Exhibit 99.2 Q4 & FY 2022 Earnings Supplement February 28, 2023

Disclosures This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this presentation, including statements regarding Flywire’s ability to successfully implement Flywire’s business plan, future results of operations and financial position, business strategy and plans and Flywire’s objectives for future operations, are forward -looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plans,” “potential,” “seeks,” “projects,” “should,” “could” and “would” and similar expressions are intended to identify forward -looking statements, although not all forward-looking statements contain these identifying words. Flywire has based these forward- looking statements largely on Flywire’s current expectations and projections about future events and financial trends that Flywire believes may affect Flywire’s financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions that are described in the Risk Factors and Management's Discussion and Analysis of Financial Condition and Results of Operations sections of Flywire's Annual Report on Form 10-K for the year ended December 31, 2021 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2022, which are on file with the Securities and Exchange Commission (SEC) and available on the SEC's website at www.sec.gov. Additional factors may be described in those sections of Flywire’s Annual Report on Form 10-K for the year ended December 31, 2022, expected to be filed with the SEC in the first quarter of 2023. In light of these risks, uncertainties and assumptions, the forward -looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events or performance. In addition, projections, assumptions and estimates of the future performance of the industries in which Flywire operates and the markets it serves are inherently imprecise and subject to a high degree of uncertainty and risk. All financial projections contained in this presentation are forward -looking statements and are based on Flywire’s management’s assessment of such matters. It is unlikely, however, that the assumptions on which Flywire has based its projections will prove to be fully correct or that the projected figures will be attained. Flywire’s actual future results may differ materially from Flywire’s projections, and it makes no express or implied representation or warranty as to attainability of the results reflected in these projections. Investments in Flywire’s securities involve a high degree of risk and should be regarded as speculative. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and Flywire’s own internal estimates and research. While Flywire believes these third-party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while Flywire believes its own internal research is reliable, such research has not been verified by any independent source. The information in this presentation is provided only as of February 28, 2023, and Flywire undertakes no obligation to update any forward-looking statements contained in this presentation on account of new information, future events, or otherwise, except as required by law. This presentation contains certain non-GAAP financial measures as defined by SEC rules. Flywire has provided a reconciliation of those measures to the most directly comparable GAAP measures, which is available in the Appendix. The company has relied upon the exception in item 10(e)(1)(i)(B) of Regulation S-K and has not provided a quantitative reconciliation from forecasted adjusted EBITDA to forecasted GAAP net income (loss) or to forecasted GAAP income (loss) before income taxes, because it is unable without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include but are not limited to income taxes which are directly impacted by unpredictable fluctuations in the market price of the company's stock. 2

Financial Disclosure Advisory The Company reports its financial results in accordance with U.S. generally accepted accounting principles (“GAAP”). The expected financial results discussed in this press release are preliminary and unaudited and represent the most current information available to the company’s management, as financial closing and audit procedures for the year ended December 31, 2022 are not yet complete. These estimates are not a comprehensive statement of the Company’s financial results for the fourth quarter and fiscal year ended December 31, 2022, and actual results may differ materially from these estimates as a result of the completion of year-end financial reporting process, finalization of the processes and procedures required by Section 404(b) of the the Sarbanes-Oxley Act of 2002, completion of the procedures relating to management's assessment of the effectiveness of the Company’s internal controls, the completion of the external audit by the Company’s independent registered public accounting firm, and the subsequent occurrence or identification of events prior to the formal issuance of the audited financial statements for fiscal year 2022. In addition, results presented in this press release or on the conference call do not present all information necessary for an understanding of the Company’s financial condition and results of operations as of and for the quarter and year ended December 31, 2022. 3

Execution Fulfillment Our mission is to deliver the most important and complex payments 4

Q4 2022 Performance 5

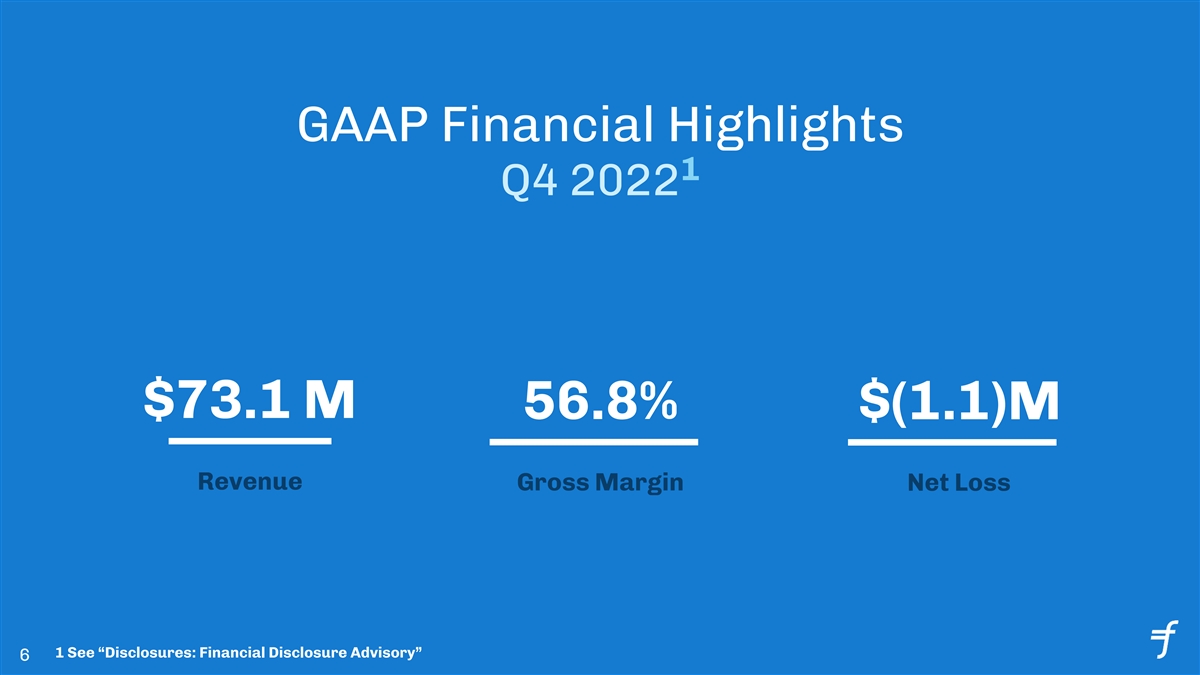

GAAP Financial Highlights 1 Q4 2022 $73.1 M 56.8% $(1.1)M Revenue Gross Margin Net Loss 1 See “Disclosures: Financial Disclosure Advisory” 6

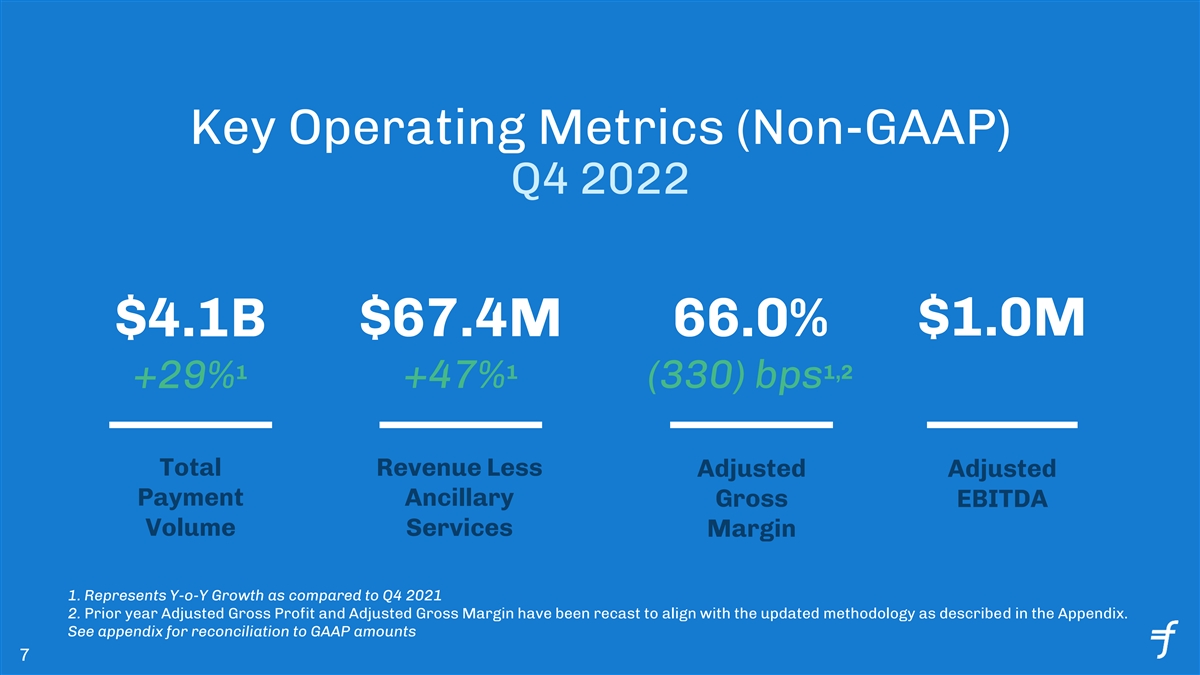

Key Operating Metrics (Non-GAAP) Q4 2022 $4.1B $67.4M 66.0% $1.0M 1 1 1,2 +29% +47% (330) bps Total Revenue Less Adjusted Adjusted Payment Ancillary Gross EBITDA Volume Services Margin 1. Represents Y-o-Y Growth as compared to Q4 2021 2. Prior year Adjusted Gross Profit and Adjusted Gross Margin have been recast to align with the updated methodology as described in the Appendix. See appendix for reconciliation to GAAP amounts 7

FY 2022 Performance 8

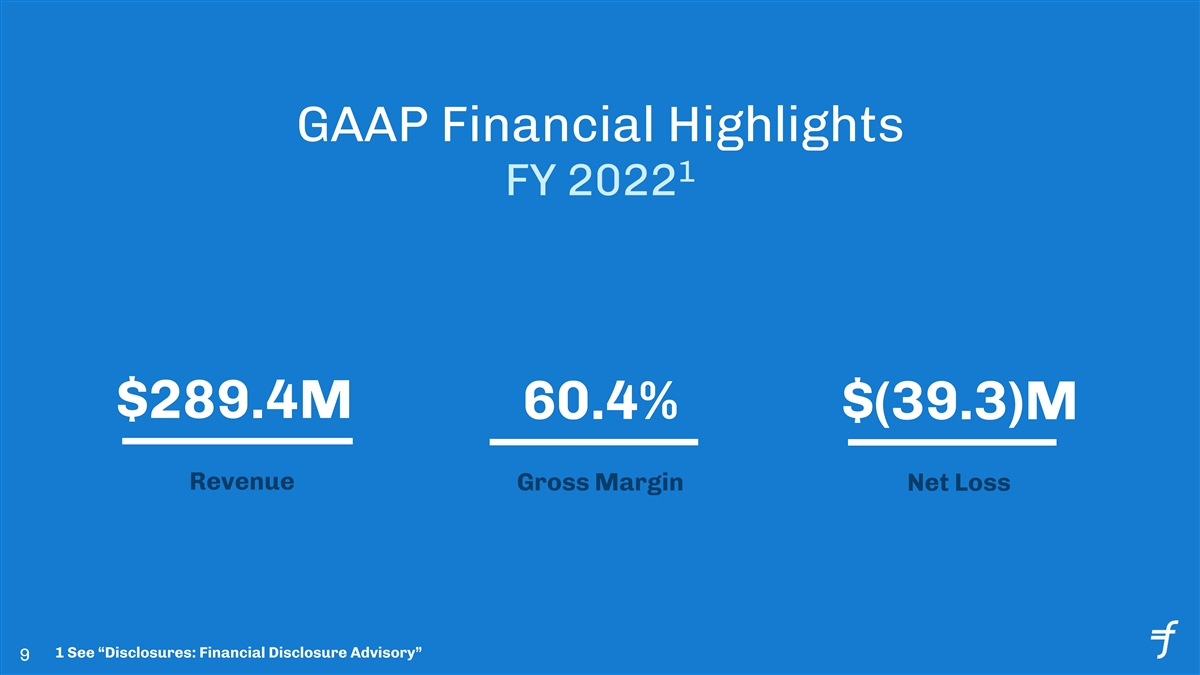

GAAP Financial Highlights 1 FY 2022 $289.4M 60.4% $(39.3)M Revenue Gross Margin Net Loss 1 See “Disclosures: Financial Disclosure Advisory” 9

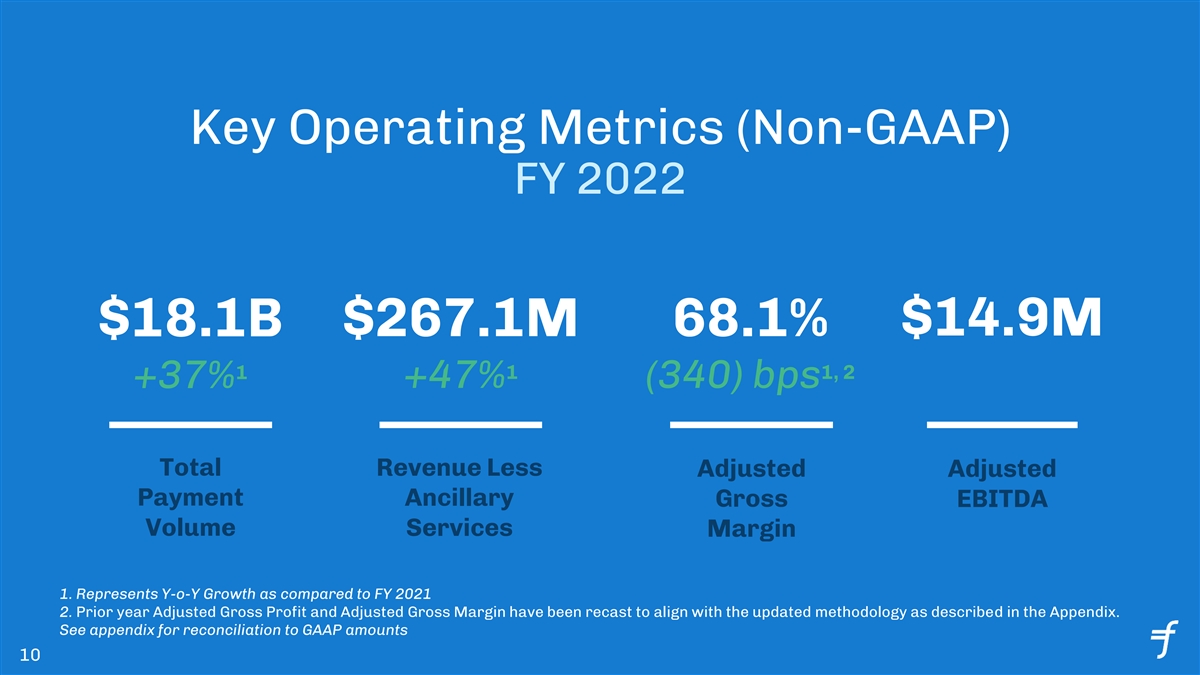

Key Operating Metrics (Non-GAAP) FY 2022 $18.1B $267.1M 68.1% $14.9M 1 1 1, 2 +37% +47% (340) bps Total Revenue Less Adjusted Adjusted Payment Ancillary Gross EBITDA Volume Services Margin 1. Represents Y-o-Y Growth as compared to FY 2021 2. Prior year Adjusted Gross Profit and Adjusted Gross Margin have been recast to align with the updated methodology as described in the Appendix. See appendix for reconciliation to GAAP amounts 10

Growth strategies Expand our Expand to Pursue strategic ecosystem new industries, & value- Grow with Grow with through channel geographies & enhancing existing new partnerships products acquisitions clients clients 124% 145+ 570+ 2022 average New clients in Q4 Travel & B2B annual dollar-based 2022 Clients net retention rate 11

1, 2, 3 Our Existing Clients Drive Revenue Growth 2022 NRR exceeds three-year corporate average New and legacy clients expand over time to drive long-term strong NRR Returning to healthy run rate post COVID recovery

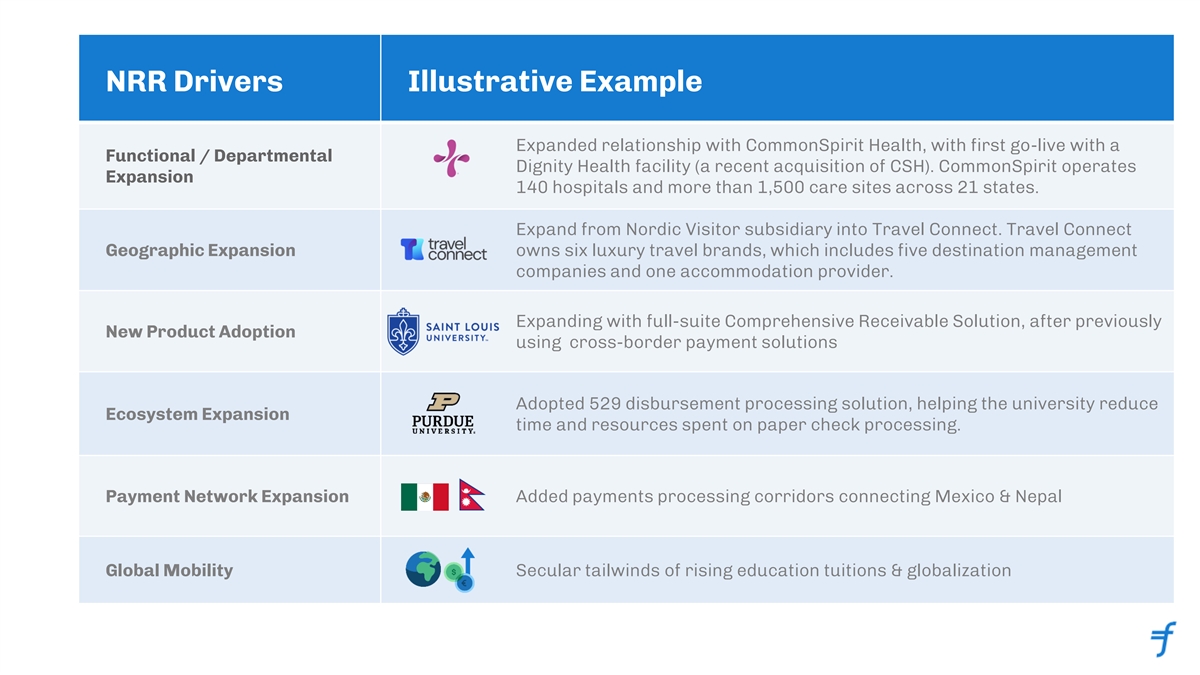

NRR Drivers Illustrative Example Expanded relationship with CommonSpirit Health, with first go-live with a Functional / Departmental Dignity Health facility (a recent acquisition of CSH). CommonSpirit operates Expansion 140 hospitals and more than 1,500 care sites across 21 states. Expand from Nordic Visitor subsidiary into Travel Connect. Travel Connect Geographic Expansion owns six luxury travel brands, which includes five destination management companies and one accommodation provider. Expanding with full-suite Comprehensive Receivable Solution, after previously New Product Adoption using cross-border payment solutions Adopted 529 disbursement processing solution, helping the university reduce Ecosystem Expansion time and resources spent on paper check processing. Payment Network Expansion Added payments processing corridors connecting Mexico & Nepal Global Mobility Secular tailwinds of rising education tuitions & globalization

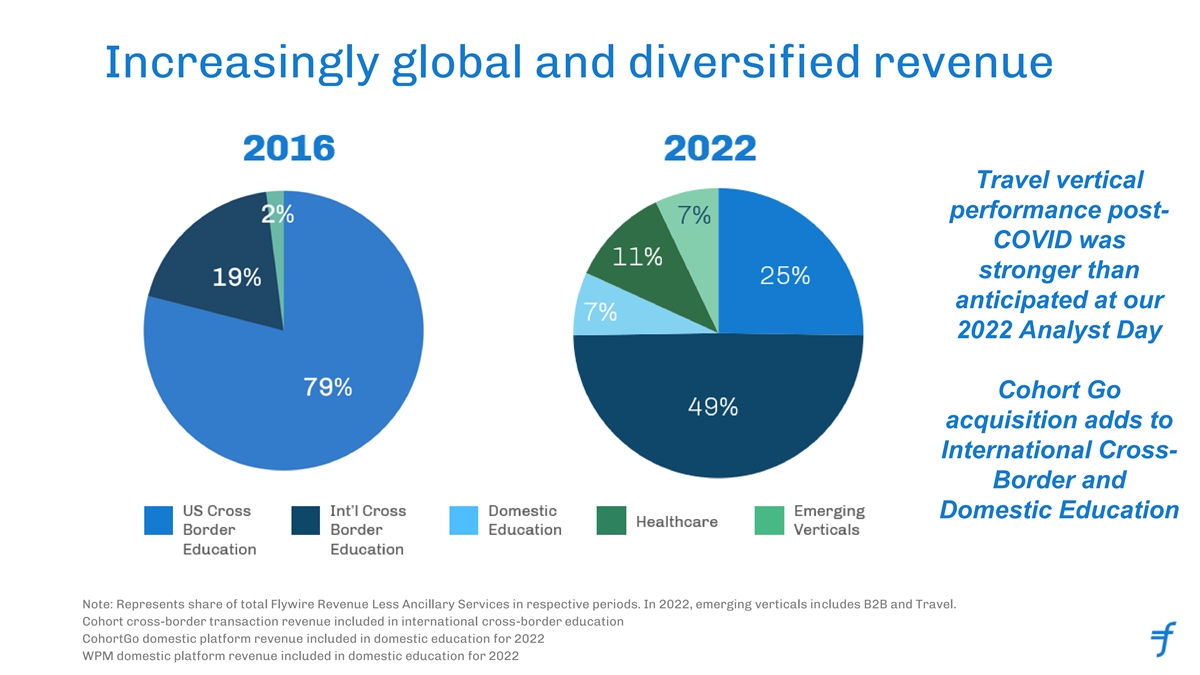

Increasingly global and diversified revenue Travel vertical performance post- COVID was stronger than anticipated at our 2022 Analyst Day Cohort Go acquisition adds to International Cross- Border and Domestic Education Note: Represents share of total Flywire Revenue Less Ancillary Services in respective periods. In 2022, emerging verticals includes B2B and Travel. Cohort cross-border transaction revenue included in international cross-border education CohortGo domestic platform revenue included in domestic education for 2022 WPM domestic platform revenue included in domestic education for 2022

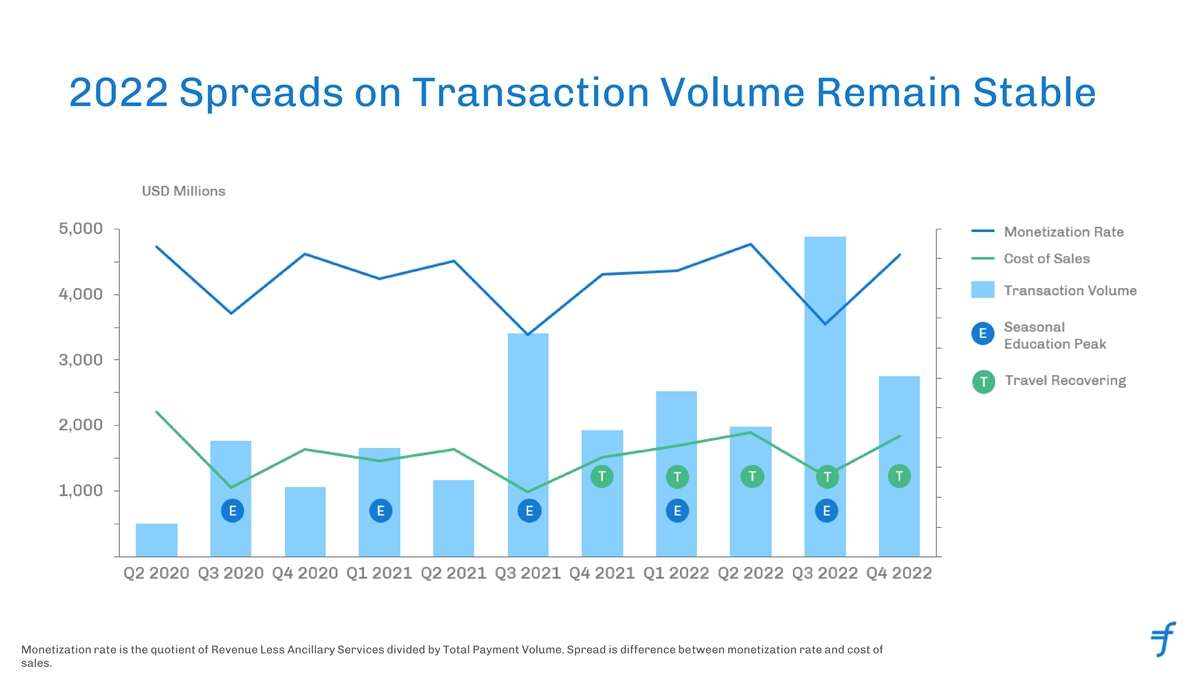

2022 Spreads on Transaction Volume Remain Stable Monetization rate is the quotient of Revenue Less Ancillary Services divided by Total Payment Volume. Spread is difference between monetization rate and cost of sales.

Financial Outlook 16

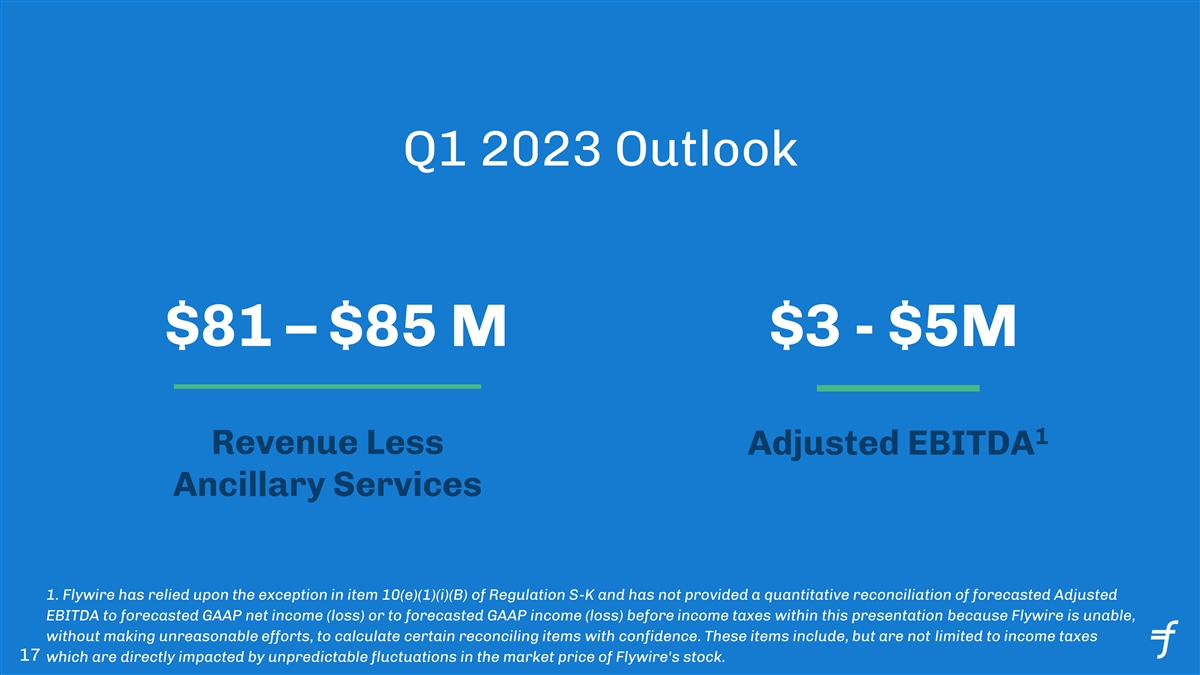

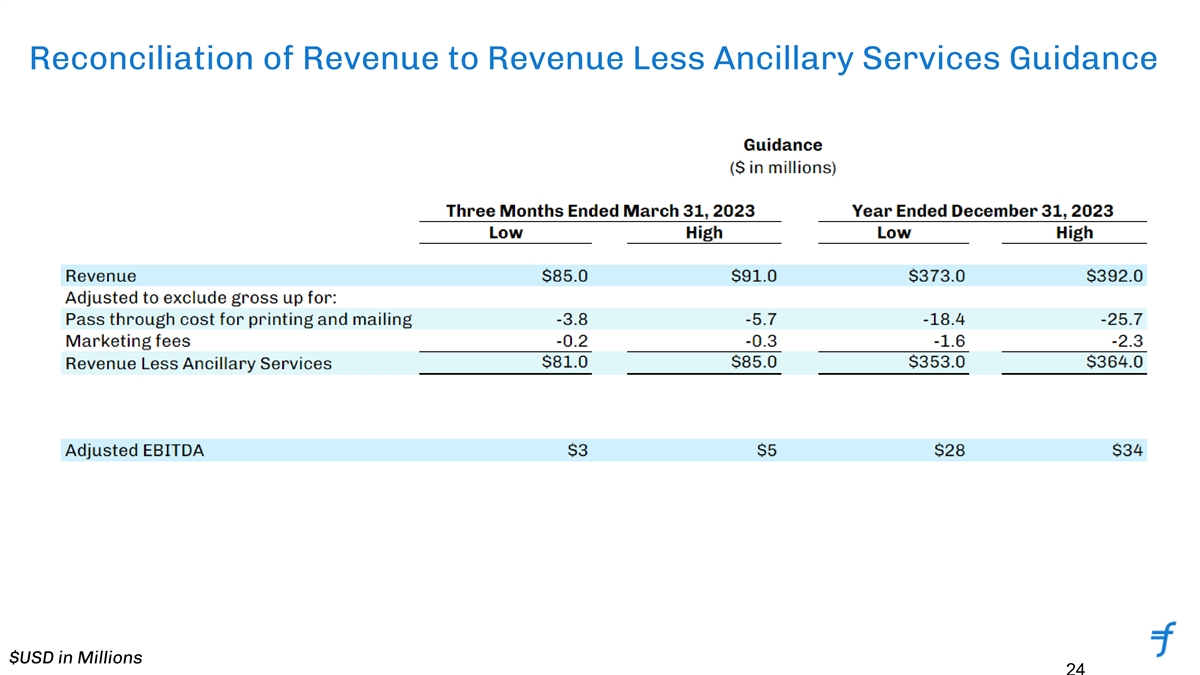

Q1 2023 Outlook $81 – $85 M $3 - $5M 1 Revenue Less Adjusted EBITDA Ancillary Services 1. Flywire has relied upon the exception in item 10(e)(1)(i)(B) of Regulation S-K and has not provided a quantitative reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net income (loss) or to forecasted GAAP income (loss) before income taxes within this presentation because Flywire is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to income taxes 17 which are directly impacted by unpredictable fluctuations in the market price of Flywire's stock.

FY 2023 Outlook $353 - $364M $28 - 34M 1 Revenue Less Adjusted EBITDA Ancillary Services 1. Flywire has relied upon the exception in item 10(e)(1)(i)(B) of Regulation S-K and has not provided a quantitative reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net income (loss) or to forecasted GAAP income (loss) before income taxes within this presentation because Flywire is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to income taxes 18 which are directly impacted by unpredictable fluctuations in the market price of Flywire's stock.

Appendix 19

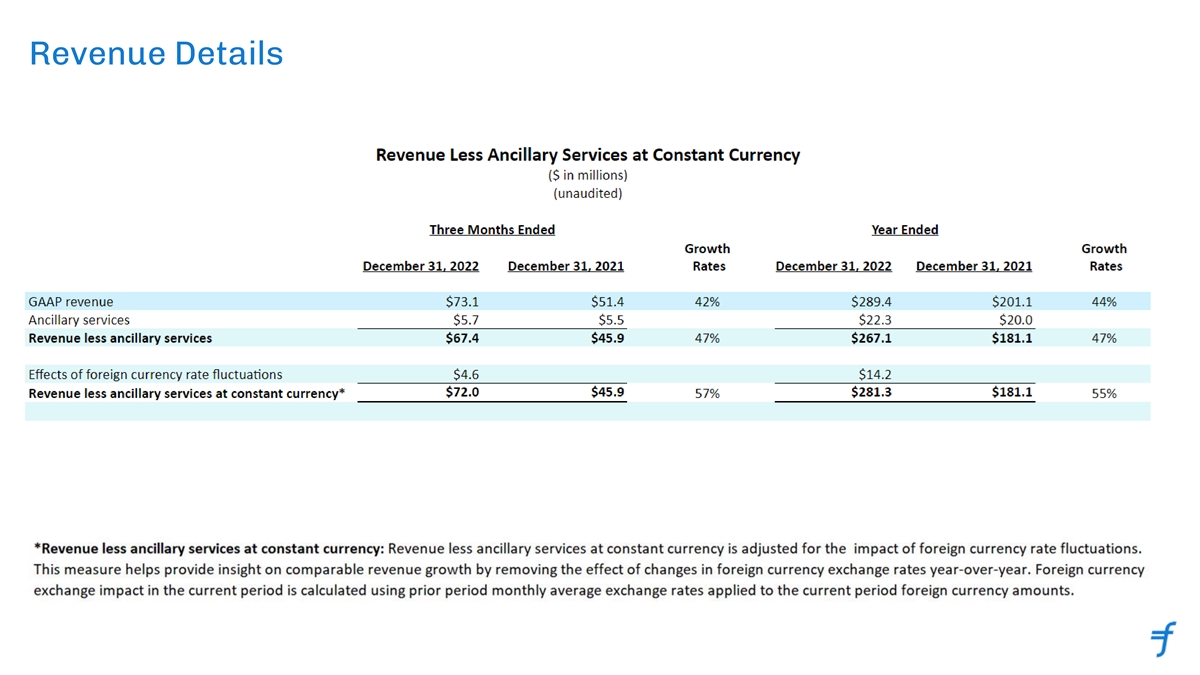

Revenue Details

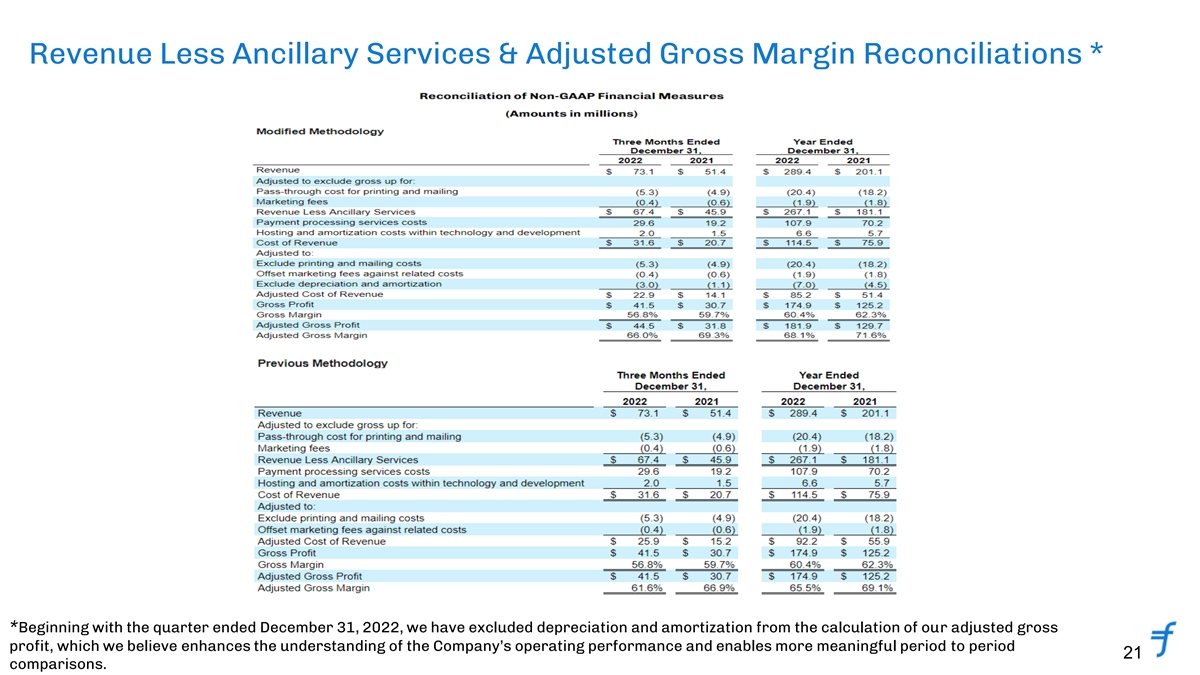

Revenue Less Ancillary Services & Adjusted Gross Margin Reconciliations * *Beginning with the quarter ended December 31, 2022, we have excluded depreciation and amortization from the calculation of our adjusted gross profit, which we believe enhances the understanding of the Company’s operating performance and enables more meaningful period to period 21 comparisons. $USD in Millions

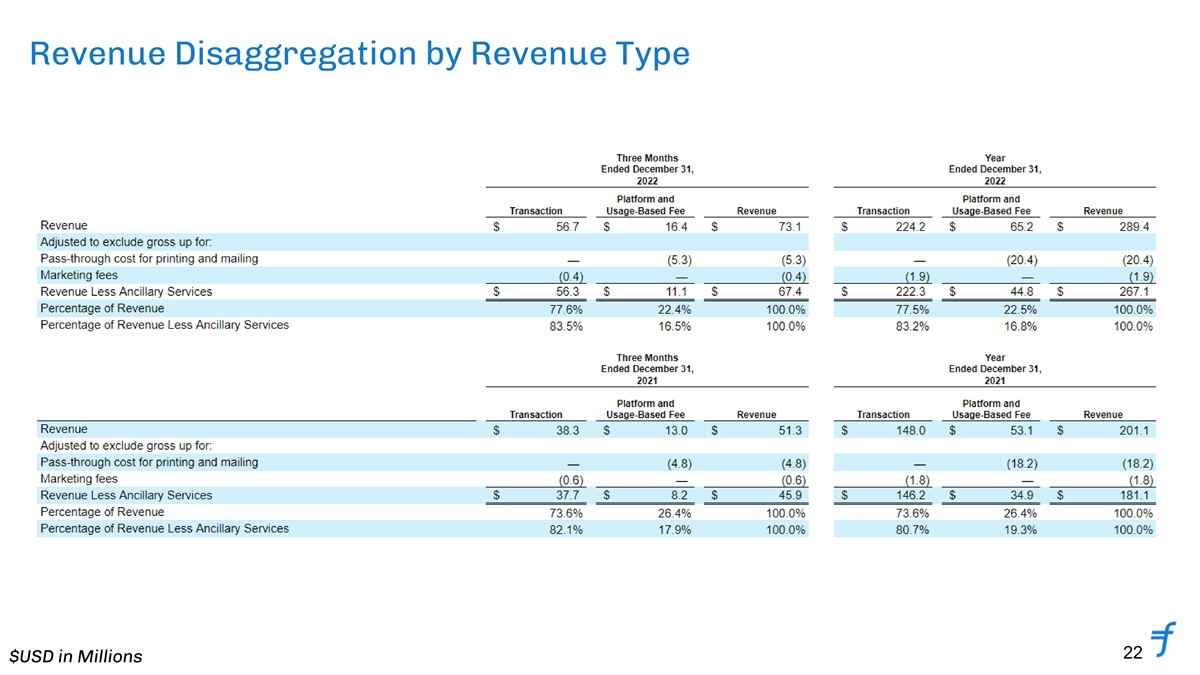

Revenue Disaggregation by Revenue Type 22 $USD in Millions

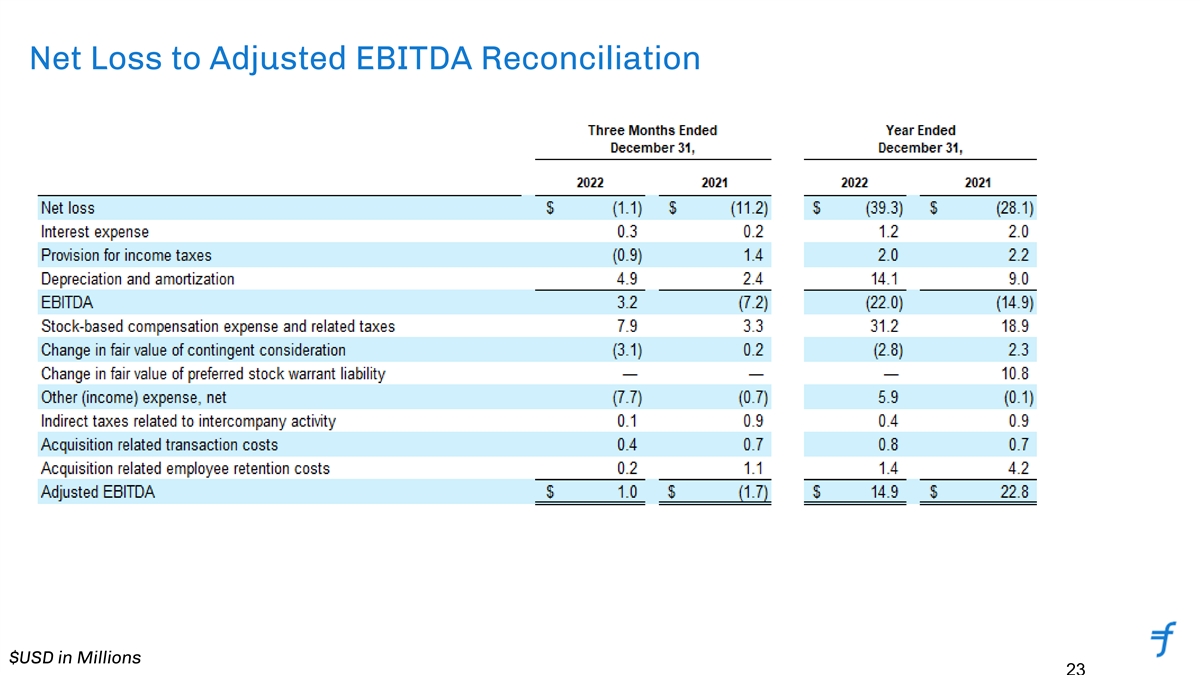

Net Loss to Adjusted EBITDA Reconciliation $USD in Millions 23

Reconciliation of Revenue to Revenue Less Ancillary Services Guidance $USD in Millions 24