Q4 & FY 2021 Earnings Supplement March 2022 Exhibit 99.2

This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this presentation, including statements regarding Flywire’s ability to successfully implement Flywire’s business plan, future results of operations and financial position, business strategy and plans and Flywire’s objectives for future operations, are forward -looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plans,” “potential,” “seeks,” “projects,” “should,” “could” and “would” and similar expressions are intended to identify forward -looking statements, although not all forward -looking statements contain these identifying words. Flywire has based these forward-looking statements largely on Flywire’s current expectations and projections about future events and financial trends that Flywire believes may affect Flywire’s financial condition, results of operations, business strategy, short -term and long-term business operations and objectives, and financial needs. These forward -looking statements are subject to a number of risks, uncertainties and assumptions that are described in the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of Flywire's Final Prospectus for its initial public offering, and Quarterly Report on Form 10-Q for the quarter ended September 30, 2021 which are on file with the Securities and Exchange Commission (SEC) and available on the SEC's website at www.sec.gov. Flywire’s Annual Report on Form 10-K for the year ended December 31, 2021, expected to be filed with the SEC in the first quarter of 2022. In light of these risks, uncertainties and assumptions, the forward -looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events or performance. In addition, projections, assumptions and estimates of the future performance of the industries in which Flywire operates and the markets it serves are inherently imprecise and subject to a high degree of uncertainty and risk. All financial projections contained in this presentation are forward -looking statements and are based on Flywire’s management’s assessment of such matters. It is unlikely, however, that the assumptions on which Flywire has based its projections will prove to be fully correct or that the projected figures will be attained. Flywire’s actual future results may differ materially from Flywire’s projections, and it makes no express or implied representation or warranty as to attainability of the results reflected in these projections. Investments in Flywire’s securities involve a high degree of risk and should be regarded as speculative. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and Flywire’s own internal estimates and research. While Flywire believes these third-party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while Flywire believes its own internal research is reliable, such research has not been verified by any independent source. The information in this presentation is provided only as of December 31, 2021, and Flywire undertakes no obligation to update any forward-looking statements contained in this presentation on account of new information, future events, or otherwise, except as required by law. This presentation contains certain non-GAAP financial measures as defined by SEC rules. Flywire has provided a reconciliation of those measures to the most directly comparable GAAP measures, which is available in the Appendix. The company is unable to provide a reconciliation from forecasted adjusted EBITDA to forecasted GAAP net income (loss) or to forecasted GAAP income (loss) before income taxes, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include but are not limited to income taxes which are directly impacted by unpredictable fluctuations in the market price of the company's stock. Financial Disclosure Advisory Flywire reports its financial results in accordance with U.S. generally accepted accounting principles ("GAAP"). The expected financial results discussed in this presentation are preliminary and unaudited and represent the most current information available to Flywire's management, as financial closing and audit procedures for the year ended December 31, 2021, are not yet complete. These estimates are not a comprehensive statement of Flywire’s financial results for the fourth quarter and fiscal year ended December 31, 2021, and actual results may differ materially from these estimates as a result of the completion of year-end accounting procedures and adjustments, including tax provision analysis and the performance of Flywire’s internal control over financial reporting, the completion of the external audit by Flywire’s independent registered public accounting firm, the preparation of Flywire’s financial statements and the subsequent occurrence or identification of events prior to the formal issuance of the audited financial statements for fiscal year 2021. Flywire has not finalized its accounting treatment of certain international income and indirect tax matters. However, Flywire expects that the maximum magnitude of any related adjustments is less than $3.3 million and would not impact revenue, gross margin or adjusted EBITDA, but would negatively impact Flywire’s loss from operations, loss before income taxes, net loss and net loss per share as may be reported in its Annual Report on Form 10-K. In addition, results presented in this presentation do not present all information necessary for an understanding of Flywire's financial condition and results of operations as of and for the quarter and year ended December 31, 2021. Disclosures

Execution Fulfillment Our mission is to deliver the most important and complex payments

…and their customers pay with ease from anywhere in the world We help our clients get paid…

Software drives value in payments Next Gen Platform + Global Payment Network

240+ Countries & Territories 2,500+ Clients Worldwide 10+ Years to Build Payment Network 700+ Global FlyMates $13.2BN Total 2021 Payment Volume 140+ Currencies Supported As of December 31, 2021

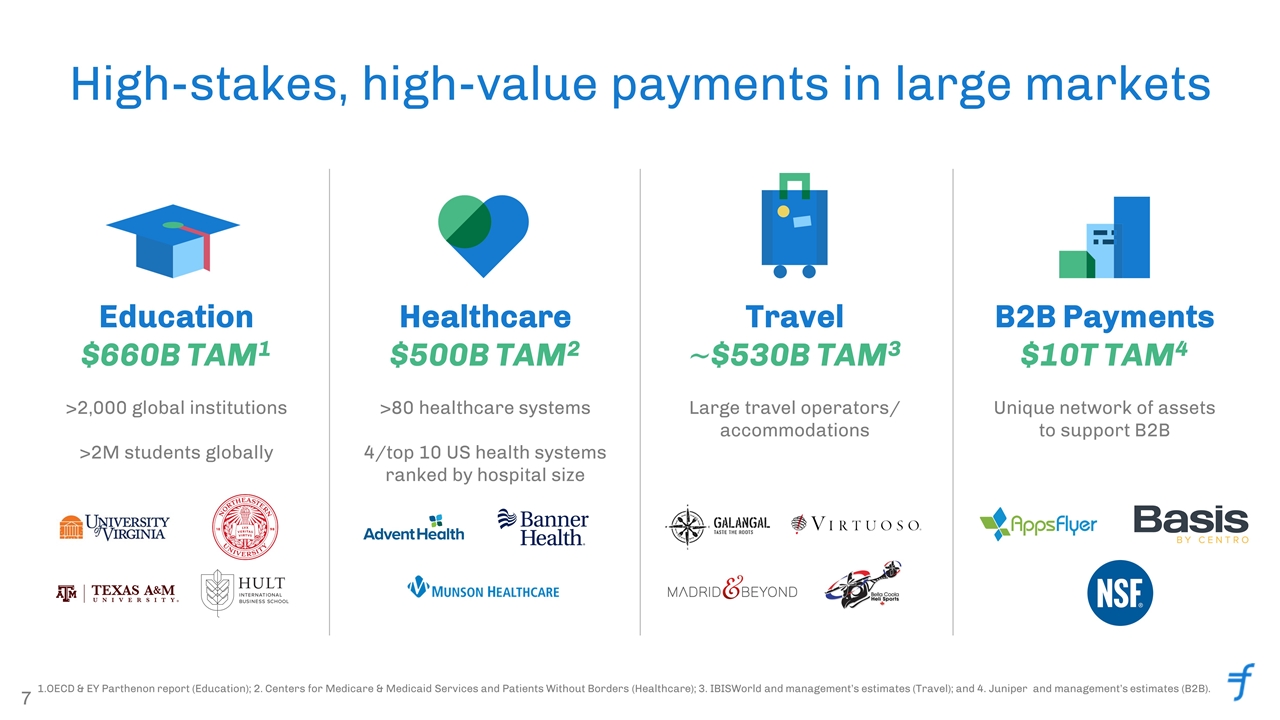

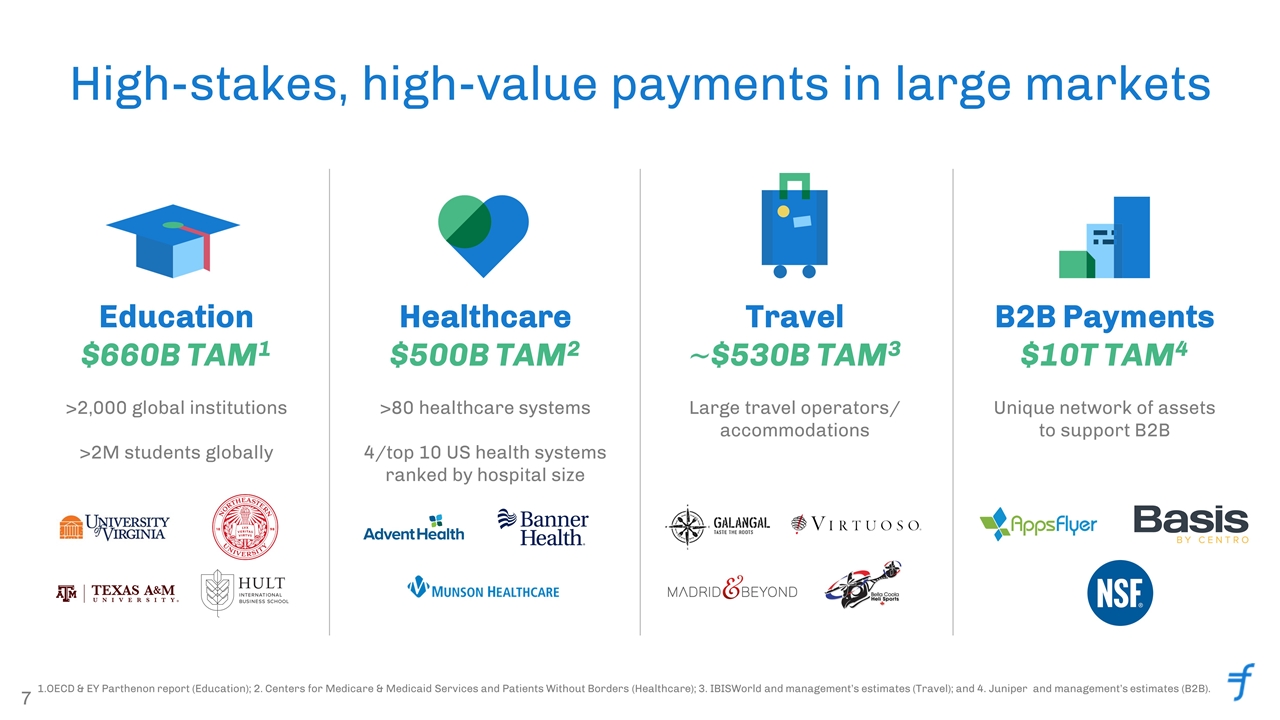

High-stakes, high-value payments in large markets Education $660B TAM1 >2,000 global institutions >2M students globally B2B Payments $10T TAM4 Unique network of assets to support B2B Travel ~$530B TAM3 Large travel operators/ accommodations Healthcare $500B TAM2 >80 healthcare systems 4/top 10 US health systems ranked by hospital size 1.OECD & EY Parthenon report (Education); 2. Centers for Medicare & Medicaid Services and Patients Without Borders (Healthcare); 3. IBISWorld and management’s estimates (Travel); and 4. Juniper and management’s estimates (B2B).

Our Flywire Advantage & Opportunity

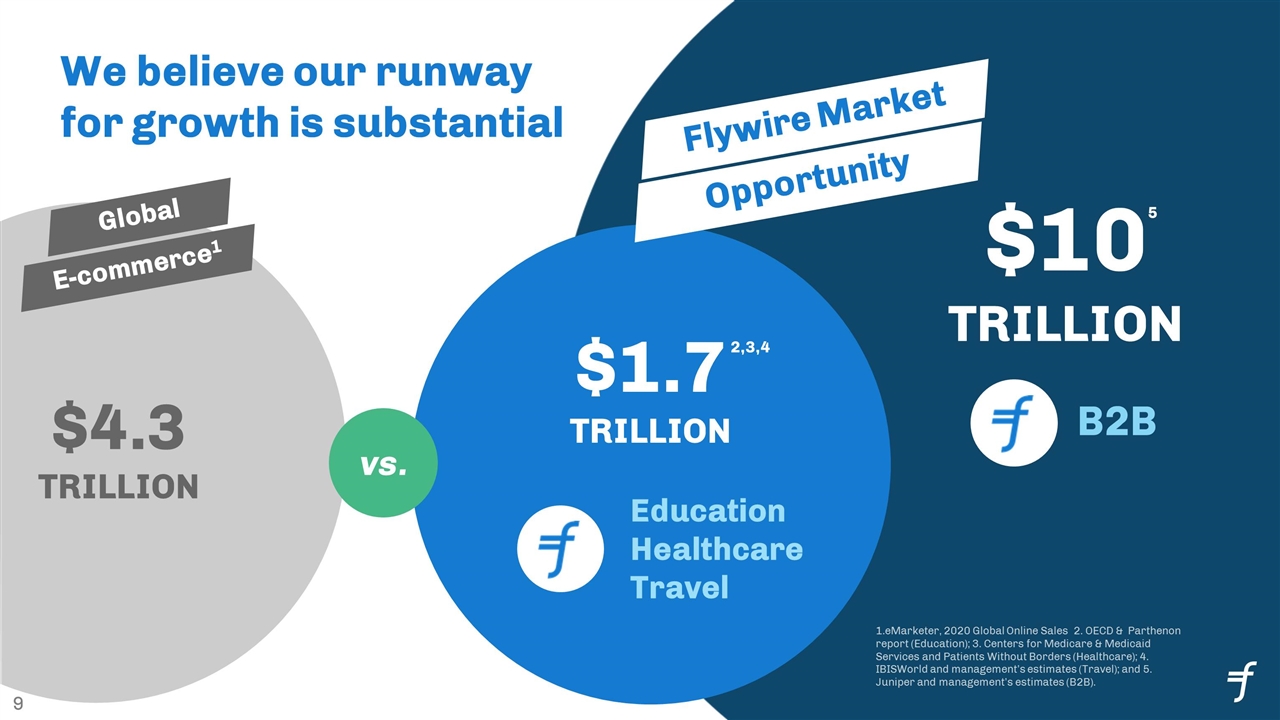

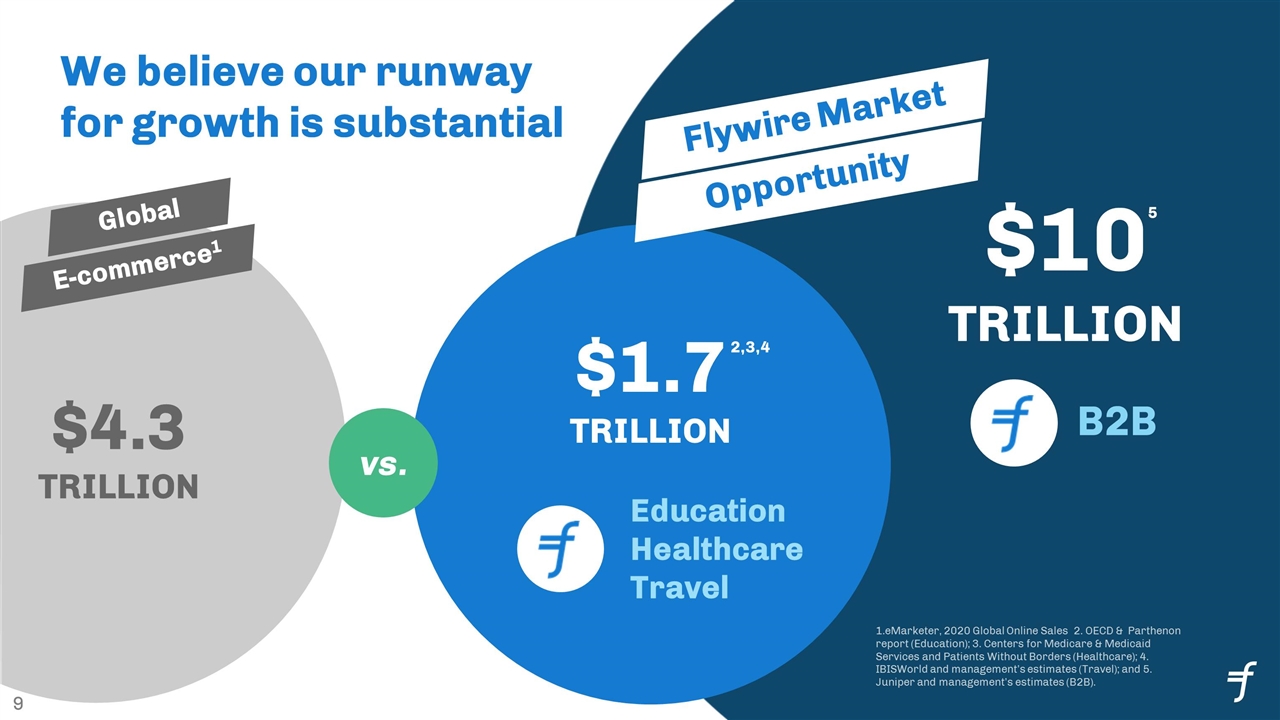

$4.3 TRILLION $1.7 TRILLION $10 TRILLION B2B We believe our runway for growth is substantial 2,3,4 5 Education Healthcare Travel vs. Global E-commerce1 Flywire Market Opportunity 1.eMarketer, 2020 Global Online Sales 2. OECD & Parthenon report (Education); 3. Centers for Medicare & Medicaid Services and Patients Without Borders (Healthcare); 4. IBISWorld and management’s estimates (Travel); and 5. Juniper and management’s estimates (B2B).

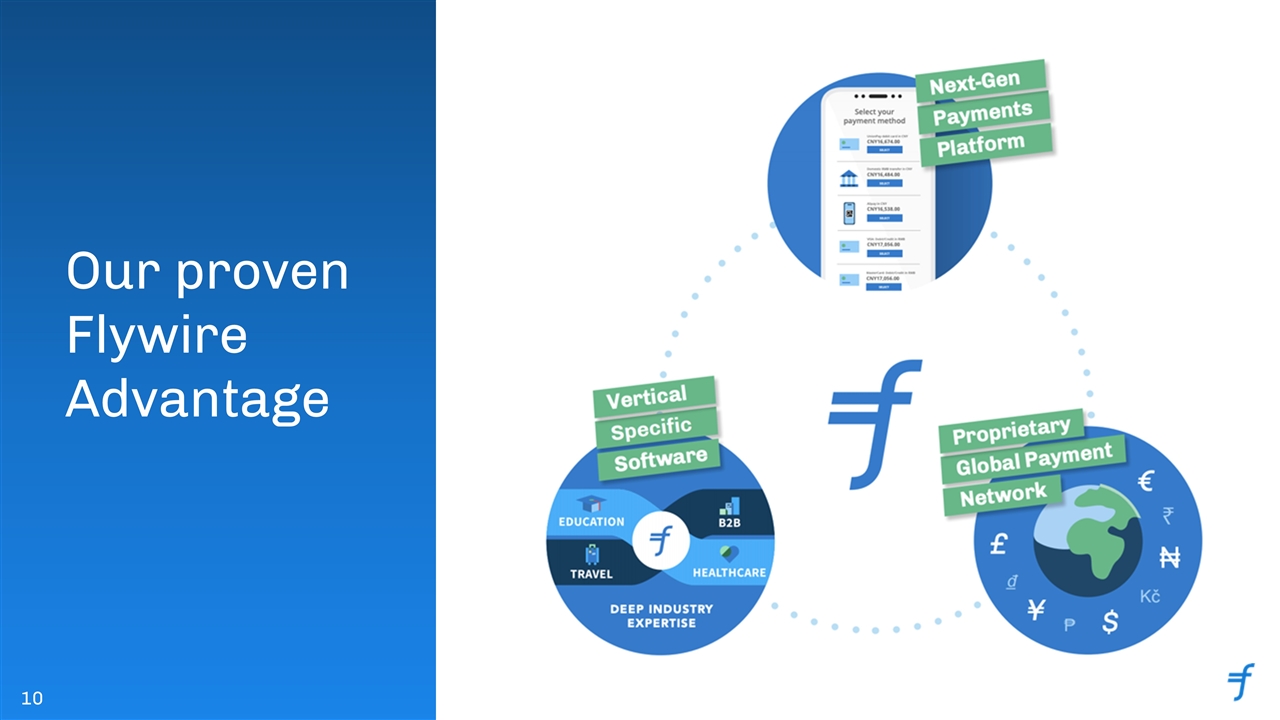

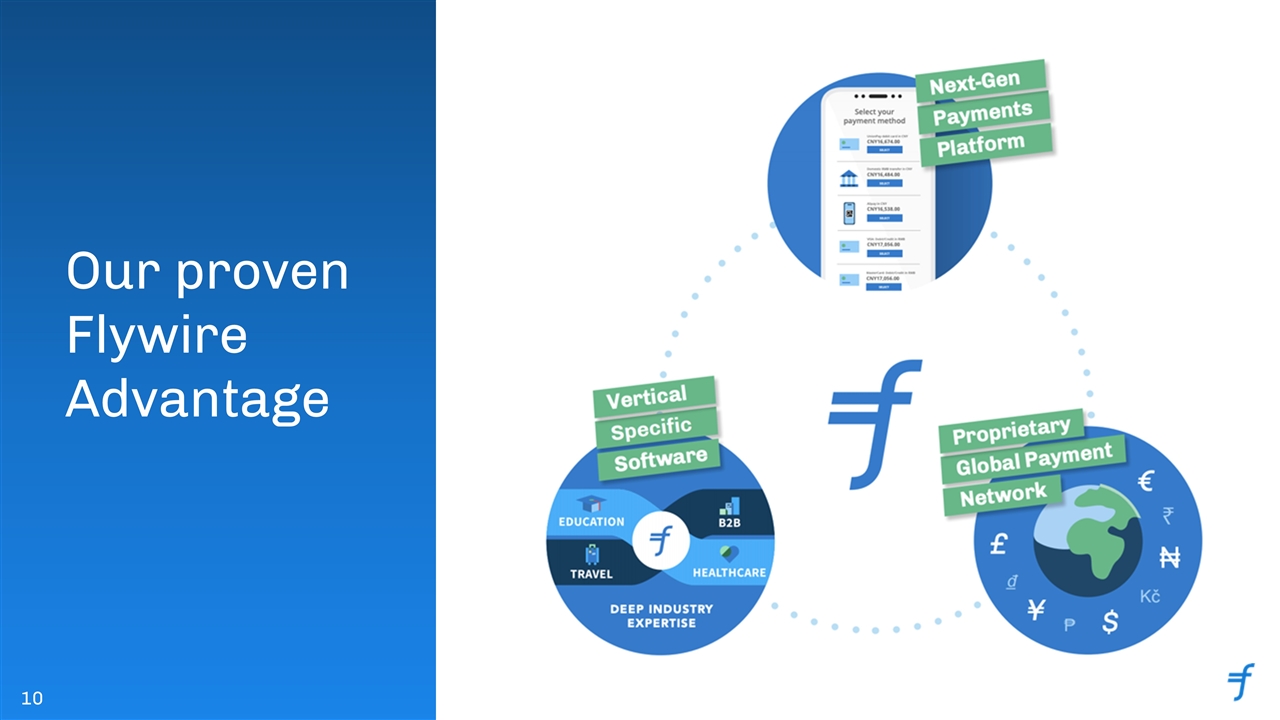

Our proven Flywire Advantage

Fueling a powerful & accelerating flywheel Improved Experience Larger Ecosystem More Products Broader Footprint

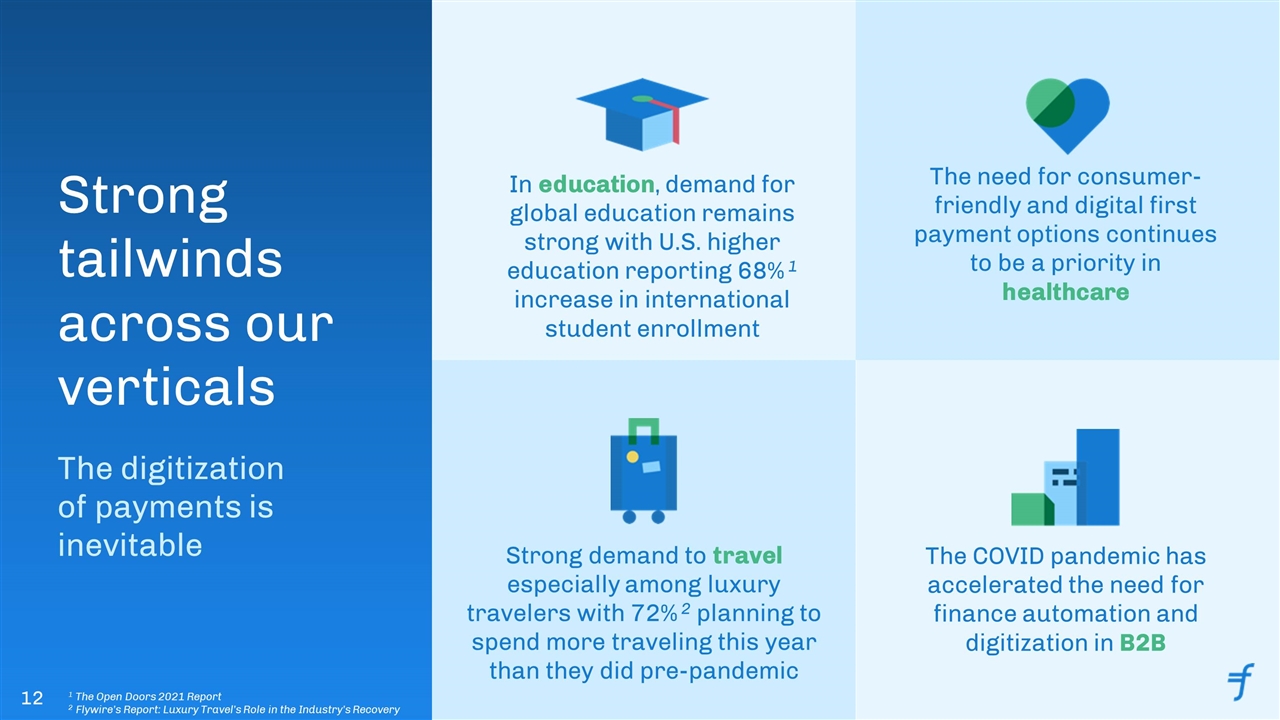

Strong tailwinds across our verticals The digitization of payments is inevitable In education, demand for global education remains strong with U.S. higher education reporting 68% 1 increase in international student enrollment The need for consumer-friendly and digital first payment options continues to be a priority in healthcare Strong demand to travel especially among luxury travelers with 72% 2 planning to spend more traveling this year than they did pre-pandemic The COVID pandemic has accelerated the need for finance automation and digitization in B2B 1 The Open Doors 2021 Report 2 Flywire’s Report: Luxury Travel’s Role in the Industry’s Recovery

Growth strategies Grow with new clients 400+ New clients in FY21 Grow with existing clients 123%1 Three year average annual dollar-based net retention rate Expand our ecosystem through channel partnerships Expand to new industries, geographies & products Pursue strategic & value-enhancing acquisitions 375+ Travel & B2B Clients 1 2019- 2021

Q4 2021 Performance

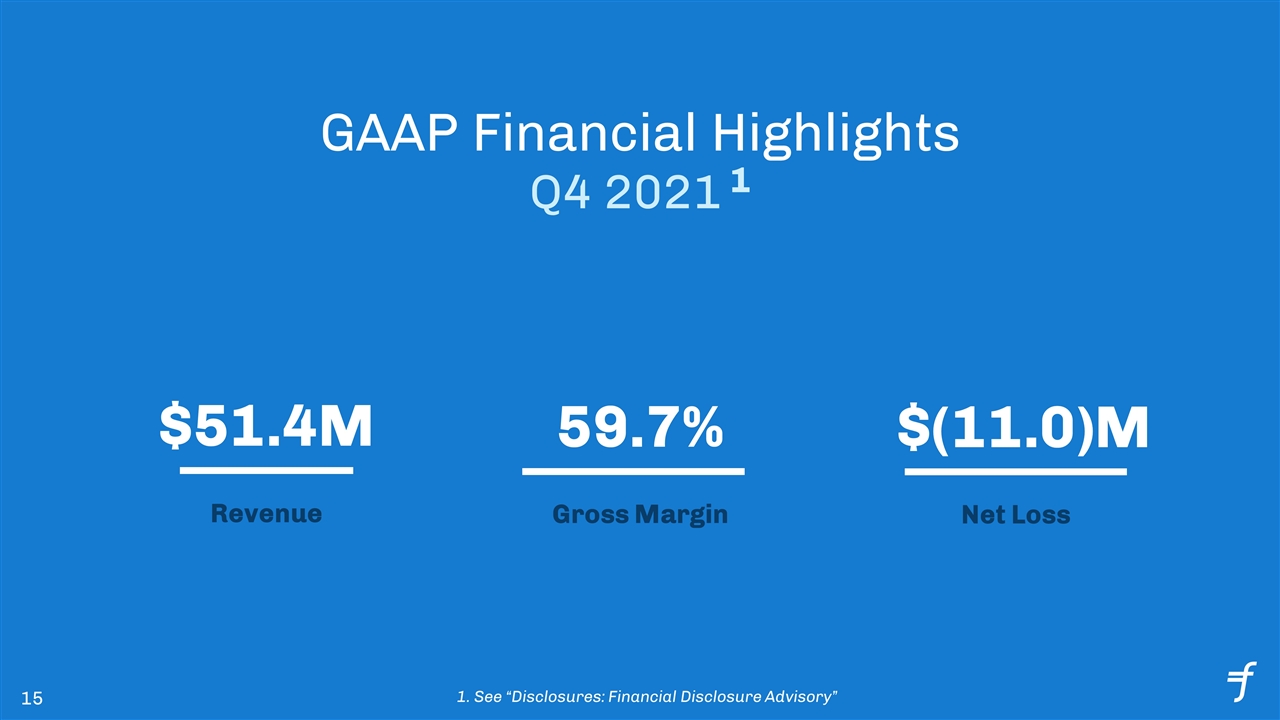

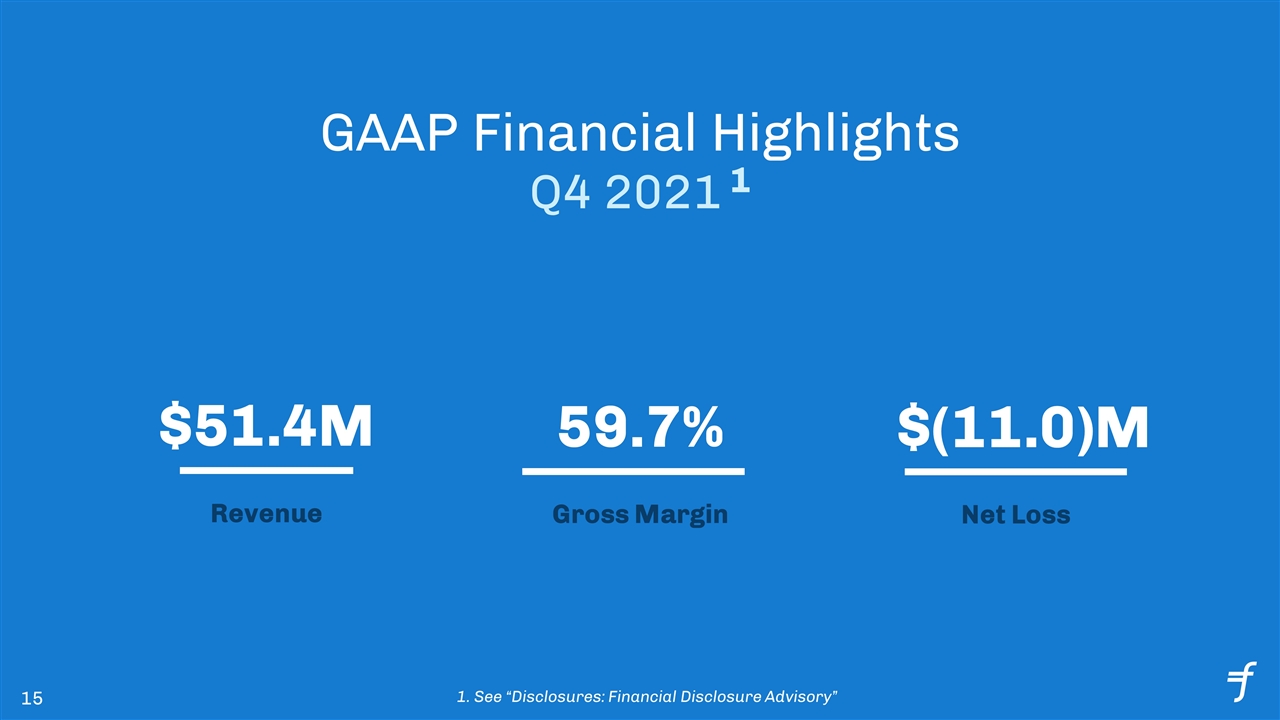

GAAP Financial Highlights Q4 2021 1 $51.4M Revenue 59.7% Gross Margin $(11.0)M Net Loss 1. See “Disclosures: Financial Disclosure Advisory”

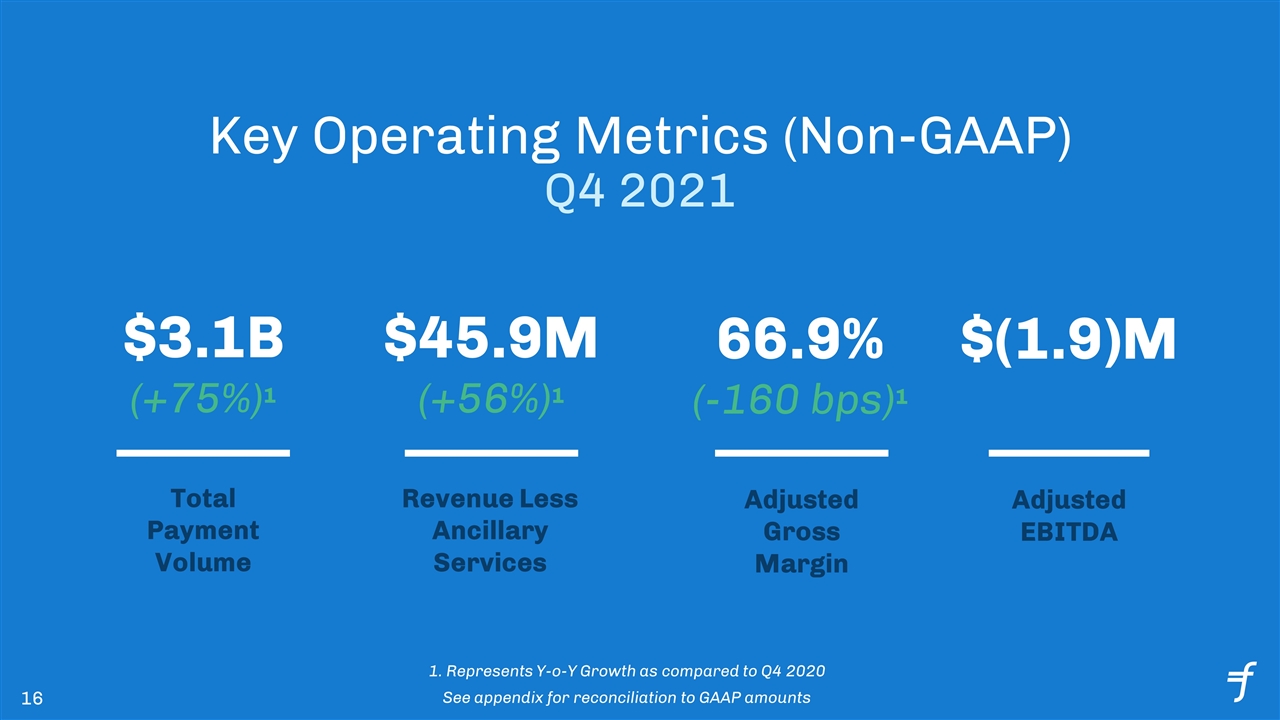

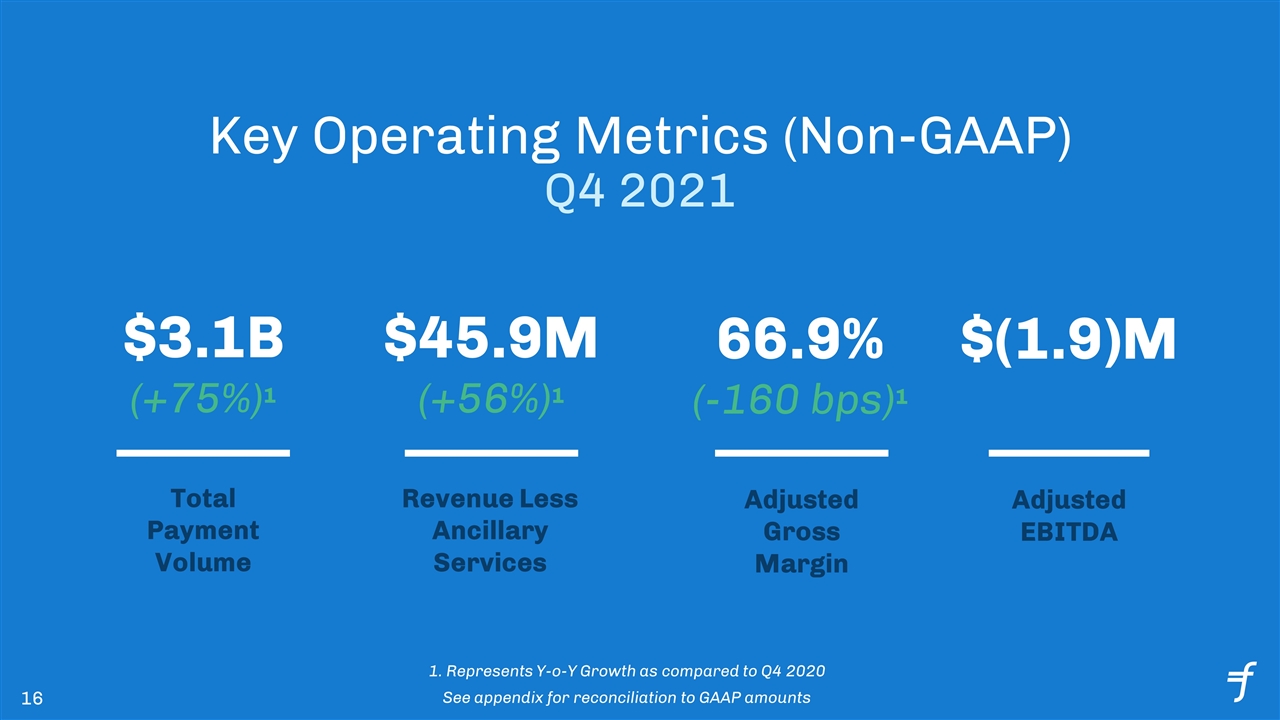

Key Operating Metrics (Non-GAAP) Q4 2021 $3.1B (+75%)1 Total Payment Volume $45.9M (+56%)1 Revenue Less Ancillary Services 66.9% (-160 bps)1 Adjusted Gross Margin $(1.9)M Adjusted EBITDA 1. Represents Y-o-Y Growth as compared to Q4 2020 See appendix for reconciliation to GAAP amounts

FY 2021 Performance

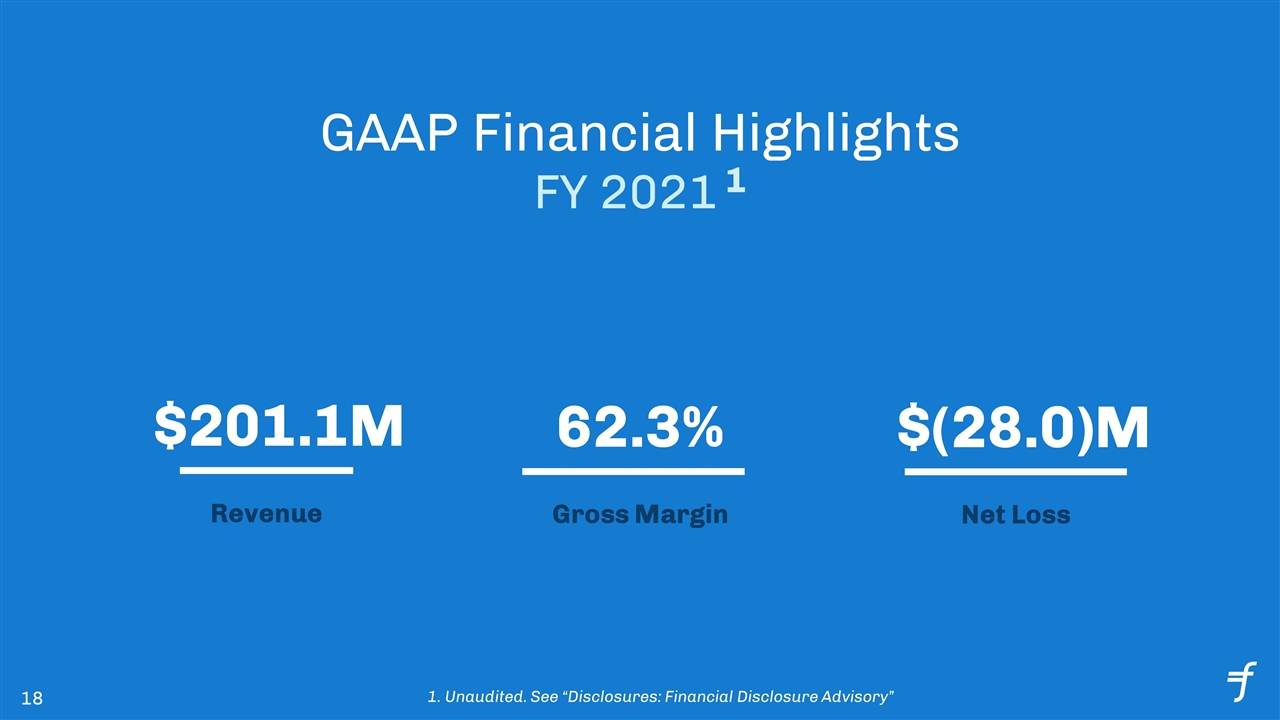

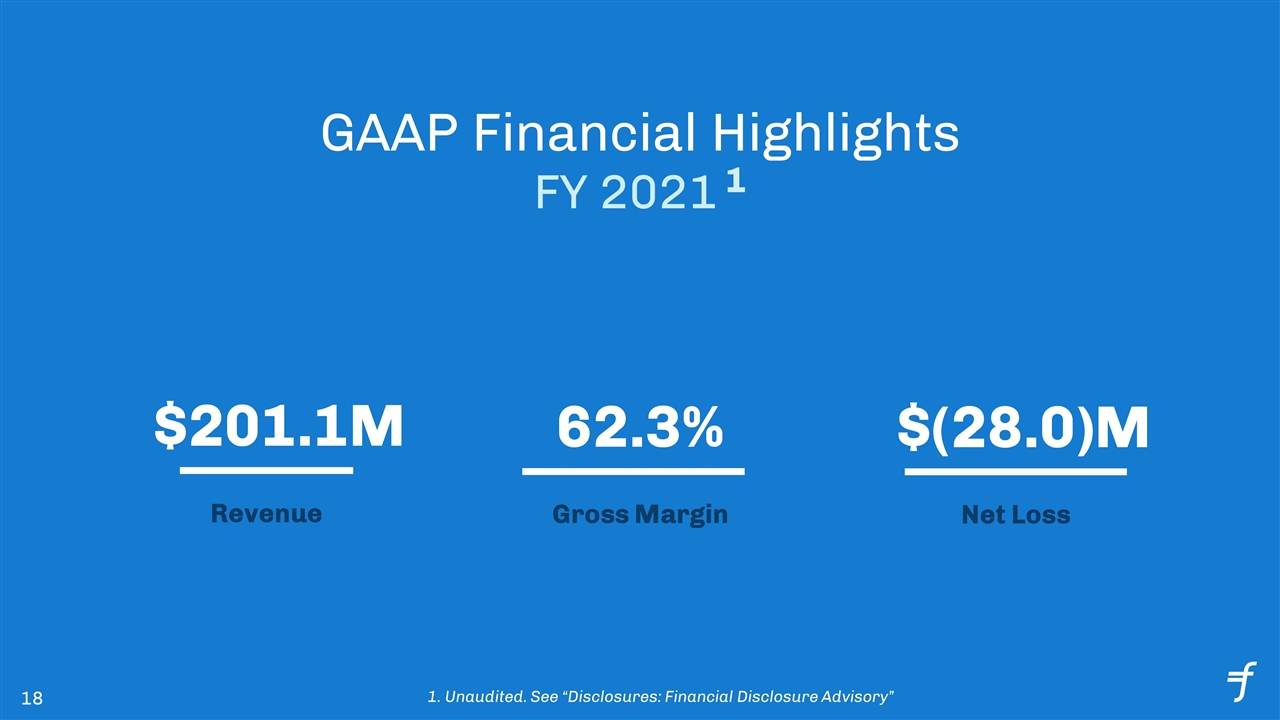

GAAP Financial Highlights FY 2021 1 $201.1M Revenue 62.3% Gross Margin $(28.0)M Net Loss 1. Unaudited. See “Disclosures: Financial Disclosure Advisory”

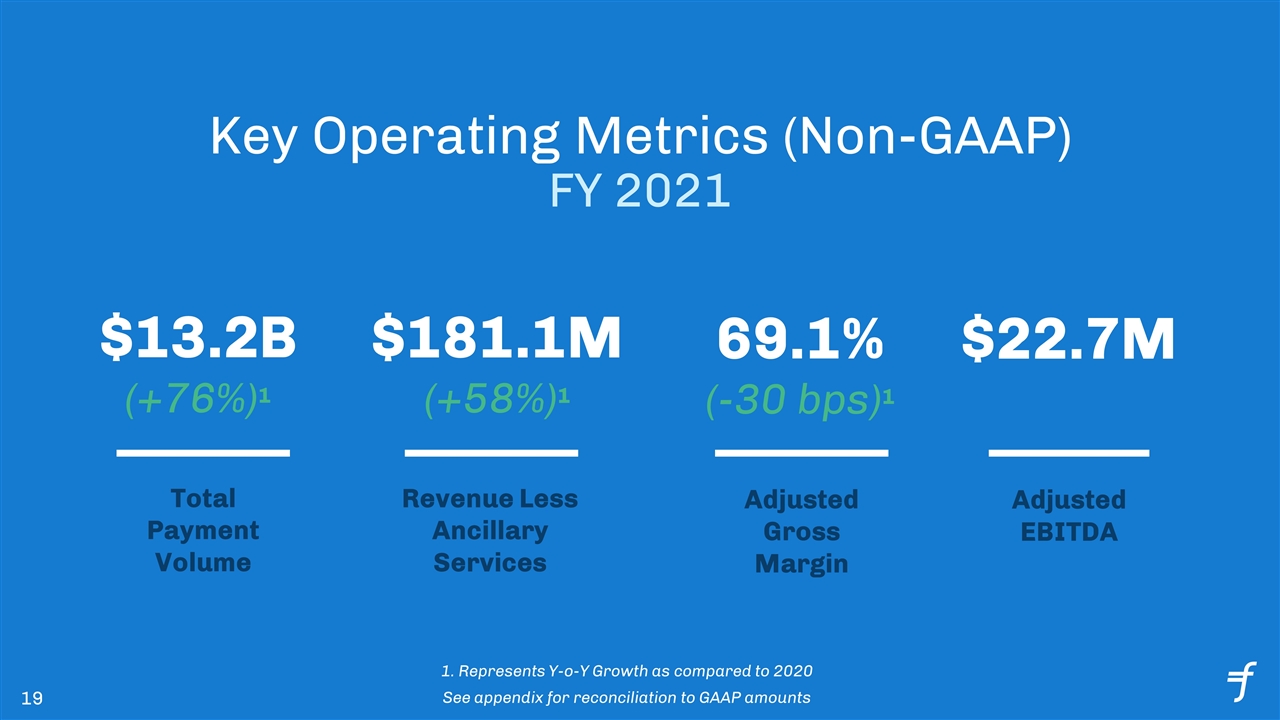

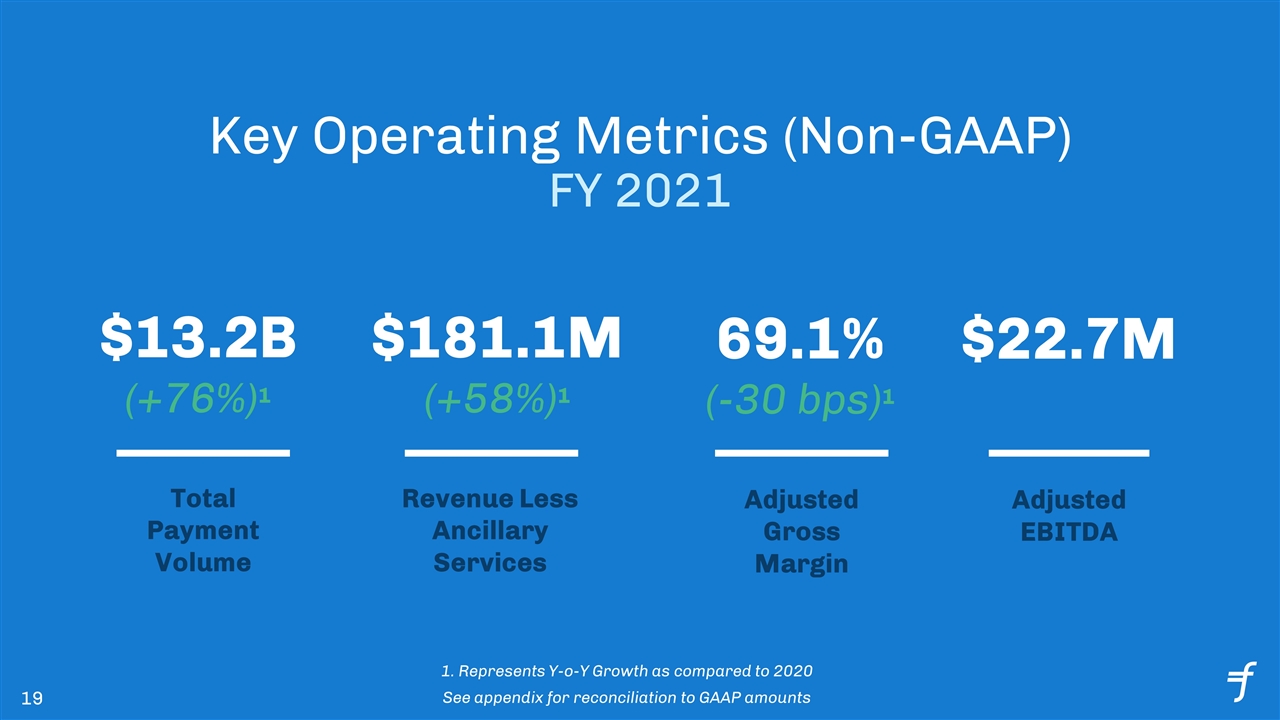

Key Operating Metrics (Non-GAAP) FY 2021 $13.2B (+76%)1 Total Payment Volume $181.1M (+58%)1 Revenue Less Ancillary Services 69.1% (-30 bps)1 Adjusted Gross Margin $22.7M Adjusted EBITDA 1. Represents Y-o-Y Growth as compared to 2020 See appendix for reconciliation to GAAP amounts

Financial Outlook

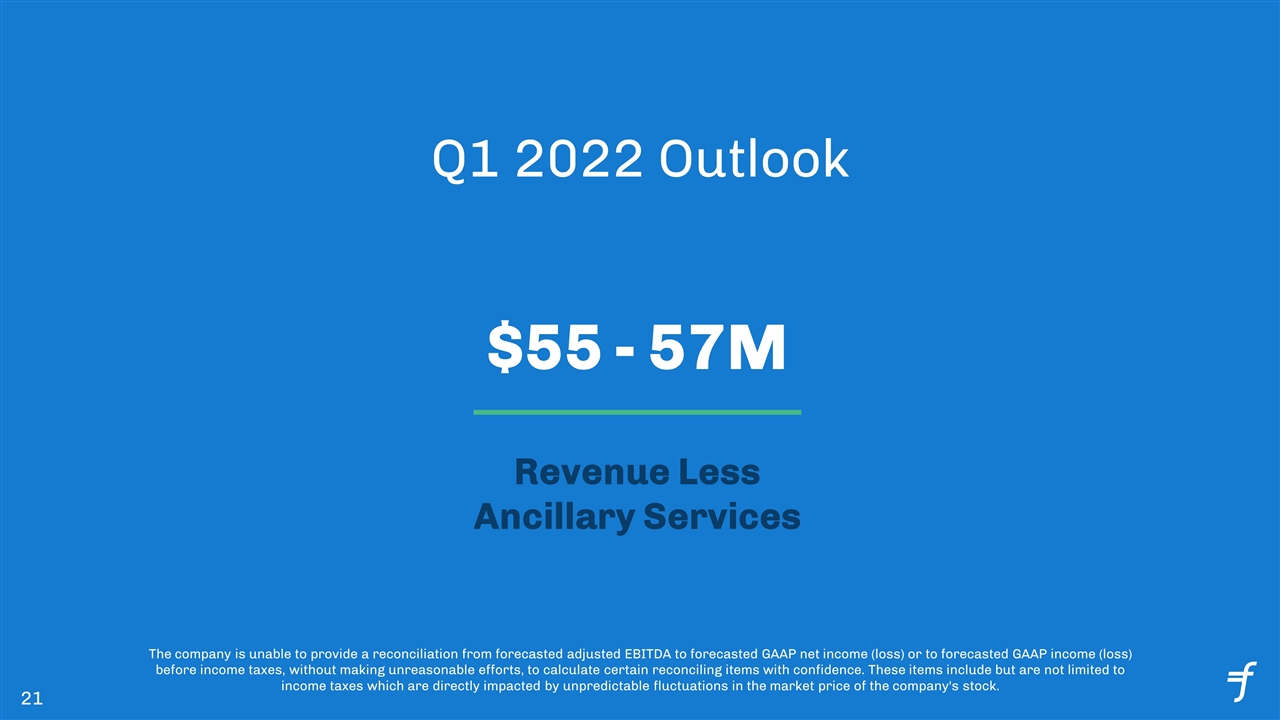

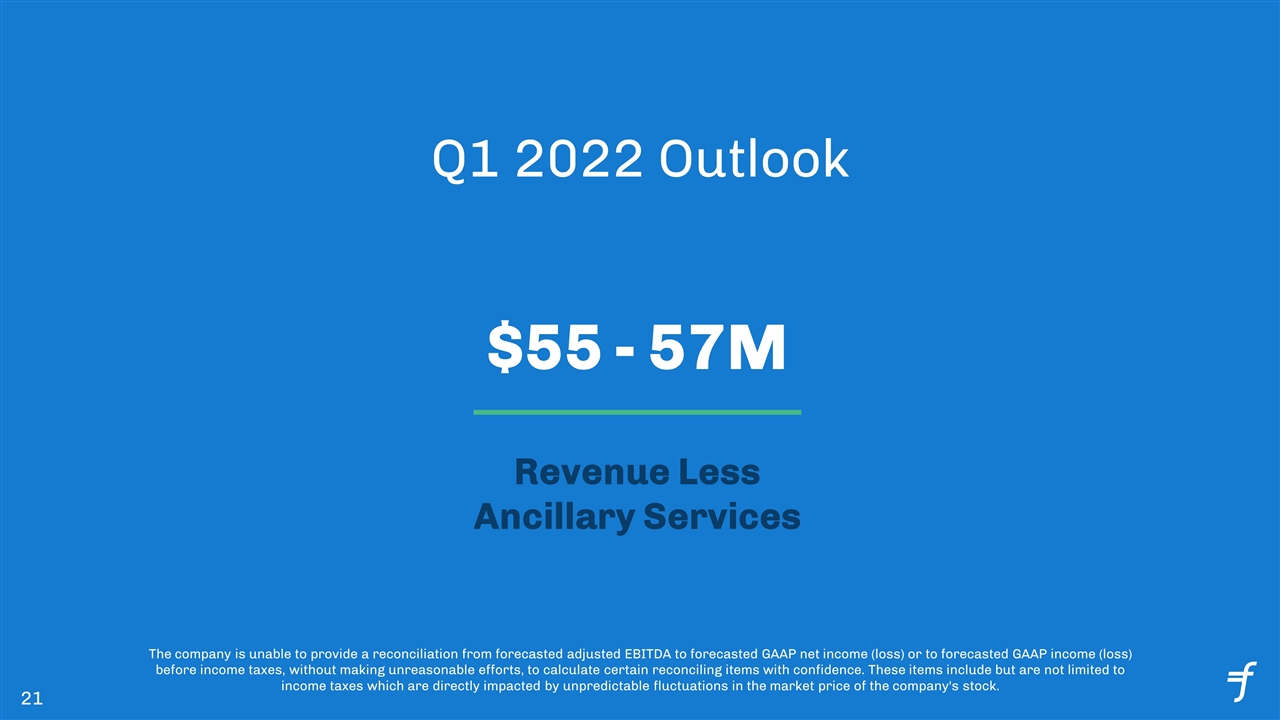

Q1 2022 Outlook $55 - 57M Revenue Less Ancillary Services The company is unable to provide a reconciliation from forecasted adjusted EBITDA to forecasted GAAP net income (loss) or to forecasted GAAP income (loss) before income taxes, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include but are not limited to income taxes which are directly impacted by unpredictable fluctuations in the market price of the company's stock.

FY 2022 Outlook $244 - 252M Revenue Less Ancillary Services $9 - 13M Adjusted EBITDA The company is unable to provide a reconciliation from forecasted adjusted EBITDA to forecasted GAAP net income (loss) or to forecasted GAAP income (loss) before income taxes, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include but are not limited to income taxes which are directly impacted by unpredictable fluctuations in the market price of the company's stock.

Appendix

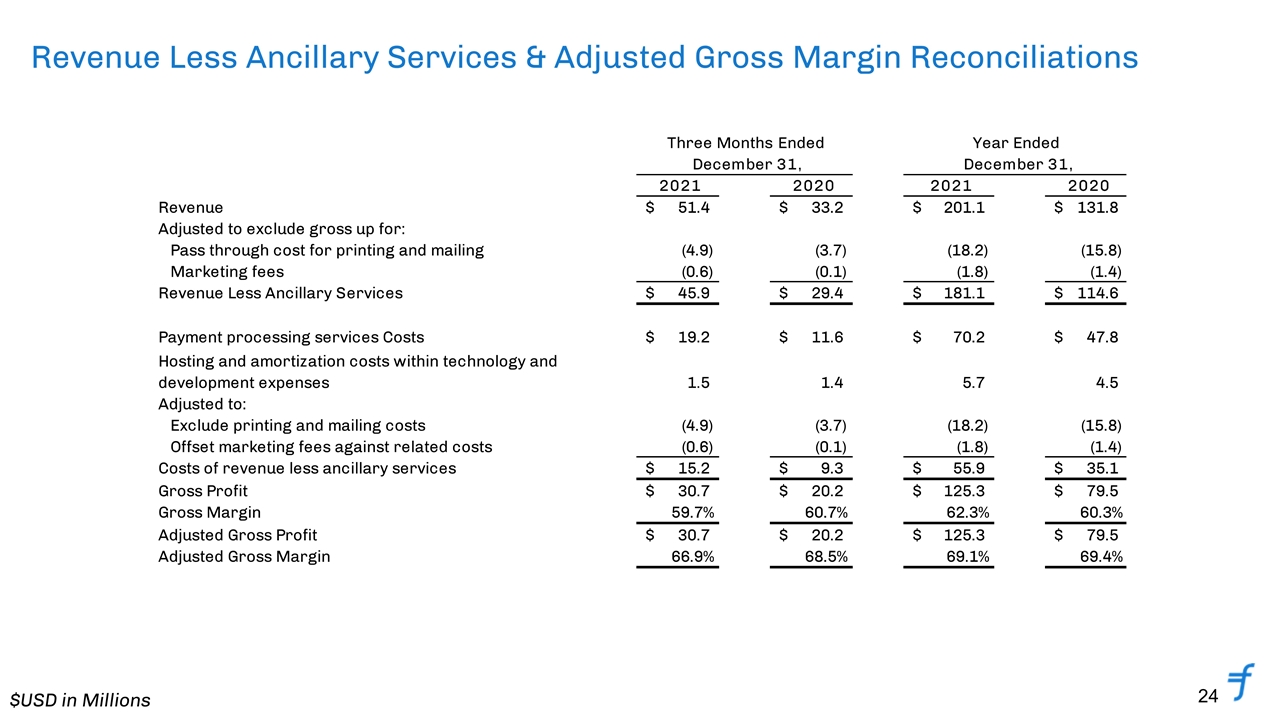

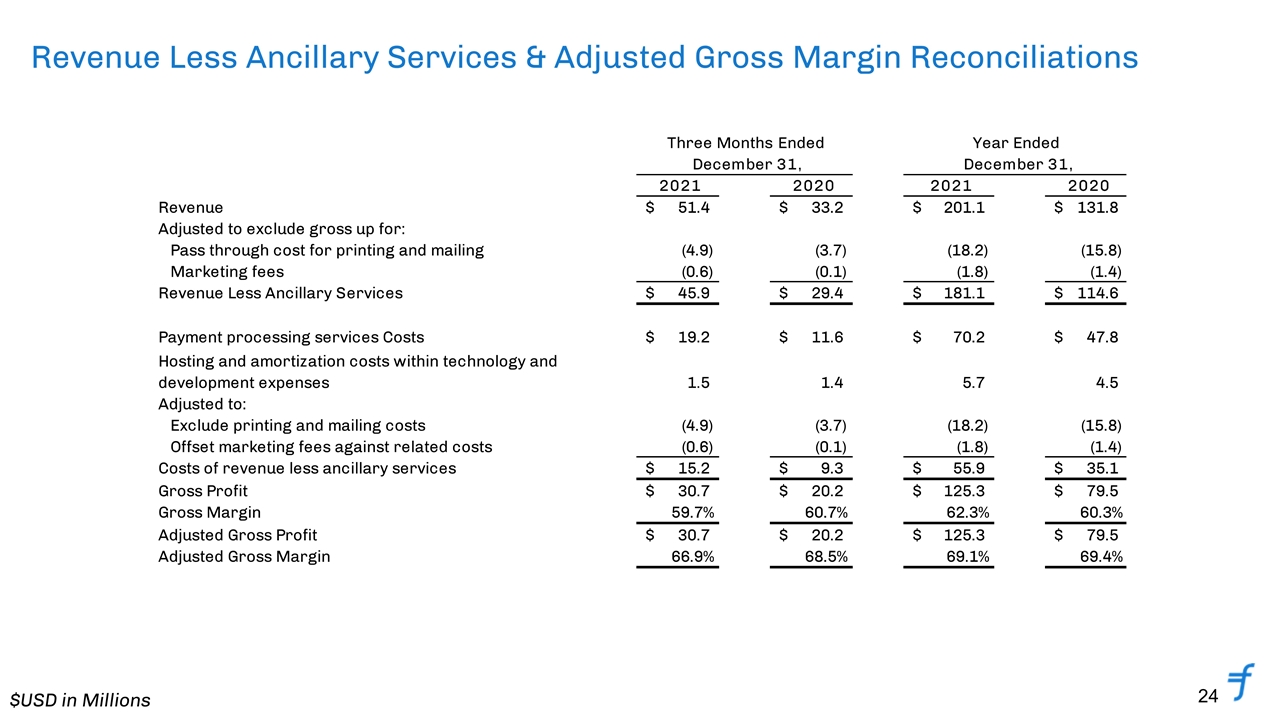

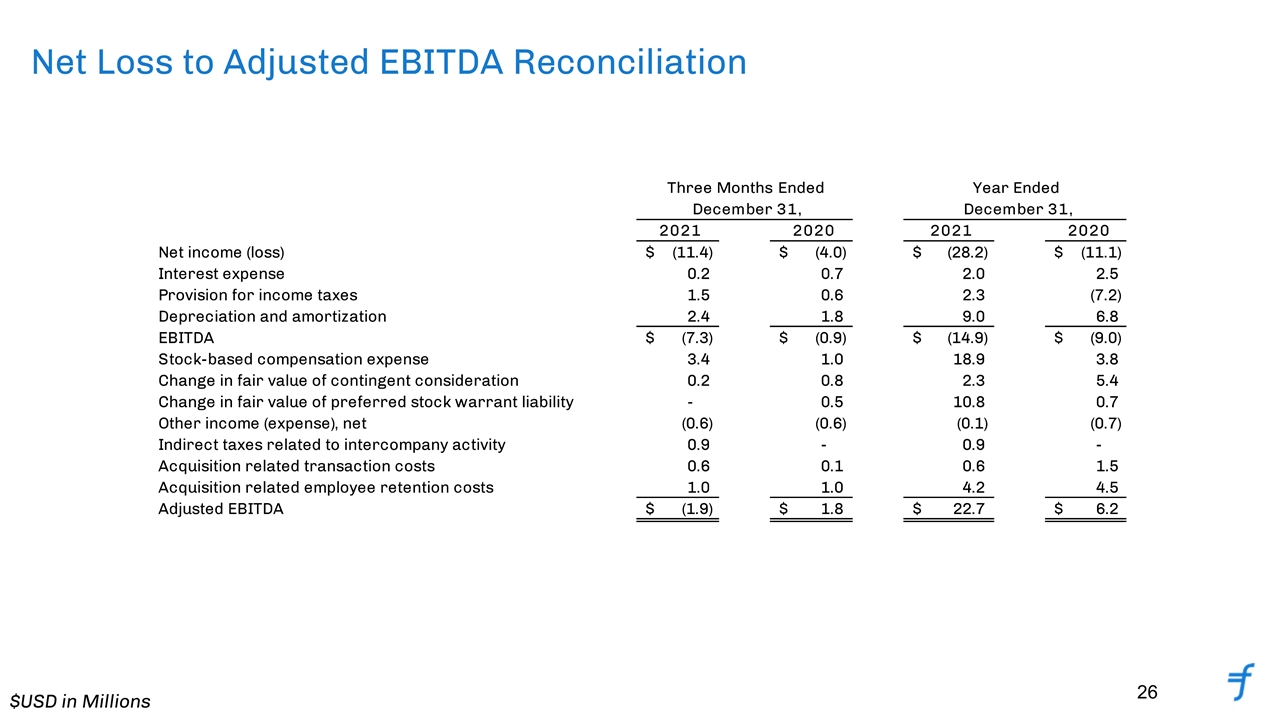

$USD in Millions Revenue Less Ancillary Services & Adjusted Gross Margin Reconciliations Reconciliation of Non-GAAP Financial Measures (Amounts in millions) Three Months Ended Year Ended December 31, December 31, 2021 2020 2021 2020 Revenue $51.393999999999998 $33.231000000000002 $201.149 $131.80000000000001 $1.5465679636484004 $1.5261684370257966 Adjusted to exclude gross up for: Pass through cost for printing and mailing -4.9000000000000004 -3.65 -18.206 -15.8 Marketing fees -0.6 -0.14499999999999999 -1.798 -1.4 Revenue Less Ancillary Services $45.893999999999998 $29.436000000000003 $181.14500000000001 $114.60000000000001 $1.5591112922951487 $1.580671902268761 Payment processing services Costs $19.2 $11.648999999999999 $70.191000000000003 $47.8 Hosting and amortization costs within technology and development expenses 1.49 1.409 5.7 4.5 Adjusted to: Exclude printing and mailing costs -4.9000000000000004 -3.65 -18.206 -15.8 Offset marketing fees against related costs -0.6 -0.14499999999999999 -1.798 -1.4 Costs of revenue less ancillary services $15.189999999999998 $9.2629999999999999 $55.887 $35.1 Gross Profit $30.704000000000001 $20.173000000000002 $125.25800000000001 $79.5 Gross Margin 0.59742382379266068 0.6070536547199904 0.62271251659217797 0.60318664643399089 Adjusted Gross Profit $30.704000000000001 $20.173000000000002 $125.25800000000001 $79.5 Adjusted Gross Margin 0.66901991545735828 0.6853172985459981 0.69147920174445887 0.69371727748691092 Three Months Ended Year Ended December 31, December 31, 2021 2020 2021 2020 Net income (loss) $-11.407 $-4.0309999999999997 $-28.210999999999999 $-11.106999999999999 Interest expense 0.217 0.67300000000000004 2 2.5 Provision for income taxes 1.466 0.622 2.2839999999999998 -7.1689999999999996 Depreciation and amortization 2.4 1.7989999999999999 9 6.8 EBITDA $-7.3239999999999998 $-0.93699999999999983 $-14.927 $-8.9759999999999991 Stock-based compensation expense 3.391 0.98299999999999998 18.899999999999999 3.8 Change in fair value of contingent consideration 0.159 0.8 2.2999999999999998 5.4 Change in fair value of preferred stock warrant liability 0 0.45 10.8 0.7 Other income (expense), net -0.60499999999999998 -0.625 -0.1 -0.7 Indirect taxes related to intercompany activity 0.876 0 0.9 0 Acquisition related transaction costs 0.57399999999999995 0.1 0.6 1.5 Acquisition related employee retntion costs 1.034 1 4.2 4.5 Adjusted EBITDA $-1.8949999999999998 $1.7710000000000004 $22.672999999999998 $6.2240000000000011 $3.6428341902313615

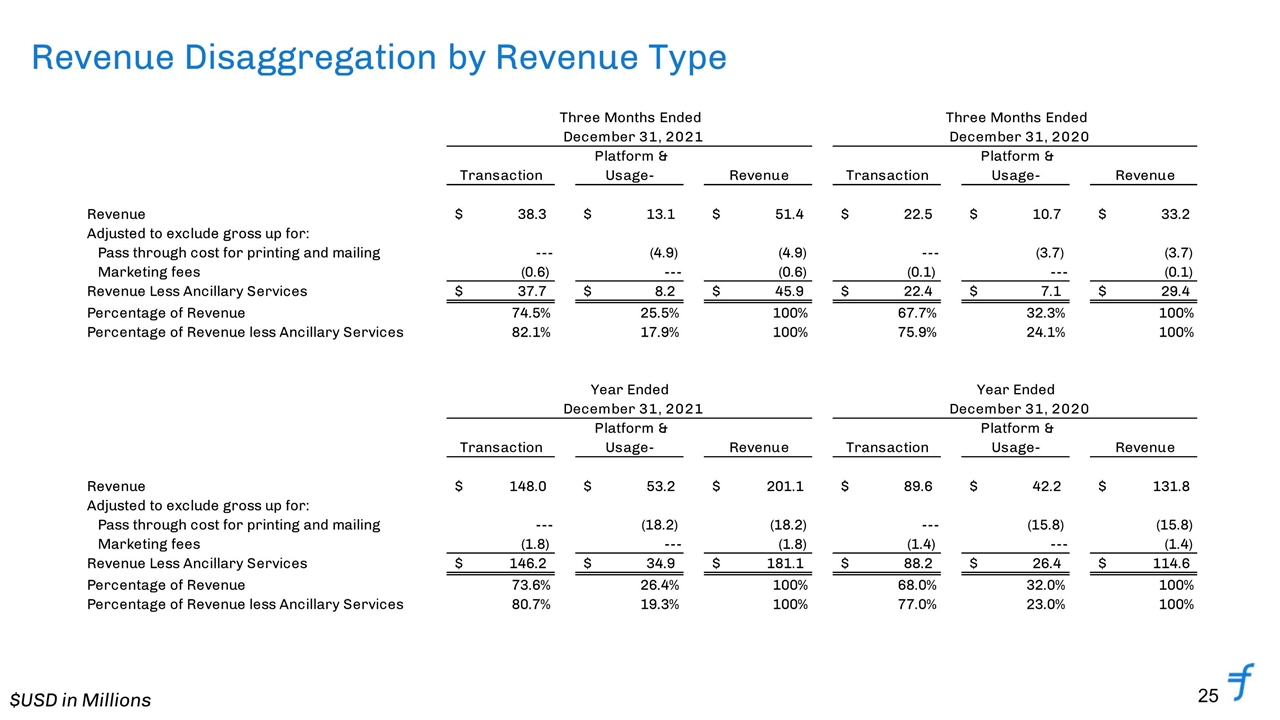

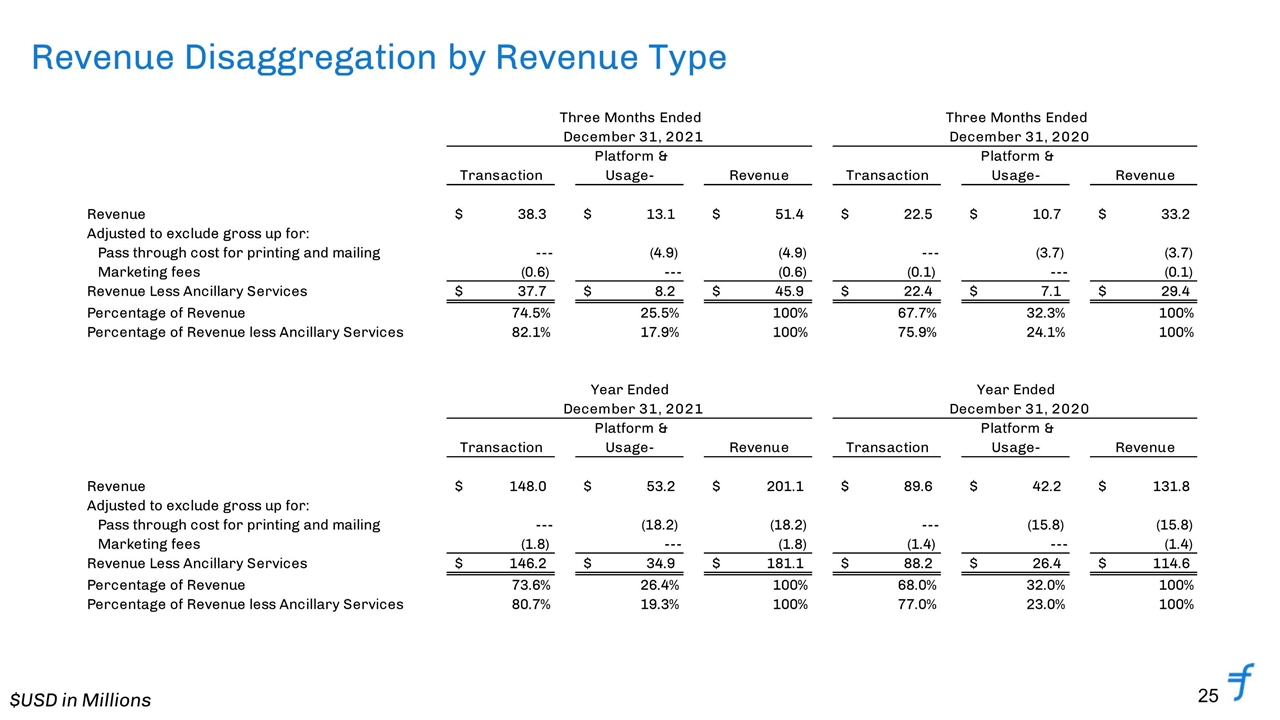

$USD in Millions Revenue Disaggregation by Revenue Type Three Months Ended Three Months Ended December 31, 2021 December 31, 2020 Platform & Platform & Transaction Usage- Revenue Transaction Usage- Revenue Revenue $38.277999999999999 $13.115 $51.393000000000001 $22.497 $10.734 $33.231000000000002 $1.7014713072854157 $-9.9999999999766942E-4 $0 Adjusted to exclude gross up for: Pass through cost for printing and mailing --- -4.9000000000000004 -4.9000000000000004 --- -3.65 -3.65 Marketing fees -0.6 --- -0.6 -0.14499999999999999 --- -0.14499999999999999 Revenue Less Ancillary Services $37.677999999999997 $8.2149999999999999 $45.893000000000001 $22.352 $7.0839999999999996 $29.436000000000003 0.6856657122405152 0.15965556182947491 Percentage of Revenue 0.74480960442083544 0.25519039557916445 0.99999999999999989 0.67698835424753989 0.32301164575246005 1 Percentage of Revenue less Ancillary Services 0.82099666615823752 0.17900333384176234 0.99999999999999989 0.75934230194319874 0.24065769805680115 0.99999999999999989 Year Ended Year Ended December 31, 2021 December 31, 2020 Platform & Platform & Transaction Usage- Revenue Transaction Usage- Revenue Revenue $147.994 $53.155000000000001 $201.149 $89.606999999999999 $42.176000000000002 $131.78300000000002 $0 $0 Adjusted to exclude gross up for: Pass through cost for printing and mailing --- -18.206 -18.206 --- -15.8 -15.8 Marketing fees -1.798 --- -1.798 -1.4 --- -1.4 Revenue Less Ancillary Services $146.196 $34.948999999999998 $181.14500000000001 $88.206999999999994 $26.376000000000001 $114.58300000000001 Percentage of Revenue 0.73574315557124326 0.2642568444287568 1 0.67995872001699753 0.32004127998300236 0.99999999999999989 Percentage of Revenue less Ancillary Services 0.80706616246653229 0.19293383753346766 1 0.76980878489828319 0.23019121510171664 0.99999999999999978

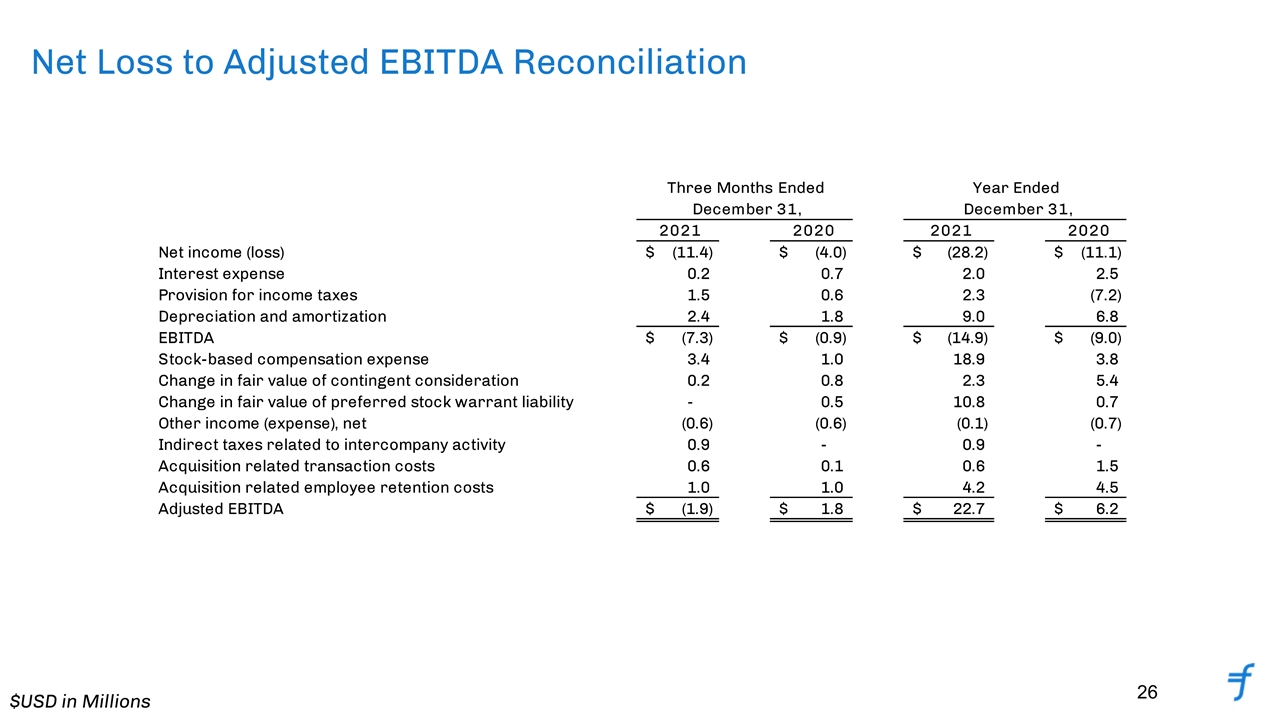

$USD in Millions Net Loss to Adjusted EBITDA Reconciliation Reconciliation of Non-GAAP Financial Measures (Amounts in millions) Three Months Ended Year Ended December 31, December 31, 2021 2020 2021 2020 Revenue $51.393999999999998 $33.231000000000002 $201.149 $131.80000000000001 $1.5465679636484004 $1.5261684370257966 Adjusted to exclude gross up for: Pass through cost for printing and mailing -4.9000000000000004 -3.65 -18.206 -15.8 Marketing fees -0.6 -0.14499999999999999 -1.798 -1.4 Revenue Less Ancillary Services $45.893999999999998 $29.436000000000003 $181.14500000000001 $114.60000000000001 $1.5591112922951487 $1.580671902268761 Payment processing services Costs $19.2 $11.648999999999999 $70.191000000000003 $47.8 Hosting and amortization costs within technology and development expenses 1.49 1.409 5.7 4.5 Adjusted to: Exclude printing and mailing costs -4.9000000000000004 -3.65 -18.206 -15.8 Offset marketing fees against related costs -0.6 -0.14499999999999999 -1.798 -1.4 Costs of revenue less ancillary services $15.189999999999998 $9.2629999999999999 $55.887 $35.1 Gross Profit $30.704000000000001 $20.173000000000002 $125.25800000000001 $79.5 Gross Margin 0.59742382379266068 0.6070536547199904 0.62271251659217797 0.60318664643399089 Adjusted Gross Profit $30.704000000000001 $20.173000000000002 $125.25800000000001 $79.5 Adjusted Gross Margin 0.66901991545735828 0.6853172985459981 0.69147920174445887 0.69371727748691092 Three Months Ended Year Ended December 31, December 31, 2021 2020 2021 2020 Net income (loss) $-11.407 $-4.0309999999999997 $-28.210999999999999 $-11.106999999999999 Interest expense 0.217 0.67300000000000004 2 2.5 Provision for income taxes 1.466 0.622 2.2839999999999998 -7.1689999999999996 Depreciation and amortization 2.4 1.7989999999999999 9 6.8 EBITDA $-7.3239999999999998 $-0.93699999999999983 $-14.927 $-8.9759999999999991 Stock-based compensation expense 3.391 0.98299999999999998 18.899999999999999 3.8 Change in fair value of contingent consideration 0.159 0.8 2.2999999999999998 5.4 Change in fair value of preferred stock warrant liability 0 0.45 10.8 0.7 Other income (expense), net -0.60499999999999998 -0.625 -0.1 -0.7 Indirect taxes related to intercompany activity 0.876 0 0.9 0 Acquisition related transaction costs 0.57399999999999995 0.1 0.6 1.5 Acquisition related employee retention costs 1.034 1 4.2 4.5 Adjusted EBITDA $-1.8949999999999998 $1.7710000000000004 $22.672999999999998 $6.2240000000000011 $3.6428341902313615

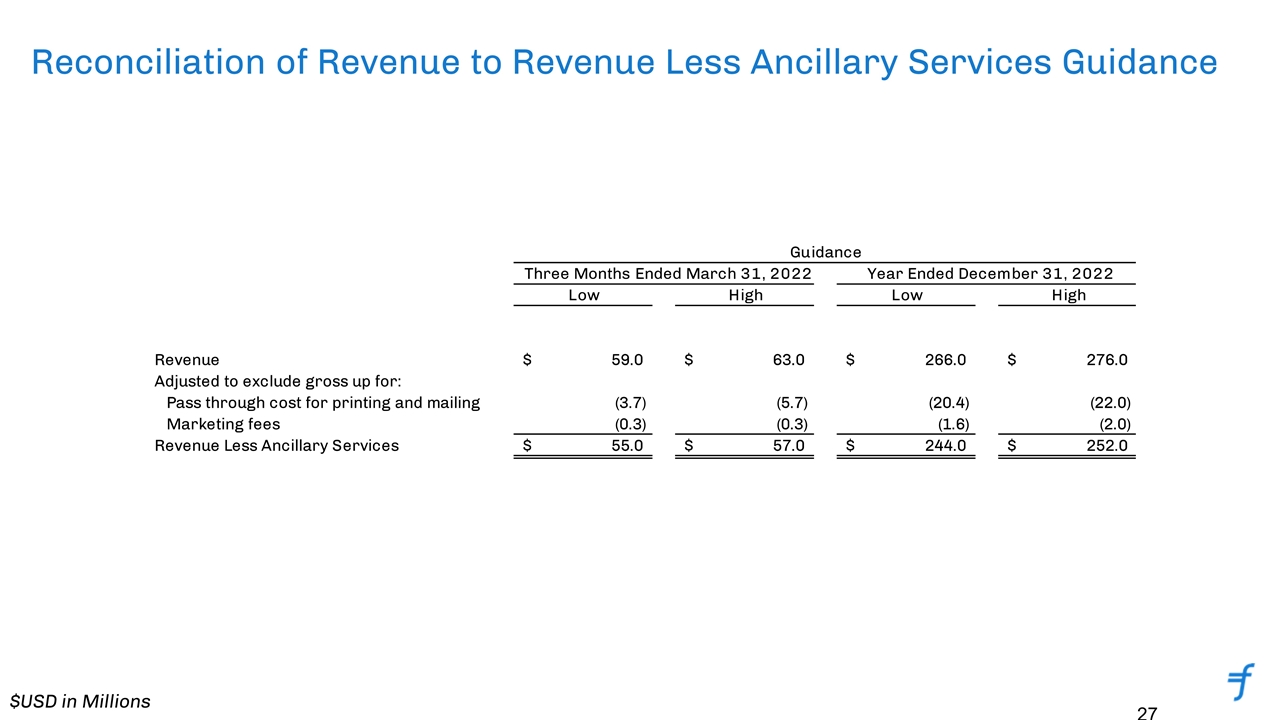

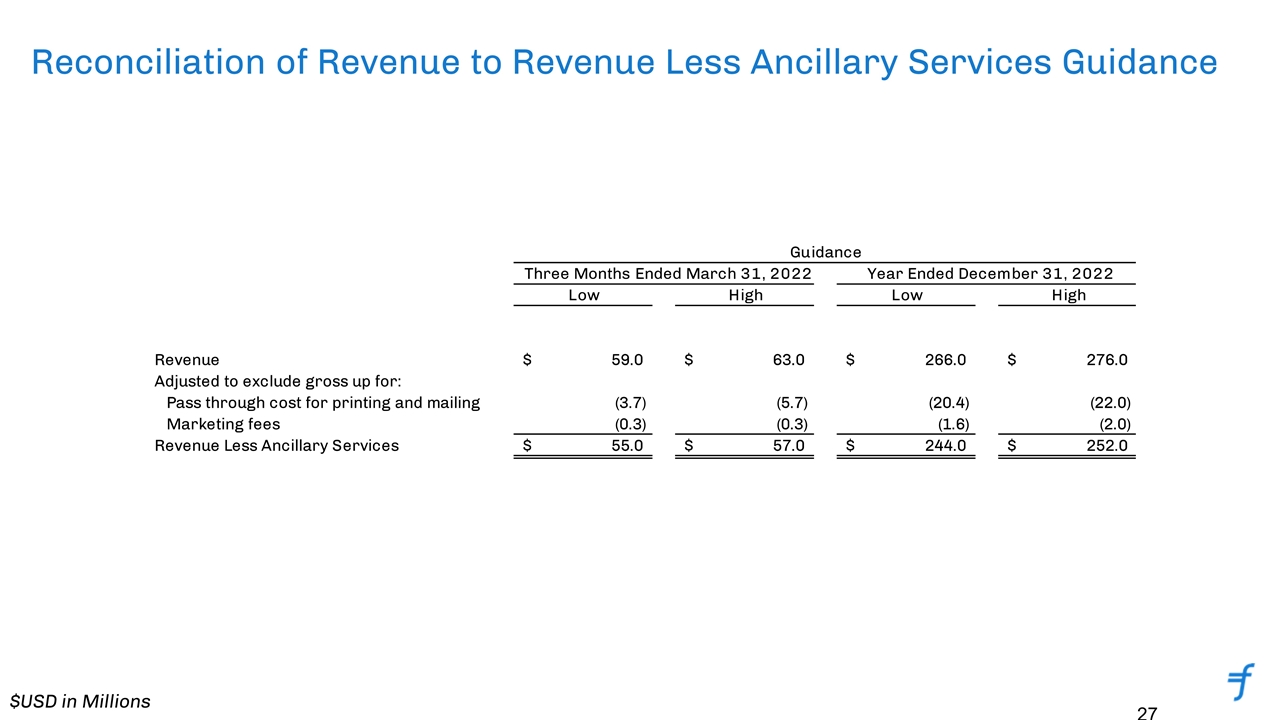

$USD in Millions Reconciliation of Revenue to Revenue Less Ancillary Services Guidance Guidance Three Months Ended March 31, 2022 Year Ended December 31, 2022 Low High Low High Revenue $59 $63 $266 $276 Adjusted to exclude gross up for: Pass through cost for printing and mailing -3.7 -5.7 -20.399999999999999 -22 Marketing fees -0.3 -0.3 -1.6 -2 Revenue Less Ancillary Services $55 $57 $244 $252