Exhibit 99.2 Q2 2023 Earnings Supplement August 8, 2023

Disclosures This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this presentation, including statements regarding Flywire’s ability to successfully implement Flywire’s business plan, future results of operations and financial position, business strategy and plans and Flywire’s objectives for future operations, are forward -looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plans,” “potential,” “seeks,” “projects,” “should,” “could” and “would” and similar expressions are intended to identify forward -looking statements, although not all forward-looking statements contain these identifying words. Flywire has based these forward- looking statements largely on Flywire’s current expectations and projections about future events and financial trends that Flywire believes may affect Flywire’s financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions that are described in the Risk Factors and Management's Discussion and Analysis of Financial Condition and Results of Operations sections of Flywire's Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, which are on file with the Securities and Exchange Commission (SEC) and available on the SEC's website at www.sec.gov. Additional factors may be described in those sections of Flywire’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, expected to be filed with the SEC in the third quarter of 2023. In light of these risks, uncertainties and assumptions, the forward -looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events or performance. In addition, projections, assumptions and estimates of the future performance of the industries in which Flywire operates and the markets it serves are inherently imprecise and subject to a high degree of uncertainty and risk. All financial projections contained in this presentation are forward -looking statements and are based on Flywire’s management’s assessment of such matters. It is unlikely, however, that the assumptions on which Flywire has based its projections will prove to be fully correct or that the projected figures will be attained. Flywire’s actual future results may differ materially from Flywire’s projections, and it makes no express or implied representation or warranty as to attainability of the results reflected in these projections. Investments in Flywire’s securities involve a high degree of risk and should be regarded as speculative. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and Flywire’s own internal estimates and research. While Flywire believes these third-party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while Flywire believes its own internal research is reliable, such research has not been verified by any independent source. The information in this presentation is provided only as of Augsut 8, 2023, and Flywire undertakes no obligation to update any forward-looking statements contained in this presentation on account of new information, future events, or otherwise, except as required by law. This presentation contains certain non-GAAP financial measures as defined by SEC rules. Flywire has provided a reconciliation of those measures to the most directly comparable GAAP measures, which is available in the Appendix. The company has relied upon the exception in item 10(e)(1)(i)(B) of Regulation S-K and has not provided a quantitative reconciliation from forecasted adjusted EBITDA to forecasted GAAP net income (loss) or to forecasted GAAP income (loss) before income taxes, because it is unable without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include but are not limited to income taxes which are directly impacted by unpredictable fluctuations in the market price of the company's stock. 2

Execution Fulfillment Our mission is to deliver the most important and complex payments 3

Q2 2023 Performance 4

GAAP Financial Highlights Q2 2023 $84.9 M 57.5% $(16.8)M Revenue Gross Margin Net Loss 5

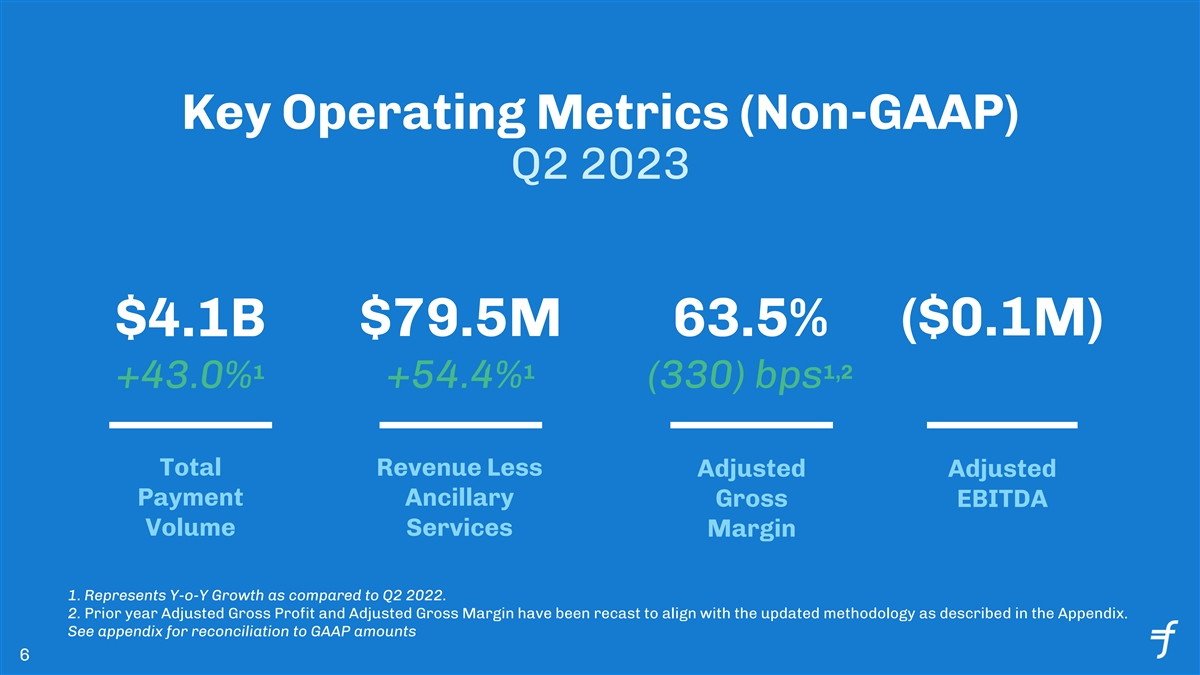

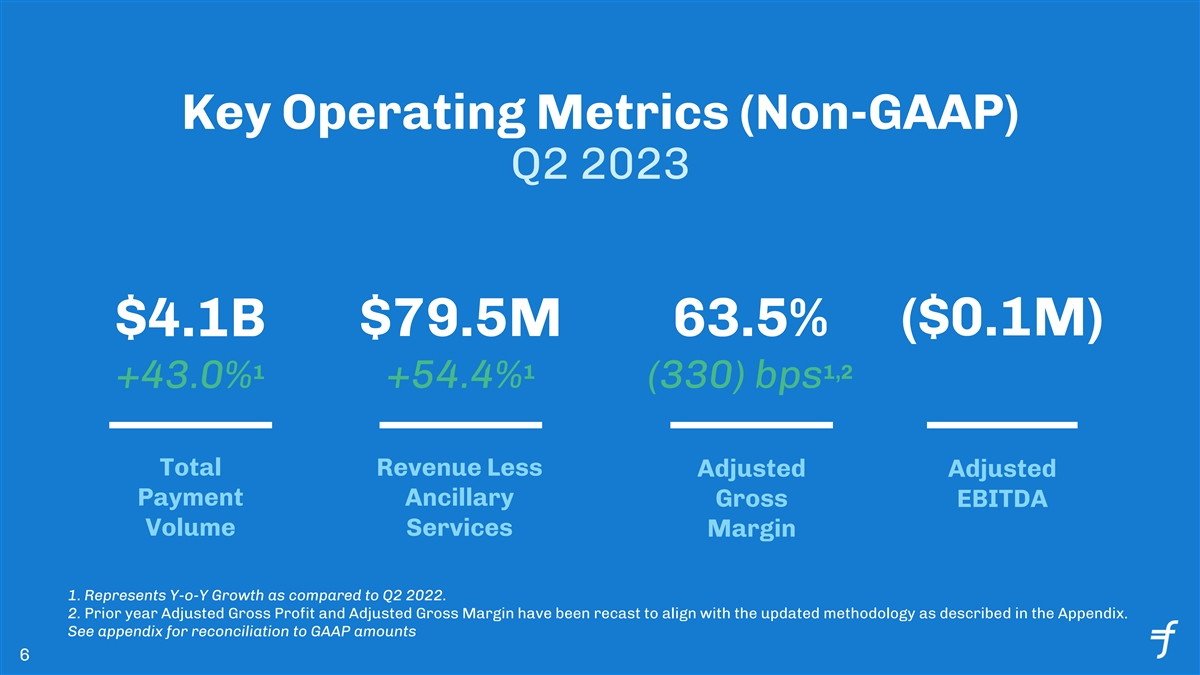

Key Operating Metrics (Non-GAAP) Q2 2023 ($0.1M) $4.1B $79.5M 63.5% 1 1 1,2 +54.4% (330) bps +43.0% Total Revenue Less Adjusted Adjusted Payment Ancillary Gross EBITDA Volume Services Margin 1. Represents Y-o-Y Growth as compared to Q2 2022. 2. Prior year Adjusted Gross Profit and Adjusted Gross Margin have been recast to align with the updated methodology as described in the Appendix. See appendix for reconciliation to GAAP amounts 6

Growth Strategies Grow with Grow with Expand our Expand to Pursue strategic existing new ecosystem new industries, & value- clients clients through channel geographies & enhancing partnerships products acquisitions 124% 165+ 2022 average New clients in Q2 annual dollar-based 2023 net retention rate 7

GROWTH with NEW CLIENTS What I love about the Flywire platform is that it is very easy to use and comprehensive. You are able to see your Overview payments quickly, and there’s so much detail provided. That ● A global software leader in is a major gain when you are doing cash application and digital insights and research technology trying to get details on a client quickly. It’s very efficient. ● Founded in 1998 with 18 global And the customer service has been great, very responsive. offices ● Over 3,200 companies use Cint to gather consumer insights Chelsea Holmes Flywire Solution Treasury Department Implemented Flywire is contracted exclusively for all cross-border payments coming into Cint’s global business lines. Flywire’s solution is seamlessly integrated with NetSuite and Quadient AR by YayPay

EXPAND ECOSYSTEM through CHANNEL PARTNERS + Flywire stood out not only for its powerful Channel Partner Overview payment technology and seamless integration, but also for its knowledge of the ● Headquartered in Tokyo, DISCO is one of the leading student application solutions for the National / Public university Japanese higher education sector. Flywire's system in Japan, providing more than 1,000 universities, colleges and vocational schools with a variety of services innovative payment processing combined from student recruitment and marketing, to professional with our additional services will enhance the training and consulting payment experience for our customers and Flywire Relationship their students. ● As the exclusive international payments provider for DISCO, Flywire integrates directly into DISCO’s e-apply system, which Masaro Niidome streamlines the application and enrollment payment President experience for international students, and improves operational efficiencies for university administrators ● DISCO customers wanted to provide their students with more payment options, and were looking for ways to reduce the manual reconciliation process for administrators

Financial Outlook 10

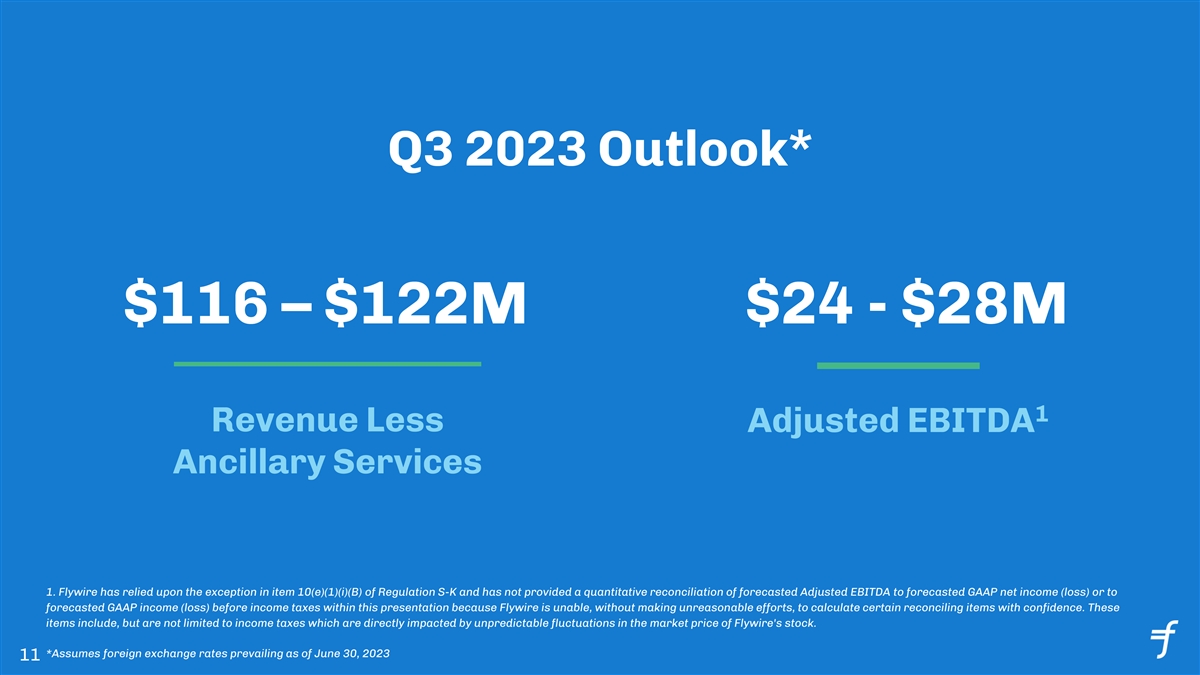

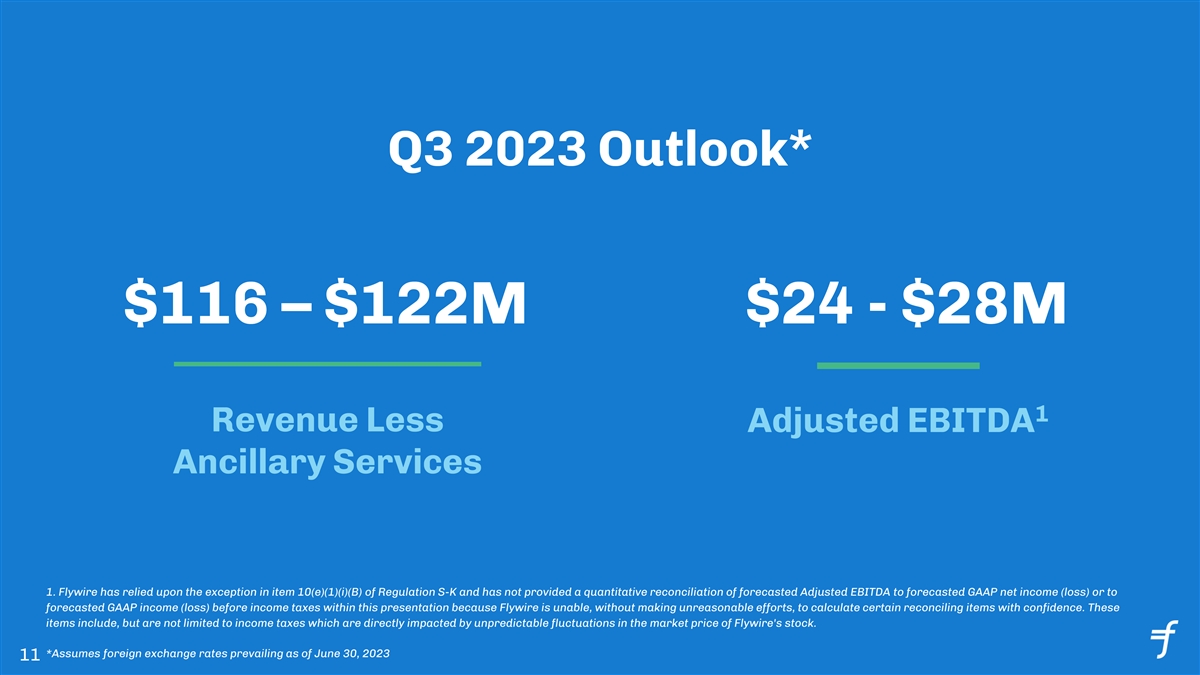

Q3 2023 Outlook* $116 – $122M $24 - $28M 1 Revenue Less Adjusted EBITDA Ancillary Services 1. Flywire has relied upon the exception in item 10(e)(1)(i)(B) of Regulation S-K and has not provided a quantitative reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net income (loss) or to forecasted GAAP income (loss) before income taxes within this presentation because Flywire is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to income taxes which are directly impacted by unpredictable fluctuations in the market price of Flywire's stock. *Assumes foreign exchange rates prevailing as of June 30, 2023 11

FY 2023 Outlook* $372 - $380M $33 - 39M 1 Revenue Less Adjusted EBITDA Ancillary Services 1. Flywire has relied upon the exception in item 10(e)(1)(i)(B) of Regulation S-K and has not provided a quantitative reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net income (loss) or to forecasted GAAP income (loss) before income taxes within this presentation because Flywire is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to income taxes which are directly impacted by unpredictable fluctuations in the market price of Flywire's stock. 12 *Assumes foreign exchange rates prevailing as of June 30, 2023

Appendix 13

Revenue Less Ancillary Services at Constant Currency* $USD in Millions

Revenue Less Ancillary Services & Adjusted Gross Margin Reconciliations * *Beginning with the quarter ended December 31, 2022, we have excluded depreciation and amortization from the calculation of our adjusted gross profit, which we believe enhances the understanding of the Company’s operating performance and enables more meaningful period to period comparisons. $USD in Millions 15

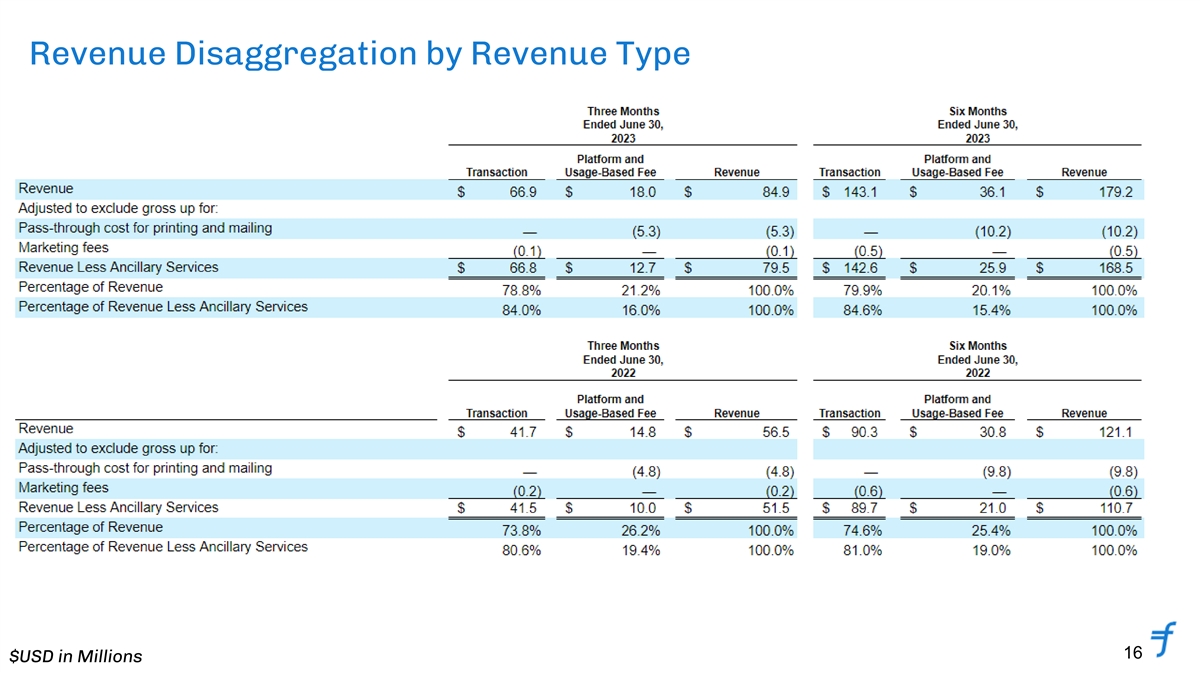

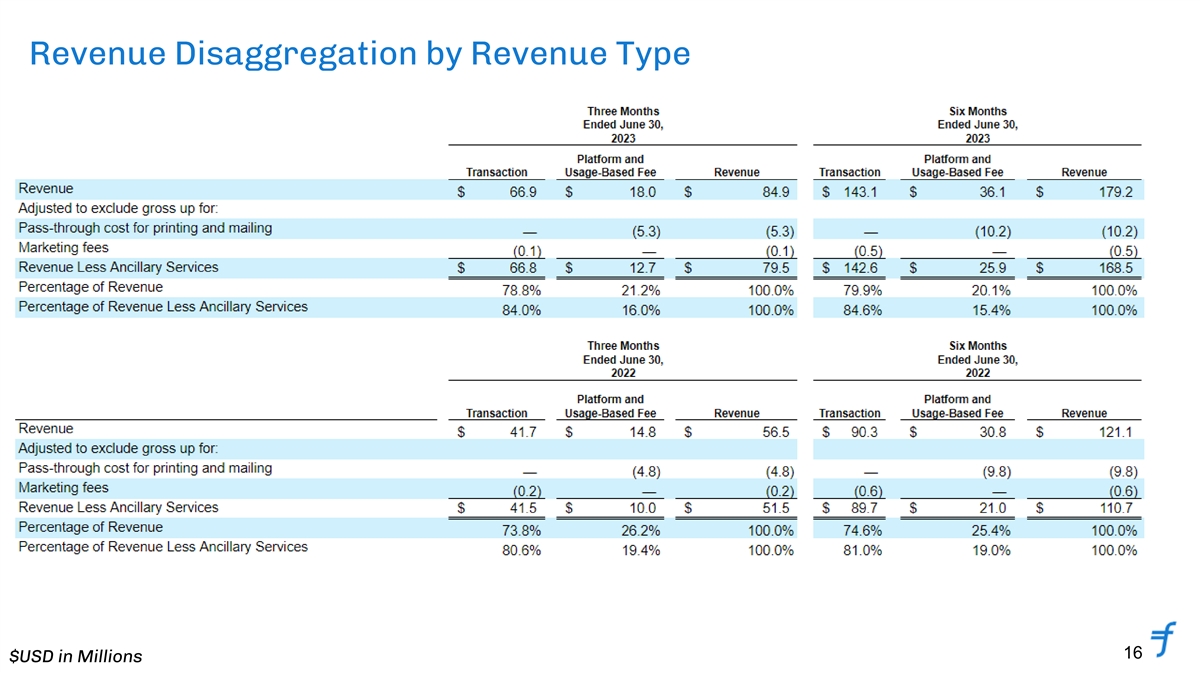

Revenue Disaggregation by Revenue Type 16 $USD in Millions

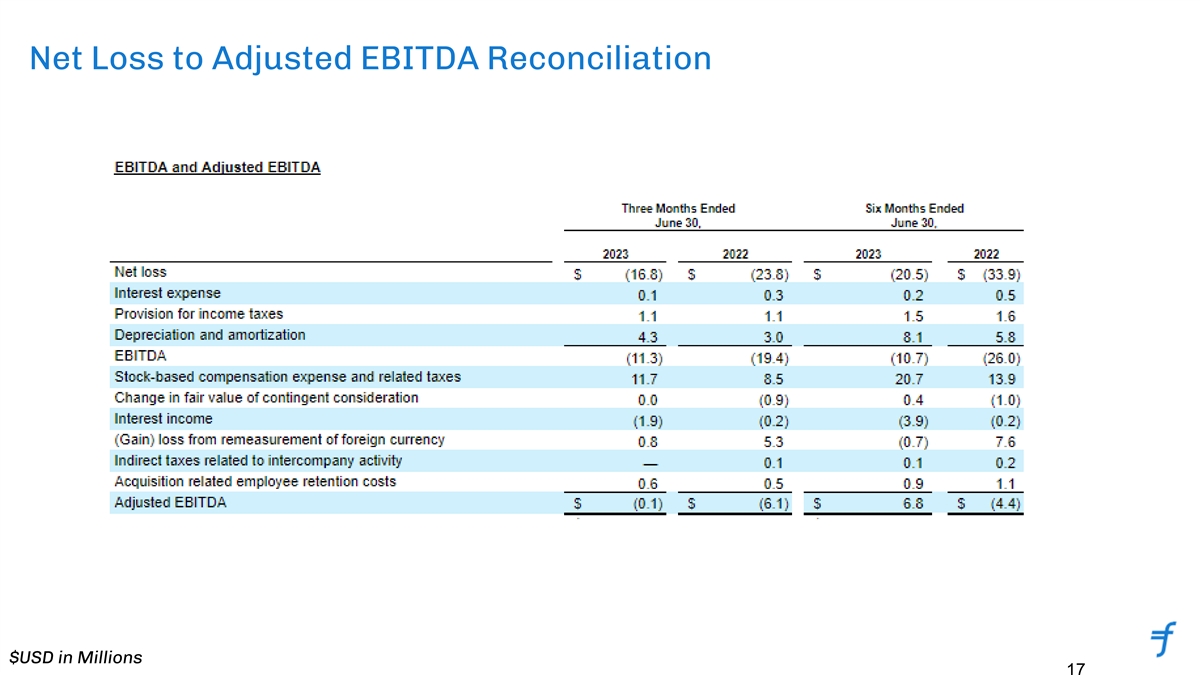

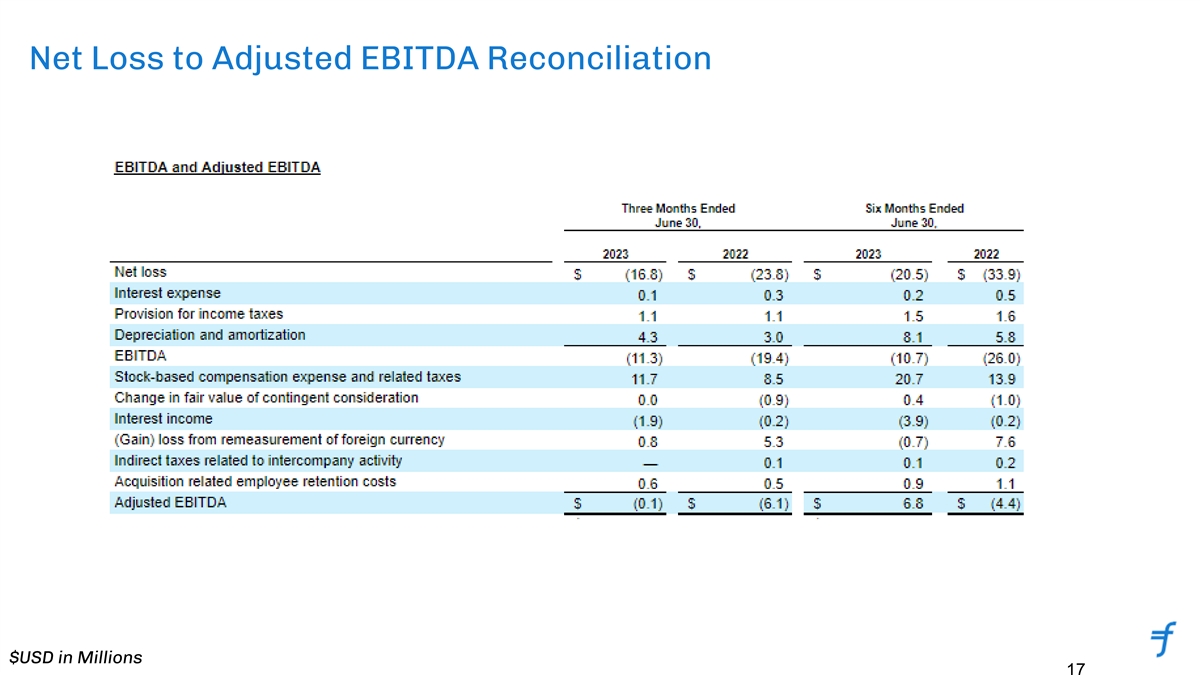

Net Loss to Adjusted EBITDA Reconciliation $USD in Millions 17

Reconciliation of Revenue to Revenue Less Ancillary Services Guidance $USD in Millions 18