united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22865

Forethought Variable Insurance Trust

(Exact name of registrant as specified in charter)

17605 Wright Street, Omaha, Nebraska 68130

(Address of principal executive offices) (Zip code)

James Ash, Gemini Fund Services, LLC.

80 Arkay Drive Suite 110, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 12/31

Date of reporting period: 06/30/15

Item 1. Reports to Stockholders.

Semi-Annual Report

June 30, 2015

FVIT Portfolios

FVIT American Funds® Managed Risk Portfolio

FVIT BlackRock Global Allocation Managed Risk Portfolio

FVIT Wellington Research Managed Risk Portfolio

(formerly FVIT WMC Research Managed Risk Portfolio)

FVIT Balanced Managed Risk Portfolio

FVIT Select Advisor Managed Risk Portfolio

FVIT Franklin Dividend and Income Managed Risk Portfolio

FVIT Growth Managed Risk Portfolio

FVIT Moderate Growth Managed Risk Portfolio

FVIT Goldman Sachs Dynamic Trends Allocation Portfolio

FVIT PIMCO Tactical Allocation Portfolio

Class II shares

Each a series of the Forethought Variable Insurance Trust

Distributed by Northern Lights Distributors, LLC

Member FINRA

| Dear Shareholders/Contract Owners: | (Unaudited) |

Thank you for investing in the FVIT Portfolios. We are pleased to present our semi-annual shareholder letter which highlights your fund’s performance and other pertinent information for the 6 months ended June 30, 2015.

Domestically, 2015 began much the way it did in 2014 as severe weather combined with a West Coast port strike and a rapid, significant strengthening of the US Dollar versus the Euro negatively impacted the economy. First quarter Real Gross Domestic Product (GDP) shrank by 0.2%, a particularly weak reading given a GDP contraction of 2.1% in the first quarter of 20141. That said, unemployment continued to improve, falling to 5.4% on June 30, 2015 from 5.7% at year-end 20142, while inflation remained benign. Overall, while U.S. economic data was weaker than expected in the first half of 2015, we believe that much of the weakness was caused by temporary factors that we expect to subside over the balance of the year. In our view, the U.S. economy is trending in a modestly positive direction, as witnessed by second quarter GDP of 2.3%1.

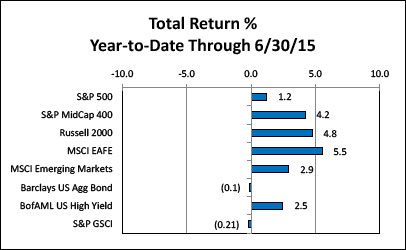

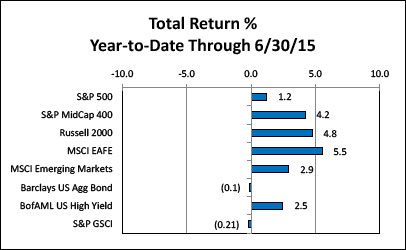

In the financial markets, while most major equity indices posted positive returns in the first half of 2015, month-to-month returns were highly variable by region. The MSCI EAFE Index (which measures developed market international equities), for example, was up 5.98% in February, down 1.52% in March, up 4.08% in April, then down 2.83% in June. Concerns regarding Greece and China, combined with a weaker than expected domestic economy, contributed to significant swings in virtually all financial markets. During this period, the U.S. Dollar strengthened rapidly and materially versus many major currencies, particularly the Euro. Global growth concerns continued, most notably in China where a significant financial market sell-off took place at the end of June and into July. These factors caused heightened volatility across the financial markets.

Domestic equity returns were positive year-to-date through June 30, 2015, particularly small- and mid-capitalization equities, which fared better than their large capitalization brethren. International equity markets outpaced domestic markets during the period, a turnaround from 2014 performance. Given the substantial strengthening of the U.S. Dollar however, the disparity between local currency and U.S. Dollar returns in foreign equity markets is worth noting.

Domestic fixed income markets had mixed returns during the period, with high yield outperforming investment grade as investors continued to reach for yield in this extended period of ultra-low interest rates. Commodities continued to weaken on lower demand from China and Europe.

Diverging central bank monetary policies have continued as expected into 2015. The U.S. Federal Reserve Bank continues to consider the timing of an interest rate increase, while the European Central Bank (ECB) not only remains firmly in a quantitative easing stance for the foreseeable future, but is also dealing with Greece’s financial difficulties. The Bank of Japan similarly continues with its aggressive monetary policy.

Consistent with our view at the end of 2014, we expect volatility in 2015 to remain higher than it has been in recent years due to a combination of several factors, including valuation levels being at the higher end of their historic range, diverging monetary policies of global central banks, concerns over global growth, and global adjustment to lower energy prices. The presence of higher levels of volatility is a good reminder of the benefits of portfolio diversification, and while diversification can’t guarantee a profit or prevent a loss, it may help improve your overall investment experience.

The following pages contain management’s discussion of recent Portfolio performance.

Sincerely,

|  |

| | |

| Eric D. Todd, CFA | Cameron Jeffreys, CFA |

| President and Co-Portfolio Manager | Vice President, Co-Portfolio Manager |

| Forethought Investment Advisors, LLC | Forethought Investment Advisors, LLC |

| 1 | U.S. Department of Commerce, Bureau of Economic Analysis |

| 2 | U.S. Department of Labor, Bureau of Labor Statistics |

| Portfolio | | Benchmark |

| FVIT American Funds® Managed Risk Portfolio | | S&P Target Risk Moderate Index |

| FVIT BlackRock Global Allocation Managed Risk Portfolio | | S&P Target Risk Moderate Index |

| FVIT Wellington Research Managed Risk Portfolio (formerly FVIT | | S&P Target Risk Moderate Index |

| WMC Research Managed Risk Portfolio) | | |

| FVIT Balanced Managed Risk Portfolio | | S&P Target Risk Conservative Index |

| FVIT Select Advisor Managed Risk Portfolio | | S&P Target Risk Moderate Index |

| FVIT Franklin Dividend and Income Managed Risk Portfolio | | S&P Target Risk Moderate Index |

| FVIT Growth Managed Risk Portfolio | | S&P Target Risk Growth Index |

| FVIT Moderate Growth Managed Risk Portfolio | | S&P Target Risk Moderate Index |

| FVIT Goldman Sachs Dynamic Trends Allocation Portfolio | | S&P Target Risk Conservative Index |

| FVIT PIMCO Tactical Allocation Portfolio | | S&P Target Risk Moderate Index |

The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance is no guarantee of future results.

This report contains the current opinions of Forethought Investment Advisors, LLC and/or sub-advisers at the time of its publication and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Such opinions are subject to change without notice and securities described herein may no longer be included in, or may at any time be removed from, a Portfolio’s portfolio. This report is distributed for informational purposes only. Information contained herein has been obtained from sources believed reliable, but not guaranteed.

Index Definitions:

S&P Target Risk Conservative Index emphasizes exposure to fixed income in order to produce a consistent income stream and avoid excessive volatility of return

S&P Target Risk Moderate Index offers significant exposure to fixed income, while also providing increased opportunity for capital growth through equities.

S&P Target Risk Growth Index increases exposure to equities, while also providing limited fixed income exposure to diversify risk.

Barclays US Aggregate Bond Index (“Barclays US Agg Bond”). An index weighted according to market capitalization and includes, among other categories, Treasury securities, mortgage backed securities, government agency bonds and corporate bonds. To be included in the index, bonds must be rated investment grade by Moody’s and Standard and Poor’s.

BofA ML High Yield Cash Pay MV USI Index (“BofA ML US High Yield”). An index that tracks the performance of US dollar denominated, below investment grade corporate debt, currently in a coupon paying period, which is publically issued in the US domestic market.

MSCI EAFE Total Return Index (“MSCI EAFE”). An index created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australasia and the Far East.

MSCI Emerging Markets Total Return Index (“MSCI Emerging Markets”). An index created by Morgan Stanley Capital International (MSCI) that is designed to measure equity market performance in global emerging markets. The index is unmanaged and not available for direct investment. The Emerging Markets Index is a float-adjusted market capitalization index that consists of indices in 21 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

Russell 2000 Total Return Index (“Russell 2000”). An index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

S&P Midcap 400 Total Return Index (“S&P MidCap 400”). A capitalization-weighted index which measures the performance of the mid-range sector of the U.S. stock market.

S&P 500 Total Return Index (“S&P 500”). A market capitalization weighted price index composed of 500 widely held US common stocks. Frequently used as a measure of US stock market performance.

S&P GSCI Total Return Index (“S&P GSCI”). A broad based, production weighted index meant to be representative of the global commodity market beta. The S&P Goldman Sachs Commodity Index (GSCI) consists of 24 commodity futures on physical commodities across five sectors; energy, agriculture, livestock, industrial metals, and precious metals.

3559-NLD-8/3/2015

(Unaudited)

Table of Contents

| | | Page |

| | | |

| FVIT Portfolio Reviews | | 1-20 |

| | | |

| Financial Statements: | | |

| | | |

| Portfolio of Investments | | 21-50 |

| | | |

| Statements of Assets and Liabilities | | 51-54 |

| | | |

| Statements of Operations | | 55-58 |

| | | |

| Statements of Changes in Net Assets | | 59-63 |

| | | |

| Financial Highlights | | 64-73 |

| | | |

| Notes to Financial Statements | | 74-92 |

| | | |

| Expense Examples | | 93-94 |

| | | |

| Supplemental Information | | 95-100 |

| | | |

| Privacy Policy | | 101-102 |

FVIT American Funds® Managed Risk Portfolio

Portfolio Review

June 30, 2015 (Unaudited)

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

How did the Portfolio perform during the period?

During the first 6 months of 2015, the Portfolio outperformed its reference benchmark, the S&P Target Risk Moderate Index. The Portfolio posted a return of 1.01% compared to a benchmark return of 0.70%, a positive difference of 31 basis points. The following discussion of relative performance pertains to this benchmark.

What factors and allocation decisions influenced the Portfolio’s performance?

An overweight to equities versus the benchmark contributed positively to performance in the first 6 months of 2015. Within equities, an underweight to international developed market equities contributed negatively. Within domestic equities, the Portfolio’s overweight position in mid-caps more than offset an underweight position in small caps and contributed positively to performance.

An underweight to fixed income versus the benchmark contributed positively to performance in the first 6 months of 2015 as equities outperformed fixed income. Within fixed income, the portfolio modestly outperformed the benchmark due to a slightly shorter duration position.

While the managed risk strategy was a modest detractor from performance during the period, it was more than offset by the overweight to equities.

How was the Portfolio positioned at period end?

At period end, the Portfolio remained overweight equities relative to the benchmark. Within equities, the Portfolio continued to be overweight U.S. large caps and underweight international and emerging market equities versus the benchmark. During the period, we reduced the Portfolio’s underweight to international equities versus the benchmark as we became more constructive on developed market Europe and Asia as economic data and growth prospects improved combined with relatively attractive valuations.

At period end, the Portfolio remained underweight fixed income versus the benchmark, and within fixed income, the Portfolio was short duration relative to the benchmark due to concerns about rising interest rates.

3559-NLD-8/3/2015

| FVIT American Funds® Managed Risk Portfolio |

| Portfolio Review (Continued) |

| June 30, 2015 (Unaudited) |

The Portfolio’s performance figures* for the periods ended June 30, 2015 as compared to its benchmark:

| | | | | | | Annualized |

| | | Six | | One | | Performance |

| | | Months | | Year | | Since Inception** |

| FVIT American Funds® Managed Risk Portfolio | | | | | | |

| Class II | | 1.01% | | 2.42% | | 5.78% |

| S&P Target Risk® Moderate Index (Total Return) | | 0.70% | | 0.77% | | 4.15% |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. The Portfolio’s total annual operating expenses, after fee waiver and/or reimbursement, were 1.19% for Class II shares per the April 30, 2015 prospectus. |

| ** | Commencement of operations is October 31, 2013. |

The S&P Target Risk® Moderate Index (Total Return) provides significant exposure to fixed income, while also providing increased opportunity for capital growth through equities.

| Holdings by Asset Class | | % of Net Assets | |

| Equity Funds | | | 59.9 | % |

| Debt Funds | | | 29.7 | % |

| Money Market Fund | | | 6.0 | % |

| Other Assets Less Liabilities - Net | | | 4.4 | % |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments in this semi-annual report for more information regarding the Portfolio’s holdings as June 30, 2015. Derivative exposure is included in “Other Assets Less Liabilities - Net”.

FVIT BlackRock Global Allocation Managed Risk Portfolio

Portfolio Review

June 30, 2015 (Unaudited)

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

How did the Portfolio perform during the year?

During the first 6 months of 2015, the Portfolio outperformed its reference benchmark, the S&P Target Risk Moderate Index. The Portfolio posted a return of 2.34% compared to a benchmark return of 0.70%, a positive difference of 164 basis points.

What factors and allocation decisions influenced the Portfolio’s performance?

The Portfolio seeks to achieve its object by investing under normal market conditions, at least 80% of its net assets, plus any borrowings for investment purposes in the BlackRock Global Allocation V.I. Fund. The Portfolio’s other investments include cash, a money market fund, and futures contracts. BlackRock Global Allocation V.I. Fund outperformed the S&P Target Risk Moderate Index during the period.

While the managed risk strategy was a modest detractor from performance during the period, it was more than offset by the overweight to equities.

How was the Portfolio positioned at period end?

At period end, the Portfolio’s primary investment remained the BlackRock Global Allocation V.I. Fund.

3559-NLD-8/3/2015

| FVIT BlackRock Global Allocation Managed Risk Portfolio |

| Portfolio Review (Continued) |

| June 30, 2015 (Unaudited) |

The Portfolio’s performance figures* for the periods ended June 30, 2015 as compared to its benchmark:

| | | | | | | Annualized |

| | | Six | | One | | Performance |

| | | Months | | Year | | Since Inception** |

| FVIT BlackRock Global Allocation Managed Risk Portfolio | | | | | | |

| Class II | | 2.34% | | 0.20% | | 3.16% |

| S&P Target Risk® Moderate Index (Total Return) | | 0.70% | | 0.77% | | 4.15% |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. The Portfolio’s total annual operating expenses, after fee waiver and/or reimbursement, were 1.25% for Class II shares per the April 30, 2015 prospectus. |

| ** | Commencement of operations is October 31, 2013. |

The S&P Target Risk® Moderate Index (Total Return) provides significant exposure to fixed income, while also providing increased opportunity for capital growth through equities.

| Holdings by Asset Class | | % of Net Assets | |

| Asset Allocation Fund | | | 95.0 | % |

| Money Market Fund | | | 0.3 | % |

| Other Assets Less Liabilities - Net | | | 4.7 | % |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments in this semi-annual report for more information regarding the Portfolio’s holdings as June 30, 2015.

FVIT Wellington Research Managed Risk Portfolio

Portfolio Review

June 30, 2015 (Unaudited)

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

How did the Portfolio perform during the year?

During the first 6 months of 2015, the Portfolio outperformed its reference benchmark, the S&P Target Risk Moderate Index. The Portfolio posted a return of 2.13% compared to a benchmark return of 0.70%, a positive difference of 143 basis points. The following discussion of relative performance pertains to this benchmark.

What factors and allocation decisions influenced the Portfolio’s performance?

An overweight to equities versus the benchmark contributed positively to performance in the first 6 months of 2015. During the period, the equity portion of the Portfolio’s outperformance versus the S&P 500 (gross of fees) was driven by security selection. Sectors where stock selection was additive to performance were Consumer Staples, Financials, Information Technology, Energy, Health Care, and Industrials. Sectors where stock selection detracted from performance were Consumer Discretionary and Utilities.

The Portfolio’s top relative contributors included Freescale Semiconductor (0.2% of net assets), Santander Consumer (0.7% of net assets), and Apple (3.5% of net assets). Freescale Semiconductor is a provider of both semiconductors and complementary devices and software. The stock surged after NXP Semiconductors and Freescale announced a $40 billion merger. Santander Consumer, a specialized consumer finance company focused on vehicle finance and other unsecured consumer lending products, saw shares rise after reporting earnings which beat expectations due to both lower than forecast expenses and increasing credit strength. Shares of Apple, the designer of the iPhone, iPad, and other interconnected mobile communications and media devices, rose during the period after the company reported record numbers due to better than expected revenue and an increase in gross margins. Western Digital (0.3% of net assets), the largest computer hard disk drive manufacturer in the world, was the Portfolio’s largest detractor during the period. The stock underperformed as the outlook for PC demand appears to be weaker than the market previously expected in the near term. Not owning JPMorgan Chase, and reducing positions in strong performing benchmark constituents, Walt Disney (0.0% of net assets) and Gilead Sciences (0.2% of net assets), detracted from relative performance during the period.

The fixed income portion of the Portfolio outperformed the Barclays U.S. Aggregate (gross of fees) during the period. Security selection within the Investment Grade Credit sector, particularly Industrials, was the primary driver of relative performance over the period. Additionally, an overweight to the Asset Backed Securities sector, as well the duration and yield curve positioning, added to relative results. On the other hand, security selection within Agency mortgage backed securities modestly detracted from relative results during the period.

The managed risk strategy was marginally accretive to performance in the period.

How was the Portfolio positioned at period end?

At period end, the Portfolio remained overweight equities relative to the benchmark. The equity portion of the Portfolio was industry-neutral, designed to add value through fundamental, bottom-up security analysis. The Portfolio consists of multiple sub-portfolios, with each sub-portfolio actively managed by one or more of Wellington Management’s global industry analysts. The allocation of assets to each sub-portfolio corresponds to the relative weight of the analysts’ coverage universe within the index. However, within in an industry, an analyst’s stock selection may result in an overweight or underweight to certain sub-industries in his or her area of coverage.

The fixed income portion of the Portfolio was positioned with a slightly short duration bias as the stronger state of the US economy points to the possibility of a Federal Reserve (Fed) increase in interest rates later this year. The Portfolio maintains a moderately pro-cyclical positioning in credit markets based on supportive monetary policy, positive credit fundamentals and attractive valuations. This view is reflected in an overweight position in the securitized sector, particularly asset-backed and commercial mortgage-backed securities as consumer benefits from improving labor and housing market. The Portfolio maintains an underweight to agency mortgage-backed securities as the sub-adviser expects more volatility in the sector with diminished Fed involvement.

3559-NLD-8/3/2015

| FVIT Wellington Research Managed Risk Portfolio |

| Portfolio Review (Continued) |

| June 30, 2015 (Unaudited) |

The Portfolio’s performance figures* for the periods ended June 30, 2015 as compared to its benchmark:

| | | | | | | Annualized |

| | | Six | | One | | Performance |

| | | Months | | Year | | Since Inception** |

| FVIT Wellington Research Managed Risk Portfolio | | | | | | |

| Class II | | 2.13% | | 6.26% | | 8.81% |

| S&P 500 Target Risk® Moderate Index (Total Return) | | 0.70% | | 0.77% | | 4.15% |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. The Portfolio’s total annual operating expenses, after fee waiver and/or reimbursement, were 1.21% for Class II shares per the April 30, 2015 prospectus. |

| ** | Commencement of operations is October 31, 2013. |

The S&P Target Risk® Moderate Index (Total Return) provides significant exposure to fixed income, while also providing increased opportunity for capital growth through equities.

| Holdings by Asset Class | | % of Net Assets | |

| Common Stocks | | | 58.5 | % |

| U.S. Treasury Securities | | | 16.8 | % |

| Mortgage Backed Securities | | | 7.6 | % |

| Corporate Bonds | | | 6.3 | % |

| Asset Backed Securities | | | 1.8 | % |

| Exchange Traded Fund | | | 3.0 | % |

| Commercial Mortgage Backed Securities | | | 0.4 | % |

| Municipal Securities | | | 0.4 | % |

| Money Market Fund | | | 9.2 | % |

| Other Assets Less Liabilities - Net | | | (4.0 | )% |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments in this semi-annual report for more information regarding the Portfolio’s holdings as June 30, 2015.

FVIT Balanced Managed Risk Portfolio

Portfolio Review

June 30, 2015 (Unaudited)

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

How did the Portfolio perform during the year?

During the first 6 months of 2015, the Portfolio outperformed its reference benchmark, the S&P Target Risk Conservative Index. The Portfolio posted a return of 0.65% compared to a benchmark return of 0.24%, a positive difference of 41 basis points. The following discussion of relative performance pertains to this benchmark.

What factors and allocation decisions influenced the Portfolio’s performance?

An overweight to equities versus the benchmark contributed positively to performance in the first 6 months of 2015. Within equities, an underweight to international developed market equities contributed negatively. Within domestic equities, the Portfolio’s overweight position in mid- and small-caps contributed positively.

An underweight to fixed income versus the benchmark contributed positively to performance in the first 6 months of 2015 as equities outperformed fixed income. Within fixed income, the Portfolio slightly underperformed the benchmark due to a modestly lower weighting to cash.

The managed risk strategy was marginally accretive to performance during the period.

How was the Portfolio positioned at period end?

At period end, the Portfolio remained overweight equities relative to the benchmark. Within equities, the Portfolio continues to be overweight U.S. large caps and underweight international and emerging market equities versus the benchmark. During the period, we reduced the Portfolio’s underweight to international equities versus the benchmark as we became more constructive on developed market Europe and Asia as economic data and growth prospects improved combined with relatively attractive valuations.

At period end, the Portfolio remained underweight fixed income versus the benchmark; within fixed income, the Portfolio was short duration relative to the benchmark due to concerns about rising rates.

3559-NLD-8/3/2015

| FVIT Balanced Managed Risk Portfolio |

| Portfolio Review (Continued) |

| June 30, 2015 (Unaudited) |

The Portfolio’s performance figures* for the periods ended June 30, 2015, as compared to its benchmark:

| | | | | | | Annualized |

| | | Six | | One | | Performance |

| | | Months | | Year | | Since Inception** |

| FVIT Balanced Managed Risk Portfolio | | | | | | |

| Class II | | 0.65% | | 2.47% | | 5.27% |

| S&P Target Risk® Conservative Index (Total Return) | | 0.24% | | 0.31% | | 3.15% |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. The Portfolio’s total annual operating expenses, after fee waiver and/or reimbursement, were 1.04% for Class II shares per the April 30, 2015 prospectus. |

| ** | Commencement of operations is October 31, 2013. |

The S&P Target Risk® Conservative Index (Total Return) emphasizes exposure to fixed income in order to produce a consistent income stream and avoid excessive volatility of returns.

| Holdings by Asset Class | | % of Net Assets | |

| Equity Funds | | | 45.1 | % |

| Debt Funds | | | 47.0 | % |

| Money Market Fund | | | 4.5 | % |

| Other Assets Less Liabilities - Net | | | 3.4 | % |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments in this semi-annual report for more information regarding the Portfolio’s holdings as June 30, 2015.

| FVIT Select Advisor Managed Risk Portfolio |

| Portfolio Review |

| June 30, 2015 (Unaudited) |

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

How did the Portfolio perform during the year?

During the first 6 months of 2015, the Portfolio underperformed its reference benchmark, the S&P Target Risk Moderate Index. The Portfolio posted a return of 0.64% compared to a benchmark return of 0.70%, a negative difference of 6 basis points. The following discussion of relative performance pertains to this benchmark.

What factors and allocation decisions influenced the Portfolio’s performance?

An overweight to equities versus the benchmark contributed positively to performance in the first 6 months of 2015. Within equities, an underweight to international developed market equities contributed negatively. Within domestic equities, the Portfolio’s overweight position in mid- and small-caps contributed positively. An underweight to emerging markets stocks contributed positively.

An underweight to fixed income versus the benchmark contributed positively to performance in the first 6 months of 2015 as equities outperformed fixed income. Within fixed income, the Portfolio outperformed the benchmark due to a slightly shorter duration position.

While the managed risk strategy was a modest detractor from performance during the period, it was more than offset by the overweight to equities.

How was the Portfolio positioned at period end?

At period end, the Portfolio remained overweight equities relative to the benchmark. Within equities, the Portfolio continued to be overweight U.S. large caps and underweight international and emerging market equities versus the benchmark. During the period, we reduced the Portfolio’s underweight to international equities versus the benchmark as we became more constructive on developed market Europe and Asia as economic data and growth prospects improved combined with relatively attractive valuations.

At period end, the Portfolio remained underweight fixed income versus the benchmark, and within fixed income, the Portfolio was short duration relative to the benchmark due to concerns about rising interest rates.

3559-NLD-8/3/2015

| FVIT Select Advisor Managed Risk Portfolio |

| Portfolio Review (Continued) |

| June 30, 2015 (Unaudited) |

The Portfolio’s performance figures* for the periods ended June 30, 2015, as compared to its benchmark:

| | | | | | | Annualized |

| | | Six | | One | | Performance |

| | | Months | | Year | | Since Inception** |

| FVIT Select Advisor Managed Risk Portfolio | | | | | | |

| Class II | | 0.64% | | 3.00% | | 6.14% |

| S&P Target Risk® Moderate Index (Total Return) | | 0.70% | | 0.77% | | 4.15% |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. The Portfolio’s total annual operating expenses, after fee waiver and/or reimbursement, were 1.18% for Class II shares per the April 30, 2015 prospectus. |

| ** | Commencement of operations is October 31, 2013. |

The S&P Target Risk® Moderate Index (Total Return) provides significant exposure to fixed income, while also providing increased opportunity for capital growth through equities.

| Holdings by Asset Class | | % of Net Assets | |

| Equity Funds | | | 67.8 | % |

| Debt Funds | | | 21.7 | % |

| Money Market Fund | | | 5.7 | % |

| Other Assets Less Liabilities - Net | | | 4.8 | % |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments in this semi-annual report for more information regarding the Portfolio’s holdings as June 30, 2015. Derivative exposure is included in “Other Assets Less Liabilities - Net”.

| FVIT Franklin Dividend and Income Managed Risk Portfolio |

| Portfolio Review |

| June 30, 2015 (Unaudited) |

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

How did the Portfolio perform during the year?

During the first 6 months of 2015, the Portfolio underperformed its reference benchmark, the S&P Target Risk Moderate Index. The Portfolio posted a return of -0.85% compared to a benchmark return of 0.70%, a negative difference of 155 basis points. The following discussion of relative performance pertains to this benchmark.

What factors and allocation decisions influenced the Portfolio’s performance?

Dividend stocks underperformed the domestic and international equity developed markets year-to-date, which is the primary driver of underperformance versus the benchmark. Additionally, the equity sleeve of the fund is less than 3% invested in international stocks, whereas the benchmark has approximately 20% invested in international stocks, which during the first half of 2015 outperformed domestic equities.

The equity sleeve of this Portfolio is managed pursuant to a rising dividends strategy which seeks to invest in equity securities that have paid consistently rising dividends. Companies that have paid consistently rising dividends include those companies that currently pay dividends on their common stock and have maintained or increased their dividend rate during the last four consecutive years. The equity sleeve of the Portfolio seeks to invest in securities of companies that have: (1) consistently increased dividends in at least 8 out of the last 10 years and have not decreased dividends during that time; (2) increased dividends substantially (at least 100%) over the last 10 years; (3) reinvested earnings, paying out less than 65% of current earnings in dividends (except for utility companies); and (4) either long-term debt that is no more than 50% of total capitalization (except for utility companies) or senior debt that has been rated investment grade by at least one of the major bond rating organizations.

Due to the higher equity exposure of this Portfolio, a higher degree of hedging is necessary during periods of volatility in order to help the Portfolio seek to meet its objective of providing capital appreciation and income while seeking to manage volatility. This increase in hedging in order to help manage higher levels of volatility can also limit upside performance. The managed risk strategy was a meaningful detractor from performance during the period, as volatility exhibited several spikes followed by rapid reversals. Additionally, dividend stocks experienced a higher level of volatility during the period than one might normally expect relative to other equities.

The Franklin Templeton Total Return Fund, the primary investment for the fixed income sleeve of the Portfolio, modestly outperformed the fixed income portion of the benchmark during the period.

How was the Portfolio positioned at period end?

At period end, the Portfolio remained overweight equities relative to the benchmark. The equity sleeve of the Portfolio’s largest holdings were Roper Technologies Inc., (formerly Roper Industries Inc.,) an industrial conglomerate (2.6% of net assets); United Technologies Corp., a building systems and aerospace products and services provider (2.2% of net assets); Praxair Inc., a producer of industrial gases (2.1% of net assets); Air Products and Chemicals Inc., a manufacturer of specialty gases (2.0% of net assets); Medtronics PLC, a manufacturer of therapeutic and diagnostic medical products (2.0% of net assets); Honeywell International Inc., a manufacturer of diversified technology (2.0% of net assets); Johnson Controls Inc., a building efficiency and auto components company (1.9% of net assets); Stryker Corp, a manufacturer of specialty surgical and medical products (1.9% of net assets); and Becton, Dickinson and Co., a manufacturer of medical devices (1.8% of net assets).

The Portfolio remained underweight fixed income versus the benchmark and the fixed income sleeve of the Portfolio was primarily invested in fixed income investment grade securities through the Franklin Templeton Total Return Fund.

3559-NLD-8/3/2015

| FVIT Franklin Dividend and Income Managed Risk Portfolio |

| Portfolio Review (Continued) |

| June 30, 2015 (Unaudited) |

The Portfolio’s performance figures* for the period ended June 30, 2015, as compared to its benchmark:

| | | | | | | Annualized |

| | | Six | | One | | Performance |

| | | Months | | Year | | Since Inception** |

| FVIT Franklin Dividend and Income Managed Risk Portfolio | | | | | | |

| Class II | | (0.85)% | | 1.56% | | 3.76% |

| S&P Target Risk® Moderate Index (Total Return) | | 0.70% | | 0.77% | | 2.74% |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. The Portfolio’s total annual operating expenses, after fee waiver and/or reimbursement, were 1.16% for Class II shares per the April 30, 2015 prospectus. |

| ** | Commencement of operations is April 30, 2014. |

The S&P Target Risk® Moderate Index (Total Return) provides significant exposure to fixed income, while also providing increased opportunity for capital growth through equities.

| Holdings by Asset Class | | % of Net Assets | |

| Common Stocks | | | 70.1 | % |

| Debt Fund | | | 23.9 | % |

| Money Market Fund | | | 1.6 | % |

| Other Assets Less Liabilities - Net | | | 4.4 | % |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments in this semi-annual report for more information regarding the Portfolio’s holdings as June 30, 2015. Derivative exposure is included in “Other Assets Less Liabilities - Net”.

| FVIT Growth Managed Risk Portfolio |

| Portfolio Review |

| June 30, 2015 (Unaudited) |

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

How did the Portfolio perform during the year?

During the first 6 months of 2015, the Portfolio underperformed its reference benchmark, the S&P Target Risk Growth Index. The Portfolio posted a return of -0.29% compared to a benchmark return of 1.74%, a negative difference of 203 basis points. The following discussion of relative performance pertains to this benchmark.

What factors and allocation decisions influenced the Portfolio’s performance?

Due to the higher equity exposure of this Portfolio, a higher degree of hedging is necessary during periods of volatility in order to help the Portfolio seek to meet its objective of providing capital appreciation and income while seeking to manage volatility. This increase in hedging in order to help manage higher levels of volatility can also limit upside performance. The managed risk strategy was a meaningful detractor from performance during the period, as volatility exhibited several spikes followed by rapid reversals.

Within equities, an underweight to international developed market equities contributed negatively. Within domestic equities, the Portfolio’s overweight position in mid- and small-caps contributed positively.

Within fixed income, the Portfolio slightly underperformed the benchmark due to a modestly lower weighting to cash.

How was the Portfolio positioned at period end?

At period end, the Portfolio remained overweight equities relative to the benchmark. Within equities, the Portfolio continued to be overweight U.S. large caps and underweight international and emerging market equities versus the benchmark. During the period, we reduced the Portfolio’s underweight to international equities versus the benchmark as we became more constructive on developed market Europe and Asia as economic data and growth prospects improved combined with relatively attractive valuations.

At period end, the Portfolio remained underweight fixed income versus the benchmark, and within fixed income, the Portfolio was short duration relative to the benchmark due to concerns about rising rates.

3559-NLD-8/3/2015

| FVIT Growth Managed Risk Portfolio |

| Portfolio Review (Continued) |

| June 30, 2015 (Unaudited) |

The Portfolio’s performance figures* for the period ended June 30, 2015, as compared to its benchmark:

| | | | | | | Annualized |

| | | Six | | One | | Performance |

| | | Months | | Year | | Since Inception** |

| FVIT Growth Managed Risk Portfolio | | | | | | |

| Class II | | (0.29)% | | 1.06% | | 3.93% |

| S&P Target Risk® Growth Index (Total Return) | | 1.74% | | 2.58% | | 4.97% |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. The Portfolio’s total annual operating expenses, after fee waiver and/or reimbursement, were 0.99% for Class II shares per the April 30, 2015 prospectus. |

| ** | Commencement of operations is April 30, 2014. |

The S&P Target Risk® Growth Index (Total Return) which offers increased exposure to equities, while also using some fixed income exposure to diversify risk.

| Holdings by Asset Class | | % of Net Assets | |

| Equity Funds | | | 78.8 | % |

| Debt Funds | | | 14.2 | % |

| Money Market Fund | | | 4.5 | % |

| Other Assets Less Liabilities - Net | | | 2.5 | % |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments in this semi-annual report for more information regarding the Portfolio’s holdings as June 30, 2015.

| FVIT Moderate Growth Managed Risk Portfolio |

| Portfolio Review |

| June 30, 2015 (Unaudited) |

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

How did the Portfolio perform during the year?

During the first 6 months of 2015, the Portfolio underperformed its reference benchmark, the S&P Target Risk Moderate Index. The Portfolio posted a return of 0.57% compared to a benchmark return of 0.70%, a negative difference of 13 basis points. The following discussion of relative performance pertains to this benchmark.

What factors and allocation decisions influenced the Portfolio’s performance?

Due to the higher equity exposure of this Portfolio, a higher degree of hedging is necessary during periods of volatility in order to help the Portfolio seek to meet its objective of providing capital appreciation and income while seeking to manage volatility. This increase in hedging in order to help manage higher levels of volatility can also limit upside performance. The managed risk strategy was a detractor from performance during the period, as volatility exhibited several spikes followed by rapid reversals.

An overweight to equities versus the benchmark contributed positively to performance in the first 6 months of 2015. While an underweight to international developed market equities contributed negatively, the Portfolio’s overweight position in domestic mid- and small-caps contributed positively.

An underweight to fixed income versus the benchmark contributed positively to performance in the first 6 months of 2015 as equities outperformed fixed income. Within fixed income, the Portfolio slightly underperformed the benchmark due to a modestly lower weighting to cash.

How was the Portfolio positioned at period end?

At period end, the Portfolio remained overweight equities relative to the benchmark. Within equities, the Portfolio continued to be overweight U.S. large caps and underweight international and emerging market equities versus the benchmark. During the period, we reduced the Portfolio’s underweight to international equities versus the benchmark as we became more constructive on developed market Europe and Asia as economic data and growth prospects improved combined with relatively attractive valuations.

At period end, the Portfolio remained underweight fixed income versus the benchmark, and within fixed income, the Portfolio was short duration relative to the benchmark due to concerns about rising rates.

3559-NLD-8/3/2015

| FVIT Moderate Growth Managed Risk Portfolio |

| Portfolio Review (Continued) |

| June 30, 2015 (Unaudited) |

The Portfolio’s performance figures* for the period ended June 30, 2015, as compared to its benchmark:

| | | | | | | Annualized |

| | | Six | | One | | Performance |

| | | Months | | Year | | Since Inception** |

| FVIT Moderate Growth Managed Risk Portfolio | | | | | | |

| Class II | | 0.57% | | 2.82% | | 4.78% |

| S&P Target Risk® Moderate Index (Total Return) | | 0.70% | | 0.77% | | 2.74% |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. The Portfolio’s total annual operating expenses, after fee waiver and/or reimbursement, were 0.99% for Class II shares per the April 30, 2015 prospectus. |

| ** | Commencement of operations is April 30, 2014. |

The S&P Target Risk® Moderate Index (Total Return) provides significant exposure to fixed income, while also providing increased opportunity for capital growth through equities.

| Holdings by Asset Class | | % of Net Assets | |

| Equity Funds | | | 59.7 | % |

| Debt Funds | | | 33.2 | % |

| Money Market Fund | | | 3.9 | % |

| Other Assets Less Liabilities - Net | | | 3.2 | % |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments in this semi-annual report for more information regarding the Portfolio’s holdings as June 30, 2015.

| FVIT Goldman Sachs Dynamic Trends Allocation Portfolio |

| Portfolio Review |

| June 30, 2015 (Unaudited) |

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

How did the Portfolio perform during the year?

The Portfolio’s inception date was April 30, 2015. For the two months ended June 30, 2015, the Portfolio underperformed its reference benchmark, the S&P Target Risk Conservative Index. The Portfolio posted a return of -1.30% compared to a benchmark return of -1.58%, a positive difference of 28 basis points. The following discussion of relative performance pertains to this benchmark.

What factors and allocation decisions influenced the Portfolio’s performance?

The Portfolio’s exposure to U.S. fixed income was the main detractor from returns, followed by exposure to European and U.S. large cap equities. Conversely, the Portfolio’s exposure to Japanese equities was the largest positive contributor to returns. The hedge overlay strategy was a slight detractor from performance during the period.

How was the Portfolio positioned at period end?

At period end, the Portfolio had approximately 40% of its assets invested in U.S. equities with an additional 19% in international equities. Furthermore, the Portfolio was allocated 36% to U.S. fixed income and held 5% in cash.

3559-NLD-8/3/2015

| FVIT Goldman Sachs Dynamic Trends Allocation Portfolio |

| Portfolio Review (Continued) |

| June 30, 2015 (Unaudited) |

The Portfolio’s performance figures* for the period ended June 30, 2015, as compared to its benchmark:

| | | Performance |

| | | Since Inception** |

| FVIT Goldman Sachs Dynamic Trends Allocation Portfolio | | |

| Class II | | (1.30)% |

| S&P Target Risk® Conservative Index (Total Return) | | (1.58)% |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. The Portfolio’s total annual operating expenses, after fee waiver and/or reimbursement, were 1.20% for Class II shares per the April 30, 2015 prospectus. |

| ** | Commencement of operations is April 30, 2015. |

The S&P Target Risk® Conservative Index (Total Return) provides significant exposure to fixed income in order to produce a consistent income stream and avoid excessive volatility of returns.

| Holdings by Asset Class | | % of Net Assets | |

| Equity Funds | | | 9.3 | % |

| U.S. Government Agencies | | | 32.5 | % |

| U.S Treasury Securities | | | 43.0 | % |

| Options Purchased | | | 0.6 | % |

| Money Market Fund | | | 15.3 | % |

| Other Assets Less Liabilities - Net | | | (0.7 | )% |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments in this semi-annual report for more information regarding the Portfolio’s holdings as June 30, 2015. Derivative exposure is included in “Other Assets Less Liabilities - Net”.

| FVIT PIMCO Tactical Allocation Portfolio |

| Portfolio Review |

| June 30, 2015 (Unaudited) |

The Portfolio seeks to provide capital appreciation and income while seeking to manage volatility.

How did the Portfolio perform during the year?

The Portfolio’s inception date was April 30, 2015. For the two months ended June 30, 2015, the Portfolio underperformed its reference benchmark, the S&P Target Risk Moderate Index. The Portfolio posted a return of -1.70% compared to a benchmark return of -1.63%, a negative difference of 7 basis points. The following discussion of relative performance pertains to this benchmark.

What factors and allocation decisions influenced the Portfolio’s performance?

During the two months since inception, the Portfolio remained overweight equities relative to the benchmark which detracted from performance as equities fell. Within equities, an underweight to emerging market equities benefitted the Portfolio but an underweight to U.S. mid-cap and U.S. small-cap detracted from relative performance as these segments of the market rallied during this time period.

The Portfolio’s underweight duration exposure in fixed income relative to the benchmark contributed positively to performance during the 2 months since inception as the 10-year Treasury rate rose 32 basis points over that time period. A tactical short to the Japanese Yen was positive as accommodative policies continued to drive the currency lower versus the dollar. Exposure to Treasury inflation protected securities (TIPS) contributed to returns as expectations for future inflation rose. Exposure to non-Agency mortgages was positive as the sector continued to benefit from the on-going housing recovery. The tail risk hedging strategy was neutral for Portfolio performance.

How was the Portfolio positioned at period end?

At period end, the Portfolio remained overweight equities relative to the benchmark. Within equities, the Portfolio is overweight U.S. large cap, equal weight international developed, and underweight emerging markets. Towards the end of the period, the Portfolio slightly reduced the overweight to U.S. large cap equities relative to the benchmark as volatility increased.

Within fixed income, the Portfolio remained defensive towards interest rate risk relative to the benchmark. The Portfolio continued to emphasize diversified sources of return that provide attractive risk-adjusted return potential such as TIPS and Agency mortgage-backed securities. Lastly, the Portfolio also held short Euro and Japanese Yen currency positions relative to the benchmark to benefit from divergent global monetary policies.

3559-NLD-8/3/2015

| FVIT PIMCO Tactical Allocation Portfolio |

| Portfolio Review (Continued) |

| June 30, 2015 (Unaudited) |

The Portfolio’s performance figures* for the period ended June 30, 2015, as compared to its benchmark:

| | | Performance |

| | | Since Inception** |

| FVIT PIMCO Tactical Allocation Portfolio | | |

| Class II | | (1.70)% |

| S&P Target Risk® Moderate Index (Total Return) | | (1.63)% |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. The Portfolio’s total annual operating expenses, after fee waiver and/or reimbursement, were 1.20% for Class II shares per the April 30, 2015 prospectus. |

| ** | Commencement of operations is April 30, 2015. |

The S&P Target Risk® Moderate Index (Total Return) provides significant exposure to fixed income, while also providing increased opportunity for capital growth through equities.

| Holdings by Asset Class | | % of Net Assets | |

| Exchange Traded Funds | | | 29.3 | % |

| Asset Backed Securities | | | 3.8 | % |

| Corporate Bonds | | | 5.2 | % |

| Mortgage Backed Securities | | | 27.7 | % |

| Collateralized Mortgage Obligations | | | 4.9 | % |

| U.S. Treasury Securities | | | 34.1 | % |

| Money Market Fund | | | 0.1 | % |

| Purchased Options | | | 1.6 | % |

| Other Assets Less Liabilities - Net | | | (6.7 | )% |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments in this semi-annual report for more information regarding the Portfolio’s holdings as June 30, 2015. Derivative exposure is included in “Other Assets Less Liabilities - Net”.

| FVIT American Funds® Managed Risk Portfolio |

| PORTFOLIO OF INVESTMENTS |

| June 30, 2015 (Unaudited) |

| Shares | | | | | Value | |

| | | | | VARIABLE INSURANCE TRUSTS - 89.6% | | | | |

| | | | | DEBT FUND - 29.7% | | | | |

| | 4,651,307 | | | American Funds Insurance Series - Bond Fund - Class 1 | | $ | 50,280,632 | |

| | | | | | | | | |

| | | | | EQUITY FUNDS - 59.9% | | | | |

| | 2,203,089 | | | American Funds Insurance Series - Blue Chip Income and Growth Fund - Class 1 | | | 29,102,809 | |

| | 1,462,863 | | | American Funds Insurance Series - Global Growth and Income Fund - Class 1 | | | 19,265,904 | |

| | 242,465 | | | American Funds Insurance Series - Growth Fund - Class 1 | | | 16,434,293 | |

| | 783,640 | | | American Funds Insurance Series - Growth-Income Fund - Class 1 | | | 36,525,481 | |

| | | | | | | | 101,328,487 | |

| | | | | TOTAL VARIABLE INSURANCE TRUSTS (Cost - $161,412,077) | | | 151,609,119 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS - 6.0% | | | | |

| | | | | MONEY MARKET FUND - 6.0% | | | | |

| | 10,240,269 | | | Fidelity Institutional Money Market - Money Market Portfolio, Institutional Class to yield 0.10% (a)(Cost - $10,240,269) | | | 10,240,269 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 95.6% (Cost - $171,652,346)(b) | | $ | 161,849,388 | |

| | | | | OTHER ASSETS LESS LIABILITIES - NET - 4.4% | | | 7,437,846 | |

| | | | | TOTAL NET ASSETS - 100.0% | | $ | 169,287,234 | |

| (a) | | Money market rate shown represents the rate at June 30, 2015. |

| (b) | | Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $171,699,217 and differs from market value by net unrealized appreciation (depreciation) of securities as follows: |

| Unrealized Appreciation: | | $ | — | |

| Unrealized Depreciation: | | | (9,849,829 | ) |

| Net Unrealized Depreciation: | | $ | (9,849,829 | ) |

| Contracts | | | | | Unrealized Appreciation | |

| | | | | SHORT FUTURES CONTRACTS | | | | |

| | 4 | | | MSCI EAFE Index Mini Future September 2015 | | | | |

| | | | | (Underlying Face Amount at Value $366,800) | | $ | 200 | |

| | 5 | | | MSCI Emerging Market E-Mini Future September 2015 | | | | |

| | | | | (Underlying Face Amount at Value $239,850) | | | 125 | |

| | 10 | | | S&P 500 E-Mini September 2015 | | | | |

| | | | | (Underlying Face Amount at Value $1,027,250) | | | 3,000 | |

| | 1 | | | S&P Midcap 400 E-Mini Future September 2015 | | | | |

| | | | | (Underlying Face Amount at Value $149,810) | | | 390 | |

| | | | | NET UNREALIZED APPRECIATION OF SHORT FUTURES CONTRACTS | | $ | 3,715 | |

See accompanying notes to financial statements.

| FVIT BlackRock Global Allocation Managed Risk Portfolio |

| PORTFOLIO OF INVESTMENTS |

| June 30, 2015 (Unaudited) |

| Shares | | | | | Value | |

| | | | | VARIABLE INSURANCE TRUSTS - 95.0% | | | | |

| | | | | ASSET ALLOCATION FUND - 95.0% | | | | |

| | 13,723,827 | | | BlackRock Global Allocation V.I. Fund - Class 1 (Cost - $240,151,441) | | $ | 229,462,383 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS - 0.3% | | | | |

| | | | | MONEY MARKET FUND - 0.3% | | | | |

| | | | | | | | | |

| | 721,185 | | | Fidelity Institutional Money Market - Money Market Portfolio, Institutional Class to yield 0.10% (a)(Cost - $721,185) | | | 721,185 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 95.3% (Cost - $240,872,626)(b) | | $ | 230,183,568 | |

| | | | | OTHER ASSETS LESS LIABILITIES -NET - 4.7% | | | 11,471,123 | |

| | | | | TOTAL NET ASSETS - 100.0% | | $ | 241,654,691 | |

| (a) | | Money market rate shown represents the rate at June 30, 2015. |

| (b) | | Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $240,872,626 and differs from market value by net unrealized appreciation (depreciation) of securities as follows: |

| Unrealized Appreciation: | | $ | — | |

| Unrealized Depreciation: | | | (10,689,058 | ) |

| Net Unrealized Depreciation: | | $ | (10,689,058 | ) |

See accompanying notes to financial statements.

| FVIT Wellington Research Managed Risk Portfolio |

| PORTFOLIO OF INVESTMENTS |

| June 30, 2015 (Unaudited) |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS - 58.5% | | | | |

| | | | | ADVERTISING - 0.0% ** | | | | |

| | 4,982 | | | The Interpublic Group of Cos., Inc. | | $ | 96,003 | |

| | | | | | | | | |

| | | | | AEROSPACE/DEFENSE - 1.6% | | | | |

| | 8,122 | | | The Boeing Co. | | | 1,126,684 | |

| | 2,680 | | | General Dynamics Corp. | | | 379,729 | |

| | 6,327 | | | Lockheed Martin Corp. | | | 1,176,189 | |

| | 7,918 | | | United Technologies Corp. | | | 878,344 | |

| | | | | | | | 3,560,946 | |

| | | | | AGRICULTURE - 0.6% | | | | |

| | 30,344 | | | Altria Group, Inc. | | | 1,484,125 | |

| | | | | | | | | |

| | | | | AIRLINES - 0.0% ** | | | | |

| | 1,230 | | | American Airlines Group, Inc. | | | 49,120 | |

| | 980 | | | United Continental Holdings, Inc. * | | | 51,950 | |

| | | | | | | | 101,070 | |

| | | | | APPAREL - 0.2% | | | | |

| | 5,290 | | | VF Corp. | | | 368,925 | |

| | | | | | | | | |

| | | | | BANKS - 4.4% | | | | |

| | 165,260 | | | Bank of America Corp. | | | 2,812,725 | |

| | 34,140 | | | Citizens Financial Group, Inc. | | | 932,363 | |

| | 7,409 | | | Northern Trust Corp. | | | 566,492 | |

| | 22,410 | | | The PNC Financial Services Group, Inc. | | | 2,143,516 | |

| | 64,769 | | | Wells Fargo & Co. | | | 3,642,609 | |

| | | | | | | | 10,097,705 | |

| | | | | BEVERAGES - 2.1% | | | | |

| | 6,323 | | | Anheuser-Busch InBev - ADR | | | 762,996 | |

| | 6,597 | | | Dr. Pepper Snapple Group, Inc. | | | 480,921 | |

| | 6,012 | | | Monster Beverage Corp. * | | | 805,728 | |

| | 15,851 | | | PepsiCo, Inc. | | | 1,479,532 | |

| | 31,406 | | | The Coca-Cola Co. | | | 1,232,057 | |

| | | | | | | | 4,761,234 | |

| | | | | BIOTECHNOLOGY - 1.0% | | | | |

| | 1,307 | | | Achillion Pharmaceuticals, Inc. * | | | 11,580 | |

| | 671 | | | Alnylam Pharmaceuticals, Inc. * | | | 80,433 | |

| | 20,971 | | | Arena Pharmaceuticals, Inc. * | | | 97,305 | |

| | 6,994 | | | BioCryst Pharmaceuticals, Inc. * | | | 104,420 | |

| | 1,000 | | | Blueprint Medicines Corp. * | | | 26,490 | |

| | 4,649 | | | Gilead Sciences, Inc. | | | 544,305 | |

| | 6,210 | | | GlycoMimetics, Inc. * | | | 49,369 | |

| | 400 | | | Incyte Corp. * | | | 41,684 | |

| | 185 | | | Karyopharm Therapeutics, Inc. * | | | 5,034 | |

| | 1,500 | | | Nivalis Therapeutics, Inc. * | | | 22,725 | |

| | 7,891 | | | Novavax, Inc. * | | | 87,906 | |

| | 3,762 | | | Otonomy, Inc. * | | | 86,488 | |

| | 1,242 | | | PTC Therapeutics, Inc. * | | | 59,777 | |

| | 83 | | | Puma Biotechnology, Inc. * | | | 9,690 | |

| | 1,608 | | | Regeneron Pharmaceuticals, Inc. * | | | 820,289 | |

| | 1,620 | | | Ultragenyx Pharmaceutical, Inc. * | | | 165,872 | |

| | | | | | | | 2,213,367 | |

| | | | | BUILDING MATERIALS - 0.4% | | | | |

| | 11,511 | | | Boise Cascade Co. * | | | 422,223 | |

| | 8,180 | | | CRH PLC - ADR | | | 229,940 | |

| | 220 | | | Martin Marietta Materials, Inc. | | | 31,132 | |

| | 7,170 | | | Summit Materials, Inc. * | | | 182,835 | |

| | 380 | | | Vulcan Materials Co. | | | 31,893 | |

| | | | | | | | 898,023 | |

See accompanying notes to financial statements.

| FVIT Wellington Research Managed Risk Portfolio |

| PORTFOLIO OF INVESTMENTS (Continued) |

| June 30, 2015 (Unaudited) |

| Shares | | | | | Value | |

| | | | | CHEMICALS - 1.0% | | | | |

| | 4,751 | | | Cabot Corp. | | $ | 177,165 | |

| | 8,813 | | | Celanese Corp. | | | 633,478 | |

| | 3,531 | | | LyondellBasell Industries | | | 365,529 | |

| | 6,512 | | | The Dow Chemical Co. | | | 333,219 | |

| | 6,930 | | | The Mosaic Co. | | | 324,671 | |

| | 2,137 | | | The Sherwin-Williams Co. | | | 587,718 | |

| | | | | | | | 2,421,780 | |

| | | | | COAL - 0.1% | | | | |

| | 6,517 | | | CONSOL Energy, Inc. | | | 141,680 | |

| | | | | | | | | |

| | | | | COMMERCIAL SERVICES - 1.2% | | | | |

| | 6,698 | | | Automatic Data Processing, Inc. | | | 537,381 | |

| | 4,095 | | | Equifax, Inc. | | | 397,584 | |

| | 3,339 | | | Global Payments, Inc. | | | 345,420 | |

| | 4,806 | | | Heartland Payment Systems, Inc. | | | 259,764 | |

| | 3,922 | | | ManpowerGroup, Inc. | | | 350,548 | |

| | 1,570 | | | McGraw Hill Financial, Inc. | | | 157,707 | |

| | 3,100 | | | TransUnion * | | | 77,810 | |

| | 5,878 | | | TriNet Group, Inc. * | | | 149,007 | |

| | 4,895 | | | WEX, Inc. * | | | 557,883 | |

| | | | | | | | 2,833,104 | |

| | | | | COMPUTERS - 4.8% | | | | |

| | 8,307 | | | Accenture PLC - Cl. A | | | 803,951 | |

| | 64,339 | | | Apple, Inc. | | | 8,069,719 | |

| | 8,322 | | | Cognizant Technology Solutions Corp. - Cl. A * | | | 508,391 | |

| | 35,436 | | | Genpact Ltd. * | | | 755,850 | |

| | 9,791 | | | Western Digital Corp. | | | 767,810 | |

| | | | | | | | 10,905,721 | |

| | | | | COSMETICS/PERSONAL CARE - 0.9% | | | | |

| | 40,730 | | | Avon Products, Inc. | | | 254,970 | |

| | 8,830 | | | Colgate-Palmolive Co. | | | 577,570 | |

| | 10,999 | | | Coty, Inc. - Cl. A | | | 351,638 | |

| | 11,328 | | | The Estee Lauder Cos., Inc. | | | 981,684 | |

| | | | | | | | 2,165,862 | |

| | | | | DIVERSIFIED FINANCIAL SERVICES - 2.2% | | | | |

| | 732 | | | Alliance Data Systems Corp. * | | | 213,700 | |

| | 3,887 | | | Ameriprise Financial, Inc. | | | 485,603 | |

| | 1,201 | | | BlackRock, Inc. - Cl. A | | | 415,522 | |

| | 5,835 | | | Invesco Ltd. | | | 218,754 | |

| | 5,550 | | | Janus Capital Group, Inc. | | | 95,016 | |

| | 2,775 | | | Raymond James Financial, Inc. | | | 165,335 | |

| | 61,085 | | | Santander Consumer USA Holdings, Inc. * | | | 1,561,943 | |

| | 24,452 | | | Visa, Inc. - Cl. A | | | 1,641,952 | |

| | 6,794 | | | WisdomTree Investments, Inc. | | | 149,230 | |

| | | | | | | | 4,947,055 | |

| | | | | ELECTRIC - 2.1% | | | | |

| | 2,300 | | | 8POINT3 Energy Partners LP * | | | 42,826 | |

| | 7,004 | | | Ameren Corp. | | | 263,911 | |

| | 1,650 | | | American Electric Power Co., Inc. | | | 87,401 | |

| | 9,925 | | | Dominion Resources, Inc. | | | 663,685 | |

| | 2,551 | | | DTE Energy Co. | | | 190,407 | |

| | 8,669 | | | Duke Energy Corp. | | | 612,205 | |

| | 7,003 | | | Edison International | | | 389,227 | |

| | 4,988 | | | Eversource Energy | | | 226,505 | |

| | 10,168 | | | Exelon Corp. | | | 319,479 | |

| | 1,250 | | | FirstEnergy Corp. | | | 40,688 | |

| | 3,944 | | | ITC Holdings Corp. | | | 126,918 | |

| | 13,690 | | | MDU Resources Group, Inc. | | | 267,366 | |

| | 10,401 | | | NextEra Energy, Inc. | | | 1,019,610 | |

| | 2,824 | | | NRG Energy, Inc. | | | 64,613 | |

| | 7,348 | | | PG&E Corp. | | | 360,787 | |

See accompanying notes to financial statements.

| FVIT Wellington Research Managed Risk Portfolio |

| PORTFOLIO OF INVESTMENTS (Continued) |

| June 30, 2015 (Unaudited) |

| Shares | | | | | Value | |

| | | | | ELECTRIC (Continued) - 2.1% | | | | |

| | 2,492 | | | Pinnacle West Capital Corp. | | $ | 141,770 | |

| | 2,433 | | | Public Service Enterprise Group, Inc. | | | 95,568 | |

| | | | | | | | 4,912,966 | |

| | | | | ELECTRICAL COMPONENTS & EQUIPMENT - 0.1% | | | | |

| | 4,130 | | | AMETEK, Inc. | | | 226,241 | |

| | 1,880 | | | SunPower Corp. * | | | 53,411 | |

| | | | | | | | 279,652 | |

| | | | | ELECTRONICS - 1.0% | | | | |

| | 9,055 | | | Agilent Technologies, Inc. | | | 349,342 | |

| | 790 | | | Arrow Electronics, Inc. * | | | 44,082 | |

| | 14,145 | | | Honeywell International, Inc. | | | 1,442,366 | |

| | 4,102 | | | Thermo Fisher Scientific, Inc. | | | 532,276 | |

| | | | | | | | 2,368,066 | |

| | | | | ENERGY - ALTERNATE SOURCES - 0.1% | | | | |

| | 2,422 | | | First Solar, Inc. * | | | 113,786 | |

| | | | | | | | | |

| | | | | ENTERTAINMENT - 0.1% | | | | |

| | 5,610 | | | DreamWorks Animation SKG, Inc. * | | | 147,992 | |

| | | | | | | | | |

| | | | | FOOD - 1.2% | | | | |

| | 41,988 | | | Mondelez International, Inc. - Cl. A | | | 1,727,386 | |

| | 11,737 | | | Post Holdings, Inc. * | | | 632,976 | |

| | 8,843 | | | SunOpta, Inc. * | | | 94,885 | |

| | 4,790 | | | TreeHouse Foods, Inc. * | | | 388,134 | |

| | | | | | | | 2,843,381 | |

| | | | | FOREST PRODUCTS & PAPER - 0.2% | | | | |

| | 11,774 | | | International Paper Co. | | | 560,325 | |

| | | | | | | | | |

| | | | | GAS - 0.1% | | | | |

| | 230 | | | Sempra Energy | | | 22,756 | |

| | 7,240 | | | UGI Corp. | | | 249,418 | |

| | | | | | | | 272,174 | |

| | | | | HEALTHCARE-PRODUCTS - 3.0% | | | | |

| | 8,475 | | | Baxter International, Inc. | | | 592,657 | |

| | 2,700 | | | Baxter International, Inc. * | | | 102,600 | |

| | 19,137 | | | Danaher Corp. | | | 1,637,936 | |

| | 35,998 | | | Medtronic, PLC | | | 2,667,452 | |

| | 2,336 | | | Ocular Therapeutix, Inc. * | | | 49,126 | |

| | 14,973 | | | St. Jude Medical, Inc. | | | 1,094,077 | |

| | 6,404 | | | Stryker Corp. | | | 612,030 | |

| | | | | | | | 6,755,878 | |

| | | | | HEALTHCARE-SERVICES - 1.7% | | | | |

| | 9,288 | | | Aetna, Inc. | | | 1,183,848 | |

| | 2,231 | | | Cigna Corp. | | | 361,422 | |

| | 11,894 | | | HCA Holdings, Inc. * | | | 1,079,024 | |

| | 9,999 | | | UnitedHealth Group, Inc. | | | 1,219,878 | |

| | | | | | | | 3,844,172 | |

| | | | | HOME FURNISHINGS - 0.2% | | | | |

| | 2,619 | | | Whirlpool Corp. | | | 453,218 | |

| | | | | | | | | |

| | | | | INSURANCE - 3.4% | | | | |

| | 32,556 | | | American International Group, Inc. | | | 2,012,612 | |

| | 23,825 | | | Assured Guaranty Ltd. | | | 571,562 | |

| | 24,638 | | | Marsh & McLennan Cos., Inc. | | | 1,396,975 | |

| | 15,279 | | | Principal Financial Group, Inc. | | | 783,660 | |

| | 8,201 | | | Prudential Financial, Inc. | | | 717,752 | |

| | 7,449 | | | The Allstate Corp. | | | 483,217 | |

| | 22,206 | | | The Hartford Financial Services Group, Inc. | | | 923,103 | |

| | 23,650 | | | XL Group PLC | | | 879,780 | |

| | | | | | | | 7,768,661 | |

| | | | | INTERNET - 3.0% | | | | |

| | 4,520 | | | Amazon.com, Inc. * | | | 1,962,087 | |

| | 14,468 | | | Facebook, Inc. - Cl. A * | | | 1,240,848 | |

| | 5,954 | | | Google, Inc. - Cl. A * | | | 3,215,398 | |

See accompanying notes to financial statements.

| FVIT Wellington Research Managed Risk Portfolio |

| PORTFOLIO OF INVESTMENTS (Continued) |

| June 30, 2015 (Unaudited) |

| Shares | | | | | Value | |

| | | | | INTERNET (Continued) - 3.0% | | | | |

| | 630 | | | Netflix, Inc. * | | $ | 413,872 | |

| | 2,000 | | | Zillow Group, Inc. * | | | 173,480 | |

| | | | | | | | 7,005,685 | |

| | | | | IRON/STEEL - 0.1% | | | | |

| | 870 | | | Nucor Corp. | | | 38,341 | |

| | 2,140 | | | Reliance Steel & Aluminum Co. | | | 129,427 | |

| | | | | | | | 167,768 | |

| | | | | LEISURE TIME - 0.6% | | | | |

| | 4,763 | | | Arctic Cat, Inc. | | | 158,179 | |

| | 16,380 | | | Harley-Davidson, Inc. | | | 923,013 | |

| | 4,821 | | | Norwegian Cruise Line Holdings Ltd. * | | | 270,169 | |

| | | | | | | | 1,351,361 | |

| | | | | LODGING - 0.3% | | | | |

| | 2,578 | | | Las Vegas Sands Corp. | | | 135,525 | |

| | 5,985 | | | Wyndham Worldwide Corp. | | | 490,231 | |

| | | | | | | | 625,756 | |

| | | | | MACHINERY - CONSTRUCTION/MINING - 0.1% | | | | |

| | 2,250 | | | Caterpillar, Inc. | | | 190,845 | |

| | | | | | | | | |

| | | | | MEDIA - 2.3% | | | | |

| | 36,636 | | | Comcast Corp. | | | 2,203,289 | |

| | 14,309 | | | Nielsen | | | 640,614 | |

| | 8,510 | | | Time Warner Cable, Inc. | | | 1,516,227 | |

| | 27,802 | | | Twenty-First Century Fox, Inc. | | | 881,384 | |

| | | | | | | | 5,241,514 | |

| | | | | MINING - 0.1% | | | | |

| | 9,231 | | | Luxfer Holdings PLC - ADR | | | 120,003 | |

| | | | | | | | | |

| | | | | MISCELLANEOUS MANUFACTURING - 1.2% | | | | |

| | 4,435 | | | Dover Corp. | | | 311,248 | |

| | 8,319 | | | Eaton Corp. PLC | | | 561,449 | |

| | 15,510 | | | General Electric Co. | | | 412,101 | |

| | 9,856 | | | Illinois Tool Works, Inc. | | | 904,682 | |

| | 9,487 | | | Pentair - PLC | | | 652,231 | |

| | | | | | | | 2,841,711 | |

| | | | | OIL & GAS - 2.8% | | | | |

| | 7,794 | | | Anadarko Petroleum Corp. | | | 608,400 | |

| | 11,309 | | | Chevron Corp. | | | 1,090,979 | |

| | 67,124 | | | Cobalt International Energy, Inc. * | | | 651,774 | |

| | 3,350 | | | Ensco PLC | | | 74,605 | |

| | 8,230 | | | EOG Resources, Inc. | | | 720,537 | |

| | 3,562 | | | Exxon Mobil Corp. | | | 296,358 | |

| | 6,662 | | | Marathon Oil Corp. | | | 176,809 | |

| | 3,800 | | | Newfield Exploration Co. * | | | 137,256 | |

| | 8,391 | | | Occidental Petroleum Corp. | | | 652,568 | |

| | 16,927 | | | Patterson-UTI Energy, Inc. | | | 318,482 | |

| | 5,044 | | | Pioneer Natural Resources Co. | | | 699,552 | |

| | 11,030 | | | Southwestern Energy Co. * | | | 250,712 | |

| | 11,083 | | | Valero Energy Corp. | | | 693,796 | |

| | | | | | | | 6,371,828 | |

| | | | | OIL & GAS SERVICES - 0.3% | | | | |

| | 1,794 | | | Baker Hughes, Inc. | | | 110,690 | |

| | 10,457 | | | Halliburton Co. | | | 450,383 | |

| | 14,060 | | | Tesco Corp. | | | 153,254 | |

| | | | | | | | 714,327 | |

| | | | | PACKAGING & CONTAINERS - 0.4% | | | | |

| | 9,339 | | | Ball Corp. | | | 655,131 | |

| | 8,082 | | | Owens-Illinois, Inc. * | | | 185,401 | |

| | | | | | | | 840,532 | |

| | | | | PHARMACEUTICALS - 4.3% | | | | |

| | 9,364 | | | Abbott Laboratories | | | 459,585 | |

| | 1,583 | | | Aerie Pharmaceuticals, Inc. * | | | 27,940 | |

| | 7,938 | | | Alkermes PLC * | | | 510,731 | |

See accompanying notes to financial statements.

| FVIT Wellington Research Managed Risk Portfolio |

| PORTFOLIO OF INVESTMENTS (Continued) |

| June 30, 2015 (Unaudited) |

| Shares | | | | | Value | |

| | | | | PHARMACEUTICALS (Continued) - 4.3% | | | | |

| | 3,849 | | | Allergan PLC * | | $ | 1,168,018 | |

| | 9,532 | | | AstraZeneca PLC - ADR | | | 607,284 | |

| | 28,109 | | | Bristol-Myers Squibb Co. | | | 1,870,373 | |

| | 5,313 | | | Cardinal Health, Inc. | | | 444,432 | |

| | 3,910 | | | Dicerna Pharmaceuticals, Inc. * | | | 54,545 | |

| | 12,541 | | | Ironwood Pharmaceuticals, Inc. - Cl. A * | | | 151,244 | |

| | 11,177 | | | Johnson & Johnson | | | 1,089,310 | |

| | 4,463 | | | McKesson Corp. | | | 1,003,327 | |

| | 27,594 | | | Merck & Co., Inc. | | | 1,570,926 | |

| | 7,700 | | | Mylan NV * | | | 522,522 | |

| | 3,055 | | | Regulus Therapeutics, Inc. * | | | 33,483 | |

| | 1,767 | | | Relypsa, Inc. * | | | 58,470 | |

| | 2,024 | | | TESARO, Inc. * | | | 118,991 | |

| | 1,991 | | | Tetraphase Pharmaceuticals, Inc. * | | | 94,453 | |

| | 7,619 | | | Trevena, Inc. * | | | 47,695 | |

| | | | | | | | 9,833,329 | |

| | | | | PIPELINES - 0.4% | | | | |

| | 21,331 | | | Enbridge, Inc. | | | 998,077 | |

| | 728 | | | ONEOK, Inc. | | | 28,741 | |

| | | | | | | | 1,026,818 | |

| | | | | REAL ESTATE INVESTMENT TRUSTS - 1.8% | | | | |

| | 8,855 | | | American Tower Corp. | | | 826,083 | |

| | 6,425 | | | AvalonBay Communities, Inc. | | | 1,027,165 | |

| | 5,020 | | | Health Care REIT, Inc. | | | 329,463 | |

| | 1,200 | | | InfraREIT, Inc. * | | | 34,032 | |

| | 2,925 | | | Public Storage | | | 539,282 | |

| | 2,544 | | | Simon Property Group, Inc. | | | 440,163 | |

| | 5,188 | | | SL Green Realty Corp. | | | 570,109 | |

| | 9,951 | | | Weyerhaeuser Co. | | | 313,457 | |

| | | | | | | | 4,079,754 | |

| | | | | RETAIL - 3.8% | | | | |

| | 7,548 | | | Advance Auto Parts, Inc. | | | 1,202,321 | |

| | 835 | | | Chipotle Mexican Grill, Inc. * | | | 505,167 | |

| | 15,679 | | | CVS Health Corp. | | | 1,644,414 | |