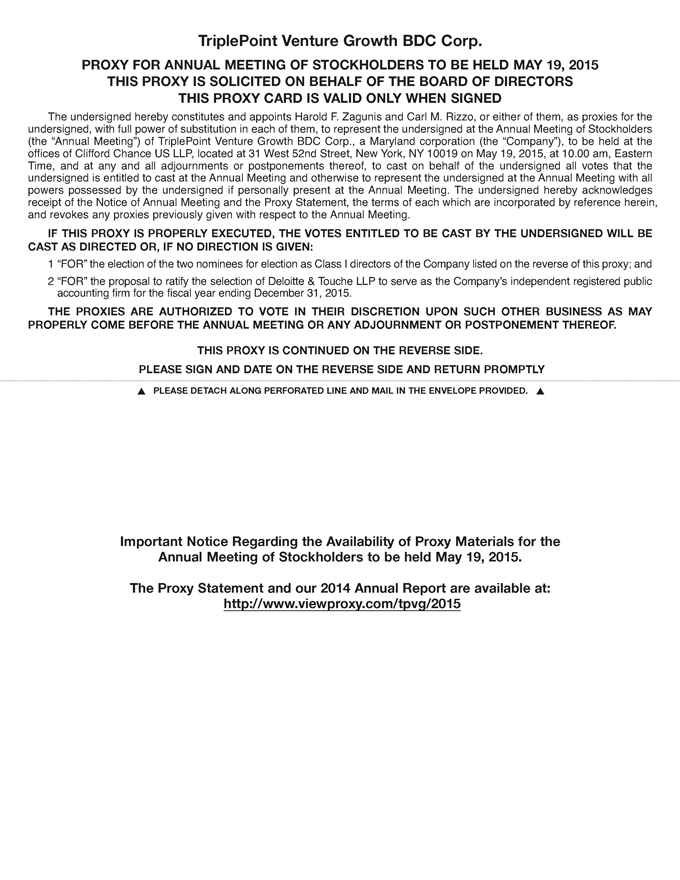

You are cordially invited to attend the 2015 Annual Meeting of Stockholders (the “Annual Meeting”) of TriplePoint Venture Growth BDC Corp. (the “Company,” “TPVG,” “we,” “us” or “our”) to be held on Tuesday, May 19, 2015 at 10:00 a.m., Eastern Time, at the offices of Clifford Chance US LLP, located at 31 West 52nd Street, New York, NY 10019.

The notice of annual meeting and proxy statement, accompanying this letter, provides an outline of the business to be conducted at the meeting. At the meeting, you will be asked to: (1) elect two directors of the Company; (2) ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015 and (3) to transact such other business as may properly come before the meeting, or any postponement or adjournment thereof. I will also report on the Company’s progress during the past year and respond to stockholders’ questions.

It is very important that your shares be represented at the Annual Meeting. Whether or not you expect to be present in person, at the Annual Meeting, please sign the enclosed proxy and return it promptly in the envelope provided, or vote via the Internet or telephone. We encourage you to vote via the Internet, if possible, as it saves us significant time and processing costs. To vote via the Internet, accesswww.cesvote.com and follow the on-screen instructions. Have your proxy card available when you access the web page. Your vote and participation in the governance of the Company is very important to us.

Sincerely yours,

/s/ James P. Labe |

James P. Labe |

Chief Executive Officer and Chairman of the Board |

TRIPLEPOINT VENTURE GROWTH BDC CORP.

2755 Sand Hill Road, Suite 150

Menlo Park, California 94025

(650) 854 2090

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 19, 2015

Notice is hereby given to the holders of shares of common stock, $0.01 par value per share, (the “Stockholders”) of TriplePoint Venture Growth BDC Corp., a Maryland corporation (the “Company,” “TPVG,” “we,” “us” or “our”) that:

The 2015 Annual Meeting of Stockholders (the “Annual Meeting”) of the Company will be held at the offices of Clifford Chance US LLP, located at 31 West 52nd Street, New York, NY 10019, on Tuesday, May 19, 2015 at 10:00 a.m., Eastern Time, to consider and vote on the following proposals:

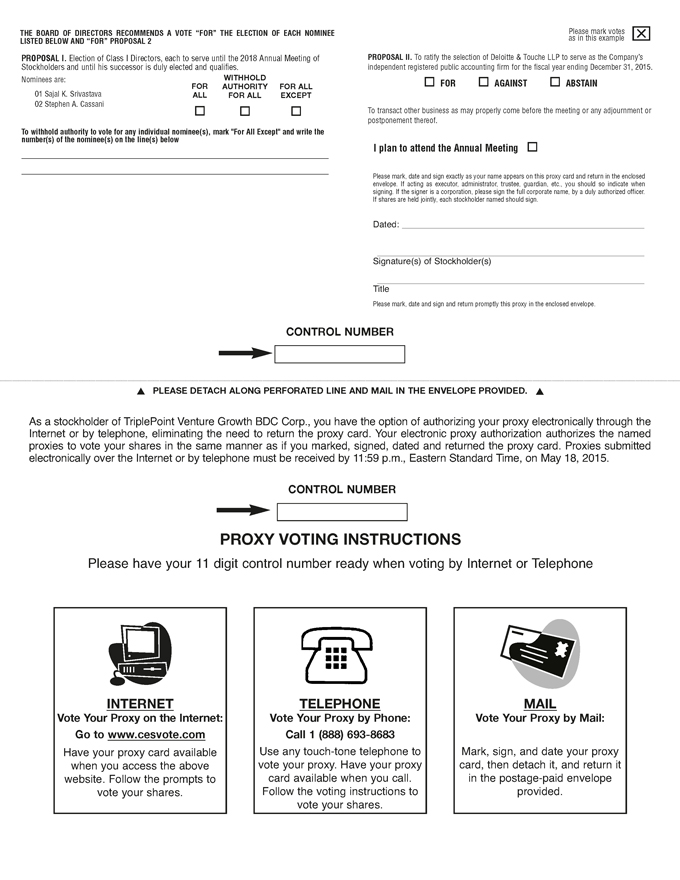

1. To elect two Class I directors of the Company who will each serve until the 2018 annual meeting of the Company’s stockholders and until his successor is duly elected and qualifies;

2. To ratify the selection of Deloitte & Touche LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015; and

3. To transact such other business as may properly come before the meeting, or any postponement or adjournment thereof.

You have the right to receive notice of, and to vote at, the Annual Meeting if you were a Stockholder of record at the close of business on April 20, 2015. Whether or not you expect to be present in person at the Annual Meeting, please sign the enclosed proxy and return it promptly in the envelope provided, or authorize a proxy via the Internet or telephone. Instructions are shown on the proxy card.

We have enclosed our annual report on Form 10-K for the year ended December 31, 2014, proxy statement and a proxy card. Please sign the enclosed proxy and return it promptly in the envelope provided, or authorize a proxy via the Internet or telephone.

Your vote is extremely important to us. In the event there are not sufficient votes for a quorum or to approve the proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies by the Company.

THE BOARD, INCLUDING EACH OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE PROPOSALS.

By Order of the Board of Directors,

/s/ Sajal K. Srivastava |

Sajal K. Srivastava |

Secretary |

Menlo Park, California

April 17, 2015

This is an important meeting. To ensure proper representation at the meeting, please complete, sign, date and return the proxy card in the enclosed, self-addressed envelope, or vote your shares electronically via the Internet or by telephone. Please see the proxy statement and the enclosed proxy card for details about electronic voting. Even if you vote your shares prior to the meeting, you still may attend the meeting and vote your shares in person if you wish to change your vote.

TRIPLEPOINT VENTURE GROWTH BDC CORP.

2755 Sand Hill Road, Suite 150

Menlo Park, California 94025

(650) 854 2090

PROXY STATEMENT

For

2015 Annual Meeting of Stockholders

To Be Held on May 19, 2015

This document will give you the information you need to vote on the matters listed on the accompanying Notice of Annual Meeting of Stockholders (“Notice of Annual Meeting”). Much of the information in this Proxy Statement is required under rules of the Securities and Exchange Commission (“SEC”), and some of it is technical in nature. If there is anything you do not understand, please contact us at (650) 854-2090 and ask for Investor Relations.

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of TriplePoint Venture Growth BDC Corp., a Maryland corporation (the “Company,” “TPVG,” “we,” “us” or “our”), for use at our 2015 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Tuesday, May 19, 2015 at 10:00 a.m., Eastern Time, at the offices of Clifford Chance US LLP, located at 31 West 52nd Street, New York, NY 10019, and at any postponements or adjournments thereof. This Proxy Statement and the Company’s Annual Report for the period from March 5, 2014 (commencement of operations) to December 31, 2014 (the “Annual Report”), are being mailed to stockholders of the Company of record as of the close of business on April 20, 2015 (the “Stockholders”) on or about April 27, 2015.

We encourage you to vote your shares, either by voting in person at the Annual Meeting or by voting by proxy, which means that you authorize someone else to vote your shares. If you properly sign, date and return the accompanying proxy card or otherwise authorize a proxy and provide voting instructions, either via the Internet or telephone, and the Company receives it in time for the Annual Meeting, the persons named as proxies will vote the shares registered directly in your name in the manner that you specified. If you authorize a proxy without specifying your voting instructions, your votes will be cast in accordance with the Board’s recommendations. If any other business is brought before the Annual Meeting, your votes will be cast at the discretion of the proxy holders.

You may revoke a proxy at any time before it is exercised by notifying the Company’s Secretary in writing, by submitting a properly executed, later-dated proxy, or by voting in person at the Annual Meeting. Any Stockholder entitled to vote at the Annual Meeting may attend the Annual Meeting and vote in person, whether or not he or she has previously authorized a proxy or wishes to change a previous vote. If you hold your shares in “street name” through a broker or other nominee, you must obtain a “legal proxy” from your broker or nominee in order to vote in person at the Annual Meeting.

PURPOSE OF ANNUAL MEETING

At the Annual Meeting, you will be asked to consider and vote on the following proposals:

| 1. | To elect two Class I directors of the Company who will each serve until the 2018 annual meeting of the Company’s stockholders – and until his successor is duly elected and qualifies; |

| 2. | To ratify the selection of Deloitte & Touche LLP (“Deloitte”) to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| 3. | To transact such other business as may properly come before the meeting, or any postponement or adjournment thereof. |

VOTING SECURITIES

You may vote at the Annual Meeting only if you were a Stockholder of record at the close of business on April 20, 2015 (the “Record Date”) or if you hold a valid proxy from a Stockholder of record as of the Record Date. There were 16,453,405 shares of the Company’s common stock, $0.01 par value per share (the “Common Stock”), outstanding on the Record Date. Each share of Common Stock entitles the holder to cast one vote on each matter properly brought before the annual meeting.

QUORUM REQUIRED

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person or by proxy, of Stockholders entitled to cast a majority of the votes entitled to be cast at the Annual Meeting will constitute a quorum. Voted entitled to be cast by a broker or other nominee for which the nominee has not received voting instructions from the beneficial owner and does not have discretionary authority to cast onnon-routine proposals (which are considered “brokernon-votes”) will be treated as present for the purpose of determining the presence of a quorum. If there are not enough Stockholders present to constitute a quorum, the chairman of the Annual Meeting may adjourn the Annual Meeting to permit the further solicitation of proxies.

VOTES REQUIRED

Election of Directors

Directors will be elected by the affirmative vote of a plurality of the votes cast in the election of directors. Stockholders may not cumulate their votes. If you instruct your proxy to “withhold authority” with respect to any of the nominees, your votes will not be cast with respect to the person indicated. Because directors are elected by a plurality of the votes cast, an abstention or instruction to “withhold authority” will have no effect on the outcome of the vote.

Ratification of Independent Registered Public Accounting Firm

The affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting is required to ratify the appointment of Deloitte & Touche LLP to serve as the Company’s independent registered public accounting firm. Abstentions will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal.

BrokerNon-Votes

Brokernon-votes are votes entitled to be cast by a broker or other nominee on a “non-routine” matter on which the broker or nominee does not have discretionary voting authority on behalf of a beneficial holder who does not provide explicit voting instructions to such broker or nominee. Proposal 1 is anon-routine matter. As a result, if you hold shares in “street name” through a broker, bank or other nominee, your broker, bank or nominee willnot be permitted to exercise voting discretion with respect to Proposal 1, the election of two Class I directors. Thus, if you beneficially own your shares through a broker or other nominee and you do not give your broker or nominee specific instructions on how to vote for you and you do not obtain a “legal proxy” from your broker or other nominee and attend the Annual Meeting and vote in person, your shares will have no effect on Proposal 1.

Proposal 2, the ratification of the selection of Deloitte & Touche LLP, is a routine matter. As a result, if you beneficially own your shares and you do not provide your broker or nominee with voting instructions, your broker or nominee will be able to vote for you in its discretion on this routine matter.

Adjournment and Additional Solicitation

If there appear not to be enough votes to approve the proposals at the Annual Meeting, the chairman of the meeting or the Stockholders who are represented in person or by proxy may vote to adjourn the Annual Meeting to permit further solicitation of proxies. Harold F. Zagunis and Carl M. Rizzo are the persons named as proxies

and, if adjournment is submitted to the Stockholders for approval, will vote proxies held by one of them for such adjournment to permit the further solicitation of proxies. Approval of any proposal to adjourn the Annual Meeting submitted to the Stockholders for approval requires the affirmative vote of a majority of the votes cast on the proposal.

A Stockholder vote may be taken on any of the proposals in this Proxy Statement prior to any such adjournment if there are sufficient votes for approval of such proposal.

INFORMATION REGARDING THIS SOLICITATION

The Company will bear the expense of the solicitation of proxies for the Annual Meeting, including the cost of preparing, printing and mailing this Proxy Statement, the accompanying Notice of Annual Meeting of Stockholders, the proxy card and Annual Report. The Company intends to use the services of Alliance Advisors to aid in the distribution and collection of proxies. The Company expects to pay market rates for such services. If brokers, trustees, or fiduciaries and other institutions holding shares in their own names or in the names of their nominee, which shares are beneficially owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners, the Company will reimburse such persons for their reasonable expenses in so doing.

No additional compensation will be paid to directors, officers or regular employees for such services. Alliance Advisors has been retained as a proxy solicitation agent for a fee of $7,500 plus reasonable out-of-pocket expenses. You could be contacted by telephone on behalf of the Company and urged to vote. Alliance Advisors will not attempt to influence how you vote your shares, but only ask that you take the time to authorize a proxy. You may also be asked if you would like to authorize a proxy over the telephone and to have your vote transmitted to our proxy tabulation firm.

Stockholders may authorize proxies and provide their voting instructions through the Internet, by telephone, or by mail by following the instructions on the proxy card. These options require Stockholders to input the Control Number, which is provided on the proxy card. If you authorize a proxy using the Internet, after visitingwww.cesvote.comand inputting your Control Number, you will be prompted to provide your voting instructions. Stockholders will have an opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their Internet link. Stockholders who authorize a proxy via the Internet, in addition to confirming their voting instructions prior to submission, will, upon request, receive ane-mail confirming their instructions.

If a Stockholder wishes to participate in the Annual Meeting but does not wish to authorize his, her or its proxy by telephone or Internet, the Stockholder may authorize a proxy by mail by completing and executing the accompanying proxy card and returning it in the postage-paid envelope or attend the Annual Meeting in person.

Any proxy authorized pursuant to this solicitation by a Stockholder or record as of the Record Date may be revoked by notice from the person giving the proxy at any time before it is exercised. A revocation may be effected by resubmitting voting instructions via the Internet voting site, by telephone, by obtaining and properly completing another proxy card that is dated later than the original proxy card and returning it, by mail, in time to be received before the Annual Meeting, by attending the Annual Meeting and voting in person, or by a notice, provided in writing and signed by the Stockholder, delivered to the Company’s Secretary on any business day before the date of the Annual Meeting. If you hold your shares in “street name” through a broker or other nominee, you must follow the instructions provided by your broker or other nominee in order to revoke your proxy or change your voting instructions.

SECURITY OWNERSHIP OF CERTAIN BENFICIAL OWNERS AND MANAGEMENT

As of the Record Date, to our knowledge, no person would be deemed to control us, as such term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”).

Our directors consist of interested directors and independent directors. An interested director is an “interested person” of the Company, as defined in the 1940 Act, and independent directors are all other directors (the “Independent Directors”).

The following table sets forth, as of April 1, 2015, certain ownership information with respect to our Common Stock for those persons who directly or indirectly own, control or hold with the power to vote 5 percent or more of our outstanding Common Stock and all officers and directors, individual and as a group.

| Percentage of Common Stock Outstanding | ||||||||||||

Name and Address | Type of Ownership | Shares Owned | Percentage | |||||||||

James P. Labe(1) | Direct | 56,659 | 0.34 | % | ||||||||

Sajal K. Srivastava(1) | Direct | 57,659 | 0.35 | % | ||||||||

Harold F. Zagunis(1) | Direct | 23,152 | 0.14 | % | ||||||||

Gilbert E. Ahye(1) | — | — | — | |||||||||

Steven P. Bird(1) | — | — | — | |||||||||

Stephen A. Cassani(1) | Direct | 500 | * | |||||||||

All directors and executive officers as a group | Direct | 137,970 | 0.84 | % | ||||||||

5% or Greater Beneficial Owners: | ||||||||||||

Clearbridge Investments, LLC(2) | Direct | 897,850 | 5.47 | % | ||||||||

Philadelphia Financial Management of San Francisco, LLC(3) | Direct | 969,768 | 5.90 | % | ||||||||

| * | Less than 0.005%. |

| (1) | The address for all of our officers and directors is c/o TriplePoint Venture Growth BDC Corp., 2755 Sand Hill Road, Suite 150, Menlo Park, California 94025. |

| (2) | Based on information provided in a Schedule 13G filed on February 17, 2015, Clearbridge Investments, LLC reported shared voting and dispositive power with respect to 897,850 shares of our Common Stock. The Schedule 13G does not include any information regarding shares acquired or sold since the date of such Schedule 13G. The business address of Clearbridge Investments, LLC is 605 Third Avenue, New York, NY 10158. |

| (3) | Based on information provided in a Schedule 13G filed on February 17, 2015, the 969,768 shares of our Common Stock noted in the table above consists of 277,574 shares held by Boathouse Row I, L.P., or “BRI,” 90,334 shares held by Boathouse Row II, L.P., or “BRII,” 473,764 shares held by Boathouse Row Offshore Ltd., or “BRO,” and 128,096 shares held by Boathouse Row Offshore Regatta Ltd., or “BROR,” collectively referred to as the “PFM Entities.” The PFM Entities are private investment funds of which Philadelphia Financial Management of San Francisco, LLC, or “PFM,” is the general partner and/or investment manager. Jordan Hymowitz is the managing member of PFM and its majority owner. The Schedule 13G does not include any information regarding shares acquired or sold since the date of such Schedule 13G. The address for PFM and the PFM Entities is c/o Philadelphia Financial Management of San Francisco, LLC, 450 Sansome Street, Suite 1500 San Francisco, CA 94111. In addition, according to information provided to us by Wells Fargo, one or more private investment funds of which PFM is the general partner and/or investment manager purchased an additional 200,000 shares of our common stock in connection with our public offering of common stock completed on April 1, 2015. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company’s directors and other executive officers, and any persons holding more than 10% of our Common Stock, are required to report their beneficial ownership and any changes therein to the SEC and the Company. Specific due dates for those reports have been established, and the Company is required to report in this Proxy Statement any failure to file such reports by those due dates. Based on the Company’s review of Forms 3, 4 and 5 filed by such persons and information provided by the Company’s directors and other executive officers, the Company believes that during the period from March 5, 2014 (commencement of operations) to December 31, 2014, all Section 16(a) filing requirements applicable to such persons were met in a timely manner.

DOLLAR RANGE OF SECURITIES BENEFICIALLY OWNED BY DIRECTORS

Information as to the beneficial ownership listed in the tables below is based on information furnished to the Company by the persons listed in the respective tables. We are not part of a “family of investment companies,” as that term is defined in the 1940 Act. The following table sets forth the dollar range of our Common Stock beneficially owned by each of our directors as of April 1, 2015.

Name of Director | Dollar Range of Equity Securities in TriplePoint Venture Growth BDC Corp.(1) | |

Independent Directors | ||

Gilbert E. Ahye | None | |

Steven P. Bird | None | |

Stephen A. Cassani | $1-$10,000 | |

Interested Directors | ||

James P. Labe | Over $100,000 | |

Sajal K. Srivastava | Over $100,000 | |

| (1) | Dollar ranges are as follows: none, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, or over $100,000. |

PROPOSAL 1: ELECTION OF DIRECTORS

In accordance with the Company’s bylaws, the Board currently has five members. Directors are divided into three classes and are elected for staggered terms of three years each, with a term of office of one of the three classes of directors expiring at the annual meeting of the Company’s stockholders each year. After this election, the terms of Class I, II and III will expire in 2018, 2016 and 2017, respectively. Each director will hold office for the term to which he or she is elected and until his or her successor is duly elected and qualifies.

A Stockholder can vote for, or instruct his or her proxy to withhold his or her vote from, any nominee. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of each nominee named below. If a nominee should decline or be unable to serve as a director, it is intended that the proxy will be voted for the election of such person as is nominated by the Board as a replacement. The Board has no reason to believe that either Sajal K. Srivastava or Stephen A. Cassani will be unable or unwilling to serve.

THE BOARD, INCLUDING EACH OF ITS INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES NAMED IN THIS PROXY STATEMENT.

Information about the Nominees and Directors

Certain information with respect to the Class I nominees for election at the Annual Meeting, as well as each of the other directors, is set forth below, including their names, ages, a brief description of their recent business experience, including present occupations and employment, certain directorships that each person holds and the year in which each person became a director of the Company. The nominees for Class I director currently serve as directors of the Company.

Sajal K. Srivastava and Stephen A. Cassani have been nominated for election as Class I directors for a term expiring at the annual meeting of the Company’s stockholders in 2018. Mr. Srivastava and Mr. Cassani are not being proposed for election pursuant to any agreement or understanding between Mr. Srivastava or Mr. Cassani and the Company.

Nominees for Class I Directors

Name, Address and Age(1) | Position(s) Held with Company | Term of Office and Length of Time Served | Principal Occupation(s) During the Past | Other Directorships Held by Director or Nominee for Director During the Past Five years(2) | ||||

Sajal K. Srivastava (39) | Chief Investment Officer, President and Director | Class I Director since 2013; Term Expires 2015 | Serves as the President of TriplePoint Capital LLC. | None | ||||

Stephen A. Cassani (48) | Director | Class I Director since 2013; Term Expires 2015 | Co-founder of Haven Capital Partners, located in Palo Alto, California since 2009. | None | ||||

Class II Directors (continuing directors not up forre-election at the Annual Meeting)

Class II Directors

Name, Address and Age(1) | Position(s) Held with Company | Term of Office and Length of Time Served | Principal Occupation(s) During the Past Five Years | Other Directorships Held by Director or Nominee for Director During the Past Five years(2) | ||||

Gilbert E. Ahye (67) | Director | Class II Director since 2013; Term Expires 2016 | Vice Chairman of American Express Global Business Travel, a joint venture with American Express and a group of private investors, since September 2014 and partner of the private equity firm of Certares. Executive Vice President – Chief Development Officer at American Express from May 2003 through August 2014. | Serves on the board of directors of the Henry Street Settlement. | ||||

Steven P. Bird (59) | Director | Class II Director since 2013; Term Expires 2016 | Co-founder and General Partner of Focus Ventures, located in Palo Alto, California, since 1997. | None | ||||

Class III Directors (continuing directors not up forre-election at the Annual Meeting)

Name, Address and Age(1) | Position(s) Held with Company | Term of Office and Length of Time Served | Principal Occupation(s) During the | Other Directorships Held by Director or Nominee for Director During the Past Five years(2) | ||||

James P. Labe (58) | Chief Executive Officer, Chairman of the Board and Director | Class III Director since 2013; Term Expires 2017 | Serves as the Chief Executive Officer of TriplePoint Capital LLC. | None |

| (1) | The business address of each of our directors is c/o TriplePoint Venture Growth BDC Corp., 2755 Sand Hill Road, Suite 150, Menlo Park, California 94025. |

| (2) | No director otherwise serves as a director of an investment company subject to the Investment Company Act of 1940, as amended. |

Information About Each Director’s Experience, Qualifications, Attributes or Skills

Below is additional information about each director (supplementing the information provided in the table above) that describes some of the specific experiences, qualifications, attributes and/or skills that each director possesses, and which the Board believes has prepared each director to be effective. The Board believes that the significance of each director’s experience, qualifications, attributes and/or skills is an individual matter (meaning that experience or a factor that is important for one director may not have the same value for another) and that these factors are best evaluated at the Board level, with no single director, or particular factor, being indicative of Board effectiveness. However, the Board believes that directors need to have the ability to review, evaluate, question and discuss critical information provided to them and to interact effectively with Company management, service providers and counsel, in order to exercise effective business judgment in the performance of their duties. The Board believes that its members satisfy this standard. Experience relevant to having thisability may be achieved through a director’s educational background, business, professional training or practice (e.g.,finance, accounting or law), public service or academic positions, experience from service as a board member (including the Board of the Company) or as an executive of investment funds, public companies or significant private or not-for-profit entities or other organizations, and/or other life experiences. To assist them in evaluating matters under federal and state law, the Independent Directors interact with TPVG Advisers LLC (“Adviser”), the Company’s investment adviser and a subsidiary of TriplePoint Capital LLC (“TPC”), and also may benefit from information provided by the Company’s counsel. Both the Independent Directors’ and the Company’s counsels have significant experience advising funds, including other business development companies, and fund board members. The Board and its committees have the ability to engage other experts as appropriate. The Board evaluates its performance on an annual basis.

Experience, Qualifications, Attributes and/or Skills that Led to the Board’s Conclusion that such Members Should Serve as Directors of the Company

The Board believes that, collectively, the directors have balanced and diverse experience, qualifications, attributes and skills, which allow the Board to operate effectively in governing the Company and protecting the interests of its Stockholders. There is no familial relationship among any of the members of our Board or our executive officers. Below is a description of the various experiences, qualifications, attributes and/or skills with respect to each director considered by the Board.

Interested Directors

James P. Labe

The Board benefits from James P. Labe’s business leadership and experience and knowledge of the venture capital lending industry. Mr. Labe has been involved in the venture capital lending and leasing segment for more than 25 years and played a key role in making venture capital lending and leasing a regular source of capital for venture capital-backed companies. In particular, Mr. Labe founded and served as Chief Executive Officer of Comdisco Ventures, a division of Comdisco, Inc., which managed more than $3 billion in loan and lease transactions for more than 870 venture capital-backed companies and generated more than $500 million in cumulative pre-tax profits over 15 years during his tenure. Prior to joining Comdisco, Mr. Labe was employed by Equitec Financial Group. Mr. Labe has served as a voting member of the TPC’s Investment Committee and has led and overseen TPC’s investment originations and venture capital relationship management efforts since its inception in 2006. Mr. Labe received a Bachelor of Arts degree from Middlebury College and received an Executive Master of Business Administration degree from the University of Chicago. Mr. Labe’s extensive venture capital lending and leasing experience led our Nominating and Corporate Governance Committee to conclude that Mr. Labe is qualified to serve as a director.

Sajal K. Srivastava

Sajal K. Srivastava brings to the Board strong investment and operating leadership experience along with a venture lending, leasing and technology finance background. Since its inception in 2006, Mr. Srivastava has served as a voting member of TPC’s Investment Committee and has led and overseen TPC’s investment analysis, account servicing, portfolio monitoring, legal and finance groups. Prior to co-founding TPC, Mr. Srivastava worked with Mr. Labe at Comdisco Ventures where he, as head of their Investment and Credit Analyst team, structured, negotiated and managed over $200 million of transactions and also managed the diligence and credit analysis team. Before joining Comdisco, Mr. Srivastava was part of Prudential Securities, Technology Investment Banking Group. Mr. Srivastava received a Bachelor of Arts degree from Stanford University and received a Master of Science degree in Engineering Economic Systems and Operations Research from Stanford University. Mr. Srivastava’s strong investment and operating leadership experience led our Nominating and Corporate Governance Committee to conclude that Mr. Srivastava is qualified to serve as a director.

Independent Directors

Gilbert E. Ahye

Gilbert E. Ahye brings to the Board expertise in accounting and business development. Mr. Ahye became Vice Chairman of American Express Global Business Travel, a joint venture with American Express and a group of private investors, in September 2014. At that time he also became a partner of the private equity firm of Certares. While at American Express he had a longstanding career as a senior executive in finance, business development, investment, and mergers and acquisitions, and was at American Express for more than 30 years. Mr. Ahye served as the Executive Vice President – Chief Development Officer at American Express from May 2003 through August 2014 where he led the Corporate Development / M&A and Innovation group and was a member of American Express’s Global Management Team. During his time at American Express, Mr. Ahye also served as Chief Financial Officer of the U.S. Consumer Card Business from 1996 to 1999 and Treasurer of International and Domestic Treasury from 1985 to 1988. Prior to joining American Express, Mr. Ahye was head of Capital Budgeting for International Paper Company from 1978 to 1981. From 1977 to 1978, Mr. Ahye served

as a Manager at Union Carbide Corporation. From 1971 to 1977, Mr. Ahye served as Senior Auditor at Ernst & Young. Mr. Ahye is a member of both the American and New York State Societies of CPAs and serves on the board of directors of the Henry Street Settlement. Mr. Ahye also serves as an advisor to a payments company in China. Mr. Ahye was named to Black Enterprise Magazine’s 75 Most Powerful Blacks on Wall Street in 2006. Mr. Ahye received a Bachelor of Science degree from Manhattan College, a Master of Business Administration degree from St. John’s University and has a Certified Public Accountant accreditation. Mr. Ahye’s extensive practical experience with executing successful investment strategies and his long term focus on business development led our Nominating and Corporate Governance Committee to conclude that Mr. Ahye is qualified to serve as a director.

Steven P. Bird

Steven P. Bird brings to the Board a diverse knowledge of business and finance. Mr. Bird is a well known veteran of the Silicon Valley venture capital community as a result of a twenty year career working with leading venture capital funds in both venture capital investing as well as venture capital debt financing. Mr. Bird is a co founder and has been a General Partner of Focus Ventures, located in Palo Alto, California, since it’s founding in 1997 and as of 2013 had over $830 million in assets under management. Focus Ventures invests in privately held, expansion stage technology companies, and Mr. Bird focuses on investments in enterprise software and internet services. Prior to co founding Focus Ventures, from 1994 to 1996, Mr. Bird was a Managing Director at Comdisco Ventures Inc. where he was involved with debt and equity capital investments for emerging growth companies. From 1984 to 1992, Mr. Bird was a General Partner at First Century Partners, a venture capital fund affiliated with Smith Barney Inc. From 1992 to 1994, Mr. Bird was a Manager at Bain & Company, a management consulting firm where he worked with companies in the communications, software, and semiconductor industries. From 1977 to 1991, Mr. Bird worked as a Senior Development Engineer in software development at Battelle Northwest Laboratories. Mr. Bird received a Bachelor of Science degree from Stanford University, a Master of Science in Mechanical Engineering degree from Stanford University and a Master of Business Administration degree from the Stanford Graduate School of Business. Mr. Bird’s extensive experience with venture capital investing and venture capital debt financing led our Nominating and Corporate Governance Committee to conclude that Mr. Bird is qualified to serve as a director.

Stephen A. Cassani

Stephen A. Cassani brings to the Board a diverse knowledge of business, finance and capital markets. Mr. Cassani has had a long standing career of over twenty years in investment banking and finance relating to growth stage venture capital and private equity backed companies and in real estate. Mr. Cassani is a co founder of Haven Capital Partners, a real estate investment, development and management company founded in 2009 and located in Palo Alto, California. At Haven Capital Partners, Mr. Cassani oversees a family office with extensive real estate holdings, where his duties include managing commercial development projects as well as new investment opportunities. Prior to co founding Haven Capital Partners, Mr. Cassani spent most of his career in investment banking, most recently serving as a Managing Director at Citigroup Global Markets, where from 2001 to 2008 he led the firm’s west coast private capital markets business focusing primarily on expansion and growth stage venture capital and private equity backed companies. From 2000 to 2001, Mr. Cassani served as Vice President of Client Management for Brand3, a venture-backed software company. From 1996 to 2000, Mr. Cassani was a Principal in the investment banking group at Montgomery Securities / Banc of America Securities, with a focus on the consumer sector. Prior to that, Mr. Cassani began his investment banking career in the Private Equity Placements Group at Chase Securities, Inc. Mr. Cassani received a Bachelor of Arts degree from the University of California, Berkeley and a Master of Business Administration degree from Columbia Business School. Mr. Cassani’s extensive investment banking and finance experience relating to growth stage venture capital and private equity backed companies led our Nominating and Corporate Governance Committee to conclude that Mr. Cassani is qualified to serve as a director.

Corporate Governance

We believe that maintaining the highest standards of corporate governance is a crucial part of our business, and we are committed to having in place the necessary controls and procedures designed to ensure compliance with applicable laws, rules and regulations.

Director Independence

NYSE corporate governance rules require listed companies to have a board of directors with at least a majority of independent directors. Under NYSE corporate governance rules, in order for a director to be deemed independent, our Board must determine that the individual does not have a relationship that would interfere with the director’s exercise of independent judgment in carrying out his or her responsibilities. On an annual basis, each member of our Board is required to complete an independence questionnaire designed to provide information to assist the Board in determining whether the director is independent under NYSE corporate governance rules, the 1940 Act and our corporate governance guidelines. Our Board has determined that each of our directors, other than Messrs. Labe and Srivastava, is independent under the listing standards of the NYSE, the Exchange Act and the 1940 Act. Our governance guidelines require any director who has previously been determined to be independent to inform the Chairman of the Board, the Chairman of the Nominating and Corporate Governance Committee and our Secretary of any change in circumstance that may cause his or her status as an Independent Director to change. The Board limits membership on the Audit Committee, the Nominating and Corporate Governance Committee and the Compensation Committee to Independent Directors.

The Board’s Oversight Role in Management

The Board’s role in management of the Company is one of oversight. Oversight of the Company’s investment activities extends to oversight of the risk management processes employed by our Adviser as part of its day-to-day management of our investment activities. The Board reviews risk management processes at both regular and special board meetings throughout the year, consulting with appropriate representatives of our Adviser as necessary and periodically requesting the production of risk management reports or presentations. The goal of the Board’s risk oversight function is to ensure that the risks associated with our investment activities are accurately identified, thoroughly investigated and responsibly addressed. The Audit Committee of the Board (which consists of all the Independent Directors) is responsible for approving our independent accountants, reviewing with our independent accountants the plans and results of the audit engagement, approving professional services provided by our independent accountants, reviewing the independence of our independent accountants and reviewing the adequacy of our internal accounting controls. The Valuation Committee is responsible for aiding the Board in valuing investments that are not publicly traded or for which current market values are not readily available. Stockholders should note, however, that the Board’s oversight function cannot eliminate all risks or ensure that particular events do not adversely affect the value of investments. The Compensation Committee’s risk oversight responsibilities include reviewing the reimbursement by the Company to TPVG Administrator LLC (“Administrator”), our administrator and a subsidiary of our Adviser, of the allocable portion of the Company’s chief financial officer and chief compliance officer and their respective staffs on an annual basis.

The Board’s Composition and Leadership Structure

The 1940 Act requires that at least a majority of the Company’s directors not be “interested persons” (as defined in the 1940 Act) of the Company. Currently, three of the Company’s five directors are Independent Directors (and are not “interested persons”). However, James P. Labe, Chief Executive Officer of TPC, and therefore an interested person of the Company, serves as Chairman of the Board. The Board believes that it is in the best interests of investors for Mr. Labe to lead the Board because of his broad experience with the day-to-day management and operations of other companies and his significant background in the financial services industry, as described below. The Board does not have a lead independent director. The Board believes that its leadership structure is appropriate in light of the characteristics and circumstances of the Company because the structure allocates areas of responsibility among the individual directors and the committees in a manner that enhances effective oversight. The Board also believes that its small size creates a highly efficient governance structure that provides ample opportunity for direct communication and interaction between our Adviser and the Board.

Board Meetings

For the period from March 5, 2014 (commencement of operations) to December 31, 2014, our Board held seven Board meetings. All directors attended 100% of the aggregate number of meetings of the Board and of the respective committees on which they served that were held while they were members of the Board. The Board’s

standing committees are set forth below. We require each director to make a diligent effort to attend all Board and committee meetings and encourage directors to attend the Annual Meeting. We did not hold a 2014 annual meeting of the stockholders.

Audit Committee

The members of our Audit Committee are Gilbert E. Ahye, Steven P. Bird and Stephen A. Cassani, each of whom meets the independence standards established by the SEC and the NYSE for audit committees and is independent for purposes of the 1940 Act. Gilbert E. Ahye serves as Chairman of our Audit Committee. Our Board has determined that Gilbert E. Ahye is an “audit committee financial expert” as that term is defined under Item 407 of Regulation S-K of the Exchange Act. Our Audit Committee is responsible for approving our independent accountants, reviewing with our independent accountants the plans and results of the audit engagement, approving professional services provided by our independent accountants, reviewing the independence of our independent accountants and reviewing the adequacy of our internal accounting controls. For the period from March 5, 2014 (commencement of operations) to December 31, 2014, our Audit Committee met three times. The Audit Committee reviews and approves the amount of audit fees and any other fees paid to our independent accountants. The Audit Committee Charter is available on the Company’s website atwww.tpvg.com.

Nominating and Corporate Governance Committee

The members of our Nominating and Corporate Governance Committee are Stephen A. Cassani, Gilbert E. Ahye and Steven P. Bird, each of whom is independent for purposes of the 1940 Act and the NYSE corporate governance regulations. Stephen A. Cassani serves as Chairman of our Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee is responsible for indentifying, selecting and nominating directors for election by our stockholders, selecting nominees to fill vacancies on our Board or a committee of our Board, developing and recommending to our Board a set of corporate governance principles and overseeing the evaluation of our Board and our management.

Our Nominating and Corporate Governance Committee may consider nominating an individual recommended by a stockholder for election as a director if such stockholder complies with the advance notice provisions of our bylaws.

For the period from March 5, 2014 (commencement of operations) to December 31, 2014, our Nominating and Corporate Governance Committee met one time.

Our Nominating and Corporate Governance Committee has not adopted a formal policy with regard to the consideration of diversity in identifying individuals for election as members of our Board, but the committee considers such factors as it may deem are in our best interests and those of our stockholders. Those factors may include a person’s differences of viewpoint, professional experience, education and skills, as well as his or her race, gender and national origin. In addition, as part of our Board’s annual-self assessment, the members of our Nominating and Corporate Governance Committee evaluate the membership of our Board and whether our Board maintains satisfactory policies regarding membership selection. The Nominating and Corporate Governance Committee has adopted a written Nominating and Corporate Governance Committee Charter that is available on the Company’s website atwww.tpvg.com.

The Nominating and Corporate Governance Committee considers Stockholder recommendations for possible nominees for election as directors when such recommendations are submitted in accordance with the Company’s bylaws, the Nominating and Corporate Governance Committee Charter and any applicable law, rule or regulation regarding director nominations. Our bylaws provide that a Stockholder who wishes to nominate a person for election as a director at a meeting of Stockholders must deliver written notice to our secretary, Sajal K. Srivastava, c/o TriplePoint Venture Growth BDC Corp., 2755 Sand Hill Road, Suite 150, Menlo Park, California 94025, between November 19, 2015 and 5:00 p.m. Eastern time on December 19, 2015. This notice must contain, as to each nominee, all information that would be required under applicable SEC rules to be disclosed in connection with election of a director and certain other information set forth in our bylaws, including

the following minimum information for each director nominee: full name, age and address; principal occupation during the past five years; directorships on publicly held companies and investment companies during the past five years; number of shares of our Common Stock owned, if any; and a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the Stockholders. In order to be eligible to be a nominee for election as a director by a Stockholder, such potential nominee must deliver to our secretary a written questionnaire providing the requested information about the background and qualifications of such nominee and a written representation and agreement that such nominee is not and will not become a party to any voting agreements, any agreement or understanding with any person with respect to any compensation or indemnification in connection with services on the Board and would be in compliance with all of our publicly disclosed corporate governance, conflict of interest, confidentiality and stock ownership and trading policies and guidelines.

Criteria considered by the Nominating and Corporate Governance Committee in evaluating the qualifications of individuals for election as members of the Board include compliance with the independence and other applicable requirements of the NYSE corporate governance rules, the 1940 Act and the SEC, and all other applicable laws, rules, regulations and listing standards; the criteria, policies and principles set forth in the Nominating and Corporate Governance Committee Charter and the ability to contribute to the effective management of the Company, taking into account the needs of the Company and such factors as the individual’s experience, perspective, skills and knowledge of the industry in which the Company operates. The Nominating and Corporate Governance Committee also may consider such other factors as it may deem are in the best interests of the Company and its Stockholders.

Compensation Committee

The members of our Compensation Committee are Steven P. Bird, Gilbert E. Ahye and Stephen A. Cassani, each of whom is independent for purposes of the 1940 Act and the NYSE corporate governance regulations. Steven P. Bird serves as Chairman of our Compensation Committee. Our Compensation Committee is responsible for overseeing our compensation policies generally and making recommendations to our Board with respect to any incentive compensation or equity-based plans that are subject to Board approval, evaluating executive officer performance, overseeing and setting compensation for our directors and, as applicable, our executive officers and, as applicable, preparing the report on executive officer compensation that SEC rules require to be included in our annual proxy statement. Currently, none of our executive officers are compensated by us and as such our Compensation Committee is not required to produce a report on executive officer compensation for inclusion in our annual proxy statement.

Our Compensation Committee has the sole authority to retain and terminate any compensation consultant assisting our Compensation Committee, including sole authority to approve all such compensation consultants’ fees and other retention terms. Our Compensation Committee may delegate its authority to subcommittees or the Chairman of the Compensation Committee when it deems appropriate and in our best interests. For the period from March 5, 2014 (commencement of operations) to December 31, 2014, our Compensation Committee met one time. The Compensation Committee charter is available on our website atwww.tpvg.com.

Communication with the Board

Stockholders with questions about the Company are encouraged to contact the Company’s Investor Relations Department at 2755 Sand Hill Road, Suite 150, Menlo Park, California 94025 or by visiting the Company website atwww.tpvg.com.However, if Stockholders believe that their questions have not been addressed, they may communicate with the Company’s Board by sending their communications to Sajal K. Srivastava, Secretary, c/o TriplePoint Venture Growth BDC Corp., 2755 Sand Hill Road, Suite 150, Menlo Park, California 94025. All Stockholder communications received in this manner will be delivered to one or more members of the Board.

Information about the Executive Officers Who Are Not Directors

The following information pertains to our executive officers who are not directors of the Company.

Name, Address and Age(1) | Positions held with | Principal Occupation(s) During the Past 5 Years | ||

| Harold F. Zagunis (57) | Chief Financial Officer | Harold F. Zagunis, our Chief Financial Officer is also Chief Financial Officer of TriplePoint Capital LLC. Before joining TriplePoint Capital LLC, Mr. Zagunis served as a Managing Director of Redwood Trust Inc., an internally-managed operating company focused on engaging in residential mortgage banking and commercial mortgage lending activities and investing in mortgage- and other real estate-related assets since 2008, and as Chief Risk Officer, Chief Financial Officer, Controller, Treasurer, Vice-President and Secretary of Redwood Trust Inc. at different times between 1995 and 2011. | ||

| Carl M. Rizzo (63) | Chief Compliance Officer | Carl M. Rizzo, our Chief Compliance Officer, has served as a Director at Alaric Compliance Services LLC since 2011 and performs his functions as our Chief Compliance Officer under the terms of the agreements between us and Alaric Compliance Services LLC and our Adviser and Alaric Compliance Services LLC. At Alaric Compliance Services LLC, Mr. Rizzo served from May 2011 to November 2011 as interim Chief Compliance Officer for AEGON USA Investment Management, LLC, an SEC-registered investment adviser then with assets under management of approximately $110 billion. From 2006 to 2009, Mr. Rizzo served as Senior Principal Consultant with ACA Compliance Group, a regulatory compliance consulting firm. | ||

| (1) | The business address of each of our executive officers, our Adviser and TriplePoint Capital LLC is c/o TriplePoint Venture Growth BDC Corp., 2755 Sand Hill Road, Suite 150, Menlo Park, California 94025. |

Each officer holds his office until his successor is chosen and qualified, or until his earlier resignation or removal.

Code of Conduct and Code of Ethics

We expect each of our officers and directors, as well as any person affiliated with our operations, to act in accordance with the highest standards of personal and professional integrity at all times and to comply with the Company’s policies and procedures and all laws, rules and regulations of any applicable international, federal, provincial, state or local government. To this effect, the Company has adopted a Code of Conduct, which is posted on the Company’s website atwww.tpvg.com. The Code of Conduct applies to the Company’s directors, executive officers, officers and their respective staffs.

As required by the 1940 Act, we and our Adviser have jointly adopted a Code of Ethics that establishes procedures that apply to our directors, executive officers, officers, their respective staffs and the employees of our Adviser with respect to their personal investments and investment transactions. Our Code of Ethics generally does not permit investments by our directors, officers or any other covered person in securities that may be purchased or held by us. We filed our Code of Ethics as Exhibit (R) to our Pre-Effective Amendment No. 1 to our registration statement on Form N-2 (File No. 333-191871) filed on January 22, 2014, and you may access it via the Internet at the website of the SEC atwww.sec.gov or our website atwww.tpvg.com. We intend to disclose any material amendments to or waivers of required provisions of our Code of Conduct or the Code of Ethics on a Current Report onForm 8-K.

Compensation of Directors

The Independent Directors receive an annual fee, fees for meetings attended plus reimbursement of reasonable out-of-pocket expenses incurred in connection with attending meetings in person. For the period from March 5, 2014 (commencement of operations) to December 31, 2014, the Independent Directors received an annual fee of $49,500, $2,500 for each regular Board meeting attended in person, $1,500 for each telephonic regular Board meeting, $1,000 for each committee meeting attended in person and $500 for each telephonic

committee meeting. The chairman of the Audit Committee received an additional annual fee of $4,125. The following table shows information regarding the compensation earned by our directors for the period from the commencement of our operations on March 5, 2014 through December 31, 2014. No compensation is paid by us to any interested director or executive officer of the Company.

Name | Aggregate Compensation from TriplePoint Capital BDC(1) | Pension or Retirement Benefits Accrued as Part of Our Expenses(2) | Total Compensation from TriplePoint Capital BDC Paid to Director(1) | |||||||||

Independent Directors | ||||||||||||

Gilbert E. Ahye | $ | 72,125 | — | $ | 72,125 | |||||||

Steven P. Bird | $ | 68,000 | — | $ | 68,000 | |||||||

Stephen A. Cassani | $ | 68,000 | — | $ | 68,000 | |||||||

Interested Directors | ||||||||||||

James P. Labe | — | — | — | |||||||||

Sajal K. Srivastava | — | — | — | |||||||||

| (1) | The amounts listed are for the period from the commencement of our operations through December 31, 2014. For a discussion of the Independent Directors’ compensation, see above. |

| (2) | We do not have a profit-sharing or retirement plan, and directors do not receive any pension or retirement benefits. |

We have obtained directors’ and officers’ liability insurance on behalf of our directors and officers.

Certain Relationships and Related Party Transactions

Policies and Procedures for Managing Conflicts; Co-investment Opportunities

Certain members of our Adviser’s senior investment team and Investment Committee serve, or may serve, as officers, directors, members or principals of entities that operate in the same or a related line of business as we do, or of investment vehicles managed by TPC with similar investment objectives. Similarly, TPC may have other clients with similar, different or competing investment objectives.

Our investment strategy includes investments in secured loans, together with, in many cases, attached equity “kickers” in the form of warrants, and direct equity investments. TPC also manages, and in the future may manage, other investment funds, accounts or vehicles that invest or may invest in these investments. Although we are the primary vehicle through which TPC focuses its venture growth stage business, other vehicles sponsored or managed by our Adviser’s senior investment team may also invest in venture growth stage companies or may have prior investments outstanding to our borrowers. As a result, members of our Adviser’s senior investment team and Investment Committee, in their roles at TPC, may face conflicts in the allocation of investment opportunities among us and other investment vehicles managed by TPC with similar or overlapping investment objectives in a manner that is fair and equitable over time and consistent with TPC’s allocation policy. Generally, when a particular investment would be appropriate for us as well as one or more other investment funds, accounts or vehicles managed by our Adviser’s senior investment team, such investment is apportioned by our Adviser’s senior investment team in accordance with (1) our Adviser’s internal conflict of interest and allocation policies, (2) the requirements of the Advisers Act and (3) certain restrictions under the 1940 Act regarding co-investments with affiliates. Such apportionment may not be strictlypro rata, depending on the good faith determination of all relevant factors, including differing investment objectives, diversification considerations and the terms of our or the respective governing documents of such investment funds, accounts or investment vehicles. These procedures could, in certain circumstances, limit whether or not a co-investment opportunity is available to us, the timing of acquisitions and dispositions of investments, the price paid or received by us for investments or the size of the investment purchased or sold by us.

We have co-invested and, in the future, may co-invest with investment funds, accounts and vehicles managed by TPC where doing so is consistent with our investment strategy as well as applicable law and SEC staff interpretations. We generally are only permitted to co-invest with such investment funds, accounts and

vehicles where the only term that is negotiated is price. However, we, TPC and our Adviser may file an exemptive application with the SEC to permit greater flexibility to negotiate the terms of co-investments with investment funds, accounts and investment vehicles managed by TPC in a manner consistent with our investment objective, positions, policies, strategies and restrictions as well as regulatory requirements and other pertinent factors. There can be no assurance that we will receive exemptive relief from the SEC to permit us to co-invest with investment funds, accounts and investment vehicles managed by TPC where terms other than price are negotiated.

Investment Advisory Agreement

In February 2014, we entered into the Investment Advisory Agreement with our Adviser. Pursuant to this agreement, we have agreed to pay to our Adviser a base management fee and an incentive fee for its services. Pursuant to the Investment Advisory Agreement, our Adviser is responsible for sourcing, reviewing and structuring investment opportunities for us, underwriting and diligencing our investments and monitoring our investment portfolio on an ongoing basis. Our Adviser’s management fee and incentive fee is based on the value of our investments and, therefore, there may be a conflict of interest when personnel of our Adviser are involved in the valuation process for our portfolio investments. For the period from March 5, 2014 (commencement of operations) to December 31, 2014, base management fee and income incentive fee paid or payable to our Adviser totaled approximately $5.3 million. Our Adviser is located at 2755 Sand Hill Road, Suite 150, Menlo Park, California 94025.

Administration Agreement

In February 2014, we entered into the Administration Agreement with our Administrator pursuant to which our Administrator is responsible for furnishing us with office facilities and equipment and provides us with clerical, bookkeeping, recordkeeping and other administrative services at such facilities. Pursuant to the Administration Agreement, we pay our Administrator an amount equal to our allocable portion (subject to the review of our Board) of our Administrator’s overhead resulting from its obligations under the Administration Agreement, including rent and the allocable portion of the cost of our Chief Compliance Officer and Chief Financial Officer and their respective staffs associated with performing compliance functions. For the period from March 5, 2014 (commencement of operations) to December 31, 2014, administration agreement expenses paid or payable totaled approximately $0.9 million. Our Administrator is located at 2755 Sand Hill Road, Suite 150, Menlo Park, California 94025.

In addition, our Administrator has entered into a sub-administration agreement with Vastardis Fund Services LLC to provide certain sub-administrative services to us on behalf of our Administrator.

Staffing Agreement

In February 2014, our Adviser entered into the Staffing Agreement with TPC. Pursuant to the Staffing Agreement, TPC has made and will continue to make, subject to the terms of the Staffing Agreement, its investment and portfolio management and monitoring teams available to our Adviser. We believe that the Staffing Agreement (i) provides us with access to deal flow generated by TPC in the ordinary course of its business; (ii) provides us with access to TPC’s investment professionals, including its senior investment team led by Messrs. Labe and Srivastava, and TPC’s non-investment employees; and (iii) commits certain key senior members of TPC’s Investment Committee to serve as members of our Adviser’s Investment Committee. TPC is obligated under the Staffing Agreement to allocate investment opportunities among its affiliates fairly and equitably over time in accordance with its allocation policy. Our Adviser is responsible for determining if we will participate in deal flow generated by TPC. The Staffing Agreement may be terminated with 60 days’ prior written notice.

License Agreement

In February 2014, we entered into the License Agreement with TPC under which TPC granted us a non-exclusive, royalty-free license to use the name “TriplePoint” and the TriplePoint logo.

PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte has been selected as the independent registered public accounting firm to audit the consolidated financial statements of the Company and its subsidiaries at and during the Company’s fiscal year ending December 31, 2015. Deloitte was selected by the Audit Committee of the Company, and that selection was ratified by a majority of the Company’s Board, including a majority of the Independent Directors, by a vote cast in person. The Company does not know of any direct or indirect financial interest of Deloitte in the Company. Representative(s) of Deloitte will attend the Annual Meeting, will have the opportunity to make a statement if they desire to do so and will be available to answer questions.

Audit Fees

Audit fees consist of fees billed for professional services rendered for the audit of ouryear-end financial statements and services that are normally provided by Deloitte in connection with statutory and regulatory filings. Audit fees for the period from March 5, 2014 (commencement of operations) to December 31, 2014 billed to the Company were $245,000. Of the audit fees billed, $20,000 related toN-2-Registration Statement and Prospectus filings during 2014.

Audit-Related Fees

Audit-related services consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under “Audit Fees.” These services include attest services that are not required by statute or regulation and consultations concerning financial accounting and reporting standards. There were no audit related fees billed by Deloitte for the period from March 5, 2014 (commencement of operations) to December 31, 2014.

Tax Fees

Tax fees consist of fees billed for professional services for tax compliance. These services include assistance regarding federal, state, and local tax compliance. $1,000 was billed by Deloitte during the period from March 5, 2014 (commencement of operations) to December 31, 2014 for tax fees.

All Other Fees

Other fees would include fees billed for products and services other than the services reported above. There were no other fees billed for the period from March 5, 2014 (commencement of operations) to December 31, 2014.

The Audit Committee has established apre-approval policy that describes the permitted audit, audit-related, tax and other services to be provided by Deloitte, the Company’s independent auditor. The policy requires that the Audit Committeepre-approve the audit and permissiblenon-audit services performed by the independent auditor in order to assure that the provision of such service does not impair the auditor’s independence. While there were no audit-related fees and other fees incurred in for the period from March 5, 2014 (commencement of operations) to December 31, 2014, if any of these would have been incurred, they would have been approved by the Audit Committee.

Any requests for audit, audit-related, tax and other services that have not received generalpre-approval must be submitted to the Audit Committee for specificpre-approval, and cannot commence until such approval has been granted. Normally,pre-approval is provided at regularly scheduled meetings of the Audit Committee. However, the Audit Committee may delegatepre-approval authority to one or more of its members. The member or members to whom such authority is delegated must report anypre-approval decisions to the Audit Committee at its next scheduled meeting. The Audit Committee does not delegate its responsibilities topre-approve services performed by the independent auditor to management.

THE BOARD, INCLUDING EACH OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” RATIFICATION OF DELOITTE AND TOUCHE LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM TO THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2015.

AUDIT COMMITTEE REPORT1

The following is the report of the Audit Committee with respect to the Company’s audited financial statements for the period from the commencement of the Company’s operations (March 5, 2014) through December 31, 2014.

The Audit Committee has reviewed and discussed the Company’s audited financial statements with management and Deloitte & Touche LLP (“Deloitte”), the Company’s independent registered public accounting firm, with and without management present. Management has represented to the Audit Committee that the Company’s financial statements were prepared in accordance with accounting principles generally accepted in the United States. The Audit Committee is not, however, professionally engaged in the practice of accounting or auditing and does not provide any expert or other special assurance as to such financial statements concerning compliance with laws, regulations or accounting principles generally accepted in the United States or as to auditor independence. The Audit Committee relies, without independent verification, on the information provided to it and on the representations made by management and the Company’s independent registered public accounting firm.

The Audit Committee also has discussed with Deloitte matters relating to Deloitte’s judgments about the quality, as well as the acceptability, of the Company’s accounting principles as applied in its financial reporting as required by Statement of Auditing Standards No. 61 (Communication with Audit Committees). In addition, the Audit Committee has discussed with Deloitte its independence from management and the Company, as well as the matters in the written disclosures received from Deloitte and required by Public Company Accounting Oversight Board Rule 3526 (Communication with Audit Committee Concerning Independence). The Audit Committee received disclosures from Deloitte confirming its independence and discussed it with them. The Audit Committee reviewed and approved the amount of audit fees paid to Deloitte for the period from the commencement of the Company’s operations (March 5, 2014) through December 31, 2014. The Audit Committee discussed and reviewed with Deloitte the Company’s critical accounting policies and practices, internal controls, other material written communications to management, and the scope of Deloitte’s audits and all fees paid to Deloitte during the period. The Audit Committee adopted guidelines requiring review and pre-approval by the Audit Committee of audit and non-audit services performed by Deloitte for the Company. The Audit Committee has reviewed and considered the compatibility of Deloitte’s performance of non-audit services with the maintenance of Deloitte’s independence as the Company’s independent registered public accounting firm.

Based on the Audit Committee’s review and discussions referred to above, the Audit Committee recommended to the Board (and the Board has approved) that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the period from the commencement of the Company’s operations (March 5, 2014) through December 31, 2014 for filing with the SEC. In addition, the Audit Committee has engaged Deloitte to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015.

The Audit Committee

Gilbert E. Ahye,Chair

Steven P. Bird

Stephen A. Cassani

| 1 | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

OTHER BUSINESS

The Board knows of no other matter that is likely to come before the Annual Meeting or that may properly come before the Annual Meeting, apart from the consideration of an adjournment.

If there appears not to be enough stockholders present in person or by proxy for a quorum or to approve the proposals at the Annual Meeting the chairman of the meeting without a vote of stockholders or the Stockholders who are present in person or by proxy may vote to adjourn the Annual Meeting to permit the further solicitation of proxies. The person(s) named as proxies will vote proxies held by them for such adjournment.

ANNUAL AND QUARTERLY REPORTS

Copies of our Annual Report onForm 10-K, Quarterly Reports onForm 10-Q and Current Reports onForm 8-K are available at our website atwww.tpvg.com or without charge upon request by calling us at(650) 854-2090. Please direct your request to TriplePoint Venture Growth BDC Corp., Attention: Investor Relations, 2755 Sand Hill Road, Suite 150, Menlo Park, California 94025. Copies of such reports are also posted via EDGAR on the SEC’s website atwww.sec.gov.

SUBMISSION OF STOCKHOLDER PROPOSALS

The Company expects that the 2016 Annual Meeting of Stockholders will be held in May 2016, but the exact date, time and location of such meeting have yet to be determined. Proposals to be included in our proxy statement for the 2016 Annual Meeting must be submitted by eligible stockholders who have complied with the relevant regulations of the SEC and received no later than 5:00 p.m. Eastern time on December 19, 2015. The submission of a proposal does not guarantee its inclusion in the Company’s proxy statement or presentation at the Annual Meeting unless certain securities law requirements are met.

In addition, the Company’s bylaws currently contain an advance notice provision requiring that, if a Stockholder’s proposal, including nomination of an individual for election as a director, is to brought before the next annual meeting of the Stockholders, such Stockholder must provide timely notice thereof in writing addressed to the Secretary, c/o TriplePoint Venture Growth BDC Corp., 2755 Sand Hill Road, Suite 150, Menlo Park, California 94025. Notices of intention to present proposals, including nomination of an individual for election as a director, at the 2016 Annual Meeting of Stockholders must be received by the Company between November 19, 2015 and 5:00 p.m. Eastern time on December 19, 2015 by a stockholder who was a stockholder of record both at the time of giving the notice required by the Company’s bylaws and at the time of the meeting and who is entitled to vote at the meeting on such business or in the election of each such nominee, and the notice must contain the information about the stockholder, certain affiliates of the stockholder and the proposal or nominee required by the advance notice provisions set forth in the Company’s bylaws. The Company reserves the right to reject, rule out of order, or to take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

The Company’s Audit Committee has established guidelines and procedures regarding the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters (collectively, “Accounting Matters”). Persons with complaints or concerns regarding Accounting Matters may submit their complaints to the Company’s Chief Compliance Officer. Persons who are uncomfortable submitting complaints to the Chief Compliance Officer, including complaints involving the Chief Compliance Officer, may submit complaints directly to the Company’s Audit Committee. Complaints may be submitted on an anonymous basis.

The Chief Compliance Officer may be contacted at:

Mr. Carl M. Rizzo

TriplePoint Venture Growth BDC Corp.

Chief Compliance Officer

2755 Sand Hill Road, Suite 150

Menlo Park, CA 94025

The Audit Committee Members may be contacted at:

Messrs. Gilbert E. Ahye, Steven P. Bird and / or Stephen A. Cassani

TriplePoint Venture Growth BDC Corp.

Audit Committee Member

2755 Sand Hill Road, Suite 150

Menlo Park, CA 94025

You are cordially invited to attend our Annual Meeting in person. Whether or not you plan to attend the Annual Meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage paid envelope, or authorize a proxy to vote your shares via the Internet or telephone, so that you may be represented at the Annual Meeting.

By Order of the Board of Directors,

/s/ Sajal K. Srivastava |

Sajal K. Srivastava |

Secretary |

Menlo Park, California

April 17, 2015